Form 6-K CREDICORP LTD For: Nov 07

�

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

�

FORM 6-K

�

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under the

Securities Exchange Act of 1934

�

For the month of November 2014

�

Commission File Number: 001-14014

�

CREDICORP LTD.

(Translation of registrant’s name into English)

�

Clarendon House

Church Street

Hamilton HM 11 Bermuda

(Address of principal executive office)

�

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

�

Form 20-F x Form 40-F �

�

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

�

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

�

| � |

| � |

�

SIGNATURE

�

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

�

Date: November 6, 2014

�

| � |

CREDICORP LTD. (Registrant) |

� | |

| � | � | � | |

| � | � | � | � |

| � | By: | /s/ Mario Ferrari | � |

| � | � | Mario Ferrari | � |

| � | � | Authorized Representative | � |

�

| � |

�

�

Exhibit 99.1

�

|

CREDICORP Ltd. � Third Quarter 2014 Results � Lima, Per�, November 06th, 2014 - Credicorp (NYSE: BAP) announced today its unaudited results for the third quarter of 2014. These results are reported on a consolidated basis in accordance with IFRS in nominal Peruvian Nuevos Soles (PEN). � HIGHLIGHTS � � Credicorp reported this 3Q14 net income of PEN 645.4 million, leading to a ROAE of 19.7%. Excluding Mibanco, which is still in its stabilization phase, net earnings for Credicorp reached PEN 666.2 million, which represents a ROAE of 21.7%. � Despite the economic slowdown in the 1H14, total loans continued expanding and were up 3% QoQ, a strong number given the contraction in Mibanco’s portfolio, and reached an even higher 4.1% growth, measured in average daily balances. However, this expansion was concentrated in the wholesale banking segment, which has lower margins and responds to an investment activity in anticipation of upcoming larger investments in infrastructure, energy and mining; as well as, year-end campaigns. � NII improved 4.7% QoQ due to interest income expansion of 4.7% QoQ, which in turn was in line with loan growth; and despite interest expenses which grew also 4.7% QoQ. The use of alternative funding sources allowed funding costs to remain stable QoQ. � The above, coupled with the 4.3% growth of interest earning assets, resulted in Credicop’s NIM expanding 8bps, to reach 5.75% this Q. NIM of BCP showed a larger increase of 12bps as a result of the excellent performance of loans, better pricing, and good management of funding costs. � Provisions for loan losses showed a significant drop of 9.9%, reaching 2.29% of total loans vs. 2.62% reported in 2Q, as the portfolio’s deterioration eased and measures to recover delinquent clients were successfully implemented. Furthermore, excluding the provisions related to Mibanco, total provisions for the Q dropped almost 20% QoQ, representing 1.85% of total loans, which is the result of significant efforts to control and reduce the delinquent portfolio. � The improvement in portfolio quality is also reflected in the PDL ratio that, for the first time in almost two years, shows an inflexion, and reported a drop of 5 bps from 2.64% in 2Q14 to 2.59% in 3Q14. This improvement is also reflected in the coverage ratio which increased to reach 161.5% this 3Q. � Fee income expanded 1.4% at BCP, but at Credicorp level, it increased 0.4% QoQ. The aforementioned is explained by the elimination in the consolidation process of fees related to bancassurance among Credicorp’s subsidiaries; and the drop of fee income from Credicorp Capital’s corporate finance business, in line with the economic slowdown and reduced capital markets activities. � Though fee income remained fairly flat QoQ, other non-interest income showed healthy expansion, with gains on FX transactions and on sales of securities generating good earnings levels. However, in the absence of substantial extraordinary income as reported in 2Q, total non-financial income showed growth of only 0.9% QoQ. � The insurance business continued its improving trend, and reported 1.9% higher net earned premiums and 6.2% lower expenses QoQ, which led to a 12.9% higher technical result. Moreover, medical services’ gross margin also improved 14%, contributing to the overall recovery of our insurance business, and ultimately contributed to an improved Credicorp’s bottom line. � Consequently, operating income for Credicorp grew 15.8% this 3Q, or 19.8% excluding Mibanco, which still incorporates relevant acquisition and merger costs. � In line with this general business recovery, expense controls remained in place as it was reflected in the contraction of -1.8% (with Mibanco) of operating expenses that are considered in the efficiency ratio; and -2% excluding Mibanco. The reduction of expenses combined with the expansion of income generation resulted in a significant improvement in the efficiency ratio of Credicorp that decreased from 43.9% (42.7% excl. Mibanco) to 41.9% (40.4% excl. Mibanco) in the 3Q. � However, some extraordinary costs affected Credicorp’s bottom line, as some non-profitable businesses were shut down, and an adjustment in Credicorp Capital’s derivatives were recorded. � A small open US Dollar position held in the balance sheet generated a PEN 2.6 million translation gain. On the other hand, taxes reflected an improved income generation, and were up 34% this quarter, with an effective tax rate reaching levels of 29.6%. � These results, allowed Credicorp to deliver a ROAE in line with the management’s guidance and expectations, as reflected by the 21.7% ROAE and a 2.2% ROAA reported for Credicorp’s business excluding the recent acquisition of Mibanco. As we expected, the consolidation of Mibanco had a negative impact on returns bringing the corporation’s ROAE down to a still solid 19.7% for 3Q. � Year-to-date results are also in line with expectations even if the recent acquisition and all its related costs are included, as it is reflected in Credicorp’s main indicators: ROAE of 19.9% and ROAA of 2%; an efficiency ratio of 42.1% (100 bps of reduction YoY); and excellent margin evolution showed in a NIM that grew 55 bps reaching a level of 5.61%. Furthermore, the PDL ratio for over 90-day for BPC (excluding Mibanco) was 1.7%; and its coverage ratio increased to 161.5%. |

�

| � |

|

�

I. Credicorp Ltd.

�

Overview

�

Credicorp reported this 3Q14 net income of PEN 645.4 million, leading to a ROAE of 19.7% and a ROAA of 2%. The recent acquisition of Mibanco, which is still in its clean-up and stabilization phase, and therefore, requires the absorption of some losses; has a negative effect in the aforementioned ratios hindering the excellent performance of Credicorp’s businesses. Excluding Mibanco’s impact, Credicorp’s net income reaches PEN 666.2 million, which represents a ROAE of 21.7% and a ROAA of 2.2%.

�

Despite the economic slowdown reported this year, total loans continued expanding, and grew 3% QoQ, even after including Mibanco’s contraction. This growth in explained mainly due to an increase in loan demand from the wholesale banking, and responds to activity related to the anticipation of upcoming larger investments in infrastructure, energy and mining, as well as to the year-end campaigns. On a YoY basis, BCP loans measured in average daily balances reveal a 14.6% expansion, and are boosted to a 21.4% YoY growth through the acquisition of Mibanco.

�

Retail loans, which were strongly affected by the economic slowdown and the high delinquencies, also showed signs of recovery, reporting 3.5% QoQ growth in average daily balances, higher rate than those reported in previous quarters (0.5% in 1Q and 1.4% in 2Q). The best performers in the retail segment were SME-Business Loans which were up 12.6% QoQ, followed by mortgages (+3%) and consumer lending (+3.3%). More subdued growth was reported by Credit Card and SME-Pyme, whereby this last sector shows a turning point from having been contracting its portfolio in the previous Qs (-1.5% in 1Q and -0.9% in 2Q) to growing 1.4% this 3Q. On the other hand, our Micro lending business (Edyficar), continues performing above average with a portfolio growth of 6.3% QoQ. On a YoY basis, the strongest performers were the wholesale banking with a solid 18% expansion, and Micro lending at Edyficar with a very strong 33% expansion.

�

| � | � | Excluding MiBanco | � | � | Including MiBanco | � | ||||||||||||||||||||||||||

| Credicorp Ltd. | � | Quarter | � | � | % Change | � | � | Quarter | � | � | % Change | � | ||||||||||||||||||||

| PEN (000) | � | 2Q14 | � | � | 3Q14 | � | � | QoQ | � | � | 3Q13 | � | � | 2Q14 | � | � | 3Q14 | � | � | QoQ | � | � | YoY | � | ||||||||

| Net Interest income | � | � | 1,434,829 | � | � | � | 1,513,111 | � | � | � | 5.5 | % | � | � | 1,281,567 | � | � | � | 1,610,499 | � | � | � | 1,686,184 | � | � | � | 4.7 | % | � | � | 31.6 | % |

| Net provisions for loan losses | � | � | (411,624 | ) | � | � | (330,398 | ) | � | � | -19.7 | % | � | � | (331,280 | ) | � | � | (480,731 | ) | � | � | (433,219 | ) | � | � | -9.9 | % | � | � | 30.8 | % |

| Net interest income after net provisions for loan losses | � | � | 1,023,205 | � | � | � | 1,156,021 | � | � | � | 13.0 | % | � | � | 950,287 | � | � | � | 1,129,768 | � | � | � | 1,226,274 | � | � | � | 8.5 | % | � | � | 29.0 | % |

| Non financial income | � | � | 860,015 | � | � | � | 869,150 | � | � | � | 1.1 | % | � | � | 755,474 | � | � | � | 873,631 | � | � | � | 881,287 | � | � | � | 0.9 | % | � | � | 16.7 | % |

| Insurance services technical result | � | � | 104,165 | � | � | � | 117,638 | � | � | � | 12.9 | % | � | � | 106,303 | � | � | � | 104,165 | � | � | � | 117,638 | � | � | � | 12.9 | % | � | � | 10.7 | % |

| Medical Services Technical Result | � | � | 25,242 | � | � | � | 28,813 | � | � | � | 14.1 | % | � | � | 19,343 | � | � | � | 25,242 | � | � | � | 28,813 | � | � | � | 14.1 | % | � | � | 49.0 | % |

| Operating expenses | � | � | (1,209,198 | ) | � | � | (1,235,614 | ) | � | � | 2.2 | % | � | � | (1,100,645 | ) | � | � | (1,328,766 | ) | � | � | (1,349,566 | ) | � | � | 1.6 | % | � | � | 22.6 | % |

| Operating income | � | � | 803,429 | � | � | � | 962,699 | � | � | � | 19.8 | % | � | � | 730,762 | � | � | � | 804,041 | � | � | � | 931,137 | � | � | � | 15.8 | % | � | � | 27.4 | % |

| Core operating income | � | � | 754,973 | � | � | � | 962,699 | � | � | � | 27.5 | % | � | � | 730,762 | � | � | � | 755,584 | � | � | � | 931,137 | � | � | � | 23.2 | % | � | � | 27.4 | % |

| Non core operating income (1) | � | � | 48,457 | � | � | � | - | � | � | � | - | � | � | � | - | � | � | � | 48,457 | � | � | � | - | � | � | � | - | � | � | � | - | � |

| Translation results | � | � | 711 | � | � | � | 2,478 | � | � | � | 248.5 | % | � | � | (9,375 | ) | � | � | 581 | � | � | � | 2,603 | � | � | � | 348.2 | % | � | � | -127.8 | % |

| Income taxes | � | � | (206,327 | ) | � | � | (286,006 | ) | � | � | 38.6 | % | � | � | (208,887 | ) | � | � | (204,934 | ) | � | � | (275,364 | ) | � | � | 34.4 | % | � | � | 31.8 | % |

| Net income | � | � | 597,814 | � | � | � | 679,171 | � | � | � | 13.6 | % | � | � | 512,500 | � | � | � | 599,687 | � | � | � | 658,376 | � | � | � | 9.8 | % | � | � | 28.5 | % |

| Minority Interest | � | � | 15,002 | � | � | � | 12,941 | � | � | � | -13.7 | % | � | � | 11,451 | � | � | � | 15,002 | � | � | � | 12,941 | � | � | � | -13.7 | % | � | � | 13.0 | % |

| Net income attributed to Credicorp | � | � | 582,812 | � | � | � | 666,230 | � | � | � | 14.3 | % | � | � | 501,049 | � | � | � | 584,685 | � | � | � | 645,435 | � | � | � | 10.4 | % | � | � | 28.8 | % |

| Net income / share (S/.) | � | � | 7.31 | � | � | � | 8.35 | � | � | � | 14.3 | % | � | � | 6.28 | � | � | � | 7.33 | � | � | � | 8.09 | � | � | � | 10.4 | % | � | � | 28.8 | % |

| Total loans | � | � | 69,154,209 | � | � | � | 71,448,819 | � | � | � | 3.3 | % | � | � | 62,358,185 | � | � | � | 73,464,928 | � | � | � | 75,680,558 | � | � | � | 3.0 | % | � | � | 21.4 | % |

| Deposits and obligations | � | � | 71,639,332 | � | � | � | 71,232,928 | � | � | � | -0.6 | % | � | � | 66,845,892 | � | � | � | 75,611,060 | � | � | � | 74,863,615 | � | � | � | -1.0 | % | � | � | 12.0 | % |

| Net shareholders' equity | � | � | 11,972,388 | � | � | � | 12,599,399 | � | � | � | 5.2 | % | � | � | 11,378,145 | � | � | � | 12,807,368 | � | � | � | 13,414,052 | � | � | � | 4.7 | % | � | � | 17.9 | % |

| Net interest margin | � | � | 5.33 | % | � | � | 5.41 | % | � | � | � | � | � | � | 5.12 | % | � | � | 5.67 | % | � | � | 5.75 | % | � | � | � | � | � | � | � | � |

| Efficiency ratio | � | � | 42.7 | % | � | � | 40.4 | % | � | � | � | � | � | � | 42.0 | % | � | � | 43.9 | % | � | � | 41.5 | % | � | � | � | � | � | � | � | � |

| Return on average shareholders' equity | � | � | 20.2 | % | � | � | 21.7 | % | � | � | � | � | � | � | 18.1 | % | � | � | 18.9 | % | � | � | 19.7 | % | � | � | � | � | � | � | � | � |

| Return on average total assets | � | � | 2.0 | % | � | � | 2.2 | % | � | � | � | � | � | � | 1.8 | % | � | � | 1.9 | % | � | � | 2.0 | % | � | � | � | � | � | � | � | � |

| PDL ratio | � | � | 2.39 | % | � | � | 2.33 | % | � | � | � | � | � | � | 2.18 | % | � | � | 2.64 | % | � | � | 2.59 | % | � | � | � | � | � | � | � | � |

| PDL over 90 days (2) | � | � | 1.67 | % | � | � | 1.70 | % | � | � | � | � | � | � | 1.52 | % | � | � | 1.67 | % | � | � | 1.70 | % | � | � | � | � | � | � | � | � |

| NPL ratio (3) | � | � | 2.96 | % | � | � | 2.93 | % | � | � | � | � | � | � | 2.76 | % | � | � | 3.30 | % | � | � | 3.26 | % | � | � | � | � | � | � | � | � |

| Annualized net provisions / Total loans | � | � | 2.38 | % | � | � | 1.85 | % | � | � | � | � | � | � | 2.13 | % | � | � | 2.62 | % | � | � | 2.29 | % | � | � | � | � | � | � | � | � |

| Coverage of PDLs | � | � | 152.32 | % | � | � | 156.09 | % | � | � | � | � | � | � | 162.6 | % | � | � | 158.4 | % | � | � | 161.48 | % | � | � | � | � | � | � | � | � |

| Coverage of NPLs | � | � | 122.75 | % | � | � | 123.27 | % | � | � | � | � | � | � | 128.7 | % | � | � | 126.6 | % | � | � | 128.32 | % | � | � | � | � | � | � | � | � |

| Employees | � | � | 28,473 | � | � | � | 28,443 | � | � | � | � | � | � | � | 27,457 | � | � | � | 31,971 | � | � | � | 32,162 | � | � | � | � | � | � | � | � | � |

(1) At 2T14, PEN 40.8 million correspond to ASB for a compensation received from reinsurers for incurred losses in 2008 and PEN 7.6 million to Prima for a real estate sale and a reversal of tax provisions. At 1T14, PEN 62.7 million and PEN 14.4 million correspond to a gain from a sale of stocks and bonds, respectively.

(2) PDL for BCP without subsidiaries, does not include Mibanco.

(3) NPLs: Non-performing loans = Past due loans + Refinanced and restructued loans. NPL Ratio = NPLs / Total loans.

�

| 2 |

|

�

NII improved 4.7% QoQ due to interest income expansion of 4.7% QoQ, which in turn was in line with loan growth. On the other hand, interest expenses increased also 4.7%, as a result of using less expensive funding sources, such as central bank instruments, which allowed maintaining stable funding costs.

�

The above, coupled with the growth of 4.3% in interest earning assets, resulted in Credicop’s NIM expanding 8bps, to reach 5.75% this Q. NIM of BCP showed a larger increase of 12bps as a result of the excellent performance of loans, better pricing, and good management of funding costs.

�

The following table shows the Net Interest Margin’s breakdown and explains the individual contributions to the margin by Credicorp’s subsidiaries:

�

| NIM Breakdown | � | 3Q14 | � | |||||||||||||||||

| PEN (000) | � | BCP Cons. | � | � | ASB | � | � | Pac�fico | � | � | Others (1) | � | � | Credicorp | � | |||||

| Average IEA | � | � | 105,482,495 | � | � | � | 5,460,759 | � | � | � | 5,540,922 | � | � | � | 870,961 | � | � | � | 117,355,138 | � |

| % Total IEA Credicorp | � | � | 90 | % | � | � | 5 | % | � | � | 5 | % | � | � | 0 | % | � | � | 100 | % |

| � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � |

| NII for 3Q14 (Annualized) | � | � | 6,351,833 | � | � | � | 113,149 | � | � | � | 270,585 | � | � | � | 9,171 | � | � | � | 6,744,737 | � |

| % Total NII Credicorp | � | � | 94 | % | � | � | 2 | % | � | � | 4 | % | � | � | 0 | % | � | � | 100 | % |

| � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � |

| NIM for 3Q14 | � | � | 6.02 | % | � | � | 2.07 | % | � | � | 4.88 | % | � | � | 1.05 | % | � | � | 5.75 | % |

NIM: Annualized Net interest income / Average period end and period beginning interest earning assets.

(1) Others include Credicorp Capital, Prima, Grupo Credito and Eliminations for consolidation.

�

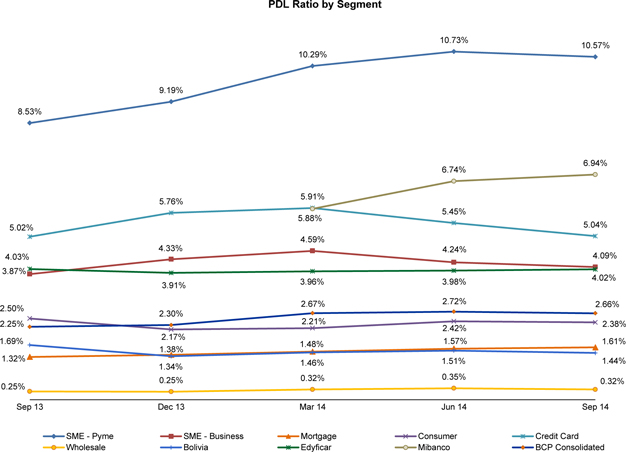

Portfolio quality also shows an important improvement, as the deterioration of the portfolio eased, and measures to recover delinquent clients were successfully implemented. Consequently, the PDL ratio showed a turning point for the first time in two years, and reported a drop of 5 bps moving from 2.64 in 2Q14 to 2.59 in 3Q14. This improvement is also reflected in the coverage ratio which increased to reach 161.5%. Furthermore, and more importantly, provisions for loan losses showed a significant decline of 9.9%, reaching levels of 2.29% of total loans in 3Q14 vs. 2.64% reported in 2Q13. If we exclude the provisions related to Mibanco, total provisions for the quarter dropped almost 20% QoQ, and represented 1.85% of total loans, reflecting the significant effort to control and reduce the delinquent portfolio.

�

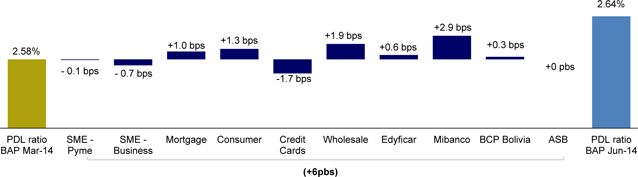

The following tables show the decomposition of the PDL ratio:

�

Mar 14 - Jun14

�

�

| 3 |

|

�

Jun 14 - Sep 14

�

�

On a QoQ comparison, fee income at BCP revealed a 1.4% expansion, but at Credicorp it grew only 0.4%. This difference was mainly due to: i) the elimination in the consolidation process of fees related to bancassurance among Credicorp’s subsidiaries; and ii) the drop of fee income from Credicorp Capital’s corporate finance business, in line with the economic slowdown and reduced capital markets activities. Though fee income remained fairly flat QoQ, other non-interest income, such as gains on FX transactions and gain on sales of securities, generated good earnings levels. Nevertheless, in the absence of substantial extraordinary income as the one reported in 2Q, total non-financial income grew only 0.9% QoQ.

�

The insurance business continued its improving trend, with an increase of 1.9% in net earned premiums and a decrease of 6.2% in expenses that led to a 12.9% higher technical result. Furthermore, medical services gross margin improved 14%, contributing to the overall recovery in the insurance business and, ultimately, a better contribution to Credicorp’s bottom line.

�

Consequently, operating income for Credicorp was up 15.8% this 3Q, 19.8% when excluding Mibanco, which still incorporates relevant acquisition and merger costs.

�

To focus on modifying our business culture and structure to become a more efficient operation continues being an important mandate at all levels in the organization. Hence, we are focused on achieving aggressive efficiency targets. In line with these objectives, expense controls remained in place, achieving a small contraction in general operating expenses; which helped increase the gap between the income and the expense growth rate. However, additional charges related to the shutting down of non-profitable businesses, and to an adjustment in derivative contracts related to Credicorp Capital, increased the expense line to show a small 1.6% expansion for the quarter. Nevertheless, the contraction in operating expenses mentioned before showed a significant 2% improvement in the efficiency ratio of Credicorp that moved from 43.9% (42.7% excl.Mibanco) in 2Q, to 41.5% (40.8% excl. Mibanco) in 3Q.

�

| � | � | � | � | BCP Cons | � | � | Prima | � | � | ASB | � | � | PGA | � | � | Credicorp Capital | � | � | Others (1) | � | � | Credicorp | � | |||||||

| 2Q14 | � | % of Income | � | � | 72.3 | % | � | � | 3.1 | % | � | � | 1.2 | % | � | � | 22.1 | % | � | � | 2.9 | % | � | � | -1.6 | % | � | � | 100.0 | % |

| � | � | % of Opex | � | � | 79.7 | % | � | � | 3.1 | % | � | � | 0.6 | % | � | � | 9.6 | % | � | � | 7.4 | % | � | � | -0.5 | % | � | � | 100.0 | % |

| � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � |

| � | � | Efficiency ratio | � | � | 48.4 | % | � | � | 43.1 | % | � | � | 23.0 | % | � | � | 19.1 | % | � | � | 110.6 | % | � | � | 12.4 | % | � | � | 43.9 | % |

| � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � |

| 3Q14 | � | % of Income | � | � | 73.1 | % | � | � | 3.2 | % | � | � | 1.1 | % | � | � | 21.9 | % | � | � | 2.8 | % | � | � | -2.1 | % | � | � | 100.0 | % |

| � | � | % of Opex | � | � | 79.2 | % | � | � | 3.2 | % | � | � | 0.7 | % | � | � | 10.7 | % | � | � | 7.2 | % | � | � | -1.0 | % | � | � | 100.0 | % |

| � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � |

| � | � | Efficiency ratio | � | � | 44.9 | % | � | � | 41.7 | % | � | � | 24.3 | % | � | � | 20.2 | % | � | � | 107.9 | % | � | � | 18.6 | % | � | � | 41.5 | % |

| � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � |

| � | � | Var. 3Q14 / 2Q14 | � | � | -350 bps | � | � | � | -140 bps | � | � | � | + 130 bps | � | � | � | +110 bps | � | � | � | -270 bps | � | � | � | - | � | � | � | - 240 bps | � |

(1) Others include Grupo Credito and Eliminations for consolidations.

�

After the change in the functional currency at the start of the year, only a small open US dollar position is held in the balance sheet, which generated a PEN 2.6 million translation gain following the slight strengthening of the US dollar. On the other hand, taxes reflected an improved income generation, and increased 34% QoQ, with an effective tax rate reaching a level of 29.6%.

�

| 4 |

|

�

These results, allowed Credicorp to deliver a return in line with the management’s guidance and expectations, as reflected by the 21.7% ROAE and 2.2% ROAA reported for Credicorp’s businesses, excluding the acquisition of Mibanco, which, as expected, had a negative impact on returns, given its current situation.

�

Nevertheless, even including the new still underperforming institution of Mibanco, year to date results are in line with our expectations with total net income of PEN 1.94 billion; ROAE of 19.9% and ROAA of 2%; a PDL ratio of 2.59% for all delinquencies and 1.7% for delinquencies over 90 days; a coverage ratio of 161.5%; and an efficiency ratio of 41.5%.

�

Credicorp – The Sum of Its Parts

�

This 3Q, BCP posted a significant recovery in all of its indicators, which is proof of its management capacity and strong position in the market. These factors have allowed the bank to recover its profitability levels despite a context of low economic growth.

�

BCP reported excellent results in 3Q14, and achieved net income of PEN 585.8 million. This represents a 35.3% increase with regard to 2Q14’s, which led to a ROAE of 25.4% and a ROAA of 2.1%.

�

Total loans expanded 4.1% QoQ in terms of average daily balances, which reflects excellent dynamism despite a complicated environment. The global NIM increased 12 bps to reach 6.02% in 3Q14. This was primarily due to more dynamism in the retail sector, a correction in rates and excellent control of funding costs.

�

The PDL ratio fell 6bps to 2.66%, which reflects a deceleration in delinquency and a recovery in the retail loan portfolio. This portfolio posted a noteworthy change in the trend of the SME segment, which had contracted in previous quarters, but posted growth of 1.7% QoQ in 3Q. In line with the aforementioned, provisions for loan losses at BCP fell 19.8%. Even if we include provisions for Mibanco, the reduction remains high at 9.9% for the quarter.

�

Finally, at the end of 3Q14, a 1.3% QoQ decrease in operating expenses, along with income growth, resulted in the improvement of the efficiency ratio that went down from 48.5% in 2Q14 to 44.9% in 3Q.

�

| Earnings contribution to Credicorp | � | Quarter | � | � | % Change | � | � | Year to date | � | � | % Change | � | ||||||||||||||||||||

| PEN (000) | � | 3Q13 | � | � | 2Q14 | � | � | 3Q14 | � | � | QoQ | � | � | YoY | � | � | Sep 13 | � | � | Sep 14 | � | � | Sep 14 / Sep 13 | � | ||||||||

| Banco de Cr�dito BCP (1) | � | � | 408,523 | � | � | � | 422,951 | � | � | � | 572,056 | � | � | � | 35 | % | � | � | 40 | % | � | � | 853,867 | � | � | � | 1,461,935 | � | � | � | 71 | % |

| BCB (2) | � | � | 11,353 | � | � | � | 19,016 | � | � | � | 17,418 | � | � | � | -8 | % | � | � | 53 | % | � | � | 34,101 | � | � | � | 51,915 | � | � | � | 52 | % |

| Edyficar (3) | � | � | 31,734 | � | � | � | 31,925 | � | � | � | 19,643 | � | � | � | -38 | % | � | � | -38 | % | � | � | 66,182 | � | � | � | 79,249 | � | � | � | 20 | % |

| Pacifico Grupo Asegurador | � | � | 51,710 | � | � | � | 46,432 | � | � | � | 60,031 | � | � | � | 29 | % | � | � | 16 | % | � | � | 95,294 | � | � | � | 144,380 | � | � | � | 52 | % |

| Atlantic Security Bank | � | � | 28,268 | � | � | � | 80,071 | � | � | � | 28,112 | � | � | � | -65 | % | � | � | -1 | % | � | � | 103,684 | � | � | � | 137,825 | � | � | � | 33 | % |

| Prima | � | � | 36,144 | � | � | � | 40,786 | � | � | � | 37,363 | � | � | � | -8 | % | � | � | 3 | % | � | � | 103,896 | � | � | � | 116,277 | � | � | � | 12 | % |

| Credicorp Capital (4) | � | � | 2,718 | � | � | � | 12,105 | � | � | � | 11,308 | � | � | � | -7 | % | � | � | 316 | % | � | � | 23,321 | � | � | � | 39,736 | � | � | � | 70 | % |

| Credicorp Ltd. (5) | � | � | (17,796 | ) | � | � | (8,705 | ) | � | � | (48,106 | ) | � | � | 453 | % | � | � | 170 | % | � | � | (45,991 | ) | � | � | 27,062 | � | � | � | -159 | % |

| Others (6) | � | � | (8,518 | ) | � | � | (8,956 | ) | � | � | (15,330 | ) | � | � | 71 | % | � | � | 80 | % | � | � | (17,737 | ) | � | � | (34,970 | ) | � | � | 97 | % |

| Net income attributable to Credicorp | � | � | 501,048 | � | � | � | 584,686 | � | � | � | 645,435 | � | � | � | 10 | % | � | � | 29 | % | � | � | 1,116,334 | � | � | � | 1,892,245 | � | � | � | 70 | % |

(1) Includes Banco de Cr�dito de Bolivia, Edyficar and Mibanco.

(2)The figure is lower than the net income of BCB because Credicorp owns 97.7% of BCB (directly and inderectly).

(3) Includes investment in Mibanco.

(4) Includes Credicorp Inv, which includes IM Trust, Credicorp Capital Individual, Credicorp Capital Colombia and CSI; and Credicorp Capital Peru which includes Credicorp Capital Bolsa, Credicorp Capital Fondos and Credicorp Capital Titulizadora.

(5) Includes taxes on BCP's and PPS's dividends, and other expenses at the holding company level. Also, at 3T14, includes other expenses related to the valuation of derivatives in Credicorp Capital associated to the acdquisition of Correval and IMTrust.

(6) Includes Grupo Cr�dito excluding Prima (Servicorp and Emisiones BCP Latam), others of Atlantic Security Holding Corporation and others of Credicorp Ltd.

�

Atlantic Security Bank (ASB) reported net income of US$9.7 million which reflected an ROAE of 18% in 3T14. This fell below the figure registered in 2Q14 (US$28.9 million) since the latter included extraordinary income received from reinsurers for US$14.6 million following the payment of a claim for losses incurred during the financial crisis in 2008; and 3Q registered lower net gains on the investment portfolio; and losses on foreign exchange transactions.

�

Interest earning assets fell US$37 million QoQ, where loans dropped US$21 million due to pre-payment and cancelations at maturity in 3Q14, and investments decreased US$11 million due to mark-to-market adjustments.

�

| 5 |

|

�

Finally, deposits reflect growth of US$10 million QoQ (US$1,550 million in 3Q14 vs US$1,540 million in 2Q14) as new client deposits were captured.

�

Net income at BCP Bolivia fell 8.4% QoQ, which was due primarily to lower gains on foreign exchange transactions and growth in expenses for police security (price increase set by the government), that was only partially offset by higher interest income on loans. Nevertheless, YoY, income increased 58.9% due to a drop in net provisions for loan losses and growth in interest income on loans, which offset the growth in personnel expenses after a statutory wage increase and holiday related salary increases.

�

Loan expansion was 6.0% QoQ and 19.3% YoY, which was due primarily to growth in Retail Banking in the Mortgage and SME segments. The bank’s prudential approach to lending led to a PDL ratio of 1.45% and a coverage ratio of 262.2%. Deposits increased 5.6% QoQ due to growth in time deposits (+3.8% QoQ).

�

Edyficar continues to perform in line with our forecasts, despite the downturn in the local economy and in the SME sector in particular. It is important to note that the organization’s loan growth is higher than that of its competitors, and its portfolio quality ratios are the only ones in the system that have remained stable(4.02%).

�

In this context, total loans at the end of 3Q14 were situated at PEN 3,209 million, which led to growth (+5.7% QoQ) in net interest income. These results (without including the effect of Mibanco) led to net income of PEN 38.1 million and a ROAE of 27.7%. Nevertheless, if we incorporate the effects of Mibanco, we obtain net income of PEN 20.2 million and a ROAE of 7.1%. The latter figure was affected by the capital contributions (PEN 506 million and PEN 146 million) made to finance the acquisition of Mibanco, and to cover other expenses associated with the acquisition process. In line with this growth, the number of branches increased from 199 in 2Q14 to 203 in 3Q14.

�

Pacifico Insurance Group reported net income of PEN 55.9 million in 3Q14, which represents a 33.6% increase with regard to the PEN 41.8 million obtained in 2Q14. In this context, ROAE was situated at 13.9%, which reflects a significant improvement from 2Q14. This increase in income was due to a better underwriting result (+22.4 million) and higher financial income (+9.6 million), which was accompanied by an effective expenses control.

�

The increase reported in the underwriting result is reflected in all three business lines. In PPS, an improvement was due to i) an increase in net earned premiums in all businesses, ii) a reduction in claims, particularly in the car segment and iii) a decrease in underwriting expenses due to a reversal of provisions. In EPS, the improvement reflects an increase in Complementary Insurance for High Risk Occupations (SCRR) premiums; while at the medical subsidiaries, a better result is due to an increase in volumes in line with the business expansion.

�

In the third quarter, Prima AFP’s results were favorable. Income grew 6.4% with regard to 2Q14, which coupled with strict spending control, led to operating income of PEN 56.9 million and net income of PEN 37.4 million. The net result represented an 8.4% drop with regard to 2Q14’s figure which includes an extraordinary gain from an asset sale registered last quarter. As such, this decline generated no negative effect on the business’s operating income in 3Q14. ROAE was situated at 29% for the quarter.

�

Prima AFP’s funds under management (FuMs) totaled PEN 35,606 million, which represented 32.1% of total FuMs in the private pension system. The nominal profitability of investments over the last 12 months was 7.9%, 10.5% and 9.5% for Funds 1, 2 and 3, respectively. These results situate Prima AFP first in the market for funds 2 and 3 and second for fund 1 system-wide.

�

| 6 |

|

�

Credicorp Capital did not achieve a stable level of income generation and reported a decline of 7% in 3Q14. This led to a net consolidated result of PEN11.3 million, which represented an ROAE of 6.4%. The decrease in quarterly income is due to a lag in economic activity, which had a negative effect on income generation. This caused a 5% decline in net non-financial income, which was situated at PEN 111.3 million in 3Q14. Lower income in the third quarter affected i) the Corporate Finance business, due to less structuring of primary issuances, and fewer advisory services for mergers and acquisitions; ii) the Treasury due to lower commissions; and iii) the Capital Markets activities, due to lower income for currencies and derivatives. Although income generation remains weak, expenses also fell given that lower levels of provisions were reported for short term incentives linked to earnings generated in Peru and Chile. This represented a 35.3% reduction with regard to the second quarter.

�

The Credicorp Ltd. line primarily includes provisions for income tax on dividends from BCP and PPS, and other expenses at the holding level. Nevertheless, a strong decrease in income was registered in 3Q14 due to a loss of PEN 48.1 million that was mainly associated with adjustments in the valuation of calls and puts related to the acquisition of IM Trust and Correval.

�

The Others account includes primarily the results of the Grupo Credito, which is responsible for initiatives such as Tarjeta Naranja (which still accounts for the majority of the losses reported as a result of the shutdown of operations), and the fiduciary business. In 3Q14, the results were negative and reflected losses for PEN 15.3 million.

�

| Regulatory Capital and Capital Adequacy Ratios | � | Balance as of | � | � | % Change | � | ||||||||||||||

| PEN (000) | � | Sep 13 | � | � | Jun 14 | � | � | Sep 14 | � | � | Sep 14 / Jun 14 | � | � | Sep 14 / Sep 13 | � | |||||

| Capital Stock | � | � | 1,379,986 | � | � | � | 1,385,849 | � | � | � | 1,410,614 | � | � | � | 1.8 | % | � | � | 2.2 | % |

| Legal and Other capital reserves (1) | � | � | 8,064,441 | � | � | � | 9,288,799 | � | � | � | 9,303,397 | � | � | � | 0.2 | % | � | � | 15.4 | % |

| Minority interest (2) | � | � | 285,054 | � | � | � | 538,564 | � | � | � | 427,182 | � | � | � | -20.7 | % | � | � | 49.9 | % |

| Loan loss reserves��(3) | � | � | 862,653 | � | � | � | 1,036,969 | � | � | � | 1,102,385 | � | � | � | 6.3 | % | � | � | 27.8 | % |

| Perpetual subordinated debt | � | � | 632,905 | � | � | � | 699,000 | � | � | � | 722,500 | � | � | � | 3.4 | % | � | � | 14.2 | % |

| Subordinated Debt | � | � | 3,567,314 | � | � | � | 4,268,816 | � | � | � | 4,476,785 | � | � | � | 4.9 | % | � | � | 25.5 | % |

| Investments in equity and subordinated debt of financial and insurance companies | � | � | (465,684 | ) | � | � | (482,109 | ) | � | � | (509,210 | ) | � | � | 5.6 | % | � | � | 9.3 | % |

| Goodwill | � | � | (1,006,441 | ) | � | � | (1,254,236 | ) | � | � | (1,242,768 | ) | � | � | -0.9 | % | � | � | 23.5 | % |

| Deduction for subordinated debt limit (50% of Tier I excluding deductions) (4) | � | � | - | � | � | � | - | � | � | � | - | � | � | � | - | � | � | � | - | � |

| Deduction for Tier I Limit (50% of Regulatory capital) (4) | � | � | - | � | � | � | - | � | � | � | - | � | � | � | - | � | � | � | - | � |

| Total Regulatory Capital (A) | � | � | 13,320,228 | � | � | � | 15,481,651 | � | � | � | 15,690,887 | � | � | � | 1.4 | % | � | � | 17.8 | % |

| � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � |

| Tier I (5) | � | � | 7,894,642 | � | � | � | 9,197,001 | � | � | � | 9,131,803 | � | � | � | -0.7 | % | � | � | 15.7 | % |

| Tier II (6) + Tier III (7) | � | � | 5,425,585 | � | � | � | 6,284,650 | � | � | � | 6,559,083 | � | � | � | 4.4 | % | � | � | 20.9 | % |

| � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � |

| Financial Consolidated Group (FCG) Regulatory Capital Requirements | � | � | 10,421,601 | � | � | � | 11,844,509 | � | � | � | 13,117,587 | � | � | � | 10.7 | % | � | � | 25.9 | % |

| Insurance Consolidated Group (ICG) Capital Requirements | � | � | 884,360 | � | � | � | 879,268 | � | � | � | 902,190 | � | � | � | 2.6 | % | � | � | 2.0 | % |

| FCG Capital Requirements related to operations with ICG (8) | � | � | (149,892 | ) | � | � | (140,607 | ) | � | � | (163,420 | ) | � | � | 16.2 | % | � | � | 9.0 | % |

| ICG Capital Requirements related to operations with FCG (9) | � | � | - | � | � | � | - | � | � | � | - | � | � | � | - | � | � | � | - | � |

| Total Regulatory Capital Requirements (B) | � | � | 11,156,069 | � | � | � | 12,583,170 | � | � | � | 13,856,358 | � | � | � | 10.1 | % | � | � | 24.2 | % |

| Regulatory Capital Ratio (A) / (B) | � | � | 1.19 | � | � | � | 1.23 | � | � | � | 1.13 | � | � | � | � | � | � | � | � | � |

| Required Regulatory Capital Ratio (10) | � | � | 1.00 | � | � | � | 1.00 | � | � | � | 1.00 | � | � | � | � | � | � | � | � | � |

(1) Legal and other capital reserves include restricted capital reserves (PEN 8,071 million) and optional capital reserves (PEN 1,217 million).

(2) Minority interest includes Tier I (PEN 536.5 million) and Tier II (PEN 2.1 million) minority interests.

(3) Up to 1.25% of total risk-weighted assets of Banco de Cr�dito del Per�, Soluci�n Empresa Administradora Hipotecaria, Financiera Edyficar and Atlantic Security Bank.

(4) Tier II + Tier III can not be more than 50% of total regulatory capital.

(5) Tier I = capital + restricted capital reserves + Tier I minority interest - goodwill - (0.5 x investment in equity and subordinated debt of financial and insurance companies) + perpetual subordinated debt.

(6) Tier II = subordinated debt + TierII minority interest tier + loan loss reserves - (0.5 x investment in equity and subordinated debt of financial and insurance companies).

(7) Tier III = Subordinated debt covering market risk only.

(8) Includes regulatory capital requirements of the financial consolidated group.

(9) Includes regulatory capital requirements of the insurance consolidated group.

(10) Regulatory Capital / Total Regulatory Capital Requirements (legal minimum = 1.00).

�

As the table indicates, in general terms Credicorp, as a holding, has maintained a comfortable capitalization level that is equivalent to 1.13 times the capital required by the Peruvian regulator. This ratio falls below the figure reported at the end of 2Q14, mainly because regulatory capital requirements grew at a higher rate (+10.1% QoQ) than regulatory capital (+1.4% QoQ).The increase in regulatory capital requirements came from the financial consolidated group’s regulatory capital and is mainly explained by an increase in credit risk weighted assets and additional capital requirements at BCP.

�

The aforementioned also explains the year over year variation; in which Credicorp decreased its capitalization level from 1.19 in 2Q14 to 1.13 in 3Q14.

�

Additionally, it is also important to note that the Tier 1 represents 58.2% of Credicorp’s total regulatory capital (similar to 59.4% in 2Q14).

�

The table shows that the majority of the capital requirement (94.1%) is associated with its financial business, and in particular more than 70% of the group’s total regulatory capital requirement is concentrated in BCP.

�

| 7 |

|

�

Also, Credicorp’s income generation, coupled with the corporation’s policies on retained earnings, dividend payments, capitalization of earnings and reserve building, has allowed Credicorp to build a comfortable capital reserve to support its business expansion.

�

Finally, Credicorp holds approximately PEN 1,358 million in liquid investments that can be used at any time to strengthen its regulatory capital, which involves a capital buffer of 10% and would turn the regulatory capital ratio to 1.23.

�

| 8 |

|

�

II. Banco de Cr�dito del Peru Consolidated

�

| Banco de Credito and Subsidiaries | � | Quarter | � | � | % Change | � | � | Year to date | � | � | % Change | � | ||||||||||||||||||||

| PEN (000) | � | 3Q13 | � | � | 2Q14 | � | � | 3Q14 | � | � | QoQ | � | � | YoY | � | � | Sep 13 | � | � | Sep 14 | � | � | Sep 14 / Sep 13 | � | ||||||||

| Net interest income | � | � | 1,188,024 | � | � | � | 1,507,462 | � | � | � | 1,587,958 | � | � | � | 5.3 | % | � | � | 33.7 | % | � | � | 3,355,396 | � | � | � | 4,386,417 | � | � | � | 30.7 | % |

| Total provisions for loan loasses | � | � | (332,505 | ) | � | � | (481,036 | ) | � | � | (433,343 | ) | � | � | -9.9 | % | � | � | 30.3 | % | � | � | (890,671 | ) | � | � | (1,279,399 | ) | � | � | 43.6 | % |

| Net interest income after net provisions for loan losses | � | � | 855,519 | � | � | � | 1,026,426 | � | � | � | 1,154,615 | � | � | � | 12.5 | % | � | � | 35.0 | % | � | � | 2,464,725 | � | � | � | 3,107,018 | � | � | � | 26.1 | % |

| Non financial income | � | � | 591,130 | � | � | � | 642,331 | � | � | � | 688,818 | � | � | � | 7.2 | % | � | � | 16.5 | % | � | � | 1,657,175 | � | � | � | 1,942,057 | � | � | � | 17.2 | % |

| Operating expenses | � | � | (847,610 | ) | � | � | (1,062,699 | ) | � | � | (1,049,175 | ) | � | � | -1.3 | % | � | � | 23.8 | % | � | � | (2,541,043 | ) | � | � | (2,981,137 | ) | � | � | 17.3 | % |

| Operating income | � | � | 599,039 | � | � | � | 606,058 | � | � | � | 794,258 | � | � | � | 31.1 | % | � | � | 32.6 | % | � | � | 1,580,857 | � | � | � | 2,067,938 | � | � | � | 30.8 | % |

| Core operating income | � | � | 599,039 | � | � | � | 606,058 | � | � | � | 794,258 | � | � | � | 31.1 | % | � | � | 32.6 | % | � | � | 1,580,857 | � | � | � | 2,067,938 | � | � | � | 30.8 | % |

| Non core operating income | � | � | - | � | � | � | - | � | � | � | - | � | � | � | - | � | � | � | - | � | � | � | - | � | � | � | - | � | � | � | - | � |

| Translation results | � | � | (8,144 | ) | � | � | (1,198 | ) | � | � | 13,066 | � | � | � | 1190.7 | % | � | � | -260.4 | % | � | � | (220,998 | ) | � | � | 9,921 | � | � | � | 104.5 | % |

| Income taxes | � | � | (169,166 | ) | � | � | (170,049 | ) | � | � | (224,940 | ) | � | � | 32.3 | % | � | � | 33.0 | % | � | � | (500,324 | ) | � | � | (581,802 | ) | � | � | 16.3 | % |

| Net income | � | � | 421,201 | � | � | � | 433,079 | � | � | � | 585,764 | � | � | � | 35.3 | % | � | � | 39.1 | % | � | � | 858,025 | � | � | � | 1,496,961 | � | � | � | 74.5 | % |

| Net income / share (PEN) | � | � | 0.09 | � | � | � | 0.09 | � | � | � | 0.12 | � | � | � | 35.2 | % | � | � | 39.0 | % | � | � | 0.18 | � | � | � | 0.32 | � | � | � | 74.5 | % |

| Total loans | � | � | 60,412,012 | � | � | � | 71,396,079 | � | � | � | 73,636,007 | � | � | � | 3.1 | % | � | � | 21.9 | % | � | � | 60,412,012 | � | � | � | 73,636,007 | � | � | � | 21.9 | % |

| Deposits and obligations | � | � | 63,385,310 | � | � | � | 72,094,492 | � | � | � | 70,820,124 | � | � | � | -1.8 | % | � | � | 11.7 | % | � | � | 63,385,310 | � | � | � | 70,820,124 | � | � | � | 11.7 | % |

| Net shareholders' equity | � | � | 7,910,039 | � | � | � | 8,937,830 | � | � | � | 9,513,534 | � | � | � | 6.4 | % | � | � | 20.3 | % | � | � | 7,910,039 | � | � | � | 9,513,534 | � | � | � | 20.3 | % |

| Net financial margin | � | � | 5.33 | % | � | � | 5.90 | % | � | � | 6.02 | % | � | � | � | � | � | � | � | � | � | � | 5.21 | % | � | � | 5.84 | % | � | � | � | � |

| Efficiency ratio | � | � | 46.1 | % | � | � | 48.5 | % | � | � | 44.9 | % | � | � | � | � | � | � | � | � | � | � | 48.0 | % | � | � | 46.1 | % | � | � | � | � |

| Return on average equity | � | � | 22.0 | % | � | � | 19.9 | % | � | � | 25.4 | % | � | � | � | � | � | � | � | � | � | � | 15.3 | % | � | � | 22.4 | % | � | � | � | � |

| Return on average total assets | � | � | 1.8 | % | � | � | 1.6 | % | � | � | 2.1 | % | � | � | � | � | � | � | � | � | � | � | 1.2 | % | � | � | 1.9 | % | � | � | � | � |

| PDL ratio | � | � | 2.25 | % | � | � | 2.72 | % | � | � | 2.66 | % | � | � | � | � | � | � | � | � | � | � | 2.25 | % | � | � | 2.66 | % | � | � | � | � |

| NPL ratio (1) | � | � | 2.84 | % | � | � | 3.40 | % | � | � | 3.35 | % | � | � | � | � | � | � | � | � | � | � | 2.84 | % | � | � | 2.66 | % | � | � | � | � |

| Coverage ratio of PDLs | � | � | 162.7 | % | � | � | 158.4 | % | � | � | 161.5 | % | � | � | � | � | � | � | � | � | � | � | 162.7 | % | � | � | 161.5 | % | � | � | � | � |

| Coverage ratio of NPLs | � | � | 128.7 | % | � | � | 126.6 | % | � | � | 128.3 | % | � | � | � | � | � | � | � | � | � | � | 128.7 | % | � | � | 128.3 | % | � | � | � | � |

| BIS ratio | � | � | 14.12 | % | � | � | 14.58 | % | � | � | 14.78 | % | � | � | � | � | � | � | � | � | � | � | 14.12 | % | � | � | 14.78 | % | � | � | � | � |

| Branches (2) | � | � | 619 | � | � | � | 781 | � | � | � | 784.00 | � | � | � | � | � | � | � | � | � | � | � | 619 | � | � | � | 784 | � | � | � | � | � |

| Agentes BCP (3) | � | � | 5,426 | � | � | � | 7,894 | � | � | � | 7,954 | � | � | � | � | � | � | � | � | � | � | � | 5,426 | � | � | � | 7,954 | � | � | � | � | � |

| ATMs (3) | � | � | 2,282 | � | � | � | 2,507 | � | � | � | 2,504 | � | � | � | � | � | � | � | � | � | � | � | 2,282 | � | � | � | 2,504 | � | � | � | � | � |

| Employees | � | � | 22,403 | � | � | � | 27,241 | � | � | � | 27,555 | � | � | � | � | � | � | � | � | � | � | � | 22,403 | � | � | � | 27,555 | � | � | � | � | � |

(1) NPLs: Non-performing lons = Past due loans + Refinanced and restructured loans. NPL Ratio = NPLs / Total loans.

(2) Includes: BCP, Edyficar, Mibanco and BCP Bolivia.

(3) Includes: BCP Mibanco and BCP Bolivia.

�

BCP consolidated reported net income of PEN 585.8 million in 3Q14, which represented an historic record for quarterly earnings in the banking business. This result, which does not reflect the business’s full potential, nonetheless clearly shows a turning point after a strong economic slowdown in the first half of the year. This was further accentuated by challenges in the SME - Pyme business, which had a negative effect on business that was mainly evident in a significant increase in the cost of risk.

�

The aforementioned, led to an excellent ROAE of 25.4% and an ROAA of 2.1%. This was accompanied by a considerable improvement in operating efficiency, which dropped -306 bps to situate at 44.9%. NIM posted an improvement at both the global and loan levels with 6.02% and 9.01% respectively, which tops the 5.90% and 8.91% posted in 2Q14.

�

The bank’s portfolio quality ratios reflected a recovery that is evident in: i) a decrease in the PDL ratio, which was situated at 2.66% (vs 2.72% in 2Q14), and a drop in the NPL ratio, which weighed in at 3.35% (vs 3.40% in 2Q14); ii) higher coverage of past due and non-performing loans, with levels of 161.5% and 128.3%, respectively; and iii) a lower provisions ratio with regard to loans and the NII, which were situated at 2.4% and 27.3% respectively vs 2.7% and 31.9% respectively of last quarter.

�

The excellent result in 3Q14 is due primarily to:

�

| i) | The expansion of +5.3% QoQ and +33.7% YoY posted in NII, attributable to higher interest on loans, which was attributable to +4.1% growth QoQ and +21.4% YoY on average daily loan balances; as well as lower growth (+3.1% QoQ and +2.0% YoY) in interest expenses, due to lower funding costs thus far this year. |

�

| ii) | The -9.9% QoQ reduction in provisions for loan losses was attributable to an improvement in delinquency, which was in line with expectations after the changes implemented primarily in the SME - Pyme, Credit Cards and Consumer businesses. This helped offset higher expenditure for provisions for loan losses at Mibanco, which were in turn associated with maturities in the past due portfolio. |

�

| iii) | The increase of +7.2% QoQ and +16.5% YoY in non-financial income, which was due to higher gains on sales of securities, gains on foreign exchange transactions and fee income. |

�

| 9 |

|

�

| iv) | The -1.3% QoQ decrease in operating expenses, which was due primarily to lower expenses at almost all of the group’s subsidiaries. This Q, there was a noteworthy decrease in expenses incurred for employee�s salaries and benefits (-4.9% QoQ), which is in line with a reduction in the organization’s organic structure; and lower administrative and general expenses this quarter compared to last quarter, which posted non-recurring expenses for marketing (125 years of BCP) and consultancy services. |

�

| v) | Translation gains for PEN 13.1 million, as a result of a 3.4% appreciation in the US Dollar with regard to the Nuevo Sol in 3Q14, due to a long position in US Dollars and given the fact that the functional currency is now the Nuevo Sol. |

�

As is shown above, the excellent result obtained this quarter is attributable to the good performance in all business segments.

�

In 3Q14, BCP’s interest earning assets expanded +3.9% QoQ. This was due primarily to growth in total loans (+3.1% QoQ); and the Bank’s most profitable assets, which reflected dynamism in Wholesale Banking and the fact that Retail Banking has begun to recover. Additionally, a +43.3% increase was posted QoQ in trading securities due to more investments in CDs from BCRP.

�

The evolution of average daily loan balances clearly reflected more dynamism. In this scenario, Wholesale Banking maintained the trend posted in the first semester of 2014, with growth of +5.4% QoQ, which was the highest rate registered thus far this year. Within this portfolio, loans in LC, which are associated with better margins, were more dynamic this quarter. Retail Banking bounced back and registered growth of +3.5% QoQ in loans, which represents a higher growth rate than that seen in previous quarters (+0.5% in 1Q1 and + 1.4% in 2Q). Within Retail Banking, the star performer was the SME - Business, followed by Mortgage and Consumer. Nevertheless, it is important to note that this dynamic is not reflecting yet the business’s potential.

�

The aforementioned, coupled with a stable funding cost (2.05% in 3Q14 vs 2.04% in 2Q14), facilitated a 12 bps and 10 bps improvement in the global NIM and loan NIM respectively.

�

In terms of the quality of the loan portfolio, the PDL ratio fell 6 bps to situate at 2.66%, due to on-going deceleration in delinquency levels and more dynamism of loans. The improvement posted in the PDL ratio was due to lower levels of delinquency in the SME - Pyme, SME - Business and Credit Cards segments. On the other hand, the PDL ratio at 90 days increased 3 bps due to the impact of installment loans (i.e. mortgage and consumer), which during the first 90 days only reflect past due installments but after day 91, reflect the total loan balance due. The NPL ratio was situated at 3.35% at the end of 2Q14, which represented a slight reduction of 5 bps QoQ.

�

Finally, the BIS capital adequacy ratio (for BCP Stand-alone), based on results in Local Peru GAAP), increased slightly, going from 14.58% to 14.78%. This was attributable to the agreements to capitalize retained earnings, which also helped improve the TIER 1 and TIER 1 Common Equity ratios, which increased from 9.72% to 10.19% and from 7.18% to 7.20% respectively.

�

II.1 Interest-Earning Assets

�

Interest earning assets grew +3.9% QoQ and +19.1% YoY due to growth in total loans (+3.1% QoQ), which are the Bank’s most profitable assets. This expansion reflects the dynamism of Wholesale Banking, and the fact that Retail Banking has begun to recover. An increase of +43.3% QoQ was also posted in trading securities, due to more investment in CDs from BCRP.

�

| 10 |

|

�

| Interest earning assets | � | Quarter | � | � | % Change | � | ||||||||||||||

| PEN (000) | � | 3Q13 | � | � | 2Q14 | � | � | 3Q14 | � | � | QoQ | � | � | YoY | � | |||||

| BCRP and other banks | � | � | 18,137,053 | � | � | � | 18,891,599 | � | � | � | 19,529,988 | � | � | � | 3.4 | % | � | � | 7.7 | % |

| Interbank funds | � | � | 282,544 | � | � | � | 297,004 | � | � | � | 435,939 | � | � | � | 46.8 | % | � | � | 54.3 | % |

| Trading securities | � | � | 300,817 | � | � | � | 1,717,501 | � | � | � | 2,460,868 | � | � | � | 43.3 | % | � | � | 718.1 | % |

| Investments securities available for sale | � | � | 10,447,902 | � | � | � | 9,380,457 | � | � | � | 9,336,182 | � | � | � | -0.5 | % | � | � | -10.6 | % |

| Investments held to maturity | � | � | 675,039 | � | � | � | 1,760,575 | � | � | � | 2,122,790 | � | � | � | 20.6 | % | � | � | 214.5 | % |

| Total loans | � | � | 60,412,012 | � | � | � | 71,396,079 | � | � | � | 73,636,007 | � | � | � | 3.1 | % | � | � | 21.9 | % |

| Total interest earning assets | � | � | 90,255,367 | � | � | � | 103,443,215 | � | � | � | 107,521,774 | � | � | � | 3.9 | % | � | � | 19.1 | % |

�

If we analyze the QoQ evolution of BCP’s interest earning assets, we can see the impact of the good dynamic of total loans. The evolution of Wholesale Banking, which expanded +5.4% QoQ (measured in average daily balances), was particularly noteworthy. The dynamism of this portfolio was evident in both Corporate Banking (+4.7% QoQ, measured in average daily balances) and in Middle Market Banking (+6.5% QoQ). On the other hand, Retail Banking reported growth of +3.5% QoQ, which is significantly higher than the rate registered in previous quarters (+0.5% in 1Q14 and + 1.4% in 2Q14). This was due not only to a slight recovery in the economy, but also to the campaigns conducted in the second half of the year.

�

Trading securities increased +43.3% QoQ. This growth was associated with more investments in Certificates of Deposits from BCRP, which registered better performance and fluctuation in 3Q14. This was in line with BCP’s asset and liability management strategy to improve short term margins.

�

It is important to note that deposits in BCRP and in other banks reported growth of +3.4% QoQ, due to REPO transactions with BCRP in 3Q14 (which will be discussed later in the report), and an increase in deposits in banks locally and abroad this past quarter.

�

The increase in the held-to-maturity portfolio (+20.6 QoQ) was due to a larger position in Peruvian Government bonds, which clearly reflects our assets and liabilities management strategy.

�

If we analyze the YoY evolution, a +19.1% increase is evident in total interest earning assets. This was primarily due to the inclusion of Mibanco at the end of 1Q14, and an expansion in total loans (+21.9% YoY).

�

Loan Portfolio

�

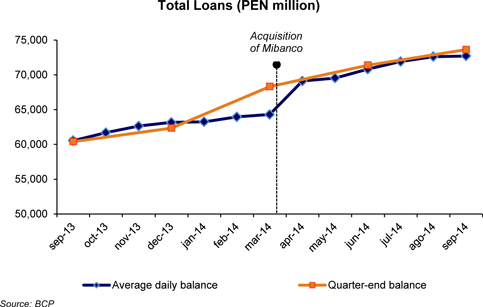

The following figure depicts the evolution of average daily balances over the last 12 months of loans at the end of each month, and accounting balances at quarter-end:

�

�

| 11 |

|

�

The favorable evolution of the loan portfolio, measured in average daily balances, led to an increase of +4.1% QoQ. Growth in Corporate Banking and Middle Market Banking were particularly noteworthy this quarter. On the other hand, at the end of 3Q14, total loans, expressed in accounting balances, were situated at PEN 73,636 million. This represents growth of +3.1% QoQ and +21.9% YoY.

�

QoQ growth in average daily loan balances is attributable to the fact that the year-end campaign has begun, and is in line with the increase in dynamism that characterizes the second half of every year.

�

It is important to note, that the lower growth in accounting balances with regard to average daily balances was due to loan balance cancelations in Corporate Banking�s FC portfolio at the end of 3Q14. This did not have a material effect on average daily balances this quarter, in a scenario marked by an appreciation in the US Dollar, and a decrease in BCRP’s reserve requirements for LC (in June, the rate was 11.5% and at the end of September, it was 10.5%), which improved conditions for loans in LC and reflects the effect of migrating from FC to LC by the end of 3Q14.

�

The YoY analysis indicates that average daily balances, including Mibanco, appreciated +21.4% YoY. Nevertheless, if we exclude Mibanco, growth was situated at +14.4% YoY.

�

Average Daily Balances

�

| � | � | TOTAL LOANS (1) | � | |||||||||||||||||

| � | � | (Expressed in million PEN)* | � | |||||||||||||||||

| � | � | 3Q13 | � | � | 2Q14 | � | � | 3Q14 | � | � | QoQ | � | � | YoY | � | |||||

| Wholesale Banking | � | � | 27,649 | � | � | � | 31,035 | � | � | � | 32,704 | � | � | � | 5.4 | % | � | � | 18.3 | % |

| Corporate | � | � | 17,700 | � | � | � | 19,790 | � | � | � | 20,729 | � | � | � | 4.7 | % | � | � | 17.1 | % |

| Middle-Market | � | � | 9,948 | � | � | � | 11,245 | � | � | � | 11,975 | � | � | � | 6.5 | % | � | � | 20.4 | % |

| Retail Banking | � | � | 26,912 | � | � | � | 28,200 | � | � | � | 29,177 | � | � | � | 3.5 | % | � | � | 8.4 | % |

| SME- Pyme | � | � | 6,973 | � | � | � | 6,921 | � | � | � | 7,042 | � | � | � | 1.7 | % | � | � | 1.0 | % |

| SME- Business | � | � | 2,528 | � | � | � | 2,517 | � | � | � | 2,835 | � | � | � | 12.6 | % | � | � | 12.2 | % |

| Mortgage | � | � | 9,414 | � | � | � | 10,247 | � | � | � | 10,555 | � | � | � | 3.0 | % | � | � | 12.1 | % |

| Consumer | � | � | 5,378 | � | � | � | 5,555 | � | � | � | 5,737 | � | � | � | 3.3 | % | � | � | 6.7 | % |

| Credit Card | � | � | 2,620 | � | � | � | 2,959 | � | � | � | 3,009 | � | � | � | 1.7 | % | � | � | 14.8 | % |

| Edyficar | � | � | 2,299 | � | � | � | 2,878 | � | � | � | 3,058 | � | � | � | 6.3 | % | � | � | 33.0 | % |

| Bolivia | � | � | 2,693 | � | � | � | 3,021 | � | � | � | 3,168 | � | � | � | 4.9 | % | � | � | 17.6 | % |

| Mibanco | � | � | - | � | � | � | 4,259 | � | � | � | 4,167 | � | � | � | -2.1 | % | � | � | - | � |

| Others (2) | � | � | 373 | � | � | � | 444 | � | � | � | 447 | � | � | � | 0.7 | % | � | � | 20.0 | % |

| � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � |

| Consolidated total loans | � | � | 59,925 | � | � | � | 69,836 | � | � | � | 72,721 | � | � | � | 4.1 | % | � | � | 21.4 | % |

(1) Average daily balance.

(2) Includes Work Out Unit, and other banking.

* For consolidation purposes, loans generated in FC are converted to LC.

Source: BCP

�

As discussed above, loan evolution (measured in average daily balances) in 3Q14 is due to a +5.4% QoQ increase in Wholesale Banking, which reflected the excellent dynamism in Corporate Banking (+4.7% QoQ) and Middle Market Banking (+6.5% QoQ). The expansion posted in both portfolios, was due primarily to more medium and long term working capital financing, and foreign trade financing in FC (+5.3% QoQ and +4.5% QoQ respectively).

�

The Retail Banking portfolio registered +3.5% growth QoQ, that was due primarily to an increase in LC loans (+3.0% QoQ), which was in line with expansion in the SME - Business, Mortgage and Consumer segments. It is important to note the recovery posted in this portfolio’s growth, although it is still not normalized, given that in 1Q, expansion was situated at +0.5% QoQ and in 2Q, the figure was +1.4% QoQ. As such, there is a clear upward trend in Retail Banking. The variations seen within this portfolio were due to:

�

| i) | The SME - Business segment grew +12.6% QoQ, primarily due to an expansion in the FC portfolio that grew +11.2% QoQ, because of better rates. On the other hand, the LC portfolio grew +10.9% QoQ. The aforementioned factors are in line with the effect of year-end financing campaigns. |

�

| 12 |

|

�

| ii) | The Mortgage Segment increased +3.0% QoQ, due to growth in the LC portfolio (3.7% QoQ). This rate falls below that posted in the first two quarters of the year (1Q14: +6.5% QoQ; 2Q14: +5.5% QoQ) due to the economic slowdown. The FC portfolio continued to fall due to amortizations (-0.2% QoQ). |

�

| iii) | The Consumer segment posted an increase of +3.3% QoQ. This segment also reflected a better pace with regard to the figures posted in the first half of the year (+1.8% in 1Q and +1.6% in 2Q). If we analyze the evolution by currency, an increase of +2.7% QoQ is evident in the LC portfolio, while the FC portfolio posted growth of +3.5% QoQ. It is important to note that the LC portfolio represents approximately 80% of all loans in this segment, while the FC portfolio is associated with credit lines issued to high-income clients. |

�

| iv) | The Credit Card segment grew +1.7% QoQ. This quarter, more growth was seen in this segment’s LC portfolio (+1.5% QoQ) due to recurrent credit card campaigns (Lanpass Program) in 3Q14. Unlike other businesses, the dynamic of the Credit Card segment shows growth rates that are slightly below those registered in previous quarters +2% in 1Q and + 2.2% in 2Q. |

�

| v) | The SME - Pyme segment posted growth of +1.7% QoQ, which was primarily attributable to the end-of-year campaign. This result contrasts with that seen in the first half of the year, with a -1.5% drop in 1Q and a -0.9% decline in 2Q, due to the changes implemented in the business and risk models. In this line, the LC portfolio, which represents 90% of SME loans, expanded +2.1% QoQ, while the FC segment dropped -3.2% QoQ. |

�

Edyficar’s portfolio, measured in average daily balances, posted a significant increase (+6.3% QoQ), going from PEN 2,878 million in 2Q14 to PEN 3,058 million in 3Q14. The aforementioned, is in line with growth in the labor force, which helped fuel an increase in Edyficar’s share of the loan market, which rose from 8.9% in 2Q to 9.2% in 3Q. On the other hand, BCP Bolivia’s loans grew +4.9% QoQ due to expansion in its Retail Banking portfolio, which will be covered in detail later in this report.

�

In the YoY evolution, average daily loan balances grew +21.4%, which was due primarily to:

�

| i) | Growth in the Wholesale Banking portfolio (+18.3% YoY), which posted noteworthy growth in the LC portfolio (+61.6% YoY). This component accounts for approximately 40% of the YoY growth. |

�

| ii) | The impact of the Mibanco acquisition, which is responsible for approximately 33% of the YoY growth in average daily balances. |

�

| iii) | The +8.4% YoY growth in Retail Banking loans, which are responsible for approximately 18% of the total increase; in this division, the evolution of the Mortgage, Consumer and Credit Card portfolios is particularly noteworthy. |

�

| iv) | Growth of +33.0% YoY in Edyficar’s portfolio; this excellent performance was accompanied by good portfolio quality, which is in turn reflected in its stable delinquency ratio. The aforementioned is even more outstanding, if we consider that the scenario in the SME - Pyme and Micro segments is currently challenging. |

�

| v) | Finally, BCP Bolivia achieved growth of +17.6% YoY in loans. This was due primarily to on-going growth in its Retail Banking portfolio. |

�

| 13 |

|

�

Average Daily Balances

�

| � | � | DOMESTIC CURRENCY LOANS (1) | � | � | FOREIGN CURRENCY LOANS (1) | � | ||||||||||||||||||||||||||||||||||

| � | � | (Expressed in million PEN) | � | � | (Expressed in million USD) | � | ||||||||||||||||||||||||||||||||||

| � | � | 3Q13 | � | � | 2Q14 | � | � | 3Q14 | � | � | QoQ | � | � | YoY | � | � | 3Q13 | � | � | 2Q14 | � | � | 3Q14 | � | � | QoQ | � | � | YoY | � | ||||||||||

| Wholesale Banking | � | � | 6,379 | � | � | � | 10,104 | � | � | � | 10,307 | � | � | � | 2.0 | % | � | � | 61.6 | % | � | � | 7,613 | � | � | � | 7,502 | � | � | � | 7,878 | � | � | � | 5.0 | % | � | � | 3.5 | % |

| Corporate | � | � | 4,215 | � | � | � | 6,763 | � | � | � | 6,750 | � | � | � | -0.2 | % | � | � | 60.1 | % | � | � | 4,827 | � | � | � | 4,669 | � | � | � | 4,918 | � | � | � | 5.3 | % | � | � | 1.9 | % |

| Middle-Market | � | � | 2,164 | � | � | � | 3,342 | � | � | � | 3,558 | � | � | � | 6.5 | % | � | � | 64.4 | % | � | � | 2,786 | � | � | � | 2,833 | � | � | � | 2,960 | � | � | � | 4.5 | % | � | � | 6.3 | % |

| Retail Banking | � | � | 18,751 | � | � | � | 20,549 | � | � | � | 21,165 | � | � | � | 3.0 | % | � | � | 12.9 | % | � | � | 2,906 | � | � | � | 2,742 | � | � | � | 2,817 | � | � | � | 2.7 | % | � | � | -3.0 | % |

| SME- Pyme | � | � | 6,132 | � | � | � | 6,200 | � | � | � | 6,330 | � | � | � | 2.1 | % | � | � | 3.2 | % | � | � | 285 | � | � | � | 259 | � | � | � | 250 | � | � | � | -3.2 | % | � | � | -12.2 | % |

| SME- Business | � | � | 641 | � | � | � | 782 | � | � | � | 868 | � | � | � | 10.9 | % | � | � | 35.5 | % | � | � | 675 | � | � | � | 622 | � | � | � | 691 | � | � | � | 11.2 | % | � | � | 2.4 | % |

| Mortgage | � | � | 5,388 | � | � | � | 6,536 | � | � | � | 6,779 | � | � | � | 3.7 | % | � | � | 25.8 | % | � | � | 1,441 | � | � | � | 1,330 | � | � | � | 1,328 | � | � | � | -0.2 | % | � | � | -7.9 | % |

| Consumer | � | � | 4,287 | � | � | � | 4,402 | � | � | � | 4,521 | � | � | � | 2.7 | % | � | � | 5.5 | % | � | � | 391 | � | � | � | 413 | � | � | � | 427 | � | � | � | 3.5 | % | � | � | 9.4 | % |

| Credit Card | � | � | 2,304 | � | � | � | 2,629 | � | � | � | 2,667 | � | � | � | 1.5 | % | � | � | 15.8 | % | � | � | 113 | � | � | � | 119 | � | � | � | 120 | � | � | � | 1.2 | % | � | � | 6.1 | % |

| Edyficar | � | � | 2,270 | � | � | � | 2,853 | � | � | � | 3,033 | � | � | � | 6.3 | % | � | � | 33.6 | % | � | � | 10 | � | � | � | 9 | � | � | � | 9 | � | � | � | -1.5 | % | � | � | -14.2 | % |

| Bolivia | � | � | - | � | � | � | - | � | � | � | - | � | � | � | - | � | � | � | - | � | � | � | 964 | � | � | � | 1,083 | � | � | � | 1,114 | � | � | � | 2.9 | % | � | � | 15.6 | % |

| Mibanco | � | � | - | � | � | � | 3,686 | � | � | � | 3,622 | � | � | � | -1.7 | % | � | � | - | � | � | � | - | � | � | � | 206 | � | � | � | 192 | � | � | � | -6.8 | % | � | � | - | � |

| Others (2) | � | � | 115 | � | � | � | 163 | � | � | � | 142 | � | � | � | -12.7 | % | � | � | 23.6 | % | � | � | 108 | � | � | � | 101 | � | � | � | 107 | � | � | � | 6.3 | % | � | � | -0.8 | % |

| � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � |

| Consolidated total loans | � | � | 27,515 | � | � | � | 37,354 | � | � | � | 38,270 | � | � | � | 2.5 | % | � | � | 39.1 | % | � | � | 11,601 | � | � | � | 11,643 | � | � | � | 12,117 | � | � | � | 4.1 | % | � | � | 4.4 | % |

(1) Average daily balance.

(2) Includes Work Out Unit, other banking and BCP Bolivia.

Fuente: BCP

�

Market Share in loans

�

�

At the end of August 2014, BCP consolidated continued to lead the market with a share of 31.0%, which situates it 11% above its closest competitor.

�

During the same period, Retail Banking continued to lead the market in the majority of its segments, with the exception of Credit Cards, where it is situated in second place. It is important to note that BCP’s market share of the SME segment, without Mibanco, increased slightly (+0.4%) from June to August 2014; and, if we include Mibanco’s share, the portfolio’s total market share is situated at 35.9%.

�

Wholesale Banking continued to consolidate its market leadership by increasing its share of both Corporate Banking and Middle Market Banking, going from 44.4% and 33.1% in June 2014, respectively to 44.7% and 33.3% at the end of September 2014, respectively.

�

Dollarization

�

If we analyze the evolution of dollarization in the loan portfolio using accounting balances at quarter-end, we see that FC-denominated loans continued to fall QoQ and YoY, going from 53.1% in 3Q13 and 47.6% in 2Q14, to 47.0% in 3Q14. The aforementioned is due to the dedollarization process that is underway, which is driven by better conditions for LC loans and the devaluation of the Nuevo Sol in 2013, which has continued in 2014. In this sense, the quarterly decrease is due primarily to expansion in the LC portfolio, which was led by the Retail Banking portfolio.

�

| 14 |

|

�

�

II. 2 Funding

�

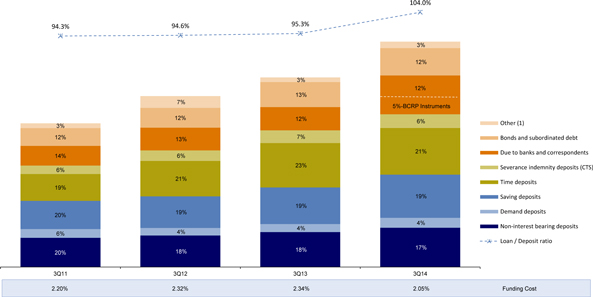

BCP’s funding cost remained stable QoQ, despite a recomposition in funding sources, which was due primarily to an increase in Due to Banks and Correspondents (+30.7 QoQ) that offset the decrease in time deposits (-7.9% QoQ) and CTS deposits (-10.6% QoQ). The loan/deposit ratio increased to 104.0% at the end of 3Q14, which is +500 bps higher than the 99.0% posted in 2Q14, due to a drop in deposits (-1.8% QoQ), while total loans grew +3.1% QoQ. The aforementioned shows the trade-off between the increase of the ratio and the protection of funding costs that BCP decided.

�

| Funding | � | Quarter | � | � | % Change | � | ||||||||||||||

| PEN (000) | � | 3Q13 | � | � | 2Q14 | � | � | 3Q14 | � | � | QoQ | � | � | YoY | � | |||||

| Non-interest bearing deposits | � | � | 16,140,468 | � | � | � | 18,393,882 | � | � | � | 18,154,246 | � | � | � | -1.3 | % | � | � | 12.5 | % |

| Demand deposits | � | � | 3,758,975 | � | � | � | 3,996,195 | � | � | � | 4,612,503 | � | � | � | 15.4 | % | � | � | 22.7 | % |

| Saving deposits | � | � | 16,888,339 | � | � | � | 19,036,056 | � | � | � | 19,965,805 | � | � | � | 4.9 | % | � | � | 18.2 | % |

| Time deposits | � | � | 20,468,453 | � | � | � | 23,314,183 | � | � | � | 21,466,868 | � | � | � | -7.9 | % | � | � | 4.9 | % |

| Severance indemnity deposits (CTS) | � | � | 5,926,255 | � | � | � | 7,148,162 | � | � | � | 6,390,609 | � | � | � | -10.6 | % | � | � | 7.8 | % |

| Interest payable | � | � | 202,821 | � | � | � | 206,014 | � | � | � | 230,093 | � | � | � | 11.7 | % | � | � | 13.4 | % |

| Total customer deposits | � | � | 63,385,310 | � | � | � | 72,094,492 | � | � | � | 70,820,124 | � | � | � | -1.8 | % | � | � | 11.7 | % |

| � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � |

| Due to banks and correspondents | � | � | 10,662,697 | � | � | � | 13,674,528 | � | � | � | 17,871,327 | � | � | � | 30.7 | % | � | � | 67.6 | % |

| Bonds and subordinated debt | � | � | 11,537,940 | � | � | � | 12,263,511 | � | � | � | 12,644,297 | � | � | � | 3.1 | % | � | � | 9.6 | % |

| Other liabilities | � | � | 2,013,193 | � | � | � | 2,085,196 | � | � | � | 2,781,552 | � | � | � | 33.4 | % | � | � | 38.2 | % |

| � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � |

| Total funding | � | � | 87,599,140 | � | � | � | 100,117,727 | � | � | � | 104,117,300 | � | � | � | 4.0 | % | � | � | 18.9 | % |

| � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � | � |

| Funding cost | � | � | 2.34 | % | � | � | 2.04 | % | � | � | 2.05 | % | � | � | � | � | � | � | � | � |

�

Funding Cost

�

BCPs’ funding cost1 remained stable QoQ, and situated at 2.05% in 3Q14 vs. 2.04% in 2Q14. Although total funding increased +4.0% QoQ, and a recomposition was evident, which will be explained later on, interest expenses expanded moderately (+3.1% QoQ).

�

1 El costo de fondeo es calculado usando la siguiente f�rmula:

�

�

* Uses the average of the initial balance and the closing balance of total liabilities (without including other liabilities) for the period.

�

| 15 |

|

�

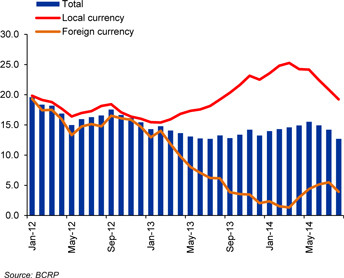

In terms of the funding structure, although the share of total deposits fell from 72% in 2Q14 to 68% in 3Q14 and the share of Due to Banks and Correspondents increased from 13.7% in 2Q14 to 17.4% in 3Q14; the funding cost remained stable due to the fact that the aforementioned was attributable to an increase in the use of alternative sources of funding, which are less expensive than some kinds of deposits, such as time deposits. The increase in Repo and Currency repo with BCRP was noteworthy, and was in line with the increase in the availability of this source of funds in 3Q14. The purpose of BCRP’s instruments for funding is to inject more LC liquidity into the market and to reduce exchange rate volatility.

�

It is important to remember that alternative sources of funding, such as REPO transactions, are exempt from the implicit cost of legal reserve requirements, which reduces costs particularly in comparison to other sources of funding such as time deposits.

�

The drop in deposits was evident primarily in higher-cost options such as company time deposits. Nevertheless, it is important to note that the main QoQ decline in time deposits was evident in the FC portfolio, which offers lower interest rates (approximately -300 bps) than LC time deposits.

�

In 3Q14, CTS deposits also posted a decline. This was attributable to a decrease in legal requirements (the minimum level to calculate the surplus that an employee can access was reduced from 6 monthly salaries to 4). It is important to remember that these deposits have low funding costs, even lower than those associated with BCRP’s funding instruments.

�

Funding – Structure and Cost (excluding Mibanco)

�

�

If we analyze the evolution of the funding structure, we see that the deposits’ share of total funding remained relatively stable in 2011-2013, representing between 73% and 75% of total funding. Nevertheless, the share of total deposits in total funding fell in 3Q14 and situated at 68%2. The aforementioned, was due to a decrease in time deposits (-7.9% QoQ), followed by a drop in CTS deposits (-10.6% QoQ), which we explained before.

�

The loan/deposit (L/D) ratio was situated at 104.0% at the end of 3Q14, which represents a +500 bps increase with regard to the figure registered in 2Q14 (99.0%). This was due primarily to the -1.8% QoQ drop in total deposits vs. growth of +3.1% QoQ in total loans.

�

It is important to highlight that BCP’s asset and liability management in 3Q prioritized the defense of funding cost (to avoid its increase) against that of the L/D ratio. In line with this, BCP preferred to take BCRP instruments as a source of funds instead of attracting LC time deposits by increasing the interest rate.

�

2 These figures consider share vs. total funding. The figure “Evolution of the structure and funding cost” does not include Other Liabilities.

�

| 16 |

|

�

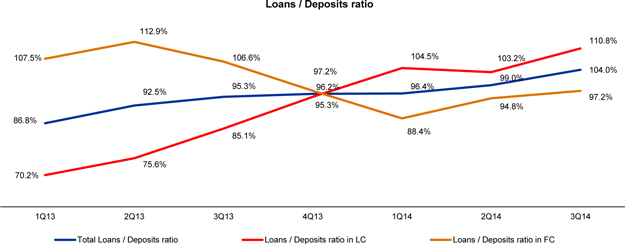

An analysis of the L/D ratio per currency indicates that LC’s ratio rose to 110.8%, which represents a +760 bps increase with regard to the 103.2% registered in 2Q14. During this same period, FC’s ratio increased to 97.2%, which represents a +240 bps increase with regard to the 94.8% reported in 2Q14. The evolution of the ratio per currency reflects a larger increase in the LC portfolio in terms of accounting balances. It is important to note that the L/D ratio in LC and FC have remained at reasonable levels and within the parameters set by the bank’s asset and liability management policy, and are among the lowest in the Peruvian banking system.

�

Finally, although the loan/deposit ratio has experienced an upward trend over the past few years, which was due to higher growth in loans than in deposits, this is not a reason for concern given that the pace of loan expansion, which has been accompanied by alternative funding, has not been deterred by lower growth in deposits.

�

The figure below shows the evolution of the loan/deposit ratio by currency:

�

�

Deposits

�

If we analyze the evolution of deposits in 3Q14, we see that they continue to be the main source of funding; nevertheless, their share in total funding drops QoQ (68% at the end of 3Q14 vs. 72% at the end of 2Q14). The aforementioned is a result of a decrease of -1.8% QoQ in total deposits, mainly in CTS deposits (-10.6% QoQ) and time deposits (-7.9% QoQ).

�

CTS deposits declined -10.6% QoQ due to a decrease in the legal minimum, which changed the withdrawal limit of surplus funds from six to four monthly salaries. It is also important to note that CTS is paid in May, which means that 2Q14 includes a seasonal expansion that leads to a subsequent contraction in 3Q every year.

�

Time deposits fell -7.9% QoQ in accounting balances, led by the drop in LC deposits. Additionally, it is important to note that deposits at Mibanco drop (83% in LC), which is in line with Mibanco’s asset and liability strategy.

�

It is important to note that the evolution of time deposits in terms of average daily balances shows that during the first two months of 3Q14, there was a larger decline in FC time deposits by corporate clients. The aforementioned is explained due to these clients decided to enter into forward agreements to take the arbitrage opportunity of the forward market in previous months to the 3Q. Therefore, at the beginning of 3Q, they withdrew FC deposits and changed them to LC deposits (in other banks) in order to fulfill their obligations in the forward market.

�

At the end of 3Q, there was a decrease in LC time deposits mainly by corporate clients, in line with their expectations of higher spreads in the forward market.

�

| 17 |

|

�

The aforementioned, was offset by the increase in saving deposits (+4.9% QoQ) and demand deposits (+15.4% QoQ) in both LC and FC. In this context, core deposits (demand, savings and CTS) increased only +1.1% QoQ.

�