Form 6-K MFC Industrial Ltd. For: Aug 14

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August, 2015

Commission File No.: 001-04192

MFC Industrial Ltd.

(Translation of Registrant's name into English)

Suite #1860 - 400 Burrard Street, Vancouver, British Columbia, Canada V6C 3A6

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

|

☒ Form 20-F

|

|

o Form 40-F

|

Indicate by check mark whether the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark whether the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

|

o Yes

|

|

☒ No

|

If “Yes” is marked, indicate below the file number assigned to the Registrant in connection with Rule 12g3-2(b): o

Quarterly Report for the Three and Six Months Ended June 30, 2015

(August 14, 2015)

The following report and the discussion and analysis of our financial condition and results of operations for the three- and six-month periods ended June 30, 2015 should be read in conjunction with our unaudited interim financial statements and notes for the three and six months ended June 30, 2015, our 2014 annual audited financial statements and the notes thereto and our 2014 annual report on Form 20-F filed with the United States Securities and Exchange Commission, referred to as the “SEC”, and Canadian securities regulators. Our financial statements for the three and six months ended June 30, 2015 have been prepared in accordance with International Financial Reporting Standards, referred to as “IFRS”, as issued by the International Accounting Standards Board, referred to as “IASB”, and may not be comparable to financial statements prepared in accordance with United States generally accepted accounting principles.

Unless otherwise stated, all references to dollar amounts herein are to United States dollars, all references to “C$” herein are to Canadian dollars and all references to “Euro” or “€” herein are to the European Union Euro. As used in this document, the terms “we”, “us” and “our” mean MFC Industrial Ltd. and our subsidiaries, unless otherwise indicated. Due to rounding, numbers presented throughout this document may not add up precisely to totals we provide and percentages may not precisely reflect the absolute figures.

Disclaimer for Forward-Looking Information

Certain statements in this document are forward-looking statements, which reflect our expectations regarding our future growth, results of operations, performance and business prospects and opportunities. Forward-looking statements consist of statements that are not purely historical, including statements regarding our planned acquisition of a Western European bank, future business prospects, estimated capital expenditures, the anticipated benefits of new projects, plans regarding our interest in the Wabush mine, our plan to rationalize certain oil and gas assets and any statements regarding beliefs, plans, expectations or intentions regarding the future. While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. No assurance can be given that any of the events anticipated by the forward-looking statements will occur or, if they do occur, what benefits we will obtain from them. These forward-looking statements reflect our current views and are based on certain assumptions and speak only as of the date hereof. These assumptions, which include our current expectations, estimates and assumptions about our business and the markets we operate in, the global economic environment, interest rates, commodities prices, exchange rates, our ability to identify, complete and finance additional acquisitions and sources of supply for our global supply chain business, the plans and decisions of the operator of the Wabush mine, the timing and amounts received as a result of our plan to rationalize certain oil and gas assets, the satisfaction or waiver of conditions in respect of the bank acquisition, our ability to integrate such acquired business and our ability to manage our assets and operating costs, may prove to be incorrect. No forward-looking statement is a guarantee of future results. A number of risks and uncertainties could cause our actual results to differ materially from those expressed or implied by the forward-looking statements, including those described herein and in our 2014 annual report on Form 20-F. Such forward-looking statements should therefore be construed in light of such factors. Investors are cautioned not to place undue reliance on these forward-looking statements. Other than in accordance with our legal or regulatory obligations, we are not under any obligation and we expressly disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Additional information about these and other assumptions, risks and uncertainties is set out in the “Risk Factors” section of this report and in our annual report on Form 20-F for the year ended December 31, 2014 filed with the SEC and Canadian securities regulators.

Note Regarding Natural Gas Disclosure

Where applicable, barrels of oil equivalent, referred to as “boe”, amounts have been calculated using a conversion ratio of six thousand cubic feet of natural gas to one barrel of oil, which is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. Where applicable, boe amounts including sulphur have been calculated using a conversion ratio of one ton of sulphur to one barrel of oil. “Boe” amounts may be misleading, particularly if used in isolation.

The following industry specific terms and abbreviations are utilized in this document:

| • | AECO – Alberta Energy Company (Canada), a storage and exchange point for Canadian natural gas located within Alberta, Canada, for which the reference price paid for Alberta, Canada natural gas is set. |

| • | mbbl – Thousand barrels. |

| • | mboe – Thousand barrels of oil equivalent. |

| • | mcf – Thousand cubic feet. |

| • | mmcf – Million cubic feet. |

| • | mmcf/d – Million cubic feet per day. |

| • | Natural gas or gas – The lighter hydrocarbons and associated non-hydrocarbon substances occurring naturally in an underground reservoir, which under atmospheric conditions are essentially gases, but which may contain natural gas liquids. Natural gas can exist in a reservoir either dissolved in crude oil (solution gas) or in a gaseous form (associated gas or non-associated gas). Non-hydrocarbon substances may include hydrogen sulphide, carbon dioxide and nitrogen. |

| • | Net wells – The sum of the fractional working interests owned by us in gross acres or gross wells. |

| • | NGL or NGLs – Natural gas liquid or natural gas liquids, which are naturally occurring substances found in natural gas, including ethane, butane, isobutane, propane and natural gasoline that can be collectively removed from produced natural gas, separated into these substances and sold. |

| • | Producing Well – A well that is not a dry well. Productive wells include producing wells and wells that are mechanically capable of production. |

| • | Proved reserves – Proved natural gas, NGL and oil reserves are those quantities of natural gas, NGL and oil, which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible. |

| • | Undeveloped reserves – Proved reserves that are expected to be recovered from new wells on undrilled acreage or from existing wells where a relatively major expenditure is required for recompletion. |

| • | Working interest – The interest in a property which gives the owner that share of production from the property. A working interest owner bears that share of the costs of exploration, development and production in return for a share of production. Working interests are typically burdened by overriding royalty interest or other interests. |

Non-IFRS Financial Measures

This document includes “non-IFRS financial measures”, that is, financial measures that either exclude or include amounts that are not excluded or included in the most directly comparable measure calculated and presented in accordance with IFRS. Specifically, we make use of the non-IFRS measure “Operating EBITDA”.

Operating EBITDA is defined as earnings before interest, taxes, depreciation, depletion, amortization and impairment. Our management uses Operating EBITDA as a measure of our operating results and considers it to be a meaningful supplement to net income as a performance measurement, primarily because we incur significant depreciation and depletion and the exclusion of impairment losses in Operating EBITDA eliminates the non-cash impact.

Operating EBITDA is used by investors and analysts for the purpose of valuing an issuer. The intent of Operating EBITDA is to provide additional useful information to investors and the measure does not have any standardized meaning under IFRS. Accordingly, this measure should not be considered in isolation or used in substitute for measures of performance prepared in accordance with IFRS. Other companies may calculate Operating EBITDA differently. For a reconciliation of Operating EBITDA to net income please see “Results of Operations”.

DEAR FELLOW SHAREHOLDERS AND BUSINESS PARTNERS: Our gross revenues for the first half of 2015 increased 12.9% to $709.6 million from $628.7 million in the same period of 2014, primarily as a result of the consolidation of two acquisitions in the second quarter of 2014, partially offset by a decrease in average natural gas prices and the impact of the stronger United States dollar against the Euro and Canadian dollar. Our net income increased in the first half of the year to $13.3 million from $12.9 million in the first six months of 2014.

While costs of sales and services increased to $649.8 million during the six months ended June 30, 2015 from $554.8 million for the same period of 2014, gross margin declined to 7.7% compared to 11.0% in the prior year period. Again, this was a result of the consolidation of two acquisitions in the second quarter of 2014 with margin profiles below our corporate average, as well as lower average natural gas prices and less income from our iron ore interest.

Selling, general and administrative expenses (“SG&A”) decreased to $36.5 million for the six months ended June 30, 2015 from $44.0 million for the same period in 2014, primarily due to the stronger United States dollar versus the Euro and Canadian dollar, partially offset by investments into new markets and geographies. The majority of our SG&A is incurred in Euro and Canadian dollars, and a weakening of these currencies results in a decline when denominated in US dollars. As a percentage of gross revenues, selling, general and administrative expenses were 5.1% in the first six months of 2015, compared to 7.0% in same period of 2014.

For the first half of 2015, our Operating EBITDA decreased by 16.0% to $33.2 million from $39.5 million for the same period of 2014.

Operating EBITDA is defined as earnings before interest, taxes, depreciation, depletion, amortization and impairment. Operating EBITDA is a non-IFRS financial measure and should not be considered in isolation or as a substitute for performance measures under IFRS. Management uses Operating EBITDA as a measure of the Company’s operating results and considers it to be a meaningful supplement to net income as a performance measure, primarily because we incur significant depreciation and depletion from time to time.

The following table reconciles our net income to Operating EBITDA for each of the six months ended June 30, 2015 and 2014:

OPERATING EBITDA (in US $ thousands) |

6/30/15 |

6/30/14 |

||||

Net Income(1) |

13,759 | 13,483 | ||||

Income Taxes (Recovery) Expense |

(252 | ) |

5,857 | |||

Finance Costs |

9,054 | 8,777 | ||||

Depreciation, Depletion and Amortization |

10,676 | 11,402 | ||||

Operating EBITDA(2) |

33,237 | 39,519 | ||||

Notes:

| (1) | Includes net income attributable to non-controlling interests. |

| (2) | There were no impairments in the first six months of 2015 and 2014. |

Our income attributable to shareholders increased 3.0% to $13.3 million, or $0.21 per share on a basic and diluted basis, in the first half of 2015, compared to $12.9 million, or $0.21 per share on a basic and diluted basis, in the same period of 2014.

These results are unacceptable, and we are working diligently to execute our strategy, which we believe will return MFC back to greater profitability growth.

I

LETTER TO SHAREHOLDERS

Results by Operating Segment

Our income by operating segment for each of the six months ended June 30, 2015 and 2014 are broken out in the table below. We report in three segments: Global Supply Chain; Trade Finance and Services; and Other.

REVENUES BY SEGMENT (in US $ thousands) |

6/30/15 |

6/30/14 |

||||

Global Supply Chain |

693,479 | 605,542 | ||||

Trade Finance and Services |

2,558 | 9,377 | ||||

All Other |

13,561 | 13,792 | ||||

Gross Revenues |

709,598 | 628,711 | ||||

INCOME (LOSS) BY SEGMENT (in US $ thousands) |

6/30/15 |

6/30/14 |

||||

Global Supply Chain |

8,856 | 13,287 | ||||

Trade Finance and Services |

5,306 | 11,221 | ||||

All Other |

-655 | -5,168 | ||||

Income Before Taxes |

13,507 | 19,340 | ||||

Income Tax Recovery (Expense) |

383 | -5,275 | ||||

Resource Property Revenue Tax Expense |

-131 | -582 | ||||

Net Income Attributable to Non-Controlling Interests |

-495 | -604 | ||||

Net Income Attributable to Our Shareholders |

13,264 | 12,879 | ||||

Earnings Per Share, Basic and Diluted |

0.21 | 0.21 | ||||

Revenues by Geography and Product

Our revenue by geography and product for each of the six months ended June 30, 2015 and 2014 are broken out in the tables below:

|

GLOBAL SUPPLY CHAIN REVENUES

|

6/30/15

|

6/30/14

|

|

Wood Products

|

21%

|

28%

|

|

Steel Products

|

17%

|

14%

|

|

Minerals, Chemicals and Alloys

|

40%

|

31%

|

|

Metals

|

14%

|

10%

|

|

Energy

|

4%

|

11%

|

|

Other

|

4%

|

6%

|

|

GROSS REVENUES BY GEOGRAPHY

|

6/30/15

|

6/30/14

|

|

European Union (excluding Germany)

|

33%

|

22%

|

|

Germany

|

34%

|

38%

|

|

Americas

|

19%

|

32%

|

|

Asia

|

9%

|

4%

|

|

Europe, Non-European Union

|

2%

|

2%

|

|

Africa

|

3%

|

2%

|

II

LETTER TO SHAREHOLDERS

Balance Sheet

Cash and cash equivalents were $250.1 million on June 30, 2015, compared to $297.3 million as of December 31, 2014. The decrease in cash was primarily the result of a reduction of short-term borrowings and debt.

On June 30, 2015, our trade receivables were $131.0 million and our inventories were $194.0 million, compared to trade receivables of $161.7 million and inventories of $212.6 million as of December 31, 2014.

TRADE RECEIVABLES AND INVENTORIES (in US $ thousands) |

6/30/15 |

12/31/14 |

||||

Trade Receivables |

130,975 | 161,674 | ||||

Inventories |

194,003 | 212,577 | ||||

More than 50% of our inventories have been contracted at fixed prices, while the remainder is comprised of the raw materials, work-in-progress and finished goods at our production facilities, strategic inventories (such as consignment positions) and goods in transit.

Assets held for sale, consisting of certain natural gas assets and an investment property, were $119.3 million on June 30, 2015, compared to $131.1 million on December 31, 2014. The decrease in assets held for sale was a result of the negative impact of the higher United States dollar against the Euro and the Canadian dollar. Liabilities relating to assets held for sale (decommissioning obligations) were $12.5 million on June 30, 2015, compared to $15.3 million as at December 31, 2014.

Our short-term bank borrowings decreased to $133.4 million on June 30, 2015 from $161.3 million on December 31, 2014. Total long-term debt decreased to $270.2 million on June 30, 2015 from $313.1 million on December 31, 2014, primarily as a result of repayments and the negative impact of the higher United States dollar against the Euro.

The following table highlights selected key numbers and ratios as of June 30, 2015 and December 31, 2014:

FINANCIAL POSITION (in US $ thousands) |

6/30/15 |

12/31/14 |

||||

Cash and Cash Equivalents |

250,077 | 297,294 | ||||

Securities |

192 | 250 | ||||

Trade Receivables |

130,975 | 161,674 | ||||

Inventories |

194,003 | 212,577 | ||||

Current Assets |

745,289 | 864,804 | ||||

Current Liabilities |

283,278 | 379,944 | ||||

Working Capital |

462,011 | 484,860 | ||||

Current Ratio(1) |

2.63 | 2.28 | ||||

Total Assets |

1,272,110 | 1,458,684 | ||||

Total Liabilities |

605,163 | 787,248 | ||||

Shareholders' Equity |

666,379 | 670,388 | ||||

Equity Per Common Share |

10.55 | 10.63 | ||||

Note:

| (1) | The current ratio is calculated as current assets divided by current liabilities. |

Our objectives when managing capital are to continue to match the duration of our assets and liabilities to the extent possible and to maintain a flexible capital structure that optimizes the cost of capital at acceptable risk. We set the amount of capital in proportion to risk.

We actively manage our capital structure and make adjustments to it in accordance to changes in economic conditions.

III

LETTER TO SHAREHOLDERS

We maintain various kinds of credit lines and facilities with banks. Most of these facilities are short-term and are used for our day-to-day business and trade financing activities in our global supply chain business. The amounts drawn under such facilities fluctuate with the type and level of transactions being undertaken.

As at June 30, 2015, we had credit facilities aggregating approximately $649.4 million, approximately the same on a constant currency basis since December 31, 2104. These credit facilities are comprised of: (1) unsecured revolving credit facilities aggregating $329.7 million from banks; (2) revolving credit facilities aggregating $76.3 million from banks for structured solutions; (3) a non-recourse factoring arrangement with a bank for up to a credit limit of $184.5 million for our supply chain business; and (4) foreign exchange credit facilities of $58.9 million with banks. All of these facilities are either renewable on a yearly basis or usable until further notice.

Iron Ore and Natural Gas

While market conditions are difficult and commodity prices have declined, one of our greatest challenges is that we have a significant percentage of our equity allocated to assets that are simply not contributing to our results. Specifically, our interest in iron ore and our natural gas production and processing subsidiaries are both utilizing significant capital without providing the income for us to generate sufficient returns. We are diligently working to rationalize these assets in a responsible and timely manner.

IV

LETTER TO SHAREHOLDERS

Iron Ore Interest:

We indirectly derive royalty revenue from a mining lease based on the production of iron ore from the Wabush Ore Mine (the “Mine”) in Labrador, Canada. The Mine has operated since 1966, historically producing up to six million tonnes of iron ore concentrates and/or pellets per year.

The Mine is owned by Cliffs Natural Resources Inc. (“Cliffs”). In the first half of 2015, Cliffs announced that it had closed all of their Canadian operations, and subsequently commenced proceedings under the Companies’ Creditors Arrangement Act (Canada) (“CCAA”) with respect to its Canadian operations. CCAA allows financially troubled corporations the opportunity to restructure their affairs.

When we are able to terminate the lease, we intend to re-take the Mine and exercise our contractual right to acquire the Mine infrastructure and all of the related property. Our rights may be delayed due to the CCAA filing.

IRON ORE INTEREST (in US $ thousands) |

6/30/15 |

||

Interest in Resource Properties |

160,964 | ||

Deferred Tax Asset |

-40,165 | ||

Net Equity Allocated to the Mine |

120,799 | ||

While iron ore prices have declined, it is very important that we do not have any debt on this property. This enables us to take a long-term and unencumbered view to evaluate and exploit this asset.

We believe that the Mine presents an interesting long-term opportunity and we will continue to be responsible stewards of our capital when pursuing this project.

Natural Gas Production and Processing Subsidiary:

We are active in the energy sector through the development, production and processing of natural gas and natural gas liquids at our subsidiary, MFC Energy, in Alberta, Canada.

In late March, we announced a plan to rationalize our energy assets and return certain net proceeds to shareholders and redeploy certain net proceeds in our trade finance business.

MFC ENERGY (in US $ thousands) |

6/30/15 |

||

Property, Plant and Equipment |

54,738 | ||

Interest in Resource Properties |

132,843 | ||

Hydrocarbon Probable Reserves |

40,600 | ||

Hydrocarbon Unproved Lands |

19,968 | ||

Gross Assets of MFC Energy |

248,149 | ||

Long-Term Debt |

-68,053 | ||

Decommissioning Obligations |

-76,791 | ||

Net Long-Term Assets of MFC Energy |

103,305 | ||

Assets Held for Sale |

91,199 | ||

Liabilities Related to Assets Held for Sale |

-12,502 | ||

Net Assets Held for Sale of MFC Energy |

78,697 | ||

While this plan is still ongoing, we have no specified timeline and will make responsible long-term business decisions in the interim period.

V

LETTER TO SHAREHOLDERS

We are continuing to preserve our long-term natural gas reserves and ensure that we do not deplete our resources at uneconomic prices. We initiated a program to curtail production at certain of our wells that has focused on our properties in central Alberta that produce a higher mix of natural gas liquids. We are focused on these properties because, while we are able to effectively hedge natural gas, we are not able to effectively hedge natural gas liquids. When production at such wells becomes economical, we will resume operations.

We believe that this program is the prudent action in this environment, as it will ensure that our natural gas remains in the ground, while maintaining the flexibility to monetize our reserves when attractive pricing resumes. Importantly, this preserves the long-term asset value of these properties.

Additionally, we have been hedging our natural gas production with Canadian dollar denominated futures based on Alberta market prices. These hedges protect against further price declines, and our intention is to continue this program and hedge additional volumes to preserve our assets and maximize value over the long-term. We currently have approximately fifteen months of natural gas production hedged with durations from September 2015 to March 2017.

Update on Agreement to Acquire a Western European Bank

In June, we announced that we had entered into an agreement to acquire a licensed bank in Western Europe, subject to customary closing conditions, such as the receipt of the regulatory approvals. This will be a major part of our future. An in-house bank will enable us to grow the supply chain and structured finance solutions we currently offer to our customers and suppliers. The Company currently expects such regulatory approval process to be completed before year-end.

Alongside this new direction to focus on trade and structured finance, in July 2015 we announced that Peter Kellogg and William Horn III stepped down as directors of MFC. We would like to thank Mr. Kellogg and Mr. Horn for their guidance and contributions. They left the Company with their ideas

VI

LETTER TO SHAREHOLDERS

on corporate governance firmly in place. We are now actively in discussions with a number of potential directors with experience and expertise in export credit, trade finance and banking.

Our Vision

Our corporate priority is simply to do good business, ethically. We adhere to prudent and disciplined policies and practices to provide certainty for our banking partners, our customers and suppliers. Our employees are our greatest assets, and we encourage their entrepreneurialism and advancement through training and experience.

As we move forward, our goal is to become a premiere regulated trade finance institution. With the acquisition of a European bank, we will be able to offer our customers and suppliers a wider range of structured finance solutions including factoring, inventory financing, forfaiting, marketing and other types of risk management and financing solutions.

Share Price Development

On August 7, MFC shares closed at $3.41, down 52% since the beginning of the year. Not only have the industries in which we participate underperformed the market, but MIL shares have underperformed those industries.

While our focus is on long-term value creation, we are disappointed with this recent performance on both a comparative and absolute basis.

To put this in another perspective, MFC’s shareholders’ equity is $666 million, or $10.55 per share, and before including our interest in an iron ore mine and our natural gas assets, is approximately $364 million, or $5.76 per share. Without considering two of our most significant assets, our common shares trade at 0.59x book value, which consists mainly of working capital.

MFC INDUSTRIAL LTD. AS OF JUNE 30, 2015 |

SHAREHOLDERS’ EQUITY |

EQUITY PER SHARE |

SHARE PRICE (08/07) |

PRICE / EQUITY (%) |

||||||||

(in US $ thousands, other than per share amounts, share price and percentages) |

||||||||||||

Working Capital(1) |

400,616 | 6.34 | ||||||||||

Long-Term Debt |

(171,961 | ) |

(2.72 | ) |

||||||||

Other Long-Term Assets |

157,873 | 2.50 | ||||||||||

Other Long-Term Liabilities |

(22,950 | ) |

(0.36 | ) |

||||||||

Sub-total |

363,578 | 5.76 | 3.41 | 0.59 | ||||||||

Net Assets Held for Sale, MFC Energy |

78,697 | 1.25 | ||||||||||

Net Long-Term Assets, MFC Energy |

103,305 | 1.64 | ||||||||||

The Mine |

120,799 | 1.91 | ||||||||||

Total |

666,379 | 10.55 | 3.41 | 0.32 | ||||||||

Note:

| (1) | Not including Net Assets Held for Sale, MFC Energy |

We remain confident in our strategy to rationalize certain assets and leverage our global supply platform with the addition of regulated trade finance products and services. We believe this will benefit all of our stakeholders, and over time, our common share price will converge with its intrinsic value.

Respectfully submitted,

Gerardo Cortina

President and CEO

VII

LETTER TO SHAREHOLDERS

|

CORPORATE INFORMATION

|

BOARD OF DIRECTORS

Michael J. Smith

Director since 1987

Indrajit Chatterjee*

Director since 2005

Silke S. Stenger*

Director since 2013

Dr. Shuming Zhao*

Director since 2014

Gerardo Cortina

Director since 2014

* Member of the Audit Committee

AUDITORS

PricewaterhouseCoopers LLP

Suite 700

250 Howe Street

Vancouver, BC V6C 3S7

Canada

Telephone: (1) 604 806 7000

www.pwc.com/ca

STOCK LISTING

New York Stock Exchange

11 Wall Street

New York, NY 10005 USA

Telephone: (1) 212 656 3000

Email: [email protected]

Trading Symbol: MIL

WEBSITE

www.mfcindustrial.com

OFFICES AND SUBSIDIARIES

AUSTRIA

Millennium Tower, 21st Floor

Handelskai 94-96

1200 Vienna, Austria

Telephone: (43) 1 24025 0

Email: [email protected]

MEXICO

Bosques de Alisos No. 47B

Officina A1 - 01

Bosques de las Lomas, Cuajimalpa

Mexico D.F. C.P. 05120, Mexico

Telephone: (52) 55 9177 7440

Email: [email protected]

CANADA

400 Burrard Street, Suite 1860

Vancouver, BC Canada V6C 3A6

Telephone: (1) 604 683 8286

Email: [email protected]

CANADA

1035 7th Ave S.W., Suite 400

Calgary, AB Canada T2P 3E9

Telephone: (1) 403 237 9400

Email: [email protected]

UNITED STATES

393 Vanadium Road, Suite 201

Pittsburgh, PA 15243 USA

Telephone: (1) 412 279 9130

Email: [email protected]

UNITED STATES

5005 Woodway Drive, Suite 250

Houston, TX 77056 USA

Telephone: (1) 832 932 9472

Email: [email protected]

CHINA

Room 2409, Shanghai Mart Tower

2299 Yan An Road West

Changning District

Shanghai, P.R. China 200336

Telephone: (86) 21 6115 6996

Email: [email protected]

CHINA

Beijing International Building

Room 320

21 Jianguomenwai Dajei

Chaoyang District,

100020 Beijing, P.R. China

Telephone: (86) 10 6532 5928

Email: [email protected]

ARGENTINA

Manuela Saenz 323, 6° - 615

CABA (1107) Argentina

Telephone: (54) 11 5238 7788

Email: [email protected]

NORWAY

Vikelvfaret 4

C7054 Alzingen

Norway

Telephone: (47) 73 87 7900

Email: [email protected]

LUXEMBOURG

469 route de Thionville

5887 Alzingen, G.D. Luxembourg

Telephone: (352) 26 51 521

Email: [email protected]

GERMANY

Schifferstr. 200

47059 Duisburg, Germany

Telephone: (49) 203 30 00 70

Email: [email protected]

CORPORATE CONTACT

Rene Randall, MFC industrial Ltd.

400 Burrard Street, Suite 1860

Vancouver, BC Canada V6C 3A6

Telephone: (1) 604 683 8286

Email: [email protected]

TRANSFER AGENT

Computershare

480 Washington Blvd, 27th Floor

Jersey City, NJ 07310, USA

Telephone: (1) 888 478 2338

www.computershare.com

VIII

LETTER TO SHAREHOLDERS

Nature of Business

We are a global supply chain company which utilizes innovative finance alongside customized structured solutions to facilitate the working capital and other requirements of our customers. Our business activities are supported by captive sources and products secured from third parties. We do business in multiple geographies and specialize in a wide range of industrial products such as metals, alloys, minerals, chemicals and wood products.

As a supplement to our internal growth initiatives, we seek out and evaluate strategic acquisition and financing candidates to further expand our global supply chain and trade finance and services businesses.

Recent Developments

In the second quarter of 2015, we announced that we had entered into an agreement to acquire a licenced bank in Western Europe. The purchase price under the transaction is subject to finalization on completion and will be based on, among other things, the net realizable capital at such time. The transaction is subject to customary conditions, including, among others, the receipt of requisite national and European Central Bank regulatory approvals. We are currently working towards the satisfaction of such conditions and expect the regulatory approval process to take several months. The acquisition of the bank is in line with our previously announced long-term strategy to continue the growth of our trade finance and supply chain solutions businesses by offering additional and complete trade finance services and solutions to our existing customers. We believe that this will allow us to capitalize on cross-selling opportunities and synergies between our global supply chain and trade finance and services businesses. We expect that ownership of a licenced bank will enable us to expand the supply chain solutions we currently offer our customers.

In the first quarter of 2015, we announced that we determined to rationalize certain assets of MFC Energy Corporation, referred to as “MFC Energy”, with a portion of the net proceeds to be redeployed to our other businesses and the balance returned to our shareholders. Due to the decline of natural gas and natural gas liquids pricings, we have not adopted a specific timeline for this plan. Prior to declaring any distributions to our shareholders, we will repay any bank debt incurred to refinance the acquisition of these assets. The amount and timing of such distributions will depend on the timing of, and amounts received in connection with, the rationalization of such assets. We will not pay a quarterly cash dividend in 2015.

In the first half of 2015, we sold certain non-core hydrocarbon assets located in the Brant and Callum areas of Southern Alberta for nominal consideration. The transaction resulted in the elimination of related decommissioning obligations and, as a result, we recognized a non-cash gain of $7.0 million, which was included in our gross revenues for the first half of 2015 and may be subject to post-closing adjustments.

Business Segments

Our business is divided into three operating segments: (i) global supply chain, which includes our marketing activities and captive supply assets; (ii) trade finance and services, which includes structured solutions, financial services and proprietary investing activities; and (iii) all other, which encompasses our corporate and other investments and business interests, including our medical supplies and servicing business.

Global Supply Chain

Our supply chain business is globally focused and includes our integrated operations and interests. We conduct such operations primarily through our subsidiaries based in Austria, Germany, Luxembourg, Norway, the United States, Latin America and Canada. We supply various products, including minerals, ferrous and non-ferrous metals, chemicals, refractory and ceramic materials and wood products. These are sourced from our directly or indirectly held interests in resource projects, or are secured by us from third parties.

Since entering the global supply chain business in 2010, we have implemented a long-term growth strategy to achieve critical mass by increasing our revenues through expanding our geographic reach and diversifying our product offerings. Over the last three years, we have completed several strategic acquisitions to support this long-term strategy, including:

| • | in April 2014, we acquired a 100% interest in a vertically integrated supply chain management group with marketing offices across the globe and one of the world’s leading producers of ferrosilicon through its production plant in Mo i Rana, Norway; |

| • | in March 2014, we acquired an Austrian global supply chain company, focused on steel products, with longstanding relationships with various steel mills in Eastern and Southern Europe, as well as the Baltic States and the Commonwealth of Independent States; and |

1

| • | in 2012, we acquired majority interests in two global supply chain companies based in North and Latin America, whose product offerings include refractory and ceramic materials and other products. |

In addition to increasing our product offering, these transactions also expanded our customer base and geographic presence through the addition of sales offices throughout the world.

Our integrated operations include sourcing and supplying various products. To a lesser extent, we also act as an agent for our clients. Our operations often utilize innovative strategies and financing structures. We currently engage in purchases and sales with producers who are unable to effectively realize sales due to their specific circumstances.

Further, producers and end customers often work with us to better manage their internal supply chain, distribution risk and currency and capital requirements. In such operations, we try to capture various product, financing and currency spreads. Through our operations, we have been able to develop long-standing relationships with producers, end customers and financiers and integrate them into our financial activities.

We generally source from Asia, Africa, Europe, North America, South America and the Middle East and we sell in global markets.

We provide supply chain services, logistics and other trade and finance services to producers and consumers of our products. These activities provide cost effective and efficient transportation, as well as payment terms accommodating working capital requirements for our customers and partners. They are supported by strategic direct and indirect investments in assets operating in our core businesses.

Our global supply chain business employs personnel worldwide and our main marketing office is located in Vienna, Austria. We also maintain offices in Canada, the United States, Mexico, Argentina, China, the United Arab Emirates, Serbia, Norway, Germany, Luxembourg and Spain. In addition, we establish relationships with and seek to further market our products through agents located worldwide. Our marketing and other business activities in this segment are supported by a global network of agents and relationships, which provides us with worldwide sourcing and distribution capabilities.

We indirectly derive royalty revenue from a mining sub-lease of the lands upon which the Wabush iron ore mine is situated in Newfoundland and Labrador, Canada, which commenced in 1956 and expires in 2055. The mine is owned by Cliffs Natural Resources Inc., referred to as “Cliffs”, which, in late 2014, announced its closure and, in the first quarter of 2015, commenced proceedings under the Companies’ Creditors Arrangement Act (Canada), referred to as “CCAA”, with respect to its Canadian operations, including the subsidiary that holds a majority interest in the mine. In the second quarter of 2015, Cliffs’ subsidiaries that hold and operate its Wabush mine interest became parties to the CCAA proceedings.

Pursuant to the sub-lease, we are entitled to minimum lease payments of C$3.25 million per year until termination thereof. If the sub-lease is terminated in accordance with its terms, we intend to exercise our step-in rights and acquire the mine property pursuant to the terms thereof. In such event, under the terms of the sub-lease, we can elect to purchase certain infrastructure onsite at the then reasonable market price. There can be no assurance as to when and if the sub-lease will be terminated. We are currently exploring opportunities for this asset with stakeholders and third parties.

Investors are cautioned that we have not completed any technical reports, including reserve or resource estimates under Canadian National Instrument 43-101, referred to as “NI 43-101”, with respect to the mine. No final production decision has been made regarding the project in the event we re-take the mine property and any such decision will be based on studies demonstrating economic and technical viability.

We hold a 50% interest in the Pea Ridge Iron Ore Mine, located near Sullivan, Missouri, U.S.A., approximately 70 miles southwest of St. Louis, Missouri, U.S.A, which has not operated since 2001. We are currently conducting additional analysis and investigations in respect of the project. In the first half of 2015, we invested $0.4 million in connection with the project.

Natural Gas Interests

We are active in the energy sector through the development, production and processing of natural gas and NGLs in Western Canada. The majority of such operations are located in the central fairway of the Western Canada Sedimentary Basin, primarily situated in the Province of Alberta. As at June 30, 2015, we had an interest in 886 producing natural gas wells, and 137 producing oil wells and a land position that included 229,279 net working

2

interest undeveloped acres. Our assets are situated in the following areas of the Western Canada Sedimentary Basin: (i) the Rock Creek sands and other Cretaceous sands in the Niton area of Central Alberta; (ii) the Cretaceous and Tertiary sands in Okotoks and Southern Alberta; and (iii) the Mannville sands in the High River area of Southern Alberta.

The Niton area includes multi-zone, liquids-rich, tight gas plays with production to date primarily coming from Rock Creek and Ellerslie sandstones. We have a large number of mineral agreements that cover specific zonal rights in this area. As at June 30, 2015, we had an average 67% working interest in 88,219 gross acres of land to the base of the Rock Creek Member of the Fernie Group. The Niton area has other productive zones that provide opportunities to expand our development base by moving into other geological horizons. These zones lie above the Rock Creek and include the Wilrich and Notikewin sandstones of the Upper Mannville and Spirit River Group.

The Southern Plains is comprised primarily of multi Belly River sands along with upper Edmonton Group coal-bed methane formations. As well, in select areas of Southern Alberta, there are productive Mannville sands. As at June 30, 2015, we controlled approximately 314,300 gross acres of land, which provides a significant multi-year, low risk natural gas drilling inventory. Infrastructure is in place in the area for future production increases.

Our High River asset is primarily a low to medium permeability Basal Quartz channel sandstone pool, which is the Southern Alberta extension of the Lower Cretaceous Deep Basin gas trend.

We also have interests in natural gas infrastructure. Overall, we operate over 33,000 horsepower of compression totaling 160 mmcf/d of available field compression capacity, having over 168 mmcf/d of operated processing capacity and over 1,770 km of pipeline infrastructure in place. Key facilities are as follows:

| • | MFC Sour Gas Processing Plant – We own the MFC sour gas processing plant and gas gathering system through our ownership of MFC Processing Partnership, referred to as “MPP”. The MPP sour gas processing plant is located in the High River area and currently has production capacity of 90 mmcf/d (licensed plant capacity) of sour natural gas and 45 mmcf/d of sweet natural gas. Additionally, final commissioning of the recently installed 16.5 MW natural gas power project at the processing plant is expected in late August 2015. |

| • | High River – In the High River area there is 9,150 horsepower installed with a gas compression capacity of 42.5 mmcf/d and 270 km of pipeline infrastructure in place. Volumes are all produced through the MPP gas gathering system and sour gas processing plant. |

| • | Edson, Niton, and McLeod – This foothills area property has compression capacity of 23 mmcf/d utilizing over 6,400 horsepower, including the MFC Energy’s McLeod River gas processing plant with 23 mmcf/d of capacity with 100% plant ownership. Additionally, there is over 185 km of pipeline infrastructure in the area. In November 2013, we entered into an agreement, referred to as the “Participation Agreement”, with an oil and gas operator, pursuant to which the operator committed to spending a minimum of C$50.0 million to drill a total of 12 net wells over an initial three-year term. Drilling under the Participation Agreement is primarily focused on our undeveloped reserves at Niton. Please see below for further information regarding the Participation Agreement. |

| • | Shallow Gas Properties – Our shallow gas infrastructure consists of over 70 mmcf/d of compression capacity and 10 mmcf/d of processing capacity utilizing 9,000 horsepower with over 670 km of pipeline infrastructure in place. Final processing gas volumes are linked into the Nova/TransCanada pipeline systems at multiple sales locations. |

In the second quarter of 2014, we entered into an agreement with a contractor for the design, construction, supply and installation of a 16.5 MW natural gas power plant at our sour gas processing plant. Upon completion, the plant will supply our processing plant’s electrical needs, with excess power being sold into the grid based on Alberta Electricity System Operator’s rates. The project is designed to cost approximately C$25.0 million, with initial sales of electricity occurring in the second quarter of 2015 and final commissioning expected to occur in August 2015.

In the first half of 2015, we produced 5,807 mmcf of natural gas, 120 mboe of NGLs and 45 mbbl of crude oil, for total production of hydrocarbons of 1,133 mboe, compared to 8,496 mmcf of natural gas, 160 mboe of NGLs and 62 mbbl of crude oil, for total production of hydrocarbons of 1,638 mboe on a net working interest basis in the same period of 2014. We also produced 32 mT of sulphur as a byproduct of our hydrocarbon production activities in the first half of 2015, compared to 26 mT for the same period of 2014. Total production of natural gas, NGLs and crude oil decreased due to natural decline rates and the disposition of non-core gas assets in Southern Alberta in the first quarter of 2015. We did not engage in any drilling or exploration activity in the first half of 2015, other than pursuant to the Participation Agreement described below.

3

The following table sets forth our average sales prices, operating costs, royalty amounts and transportation costs for each of the periods indicated:

Six Months Ended June 30, |

||||||||||||||||||||||||||||||

2015 |

2014 |

|||||||||||||||||||||||||||||

Area |

Natural Gas (C$/mcf) |

NGLs (C$/bbl) |

Crude Oil (C$/bbl) |

Total Hydro- carbons (C$/boe) |

Sulphur (C$/ton) |

Natural Gas (C$/mcf) |

NGLs (C$/bbl) |

Crude Oil (C$/bbl) |

Total Hydro- carbons (C$/boe) |

Sulphur (C$/ton) |

||||||||||||||||||||

Price(1) |

$ | C3.00 | $ | C41.76 | $ | C57.90 | $ | C22.09 | $ | C159.64 | $ | C5.53 | $ | C89.67 | $ | C94.19 | $ | C40.98 | $ | C154.50 | ||||||||||

Royalties |

0.59 | 12.90 | 15.61 | 5.01 | 20.96 | 0.96 | 32.23 | 25.00 | 9.09 | 30.86 | ||||||||||||||||||||

Operating costs(2) |

N/A | N/A | N/A | 13.67 | N/A | N/A | N/A | N/A | 12.71 | N/A | ||||||||||||||||||||

Transportation costs |

0.13 | 5.45 | 1.71 | 1.30 | 60.54 | 0.16 | 6.01 | 2.77 | 1.52 | 66.82 | ||||||||||||||||||||

Notes:

| (1) | Excludes third-party processing fees. |

| (2) | A portion of our natural gas production is associated with crude oil production. As a result, per unit operating costs for each product reflect the allocation of certain common costs. |

Our operating costs per boe increased in the first half of 2015, primarily as a result of fixed costs spread over lower production volumes due to natural declines.

In addition, we generated third party processing revenues of C$2.9 million during the first half of 2015, compared to C$2.0 million in the same period of 2014. The increase in third party processing revenues was primarily a result of additional volumes under the Participation Agreement.

Transportation costs per boe decreased in the first half of 2015, primarily as a result of lower gas transmission rates and trucking and related costs with respect to NGL and oil volumes.

In November 2013, we entered into the Participation Agreement with a natural gas operator, pursuant to which the operator has committed to spending a minimum of C$50.0 million to drill a total of 12 net wells over an initial three-year term. Such drilling is primarily focused on our undeveloped oil and gas properties located in the Niton area of Alberta, Canada. Under the terms of such agreement, the operator pays 100% of the costs required to drill and complete each well. If any of the initial 12 net wells achieves continuous production, we may elect to: (i) participate for up to a 30% interest in the well by reimbursing the operator 25% of the costs of such well; or (ii) receive a 10% gross royalty on production. Additionally, any gas produced from a large proportion of these wells will be processed exclusively by our existing processing facility in the area. We believe that this arrangement provides us with the opportunity to further advance our undeveloped properties at minimal investment risk and, at the same time, provide a potential source of revenue expansion through royalty and processing arrangements. The operator commenced its program under the Participation Agreement in the first quarter of 2014 and, as of June 30, 2015, had completed eight gross wells on our lands in the Niton area. Seven of such wells have been tied in with production from six of such wells flowing through our facilities in the area. We elected to receive the 10% gross royalty on the five producing wells drilled in 2014. The agreement requires a minimum of three wells to be drilled and completed in 2015. The drilling of such wells began in the first half of 2015 and we intend to elect to receive the 10% gross royalty on such production.

In the first half of 2015, we initiated a program to curtail production on certain of our wells with the goal of preserving long-term natural gas reserves during the currently weakened pricing environment. To date, this program has focused on our properties in central Alberta that produce a higher proportion of natural gas liquids because, while we are able to hedge natural gas in a liquid market, we are not able to effectively hedge natural gas liquids.

Trade Finance and Services

Our trade finance and services operations include third-party financing and other services, proprietary investing and our real property.

We utilize our established relationships with international financial institutions, insurers and factoring companies to provide flexible, customized financial tools, extensive credit and risk management and structured solutions for our customers. Working closely with our customers, our professional staff arranges support for hedging and marketing of materials, financing and risk management solutions.

Our trade finance and services activities also include leveraging our marketing and financial experience and relationships to provide marketing services and trade finance services to our customers.

4

Our trade finance and services business generates revenues in the form of corporate and trade finance service fees and interest income. We also realize gains from time to time on our proprietary investments, upon their sale, the execution of an equity or debt restructuring or the completion of other forms of divestment.

We use our financial and management expertise to add or unlock value within a relatively short timeframe. Our trade finance and services activity is generally not passive and we seek investments where our financial expertise and management can add or unlock value. Proprietary investments are generated and made as part of our overall trade finance activities and are realized upon over time, sometimes taking more than one year. In addition, as part of our overall strategy, we often seek to acquire interests or establish relationships with producers to realize upon potential synergies. Such interests can be acquired through purchases of, or investments in, producers, or through contractual arrangements with them, including off-take agreements. To a degree, our trade finance and services and global supply chain businesses supplement each other, which results in synergies in our overall business activities.

Our activities include making proprietary investments through using our own capital and expertise to capture investment opportunities. We seek to participate in many industries, emphasizing those business opportunities where the perceived intrinsic value is not properly recognized. Often such investments are in companies or assets that are under financial, legal or regulatory distress and our services include resolving such distress. These activities take many forms and can include acquiring entire businesses or portions thereof, investing in equity or investing in the existing indebtedness (secured and unsecured) of a business or in new equity or debt issues. Such activities are generally not passive and we invest where we believe our expertise in financial restructuring and management and complementary supply chain and corporate finance capabilities can add or unlock value. Our investments in distressed businesses and/or assets can result in complex and intricate legal issues relating to priorities, claims and other rights of stakeholders. Such issues can result in our being involved in legal and other claims as a result of our overall proprietary investment strategy. Our proprietary investments are often made as a part of, or complementary to, our global supply chain activities.

We consider opportunities where:

| • | our existing participation in marketing and production provides expert insight; |

| • | we can obtain a satisfactory return of future capital investment; and |

| • | there are synergistic benefits with our existing business. Our philosophy is to utilize our financial strength to realize the commercial potential of assets in markets where we have a comprehensive understanding of the drivers of value. |

All Other

Our all other segment includes our corporate and other operating segments and investments, which include financing joint ventures through our China-based subsidiaries and providing medical services, equipment and supplies.

Discussion of Operations

The following discussion and analysis of our financial condition and results of operations for the six and three months ended June 30, 2015 and 2014 should be read in conjunction with our unaudited condensed consolidated financial statements and related notes.

General

We are a global supply chain company that utilizes innovative finance alongside sophisticated customized structured solutions to facilitate the working capital and other requirements of our customers. We also commit our own capital to promising enterprises and invest and otherwise capture investment opportunities for our own account. We seek to invest in businesses or assets whose intrinsic value is not properly reflected in their share price or value. Our investing activities are generally not passive. We actively seek investments where our financial expertise and management can add or unlock value.

Our results of operations have been and may continue to be affected by many factors of a global nature, including economic and market conditions, the availability of capital, the level and volatility of equity prices and interest rates, currency values, asset prices and other market indices, technological changes, the availability of credit, inflation and legislative and regulatory developments. Our results of operations may also be materially affected by competitive factors. Our competitors include firms traditionally engaged in trade finance such as merchant and investment banks, along with other capital sources such as hedge funds, private equity firms, insurance companies and other trade companies engaged in supply chain activities in Europe, Asia and globally.

5

Our results of operations for any particular period may also be materially affected by our realization on proprietary investments. These investments are made to maximize total return through long-term appreciation and recognized gains on divestment. We realize on our proprietary investments through a variety of methods including sales, capital restructuring or other forms of divestment.

A majority of our revenues is derived from our global supply chain operations. The remaining portions are generally derived from financial services, sales of properties and net gains on securities.

We view our net book value per share as a key indicator of our overall financial performance. Our net book value as at the dates indicated is set forth below:

June 30, 2015 |

December 31, 2014 |

|||||

(United States dollars in thousands, except per share amounts) |

||||||

Net book value |

$ | 666,379 | $ | 670,388 | ||

Net book value per share |

10.55 | 10.63 | ||||

Business Environment

Our financial performance is, and our consolidated results in any period can be, materially affected by global economic conditions and financial markets generally.

A favourable business environment is characterized by many factors, including a stable geopolitical climate, transparent financial markets, low inflation, low interest rates, availability of credit, low unemployment, strong business profitability and high business and investor confidence. Unfavourable or uncertain economic and market conditions can be caused by declines in economic growth, business activity or investor or business confidence, limitations on the availability or increase in the cost of credit and capital, increases in inflation, interest rates, exchange rate volatility, outbreaks of hostilities or other geopolitical instability, corporate, political or other scandals that reduce investor confidence in the capital markets or a combination of these or other factors.

Ongoing global economic conditions and uncertainties, including slower economic growth in China and continuing economic uncertainty in Europe, continued to impact markets and cause significant volatility in commodity prices in the first half of 2015. Metals prices generally declined in the first half of 2015 as most remained in surplus. For example, oversupply in the steel sector has negatively impacted prices and supply chain volumes.

Natural gas prices decreased in the second quarter of 2015 with AECO prices averaging approximately 40% lower than in the same period of 2014. Natural gas prices weakened as United States gas production continued to grow while natural gas inventories remained at normal industry levels. From time to time, we may enter into hedging transactions to manage pricing risks for our products. In December 2013, to hedge the volatility and the organically long nature of our natural gas subsidiary, we entered into a short position of long-term New York Mercantile Exchange (NYMEX) natural gas futures with a notional value of approximately $50 million, which were covered during the second and third quarters of 2014. In the first half of 2015, we recommenced hedging our natural gas production with AECO-based Canadian dollar futures to protect against further price declines in the near-term. We currently have approximately 15 months of natural gas production hedged with durations from September 2015 to March 2017.

We operate internationally and therefore our financial performance and position are impacted by changes in the United States dollar, our reporting currency, against the other functional currencies of our international subsidiaries and operations, particularly the Euro and the Canadian dollar. Changes in currency rates affect our financial performance and position because our European and Canadian subsidiaries’ assets, liabilities, revenues and operating costs are denominated in the Euro and the Canadian dollar, respectively. Accordingly, a weakening of the United States dollar against the Euro and Canadian dollar would have the effect of increasing the value of such assets, liabilities, revenues and operating costs when translated into United States dollars, our reporting currency. Conversely, a strengthening of the United States dollar against these currencies would have the effect of decreasing such values.

As at June 30, 2015, the United Sates dollar had strengthened by 8.5% and 7.5% against the Euro and Canadian dollar from the end of 2014. Such strengthening negatively impacted our asset values (net of liabilities) as at June 30, 2015. As a result, we recognized a net $16.9 million currency translation adjustment loss under other comprehensive loss within equity in the first half of 2015, compared to $0.4 million in the comparative period of 2014.

6

Results of Operations

Summary of Quarterly Results

The following tables provide selected unaudited financial information for the most recent eight quarters:

June 30, 2015 |

March 31, 2015 |

December 31, 2014 |

September 30, 2014 |

|||||||||

(United States dollars in thousands, except per share amounts) |

||||||||||||

Net sales |

$ | 372,202 | $ | 331,434 | $ | 389,646 | $ | 389,423 | ||||

Equity income |

2,874 | 3,088 | 1,670 | 2,336 | ||||||||

Gross revenues |

375,076 | 334,522 | 391,316 | 391,759 | ||||||||

Net income (loss)(1) |

6,950 | 6,314 | (18,460 | )(2) |

6,419 | |||||||

Basic earnings (loss), per share |

0.11 | 0.10 | (0.29 | ) |

0.10 | |||||||

Diluted earnings (loss), per share |

0.11 | 0.10 | (0.29 | ) |

0.10 | |||||||

Notes:

| (1) | Net income attributable to our shareholders. |

| (2) | Includes an impairment of interests in resource properties of $28.6 million before an income tax recovery of $7.2 million. |

June 30, 2014(1) |

March 31, 2014 |

December 31, 2013 |

September 30, 2013 |

|||||||||

(United States dollars in thousands, except per share amounts) |

||||||||||||

Net sales |

$ | 394,042 | $ | 229,147 | $ | 220,707 | $ | 213,418 | ||||

Equity income |

3,294 | 2,228 | 1,428 | 2,198 | ||||||||

Gross revenues |

397,336 | 231,375 | 222,135 | 215,616 | ||||||||

Net income (loss)(2) |

7,078 | 5,801 | (12,562 | )(3) |

6,977 | |||||||

Basic earnings (loss), per share |

0.11 | 0.09 | (0.20 | ) |

0.11 | |||||||

Diluted earnings (loss), per share |

0.11 | 0.09 | (0.20 | ) |

0.11 | |||||||

Notes:

| (1) | We commenced consolidation of the operations of F.J. Elsner & Co and FESIL AS from March 31 and April 1, 2014, respectively. |

| (2) | Net income attributable to our shareholders. |

| (3) | Includes an impairment of interests in resource properties of $6.1 million before an income tax recovery of $1.6 million. |

Three Months Ended June 30, 2015 Compared to Three Months Ended June 30, 2014

The following table sets forth our selected operating results and other financial information for each of the periods indicated:

Three Months Ended June 30, |

||||||

2015 |

2014 |

|||||

(United States dollars in thousands, except per share amounts) |

||||||

Net sales |

$ | 372,202 | $ | 394,042 | ||

Gross revenues |

375,076 | 397,336 | ||||

Costs and expenses |

369,851 | 389,341 | ||||

Costs of sales and services |

346,415 | 357,252 | ||||

Selling, general and administrative expenses |

19,171 | 26,625 | (1) |

|||

Finance costs |

4,265 | 5,081 | ||||

Income from operations |

5,225 | 7,995 | ||||

Net income(2) |

6,950 | 7,078 | ||||

Earnings per share: |

||||||

Basic |

0.11 | 0.11 | ||||

Diluted |

0.11 | 0.11 | ||||

Notes:

| (1) | Not including share-based compensation of $0.4 million. |

| (2) | Net income attributable to our shareholders. |

7

The following is a breakdown of our gross revenues by activity for each of the periods indicated:

Three Months Ended June 30, |

||||||

2015 |

2014 |

|||||

(United States dollars in thousands) |

||||||

Gross Revenues: |

||||||

Global supply chain |

$ | 366,708 | $ | 384,504 | ||

Trade finance and services |

1,421 | 6,109 | ||||

All other |

6,947 | 6,723 | ||||

$ | 375,076 | $ | 397,336 | |||

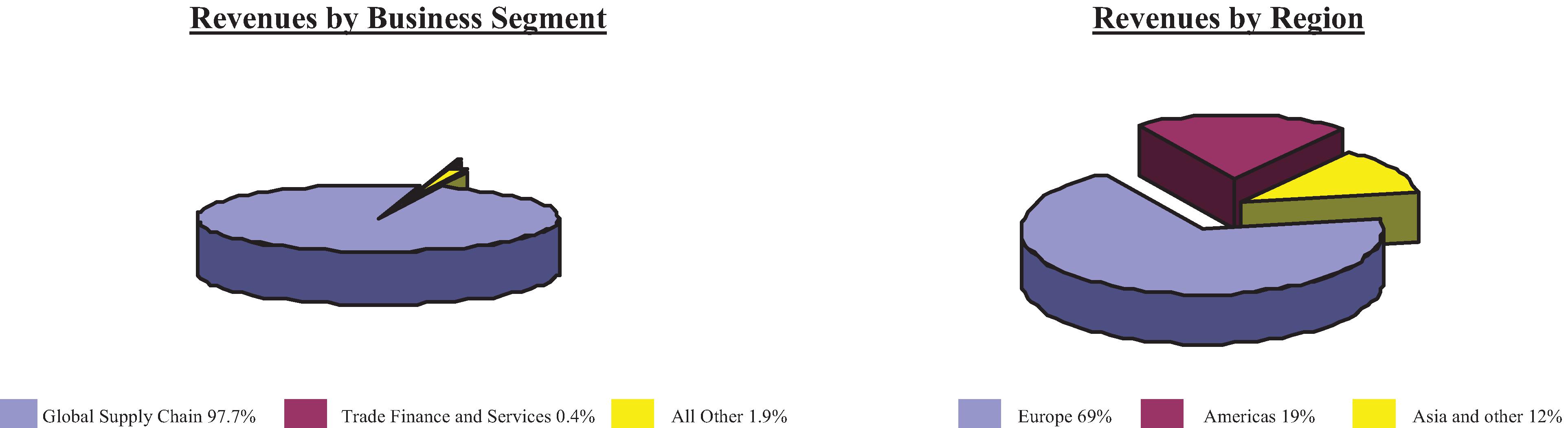

The following charts illustrate our revenues by business segment and geographic distribution in the three months ended June 30, 2015:

Based upon the average exchange rates for the three months ended June 30, 2015, the United States dollar increased by approximately 24.0% and 11.3% in value against the Euro and the Canadian dollar, respectively, compared to the average exchange rates for the same period in 2014. As at June 30, 2015, the United States dollar had increased by approximately 8.5% against the Euro and 7.5% against the Canadian dollar since December 31, 2014.

Revenues for the second quarter of 2015 decreased to $375.1 million (consisting of net sales of $372.2 million and equity income from medical joint ventures of $2.9 million) from $397.3 million (consisting of net sales of $394.0 million and equity income of $3.3 million) in the same quarter of 2014. The decrease in revenues was primarily as a result of a decrease in natural gas prices and volumes and the negative impact of the higher United States dollar against the Euro and Canadian dollar.As a substantial portion of our revenues are generated in Euros and Canadian dollars, the weakening of the Euro and Canadian dollar against the United States dollar negatively impacted our revenues in the second quarter of 2015 when such Euro- and Canadian dollar-denominated revenues were translated to United States dollars.

Revenues for our global supply chain business were $366.7 million for the second quarter of 2015, compared to $384.5 million in the same quarter in 2014, primarily as a result of a decrease in natural gas prices and volumes compared to the comparative period, the negative impact of the higher United States dollar against the Euro and the Canadian dollar. During each of the second quarters of 2015 and 2014, there were no gross revenues generated by our royalty interest.

In late 2014, the operator of the Wabush mine closed the mine and, in the second quarter of 2015, the Wabush mine was included in CCAA proceedings initiated by Cliffs. We reviewed related information and performed a sensitivity analysis on the expected future cash flows from our royalty interest. Based upon our review and impairment analysis, we determined that the fair value of our interest in the Wabush mine was above our current carrying amount, and therefore we concluded that an impairment loss was not required as at June 30, 2015. We continue to monitor the situation as it develops and may re-assess the value of this asset in the future.

Revenues for our trade finance and services business were $1.4 million in the second quarter of 2015, compared to $6.1 million in the same quarter of 2014.

Revenues for our all other segment were $6.9 million in the second quarter of 2015, compared to $6.7 million in the same quarter of 2014.

8

Costs of sales and services decreased to $346.4 million during the second quarter of 2015 from $357.3 million in the same quarter in 2014, primarily as a result the weakening of the Canadian dollar and Euro against the United States dollar. The following is a breakdown of our costs of sales for each of the periods indicated:

Three Months Ended June 30, |

||||||

2015 |

2014 |

|||||

(United States dollars in thousands) |

||||||

Supply chain products and services |

$ | 346,338 | $ | 355,169 | ||

Loss on trading securities |

23 | — | ||||

Credit losses (recovery) on loans and receivables |

89 | (41 | ) |

|||

Gain on derivative instruments, net |

(1,142 | ) |

(1,303 | ) |

||

Market value (increase) decrease on commodity inventories |

(1,470 | ) |

930 | |||

Other |

2,577 | 2,497 | ||||

Total cost of sales and services |

$ | 346,415 | $ | 357,252 | ||

The gain on derivative instruments of $1.1 million in the second quarter of 2015 stemmed from commodity (including natural gas futures) and currency derivatives (see “Discussion of Operations - Business Environment” for additional information).

Selling, general and administrative expenses decreased to $19.2 million in the second quarter of 2015 from $26.6 million in the same quarter of 2014, primarily due to the weakening of the Canadian dollar and Euro against the United States dollar in 2015 and the payments of certain restructuring and severance expenses in 2014.

In the second quarter of 2015, finance costs decreased to $4.3 million from $5.1 million in the same quarter of 2014 as a result of the weakening of the Euro against the United States dollar and a reduction in short-term borrowings.

In the second quarter of 2015, we recognized a net foreign currency transaction loss of $2.0 million, compared to a net foreign currency transaction gain of $2.6 million in the same quarter of 2014, in the consolidated statement of operations.

We recognized an income tax recovery (other than resource property revenue taxes) of $3.9 million in the second quarter of 2015, compared to an income tax expense of $3.3 million in the same quarter of 2014. Our statutory tax rate was 26% in each of the second quarters of 2015 and 2014. The income tax paid in cash (excluding resource property revenue taxes) during the second quarter of 2015 was $0.9 million, compared to $0.8 million in the same quarter of 2014. The income tax recovery in 2015 is attributable to the enacted increase in the corporation tax rate on our deferred tax assets in a Canadian jurisdiction.

In the second quarter of 2015, our income attributable to shareholders was $7.0 million, or $0.11 per share on a basic and diluted basis, compared to $7.1 million, or $0.11 per share on a basic and diluted basis, in the same quarter of 2014.

For the second quarter of 2015, our Operating EBITDA decreased by 38% to $13.6 million from $21.8 million for the same quarter of 2014. Operating EBITDA is defined as earnings before interest, taxes, depreciation, depletion, amortization and impairment. Operating EBITDA is not a measure of financial performance under IFRS and should not be considered in isolation or as a substitute for analysis of our results as reported under IFRS.

The following is a reconciliation of our net income to Operating EBITDA.

Three Months Ended June 30, |

||||||

2015 |

2014 |

|||||

Operating EBITDA |

(United States dollars in thousands) |

|||||

Net income(1) |

$ | 7,154 | $ | 7,184 | ||

Income tax (recovery) expense |

(3,916 | ) |

3,344 | |||

Finance costs |

4,265 | 5,081 | ||||

Amortization, depreciation and depletion |

6,110 | 6,217 | ||||

Operating EBITDA(2) |

$ | 13,613 | $ | 21,826 | ||

Notes:

| (1) | Includes net income attributable to non-controlling interests. |

| (2) | There were no impairments in the first three months of 2015 and 2014. |

Please see “Non-IFRS Financial Measures” for additional information.

9

Six Months Ended June 30, 2015 Compared to Six Months Ended June 30, 2014

The following table sets forth our selected operating results and other financial information for each of the periods indicated:

Six Months Ended June 30, |

||||||

2015 |

2014(1) |

|||||

(United States dollars in thousands, except per share amounts) |

||||||

Net sales |

$ | 703,636 | $ | 623,189 | ||

Gross revenues |

709,598 | 628,711 | ||||

Costs and expenses |

695,347 | 607,961 | ||||

Costs of sales and services |

649,786 | 554,801 | ||||

Selling, general and administrative expenses |

36,507 | 44,000 | (2) |

|||

Finance costs |

9,054 | 8,777 | ||||

Income from operations |

14,251 | 20,750 | ||||

Net income(3) |

13,264 | 12,879 | ||||

Earnings per share: |

||||||

Basic |

0.21 | 0.21 | ||||

Diluted |

0.21 | 0.21 | ||||

Notes:

| (1) | We commenced consolidation of the operations of F.J. Elsner & Co and FESIL AS from March 31 and April 1, 2014, respectively. |

| (2) | Not including share-based compensation of $0.4 million. |

| (3) | Net income attributable to our shareholders. |

The following is a breakdown of our gross revenues by activity for each of the periods indicated:

Six Months Ended June 30, |

||||||

2015 |

2014 |

|||||

(United States dollars in thousands) |

||||||

Gross Revenues: |

||||||

Global supply chain |

$ | 693,479 | $ | 605,542 | ||

Trade finance and services |

2,558 | 9,377 | ||||

All other |

13,561 | 13,792 | ||||

$ | 709,598 | $ | 628,711 | |||

The following charts illustrate our revenues by business segment and geographic distribution in the six months ended June 30, 2015:

Based upon the average exchange rates for the six months ended June 30, 2015, the United States dollar increased by approximately 22.9% and 12.6% in value against the Euro and the Canadian dollar, respectively, compared to the average exchange rates for the same period in 2014. As at June 30, 2015, the United States dollar had increased by approximately 8.5% against the Euro and 7.5% against the Canadian dollar since December 31, 2014.

10

Revenues for the first half of 2015 increased to $709.6 million (consisting of net sales of $703.6 million and equity income from medical joint ventures of $6.0 million) from $628.7 million (consisting of net sales of $623.2 million and equity income of $5.5 million) in the same period of 2014, primarily as a result of the consolidation of our acquisitions in the second quarter of 2014, partially offset by a decrease in natural gas prices and volumes and the negative impact of the higher United States dollar against the Euro and Canadian dollar. As a substantial portion of our revenues are generated in Euros and Canadian dollars, the weakening of the Euro and Canadian dollar against the United States dollar negatively impacted our revenues in the first half of 2015 when such Euro-and Canadian dollar-denominated revenues were translated to United States dollars.

Revenues for our global supply chain business were $693.5 million for the first half of 2015, compared to $605.5 million in the same period in 2014, primarily as a result of the consolidation of our acquisitions in the second quarter of 2014, partially offset by a decrease in natural gas prices and volumes compared to the comparative period and the negative impact of the higher United States dollar against the Euro and the Canadian dollar. During the first half of 2015, gross revenues generated by our royalty interest decreased to $0.7 million (representing one quarter’s minimum royalty payment) from $3.0 million in the same period of 2014.

In late 2014, the operator of the Wabush mine closed the mine and, in the second quarter of 2015, the Wabush mine was included in CCAA proceedings initiated by Cliffs. We reviewed related information and performed a sensitivity analysis on the expected future cash flows from our royalty interest. Based upon our review and impairment analysis, we determined that the fair value of our interest in the Wabush mine was above our current carrying amount, and therefore we concluded that an impairment loss was not required as at June 30, 2015. We continue to monitor the situation as it develops and may re-assess the value of this asset in the future.

Revenues for our trade finance and services business were $2.6 million in the first half of 2015, compared to $9.4 million in the same period of 2014.

Revenues for our all other segment were $13.6 million in the first half of 2015, compared to $13.8 million in the same period of 2014.

Costs of sales and services increased to $649.8 million during the first half of 2015 from $554.8 million for the same period in 2014, primarily as a result of the consolidation of our acquisitions in the second quarter of 2014. The following is a breakdown of our costs of sales for each of the periods indicated:

Six Months Ended June 30, |

||||||

2015 |

2014 |

|||||

(United States dollars in thousands) |

||||||

Supply chain products and services |

$ | 645,921 | $ | 548,799 | ||

Loss on trading securities |

45 | — | ||||