Form 6-K ENCANA CORP For: Mar 24

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For March 24, 2016

Commission File Number: 1-15226

ENCANA CORPORATION

(Translation of registrant’s name into English)

Suite 4400, 500 Centre Street SE

PO Box 2850

Calgary, Alberta, Canada T2P 2S5

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ¨ Form 40-F x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Exhibit 99.1 to this report on Form 6-K is hereby filed with the Securities and Exchange Commission and shall be incorporated by reference into each of the following registrant’s Registration Statements under the Securities Act of 1933: Form F-3 (File No. 333-187492), Form S-8 (File Nos. 333-124218, 333-85598, 333-140856 and 333-188758) and Form F-10 (File No. 333-196927).

DOCUMENTS FILED AS PART OF THIS FORM 6-K

See the Exhibit Index to this Form 6-K.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: March 24, 2016

| ENCANA CORPORATION | ||||

| (Registrant) | ||||

| By: | /s/ Dawna I. Gibb | |||

| Name: | Dawna I. Gibb | |||

| Title: | Assistant Corporate Secretary | |||

Form 6-K Exhibit Index

| Exhibit No. | The following documents have been filed with Canadian securities commissions: |

| 99.1 | Notice of Annual Meeting of Shareholders dated March 1, 2016 and Information Circular dated March 1, 2016. |

| 99.2 | Form of Proxy to Registered Shareholders. |

Table of Contents

Exhibit 99.1

Table of Contents

| Voting Summary |

TO BE COUNTED, PROXIES MUST BE RECEIVED NO LATER THAN

10:00 AM (CALGARY TIME) ON APRIL 29, 2016

To ensure your proxy is received in time for Encana’s Annual Meeting of Shareholders to be held on Tuesday, May 3, 2016, we recommend you vote in one of the following ways:

|

Voting Method |

Registered Shareholders (Shares are held in your name) |

Beneficial Shareholders (Your shares are held with a broker, bank or other | ||

| BY INTERNET |

Visit www.cstvotemyproxy.com and follow the instructions. You will need your 13-digit control number located on the back of the proxy form. |

Visit www.proxyvote.com and follow the instructions using your 16-digit control number located on your voting instruction form. | ||

|

BY TELEPHONE |

Call 1-888-489-5760 from a touch-tone phone and follow the voice instructions. You will need your 13-digit control number located on the back of the proxy form. Please note you cannot appoint a proxyholder via the telephone voting system. |

Call from a touch-tone phone and follow the voice instructions. You will need your 16-digit control number located on the back of your voting instruction form. Please note you cannot appoint a proxyholder via the telephone voting system. In Canada, call 1-800-474-7493 (English) or 1-800-474-7501 (French). In the U.S., call 1-800-454-8683. | ||

| BY MAIL |

Complete, sign and date your proxy form and return it in the business-reply envelope included in your package. |

Complete, sign and date your voting instruction form and return it in the business-reply envelope included in your package. | ||

| BY FAX |

Complete, sign and date your proxy form, faxing both sides of the proxy form to 1-866-781-3111 (toll free in North America) or 1-416-368-2502 (outside of North America). |

Complete, sign and date your voting instruction form, faxing both sides of the voting instruction form to 1-866-623-5305 (toll free in North America) or 1-905-507-7793 (outside of North America). |

|

General Information

|

This Management Information Circular is dated March 1, 2016 and delivered in connection with the solicitation of proxies by and on behalf of the management of Encana Corporation for use at the Annual Meeting of Shareholders on May 3, 2016 (the “Meeting”) and any adjournment or postponement thereof. In this document, “we”, “us”, “our”, “Company”, “Corporation” and “Encana” refer to Encana Corporation. The solicitation will be primarily by mail, but proxies may also be solicited personally by employees and agents of Encana. Encana is sending the meeting materials in connection with the Meeting directly to its Registered Shareholders and indirectly to all Non-Registered Shareholders through their intermediaries. Encana will pay for an intermediary to deliver the meeting materials to “objecting beneficial owners”. Encana is not sending the meeting materials directly to “non-objecting beneficial owners”.

Unless otherwise stated, information in this Management Information Circular (the “Circular”) is given as of March 1, 2016. All dollar amounts are in Canadian dollars (“C$”), except as otherwise noted and except for dollar amounts contained in the “Director Compensation” and “Statement of Executive Compensation” sections, which are expressed in United States dollars (“US$”). For disclosure with respect to references to non-GAAP measures and information relating to the presentation of oil and gas information, see Appendix E to this Circular.

Encana’s by-laws require advance notice for nomination of directors for consideration at a shareholders meeting. Any notices of director nominations must be submitted to the Secretary of the Corporation no later than 30 days and not more than 65 days prior to the date of an annual meeting. The notice must include certain information about the proposed director nominee(s) (including name, age, residency, citizenship and principal occupation) and the nominating shareholder. Only those director nominees that comply with applicable requirements set out in Encana’s by-laws will be eligible for election as directors of Encana. A copy of Encana’s by-laws was filed on the System for Electronic Documentation Analysis and Retrieval (“SEDAR”) on May 14, 2014 and is available under our profile at www.sedar.com. Information on how to contact the Secretary of the Corporation (or our “Corporate Secretary”) is provided on page 49 of this Circular.

We have retained Kingsdale Shareholder Services (“Kingsdale”) as our proxy solicitation agent in Canada and the United States at a fee of approximately C$40,000, plus out-of-pocket expenses. Encana may also reimburse brokers and other persons holding shares in their name or in the name of nominees for costs incurred in sending proxy materials to their principals to obtain their proxies. Encana pays the cost of soliciting your proxy. Kingsdale has reviewed this Circular and recommended corporate governance best practices, where applicable. They will also be advising with respect to Meeting and proxy protocol and reviewing the tabulation of shareholder proxies.

If you have questions about the information contained in this Circular or require assistance in completing your proxy or voting instruction form, please call Kingsdale at 1-866-229-8166 (North American toll-free) or 1-416-867-2272 (for collect calls outside North America) or by email at [email protected].

Table of Contents

| Notice of 2016 Annual Meeting of Shareholders

|

You are invited to attend the 2016 Annual Meeting of Shareholders.

| When |

Where | |

| Tuesday, May 3, 2016 |

BMO Centre, Palomino Room | |

| 10:00 a.m. Calgary Time |

20 Roundup Way S.E. | |

| Calgary, Alberta |

Business of the Meeting

| 1. | receive the Consolidated Financial Statements and the Auditor’s Report for the year ended December 31, 2015; |

| 2. | elect the directors; |

| 3. | appoint the auditors for the upcoming year and authorize the directors to fix the auditors’ fees; |

| 4. | hold a non-binding advisory vote approving Encana’s approach to executive compensation; |

| 5. | consider and, if deemed appropriate, pass an ordinary resolution amending and reconfirming our Shareholder Rights Plan, as described in this Circular; and |

| 6. | consider such other business as may properly be brought before the Meeting or any adjournment or postponement thereof. |

You are entitled to receive notice of and vote at the Meeting, or any adjournment or postponement, if you were a holder of common shares of Encana (“Common Shares”) at the close of business on March 14, 2016, and are encouraged to participate either in person or by proxy. The process for voting depends on whether you are a registered or beneficial shareholder. Please refer to pages one to four of this Circular for more information.

If you cannot attend the Meeting, a live broadcast of the Meeting will be available on our website at www.encana.com.

The Board of Directors has approved the contents of this Circular and has authorized us to send it to you.

By order of the Board of Directors,

Joanne Alexander

Executive Vice-President, General Counsel & Corporate Secretary

Encana Corporation

Calgary, Alberta

March 1, 2016

Table of Contents

| To Our Shareholders

|

March 1, 2016

Dear Fellow Shareholder,

On behalf of the Board and management of Encana, it is our pleasure to invite you to our Meeting to be held on Tuesday, May 3, 2016 at 10:00 a.m. Calgary time at the BMO Centre, Palomino Room, 20 Roundup Way S.E., Calgary, Alberta. Live coverage of the Meeting will be broadcast on our website at www.encana.com. An audio recording will also be available on our website for a period of time after the Meeting.

As a shareholder, you have the right to participate in and to vote your Common Shares on items of business at the Meeting. This Circular describes the business to be conducted at the Meeting and provides important information regarding our nominated directors, corporate governance practices and approach to executive compensation. This information will assist you in deciding how to vote your Common Shares.

Your vote and participation at the Meeting are important. We therefore encourage you to review this Circular in advance of the Meeting.

In addition to the ordinary business of the Meeting, a special item will be proposed to shareholders regarding the amendment and reconfirmation of our Shareholder Rights Plan.

We look forward to seeing you at the Meeting on May 3, 2016.

Sincerely,

|

|

|

|||

| Clayton H. Woitas Chairman of the Board |

Douglas J. Suttles President & Chief Executive Officer |

|

|

Encana is a leading North American energy producer focused on developing its strong portfolio of diverse resource plays producing natural gas, oil and natural gas liquids. By partnering with employees, community organizations and other businesses, Encana contributes to the strength and sustainability of the communities where it operates.

We are headquartered in Calgary, Alberta, Canada. Our Common Shares are traded on the Toronto Stock Exchange and on the New York Stock Exchange under the symbol ECA.

Table of Contents

|

|

Your vote is important. As a shareholder, it is important that you read this Circular carefully and then vote your Common Shares, either in person or by proxy, at the Meeting.

You may convey your voting instructions as follows:

| 1. | by Internet; |

| 2. | by telephone; |

| 3. | by mail; |

| 4. | by fax; or |

| 5. | by appointing another person to attend the Meeting and vote your Common Shares for you (“your proxyholder”). |

You may authorize the directors of Encana who are named on the enclosed proxy form to vote your Common Shares at the Meeting or any adjournment or postponement thereof. You have the right to appoint another person to act as your proxyholder. If you appoint someone else, he or she must be present at the Meeting to vote your Common Shares.

If you are voting your Common Shares by proxy, our registrar and transfer agent, CST Trust Company (“CST”), or other agents we appoint, must receive your completed proxy form by 10:00 a.m. (Calgary time) on April 29, 2016 or, in the case of any adjournment or postponement of the Meeting, not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time of the adjourned or postponed Meeting.

Registered Shareholders

You are a “Registered Shareholder” if Common Shares are registered in your name.

Non-Registered (or Beneficial) Shareholders

You are a “Non-Registered Shareholder” if a broker, investment dealer, bank, trust company, trustee, nominee or other intermediary (your “Intermediary”) holds your Common Shares for you. Non-Registered Shareholders do not ordinarily have a physical (paper) share certificate. Most shareholders are Non-Registered Shareholders.

A shareholder can contact CST if he or she has any questions:

| CST TRUST COMPANY |

||||

| 600 The Dome Tower |

Telephone: | 1-866-580-7145 (toll free in North America) | ||

| 333 - 7 Avenue S.W. |

1-416-682-3863 (outside North America) | |||

| Calgary, Alberta |

Fax: | 1-888-249-6189 | ||

| Canada T2P 2Z1 |

Internet: | www.canstockta.com |

Matters to be Voted on

At the Meeting, shareholders will vote on:

| • | the election of directors; |

| • | the appointment of the auditors and the authorization of the directors to approve the auditors’ fees; |

| • | Encana’s approach to executive compensation; and |

| • | the amendment and reconfirmation of our Shareholder Rights Plan. |

A simple majority (50 percent plus one) of votes cast in person or by proxy at the Meeting is required to approve each of the matters proposed to come before the Meeting.

How to Vote – Registered Shareholders

The following summarizes the means by which a Registered Shareholder can vote during the Meeting. For more information, please see “Completing the Proxy Form – Registered Shareholders” section.

In Person

Attend the Meeting and register with CST at one of the registration stations. You do not need to complete or return the proxy form ahead of the Meeting.

| 1 | ||||

| If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder Services at 1-866-229-8166 or email [email protected]. |

Table of Contents

By Proxy

There are a number of ways you can vote your Common Shares by proxy:

| Internet |

Visit www.cstvotemyproxy.com and follow the instructions. You will need your 13-digit control number found on the back of the proxy form. | |

| Phone |

Call 1-888-489-5760 from a touch-tone phone and follow the voice instructions. You will need your 13-digit control number found on the back of the proxy form. Please note you cannot appoint a proxyholder via the telephone voting system. | |

| |

Complete, sign and date your proxy form and return it in the business-reply envelope included in your package. | |

| Fax |

Complete, sign and date your proxy form, faxing both sides of the proxy form to 1-866-781-3111 (toll free in North America) or 1-416-368-2502 (outside of North America). |

By Proxyholder

You can appoint a proxyholder to attend the Meeting and vote your Common Shares.

The proxyholder does not have to be an Encana shareholder. To properly appoint a proxyholder by mail or fax, write the person’s name in the space provided on the proxy form. Ensure to sign and date the proxy form before sending it back. If appointing a proxyholder by Internet, go to the website and follow the online instructions.

Your proxyholder should plan to arrive in advance of the Meeting and register with CST at one of the registration stations.

Your proxyholder will vote your Common Shares as he or she sees fit on each item and on any other matter that may properly come before the Meeting and in respect of which you are entitled to vote, unless you indicate otherwise.

COMPLETING THE PROXY FORM – REGISTERED SHAREHOLDERS

You can choose to vote “For” or “Withhold Vote” from:

| • | the election of any one or more of the persons nominated for election as directors; and |

| • | the appointment of PricewaterhouseCoopers LLP, Chartered Professional Accountants, as auditors and the authorization of the directors to fix their fees. |

You can choose to vote “For” or “Against”:

| • | the approval, on an advisory and non-binding basis, of Encana’s approach to executive compensation; and |

| • | the amendment and reconfirmation of our Shareholder Rights Plan. |

Complete your voting instructions, sign and date your proxy form and return it in the envelope provided so that it is received by 10:00 a.m. (Calgary time) on April 29, 2016 or, in the case of any adjournment or postponement of the Meeting, not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time of the adjourned or postponed Meeting. The Chairman of the Meeting may waive or extend the proxy cut-off time at his discretion without notice.

If you do not specify how you want your Common Shares voted, your proxyholder will vote your Common Shares as he or she sees fit on each item and on any other matter that may properly come before the Meeting and in respect of which you are entitled to vote.

When you sign the proxy form without appointing a proxyholder, you authorize appointees Mr. Woitas and Mr. Suttles, who are directors of Encana, to act as your proxyholders and to vote your Common Shares for, against or withhold from voting, in accordance with your instructions on any vote or ballot that may be called for at the Meeting. If you specify a choice with respect to any matter to be acted upon at the Meeting, your Common Shares will be voted accordingly.

If you return your proxy form and do not indicate how you want to vote your Common Shares, your vote will be cast as follows:

| • | FOR the election of the persons nominated for election as directors; |

| • | FOR the appointment of PricewaterhouseCoopers LLP, Chartered Professional Accountants, as auditors and the authorization of the directors to fix their fees; |

| • | FOR the approval, on an advisory and non-binding basis, of Encana’s approach to executive compensation; and |

| • | FOR the amendment and reconfirmation of our Shareholder Rights Plan. |

| 2 | ||||

| If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder Services at 1-866-229-8166 or email [email protected]. |

Table of Contents

The appointees will vote your Common Shares as he or she sees fit on any other matter, including any amendments or variations of matters that may properly come before the Meeting and in respect of which you are entitled to vote.

If you are an individual shareholder, you (or your authorized attorney) must sign the proxy form. If the shareholder is a corporation or other legal entity, an authorized officer or attorney must sign the proxy form.

If you need help completing your proxy, please contact Kingsdale at 1-866-229-8166 (North America toll free) or 1-416-867-2272 (for collect calls outside North America) or by email at [email protected].

Changing Your Vote – Registered Shareholders

You can change a vote you made by proxy provided such change is received before 10:00 a.m. (Calgary time) on April 29, 2016 or, in the case of any adjournment or postponement of the Meeting, not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time of the adjourned or postponed Meeting by:

| • | completing a proxy form that is dated later than the proxy form previously submitted and mailing it or faxing it to CST; or |

| • | voting again by telephone or on the Internet. |

You can revoke a vote you made by proxy by voting in person at the Meeting, provided you have previously sent or given a notice of revocation in writing as set out below:

| • | sending a notice of revocation in writing from you or your authorized attorney to CST so that it is received before the close of business (Calgary time) on April 29, 2016 or, in the case of any adjournment or postponement of the Meeting, on the business day immediately preceding the day of the adjourned or postponed Meeting; or |

| • | giving a notice of revocation in writing from you or your authorized attorney to the Chairman of the Meeting prior to the commencement of the Meeting or any adjournment or postponement of the Meeting. |

How to Vote – Non-Registered (or Beneficial) Shareholders

In Person

We do not have access to the names or holdings of our Non-Registered Shareholders. As a Non-Registered Shareholder, if you want your Common Shares to be voted in person at the Meeting, you must appoint a proxyholder who will attend the Meeting in person. You can appoint yourself, or someone else, as proxyholder by printing your name, or the name of another person, in the space provided on the voting instruction form received from your Intermediary and submit it as directed. Your voting instructions, including your proxyholder appointment, must be received at least one business day prior to April 29, 2016 to allow your voting instructions to be received by CST by 10:00 a.m. (Calgary time) on April 29, 2016 or, in the case of any adjournment or postponement of the Meeting, not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time of the adjourned or postponed Meeting. The Chairman of the Meeting may waive or extend the proxy cut-off time at his discretion without notice.

On the day of the Meeting, proxyholders must register with CST at one of the registration stations.

By Proxy

Your Intermediary is required to ask for your voting instructions before the Meeting. In most cases, you will receive a voting instruction form from your Intermediary allowing you to provide your voting instructions by telephone, Internet or mail. If you want to provide your voting instructions on the Internet, go to www.proxyvote.com and follow the instructions using your 16-digit control number located on your voting instruction form.

In some instances, you may receive a proxy form from your Intermediary which:

| • | is to be completed and returned by you as directed in the instructions provided; or |

| • | has been pre-authorized by your Intermediary and which is to be completed, dated, signed and returned by you to CST, by mail or by fax. |

Changing Your Vote – Non-Registered Shareholders

You may change your voting instructions by contacting your Intermediary as per its instructions.

| 3 | ||||

| If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder Services at 1-866-229-8166 or email [email protected]. |

Table of Contents

How the Votes are Counted

Each shareholder is entitled to one vote for each Common Share he or she holds as of March 14, 2016 on all matters proposed to come before the Meeting. As of March 1, 2016, there were 849,893,635 issued and outstanding Common Shares.

Principal Holders of 10 percent or more Common Shares

As at March 1, 2016, to the knowledge of the directors and executive officers of Encana, no person or company beneficially owns, or controls or directs, directly or indirectly, Common Shares carrying 10 percent or more of the voting rights attached to the Common Shares, except as set out below in the following table:

|

Name |

Type of Ownership |

(#) of Common Shares Owned or Controlled

|

Common Shares Outstanding (%) | |||

| Blackrock, Inc. |

Beneficial | 101,209,308 | 11.90% |

| (*) | This information is based upon an Alternative Monthly Report filed on March 8, 2016 on SEDAR which can be retrieved at www.sedar.com. |

|

|

The Meeting will cover the following items of business. For items requiring shareholder approval, a simple majority (50 percent plus one) of votes cast in person or by proxy at the Meeting is required.

Receive the Financial Statements and Report of the Auditors

Our audited Consolidated Financial Statements for the year ended December 31, 2015 and Auditor’s Report will be placed before the Meeting. Our 2015 Consolidated Financial Statements have been reviewed and approved by our Board.

Our 2015 Consolidated Financial Statements and Auditor’s Report were mailed to shareholders who requested them. They are also contained in our 2015 Annual Report, available at www.encana.com, www.sedar.com or www.sec.gov. No formal action will be taken at the Meeting to approve our 2015 Consolidated Financial Statements; however you will have an opportunity to ask any questions you may have about them at the Meeting.

Elect the Directors

Encana’s articles of incorporation provide that the minimum number of directors shall be eight and the maximum number shall be 17. There are currently 11 directors. The Board has set the number of directors to be elected at the Meeting at 11.

At the Meeting, you will be asked to elect 11 directors to our Board for a one-year term. Information on each of these directors can be found starting at page seven. You may vote for all nominated directors, vote for some and withhold for others, or withhold for all. To be elected, except in the circumstances described below, each nominated director requires an affirmative vote of the majority of votes cast by shareholders at the Meeting.

Our Nominating and Corporate Governance (“NCG”) Committee believes each of our nominated directors is well qualified and has the necessary skills and experience required to serve as one of our Board members. Each nominated director is a current member of our Board and is independent, excluding Mr. Suttles, who is not independent as he is our President & Chief Executive Officer.

If elected, each nominated director will serve as a director until the close of the next annual meeting of shareholders, or until their respective successors are otherwise duly elected or appointed. Management has no reason to believe that any of the nominees will be unable to serve as a director; however, if a nominated director withdraws his or her name, or is otherwise unable to serve as director, you or your proxyholder will have the right to use discretion in voting for such other properly qualified nominees.

| 4 | ||||

| If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder Services at 1-866-229-8166 or email [email protected]. |

Table of Contents

Policy on Majority Voting

If a director receives more “withhold” than “for” votes at the Meeting, he or she must immediately tender his or her resignation to the Board even though the director may have been duly elected under applicable law. The NCG Committee will review the matter and make a recommendation to the Board whether to accept or reject the resignation, having regard to the best interests of Encana and any other factors it considers relevant. The Board shall accept the resignation absent exceptional circumstances and the resignation will be effective when accepted by the Board. The director will not participate in Board or Committee deliberations on the matter. It is anticipated the Board will make a decision within 90 days. If the Board accepts the resignation, it may appoint a new director to fill the vacancy in accordance with our articles, by-laws and applicable law.

Our policy only applies to uncontested elections where the number of nominated directors equals the number of directors to be elected at the Meeting. In a contested election (where the number of nominated directors exceeds the number of directors to be elected), the directors with the most number of Common Shares voted in their favour will be elected to the available Board seats.

The Board recommends that you vote FOR each of the nominated directors. Unless otherwise instructed, the persons designated in the proxy form and the voting information form intend to vote FOR the election of the nominated directors.

Appoint the Auditors

At the Meeting, you will be asked to appoint PricewaterhouseCoopers LLP (“PwC”), Chartered Professional Accountants, as Encana’s auditors, to serve until the next annual shareholder meeting and to authorize the Board to fix the auditors’ fees.

PwC has served as Encana’s auditors for over 10 consecutive years. Representatives of PwC will be at the Meeting and available to answer questions. For information regarding fees paid to PwC for the year ended December 31, 2015, please see Appendix A – “Audit Committee Disclosure: Audit & Non-Audit Related Fees 2015 & 2014.”

To be approved, the appointment of PwC as Encana’s auditors requires an affirmative vote of the majority of votes cast at the Meeting.

The Board recommends that you vote FOR the appointment of PricewaterhouseCoopers LLP as Encana’s auditors until the close of the next annual meeting of shareholders. Unless otherwise instructed, the persons designated in the proxy form and the voting information form intend to vote FOR the appointment of PricewaterhouseCoopers LLP as auditors of Encana to hold office until the next annual meeting of shareholders and their fees to be fixed by the Board.

Hold a Non-Binding Advisory Vote on Executive Compensation

At the Meeting, you will have the opportunity to participate in our non-binding advisory vote on our approach to executive compensation (or Say on Pay vote).

Since 2011, Encana has provided shareholders an opportunity to provide feedback on our compensation approach by way of a Say on Pay vote. At last year’s annual meeting of shareholders, shareholders voted 94.53 percent in favour of our approach to executive compensation. We believe our approach to executive compensation is fair and balanced and is aligned with our shareholders’ interests over the long-term.

At the Meeting, you will have the opportunity to have your Say on Pay vote through the resolution set out below.

The Board recommends that you vote FOR the resolution set out below. Unless instructed otherwise, the persons designated in the proxy form and the voting information form intend to vote FOR the following resolution affirming Encana’s approach to executive compensation.

“RESOLVED that, on an advisory basis, and not to diminish the role and responsibilities of the Board of Directors, the shareholders approve the approach to executive compensation described in Encana’s Management Information Circular dated March 1, 2016 delivered in advance of the 2016 Annual Meeting of Shareholders.”

As an advisory vote, the results are non-binding on the Board. The Board will, however, carefully consider the results of the vote and other shareholder feedback when evaluating its compensation approach going forward. In the event there is a significant proportion of negative Say on Pay votes, the Board will take steps to better understand shareholder concerns which might have influenced voting results.

| 5 | ||||

| If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder Services at 1-866-229-8166 or email [email protected]. |

Table of Contents

SPECIAL BUSINESS OF THE MEETING

Amendment and Reconfirmation of the Shareholder Rights Plan

Encana adopted a shareholder rights plan (the “Rights Plan”) effective July 30, 2001, which has been amended and restated several times, most recently on April 21, 2010. The Rights Plan was reconfirmed and approved at an annual meeting of shareholders held on April 23, 2013.

Shareholders will be asked to consider and, if deemed appropriate, approve an ordinary resolution to amend and reconfirm the Rights Plan at the Meeting. The text of this ordinary resolution is provided below (the “Rights Plan Resolution”). For the Rights Plan to be amended and continue in effect after the Meeting, the Rights Plan Resolution must be approved by a simple majority of votes (50 percent plus one) cast by shareholders at the Meeting. If the Rights Plan Resolution is not passed, the Rights Plan will terminate May 3, 2016. If the Rights Plan Resolution is passed, the Rights Plan will require reconfirmation by Encana’s shareholders at the 2019 annual meeting of shareholders.

Proposed Amendments

On February 25, 2016, the Canadian Securities Administrators (the “CSA”) announced amendments, effective May 9, 2016, to the minimum period a take-over bid must remain open for deposits of securities thereunder, which extend the minimum period to 105 days (from its current 35 days), with the ability of the target issuer to voluntarily reduce the period to not less than 35 days. Additionally, the minimum period may be reduced due to the existence of certain competing take-over bids or alternative change in control transactions. As a result, the only proposed substantive amendment to the Rights Plan is to extend the period of time a Permitted Bid must remain open solely to reflect changes to the take-over bid regime by the CSA. To ensure the Permitted Bid definition in the Rights Plan remains aligned with the minimum period a take-over bid must remain open under applicable Canadian securities laws, the proposed amendments to the Rights Plan include:

| • | amending the definition of Permitted Bid to be outstanding for a minimum period of 105 days or such shorter period that a take-over bid must remain open for deposits of securities, in the applicable circumstances, pursuant to Canadian securities laws; and |

| • | certain additional non-substantive, technical and administrative amendments, including to align the definition of a Competing Permitted Bid to the minimum number of days as required under Canadian securities laws, permit book entry form registration of Rights and provide an exception for certain Exempt Acquisitions. |

The purpose and principal terms of the Rights Plan, including the proposed amendments, are set forth in Appendix B to this Circular. A copy of the Rights Plan, as proposed to be amended, may be obtained by contacting the Corporate Secretary at (403) 645-2000 or by fax at (403) 645-4617, and will be available on Encana’s website at www.encana.com.

Approval

The Board has determined that the proposed continuation and amendment and restatement of the Rights Plan are in the best interests of Encana and its shareholders. The Board recommends that shareholders vote FOR the Rights Plan Resolution. Unless otherwise instructed, the persons designated in the proxy form and the voting information form intend to vote FOR the Rights Plan Resolution. The text of the Rights Plan Resolution, subject to such amendments, variations or additions as may be approved at the Meeting, is set forth below:

“RESOLVED AS AN ORDINARY RESOLUTION OF THE HOLDERS OF COMMON SHARES that:

| 1. | The shareholder rights plan (“Rights Plan”) of Encana Corporation (the “Corporation”), including the amendments thereto, be confirmed, and the Amended and Restated Shareholder Rights Plan Agreement to be dated as of May 3, 2016 between the Corporation and CST Trust Company (formerly CIBC Mellon Trust Company), which amends and restates the Amended and Restated Shareholder Rights Plan Agreement dated April 21, 2010, and continues the rights issued thereunder, be and is hereby ratified, confirmed and approved. |

| 2. | Any director or officer of the Corporation is authorized and directed for and on behalf of the Corporation (whether under its corporate seal or otherwise) to enter into, to execute and deliver all such instruments, agreements, corollary agreements and documents, including all notices, consents, applications, acknowledgements, certificates and other instruments (herein the “Instruments”) and do, or cause to be done, all such other acts and things (herein “Acts”) as may be necessary for the purpose of giving effect to the foregoing resolutions or to comply with any Instrument or Act, and such Instruments and Acts authorized and approved by these resolutions shall constitute valid and binding obligations of the Corporation, and the performance by the Corporation under such Instruments and pursuant to such Acts is hereby authorized.” |

| 6 | ||||

| If you have any questions or need assistance completing your proxy or voting instruction form, please call Kingsdale Shareholder Services at 1-866-229-8166 or email [email protected]. |

Table of Contents

| Nominees for Election to the Board

|

The following tables provide information on our nominated directors. This includes the nominees’ place of residence, principal occupations and public directorships in the past five years, current Committee membership on our Board and respective attendance record for 2015. Also shown are the Encana securities held by each nominated director, directly, indirectly, controlled or directed (Common Shares and Deferred Share Units (“DSUs”)) as at March 1, 2016 and March 16, 2015, and the minimum director shareholding requirements as at March 1, 2016.

|

Peter A. Dea Age: 62 | Denver, Colorado, USA | Independent | Director since 2010

|

|

|

Mr. Dea has been President & Chief Executive Officer of Cirque Resources LP (a private oil and gas company) since May 2007. From November 2001 through August 2006, he was President & Chief Executive Officer and a director of Western Gas Resources, Inc. (a public natural gas company which was sold in 2006 for approximately US$5.3 billion). He joined Barrett Resources Corporation (a public natural gas company which was sold in 2001 for approximately US$2.7 billion) in November 1993 and served as Chief Executive Officer and director from November 1999 and as Chairman from February 2000 through August 2001, prior to which time he held several managerial and geologic positions with Exxon Company, U.S.A.

Skills and Qualifications Mr. Dea brings over 30 years of oil and gas exploration and production experience and involvement in state and national energy policies to Encana’s Board of Directors. | |||||

|

2015 Board/Committee Membership

|

2015 Meeting Attendance |

Areas of Expertise • Energy, Oil and Natural Gas • Energy Policy • Higher Education | ||||

| Board Corporate Responsibility, Environment, Health and Safety – Chairman Nominating and Corporate Governance Reserves |

6 of 7 3 of 3 3 of 3 2 of 3 |

86% 100% 100% 67% |

||||

|

Education • Bachelor of Arts in Geology (Western State Colorado University) • Masters of Science in Geology (University of Montana) • Harvard Business School, Advanced Management Program • Certified Professional Geologist

Non-profit Sector Affiliations • Trustee, Denver Museum of Nature and Science • Co-Chairman and Trustee, ACE Scholarships

|

Awards and Accomplishments • Named “Wildcatter of the Year” for 2010 by the Independent Petroleum Association of Mountain States • Rocky Mountain Oil & Gas Hall of Fame inductee in 2009 • Inducted to All American Wildcatters in 2014 • Fellow National Member, The Explorers Club | |||||

|

Securities Held | ||||||||

| Year |

Common Shares (#)(1) | DSUs (#) and Market or Payout Value(2,3) |

Total Market Value of Common Shares/DSUs(1,2,4) |

Minimum Share Ownership Required (Value Equivalent)(5) | ||||

| 2016 |

135 | 83,172 ($478,239) | $479,015 | 29,400 ($169,050) | ||||

| 2015 |

135 | 64,293 ($900,745) | $902,636 | |||||

7

Table of Contents

|

Fred J. Fowler Age: 69 | Houston, Texas, USA | Independent | Director since 2010

|

|

|

Mr. Fowler is a Corporate Director. He was Chairman of Spectra Energy Partners, LP (a public natural gas pipeline and storage entity) from October 2008 to November 2013 and continues as a director of that company. Mr. Fowler is a director of PG&E Corporation (a public natural gas and electric utility company) and DCP Midstream Partners, LP (a public master limited partnership engaged in natural gas and natural gas liquids transport, storage, production and sale). He was President & Chief Executive Officer of Spectra Energy Corp. (a natural gas gathering, processing and mainline transportation company) from December 2006 to December 2008 and served as a director from December 2006 to May 2009. He was President & Chief Executive Officer of Duke Energy Gas Transmission, LLC (a subsidiary of Duke Energy Corporation) from April 2006 through December 2006. From June 1997, he occupied various executive positions with Duke Energy Corporation (a public electric and gas company), including President and Chief Operating Officer from November 2002 to April 2006.

Skills and Qualifications Mr. Fowler brings extensive experience in the areas of natural gas liquids, natural gas processing and transportation to Encana’s Board of Directors. | |||||

|

2015 Board/Committee Membership

|

2015 Meeting Attendance | Areas of Expertise • Energy, Oil and Natural Gas, Natural Gas Liquids • Natural Gas Processing and Transportation • Corporate Governance | ||||

| Board Corporate Responsibility, Environment, Health and Safety Human Resources and Compensation |

7 of 7 3 of 3 5 of 5 |

100% 100% 100% |

||||

| Education • Bachelor of Finance (Oklahoma State University)

Past Five Years of Public Company Directorships • Spectra Energy Corp. • Spectra Energy Partners, LP • DCP Midstream Partners, LP • PG&E Corporation

|

||||||

|

Securities Held | ||||||||

| Year |

Common Shares (#)(1) | DSUs (#) and Market or Payout Value(2,3) |

Total Market Value of Common Shares/DSUs(1,2,4) |

Minimum Share Ownership Required (Value Equivalent)(5) | ||||

| 2016 |

15,000 | 76,468 ($439,691) | $525,941 | 29,400 ($169,050) | ||||

| 2015 |

5,000 | 64,368 ($901,796) | $971,846 | |||||

|

Howard J. Mayson Age: 63 | Breckenridge, Colorado, USA | Independent | Director since 2014

|

|

|

Mr. Mayson is an independent businessman and corporate director. He has over 35 years of exploration & development experience, mostly with British Petroleum (“BP”), and has held a variety of roles in North America, the Middle East, Australia and the UK. He held a number of senior roles, including CEO of BP Russia, President of BP Angola, Director of BP’s Exploration & Production Technology Group and previously ran BP’s Alaska Western North Slope Business. He also headed up BP’s Global Subsurface function. Mr. Mayson is currently a director of Corex Resources Ltd. and Hawkwood Energy LLC, both of which are private entities. He also serves on the Advisory Board for the private equity firm Azimuth Capital Management LLC (formerly KERN Partners Ltd.).

Skills and Qualifications Mr. Mayson brings over 35 years of extensive experience in oil and gas exploration, development and production to Encana’s Board of Directors. | |||||

|

2015 Board/Committee Membership

|

2015 Meeting Attendance |

Areas of Expertise • Exploration, Development and Production • Oil and Gas Reserves Management and Reporting • E&P Technology | ||||

| Board Corporate Responsibility, Environment, Health and Safety Nominating and Corporate Governance Reserves – Chairman |

7 of 7 3 of 3 3 of 3 3 of 3 |

100% 100% 100% 100% |

||||

|

Education • Bachelor of Engineering (Honors), The University of Sheffield • Master of Science (Mechanical Engineering), MIT • Advanced Management Program, Wharton Business School

Non-profit Sector Affiliations • Chairman, Industry Advisory Board, Institute of Petroleum Engineering, Edinburgh, 1997-2009

|

Awards and Accomplishments • Honorary Doctor of Engineering (Heriot-Watt University) | |||||

| Securities Held |

||||||||

| Year |

Common Shares (#)(1) | DSUs (#) and Market or Payout Value(2,3) |

Total Market Value of Common Shares/DSUs(1,2,4) |

Minimum Share Ownership Required (Value Equivalent)(5) | ||||

| 2016 |

20,104 | 30,393 ($174,760) | $290,358 | 29,400 ($169,050) | ||||

| 2015 |

0 | 19,883 ($278,561) | $278,561 | |||||

8

Table of Contents

|

Lee A. McIntire Age: 67 | Denver, Colorado, USA | Independent | Director since 2014

|

|

|

Mr. McIntire has been the Chief Executive Officer of TerraPower, LLC (a private nuclear energy technology company) since August 2015. He served as Chief Executive Officer and President of CH2M HILL (a private consulting company) from January 2009 to January 2014, Chairman from 2010 through 2014 and Executive Chairman of the Board from January 2014 to October 2014. During his tenure as CEO, CH2M HILL enjoyed growth and stability, increasing to over 30,000 employees, expanding its international presence to over 100 countries, diversifying its service offerings, and doubling revenues to US$7.0 billion. Mr. McIntire previously served as the firm’s Chief Operating Officer and President. Prior to joining CH2M HILL, Mr. McIntire was a partner, Executive Vice-President, and served on the Board of Directors of the Bechtel Group of Companies from 1989 to 2004. Mr. McIntire served on the Chairman’s Leadership Council, and was President of several of Bechtel’s multibillion-dollar companies.

Skills and Qualifications Mr. McIntire brings over 35 years of executive leadership and governance experience to Encana’s Board of Directors.

| |||||

|

2015 Board/Committee Membership

|

2015 Meeting Attendance |

Areas of Expertise • Risk Management • Finance and Accounting • Corporate Governance | ||||

| Board Corporate Responsibility, Environment, Health and Safety Human Resources and Compensation |

6 of 7 2 of 3 4 of 5 |

86% 67% 80% |

||||

|

Education • Bachelor of Science in Civil Engineering (University of Nebraska College of Civil Engineering) • Masters from the Thunderbird School of Global Management in Arizona • Executive Management Program at Dartmouth’s Tuck School of Business

Past Five Years of Public Company Directorships • BAE Systems (British Aerospace) PLC |

Awards and Accomplishments • Woodrow Wilson Award, 2011 • Joseph Korbel Award, 2012 • Elected to Presidents’ Circle of National Academy of Science, 2015 | |||||

| Securities Held |

||||||||

| Year |

Common Shares (#)(1) | DSUs (#) and Market or Payout Value(2,3) |

Total Market Value of Common Shares/DSUs(1,2,4) |

Minimum Share Ownership Required (Value Equivalent)(5) | ||||

| 2016 |

17,100 | 26,643 ($153,197) | $251,522 | 29,400 ($169,050) | ||||

| 2015 |

7,100 | 10,649 ($149,192) | $248,663 | |||||

|

Margaret A. McKenzie Age: 54 | Calgary, Alberta, Canada | Independent | Director since 2015

|

|

|

Ms. McKenzie is a Corporate Director. She is a director of Inter Pipeline Ltd. (a public petroleum pipeline company), Bonavista Energy Corporation (a public oil and gas company) and PrairieSky Royalty Ltd. (a public oil and gas company). She was Vice-President, Finance and Chief Financial Officer of Range Royalty Management Ltd. (a private oil and gas royalty company) from July 2006 to December 2014, Vice-President Finance and Chief Financial Officer of Profico Energy Management Ltd. (a private oil and natural gas exploration company) from 2000 to 2006 and was a member of the finance and treasury group of Renaissance Energy Ltd. (a public oil and natural gas exploration company) from 1987 to 2000. Ms. McKenzie is a director of Spur Resources Ltd. (a private oil and gas company) and a director of Endurance Energy Ltd. (a private oil and gas company).

Skills and Qualifications Ms. McKenzie brings over 18 years of energy, oil and natural gas exploration experience to Encana’s Board of Directors.

| |||||

|

2015 Board/Committee Membership

|

2015 Meeting Attendance |

Areas of Expertise • Energy, Oil and Natural Gas • Business Strategy • Finance and Accounting | ||||

| Board Human Resources and Compensation Audit |

5 of 5 3 of 3 3 of 3 |

100% 100% 100% |

||||

|

Education • Bachelor of Commerce (University of Saskatchewan) • Chartered Accountant • ICD.D (Institute of Corporate Directors)

Non-profit Sector Affiliations • Community Member, Audit Committee, University of Calgary

|

Past Five Years of Public Company Directorships • Bonavista Energy Corporation • PrairieSky Royalty Ltd. • Zargon Oil and Gas Ltd. • Inter Pipeline Ltd. | |||||

| Securities Held |

||||||||

| Year |

Common Shares (#)(1) | DSUs (#) and Market or Payout Value(2,3) |

Total Market Value of Common Shares/DSUs(1,2,4) |

Minimum Share Ownership Required (Value Equivalent)(5) | ||||

| 2016 |

12,000 | 17,868 ($102,741) | $171,741 | 29,400 ($169,050) | ||||

| 2015 |

12,000 | 7,840 ($109,838) | $277,958 | |||||

9

Table of Contents

|

Suzanne P. Nimocks Age: 57 | Houston, Texas, USA | Independent | Director since 2010

|

|

|

Ms. Nimocks is a Corporate Director. She is a director of Rowan Companies plc (a public international contract drilling services company), ArcelorMittal (world’s largest public steel company) and Owens Corning (a leading global producer of residential and commercial building materials). She was a director (senior partner) with McKinsey & Company (a private global management consulting firm) from June 1999 to March 2010 and was with the firm in various other capacities since 1989, including as a leader in the firm’s Global Petroleum Practice, Electric Power & Natural Gas Practice, Organization Practice and Risk Management Practice. She served as a member of the firm’s worldwide personnel committees for many years and as the Manager of the Houston office for eight years.

Skills and Qualifications Ms. Nimocks brings strategy and risk management expertise in the energy industry to Encana’s Board of Directors. | |||||

|

2015 Board/Committee Membership

|

2015 Meeting Attendance |

Areas of Expertise • International Energy Business • Strategy • Risk Management | ||||

| Board Audit Human Resources and Compensation – Chairperson Nominating and Corporate Governance |

7 of 7 5 of 5 5 of 5 3 of 3 |

100% 100% 100% 100% |

||||

|

Education • Bachelor of Arts in Economics (Cum Laude) (Tufts University) • Masters in Business Administration (Harvard Graduate School of Business)

Non-profit Sector Affiliations • Chairman, Houston Zoo, Inc. • Trustee, Texas Children’s Hospital

|

Past Five Years of Public Company Directorships • Rowan Companies plc • ArcelorMittal • Owens Corning

| |||||

|

Securities Held | ||||||||

| Year |

Common Shares (#)(1) | DSUs (#) and Market or Payout Value(2,3) |

Total Market Value of Common Shares/DSUs(1,2,4) |

Minimum Share Ownership Required (Value Equivalent)(5) | ||||

| 2016 |

5,600 | 78,285 ($450,139) | $482,339 | 29,400 ($169,050) | ||||

| 2015 |

0 | 64,368 ($901,796) | $901,796 | |||||

|

Jane L. Peverett Age: 57 | West Vancouver, British Columbia, Canada | Independent | Director since 2003

|

|

|

Ms. Peverett is a Corporate Director. She is a director of Hydro One Limited (a public utility company), Northwest Natural Gas Company (a public natural gas distribution company), Canadian Imperial Bank of Commerce (one of Canada’s largest banks), and Associated Electric & Gas Insurance Services Limited (a private mutual insurance company). Ms. Peverett was President & Chief Executive Officer of BC Transmission Corporation (electrical transmission) from April 2005 to January 2009 and was previously Vice-President, Corporate Services and Chief Financial Officer (since June 2003). She was the President of Union Gas Limited (a natural gas storage, transmission and distribution company) from April 2002 to May 2003, President & Chief Executive Officer from April 2001 to April 2002, Senior Vice-President Sales & Marketing from June 2000 to April 2001 and Chief Financial Officer from March 1999 to June 2000.

Skills and Qualifications Ms. Peverett brings experience as CEO of both gas and electric utilities companies to her role as a member of Encana’s Board of Directors.

| |||||

|

2015 Board/Committee Membership

|

2015 Meeting Attendance |

Areas of Expertise • Energy, Oil and Natural Gas • Financial Services • Utilities | ||||

| Board Audit – Chairperson Nominating and Corporate Governance Reserves |

7 of 7 5 of 5 3 of 3 3 of 3 |

100% 100% 100% 100% |

||||

|

Education • Bachelor of Commerce (McMaster University) • Master of Business Administration (Queen’s University) • Certified Management Accountant • ICD.D (Institute of Corporate Directors)

Past Five Years of Public Company Directorships • Canadian Imperial Bank of Commerce • Northwest Natural Gas Company • Postmedia Network Canada Corp. • Hydro One Limited

|

Awards and Accomplishments • Canadian Security Analyst Certificate • Fellow, Certified Management Accountants

| |||||

|

Securities Held | ||||||||

| Year |

Common Shares (#)(1) | DSUs (#) and Market or Payout Value(2,3) |

Total Market Value of Common Shares/DSUs(1,2,4) |

Minimum Share Ownership Required (Value Equivalent)(5) | ||||

| 2016 |

0 | 163,578 ($940,574) | $940,574 | 29,400 ($169,050) | ||||

| 2015 |

0 | 148,473 ($2,080,107) | $2,080,107 | |||||

10

Table of Contents

|

Brian G. Shaw Age: 62 | Toronto, Ontario, Canada | Independent | Director since 2013

|

|

|

Mr. Shaw is a Corporate Director. He is an experienced financial industry executive with particular expertise in capital markets and investing activities and is a private investor and corporate advisor. Mr. Shaw is an alumni of CIBC World Markets Inc. (and its predecessor firm Wood Gundy) where he was employed for 23 years. He was Chairman and Chief Executive Officer of CIBC World Markets Inc. from 2005 through 2008 and prior to that managed the Global Equities Division for a number of years. Mr. Shaw is currently a director of Manulife Bank of Canada (a private chartered bank), Manulife Trust Company (a private trust company), NuVista Energy Ltd. (a public oil and gas company), Ivey Canadian Exploration Ltd. (a private exploration company) and Lakeview Mortgage Funding Inc. (a private structured credit company).

Skills and Qualifications Mr. Shaw brings extensive experience as a financial services executive to his role as a member of Encana’s Board of Directors. | |||||

|

2015 Board/Committee Membership

|

2015 Meeting Attendance |

Areas of Expertise • Capital Markets and Investing • Financial Services • Energy, Oil and Natural Gas | ||||

| Board Audit Reserves |

7 of 7 5 of 5 3 of 3 |

100% 100% 100% |

||||

|

Education • Bachelor of Commerce (University of Alberta) • Master of Business Administration (University of Alberta) • Chartered Financial Analyst

Non-profit Sector Affiliations • Member, CFA Society Toronto • Chairman, TMX IP Governance Committee

|

Past Five Years of Public Company Directorships • Patheon Inc. • NuVista Energy Ltd. • PrairieSky Royalty Ltd.

| |||||

|

Securities Held | ||||||||

| Year |

Common Shares (#)(1) | DSUs (#) and Market or Payout Value(2,3) |

Total Market Value of Common Shares/DSUs(1,2,4) |

Minimum Share Ownership Required (Value Equivalent)(5) | ||||

| 2016 |

10,000 | 45,809 ($263,402) | $320,902 | 29,400 ($169,050) | ||||

| 2015 |

10,000 | 31,960 ($447,760) | $587,860 | |||||

|

Douglas J. Suttles Age: 55 | Calgary, Alberta, Canada | Not Independent | Director since 2013

|

|

|

Mr. Suttles was appointed Encana’s President & Chief Executive Officer on June 10, 2013. From March 2011 until June 2013, Mr. Suttles was an independent businessman, having over 30 years of experience in the oil and gas industry in various engineering and leadership roles. He has held a number of senior leadership posts at British Petroleum (“BP”), including Chief Operating Officer of BP Exploration & Production from January 2009 until March 2011 and President of BP Alaska from December 2006 until December 2008. He was a member of the board of BP America, as well as the BP America Operations Advisory Board. Previously, he served as President of BP Sakhalin Inc., where he was responsible for BP’s activities in Sakhalin, Russia and held other senior leadership roles in BP, including Vice-President for North Sea operations and President of BP’s Trinidadian oil business. Prior to joining BP, Mr. Suttles was an engineer with Exxon from 1983 to 1988.

Skills and Qualifications Mr. Suttles brings extensive North American and international energy development and production experience to Encana’s Board of Directors.

| |||||

|

2015 Board/Committee Membership

|

2015 Meeting Attendance

|

Areas of Expertise • Energy, Oil and Natural Gas • Acquisitions • Oil and Natural Gas Exploration and Production

| ||||

| Board |

7 of 7 | 100% |

||||

|

Education • Bachelor of Science in Mechanical Engineering (University of Texas, Austin)

Non-profit Sector Affiliations • Spindletop Charities Advisory Board • University of Texas Engineering Advisory Board

|

Awards and Accomplishments • Recipient of University of Texas at Austin Mechanical Engineering Distinguished Alumni Award, 2008 • “Mr. Spindletop Award” Honoree by Spindletop Charities, Inc., 2013

Past Five Years of Public Company Directorships • Ceres, Inc.

| |||||

|

Securities Held | ||||||||

| Year |

Common Shares (#)(1) | DSUs (#) and Market or Payout Value(2,3) |

Total Market Value of Common Shares/DSUs(1,2,4) |

Minimum Share Ownership Required (Value Equivalent)(5) | ||||

| 2016 |

51,212 | 0 | $294,469 | N/A | ||||

| 2015 |

7,562 | 0 | $105,944 | |||||

11

Table of Contents

|

Bruce G. Waterman Age: 65 | Calgary, Alberta, Canada | Independent | Director since 2010

|

|

|

Mr. Waterman is a Corporate Director. He retired in January 2013 from Agrium Inc. (a public agricultural company) as Executive Vice-President, having held senior roles as Chief Financial Officer, as well as in Business Development and Strategy since April 2000. Mr. Waterman is a director of Enbridge Income Fund Holdings Inc., a Trustee of Enbridge Commercial Trust, a director of Irving Oil Limited (a private oil and gas company) and a director of Prairie Storm Energy Corp. (a private oil and gas company). He was Vice-President and Chief Financial Officer of Talisman Energy Inc. (a public oil and gas company) from January 1996 to April 2000. Mr. Waterman also has extensive expertise in oil and gas exploration and production operations, having spent 15 years (1981 to 1996) at Amoco Corporation, including Dome Petroleum Limited, a predecessor company and as a result of serving as Talisman’s Chief Financial Officer for over four years (as noted above). At Amoco (a global chemical, oil and gas company which merged with British Petroleum in 1998), his roles included various positions in finance, accounting and business development.

Skills and Qualifications Mr. Waterman brings a wealth of energy industry, financial, business development and government relations knowledge to Encana’s Board of Directors.

| |||||

|

2015 Board/Committee Membership

|

2015 Meeting Attendance |

Areas of Expertise • Energy, Oil and Natural Gas • Finance and Accounting • Business Development | ||||

| Board Audit Human Resources and Compensation |

7 of 7 5 of 5 5 of 5 |

100% 100% 100% |

||||

|

Education • Bachelor of Commerce (Honours) (Queen’s University) • Chartered Accountant • ICD.D (Institute of Corporate Directors)

Non-profit Sector Affiliations • Selection Committee Chairman, Canada’s CFO of the YearTM • FEI Canada Advisory Board

|

Awards and Accomplishments • Named Canada’s CFO of the YearTM in 2008 • Fellow of the Chartered Accountants

Past Five Years of Public Company Directorships • Enbridge Income Fund Holdings Inc. • PrairieSky Royalty Ltd.

| |||||

|

Securities Held | ||||||||

| Year |

Common Shares (#)(1) | DSUs (#) and Market or Payout Value(2,3) |

Total Market Value of Common Shares/DSUs(1,2,4) |

Minimum Share Ownership Required (Value Equivalent)(5) | ||||

| 2016 |

125,000 | 91,904 ($528,448) | $1,247,198 | 29,400 ($169,050) | ||||

| 2015 |

42,000 | 73,659 ($1,031,963) | $1,620,383 | |||||

|

Clayton H. Woitas Age: 67 | Calgary, Alberta, Canada | Independent | Director since 2008

|

|

|

Mr. Woitas is a Corporate Director and has been Encana’s Chairman of the Board since July 22, 2013. From January 11, 2013 to June 10, 2013 Mr. Woitas acted as Interim President & Chief Executive Officer of Encana. He was Chairman & Chief Executive Officer of Range Royalty Management Ltd. (a private oil and gas royalty company) from 2006 to December 2014. He is a director of Gibson Energy Inc. (a public oil and gas midstream company). He is also a director of several private energy-related companies and advisory boards. Mr. Woitas was founder, Chairman, and President & Chief Executive Officer of Profico Energy Management Ltd. (a private company focused on natural gas exploration and production in Western Canada) from January 2000 to June 2006. Prior to April 2000, he was a director and President & Chief Executive Officer of Renaissance Energy Ltd. (a public company focused on the Western Canadian energy sector).

Skills and Qualifications Mr. Woitas brings extensive experience in the areas of acquisitions, exploration and production to Encana’s Board of Directors.

| |||||

|

2015 Board/Committee Membership

|

2015 Meeting Attendance(6) |

Areas of Expertise • Energy, Oil and Natural Gas • Acquisitions • Natural Gas Exploration and Production | ||||

| Board Nominating and Corporate Governance – Chairman |

7 of 7 3 of 3 |

100% 100% |

||||

|

Education • Bachelor of Science in Civil Engineering (University of Alberta)

Non-profit Sector Affiliations • Member, Association of Professional Engineers, Geologists and Geophysicists of Alberta (APEGA)

|

Past Five Years of Public Company Directorships • NuVista Energy Ltd. • Enerplus Corporation • Gibson Energy Inc.

| |||||

|

Securities Held | ||||||||

| Year |

Common Shares (#)(1) | DSUs (#) and Market or Payout Value(2,3) |

Total Market Value of Common Shares/DSUs(1,2,4) |

Minimum Share Ownership Required (Value Equivalent)(5) | ||||

| 2016 |

262,690 | 129,477 ($744,493) | $2,254,960 | 54,000 ($310,500) | ||||

| 2015 |

102,690 | 95,938 ($1,344,091) | $2,782,778 | |||||

12

Table of Contents

Notes:

| (1) | The information as to Common Shares held has been furnished by each of the nominees as of March 1, 2016 and March 16, 2015, respectively. |

| (2) | The information as to the DSUs held by directors is as of March 1, 2016 and March 16, 2015, respectively. For more detailed information relating to DSUs held by the directors, see “Director Compensation”. |

| (3) | “Market or Payout Value” represents the market or payout value expressed in Canadian dollars of vested DSUs not paid out or distributed and determined by multiplying the number of DSUs held by each nominee as of March 1, 2016 by the closing price of the Common Shares on the Toronto Stock Exchange (“TSX”) on that same date (C$5.75). |

| (4) | “Total Market Value (Common Shares/DSUs)” is expressed in Canadian dollars and determined by multiplying the number of Common Shares and DSUs held by each nominee as of March 1, 2016 in respect of 2016 and as of March 16, 2015 in respect of 2015 by the closing price of the Common Shares on the TSX on those same dates (C$5.75 and C$14.01, respectively). |

| (5) | Encana’s share ownership guidelines for directors require each director, other than the President & CEO, within three years immediately following the individual becoming a director, to purchase Common Shares or hold DSUs totaling in number at least three times the annual grant of DSUs which the director receives in his or her capacity as a director pursuant to the DDSU Plan of Encana. See “Director Compensation”. Dollar values indicate the value of the minimum number of Common Shares/DSUs in Canadian dollars as at March 1, 2016. Mr. Suttles is subject to executive share ownership guidelines and has achieved his required share ownership level. Please see page 37 with respect to Mr. Suttles’ executive share ownership requirements. |

| (6) | In addition to being a member of the NCG Committee, Mr. Woitas is an ex officio non-voting member of all other Board Committees. As an ex officio non-voting member, Mr. Woitas attends as his schedule permits and may vote when necessary to achieve a quorum. |

|

|

Philosophy and Objectives

Our compensation program is designed to attract and retain skilled director talent and create alignment with shareholder interests. To achieve these objectives, compensation for our directors consists of an annual retainer, director DSUs granted under the Directors’ Deferred Share Unit Plan (“DDSU Plan”) and share ownership requirements. Each of these compensation elements is described below.

Independent directors do not receive performance-based compensation, benefits or other perquisites from Encana. Our President & CEO, Mr. Suttles, does not receive any compensation from Encana in his capacity as a director.

Director Compensation Structure

Effective January 1, 2015, the Board adopted a new director compensation structure. The new structure consists of an all-inclusive Board retainer (as opposed to an individual meeting and travel-based fee structure) and, for the Chairman of the Board, increased proportion of equity-based compensation (in the form of DSUs under the DDSU Plan), and corresponding decrease in annual cash compensation. This new structure consists of the following key elements:

| Annual Retainer |

||

| Chairman of the Board |

$97,750 | |

| Board Member |

$46,920 | |

| Audit Committee Chair |

$15,640 | |

| Human Resources and Compensation Committee Chair |

$11,730 | |

| Other Committee Chairs1 |

$7,820 | |

| Annual DSU Grant |

||

| Chairman of the Board |

18,000 | |

| Board Member |

9,800 |

Annual retainers are paid in quarterly installments. Annual retainers and any initial DSU grants are pro-rated for periods of partial service.

Directors’ Deferred Share Unit Plan

Directors receive an initial grant of DSUs upon joining the Board. Directors may also choose to receive a portion or all of their annual retainer either in cash or as DSUs. Separate DSU accounts are retained for each director. DSUs are credited with dividend equivalent DSUs whenever a dividend is paid on Common Shares.

| 1 | As Chairman of the Board, Mr. Woitas does not receive a Committee Chair retainer for serving as Chair of the NCG Committee. |

13

Table of Contents

DSUs vest immediately but cannot be redeemed until a director ceases to be a member of the Board. Directors must redeem their DSUs prior to December 15 of the year following retirement from the Board. The value of redeemed DSUs is paid to the director in cash (on an after-tax basis) based on multiplying the number of DSUs redeemed by the then market value of a Common Share. Market value for this purpose is defined as the closing price of our Common Shares on the date immediately prior to the redemption date. Redemption may be in respect of all DSUs or may occur in stages, provided it is prior to the redemption deadline.

For information regarding the total number and market value of DSUs and the total market value of Common Shares and DSUs held by our directors, see “Nominees for Election to the Board”.

Share Ownership Guidelines

Our independent directors are required to maintain an ownership stake in Encana to align their interests with those of our shareholders. Each director is expected to own at least three times the value of his or her annual grant of DSUs within three years of joining the Board. Common Shares held directly or beneficially through a nominee, and DSUs, count towards meeting the guidelines. Each of our current directors is currently in compliance with the guidelines.

Director Compensation Table

The following table summarizes the annual compensation of our non-executive directors for the year ended December 31, 20152.

| Name | Fees Earned(1) ($) |

Share-Based Awards(2) ($) |

All Other Compensation(3) ($) |

Total ($) | ||||

| Peter A. Dea(4) |

54,740 | 114,492 | 369 | 169,601 | ||||

| Fred J. Fowler |

46,920 | 114,492 | 369 | 161,781 | ||||

| Howard J. Mayson |

54,740 | 114,492 | 369 | 169,601 | ||||

| Lee A. McIntire(4) |

46,920 | 114,492 | 369 | 161,781 | ||||

| Margaret A. McKenzie(6) |

37,406 | 91,593 | 279 | 129,278 | ||||

| Suzanne P. Nimocks(4) |

58,650 | 114,492 | 369 | 173,511 | ||||

| Jane L. Peverett |

62,560 | 114,492 | 369 | 177,421 | ||||

| Brian G. Shaw(4) |

46,920 | 114,492 | 369 | 161,781 | ||||

| Douglas J. Suttles(5) |

n/a | n/a | n/a | n/a | ||||

| Bruce G. Waterman(4) |

46,920 | 114,492 | 369 | 161,781 | ||||

| Clayton H. Woitas(4) |

97,750 | 210,291 | 369 | 308,410 |

Notes:

| (1) | Fees earned include annual Board and Committee retainers. |

| (2) | The value of the annual DSU grants to the Chairman of the Board in 2015 was C$291,060 and to our other independent directors was C$158,466 (18,000 DSUs to the Chairman of the Board and 9,800 DSUs for independent directors). The amounts have been calculated based on the closing price of Common Shares on the TSX on December 31, 2014 of C$16.17 and converted to U.S. dollars using a December 31, 2015 exchange rate of C$1.00 = US$0.7225. |

| (3) | Represents the cost of Encana-provided life insurance coverage. |

| (4) | Elected to receive all or a portion of fees in the form of DSUs in lieu of cash. |

| (5) | Mr. Suttles receives no compensation in his capacity as a director. |

| (6) | Ms. McKenzie was appointed to the Board effective March 15, 2015 and therefore her annual retainer and DSU grants reflect the period of partial service during 2015. |

| 2 | Amounts above originally paid to our directors in Canadian dollars have been converted to U.S. dollars using an exchange rate of C$1.00 = US$0.782, the average exchange rate for 2015, based on the daily noon buying rate published by the Bank of Canada. |

14

Table of Contents

Trading and Hedging Restrictions

Directors are subject to many of our policies and practices, including our Securities Trading and Insider Reporting Policy, which prohibit directors from directly or indirectly engaging in any of the following in respect of Encana securities, including DSUs granted under the DDSU Plan:

| • | selling those they do not own, have not fully paid for or have no right to own (engaging in a “short sale”); |

| • | selling a “call option” or buying a “put option”; |

| • | entering into equity monetization transactions involving any securities subject to our share ownership guidelines or that is the equivalent of “short selling”; and |

| • | entering into any brokerage arrangements which might result in a sale at a time when he or she is not permitted to trade. |

15

Table of Contents

|

Statement of Executive Compensation

|

Dear Fellow Shareholders:

To help you understand our compensation approach, we are pleased to provide you with an overview of our program and how our Board, assisted by the Human Resources and Compensation (“HRC”) Committee, makes executive compensation decisions. As detailed below, our program is designed to reward performance and align the interests of our executives with those of our shareholders.

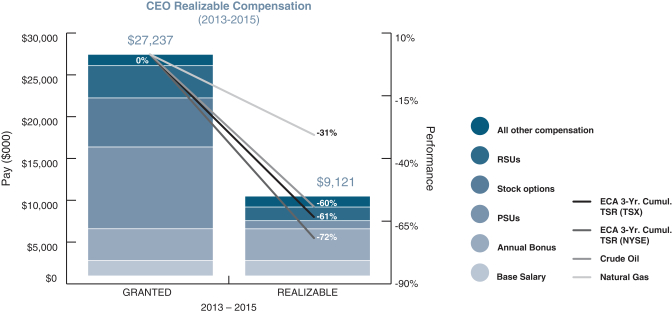

Despite a highly challenging and volatile commodity price environment, Encana demonstrated considerable resilience in 2015. This resilience reflects our dramatic transformation and disciplined focus since the appointment of Doug Suttles as our President & CEO in June, 2013. Our strategic transformation, originally projected to take five years, has been substantially completed in two years. We believe this remarkable progress provides important context when considering the achievements of Mr. Suttles and his Executive Leadership Team (“ELT”), as well as the decisions reached by the Board regarding their 2015 compensation.

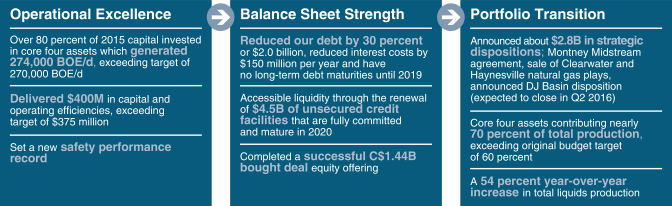

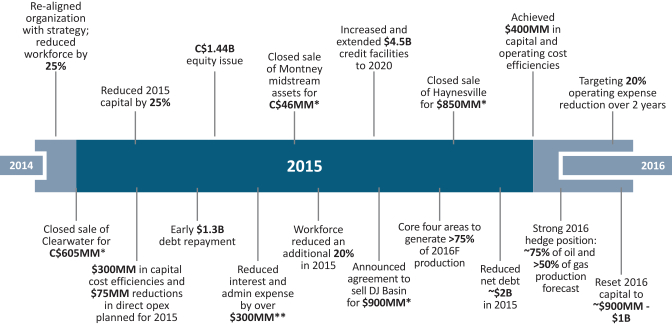

2015: Strategic Achievements

Within the oil and gas industry, 2015 was characterized by an unprecedented, steep decline in commodity prices. Encana responded quickly, reducing our planned capital expenditures by 25 percent, and announcing continued company-wide cost reductions and efficiency measures. Strict discipline was applied to our capital allocation decisions, as we focused over 80 percent of our 2015 capital on our four core assets, the Permian, Eagle Ford, Duvernay and Montney. We also took decisive action to strengthen our balance sheet, reducing our debt by about $2.0 billion, completing a C$1.44 billion bought deal equity offering and executing over $2.0 billion in strategic dispositions. Most importantly, we delivered another year of record breaking occupational safety performance in our operations.

Encana entered 2015 with an ambitious plan to advance our strategy. By delivering on our objectives, we exited the year more competitive than we entered it, despite challenging industry conditions and a highly volatile and low commodity price environment.

2013 - 2015: Transformative Change

In 2013, Encana was almost exclusively a natural gas company and facing a sharp decline in natural gas prices. Capital was widely dispersed over 28 funded plays. Our natural gas weighting, combined with our cost structures, resulted in low profit margins. Our diverse portfolio called for simplification through a combination of key dispositions and strategic acquisitions of higher margin producing assets. Execution of these changes called for maximum financial flexibility, placing great importance on proactive management of our balance sheet.

Within five months of becoming CEO, Mr. Suttles completed a comprehensive strategic review and unveiled a new corporate strategy. He set a vision to transform Encana into a leading North American resource-play company with a balanced, high-margin commodity portfolio, focused on growing shareholder value. The executive and management teams were quickly restructured and our work-force reduced by 25 percent. A disciplined capital allocation process was implemented, focused on our core assets. In November, 2013, Mr. Suttles announced our new strategy based on the following four pillars, which we believe represent a solid foundation for delivering sustainable long-term shareholder value:

| Ø |

Top Tier Assets: |

Premier positions in the highest quality assets that offer high returns and scale | ||

| Ø |

Market Fundamentals: |

Monitor and pro-actively manage market volatility and maximize margins | ||

| Ø |

Capital Allocation: |

Highly disciplined investment in assets that generate the most value | ||

| Ø |

Operational Excellence: |

Drive greater returns through innovation, efficiency and relentless cost control |

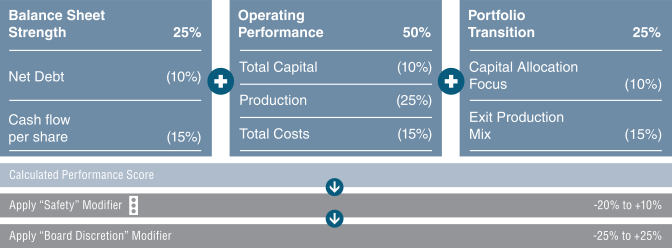

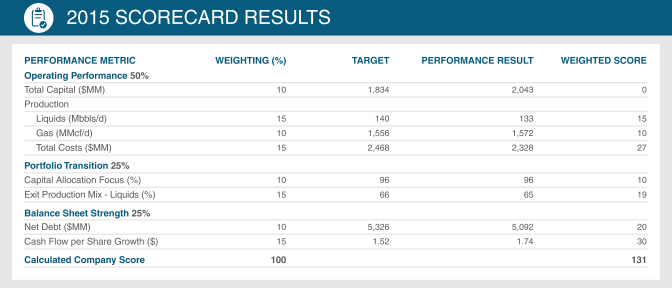

These four pillars also form the basis of our annual Company Scorecard, used to determine annual incentive (or “Bonus”) opportunity for our employees, including Mr. Suttles and ELT members (our “Company Scorecard”). Details regarding our 2015 Company Scorecard are provided starting at page 27.

Our transformation continued in 2014, as Encana simplified its portfolio, reduced its cost structures and focused capital on our most strategic assets. Executing on our goal to transition to the highest margin assets, we completed $18 billion of divestitures and acquisitions, including the acquisition of premium positions in the Eagle Ford and Permian, two of North America’s highest quality oil plays. By year-end 2014, Encana delivered a 61 percent increase in high margin liquids production and a 14 percent increase in year-over-year cash flow. We also proudly delivered the strongest safety record in Encana’s history. These efforts, executed well in advance of the current low commodity price environment, demonstrate Mr. Suttles’ exceptional leadership and focus on building a company capable of delivering sustainable long-term shareholder value.

16

Table of Contents

2015 Performance Results

The advancement of the strategy continued at a rapid pace throughout 2015. An overview of our key strategic accomplishments in 2015 is found at page 20 in “2015: Advancing Our Strategy”.

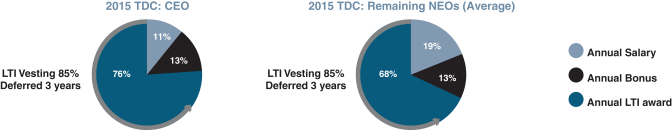

2015 CEO Compensation

In a year of unprecedented challenges, Mr. Suttles successfully led Encana to meet or exceed all but one of the performance objectives set out for the year.