Form 6-K Itau Unibanco Holding For: Mar 31

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of

May 2016

Commission File Number: 001-15276

Itaú Unibanco Holding S.A.

(Exact name of registrant as specified in its charter)

Itaú Unibanco Holding S.A.

(Translation of Registrant’s Name into English)

Praça Alfredo Egydio de Souza Aranha, 100-Torre Conceicao - CEP

04344-902 São Paulo, SP, Brazil

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F: x Form 40-F: ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes: ¨ No: x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes: ¨ No: x

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes: ¨ No: x

If

“Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

82-___________________.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Itaú Unibanco Holding S.A. | ||||

| (Registrant) | ||||

| Date: May 5, 2016 | By: | /s/ Marcelo Kopel | ||

| Name: | Marcelo Kopel | |||

| Title: | Investor Relations Officer | |||

| By: | /s/ Eduardo Mazzilli de Vassimon | |||

| Name: | Eduardo Mazzilli de Vassimon | |||

| Title: | Chief Financial Officer | |||

EXHIBIT INDEX

| 99.1 |

Risk and Capital Management Pillar 3 - 1st quarter of 2016 |

Exhibit 99.1

| Risk and Capital Management – Pillar 3 |

| OBJECTIVE | 4 | |

| KEY INDICATORS | 4 | |

| 1 | RISK AND CAPITAL MANAGEMENT | 5 |

| 1.1 | Organizational Structure | 5 |

| 1.2 | Risk and Capital Governance | 6 |

| 2 | CAPITAL | 7 |

| 2.1 | Capital Management | 7 |

| 2.2 | Capital Requirements in Place and in Progress | 7 |

| 2.3 | Capital Composition | 9 |

| 2.4 | Risk-Weighted Asset (RWA) | 10 |

| Risk-Weighted Assets for Credit Risk (RWACPAD) | 11 | |

| Risk-Weighted Assets for Market Risk (RWAMPAD) | 11 | |

| Risk-Weighted Assets for Operational Risk (RWAOPAD) | 11 | |

| 2.5 | Additional Common Equity Tier I | 12 |

| 2.6 | Capital Adequacy | 12 |

| 2.7 | Leverage Ratio | 14 |

| 3 | BALANCE SHEET | 15 |

| Balance Sheet | 15 | |

| Institutions that comprises the Financial Statements of Itaú Unibanco Holding | 17 | |

| Material entities | 18 | |

| 4 | INVESTMENTS IN OTHER ENTITIES | 19 |

| 4.1 | Investments in other entities not classified in the trading book | 19 |

| 5 | CREDIT RISK | 20 |

| 5.1 | Framework and Treatment | 20 |

| 5.2 | Credit Portfolio Analysis | 22 |

| Operations with Credit Granting Characteristics by Brazil Geographic Regions and by Countries | 22 | |

| Operations with Credit Granting Characteristics by Economic Sector | 23 | |

| Remaining maturity of loan transactions | 24 | |

| Concentration on the Major Debtors | 24 | |

| Overdue Amounts | 25 | |

| Allowance for Loan Losses | 25 | |

| Mitigating Instruments | 26 | |

| Counterparty Credit Risk | 27 | |

| Acquisitions, Sale or Transfer of Financial Assets | 28 | |

| Operations of Securitization | 29 | |

| Credit Derivatives | 30 | |

| 6 | MARKET RISK | 31 |

| 6.1 | Framework and Treatment | 31 |

| 6.2 | Portfolio Analysis | 34 |

| Interest rate risk in the non-trading book | 34 | |

| Evolution of the Trading Portfolio | 35 | |

| Evolution of the Derivatives Portfolio | 35 | |

| VaR - Consolidated Itaú Unibanco | 36 | |

| VaR - Trading Portfolio | 36 | |

| Backtesting | 37 | |

| Itaú Unibanco |

| Risk and Capital Management – Pillar 3 |

| 7 | OPERATIONAL RISK | 38 |

| 7.1 | Framework and Treatment | 38 |

| 7.2 | Crisis Management and Business Continuity | 39 |

| 8 | LIQUIDITY RISK | 40 |

| 8.1 | Framework and Treatment | 40 |

| 8.2 | Primary Sources of Funding | 41 |

| 9 | OTHER RISKS | 41 |

| Insurance products, pension plans and “capitalização” risks | 41 | |

| Social and Environmental Risk | 42 | |

| Risk Regulatory Risk | 42 | |

| Model Risk | 42 | |

| Country Risk | 43 | |

| Business and Strategy Risk | 43 | |

| Reputational Risk | 43 | |

| 10 | ENTERPRISE RISK MANAGEMENT AND ALIGNMENT OF INCENTIVES | 45 |

| Risk Appetite | 45 | |

| Stress Test | 45 | |

| Risk-adjusted Compensation | 45 | |

| 11 | APPENDIX I | 47 |

| 12 | GLOSSARIES | 50 |

| 12.1 | Glossary of Acronyms | 50 |

| 12.2 | Glossary of Regulations | 52 |

| Itaú Unibanco |

| Risk and Capital Management – Pillar 3 |

Objective

This document aims at submitting Itaú Unibanco Holding S.A. (Itaú Unibanco) information required by the Central Bank of Brazil (BACEN) through Circulars 3,678 and 3,716, which address the disclosure of information on risks management, calculation of risk-weighted assets (RWA), and calculation of the Referential Equity (PR), consistently with the capital rules and in accordance with Itaú Unibanco’s institutional standards.

For other information than the contained on this document, please visit http://www.itau.com.br/investor-relations.

Key indicators

Itaú Unibanco’s risk and capital management focuses on maintaining the institution’s risk profile in line with the risk strategy and guidelines approved by the Board of Directors. The main metrics of the Prudential Conglomerate, on March 31, 2016, are summarized below.

| BIS Ratio | Common Equity Tier I Ratio | Tier II Ratio | ||

| 17.7% | 14.3% | 3.4% | ||

| December 31, 2015: 17.8% | December 31, 2015: 14.0% | December 31, 2015: 3.8% | ||

| Referential Equity | Common Equity Tier I | Tier II | ||

| R$ 122,872 million | R$ 99,220 million | R$ 23,582 million | ||

| December 31, 2015: R$ 128,465 million | December 31, 2015: R$ 100,955 million | December 31, 2015: R$ 27,464 million |

| RWA | Credit Risk Exposure | |

| R$ 694,899 million | R$ 637,179 million | |

| December 31, 2015: R$ 722,468 million | December 31, 2015: R$ 679,593 million | |

|

|

| 4 | |

| Itaú Unibanco |

| Risk and Capital Management – Pillar 3 |

| 1 | Risk and Capital Management |

Itaú Unibanco understands risk and capital management as essential to optimize the use of resources and to select the best business opportunities, seeking to maximize value creation for its shareholders.

The Risk Management process at Itaú Unibanco:

| · | Identifies and measures existing and potential risks to Itaú Unibanco’s positions; |

| · | Aligns risk management and control institutional policies, procedures and methodologies with the directives from, and approved by, the Board of Directors; |

| · | Seeks the best risk-return ratios for Itaú Unibanco’s portfolio management. |

The risk identification process purpose is to map internal and external risk threats that may affect the business’ and support units’ strategies, potentially impacting Itaú Unibanco’s results, capital, liquidity and reputation.

The risk management processes permeate the entire institution and are aligned with the Board of Directors and the Senior Management directives, which define the overall objectives by setting targets and limits for business units through its corporate bodies. The capital management and control units support Itaú Unibanco’s management through monitoring and analyzing risk and capital processes.

Itaú Unibanco, aiming at strengthening its values and aligning its employees' behavior with the guidelines established in risk management, adopts a number of initiatives to stimulate the risk culture. In addition to policies, procedures and processes, risk culture strengthens the individual and collective responsibility of employees in the management of risks inherent in the activities performed individually, respecting the ethical way of managing business.

Itaú Unibanco’s four risk culture principles are conscious risk-taking, discussion of the risks the institution faces, the corresponding action taken and the management of risks by the entire staff. With these principles disseminated throughout the institution, there is an incentive for risk to be widely understood and openly debated, to be kept within the levels indicated by the risk appetite, and to be taken as the individual responsibility of each employee of Itaú Unibanco, irrespective of their position, area or function. There are also other mechanisms to help communicate concepts of risk culture, such as training incentives, surveys, team conduct assessments and recording of risk events.

According to National Monetary Council (CMN) Resolution 3,988, BACEN Circular 3,547 and BACEN Circular Letter 3,685, Itaú Unibanco implemented a capital management structure and the Internal Capital Adequacy Assessment Process (ICAAP), adopting a prospective capital management attitude.

| 1.1 | Organizational Structure |

Itaú Unibanco’s risk management organizational structure complies with Brazilian and international regulations in place and is aligned with the market’s best practices. Responsibilities for risk management at Itaú Unibanco are structured according to the concept of three lines of defense, namely:

| · | in the first line of defense, the business and corporate support areas to have the role of managing the risks they themselves give rise to, by identifying, assessing, controlling and reporting the risks; |

| · | in the second line of defense, an independent unit provides central control, so as to ensure that Itaú Unibanco’s risk is managed according to the risk appetite and established policies and procedures. This centralized control provides the Board and executives with a global overview of Itaú Unibanco’s exposure, to ensure correct and speedy corporate decisions; |

| · | the role of the third line of defense, internal audit, is to provide an independent assessment of the institution’s activities, so that senior management can see that controls are adequate, risk management is effective and that internal controls and regulatory requirements are being complied with. |

Itaú Unibanco uses information technology (IT) systems, managed to fully comply with Central Bank’s requirements on capital adequacy and risk measurement, in accordance with regulatory models and requirements in place. It also monitors adherence to the qualitative and quantitative regulators’ minimum capital and risk management requirements.

| 5 | |

| Itaú Unibanco |

| Risk and Capital Management – Pillar 3 |

| 1.2 | Risk and Capital Governance |

Itaú Unibanco has established risk and capital management committees that report directly to the Board of Directors, with members being elected or appointed by the Board. At the executive level, risk is managed by corporate bodies.

A detailed description of the structure can be found in the Consolidated Annual Report in session Our Risk Management. The Consolidated Annual Report can be found in the website www.itau.com.br/investor-relations, section “Financial Information”.

| 6 | |

| Itaú Unibanco |

| Risk and Capital Management – Pillar 3 |

| 2 | Capital |

| 2.1 | Capital Management |

The Board of Directors is the main body in the Itaú Unibanco’s capital management and it is responsible for approving the capital management institutional policy and guidelines regarding the capitalization level of the conglomerate. The Board is also involved in approving the ICAAP report, a process which is intended to assess the adequacy of Itaú Unibanco’s capital by identifying material risks; by defining the need for additional capital for such risks and the internal means of quantifying it; by preparing a capital plan, both for normal and stress situations; and by structuring a capital contingency plan.

The result of the latest ICAAP – which was dated December 2015 – shows that, in addition to the capital required to cover material risks, Itaú Unibanco has a significant capital surplus, thus ensuring the organization’s soundness.

At the executive level, corporate bodies are responsible for approving risk assessment and capital calculation methodologies, as well as reviewing, monitoring and recommending capital-related documents and topics to the Board of Directors. As for the corporate bodies governance, Itaú Unibanco has a dedicated structure for capital management, which consolidates information and coordinates related processes, all of which subject to verification by the independent validation, internal controls and audit areas.

In order to provide the necessary information for supporting decision taking by the Executives and the Board of Directors, management reports are prepared and presented at corporate bodies, informing about Itau Unibanco’s capital adequacy, as well as about the projections of future capital levels in normal and stress situations.

The guidelines of the institutional capital management policy can be accessed at www.itau.com.br/investor-relations, under “Corporate Governance, Regulations and Policies, Public Access Report – Capital Management”.

| 2.2 | Capital Requirements in Place and in Progress |

Itaú Unibanco’s minimum capital requirements follow the set of resolutions(2) and circulars disclosed by the Central Bank of Brazil (BACEN) that implemented, in Brazil, the global capital requirement standards known as Basel III. These are expressed as ratios of the capital available stated by the Referential Equity (PR), or Total Capital, composed by the Tier I Capital (which comprises the Common Equity and Additional Tier I Capital) and Tier II Capital, and the risk-weighted assets, or RWA.

The Total Capital, Tier I Capital and Common Equity Tier I Capital ratios are calculated on a consolidated basis, applied to institutions included in Prudential Conglomerate(3), which comprises not only financial institutions but also collective financing plans (“consórcios”), payment entities, factoring companies or companies that directly or indirectly assume credit risk, and investment funds in which the conglomerate retains substantially all risks and rewards.

For purposes of calculating these minimum capital requirements, the total RWA is determined as the sum of the risk-weighted asset amounts for credit risk, market risk, and operational risk. Itaú Unibanco uses the standardized approaches to calculate these risk-weighted asset amounts described in section “2.4 Risk-weighted Assets”.

The required minimum Total Capital ratio is 11% between October 1, 2013, and December 31, 2015, reducing gradually to 8% on January 1, 2019. To counteract this, the BACEN rules call for Additional Common Equity Tier I Capital (ACP), corresponding to the sum of the components ACPConservation, ACPCountercyclical and ACPSystemic, which, in conjunction with the requirements mentioned in the preceding paragraph, increase capital requirements over time. Under CMN Resolution 4,193, the sum of the values of the components ACPConservation and ACPCountercyclical will increase gradually from 0.625%, as from January 1, 2016, to 2.5% as from January 1, 2019. However, nowadays, according to BACEN Circular 3,769, the value required for component ACPCountercyclical is zero, and if this portion should increase, the new percentage takes effect twelve months after the announcement. In the case of component ACPSystemic, the current requirement applicable to Itaú Unibanco under BACEN Circular 3,768 is 0%, increasing gradually from 0.25%, as from January 1, 2017, to 1% as from January 1, 2019, since the ratio between the amount of Itaú Unibanco’s Total Exposure and Brazil’s Gross Domestic Product (GDP) is more than ten percent (10%) and less than fifty percent (50%).

(2) The standards that implemented the Basel III rules in Brazil were disclosed on March 1, 2013 through Resolutions No. 4,192 to No. 4,195 of the National Monetary Council (CMN) (Resolution No. 4,195 was revoked by Resolution No. 4,280), together with 15 Circulars published by BACEN on March 4, 2013, as amended.

(3)Further details of Prudential Conglomerate can be found in BACEN Circular No. 3,701, CMN Resolution No. 4,280 or in the link: http://www.bcb.gov.br/?BRPRUDENTIALFINREG.

| 7 | |

| Itaú Unibanco |

| Risk and Capital Management – Pillar 3 |

New requirements were redefined to qualify instruments eligible for Tier I or Tier II Capital. Additionally, it was established a gradual reduction of the eligibility of the instrument inventory issued pursuant to CMN Resolution 3,444.

The table below shows Basel III implementation calendar, set by the BACEN. The percentages refer to the portion of risk-weighted asset by Itaú Unibanco.

| Basel III - Schedule | From January 1st | |||||||||||||||||||

| 2015 | 2016 | 2017 | 2018 | 2019 | ||||||||||||||||

| Common Equity Tier I | 4.5 | % | 4.5 | % | 4.5 | % | 4.5 | % | 4.5 | % | ||||||||||

| Tier I | 6.0 | % | 6.0 | % | 6.0 | % | 6.0 | % | 6.0 | % | ||||||||||

| Total Capital | 11 | % | 9.875 | % | 9.25 | % | 8.625 | % | 8.0 | % | ||||||||||

| Additional Common Equity Tier I (ACP) | 0.0 | % | 0.625 | % | 1.50 | % | 2.375 | % | 3.5 | % | ||||||||||

| conservation | 0 | % | 0.625 | % | 1.25 | % | 1.875 | % | 2.5 | % | ||||||||||

| countercyclical (1) | 0 | % | 0 | % | 0 | % | 0 | % | 0 | % | ||||||||||

| systemic | 0 | % | 0 | % | 0.25 | % | 0.5 | % | 1.0 | % | ||||||||||

| Common Equity Tier I + ACP | 4.5 | % | 5.1 | % | 6.0 | % | 6.9 | % | 8.0 | % | ||||||||||

| Total Capital + ACP | 11.0 | % | 10.5 | % | 10.8 | % | 11.0 | % | 11.5 | % | ||||||||||

| Prudential adjustments deductions | 40 | % | 60 | % | 80 | % | 100 | % | 100 | % | ||||||||||

(1) According to Circular Bacen no 3,769, the ACP countercyclical requirement is zero.

In addition to the minimum capital requirements, BACEN Circular No. 3,748 has been in force since the fourth quarter of 2015. It incorporates the Leverage Ratio (the ratio between Tier I Capital and Total Exposure, calculated as indicated in this Circular) in the Basel III framework in Brazil. More details are given in section “2.7 Leverage Ratio” in this report.

Additionally, in March 2015, Circular BACEN No. 3,751 came into force. It provides for the calculation of the relevant indicators for assessing the Global Systemically Important Banks (G-SIBs) of financial institutions in Brazil. Information on the values of the G-SIBs indicators can been found at www.itau.com.br/investor-relations, section “Corporate Governance, Pillar 3- Spreadsheet Support”, “Annex I- IAISG”.

The compliance of BACEN to the standards recommended by the Basel Committee was assessed at the end of 2013, under the Regulatory Consistency Assessment Programme (RCAP)(4). The rules effective in Brazil were considered compliant—pursuant to the BIS, Brazil is a compliant jurisdiction—i.e., the capital standards established in Brazil also consistent with the internationally accepted minimum requirements. The pointed out discrepancies were considered immaterial.

Minimum capital requirement for Insurance

In July 2015, the National Council of Private Insurance (CNSP) issued CNSP Resolution 321, which, among other things, deals with the minimum capital requirements for underwriting, credit, operating and market risks for insurers, open private pension entities, premium bonds companies and reinsurers. Upon publication of this resolution, CNSP Resolutions 228, 280, 283, 284, 316 and 317 are cancelled.

(4) Regulatory Consistency Assessment Programme (RCAP). Assessment of Basel III regulations in Brazil, December 2013, updated in March 2015 with no additional material points.

| 8 | |

| Itaú Unibanco |

| Risk and Capital Management – Pillar 3 |

| 2.3 | Capital Composition |

The Referential Equity (PR), used to monitor compliance with the operational limits imposed by BACEN, is the sum of three levels, where:

| · | Common Equity Tier I: the sum of social capital, reserves and retained earnings, less deductions and prudential adjustment; |

| · | Additional Tier I Capital: consists of instruments of a perpetual nature, which meet eligibility requirements. Together with Common Equity Tier I it makes up Tier I; |

| · | Tier II: consists of subordinated debt instruments with defined maturity dates that meet eligibility requirements. Together with Common Equity Tier I and Additional Tier I Capital, makes up Total Capital. |

The table below presents the composition of the referential equity and its components (Common Equity Tier I, Additional Tier I Capital and Tier II Capital), taking into consideration their respective deductions and prudential adjustments, as per Resolutions mentioned.

| Composition of Referential Equity | R$ million | |||||||||||

| 03/31/2016 | 12/31/2015 | 03/31/2015 | ||||||||||

| Stockholders’ equity Itaú Unibanco Holding S.A. (Consolidated) | 106,647 | 106,462 | 96,954 | |||||||||

| Minority Interest in Subsidiaries | 937 | 916 | 860 | |||||||||

| Changes in ownership interest in a subsidiary in capital transactions | 3,378 | 3,683 | 4,579 | |||||||||

| Consolidated Stockholders’ Equity (BACEN) | 110,962 | 111,061 | 102,393 | |||||||||

| Preferred shares with clause of redemption excluded from Tier I | - | - | - | |||||||||

| Deductions | (11,742 | ) | (10,107 | ) | (10,942 | ) | ||||||

| Common Equity Tier I | 99,220 | 100,955 | 91,451 | |||||||||

| Instruments eligible to comprise Additional Tier I | - | - | - | |||||||||

| Additional Tier I deductions | 70 | 46 | 50 | |||||||||

| Additional Tier I Capital | 70 | 46 | 50 | |||||||||

| Tier I (Common Equity Tier I + Additional Tier I Capital) | 99,290 | 101,001 | 91,501 | |||||||||

| Instruments eligible to comprise Tier II (1) | 23,488 | 27,403 | 29,354 | |||||||||

| Tier II deductions | 93 | 61 | 48 | |||||||||

| Tier II | 23,582 | 27,464 | 29,402 | |||||||||

| Reference Equity (Tier I + Tier II) | 122,872 | 128,465 | 120,903 | |||||||||

(1) The Instruments eligible to comprise Tier II also includes R$ 194 million of Preferred Shares.

Appendix I (“Breakdown of the Referential Equity and Information on its adequacy”) hereto breaks down in detail the Referential Equity as required by BACEN Circulars 3,678 and 3,716.

Funds obtained through the issue of subordinated debts that compose Tier II capital, for the purpose of the Basel ratio between capital and risk-weighted assets, are described below:

| Subordinated Debt and Referential Equity Tier II | R$ million |

| Maturities | 03/31/2016 | 12/31/2015 | 03/31/2015 | |||||||||||||||||||||||||||||||||

| Name of instrument | <1 year | 1-2 years | 2-3 years | 3-4 years | 4-5 years | > 5 years | Total | Total | Total | |||||||||||||||||||||||||||

| Bank Deposit Certificate (CDB) | 2,125 | - | - | - | - | - | 2,125 | 7,463 | 7,618 | |||||||||||||||||||||||||||

| Financial Bills | 5,657 | 9,251 | 8,553 | 120 | - | 3,636 | 27,217 | 26,912 | 26,043 | |||||||||||||||||||||||||||

| Euronotes | 392 | - | - | - | 7,917 | 19,485 | 27,794 | 30,486 | 25,047 | |||||||||||||||||||||||||||

| Subordinated Debt (Mar/16) | 8,173 | 9,251 | 8,553 | 120 | 7,917 | 23,121 | 57,136 | 64,861 | 58,708 | |||||||||||||||||||||||||||

| Subordinated Debt Not Elegible to Capital | 38 | 31 | 30 | 28 | 97 | 560 | 783 | 923 | 820 | |||||||||||||||||||||||||||

| Subordinated Debt - Total (Mar/16) | 8,210 | 9,282 | 8,583 | 148 | 8,014 | 23,682 | 57,919 | |||||||||||||||||||||||||||||

| Subordinated Debt after Reducer (Mar/16) | - | 1,850 | 3,421 | 72 | 6,334 | 23,121 | 34,799 | |||||||||||||||||||||||||||||

| Subordinated Debt Elegible to Capital (Dec/12) | - | 990 | 290 | 4,198 | 6,993 | 26,352 | 38,824 | |||||||||||||||||||||||||||||

| Threshold (1) Subordinated debt (Dec/12) | - | 594 | 174 | 2,519 | 4,196 | 15,811 | 23,294 | |||||||||||||||||||||||||||||

| Subordinated Debt Elegible to Capital (Mar/16) (2) | - | 594 | 174 | 2,519 | 4,196 | 15,811 | 23,294 | |||||||||||||||||||||||||||||

(1) Subordinated debt with application of threshold in accordance with the current rules (Resolution 4,192/13 - Art 28).

(2) According to current legislation, the accounting balance of subordinated debt as of December 2012 was used for the calculation of referential equity as of March, 2016.

| 9 | |

| Itaú Unibanco |

| Risk and Capital Management – Pillar 3 |

Details concerning maturities, compensation, principal amount, accounting balance and subordinated debt balance are described next:

| Subordinated Debts Elegibles to Capital - Details | R$ million | ||||||||||||||||||||||||||||||||

| 03/31/2016 | 12/31/2015 | 03/31/2015 | Mar/16-Dec/15 | Mar/16-Mar/15 | 03/31/2016 | ||||||||||||||||||||||||||||

| Name of instrument/ Currency | Issue | Maturity | Compensation p.a. | Principal Value | Principal Variation | Accouting Balance |

|||||||||||||||||||||||||||

| Subordinated CDB (1)(2) - BRL | |||||||||||||||||||||||||||||||||

| 2008 | 2015 | 119.8% of CDI (1) | - | - | 400 | - | (400 | ) | - | ||||||||||||||||||||||||

| 2010 | 2015 | 113% of CDI | - | - | 50 | - | (50 | ) | - | ||||||||||||||||||||||||

| 2006 | 2016 | 100% of CDI + 0.7% | 466 | 466 | 466 | - | - | 1,278 | |||||||||||||||||||||||||

| 2010 | 2016 | 110% to 114% of CDI | - | 2,665 | 2,665 | (2,665 | ) | (2,665 | ) | - | |||||||||||||||||||||||

| IPCA (2) + 7.21% to 7.33% | - | 123 | 123 | (123 | ) | (123 | ) | - | |||||||||||||||||||||||||

| 2010 | 2017 | IPCA + 7.21% to 7.33% | 367 | 367 | 367 | - | - | 847 | |||||||||||||||||||||||||

| Total | 833 | 3,621 | 4,071 | (2,788 | ) | (3,238 | ) | 2,125 | |||||||||||||||||||||||||

| Subordinated Financial Bills - BRL | |||||||||||||||||||||||||||||||||

| 2010 | 2016 | 100% of CDI + 1.35% to 1.36% | 365 | 365 | 365 | - | - | 371 | |||||||||||||||||||||||||

| 112% to 112.5% of CDI | 1,874 | 1,874 | 1,874 | - | - | 1,904 | |||||||||||||||||||||||||||

| IPCA + 7% | 30 | 30 | 30 | - | - | 62 | |||||||||||||||||||||||||||

| 2010 | 2017 | IPCA + 6.95% to 7.2% | 206 | 206 | 206 | - | - | 327 | |||||||||||||||||||||||||

| 2011 | 2017 | 108% to 112% of CDI | 3,224 | 3,224 | 3,224 | - | - | 3,467 | |||||||||||||||||||||||||

| 100% of CDI + 1.29% to 1.52% | 3,650 | 3,650 | 3,650 | - | - | 3,765 | |||||||||||||||||||||||||||

| IPCA + 6.15% to 7.8% | 352 | 352 | 352 | - | - | 600 | |||||||||||||||||||||||||||

| IGPM (2) + 6.55% to 7.6% | 138 | 138 | 138 | - | - | 252 | |||||||||||||||||||||||||||

| 2012 | 2017 | 100% of CDI + 1.12% | 500 | 500 | 500 | - | - | 524 | |||||||||||||||||||||||||

| 2011 | 2018 | IGPM + 7% | 42 | 42 | 42 | - | - | 59 | |||||||||||||||||||||||||

| IPCA + 7.53% to 7.7% | 30 | 30 | 30 | - | - | 47 | |||||||||||||||||||||||||||

| 2012 | 2018 | 108% to 113% of CDI | 6,373 | 6,373 | 6,373 | - | - | 7,155 | |||||||||||||||||||||||||

| IPCA + 4.4% to 6.58% | 461 | 461 | 461 | - | - | 700 | |||||||||||||||||||||||||||

| 100% of CDI + 1.01% to 1.32% | 3,782 | 3,782 | 3,782 | - | - | 3,963 | |||||||||||||||||||||||||||

| 9.95% to 11.95% | 112 | 112 | 112 | - | - | 162 | |||||||||||||||||||||||||||

| 2011 | 2019 | 109% to 109.7% of CDI | 2 | 2 | 2 | - | - | 3 | |||||||||||||||||||||||||

| 2012 | 2019 | 110% of CDI | 1 | 1 | 1 | - | - | 2 | |||||||||||||||||||||||||

| 11.96% | 12 | 12 | 12 | - | - | 19 | |||||||||||||||||||||||||||

| IPCA + 4.7% to 6.3% | 101 | 101 | 101 | - | - | 155 | |||||||||||||||||||||||||||

| 2012 | 2020 | 111% to CDI | 1 | 1 | 1 | - | - | 2 | |||||||||||||||||||||||||

| IPCA + 6% to 6.17% | 20 | 20 | 20 | - | - | 34 | |||||||||||||||||||||||||||

| 2011 | 2021 | 109.25% to 110.5% of CDI | 6 | 6 | 6 | - | - | 10 | |||||||||||||||||||||||||

| 2012 | 2022 | IPCA + 5.15% to 5.83% | 2,307 | 2,307 | 2,307 | - | - | 3,608 | |||||||||||||||||||||||||

| IGPM + 4.63% | 20 | 20 | 20 | - | - | 26 | |||||||||||||||||||||||||||

| Total | 23,609 | 23,609 | 23,609 | - | - | 27,217 | |||||||||||||||||||||||||||

| Subordinated Euronotes - USD | |||||||||||||||||||||||||||||||||

| 2010 | 2020 | 6.2% | 990 | 990 | 990 | - | - | 3,630 | |||||||||||||||||||||||||

| 2010 | 2021 | 5.75% | 1,000 | 1,000 | 1,000 | - | - | 3,533 | |||||||||||||||||||||||||

| 2011 | 2021 | 5.75% to 6.2% | 730 | 730 | 730 | - | - | 2,725 | |||||||||||||||||||||||||

| 2012 | 2021 | 6.2% | 550 | 550 | 550 | - | - | 1,957 | |||||||||||||||||||||||||

| 2012 | 2022 | 5.5% to 5.65% | 2,600 | 2,600 | 2,600 | - | - | 9,231 | |||||||||||||||||||||||||

| 2012 | 2023 | 5.13% | 1,851 | 1,851 | 1,851 | - | - | 6,718 | |||||||||||||||||||||||||

| Total USD | 7,721 | 7,721 | 7,721 | ||||||||||||||||||||||||||||||

| Total BRL | 27,794 | ||||||||||||||||||||||||||||||||

| Grand Total | 57,136 | ||||||||||||||||||||||||||||||||

| Subordinated Debt after Reducer | 34,799 | ||||||||||||||||||||||||||||||||

| Subordinated Debts Elegibles to Capital (Mar/16) | 23,294 | ||||||||||||||||||||||||||||||||

(1) CDB is Bank Deposit Certificate and CDI is Interbank Deposit Certificate.

(2) IPCA and IGP-M are Brazilian Inflation Indexes.

For information on each instrument that is part of the Referential Equity as required by BACEN Circulars 3,678 and 3,716, please visit the website www.itau.com.br/investor-relations, section “Corporate Governance, Pillar 3 – Spreadsheet Support”, “Appendix I and II – Pillar 3”, “Appendix II – Main Features of the Referential Equity Instruments (PR)”.

| 2.4 | Risk-Weighted Asset (RWA) |

According to CMN Resolutions 4,193 and 4,281, for assessing the minimum capital requirements, the RWA must be calculated by adding the portions, as shown below:

| · | RWACPAD = portion related to exposures to credit risk; |

| · | RWACAM = portion related to the exposures in gold, foreign exchange rate and assets subject to foreign exchange rate variations; |

| · | RWAJUR = portion related to exposures subjects to variations of interest rates, interest coupons and coupon rates and classified in the Trading Portfolio; |

| · | RWACOM = portion related to exposures subjects to variations in commodity prices; |

| · | RWAACS = portion related to exposures subjects to variations in equities prices and classified in the Trading Portfolio; |

| 10 | |

| Itaú Unibanco |

| Risk and Capital Management – Pillar 3 |

| · | RWAOPAD = portion relating to the calculation of operational risk capital requirements. |

The table below presents the consolidated evolution of RWA composition of Itaú Unibanco. Each of the portions mentioned above will be presented in detail in the following topics.

| Composition of Risk-Weighted Asset | R$ million | |||||||||||||||||||||||

| Risk exposures | 03/31/2016 | 12/31/2015 | 03/31/2015 | |||||||||||||||||||||

| Risk-Weighted Assets for Credit Risk (RWACPAD) | 637,179 | 92 | % | 679,593 | 94 | % | 728,559 | 92 | % | |||||||||||||||

| Risk-Weighted Assets for Market Risk (RWAMPAD) | 20,356 | 3 | % | 14,252 | 2 | % | 24,776 | 3 | % | |||||||||||||||

| Risk-Weighted Assets for Operational Risk (RWAOPAD) | 37,364 | 5 | % | 28,623 | 4 | % | 35,509 | 5 | % | |||||||||||||||

| Risk-Weighted Assets (RWA) | 694,899 | 100 | % | 722,468 | 100 | % | 788,844 | 100 | % | |||||||||||||||

Risk-Weighted Assets for Credit Risk (RWACPAD)

The table below presents the credit risk-weighted assets (RWACPAD) separated by risk weighting factor and asset type:

| Composition of Risk-Weighted Assets for Credit Risk (RWACPAD) | R$ million | |||||||||||

| 03/31/2016 | 12/31/2015 | 03/31/2015 | ||||||||||

| Risk exposures | ||||||||||||

| Risk-Weighted Assets for Credit Risk (RWACPAD) | 637,179 | 679,593 | 728,559 | |||||||||

| a) Per Risk Weighting Factor (FPR): | ||||||||||||

| FPR at 2% | 149 | 179 | 136 | |||||||||

| FPR at 20% | 6,484 | 7,000 | 6,291 | |||||||||

| FPR at 35% | 11,888 | 11,695 | 8,579 | |||||||||

| FPR at 50% | 46,622 | 46,025 | 46,681 | |||||||||

| FPR at 75% | 129,244 | 136,104 | 145,250 | |||||||||

| FPR at 85% | 117,929 | 129,884 | 147,950 | |||||||||

| FPR at 100% | 267,515 | 288,057 | 305,875 | |||||||||

| FPR at 250% | 36,973 | 37,858 | 34,294 | |||||||||

| FPR at 300% | 9,066 | 10,751 | 18,002 | |||||||||

| FPR up to 1250%(1) | 1,305 | 1,990 | 1,688 | |||||||||

| Derivatives – Future potential gain and Variation of the counterparty credit quality | 10,005 | 10,050 | 13,812 | |||||||||

| b) Per Type: | ||||||||||||

| Securities | 45,130 | 51,085 | 55,102 | |||||||||

| Loan operations - Retail | 102,840 | 109,882 | 119,257 | |||||||||

| Loan operations - Non-retail | 218,141 | 237,365 | 232,035 | |||||||||

| Joint liabilities - Retail | 202 | 242 | 324 | |||||||||

| Joint liabilities - Non-retail | 44,451 | 46,655 | 65,499 | |||||||||

| Loan commitments - Retail | 26,199 | 25,972 | 25,651 | |||||||||

| Loan commitments - non-retail | 11,464 | 12,924 | 17,629 | |||||||||

| Other exposures | 188,752 | 195,468 | 213,063 | |||||||||

(1) Taking into consideration the application of the “F” factor required by Article 29 of BACEN Circular 3,644, 2013.

Risk-Weighted Assets for Market Risk (RWAMPAD)

The amount of RWAMPAD is obtained by adding the portions terms: RWACAM, RWAJUR, RWACOM, RWAACS. The table below presents the risk weighted assets for Market Risk:

| Composition of Risk-Weighted Assets for Market Risk (RWAMPAD) | R$ million | |||||||||||

| 03/31/2016 | 12/31/2015 | 03/31/2015 | ||||||||||

| Risk-Weighted Assets for Market Risk (RWAMPAD) | 20,356 | 14,252 | 24,776 | |||||||||

| Trades subject to interest rate variation (RWAJUR) | 15,779 | 11,291 | 12,046 | |||||||||

| Fixed income interest rate denominated in reais (RWAJUR1) | 5,051 | 2,127 | 3,995 | |||||||||

| Foreign exchange linked interest rate (RWAJUR2) | 7,622 | 6,700 | 4,858 | |||||||||

| Price index linked interest rate (RWAJUR3) | 3,107 | 2,464 | 3,194 | |||||||||

| Interest rate linked interest rate (RWAJUR 4) | 0 | 0 | 0 | |||||||||

| Operations subject to commodity price variation (RWACOM) | 624 | 473 | 921 | |||||||||

| Operations subject to stock price variation (RWAACS) | 913 | 952 | 610 | |||||||||

| Operations subject to the risk of exposures in gold, foreign currency and foreign exchange rate variations (RWACAM) | 3,040 | 1,536 | 11,198 | |||||||||

| Referential equity calculated for covering the interest rate risk of trades of the banking book (RBAN) | 1,026 | 1,275 | 1,216 | |||||||||

Risk-Weighted Assets for Operational Risk (RWAOPAD)

BACEN Circulars 3,640, 3,675 and 3,739 establish the criteria for determining the portion of risk-weighted assets related to the capital required for operational risk (RWAOPAD). In accordance with current regulation, the exposure of RWAOPAD is calculated on a semiannual basis, related to June 30th and December 31st.

| 11 | |

| Itaú Unibanco |

| Risk and Capital Management – Pillar 3 |

The RWA for operational risk is presented below:

| Composition of Risk-Weighted Assets for Operational Risk (RWAOPAD) | R$ million | |||||||||||

| 03/31/2016 | 12/31/2015 | 03/31/2015 | ||||||||||

| Risk-Weighted Assets for Operational Risk (RWA OPAD) | 37,364 | 28,623 | 35,509 | |||||||||

| Retail | 6,899 | 7,470 | 6,946 | |||||||||

| Commercial | 19,496 | 16,491 | 16,653 | |||||||||

| Corporate finance | 1,526 | 1,380 | 1,370 | |||||||||

| Negotiation and sales | 577 | (4,927 | ) | 2,581 | ||||||||

| Payments and settlements | 3,419 | 3,074 | 3,070 | |||||||||

| Financial agent services | 3,070 | 2,873 | 2,756 | |||||||||

| Asset management | 2,375 | 2,145 | 2,132 | |||||||||

| Retail brokerage | 2 | 118 | 1 | |||||||||

| 2.5 | Additional Common Equity Tier I |

As per CMN Resolution 4,193 and Central Bank Circulars 3,768 and 3,769, the Additional Common Equity Tier I requirement comes into effect as of the first quarter of 2016. Details of its portions are shown below:

| Additional Common Equity Tier I (ACP) | R$ million | |||

| 03/31/2016 | ||||

| Additional Common Equity Tier I requirement (ACPrequirement) | ||||

| conservation | 4,343 | |||

| countercyclical | - | |||

| systemic | - | |||

As required by Central Bank Circular No. 3,769, more details of the portion of ACPcountercyclical are shown below, including RWA for non-banking private sector credit risk exposures and percentage ACPcountercyclical for Itaú Unibanco’s main jurisdictions with their activation dates and duration of this portion.

| Additional Common Equity Tier I countercyclical (ACPcountercyclical) | R$ million | |||||||||||||||

| 03/31/2016 | ||||||||||||||||

| RWA (1) | ACCP(2) | date of announcement | date of effectiveness | |||||||||||||

| Brazil | 377,617 | 0 | % | oct/15 | jan/16 | |||||||||||

| Chile (3) | 33,352 | 0 | % | - | - | |||||||||||

| Total | 410,969 | - | - | - | ||||||||||||

(1) portion of the RWA balance for credit risk exposure to the non-banking private sector in the relevant jurisdictions.

(2) percentage amount of the Additional Common Equity Tier I countercyclical in the relevant jurisdictions.

(3) method of calculating countercyclical portion of the increase not announced in this jurisdiction. According to Article 2 of BACEN Circular No. 3,769 the ACCP of Brazil value should be used.

| 2.6 | Capital Adequacy |

Itaú Unibanco, through the ICAAP, assesses the adequacy of its capital to face the incurred risks. For ICAAP, capital is composed by regulatory capital for credit, market and operational risks and by the necessary capital to face other risks.

In order to ensure the robustness of Itaú Unibanco and the availability of capital to support business growth, Itaú Unibanco maintains PR levels above the minimum levels, according to the Basel ratio, Common Equity Tier I, Additional Tier I Capital and Tier II.

On March 31, 2016, the PR reached R$ 122,872 million, R$ 99,290 million of Tier I and R$ 23,582 million of Tier II.

| Composition of Referential Equity (PR) | R$ million | |||||||||||

| 03/31/2016 | 12/31/2015 | 03/31/2015 | ||||||||||

| Tier I | 99,290 | 101,001 | 91,501 | |||||||||

| Common Equity Tier I | 99,220 | 100,955 | 91,451 | |||||||||

| Additional Tier I Capital | 70 | 46 | 50 | |||||||||

| Tier II | 23,582 | 27,464 | 29,402 | |||||||||

| Referential Equity (PR) | 122,872 | 128,465 | 120,903 | |||||||||

| Required Referential Equity (PRE) | 68,621 | 79,471 | 86,773 | |||||||||

| Excess capital in relation to Required Referential Equity | 54,250 | 48,994 | 34,130 | |||||||||

| Additional Common Equity Ti I requirement er (ACPrequirement) | 4,343 | - | - | |||||||||

| 12 | |

| Itaú Unibanco |

| Risk and Capital Management – Pillar 3 |

As at March 31, 2016, the BIS ratio reached 17.7%, a decrease of 10 basis points from December 31, 2015. Contributed to this result the impact of Basel III schedule applied to Tier II instruments and to deductions capital, and also the distribution of interest on capital and dividends in the period.

Itaú Unibanco has a R$ 54,250 million excess for Required Referential Equity, higher than the ACP of R$ 4,343, and will not be subject to any restrictions due to insufficient Additional Common Equity Tier I.

In what regards the fixed asset ratio, (the level of adjusted PR committed to adjusted permanent assets), Itaú Unibanco is within the maximum limit of 50% of the adjusted PR, as established by BACEN.

The Basel and Fixed asset ratios are presented in the table below.

| Basel and Fixed Asset Ratios | R$ million | |||||||||||

| 03/31/2016 | 12/31/2015 | 03/31/2015 | ||||||||||

| Basel ratio | 17.7 | % | 17.8 | % | 15.3 | % | ||||||

| Tier I | 14.3 | % | 14.0 | % | 11.6 | % | ||||||

| Common Equity Tier I | 14.3 | % | 14.0 | % | 11.6 | % | ||||||

| Additional Tier I Capital | 0.0 | % | 0.0 | % | 0.0 | % | ||||||

| Tier II | 3.4 | % | 3.8 | % | 3.7 | % | ||||||

| Fixed assets ratio | 27.4 | % | 27.7 | % | 47.5 | % | ||||||

| Excess Capital in Relation to Fixed Assets | 27,813 | 28,616 | 3,054 | |||||||||

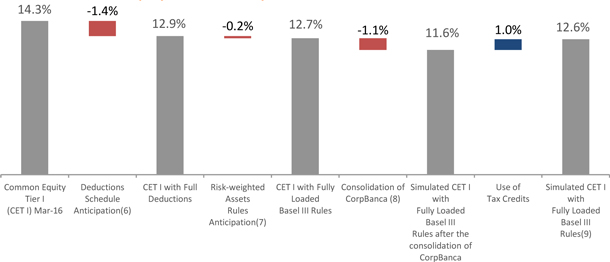

Considering Itaú Unibanco´s current capital base, and if the Basel III rules were fully implemented, the core capital (Common Equity Tier I) would be 12.6% on March 31, 2016, taking into consideration the consolidation of CorpBanca (estimated impact with preliminary information) and the use of tax credits. This scenario is presented in the following chart.

Simulated Common Equity TierI with Fully Loaded Basel III Rules

(6) Includes deductions of Goodwill, Intangible Assets (before and after October/13), Tax Credits from Temporary Differences and Tax Loss, Pension Fund Assets, Equity Investments in Financial Institutions, Insurance and similar companies.

(7) Includes the increase of the multiplier of the market risk, operational risk and certain credit risk accounts. This multiplier, which is at 10.1 nowadays, will be to 12.5 in 2019.

(8) Estimated impact based on preliminary information.

(9) Does not include any reversal of the complementary allowance for loan losses.

| 13 | |

| Itaú Unibanco |

| Risk and Capital Management – Pillar 3 |

| 2.7 | Leverage Ratio |

The following information is based on the methodology and standard format introduced by BACEN Circular 3,748. As of March 31, 2016 Itaú Unibanco’s Leverage Ratio stood at 8.3%.

| Comparative Summary of Published Financial Statements and Leverage Ratio | ||||||||||

| R$ Thousand | ||||||||||

| 03/31/2016 | 12/31/2015 | |||||||||

| 1 | Total assets according to published financial statements | 1,283,071,018 | 1,359,172,441 | |||||||

| 2 | Adjustment for differences in consolidation of accounts | (127,750,594 | ) | (122,280,032 | ) | |||||

| 3 | Adjustment for assets assigned or transferred with substantial transfer of risks and benefits and | (4,899,420 | ) | (4,855,298 | ) | |||||

| 4 | Adjustment for changes in reference values and potential future gains on derivative financial | 16,039,230 | 18,170,046 | |||||||

| 5 | Adjustment for repurchase transactions and securities lending | 7,024,353 | 6,749,914 | |||||||

| 6 | Adjustment for transactions not booked in prudential conglomerate's total assets | 106,441,369 | 110,181,720 | |||||||

| 7 | Other adjustments | (81,473,482 | ) | (81,883,640 | ) | |||||

| 8 | Total Exposure | 1,198,452,474 | 1,285,255,152 | |||||||

| Disclosure of information on Leverage Ratio | ||||||||||

| R$ Thousand | ||||||||||

| 03/31/2016 | 12/31/2015 | |||||||||

| Items shown in the Balance Sheet | ||||||||||

| 1 | Balance sheet items other than derivative financial instruments, securities received on loan and resales | 853,469,456 | 891,531,269 | |||||||

| 2 | Adjustments for equity items deducted in calculating Level I Capital | (17,035,289 | ) | (14,903,083 | ) | |||||

| 3 | Total exposure shown in the Balance Sheet | 836,434,166 | 876,628,185 | |||||||

| Transactions using Derivative Financial Instruments | ||||||||||

| 4 | Replacement value for derivatives transactions | 27,347,728 | 27,570,116 | |||||||

| 5 | Potential future gains from derivatives transactions | 12,805,779 | 13,839,814 | |||||||

| 6 | Adjustment for collateral in derivatives transactions | - | - | |||||||

| 7 | Adjustment for daily margin held as collateral | - | - | |||||||

| 8 | Derivatives in the name of customers where there is no contractual obligation to reimburse in the event of bankruptcy or default of the entities responsible for the settlement system | - | - | |||||||

| 9 | Reference value adjusted for credit derivatives | 7,717,367 | 8,798,831 | |||||||

| 10 | Adjustment of reference value calculated for credit derivatives | (3,117,465 | ) | (3,424,798 | ) | |||||

| 11 | Total exposure for derivative financial instruments | 44,753,409 | 46,783,963 | |||||||

| Repurchase Transactions and Securities Lending (TVM) | ||||||||||

| 12 | Investments in repurchase transactions and securities lending | 203,799,176 | 244,911,369 | |||||||

| 13 | Adjustment for repurchases for settlement and creditors of securities lending | - | - | |||||||

| 14 | Amount of counterparty credit risk | 7,024,353 | 6,749,914 | |||||||

| 15 | Amount of counterparty credit risk in transactions as intermediary | - | - | |||||||

| 16 | Total exposure for repurchase transactions and securities lending | 210,823,529 | 251,661,283 | |||||||

| Off-balance sheet items | ||||||||||

| 17 | Reference value of off-balance sheet transactions | 289,663,328 | 293,415,937 | |||||||

| 18 | Adjustment for application of FCC specific to off-balance sheet transactions | (183,221,959 | ) | (183,234,216 | ) | |||||

| 19 | Total off-balance sheet exposure | 106,441,369 | 110,181,720 | |||||||

| Capital and Total Exposure | ||||||||||

| 20 | Level I | 99,290,054 | 101,000,684 | |||||||

| 21 | Total Exposure | 1,198,452,474 | 1,285,255,152 | |||||||

| Leverage Ratio | ||||||||||

| 22 | Basel III Leverage Ratio | 8.3 | % | 7.9 | % | |||||

| 14 | |

| Itaú Unibanco |

| Risk and Capital Management – Pillar 3 |

| 3 | Balance Sheet |

Balance Sheet

The following is a comparison between Itaú Unibanco’s Prudential Conglomerate Balance Sheet and its Consolidated Balance Sheet presented in the Financial Statements. Information presented in the Prudential Conglomerate are detailed so that the elements disclosed in Appendix I are identified in the last column of the table below.

| Comparisson of balance sheets – Assets | R$ million | |||||||||||||

Consolidated balance sheet | Differences 1 | Prudential | Ref. Annex I | |||||||||||

| Assets | 03/31/2016 | |||||||||||||

| Current assets and Long-term receivables | 1,263,779 | (148,519 | ) | 1,115,260 | ||||||||||

| Cash and cash equivalents | 18,384 | (218 | ) | 18,166 | ||||||||||

| Interbank investments | 237,642 | (3,277 | ) | 234,365 | ||||||||||

| Securities and derivative financial instruments | 338,997 | (137,930 | ) | 201,067 | ||||||||||

| Interbank accounts | 70,709 | - | 70,709 | |||||||||||

| Interbranch accounts | 149 | - | 149 | |||||||||||

| Loan, lease and other credit operations | 409,431 | (3,520 | ) | 405,911 | ||||||||||

| Other receivables | 184,933 | (2,955 | ) | 181,978 | ||||||||||

| Tax credit and Actuarial Assets | - | - | 19,551 | |||||||||||

| Tax credits arising from income tax losses and social contribution | - | - | 7,594 | (b) | ||||||||||

| Credits resulting from temporary differences | - | - | 11,733 | (c) | ||||||||||

| Actuarial assets related to defined benefit pension funds | - | - | 224 | (d) | ||||||||||

| Other | - | - | 162,427 | |||||||||||

| Other assets | 3,533 | (618 | ) | 2,915 | ||||||||||

| Permanent assets | 19,292 | 20,768 | 40,060 | |||||||||||

| Investments | 4,342 | 17,077 | 21,419 | |||||||||||

| Goodwill based on the expectation of future profitability | - | - | 965 | (e) | ||||||||||

| investments in the capital of companies that are similar to non-consolidated financial institutions and insurance companies | - | - | 7,805 | (f) | ||||||||||

| investments in the capital of financial institutions | - | - | 749 | (a) | ||||||||||

| Other | - | - | 11,900 | |||||||||||

| Real estate in use | 6,756 | (562 | ) | 6,194 | ||||||||||

| Deferred permanent assets | - | - | 21 | (g) | ||||||||||

| Other | - | - | 6,173 | |||||||||||

| Goodwill | 853 | (718 | ) | 135 | ||||||||||

| Goodwill based on the expectation of future profitability | - | - | 135 | (e) | ||||||||||

| Intangible assets | 7,341 | 4,971 | 12,312 | |||||||||||

| Acquisition of rights to credit payroll | 1,038 | - | 1,038 | |||||||||||

| Intangible assets acquired from October 1st 2013 | - | - | 314 | (h) | ||||||||||

| Intangible assets acquired before October 1st 2013 | - | - | 724 | (i) | ||||||||||

| Other intangible assets | 9,728 | 10,876 | 20,604 | |||||||||||

| Intangible assets acquired from October 1st 2013 | - | - | 3,427 | (h) | ||||||||||

| Intangible assets acquired before October 1st 2013 | - | - | 3,722 | (i) | ||||||||||

| Goodwill based on the expectation of future profitability | - | - | 12,826 | (e) | ||||||||||

| Deferred permanent assets | - | - | 444 | (g) | ||||||||||

| Other | - | - | 185 | |||||||||||

| (Accumulated amortization) | (3,425 | ) | (5,905 | ) | (9,330 | ) | ||||||||

| Intangible assets acquired from October 1st 2013 | - | - | (840 | ) | (h) | |||||||||

| Intangible assets acquired before October 1st 2013 | - | - | (1,713 | ) | (i) | |||||||||

| Goodwill based on the expectation of future profitability | - | - | (6,380 | ) | (e) | |||||||||

| Deferred permanent assets | - | - | (397 | ) | (g) | |||||||||

| Total assets | 1,283,071 | (127,751 | ) | 1,155,320 | ||||||||||

1Differences are mainly due to non-consolidation of non financial companies (highlighting the following companies: Insurance, Pension Plan and Premium Bonds) within the Prudential Conglomerate and also by the eliminations of transactions with related parties.

| 15 | |

| Itaú Unibanco |

| Risk and Capital Management – Pillar 3 |

| Comparisson of balance sheets – Liabilities | R$ million | |||||||||||||

Consolidated Balance Sheet | Diferences 1 | Prudential | Ref. Annex I | |||||||||||

| Liabilities | 03/31/2016 | |||||||||||||

| Current and Long-term Liabilities | 1,172,779 | (130,232 | ) | 1,042,547 | ||||||||||

| Deposits | 266,318 | 5,156 | 271,474 | |||||||||||

| Deposits received under securities repurchase agreements | 318,964 | 2,242 | 321,206 | |||||||||||

| Funds from acceptances and issuance of securities | 74,352 | 6 | 74,358 | |||||||||||

| Interbank accounts | 4,034 | - | 4,034 | |||||||||||

| Interbranch accounts | 5,789 | 2 | 5,791 | |||||||||||

| Borrowings and onlending | 95,352 | - | 95,352 | |||||||||||

| Derivative financial instruments | 28,917 | - | 28,917 | |||||||||||

| Technical provision for insurance, pension plan and capitalization | 137,677 | (137,677 | ) | - | ||||||||||

| Other liabilities | 241,377 | 38 | 241,415 | |||||||||||

| Social and statutory | 13,413 | (1,679 | ) | 11,734 | ||||||||||

| Tax credits arising from income tax losses and social contribution | - | - | 5,710 | (b)/(c) | ||||||||||

| Provision of Actuarial assets related to defined benefit pension funds | - | - | 145 | (d) | ||||||||||

| Other | - | - | 5,879 | |||||||||||

| Other | - | - | 229,681 | |||||||||||

| Deferred income | 1,847 | (36 | ) | 1,811 | ||||||||||

| Minority interest in subsidiaries | 1,799 | (862 | ) | 937 | ||||||||||

| Non-controlling interest in subsidiaries that are part of the conglomerate | - | - | 937 | (j) | ||||||||||

| Stockholders' equity | 106,647 | 3,378 | 110,025 | |||||||||||

| Capital | 85,148 | - | 85,148 | |||||||||||

| Eligible Instruments | - | - | 85,148 | (k) | ||||||||||

| Capital reserves | 1,209 | - | 1,209 | |||||||||||

| Capital reserves | - | - | 1,209 | (m) | ||||||||||

| Revenue reserves | 26,535 | 2,379 | 28,914 | |||||||||||

| Revenue reserves | - | - | 28,914 | (l) | ||||||||||

| Asset valuation adjustment | (2,101 | ) | 999 | (1,102 | ) | |||||||||

| Other revenue and other reserve | - | - | (1,102 | ) | (m) | |||||||||

| (Treasury shares) | (4,144 | ) | - | (4,144 | ) | |||||||||

| Shares or other instruments issued by the bank | - | - | (4,144 | ) | (n) | |||||||||

| Total liabilities and stockholders' equity | 1,283,071 | (127,751 | ) | 1,155,320 | ||||||||||

1 Differences are mainly due to non-consolidation of non financial companies (highlighting the following companies: Insurance, Pension Plan and Premium Bonds) within the Prudencial Conglomerate and also by the eliminations of transactions with related parties.

| 16 | |

| Itaú Unibanco |

| Risk and Capital Management – Pillar 3 |

Institutions that comprises the Financial Statements of Itaú Unibanco Holding

The following is a list of institutions that comprise the financial statements of Itaú Unibanco Holding for means of the disclosure of its Financial Statements. The institutions that, in addition to being included in the Consolidated Balance Sheet, are also included in the Prudential Conglomerate, are listed below.

List of institutions that comprises the Financial Statements of Itaú Unibanco Holding

| Institutions | ||||

| ACO Ltda. | Itaú BBA International (Cayman) Ltd. (1) | Karen International Limited | ||

| Afinco Americas Madeira, SGPS, Sociedade Unipessoal, Lda | Itau BBA International plc (1) | Kinea Dinâmico Master - Long Biased Fundo de Investimento em Ações (1) | ||

| Aj Títulos Públicos Fundo de Investimento Referenciado DI (1) | Itaú BBA México Casa de Bolsa, S.A. de C.V. (1) | Kinea I Pipe Fundo de Investimento em Ações (1) | ||

| Albarus S.A. | Itaú BBA México, S.A. de C.V. | Kinea I Private Equity Fundo de Investimento em Participações (1) | ||

| Banco Del Paraná S.A. | Itaú BBA Participações S.A. | Kinea I Total Return Equity - Fundo de Investimento em Cotas de Fundos de Investimento Multimercado (1) | ||

| Banco Investcred Unibanco S.A. (1) | Itaú BBA Trading S.A. | Kinea II Macro Fundo de Investimento Multimercado (1) | ||

| Banco Itaú (Suisse) S.A. (1) | Itau BBA UK Securities Limited (1) | Kinea Investimentos Ltda. | ||

| Banco Itaú Argentina S.A. (1) | Itau BBA USA Securities Inc. (1) | Kinea Macro Offshore Segregated Portfolio (1) | ||

| Banco Itaú BBA S.A. (1) | Itaú BMG Corretora de Seguros Ltda. | Licania Fund Limited (1) | ||

| Banco Itaú BMG Consignado S.A. (1) | Itaú BMG Gestão de Vendas Ltda. | Luizacred S.A. Soc. de Crédito Financiamento e Investimento (1) | ||

| Banco Itaú Chile (1) | Itaú BMG Participação Ltda. | Marcep Corretagem de Seguros S.A. | ||

| Banco Itaú International (1) | Itaú BMG Seguradora S.A. | Maxipago Serviços de Internet S.A. | ||

| Banco Itaú Paraguay S.A. (1) | Itau Cayman Directors Ltd. | MCC Asesorías Limitada | ||

| Banco Itaú Uruguay S.A. (1) | Itau Cayman Nominees Ltd. | MCC S.A. Corredores de Bolsa (1) | ||

| Banco Itaú Veículos S.A. (1) | Itaú Chile Administradora General de Fondos S.A. | MCC Securities Inc. (1) | ||

| Banco Itaubank S.A. (1) | Itaú Chile Compañía de Seguros de Vida S.A. | Megabônus Negócios de Varejo Ltda. | ||

| Banco Itaucard S.A. (1) | Itaú Chile Corredora de Seguros Ltda. | Microinvest S.A. Soc. de Crédito a Microempreendedor (1) | ||

| Banco Itauleasing S.A. (1) | Itaú Chile Inversiones, Servicios y Administracion S.A. | Mundostar S.A. | ||

| BICSA Holdings Ltd. | Itaú Cia. Securitizadora de Créditos Financeiros (1) | Nevada Woods S.A. | ||

| BIE Cayman Ltd. | Itaú Corretora de Valores S.A. (1) | OCA S.A. (1) | ||

| Borsen Renda Fixa Crédito Privado - Fundo de Investimento | Itaú Distribuidora de Títulos e Valores Mobiliários S.A. (1) | Oiti Fundo de Investimento Multimercado Crédito Privado Investimento no Exterior (1) | ||

| Cia. Itaú de Capitalização | Itaú EU Lux-Itaú Latin America Equity Fund (1) | Pró-Imóvel Promotora Ltda. | ||

| Conectcar Soluções de Mobilidade Eletronica S.A. (1)(2) | Itaú Europa Luxembourg S.A. | Proserv - Promociones y Servicios S.A. de Capital Variable | ||

| Credicard Promotora de Vendas Ltda. | Itau Global Asset Management Limited | Provar Negócios de Varejo Ltda. | ||

| Ctbh Fundo de Investimento Imobiliário - FII (1) | Itaú Institucional Curto Prazo - Fundo de Investimento | Recovery do Brasil Consultoria S.A. | ||

| Dibens Leasing S.A. - Arrendamento Mercantil (1) | Itaú International Investment LLC | Recovery do Brasil Gestão de Ativos Ltda. | ||

| Estrel Serviços Administrativos S.A. | Itaú International Securities Inc. (1) | Recuperadora de Creditos Ltda. | ||

| Estrutura III - Fundo de Investimento em Participações (1) | Itaú Japan Asset Management Limited | Redecard S.A. (1) | ||

| Facilita Promotora Ltda. | Itaú Kinea Private Equity Multimercado Fundo de Investimento em Cotas de Fundos de Investimento Crédito Privado (1) | Rt Alm 5 Fundo de Investimento Renda Fixa | ||

| FC Recovery S.A. | Itaú Middle East Limited | Rt Alm Soberano 2 Fundo de Investimento Renda Fixa | ||

| FIC Promotora de Vendas Ltda. | Itaú Rent Administração e Participações Ltda. | Rt Challenger Renda Fixa Crédito Privado - Fundo de Investimento em Cotas de Fundos de Investimento | ||

| Fideicomisos Financiero AC1 (1) | Itaú Seguros S.A. | Rt Columbia Renda Fixa Crédito Privado - Fundo de Investimento em Cotas de Fundos de Investimento | ||

| Fideicomisos Financiero Privados BHSA (1) | Itaú Singapore Securities Pte. Ltd. (1) | Rt Discovery Renda Fixa Crédito Privado - Fundo de Investimento em Cotas de Fundos de Investimento | ||

| Fideicomisos Financiero Renova (1) | Itau UK Asset Management Limited | Rt Endeavour Renda Fixa Crédito Privado - Fundo de Investimento | ||

| Fideicomisos Financiero TB1 (1) | Itaú Unibanco Holding Cayman Branch (1) | Rt Enterprise Soberano Renda Fixa Fundo de Investimento (1) | ||

| Fideicomisos Financiero TR1 (1) | Itaú Unibanco Holding S.A. (1) | Rt Excelsior Renda Fixa Crédito Privado - Fundo de Investimento | ||

| Financeira Itaú CBD S.A. - Crédito, Financ. e Investimento (1) | Itaú Unibanco S.A. Cayman Branch (1) | Rt Defiant Multimercado - Fundo de Investimento | ||

| Fundo de Investimento em Direitos Creditórios Não-Padronizados Barzel (1) | Itaú Unibanco S.A. New York Branch (1) | Rt Galileo Renda Fixa Crédito Privado - Fundo de Investimento em Cotas de Fundos de Investimento | ||

| Fundo de Investimento em Direitos Creditórios Não-Padronizados NPL I (1) | Itaú Unibanco S.A. Tokyo Branch (1) | Rt Itaú Dj Títulos Públicos Fundo de Investimento Referenciado DI (1) | ||

| Fundo Fortaleza de Investimento Imobiliário (1) | Itaú Unibanco S.A. (1) | Rt Itaú SIF – Brasil (1) | ||

| Garnet Corporation | Itaú Unibanco S.A.Nassau Branch (1) | Rt Magellan Renda Fixa Crédito Privado - Fundo de Investimento em Cotas de Fundos de Investimento | ||

| Hipercard Banco Múltiplo S.A. (1) | Itaú Unibanco Serviços e Processamento de Informações Comerciais Ltda. | Rt Multigestor 4 Fundo de Investimento em Cotas De Fundos de Investimento Multimercado | ||

| iCarros Ltda. | Itaú Unibanco Veículos Administradora de Consórcios Ltda. (1) | Rt Nation Renda Fixa - Fundo de Investimento | ||

| IGA Participações S.A. | Itau USA Asset Management Inc. | Rt Nor Renda Fixa - Fundo de Investimento em Cotas de Fundos de Investimento (1) | ||

| Intrag Distribuidora de Títulos e Valores Mobiliários Ltda. (1) | Itau USA Inc. | Rt Odyssey Renda Fixa Crédito Privado - Fundo de Investimento em Cotas de Fundos de Investimento | ||

| Intrag-Part Administração e Participações Ltda. | Itaú Valores S.A. (1) | Rt Pathfinder Renda Fixa Crédito Privado - Fundo de Investimento em Cotas de Fundos de Investimento | ||

| Investimentos Bemge S.A. | Itaú Vida e Previdência S.A. | Rt Union Renda Fixa Fundo de Investimento | ||

| IPI - Itaúsa Portugal Investimentos, SGPS, Lda | Itauprev Retirement Renda Fixa Crédito Privado - Fundo de Investimento | Rt Valiant Renda Fixa - Fundo de Investimento | ||

| Itaú Administração Previdenciária Ltda. | Itaúsa Europa - Investimentos, SGPS, Lda | Rt Voyager Renda Fixa Crédito Privado - Fundo de Investimento (1) | ||

| Itaú Administradora de Consórcios Ltda. (1)(2) | Itaúsa Portugal - Soc. Gestora de Partic. Sociais, S.A. | Scala Curto Prazo - Fundo de Investimento em Cotas de Fundos de Investimento (1) | ||

| Itaú Asia Securities Ltd. (1) | Itauseg Participações S.A. | Topaz Holding Ltd. | ||

| Itaú Asset Management S.A. Sociedad Gerente de Fondos Comunes de Inversión | Itauseg Saúde S.A. | Trishop Promoção e Serviços Ltda. | ||

| Itaú Bahamas Directors Ltd. | Itauvest Distribuidora de Títulos e Val. Mobiliários S.A. (1) | Tulipa S.A. | ||

| Itaú Bahamas Nominees Ltd. | ITB Holding Brasil Participações Ltda. | Unibanco Empreendimentos Ltda. | ||

| Itaú Bank & Trust Bahamas Ltd. (1) | ITB Holding Ltd. (1) | Unibanco Negócios Imobiliários Ltda. | ||

| Itaú Bank & Trust Cayman Ltd. (1) | Itrust Servicios Inmobiliarios S.A.C.I. | Uni-Investment International Corp. (1) | ||

| Itau Bank, Ltd. (1) | IU Seguros S.A. | Unión Capital AFAP S.A. | ||

| Itaú BBA Colombia S.A. Corporacion Financiera (1) | Iucor Corretora de Seguros Ltda. | Universo Fundo de Investimento em Participações (1) | ||

| Itaú BBA Corredor de Bolsa Ltda. (1) | Jasper International Investment LLC | |||

(1) Institutions that also comprise the Prudential Conglomerate.

(2) Institution that comprises only the Prudential Conglomerate.

| 17 | |

| Itaú Unibanco |

| Risk and Capital Management – Pillar 3 |

Material entities

Total assets, shareholders’ equity, and the industries of the material entities, including those subject to the risk weight for the purpose of capital requirements are as follows:

| Major Institutions | R$ million | |||||||||||||||||||||||||||

| 03/31/2016 | 12/31/2015 | 03/31/2015 | ||||||||||||||||||||||||||

| Institutions | Country | Activity | Total Assets | Equity | Total Assets | Equity | Total Assets | Equity | ||||||||||||||||||||

| Banco Itaú Argentina S.A. (1) | Argentina | Financial institution | 5,387 | 678 | 6,918 | 777 | 6,209 | 703 | ||||||||||||||||||||

| Banco Itaú BBA S.A. (1) | Brazil | Financial institution | 6,277 | 5,891 | 6,293 | 5,690 | 6,279 | 5,893 | ||||||||||||||||||||

| Banco Itaú BMG Consignado S.A (1) | Brazil | Financial institution | 44,366 | 2,343 | 42,265 | 2,290 | 46,971 | 2,151 | ||||||||||||||||||||

| Banco Itaú Chile (1) | Chile | Financial institution | 47,242 | 6,317 | 46,458 | 4,315 | 40,478 | 3,771 | ||||||||||||||||||||

| Banco Itaú Paraguay S.A. (1) | Paraguay | Financial institution | 11,770 | 1,625 | 12,417 | 1,639 | 11,042 | 1,397 | ||||||||||||||||||||

| Banco Itaú Suisse S.A. (1) | Switzerland | Financial institution | 5,340 | 691 | 6,096 | 714 | 4,840 | 584 | ||||||||||||||||||||

| Banco Itaú Uruguay S.A. (1) | Uruguay | Financial institution | 14,964 | 1,228 | 16,510 | 1,296 | 13,475 | 1,094 | ||||||||||||||||||||

| Banco Itaucard S.A. (1) | Brazil | Financial institution | 105,929 | 19,687 | 107,221 | 19,383 | 123,034 | 19,664 | ||||||||||||||||||||

| Banco Itauleasing S.A. (1) | Brazil | Financial institution | 10,911 | 10,355 | 10,875 | 10,245 | 10,265 | 9,752 | ||||||||||||||||||||

| Cia. Itaú de Capitalização | Brazil | Premium Bonds | 3,974 | 560 | 4,099 | 679 | 4,169 | 841 | ||||||||||||||||||||

| Dibens Leasing S.A. - Arrendamento Mercantil (1) | Brazil | Leasing | 170,284 | 4,023 | 167,917 | 3,864 | 150,805 | 3,197 | ||||||||||||||||||||

| Financeira Itaú CBD S.A. Crédito, Financiamento e Investimento (1) | Brazil | Consumer Finance Credit | 3,798 | 957 | 3,983 | 908 | 3,796 | 978 | ||||||||||||||||||||

| Hipercard Banco Múltiplo S.A. (1) | Brazil | Financial institution | 9,372 | 3,996 | 9,516 | 3,915 | 8,141 | 3,627 | ||||||||||||||||||||

| Itau Bank, Ltd. (1) | Cayman Islands | Financial institution | 43,688 | 2,805 | 43,097 | 1,592 | 28,137 | 2,913 | ||||||||||||||||||||

| Itaú BBA Colombia S.A. Corporación Financiera (1) | Colombia | Financial institution | 630 | 374 | 677 | 393 | 474 | 398 | ||||||||||||||||||||

| Itau BBA International plc (1) | United Kingdom | Financial institution | 22,579 | 3,618 | 27,497 | 3,938 | 22,105 | 3,184 | ||||||||||||||||||||

| Itau BBA USA Securities Inc. (1) | United States | Broker | 1,654 | 1,506 | 1,811 | 1,687 | 7,741 | 1,446 | ||||||||||||||||||||

| Itaú BMG Seguradora S.A. | Brazil | Insurance | 193 | 71 | 195 | 77 | 207 | 74 | ||||||||||||||||||||

| Itaú Corretora de Valores S.A. (1) | Brazil | Broker | 4,375 | 1,427 | 4,519 | 1,365 | 5,475 | 2,745 | ||||||||||||||||||||

| Itaú Seguros S.A. | Brazil | Insurance | 10,775 | 5,161 | 10,858 | 5,435 | 12,159 | 5,817 | ||||||||||||||||||||

| Itaú Unibanco S.A. (1) | Brazil | Financial institution | 1,240,269 | 58,153 | 1,297,135 | 56,199 | 1,185,732 | 51,699 | ||||||||||||||||||||

| Itaú Vida e Previdência S.A. | Brazil | Pension Plan | 134,872 | 3,827 | 128,760 | 3,769 | 114,424 | 5,202 | ||||||||||||||||||||

| Luizacred S.A. Soc. Cred. Financiamento Investimento (1) | Brazil | Consumer Finance Credit | 4,131 | 579 | 4,376 | 609 | 4,476 | 561 | ||||||||||||||||||||

| Redecard S.A. - REDE (1) | Brazil | Acquirer | 48,684 | 14,202 | 50,635 | 13,729 | 45,176 | 13,074 | ||||||||||||||||||||

(1) Prudential Conglomerate Institutions.

| 18 | |

| Itaú Unibanco |

| Risk and Capital Management – Pillar 3 |

| 4 | Investments in other entities |

| 4.1 | Investments in other entities not classified in the trading book |

The financial statements of Itaú Unibanco and its subsidiaries have been prepared in accordance with accounting practices adopted in Brazil, as established by Brazilian Corporate Law, together with CMN and Brazilian Securities and Exchange Commission (CVM) regulations, in the latter cases when such regulations are not inconsistent with BACEN regulations.

The interests held in other entities, except those measured at book value (equity method of accounting), which we intend to hold for a long term, are classified in Permanent Assets and measured at their acquisition cost (cost method). Investments measured under the cost method are stated at their historical amount, i.e., the price the company paid to acquire them. The investor does not account for the profits or losses of an investee, except when related to the dividends based on profits obtained, when distributed.

Investments in other companies which there is no intention to hold for a long term are classified as Securities and, based on the designation defined pursuant to Management strategies, they are recognized at fair value, in Other Comprehensive Income.

Itaú Unibanco applies its policies on a systematic basis, ensuring the consistency and comparability of its information, except when otherwise required by regulators, under amended regulations.

In the first quarter of 2016, there were no significant amendments to policies related to equity interests.

For further information on Itaú Unibanco’s accounting policies, please see Note 4 – “Summary of the main accounting practices”, to the Complete Financial Statements, that can be found on the website www.itau.com.br/investor-relations.

The table below presents the amounts for corporate shareholdings classified as permanent assets, excluding those valued by equity accounting, and for investments in equity classified as securities, both of which are not included in the trading portfolio. As of March 31, 2016, the capital required for these shareholdings was R$ 64.5 million.

| Investments in other entities | R$ million | |||||||||||

| 03/31/2016 | 12/31/2015 | 03/31/2015 | ||||||||||

| Carrying Amount | 585.1 | 573.9 | 856.3 | |||||||||

| Public | 409.4 | 396.7 | 103.2 | |||||||||

| Private | 175.8 | 177.2 | 753.1 | |||||||||

| Fair value | 778.2 | 715.1 | 966.6 | |||||||||

| Public | 570.4 | 516.3 | 206.0 | |||||||||

| Private | 207.8 | 198.8 | 760.6 | |||||||||

| Gain or losses arising on investments in other entities | 0.1 | 0.1 | (0.0 | ) | ||||||||

| Recognized and unrealized gain or losses | (150.7 | ) | (159.2 | ) | (249.5 | ) | ||||||

| Unrecognized and unrealized gain or losses | 193.0 | 141.1 | 107.9 | |||||||||

The risk of shareholdings not included in the trading portfolio is assessed, for ICAAP purposes, as part of the Itaú Unibanco risk assessment process.

| 19 | |

| Itaú Unibanco |

| Risk and Capital Management – Pillar 3 |

| 5 | Credit Risk |

| 5.1 | Framework and Treatment |

Credit risk is the possibility of losses associated with: failure by a borrower, issuer or counterparty to fulfill their respective financial obligations as defined in the contracts; value loss of credit agreements resulting from deterioration of the borrower’s issuer’s or counterparty’s credit rating; reduction of profits or income; benefits granted upon subsequent renegotiations; or debt recovery costs.

Itaú Unibanco’s credit risk management and control structure establishes operational limits, risk mitigation mechanisms and processes, and instruments to measure, monitor and control risk that can quantify the credit risk inherent to all products, portfolio concentrations and the impacts of potential changes in the economic environment. The Bank’s portfolio, policies and strategies are continuously monitored so as to ensure compliance with the rules and laws in effect in each country.

Itaú Unibanco’s credit risk management is the primary responsibility of all Business Areas and is aimed at maintaining the quality of the credit portfolio at levels that are consistent with the institution’s risk appetite, for each market segment in which it operates. The Business Areas have to:

| · | Follow up and closely monitor the portfolios under their responsibility; |

| · | Grant credit in accordance to the authority levels, market conditions, macroeconomic prospects, changes in markets and products and the effects of sector and geographic concentrations; |

| · | Manage credit risk adopting actions that provide sustainability to its business. |

Itaú Unibanco’s credit policy is based on internal factors, such as: client rating criteria, performance and evolution of the portfolio, default levels, return rates, and allocated economic capital; and on external factors, related to the economic environment, interest rates, market default indicators, inflation and changes in consumption.

Itaú Unibanco has a structured process to maintain a diversified portfolio, which is considered appropriate by the institution. The concentrations are monitored continuously for economic sectors, and largest debtors, allowing preventive measures to be taken to avoid the violation of the established limits.

The credit risk management governance is conducted through corporate bodies, and act primarily by assessing the competitive market conditions, setting the credit limits for the institution, reviewing control practices and policies, approving these actions at the respective authority levels. The risk communication and reporting process, including disclosure of institutional policies on credit risk management, are responsibility of this structure.

The credit risk control is carried out by an independent executive area segregated from the business units, as required by the current regulation. Among others, the mains responsibilities of the credit risk control area are to:

| · | Monitor and control the performance of the credit portfolios in view of the limits approved by senior management; |

| · | Conduct the centralized control of the credit risk segregated from the business units; |

| · | Manage the process of preparation, review and approval of institutional policies of credit risk, meeting the regulatory guidelines; |

| · | Assess the credit risk of the operations at the authority levels appointed by the credit commissions. |

The policies and products’ evaluation process enables the Itaú Unibanco to identify potential risks in order to ensure that credit decisions make sense from an economic and risk perspective.

Itaú Unibanco’s centralized process for approving credit policies and validating models ensures the synchronization of credit actions.

The credit rating process for wholesale transactions is based on information such as the economic and financial condition of the counterparty, its cash-generating capabilities, the economic group to which it belongs, the current and prospective situation of the economic sector in which it operates. Credit proposals are analyzed on a case-by-case basis through the approval governance.

With respect to retail transactions (individuals, small and medium companies), ratings are assigned based on statistical application (in the early stages of Itaú Unibanco’s relationship with a customer) and behavior score (used for customers with whom Itaú Unibanco already has a relationship) models. Decisions are met based on continuously monitored scoring models. Extraordinarily, an individual analysis of specific cases may be performed, in which case credit approval follows the applicable authority levels.

| 20 | |

| Itaú Unibanco |

| Risk and Capital Management – Pillar 3 |

Additionally, the risk assessment of both the retail segments and the wholesale segment incorporate client debts both to Itaú and the market.

Itaú Unibanco rates government securities and other debt instruments according to their credit quality with the purpose of managing the exposures.

Itaú Unibanco strictly controls credit exposure to clients and counterparties, acting on occasional limit breaches. In this sense, contractual covenants may be used, such as the right to demand early payment or require of additional collateral.

Itaú Unibanco counts on a specific structure and processes aimed at ensuring that the country risk is managed and controlled, including: (i) country risk governance; (ii) country ratings; (iii) credit limits for countries; (iv) limits monitoring; and (v) actions for limit breaches.

In line with the principles of CMN Resolution 3,721, Itaú Unibanco’s credit risk management structure and institutional policy are approved by its Board of Directors, applicable to all companies and subsidiaries in Brazil and abroad.

The guidelines of the institutional credit risk management policy can be accessed at http://www.itau.com.br/investor-relations, under Corporate Governance, Regulations and Policies, Public Access Report – Credit Risk.

| 21 | |

| Itaú Unibanco |

| Risk and Capital Management – Pillar 3 |

| 5.2 | Credit Portfolio Analysis |

The information presented in the following tables allow the analysis of the credit portfolio, and its behavior, from different view stands: operations with credit granting characteristics segregated by Brazil Geographic Regions, by Countries, economic sector, by type of product and remaining maturity, concentration of the credit portfolio on largest debtors and the amount of the overdue transactions and allowance for loan losses.

Operations with Credit Granting Characteristics by Brazil Geographic Regions and by Countries

| Operations with Credit(1) Granting Characteristics in Brazil: Exposure | R$ million | |||||||||||||||||||||||||||

| 03/31/2016 | 12/31/2015 | |||||||||||||||||||||||||||

| Southeast | South | North | Northeast | Midwest | Brazil | Brazil | ||||||||||||||||||||||

| Individuals | 123,047 | 21,430 | 7,635 | 29,097 | 12,598 | 193,807 | 197,009 | |||||||||||||||||||||

| Rural Loans | 167 | 32 | - | 2 | 4 | 205 | 213 | |||||||||||||||||||||

| Real State | 29,562 | 2,428 | 371 | 1,338 | 1,644 | 35,343 | 34,582 | |||||||||||||||||||||

| Payroll | 24,634 | 5,401 | 3,724 | 8,662 | 3,679 | 46,100 | 45,365 | |||||||||||||||||||||

| Vehicle and Leasing | 9,634 | 2,842 | 840 | 2,250 | 1,797 | 17,363 | 19,112 | |||||||||||||||||||||

| Credit card | 37,045 | 7,564 | 2,136 | 15,045 | 3,635 | 65,425 | 68,283 | |||||||||||||||||||||

| Endorsements and Sureties(2) | 623 | 32 | 2 | 8 | 50 | 715 | 749 | |||||||||||||||||||||

| Personal Loans (Other) | 21,382 | 3,131 | 562 | 1,792 | 1,789 | 28,656 | 28,705 | |||||||||||||||||||||

| Companies | 205,742 | 18,359 | 1,869 | 8,333 | 5,100 | 239,403 | 264,147 | |||||||||||||||||||||

| Rural Loans | 5,255 | 2,960 | - | 240 | 315 | 8,770 | 9,358 | |||||||||||||||||||||

| Investments | 50,488 | 5,720 | 781 | 3,093 | 2,156 | 62,238 | 68,928 | |||||||||||||||||||||

| Import and Export | 23,657 | 1,429 | 138 | 670 | 171 | 26,065 | 28,330 | |||||||||||||||||||||

| Working Capital, Discount Bonds and Guaranteed Account | 76,826 | 7,389 | 859 | 3,946 | 2,222 | 91,242 | 103,647 | |||||||||||||||||||||

| Endorsements and Sureties(2) | 46,923 | 367 | 31 | 140 | 90 | 47,551 | 50,136 | |||||||||||||||||||||

| Other | 2,593 | 494 | 60 | 244 | 146 | 3,537 | 3,748 | |||||||||||||||||||||

| Total | 328,789 | 39,789 | 9,504 | 37,430 | 17,698 | 433,210 | 461,156 | |||||||||||||||||||||

(1) The amount includes endorsements, sureties and committed loans, net of allowance for loan losses.

(2) From the 4th quarter of 2015, the BACEN Circular 3,770 has changed the Credit Conversion Factor (“Fator de Conversão de Crédito”) applied to some specific Endorsements and Sureties to 50%.