Form 6-K Itau Unibanco Holding For: May 05

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of

May 2016

Commission File Number: 001-15276

Itaú Unibanco Holding S.A.

(Exact name of registrant as specified in its charter)

Itaú Unibanco Holding S.A.

(Translation of Registrant’s Name into English)

Praça Alfredo Egydio de Souza Aranha, 100-Torre Conceicao - CEP

04344-902 São Paulo, SP, Brazil

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F: x Form 40-F: ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes: ¨ No: x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes: ¨ No: x

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes: ¨ No: x

If

“Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

82-___________________.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Itaú Unibanco Holding S.A. | ||||

| (Registrant) | ||||

| Date: May 5, 2016 | By: | /s/ Marcelo Kopel | ||

| Name: | Marcelo Kopel | |||

| Title: | Investor Relations Officer | |||

| By: | /s/ Eduardo Mazzilli de Vassimon | |||

| Name: | Eduardo Mazzilli de Vassimon | |||

| Title: | Chief Financial Officer | |||

EXHIBIT INDEX

| 99.1 |

1st quarter of 2016 Management Discussion & Analysis |

Exhibit 99.1

(This page was intentionally left blank)

| Itaú Unibanco Holding S.A. | 04 |

| Management Discussion & Analysis | Executive Summary |  |

Itaú Unibanco Holding S.A. (Itaú Unibanco) information and financial indicators are presented below.

Highlights

| In R$ millions (except where indicated), end of period | 1Q16 | 4Q15 | 1Q15 | |||||||||

| Results | ||||||||||||

| Recurring Net Income | 5,235 | 5,773 | 5,808 | |||||||||

| Net Income | 5,184 | 5,698 | 5,733 | |||||||||

| Operating Revenues (1) | 25,867 | 26,680 | 24,946 | |||||||||

| Managerial Financial Margin (2) | 16,557 | 16,764 | 15,963 | |||||||||

| Shares | ||||||||||||

| Recurring Net Income per share (R$) (3) | 0.88 | 0.97 | 0.97 | |||||||||

| Net Income per share (R$) (3) | 0.88 | 0.96 | 0.95 | |||||||||

| Number of Outstanding Shares at the end of period – in thousands (4) | 5,928,684 | 5,921,351 | 6,015,886 | |||||||||

| Average price of non-voting share on the last trading day of the period (R$) (4) | 31.27 | 26.30 | 32.03 | |||||||||

| Book Value per Share (R$) | 17.99 | 17.98 | 16.12 | |||||||||

| Dividends and Interest on Own Capital net of taxes (5) | 1,012 | 3,429 | 1,319 | |||||||||

| Dividends and Interest on Own Capital net of taxes (5) per share (R$) (*) | 0.17 | 0.58 | 0.22 | |||||||||

| Market Capitalization (6) | 185,390 | 155,732 | 192,672 | |||||||||

| Market Capitalization (6) (US$ millions) | 52,092 | 39,882 | 60,060 | |||||||||

| Performance | ||||||||||||

| Recurring Return on Average Equity – Annualized (7) | 19.9 | % | 22.3 | % | 24.5 | % | ||||||

| Return on Average Equity – Annualized (7) | 19.7 | % | 22.0 | % | 24.2 | % | ||||||

| Recurring Return on Average Assets – Annualized (8) | 1.6 | % | 1.7 | % | 1.9 | % | ||||||

| Return on Average Assets – Annualized (8) | 1.6 | % | 1.7 | % | 1.8 | % | ||||||

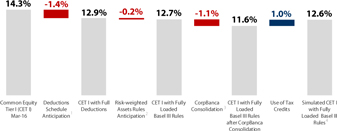

| Solvency Ratio - Prudential Conglomerate (BIS Ratio) | 17.7 | % | 17.8 | % | 15.3 | % | ||||||

| Common Equity Tier I | 14.3 | % | 14.0 | % | 11.6 | % | ||||||

| Estimated BIS III (Common Equity Tier I) - Full Implementation of BIS III (9) | 12.6 | % | 13.6 | % | 11.4 | % | ||||||

| Annualized Net Interest Margin of Spread-Sensitive Operations (10) | 11.1 | % | 11.0 | % | 10.6 | % | ||||||

| Annualized Net Interest Margin with Clients (10) | 10.9 | % | 10.9 | % | 10.5 | % | ||||||

| Annualized Net Interest Margin of Spread-Sensitive Operations after Provision for Credit Risk (10) | 5.5 | % | 7.1 | % | 6.7 | % | ||||||

| Annualized Net Interest Margin with Clients after Provision for Credit Risk (10) | 6.1 | % | 7.5 | % | 7.0 | % | ||||||

| Nonperforming Loans Index (NPL over 90 days) | 3.9 | % | 3.5 | % | 3.0 | % | ||||||

| Nonperforming Loans Index (NPL 15 to 90 days) | 3.1 | % | 2.6 | % | 2.9 | % | ||||||

| Coverage Ratio (Provision for Loan Losses/NPL over 90 days) | 210 | % | 208 | % | 200 | % | ||||||

| Efficiency Ratio (ER) (11) | 43.0 | % | 45.5 | % | 43.2 | % | ||||||

| Risk-Adjusted Efficiency Ratio (RAER) (11) | 69.9 | % | 64.5 | % | 62.7 | % | ||||||

| Balance Sheet | ||||||||||||

| Total Assets | 1,283,071 | 1,359,172 | 1,294,613 | |||||||||

| Total Credit Portfolio, including Sureties and Endorsements | 517,484 | 548,073 | 543,394 | |||||||||

| Loan Portfolio (A) | 445,467 | 473,829 | 468,105 | |||||||||

| Sureties, Endorsements and Guarantees | 72,017 | 74,244 | 75,289 | |||||||||

| Deposits + Debentures + Securities + Borrowings and Onlending (B) (12) | 610,234 | 648,664 | 584,649 | |||||||||

| Loan Portfolio/Funding (A/B) | 73.0 | % | 73.0 | % | 80.1 | % | ||||||

| Stockholders' Equity | 106,647 | 106,462 | 96,954 | |||||||||

| Other | ||||||||||||

| Assets Under Administration | 807,267 | 765,102 | 694,824 | |||||||||

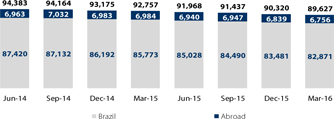

| Total Number of Employees | 89,627 | 90,320 | 92,757 | |||||||||

| Brazil | 82,871 | 83,481 | 85,773 | |||||||||

| Abroad | 6,756 | 6,839 | 6,984 | |||||||||

| Branches and CSBs – Client Service Branches | 4,921 | 4,985 | 5,032 | |||||||||

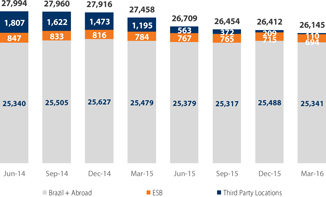

| ATM – Automated Teller Machines (13) | 26,145 | 26,412 | 27,458 | |||||||||

| Indicators | ||||||||||||

| EMBI Brazil Risk | 409 | 517 | 319 | |||||||||

| CDI rate – In the Period (%) | 3.2 | % | 3.4 | % | 2.8 | % | ||||||

| Dollar Exchange Rate – Quotation in R$ | 3.5589 | 3.9048 | 3.2080 | |||||||||

| Dollar Exchange Rate – Change in the Period (%) | -8.9 | % | -1.7 | % | 20.8 | % | ||||||

| Euro Exchange Rate – Quotation in R$ | 4.0539 | 4.2504 | 3.4457 | |||||||||

| Euro Exchange Rate – Change in the Period (%) | -4.6 | % | -4.2 | % | 6.8 | % | ||||||

| IGP-M – In the Period (%) | 3.0 | % | 3.9 | % | 2.0 | % | ||||||

(*) The number of outstanding shares was adjusted to reflect the share bonus of 10% granted on June 05, 2014 and July 17, 2015.

Note: (1) Operating Revenues are the sum of Managerial Financial Margin, Commissions and Fees, Other Operating Income and Result from Insurance, Pension Plan and Premium Bonds Operations Before Retained Claims and Selling Expenses; (2) Described on pages 16 to 17; (3) Calculated based on the weighted average number of outstanding shares; (4) The number of outstanding shares was adjusted to reflect the share bonus of 10% granted on June 05, 2014 and July 17, 2015; (5) IOC – Interest on Capital. Declared amounts paid/accrued; (6) Total number of outstanding shares (common and non-voting shares) multiplied by the average price of non-voting share on the last trading day in the period; (7) Annualized Return was calculated by dividing Net Income by Average Stockholders’ Equity. The quotient of this division was multiplied by the number of periods in the year to derive the annualized rate. The calculation bases of returns were adjusted by the amount of dividends that has not yet been approved at shareholders’ or Board meetings, proposed after the balance sheet closing date; (8) Return was calculated by dividing Net Income by Average Assets. The quotient of this division was multiplied by the number of periods in the year to derive the annualized rate; (9) Takes into consideration the use of tax credit; (10) Does not include financial margin with the market. See details on page 17; (11) For further details on the calculation methodology of both Efficiency and Risk-Adjusted Efficiency ratios, please refer to page 34; (12) As described on page 38; (13) Includes ESBs (electronic service branches) and service points at third parties’ establishments.

| Itaú Unibanco Holding S.A. | 05 |

| Management Discussion & Analysis | Executive Summary |  |

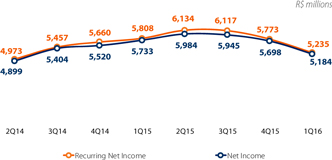

Net Income and Recurring Net Income

Our recurring net income totaled R$5,235 million in the first quarter of 2016 as a result of the elimination of non-recurring events, which are presented in the table below, from net income of R$5,184 million for the period.

Non-Recurring Events Net of Tax Effects

| In R$ millions | 1Q16 | 4Q15 | 1Q15 | |||||||||

| Recurring Net Income | 5,235 | 5,773 | 5,808 | |||||||||

| Non-Recurring Events | (51 | ) | (75 | ) | (75 | ) | ||||||

| Contingencies Provision (a) | (25 | ) | (28 | ) | (42 | ) | ||||||

| Goodwill Amortization (b) | (32 | ) | (32 | ) | (60 | ) | ||||||

| Program for Settlement or Installment Payment of Taxes (c) | 12 | (4 | ) | 27 | ||||||||

| Impairment (d) | - | (7 | ) | - | ||||||||

| Porto Seguro (e) | - | 17 | - | |||||||||

| Other | (6 | ) | (20 | ) | - | |||||||

| Net Income | 5,184 | 5,698 | 5,733 | |||||||||

Note: The impacts of the non-recurring events, described above, are net of tax effects – further details are presented in Note 22-K of the Financial Statements.

Non-Recurring Events

(a) Contingencies Provision: Recognition of provisions for tax and social security lawsuits and losses arising from economic plans in effect in Brazil during the 1980's.

(b) Goodwill Amortization: Effect of the goodwill amortization generated by acquisitions made by the Conglomerate.

(c) Program for the Settlement or Installment Payment of Taxes: Effects of our adherence to the Program for the Settlement or Installment Payment of Federal and Municipal Taxes.

(d) Impairment: Adjustment in the carrying amount of assets in order to reflect its fair value.

(e) Porto Seguro: Effect on the balance of the social contribution tax credit resulting from the rate increase in proportion to our stake in the company.

Managerial Income Statement

We apply consolidation criteria for the managerial results that affect only the breakdown of accounts and, therefore, do not affect net income. These effects are shown in the table on the following page ("Accounting and Managerial Statements Reconciliation"). Additionally, we adjusted the tax effects of the hedges of investments abroad - originally accounted for as tax expenses (PIS and COFINS) and income tax and social contribution on net income and then reclassified to the financial margin - and non-recurring events.

Our strategy for the foreign exchange risk management of the capital invested abroad is aimed at mitigating, through financial instruments, the effects resulting from foreign exchange variations and takes into consideration the impact of all tax effects. In the first quarter of 2016, the Brazilian real appreciated 8.9% against the U.S. dollar and 4.6% against the Euro, compared with appreciations of 1.7% and 4.2%, respectively, in the previous quarter.

Highlights

On April 1st, 2016, pursuant the agreement disclosed to the market as material information on January 29, 2014, we announced the consummation of the merger of operations between Banco Itaú Chile and CorpBanca, after obtaining all the corporate and regulatory approvals required. Accordingly, we now hold the control of the resulting bank (Itaú CorpBanca) with a 33.58% stake in its capital.

The completion of the merger represents an important step in our internationalization process and in our purpose of being a leading bank in Latin America.

| Itaú Unibanco Holding S.A. | 06 |

| Management Discussion & Analysis | Executive Summary |  |

Accounting and Managerial Income Statements reconciliation for the past two quarters is presented below.

Accounting and Managerial Statements Reconciliation | 1st Quarter of 2016

| In R$ millions | Accounting | Non-recurring Events | Tax Effect of Hedge | Managerial Reclassifications | Managerial | |||||||||||||||

| Operating Revenues | 29,234 | 53 | (3,093 | ) | (326 | ) | 25,867 | |||||||||||||

| Managerial Financial Margin | 19,573 | 64 | (3,093 | ) | 14 | 16,557 | ||||||||||||||

| Financial Margin with Clients | 14,743 | 64 | - | 14 | 14,820 | |||||||||||||||

| Financial Margin with the Market | 4,830 | - | (3,093 | ) | - | 1,737 | ||||||||||||||

| Commissions and Fees | 7,729 | - | - | (560 | ) | 7,169 | ||||||||||||||

| Result from Insurance, Pension Plan and Premium Bonds Operations Before Retained Claims and Selling Expenses | 1,584 | - | - | 557 | 2,141 | |||||||||||||||

| Other Operating Income | 200 | (11 | ) | - | (189 | ) | - | |||||||||||||

| Equity in Earnings of Affiliates and Other Investments | 132 | - | - | (132 | ) | - | ||||||||||||||

| Non-operating Income | 16 | - | - | (16 | ) | - | ||||||||||||||

| Result from Loan Losses | (6,364 | ) | - | - | (38 | ) | (6,402 | ) | ||||||||||||

| Provision for Loan Losses | (7,193 | ) | - | - | (38 | ) | (7,231 | ) | ||||||||||||

| Recovery of Loans Written Off as Losses | 829 | - | - | 0 | 829 | |||||||||||||||

| Retained Claims | (394 | ) | - | - | - | (394 | ) | |||||||||||||

| Other Operating Income/(Expenses) | (12,660 | ) | 52 | 370 | 312 | (11,926 | ) | |||||||||||||

| Non-interest Expenses | (10,607 | ) | 52 | - | 340 | (10,215 | ) | |||||||||||||

| Tax Expenses for ISS, PIS, Cofins and Other Taxes | (1,857 | ) | - | 370 | (28 | ) | (1,515 | ) | ||||||||||||

| Insurance Selling Expenses | (196 | ) | - | - | - | (196 | ) | |||||||||||||

| Income before Tax and Profit Sharing | 9,816 | 105 | (2,722 | ) | (53 | ) | 7,145 | |||||||||||||

| Income Tax and Social Contribution | (4,529 | ) | (53 | ) | 2,722 | 14 | (1,846 | ) | ||||||||||||

| Profit Sharing | (39 | ) | - | - | 39 | - | ||||||||||||||

| Minority Interests | (64 | ) | - | - | - | (64 | ) | |||||||||||||

| Net Income | 5,184 | 51 | - | - | 5,235 | |||||||||||||||

Accounting and Managerial Statements Reconciliation | 4th Quarter of 2015

| In R$ millions | Accounting | Non-recurring Events | Tax Effect of Hedge | Managerial Reclassifications | Managerial | |||||||||||||||

| Operating Revenues | 27,543 | (202 | ) | (499 | ) | (162 | ) | 26,680 | ||||||||||||

| Managerial Financial Margin | 17,051 | 23 | (499 | ) | 189 | 16,764 | ||||||||||||||

| Financial Margin with Clients | 15,283 | 23 | - | 189 | 15,495 | |||||||||||||||

| Financial Margin with the Market | 1,768 | - | (499 | ) | - | 1,269 | ||||||||||||||

| Commissions and Fees | 8,201 | - | - | (556 | ) | 7,645 | ||||||||||||||

| Result from Insurance, Pension Plan and Premium Bonds Operations Before Retained Claims and Selling Expenses | 1,849 | (205 | ) | - | 627 | 2,271 | ||||||||||||||

| Other Operating Income | 277 | (3 | ) | - | (274 | ) | - | |||||||||||||

| Equity in Earnings of Affiliates and Other Investments | 194 | (17 | ) | - | (177 | ) | - | |||||||||||||

| Non-operating Income | (30 | ) | - | - | 30 | - | ||||||||||||||

| Result from Loan Losses | (4,384 | ) | - | - | (250 | ) | (4,634 | ) | ||||||||||||

| Provision for Loan Losses | (5,866 | ) | - | - | (250 | ) | (6,116 | ) | ||||||||||||

| Recovery of Loans Written Off as Losses | 1,482 | - | - | - | 1,482 | |||||||||||||||

| Retained Claims | (406 | ) | - | - | - | (406 | ) | |||||||||||||

| Other Operating Income/(Expenses) | (13,699 | ) | 312 | 80 | 349 | (12,959 | ) | |||||||||||||

| Non-interest Expenses | (11,782 | ) | 302 | - | 361 | (11,119 | ) | |||||||||||||

| Tax Expenses for ISS, PIS, Cofins and Other Taxes | (1,660 | ) | 10 | 80 | (13 | ) | (1,582 | ) | ||||||||||||

| Insurance Selling Expenses | (258 | ) | - | - | - | (258 | ) | |||||||||||||

| Income before Tax and Profit Sharing | 9,053 | 110 | (419 | ) | (64 | ) | 8,680 | |||||||||||||

| Income Tax and Social Contribution | (3,191 | ) | (35 | ) | 419 | (8 | ) | (2,815 | ) | |||||||||||

| Profit Sharing | (72 | ) | - | - | 72 | - | ||||||||||||||

| Minority Interests | (92 | ) | - | - | - | (92 | ) | |||||||||||||

| Net Income | 5,698 | 75 | - | - | 5,773 | |||||||||||||||

| Itaú Unibanco Holding S.A. | 07 |

| Management Discussion & Analysis | Executive Summary |  |

We present below the income statement from a standpoint that highlights Operating Revenues, which is composed by the sum of the main accounts in which revenues from banking, insurance, pension plan and premium bonds operations are recorded.

Income Statement | Operating Revenues Perspective

| In R$ millions | 1Q16 | 4Q15 | change | 1Q15 | change | |||||||||||||||||||||||

| Operating Revenues | 25,867 | 26,680 | (812 | ) | -3.0 | % | 24,946 | 921 | 3.7 | % | ||||||||||||||||||

| Managerial Financial Margin | 16,557 | 16,764 | (207 | ) | -1.2 | % | 15,963 | 594 | 3.7 | % | ||||||||||||||||||

| Financial Margin with Clients | 14,820 | 15,495 | (675 | ) | -4.4 | % | 14,092 | 728 | 5.2 | % | ||||||||||||||||||

| Financial Margin with the Market | 1,737 | 1,269 | 468 | 36.9 | % | 1,871 | (134 | ) | -7.1 | % | ||||||||||||||||||

| Commissions and Fees | 7,169 | 7,645 | (476 | ) | -6.2 | % | 6,867 | 303 | 4.4 | % | ||||||||||||||||||

| Result from Insurance, Pension Plan and Premium Bonds Operations Before Retained Claims and Selling Expenses | 2,141 | 2,271 | (130 | ) | -5.7 | % | 2,117 | 25 | 1.2 | % | ||||||||||||||||||

| Result from Loan Losses | (6,402 | ) | (4,634 | ) | (1,768 | ) | 38.1 | % | (4,455 | ) | (1,947 | ) | 43.7 | % | ||||||||||||||

| Provision for Loan Losses | (7,231 | ) | (6,116 | ) | (1,115 | ) | 18.2 | % | (5,515 | ) | (1,716 | ) | 31.1 | % | ||||||||||||||

| Recovery of Loans Written Off as Losses | 829 | 1,482 | (652 | ) | -44.0 | % | 1,060 | (231 | ) | -21.8 | % | |||||||||||||||||

| Retained Claims | (394 | ) | (406 | ) | 12 | -3.0 | % | (368 | ) | (26 | ) | 7.0 | % | |||||||||||||||

| Operating Margin | 19,071 | 21,639 | (2,568 | ) | -11.9 | % | 20,123 | (1,052 | ) | -5.2 | % | |||||||||||||||||

| Other Operating Income/(Expenses) | (11,926 | ) | (12,959 | ) | 1,033 | -8.0 | % | (11,602 | ) | (324 | ) | 2.8 | % | |||||||||||||||

| Non-interest Expenses | (10,215 | ) | (11,119 | ) | 904 | -8.1 | % | (9,881 | ) | (334 | ) | 3.4 | % | |||||||||||||||

| Tax Expenses for ISS, PIS, Cofins and Other Taxes | (1,515 | ) | (1,582 | ) | 67 | -4.2 | % | (1,455 | ) | (60 | ) | 4.1 | % | |||||||||||||||

| Insurance Selling Expenses | (196 | ) | (258 | ) | 62 | -24.1 | % | (266 | ) | 70 | -26.4 | % | ||||||||||||||||

| Income before Tax and Minority Interests | 7,145 | 8,680 | (1,535 | ) | -17.7 | % | 8,520 | (1,375 | ) | -16.1 | % | |||||||||||||||||

| Income Tax and Social Contribution | (1,846 | ) | (2,815 | ) | 969 | -34.4 | % | (2,607 | ) | 761 | -29.2 | % | ||||||||||||||||

| Minority Interests in Subsidiaries | (64 | ) | (92 | ) | 28 | -30.4 | % | (105 | ) | 41 | -39.2 | % | ||||||||||||||||

| Recurring Net Income | 5,235 | 5,773 | (538 | ) | -9.3 | % | 5,808 | (573 | ) | -9.9 | % | |||||||||||||||||

We present below the income statement from the standpoint that highlights the Managerial Financial Margin.

Income Statement | Managerial Financial Margin Perspective

| In R$ millions | 1Q16 | 4Q15 | change | 1Q15 | change | |||||||||||||||||||||||

| Managerial Financial Margin | 16,557 | 16,764 | (207 | ) | -1.2 | % | 15,963 | 594 | 3.7 | % | ||||||||||||||||||

| Financial Margin with Clients | 14,820 | 15,495 | (675 | ) | -4.4 | % | 14,092 | 728 | 5.2 | % | ||||||||||||||||||

| Financial Margin with the Market | 1,737 | 1,269 | 468 | 36.9 | % | 1,871 | (134 | ) | -7.1 | % | ||||||||||||||||||

| Result from Loan Losses | (6,402 | ) | (4,634 | ) | (1,768 | ) | 38.1 | % | (4,455 | ) | (1,947 | ) | 43.7 | % | ||||||||||||||

| Provision for Loan Losses | (7,231 | ) | (6,116 | ) | (1,115 | ) | 18.2 | % | (5,515 | ) | (1,716 | ) | 31.1 | % | ||||||||||||||

| Recovery of Loans Written Off as Losses | 829 | 1,482 | (652 | ) | -44.0 | % | 1,060 | (231 | ) | -21.8 | % | |||||||||||||||||

| Net Result from Financial Operations | 10,155 | 12,130 | (1,975 | ) | -16.3 | % | 11,508 | (1,353 | ) | -11.8 | % | |||||||||||||||||

| Other Operating Income/(Expenses) | (3,010 | ) | (3,450 | ) | 439 | -12.7 | % | (2,988 | ) | (22 | ) | 0.7 | % | |||||||||||||||

| Commissions and Fees | 7,169 | 7,645 | (476 | ) | -6.2 | % | 6,867 | 303 | 4.4 | % | ||||||||||||||||||

| Result from Insurance, Pension Plan and Premium Bonds Operations | 1,551 | 1,607 | (55 | ) | -3.5 | % | 1,482 | 69 | 4.7 | % | ||||||||||||||||||

| Non-interest Expenses | (10,215 | ) | (11,119 | ) | 904 | -8.1 | % | (9,881 | ) | (334 | ) | 3.4 | % | |||||||||||||||

| Tax Expenses for ISS, PIS, Cofins and Other Taxes | (1,515 | ) | (1,582 | ) | 67 | -4.2 | % | (1,455 | ) | (60 | ) | 4.1 | % | |||||||||||||||

| Income before Tax and Minority Interests | 7,145 | 8,680 | (1,535 | ) | -17.7 | % | 8,520 | (1,375 | ) | -16.1 | % | |||||||||||||||||

| Income Tax and Social Contribution | (1,846 | ) | (2,815 | ) | 969 | -34.4 | % | (2,607 | ) | 761 | -29.2 | % | ||||||||||||||||

| Minority Interests in Subsidiaries | (64 | ) | (92 | ) | 28 | -30.4 | % | (105 | ) | 41 | -39.2 | % | ||||||||||||||||

| Recurring Net Income | 5,235 | 5,773 | (538 | ) | -9.3 | % | 5,808 | (573 | ) | -9.9 | % | |||||||||||||||||

| Itaú Unibanco Holding S.A. | 08 |

| Management Discussion & Analysis | Executive Summary |  |

Net Income

The recurring net income for the first quarter of 2016 amounted to R$5,235 million, representing a decrease of 9.3% from the previous quarter and of 9.9% from the same period of the previous year.

The main positive highlights in the quarter when compared to the previous quarter were the 36.9% increase in our financial margin with the market and the 8.1% decrease in non-interest expenses.

These positive highlights were more than offset by the 18.2% increase in provision for loan losses and by the 44.0% decrease in income from recovery of loans written off as losses.

Return on Average Equity

The annualized recurring return on average equity reached 19.9% in the first quarter of 2016. Stockholders’ equity reached R$106.6 billion, a 0.2% increase from the previous quarter. In this quarter, stockholders’ equity was impacted by the payment of additional interest on capital in the amount of R$2,697 million.

Annualized recurring return on average assets reached 1.6% in the first quarter of 2016, decreasing 10 basis points from the previous quarter.

Operating Revenues

In the first quarter of 2016, operating revenues, representing revenues from banking, and insurance, pension plan and premium bonds operations, totaled R$25,867 million, a 3.0% decrease from the previous quarter and a 3.7% increase from the same period of the previous year. The main components of operating revenues and other items of income statement are presented ahead.

Managerial Financial Margin

The managerial financial margin for the first quarter of 2016 totaled R$16,557 million, a decrease of R$207 million compared to the previous quarter, mainly due to the decrease of R$675 million in our financial margin with clients, basically as a result of lower volumes and lower number of calendar days. Our financial margin with the market increased R$468 million in the quarter.

Compared to the first quarter of 2015, our managerial financial margin increased 3.7%. This growth was due to the increase of R$728 million in financial margin with clients and to the reduction of R$134 million in financial margin with the market.

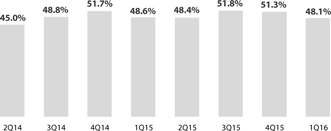

Financial Margin of Spread-Sensitive Operations, net of the Provision from Loan Losses

Our financial margin of spread-sensitive operations, net of provision for loan losses and recovery of loans written off as losses, decreased 24.4% from the previous quarter. The ratio of the provision for loan losses, net of recovery of loans written off as losses, to the spread-sensitive operations financial margin reached 48.5% this quarter, increasing 1,450 basis points compared to the previous quarter.

| Itaú Unibanco Holding S.A. | 09 |

| Management Discussion & Analysis | Executive Summary |  |

Result from Loan Losses

The result from loan losses, net of recovery of credits, grew 38.1% compared to the previous quarter, totaling R$6,402 million in the quarter. This increase was due to the 18.2% (R$1,115 million) increase in provision for loan losses, partially due to provisions for non-overdue operations (generic allowance), as a result of a more challenging economic scenario. Furthermore, our income from recovery of loans written off as losses decreased 44.0% (R$652 million), due to the positive effect in the previous quarter related to the restructuring of one operation of a specific group in the corporate segment which had been written off as a loss.

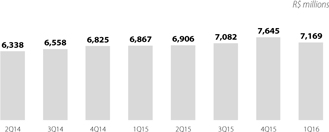

Commissions and Fees

Commissions and fees increased 4.4% when compared to the same quarter of the previous year, mainly driven by higher revenues from credit card and current account services. The reduction in the first quarter of 2016 compared to the prior quarter was mainly due to the typical seasonality of the period.

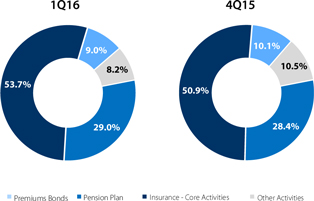

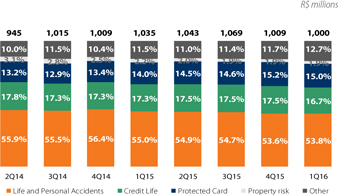

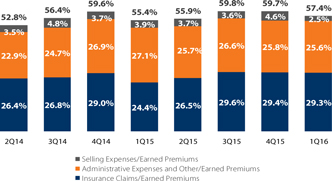

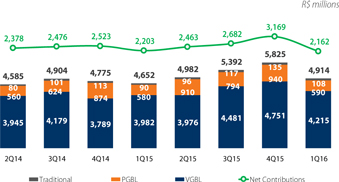

Result from Insurance, Pension Plan and Premium Bonds

In the first quarter of 2016, the result from insurance, pension plan and premium bonds from core activities, which consist of mass-market products related to life, property, credit, pension plan and premium bonds reached R$1,446 million, practically stable when compared to the previous quarter and an increase of 3.5% when compared to the first quarter of 2015. The loss ratio of core activities reached 29.3% this quarter.

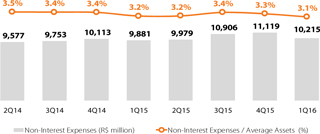

Non-Interest Expenses

In the first quarter of 2016, non-interest expenses decreased 8.1% when compared to the fourth quarter of 2015. Personnel expenses were 3.0% lower, mainly driven by the larger number of employees in vacations in the first quarter of 2016, which reduces compensation expenses, whereas administrative expenses were 11.1% lower than in the previous quarter, mainly due to expenses related to third-party services, data processing and telecommunications.

Compared to the first quarter of 2015, non-interest expenses increased 3.4%. Excluding operations abroad expenses, this increase would have been 1.9% in the period.

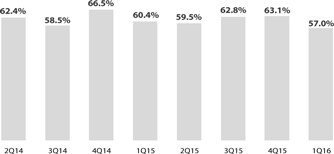

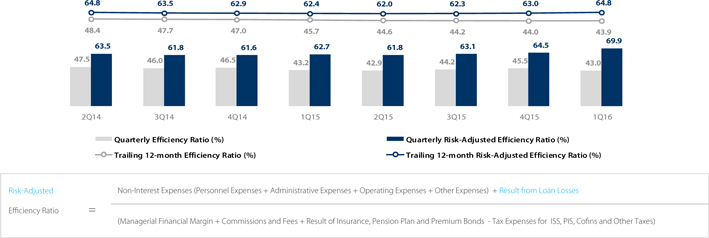

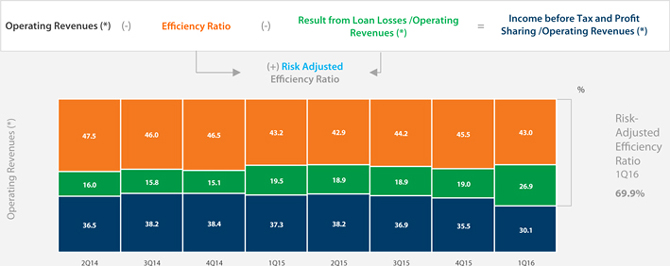

Efficiency Ratio and Risk-Adjusted Efficiency Ratio (*)

(*) Calculation criteria are detailed on page 34.

In the first quarter of 2016, the efficiency ratio, according to the criteria that include all expenses except result from loan losses, reached 43.0%, an improvement of 250 basis points from the previous quarter, mainly driven by the decrease in non-interest expenses (8.1%). In the 12-month period, efficiency ratio reached 43.9%, improving 10 basis points from the previous quarter and 180 basis points from the same period of the previous year.

In the first quarter of 2016, the risk-adjusted efficiency ratio, which also includes the result from loan losses, reached 69.9%, an increase of 540 basis points from the previous quarter, as a result of a higher result from loan losses (38.1%). In the 12-month period, risk-adjusted efficiency ratio reached 64.8%.

| Itaú Unibanco Holding S.A. | 10 |

| Management Discussion & Analysis | Executive Summary |  |

Balance Sheet | Assets

| In R$ millions, end of period | 1Q16 | 4Q15 | change | 1Q15 | change | |||||||||||||||

| Current and Long-term Assets | 1,263,779 | 1,340,483 | -5.7 | % | 1,274,667 | -0.9 | % | |||||||||||||

| Cash and Cash Equivalents | 18,384 | 18,544 | -0.9 | % | 18,687 | -1.6 | % | |||||||||||||

| Short-term Interbank Investments | 237,642 | 280,944 | -15.4 | % | 225,076 | 5.6 | % | |||||||||||||

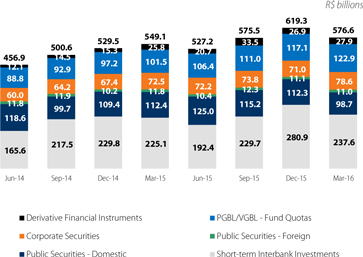

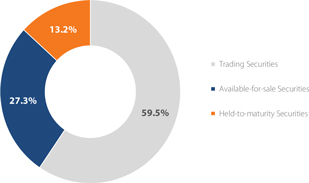

| Securities and Derivative Financial Instruments | 338,997 | 338,391 | 0.2 | % | 324,060 | 4.6 | % | |||||||||||||

| Interbank and Interbranch Accounts | 70,858 | 67,373 | 5.2 | % | 67,001 | 5.8 | % | |||||||||||||

| Loan, Lease and Other Loan Operations | 445,467 | 473,829 | -6.0 | % | 468,105 | -4.8 | % | |||||||||||||

| (Allowance for Loan Losses) | (36,036 | ) | (34,078 | ) | 5.7 | % | (28,354 | ) | 27.1 | % | ||||||||||

| Other Assets | 188,467 | 195,480 | -3.6 | % | 200,092 | -5.8 | % | |||||||||||||

| Foreign Exchange Portfolio | 63,795 | 68,909 | -7.4 | % | 83,050 | -23.2 | % | |||||||||||||

| Other | 124,672 | 126,571 | -1.5 | % | 117,042 | 6.5 | % | |||||||||||||

| Permanent Assets | 19,292 | 18,689 | 3.2 | % | 19,947 | -3.3 | % | |||||||||||||

| Investments | 4,342 | 3,939 | 10.2 | % | 3,539 | 22.7 | % | |||||||||||||

| Real Estate in Use | 6,756 | 7,055 | -4.2 | % | 7,521 | -10.2 | % | |||||||||||||

| Intangible Assets and Goodwill | 8,194 | 7,695 | 6.5 | % | 8,887 | -7.8 | % | |||||||||||||

| Total Assets | 1,283,071 | 1,359,172 | -5.6 | % | 1,294,613 | -0.9 | % | |||||||||||||

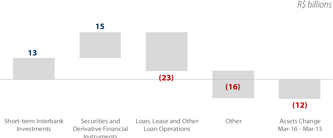

At the end of the first quarter of 2016, our assets totaled R$1.28 trillion, a decrease of 5.6% (R$76.1 billion) from the previous quarter. The main changes are presented below:

Compared to the previous year, the decrease of 0.9% (R$11.5 billion) was mainly driven by a reduction in our loan operations.

Balance Sheet | Liabilities and Equity

| In R$ millions, end of period | 1Q16 | 4Q15 | change | 1Q15 | change | |||||||||||||||

| Current and Long-Term Liabilities | 1,172,779 | 1,248,995 | -6.1 | % | 1,194,447 | -1.8 | % | |||||||||||||

| Deposits | 266,318 | 292,610 | -9.0 | % | 298,652 | -10.8 | % | |||||||||||||

| Demand Deposits | 58,557 | 61,092 | -4.1 | % | 56,660 | 3.3 | % | |||||||||||||

| Savings Deposits | 107,292 | 111,319 | -3.6 | % | 117,357 | -8.6 | % | |||||||||||||

| Interbank Deposits | 8,552 | 14,949 | -42.8 | % | 28,135 | -69.6 | % | |||||||||||||

| Time Deposits | 91,916 | 105,250 | -12.7 | % | 96,500 | -4.8 | % | |||||||||||||

| Deposits Received under Securities Repurchase Agreements | 318,964 | 350,954 | -9.1 | % | 330,858 | -3.6 | % | |||||||||||||

| Fund from Acceptances and Issue of Securities | 74,352 | 75,590 | -1.6 | % | 50,753 | 46.5 | % | |||||||||||||

| Interbank and Interbranch Accounts | 9,823 | 6,926 | 41.8 | % | 9,365 | 4.9 | % | |||||||||||||

| Borrowings and Onlendings | 95,352 | 104,589 | -8.8 | % | 96,265 | -0.9 | % | |||||||||||||

| Derivative Financial Instruments | 28,917 | 31,116 | -7.1 | % | 30,997 | -6.7 | % | |||||||||||||

| Technical Provisions for Insurance, Pension Plans and Premium Bonds | 137,677 | 132,053 | 4.3 | % | 116,737 | 17.9 | % | |||||||||||||

| Other Liabilities | 241,377 | 255,155 | -5.4 | % | 260,819 | -7.5 | % | |||||||||||||

| Subordinated Debt | 57,919 | 65,785 | -12.0 | % | 59,527 | -2.7 | % | |||||||||||||

| Foreign Exchange Portfolio | 64,240 | 68,466 | -6.2 | % | 84,030 | -23.6 | % | |||||||||||||

| Other | 119,218 | 120,905 | -1.4 | % | 117,262 | 1.7 | % | |||||||||||||

| Deferred Income | 1,847 | 1,960 | -5.8 | % | 1,513 | 22.1 | % | |||||||||||||

| Minority Interest in Subsidiaries | 1,799 | 1,755 | 2.5 | % | 1,700 | 5.8 | % | |||||||||||||

| Stockholders' Equity | 106,647 | 106,462 | 0.2 | % | 96,954 | 10.0 | % | |||||||||||||

| Total Liabilities and Equity | 1,283,071 | 1,359,172 | -5.6 | % | 1,294,613 | -0.9 | % | |||||||||||||

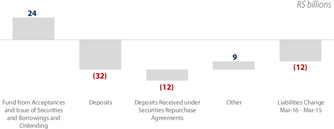

The main changes in liabilities at the end of the first quarter of 2016, compared to the previous quarter, are presented in the chart below:

Compared to the previous year, the main changes are highlighted as follows:

| Itaú Unibanco Holding S.A. | 11 |

| Management Discussion & Analysis | Executive Summary |  |

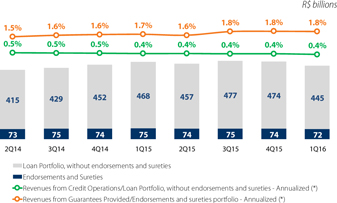

Credit Portfolio with Endorsements, Sureties and Private Securities

At the end of the first quarter of 2016, our total credit portfolio (including sureties, endorsements and private securities) reached R$554,252 million, reducing 5.3% from the previous quarter and 4.2% from the same period of the previous year. Excluding the effect of the foreign exchange variation, our loan portfolio would have decreased 3.5% in the quarter and 5.5% in the 12-month period.

In the individuals segment, the highlight was the growth of the low-risk loan portfolios: payroll loans, with a 2.9% increase in the quarter and 4.8% in 12 months (mainly driven by INSS beneficiaries), and mortgage loans, with increases of 2.1% and 17.1%, respectively, whereas the vehicles portfolio decreased 9.4% in the quarter and 31.2% in 12 months, due to a lower volume of credit origination.

The companies segment, excluding private securities, decreased 8.1% in the quarter and 9.9% in the 12-month period. The corporate portfolio decreased 9.2% from the previous quarter and 9.8% in the 12-month period, whereas the very small, small and middle-market companies portfolio decreased 4.9% in the quarter and 9.9% in 12 months. Excluding the effect of the foreign exchange variation, the corporate portfolio would have decreased 6.8% from the previous quarter and 12.5% in the 12-month period.

Our operations in Latin America decreased 5.2% in the quarter, but increased 9.8% in the 12-month period. Excluding the effect of the foreign exchange variation, the growth of this portfolio would have been 1.4% compared to the previous quarter and the same 9.8% when compared to the previous year.

The balance of endorsements and sureties reached R$72,017 million at the end of the first quarter of 2016, with decreases of 3.0% from the previous quarter and of 4.3% in the past 12 months, mainly driven by changes in the corporate portfolio, which decreased 3.1% from the previous quarter and 4.8% in the 12-month period.

| In R$ millions, end of period | 1Q16 | 4Q15 | change | 1Q15 | change | |||||||||||||||

| Individuals | 184,226 | 187,556 | -1.8 | % | 187,286 | -1.6 | % | |||||||||||||

| Credit Card Loans | 54,867 | 58,542 | -6.3 | % | 56,331 | -2.6 | % | |||||||||||||

| Personal Loans | 29,159 | 28,961 | 0.7 | % | 29,822 | -2.2 | % | |||||||||||||

| Payroll Loans (1) | 46,742 | 45,437 | 2.9 | % | 44,608 | 4.8 | % | |||||||||||||

| Vehicle Loans | 18,105 | 19,984 | -9.4 | % | 26,331 | -31.2 | % | |||||||||||||

| Mortgage Loans | 35,353 | 34,631 | 2.1 | % | 30,194 | 17.1 | % | |||||||||||||

| Companies | 264,896 | 288,393 | -8.1 | % | 293,862 | -9.9 | % | |||||||||||||

| Corporate Loans (2) | 199,273 | 219,418 | -9.2 | % | 221,026 | -9.8 | % | |||||||||||||

| Very Small, Small and Middle Market Loans (2)(3) | 65,622 | 68,974 | -4.9 | % | 72,836 | -9.9 | % | |||||||||||||

| Latin America (4) | 68,362 | 72,125 | -5.2 | % | 62,246 | 9.8 | % | |||||||||||||

| Total with Endorsements and Sureties | 517,484 | 548,073 | -5.6 | % | 543,394 | -4.8 | % | |||||||||||||

| Corporate - Private Securities (5) | 36,768 | 37,431 | -1.8 | % | 35,202 | 4.4 | % | |||||||||||||

| Total with Endorsements, Sureties and Private Securities | 554,252 | 585,504 | -5.3 | % | 578,596 | -4.2 | % | |||||||||||||

| Total with Endorsements, Sureties and Private Securities (6) ex-foreign exchange rate variation) | 554,252 | 574,163 | -3.5 | % | 586,654 | -5.5 | % | |||||||||||||

| Endorsements and Sureties | 72,017 | 74,244 | -3.0 | % | 75,289 | -4.3 | % | |||||||||||||

| Individuals | 514 | 550 | -6.6 | % | 478 | 7.5 | % | |||||||||||||

| Corporate | 65,095 | 67,152 | -3.1 | % | 68,407 | -4.8 | % | |||||||||||||

| Very Small, Small and Middle Market | 3,210 | 2,891 | 11.1 | % | 3,249 | -1.2 | % | |||||||||||||

| Latin America (4) | 3,198 | 3,650 | -12.4 | % | 3,156 | 1.3 | % | |||||||||||||

(1) Includes operations originated by the institution and acquired operations. (2) In the 1Q16, the Very Small, Small and Middle-Market companies segment started to include clients with sales from R$30 million up to R$200 million (previously up to R$300 million). For this reason, certain clients (those with sales above R$200 million) were reclassified to the Corporate segment and, for comparison purposes, previous periods were also reclassified. (3) Includes Rural Loans to Individuals. (4) Includes Argentina, Chile, Colombia, Paraguay and Uruguay. (5) Includes Debentures, CRI and Commercial Papers. (6) Calculated based on the conversion of the foreign currency portfolio (U.S. dollar and currencies of Latin America). Note: Mortgage and Rural Loan portfolios from the companies segment are allocated according to the client’s size. For further details, please refer to page 18.

Credit Portfolio – Currency Breakdown

On March 31, 2016, R$132.8 billion of our total credit assets were denominated in or indexed to foreign currencies. This portion decreased 9.7% in the quarter, mainly due to the appreciation of the Brazilian real against the U.S. dollar and the currencies of the Latin American countries.

NPL Ratio (90 days overdue)

At the end of the first quarter of 2016, the NPL ratio for operations overdue for more than 90 days (NPL 90) increased 40 basis points from the previous quarter and 90 basis points from the same period of 2015. Excluding the effect of the foreign exchange variation, the NPL 90 days increase would have been 30 basis points in the quarter.

| Itaú Unibanco Holding S.A. | 12 |

| Management Discussion & Analysis | Executive Summary |  |

2016 Forecast (*)

Below, we reiterate our 2016 forecast:

| Consolidated | Brazil 3 | |||

| Total Credit Portfolio 1 | from -0.5% to 4.5% | from -1.0% to 3.0% | ||

| Financial Margin with Clients | Growth of 2.0% to 5.0% | Growth of 1.0% to 4.0% | ||

| Provision for Loan Losses Net of Recovery of Loans | Between R$22 billion and R$25 billion | Between R$21 billion and R$24 billion | ||

| Commissions and Fees and Result from Insurance Operations2 | Growth of 6.0% to 9.0% | Growth of 4.5% to 7.5% | ||

| Non-Interest Expenses | Growth of 5.0% to 7.5% | Growth of 4.0% to 6.5% |

| (1) | Includes endorsements, sureties and private securities; |

| (2) | Commissions and Fees (+) Income from Insurance, Pension Plan and Premium Bonds Operations (-) Expenses for Claims (-) Insurance, Pension Plan and Premium Bonds Selling Expenses; |

| (3) | Includes units abroad ex-Latin America. |

| (*) | Does not include the effect of CorpBanca´s transaction. |

Although the growth plans and projections of results presented above are based on management assumptions and information available in the market to date, these expectations involve inaccuracies and risks that are difficult to anticipate and there may be, therefore, results or consequences that differ from those anticipated. This information is not a guarantee of future performance. The use of these expectations should take into consideration the risks and uncertainties that involve any activities and that are beyond our control. These risks and uncertainties include, but are not limited to, our ability to perceive the dimension of the synergies projected and their timing, political and economic changes, volatility in interest and foreign exchange rates, technological changes, inflation, financial disintermediation, competitive pressures on products, prices and changes in tax legislation, among others.

| Itaú Unibanco Holding S.A. | 13 |

(This page was intentionally left blank)

| Itaú Unibanco Holding S.A. | 14 |

| Management Discussion & Analysis | Income Statement Analysis |  |

Managerial Financial Margin

In the first quarter of 2016, the managerial financial margin totaled R$16,557 million, a 1.2% decrease compared to the previous quarter.

Compared to the same period of the previous year, the managerial financial margin increased 3.7%.

The main drivers of these variations are presented below:

| In R$ millions | 1Q16 | 4Q15 | change | 1Q15 | change | |||||||||||||||||||||||

| Financial Margin with Clients | 14,820 | 15,495 | (675 | ) | -4.4 | % | 14,092 | 728 | 5.2 | % | ||||||||||||||||||

| Spread-Sensitive Operations | 13,198 | 13,629 | (431 | ) | -3.2 | % | 12,658 | 539 | 4.3 | % | ||||||||||||||||||

| Working Capital and Other | 1,622 | 1,866 | (244 | ) | -13.1 | % | 1,434 | 189 | 13.2 | % | ||||||||||||||||||

| Financial Margin with the Market | 1,737 | 1,269 | 468 | 36.9 | % | 1,871 | (134 | ) | -7.1 | % | ||||||||||||||||||

| Total | 16,557 | 16,764 | (207 | ) | -1.2 | % | 15,963 | 594 | 3.7 | % | ||||||||||||||||||

Managerial Financial Margin with Clients

The managerial financial margin with clients consists of revenues generated by the use of financial products by clients, including both account and non-account holders.

For clarity purposes, we classify these operations into two different groups: i) financial margin of spread-sensitive operations and ii) working capital and other.

In the first quarter of 2016, the managerial financial margin with clients totaled R$14,820 million, a 4.4% decrease from the previous quarter. Compared to the same period of the previous year, the financial margin with clients increased 5.2% driven by higher margins with spread-sensitive operations and working capital and other.

Spread-Sensitive Operations

In the first quarter of 2016, the financial margin of spread-sensitive operations, which includes the results from credit assets, non-credit assets and liabilities, totaled R$13,198 million, a decrease of 3.2% or R$431 million from the previous period, mainly driven by lower volumes and lower number of calendar days in this quarter compared to the previous one.

Compared to the first quarter of 2015, the financial margin of spread variation-sensitive operations increased R$539 million, an increase of 4.3% from the previous year.

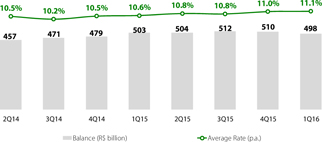

Annualized Rate of Spread-Sensitive Operations

| In R$ millions | 1Q16 | 4Q15 | change | |||||||||||||

| Average Balance | 497,892 | 510,263 | (12,371 | ) | -2.4 | % | ||||||||||

| Financial Margin | 13,198 | 13,629 | (431 | ) | -3.2 | % | ||||||||||

| Average Rate ( p.a. ) | 11.1 | % | 11.0 | % | 10 | bps | ||||||||||

Working Capital and Other

In the first quarter of 2016, our financial margin of working capital and other totaled R$1,622 million, with a 13.1% decrease from the last quarter of 2015, as a result of a 12.0% reduction in the average balance. This reduction was mainly due to the higher allocation of capital to treasury, related to the application of BIS III rules to our managerial capital allocation model.

Annualized Rate of Working Capital and Other

| In R$ millions | 1Q16 | 4Q15 | change | |||||||||||||

| Average Balance | 68,096 | 77,412 | (9,316 | ) | -12.0 | % | ||||||||||

| Financial Margin | 1,622 | 1,866 | (244 | ) | -13.1 | % | ||||||||||

| Average Rate ( p.a. ) | 9.9 | % | 9.9 | % | 0 | bps | ||||||||||

| CDI - Annualized Quarterly Rate | 14.1 | % | 14.1 | % | 0 | bps | ||||||||||

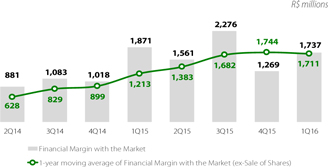

Managerial Financial Margin with the Market

The financial margin with the market consists of treasury transactions that include Asset and Liability Management (ALM) and proprietary trading operations.

In the quarter, the financial margin with the market totaled R$1,737 million, mainly driven by the management of proprietary and structural positions in Brazil and abroad.

Financial Margin with the Market

| Itaú Unibanco Holding S.A. | 16 |

| Management Discussion & Analysis | Income Statement Analysis |  |

Managerial Financial Margin with Clients

In the first quarter of 2016, as a result of the previously mentioned changes, the annualized rate of managerial financial margin with clients, which excludes the financial margin with the market, reached 10.9%, remaining stable compared to the fourth quarter of 2015.

In this quarter, the annualized average rate of the risk-adjusted financial margin with clients reached 6.1%, a reduction of 140 basis points from the fourth quarter of 2015, mainly driven by higher provision for loan losses.

In this quarter, the annualized average rate of the financial margin with spread-sensitive operations reached 11.1%, an increase of 10 basis points from the previous quarter.

In the first quarter of 2016, the annualized average rate of the financial margin with spread-sensitive operations reached 5.5%, a reduction of 160 basis points from the previous quarter, mainly driven by higher provisions for loan losses.

| 1Q16 | 4Q15 | |||||||||||||||||||||||

| Average | Financial | Average Rate | Average | Financial | Average Rate | |||||||||||||||||||

| In R$ millions, end of period | Balance | Margin | (p.a.) | Balance | Margin | (p.a.) | ||||||||||||||||||

| Spread-Sensitive Operations | 497,892 | 13,198 | 11.1 | % | 510,263 | 13,629 | 11.0 | % | ||||||||||||||||

| Working Capital and Other | 68,096 | 1,622 | 9.9 | % | 77,412 | 1,866 | 9.9 | % | ||||||||||||||||

| Financial Margin with Clients | 565,988 | 14,820 | 10.9 | % | 587,675 | 15,495 | 10.9 | % | ||||||||||||||||

| Provision for Loan Losses | (7,231 | ) | (6,116 | ) | ||||||||||||||||||||

| Recovery of Loans Written Off as Losses | 829 | 1,482 | ||||||||||||||||||||||

| Financial Margin of Spread-Sensitive Operations after Provisions for Credit Risk | 497,892 | 6,796 | 5.5 | % | 510,263 | 8,994 | 7.1 | % | ||||||||||||||||

| Financial Margin with Clients after Provisions for Credit Risk | 565,988 | 8,418 | 6.1 | % | 587,675 | 10,861 | 7.5 | % | ||||||||||||||||

Financial Margin with Clients and Spread-Sensitive Operations before and after Provisions for Credit Risk

Composition of the Change in the Financial Margin with Clients

For a better understanding of the changes in our financial margin with clients, we segregated effects from changes in the volume of spread-sensitive operations, the mix of products, clients and spread, and working capital and other effects.

In the first quarter of 2016, the 4.4% decrease in our financial margin with clients was mainly driven by lower volumes of spread-sensitive operations, and by the decrease in the financial margin with working capital and other.

Financial Margin with Clients Change

(*) Balances do not include the effects of foreign exchange rate variations.

| Itaú Unibanco Holding S.A. | 17 |

| Management Discussion & Analysis | Income Statement Analysis |  |

Credit Portfolio

Credit Portfolio by Product

In the table below, the loan portfolio is split into two groups: individuals and companies. For a better understanding of the performance of these portfolios, the main product groups of each segment are presented below.

| In R$ millions, end of period | 1Q16 | 4Q15 | change | 1Q15 | change | |||||||||||||||

| Individuals | 204,965 | 209,319 | -2.1 | % | 205,850 | -0.4 | % | |||||||||||||

| Credit Card | 54,867 | 58,542 | -6.3 | % | 56,331 | -2.6 | % | |||||||||||||

| Personal Loans | 28,645 | 28,411 | 0.8 | % | 29,344 | -2.4 | % | |||||||||||||

| Payroll Loans (1) | 46,742 | 45,437 | 2.9 | % | 44,608 | 4.8 | % | |||||||||||||

| Vehicles | 18,105 | 19,984 | -9.4 | % | 26,331 | -31.2 | % | |||||||||||||

| Mortgage Loans | 35,353 | 34,631 | 2.1 | % | 30,194 | 17.1 | % | |||||||||||||

| Rural Loans | 250 | 258 | -3.2 | % | 275 | -9.1 | % | |||||||||||||

| Latin America (2) | 21,003 | 22,055 | -4.8 | % | 18,768 | 11.9 | % | |||||||||||||

| Companies | 240,501 | 264,511 | -9.1 | % | 262,255 | -8.3 | % | |||||||||||||

| Working Capital (3) | 96,087 | 107,850 | -10.9 | % | 110,880 | -13.3 | % | |||||||||||||

| BNDES/Onlending | 43,293 | 48,559 | -10.8 | % | 53,490 | -19.1 | % | |||||||||||||

| Export / Import Financing | 33,241 | 37,071 | -10.3 | % | 33,835 | -1.8 | % | |||||||||||||

| Vehicles | 3,945 | 4,253 | -7.3 | % | 5,595 | -29.5 | % | |||||||||||||

| Mortgage Loans | 10,980 | 10,966 | 0.1 | % | 10,337 | 6.2 | % | |||||||||||||

| Rural Loans | 8,796 | 9,393 | -6.4 | % | 7,795 | 12.8 | % | |||||||||||||

| Latin America (2) | 44,161 | 46,419 | -4.9 | % | 40,322 | 9.5 | % | |||||||||||||

| Total without Endorsements and Sureties | 445,467 | 473,829 | -6.0 | % | 468,105 | -4.8 | % | |||||||||||||

| Endorsements and Sureties | 72,017 | 74,244 | -3.0 | % | 75,289 | -4.3 | % | |||||||||||||

| Total with Endorsements and Sureties | 517,484 | 548,073 | -5.6 | % | 543,394 | -4.8 | % | |||||||||||||

| Corporate Private Securities (4) | 36,768 | 37,431 | -1.8 | % | 35,202 | 4.4 | % | |||||||||||||

| Total Risk | 554,252 | 585,504 | -5.3 | % | 578,596 | -4.2 | % | |||||||||||||

(1) Includes operations originated by the institution and acquired operations. (2) Includes Argentina, Chile, Colombia, Paraguay and Uruguay. (3) Also includes Overdraft, Receivables, Hot Money, Leasing, and other; (4) Includes Debentures, CRI and Commercial Paper.

At the end of the first quarter of 2016, our total credit portfolio (including sureties, endorsements and private securities) reached R$554,252 million, decreasing 5.3% from the previous quarter and 4.2% compared to the first quarter of 2015. Excluding the effect of the foreign exchange variation and corporate private securities, the loan portfolio, without endorsements and sureties, would have decreased 3.8% compared to the previous quarter and 6.3% in the 12-month period.

Individuals loan portfolio reached R$204,965 million at the end of the first quarter of 2016, with a 2.1% decrease from the previous quarter. In the quarter, the highlight was the growth in low-risk loan portfolios: 2.9% in payroll loans (mainly loans to INSS beneficiaries) and 2.1% in mortgage loans. On the other hand, vehicle portfolio decreased 9.4% due to a lower demand, and the credit card portfolio, with more conservative credit standards, decreased 6.3%. The Latin America portfolio decreased 4.8%, and reached R$21,003 million.

The companies loan portfolio decreased 9.1% in the first quarter of 2016, totaling R$240,501 million. The change in this portfolio is mainly driven by the decreases of 10.9% in working capital, of 10.8% in BNDES/Onlending, and of 10.3% in export-import financing. These decreases were due to a lower demand from companies, as a result of a more challenging economic scenario and by the appreciation of the Brazilian real against the U.S. dollar. The companies portfolio – Latin America decreased 4.9%, and reached R$44,161 million.

Credit Portfolio by Business Sector (including endorsements and sureties)

The changes in the companies loans portfolio, including the Latin America portfolio, are listed below:

| In R$ millions, end of period | 1Q16 | 4Q15 | change | |||||||||||||

| Public Sector | 4,507 | 4,648 | (141 | ) | -3.0 | % | ||||||||||

| Private Sector | Companies | 303,475 | 329,428 | (25,953 | ) | -7.9 | % | ||||||||||

| Real Estate | 21,202 | 21,124 | 78 | 0.4 | % | |||||||||||

| Vehicles and auto parts | 19,505 | 21,867 | (2,361 | ) | -10.8 | % | ||||||||||

| Food and beverage | 19,029 | 20,484 | (1,454 | ) | -7.1 | % | ||||||||||

| Agribusiness and fertilizers | 15,652 | 16,403 | (751 | ) | -4.6 | % | ||||||||||

| Transportation | 15,267 | 16,695 | (1,428 | ) | -8.6 | % | ||||||||||

| Energy and water treatment | 12,777 | 13,750 | (973 | ) | -7.1 | % | ||||||||||

| Steel and metallurgy | 11,887 | 13,234 | (1,347 | ) | -10.2 | % | ||||||||||

| Sugar and Alcohol | 10,553 | 11,028 | (475 | ) | -4.3 | % | ||||||||||

| Telecommunications | 9,680 | 9,614 | 65 | 0.7 | % | |||||||||||

| Banks and other financial institutions | 9,350 | 10,255 | (905 | ) | -8.8 | % | ||||||||||

| Petrochemical and chemical | 9,010 | 9,977 | (968 | ) | -9.7 | % | ||||||||||

| Capital Assets | 7,946 | 9,366 | (1,420 | ) | -15.2 | % | ||||||||||

| Mining | 7,521 | 8,214 | (693 | ) | -8.4 | % | ||||||||||

| Construction Material | 7,125 | 7,457 | (332 | ) | -4.5 | % | ||||||||||

| Infrastructure work | 6,301 | 6,745 | (444 | ) | -6.6 | % | ||||||||||

| Pharmaceutical and cosmetics | 6,272 | 6,791 | (519 | ) | -7.6 | % | ||||||||||

| Oil and gas | 5,965 | 6,497 | (533 | ) | -8.2 | % | ||||||||||

| Electronic and IT | 5,952 | 6,267 | (315 | ) | -5.0 | % | ||||||||||

| Clothing and footwear | 4,643 | 5,312 | (668 | ) | -12.6 | % | ||||||||||

| Services - Other | 29,096 | 31,397 | (2,301 | ) | -7.3 | % | ||||||||||

| Commerce - Other | 16,603 | 19,208 | (2,605 | ) | -13.6 | % | ||||||||||

| Industry - Other | 8,556 | 9,547 | (991 | ) | -10.4 | % | ||||||||||

| Other | 43,582 | 48,195 | (4,613 | ) | -9.6 | % | ||||||||||

| Total | 307,983 | 334,076 | (26,094 | ) | -7.8 | % | ||||||||||

| Itaú Unibanco Holding S.A. | 18 |

| Management Discussion & Analysis | Income Statement Analysis |  |

Credit Concentration

Our loan, lease and other credit operations, including endorsements and sureties, are spread over our loan portfolio in a way that only 22.1% of the credit risk was concentrated on the 100 largest debtors at the end of the first quarter of 2016. The credit concentration of the 100 largest debtors (group consolidated) is as follows:

| In R$ millions, end of period | Risk | % of total credits | % of total Assets | |||||||||

| Largest Debtor | 4,155 | 0.8 | 0.3 | |||||||||

| 10 Largest Debtors | 33,084 | 6.4 | 2.4 | |||||||||

| 20 Largest Debtors | 50,638 | 9.8 | 3.7 | |||||||||

| 50 Largest Debtors | 85,397 | 16.5 | 6.3 | |||||||||

| 100 Largest Debtors | 114,344 | 22.1 | 8.4 | |||||||||

Renegotiated Loan Operations

According to the rules of CMN Resolution No. 2,682/99, balances of all contracts that have had changes to their original contractual terms should be reported as renegotiated loans. We segregate renegotiated loans, taking into account all types of renegotiation, either non overdue, overdue, or coming from the recovery of loans written off as losses, by overdue period measured at the moment of renegotiation, as shown below:

The NPL 90 days of total renegotiated loans operations reached 20.4% at the end of the first quarter of 2016, and the coverage ratio of these loans overdue for more than 90 days reached 184%. The evolution of these ratios is as follows:

On march 31, 2016, total renegotiated credit reached R$22,708 million, remaining relatively stable compared to the previous quarter.

| In R$ millions, end of period | Portfolio | LLP | % | |||||||||

| Total Renegotiated Loans Operations | 22,708 | (8,527 | ) | 37.5 | % | |||||||

| Loan Operations Renegotiated when up to 90 days overdue* | 14,098 | (3,529 | ) | 25.0 | % | |||||||

| Loan Operations Renegotiated when over 90 days overdue * | 8,610 | (4,997 | ) | 58.0 | % | |||||||

* Measured at the moment of renegotiation.

Further information on Note 8-d to our financial statements.

Loan operations renegotiated when over 90 days overdue reached R$8,610 million, an increase of R$328 million in the quarter. The ratio of allowance for loan losses to the total portfolio for these operations reached 58.0%.

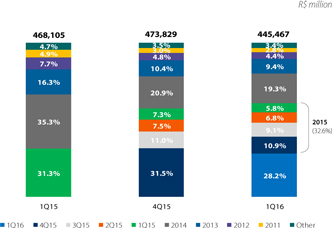

Loan Portfolio by Origination Period

The chart below shows the evolution of our loan portfolio, excluding endorsements and sureties, by origination period (vintages).

The reduction of 330 basis points in the origination volume in the quarter is driven by a lower credit demand from clients, as a result of a more challenging economic scenario and a seasonally larger volume of credit card products in the last quarter of the year.

| Itaú Unibanco Holding S.A. | 19 |

| Management Discussion & Analysis | Income Statement Analysis |  |

Loan Portfolio Mix Evolution in Brazil (excluding endorsements and sureties)

Our loan portfolio mix presented below highlights its major components and their share in past quarters.

Loan Portfolio Mix - Companies

In the first quarter of 2016, the proportion of credits to very small, small and middle-market companies increased compared to credits to large companies in our loan portfolio mix. This increase was mainly driven by the impact of the appreciation of the Real against the U.S. dollar on the corporate loan portfolio.

Loan Portfolio Mix – Individuals

The evolution of our loan portfolio mix for individuals in past periods shows the growth of the payroll loan and mortgage loan portfolios, which currently represent the second and third largest balances in our individuals portfolio. The decrease in the share of vehicle financing is a result of the nominal balance reduction of this portfolio.

We present below additional information about Payroll Loans, Mortgage Loans and Vehicle Financing.

Payroll Loans

We operate in the payroll loans market through two different distribution channels: directly through our own distribution network (branches, CSBs and electronic channels) and through Banco Itaú BMG Consignado S.A., a financial institution controlled by us aimed at offering, distributing and marketing payroll loans. This operation started in December 2012 and enables us to expand our business in this segment, based on our values and transparency principles, following our good management practices and policies.

Evolution of the Payroll Loan Portfolio and NPL

At the end of March 2016, total payroll loans reached R$46,742 million, a 4.8% increase in twelve months. The highlight is the 16,0% increase in the portfolio of loans to retirees and pensioners of the INSS compared to the end of March 2015.

Payroll loans originated by the branch network totaled R$16,554 million on March 31, 2016, a 10.7% increase in twelve months, whereas payroll loans originated by other channels reached R$30,187 million, a 1.8% increase from the same period of the previous year.

Evolution of Payroll Loan Portfolio

Our strategy of higher growth in the INSS Beneficiaries segment, combined with the credit policies adopted, allowed the portfolio growth to be followed by a low delinquency levels over the last two years. A slower pace of the portfolio growth drove the recent increase in 90-day NPL ratio.

90-day NPL ratio (Mar -12 = 100) | Total Payroll Loan Portfolio

Note: Comparable to the National Financial System information disclosed by the Brazilian Central Bank.

Evolution of the Share of Payroll Loans in Personal Loans

The increase in the payroll loans balance allowed for a higher share of the personal loans, which reached 61.6% in this period from 59.9% in March 2015, a 170 basis point increase in twelve months.

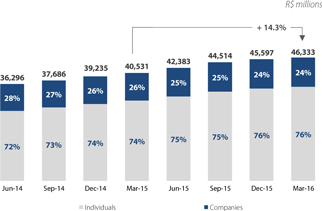

Mortgage Loans

Our mortgage portfolio reached R$46,333 million at the end of March 2016. Our portfolio increased 1.6% in the quarter and 14.3% in the past twelve months. The individuals portfolio, totaling R$35,353 million at the end of this quarter, increased 2.1% from the previous quarter and 17.1% in twelve months. At the end of March 2016, the companies portfolio totaled R$10,980 million, up 0.1% and 6.2%, respectively, from the previous quarter and the past twelve months.

Evolution of the Mortgage Portfolio

| Itaú Unibanco Holding S.A. | 20 |

| Management Discussion & Analysis | Income Statement Analysis |  |

In the first quarter of 2016, the volume of new mortgage loan financing contracts for individuals was R$1,892 million, whereas financing to companies amounted to R$154 million, totaling R$2,046 million.

Origination Volume

| In R$ millions | 1Q16 | 4Q15 | change | 1Q15 | change | |||||||||||||||

| Individuals | 1,892 | 2,384 | -20.6 | % | 2,527 | -25.1 | % | |||||||||||||

| Companies | 154 | 702 | -78.0 | % | 614 | -74.9 | % | |||||||||||||

| Total | 2,046 | 3,086 | -33.7 | % | 3,142 | -34.9 | % | |||||||||||||

Source: ABECIP.

At the end of the first quarter of 2016, our individual mortgage loan portfolio collaterals, under the legal framework of fiduciary lien (alienação fiduciária), accounted for 99.6% of the portfolio. Since 2007, we have been using this framework for 100% of our contracts.

Our new financing contracts use the Equal Amortization System, through which decreasing installments lead to faster balance amortization, reducing the loan-to-value ratio (ratio of the amount of the financing to the value of the real estate property) at a faster pace than other amortization systems.

The portfolio loan-to-value (LTV) reached 43.9% at the end of March 2016. The average quarterly LTV of originated vintages reached 54.8%, down 50 basis points from the LTV of vintages originated in the fourth quarter of 2015 and down 470 basis points from the first quarter of 2015.

Loan–to-value | Vintage and Portfolio

In the current period, the 90-day NPL of the vintage originated in September 2015 reached 0.09%, remaining at levels that demonstrate the high quality of the portfolio.

NPL over 90 (%) | Six months after origination

Note: Loan portfolio to individuals.

Vehicle Financing

Our portfolio of vehicle financing to individuals amounted to R$18,105 million and to companies, R$3,945 million, totaling R$22,050 million on March 31, 2016.

This quarter, the average amount of vehicle financing to individuals originated by the branch network, dealerships and car retailers was R$24.7 thousand, with an average term of 39 months and average down payment of 42%. Both the average down payment and the financing term remained relatively stable in the past quarters, continuing at conservative levels.

Average Term and Down Payment - Individuals

New loans granted to individuals through our branches, dealerships and car retailers totaled R$1,807 million, whereas new loans granted to companies totaled R$353 million in the first quarter of 2016.

The loan-to-value of our vehicle portfolio reached 70.3% at the end of March 2016, continuing the declining trend of the past few quarters.

Loan–to-value | Portfolio (*)

(*) Loans originated by dealerships and car retailers to individuals and companies.

The 90-day NPL of vintages originated in November 2015 reached 0.32% in March 2016.

NPL over 90 (%) | Four months after origination

In this quarter, we received a monthly average of 14.8 million visits through iCarros, a classified ads website that facilitates the purchase and sale of new and used vehicles, a 6.4% increase compared to the month average of the previous quarter.

| Itaú Unibanco Holding S.A. | 21 |

| Management Discussion & Analysis | Income Statement Analysis |  |

Result from Loan Losses

| In R$ millions | 1Q16 | 4Q15 | change | 1Q15 | change | |||||||||||||||||||||||

| Provision for Loan Losses | (7,231 | ) | (6,116 | ) | (1,115 | ) | 18.2 | % | (5,515 | ) | (1,716 | ) | 31.1 | % | ||||||||||||||

| Recovery of Loans Written Off as Losses | 829 | 1,482 | (652 | ) | -44.0 | % | 1,060 | (231 | ) | -21.8 | % | |||||||||||||||||

| Result from Loan Losses | (6,402 | ) | (4,634 | ) | (1,768 | ) | 38.1 | % | (4,455 | ) | (1,947 | ) | 43.7 | % | ||||||||||||||

In the first quarter of 2016, the result from loan losses (provision, net of recovery of loans written off as losses) totaled R$6,402 million, a 38.1% increase compared to the previous quarter, mainly due to the increase in provision for loan losses.

Provision for loan losses was up 18.2% compared to the previous quarter, partially driven by the increase in the generic allowance for specific economic groups, as a result of the challenging economic scenario.

Recovery of loans written off as losses decreased 44.0% from the fourth quarter of 2015. This decrease was mainly due to the recovery of loans written off as losses of a specific group of the corporate segment in the amount of R$488 million recognized in the fourth quarter of 2015. Excluding the effect of this operation in the previous quarter, income from recovery of loans written off as losses would have decreased 16.5% compared to the fourth quarter of 2015, due to typical seasonal effects early in the year.

Compared to the first quarter of 2015, result from loan losses recorded a 43.7% increase, mainly driven by a higher provision for loan losses, as a result of the challenging economic scenario. Additionally, income from recovery of loans written off as losses decreased 21.8% from the same period of the previous year.

Provision for Loan Losses by Segment

Note: Retail Banking includes loan loss provisions expenses of Corporation segment.

In the first quarter of 2016, provision for loan losses totaled R$4,323 million in the Retail segment, a 6.4% decrease from the previous quarter, and totaled R$2,908 million in the Wholesale segment, a 94.5% increase from the previous quarter. The increase in the Wholesale segment is mainly due to higher provisions for specific economic groups due to the challenging economic scenario.

Provision for Loan Losses and Loan Portfolio

In the first quarter of 2016, the ratio of the provision for loan losses to the loan portfolio reached 6.3%, an increase of 110 basis points from the previous quarter.

The ratio of the result from loan losses to loan portfolio reached 5.6% in this quarter, an increase of 160 basis points compared to the previous quarter.

Result from Loan Losses and Loan Portfolio

(*) Average balance of the Loan Portfolio of the two previous quarters.

Allowance for Loan Losses and Loan Portfolio

At the end of March 2016, the loan portfolio decreased 6.0% when compared to December 2015, totaling R$445,467 million, whereas the allowance for loan losses increased 5.7% in the quarter. The observed growth in the allowance for loan losses was mainly a result of the increase of 13.0% in the generic allowance. With this increase, related to specific economic groups, the ratio between the total allowance for loan losses to the loan portfolio went from 7.2% at the end of December 2015 to 8.1% at the end of March 2016, an increase of 90 basis points in the period.

The complementary allowance remained at R$10,985 million at the end of the first quarter of 2016. This amount includes provisions recognized for endorsements and sureties, which totaled R$713 million.

The ratio of the allowance for loan losses without the complementary allowance to the loan portfolio reached 5.6% on March 31, 2016, an increase of 70 basis points from December 2015.

| Itaú Unibanco Holding S.A. | 22 |

| Management Discussion & Analysis | Income Statement Analysis |  |

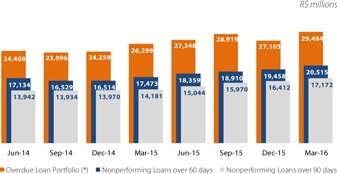

Delinquency Ratios

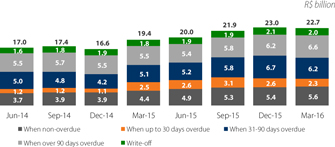

Nonperforming Loans

(*) Overdue loans are loan operations having at least one installment more than 14 days overdue, irrespective of collateral provided.

The overdue loan portfolio increased 8.8% from the fourth quarter of 2015 and 12.1% from March 2015. At the end of March 2016, the coverage ratio, which is the ratio of the allowance for loan losses to the total overdue loan portfolio, reached 122%, up 1,400 basis points compared to March 2015, mainly due to the increased complementary allowance for loan losses.

The portfolio of credits overdue for over 90 days increased 4.6% from the previous quarter, practically stable for individuals and up 14.0% for companies. Compared to March 2015, this portfolio increased 21.1%, up 21.7% for individuals and 19.9% for companies.

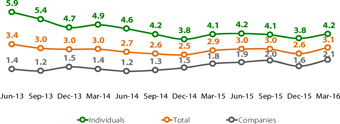

NPL Ratio (%) | over 90 days

The NPL ratio of credits overdue for over 90 days increased 40 basis points (or 30 basis points excluding the effect of foreign exchange variation) compared to the previous quarter and reached 3.9% in the end of March 2016. Compared to the same period of 2015, it recorded an increase of 90 basis points.

For individuals, this ratio increased 20 basis points (foreign exchange rate variation had no significant impact in the quarter) from the previous quarter, mainly due to the reduction of the credit card portfolio. Compared to March 2015, this ratio grew 110 basis points, mainly due to increased delinquency rates for personal loans and credit card products.

For companies, this ratio increased 50 basis points (or 40 basis points excluding the effect of foreign exchange variation) from December 2015, mainly in the industry and commerce and services.

NPL Ratio (%) | over 90 days

Corporate, Very Small, Small and Middle Market Companies

In this quarter, the 90-day NPL for large companies reached 1.3%, up 30 basis points (foreign exchange rate variation had no significant impact in the quarter) from the previous quarter.

The ratio for very small, small and middle-market companies increased 70 basis points (or 60 basis points excluding the effect of foreign exchange variation) from the previous quarter and reached 4.3% at the end of March 2016.

NPL Ratio (%) | 15 to 90 days

Short-term delinquency, measured based on the balance of operations overdue from 15 to 90 days (NPL 15-90), increased 50 basis points compared to December 2015.

In the quarter, the ratio for individuals increased 40 basis points and the highlight was the increase in personal loans and credit cards, due to the typical seasonal effects of the period.

For companies, the ratio increased 50 basis points from the previous quarter, mainly due to the increases in the industry and commerce and services sectors.

NPL Ratio by Activity Sector

| In R$ millions, end of | NPL 15-90 days | NPL Over 90 days | ||||||||||||||

| March 2016 | 1Q16 | 4Q15 | 1Q16 | 4Q15 | ||||||||||||

| Public Sector | 0.0 | % | 0.0 | % | 0.0 | % | 0.0 | % | ||||||||

| Private Sector | 3.1 | % | 2.6 | % | 3.9 | % | 3.5 | % | ||||||||

| Companies | 2.1 | % | 1.6 | % | 2.4 | % | 1.9 | % | ||||||||

| Industry and Commerce | 1.9 | % | 1.5 | % | 2.7 | % | 2.0 | % | ||||||||

| Services | 2.5 | % | 1.7 | % | 2.2 | % | 1.7 | % | ||||||||

| Primary Sector | 1.7 | % | 1.8 | % | 1.6 | % | 2.5 | % | ||||||||

| Other | 0.6 | % | 0.6 | % | 0.6 | % | 0.6 | % | ||||||||

| Individuals | 4.2 | % | 3.8 | % | 5.6 | % | 5.4 | % | ||||||||

| Total | 3.1 | % | 2.6 | % | 3.9 | % | 3.5 | % | ||||||||

Regarding the NPL by activity sector in March 2016, the 90-day NPL for industry and commerce was 2.7%, for services it was 2.2% and for the primary sector it was 1.6%. For further information on NPL Ratios by Activity, please refer to the Risk Management Report required by Circular No. 3,678 of the Brazilian Central Bank, of October 31, 2013, which is available on our Investor Relations website.

| Itaú Unibanco Holding S.A. | 23 |

| Management Discussion & Analysis | Income Statement Analysis |  |

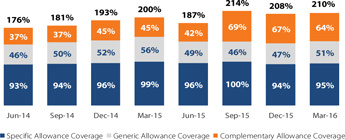

Coverage Ratio | 90 days

Note: Coverage ratio is derived from the division of the allowance for loans losses balance by the balance of operations more than 90 days overdue.

On March 31, 2016, the 90-day coverage ratio reached 210%, a 200 basis point increase compared to the previous quarter, mainly driven by the generic allowance, which was increased as a result of the challenging economic scenario.

Compared to March 2015, the 90-day coverage ratio increased 1,000 basis points, mainly due to the increased complementary allowance of R$4,655 million recognized in the third quarter of 2015.

Loan Portfolio Risk Level

Our credit risk management is aimed at maintaining the quality of the loan portfolio at levels appropriate for each market segment in which we operate.

We improved the guarantee control system to capture the updated market values for these individual operations. Therefore, operations with guarantees where the updated amount exceeds the debt balance are classified at better risk levels. On the other hand, operations with guarantees where the updated amount is insufficient to mitigate the entire risk are classified at worse risk levels.

On March 31, 2016, the portfolios rated “AA” and “A” accounted for 77.8% of the total loan portfolio, compared to 79.6% in December 2015.

Total loans rated from "D" and "H" accounted for 9.6% of total loans, 90 basis points higher than that recorded in the previous quarter.

Loan Portfolio Evolution by Risk Level

Note: Does not include endorsements and sureties.

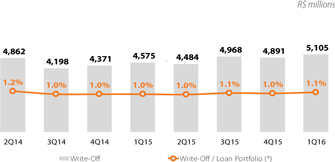

Loan Portfolio Write-Off

(*) Loan portfolio average balance for the previous two quarters.

In the first quarter of 2016, the loan portfolio write-off totaled R$5,105 million, a 4.4% increase compared to the previous quarter.

The ratio of written-off operations to the average balance of the credit portfolio reached 1.1%, practically unchanged from the fourth quarter of 2015.

Recovery of Loans Written off as Losses

In the first quarter of 2016, income from recovery of loans written off as losses decreased R$652 million, or 44.0%, from the previous quarter, mainly due to the recovery of loans written off as losses of a specific group of the corporate segment, in the amount of R$488 million, recognized in the fourth quarter of 2015.

Compared to the first quarter of 2015, income from recovery of loans written off as losses decreased R$231 million, or 21.8%, mainly due to the challenging economic scenario.

| Itaú Unibanco Holding S.A. | 24 |

| Management Discussion & Analysis | Income Statement Analysis |  |

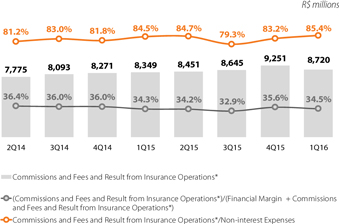

Commissions and Fees and Result from Insurance, Pension Plan and Premium Bonds

| In R$ millions | 1Q16 | 4Q15 | change | 1Q15 | change | |||||||||||||||||||||||

| Asset Management | 725 | 756 | (31 | ) | -4.1 | % | 662 | 63 | 9.5 | % | ||||||||||||||||||

| Current Account Services | 1,607 | 1,623 | (16 | ) | -1.0 | % | 1,405 | 203 | 14.4 | % | ||||||||||||||||||

| Credit Operations and Guarantees Provided | 766 | 840 | (74 | ) | -8.8 | % | 800 | (35 | ) | -4.3 | % | |||||||||||||||||

| Collection Services | 371 | 382 | (11 | ) | -2.8 | % | 365 | 6 | 1.5 | % | ||||||||||||||||||

| Credit Cards | 2,998 | 3,204 | (206 | ) | -6.4 | % | 2,884 | 114 | 3.9 | % | ||||||||||||||||||

| Other | 702 | 840 | (138 | ) | -16.4 | % | 750 | (48 | ) | -6.4 | % | |||||||||||||||||

| Commissions and Fees | 7,169 | 7,645 | (476 | ) | -6.2 | % | 6,867 | 303 | 4.4 | % | ||||||||||||||||||

| Result from Insurance, Pension Plan and Premium Bonds | 1,551 | 1,607 | (55 | ) | -3.5 | % | 1,482 | 69 | 4.7 | % | ||||||||||||||||||

| Total | 8,720 | 9,251 | (531 | ) | -5.7 | % | 8,349 | 372 | 4.5 | % | ||||||||||||||||||

| (-) Result from Other Insurance Activities(*) | 105 | 152 | (47 | ) | -31.1 | % | 85 | 20 | 23.8 | % | ||||||||||||||||||

| Total excluding Other Insurance Activities(*) | 8,616 | 9,099 | (484 | ) | -5.3 | % | 8,264 | 352 | 4.3 | % | ||||||||||||||||||

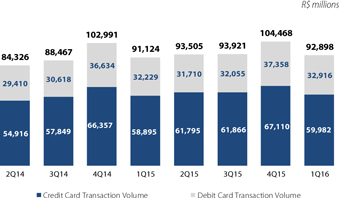

In the first quarter of 2016, commissions and fees amounted to R$7,169 million, a 6.2% decrease compared to the previous quarter. Compared to the first quarter of 2015, these revenues increased 4.4%, mainly driven by higher revenues from current account services and credit card.

In the first quarter of 2016, these revenues, combined with the result from insurance, pension plan and premium bonds, totaled R$8,720 million, a 5.7% decrease from the previous quarter and a 4.5% increase from the same period of the previous year.

Excluding the result from other insurance activities(*), our revenues reached R$8,616 million in the quarter, a decrease of 5.3% from the fourth quarter of 2015 and an increase of 4.3% from the same period of the previous year.

(*) Other insurance activities include extended warranty, health insurance, other products and our stake in IRB.

Asset Management

Asset management revenues totaled R$725 million in the first quarter of 2016, a decrease of 4.1% from the previous quarter, mainly driven by the smaller number of business days in the quarter.

Compared to the first quarter of 2015, these revenues recorded a 9.5% increase mainly driven by the higher volume of consortium and fund management operations.

Asset Administration

In the first quarter of 2016, fund management fees amounted to R$555 million, a 4.0% decrease compared to the fourth quarter of 2015, mainly due to the smaller number of business days in the quarter.

In March 2016, assets under administration totaled R$807 billion, with increases of 5.5% from the previous quarter and of 16.2% from the same period of the previous year.

According to the ANBIMA ranking, in March 2016 we were second in the fund management and managed portfolio* ranking, with a 21.5% market share.

* Includes Itaú Unibanco and Intrag.

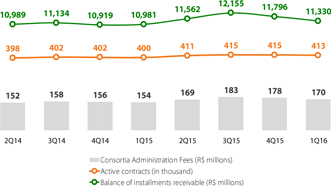

Consortia Administration Fees

Consortia administration fees totaled R$170 million in the first quarter of 2016, decreasing 4.4% from the fourth quarter of 2015. Compared to the same period of the previous year, a 10.6% increase was recorded, mainly driven by the growth in the consortia market and campaigns carried out internally.

In March 2016, we reached approximately 413 thousand active contracts, a 3.2% increase from the same period of the previous year.

In March 2016, the balance of installments receivable reached R$11.3 billion, a 4.0% decrease from December 2015 and a 3.2% increase from March 2015.

| Itaú Unibanco Holding S.A. | 25 |

| Management Discussion & Analysis | Income Statement Analysis |  |

Current Account Services

In the first quarter of 2016, revenues from current account services totaled R$1,607 million, remaining relatively stable compared to the previous period.