Form 6-K BioLineRx Ltd. For: Mar 05

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2015

BioLineRx Ltd.

(Translation of registrant’s name into English)

P.O. Box 45158

19 Hartum Street

Jerusalem 9777518, Israel

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form 40-F o

Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes o No x

Item 7.01. Regulation FD Disclosure

A copy of the Management Presentation of BioLineRx Ltd. (the “Company”) is furnished as Exhibit 99.1 to this Item 7.01.

The information contained in Item 7.01 of this report and in Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”) or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 8.01 Other Events.

On March 5, 2015, the Company issued a press release announcing that it has commenced an underwritten offering of American Depositary Shares (“ADSs”), each representing ten of its ordinary shares (“Ordinary Shares”), par value NIS 0.01 per share, pursuant to a prospectus supplement, dated March 5, 2014, to the Company’s prospectus dated August 14, 2012, filed as part of its effective shelf registration statement on Form F-3 (File No. 333-182997) previously filed with, and declared effective by, the Securities and Exchange Commission (SEC).

The Company expects to grant the underwriters an option to purchase up to an additional 15 percent of its ADSs, exercisable for 30 days after the pricing date of the ADSs offering. The offering is subject to market conditions, and there can be no assurance as to whether or when the offering may be completed, or as to the actual size or terms of the offering. A copy of the press release is furnished as Exhibit 99.2.

This Current Report on Form 6-K shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of ADSs in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state.

In connection with this offering, the Company has updated certain business and risk factor information. This information and risk factor disclosure is attached as Exhibit 99.3 to this Current Report on Form 6-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

|

(d)

|

Exhibits

|

The following Exhibits are filed as part of this report:

|

Exhibit No.

|

Description of Exhibit

|

|

99.1

|

Company Presentation

|

|

99.2

|

Press Release dated March 5, 2015

|

|

99.3

|

Business and risk factor disclosure

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

BioLineRx Ltd.

|

|||

|

By:

|

/s/ Philip Serlin | ||

| Philip Serlin | |||

| Chief Financial and Operating Officer | |||

Dated: March 5, 2015

Exhibit 99.1

Company Presentation

February 2015

|

|

This presentation contains "forward-looking statements." These statements include words like "may," "expects," "believes," “plans,” “scheduled," and "intends," and describe opinions about future events. These forward-looking statements involve known and unknown risks and uncertainties that may cause the actual results, performance or achievements of BioLineRx to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

|

2

Forward Looking Statements

Offering Summary

|

Issuer:

|

BioLineRx Ltd. (NasdaqCM:BLRX / TASE: BLRX)

|

|

Offering Size:

|

~$30 million (100% primary; excluding overallotment)

|

|

Overallotment Option:

|

15.0% (100% primary)

|

|

Offering Type:

|

Confidentially-Marketed Follow-On

|

|

Securities Offered:

|

American Depositary Shares

(1 ADS represents 10 Ordinary Shares)

|

|

Use of Proceeds:

|

• Continued clinical development of BL-8040 platform for AML and other

hematological indications • EU post-marketing and US clinical studies for BL-7010 in celiac disease

• Develop potential product candidates through Novartis collaboration

• Working capital and other general corporate purposes

|

|

Expected Pricing:

|

March 6, 2015 (before market opens)

|

|

Sole Bookrunner:

|

JMP Securities

|

3

BioLineRx Snapshot

• Drug development company focused on oncology & immunology

– Founded in 2003 by Teva and other key players in Israeli Life Sciences industry

• Bridge “development gap” for Israeli assets

– Leverage carefully selected early-stage technology, primarily at academia level,

following proof of concept in animals (at a minimum)

following proof of concept in animals (at a minimum)

• Current pipeline of 10 assets, 6 in clinical development

• Lead clinical programs:

– BL-8040 for AML and other hematological indications

– BL-1040 to prevent ventricular remodeling post AMI

– BL-7010 for celiac disease

• Strategic collaboration with Novartis for co-development of

selected Israeli-sourced programs

selected Israeli-sourced programs

4

Jerusalem

Rehovot

Tel-Aviv

Haifa

Be’er Sheva

Long Term Relationships with Israeli Institutions

Extensive in-licensing track record with majority of

academic & research centers in Israel

Technion

Tel Aviv University

Hebrew University

Weizmann Institute

Ben-Gurion University

Rambam Medical Center

Sheba Medical Center

Hadassah Medical Center

Sourasky Medical Center

5

Main Pipeline Assets

6

Main 2014 Achievements

• R&D Achievements in 2014

– All three lead development programs met their objectives in 2014

• BL-8040 (r/r AML) - phase 2 study partial results

– Clinical evidence for MOA (mobilization and apoptosis)

• BL-7010 (celiac program) - phase 1/2 completion

• BL-1040 (AMI) - completed enrollment for EU pivotal study

• BD Achievements in 2014

– Entered into strategic collaboration with Novartis

– Out-license of BL-5010 (skin lesion program) for EU market

• Deal signed with Omega Pharma, a leader in the OTC market, for Europe and

other selected territories

other selected territories

7

Main 2015 Value Drivers

• BL-8040 stem cell mobilization study

– Top line results by end of Q1 2015

• BL-8040 r/r AML study

– Top line results H2 2015

• BL-1040 CE Mark registration study

– Topline results mid-year 2015

• BL-7010 project

– Final approval of device regulatory path in EU from Notified Body in 2015

– Initiation of EU pivotal study in H2 2015

8

LEAD DEVELOPMENT PROGRAMS

9

10

BL-8040:

BEST-IN-CLASS CXCR4

ANTAGONIST FOR

TREATMENT OF

HEMATOLOGICAL

CANCERS

BEST-IN-CLASS CXCR4

ANTAGONIST FOR

TREATMENT OF

HEMATOLOGICAL

CANCERS

BL-8040 Highlights

• Platform Molecule: Can Address Multiple Cancer Indications

– Acute myeloid leukemia (AML) & other blood cancers

– Received Orphan designation from FDA for lead indications (accelerates development)

• Mode of Action: Inhibits CXCR4 (a cell surface protein)

– Present in high quantities on >70% of tumors; correlates with disease severity

– Inhibition induces cancer cell death

– Exposes cancer cells to treatment by mobilizing from bone marrow to blood circulation

• Status (AML): Phase 2 study ongoing

– Encouraging efficacy and excellent safety results to date

– To conclude in 2H 2015; Interim data in early 2015

• Status (Cell Mobilization): Phase 1 study ongoing

– Results to be reported early 2015

• AML is most common acute leukemia in adults

– Over 60,000 new cases recorded worldwide in 2010, growing to 130,000 by 2020

– 14,000 cases of AML diagnosed in the US in 2012

– Majority of AML patients relapse and require repeated treatment cycles

• AML has poor prognosis - less than 25% five-year survival

– Over 10,000 fatalities from AML in the US in 2012

• AML treatment regimens have changed little in past 30 years

– Treatment of AML is based largely on use of older chemotherapeutic drugs

AML - Treatment and Unmet Medical Need

12

BL-8040 Mechanism Of Action

• Binds CXCR4 with high affinity (1-2 nM)

• Maintains extended inhibition of CXCR4 through long receptor occupancy (>24 hours)

• Works as inverse agonist of CXCR4

• Induces apoptosis of tumor cells dependent on CXCR4 for survival

• Increases sensitivity to anti-cancer agents by mobilizing tumor cells from protective

microenvironment

microenvironment

• Induces terminal differentiation of immature cancer cells

13

BL-8040 directly

induces apoptosis

induces apoptosis

BL-8040

sensitizes tumor cells

to other drugs

BL-8040

Induces terminal

differentiation of

tumor cells

differentiation of

tumor cells

BL-8040

BL-8040

+ SOC

+ SOC

BL-8040

induces tumor

cells mobilization

cells mobilization

BL-8040 Shows Superiority to Current Therapy

14

Time post BL-8040/Mozobil injection

BL-8040 12 mg/kg

Mozobil 3.2 mg/kg

BL-8040 Stimulates Greater Mobilization

of Cells from the Bone Marrow

Compared to Mozobil

of Cells from the Bone Marrow

Compared to Mozobil

BL-8040 Causes Significant Cancer Cell

Death Compared to Mozobil

Death Compared to Mozobil

Drug Concentration

(μm)

(μm)

Mozobil

BL-8040

Beider K., Experimental Hematology 2011;39:282-292

Abraham M., Stem Cells 2007;25:2158 -2166

|

|

BL-8040

|

Mozobil

|

BMS-936564

(MDX1338)

|

|

Affinity for CXCR4

|

1-2 nM

|

84 nM

|

5nM

|

|

Inhibition

|

Inverse agonist

|

Antagonist (partial agonist)

|

Antagonist

|

|

CXCR4 Binding site

|

Extracellular domains in the

CXCR4 receptor |

Trans-membrane regions in the

CXCR4 receptor |

Extracellular domains in the

CXCR4 receptor |

|

Plasma half-life

|

0.3 - 0.7 hr

|

~3-5 hr

|

More than 24hr

|

|

Receptor occupancy

|

More than 24 hr

|

~2 hr

|

Not published

|

|

Cancer Cell Death

|

Induces apoptosis in preclinical

models. Evidence of remarkable apoptosis in samples from patients administrated with 0.75 and 1 mg/kg (phase 2). |

None

|

Demonstrated apoptosis in

preclinical models, modest effect in patients (ASH 2013) |

|

Mobilization

|

6-8 fold increase

(6/8 patients, phase 2a)

|

2.5 fold

(A phase 1/2 study, Blood 2012)

|

2.1-fold increase

(14/24 patients in phase 2 study,

ASH 2013) |

|

Other remarks of BL-8040:

•Synergizes with Rituximab and Bendamustine to stimulate Lymphoma cell death in vitro.

•Synergizes with Bortezomib (Velcade) to stimulate multiple myeloma cell death in vitro.

•Combination of BL-8040 with Imatinib in CML cells overcomes the protective effect of stroma in vitro.

•BL-8040 alone is highly efficient in eliminating lymphoma cells in the bone marrow and combined with Rituximab

significantly reduces tumor load (in vivo). •Synergizes with AC220 to minimize residual disease in FLT3+ AML (in vivo)

|

|||

BL-8040 is Best-in-Class vs. Competitors

15

Superior

Comparative

Inferior

Phase 2a - Treatment of r/r AML patients

Open-label study to evaluate safety and efficacy profile of repeated escalating doses of BL

-8040 in up to 70 adult subjects with relapsed or refractory AML

-8040 in up to 70 adult subjects with relapsed or refractory AML

Study design:

– Dose escalation phase - 3+3 design (last update given re 5th cohort of 1.5 mg/kg)

– Expansion phase: expand safe, efficacious dose group

Treatment:

– 2 consecutive days of BL-8040 monotherapy

– 5 days of BL-8040 + chemotherapy

Endpoints:

– To assess the safety and tolerability of escalating repeated doses of BL-8040 as monotherapy and when

combined with high-dose Ara-C in AML adult subjects with relapsed or refractory disease

combined with high-dose Ara-C in AML adult subjects with relapsed or refractory disease

– To assess the clinical efficacy (response rates) of escalating repeated doses of BL-8040

– To assess the apoptotic effect of BL-8040 on leukemic blasts

– To assess the effect of BL-8040 on mobilization of AML blasts to peripheral blood (PB)

– To assess the single and multiple dose pharmacokinetic profile of BL-8040

Treatment

Follow up

Screening

BM biopsy

BL-8040

Day

Ara-C

1 2 3 4 5 6 7 ------------------------------------------------------------------------------ 30

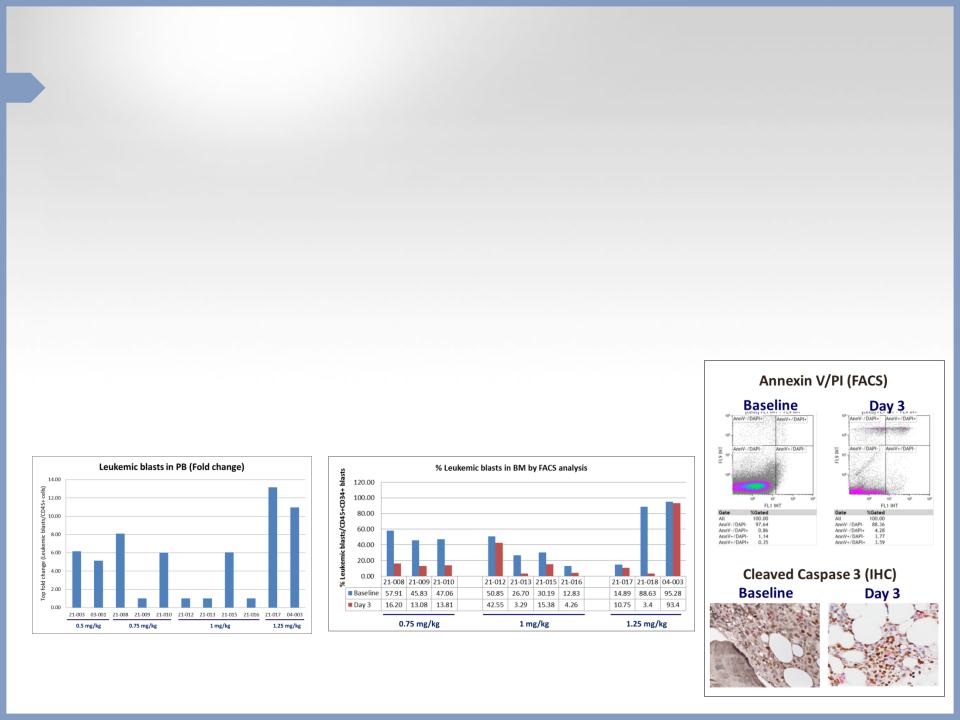

Partial Results in AML Phase 2 Study

• No BL-8040 related SAEs and no AEs were considered DLTs

• Robust leukemic blast mobilization was observed (median of 6-fold

increase)

increase)

• BL-8040 monotherapy decreased amount of leukemic cells in BM by median

of ~70%

of ~70%

• BL-8040 monotherapy achieved 3.5-fold increase in AML cell apoptosis

• Topline results are expected during H2 2015

17

Phase 1 - Single Agent Stem Cell Mobilization

A Phase 1, Two Part Study Exploring the Safety, Tolerability, Pharmacodynamic and

Pharmacokinetic Effect of Ascending Doses of BL-8040 in Healthy Subjects

Pharmacokinetic Effect of Ascending Doses of BL-8040 in Healthy Subjects

Study design:

•Part 1 - Dose escalation, randomized, placebo controlled - up to 4 escalating doses (0.5-1.25 mg/kg) P

•Part 2 - Dose expansion of safe and efficacious dose group

Endpoints:

– Safety and tolerability of escalating repeated doses

– Effect of BL-8040 on mobilization of hematopoietic stem cells (HSC) to peripheral blood (PB)

– Pharmacokinetic profile of BL-8040

– Yields of hematopoietic progenitor cells, immune cells, and other cellular subsets collected by leukapheresis

– Viability, biological activity and repopulating capacity of the cells collected by leukapheresis

Timelines

•Topline results expected by end of Q1/2015

Mobilization

Safety follow up

Safety follow up

Mobilization

Screening

Screening

Part 1

Part 2

BL-8040

1

-28

Day

2

7

3

18

Three New Studies to be Initiated in 2015

|

Study

|

Collaborator

|

Description

|

Results

Œ

|

|

AML

Consolidation Phase 2b

(200 patients)

|

German Study

Alliance Leukemia Group |

Double-blind, placebo-controlled,

repeated-administration, multi treatment cycles |

Topline results

Q4 2017

|

|

AML FLT3-ITD

Phase 1/2

(up to 100 patients)

|

MD Anderson

Cancer Center |

Open-label, 2 parts:

•Dose selection, with Sorafinib and

BL-8040 •Expansion in different FLT3

patients |

Partial results

H2 2016 Final results

Q1 2017

|

|

Myelodysplatic

Syndrome and Aplastic Anemia

Phase 1/2

(up to 25 patients)

|

MD Anderson

Cancer Center |

Open-label, repeated administration,

single-treatment cycle |

Partial results

H2 2016 Final results

H2 2017

|

19

BL-8040 Summary

• CXCR4 is a validated target

• BL-8040 has robust mobilization activity and apoptosis

– Validated in preliminary data from Phase II study in AML, and Phase 1/2 study in multiple

myeloma

myeloma

– BL-8040 has very favorable profile in comparison with leading CXCR4 antagonists

• BL-8040 is an inverse agonist

– Blocks the auto-signaling of CXCR4

• BL-8040 is a platform for a number of hematological indications

– Three new studies planned for 2015

20

BL-1040:

FIRST-IN-CLASS

MYOCARDIAL IMPLANT

FOR PREVENTION OF

VENTRICULAR REMODELING

FOLLOWING AMI

FIRST-IN-CLASS

MYOCARDIAL IMPLANT

FOR PREVENTION OF

VENTRICULAR REMODELING

FOLLOWING AMI

Out-licensed to Bellerophon

(f/k/a Ikaria) and being

developed as Bioabsorbable

Cardiac Matrix (BCM)

(f/k/a Ikaria) and being

developed as Bioabsorbable

Cardiac Matrix (BCM)

21

BL-1040 Highlights

• Indication: Cardiac remodeling post-AMI

• Mode of Action: Provides support to ischemic tissue during healing

• Status: CE Mark registration trial - enrollment completed; top-line results in

mid-2015

mid-2015

• Device designation (including FDA)

• Partnered with Bellerophon BCM (f/k/a Ikaria)

– All program costs funded by Bellerophon BCM

• Market Opportunity: >$1 Billion*

22

*Based on a customized survey and report prepared for BioLineRx by Defined Health

Unmet Medical Need

Vessel occlusion

Tissue damage

23

How Does BL-1040 Work?

Arterial injection deposits

material into infarcted tissue

material into infarcted tissue

Turns from liquid to gel on

contact with infarcted tissue

contact with infarcted tissue

Gel-like scaffold provides

mechanical support to damaged

tissue

mechanical support to damaged

tissue

Transitions to liquid and exits

the body within 6 weeks

the body within 6 weeks

BL-1040

Untreated

Porcine AMI model, day 60

L

V

V

L

V

V

• Dilated

• Dilated

• Thin LV wall

• Thin LV wall

• Normal size

• Normal size

• Normal LV wall

• Normal LV wall

L

V

V

L

V

V

24

Designated as device by regulatory authorities

BL-1040 Clinical studies

Pivotal CE Mark Registration trial progressing at full steam

•Placebo controlled, enrollment of 303 patients P

• 6-month follow-up

•Includes ~90 sites in nine countries (including 16 sites in US)

•Endpoints: end diastolic volume, QLQ, six-minute walk test

•Top-line results expected in mid-2015

US pivotal trial in final discussions with FDA

•Placebo controlled, ~1,000 patients, ~200 sites

•12-month follow-up

•The study expected to start early 2016

25

* Intracoronary Delivery of Injectable Bioabsorbable Scaffold (IK-5001) to Treat

Left Ventricular Remodeling After ST-Elevation Myocardial Infarction - A First-in

-Man Study, Frey N et al., Circ: Cardiovasc Interv. 2014

Left Ventricular Remodeling After ST-Elevation Myocardial Infarction - A First-in

-Man Study, Frey N et al., Circ: Cardiovasc Interv. 2014

BL-1040 Summary

• Huge unmet medical need

– >$1 billion market

• Designated as device in both US and Europe

• Pilot study successfully completed

– No safety or tolerability issues after six months of follow-up

– Promising efficacy in comparison to historical data

• Top-line results of CE mark registration study expected in mid-2015

– Enrollment of 303 patients completed

26

27

BL-7010:

NOVEL GLIADIN

BINDING POLYMER

FOR

NOVEL GLIADIN

BINDING POLYMER

FOR

CELIAC DISEASE

BL-7010: Polymeric Binder for Celiac Disease

• Indication: Celiac disease

• Mode of Action: Non-absorbable polymer with high affinity to gliadins

(immunogenic peptides contained in gluten)

(immunogenic peptides contained in gluten)

• Status: Phase 1/2 completed

• Product Highlights

– Prevents pathological damage to small intestine

– Non-absorbable

– Non-toxic

28

Celiac Disease - Large Unmet Medical Need

29

• 1% of world’s population suffers from celiac disease

– Number underestimated due to lack of awareness/diagnostic tools

• Market projected to reach $8 billion by 2019

• No current pharmacological agents approved for celiac

– Only treatment option is life-long, strict gluten-free diet (GFD)

– ~20% of celiac patients are symptomatic even with GFD

• Major interest shown by Big Pharma

– AbbVie recently acquired rights to phase 2 asset from Alvine for $70 million upfront

Copolymer of sodium

styrene sulfonate (SS)

and 2-hydroxyethyl

methacrylate (HEMA)

styrene sulfonate (SS)

and 2-hydroxyethyl

methacrylate (HEMA)

Gluten

BL-7010 demonstrates

distinguished specificity

towards gliadin

distinguished specificity

towards gliadin

Prevention of intestinal damage

30

Small intestinal damage with loss of

absorptive villi and hyperplasia of the

crypts, typically leading to malabsorption

APC

BL-7010

Gluten

Gliadin

Enterocytes

Lymphocytes

Inflammatory Cytokines

31

BL-7010 Maintains Normal Structure of GI

non-sensitized

mice

mice

Gluten-sensitized

mice

mice

Gluten-sensitized

mice + BL-7010

mice + BL-7010

5.96 ± 1.23

Villus-to-crypt ratio

2.58 ± 0.43

4.89 ± 1.51

Model: HLA-DQ8/HCD4 transgenic male mice sensitized to gliadin

BL-7010 Clinical Program Overview

• Phase 1/2 study in celiac patients completed

– Positive top-line results presented in early November

• Safe and well tolerated; no serious or dose-limiting side effects

• Optimal dose identified: 1 gram x 3 per day

• Confirmed no systemic absorption; supports medical device classification in Europe

(significantly accelerates potential approval)

(significantly accelerates potential approval)

32

– Single ascending dose

– Safety endpoints

– No efficacy endpoints

– Assessment of systemic exposure

– 14 days repeated administration

– 3 times per day

– Safety w/o efficacy endpoints

– Assessment of systemic exposure

BL-7010 Summary

• Celiac disease is huge unmet medical need

– There are only a handful of clinical-stage programs in development

• BL-7010 has unique and simple MOA

• Successful Phase 1/2 pilot study

– Well tolerated, no systemic exposure

– Will likely be classified as medical device in Europe

• Pivotal study for EU in celiac patients expected to begin in 2015

– 6-week repeated oral administration

– Efficacy endpoints (primary and secondary) and safety endpoints

33

CORPORATE

34

Transformative Collaboration with Novartis

• Novartis selected BioLineRx as its leading partner for identification

and early development of Israeli-sourced drug candidates

and early development of Israeli-sourced drug candidates

– Exclusive first look at all Israeli-based projects scouted by BioLineRx

– Co-develop selected projects through clinical proof-of-concept (POC)

• Provides lasting shareholder value and key insights

– Builds pipeline in conjunction with global leader, gaining Big Pharma perspective

• Financial highlights:

– Upfront $10 million equity investment in BLRX

– Upon selection of project, BioLineRx will receive:

• $5 million option fee (non-dilutive)

• 50% of remaining R&D expenses up to POC (in equity at a premium to market)

– Novartis receives right of first negotiation for full out-license upon clinical POC

35

Financial and Corporate Summary

Cash position

• $29.6 million as of September 30, 2014

– Does not include $10 million received from Novartis in December

• Funds operational capital into 2016

Capital structure

• Traded on NASDAQ and TASE (Symbol: BLRX)

• 39 million shares outstanding; 45 million fully diluted (based on ADSs)

• US shareholders represent ~60% of investor base

– Novartis holds ~13% of Company

Other

• 47 employees, approximately 2/3 with advanced degrees

36

Major Development Milestones - 2015 and 2016

37

BL-7010 (Celiac) CE pivotal study initiation

BL-1040 (AMI) CE mark study completion

BL-8040 (AML) phase 2 completion

BL-8040 (AML) phase 2 partial results*

BL-8040 (SC Mobilization) phase 1 apheresis data

BL-8040 (FLT-3) phase 1/2 initiation

BL-8040 (hMDS & AA) phase 1/2 initiation

BL-8040 (SC Mobilization) phase 1 completion

√

BL-7010 (Celiac ) CE pivotal study completion

BL-8040 (hMDS & AA) phase 1/2 interim results

BL-8040 (SC Mobilization) phase 2 Initiation

BL-8040 (SC Mobilization) phase 2 LPI

BL-8040 (AML) - end of phase 2 meeting

BL-8040 (Consolidation) phase 2b LPI

BL-1040 (AMI) US pivotal study initiation

BL-1040 (AMI) complete CE mark study enrollment

√

38

Exhibit 99.2

For Immediate Release

BioLineRx Announces Underwritten Public Offering

of its American Depositary Shares

Jerusalem, March 5, 2015 - BioLineRx (NASDAQ: BLRX; TASE: BLRX), a clinical-stage biopharmaceutical company dedicated to identifying, in-licensing and developing promising therapeutic candidates, today announced that it has commenced an underwritten public offering of American Depositary Shares (“ADSs”), each representing ten (10) of its Ordinary Shares. All of the ADSs in the offering are to be sold by BioLineRx.

JMP Securities is acting as sole book-running manager for the offering. BioLineRx intends to grant the underwriters a 30-day option to purchase up to an additional 15 percent of the amount sold to cover over-allotments, if any. The offering is subject to market conditions, and there can be no assurance as to whether or when the offering may be completed, or as to the actual size or terms of the offering.

The ADSs will be issued pursuant to a shelf registration statement that was previously filed with, and declared effective by, the Securities and Exchange Commission (SEC). A final prospectus supplement related to the offering will be filed with the SEC and will be available on the SEC's website located at www.sec.gov.

This press release does not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. Any offer, if at all, will be made only by means of a prospectus supplement and accompanying prospectus forming a part of the effective registration statement, copies of which may be obtained, when available, from JMP Securities LLC, 600 Montgomery Street, 10th Floor, San Francisco, California 94111, Attention: Prospectus Department, or by telephone: (415) 835-8985.

About BioLineRx

BioLineRx is a publicly-traded, clinical-stage biopharmaceutical company dedicated to identifying, in-licensing and developing promising therapeutic candidates. The Company in-licenses novel compounds primarily from academic institutions and biotech companies based in Israel, develops them through pre-clinical and/or clinical stages, and then partners with pharmaceutical companies for advanced clinical development and/or commercialization.

BioLineRx’s current portfolio consists of a variety of clinical and pre-clinical projects, including: BL-1040 for prevention of pathological cardiac remodeling following a myocardial infarction, which has been out-licensed to Bellerophon BCM (f/k/a Ikaria) and is in the midst of a pivotal CE-Mark registration trial scheduled for completion in mid-2015; BL-8040, a cancer therapy platform, which is in the midst of a Phase 2 study for acute myeloid leukemia (AML) as well as a Phase 1 study for stem cell mobilization; and BL-7010 for celiac disease, which has successfully completed a Phase 1/2 study.

In December 2014, BioLineRx entered into a strategic collaboration with Novartis for the co-development of selected Israeli-sourced novel drug candidates. The companies intend to co-develop a number of pre-clinical and early clinical therapeutic projects through clinical proof-of-concept for potential future licensing by Novartis.

For more information on BioLineRx, please visit www.biolinerx.com or download the investor relations mobile device app, which allows users access to the Company’s SEC documents, press releases, and events. BioLineRx’s IR app is available on the iTunes App Store as well as the Google Play Store.

Various statements in this release concerning BioLineRx’s future expectations constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include words such as “may,” “expects,” “anticipates,” “believes,” and “intends,” and describe opinions about future events. These forward-looking statements involve known and unknown risks and uncertainties that may cause the actual results, performance or achievements of BioLineRx to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Some of these risks are: changes in relationships with collaborators; the impact of competitive products and technological changes; risks relating to the development of new products; and the ability to implement technological improvements. These and other factors are more fully discussed in the “Risk Factors” section of BioLineRx’s most recent annual report on Form 20-F filed with the Securities and Exchange Commission on March 17, 2014. In addition, any forward-looking statements represent BioLineRx’s views only as of the date of this release and should not be relied upon as representing its views as of any subsequent date. BioLineRx does not assume any obligation to update any forward-looking statements unless required by law.

Contact:

Tiberend Strategic Advisors, Inc.

Joshua Drumm, Ph.D.

+1-212-375-2664

Andrew Mielach

+1-212-375-2694

or

Tsipi Haitovsky

Public Relations

+972-3-6240871

Exhibit 99.3

Our stockholders or potential investors may be referred to as “you” or “your” in this disclosure and BioLineRx Ltd. is referred to as “the company,” “we,” “our,” or “us”.

|

Our Business

|

We are a clinical stage biopharmaceutical development company dedicated to identifying, in-licensing and developing therapeutic candidates that have advantages over currently available therapies or that address unmet medical needs. Our current development pipeline consists of six clinical-stage therapeutic candidates: BL-1040, a novel polymer solution for use in the prevention of ventricular remodeling following an acute myocardial infarction, or AMI; BL-8040, a novel peptide for the treatment of acute myeloid leukemia (AML), stem cell mobilization and other hematological indications; BL-7010, a novel polymer for the treatment of celiac disease; BL-5010, a customized, proprietary, pen-like applicator containing a novel, acidic, aqueous solution, which is being developed in Europe as a medical device for the non-surgical removal of benign skin lesions; BL-7040, an oligonucleotide for the treatment of inflammatory bowel disease, or IBD; and BL-8020, an orally available treatment for the hepatitis C virus, or HCV, and other viral indications, with a unique mechanism of action involving the inhibition of virus-induced autophagy in host cells. In addition, we have four therapeutic candidates in the preclinical stages of development. We generate our pipeline by systematically identifying, rigorously validating and in-licensing therapeutic candidates that we believe exhibit a relatively high probability of therapeutic and commercial success. None of our therapeutic candidates have been approved for marketing and, to date, there have been no commercial sales of any of our therapeutic candidates. Our strategy includes commercializing our therapeutic candidates through out-licensing arrangements with biotechnology and pharmaceutical companies. We also evaluate, on a case-by-case basis, co-development and similar arrangements and the commercialization of our therapeutic candidates independently.

In December 2014, we entered into a strategic collaboration with Novartis Pharma AG, or Novartis, for the co-development of selected Israeli-sourced novel drug candidates. Under the agreement, we intend, in collaboration with Novartis, to co-develop a number of pre-clinical and early clinical therapeutic projects through clinical proof-of-concept for potential future licensing by Novartis.

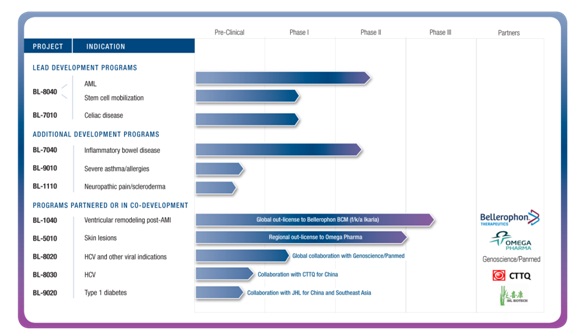

Our Product Pipeline

The table below summarizes our current pipeline of therapeutic candidates, including the target indications and status of each candidate and our development partners.

BL-1040

Our first therapeutic candidate, BL-1040 (now called “Bioabsorbable Cardiac Matrix,” or BCM), is a medical device, injected in patients following an AMI, intended for prevention of ventricular remodeling and subsequent congestive heart failure. Ventricular remodeling is the structural alteration of the damaged heart muscle that occurs following an acute heart attack. Once this damage occurs, the weakened heart muscle forces the rest of the heart to compensate. Under this extra workload, the heart muscle dilates, the walls of the heart thin, and the heart further remodels, thereby causing another cycle of dilation and overcompensation. The extra workload to the heart causes further structural damage and can lead to congestive heart failure. BL-1040 is a liquid polymer which is delivered in a bolus injection via the coronary artery during catheterization and flows into the damaged heart muscle, creating a scaffold within injured cardiac muscle designed to enhance cardiac mechanical strength during the healing period and prevent pathological ventricular dilation. BL-1040 remains in the infarct zone for a few months and is excreted through the kidneys. The data from our preclinical trials in various animal models indicate that, by supporting the damaged heart tissue, BL-1040 preserves the normal functioning of the heart, and the data from our clinical trials indicate that BL-1040 should be safe. After consultation by our out-licensing partner, Bellerophon BCM LLC, or Bellerophon, with the FDA, BL-1040 is being developed as a class III medical device under the FDA’s pre-marketing approval, or PMA, regulatory pathway. In December 2011, Bellerophon commenced PRESERVATION 1, a CE Mark registration clinical trial of BL-1040. PRESERVATION 1 aims to evaluate the safety and effectiveness of BL-1040 for prevention of ventricular remodeling when administered following AMI. The trial is a placebo-controlled, randomized, double-blind, multi-country and multi-center trial. BL-1040 is being administered to subjects who had successful percutaneous coronary intervention with stent placement after ST-segment elevation myocardial infarction (STEMI). Enrollment for this trial was completed in December 2014, with 303 AMI patients having been recruited and treated. There are almost 90 sites activated worldwide for this trial, 16 of which are in the United States. Bellerophon expects to report top line results from the study, which includes a six-month follow-up period, in mid-2015.

In 2009, we entered into an out-licensing arrangement with Bellerophon (formerly known as “Ikaria Development Subsidiary One LLC”) with regard to BL-1040, which we amended in January 2015. Under this arrangement, Bellerophon is obligated to use commercially reasonable efforts to complete clinical development of, and to commercialize, BL-1040 or a product related thereto. To date, we have received $17.0 million from Bellerophon, and we are entitled to receive up to an additional $265.5 million from Bellerophon upon achievement of certain development, regulatory, and commercial milestones. In addition, we are entitled to receive from Bellerophon royalties from net sales of any product developed under the arrangement. Pursuant to the January 2015 amendment, a certain milestone and related payments have been adjusted, but the total potential milestone payments to be paid to us under the license agreement remain the same. We believe that Bellerophon has financial resources sufficient to meet its contractual obligations under its agreement with us.

2

We are obligated to pay 28% of all net consideration received under this arrangement to B.G. Negev Technologies and Applications Ltd., or B.G. Negev Technologies, the party from which we in-licensed BL-1040 in 2004. We have agreed to pay Ramot at Tel Aviv University Ltd., or Ramot, a portion of the payments we make to B.G. Negev Technologies in connection with the in-license arrangement to satisfy contractual obligations between B.G. Negev Technologies and Ramot with respect to certain intellectual property rights to the licensed technology. We have also agreed to indemnify Ramot and certain of its related parties in connection with our use of the technology we in-licensed from B.G. Negev Technologies.

BL-8040

Our second clinical-stage therapeutic candidate, BL-8040, is a novel, short peptide that functions as a high-affinity antagonist for CXCR4, which we intend to develop for AML, stem cell mobilization and other hematological indications. CXCR4 is a chemokine receptor that is directly involved in tumor progression, angiogenesis (growth of new blood vessels in the tumor), metastasis (spread of tumor to other organs) and cell survival. CXCR4 is over-expressed in more than 70% of human cancers and its over-expression often correlates with poor prognosis. BL-8040 mobilizes cancer cells from the bone marrow and may therefore sensitize these cells to chemo- and bio-based anti-cancer therapy. In addition, BL-8040 has demonstrated a direct anti-cancer effect by inducing apoptosis (cell death). Multiple pre-clinical studies have shown the safety and efficacy of BL-8040. These studies have shown that BL-8040 is efficient, both alone and in combination with chemotherapy, in reducing bone marrow malignant cells and stimulating their cell death. BL-8040 also mobilizes stem cells from the bone marrow to the peripheral blood, enabling their collection for subsequent autologous or allogeneic transplantation in cancer patients. In September 2013, the FDA granted an Orphan Drug Designation to BL-8040 as a therapeutic for the treatment of AML; and in January 2014, the FDA granted an Orphan Drug Designation to BL-8040 as a treatment for stem cell mobilization.

In June 2013, we commenced a Phase 2 trial for BL-8040 for the treatment of AML. The study is currently being conducted at four sites in the United States, including MD Anderson Cancer Center in Houston, Memorial Sloan-Kettering Cancer Center in New York, Northwestern University Hospital in Chicago, and Mayo Clinic in Jacksonville, as well as at five well-known sites in Israel. The study is a multicenter, open-label study under an Investigational New Drug, or IND, approval from the FDA, designed to evaluate the safety and efficacy profile of repeated escalating doses of BL-8040 in adult subjects with relapsed/refractory AML. As of the date of this prospectus supplement, 19 patients have been enrolled in the study, out of a total expected enrollment of up to 70 patients. Early results of this trial showed that BL-8040, as a stand-alone therapy and in combination with high-dose Cytarabine (Ara-C), is safe at all doses tested to date, and triggers substantial mobilization of cancer cells from the bone marrow to the peripheral blood, thereby increasing the vulnerability of the cells to chemotherapy treatment. In addition, signs of robust apoptosis of cancer cells were observed following administration of higher doses tested.

At the annual ASH conference in December 2014, we presented data from the trial showing that even at the highest dose reached at that time (1.25 mg/kg), there were no dose-limiting toxicity events or serious adverse events, nor early discontinuations attributable to BL-8040. Furthermore, we presented data showing that BL-8040 triggered substantial mobilization of AML cancer cells from the bone marrow to the peripheral blood, with a median 6-fold increase of AML cells in the blood. This mobilization is crucial for exposing a higher ratio of AML cells to accompanying chemotherapy such as Ara-C. Additional results from the trial show that after only two days of BL-8040 monotherapy, there was a median decrease of approximately 70% in the amount of AML cells in the bone marrow, while the levels of normal progenitor cells remained stable. Furthermore, BL-8040 as a monotherapy showed a 3.5-fold increase in cell death (apoptosis) of AML cells, both in the bone marrow and in peripheral blood samples.

3

The dose-escalation stage of the study is expected to be completed in early 2015, while the full study results from both the dose-escalation and dose-expansion stages of the study are expected in the second half of 2015.

Targeting a second AML treatment line, BL-8040 is scheduled to commence a Phase 2b trial, as a consolidation treatment for AML patients who have responded to standard induction treatment, in the first half of 2015. The trial will be conducted in collaboration with the German Study Alliance Leukemia Group. The trial aims to improve the response of AML patients to the second stage of AML treatment, termed consolidation therapy, by eliminating the minimal residual disease left in the bone marrow after the first stage of the standard treatment regimen, called induction therapy. We recently announced the filing of the regulatory submissions required to commence the trial.

In addition, BL-8040 is scheduled to commence a Phase 1/2 trial for the treatment of a third population of AML patients, those with the FLT3-ITD mutation, in the first half of 2015. The Phase 1/2 trial, which will be conducted in collaboration with the MD Anderson Cancer Center, is aimed at improving the response of FLT3-ITD mutated AML patients to treatment with sorafenib (a FLT3 inhibitor). This trial follows the presentation at several conferences during 2014 of positive preclinical results of BL-8040 as a treatment for AML patients with FLT3 mutations.

In September 2014, we announced the dosing of the first patient in a Phase 1 trial for another indication of BL-8040 - as a novel treatment for the mobilization of stem cells from the bone marrow to the peripheral blood circulation, where they can be harvested for transplant supporting the treatment of hematological indications. The study is being conducted at the Hadassah Medical Center in Jerusalem. Part 1 of the study is a randomized, double-blind, placebo-controlled dose escalation study exploring the safety and tolerability of escalating repeated doses of BL-8040 in healthy volunteers. In January 2015, we announced that all healthy volunteers had completed the treatment phase of the study. Following initial analysis of the data, the optimal safe and efficacious dose of BL-8040 was selected to be used as a stand-alone therapy in the second part of the study. Part 2 is an open-label study designed to assess BL-8040’s stem cell mobilization capacity, as well as the yield of cells collected by apheresis. The top line results of both parts of this study are expected by the end of the first quarter of 2015.

We are also planning to conduct a Phase 1/2 trial, again in collaboration with the MD Anderson Cancer Center, for a fifth indication of BL-8040 - as a treatment for hypoplastic myelodysplastic syndrome, or hMDS, and aplastic anemia, or AA. The study will be open label and designed to evaluate the safety, tolerability and efficacy of the combination of BL-8040 with immunosuppressive therapies (hATG, cyclosporine and prednisone). We plan to commence the trial in first half of 2015.

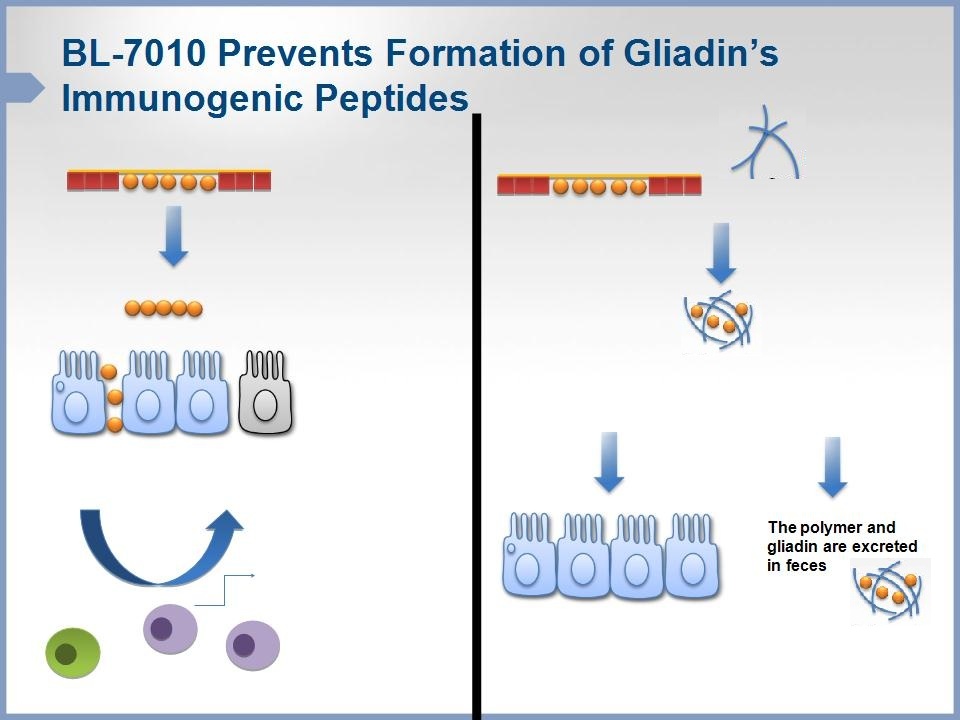

BL-7010

Our third clinical-stage therapeutic candidate, BL-7010, is a novel, non-absorbable, orally available, high-molecular-weight co-polymer intended for the treatment of celiac disease. It has a high affinity for gliadins, the immunogenic proteins present in gluten that cause an immune response in patients with celiac disease. BL-7010 effectively masks gliadins from enzymatic degradation and prevents the formation and absorption of immunogenic peptides that trigger the immune system. BL-7010 is excreted with gliadin from the digestive tract, preventing the absorption of gliadin peptides. This significantly reduces the immune response triggered by gluten. The safety and efficacy of BL-7010 were demonstrated in pre-clinical and clinical studies.

In December 2013, we commenced a Phase 1/2 trial for BL-7010 at Tampere Hospital in Finland. The trial was a two-part (single and repeated administration), double-blind, placebo-controlled, dose escalation study of BL-7010 in up to 40 well-controlled celiac patients. The primary objective of the study was to assess the safety of single and repeated ascending doses of BL-7010. Secondary objectives included an assessment of the systemic exposure, if any, of BL-7010 in the study patients. In November 2014, we reported the final results of the study. Those results confirmed that BL-7010 is safe and well tolerated in both single and repeated-dose administrations. Based on these results, we selected the dosing regimen of one gram, three times per day, of BL-7010 as the optimal repeated dose for the upcoming efficacy study, which is expected to commence in the second half of 2015. In addition, pharmacokinetic analyses revealed no systemic exposure of BL-7010 in plasma and urine samples from all patients at all doses and time points tested, both in the single- and repeated-dose regimens. Based on previous communications with a Notified Body in the European Union, we believe the lack of systemic exposure will likely support a medical-device classification in Europe for BL-7010, which would significantly accelerate its development in Europe.

4

BL-5010

Our fourth clinical-stage therapeutic candidate, BL-5010, is a novel medical device containing a novel, acidic aqueous solution for the non-surgical removal of benign skin lesions. It offers an alternative to painful, invasive and expensive removal treatments including cryotherapy, laser treatment and surgery. Since the treatment is non-invasive, it poses minimal infection risk and eliminates the need for anesthesia, antiseptic precautions and bandaging. The pre-filled device controls and standardizes the volume of solution applied to a lesion, ensuring accurate administration directly on the lesion and preventing both accidental exposure of the healthy surrounding tissue and unintentional dripping. It has an ergonomic design, making it easy to handle, and it will be childproofed. The product has completed a phase 1/2 pilot clinical study for the removal of seborrheic keratosis, or SK, which showed excellent efficacy and cosmetic results, and has received confirmation in Europe for the regulatory pathway classification as a Class 2a medical device.

Our original development plan for BL-5010 consisted of clinical testing for the treatment of SK. However, during discussions in recent years with potential partners for the development and commercialization of BL-5010, we learned that they had more interest in the possibilities of BL-5010 for over-the-counter, or OTC, indications. In December 2014, we entered into an exclusive out-licensing arrangement with a subsidiary of Omega Pharma NV, or Omega Pharma, for the rights to BL-5010 for OTC indications in the territories of Europe, Australia and additional selected countries. We will retain the non-OTC rights to BL-5010 in Omega Pharma’s territories as well as all rights to BL-5010 in the United States and the rest of the world. Under our out-licensing arrangement with Omega Pharma, Omega Pharma is obligated to use commercially reasonable best efforts to obtain regulatory approval in the licensed territory for at least two OTC indications and to commercialize BL-5010 for those two OTC indications. In addition, Omega Pharma will sponsor and manufacture BL-5010 in the relevant regions. Omega Pharma will pay us an agreed amount for each unit sold, and we will be entitled to certain commercial milestone payments. In addition, we will have full access to all clinical and research and development data generated during the performance of the development plan and may use these data in order to develop or license the product in other territories and fields of use where we retain the rights. We expect that the first OTC products will enter the market in 2016. As a result of this out-licensing arrangement, as well as the previous discussions with other potential partners for this product, the development activities for BL-5010 are currently focused on OTC indications. However, we may decide to continue development of BL-5010 for non-OTC indications, including but not limited to, SK.

We are required to pay a portion, within the standard range of sublicense receipt consideration paid to our licensors, of the revenues we receive from our arrangement with Omega Pharma, to Innovative Pharmaceutical Concepts, Inc. or IPC, the party from which we in-licensed BL-5010 in 2007.

BL-7040

Our fifth clinical-stage therapeutic candidate, BL-7040, is an oligonucleotide being developed for the treatment of inflammatory bowel disease (IBD). The compound had already been the subject of phase 1 safety and pharmacokinetics studies and a phase 2a study examining the efficacy of the compound for the treatment of myasthenia gravis, an autoimmune, neurodegenerative disease. BL-7040 showed a high level of safety and efficacy in those trials. The compound was also found to target the innate inflammatory pathway and, therefore, we decided to develop the compound for the treatment of IBD and other inflammatory diseases.

In April 2013, we announced positive results from a phase 2a proof-of-concept study to evaluate the effectiveness of BL-7040 for the treatment of IBD at five sites in Israel. The study showed that BL-7040 is safe and effective in treating ulcerative colitis, a form of IBD. Sixteen of the 22 patients who were enrolled in the clinical trial completed the full five-week course of treatment and two-week follow-up. The primary clinical endpoint in the study – a 3-point and 30% reduction in the Mayo score between baseline and completion of treatment – was achieved. Fifty percent of patients (8 patients) met the primary endpoint, while the remaining 8 patients demonstrated a stable clinical condition or minor improvement.

In November 2013, we announced additional results from this study showing significant improvement of disease measurements in biopsies taken from IBD patients treated with BL-7040. The histological and biochemical analyses of inflammation indicators reinforced the initial positive results of the study described above. During the third quarter of 2014, we conducted a pharmacokinetic study which indicated that BL-7040 reaches the target organ (the colon) and appears to have a local, as opposed to systemic, effect. We are currently discussing this therapeutic candidate with a number of potential co-development partners, as well as planning the next stages of development.

5

BL-8020

Our sixth clinical-stage therapeutic candidate, BL-8020, is an orally available treatment for the hepatitis C virus, or HCV, and other viral indications, with a unique mechanism of action involving the inhibition of virus-induced autophagy in host cells. In April 2013, we commenced a phase 1/2 clinical trial to evaluate the safety, tolerability and effectiveness of BL-8020 at two sites in France. In January 2014, we entered into a collaboration agreement with the licensors of the compound whereby, in consideration for the payment of future royalties to us, we terminated the license agreement, the licensors agreed to take over development of the compound and we agreed to supply, at the licensors’ request and for full payment, the drug product needed for a clinical trial to be administered by the licensors. In August 2014, the licensors decided to terminate the ongoing phase 1/2 trial in HCV due to a very slow recruitment rate, and are now determining the next steps in the clinical development plan of the compound, including an assessment regarding potential additional viral indications for development.

|

Our Product Development Approach

|

As part of our business strategy, we continue to actively source, rigorously evaluate and in-license selected therapeutic candidates. We establish and maintain close relationships with research institutes, academic institutions and biotechnology companies in Israel, including, in some instances, a formal right of first offer for therapeutic compounds in their portfolios. In the last several years, we have extended our sourcing activities to other countries. Before in-licensing, each therapeutic candidate must pass through our thorough screening process. Our Scientific Advisory Board and disease-specific third-party advisors are active in evaluating each therapeutic candidate. Our approach is consistent with our objective of proceeding only with therapeutic candidates that we believe exhibit a relatively high probability of therapeutic and commercial success. To date, we have screened over 2,000 compounds, presented more than 70 candidates to our Scientific Advisory Board for consideration, initiated development of 45 therapeutic candidates and terminated 35 feasibility programs.

Our Strategy

Our objective is to be a leader in developing innovative pharmaceutical and biopharmaceutical products. We continuously identify and in-license therapeutic candidates in order to maximize our potential for commercial success. We repeatedly assess compounds by evaluating their efficacy, safety, total estimated development costs, technological novelty, patent status, market potential and approvability. Our approach to evaluating, in-licensing and developing therapeutic candidates allows us to:

|

|

•

|

continually build our pipeline of therapeutic candidates;

|

|

|

•

|

advance those therapeutic candidates with the greatest potential;

|

|

|

•

|

quickly identify, and terminate the development of, unattractive therapeutic candidates; and

|

|

|

•

|

avoid dependency on a small number of therapeutic candidates.

|

Using this approach, we have successfully advanced six therapeutic candidates into clinical development. Specific elements of our current strategy include the following:

|

|

•

|

Support the successful development and commercialization of therapeutic candidates that have already been partnered. We currently have five programs at various stages of development in our pipeline, which have already been partnered.

|

|

|

•

|

Commercialize additional therapeutic candidates through out-licensing arrangements or, where appropriate, by ourselves. We intend to commercialize many of our other products through out-licensing arrangements with third parties who may perform any or all of the following tasks: completing development, securing regulatory approvals, manufacturing and/or marketing. If appropriate, we may also enter into co-development and similar arrangements with respect to any therapeutic candidate with third parties or commercialize a therapeutic candidate ourselves.

|

6

|

|

•

|

Design development programs that reach critical decisions quickly. At each step of our screening process for therapeutic candidates, a candidate is subjected to rigorous feasibility testing and potential advancement or termination. We believe our feasibility approach reduces costs and increases the probability of commercial success by eliminating less promising candidates quickly before advancing them into more costly preclinical and clinical programs.

|

|

|

•

|

Use our expertise and proprietary screening methodology to evaluate in-licensing opportunities. In order to review and select among various candidates efficiently and effectively, we employ a rigorous screening system we developed. Our Scientific Advisory Board and disease-specific third-party advisors evaluate each candidate. We intend to in-license a sufficient number of therapeutic candidates to allow us to move a new therapeutic candidate into clinical development every 12 to 24 months.

|

|

|

•

|

Leverage and expand our relationships with research institutes, academic institutions and biotechnology companies, including the specific strategic relationships that we have developed with Israeli research and academic institutions, to identify and in-license promising therapeutic candidates. To date, we have successfully in-licensed compounds from major Israeli universities, as well as from Israeli hospitals, technology incubators and biotechnology companies. We continue to maintain close contacts with university technology transfer offices, research and development authorities, university faculty, and many biotechnology companies to actively seek out early stage compounds. In addition, we actively source and evaluate non-Israeli compounds.

|

|

|

•

|

Seek to co-develop certain pre-clinical and early clinical therapeutic projects through clinical proof-of-concept by means of our multi-year strategic collaboration agreement with Novartis. Novartis will evaluate Israeli-sourced projects identified and presented by us for co-development and potential future licensing under the collaboration. Pursuant to an agreement entered into in December 2014, Novartis will evaluate jointly with us both clinical and pre-clinical stage projects presented by us via a Joint Steering Committee, which will determine which projects to advance further in development and on what terms. Projects at or reaching the clinical stage will be eligible for selection by Novartis. Upon selection of a project, Novartis will pay us an option fee of $5 million, as well as fund 50% of the anticipated remaining development costs associated with establishing clinical proof-of-concept, in the form of an additional equity investment in BioLineRx. The companies intend to develop up to three programs pursuant to this collaboration. Under the terms of the agreement, Novartis acquired 5,000,000 ADSs of BioLineRx in a private transaction at a price of $2.00 per ADS for a total equity investment of $10 million and agreed to certain standstill provisions.

|

7

RISK FACTORS

Investing in our Ordinary Shares or ADSs involves a high degree of risk. You should carefully consider the specific risks described below, including, but not limited to, the risks included in our Current Report on Form 6-K filed March 5, 2015, before making an investment decision. Any of the risks we describe below could cause our business, financial condition or operating results to suffer. The market price of our Ordinary Shares and ADSs could decline if one or more of these risks and uncertainties develop into actual events. You could lose all or part of your investment.

Risks Related to Our Financial Condition and Capital Requirements

We are a clinical stage biopharmaceutical development company with a history of operating losses, expect to incur additional losses in the future and may never be profitable.

We are a clinical stage biopharmaceutical development company that was incorporated in 2003. Since our incorporation, we have been focused on research and development. Our most advanced therapeutic candidates are in clinical development. We, or our licensees, as applicable, will be required to conduct significant additional clinical trials before we or they can seek the regulatory approvals necessary to begin commercial sales of our therapeutic candidates. We have incurred losses since inception, principally as a result of research and development and general administrative expenses in support of our operations. We recorded net losses of approximately NIS 24.0 million ($6.5 million) in the nine months ended September 30, 2014, NIS 61.4 million ($17.7 million) in 2013 and NIS 76.3 million ($20.4 million) in 2012. As of September 30, 2014, we had an accumulated deficit of approximately NIS 529.8 million ($143.4 million). We anticipate that we will incur significant additional losses as we continue to focus our resources on prioritizing, selecting and advancing our most promising therapeutic candidates. We may never be profitable and we may never achieve significant sustained revenues.

We cannot ensure investors that our existing cash and investment balances will be sufficient to meet our future capital requirements.

As of September 30, 2014, we held cash and short-term investments of approximately $29.6 million. In December 2014, we received an additional $10.0 million in connection with the strategic collaboration agreement signed with Novartis. We believe that our existing cash and investment balances and other sources of liquidity, not including potential milestone and royalty payments under our out-licensing agreements with Bellerophon and Omega Pharma, will be sufficient to meet our requirements through the end of 2016. We have funded our operations primarily through public and private offerings of our securities and, until 2013, grants from the Office of the Chief Scientist of Israel’s Ministry of the Economy, or the OCS. In addition, we have funded our operations through out-licensing arrangements with respect to our therapeutic candidates. The adequacy of our available funds to meet our operating and capital requirements will depend on many factors including: the number, breadth, progress and results of our research, product development and clinical programs; the costs and timing of obtaining regulatory approvals for any of our therapeutic candidates; the terms and conditions of in-licensing and out-licensing therapeutic candidates; and costs incurred in enforcing and defending our patent claims and other intellectual property rights.

While we will continue to explore alternative financing sources, including the possibility of future securities offerings, government funding, and public and private grants, we cannot be certain that in the future these liquidity sources will be available when needed on commercially reasonable terms or at all, or that our actual cash requirements will not be greater than anticipated. We will also continue to seek to finance our operations through other sources, including out-licensing arrangements or other partnerships or joint ventures. If we are unable to obtain future financing through the methods we describe above or through other means, we may be unable to achieve our business objectives and may be unable to continue operations, which would have a material adverse effect on our business and financial condition.

8

Risks Related to Our Business and Regulatory Matters

If we or our licensees are unable to obtain U.S. and/or foreign regulatory approval for our therapeutic candidates, we will be unable to commercialize our therapeutic candidates.

To date, we have not marketed, distributed or sold an approved product. Currently, we have six clinical-stage therapeutic candidates in development: BL-1040 for the reduction or prevention of ventricular remodeling following an acute myocardial infarction, or AMI; BL-8040 for the treatment of acute myeloid leukemia, or AML, and other hematological indications; BL-7010 for the treatment of celiac disease; BL-5010 for the treatment of benign skin lesions; BL-7040 for the treatment of inflammatory bowel disease, or IBD; and BL-8020 for the treatment of the hepatitis C virus, or HCV, as well as other viral indications. Our therapeutic candidates are subject to extensive governmental regulations relating to development, clinical trials, manufacturing and commercialization of drugs and devices. We may not obtain marketing approval for any of our therapeutic candidates in a timely manner or at all. In connection with the trials for our clinical products and other therapeutic candidates that we are currently developing or may seek to develop in the future, either on our own or through out-licensing arrangements, we face the risk that:

|

|

·

|

a therapeutic candidate or medical device may not prove safe or efficacious;

|

|

|

·

|

the results with respect to any therapeutic candidate may not confirm the positive results from earlier preclinical studies or clinical trials;

|

|

|

·

|

the results may not meet the level of statistical significance required by the U.S. Food and Drug Administration, or FDA, or other regulatory authorities; and

|

|

|

·

|

the results will justify only limited and/or restrictive uses, including the inclusion of warnings and contraindications, which could significantly limit the marketability and profitability of the therapeutic candidate.

|

Any delay in obtaining, or the failure to obtain, required regulatory approvals will materially and adversely affect our ability to generate future revenues from a particular therapeutic candidate. Any regulatory approval to market a product may be subject to limitations on the indicated uses for which we may market the product or may impose restrictive conditions of use, including cautionary information, thereby limiting the size of the market for the product. We and our licensees, as applicable, also are, and will be, subject to numerous foreign regulatory requirements that govern the conduct of clinical trials, manufacturing and marketing authorization, pricing and third-party reimbursement. The foreign regulatory approval process includes all of the risks associated with the FDA approval process that we describe above, as well as risks attributable to the satisfaction of foreign requirements. Approval by the FDA does not ensure approval by regulatory authorities outside the United States. Foreign jurisdictions may have different approval processes than those required by the FDA and may impose additional testing requirements for our therapeutic candidates.

Clinical trials involve a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials may not be predictive of future trial results.

We have limited experience in conducting and managing the clinical trials necessary to obtain regulatory approvals, including FDA approval. Clinical trials are expensive and complex, can take many years and have uncertain outcomes. We cannot predict whether we or our licensees will encounter problems with any of the completed, ongoing or planned clinical trials that will cause us, our licensees or regulatory authorities to delay or suspend clinical trials, or delay the analysis of data from completed or ongoing clinical trials. We estimate that clinical trials of our most advanced therapeutic candidates will continue for several years, but they may take significantly longer to complete. Failure can occur at any stage of the testing and we may experience numerous unforeseen events during, or as a result of, the clinical trial process that could delay or prevent commercialization of our current or future therapeutic candidates, including but not limited to:

|

|

·

|

delays in securing clinical investigators or trial sites for the clinical trials;

|

|

|

·

|

delays in obtaining institutional review board and other regulatory approvals to commence a clinical trial;

|

|

|

·

|

slower than anticipated patient recruitment and enrollment;

|

|

|

·

|

negative or inconclusive results from clinical trials;

|

9

|

|

·

|

unforeseen safety issues;

|

|

|

·

|

uncertain dosing issues;

|

|

|

·

|

an inability to monitor patients adequately during or after treatment; and

|

|

|

·

|

problems with investigator or patient compliance with the trial protocols.

|

A number of companies in the pharmaceutical, medical device and biotechnology industries, including those with greater resources and experience than us, have suffered significant setbacks in advanced clinical trials, even after seeing promising results in earlier clinical trials. Despite the results reported in earlier clinical trials for our therapeutic candidates, we do not know whether any phase 3 or other clinical trials we or our licensees may conduct will demonstrate adequate efficacy and safety to result in regulatory approval to market our therapeutic candidates. If later-stage clinical trials of any therapeutic candidate do not produce favorable results, our ability to obtain regulatory approval for the therapeutic candidate may be adversely impacted, which will have a material adverse effect on our business, financial condition and results of operations.

Even if we obtain regulatory approvals, our therapeutic candidates will be subject to ongoing regulatory review and if we fail to comply with continuing U.S. and applicable foreign regulations, we could lose those approvals and our business would be seriously harmed.

Even if products we or our licensees develop receive regulatory approval or clearance, we or our licensees, as applicable, will be subject to ongoing reporting obligations and the products and the manufacturing operations will be subject to continuing regulatory review, including FDA inspections. The results of this ongoing review may result in the withdrawal of a product from the market, the interruption of the manufacturing operations and/or the imposition of labeling and/or marketing limitations. Since many more patients are exposed to drugs and medical devices following their marketing approval, serious but infrequent adverse reactions that were not observed in clinical trials may be observed during the commercial marketing of the product. In addition, the manufacturer and the manufacturing facilities we or our licensees, as applicable, will use to produce any therapeutic candidate will be subject to periodic review and inspection by the FDA and other, similar foreign regulators. Later discovery of previously unknown problems with any product, manufacturer or manufacturing process, or failure to comply with regulatory requirements, may result in actions such as:

|

|

·

|

restrictions on such product, manufacturer or manufacturing process;

|

|

|

·

|

warning letters from the FDA or other regulatory authorities;

|

|

|

·

|

withdrawal of the product from the market;

|

|

|

·

|

suspension or withdrawal of regulatory approvals;

|

|

|

·

|

refusal to approve pending applications or supplements to approved applications that we or our licensees submit;

|

|

|

·

|

voluntary or mandatory recall;

|

|

|

·

|

fines;

|

|

|

·

|

refusal to permit the import or export of our products;

|

|

|

·

|

product seizure or detentions;

|

|

|

·

|

injunctions or the imposition of civil or criminal penalties; or

|

|

|

·

|

adverse publicity.

|

10

If we, or our licensees, suppliers, third party contractors, partners or clinical investigators are slow to adapt, or are unable to adapt, to changes in existing regulatory requirements or the adoption of new regulatory requirements or policies, we or our licensees may lose marketing approval for any of our products, if any of our therapeutic products are approved, resulting in decreased or lost revenue from milestones, product sales or royalties.

We rely on third parties to conduct our clinical trials and provide other services, and those third parties may not perform satisfactorily, including by failing to meet established deadlines for the completion of such services.

We do not have the ability to conduct certain preclinical studies and clinical trials independently for our therapeutic candidates, and we rely on third parties, such as contract laboratories, contract research organizations, medical institutions and clinical investigators to conduct these studies and our clinical trials. Our reliance on these third parties limits our control over these activities. The third-party contractors may not assign as great a priority to our clinical development programs or pursue them as diligently as we would if we were undertaking such programs directly. Accordingly, these third-party contractors may not complete activities on schedule, or may not conduct the studies or our clinical trials in accordance with regulatory requirements or with our trial design. If these third parties do not successfully carry out their contractual duties or meet expected deadlines, or if their performance is substandard, we may be required to replace them. Although we believe that there are a number of other third-party contractors that we could engage to continue these activities, replacement of these third parties will result in delays. As a result, our efforts to obtain regulatory approvals for, and to commercialize, our therapeutic candidates may be delayed. The third-party contractors may also have relationships with other commercial entities, some of whom may compete with us. If the third-party contractors assist our competitors, our competitive position may be harmed.

In addition, our ability to bring future products to market depends on the quality and integrity of data that we present to regulatory authorities in order to obtain marketing authorizations. Although we attempt to audit and control the quality of third-party data, we cannot guarantee the authenticity or accuracy of such data, nor can we be certain that such data has not been fraudulently generated. The failure of these third parties to carry out their obligations would materially adversely affect our ability to develop and market new products and implement our strategies.

We depend on out-licensing arrangements to develop, market and commercialize our therapeutic candidates.

We depend on out-licensing arrangements to develop, market and commercialize our therapeutic candidates. We have limited experience in developing, marketing and commercializing therapeutic candidates. Dependence on out-licensing arrangements subjects us to a number of risks, including the risk that:

|

|

·

|

we may not be able to control the amount and timing of resources that our licensees devote to our therapeutic candidates;

|

|

|

·

|

our licensees may experience financial difficulties;

|

|

|

·

|

our licensees may fail to secure adequate commercial supplies of our therapeutic candidates upon marketing approval, if at all;

|

|

|

·

|

our future revenues depend heavily on the efforts of our licensees;

|

|

|

·

|

business combinations or significant changes in a licensee’s business strategy may adversely affect the licensee’s willingness or ability to complete its obligations under any arrangement with us;

|

|

|

·

|

a licensee could move forward with a competing therapeutic candidate developed either independently or in collaboration with others, including our competitors; and

|

|

|

·

|

out-licensing arrangements are often terminated or allowed to expire, which would delay the development and may increase the development costs of our therapeutic candidates.

|