Form 6-K ELBIT SYSTEMS LTD For: Oct 29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

�

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the Month of�October 2014

_______________________

�

Commission File Number 000-28998

�

ELBIT SYSTEMS LTD.

(Translation of Registrants Name into English)

�

Advanced Technology Center, P.O.B. 539, Haifa 31053, Israel

(Address of Principal Corporate Offices)

�

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

�

Form 20-F x��������������������������������Form 40-F o

�

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

�

Note : Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

�

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):�o

�

Note : Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrants

home country

), or under the rules of the home country exchange on which the registrants securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrants security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

�

Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934: o

Yes o������No x

��

If

Yes

is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-______________

�

�

�

�

�

Attached hereto and incorporated herein by reference as Exhibits 1,2 and 3, respectively, are the Registrant's Press Release dated October 29,��2014, the Unofficial English Translation of Elbit Systems Ltd. Monitoring Report - October 2014 and the Consent of the Rating Agency dated October 29,��2014.

SIGNATURE

��

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

�

| � |

ELBIT SYSTEMS LTD.

(Registrant)

|

� | |

| � | � | � | � |

| � |

By:

|

/s/�Ronit Zmiri | � |

| � |

Name:

|

Ronit Zmiri

|

� |

| � |

Title:

|

Corporate Secretary

|

� |

| � | � | � | � |

Dated:�October 29, 2014

�

�

�

�

�

EXHIBIT INDEX

�

|

Exhibit No.

|

Description

|

|

1.

2.

3.

|

Registrant's Press Release dated October 29, 2014

Unofficial English Translation of Elbit Systems Ltd. Monitoring Report- October 2014

Consent of Rating Agency Dated October 29, 2014

|

�

Exhibit 1

�

ELBIT SYSTEMS LTD. ANNOUNCES

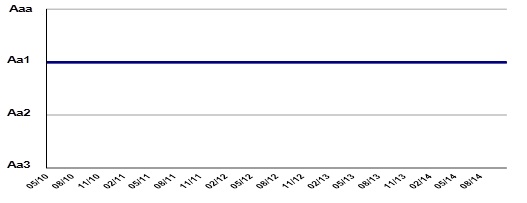

MIDROOG LTD. REAFFIRMING RATING "Aa1"

(LOCAL SCALE), WITH STABLE OUTLOOK, FOR ELBIT SYSTEMS SERIES "A" NOTES

�

Haifa, Israel, October 29, 2014 Elbit Systems Ltd. (NASDAQ and TASE: ELST) (the "Company" or "Elbit Systems") announced today that Midroog Ltd., an Israeli rating agency ("Midroog"),��reaffirmed Midroog's��"Aa1" rating (on a local scale), with a��stable outlook, of the Series "A" Notes issued by the Company in 2010 and in 2012.

�

Midroog's official report in Hebrew will be submitted by the Company to the Israel Securities Authority and the TASE. An unofficial English translation of Midroog's report will be submitted by the Company on Form 6-K to the U.S. Securities and Exchange Commission.

�

This press release shall not constitute an offer to sell or a solicitation of an offer to buy any Series "A" Notes.

Joseph Gaspar, Elbit Systems Executive Vice President and Chief Financial Officer, noted that the high rating awarded to Elbit Systems Companys Notes attests to the Companys long-term business stability and financial strength.

�

About Elbit Systems

�

Elbit Systems Ltd. is an international defense electronics company engaged in a wide range of programs throughout the world. The Company, which includes Elbit Systems and its subsidiaries, operates in the areas of aerospace, land and naval systems, command, control, communications, computers, intelligence surveillance and reconnaissance ("C4ISR"), unmanned aircraft systems ("UAS"), advanced electro-optics, electro-optic space systems, EW suites, signal intelligence ("SIGINT") systems, data links and communications systems and radios.�The Company also focuses on the upgrading of existing military platforms, developing new technologies for defense, homeland security and commercial aviation applications and providing a range of support services, including training and simulation systems.

�

For additional information, visit: www.elbitsystems.com or follow us on Twitter.

�

�

�

�

�

Contacts:

|

Company Contact:

�

Joseph Gaspar, Executive VP & CFO

Tel:��+972-4-8316663

Dalia Rosen, VP, Head of Corporate Communications

Tel: +972-4-8316784

Elbit Systems Ltd.

|

IR Contact:

�

Ehud Helft

Kenny Green

GK Investor Relations

Tel: 1-646-201-9246

|

This press release contains forward-looking statements (within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended) regarding Elbit Systems Ltd. and/or its subsidiaries (collectively the Company), to the extent such statements do not relate to historical or current fact.��Forward Looking Statements are based on managements expectations, estimates, projections and assumptions.��Forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended.��These statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict.��Therefore, actual future results, performance and trends may differ materially from these forward-looking statements due to a variety of factors, including, without limitation: scope and length of customer contracts; governmental regulations and approvals; changes in governmental budgeting priorities; general market, political and economic conditions in the countries in which the Company operates or sells, including Israel and the United States among others; differences in anticipated and actual program performance, including the ability to perform under long-term fixed-price contracts; and the outcome of legal and/or regulatory proceedings.��The factors listed above are not all-inclusive, and further information is contained in Elbit Systems Ltd.s latest annual report on Form 20-F, which is on file with the U.S. Securities and Exchange Commission. All forward-looking statements speak only as of the date of this release. The Company does not undertake to update its forward-looking statements.

Elbit Systems Ltd. , its logo, brand, product, service, and process names appearing in this Press Release are the trademarks or service marks of Elbit Systems Ltd. or its affiliated companies.��All other brand, product, service, and process names appearing are the trademarks of their respective holders.��Reference to or use of a product, service, or process other than those of Elbit Systems Ltd. does not imply recommendation, approval, affiliation, or sponsorship of that product, service, or process by Elbit Systems Ltd. Nothing contained herein shall be construed as conferring by implication, estoppel, or otherwise any license or right under any patent, copyright, trademark, or other intellectual property right of Elbit Systems Ltd. or any third party, except as expressly granted herein.

�

Exhibit 2

�

Elbit Systems Ltd.

�

�Monitoring Report October 2014

�

(Unofficial English Translation)

�

Author:

�

Elad Biton, Analyst

�

Contacts:

Avi Ben-Nun, Team Leader

�

Sigal Issaschar, Head of Corporate Finance

�

�

�

�

�

Elbit Systems Ltd.

�

|

Series Rating

|

Aa1

|

Outlook: Stable

|

�

Midroog reaffirms its Aa1/stable outlook rating of the bonds (Series A) issued by Elbit Systems Ltd. ("Elbit" or the "Company").

�

Bond series rated by Midroog:

�

|

Series

|

Stock No.

|

Original Issue Date

|

Annual Coupon

|

Terms of Linkage

|

Book Value of Bonds as of June 30, 2014 (NIS M)*

|

Remainder of

Bond Principal Repayment Years

|

|

A

|

1119635

|

June 2010

|

4.84%

|

Shekel

|

1,128

|

2015-2020

|

�

* Translated from dollars into shekels according to the exchange rate of June 30, 2014. The Company hedges the balance of the bonds by a swap transaction at variable dollar interest of LIBOR + 1.84%.

Summary of Key Rating Rationale

�

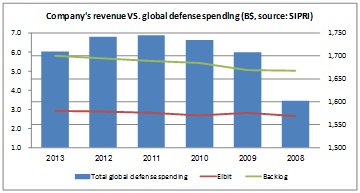

The Company's rating is supported by its leading position in the Israeli defense industry and niche defense fields worldwide. The Company's strong positioning and comparative advantage are attributed to its ability to develop relevant technological solutions coupled with a strong management team since its establishment. Besides the strategic importance of the Company's operations to the Ministry of Defense, the Company has an outstanding scope of activity, geographic spread and array of products. Over the years, the Company's growth opportunities stem from the acquisition of companies contributing synergy and added value to the customer, while cooperating with local industries in countries where the Company identifies projected growth in the defense budgets. All these factors are reflected in good income visibility which is also supported by a sizable backlog of orders. The ratio between the Company's orders backlog and sales is stable and is about 2 in the last three years, a positive indication of good visibility of the Company's future income-generating ability in the short and medium terms.

�

The global aviation and defense industry adapts itself to a challenging reality. According to Moody's forecasts1, there stands to be a continued cut in the aggregated global defense budget in the next two years. This is expected to show its signs gradually with global defense budgets declining by 4%-6%. Consequently, in our assessment, the western defense companies will continue to invest growth efforts in emerging markets, which will lead to tougher competition in the industry and a gradual erosion in profit margins with a certain lag after the cuts are made. Moreover, the erosion in the global defense budget in 2013 stands to cut into the revenues of the global defense companies, erode profitability and raise the level of competition in the short term.

�

1 Shrinking Defense Spending to Weigh on Profits; Commercial Growth To Remain Strong

�

�

�

�

�

�

We do not believe the erosion in defense budgets and the implications this will have on the business environment will affect the Company's revenues. However, this is likely to have a delayed effect on the Company's profit reserves which, in our assessment, stand to decline somewhat in the medium term also due to the need for continued investments in R&D and marketing to overcome tougher competition. In Midroog's assessment, the ability to streamline operations is limited because of the need to maintain technological advantages and top caliber manpower.

�

The Company posted stable and strong funds from operations (FFO) in the past few years owing to good visibility of revenue and reasonable profitability. The Companys coverage ratios are not particularly good for the rating grade. According to Midroog's base scenario, we assume certain stability in coverage ratios in the short-medium term. We believe that the adjusted debt-to-EBITDA and adjusted debt-to-FFO coverage ratios will range between 2.0 - 2.5 and 2.5 - 3.0 in this time span, respectively (assuming no M&A activity during this period). The rating is also supported by particularly good liquidity and financial flexibility owing to a substantial volume of liquid assets, projected positive free cash flow (discounting the acquisition of foreign companies and payment of the Government of Israel) in the next twelve months, access to sources of financing and the fact that most of the Company's assets are unencumbered.

�

The stable rating outlook is premised on our assessment that there will not be a downturn in the Company's fundamentals beyond the forecasted range.

�

Elbit Systems - Key Financial Figures��($M):

�

| � | � | � | H1 2014 | � | � | � | H1 2013 | � | � |

FY 2013

|

� | � |

FY 2012

|

� | � |

FY 2011

|

� | � |

FY 2010

|

� | � |

FY 2009

|

� | |||||

|

Revenue

|

� | � | 1,385 | � | � | � | 1,383 | � | � | � | 2,925 | � | � | � | 2,889 | � | � | � | 2,817 | � | � | � | 2,670 | � | � | � | 2,832 | � |

|

Gross profit

|

� | � | 393 | � | � | � | 396 | � | � | � | 825 | � | � | � | 816 | � | � | � | 732 | � | � | � | 798 | � | � | � | 849 | � |

|

Gross profit margin

|

� | � | 28.3 | % | � | � | 28.6 | % | � | � | 28.2 | % | � | � | 28.2 | % | � | � | 26.0 | % | � | � | 29.9 | % | � | � | 30.0 | % |

|

R&D Expenses

|

� | � | 101 | � | � | � | 103 | � | � | � | 220 | � | � | � | 233 | � | � | � | 241 | � | � | � | 234 | � | � | � | 217 | � |

|

Operating margin (before others)

|

� | � | 117 | � | � | � | 120 | � | � | � | 239 | � | � | � | 203 | � | � | � | 116 | � | � | � | 203 | � | � | � | 262 | � |

|

EBIT margin

|

� | � | 8.4 | % | � | � | 8.7 | % | � | � | 8.2 | % | � | � | 7.0 | % | � | � | 4.1 | % | � | � | 7.6 | % | � | � | 9.3 | % |

|

Net profit

|

� | � | 96 | � | � | � | 98 | � | � | � | 191 | � | � | � | 170 | � | � | � | 90 | � | � | � | 195 | � | � | � | 229 | � |

|

Net profit margins

|

� | � | 7.0 | % | � | � | 7.1 | % | � | � | 6.5 | % | � | � | 5.9 | % | � | � | 3.2 | % | � | � | 7.3 | % | � | � | 8.1 | % |

|

Average revenue/assets

�(t,t-1)

|

� | � | 0.7 | � | � | � | 0.7 | � | � | � | 0.8 | � | � | � | 0.8 | � | � | � | 0.8 | � | � | � | 0.8 | � | � | � | 0.9 | � |

|

Return on assets (ROA)

|

� | � | 4.9 | % | � | � | 4.9 | % | � | � | 4.7 | % | � | � | 4.5 | % | � | � | 2.5 | % | � | � | 5.5 | % | � | � | 7.2 | % |

|

Liquidity reserves

|

� | � | 277 | � | � | � | 204 | � | � | � | 265 | � | � | � | 265 | � | � | � | 224 | � | � | � | 215 | � | � | � | 280 | � |

|

Adjusted debt*

|

� | � | 665 | � | � | � | 562 | � | � | � | 607 | � | � | � | 650 | � | � | � | 659 | � | � | � | 603 | � | � | � | 392 | � |

|

Lease-adjusted debt **

|

� | � | 863 | � | � | � | 760 | � | � | � | 805 | � | � | � | 848 | � | � | � | 883 | � | � | � | 825 | � | � | � | 606 | � |

|

Equity/total assets

|

� | � | 31 | % | � | � | 28 | % | � | � | 30 | % | � | � | 27 | % | � | � | 25 | % | � | � | 28 | % | � | � | 28 | % |

|

EBITDA

|

� | � | 179 | � | � | � | 185 | � | � | � | 369 | � | � | � | 342 | � | � | � | 266 | � | � | � | 339 | � | � | � | 386 | � |

|

FFO

|

� | � | 157 | � | � | � | 174 | � | � | � | 319 | � | � | � | 308 | � | � | � | 252 | � | � | � | 280 | � | � | � | 346 | � |

|

CAPEX

|

� | � | 27 | � | � | � | 33 | � | � | � | 63 | � | � | � | 82 | � | � | � | 122 | � | � | � | 139 | � | � | � | 108 | � |

|

Investment in subsidiaries and affiliates

|

� | � | 3 | � | � | � | 5 | � | � | � | 6 | � | � | � | 4 | � | � | � | 26 | � | � | � | 235 | � | � | � | 68 | � |

|

Dividend paid

|

� | � | 35 | � | � | � | 34 | � | � | � | 76 | � | � | � | 51 | � | � | � | 62 | � | � | � | 63 | � | � | � | 76 | � |

|

Adjusted debt-to-EBITDA

|

� | � | 2.2 | � | � | � | 1.9 | � | � | � | 2.0 | � | � | � | 2.3 | � | � | � | 2.9 | � | � | � | 2.2 | � | � | � | 1.4 | � |

|

Adjusted debt-to-FFO

|

� | � | 2.7 | � | � | � | 2.1 | � | � | � | 2.4 | � | � | � | 2.6 | � | � | � | 3.2 | � | � | � | 2.7 | � | � | � | 1.6 | � |

�

* The adjusted debt includes the fair value of the hedging of the shekel debt.

�

** The lease-adjusted debt includes capitalization of leasing fees.

�

�

�

�

�

| Key Rating Factors

Mdium-low sector risk with a projected slight erosion in the global defense budget in the short-medium term

�

In Midroog's assessment, the sector of defense industries being a global industry is characterized by medium-low risk relative to the average overall economy. The industry is led by U.S. and European mega-corporations, and is characterized by marketing to the local markets where the manufacturing is carried out. This feature is particularly prominent among the U.S. corporations, which use prime contractors in U.S. Government defense projects accounting for about 40% of total global defense spending over time, while the European corporations are more export-oriented and their activity is more global. The most defining feature of the sector is its dependence on government defense budgets characterized by relatively long cycles.��A shift in trend could be triggered by unexpected security conflicts, while there is a high correlation between the change in the defense budget and the growth potential of the companies in the industry. According to Moody's forecasts, because of the challenging economic environment in the Western world, there will be a further decline in defense budgets worldwide (stability in the U.S. budget after two years of cuts and continued defense budget reductions in Central and Western Europe), which could be reflected gradually with a cumulative reduction in global defense budgets by 4%-6% over the next two years.

|

|

�

In recent years, there has been an ongoing shift in the defense perception. Greater emphasis is now placed on high-tech asymmetrical warfare used by terrorist organizations in several arenas at once, with growing demands for fast and high-tech systems, command and control (C2) systems, unmanned vehicles, soldier protection systems and advanced electronic systems - at the expense of large military platforms.

�

�

�

�

�

In our assessment, the downtrend in global defense spending and the change in the defense perception will be an ongoing challenge to the growth potential and profitability rates of the defense companies, while competition in the global market will become tougher, with emphasis placed on operating efficiency, product maturation times and supplying the technologies to the market. Also expected are continued consolidation processes and an increasing number of acquisitions of small technology companies by large corporations, a trend which began in recent years on the heels of the need to broaden technological abilities and speed up time-to-market.

�

Other features of the sector: Dependency on prime contractors - most of the defense companies use subcontractors in the second and third tier of suppliers. This situation creates exposure to the competitive positioning of the prime contractors and reduces the companies' price flexibility; large-scale and ongoing projects, many of which are set at a predetermined price, create exposure to an unforeseen change in expenditures and the need for tight management of projects; large component of wage and fixed overhead expenditures, including the R&D component, which weigh down on profitability when operations are downsized and impair operating flexibility; strong backlog of orders support the ability to generate sustainable income and provide good revenue visibility in the short and medium term; diversification and spread of activity over hundreds of different projects, products and geographic markets; low credit risks, including prepayments from customers contribute to liquidity; security threats are on the rise, such as the instability in the Middle East and tensions between Russia and the West, support a continued demand for the world governments to invest in substantial defense spending; high entry barriers, including high R&D costs, proven technological capabilities, human capital, business experience and management of a large number of projects and companies simultaneously as well as strict regulation all create high entry barriers and give the veteran competitors a competitive advantage; strategic importance for the base countries owing to the knowledge and technological abilities which the activity embodies.

�

�

�

�

�

Strong business positioning and technological flexibility support an array of products which match the perception of the future battlefield

�

The Company is characterized by a relatively strong business profile, supported by its outstanding technological and managerial capabilities, ability to manage a large number of project simultaneously, wide and cutting-edge array of products and broad customer diversification.��The Company has relatively high R&D costs, which support the need to keep its technological edge and ability to provide suitable solutions to meet the challenges of the future battlefield. Elbit Systems has proven experience with mergers and acquisitions, creating synergy and business development of complementary companies and technologies while establishing a strategy of penetrating and focusing on growing markets. The Company's mix of operations and supply of products and solutions adapted to the modern day battlefield support the continued ability to generate relatively high income in the short and medium terms, despite projections of a downturn in defense budgets in the western world (a market which today accounts for about 50% of the Company's total revenue).

�

The Company enjoys extensive goodwill and top-ranking and strategic status in Israel's defense industry, which helps to get its products recognized worldwide and serves as a testing field for new technologies. On the other hand, the projections for tougher competition in the industry owing to the budget limitation and the fact that Elbit is a prime contractor in multiple export projects are likely to limit the Company's flexibility, both in terms of pricing future projects, price flexibility and the derived profitability and in terms of the time to launch the product and deviate from original timetables, when the streamlining potential is limited due to relatively rigid costs structure and the need to maintain technological comparative advantages.

�

Relatively good revenue recovery ability; projected decline in profitability in the medium term

�

The Company has a mix of revenues spread over lines of business and countries, while most of its products are earmarked for export. In 2013, the Company's revenues were primarily based on the U.S. and European countries (48%), Israel (24%) and the emerging markets - Asia-Pacific and Latin America (25%).��Approximately 75% of the Company's sales in 2013 came from the field of airborne systems (39%) and intelligence and C4 systems (37%), which embed electronic and electro-optic technology. We believe these technologies support the modern day and future battlefield, which leans towards low intensity military conflicts and guerrilla warfare.

�

The Company's high business positioning, its technological flexibility, relevant basket of products even in the face of the challenging business environment and the��consolidation of its position in emerging markets with growth potential - all support the Company's future revenue recoverability owing to the changing business environment and the change in the perception of the contemporary and future battlefield.

�

�

�

�

�

�

�

|

The Company has an orders backlog valued at $6.114 billion as of June 30, 2014, up by about 7.7% compared to the orders backlog in the corresponding period last year, a figure which is particularly good given the challenging business environment. The orders backlog is diversified and spread over a large number of projects and geographic areas, and is not oriented towards a specific project. In Midroog's assessment, this supports good visibility of the ability to general revenue and provides relatively good protection against a projected downturn in the business environment in the short and medium term.

|

�

The Company's gross and operating profitability has been relatively stable in recent years (excluding a onetime loss in 2011) and ranges at about 38%-30% and 7%-8.5% respectively in the last five years. It is noteworthy that the Company's operating profitability rates are not particularly good for the rating and are limited owing to relatively low operating flexibility.

�

Elbit Systems' technological advantage and its ability to provide innovative and relevant solutions derive from the Company's investments in R&D. In 2013, R&D spending totaled about $220 million, accounting for about 7.5% of the sales turnover, and was lower than the average in recent years due to the Company's desire to cut operating costs. Midroog estimates that the R&D costs will rise in the short and medium term in view of the Company's desire to maintain its positioning in the sector and its comparative advantages given the expected increase in the level of competition. In Midroog's assessment, the Company's streamlining capacity is relatively low due to the need to maintain high quality manpower and technological innovation, which makes up part of its ability to compete in the industry along with the constant demand for flexibility and the ability to provide dynamic solutions for changing needs.

�

�

�

�

�

According to Midroog's base scenario, we assume relative stability in the Company's revenues in the short and medium term despite a 4%-6% decline in global aggregate defense spending, with a variance in different geographic regions. We also assume an intensification of competition, with emphasis on growing pressures to meet timetables, budget constraints and time-to-market. In our assessment, the effect of the erosion in defense budgets and the implications it will have on the business environment will not impact the Company's revenues, but is likely to have a delayed effect on the Company's profit reserves which, in our assessment, stand to decline somewhat in the medium term also due to the need for continued investments in R&D and marketing to overcome tougher competition.

�

Cash flow visibility has weakened, but it is projected that the Company will continue to generate strong cash flows; coverage ratios are not particularly good for the rating grade

�

The Company has had a relatively good profit recovery ability in recent years, which support strong and stable cash flows during this period (discounting a loss for the cancellation of a contract with a foreign country in 2011). The Company is expected to continue to post relatively strong cash flows in the coming years, although these are likely to be partly eroded, which in our opinion is due to the projected decline in profitability.

�

As of June 30, 2014, the Company has a derivative-adjusted debt of about $665 million - without a material change compared to the last two years. Most of the debt is long-term, a factor which is commensurate with the duration of the projects financed with its assistance. The Company's debt consists of a marketable bond (50%) and bank and institutional financing (50%). In our base scenario, there are two situations in which the Company will pay back its debt according to the amortization schedule, without having to raise new debt (while reducing leveraging) owing to substantial cash balances and positive free cash flow in the short and medium term, or refinancing debt and accumulating cash so that the amount of the net debt is not expected to vary materially.��This is assuming no major acquisitions of companies in 2014-2016.

�

The Company's adjusted coverage ratios are not particularly good for the rating grade and are not expected to materially change in the short-medium term. Midroog anticipates that the adjusted debt-to-EBITDA and adjusted debt-to-FFO coverage ratios will be between 2.0 - 2.5 and 2.5 - 3.0 respectively in the short-medium term. As stated, these are slow coverage ratios for the rating grade. If the coverage ratios deviate significantly and over time from Midroog's forecasts, there could be a change in the rating.

�

The Company has a reasonable leverage level and capital reserves, as derived from the ratio of equity-to-total assets, which was about 30.9% as of June 30, 2014. This ratio is reasonable and supports Elbit Systems' ability to absorb unforeseen onetime losses. Midroog believes the capital reserves will continue to be built up from the accumulation of net profit and continued non-aggressive dividend payouts which averaged at about 30% of the net profit in recent years.

�

�

�

�

�

Particularly good liquidity and financial flexibility

�

The Company enjoys high liquidity, which is supported by significant liquidity reserves owing to the nature of the activity and receipt of prepayments from customers.��As of June 30, 2014, liquid assets totaled approximately $277 million, which is 3.4 times the expected current maturities by the end of 2015. It should be noted that the Company tends to maintain significant liquidity reserves over time, which are invested in relatively conservative investment channels. We believe (assuming no major acquisitions of new companies) that in the coming twelve months, the Company will generate strong free cash flow to support the annual debt servicing needs, also given the relatively convenient amortization schedule and assuming that the Israel Ministry of Defense will reduce its debt to the Company within this time span.

�

The Company has high financial flexibility. Most of its assets are unencumbered and it has good accessibility to financiers. The Company is required to meet a number of financial covenants for the purpose of the loan. Equity is reduced by at least 20% of total assets. As of the date of this report, the Company meets the financial covenants with an adequate margin.

�

Rating Outlook

�

Factors likely to downgrade the rating:

�

|

�

|

Continued erosion in the orders backlog which could impair income-generating ability.

|

�

|

�

|

Long-term erosion in profit margins.

|

�

|

�

|

Significant and permanent slowdown in debt coverage ratios

|

�

|

�

|

Extensive dividend payout which could weaken the ability to repay the Company's obligations.

|

�

About the Company

�

Elbit Systems Ltd. is a multinational Israeli defense electronics company, which operates directly and through subsidiaries, in the development, manufacture, integration and marketing of electronic��systems for military applications in the air, sea and on land. The Company serves as a prime contractor of defense solutions for armed forces and governments and as a supplier of products and systems for leading manufacturers in the global defense industry. The Company's largest shareholder isthe Federmann Group, controlled by Michael Federmann, with a 46.5% stake (indirect) and the rest is held by the public. The Company has four core fields of business: airborne systems (accounting for about 39% of revenues in 2013), land vehicle systems (11%),��C4 and surveillance and reconnaissance systems��(C4ISR) (37%) and��electro-optic systems��(11%), The Company has a work force of approximately 11,600 employees, mostly in Israel and the rest in subsidiaries worldwide.

�

�

�

�

Rating History

�

�

�

Related Reports

�

Elbit Systems Ltd. - Monitoring Report, June 2013

�

Rating of Defense Industry Companies, Methodology Report, February 2014

�

Date of the report: October 23, 2014

�

�

�

�

�

KEY FINANCIAL TERMS

�

|

Interest

|

Net financing expenses from Income Statement

|

|

Cash Interest

|

Financing expenses from income statement after adjustments for non-cash flow expenditures from statement of cash flows

|

|

Operating profit (EBIT)

|

Profit before tax, financing and onetime expenses/profits

|

|

Operating profit before amortization

(EBITA)

|

EBIT + amortization of intangible assets.

|

|

Operating profit before depreciation and amortization (EBITDA)

|

EBIT + depreciation + amortization of intangible assets.

|

|

Operating profit before depreciation, amortization and rent/leasing

(EBITDAR)

|

EBIT + depreciation + amortization of intangible assets + rent + operational leasing.

|

|

Assets

|

Company's total balance sheet assets.

|

|

Debt

|

Short term debt + current maturities of long-term loans + long-term debt + liabilities on operational leasing

|

|

Net debt

|

Debt - cash and cash equivalent � long-term investments

|

|

Capitalization (CAP)

|

Debt + total shareholders' equity (including minority interest) + long-term deferred taxes in balance sheet

|

|

Capital investments

Capital Expenditures (CAPEX)

|

Gross investments in equipment, machinery and intangible assets

|

|

Funds From Operations (FFO)*

�

|

Cash flow from operations before changes in working capital and before changes in other asset and liabilities

|

|

Cash Flow from Operation (CFO)*

|

Cash flow from operating activity according to consolidated cash flow statements

|

|

Disposable cash flow*

Retained Cash Flow (RCF)

|

Funds from operations (FFO) less dividend paid to shareholders

|

|

Free Cash Flow*

Free Cash Flow (FCF)

|

Cash flow from operating activity (CFO) - CAPEX - dividends

|

�

* It should be noted that in IFRS reports, interest payments and receipts, tax and dividends from investees will be included in the calculation of the operating cash flows, even if they are not entered in cash flow from operating activity.

�

�

�

�

Obligations Rating Scale

�

|

Investment grade

|

Aaa

|

Obligations rated Aaa are those that, in Midroog's judgment, are of the highest quality and involve minimal credit risk.

|

|

Aa

|

Obligations rated Aa are those that, in Midroog's judgment, are of high quality and involve very low credit risk.

|

|

|

A

|

Obligations rated A are considered by Midroog to be in the upper-end of the middle rating, and involve low credit risk.

|

|

|

Baa

|

Obligations rated Baa are those that, in Midroog's judgment, involve moderate credit risk. They are considered medium grade obligations, and could have certain speculative characteristics.

|

|

|

Speculative Investment

|

Ba

|

Obligations rated Ba are those that, in Midroog's judgment, contain speculative elements, and involve a significant degree of credit risk.

|

|

B

|

Obligations rated B are those that, in Midroog's judgment, are speculative and involve a high credit risk.

|

|

|

Caa

|

Obligations rated Caa are those that, in Midroog's judgment, have weak standing and involve a very high credit risk.

|

|

|

Ca

|

Obligations rated Ca are very speculative investments, and are likely to be in, or very near to, a situation of insolvency, with some prospect of recovery of principal and interest.

|

|

|

C

|

Obligations rated C are assigned the lowest rating, and are generally in a situation of insolvency, with poor prospects of repayment of principal and interest.

|

�

Midroog applies numerical modifiers 1, 2 and 3 in each of the rating categories from Aa to Caa. Modifier 1 indicates that the bond ranks in the higher end of the letter-rating category. Modifier 2 indicates that the bonds are in the middle of the letter-rating category; and modifier 3 indicates that the bonds are in the lower end of the letter-rating category.

�

�

�

�

Report No. CDE070713440M

�

Midroog Ltd.., Millennium 17 HaArba'a Street, Tel-Aviv 64739

Tel: 03-6844700, Fax: 03-6855002, www.midroog.co.il

� Copyright 2014, Midroog Ltd. (

Midroog

). All rights reserved.

This document (including the contents thereof) is the property of Midroog and is protected by copyright and other intellectual property laws. There is to be no copying, photocopying, reproduction, modification, distribution, or display of this document for any commercial purpose without the express written consent of Midroog.

All the information contained herein on which Midroog relied was submitted to it by sources it believes to be reliable and accurate. Midroog does not independently check the correctness, completeness, compliance, accuracy or reliability of the information (hereinafter: the "information") submitted to it, and it relies on the information submitted to it by the rated Company for assigning the rating.

The rating is subject to change as a result of changes in the information obtained or for any other reason, and therefore it is recommended to monitor its revision or modification on Midroog's website www.midroog.co.il. The ratings assigned by Midroog express a subjective opinion, and they do not constitute a recommendation to buy or not to buy bonds or other rated instruments. The ratings should not be referred as endorsements of the accuracy of any of the data or opinions, or attempts to independently assess or vouch for the financial condition of any company. The ratings should not be construed as an opinion on the attractiveness of their price or the return of bonds or other rated instruments. Midroog's ratings relate directly only to credit risks and not to any other risk, such as the risk that the market value of the rated debt will drop due to changes in interest rates or due to other factors impacting the capital market. Any other rating or opinion given by Midroog must be considered as an individual element in any investment decision made by the user of the Information contained in this document or by someone on his behalf. Accordingly, any user of the information contained in this document must conduct his own investment feasibility study on the Issuer, guarantor, debenture or other rated document that he intends to hold, buy or sell. Midroog's ratings are not designed to meet the investment needs of any particular investor. The investor should always seek the assistance of a professional for advice on investments, the law, or other professional matters. Midroog hereby declares that the Issuers of bonds or of other rated instruments or in connection with the issue thereof the rating is being assigned, have undertaken, even prior to performing the rating, to render Midroog a payment for valuation and rating services provided by Midroog.

Midroog is a 51% subsidiary of Moodys. Nevertheless, Midroog's rating process is entirely independent of Moody's and Midroog has its own policies, procedures and independent rating committee; however, its methodologies are based on those of Moodys.

For further information on the rating procedures of Midroog or of its rating committee, please refer to the relevant pages on Midroog's website.

�

Exhibit 3

�

CONSENT OF RATING AGENCY

�

We consent to the incorporation by reference in the Registration Statement on Form S-8 No. 333-139512 pertaining to employees stock option plan of Elbit Systems Ltd. (the

Company

) of the reference to our

Aa1

rating (Israeli Rating Scale) and of the unofficial translation of our Monitoring Report dated October 29, 2014, with respect to the Series A Notes issued by the Company, included in this current report on Form 6-K.

�

| � |

/s/�Eran Heimer_____________________

Eran Heimer, CEO

Midroog Ltd

|

�

Tel-Aviv, Israel,

October 29, 2014.

�

�

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Elbit Systems Announces a Postponement of its Extraordinary General Meeting of Shareholders

- BlackRock® Canada Announces Final April Cash Distributions for the iShares® Premium Money Market ETF

- Marex Group plc Announces Pricing of Initial Public Offering

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share