Form 6-K CaesarStone Sdot-Yam For: Dec 09

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of December 2015

Commission File Number: 001-35464

Caesarstone Sdot-Yam Ltd.

(Translation of registrant’s name into English)

Kibbutz Sdot Yam

MP Menashe

Israel 3780400

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): __

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): __

EXPLANATORY NOTE

This Report on Form 6-K contains Caesarstone Sdot-Yam Ltd.’s updated investor presentation, a copy of which is attached hereto as Exhibit 99.1.

The information in this Form 6-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

CAESARSTONE SDOT-YAM LTD.

|

|||

|

Date: December 9, 2015

|

By:

|

/s/ Michal Baumwald Oron

|

|

|

Name: Michal Baumwald Oron

|

|||

|

Title: VP Business Development & General Counsel

|

|||

3

EXHIBIT INDEX

|

Exhibit

|

Description

|

|

99.1

|

Investor Presentation.

|

4

Exhibit 99.1

1

1

Investors presentation

December, 2015

2

2

Disclaimer

Written and oral statements made in and in connection with the following presentation that reflect management’s views about

the Company’s future performance, financial position, business strategy and plans and objectives for future operations

constitute “forward-looking statements” under the Private Securities Litigation Reform Act of 1995.

the Company’s future performance, financial position, business strategy and plans and objectives for future operations

constitute “forward-looking statements” under the Private Securities Litigation Reform Act of 1995.

These statements, which contain words such as "believe,” “expect,” “anticipate,” “intend,” “estimate,” “forecast,” “project,”

“will,” “may,” “should”, “plan”, “seek” and similar expressions or references to future periods, reflect the beliefs and

expectations of the Company and are subject to risks and uncertainties, including those described under “Risk factors” in the

Company’s annual report on Form 20-F for the year ended December 31, 2014 and other documents filed with the U.S.

Securities and Exchange Commission, that may cause actual results to differ materially from the results discussed in our

forward-looking statements. This presentation should be read in conjunction with our annual report on Form 20-F for the

year ended December 31, 2014 and our other documents filed with the SEC. These risks and uncertainties include, among

other factors, the strength of the home renovation and construction sectors; economic conditions within any of our key

existing markets; actions by our competitors; changes in raw material prices; unpredictability of seasonal fluctuations in

revenues; the outcome of silicosis claims; the outcome of the claim by our former quartz processor; fluctuations in currency

exchange rates; delays in manufacturing if our suppliers are unable to supply raw materials; and other factors discussed

under the heading “Risk Factors” in the annual report on Form 20-F and other documents filed with the U.S. Securities and

Exchange Commission. These and other factors could adversely affect the outcome and financial effects of the plans and

events described herein.

“will,” “may,” “should”, “plan”, “seek” and similar expressions or references to future periods, reflect the beliefs and

expectations of the Company and are subject to risks and uncertainties, including those described under “Risk factors” in the

Company’s annual report on Form 20-F for the year ended December 31, 2014 and other documents filed with the U.S.

Securities and Exchange Commission, that may cause actual results to differ materially from the results discussed in our

forward-looking statements. This presentation should be read in conjunction with our annual report on Form 20-F for the

year ended December 31, 2014 and our other documents filed with the SEC. These risks and uncertainties include, among

other factors, the strength of the home renovation and construction sectors; economic conditions within any of our key

existing markets; actions by our competitors; changes in raw material prices; unpredictability of seasonal fluctuations in

revenues; the outcome of silicosis claims; the outcome of the claim by our former quartz processor; fluctuations in currency

exchange rates; delays in manufacturing if our suppliers are unable to supply raw materials; and other factors discussed

under the heading “Risk Factors” in the annual report on Form 20-F and other documents filed with the U.S. Securities and

Exchange Commission. These and other factors could adversely affect the outcome and financial effects of the plans and

events described herein.

These forward-looking statements are made only as of the date hereof, and neither the Company nor any of its respective

agents, employees or advisors intend, undertake or have any duty or obligation to supplement, amend, update or revise any

of the forward-looking statements contained in this presentation, whether as a result of new information, future events or

otherwise.

agents, employees or advisors intend, undertake or have any duty or obligation to supplement, amend, update or revise any

of the forward-looking statements contained in this presentation, whether as a result of new information, future events or

otherwise.

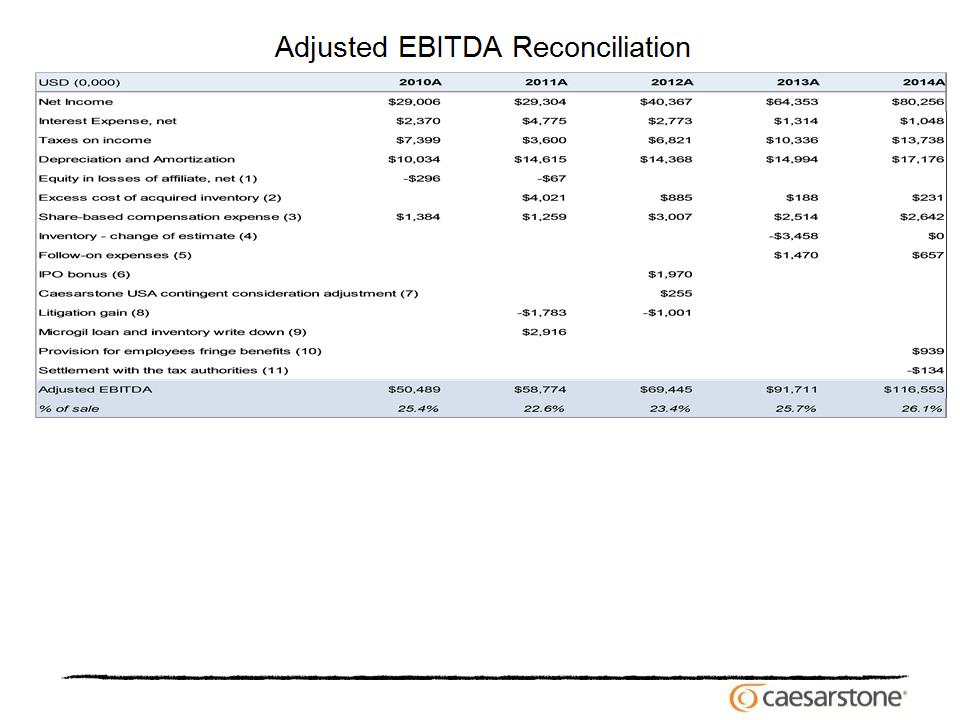

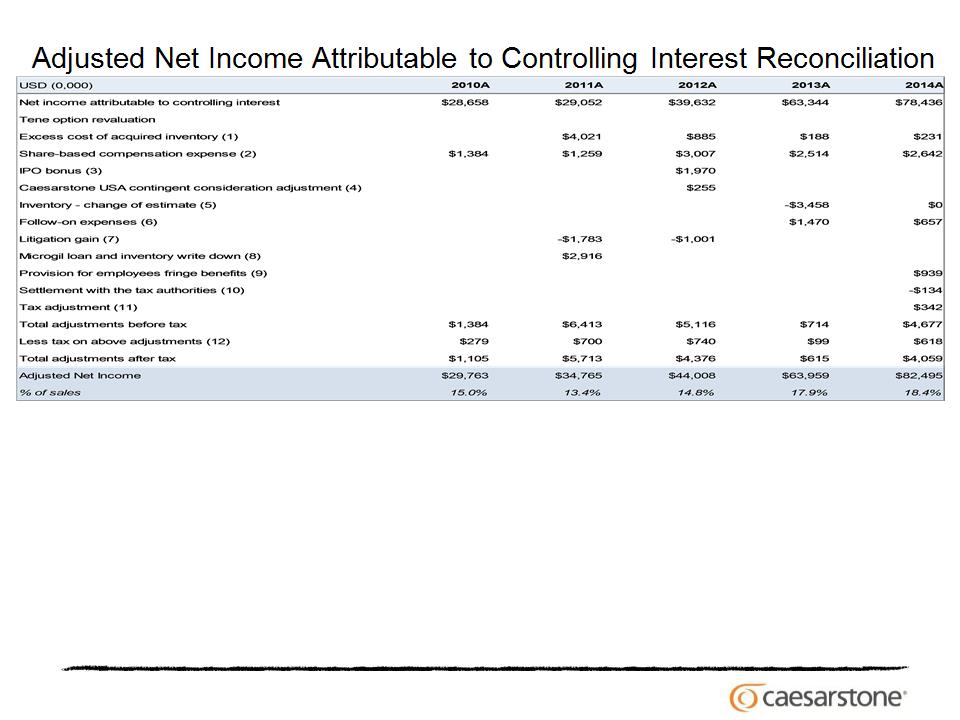

This presentation includes certain non-GAAP measures, which should all be considered in addition to, and not as a substitute

for, comparable GAAP measures. A reconciliation of GAAP net income to adjusted net income is provided below. The

Company provides these non-GAAP financial measures because it believes that they present a better measure of the

Company’s core business and management uses the non-GAAP measures internally to evaluate the Company’s ongoing

performance. Accordingly, the Company believes that they are useful to investors in enhancing an understanding of the

Company’s operating performance. However, these measures should not be considered as substitutes for GAAP measures

and may be inconsistent with similar measures presented by other companies.

for, comparable GAAP measures. A reconciliation of GAAP net income to adjusted net income is provided below. The

Company provides these non-GAAP financial measures because it believes that they present a better measure of the

Company’s core business and management uses the non-GAAP measures internally to evaluate the Company’s ongoing

performance. Accordingly, the Company believes that they are useful to investors in enhancing an understanding of the

Company’s operating performance. However, these measures should not be considered as substitutes for GAAP measures

and may be inconsistent with similar measures presented by other companies.

3

Company Overview

• 27 years of leadership

• Strong premium brand

• 12% global market share (by volume)

• Distribution network across over 50

countries

countries

• Diversified revenue with approximately

55% of revenue from North America

55% of revenue from North America

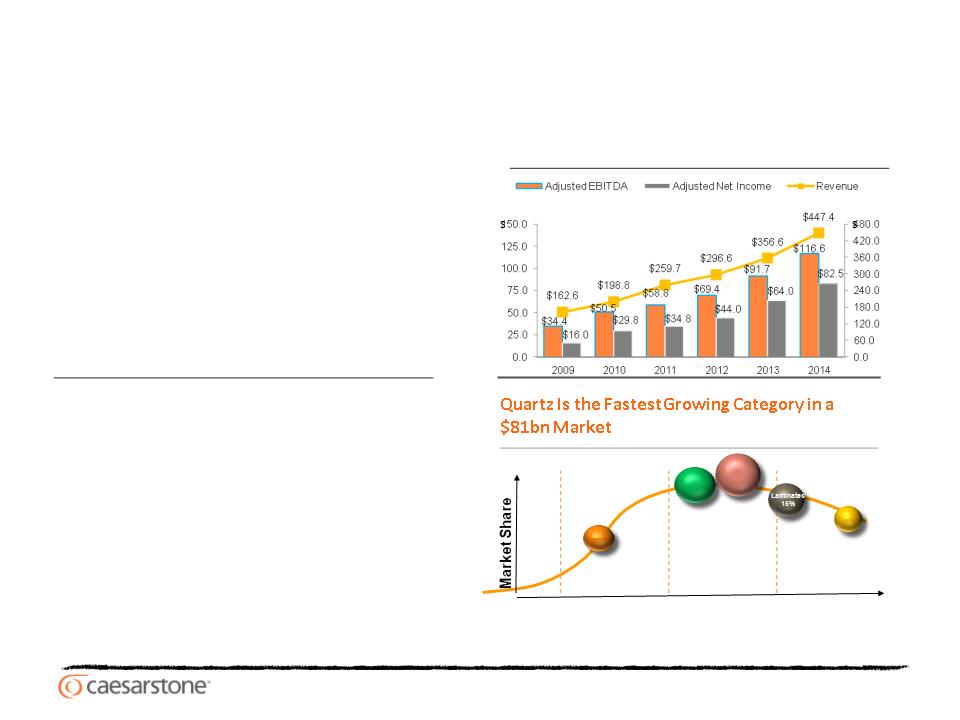

Quartz Market Opportunity1

• 2014 market penetration: 10% by sales

• Fastest growing surfaces category (’99 -

’14)

’14)

• Grew at 15.7% CAGR

• From 2% penetration in 1999

• Capturing high % market share in key

markets

markets

Global Leader in the Attractive Quartz Surface Market

Source: Freedonia February 2015

Quartz is the

fastest

growing

category

fastest

growing

category

Quartz

10%

10%

Growth

Development

Maturity

Dwindling

Solid

Surface

25%

25%

Granite

27%

27%

Marble

2%

Strong Performance Through the Cycle

($mm)

($mm)

4

4

Key Investment Highlights

• Premium brand with superior customer value proposition

• Global market leader in high growth quartz surfaces market

• Strong, diversified global distribution platform

• World-class marketing, R&D and manufacturing capabilities

• Proven track record of growth and product innovation

• Experienced management team

• Attractive financial profile

5

5

Caesarstone’s Superior Value Proposition

• Premium product with unique

combination of high quality & long

lasting beauty

combination of high quality & long

lasting beauty

• Trend-setting innovation with top

design

design

• High service level with

comprehensive sales and marketing

approach

comprehensive sales and marketing

approach

-

Quartz received the highest overall

score among countertop materials

- Consumer Reports Magazine, July 2013

score among countertop materials

- Consumer Reports Magazine, July 2013

6

6

A Globally Recognized Premium Brand

Basic colors

Concetto

Supernatural

• Patterned textures

• Patented

• Customizable

• Hand-incorporated semi-

precious stones

precious stones

Supernatural Ultra

• The beauty of luxurious marble with

Caesarstone quality

Caesarstone quality

• Proprietary technology

• Inspired by nature

• Marble and granite designs

• Over 70 colors

• Represent the majority of sales

7

7

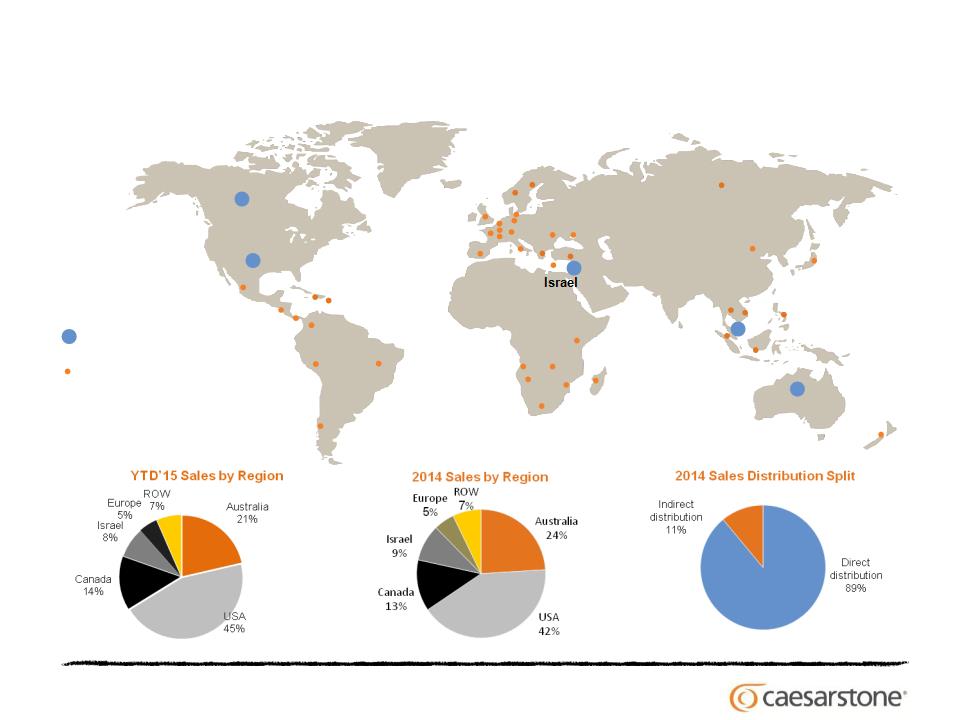

Leading Global Footprint with Diverse Revenue Mix

Singapore

Canada

USA

Australia

Direct distribution

Indirect distribution

8

8

Positioned to Capture Growth from Quartz Penetration

$81B Global Countertop Market Material

Segmentation (2014 sales)

Segmentation (2014 sales)

2014 Quartz Share of Countertop Market

by Region (by volume)

Source: Freedonia February 2015; company estimates

Note: Quartz share based on value

9

9

The U.S. Remains a Significant Opportunity

Caesarstone continues to execute on its go-to-market strategy in the U.S. driven by

increasing quartz penetration

increasing quartz penetration

Source: Freedonia February 2015; Company estimates

1 Calculation applies 1% increase in quartz penetration (by volume) based on 2014 total market volume and 2014 quartz prices as provided by Freedonia February 2015 report

2 HousingEconomics.com - Feb’15

3 Home Improvement Research Institute, March 2015

1,001k

2014

2016E

1,400k

U.S. New Housing Starts2

U.S. Home Improvement Product Sales3

Caesarstone U.S. Revenue Performance ($mm)

U.S. Market Penetration (by volume)

1% increase in

penetration ≈ $350mm1

penetration ≈ $350mm1

21%

9%

42%

50%

YoY organic growth

23%

11

11

THE MOST

IMPORTANT TOOL

IN THE KITCHEN IS

NOT A TOOL AT ALL

IMPORTANT TOOL

IN THE KITCHEN IS

NOT A TOOL AT ALL

12

12

Quartz Market Opportunity2

• Fastest growing surfaces category

(’99 - ’14)

(’99 - ’14)

• Grew at 15.7% CAGR

• From 2% penetration in 1999

Significant Growth Potential

$8bn Quartz Market

(10% penetration)2

(10% penetration)2

Premium

Value For

Money

Money

Price

$81bn¹

Total Market

Premium

Value For

Money

Money

Price

> $81bn

Total Potential Addressable

Market

Market

• Caesarstone is leading the

material conversion with 12%

global market share in 2014 (by

volume)

material conversion with 12%

global market share in 2014 (by

volume)

¹ Freedonia February 2015; Sales to end-consumers in 2014 based on average installed price, which includes installation and other related costs; the Company estimates that 30-

40% of the total sales represents sales by manufacturers

40% of the total sales represents sales by manufacturers

2 2014 by sales

13

13

A Comprehensive Marketing Approach

Distributor

Fabricator

Kitchen/

Bathroom

Store

Bathroom

Store

Contractor/

Commercial

Commercial

End User

Push

Fabricator

§ Technical support

§ Seminars

§ Warranty

§ Loyalty Club

In-Store

§ Display slabs

§ Brochures

§ Sample books

§ Display stands

Architects & Designers

§ Exhibitions & special events

§ Sales promotions

§ Seminars

§ Social media

§ Sample books

End User

§TV, Magazines,

Billboards, PR

Billboards, PR

§Exhibitions

§Online: Website,

Media, Social media,

Google promos,

SEM/SEO

Media, Social media,

Google promos,

SEM/SEO

Architects &

Designers

Pull

14

14

• Unique advanced technological capabilities

• Continued investment in differentiated products

• Product superiority with zero defect policy

World Class Manufacturing and R&D Capabilities

Current Facilities

• High standards (ISO, Leed, NSF SCS, Greenguard)

• High throughput and lean approach

• Binder chemistry and formulation optimization

Future Expansion

• Recent agreement for the acquisition of additional land in Richmod Hill, Georgia,

adjacent to the Company’s U.S. plant, to accommodate additional manufacturing

capacity in the future as needed to satisfy potential demand

adjacent to the Company’s U.S. plant, to accommodate additional manufacturing

capacity in the future as needed to satisfy potential demand

15

15

16

18

18

Differentiated Products Backed by R&D and IP

Our successful collection backed by proprietary technology drives ASP and margins

Calacatta Nuvo

• Luxurious natural marble look

• Launched in 2014

Supernatural - Marble

• Inspired by marble

• Successful 2012 rollout

Shitake

• Sophisticated blend of browns & grays

• Launched in 2011

Supernatural - Granite

• Inspired by granite

• Successful 2013 rollout

Note: Represents select products out of the Caesarstone collection

19

19

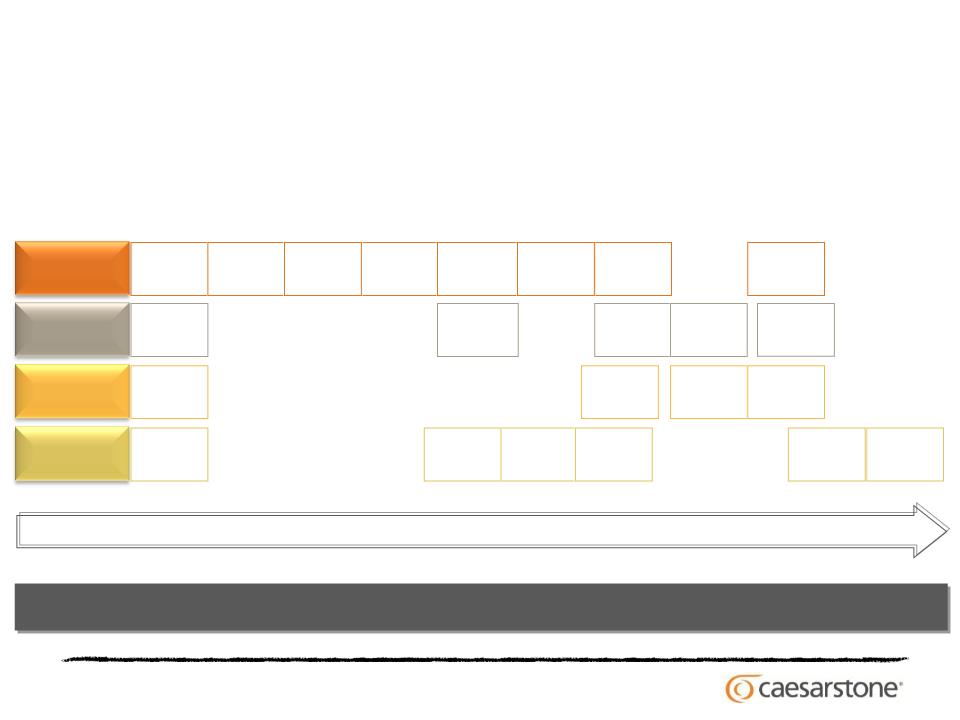

Proven Track Record of Growth and Innovation

• Proven ability to enter and develop key markets

• Continued introduction of innovative new products

1987

1999

2006

2009

2010

1987

Israel

Israel

2009

South

South

East Asia

Market Entry

New

Products

Products

2003

Concetto

Concetto

1998

1987

Classico

Classico

2009

Motivo

Motivo

2010

Supremo

Supremo

1999

U.S.

U.S.

2003

Canada &

South Africa

Canada &

South Africa

2003

1988

Europe

Europe

1998

Australia

Australia

2006

China

China

2008

Australia

Australia

2010

Canada

Canada

2011

U.S. &

Singapore

U.S. &

Singapore

Direct

Distribution

Distribution

1987

Israel

Israel

Manufacturing

1987

1st plant

1st plant

2005

2nd plant

2nd plant

(3rd line)

2007

4th line

4th line

2002

2nd line

2015

History of execution with a clear strategy to capture future growth

2012

Super

Natural

Super

Natural

2012

U.S. plant

6th, 7th lines

2011

Brazil

Brazil

Q3 2014

5th line

5th line

20

20

Strong Growth and Profitability

Revenue ($mm)

Adj. EBITDA and % Margin ($mm)

Adj. Net Income and % Margin 1 ($mm)

Gross Profit and % Margin ($mm)

YoY

Growth:

30.6%

22.2%

20.2%

14.2%

33.2%

45.6%

27.3%

22.2%

YoY

Growth:

YoY

Growth:

16.4%

46.8%

32.1%

18.2%

16.8%

85.9%

45.3%

26.6%

YoY

Growth:

¹ Adjusted net income attributable to controlling interest

25.5%

17.0%

27.1%

29.0%

21

21

Quarterly Financial Performance

• Industry characterized by seasonality with strong Q3 and

weaker Q1 annually

weaker Q1 annually

• Consistent year-over-year revenue growth across quarters

• Robust Adjusted EBITDA growth year-over-year despite

volatility in raw material costs, exchange rates fluctuations

and U.S. manufacturing unabsorbed/start-up costs

volatility in raw material costs, exchange rates fluctuations

and U.S. manufacturing unabsorbed/start-up costs

Revenue ($mm)

Adj. EBITDA ($mm)

13.6%

27.0%

17.4%

4.6%

21.6%

30.7%

11.0%

14.2%

17.9%

30.4%

9.9%

13.9%

36.9%

23.3%

10.4%

YoY Growth

’11-’12 28.5%

‘12-’13 13.5%

‘13-’14 23.5%

‘14-’15 14.2%

18.2%

18.4%

42.4%

0.8%

22.4%

47.1%

16.1%

YoY Growth

’11-’12 18.9%

‘12-’13 28.9%

‘13-’14 25.4%

‘14-’15 15.3%

22

22

Cash Flow Supports Future Growth

• Strong cash flow generation and growth enabling

$20mm dividend distribution in 2013 and 2014

$20mm dividend distribution in 2013 and 2014

• Ability to invest in future growth opportunities, both

organic and via potential acquisitions

organic and via potential acquisitions

Strong and robust free cash flow generation will support investment in future growth

Capital Expenditure ($mm)

Adj. EBITDA Less Capital Expenditure ($mm)

% of

revenue:

revenue:

3.4%

2.8%

19.3%

4.5%

19.3%

22.6%

6.7%

18.9%

% of

revenue:

revenue:

7.7%

18.0%

23

23

YTD’15 Highlights

24

24

Financial Highlights

• Revenue growth of 11.5% YoY, 22.3% on a constant currency basis -

§ U.S. up 22.7% despite slower housing growth, reflecting continued Quartz conversion;

§ Australia up 21.3% on a constant currency basis, driven by our new product successes (new

Calacatta and Statuario) and strong growth in new housing completions

Calacatta and Statuario) and strong growth in new housing completions

§ Canada up 38.2% on a constant currency basis driven by continued strong performance in

general and the positive impact of IKEA Canada

general and the positive impact of IKEA Canada

§ Israel up 3.9% on a constant currency basis

§ Europe up 23.0% and ROW up 20.6% both on a constant currency basis

• Gross margin @40.8%, down 140 basis points

§ Unfavorable exchange rates and start-up costs related to the new US manufacturing facility are

partially offset by positive differentiated product mix and raw material costs (most notably

Polyester but also Quartz)

partially offset by positive differentiated product mix and raw material costs (most notably

Polyester but also Quartz)

• Adjusted EBITDA grew 7.7% to $95.2M

§ Margin of 25.6% vs. 26.5% in 2014, reflecting FX impact and start up cost of U.S. manufacturing

• Adjusted Net Income of $64.0M; 4.1% above last year

§ Margin of 17.2% vs. 18.4% last year

§ Diluted EPS of $1.80 vs. $1.74

25

25

Additional Information

26

26

Additional Information - cnt’d

27

27

Additional Information - cnt’d

• Legal Proceedings*

§ Silicosis claims - Q3’15 included a non-cash expense of $4.7M related to

silicosis claims (other than the claim filed seeking class action status), reflecting

an estimate of the Company’s total uninsured exposure (recorded under

Operating Expenses and adjusted out in non-GAAP measures below). The

recording of this expense was triggered by certain developments in Q3 and

thereafter, including two settlements and an agreement with the State of Israel

related to the silicosis claims.

silicosis claims (other than the claim filed seeking class action status), reflecting

an estimate of the Company’s total uninsured exposure (recorded under

Operating Expenses and adjusted out in non-GAAP measures below). The

recording of this expense was triggered by certain developments in Q3 and

thereafter, including two settlements and an agreement with the State of Israel

related to the silicosis claims.

§ Microgil Agricultural Cooperative Society Ltd. Claim and counterclaim - The

dispute continues to be subject to arbitration. The Company intends to continue

to defend vigorously its position that Microgil’s claim is without merit.

dispute continues to be subject to arbitration. The Company intends to continue

to defend vigorously its position that Microgil’s claim is without merit.

§ Securities class action claim - The company and managers are subject to a

putative securities class action claim in the U.S. District Court for the Southern

District of New York related to losses allegedly suffered as a result of the decline

in the Company's share price following the publication of the Spruce Point report

on August 19, 2015. The plaintiffs allege, based on statements in the Spruce

Point report, that there were material misstatement or omissions in the

Company's securities filings. The Company believes the claim is without merit

and intends to contest it vigorously.

putative securities class action claim in the U.S. District Court for the Southern

District of New York related to losses allegedly suffered as a result of the decline

in the Company's share price following the publication of the Spruce Point report

on August 19, 2015. The plaintiffs allege, based on statements in the Spruce

Point report, that there were material misstatement or omissions in the

Company's securities filings. The Company believes the claim is without merit

and intends to contest it vigorously.

•

*For additional information related to legal proceedings - see the Company’s annual report on Form 20-F

28

28

Caesarstone’s Growth Prospects

• Strengthen the brand through investment in strong R&D and continue developing

innovative new colors, designs, and textures

innovative new colors, designs, and textures

• Increase awareness of our premium brand by continuing to focus on quality,

service and implementation of our proven marketing approach

service and implementation of our proven marketing approach

Premium

Brand

• Execute on the U.S. and Canadian opportunity, as well as grow our footprint in

other markets

other markets

• Continue to expand direct distribution coverage in the U.S.

Market

Penetration

Penetration

• Extend our global presence through entry into new geographies and increase our

reach in recently entered markets

reach in recently entered markets

• Find new markets that meet our criteria of having existing demand for stone

products, strong economic growth rates, and high GDP per capita

products, strong economic growth rates, and high GDP per capita

Global

Footprint

Footprint

Selective

Acquisitions

Acquisitions

• Pursue selective acquisitions of manufacturers in order to build scale, enhance

our marketing/distribution, accelerate global expansion

our marketing/distribution, accelerate global expansion

29

29

Thank You.

30

30

(1) Consists of our portion of the results of operations of Caesarstone USA prior to its acquisition by us in May 2011.

(2) Consists of charges to cost of goods sold for the difference between the higher carrying cost of the inventory of two of the Company's subsidiaries- Caesarstone USA's inventory at the time of its acquisition and

inventory that was purchased from its distributor and Caesarstone Australia Pty Limited's inventory that was purchased from its distributor, and the standard cost of the Company's inventory-which adversely

impacts the Company's gross margins until such inventory is sold. The majority of the inventory acquired from Caesarstone USA was sold in 2011, and the majority of the inventory acquired from the Australian

distributor was sold in 2012.

inventory that was purchased from its distributor and Caesarstone Australia Pty Limited's inventory that was purchased from its distributor, and the standard cost of the Company's inventory-which adversely

impacts the Company's gross margins until such inventory is sold. The majority of the inventory acquired from Caesarstone USA was sold in 2011, and the majority of the inventory acquired from the Australian

distributor was sold in 2012.

(3) In 2013, share-based compensation consists of expenses related to the stock options granted to employees of the Company. In 2014, share-based compensation consists primarily of expenses related to the

stock options granted to employees of the Company, as well as expenses related to share-based rights granted during the period.

stock options granted to employees of the Company, as well as expenses related to share-based rights granted during the period.

(4) Relates to a change in estimate for the value of inventory following the implementation of the Company's new ERP system in April 2013.

(5) In 2013, consists of direct expenses related to a follow-on offering that closed in April 2013, including a bonus paid by the Company' former shareholder, Tene, to certain of its employees that under US GAAP

the Company is required to expense against paid-in capital. In 2014, consists of direct expenses related to a follow-on offering that closed in June 2014.

the Company is required to expense against paid-in capital. In 2014, consists of direct expenses related to a follow-on offering that closed in June 2014.

(6) Consists of the payment of $1.72 million to certain employees of the Company and $0.25 million to the Company's Chairman for their contribution to the completion of the Company's initial public offering, or

IPO.

IPO.

(7) Relates to the change in fair value of the contingent consideration that was part of the consideration transferred in connection with the acquisition of Caesarstone USA.

(8) In 2011, litigation gain consists of a mediation award in the Company's favor pursuant to two trademark infringement cases brought by Caesarstone Australia Pty Limited. In 2012, litigation gain resulted from a

settlement agreement with the former chief excecutive officer of Caesarstone Australia Pty Limited related to litigation that had been commenced in 2010. Pursuant to the settlement, he transferred to the

Company the ownership of all his shares in Caesarstone Australia Pty Limited received in connection with his employment. The Company did not make any payments in connection with such transfer or other

payments to the former chief executive officer. As a result of the settlement, the Company reversed the liability provision in connection with the litigation and the adjustment is presented net of the related

litigation expenses incurred in connection with the settlement.

settlement agreement with the former chief excecutive officer of Caesarstone Australia Pty Limited related to litigation that had been commenced in 2010. Pursuant to the settlement, he transferred to the

Company the ownership of all his shares in Caesarstone Australia Pty Limited received in connection with his employment. The Company did not make any payments in connection with such transfer or other

payments to the former chief executive officer. As a result of the settlement, the Company reversed the liability provision in connection with the litigation and the adjustment is presented net of the related

litigation expenses incurred in connection with the settlement.

(9) Relates to our writing down to zero the cost of inventory provided to Microgil, our former third-party quartz processor in Israel, in 2011 in the amount of $1.8 million and our writing down to zero our $1.1 million

loan to Microgil, in each case, in connection with a dispute.

loan to Microgil, in each case, in connection with a dispute.

(10) Relates to an adjustment of provision for taxable employee fringe benefits as a result of a settlement with the Israel Tax Authority and with the National Insurance Intitute of Israel.

(11) Relates to a refund of Israeli value added tax (VAT) associated with a bad debt from 2007

31

31

(1) Consists of charges to cost of goods sold for the difference between the higher carrying cost of the inventory of two of the Company's subsidiaries- Caesarstone USA's inventory at the time of its acquisition and

inventory that was purchased from its distributor and Caesarstone Australia Pty Limited's inventory that was purchased from its distributor, and the standard cost of the Company's inventory-which adversely

impacts the Company's gross margins until such inventory is sold. The majority of the inventory acquired from Caesarstone USA was sold in 2011, and the majority of the inventory acquired from the Australian

distributor was sold in 2012.

inventory that was purchased from its distributor and Caesarstone Australia Pty Limited's inventory that was purchased from its distributor, and the standard cost of the Company's inventory-which adversely

impacts the Company's gross margins until such inventory is sold. The majority of the inventory acquired from Caesarstone USA was sold in 2011, and the majority of the inventory acquired from the Australian

distributor was sold in 2012.

(2) In 2013, share-based compensation consists of expenses related to the stock options granted to employees of the Company. In 2014, share-based compensation consists primarily of expenses related to the stock

options granted to employees of the Company, as well as expenses related to share-based rights granted during the period.

options granted to employees of the Company, as well as expenses related to share-based rights granted during the period.

(3) Consists of the payment of $1.72 million to certain employees of the Company and $0.25 million to the Company's Chairman for their contribution to the completion of the Company's IPO.

(4) Relates to the change in fair value of the contingent consideration that was part of the consideration transferred in connection with the acquisition of Caesarstone USA.

(5) Relates to a change in estimate for the value of inventory following the implementation of the Company's new ERP system in April 2013.

(6) In 2013, consists of direct expenses related to a follow on-offering that closed in April 2013, including a bonus paid by the Company' former shareholder, Tene, to certain of its employees that under US GAAP the

Company is required to expense against paid-in capital. In 2014, consists of direct expenses related to a follow on offering that closed in June 2014.

Company is required to expense against paid-in capital. In 2014, consists of direct expenses related to a follow on offering that closed in June 2014.

(7) In 2011, litigation gain consists of a mediation award in the Company's favor pursuant to two trademark infringement cases brought by Caesarstone Australia Pty Limited. In 2012, litigation gain resulted from a

settlement agreement with the former chief excecutive officer of Caesarstone Australia Pty Limited related to litigation that had been commenced in 2010. Pursuant to the settlement, he transferred to the Company

the ownership of all his shares in Caesarstone Australia Pty Limited received in connection with his employment. The Company did not make any payments in connection with such transfer or other payments to the

former chief executive officer. As a result of the settlement, the Company reversed the liability provision in connection with the litigation and the adjustment is presented net of the related litigation expenses incurred

in connection with the settlement.

settlement agreement with the former chief excecutive officer of Caesarstone Australia Pty Limited related to litigation that had been commenced in 2010. Pursuant to the settlement, he transferred to the Company

the ownership of all his shares in Caesarstone Australia Pty Limited received in connection with his employment. The Company did not make any payments in connection with such transfer or other payments to the

former chief executive officer. As a result of the settlement, the Company reversed the liability provision in connection with the litigation and the adjustment is presented net of the related litigation expenses incurred

in connection with the settlement.

(8) Relates to our writing down to zero the cost of inventory provided to Microgil, our former third-party quartz processor in Israel, in 2011 in the amount of $1.8 million and our writing down to zero our $1.1 million loan

to Microgil, in each case, in connection with a dispute.

to Microgil, in each case, in connection with a dispute.

(9) Relates to an adjustment of provision for taxable employee fringe benefits as a result of a settlement with the Israel Tax Authority and with the National Insurance Intitute of Israel.

(10) Relates to a refund of Israeli value added tax (VAT) associated with a bad debt from 2007

(11) Tax adjustment as a result of tax settlement with the Israeli tax authorities.

(12) The tax adjustments for the three and Twelve months ended December 31, 2014 and 2013 were based on the effective tax rate (excluding adjustments to the tax line item) for these periods, respectively.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- CARFAX Canada Launches Exciting New Partnership with Copart Canada

- Rising Malaria Threat: International SOS Shares Advice on How to Keep Your Workforce Healthy

- iQor Wins 2024 Bronze Stevie® Award for Sales & Customer Service

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share