Form 6-K CREDIT SUISSE GROUP AG For: Dec 07 Filed by: CREDIT SUISSE AG

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

UNDER THE SECURITIES EXCHANGE ACT OF 1934

December 7, 2016

Commission File Number 001-15244

CREDIT SUISSE GROUP AG

(Translation of registrant’s name into English)

Paradeplatz 8, CH 8001 Zurich, Switzerland

(Address of principal executive office)

(Address of principal executive office)

Commission File Number 001-33434

CREDIT SUISSE AG

(Translation of registrant’s name into English)

Paradeplatz 8, CH 8001 Zurich, Switzerland

(Address of principal executive office)

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or

Form 40-F.

Form 40-F.

Form 20-F  Form 40-F

Form 40-F

Form 40-F

Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

This report includes the slides for the presentation to investors in connection with Investor Day 2016 on December 7, 2016.

Credit Suisse Investor Day 2016Tidjane Thiam, CEO Credit Suisse December 7, 2016

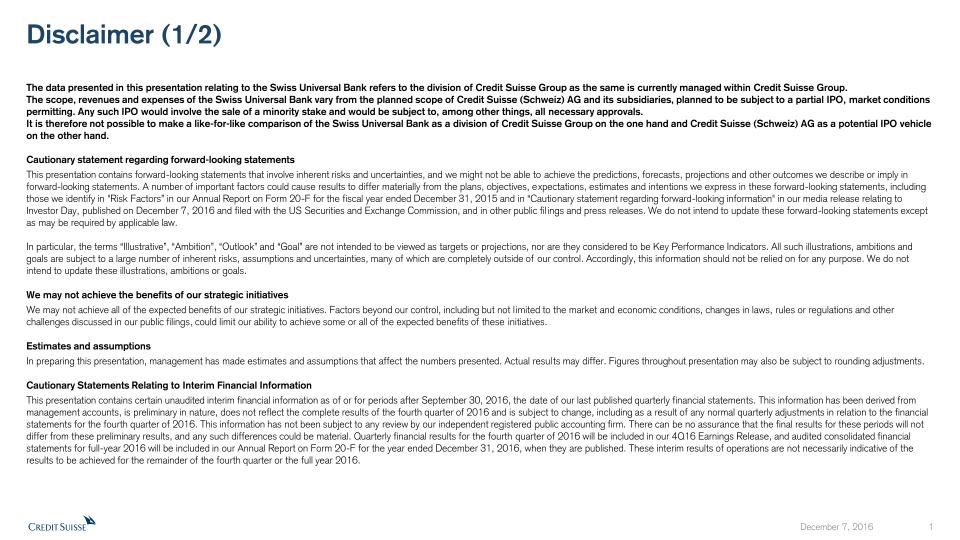

Disclaimer (1/2) The data presented in this presentation relating to the Swiss Universal Bank refers to the division of Credit Suisse Group as the same is currently managed within Credit Suisse Group. The scope, revenues and expenses of the Swiss Universal Bank vary from the planned scope of Credit Suisse (Schweiz) AG and its subsidiaries, planned to be subject to a partial IPO, market conditions permitting. Any such IPO would involve the sale of a minority stake and would be subject to, among other things, all necessary approvals.It is therefore not possible to make a like-for-like comparison of the Swiss Universal Bank as a division of Credit Suisse Group on the one hand and Credit Suisse (Schweiz) AG as a potential IPO vehicle on the other hand.Cautionary statement regarding forward-looking statements This presentation contains forward-looking statements that involve inherent risks and uncertainties, and we might not be able to achieve the predictions, forecasts, projections and other outcomes we describe or imply in forward-looking statements. A number of important factors could cause results to differ materially from the plans, objectives, expectations, estimates and intentions we express in these forward-looking statements, including those we identify in "Risk Factors” in our Annual Report on Form 20-F for the fiscal year ended December 31, 2015 and in “Cautionary statement regarding forward-looking information" in our media release relating to Investor Day, published on December 7, 2016 and filed with the US Securities and Exchange Commission, and in other public filings and press releases. We do not intend to update these forward-looking statements except as may be required by applicable law. In particular, the terms “Illustrative”, “Ambition”, “Outlook” and “Goal” are not intended to be viewed as targets or projections, nor are they considered to be Key Performance Indicators. All such illustrations, ambitions and goals are subject to a large number of inherent risks, assumptions and uncertainties, many of which are completely outside of our control. Accordingly, this information should not be relied on for any purpose. We do not intend to update these illustrations, ambitions or goals.We may not achieve the benefits of our strategic initiativesWe may not achieve all of the expected benefits of our strategic initiatives. Factors beyond our control, including but not limited to the market and economic conditions, changes in laws, rules or regulations and other challenges discussed in our public filings, could limit our ability to achieve some or all of the expected benefits of these initiatives. Estimates and assumptionsIn preparing this presentation, management has made estimates and assumptions that affect the numbers presented. Actual results may differ. Figures throughout presentation may also be subject to rounding adjustments. Cautionary Statements Relating to Interim Financial InformationThis presentation contains certain unaudited interim financial information as of or for periods after September 30, 2016, the date of our last published quarterly financial statements. This information has been derived from management accounts, is preliminary in nature, does not reflect the complete results of the fourth quarter of 2016 and is subject to change, including as a result of any normal quarterly adjustments in relation to the financial statements for the fourth quarter of 2016. This information has not been subject to any review by our independent registered public accounting firm. There can be no assurance that the final results for these periods will not differ from these preliminary results, and any such differences could be material. Quarterly financial results for the fourth quarter of 2016 will be included in our 4Q16 Earnings Release, and audited consolidated financial statements for full-year 2016 will be included in our Annual Report on Form 20-F for the year ended December 31, 2016, when they are published. These interim results of operations are not necessarily indicative of the results to be achieved for the remainder of the fourth quarter or the full year 2016.

Disclaimer (2/2) Statement regarding non-GAAP financial measures This presentation also contains non-GAAP financial measures, including adjusted results. Information needed to reconcile such non-GAAP financial measures to the most directly comparable measures under US GAAP or a reference thereto can be found in this presentation in the Appendix, which is available on our website at credit-suisse.com.Statement regarding capital, liquidity and leverage As of January 1, 2013, Basel 3 was implemented in Switzerland along with the Swiss “Too Big to Fail” legislation and regulations thereunder (in each case, subject to certain phase-in periods). As of January 1, 2015, the Bank for International Settlements (BIS) leverage ratio framework, as issued by the Basel Committee on Banking Supervision (BCBS), was implemented in Switzerland by FINMA. Our related disclosures are in accordance with our interpretation of such requirements, including relevant assumptions. Changes in the interpretation of these requirements in Switzerland or in any of our assumptions or estimates could result in different numbers from those shown in this presentation. Capital and ratio numbers for periods prior to 2013 are based on estimates, which are calculated as if the Basel 3 framework had been in place in Switzerland during such periods. Unless otherwise noted, leverage exposure is based on the BIS leverage ratio framework and consists of period-end balance sheet assets and prescribed regulatory adjustments. Leverage amounts for 4Q14, which are presented in order to show meaningful comparative information, are based on estimates which are calculated as if the BIS leverage ratio framework had been implemented in Switzerland at such time. Beginning in 2015, the Swiss leverage ratio is calculated as Swiss total capital, divided by period-end leverage exposure. The look-through BIS tier 1 leverage ratio and CET1 leverage ratio are calculated as look-through BIS tier 1 capital and CET1 capital, respectively, divided by end-period leverage exposure. Selling restrictions This document, and the information contained herein, is not an offer to sell or a solicitation of offers to purchase or subscribe for securities of Credit Suisse Group AG or Credit Suisse (Schweiz) AG in Switzerland, the United States or any other jurisdiction. This document is not a prospectus within the meaning of article 652a of the Swiss Code of Obligations, nor is it a listing prospectus as defined in the listing rules of the SIX Swiss Exchange AG or any other exchange or regulated trading facility in Switzerland or a prospectus or offering document under any other applicable laws. Copies of this document may not be sent to jurisdictions, or distributed in or sent from jurisdictions, in which such documents are barred or prohibited by law. A decision to invest in securities of Credit Suisse Group AG or Credit Suisse (Schweiz) AG should be based exclusively on a written agreement with Credit Suisse Group AG or an offering and listing prospectus to be published by Credit Suisse Group AG or Credit Suisse (Schweiz) AG for such purpose. Any offer and sale of securities of Credit Suisse (Schweiz) AG will not be registered under the U.S. Securities Act of 1933, as amended, and may not be offered in the United States of America absent such registration or an exemption from registration. There will be no public offering of such securities in the United States of America.

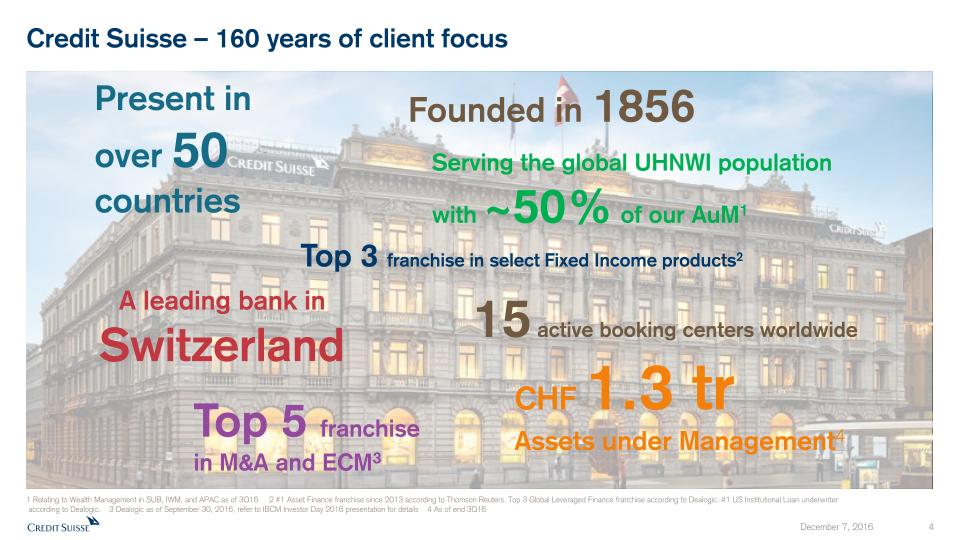

Credit Suisse – 160 years of client focus Founded in 1856 Top 5 franchise in M&A and ECM3 15 active booking centers worldwide CHF 1.3 tr Assets under Management4 Present in over 50 countries Serving the global UHNWI population with ~50% of our AuM1 A leading bank in Switzerland Top 3 franchise in select Fixed Income products2 1 Relating to Wealth Management in SUB, IWM, and APAC as of 3Q16 2 #1 Asset Finance franchise since 2013 according to Thomson Reuters. Top 3 Global Leveraged Finance franchise according to Dealogic. #1 US Institutional Loan underwriter according to Dealogic. 3 Dealogic as of September 30, 2016, refer to IBCM Investor Day 2016 presentation for details 4 As of end 3Q16

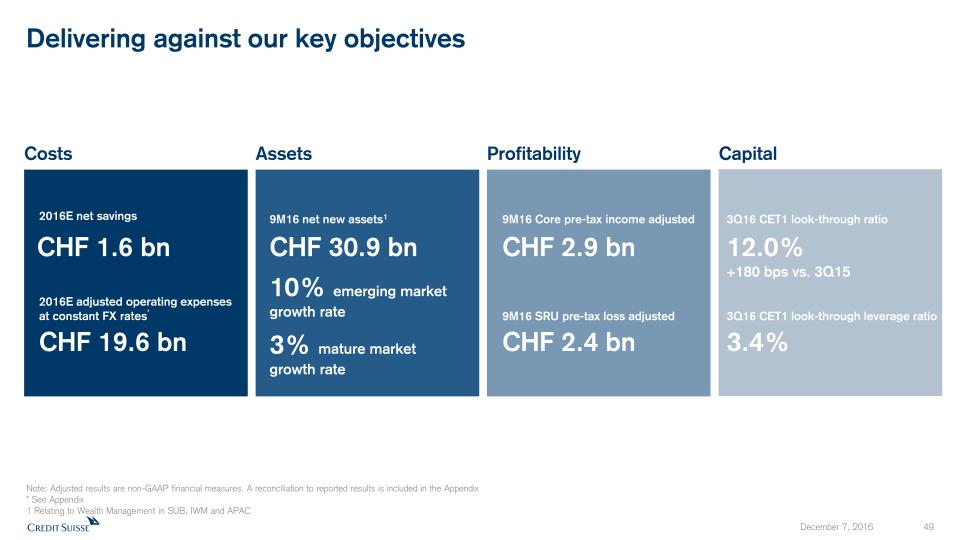

Delivering against our key objectives Costs CHF 19.6 bn 2016E adjusted operating expensesat constant FX rates* 2016E net savings CHF 1.6 bn CHF 2.9 bn 9M16 Core pre-tax income adjusted Profitability CHF 2.4 bn 9M16 SRU pre-tax loss adjusted Note: Adjusted results are non-GAAP financial measures. A reconciliation to reported results is included in the Appendix * See Appendix1 Relating to Wealth Management in SUB, IWM and APAC 3Q16 CET1 look-through ratio 12.0%+180 bps vs. 3Q15 Capital 3.4% 3Q16 CET1 look-through leverage ratio Assets 9M16 net new assets1 CHF 30.9 bn10% emerging market growth rate3% mature market growth rate

By end 2016, we will have achieved CHF 1.6 bn of net cost savings and are further raising our ambition to increase operating leverage 2015-18cost reduction program*in CHF bn, year-end Target total net cost savings have increased from CHF 2.0 bn to CHF >4.2 bn by 2018 Note: Cost reduction program measured in constant FX rates and based on expense run rate excluding major litigation expenses, restructuring costs and a goodwill impairment taken in 4Q15, but including other costs to achieve savings. Adjusted results are non-GAAP financial measures. A reconciliation to reported results is included in the Appendix.* See Appendix 1.6 >4.2 2015 2016E Prior 2018 Target (ID 2015) 2018 Target (new)

Exceeding our 2016 net headcount reduction target Net reduction to global headcount in 2016 Note: Headcount includes permanent full-time equivalent employees, contractors, consultants and other contingent workers 1 Includes departed and notified headcount 2016 Target Global Markets Accelerated Restructuring(March 2016) Prior 2016 Target(Investor Day 2015) 6,000 2,000 4,000 6,050 December 4,20161

While reducing costs, we have continued to invest in our client franchise and absorbed regulatory needs Note: Adjusted results are non-GAAP financial measures. A reconciliation to reported results is included in the Appendix. Annualized numbers do not take account of variations in operating results, seasonality and other factors and may not be indicative of actual, full-year results.* See Appendix Adjusted operatingexpenses at constantFX rates*in CHF bn Strengthening of controls Net cost savings 2016E 1.6 Investment in growth Gross cost savings 2016E 2.1

Restructuring costs progressionin CHF bn Restructuring costs expected to decrease in 2018 0.6 0.6 0.3 0.4 Severance Real Estate Other Estimated restructuring costs: CHF 1.9 bn

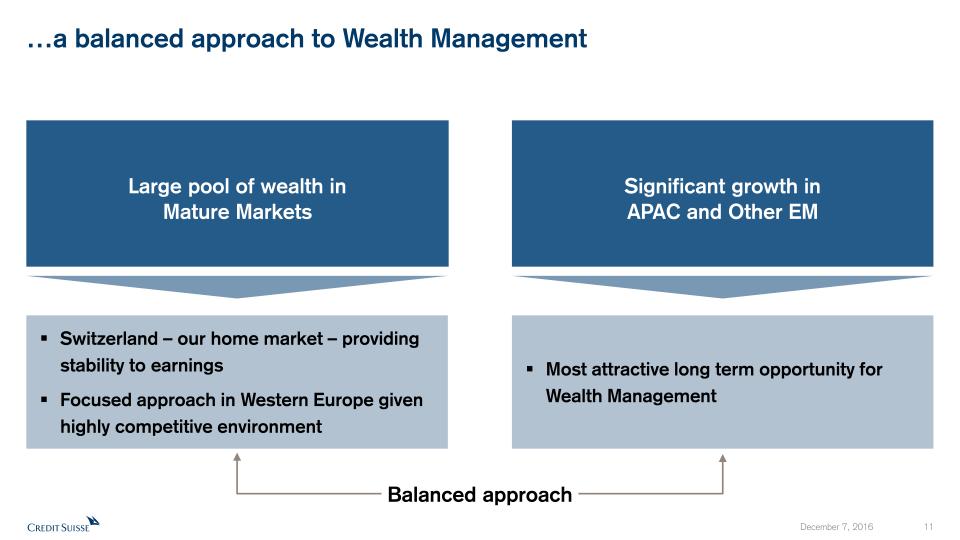

Our strategy… Be a leading Private Bankand Wealth Manager… …with strong Investment Banking capabilities

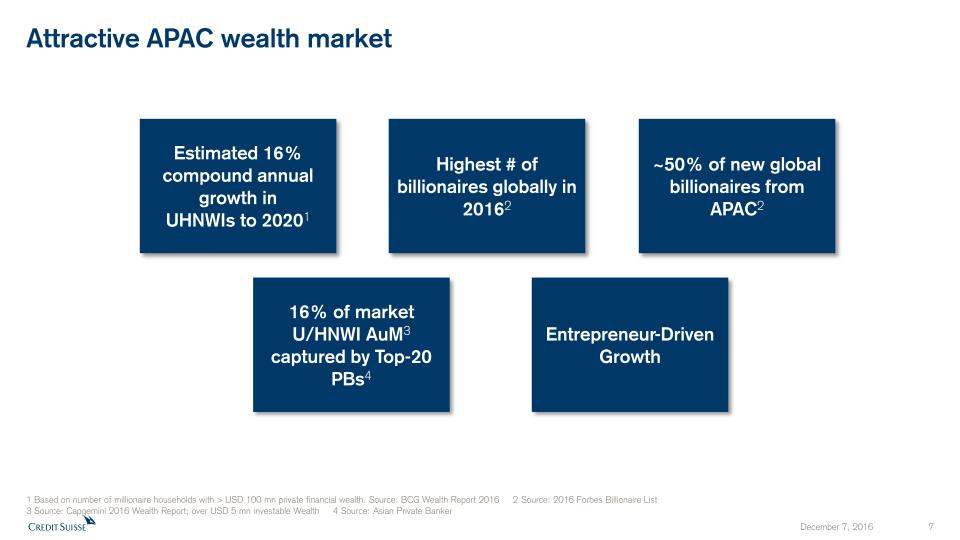

…a balanced approach to Wealth Management Significant growth in APAC and Other EM Most attractive long term opportunity for Wealth Management Large pool of wealth in Mature Markets Switzerland – our home market – providing stability to earningsFocused approach in Western Europe given highly competitive environment Balanced approach

GM maintains strong client franchises across equities and fixed income #1 Asset Finance franchise since 20134 #3 Issuerof US Structured Notes3 #2 Client rankingin Global Cashsince 20071 Top 3 Global Prime Brokerage since 20122 Bank of the year: Structured Products Most InnovativeBank for Securitisation GM SUB IWM APAC SRU IBCM 1 Third Party Competitive Analysis2 Hedge Fund Intelligence / Absolute Return / EuroHedge3 Bloomberg Brief Ranking, November 23, 20164 Thomson Reuters, 2013 to 3Q16

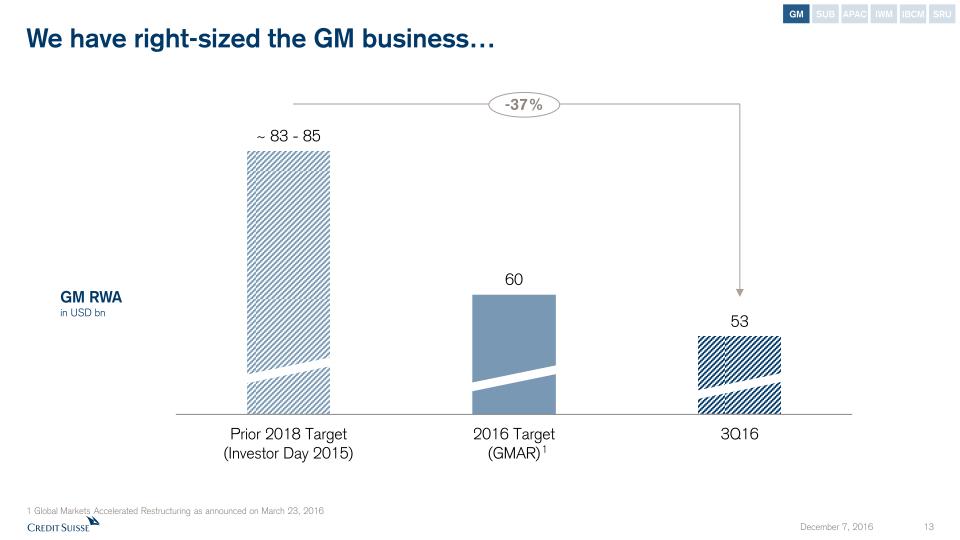

We have right-sized the GM business… -37% 1 Global Markets Accelerated Restructuring as announced on March 23, 2016 1 GM RWAin USD bn GM SUB APAC IWM SRU IBCM

GM Credit products net revenues in USD mn …while maintaining strong positions in our core franchises… GM Cash Equities net revenues1 in USD mn 1 Relating to Americas and EMEA GM SUB APAC IWM SRU IBCM

…and increasing positive operating leverage 9M16 Annualized2 2018Ambition 6.0 5.4 < 4.8 2015 Note: Adjusted results are non-GAAP financial measures. A reconciliation to reported results is included in the Appendix1 Expenses post Global Markets Accelerated Restructuring 2 Annualized numbers do not take account of variations in operating results, seasonality and other factors and may not be indicative of actual, full-year results Total adjusted operating expenses1in USD bn GM SUB APAC IWM SRU IBCM

GM – Key takeaways Strong client franchiseRight-sizing and derisking nearing completionOperating leverage materially increasedUpside from working more closely across divisionsProspects are positive, targeting Return on Regulatory Capital† between 10-15% by end-2018 † See Appendix GM SUB APAC IWM SRU IBCM

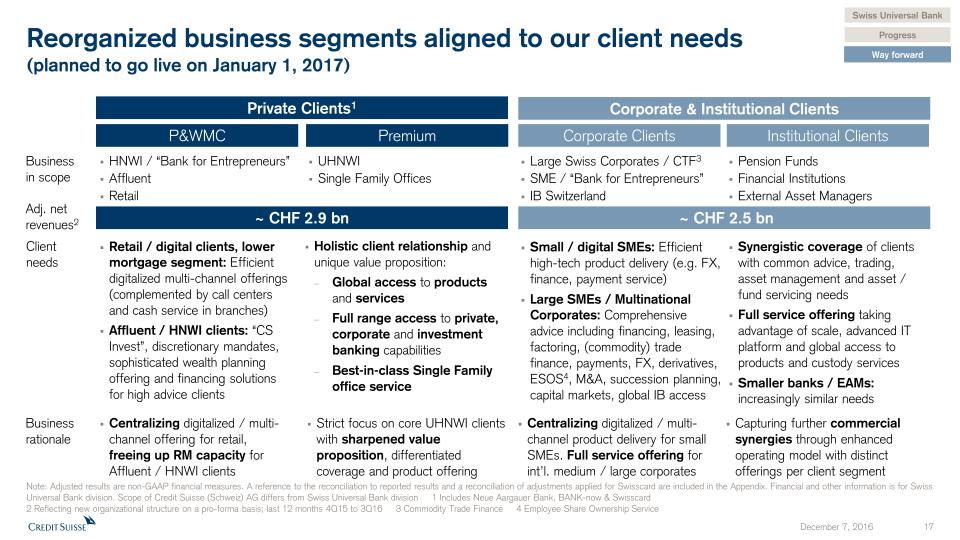

Market-leading positions in Switzerland #1 External Asset Managers #2 Mid / large SMEs #1 Institutionals #2 UHNWI #1 Investment Banking #2 Retail, Affluent & HNWI #2 Large Corporates GM SUB APAC IWM SRU IBCM 1 Source: Private Clients, Mid / Large SME, Large Corporates, Institutional Clients: The Boston Consulting Group; based on revenues 2 Source: Equity Capital Markets (ECM): Dealogic; Debt Capital Markets (DCM): IFR; M&A: Thomson Securities, SDC Platinum, Credit Suisse; based on deal volumes January 1 – December 23, 2015 3 Incl. Affiliates (BANK-now, Swisscard, Neue Aargauer Bank) 4 Small and Medium Enterprises 5 Excl. CS Asset Management Switzerland 6 Swiss-based External Asset Managers only 1 1 2 1,6 1,5 1,3 1,3

Switzerland has the highest average wealth per adult making it an attractive wealth management market China World Europe Germany Sweden France United Kingdom United States Switzerland Wealth per adult among major economies in mid-2016in USD thousands Source: Credit Suisse Global Wealth Databook, 2016 GM SUB APAC IWM SRU IBCM

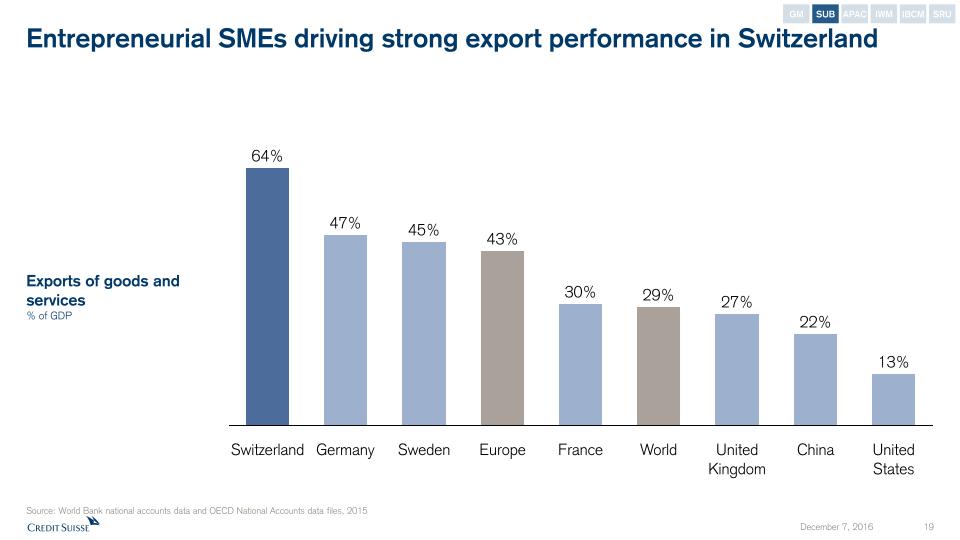

Entrepreneurial SMEs driving strong export performance in Switzerland 22% United Kingdom 27% 30% Sweden Europe 43% World 29% China United States 13% Switzerland 64% Germany 45% France 47% Exports of goods and services% of GDP Source: World Bank national accounts data and OECD National Accounts data files, 2015 GM SUB APAC IWM SRU IBCM

SUB is focused on capturing the wealth opportunity in Switzerland… 3Q15 500 237 263 +6% 3Q16 Private Banking Corporate &Institutional Banking 529 Assets under Managementin CHF bn + 8% + 3% GM SUB APAC IWM SRU IBCM Note: Financial and other information is for Swiss Universal Bank division. Scope of Credit Suisse (Schweiz) AG differs from Swiss Universal Bank division

…and is executing with discipline… Adjusted operatingexpenses1in CHF mn 9M16 2,609 Savings Regulatory, compliance & digitalization 9M15 2,697 Note: Adjusted results are non-GAAP financial measures. A reference to the reconciliation to reported results and a reconciliation of adjustments applied for Swisscard are included in the Appendix. Financial and other information is for Swiss Universal Bank division. Scope of Credit Suisse (Schweiz) AG differs from Swiss Universal Bank division1 Excludes Swisscard impact GM SUB APAC IWM SRU IBCM -3%

…leading to increased profitability +8% +6% +10% 3Q 431 400 2Q 457 432 1Q 472 431 2016 2015 SUB adjusted pre-tax income1in CHF mn Note: Adjusted results are non-GAAP financial measures. A reference to the reconciliation to reported results and a reconciliation of adjustments applied for Swisscard are included in the Appendix. Financial and other information is for Swiss Universal Bank division. Scope of Credit Suisse (Schweiz) AG differs from Swiss Universal Bank division1 Excludes Swisscard impact GM SUB APAC IWM SRU IBCM

2018Target 2015 SUB adjusted pre-tax income1in CHF bn Note: Adjusted results are non-GAAP financial measures. A reference to the reconciliation to reported results and a reconciliation of adjustments applied for Swisscard are included in the Appendix. Financial and other information is for Swiss Universal Bank division. Scope of Credit Suisse (Schweiz) AG differs from Swiss Universal Bank division1 Excludes Swisscard impact Confirming our 2018 PTI target GM SUB APAC IWM SRU IBCM

Roadmap to planned IPO June 30, 2017 December 31, 2017 Credit Suisse (Schweiz) AGgo live First published statutory financial statements of Credit Suisse (Schweiz) AG IPO of 20-30%1Market conditions permitting Final calibration of RWA requirements by FINMA Nov 20, 2016 March 24, 2017 March 31, 2017 Further guidance on Credit Suisse (Schweiz) AG financials, key metrics and parameter Intercompany model finalized / Service Company set-up 1 Any such IPO would involve the sale of a minority stake and would be subject to, among other things, all necessary approvals and would be intended to generate / raise additional capital for Credit Suisse AG or Credit Suisse (Schweiz) AG estimated timeline GM SUB APAC IWM SRU IBCM

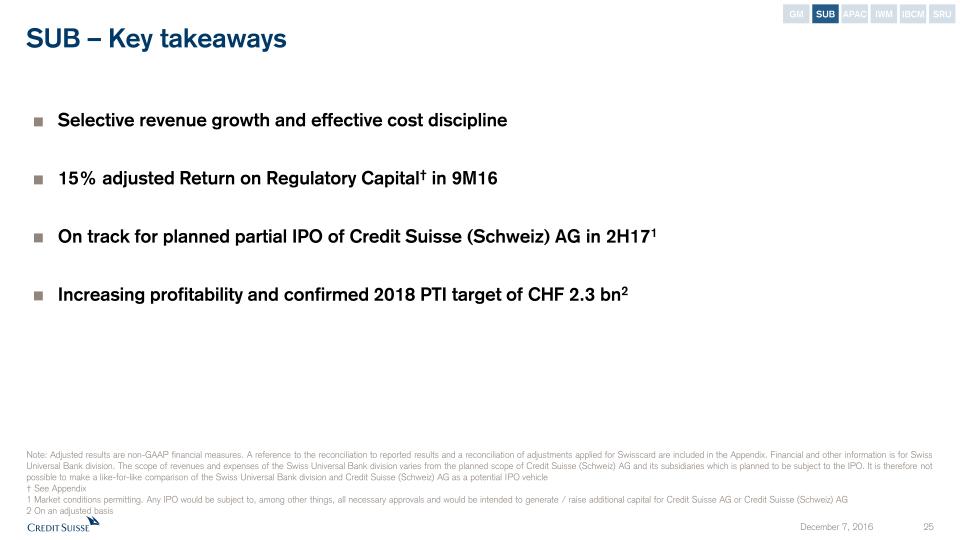

SUB – Key takeaways Selective revenue growth and effective cost discipline15% adjusted Return on Regulatory Capital† in 9M16On track for planned partial IPO of Credit Suisse (Schweiz) AG in 2H171Increasing profitability and confirmed 2018 PTI target of CHF 2.3 bn2 Note: Adjusted results are non-GAAP financial measures. A reference to the reconciliation to reported results and a reconciliation of adjustments applied for Swisscard are included in the Appendix. Financial and other information is for Swiss Universal Bank division. The scope of revenues and expenses of the Swiss Universal Bank division varies from the planned scope of Credit Suisse (Schweiz) AG and its subsidiaries which is planned to be subject to the IPO. It is therefore not possible to make a like-for-like comparison of the Swiss Universal Bank division and Credit Suisse (Schweiz) AG as a potential IPO vehicle† See Appendix1 Market conditions permitting. Any IPO would be subject to, among other things, all necessary approvals and would be intended to generate / raise additional capital for Credit Suisse AG or Credit Suisse (Schweiz) AG2 On an adjusted basis GM SUB APAC IWM SRU IBCM

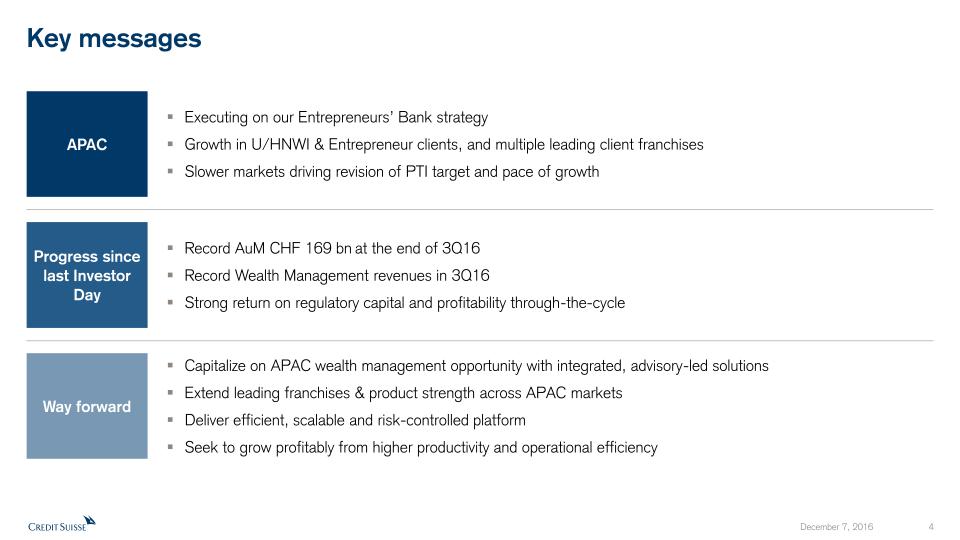

Strong and diversified franchise in APAC 1 Awards for distinction from Asian Private Banker for 2015 2 AsiaRisk magazine October 2016 edition 3 According to cash equities trading information from respective exchanges for period ending September 30, 20164 Source: Dealogic (APAC ex Japan) as of September 30, 2016. Ranking amongst international banks for the first 9 months of 2016 5 As of 3Q16 GM SUB APAC IWM SRU IBCM Wealth Management Investment Banking 2016 House of the Year for Asia ex-Japan2 #1 ranked international Equities broker3 in key markets #1 rank in APAC (ex Japan) in Underwriting & Advisory4 13 locations 7 countries 650 RMs5 Named Best Private Bank in Asia1

Growing billionaire and UHNWI population, with a broad set of financial services needs 2005 x 2.7 2015 APAC1 billionaires (USD 1 bn+) 1 Includes Asia and AustralasiaSource: Knight Frank World Wealth Report, 2016 APAC1 UHNWIs (USD 30 mn+) x 2.4 19,000 45,000 2005 2015 GM SUB APAC IWM SRU IBCM

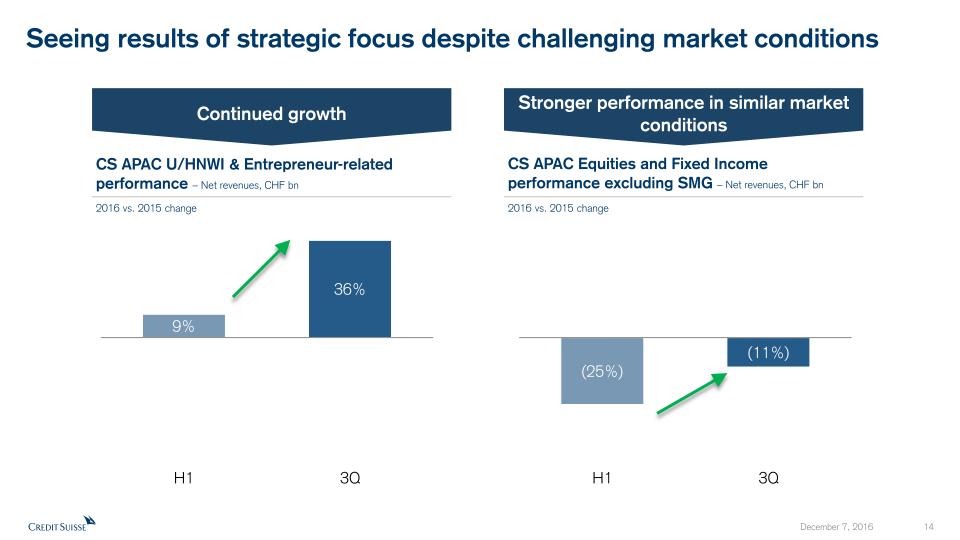

Our clients value our integrated approach Net new assets in CHF bn AuM in CHF bn Net revenues in CHF mn Underwriting &Advisory WM APAC Underwriting & Advisory rank1 #7 #1 1 Source: Dealogic (APAC ex Japan) as of September 30, 2016. Ranking amongst international banks for the first 9 months of 2015 and 2016 +14% +98% 361 461 Total + GM SUB APAC IWM SRU IBCM

2018 PTI target as communicated at the 2015 Investor Day Adjustedpre-tax income in CHF bn Wealth Management Note: Adjusted results are non-GAAP financial measures. A reconciliation to reported results is included in the Appendix1 Including contributions from wealth management connected activities Of which: CHF 0.7 bn Wealth Management1 GM SUB APAC IWM SRU IBCM

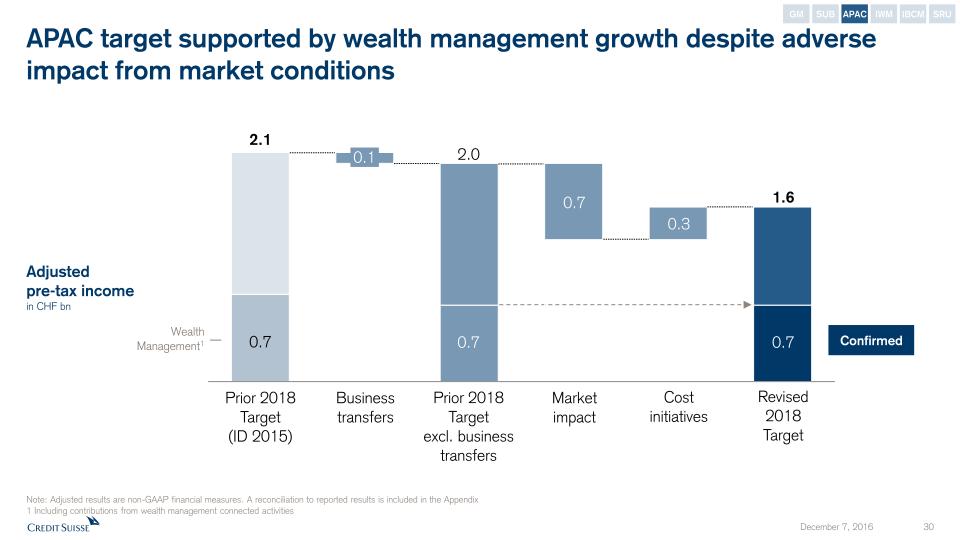

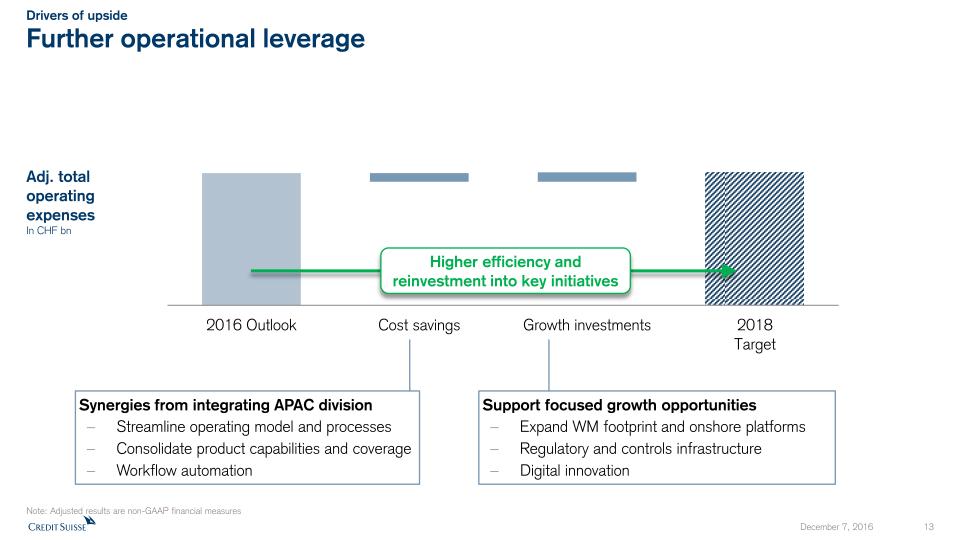

APAC target supported by wealth management growth despite adverse impact from market conditions Note: Adjusted results are non-GAAP financial measures. A reconciliation to reported results is included in the Appendix1 Including contributions from wealth management connected activities Adjustedpre-tax incomein CHF bn Prior 2018 Target excl. business transfers Market impact Revised 2018Target Cost initiatives 2.0 1.6 0.3 0.7 0.7 0.7 Wealth Management1 Business transfers Prior 2018 Target(ID 2015) 2.1 Adjusted Confirmed 0.7 0.1 GM SUB APAC IWM SRU IBCM

APAC – Key takeaways Continued growth in Wealth Management with CHF 17 bn of NNA over past four quarters and record AuM of CHF 169 bn as of end 3Q16Cost savings ambition of CHF 300 mn from efficiencies to operating model expected to be delivered by 20182018 PTI target of CHF 1.6 bn1 reduced for market dependent activities Note: Adjusted results are non-GAAP financial measures. A reconciliation to reported results is included in the Appendix.1 On an adjusted basis GM SUB APAC IWM SRU IBCM

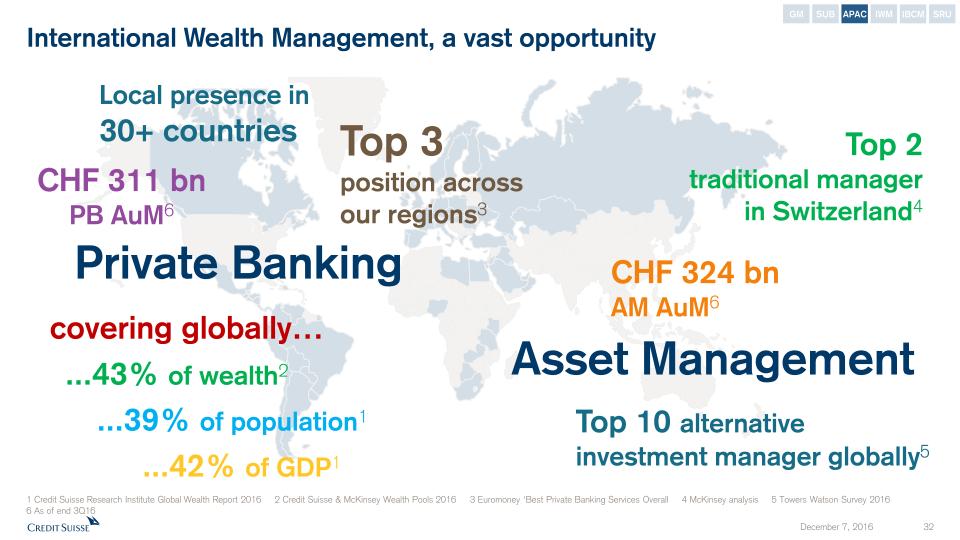

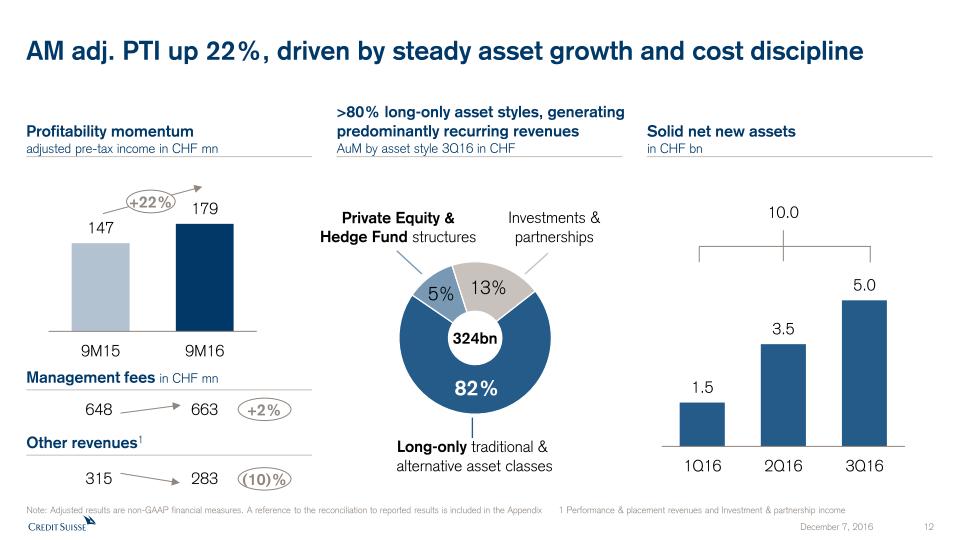

International Wealth Management, a vast opportunity GM SUB APAC IWM SRU IBCM Private Banking Asset Management CHF 324 bn AM AuM6 Top 2traditional managerin Switzerland4 Top 10 alternative investment manager globally5 1 Credit Suisse Research Institute Global Wealth Report 2016 2 Credit Suisse & McKinsey Wealth Pools 2016 3 Euromoney ‘Best Private Banking Services Overall 4 McKinsey analysis 5 Towers Watson Survey 2016 6 As of end 3Q16 CHF 311 bnPB AuM6 covering globally… ...43% of wealth2 ...39% of population1 ...42% of GDP1 Local presence in 30+ countries Top 3position across our regions3

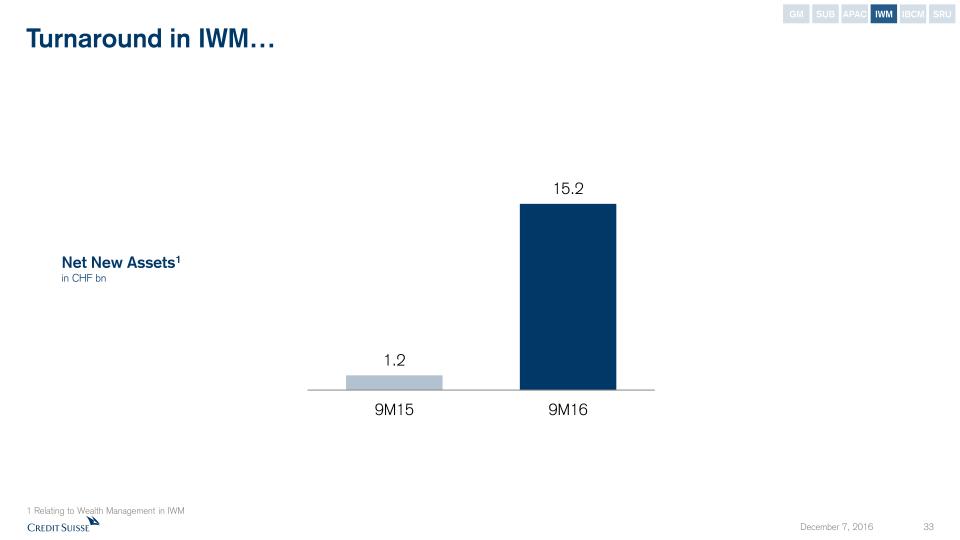

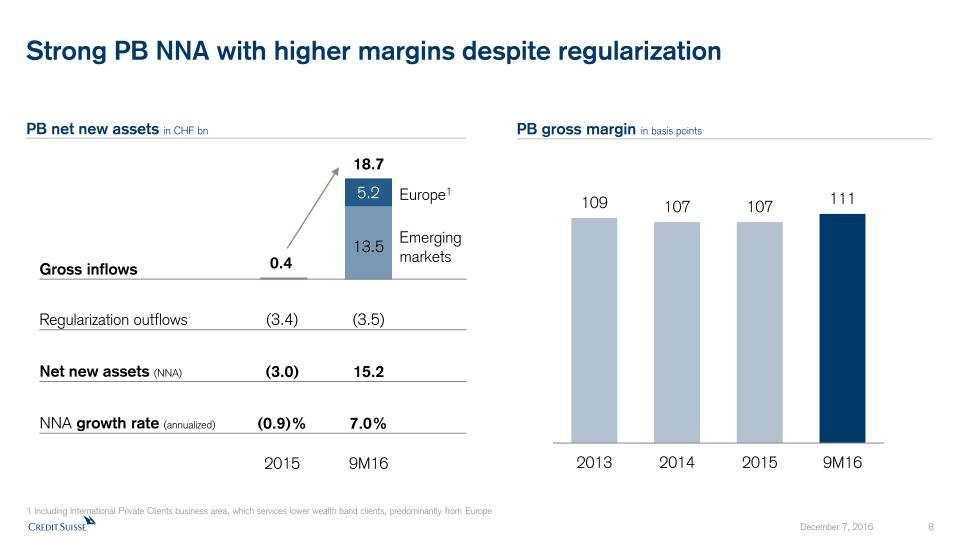

Turnaround in IWM… Net New Assets1in CHF bn 1 Relating to Wealth Management in IWM GM SUB APAC IWM SRU IBCM

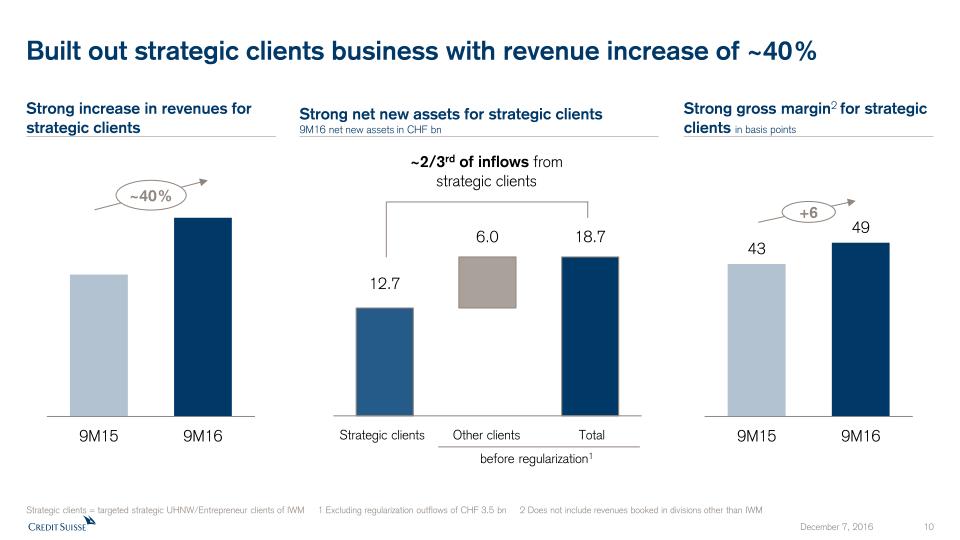

…driven by focus on strategic clients, which has led to significant inflows of net new assets… 1 Relating to Wealth Management in IWM2 Strategic clients = targeted strategic UHNWI/entrepreneur clients of IWM Other clients Strategic clients2 NNA Total Net New Assets1 in 9M16 in CHF bn GM SUB APAC IWM SRU IBCM

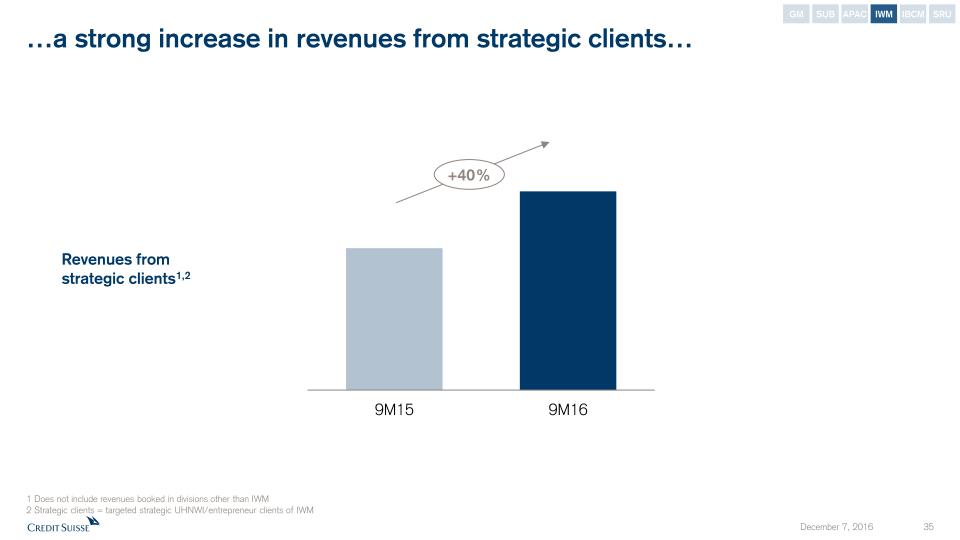

…a strong increase in revenues from strategic clients… +40% Revenues from strategic clients1,2 1 Does not include revenues booked in divisions other than IWM2 Strategic clients = targeted strategic UHNWI/entrepreneur clients of IWM GM SUB APAC IWM SRU IBCM

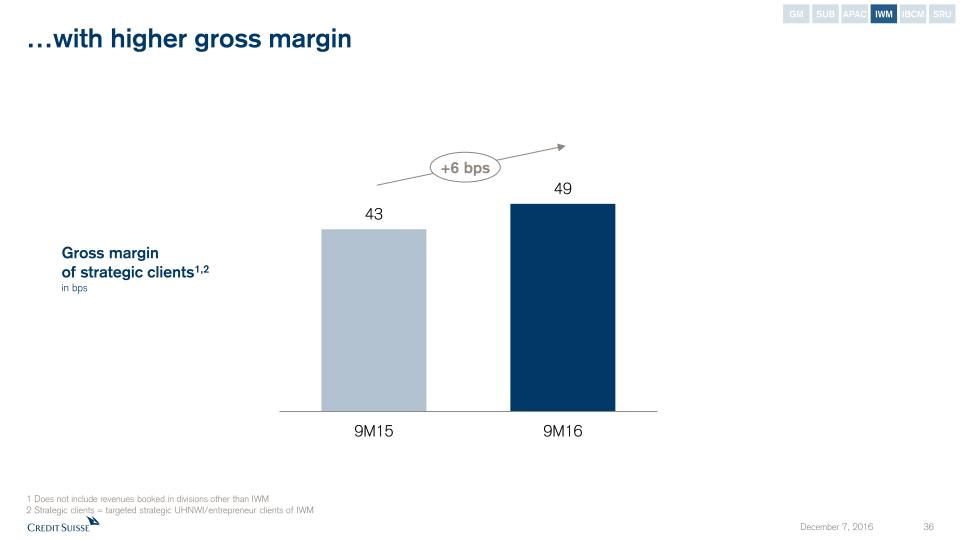

…with higher gross margin 1 Does not include revenues booked in divisions other than IWM2 Strategic clients = targeted strategic UHNWI/entrepreneur clients of IWM +6 bps Gross margin of strategic clients1,2in bps GM SUB APAC IWM SRU IBCM

IWM is lending with discipline 1 Before deducting valuation allowances and deferred fees and costs 2 Includes ship, aviation and export finance 3 9M16, client rate net of reference rate over avg. loan volume Credit volume1 in CHF bn 44 40 Lombard lending Specialty finance2 Mortgages Gross loanrevenue margin3 ~110 bps ~210 bps ~170 bps +11% GM SUB APAC IWM SRU IBCM

IWM is executing with discipline Note: Adjusted results are non-GAAP financial measures. A reconciliation to reported results is included in the Appendix 2.6 2.6 9M15 Costsavings Growth investments 9M16 Stable expenses IWM adjustedoperating expensesin CHF bn GM SUB APAC IWM SRU IBCM

IWM outlook impacted by adverse market environment in near term Note: Adjusted results are non-GAAP financial measures. A reconciliation to reported results is included in the Appendix1 Including additional market related activities Adjustedpre-tax incomein CHF bn Prior 2018 Target(ID 2015) Revised 2018Target 0.4 2.1 1.8 2015 1.0 Asset Management1 0.1 Business transfers GM SUB APAC IWM SRU IBCM

IWM – Key takeaways Integrated approach for strategic clients Strong turnaround in net new assetsDisciplined approach to lending 2018 PTI target of CHF 1.8 bn1, recalibrated for lower performance fees and transaction volumes Note: Adjusted results are non-GAAP financial measures. 1 On an adjusted basis GM SUB APAC IWM SRU IBCM

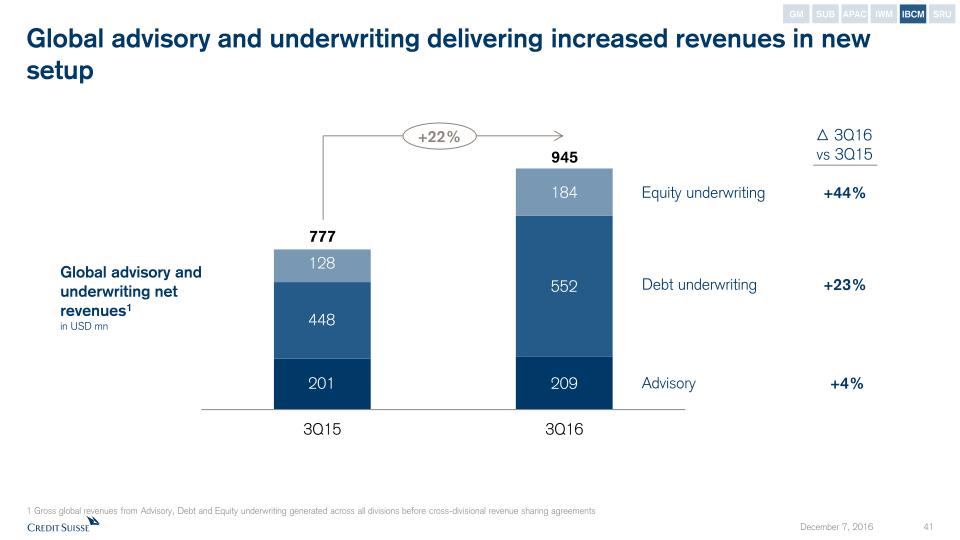

Global advisory and underwriting delivering increased revenues in new setup 1 Gross global revenues from Advisory, Debt and Equity underwriting generated across all divisions before cross-divisional revenue sharing agreements Global advisory and underwriting net revenues1in USD mn Advisory Equity underwriting Debt underwriting 3Q16 vs 3Q15 +4% +44% +23% 448 128 201 +22% GM SUB APAC IWM SRU IBCM

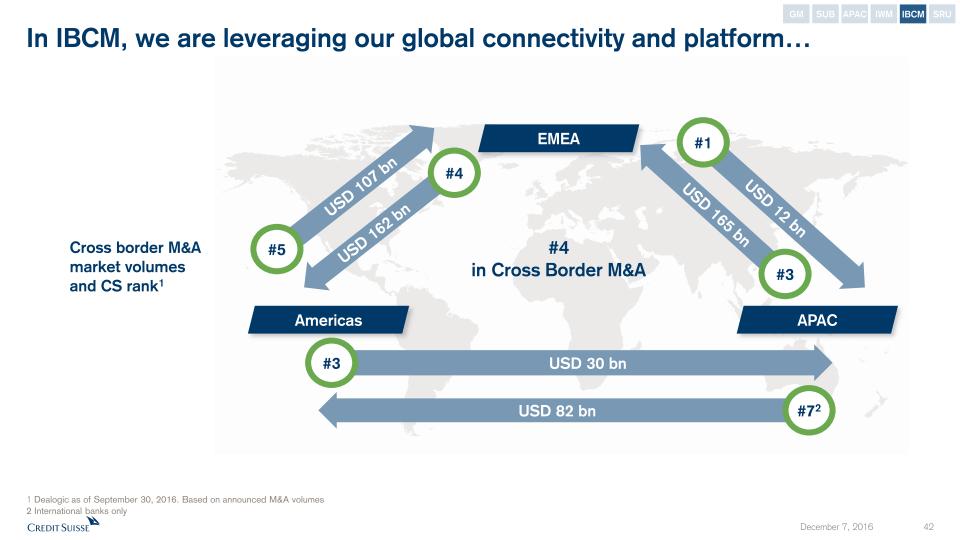

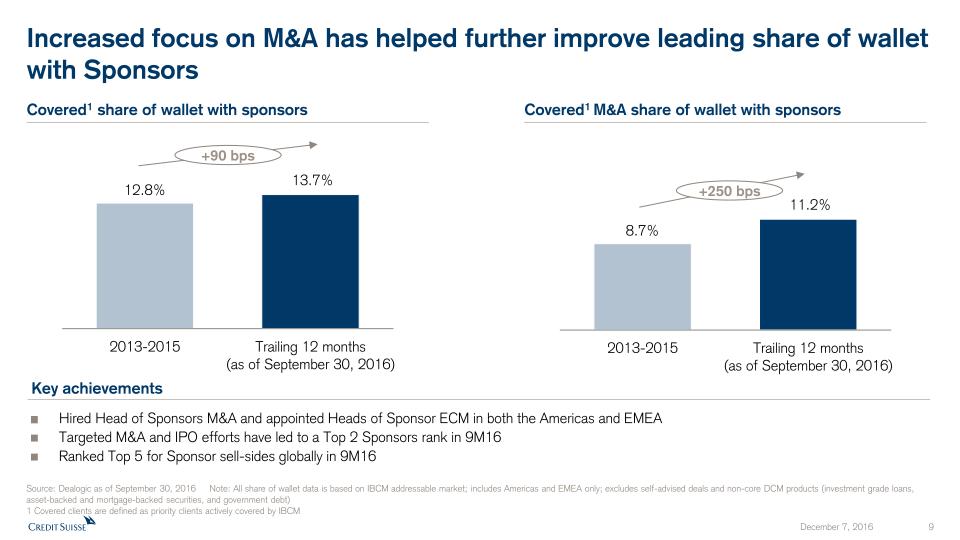

In IBCM, we are leveraging our global connectivity and platform… 1 Dealogic as of September 30, 2016. Based on announced M&A volumes2 International banks only Americas EMEA APAC USD 107 bn USD 162 bn #5 #4 USD 12 bn USD 165 bn #1 #3 USD 30 bn USD 82 bn #3 #72 #4 in Cross Border M&A Cross border M&A market volumes and CS rank1 GM SUB APAC IWM SRU IBCM

CS global M&A announced volume rank Source: Dealogic as of September 30, 2016 Selected recent global transactions Deal value Monsanto USD 66 bn Role: joint lead financial advisor to Bayer, financing Syngenta USD 48 bn Role: financial advisor to ChemChina Spectra Energy USD 47 bn Role: lead financial advisor to Enbridge First Gulf Bank USD 15 bn Role: exclusive financial advisor to National Bank of Abu Dhabi Deals > USD 10 bn EnergyFuture USD 18 bn Role: financial advisor to NextEra …with strong momentum in M&A GM SUB APAC IWM SRU IBCM

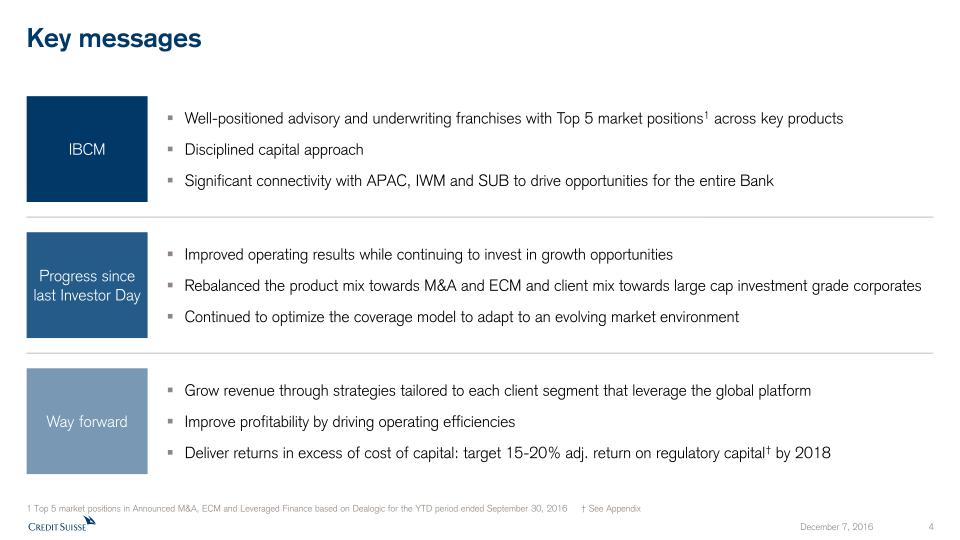

IBCM – Key takeaways Key hires across industry and product groups and successes in announced M&A in 2016Global connectivity for our clients15-20% Return on Regulatory Capital† target by end-2018 † See Appendix GM SUB APAC IWM SRU IBCM

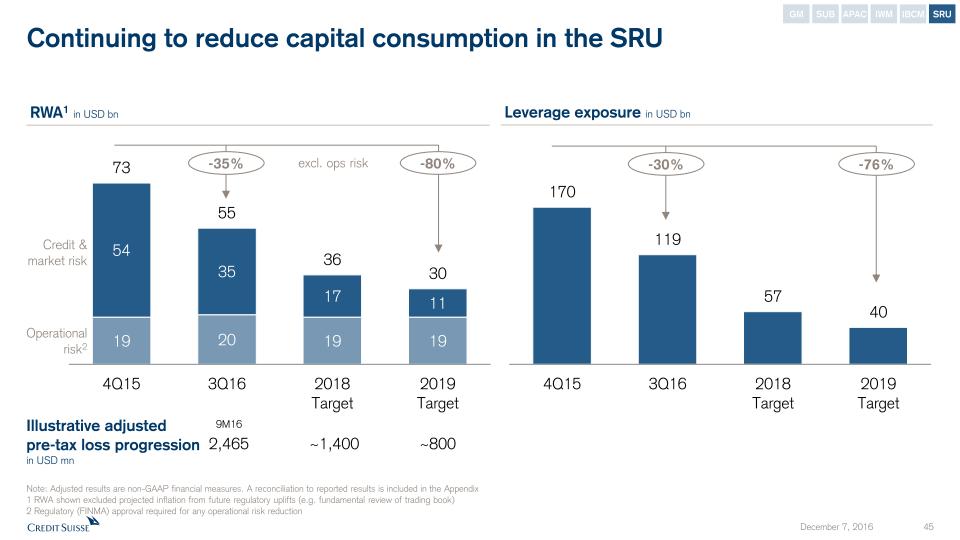

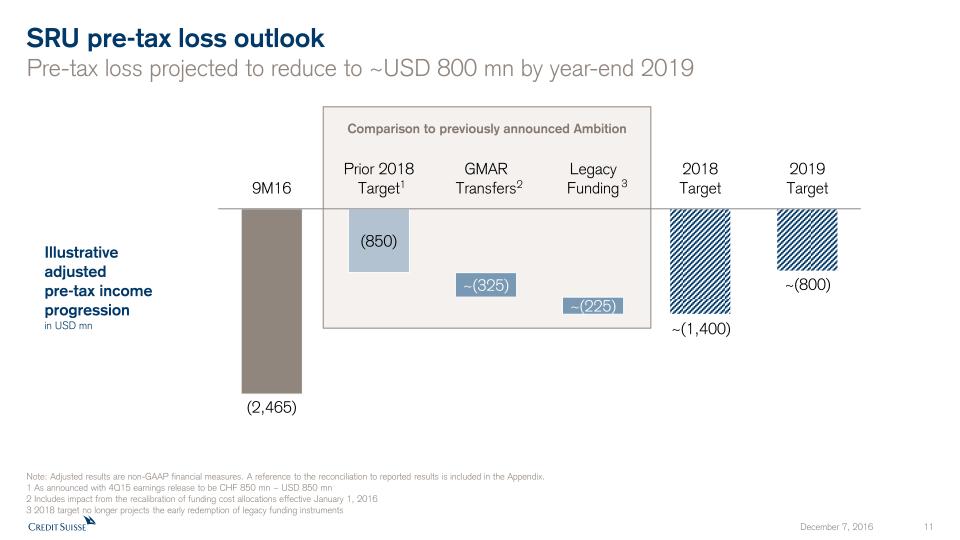

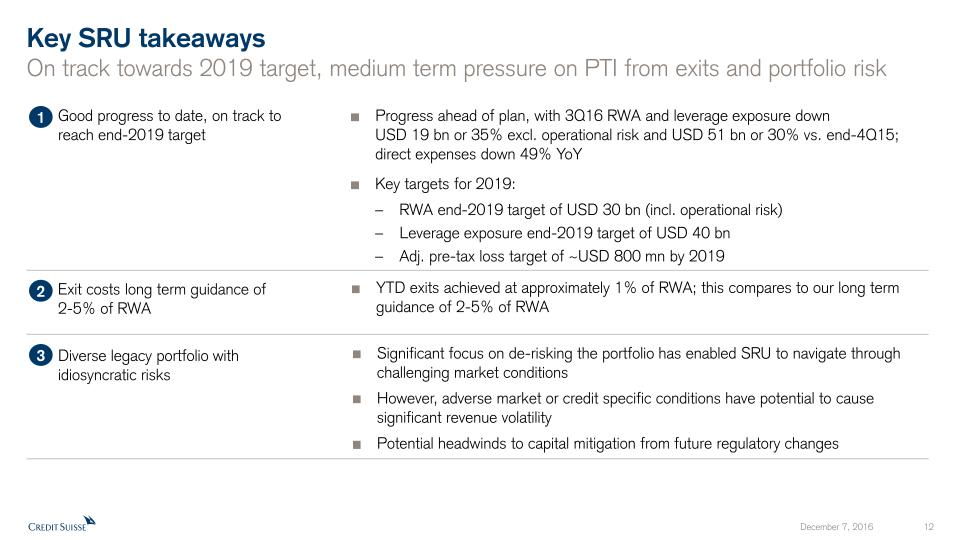

Continuing to reduce capital consumption in the SRU Note: Adjusted results are non-GAAP financial measures. A reconciliation to reported results is included in the Appendix1 RWA shown excluded projected inflation from future regulatory uplifts (e.g. fundamental review of trading book)2 Regulatory (FINMA) approval required for any operational risk reduction -35% RWA1 in USD bn Leverage exposure in USD bn -30% -80% -76% Illustrative adjustedpre-tax loss progression in USD mn 9M16 2,465 ~1,400 ~800 excl. ops risk Operational risk2 Credit & market risk GM SUB APAC IWM SRU IBCM

SRU – Key takeaways Significant reduction of RWA and leverage exposure to dateTargeting reduction of capital consumption by approximately 80% by end 2019Ambition to reduce PTI drag to USD 800 mn1 by end-2019 Note: Adjusted results are non-GAAP financial measures. A reconciliation to reported results is included in the Appendix1 On an adjusted basis GM SUB APAC IWM SRU IBCM

Overview of revised financial targets for Group and divisions APAC Pre-tax income o/w Wealth Management2 IWM Pre-tax income SUB Pre-tax income Global Markets RWA threshold1Leverage exposure threshold1Return on regulatory capital† Note: Adjusted results are non-GAAP financial measures † See Appendix1 As announced on March 23, 2016 (Credit Suisse Strategy Update) 2 Including contributions from wealth management connected activities 2016 USD 60 bnUSD 290 bn > CHF 1.4 bn1< CHF 19.8 bn111-12%1 Group Net cost savingsOperating cost baseCET1 ratio (pre significant litigation expenses)CET1 leverage ratio SRU Pre-tax lossRWALeverage exposure 2019 ~ USD 0.8 bnUSD 30 bnUSD 40 bn 2018 CHF 1.6 bnCHF 0.7 bn CHF 1.8 bn CHF 2.3 bn 10-15% > CHF 4.2 bn< CHF 17.0 bn12-13%> 3.5% 15- 20% Adjusted figures IBCM Return on regulatory capital† ~ USD 1.4 bn > 13% pre-Basel III reform uplift> 11% post-Basel III reform uplift

We have significantly strengthened our capital ratios Basel III “look-through”CET1 capital ratio +180bps

Delivering against our key objectives Costs CHF 19.6 bn 2016E adjusted operating expensesat constant FX rates* 2016E net savings CHF 1.6 bn CHF 2.9 bn 9M16 Core pre-tax income adjusted Profitability CHF 2.4 bn 9M16 SRU pre-tax loss adjusted Note: Adjusted results are non-GAAP financial measures. A reconciliation to reported results is included in the Appendix* See Appendix1 Relating to Wealth Management in SUB, IWM and APAC 3Q16 CET1 look-through ratio 12.0%+180 bps vs. 3Q15 Capital 3.4% 3Q16 CET1 look-through leverage ratio Assets 9M16 net new assets1 CHF 30.9 bn10% emerging market growth rate3% mature market growth rate

Focused on execution Delivered cost savings in excess of our 2016 target, creating additional operating leverageAchieved strong growth in AuM, with NNA of CHF 30.9 bn at 9M16Strengthened our capital position with look-through CET1 ratio of 12.0% as of end 3Q16Given unsupportive market conditions, focusing priorities on cost reduction measures and adjusting our 2018 targets to the more challenging revenue environmentProtecting returns during volatile markets and providing significant upside when conditions improve

Agenda of the day – December 7, 2016 Time (GMT) Topic Speaker 8:00 Registration All 8:30 Welcome & Progress Update Tidjane Thiam 9:15 Global Markets Brian Chin 9:45 Coffee break 10:15 Swiss Universal Bank Thomas Gottstein 10:45 Asia Pacific Helman Sitohang 11:15 International Wealth Management Iqbal Khan 11:45 Investment Banking & Capital Markets Jim Amine 12:15 Lunch 13:15 Financials and capital / Strategic Resolution Unit David Mathers 14:00 Wrap-up of the day Tidjane Thiam 14:05 Q&A session All

Appendix

Notes Throughout the presentation rounding differences may occur.All risk-weighted assets (RWA) and leverage exposure figures shown in this presentation are as of the end of the respective period and on a “look-through” basis.Gross and net margins are shown in basis points (bps). Gross margin = adj. net revenues annualized / average AuM; net margin = adj. pre-tax income annualized / average AuM.Mandates penetration reflects advisory and discretionary mandates as percentage of total AuM, excluding AuM from the external asset manager (EAM) business. General notes * “Adjusted operating expenses at constant FX rates” include adjustments as made in all our disclosures for restructuring expenses, major litigation expenses and a goodwill impairment taken in 4Q15 as well as adjustments for FX, applying the following main currency exchange rates for 1Q15: USD/CHF 0.9465, EUR/CHF 1.0482, GBP/CHF 1.4296, 2Q15: USD/CHF 0.9383, EUR/CHF 1.0418, GBP/CHF 1.4497, 3Q15: USD/CHF 0.9684, EUR/CHF 1.0787, GBP/CHF 1.4891, 4Q15: USD/CHF 1.0000, EUR/CHF 1.0851, GBP/CHF 1.5123, 1Q16: USD/CHF 0.9928, EUR/CHF 1.0941, GBP/CHF 1.4060, 2Q16: USD/CHF 0.9756, EUR/CHF 1.0956, GBP/CHF 1.3845, 3Q16: USD/CHF 0.9728, EUR/CHF 1.0882, GBP/CHF 1.2764. These currency exchange rates are unweighted, i.e. a straight line average of monthly rates. We apply this calculation consistently for the periods under review.† Regulatory capital reflects the worst of 10% of RWA and 3.5% of leverage exposure. Return on regulatory capital is based on (adjusted) returns after tax assuming a tax rate of 30% for all periods and capital allocated based on the worst of 10% of average RWA and 3.5% of average leverage exposure. For Global Markets and Investment Banking & Capital Markets, return on regulatory capital is based on US dollar denominated numbers. Specific notes Abbreviations Adj. = Adjusted; AT1 = Additional Tier 1; AM = Asset Management; ann. = annualized; APAC = Asia Pacific; AuM = Assets under Management; BCBS = Basel Committee on Banking Supervision; BIS = Bank for International Settlements; bps = basis points; BRRD = Bank Recovery and Resolution Directive; CAO = Capital Adequacy Ordinance; CET1 = Common Equity Tier 1; Corp. Ctr. = Corporate Center; C&IB = Corporate & Institutional Banking; CRO = Chief Risk Officer; CCRO = Compliance and Regulatory Affairs; CVA = Credit Valuation Adjustment; ECM = Equity Capital Markets; EM = Emerging Markets; EMEA=Europe, Middle East & Africa; FINMA = Swiss Financial Market Supervisory Authority; FRTB = Fundamental review of the trading book; FSB = Financial Stability Board; FTE = Full time equivalents; FVoD = Fair Value of Own Debt; FX = Foreign Exchange; GM = Global Markets; GMAR = Global Markets Accelerated Restructuring; HoldCo = Holding Company; HQ = Headquarters; HQLA = High Quality Liquid Assets; IB = Investment Banking; IBCM = Investment Banking & Capital Markets; ID = Investor Day; IHC = Intermediate Holding Company; IOSCO = The International Organization of Securities Commissions; IPO = Initial Public Offer; IRB = Internal Ratings-Based; IWM = International Wealth Management; KPI = Key Performance Indicator; LATAM =Latin America; LCR = Liquidity Coverage ratio; M&A = Mergers & Acquisitions; NCWOL = No Creditor Worse Off than in Liquidation; NNA = Net new assets; NSFR = Net Stable Funding Ratio; OpCo = Operating Company; OpRisk = Operational Risk PB = Private Banking; PB&WM = (Former) Private Banking & Wealth Management (division) pp. = percentage points; PTI = Pre-tax income; PONV = Point of Non-Viability; QoQ = Quarter-on-quarter; RM(s) = Relationship Manager(s); RoRC = Return on regulatory capital; RWA = Risk Weighted Assets; SA-CCR = Standardized Approach - Counterparty Credit Risk; SME = Small and Medium Enterprises; SMG = Systematic Market-Making Group; SoW = Share of Wallet; SRU = Strategic Resolution Unit; STS = Sales and Trading Services; SUB = Swiss Universal Bank; T1= Tier 1 capital; TBTF = Too Big to Fail; TLAC = Total loss absorbing capacity; (U)HNW(I) = (Ultra) High Net Worth (Individuals); WM = Wealth Management; YoY = Year-on-Year; YTD = Year To Date

Reconciliation of adjustment items (1/2) CS Group in CHF mn SRU in USD mn Corp. Ctr. in CHF mn 3Q16 2Q16 1Q16 4Q15 3Q15 2Q15 1Q15 3Q16 2Q16 1Q16 4Q15 3Q15 2Q15 1Q15 3Q16 2Q16 1Q16 4Q15 3Q15 2Q15 1Q15 Net revenues reported 5,396 5,108 4,638 4,210 5,985 6,955 6,647 (170) (371) (545) (126) (90) 437 335 72 (95) 110 (748) 752 384 173 Fair value on own debt - - - 697 (623) (228) (144) - - - - - - - - - - 697 (623) (228) (144) Real estate gains - - - (72) - (23) - - - - - - - - - - - - - - - (Gains)/losses on business sales (346) - 56 (34) - - - - - 4 - - - - - - 52 - - - - Net revenues adjusted 5,050 5,108 4,694 4,801 5,362 6,704 6,503 (170) (371) (541) (126) (90) 437 335 72 (95) 162 (51) 129 156 29 Provision for credit losses 55 (28) 150 133 110 51 30 6 (38) 119 99 21 13 5 - (2) 1 (2) 1 - - Total operating expenses reported 5,119 4,937 4,972 10,518 5,023 5,248 5,106 698 445 601 1,103 688 690 651 279 142 76 307 211 121 223 Goodwill impairment - - - (3,797) - - - - - - - - - - - - - - - - - Restructuring expenses (145) (91) (255) (355) - - - (23) (21) (80) (158) - - - - - - - - - - Major litigation provisions (306) - - (564) (203) (63) 10 (324) - - (257) (27) (9) - - - - - - - - Total operating expenses adjusted 4,668 4,846 4,717 5,802 4,820 5,185 5,116 351 424 521 688 661 680 651 279 142 76 307 211 121 223 Pre-tax income/(loss) reported 222 199 (484) (6,441) 852 1,656 1,511 (874) (778) (1,266) (1,328) (799) (266) (320) (207) (235) 33 (1,053) 540 263 (50) Total adjustments 105 91 311 5,307 (420) (188) (154) 347 21 84 415 27 9 - - - 52 697 (623) (228) (144) Pre-tax income/(loss) adjusted 327 290 (173) (1,134) 432 1,468 1,357 (527) (757) (1,181) (913) (772) (256) (320) (207) (235) 85 (356) (83) 35 (194) IWM AM in CHF mn GM in USD mn IBCM in USD mn 3Q16 2Q16 1Q16 4Q15 3Q15 2Q15 1Q15 3Q16 2Q16 1Q16 4Q15 3Q15 2Q15 1Q15 3Q16 2Q16 1Q16 4Q15 3Q15 2Q15 1Q15 Net revenues reported 292 334 320 365 308 335 320 1,396 1,671 1,252 1,168 1,632 2,052 2,272 479 558 395 418 414 605 420 Fair value on own debt - - - - - - - - - - - - - - - - - - - - - Real estate gains - - - - - - - - - - - - - - - - - - - - - (Gains)/losses on business sales - - - - - - - - - - - - - - - - - - - - - Net revenues adjusted 292 334 320 365 308 335 320 1,396 1,671 1,252 1,168 1,632 2,052 2,272 479 558 395 418 414 605 420 Provision for credit losses - - - - - - - (6) (17) 22 (5) 15 (4) 4 (9) - 30 - - - - Total operating expenses reported 243 273 253 330 267 275 274 1,310 1,532 1,430 4,517 1,346 1,641 1,498 450 417 425 902 346 451 471 Goodwill impairment - - - - - - - - - - (2,690) - - - - - - (384) - - - Restructuring expenses (2) (2) 2 (4) - - - (52) (52) (102) (97) - - - (16) 9 (28) (22) - - - Major litigation provisions - - - - - - - (7) - - (51) (132) (57) - - - - - - - - Total operating expenses adjusted 241 271 255 326 267 275 274 1,251 1,480 1,328 1,679 1,214 1,584 1,498 434 426 397 496 346 451 471 Pre-tax income/(loss) reported 49 61 67 35 41 60 46 92 156 (200) (3,345) 271 415 770 39 141 (60) (484) 68 154 (51) Total adjustments 2 2 (2) 4 - - - 59 52 102 2,838 132 57 - 16 (9) 28 406 - - - Pre-tax income/(loss) adjusted 51 63 65 39 41 60 46 150 208 (98) (507) 403 473 770 55 132 (32) (78) 68 154 (51) Adjusted results are non-GAAP financial measures that exclude goodwill impairment and certain other revenues and expenses included in our reported results. Management believes that adjusted results provide a useful presentation of our operating results for purposes of assessing our Group and divisional performance consistently over time, on a basis that excludes items that management does not consider representative of our underlying performance. Provided below is a reconciliation of our adjusted results to the most directly comparable US GAAP measures.

SUB PB in CHF mn IWM PB in CHF mn APAC PB in CHF mn 3Q16 2Q16 1Q16 4Q15 3Q15 2Q15 1Q15 3Q16 2Q16 1Q16 4Q15 3Q15 2Q15 1Q15 3Q16 2Q16 1Q16 4Q15 3Q15 2Q15 1Q15 Net revenues reported 1,160 840 846 963 857 956 920 789 811 853 808 785 830 801 346 337 319 271 303 307 297 Fair value on own debt - - - - - - - - - - - - - - - - - - - - - Real estate gains (346) - - (72) - (23) - - - - - - - - - - - - - - - (Gains)/losses on business sales - - - (10) - - - - - - (11) - - - - - - - - - - Net revenues adjusted 814 840 846 881 857 933 920 789 811 853 797 785 830 801 346 337 319 271 303 307 297 Provision for credit losses 13 7 9 14 14 9 12 - 16 (2) (7) 11 (1) 2 38 2 (17) (5) 24 - (1) Total operating expenses reported 603 582 632 784 639 690 659 593 611 622 874 618 619 567 242 245 216 228 210 188 190 Goodwill impairment - - - - - - - - - - - - - - - - - - - - - Restructuring expenses (16) (3) (35) (33) - - - (13) (13) (10) (32) - - - (3) - - (1) - - - Major litigation provisions - - - (25) - - - 19 - - (228) (50) - 10 - - - (6) - - - Total operating expenses adjusted 587 579 597 726 639 690 659 599 598 612 614 568 619 577 239 245 216 221 210 188 190 Pre-tax income/(loss) reported 544 251 205 165 204 257 249 196 184 233 (59) 156 212 232 66 90 120 48 69 119 108 Total adjustments (330) 3 35 (24) - (23) - (6) 13 10 249 50 - (10) 3 - - 7 - - - Pre-tax income/(loss) adjusted 214 254 240 141 204 234 249 190 197 243 190 206 212 222 69 90 120 55 69 119 108 SUB C&IB in CHF mn APAC IB in CHF mn APAC IB in USD mn 3Q16 2Q16 1Q16 4Q15 3Q15 2Q15 1Q15 3Q16 2Q16 1Q16 4Q15 3Q15 2Q15 1Q15 3Q16 2Q16 1Q16 4Q15 3Q15 2Q15 1Q15 Net revenues reported 507 497 510 532 507 506 480 571 574 588 555 582 733 791 587 590 595 554 603 783 835 Fair value on own debt - - - - - - - - - - - - - - - - - - - - - Real estate gains - - - - - - - - - - - - - - - - - - - - - (Gains)/losses on business sales - - - (13) - - - - - - - - - - - - - - - - - Net revenues adjusted 507 497 510 519 507 506 480 571 574 588 555 582 733 791 587 590 595 554 603 783 835 Provision for credit losses 17 2 (3) 29 25 24 11 (4) 1 (5) 8 - 11 (2) (4) 1 (5) 8 - 12 (3) Total operating expenses reported 276 293 286 304 286 271 275 489 457 449 1,212 489 474 436 503 468 452 1,221 505 505 460 Goodwill impairment - - - - - - - - - - (756) - - - - - - (765) - - - Restructuring expenses (3) (1) (5) (9) - - - (20) (10) (1) (2) - - - (21) (10) (1) (2) - - - Major litigation provisions - - - - - - - - - - - - - - - - - - - - - Total operating expenses adjusted 273 292 281 295 286 271 275 469 447 448 454 489 474 436 482 458 451 454 505 505 460 Pre-tax income/(loss) reported 214 202 227 199 196 211 194 86 116 144 (665) 93 248 357 88 121 148 (675) 98 266 378 Total adjustments 3 1 5 (4) - - - 20 10 1 758 - - - 21 10 1 767 - - - Pre-tax income/(loss) adjusted 217 203 232 195 196 211 194 106 126 145 93 93 248 357 109 131 149 92 98 266 378 Reconciliation of adjustment items (2/2)

Swisscard deconsolidation impactImpact of the deconsolidation on the Swiss Universal Bank Note: Adjusted results are non-GAAP financial measures. A reference to the reconciliation to reported results for other adjustments not relating to Swisscard is included in the Notes of this presentation † See AppendixThis is an illustrative pro-forma presentation of the impact of the deconsolidation of the card issuing business on the historical results of SUB as if it had occurred on December 31, 2014. Given that as of July 1, 2015 the business has been deconsolidated and transferred to the equity method investment, Swisscard AECS GmbH and the transaction does not qualify for discontinued operations, the historical results are not restated in this respect. The reduction in pre-tax income in the Private Banking business of Swiss Universal Bank is offset by the reduction in minority interest from the deconsolidation at the Group level, therefore there is no material impact on the Group’s net income attributable to shareholders. These illustrative figures cannot be seen as being indicative of future trends or results 1 Pro-forma impact of the card issuing business deconsolidation in CHF mn 1Q15 2Q15 3Q15 9M15 1Q15 2Q15 3Q15 9M15 1Q15 2Q15 3Q15 9M15 Net interest income 611 685 708 2,004 9 9 - 18 602 676 708 1,986 Recurring commissions & fees 412 412 372 1,196 56 59 - 115 356 353 372 1,081 Transaction-based revenues 382 349 295 1,026 8 7 - 15 374 342 295 1,011 Other revenues (5) (7) (11) (23) - - - - (5) (7) (11) (23) Net revenues 1,400 1,439 1,364 4,203 73 75 - 148 1,327 1,364 1,364 4,055 Provision for credit losses 23 33 39 95 - - - - 23 33 39 95 Total operating expenses 934 961 925 2,820 61 62 - 123 873 899 925 2,697 Pre-tax income 443 445 400 1,288 12 13 - 25 431 432 400 1,263 Return on regulatory capital† 14% 14% 13% 14% - - - - 14% 14% 13% 14% SUB adjusted Swisscard Impact1 SUB adjusted ex Swisscard

Credit Suisse Investor Day 2016Overview of Financials and CapitalDavid Mathers December 7, 2016

Disclaimer (1/2) The data presented in this presentation relating to the Swiss Universal Bank refers to the division of Credit Suisse Group as the same is currently managed within Credit Suisse Group. The scope, revenues and expenses of the Swiss Universal Bank vary from the planned scope of Credit Suisse (Schweiz) AG and its subsidiaries, planned to be subject to a partial IPO, market conditions permitting. Any such IPO would involve the sale of a minority stake and would be subject to, among other things, all necessary approvals.It is therefore not possible to make a like-for-like comparison of the Swiss Universal Bank as a division of Credit Suisse Group on the one hand and Credit Suisse (Schweiz) AG as a potential IPO vehicle on the other hand.Cautionary statement regarding forward-looking statements This presentation contains forward-looking statements that involve inherent risks and uncertainties, and we might not be able to achieve the predictions, forecasts, projections and other outcomes we describe or imply in forward-looking statements. A number of important factors could cause results to differ materially from the plans, objectives, expectations, estimates and intentions we express in these forward-looking statements, including those we identify in "Risk Factors” in our Annual Report on Form 20-F for the fiscal year ended December 31, 2015 and in “Cautionary statement regarding forward-looking information" in our media release relating to Investor Day, published on December 7, 2016 and filed with the US Securities and Exchange Commission, and in other public filings and press releases. We do not intend to update these forward-looking statements except as may be required by applicable law. In particular, the terms “Illustrative”, “Ambition”, “Outlook” and “Goal” are not intended to be viewed as targets or projections, nor are they considered to be Key Performance Indicators. All such illustrations, ambitions and goals are subject to a large number of inherent risks, assumptions and uncertainties, many of which are completely outside of our control. Accordingly, this information should not be relied on for any purpose. We do not intend to update these illustrations, ambitions or goals.We may not achieve the benefits of our strategic initiativesWe may not achieve all of the expected benefits of our strategic initiatives. Factors beyond our control, including but not limited to the market and economic conditions, changes in laws, rules or regulations and other challenges discussed in our public filings, could limit our ability to achieve some or all of the expected benefits of these initiatives. Estimates and assumptionsIn preparing this presentation, management has made estimates and assumptions that affect the numbers presented. Actual results may differ. Figures throughout presentation may also be subject to rounding adjustments. Cautionary Statements Relating to Interim Financial InformationThis presentation contains certain unaudited interim financial information as of or for periods after September 30, 2016, the date of our last published quarterly financial statements. This information has been derived from management accounts, is preliminary in nature, does not reflect the complete results of the fourth quarter of 2016 and is subject to change, including as a result of any normal quarterly adjustments in relation to the financial statements for the fourth quarter of 2016. This information has not been subject to any review by our independent registered public accounting firm. There can be no assurance that the final results for these periods will not differ from these preliminary results, and any such differences could be material. Quarterly financial results for the fourth quarter of 2016 will be included in our 4Q16 Earnings Release, and audited consolidated financial statements for full-year 2016 will be included in our Annual Report on Form 20-F for the year ended December 31, 2016, when they are published. These interim results of operations are not necessarily indicative of the results to be achieved for the remainder of the fourth quarter or the full year 2016.

Disclaimer (2/2) Statement regarding non-GAAP financial measures This presentation also contains non-GAAP financial measures, including adjusted results. Information needed to reconcile such non-GAAP financial measures to the most directly comparable measures under US GAAP or a reference thereto can be found in this presentation in the Appendix, which is available on our website at credit-suisse.com.Statement regarding capital, liquidity and leverage As of January 1, 2013, Basel 3 was implemented in Switzerland along with the Swiss “Too Big to Fail” legislation and regulations thereunder (in each case, subject to certain phase-in periods). As of January 1, 2015, the Bank for International Settlements (BIS) leverage ratio framework, as issued by the Basel Committee on Banking Supervision (BCBS), was implemented in Switzerland by FINMA. Our related disclosures are in accordance with our interpretation of such requirements, including relevant assumptions. Changes in the interpretation of these requirements in Switzerland or in any of our assumptions or estimates could result in different numbers from those shown in this presentation. Capital and ratio numbers for periods prior to 2013 are based on estimates, which are calculated as if the Basel 3 framework had been in place in Switzerland during such periods. Unless otherwise noted, leverage exposure is based on the BIS leverage ratio framework and consists of period-end balance sheet assets and prescribed regulatory adjustments. Leverage amounts for 4Q14, which are presented in order to show meaningful comparative information, are based on estimates which are calculated as if the BIS leverage ratio framework had been implemented in Switzerland at such time. Beginning in 2015, the Swiss leverage ratio is calculated as Swiss total capital, divided by period-end leverage exposure. The look-through BIS tier 1 leverage ratio and CET1 leverage ratio are calculated as look-through BIS tier 1 capital and CET1 capital, respectively, divided by end-period leverage exposure. Selling restrictions This document, and the information contained herein, is not an offer to sell or a solicitation of offers to purchase or subscribe for securities of Credit Suisse Group AG or Credit Suisse (Schweiz) AG in Switzerland, the United States or any other jurisdiction. This document is not a prospectus within the meaning of article 652a of the Swiss Code of Obligations, nor is it a listing prospectus as defined in the listing rules of the SIX Swiss Exchange AG or any other exchange or regulated trading facility in Switzerland or a prospectus or offering document under any other applicable laws. Copies of this document may not be sent to jurisdictions, or distributed in or sent from jurisdictions, in which such documents are barred or prohibited by law. A decision to invest in securities of Credit Suisse Group AG or Credit Suisse (Schweiz) AG should be based exclusively on a written agreement with Credit Suisse Group AG or an offering and listing prospectus to be published by Credit Suisse Group AG or Credit Suisse (Schweiz) AG for such purpose. Any offer and sale of securities of Credit Suisse (Schweiz) AG will not be registered under the U.S. Securities Act of 1933, as amended, and may not be offered in the United States of America absent such registration or an exemption from registration. There will be no public offering of such securities in the United States of America.

Overview of Financials and Capital Resource re-allocation: Progress in 2016 1 Update on cost reduction plans 2 Funding plan for Credit Suisse 3 Update on proposed reforms to Basel III 4 Financial and capital targets 5

On track to reduce expenses to below CHF 19.8 bn target, with CHF 1.6 bn net savings expected by end-2016 Summary of progress Cost reduction Funding Basel III reforms Targets 2015 21.2 19.8 Adjusted operating expenses at constant FX rates* in CHF bn Net savings in CHF bn 2016Target Note: Adjusted results are non-GAAP financial measures. A reconciliation to reported results is included in the Appendix1 Headcount includes permanent full-time equivalent employees, contractors, consultants and other contingent workers; Achieved as of December 4, 2016 includes departed and notified headcount * See Appendix 1.6 2016estimated (1.6) 2016 estimated 19.6 1.6 net savings Net headcount1 reductions of 6,050 as of December 4, exceeding target net reduction for full year 2016

Adjusted operatingexpenses at constantFX rates* in CHF bn Note: Adjusted results are non-GAAP financial measures. A reconciliation to reported results is included in the Appendix * See Appendix Summary of progress Cost reduction Funding Targets 2015 Gross savings Investments in growth 2016 estimated 21.2 (2.1) 19.6 Strengthening of controls 0.3 0.2 2016 target of CHF 19.8 bn Basel III reforms Expect to achieve CHF 2.1 bn of gross savings in 2016, while reinvesting in growth businesses that aims at achieving attractive returns

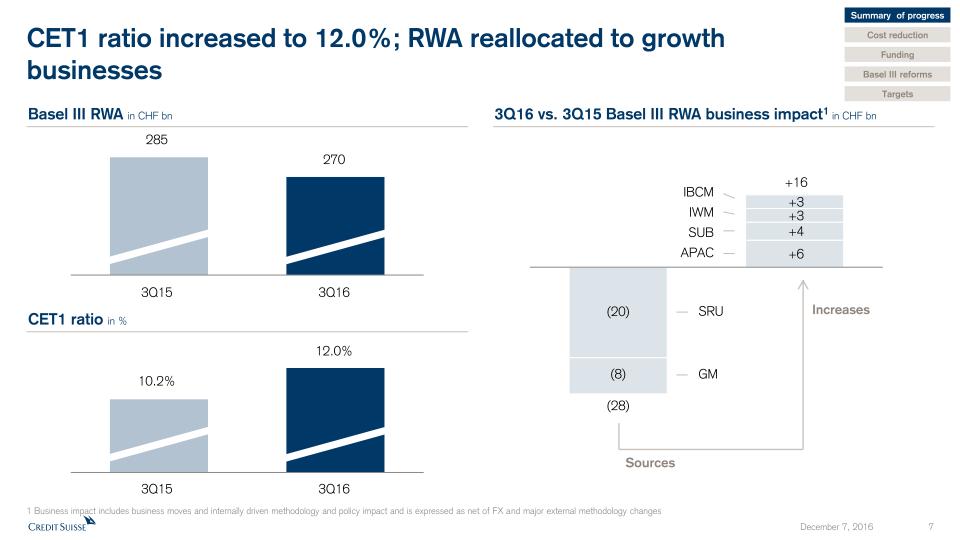

CET1 ratio increased to 12.0%; RWA reallocated to growth businesses 285 270 10.2% 12.0% 1 Business impact includes business moves and internally driven methodology and policy impact and is expressed as net of FX and major external methodology changes SRU GM IBCM IWM SUB APAC (8) (20) +3 +3 +4 +6 (28) +16 3Q15 3Q16 3Q15 3Q16 3Q16 vs. 3Q15 Basel III RWA business impact1 in CHF bn Basel III RWA in CHF bn CET1 ratio in % Summary of progress Cost reduction Funding Targets Sources Increases Basel III reforms

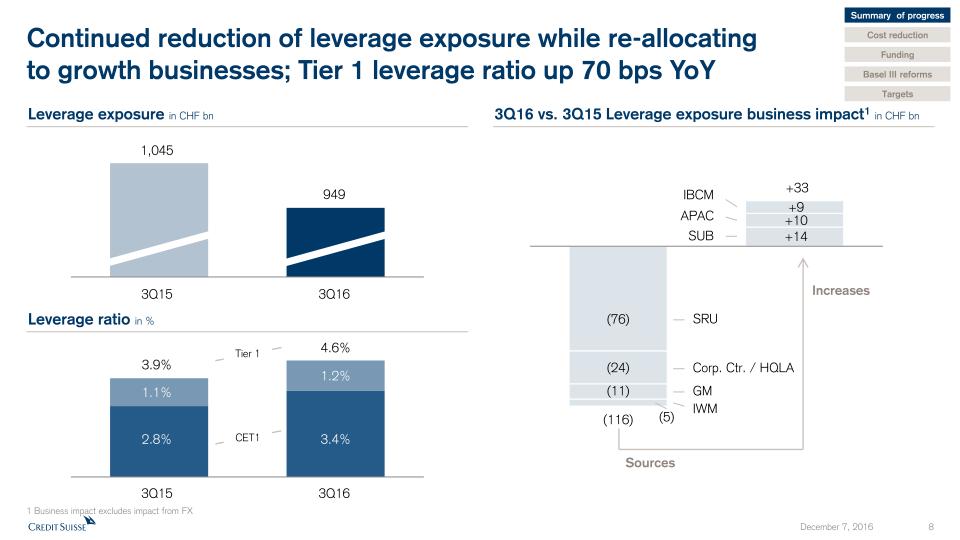

Continued reduction of leverage exposure while re-allocating to growth businesses; Tier 1 leverage ratio up 70 bps YoY 3Q15 3Q16 1,045 949 3.9% 4.6% 1 Business impact excludes impact from FX Sources SRU Corp. Ctr. / HQLA IBCM APAC SUB (24) (76) +9 +14 GM (11) +10 +33 (116) Increases IWM (5) 1.1% 2.8% 1.2% 3.4% 3Q15 3Q16 3Q16 vs. 3Q15 Leverage exposure business impact1 in CHF bn Leverage exposure in CHF bn Leverage ratio in % Summary of progress Cost reduction Funding Targets Tier 1 CET1 Basel III reforms

Overview of Financials and Capital Resource re-allocation: Progress in 2016 1 Update on cost reduction plans 2 Funding plan for Credit Suisse 3 Update on proposed reforms to Basel III 4 Financial and capital targets 5 Summary of progress Cost reduction Funding Targets Basel III reforms

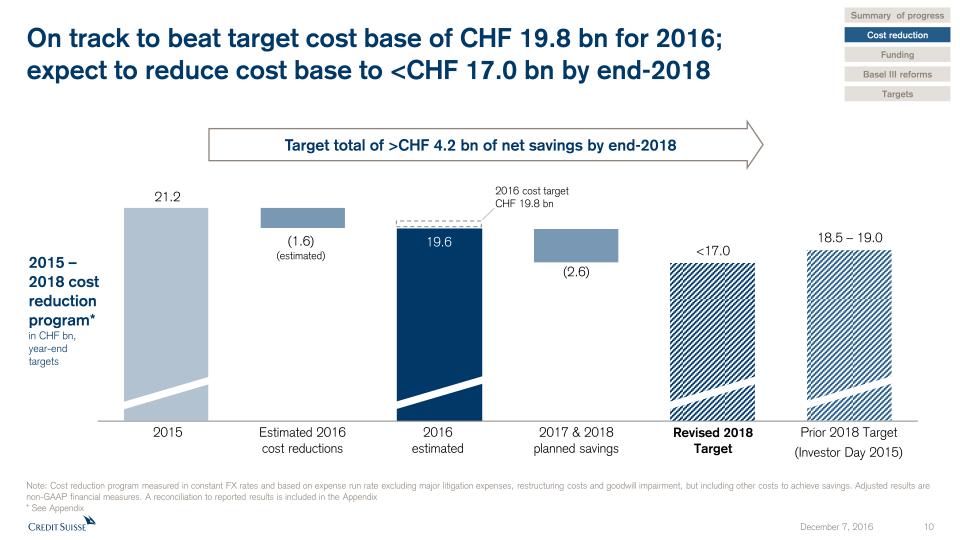

Summary of progress Cost reduction Funding Targets Basel III reforms Target total of >CHF 4.2 bn of net savings by end-2018 2015 2016estimated Estimated 2016 cost reductions 2015 – 2018 cost reduction program* in CHF bn, year-end targets 2017 & 2018planned savings Prior 2018 Target(Investor Day 2015) On track to beat target cost base of CHF 19.8 bn for 2016;expect to reduce cost base to <CHF 17.0 bn by end-2018 Revised 2018Target Note: Cost reduction program measured in constant FX rates and based on expense run rate excluding major litigation expenses, restructuring costs and goodwill impairment, but including other costs to achieve savings. Adjusted results are non-GAAP financial measures. A reconciliation to reported results is included in the Appendix* See Appendix 21.2 18.5 – 19.0 <17.0 (2.6) 2016 cost target CHF 19.8 bn

Restructuring costs progression in CHF bn Update on restructuring charges Summary of progress Cost reduction Funding Targets 0.6 0.6 0.3 2016E 2017E 2018E 2015 0.4 Severance Real Estate Other Restructuring Costs Estimated costs through 2018: CHF 1.9 bn Basel III reforms

Overview of Financials and Capital Resource re-allocation: Progress in 2016 1 Update on cost reduction plans 2 Funding plan for Credit Suisse 3 Update on proposed reforms to Basel III 4 Financial and capital targets 5

Summary of progress Cost reduction Funding Targets Basel III reforms Reduced capital instrument costs expected to offset increased HoldCo funding costs Estimated funding costs1 – capital instruments in USD bn 2.8 2.8 2.7 2.2 Estimated funding costs1 – other sources of funding in USD bn Total funding cost1 in USD bn 1.4 1.5 1.5 1.6 1 Cost represents a spread to the 3-month reference rate

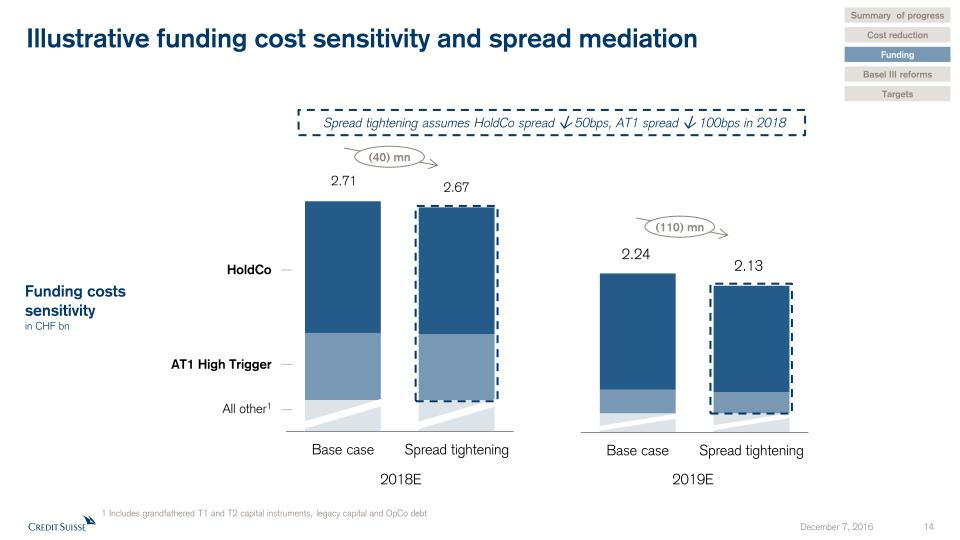

Illustrative funding cost sensitivity and spread mediation Summary of progress Cost reduction Funding Targets Basel III reforms Funding costs sensitivity in CHF bn 2019E 2.71 2.67 HoldCo All other1 2018E 2.24 2.13 Spread tightening assumes HoldCo spread 50bps, AT1 spread 100bps in 2018 (40) mn (110) mn AT1 High Trigger 1 Includes grandfathered T1 and T2 capital instruments, legacy capital and OpCo debt

Overview of Financials and Capital Resource re-allocation: Progress in 2016 1 Update on cost reduction plans 2 Funding plan for Credit Suisse 3 Update on proposed reforms to Basel III 4 Financial and capital targets 5

Recalibrated leverage ratio likely to be primary capital constraint until beginning 2020, however… 1 The binding constraint is calculated as the worse of 10% of RWA and 3.5% of leverage exposure due to the TBTF requirement of 10% CET 1 ratio and 3.5% CET 1 leverage ratio requirement2 Does not include the effects of the countercyclical buffers and any rebates for resolvability and for certain tier 2 low-trigger instruments recognized in gone concern capital …RWA uplift resulting from Basel III reforms will drive the binding constraint1 from the start of 2020 … 2018 Standardized Approach to Counterparty Credit Risk, Banking Book Securitizations and Equity Investment in Funds rules effective from January 1, 2018 Impact of revised Market Risk rules expected to be effective by December 31, 2019. Will affect primarily market risk assets in divisions with trading activity 2019 2020 Revised Swiss TBTF rules will be phased-in and become fully effective January 1, 2020 2016 Group of Governors and Heads of Supervision (GHOS) of BCBS is due to meet in January 2017 where final rules for revisions to standard rules for floors, credit risk and operational risk are expected. Significant recalibration to draft rules expected Revised Swiss TBTF rules require going concern leverage ratio of 5% (of which 3.5% CET1), 5%2 gone concern leverage ratio, going concern RWA ratio of 14.3% (of which 10% CET1) and 14.3%2 gone concern RWA ratio to become fully effective by January 1, 2020 (phase-in) Major regulatory capital changes anticipated over 2016-2020 Summary of progress Cost reduction Funding Basel III reforms Targets Recent BCBS conference comments on November 30, 2016 indicate a longer implementation and phase-in period than previously expected. Use of internal models was confirmed

Summary of progress Cost reduction Funding Basel III reforms Targets RWA estimated regulatory impact - 2018 to 2020 and beyond Estimated net regulatory impact in CHF bn 2018E 2019E 2020E and beyond Advanced rules estimated impact Equity investments in fundsSACCRBanking book securitization 2018+: >13% pre Basel III reform ; >11% post Basel III reform Final rules impact Draft rules impact FRTB Pending BCBS finalization of remaining rules; significant recalibration expected January 2017.FRTB CVAReduced IRBOperational Risk 12-13% in 2018 Estimated CET1 ratio (%)Pre significant litigation

3Q16 Operating Free Capital Generated Cash component of dividends 2018 CET1 ratio1,2in % Capital released from SRU RWA reduction4 CET1 Leverage ratio >3.5% Illustrative CET1 capital generation and impact on capital ratios Tier1 Leverage ratio ~5.0% 3.4% 4.6% CET1 benefit from Credit Suisse (Schweiz) IPO3 11-12% until end 2016 1 Pre significant litigation 2 Pre reforms to Basel III 3 Any such IPO would involve the sale of a minority stake and would be subject to, among other things, all necessary approvals and would be intended to generate / raise additional capital for Credit Suisse AG or Credit Suisse (Schweiz) AG 4 Includes business growth and methodology impacts (excluding Basel III reform) 12-13% over 2017 and 2018 >13% in 2018+ buffer for Basel III reform CET1 ratio targets1,2 CET1 equivalent of increase in RWA for other divisions4 Summary of progress Cost reduction Funding Basel III reforms Targets

Overview of Financials and Capital Resource re-allocation: Progress in 2016 1 Update on cost reduction plans 2 Funding plan for Credit Suisse 3 Update on proposed reforms to Basel III 4 Financial and capital targets 5

Overview of revised financial targets for Group and divisions APAC Pre-tax income o/w Wealth Management 2 IWM Pre-tax income SUB Pre-tax income Global Markets RWA threshold1Leverage exposure threshold1Return on regulatory capital† Note: Adjusted results are non-GAAP financial measures1 As announced on March 23, 2016 (Credit Suisse Strategy Update) 2 Including contributions from wealth management connected activities † See Appendix 2016 USD 60 bnUSD 290 bn > CHF 1.4 bn1< CHF 19.8 bn111-12%1 Group Net cost savingsOperating cost baseCET1 ratio (pre significant litigation)CET1 leverage ratio SRU Pre-tax lossRWALeverage exposure 2019 > 13% pre-Basel III reform uplift; > 11% post-Basel III reform uplift ~ USD 0.8 bnUSD 30 bnUSD 40 bn 2018 CHF 1.6 bnCHF 0.7 bn CHF 1.8 bn CHF 2.3 bn 10-15% > CHF 4.2 bn< CHF 17.0 bn12-13%> 3.5% 15- 20% Summary of progress Cost reduction Funding Targets Adjusted figures Basel III reforms IBCM Return on regulatory capital† ~ USD 1.4 bn

Summary of progress Cost reduction Funding Targets Basel III reforms Continued focus on cost discipline at SUB with maintained 2018 pre-tax income target Note: Adjusted results are non-GAAP financial measures. A reconciliation to reported results and a reconciliation of adjustments applied for Swisscard are included in the Appendix. Financial and other information is for Swiss Universal Bank division. Scope of Credit Suisse (Schweiz) AG differs from Swiss Universal Bank division1 Excludes Swisscard impact Adjustedpre-tax income1in CHF bn 2015 Prior 2018 Target(ID 2015) 2018Target 2.3 1.6 2.3

IWM outlook impacted by adverse market environment in near term Summary of progress Cost reduction Funding Targets Basel III reforms Note: Adjusted results are non-GAAP financial measures. A reconciliation to reported results is included in the Appendix1 Including additional market related activities Adjustedpre-tax incomein CHF bn Prior 2018 Target(ID 2015) Revised 2018Target (0.4) 2.1 1.8 2015 1.0 Asset Management1 Business transfers 0.1

APAC wealth management target unchanged; reduced overall target reflects adverse impact from market conditions Summary of progress Cost reduction Funding Targets Basel III reforms Adjustedpre-tax incomein CHF bn Prior 2018 Target(ID 2015) Revised 2018Target Marketimpact 2.1 1.6 0.3 0.7 0.7 2015 1.1 Wealth Mgmt.1 Businesstransfers Prior 2018 Targetexcl. business transfers Costinitiatives Note: Adjusted results are non-GAAP financial measures. A reconciliation to reported results is included in the Appendix1 Including contributions from wealth management connected activities 0.7 (0.7) (0.1) 2.0

Summary of progress Cost reduction Funding Targets Basel III reforms Global Markets targeted to meet its cost of capital by 2018 Note: Adjusted results are non-GAAP financial measures † See Appendix Adjusted net revenues Adjusted total operating expenses 2018 Ambition in USD bn 6.0+ Less than 4.8 Target return on regulatory capital†: 10 – 15%

Revenue growth and operating efficiencies to drive IBCM toward return target Summary of progress Cost reduction Funding Targets Basel III reforms Note: Adjusted results are non-GAAP financial measures † See Appendix 2018Target 15-20% Adjusted return on regulatory capital† ~60% revenue growth~40% operating efficiencies 2016 to 2018 PTI Growth

Appendix

Notes Throughout the presentation rounding differences may occurAll risk-weighted assets (RWA) and leverage exposure figures shown in this presentation are as of the end of the respective period and on a “look-through” basisGross and net margins are shown in basis points (bps) Gross margin = adj. net revenues annualized / average AuM; net margin = adj. pre-tax income annualized / average AuMMandates penetration reflects advisory and discretionary mandates as percentage of total AuM, excluding AuM from the external asset manager (EAM) business General notes * “Adjusted operating expenses at constant FX rates” include adjustments as made in all our disclosures for restructuring expenses, major litigation expenses and a goodwill impairment taken in 4Q15 as well as adjustments for FX, applying the following main currency exchange rates for 1Q15: USD/CHF 0.9465, EUR/CHF 1.0482, GBP/CHF 1.4296, 2Q15: USD/CHF 0.9383, EUR/CHF 1.0418, GBP/CHF 1.4497, 3Q15: USD/CHF 0.9684, EUR/CHF 1.0787, GBP/CHF 1.4891, 4Q15: USD/CHF 1.0000, EUR/CHF 1.0851, GBP/CHF 1.5123, 1Q16: USD/CHF 0.9928, EUR/CHF 1.0941, GBP/CHF 1.4060, 2Q16: USD/CHF 0.9756, EUR/CHF 1.0956, GBP/CHF 1.3845, 3Q16: USD/CHF 0.9728, EUR/CHF 1.0882, GBP/CHF 1.2764. These currency exchange rates are unweighted, i.e. a straight line average of monthly rates. We apply this calculation consistently for the periods under review† Regulatory capital reflects the worst of 10% of RWA and 3.5% of leverage exposure. Return on regulatory capital is based on (adjusted) returns after tax assuming a tax rate of 30% for all periods and capital allocated based on the worst of 10% of average RWA and 3.5% of average leverage exposure. For Global Markets and Investment Banking & Capital Markets, return on regulatory capital is based on US dollar denominated numbers Specific notes Abbreviations Adj. = Adjusted; AT1 = Additional Tier 1; AM = Asset Management; ann. = annualized; APAC = Asia Pacific; AuM = Assets under Management; BCBS = Basel Committee on Banking Supervision; BIS = Bank for International Settlements; bps = basis points; BRRD = Bank Recovery and Resolution Directive; CAO = Capital Adequacy Ordinance; CET1 = Common Equity Tier 1; Corp. Ctr. = Corporate Center; C&IB = Corporate & Institutional Banking; CRO = Chief Risk Officer; CCRO = Compliance and Regulatory Affairs; CVA = Credit Valuation Adjustment; ECM = Equity Capital Markets; EM = Emerging Markets; EMEA=Europe, Middle East & Africa; FINMA = Swiss Financial Market Supervisory Authority; FRTB = Fundamental review of the trading book; FSB = Financial Stability Board; FTE = Full time equivalents; FVoD = Fair Value of Own Debt; FX = Foreign Exchange; GM = Global Markets; GMAR = Global Markets Accelerated Restructuring; HoldCo = Holding Company; HQ = Headquarters; HQLA = High Quality Liquid Assets; IB = Investment Banking; IBCM = Investment Banking & Capital Markets; ID = Investor Day; IHC = Intermediate Holding Company; IOSCO = The International Organization of Securities Commissions; IPO = Initial Public Offer; IRB = Internal Ratings-Based; IWM = International Wealth Management; KPI = Key Performance Indicator; LATAM =Latin America; LCR = Liquidity Coverage ratio; M&A = Mergers & Acquisitions; NCWOL = No Creditor Worse Off than in Liquidation; NNA = Net new assets; NSFR = Net Stable Funding Ratio; OpCo = Operating Company; OpRisk = Operational Risk PB = Private Banking; PB&WM = (Former) Private Banking & Wealth Management (division) pp. = percentage points; PTI = Pre-tax income; PONV = Point of Non-Viability; QoQ = Quarter-on-quarter; RM(s) = Relationship Manager(s); RoRC = Return on regulatory capital; RWA = Risk Weighted Assets; SA-CCR = Standardized Approach - Counterparty Credit Risk; SME = Small and Medium Enterprises; SMG = Systematic Market-Making Group; SoW = Share of Wallet; SRU = Strategic Resolution Unit; STS = Sales and Trading Services; SUB = Swiss Universal Bank; T1= Tier 1 capital; TBTF = Too Big to Fail; TLAC = Total loss absorbing capacity; (U)HNW(I) = (Ultra) High Net Worth (Individuals); WM = Wealth Management; YoY = Year-on-Year; YTD = Year To Date

Reconciliation of adjustment items (1/2) CS Group in CHF mn SRU in USD mn Corp. Ctr. in CHF mn 3Q16 2Q16 1Q16 4Q15 3Q15 2Q15 1Q15 3Q16 2Q16 1Q16 4Q15 3Q15 2Q15 1Q15 3Q16 2Q16 1Q16 4Q15 3Q15 2Q15 1Q15 Net revenues reported 5,396 5,108 4,638 4,210 5,985 6,955 6,647 (170) (371) (545) (126) (90) 437 335 72 (95) 110 (748) 752 384 173 Fair value on own debt - - - 697 (623) (228) (144) - - - - - - - - - - 697 (623) (228) (144) Real estate gains - - - (72) - (23) - - - - - - - - - - - - - - - (Gains)/losses on business sales (346) - 56 (34) - - - - - 4 - - - - - - 52 - - - - Net revenues adjusted 5,050 5,108 4,694 4,801 5,362 6,704 6,503 (170) (371) (541) (126) (90) 437 335 72 (95) 162 (51) 129 156 29 Provision for credit losses 55 (28) 150 133 110 51 30 6 (38) 119 99 21 13 5 - (2) 1 (2) 1 - - Total operating expenses reported 5,119 4,937 4,972 10,518 5,023 5,248 5,106 698 445 601 1,103 688 690 651 279 142 76 307 211 121 223 Goodwill impairment - - - (3,797) - - - - - - - - - - - - - - - - - Restructuring expenses (145) (91) (255) (355) - - - (23) (21) (80) (158) - - - - - - - - - - Major litigation provisions (306) - - (564) (203) (63) 10 (324) - - (257) (27) (9) - - - - - - - - Total operating expenses adjusted 4,668 4,846 4,717 5,802 4,820 5,185 5,116 351 424 521 688 661 680 651 279 142 76 307 211 121 223 Pre-tax income/(loss) reported 222 199 (484) (6,441) 852 1,656 1,511 (874) (778) (1,266) (1,328) (799) (266) (320) (207) (235) 33 (1,053) 540 263 (50) Total adjustments 105 91 311 5,307 (420) (188) (154) 347 21 84 415 27 9 - - - 52 697 (623) (228) (144) Pre-tax income/(loss) adjusted 327 290 (173) (1,134) 432 1,468 1,357 (527) (757) (1,181) (913) (772) (256) (320) (207) (235) 85 (356) (83) 35 (194) IWM AM in CHF mn GM in USD mn IBCM in USD mn 3Q16 2Q16 1Q16 4Q15 3Q15 2Q15 1Q15 3Q16 2Q16 1Q16 4Q15 3Q15 2Q15 1Q15 3Q16 2Q16 1Q16 4Q15 3Q15 2Q15 1Q15 Net revenues reported 292 334 320 365 308 335 320 1,396 1,671 1,252 1,168 1,632 2,052 2,272 479 558 395 418 414 605 420 Fair value on own debt - - - - - - - - - - - - - - - - - - - - - Real estate gains - - - - - - - - - - - - - - - - - - - - - (Gains)/losses on business sales - - - - - - - - - - - - - - - - - - - - - Net revenues adjusted 292 334 320 365 308 335 320 1,396 1,671 1,252 1,168 1,632 2,052 2,272 479 558 395 418 414 605 420 Provision for credit losses - - - - - - - (6) (17) 22 (5) 15 (4) 4 (9) - 30 - - - - Total operating expenses reported 243 273 253 330 267 275 274 1,310 1,532 1,430 4,517 1,346 1,641 1,498 450 417 425 902 346 451 471 Goodwill impairment - - - - - - - - - - (2,690) - - - - - - (384) - - - Restructuring expenses (2) (2) 2 (4) - - - (52) (52) (102) (97) - - - (16) 9 (28) (22) - - - Major litigation provisions - - - - - - - (7) - - (51) (132) (57) - - - - - - - - Total operating expenses adjusted 241 271 255 326 267 275 274 1,251 1,480 1,328 1,679 1,214 1,584 1,498 434 426 397 496 346 451 471 Pre-tax income/(loss) reported 49 61 67 35 41 60 46 92 156 (200) (3,345) 271 415 770 39 141 (60) (484) 68 154 (51) Total adjustments 2 2 (2) 4 - - - 59 52 102 2,838 132 57 - 16 (9) 28 406 - - - Pre-tax income/(loss) adjusted 51 63 65 39 41 60 46 150 208 (98) (507) 403 473 770 55 132 (32) (78) 68 154 (51) Adjusted results are non-GAAP financial measures that exclude goodwill impairment and certain other revenues and expenses included in our reported results. Management believes that adjusted results provide a useful presentation of our operating results for purposes of assessing our Group and divisional performance consistently over time, on a basis that excludes items that management does not consider representative of our underlying performance. Provided below is a reconciliation of our adjusted results to the most directly comparable US GAAP measures.

SUB PB in CHF mn IWM PB in CHF mn APAC PB in CHF mn 3Q16 2Q16 1Q16 4Q15 3Q15 2Q15 1Q15 3Q16 2Q16 1Q16 4Q15 3Q15 2Q15 1Q15 3Q16 2Q16 1Q16 4Q15 3Q15 2Q15 1Q15 Net revenues reported 1,160 840 846 963 857 956 920 789 811 853 808 785 830 801 346 337 319 271 303 307 297 Fair value on own debt - - - - - - - - - - - - - - - - - - - - - Real estate gains (346) - - (72) - (23) - - - - - - - - - - - - - - - (Gains)/losses on business sales - - - (10) - - - - - - (11) - - - - - - - - - - Net revenues adjusted 814 840 846 881 857 933 920 789 811 853 797 785 830 801 346 337 319 271 303 307 297 Provision for credit losses 13 7 9 14 14 9 12 - 16 (2) (7) 11 (1) 2 38 2 (17) (5) 24 - (1) Total operating expenses reported 603 582 632 784 639 690 659 593 611 622 874 618 619 567 242 245 216 228 210 188 190 Goodwill impairment - - - - - - - - - - - - - - - - - - - - - Restructuring expenses (16) (3) (35) (33) - - - (13) (13) (10) (32) - - - (3) - - (1) - - - Major litigation provisions - - - (25) - - - 19 - - (228) (50) - 10 - - - (6) - - - Total operating expenses adjusted 587 579 597 726 639 690 659 599 598 612 614 568 619 577 239 245 216 221 210 188 190 Pre-tax income/(loss) reported 544 251 205 165 204 257 249 196 184 233 (59) 156 212 232 66 90 120 48 69 119 108 Total adjustments (330) 3 35 (24) - (23) - (6) 13 10 249 50 - (10) 3 - - 7 - - - Pre-tax income/(loss) adjusted 214 254 240 141 204 234 249 190 197 243 190 206 212 222 69 90 120 55 69 119 108 SUB C&IB in CHF mn APAC IB in CHF mn APAC IB in USD mn 3Q16 2Q16 1Q16 4Q15 3Q15 2Q15 1Q15 3Q16 2Q16 1Q16 4Q15 3Q15 2Q15 1Q15 3Q16 2Q16 1Q16 4Q15 3Q15 2Q15 1Q15 Net revenues reported 507 497 510 532 507 506 480 571 574 588 555 582 733 791 587 590 595 554 603 783 835 Fair value on own debt - - - - - - - - - - - - - - - - - - - - - Real estate gains - - - - - - - - - - - - - - - - - - - - - (Gains)/losses on business sales - - - (13) - - - - - - - - - - - - - - - - - Net revenues adjusted 507 497 510 519 507 506 480 571 574 588 555 582 733 791 587 590 595 554 603 783 835 Provision for credit losses 17 2 (3) 29 25 24 11 (4) 1 (5) 8 - 11 (2) (4) 1 (5) 8 - 12 (3) Total operating expenses reported 276 293 286 304 286 271 275 489 457 449 1,212 489 474 436 503 468 452 1,221 505 505 460 Goodwill impairment - - - - - - - - - - (756) - - - - - - (765) - - - Restructuring expenses (3) (1) (5) (9) - - - (20) (10) (1) (2) - - - (21) (10) (1) (2) - - - Major litigation provisions - - - - - - - - - - - - - - - - - - - - - Total operating expenses adjusted 273 292 281 295 286 271 275 469 447 448 454 489 474 436 482 458 451 454 505 505 460 Pre-tax income/(loss) reported 214 202 227 199 196 211 194 86 116 144 (665) 93 248 357 88 121 148 (675) 98 266 378 Total adjustments 3 1 5 (4) - - - 20 10 1 758 - - - 21 10 1 767 - - - Pre-tax income/(loss) adjusted 217 203 232 195 196 211 194 106 126 145 93 93 248 357 109 131 149 92 98 266 378 Reconciliation of adjustment items (2/2)

Swisscard deconsolidation impactImpact of the deconsolidation on the Swiss Universal Bank Note: Adjusted results are non-GAAP financial measures. A reference to the reconciliation to reported results for other adjustments not relating to Swisscard is included in the Notes of this presentation † See AppendixThis is an illustrative pro-forma presentation of the impact of the deconsolidation of the card issuing business on the historical results of SUB as if it had occurred on December 31, 2014. Given that as of July 1, 2015 the business has been deconsolidated and transferred to the equity method investment, Swisscard AECS GmbH and the transaction does not qualify for discontinued operations, the historical results are not restated in this respect. The reduction in pre-tax income in the Private Banking business of Swiss Universal Bank is offset by the reduction in minority interest from the deconsolidation at the Group level, therefore there is no material impact on the Group’s net income attributable to shareholders. These illustrative figures cannot be seen as being indicative of future trends or results 1 Pro-forma impact of the card issuing business deconsolidation in CHF mn 1Q15 2Q15 3Q15 9M15 1Q15 2Q15 3Q15 9M15 1Q15 2Q15 3Q15 9M15 Net interest income 611 685 708 2,004 9 9 - 18 602 676 708 1,986 Recurring commissions & fees 412 412 372 1,196 56 59 - 115 356 353 372 1,081 Transaction-based revenues 382 349 295 1,026 8 7 - 15 374 342 295 1,011 Other revenues (5) (7) (11) (23) - - - - (5) (7) (11) (23) Net revenues 1,400 1,439 1,364 4,203 73 75 - 148 1,327 1,364 1,364 4,055 Provision for credit losses 23 33 39 95 - - - - 23 33 39 95 Total operating expenses 934 961 925 2,820 61 62 - 123 873 899 925 2,697 Pre-tax income 443 445 400 1,288 12 13 - 25 431 432 400 1,263 Return on regulatory capital† 14% 14% 13% 14% - - - - 14% 14% 13% 14% SUB adjusted Swisscard Impact1 SUB adjusted ex Swisscard

Credit Suisse Investor Day 2016Global MarketsBrian Chin December 7, 2016