Form 6-K DryShips Inc. For: Jan 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13A-16 OR 15D-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2016

Commission File Number 001-33922

DRYSHIPS INC.

109 Kifissias Avenue and Sina Street

151 24, Marousi

Athens, Greece

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [X] Form 40-F [ ]

Form 20-F [X] Form 40-F [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ].

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ].

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant's "home country"), or under the rules of the home country exchange on which the registrant's securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant's security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

Attached as Exhibit 99.1 to this Report on Form 6-K is a press release of DryShips Inc. (the "Company"), dated January 15, 2016, announcing the availability of the Notice of Special Meeting and Proxy Statement for the Company's Special Meeting of Shareholders to be held on Friday, February 19, 2016 (the "Special Meeting").

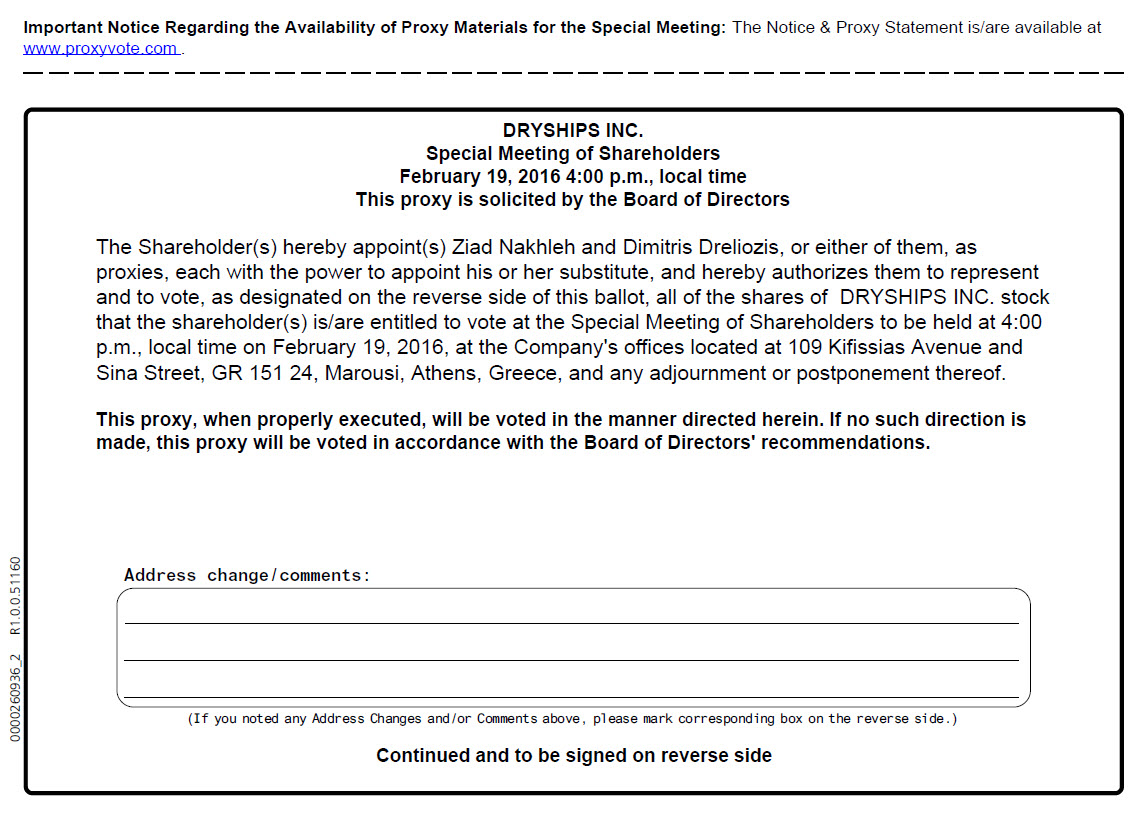

Attached to this Report on Form 6-K as Exhibit 99.2 is the notice of the Special Meeting, the Proxy Statement and the Proxy Card for the Special Meeting.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

DRYSHIPS INC.

|

||

|

(Registrant)

|

||

|

Dated: January 15, 2016

|

By:

|

/s/ George Economou

|

|

George Economou

|

||

|

Chief Executive Officer

|

||

Exhibit 99.1

DRYSHIPS ANNOUNCES AVAILABILITY OF NOTICE OF SPECIAL MEETING AND PROXY STATEMENT

ATHENS, GREECE – January 15, 2016 - DryShips Inc. (NASDAQ: DRYS) (the "Company" or "DryShips"), an international owner of drybulk carriers and offshore support vessels, announced today the availability of the Notice of Special Meeting and Proxy Statement for the Company's Special Meeting of Shareholders, to be held at the Company's offices located at 109 Kifisias Avenue & Sina Street, GR 151 24, Marousi, Athens, Greece, on Friday, February 19, 2016 at 4:00 p.m., local time. The Notice of Special Meeting and Proxy Statement were mailed on or about January 15, 2016 to shareholders of record as of January 8, 2016, and can also be found on the Company's website at: http://dryships.irwebpage.com/2016_Special_Meeting_of_Shareholders.html.

About DryShips

DryShips Inc. is an owner of drybulk carriers and offshore support vessels that operate worldwide. DryShips also owns approximately 40% of the outstanding shares of Ocean Rig UDW Inc. (NASDAQ:ORIG), an international drilling contractor. DryShips owns a fleet of 23 drybulk carriers, comprising 3 Capesize and 20 Panamax with a combined deadweight tonnage of approximately 2.1 million tons, and 6 offshore supply vessels, comprising 2 platform supply and 4 oil spill recovery vessels.

DryShips' common stock is listed on the NASDAQ Capital Market where it trades under the symbol "DRYS."

Visit the Company's website at www.dryships.com. The information contained on the Company's website does not constitute a part of this press release.

DryShips' common stock is listed on the NASDAQ Capital Market where it trades under the symbol "DRYS."

Visit the Company's website at www.dryships.com. The information contained on the Company's website does not constitute a part of this press release.

Forward-Looking Statements

Matters discussed in this release may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The Private Securities Litigation Reform Act of 1995 provides safe harbor protections for forward-looking statements in order to encourage companies to provide prospective information about their business. The Company desires to take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and is including this cautionary statement in connection with such safe harbor legislation.

Forward-looking statements reflect our current views with respect to future events and financial performance and may include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements, which are other than statements of historical facts.

The forward-looking statements in this release are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, management's examination of historical operating trends, data contained in our records and other data available from third parties. Although we believe that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond our control, we cannot assure you that it will achieve or accomplish these expectations, beliefs or projections.

Matters discussed in this release may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The Private Securities Litigation Reform Act of 1995 provides safe harbor protections for forward-looking statements in order to encourage companies to provide prospective information about their business. The Company desires to take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and is including this cautionary statement in connection with such safe harbor legislation.

Forward-looking statements reflect our current views with respect to future events and financial performance and may include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements, which are other than statements of historical facts.

The forward-looking statements in this release are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, management's examination of historical operating trends, data contained in our records and other data available from third parties. Although we believe that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond our control, we cannot assure you that it will achieve or accomplish these expectations, beliefs or projections.

Important factors that, in our view, could cause actual results to differ materially from those discussed in the forward-looking statements include the strength of world economies and currencies, general market conditions, including changes in charter rates and dayrates and vessel and drilling dayrates and drybulk vessel, drilling rig and drillship values, failure of a seller to deliver one or more vessels or drilling units, drillships or drybulk vessels, failure of a buyer to accept delivery of a drilling rig, drillship, or vessel, inability to procure acquisition financing, default by one or more customers, changes in demand for drybulk commodities or oil, changes in demand that may affect attitudes of time charterers and customer drilling programs, scheduled and unscheduled drydockings and upgrades, changes in our operating expenses, including bunker prices, drydocking and insurance costs, complications associated with repairing and replacing equipment in remote locations, limitations on insurance coverage, such as war risk coverage, in certain areas, changes in governmental rules and regulations or actions taken by regulatory authorities, potential liability from pending or future litigation, changes in tax laws, treaties and regulations, tax assessments and liabilities for tax issues, domestic and international political conditions, potential disruption of shipping routes due to accidents and political events or acts by terrorists.

Risks and uncertainties are further described in reports filed by DryShips Inc. with the U.S. Securities and Exchange Commission, including the Company's most recently filed Annual Report on Form 20-F.

Investor Relations / Media:

Nicolas Bornozis

Capital Link, Inc. (New York)

Tel. 212-661-7566

E-mail: [email protected]

Exhibit 99.2

January 15, 2016

TO THE SHAREHOLDERS OF DRYSHIPS INC.:

Enclosed is a notice of the Special Meeting of Shareholders (the "Special Meeting") of DryShips Inc., a Marshall Islands corporation (the "Company"), which will be held at the Company's offices located at 109 Kifissias Avenue and Sina Street, GR 151 24, Marousi, Athens, Greece on February 19, 2016 at 4:00 p.m. local time, and related materials. The Notice of the Meeting and related materials can also be found at www.dryships.com.

At the Special Meeting, shareholders of the Company will consider and vote upon the following proposal:

1. To approve one or more amendments to the Company's Amended and Restated Articles of Incorporation to effect one or more reverse stock splits of the Company's issued and outstanding common shares at a ratio of not less than one-for-two and not more than one-for-100, inclusive, with the exact ratio to be set at a whole number within this range to be determined by the Company's board of directors (the "Board"), or any duly constituted committee thereof, at any time after approval of each amendment in its discretion, and to authorize the Board to implement any such reverse stock split by filing any such amendment with the Registrar of Corporations of the Republic of the Marshall Islands (the "Proposal").

Only holders of record of shares of our common stock, par value $0.01 per share, (the "Common Shares") and shares of our Series B Preferred stock, par value $0.01 per share, (the "Series B Preferred Shares" and, together with the Common Shares, the "Shares") at the close of business on January 8, 2016 will be entitled to vote at the Special Meeting. Each Common Share then held entitles the holder thereof to one (1) vote on the Proposal and each Series B Preferred Share then held entitles the holder thereof to five (5) votes on the Proposal. The holders of the Common Shares and the Series B Preferred Shares will vote on the Proposal as a single class.

Provided that a quorum is present, adoption of the Proposal requires the affirmative vote of a majority of the total number of Shares of the Company issued and outstanding and entitled to vote at the Special Meeting. To constitute a quorum, there must be present either in person or by proxy shareholders of record holding at least one third of Shares issued and outstanding. If less than a quorum is present, a majority of those Shares present either in person or by proxy will have the power to adjourn the Special Meeting until a quorum is present.

The Common Shares are listed on the NASDAQ Capital Market under the symbol "DRYS."

You are cordially invited to attend the Special Meeting in person. If you attend the Special Meeting, you may revoke your proxy and vote your shares in person. Whether or not you plan to attend the Special Meeting in person, it is important that your shares be represented and voted at the Special Meeting.

ACCORDINGLY, IF YOU HAVE ELECTED TO RECEIVE YOUR PROXY MATERIALS BY MAIL, PLEASE COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY IN THE ENCLOSED ENVELOPE, WHICH DOES NOT REQUIRE POSTAGE IF MAILED IN THE UNITED STATES OR YOU MAY VOTE BY INTERNET OR TELEPHONE AS DESCRIBED ON YOUR VOTING INSTRUCTION FORM. IF YOU HAVE ELECTED TO RECEIVE YOUR PROXY MATERIALS OVER THE INTERNET, PLEASE VOTE BY INTERNET OR BY TELEPHONE IN ACCORDANCE WITH THE INSTRUCTIONS PROVIDED IN THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS THAT YOU HAVE RECEIVED IN THE MAIL. IF YOU ATTEND THE SPECIAL MEETING, YOU MAY REVOKE YOUR PROXY AND VOTE IN PERSON. ALL SHAREHOLDERS MUST PRESENT A FORM OF PERSONAL PHOTO IDENTIFICATION IN ORDER TO BE ADMITTED TO THE SPECIAL MEETING. IN ADDITION, IF YOUR SHARES ARE HELD IN THE NAME OF YOUR BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO ATTEND THE SPECIAL MEETING, YOU MUST BRING AN ACCOUNT STATEMENT OR LETTER FROM YOUR BROKER, BANK OR OTHER NOMINEE INDICATING THAT YOU WERE THE OWNER OF THE SHARES ON JANUARY 8, 2016.

ANY SIGNED PROXY RETURNED AND NOT COMPLETED WILL BE VOTED BY MANAGEMENT IN FAVOR OF THE PROPOSAL PRESENTED IN THE PROXY STATEMENT.

|

Very truly yours,

|

|

|

George Economou

Chairman, Chief Executive Officer and

President

|

DRYSHIPS INC.

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON FEBRUARY 19, 2016

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON FEBRUARY 19, 2016

NOTICE IS HEREBY given that the Special Meeting of Shareholders (the "Special Meeting") of DryShips Inc., a Marshall Islands corporation (the "Company"), which will be held at the Company's offices located at 109 Kifissias Avenue and Sina Street, GR 151 24, Marousi, Athens, Greece on February 19, 2016 at 4:00 p.m. local time, for the following Proposal as is more completely set forth in the accompanying Proxy Statement:

To approve one or more amendments to the Company's Amended and Restated Articles of Incorporation to effect one or more reverse stock splits of the Company's issued and outstanding common shares at a ratio of not less than one-for-two and not more than one-for-100, inclusive, with the exact ratio to be set at a whole number within this range to be determined by the Company's board of directors (the "Board"), or any duly constituted committee thereof, at any time after approval of any such amendment in its discretion, and to authorize the Board to implement any such reverse stock split by filing such amendment with the Registrar of Corporations of the Republic of the Marshall Islands (the "Proposal").

The Board has fixed the close of business on January 8, 2016 as the record date (the "Record Date") for the determination of the shareholders entitled to receive notice and to vote at the Special Meeting or any adjournment thereof. Holders of shares of our common stock, par value $0.01 per share (the "Common Shares") and shares of our Series B Preferred Shares, par value $0.01 per share, (the "Series B Preferred Shares" and, together with the Common Shares, the "Shares") on the Record Date will be entitled to vote at the Special Meeting. Each shareholder of record on the Record Date is entitled to one (1) vote for each Common Share and five (5) votes for each Series B Preferred Share then held. The holders of the Common Shares and the Series B Preferred Shares shall vote on the Proposal as a single class. Shareholders of record holding at least a third of our issued and outstanding Shares and who are entitled to vote at the Special Meeting in person or by proxy shall be a quorum for the purposes of the Special Meeting.

WHETHER OR NOT YOU PLAN TO ATTEND THE SPECIAL MEETING IN PERSON, IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AND VOTED AT THE SPECIAL MEETING. ACCORDINGLY, IF YOU HAVE ELECTED TO RECEIVE YOUR PROXY MATERIALS BY MAIL, PLEASE COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY IN THE ENCLOSED ENVELOPE, WHICH DOES NOT REQUIRE POSTAGE IF MAILED IN THE UNITED STATES OR YOU MAY VOTE BY INTERNET OR TELEPHONE AS DESCRIBED ON YOUR VOTING INSTRUCTION FORM. IF YOU HAVE ELECTED TO RECEIVE YOUR PROXY MATERIALS OVER THE INTERNET, PLEASE VOTE BY INTERNET OR BY TELEPHONE IN ACCORDANCE WITH THE INSTRUCTIONS PROVIDED IN THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS THAT YOU HAVE RECEIVED IN THE MAIL. IF YOU ATTEND THE SPECIAL MEETING, YOU MAY REVOKE YOUR PROXY AND VOTE IN PERSON. ALL SHAREHOLDERS MUST PRESENT A FORM OF PERSONAL PHOTO IDENTIFICATION IN ORDER TO BE ADMITTED TO THE SPECIAL MEETING. IN ADDITION, IF YOUR SHARES ARE HELD IN THE NAME OF YOUR BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO ATTEND THE SPECIAL MEETING, YOU MUST BRING AN ACCOUNT STATEMENT OR LETTER FROM YOUR BROKER, BANK OR OTHER NOMINEE INDICATING THAT YOU WERE THE OWNER OF THE SHARES ON JANUARY 8, 2016.

ANY SIGNED PROXY RETURNED AND NOT COMPLETED WILL BE VOTED BY MANAGEMENT IN FAVOR OF THE PROPOSAL PRESENTED IN THE PROXY STATEMENT.

This Notice of Special Meeting and the Proxy Statement and certain other related materials may be found on the Company's website at www.dryships.com.

If you attend the Special Meeting, you may revoke your proxy and vote in person.

|

BY ORDER OF THE BOARD OF DIRECTORS

|

|

Anastasia Pavli

Secretary |

January 15, 2016

Athens, Greece

Athens, Greece

DRYSHIPS INC.

__________________________

PROXY STATEMENT

FOR

SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON FEBRUARY 19, 2016

FOR

SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON FEBRUARY 19, 2016

__________________________

INFORMATION CONCERNING SOLICITATION AND VOTING

GENERAL

The enclosed proxy is solicited on behalf of the board of directors (the "Board") of DryShips Inc., a Marshall Islands corporation (the "Company"), which will be held at the Company's offices located at 109 Kifissias Avenue and Sina Street, GR 151 24, Marousi, Athens, Greece on February 19, 2016 at 4:00 p.m. local time, or at any adjournment or postponement thereof (the "Special Meeting"), for the purposes set forth herein and in the accompanying Notice of Special Meeting of Shareholders. This Proxy Statement together with the Notice of Special Meeting and certain other related materials are expected to be mailed to shareholders of the Company entitled to vote at the Special Meeting on or about January 15, 2016. These materials may be found on the Company's website at www.dryships.com.

VOTING RIGHTS AND OUTSTANDING SHARES

On January 8, 2016 (the "Record Date"), the Company had issued and outstanding 672,046,321 shares of common stock, par value $0.01 per share (the "Common Shares") and 100,000,000 shares of Series B Preferred Shares, par value $0.01 per share (the "Series B Preferred Shares" and together with the Common Shares, the "Shares"). Each shareholder of record at the close of business on the Record Date is entitled to one (1) vote for each Common Share and five (5) votes for each Series B Preferred Share then held. The holders of the Common Shares and the Series B Preferred Shares shall vote on the Proposal as a single class. Shareholders of record holding at least a third of our issued and outstanding Shares and who are entitled to vote at the Special Meeting in person or by proxy shall be a quorum for the purposes of the Special Meeting. The Shares represented by any proxy in the enclosed form will be voted in accordance with the instructions given on the proxy if the proxy is properly executed and is received by the Company prior to the close of voting at the Special Meeting or any adjournment or postponement thereof. Any proxies returned without instructions will be voted FOR the Proposal set forth on the Notice of Special Meeting of Shareholders.

The Common Shares are listed on NASDAQ Capital Market ("NASDAQ") under the symbol "DRYS."

REVOCABILITY OF PROXIES

A shareholder giving a proxy may revoke such proxy at any time before it is exercised. A proxy may be revoked by filing with the Secretary of the Company at the Company's principal executive office, 109 Kifissias Avenue and Sina Street, GR 151 24 Marousi, Athens, Greece, a written notice of revocation by a duly executed proxy bearing a later date, or by attending the Meeting and voting in person. If your shares are held in the name of your broker, bank or other nominee and you intend to vote in person at the Meeting, you must present a legal proxy from your bank, broker or other nominee in order to vote. Shareholders should speak to their brokers, banks or other nominees in whose custody their shares are held for additional information.

THE PROPOSAL

APPROVAL OF AN AMENDMENT TO THE THIRD AMENDED AND RESTATED ARTICLES

OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT OF THE COMPANY'S

ISSUED AND OUTSTANDING COMMON SHARES

OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT OF THE COMPANY'S

ISSUED AND OUTSTANDING COMMON SHARES

General. The Board believes that it is in the best interest of the Company and the shareholders and is hereby soliciting shareholder approval of one or more amendments (each, an "Amendment") to the Company's Amended and Restated Articles of Incorporation to effect one or more reverse stock splits of the Company's issued and outstanding Common Shares at a ratio of not less than one-for-two and not more than one-for-100, inclusive, whereby, except as explained below with respect to fractional shares, on the effective date, Common Shares issued and outstanding immediately prior thereto will be, automatically and without any action on the part of the shareholders, combined, converted and changed into new Common Shares in accordance with the reverse stock split ratio, which shall be determined by the Board of Directors in its discretion (the "Proposal"). If the shareholders approve the Proposal, the Board will have the authority, but not the obligation, in its sole discretion, and without further action on the part of the shareholders, to determine each reverse stock split ratio within the approved range and to effect one or more reverse stocks split by filing an Amendment with the Registrar of Corporations of the Republic of the Marshall Islands at any time after the approval of any such Amendment. If implemented, any such reverse stock split will become effective as of the beginning of the business day after the filing of each Amendment with the Registrar of Corporations of the Republic of the Marshall Islands. Any such reverse stock split effectuated in connection with the Proposal must be completed before the date of the Company's 2017 Annual General Meeting of Shareholders.

The Board believes that shareholder approval of an exchange ratio range (rather than an exact exchange ratio) in connection with the Proposal provides the Board with maximum flexibility to achieve the purposes of any such reverse stock split that may be effected. If shareholders approve the Proposal, a reverse stock split will only be effected, if at all, upon a determination by the Board that a reverse stock split is in the Company's and the shareholders' best interests at that time. In connection with any determination to effect a reverse stock split, the Board will set the time for such a split and select a specific exchange ratio within the approved range. These determinations will be made by the Board with the intention to create the greatest marketability of the Company's Common Shares based upon prevailing market conditions at that time. The Board reserves its right to elect not to proceed, and abandon, any reverse stock split if it determines, in its sole discretion, that implementing such reverse stock split is not in the best interests of the Company and its shareholders.

Purpose. The purpose for seeking approval to effect one or more reverse stock splits is to increase the market price of each Common Share. The Company believes that the increased market price of the Common Shares expected as a result of implementing a reverse stock split will improve the marketability and liquidity of the Common Shares and will encourage interest and trading in the Common Shares. Furthermore, the Company believes that effecting one or more reverse stock splits will help achieve compliance with the minimum bid price of $1.00 per share listing requirement for listing the Company's Common Shares on the NASDAQ. NASDAQ has several listing criteria that companies must satisfy in order to maintain their listing. One of these criteria is that the Company's Common Shares have a minimum closing bid price that is greater than or equal to $1.00 per share, and if the Company fails to maintain such $1.00 minimum closing bid price for a period of 30 consecutive business days, under NASDAQ rules, the Company would have to regain compliance during the applicable grace period. On April 13, 2015, the Company received written notification from the NASDAQ Stock Market indicating that because the closing bid price of the Company's Common Shares was below $1.00 per share for 30 consecutive business days, the Company no longer met the minimum bid price requirement for the Nasdaq Global Select Market. The Company did not regain compliance with the minimum bid price requirement prior to the 180-day compliance period and on October 13, 2015, the Company transferred its common stock to the NASDAQ Capital Market and received an additional 180-day period to regain compliance with this rule. The Company proposes to undertake one or more reverse stock splits to cause the Common Shares to trade above the minimum bid price requirement of the NASDAQ Capital Market. The Company risks having its shares delisted from NASDAQ if it fails to comply with this rule. The Company and the Board of Directors believe that maintaining the listing of the Common Shares on the NASDAQ is in the best interest of the Company and its shareholders.

The Board intends to effect one or more reverse stock splits in connection with the Proposal only if it believes that a decrease in the number of Common Shares outstanding is likely to improve the trading price for the Company's Common Shares, and only if the implementation of a reverse stock split is determined by the Board to be in the best interests of the Company and its shareholders. There can be no assurance that any reverse stock split, if and when implemented, will achieve any of the desired results. There also can be no assurance that the Company will be successful in maintaining compliance with NASDAQ requirements or that the price per share of the Company's Common Shares immediately after any such reverse stock split, if implemented, will increase proportionately with any reverse stock split, or that any increase will be sustained for any period of time.

Authorized Common Shares and Par Value. Implementing a reverse stock split will not result in a change in the number of authorized Common Shares or par value of the Common Shares. Because the Company's authorized number of Common Shares, which is currently 1,000,000,000 Common Shares under the Company's Amended and Restated Articles of Incorporation, will not decrease in accordance with the reverse stock split ratio, a reverse stock split would provide the Company with additional Common Shares, which would be available for issuance from time to time for corporate purposes such as acquisitions of companies or assets, sales of stock or securities convertible into Common Shares and raising additional capital.

Material U.S. Federal Income Tax Consequences. The following is a summary of the material U.S. federal income tax consequences of a reverse stock split to U.S. Holders (as defined below) of our Common Shares. This summary is based on the Internal Revenue Code of 1986, as amended (the "Code"), the Treasury regulations promulgated thereunder, and administrative rulings and court decisions in effect as of the date of this proxy statement, all of which may be subject to change, possibly with retroactive effect. This summary only addresses holders who hold their shares as capital assets within the meaning of the Code and does not address all aspects of U.S. federal income taxation that may be relevant to U.S. Holders subject to special tax treatment, such as financial institutions, dealers in securities, insurance companies, regulated investment companies, persons that own shares as part of a hedge, straddle, or conversion transaction, persons whose functional currency is not the U.S. dollar, foreign persons and tax-exempt entities. In addition, this summary does not consider the effects of any applicable state, local, foreign or other tax laws and does not address the U.S. federal income tax consequences of a reverse stock split to persons who are not U.S. Holders.

As used herein, the term "U.S. Holder" means a beneficial owner of common stock that is a U.S. citizen or resident, U.S. corporation or other U.S. entity taxable as a corporation, an estate the income of which is subject to U.S. federal income taxation regardless of its source, or a trust if a court within the United States is able to exercise primary jurisdiction over the administration of the trust and one or more U.S. persons have the authority to control all substantial decisions of the trust.

If a partnership holds our Common Shares, the tax treatment of a partner will generally depend upon the status of the partner and upon the activities of the partnership. If you are a partner in a partnership holding our Common Shares, you are encouraged to consult your tax advisor.

We have not sought and will not seek any ruling from the Internal Revenue Service (the "IRS"), or an opinion from counsel with respect to the U.S. federal income tax consequences discussed below. There can be no assurance that the tax consequences discussed below would be accepted by the IRS or a court. The authorities on which this summary is based are subject to various interpretations, and it is therefore possible that the U.S. federal income tax treatment may differ from the treatment described below.

We urge holders to consult with their own tax advisors as to any U.S. federal, state, or local or foreign tax consequences applicable to them that could result from the reverse stock split.

The reverse stock split is intended to constitute a "reorganization" within the meaning of Section 368 of the Code and is not intended to be part of a plan to increase periodically a shareholder's proportionate interest in our earnings and profits. Assuming the reverse stock split so qualifies,

| · | A U.S. Holder should not recognize any gain or loss for federal income tax purposes (except for cash, if any, received in lieu of a fractional Common Share); |

| · | The U.S. Holder's aggregate tax basis of the common stock received pursuant to the reverse stock split, including any fractional Common Share not actually received, should be equal to the aggregate tax basis of such holder's Common Share surrendered in the exchange; |

| · | The U.S. Holder's holding period for the Common Shares received pursuant to the reverse stock split should include such holder's holding period for the Common Shares surrendered in the exchange; and |

| · | Cash payments received by the U.S. Holder for a fractional Common Share generally should be treated as if such fractional share had been issued pursuant to the reverse stock split and then redeemed by us, and such U.S. Holder generally should recognize capital gain or loss with respect to such payment, measured by the difference between the amount of cash received and such U.S. Holder's tax basis in such fractional share. However, in certain circumstances, it is possible that the cash received in lieu of a fractional share could be characterized as a dividend for such purposes. U.S. Holders are encouraged to consult their tax adviser on the treatment of the receipt of cash in lieu of fractional shares in their specific situation. |

U.S. Holders will be required to provide their social security or other taxpayer identification numbers (or, in some instances, additional information) to the transfer agent in connection with a reverse stock split to avoid backup withholding requirements that might otherwise apply. This information is generally provided on IRS Form W-9. The letter of transmittal will require each U.S. Holder to deliver such information when the common stock certificates are surrendered following the effective date of the reverse stock split. Failure to provide such information may result in backup withholding at a rate of 28%.

THE FOREGOING IS A SUMMARY OF THE MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES OF A REVERSE STOCK SPLIT TO U.S. HOLDERS UNDER CURRENT LAW AND IS FOR GENERAL INFORMATION ONLY. THE FOREGOING DOES NOT PURPORT TO ADDRESS ALL U.S. FEDERAL INCOME TAX CONSEQUENCES OR TAX CONSEQUENCES THAT MAY ARISE UNDER THE TAX LAWS OF OTHER JURISDICTIONS OR THAT MAY APPLY TO PARTICULAR CATEGORIES OF SHAREHOLDERS. YOU ARE ENCOURAGED TO CONSULT YOUR OWN TAX ADVISOR AS TO THE PARTICULAR TAX CONSEQUENCES OF A REVERSE STOCK SPLIT TO YOU, INCLUDING THE APPLICATION OF U.S. FEDERAL, STATE, LOCAL AND FOREIGN TAX LAWS, AND THE EFFECT OF POSSIBLE CHANGES IN TAX LAWS THAT MAY AFFECT THE TAX CONSEQUENCES DESCRIBED ABOVE.

Procedure for Exchange of Stock Certificates. As soon as practicable after the effective date of each reverse stock split, the Company's shareholders will be notified that the reverse stock split has been effected. The Company expects that its transfer agent, American Stock Transfer & Trust Company, LLC, will act as exchange agent for purposes of implementing the exchange of share certificates. Holders of pre-split shares will be asked to surrender to the exchange agent certificates representing pre-split Common Shares in exchange for certificates representing post-split Common Shares or, in the case of holders of non-certificated shares, such proof of ownership as required by the exchange agent, in accordance with the procedures to be set forth in a letter of transmittal the Company will send to its registered shareholders. No new share certificates will be issued to a shareholder until such shareholder has surrendered such shareholder's outstanding share certificate(s) together with the properly completed and executed letter of transmittal to the exchange agent. Any pre-split Common Shares submitted for transfer, whether pursuant to a sale or other disposition, or otherwise, will automatically be exchanged for post-split Common Shares. SHAREHOLDERS SHOULD NOT DESTROY ANY SHARE CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

Upon each reverse stock split, the Company intends to treat shares held by shareholders in "street name" through a bank, broker or other nominee in the same manner as registered shareholders whose shares are registered in their names. Banks, brokers or other nominees will be instructed to effect the reverse stock split for their beneficial holders holding shares in "street name." However, these banks, brokers or other nominees may have different procedures from those that apply to registered shareholders for processing the reverse stock split and making payment for fractional shares. If a shareholder holds shares with a bank, broker or other nominee and has any questions in this regard, shareholders are encouraged to contact their bank, broker or other nominee.

Fractional Shares. No fractional Common Shares will be created or issued in connection with any reverse stock split. Shareholders of record who otherwise would be entitled to receive fractional Common Shares as a consequence of any reverse stock split will be entitled, upon surrender to the exchange agent of certificates representing such Common Shares or, in the case of non-certificated Common Shares, such proof of ownership as required by the exchange agent, to a cash payment in lieu thereof at a price equal to the fraction to which the shareholder would otherwise be entitled multiplied by the closing price of the Common Shares on the Nasdaq Global Select Market on the last trading day prior to the effective date of each reverse stock split, as adjusted for each reverse stock split as appropriate or, if such price is not available, a price to be determined by our Board of Directors. The ownership of a fractional interest will not give the holder thereof any voting, dividend or other rights except to receive payment therefor as described herein.

Required Vote. Adoption of the Proposal requires the affirmative vote of a majority of the outstanding Shares entitled to vote thereon.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR APPROVAL OF THE PROPOSAL. UNLESS REVOKED AS PROVIDED ABOVE, PROXIES RECEIVED BY MANAGEMENT WILL BE VOTED IN FAVOR OF SUCH APPROVAL UNLESS A CONTRARY VOTE IS SPECIFIED.

EFFECT OF ABSTENTIONS

An "abstention" occurs when a shareholder sends in a proxy with explicit instructions to decline to vote regarding a particular matter (other than the election of Directors for which the choice is limited to "for" or "withhold"). Abstentions are counted as present for purposes of determining a quorum. Abstentions will not be counted in determining whether the Proposal has been approved.

OTHER MATTERS

No other matters are expected to be presented for action at the Special Meeting. Should any additional matter come before the Special Meeting, it is intended that proxies in the accompanying form will be voted in accordance with the judgment of the person or persons named in the proxy.

|

By Order of the Board of Directors

Anastasia Pavli

Secretary |

January 15, 2016

Athens, Greece

Athens, Greece

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Aviva pledges $6M to Nature Conservancy of Canada for conservation and nature-based carbon removal projects

- Genco Shipping & Trading Limited Mails Letter to Shareholders

- GOAI Announces Strategic Partnership with Inuvo to Revolutionize Advertising Capabilities

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share