Form 6-K ASML HOLDING NV For: Jul 20

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

______________________

FORM 6-K

REPORT OF A FOREIGN ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For July 20, 2016

______________________

ASML Holding N.V.

De Run 6501

5504 DR Veldhoven

The Netherlands

(Address of principal executive offices)

______________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No x

If ‘‘Yes’’ is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

EXHIBITS 99.1, 99.3, 99.4, AND 99.5 TO THIS REPORT ON FORM 6-K ARE INCORPORATED BY REFERENCE IN THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-116337), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-126340), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-136362), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-141125), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-142254), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-144356), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-147128), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-153277), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-162439), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-170034), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-188938), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-190023), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-192951) AND THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-203390) OF ASML HOLDING N.V. AND IN THE OUTSTANDING PROSPECTUSES CONTAINED IN SUCH REGISTRATION STATEMENTS.

Exhibits

99.1 | “Strong logic ramp and healthy memory drive ASML second-quarter sales. New EUV orders intended for volume manufacturing”, press release dated July 20, 2016 |

99.2 | “Strong logic ramp and healthy memory drive ASML second-quarter sales. New EUV orders intended for volume manufacturing”, presentation dated July 20, 2016 |

99.3 | Summary U.S. GAAP Consolidated Financial Statements |

99.4 | Summary IFRS Consolidated Financial Statements |

99.5 | Statutory Interim Report for the six-month period ended July 3, 2016 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

ASML HOLDING N.V. (Registrant)

Date: July 20, 2016 By: /s/ Peter T.F.M. Wennink

Peter T.F.M. Wennink

Chief Executive Officer

Exhibit 99.1

Media Relations Contacts

Lucas van Grinsven - Corporate Communications - +31 6 101 99 532 - Veldhoven, the Netherlands

Niclas Mika - Corporate Communications - +31 6 201 528 63 - Veldhoven, the Netherlands

Investor Relations Contacts

Craig DeYoung - Investor Relations - +1 480 696 2762 - Chandler, Arizona, USA

Marcel Kemp - Investor Relations - +31 40 268 6494 - Veldhoven, the Netherlands

Strong logic ramp and healthy memory drive ASML second-quarter sales

New EUV orders intended for volume manufacturing

VELDHOVEN, the Netherlands, July 20, 2016 - ASML Holding N.V. (ASML) today publishes its 2016 second-quarter results.

• | Q2 net sales of EUR 1.74 billion, gross margin 42.6 percent |

• | ASML guides Q3 2016 net sales at approximately EUR 1.7 billion and a gross margin of around 47 percent |

• | ASML expects full-year 2016 sales to exceed 2015 record year |

(Figures in millions of euros unless otherwise indicated) | Q1 2016 | Q2 2016 |

Net sales | 1,333 | 1,740 |

...of which service and field option sales | 477 | 486 |

Other income (Co-Investment Program) | 23 | 23 |

New systems sold (units) | 28 | 39 |

Used systems sold (units) | 5 | 7 |

Average Selling Price (ASP) of net system sales | 25.9 | 27.3 |

Net bookings | 835 | 1,566 |

Systems backlog | 3,018 | 3,371 |

Gross profit | 568 | 741 |

Gross margin (%) | 42.6 | 42.6 |

Net income | 198 | 354 |

EPS (basic; in euros) | 0.46 | 0.83 |

End-quarter cash and cash equivalents and short-term investments | 3,138 | 2,926 |

A complete summary of US GAAP Consolidated Statements of Operations is published on www.asml.com

1

CEO Statement

"Our business continues to perform well. We recorded second-quarter orders of EUR 1.6 billion and posted net sales of over EUR 1.7 billion. System sales were weighted towards logic customers, supporting the initial ramp of the 10 nanometer node. System sales to memory customers remained healthy, as manufacturers continued their technology investments in DRAM and added capacity for 3D NAND. Our second-quarter net sales included around EUR 100 million in partial revenue recognition for two NXE:3350B EUV systems, which we had shipped in the fourth quarter of 2015. Confirming our previous statements on overall business trends, we now expect our full-year 2016 sales to exceed our 2015 record year. The ultimate level will depend on the timing of our EUV revenue recognition and the size of the combined 10/7 nanometer node ramp," ASML President and Chief Executive Officer Peter Wennink said.

"We took new orders for four EUV systems from foundry and memory customers, bringing our backlog to 10 units worth about EUR 1 billion. These systems are intended for volume manufacturing sites. We expect to take additional orders in the second half of this year," Wennink said.

"We announced our plans to acquire Hermes Microvision, Inc., to enhance our Holistic Lithography offering and thereby address the challenges chip makers are facing as they enter sub-10 nanometer resolutions and 3D integration. On 4 July we issued two bonds totaling EUR 1.5 billion that are intended to partially fund this acquisition."

Product and Business Highlights

• | In Deep Ultraviolet (DUV) lithography, the rollout of our TWINSCAN NXT:1980i ArF immersion systems is progressing well. Since introduction we have shipped a total of 23 systems and upgraded an additional five systems at customer sites to NXT:1980 specifications. We have also installed an enhanced version of the TWINSCAN XT:1460 ArF dry system with a 40 percent improvement in matched machine overlay, demonstrating our commitment to continue to improve the performance of our dry lithography product portfolio. |

• | In Holistic Lithography, we have shipped multiple YieldStar 350E metrology systems to our leading customers to support the qualification and ramp of the 10 nanometer logic node. We also released a new version of our process window enhancement |

2

software suite, which includes a new approach to SRAF (Sub-Resolution Assist Features) placement that improves the quality of patterning. This leading resolution enhancement technique is aimed at helping to maximize manufacturing yield for EUV and immersion-based lithography at the 7 and 5 nanometer logic and 1x memory nodes.

• | In Extreme Ultraviolet (EUV) lithography, we continued to demonstrate progress towards manufacturing insertion with productivity and availability improvements. An NXE:3350B EUV system at a customer site processed 1,200 wafers per day. We are progressing well toward our 2016 target of 1,500 wafers per day, evidenced by the peak performance achieved on a NXE:3350B at ASML of 1,488 wafers per day. |

Outlook

For the third-quarter of 2016, ASML expects net sales at approximately EUR 1.7 billion, a gross margin of around 47 percent, R&D costs of about EUR 275 million, other income of about EUR 23 million -- which consists of contributions from participants of the Customer Co-Investment Program, SG&A costs of about EUR 90 million and an effective annualized tax rate of around 12 percent.

Update Share Buyback Program

As part of ASML's financial policy to return excess cash to shareholders through dividends and regularly timed share buyback programs, ASML in January 2016 announced its intention to purchase up to EUR 1.5 billion of shares to be executed within the 2016-2017 time frame. ASML intends to cancel the shares upon repurchase.

Through July 3, 2016, ASML has acquired 4.6 million shares under this program for a total consideration of EUR 387 million. The repurchased shares will be canceled.

We will pause our share buyback program for a few quarters while we are in the midst of the HMI acquisition process. We continue to expect to complete the full 2016-2017 program, yet it may be further suspended, modified or discontinued at any time. Any transactions under this program will be published on ASML's website (www.asml.com/investors) on a weekly basis.

About ASML

ASML is one of the world’s leading manufacturers of chip-making equipment. Our vision is to enable affordable microelectronics that improve the quality of life. To achieve this, our mission is to invent, develop, manufacture and service advanced technology for high-tech lithography, metrology and software solutions for the semiconductor industry. ASML's guiding principle is continuing Moore's Law towards ever smaller, cheaper, more powerful

3

and energy-efficient semiconductors. This results in increasingly powerful and capable electronics that enable the world to progress within a multitude of fields, including healthcare, technology, communications, energy, mobility, and entertainment. We are a multinational company with over 70 locations in 16 countries, headquartered in Veldhoven, the Netherlands.We employ more than 15,000 people on payroll and flexible contracts (expressed in full time equivalents). ASML is traded on Euronext Amsterdam and NASDAQ under the symbol ASML. More information about ASML, our products and technology, and career opportunities is available on www.asml.com.

Investor and Media Conference Call

A conference call for investors and media will be hosted by CEO Peter Wennink and CFO Wolfgang Nickl at 15:00 PM Central European Time / 09:00 AM U.S. Eastern time. To register for the call and receive dial-in information, go to www.asml.com/qresultscall. Listen-only access is also available via www.asml.com.

US GAAP and IFRS Financial Reporting

ASML's primary accounting standard for quarterly earnings releases and annual reports is US GAAP, the accounting principles generally accepted in the United States of America. Quarterly US GAAP consolidated statements of operations, consolidated statements of cash flows and consolidated balance sheets, and a reconciliation of net income and equity from US GAAP to IFRS as adopted by the EU (‘IFRS’) are available on www.asml.com.

In addition to reporting financial figures in accordance with US GAAP, ASML also reports financial figures in accordance with IFRS for statutory purposes. The most significant differences between US GAAP and IFRS that affect ASML concern the capitalization of certain product development costs, the accounting of share-based payment plans and the accounting of income taxes. ASML’s quarterly IFRS consolidated statement of profit or loss, consolidated statement of cash flows, consolidated statement of financial position and a reconciliation of net income and equity from US GAAP to IFRS are available on www.asml.com.

Today, July 20, 2016, ASML has also published the Statutory Interim Report for the six-month period ended July 3, 2016. This report is in accordance with the requirements of the EU Transparency Directive as implemented in the Netherlands, and includes consolidated

4

condensed interim financial statements prepared in accordance with IAS 34 ‘Interim Financial Reporting’, an Interim Management Board Report and a Managing Directors' Statement and is available on www.asml.com.

The consolidated balance sheets of ASML Holding N.V. as of July 3, 2016, the related consolidated statements of operations and consolidated statements of cash flows for the quarter ended July 3, 2016 as presented in this press release are unaudited.

Regulated Information

This press release contains inside information within the meaning of Article 7(1) of the EU Market Abuse Regulation.

Forward Looking Statements

This document contains statements relating to certain projections and business trends that are forward-looking, including statements with respect to our outlook, including expected customer demand in specified market segments including memory, logic and foundry, expected trends and outlook, including expected levels of service sales, systems backlog, expected financial results for the third quarter and full year 2016, including expected sales, other income, gross margin, R&D and SG&A expenses and effective annualized tax rate, annual revenue opportunity for ASML and EPS potential by end of decade, productivity of our tools and systems performance, including EUV system performance (such as endurance tests), expected industry trends and expected trends in the business environment, statements with respect to the acquisition of HMI by ASML, the expected benefits of the acquisition of HMI by ASML, including expected earnings accretion, enhancement of ASML’s existing product portfolio, the creation of a new class of products which improves yield and time to market, the accelerated introduction of reticle defect detection to support future EUV ramp and related opportunity in 2020, improvement in ASML and HMI’s metrology technologies and support of EUV technologies, the benefits of the acquisition to ASML’s holistic lithography strategy, the growth opportunity represented by patterning control and expansion of market opportunity by 2020 and expected timing of completion of HMI acquisition, statements with respect to EUV targets, including availability, productivity and shipments, including the number of EUV systems expected to be shipped and timing of shipments, and roadmaps, shrink being key driver to industry growth, expected industry adoption of EUV and statements with respect to the intent of customers to insert EUV into production, the expected continuation of Moore's law and that EUV will continue to enable Moore’s law and drive long term value, goals for holistic lithography, intention to return excess cash to shareholders, and statements about our proposed dividend, dividend policy and intention to repurchase shares. You can generally identify these statements by the use of words like "may", "will", "could", "should", "project", "believe", "anticipate", "expect", "plan", "estimate", "forecast", "potential", "intend", "continue" and variations of these words or comparable words. These statements are not historical facts, but rather are based on current expectations, estimates, assumptions and projections about the business and our future financial results and readers should not place undue reliance on them. Forward-looking statements do not guarantee future performance and involve risks and uncertainties. These risks and uncertainties include, without limitation, economic conditions, product demand and semiconductor equipment industry capacity, worldwide demand and manufacturing capacity utilization for semiconductors (the principal product of our customer base), including the impact of general economic conditions on consumer confidence and demand for our customers' products, competitive products and pricing, the impact of any manufacturing efficiencies and capacity constraints, performance of our systems, the continuing success of technology advances and the related pace of new product development and customer acceptance of new products including EUV, the number and timing of EUV systems expected to be shipped and recognized in revenue, delays in EUV systems production and development, our ability to enforce patents and protect intellectual property rights, the risk of intellectual property litigation, availability of raw materials and critical manufacturing equipment, trade environment, changes in exchange rates, changes in tax rates, available cash and liquidity, our ability to refinance our indebtedness, distributable reserves for dividend payments and share repurchases, and other risks indicated in the risk factors included in ASML's Annual Report on Form 20-F and other filings with the US Securities and Exchange Commission. These forward-looking statements are made only as of the date of this document. We do not undertake to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

5

Strong logic ramp and healthy memory drive ASML second-quarter sales

New EUV orders intended for volume manufacturing

ASML 2016 Second-Quarter Results

Veldhoven, the Netherlands

July 20, 2016

Public

Public

Slide 2

July 20, 2016

Agenda

• Investor key messages

• HMI acquisition highlights

• Business highlights

• Business environment

• Outlook

• EUV highlights

• Financial statements

Public

Slide 3

July 20, 2016

Investor key messages

Public

Slide 4

July 20, 2016

Investor key messages

• Shrink is the key industry driver supporting innovation and providing long term industry growth

• Lithography enables affordable shrink and therefore delivers compelling value for our customers

• EUV will enable continuation of Moore’s Law and will drive long term value for ASML

• Current EUV focus shifts from WHEN to HOW MANY in what timeframe

• ASML’s strategy of large R&D investments in lithography product roadmaps supports future

industry needs

• DUV product improvement roadmaps and Holistic Litho enable multi-pass immersion patterning

today, with Holistic Litho supporting EUV in the future. These highly differentiated products

provide unique value drivers for us and our customers

• ASML models an annual revenue opportunity of € 10 billion* by 2020 and given the significant

leverage in our financial model this will allow a potential tripling of EPS* by the end of this

decade, compared to calendar year 2014, thereby creating significant value for all stakeholders

• We expect to continue to return excess cash to our shareholders through dividends that are

stable or growing and regularly timed share buybacks in line with our policy

• Planned HMI acquisition provides market leading e-beam metrology capability which expands

our integrated Holistic Lithography solutions to include a new class of pattern fidelity control

* HMI acquisition not included, see Press Release (date June 16th 2016 on www.asml.com)

Public

Slide 5

July 20, 2016

HMI acquisition highlights

Public

Slide 6

July 20, 2016

HMI acquisition to enhance Holistic Lithography portfolio

Rationale:

• Combination of HMI e-beam metrology technology and ASML Holistic Lithography will create a

new class of products for patterning control which improves yield and time to market needed to

support extension of Moore’s law

• Patterning control represents a major growth opportunity in the next 5 to 10 years, expands the

addressable market opportunity for qualification, monitoring and control to € 2.3 billion in 2020

• In addition, ASML and HMI will accelerate introduction of reticle defect detection to support

coming EUV ramp, an opportunity of € 200 million in 2020

• The transaction will be accretive to ASML earnings immediately (before the impact of purchase-

price accounting)

Status:

• ASML placed € 1.5 billion Eurobonds on July 4th offering intended for partial finance of the

acquisition

• The transaction is expected to close in Q4 2016 and is subject to customary closing conditions.

Closing is also subject to approval by HMI's shareholders. The HMI Extraordinary General

Meeting is scheduled for August 3rd 2016

For further information on the transaction see our Press Release (date June 16th 2016 on www.asml.com)

Public

Slide 7

July 20, 2016

ASML holistic lithography future - a new paradigm:

E-beam added: ASML model guides e-beam to improve coverage of critical

features; e-beam data enhances ASML model and control of scanner

Detailed presentation available on the HMI acquisition on www.asml.com

Public

Slide 8

July 20, 2016

Business highlights

Public

Slide 9

July 20, 2016

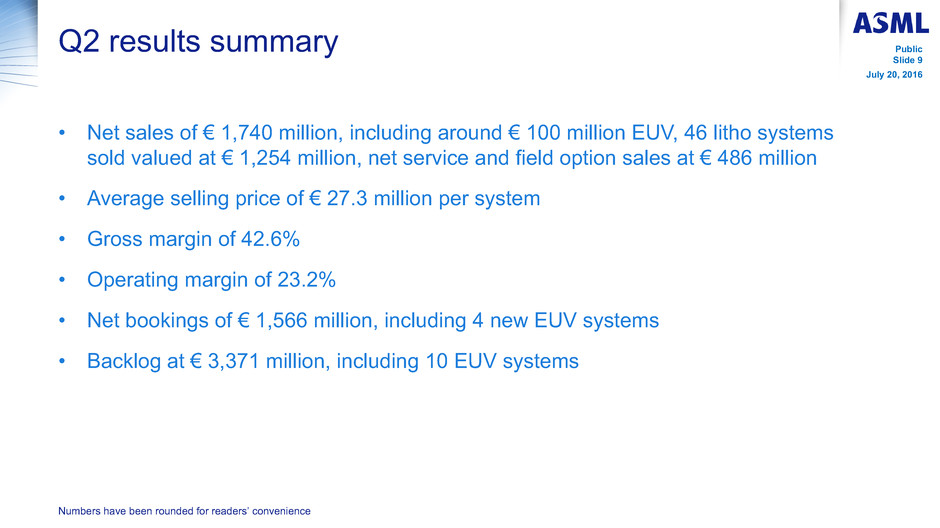

Q2 results summary

• Net sales of € 1,740 million, including around € 100 million EUV, 46 litho systems

sold valued at € 1,254 million, net service and field option sales at € 486 million

• Average selling price of € 27.3 million per system

• Gross margin of 42.6%

• Operating margin of 23.2%

• Net bookings of € 1,566 million, including 4 new EUV systems

• Backlog at € 3,371 million, including 10 EUV systems

Numbers have been rounded for readers’ convenience

Public

Slide 10

July 20, 2016

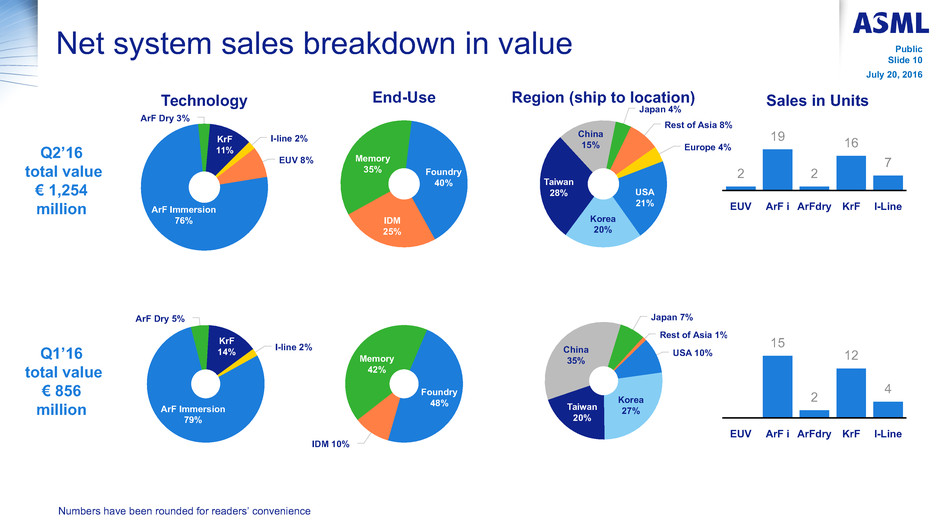

Sales in Units

EUV ArF i ArFdry KrF I-Line

2

19

2

16

7

EUV ArF i ArFdry KrF I-Line

15

2

12

4

Net system sales breakdown in value

Technology

EUV 8%

ArF Immersion

76%

ArF Dry 3%

KrF

11%

I-line 2%

End-Use

Memory

35% Foundry

40%

IDM

25%

Q2’16

total value

€ 1,254

million

Q1’16

total value

€ 856

million ArF Immersion

79%

ArF Dry 5%

KrF

14% I-line 2%

Memory

42%

Foundry

48%

IDM 10%

Numbers have been rounded for readers’ convenience

USA 10%

Korea

27%Taiwan

20%

China

35%

Japan 7%

Rest of Asia 1%

Region (ship to location)

USA

21%

Korea

20%

Taiwan

28%

China

15%

Japan 4%

Rest of Asia 8%

Europe 4%

Public

Slide 11

July 20, 2016

7,000

6,000

5,000

4,000

3,000

2,000

1,000

0

N

et

Sa

le

s

2011 2012 2013 2014 2015 2016

1,452 1,252 892

1,397 1,650 1,333

1,529

1,228

1,187

1,644

1,654

1,740

1,459

1,229

1,318

1,322

1,549

1,211

5,651

1,023

4,732

1,848

5,245

1,494

1,434

6,287

Total net sales million € by quarter

Q4

Q3

Q2

Q1

Numbers have been rounded for readers’ convenience

3,073 YTD

5,856

Public

Slide 12

July 20, 2016

7,000

6,000

5,000

4,000

3,000

2,000

1,000

0

N

et

Sa

le

s

2011 2012 2013 2014 2015 2016

2,184

935

1,489

2,225 2,115

793

844

588

440

831

514

402

1,856

2,279

2,064

1,186

1,608

915

767

5,651

930

4,732

1,252

5,245

1,614

5,856

2,050

6,287

963

Total net sales million € by End-use

3,073 YTD

Service & Options

Foundry

IDM

Memory

Numbers have been rounded for readers’ convenience

Public

Slide 13

July 20, 2016

Bookings activity by sector

Q2’16 total value

€ 1,566 million

New

systems

Used

systems

Units 40 3

Value M€ 1,555 11

New

systems

Used

systems

Units 24 6

Value M€ 802 33

Q1’16 total value

€ 835 million

Memory

25%

Foundry

57%IDM

18%

Memory

14%

Foundry

67%

IDM

19%

Numbers have been rounded for readers’ convenience

Public

Slide 14

July 20, 2016

System backlog in value

Technology

EUV

31%ArF

Immersion

59%

ArF Dry 2% KrF 7%

I-line 1%

Region (ship to location)

USA

26%Korea22%

Taiwan

35%

China 5%

Japan 2%

Rest of Asia 3%

Europe 7%

End-Use

Memory

18%

Foundry

51%IDM

31%

Q2’16

total value

€ 3,371

million

Q1’16

total value

€ 3,018

million

Memory

24% Foundry

41%

IDM

35%

USA

39%

Korea

20%

Taiwan

26%

China 8%

Rest of Asia 4%

Europe 3%

New

systems

Used

systems

Units 65 8

Value M€ 3,335 36

New

systems

Used

systems

Units 64 12

Value M€ 2,975 43

Numbers have been rounded for readers’ convenience

EUV

24%

ArF

Immersion

61%

ArF Dry 3% KrF 10%

I-line 2%

Public

Slide 15

July 20, 2016

Capital return to shareholders

• ASML paid € 446 million in dividend or € 1.05 per ordinary share in Q2

• Purchased € 387 million worth of shares in Q1 and Q2 as part of our 2016/2017

share buyback program for up to € 1.5 billion

◦ Share buyback program will be paused for a few quarters while we are in

the midst of the HMI acquisition process

Dividend history

1.2

1.0

0.8

0.6

0.4

0.2

0.0

D

iv

id

en

d

(e

ur

o)

2008 2009 2010 2011 2012 2013 2014 2015

0.20 0.20

0.40 0.46

0.53 0.61

0.70

1.05

Cumulative capital return

8,000

6,000

4,000

2,000

0

€

m

illi

on

2008 2009 2010 2011 2012 2013 2014 2015 2016

Dividend

Share buyback

The dividend for a year is paid in the subsequent year

Numbers have been rounded for readers’ convenience

YTD

Public

Slide 16

July 20, 2016

Business environment

Public

Slide 17

July 20, 2016

• 2x nm DRAM node progressing, 1x nm node initial production starting

• 3D NAND technology ramping

• X-Point initial production expected to start this year

• Tool shipments continue across multiple nodes

• 10 nm foundry and MPU volume ramping

• Growing service and field options business continues to be driven by

Holistic Litho, growing installed base and upgrade products which

allows for improved process control and capital efficiency

Business environment

Service &

field options

Memory

Logic

Public

Slide 18

July 20, 2016

Outlook

Public

Slide 19

July 20, 2016

Outlook

• Q3 net sales approximately € 1.7 billion

• Gross margin around 47%

• R&D costs of about € 275 million

• SG&A costs of about € 90 million

• Other income (Customer Co-Investment Program) of about € 23 million

• Effective annualized tax rate around 12%

• Our guidance for third-quarter:

Numbers have been rounded for readers’ convenience

• Full-year 2016 sales:

• Expected to exceed our 2015 record sales, ultimate level depends on timing

of EUV revenue recognition and size of the combined 10/7 nm node ramp

Public

Slide 20

July 20, 2016

EUV highlights

Public

Slide 21

July 20, 2016

EUV 2016 targets and achievements

• More than 1,200 wafers per day (wpd) exposed on NXE:3350B at a customer site

• Peak performance near target (1,488 wpd achieved at ASML)

• Five customer systems have achieved a four-week average availability of more than 80%, however consistency

still needs to be improved

• On track for target: one NXE:3350B system shipped in Q1, one NXE:3350B system shipped in Q2

Productivity - Target: 1500 wafers per day

Availability - Target: 80%

NXE shipments: 6-7

Public

Slide 22

July 20, 2016

Financial statements

Public

Slide 23

July 20, 2016

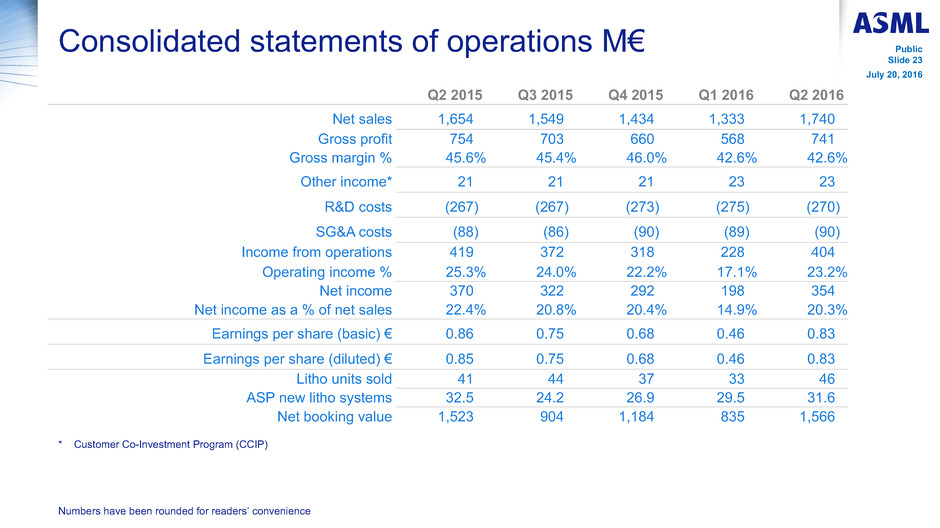

Consolidated statements of operations M€

Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016

Net sales 1,654 1,549 1,434 1,333 1,740

Gross profit 754 703 660 568 741

Gross margin % 45.6% 45.4% 46.0% 42.6% 42.6%

Other income* 21 21 21 23 23

R&D costs (267) (267) (273) (275) (270)

SG&A costs (88) (86) (90) (89) (90)

Income from operations 419 372 318 228 404

Operating income % 25.3% 24.0% 22.2% 17.1% 23.2%

Net income 370 322 292 198 354

Net income as a % of net sales 22.4% 20.8% 20.4% 14.9% 20.3%

Earnings per share (basic) € 0.86 0.75 0.68 0.46 0.83

Earnings per share (diluted) € 0.85 0.75 0.68 0.46 0.83

Litho units sold 41 44 37 33 46

ASP new litho systems 32.5 24.2 26.9 29.5 31.6

Net booking value 1,523 904 1,184 835 1,566

* Customer Co-Investment Program (CCIP)

Numbers have been rounded for readers’ convenience

Public

Slide 24

July 20, 2016

Cash flows M€

Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016

Net income 370 322 292 198 354

Net cash provided by (used in) operating activities 284 420 985 (6) 481

Net cash provided by (used in) investing activities (107) (99) (1,078) (183) (24)

Net cash provided by (used in) financing activities (458) (133) (131) (204) (607)

Net increase (decrease) in cash & cash equivalents (284) 186 (222) (395) (137)

Free cash flow* 205 333 864 (65) 381

* Free cash flow is defined as net cash provided by (used in) operating activities minus investments in Capex (Purchase of Property,

plant and equipment and intangibles), see US GAAP Consolidated Financial Statements

Numbers have been rounded for readers’ convenience

Public

Slide 25

July 20, 2016

Balance sheets M€

Assets Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016

Cash & cash equivalents and short-term investments 2,520 2,681 3,409 3,138 2,926

Net accounts receivable and finance receivables 1,589 1,593 1,208 1,302 1,362

Inventories, net 2,592 2,537 2,574 2,750 2,715

Other assets 871 846 940 987 1,146

Tax assets 264 203 181 143 228

Goodwill 2,569 2,574 2,624 2,538 2,603

Other intangible assets 751 739 738 706 714

Property, plant and equipment 1,519 1,533 1,621 1,580 1,609

Total assets 12,675 12,706 13,295 13,144 13,303

Liabilities and shareholders' equity

Current liabilities 2,854 2,711 3,107 3,248 3,720

Non-current liabilities 1,859 1,850 1,799 1,593 1,434

Shareholders' equity 7,962 8,145 8,389 8,303 8,149

Total liabilities and shareholders' equity 12,675 12,706 13,295 13,144 13,303

As of January 1, 2016 ASML early adopted the amendment to ASC 740 “Income taxes (Topic 740): Balance Sheet Classification of Deferred Taxes”, which requires that deferred

tax liabilities and assets are classified as non-current in the consolidated balance sheets. The comparative figures have not been adjusted to reflect this change in accounting

policy.

Numbers have been rounded for readers’ convenience

Public

Slide 26

July 20, 2016

This document contains statements relating to certain projections and business trends that are forward-looking, including statements with respect to our outlook,

including expected customer demand in specified market segments including memory, logic and foundry, expected trends and outlook, including expected levels

of service sales, systems backlog, expected financial results for the third quarter and full year 2016, including expected sales, other income, gross margin, R&D

and SG&A expenses and effective annualized tax rate, annual revenue opportunity for ASML and EPS potential by end of decade, productivity of our tools and

systems performance, including EUV system performance (such as endurance tests), expected industry trends and expected trends in the business

environment, statements with respect to the acquisition of HMI by ASML, the expected benefits of the acquisition of HMI by ASML, including expected earnings

accretion, enhancement of ASML’s existing product portfolio, the creation of a new class of products which improves yield and time to market, the accelerated

introduction of reticle defect detection to support future EUV ramp and related opportunity in 2020, improvement in ASML and HMI’s metrology technologies and

support of EUV technologies, the benefits of the acquisition to ASML’s holistic lithography strategy, the growth opportunity represented by patterning control and

expansion of market opportunity by 2020 and expected timing of completion of HMI acquisition, statements with respect to EUV targets, including availability,

productivity and shipments, including the number of EUV systems expected to be shipped and timing of shipments, and roadmaps, shrink being key driver to

industry growth, expected industry adoption of EUV and statements with respect to the intent of customers to insert EUV into production, the expected

continuation of Moore's law and that EUV will continue to enable Moore’s law and drive long term value, goals for holistic lithography, intention to return excess

cash to shareholders, and statements about our proposed dividend, dividend policy and intention to repurchase shares. You can generally identify these

statements by the use of words like "may", "will", "could", "should", "project", "believe", "anticipate", "expect", "plan", "estimate", "forecast", "potential", "intend",

"continue" and variations of these words or comparable words.

These statements are not historical facts, but rather are based on current expectations, estimates, assumptions and projections about the business and our future

financial results and readers should not place undue reliance on them. Forward-looking statements do not guarantee future performance and involve risks and

uncertainties. These risks and uncertainties include, without limitation, economic conditions, product demand and semiconductor equipment industry capacity,

worldwide demand and manufacturing capacity utilization for semiconductors (the principal product of our customer base), including the impact of general

economic conditions on consumer confidence and demand for our customers' products, competitive products and pricing, the impact of any manufacturing

efficiencies and capacity constraints, performance of our systems, the continuing success of technology advances and the related pace of new product

development and customer acceptance of new products including EUV, the number and timing of EUV systems expected to be shipped and recognized in

revenue, delays in EUV systems production and development, our ability to enforce patents and protect intellectual property rights, the risk of intellectual property

litigation, availability of raw materials and critical manufacturing equipment, trade environment, changes in exchange rates, changes in tax rates, available cash

and liquidity, our ability to refinance our indebtedness, distributable reserves for dividend payments and share repurchases, and other risks indicated in the risk

factors included in ASML's Annual Report on Form 20-F and other filings with the US Securities and Exchange Commission. These forward-looking statements

are made only as of the date of this document. We do not undertake to update or revise the forward-looking statements, whether as a result of new information,

future events or otherwise.

Forward looking statements

Exhibit 99.3

ASML - Summary US GAAP Consolidated Statements of Operations 1,2

Three months ended, | Six months ended, | |||||||||||

Jun 28, | Jul 3, | Jun 28, | Jul 3, | |||||||||

2015 | 2016 | 2015 | 2016 | |||||||||

(in millions EUR, except per share data) | ||||||||||||

Net system sales | 1,134.5 | 1,254.1 | 2,381.0 | 2,109.9 | ||||||||

Net service and field option sales | 519.6 | 485.5 | 923.0 | 962.9 | ||||||||

Total net sales | 1,654.1 | 1,739.6 | 3,304.0 | 3,072.8 | ||||||||

Total cost of sales | (900.3 | ) | (998.2 | ) | (1,771.6 | ) | (1,763.3 | ) | ||||

Gross profit | 753.8 | 741.4 | 1,532.4 | 1,309.5 | ||||||||

Other income | 20.8 | 23.5 | 41.6 | 46.9 | ||||||||

Research and development costs | (267.4 | ) | (270.3 | ) | (528.8 | ) | (545.0 | ) | ||||

Selling, general and administrative costs | (88.3 | ) | (90.4 | ) | (170.6 | ) | (179.2 | ) | ||||

Income from operations | 418.9 | 404.2 | 874.6 | 632.2 | ||||||||

Interest and other, net | (4.2 | ) | (3.6 | ) | (7.7 | ) | (7.2 | ) | ||||

Income before income taxes | 414.7 | 400.6 | 866.9 | 625.0 | ||||||||

Benefit from (provision for) income taxes | (45.0 | ) | (46.8 | ) | (94.5 | ) | (73.2 | ) | ||||

Net income | 369.7 | 353.8 | 772.4 | 551.8 | ||||||||

Basic net income per ordinary share | 0.86 | 0.83 | 1.79 | 1.30 | ||||||||

Diluted net income per ordinary share 3 | 0.85 | 0.83 | 1.78 | 1.29 | ||||||||

Weighted average number of ordinary shares used in computing per share amounts (in millions): | ||||||||||||

Basic | 431.4 | 424.5 | 432.0 | 425.7 | ||||||||

Diluted 3 | 433.8 | 426.5 | 434.4 | 427.8 | ||||||||

ASML - Ratios and Other Data 1,2

Three months ended, | Six months ended, | |||||||||||

Jun 28, | Jul 3, | Jun 28, | Jul 3, | |||||||||

2015 | 2016 | 2015 | 2016 | |||||||||

(in millions EUR, except otherwise indicated) | ||||||||||||

Gross profit as a percentage of net sales | 45.6 | % | 42.6 | % | 46.4 | % | 42.6 | % | ||||

Income from operations as a percentage of net sales | 25.3 | % | 23.2 | % | 26.5 | % | 20.6 | % | ||||

Net income as a percentage of net sales | 22.4 | % | 20.3 | % | 23.4 | % | 18.0 | % | ||||

Income taxes as a percentage of income before income taxes | 10.8 | % | 11.7 | % | 10.9 | % | 11.7 | % | ||||

Shareholders’ equity as a percentage of total assets | 62.8 | % | 61.3 | % | 62.8 | % | 61.3 | % | ||||

Sales of systems (in units) | 41 | 46 | 88 | 79 | ||||||||

Average selling price of system sales (EUR millions) | 27.7 | 27.3 | 27.1 | 26.7 | ||||||||

Value of systems backlog (EUR millions) 4 | 3,015 | 3,371 | 3,015 | 3,371 | ||||||||

Systems backlog (in units) 4 | 81 | 73 | 81 | 73 | ||||||||

Average selling price of systems backlog (EUR millions) 4 | 37.2 | 46.2 | 37.2 | 46.2 | ||||||||

Value of booked systems (EUR millions) 4 | 1,523 | 1,566 | 2,551 | 2,401 | ||||||||

Net bookings (in units) 4 | 46 | 43 | 86 | 73 | ||||||||

Average selling price of booked systems (EUR millions) 4 | 33.1 | 36.4 | 29.7 | 32.9 | ||||||||

Number of payroll employees in FTEs | 11,676 | 12,598 | 11,676 | 12,598 | ||||||||

Number of temporary employees in FTEs | 2,527 | 2,569 | 2,527 | 2,569 | ||||||||

ASML - Summary US GAAP Consolidated Balance Sheets 1,2

Dec 31, | Jul 3, | |||||

2015 | 2016 | |||||

(in millions EUR) | ||||||

ASSETS | ||||||

Cash and cash equivalents | 2,458.7 | 1,926.1 | ||||

Short-term investments | 950.0 | 1,000.0 | ||||

Accounts receivable, net | 803.7 | 732.4 | ||||

Finance receivables, net | 280.5 | 524.0 | ||||

Current tax assets | 19.1 | 178.0 | ||||

Inventories, net | 2,573.7 | 2,715.3 | ||||

Deferred tax assets 5 | 133.1 | — | ||||

Other assets | 488.8 | 504.7 | ||||

Total current assets | 7,707.6 | 7,580.5 | ||||

Finance receivables, net | 124.0 | 105.7 | ||||

Deferred tax assets 5 | 29.0 | 50.0 | ||||

Other assets | 450.9 | 641.2 | ||||

Goodwill | 2,624.6 | 2,603.7 | ||||

Other intangible assets, net | 738.2 | 713.5 | ||||

Property, plant and equipment, net | 1,620.7 | 1,608.9 | ||||

Total non-current assets | 5,587.4 | 5,723.0 | ||||

Total assets | 13,295.0 | 13,303.5 | ||||

LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||

Total current liabilities 5 | 3,107.2 | 3,720.1 | ||||

Long-term debt | 1,125.5 | 901.9 | ||||

Deferred and other tax liabilities 5 | 256.7 | 196.4 | ||||

Provisions | 2.4 | 12.6 | ||||

Accrued and other liabilities | 414.4 | 323.3 | ||||

Total non-current liabilities | 1,799.0 | 1,434.2 | ||||

Total liabilities | 4,906.2 | 5,154.3 | ||||

Total shareholders’ equity | 8,388.8 | 8,149.2 | ||||

Total liabilities and shareholders’ equity | 13,295.0 | 13,303.5 | ||||

ASML - Summary US GAAP Consolidated Statements of Cash Flows 1,2

Three months ended, | Six months ended, | |||||||||||

Jun 28, | Jul 3, | Jun 28, | Jul 3, | |||||||||

2015 | 2016 | 2015 | 2016 | |||||||||

(in millions EUR) | ||||||||||||

CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||||||

Net income | 369.7 | 353.8 | 772.4 | 551.8 | ||||||||

Adjustments to reconcile net income to net cash flows from operating activities: | ||||||||||||

Depreciation and amortization | 72.8 | 84.1 | 138.9 | 166.1 | ||||||||

Impairment | 0.6 | 0.4 | 0.6 | 0.9 | ||||||||

Loss on disposal of property, plant and equipment | 0.4 | 0.9 | 1.3 | 2.1 | ||||||||

Share-based payments | 15.0 | 10.9 | 29.6 | 24.1 | ||||||||

Allowance for doubtful receivables | 1.7 | 0.8 | 2.1 | 1.7 | ||||||||

Allowance for obsolete inventory | 60.3 | 22.5 | 97.3 | 59.1 | ||||||||

Deferred income taxes | (9.4 | ) | (6.6 | ) | 7.1 | (11.1 | ) | |||||

Changes in assets and liabilities | (227.3 | ) | 14.3 | (428.3 | ) | (319.4 | ) | |||||

Net cash provided by (used in) operating activities | 283.8 | 481.1 | 621.0 | 475.3 | ||||||||

CASH FLOWS FROM INVESTING ACTIVITIES | ||||||||||||

Purchase of property, plant and equipment | (79.2 | ) | (98.9 | ) | (164.8 | ) | (154.1 | ) | ||||

Purchase of intangible assets | — | (1.3 | ) | (1.1 | ) | (4.9 | ) | |||||

Purchase of available for sale securities | — | (350.0 | ) | — | (700.0 | ) | ||||||

Maturity of available for sale securities | 35.0 | 425.0 | 309.9 | 650.0 | ||||||||

Cash from (used for) derivative financial instruments | (63.0 | ) | 7.7 | (127.0 | ) | 8.8 | ||||||

Loans issued and other investments | — | (6.0 | ) | — | (6.0 | ) | ||||||

Net cash provided by (used in) investing activities | (107.2 | ) | (23.5 | ) | 17.0 | (206.2 | ) | |||||

CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||||||

Dividend paid | (302.3 | ) | (445.9 | ) | (302.3 | ) | (445.9 | ) | ||||

Purchase of shares | (165.6 | ) | (171.9 | ) | (282.7 | ) | (385.4 | ) | ||||

Net proceeds from issuance of shares | 10.1 | 12.1 | 14.5 | 22.7 | ||||||||

Repayment of debt | (0.7 | ) | (1.2 | ) | (1.5 | ) | (2.4 | ) | ||||

Tax benefit from share-based payments | 0.6 | 0.1 | 2.4 | 0.1 | ||||||||

Net cash provided by (used in) financing activities | (457.9 | ) | (606.8 | ) | (569.6 | ) | (810.9 | ) | ||||

Net cash flows | (281.3 | ) | (149.2 | ) | 68.4 | (541.8 | ) | |||||

Effect of changes in exchange rates on cash | (2.2 | ) | 11.9 | 7.1 | 9.2 | |||||||

Net increase (decrease) in cash and cash equivalents | (283.5 | ) | (137.3 | ) | 75.5 | (532.6 | ) | |||||

ASML - Quarterly Summary US GAAP Consolidated Statements of Operations 1,2

Three months ended, | |||||||||||||||

Jun 28, | Sep 27, | Dec 31, | Apr 3, | Jul 3, | |||||||||||

2015 | 2015 | 2015 | 2016 | 2016 | |||||||||||

(in millions EUR, except per share data) | |||||||||||||||

Net system sales | 1,134.5 | 975.3 | 880.9 | 855.8 | 1,254.1 | ||||||||||

Net service and field option sales | 519.6 | 573.9 | 553.3 | 477.4 | 485.5 | ||||||||||

Total net sales | 1,654.1 | 1,549.2 | 1,434.2 | 1,333.2 | 1,739.6 | ||||||||||

Total cost of sales | (900.3 | ) | (845.7 | ) | (774.4 | ) | (765.1 | ) | (998.2 | ) | |||||

Gross profit | 753.8 | 703.5 | 659.8 | 568.1 | 741.4 | ||||||||||

Other income | 20.8 | 20.8 | 20.8 | 23.4 | 23.5 | ||||||||||

Research and development costs | (267.4 | ) | (266.3 | ) | (273.0 | ) | (274.7 | ) | (270.3 | ) | |||||

Selling, general and administrative costs | (88.3 | ) | (85.6 | ) | (89.5 | ) | (88.8 | ) | (90.4 | ) | |||||

Income from operations | 418.9 | 372.4 | 318.1 | 228.0 | 404.2 | ||||||||||

Interest and other, net | (4.2 | ) | (4.2 | ) | (4.6 | ) | (3.6 | ) | (3.6 | ) | |||||

Income before income taxes | 414.7 | 368.2 | 313.5 | 224.4 | 400.6 | ||||||||||

Benefit from (provision for) income taxes | (45.0 | ) | (45.8 | ) | (21.1 | ) | (26.4 | ) | (46.8 | ) | |||||

Net income | 369.7 | 322.4 | 292.4 | 198.0 | 353.8 | ||||||||||

Basic net income per ordinary share | 0.86 | 0.75 | 0.68 | 0.46 | 0.83 | ||||||||||

Diluted net income per ordinary share 3 | 0.85 | 0.75 | 0.68 | 0.46 | 0.83 | ||||||||||

Weighted average number of ordinary shares used in computing per share amounts (in millions): | |||||||||||||||

Basic | 431.4 | 429.9 | 428.8 | 427.0 | 424.5 | ||||||||||

Diluted 3 | 433.8 | 432.3 | 430.8 | 429.1 | 426.5 | ||||||||||

ASML - Quarterly Summary Ratios and other data 1,2

Jun 28, | Sep 27, | Dec 31, | Apr 3, | Jul 3, | |||||||||||

2015 | 2015 | 2015 | 2016 | 2016 | |||||||||||

(in millions EUR, except otherwise indicated) | |||||||||||||||

Gross profit as a percentage of net sales | 45.6 | % | 45.4 | % | 46.0 | % | 42.6 | % | 42.6 | % | |||||

Income from operations as a percentage of net sales | 25.3 | % | 24.0 | % | 22.2 | % | 17.1 | % | 23.2 | % | |||||

Net income as a percentage of net sales | 22.4 | % | 20.8 | % | 20.4 | % | 14.9 | % | 20.3 | % | |||||

Income taxes as a percentage of income before income taxes | 10.8 | % | 12.4 | % | 6.7 | % | 11.7 | % | 11.7 | % | |||||

Shareholders’ equity as a percentage of total assets | 62.8 | % | 64.1 | % | 63.1 | % | 63.2 | % | 61.3 | % | |||||

Sales of systems (in units) | 41 | 44 | 37 | 33 | 46 | ||||||||||

Average selling price of system sales (EUR millions) | 27.7 | 22.2 | 23.8 | 25.9 | 27.3 | ||||||||||

Value of systems backlog (EUR millions) 4 | 3,015 | 2,880 | 3,184 | 3,018 | 3,371 | ||||||||||

Systems backlog (in units) 4 | 81 | 72 | 79 | 76 | 73 | ||||||||||

Average selling price of systems backlog (EUR millions) 4 | 37.2 | 40.0 | 40.3 | 39.7 | 46.2 | ||||||||||

Value of booked systems (EUR millions) 4 | 1,523 | 904 | 1,184 | 835 | 1,566 | ||||||||||

Net bookings (in units) 4 | 46 | 35 | 44 | 30 | 43 | ||||||||||

Average selling price of booked systems (EUR millions) 4 | 33.1 | 25.8 | 26.9 | 27.8 | 36.4 | ||||||||||

Number of payroll employees in FTEs | 11,676 | 11,920 | 12,168 | 12,407 | 12,598 | ||||||||||

Number of temporary employees in FTEs | 2,527 | 2,498 | 2,513 | 2,492 | 2,569 | ||||||||||

ASML - Quarterly Summary US GAAP Consolidated Balance Sheets 1,2

Jun 28, | Sep 27, | Dec 31, | Apr 3, | Jul 3, | |||||||||||

2015 | 2015 | 2015 | 2016 | 2016 | |||||||||||

(in millions EUR) | |||||||||||||||

ASSETS | |||||||||||||||

Cash and cash equivalents | 2,495.0 | 2,680.9 | 2,458.7 | 2,063.4 | 1,926.1 | ||||||||||

Short-term investments | 25.0 | — | 950.0 | 1,075.0 | 1,000.0 | ||||||||||

Accounts receivable, net | 1,282.3 | 1,089.4 | 803.7 | 753.2 | 732.4 | ||||||||||

Finance receivables, net | 251.2 | 453.7 | 280.5 | 446.5 | 524.0 | ||||||||||

Current tax assets | 52.3 | 42.8 | 19.1 | 96.0 | 178.0 | ||||||||||

Inventories, net | 2,592.1 | 2,537.0 | 2,573.7 | 2,750.0 | 2,715.3 | ||||||||||

Deferred tax assets 5 | 178.1 | 127.6 | 133.1 | — | — | ||||||||||

Other assets | 435.8 | 416.1 | 488.8 | 502.1 | 504.7 | ||||||||||

Total current assets | 7,311.8 | 7,347.5 | 7,707.6 | 7,686.2 | 7,580.5 | ||||||||||

Finance receivables, net | 55.7 | 49.8 | 124.0 | 102.2 | 105.7 | ||||||||||

Deferred tax assets 5 | 33.3 | 32.8 | 29.0 | 47.4 | 50.0 | ||||||||||

Other assets | 435.0 | 429.4 | 450.9 | 483.8 | 641.2 | ||||||||||

Goodwill | 2,569.4 | 2,574.0 | 2,624.6 | 2,537.7 | 2,603.7 | ||||||||||

Other intangible assets, net | 751.2 | 739.5 | 738.2 | 706.0 | 713.5 | ||||||||||

Property, plant and equipment, net | 1,518.9 | 1,532.6 | 1,620.7 | 1,580.3 | 1,608.9 | ||||||||||

Total non-current assets | 5,363.5 | 5,358.1 | 5,587.4 | 5,457.4 | 5,723.0 | ||||||||||

Total assets | 12,675.3 | 12,705.6 | 13,295.0 | 13,143.6 | 13,303.5 | ||||||||||

LIABILITIES AND SHAREHOLDERS’ EQUITY | |||||||||||||||

Total current liabilities 5 | 2,853.9 | 2,711.3 | 3,107.2 | 3,246.8 | 3,720.1 | ||||||||||

Long-term debt | 1,115.8 | 1,125.3 | 1,125.5 | 1,144.3 | 901.9 | ||||||||||

Deferred and other tax liabilities 5 | 269.5 | 259.2 | 256.7 | 138.0 | 196.4 | ||||||||||

Provisions | 3.2 | 2.8 | 2.4 | — | 12.6 | ||||||||||

Accrued and other liabilities | 470.3 | 462.1 | 414.4 | 311.1 | 323.3 | ||||||||||

Total non-current liabilities | 1,858.8 | 1,849.4 | 1,799.0 | 1,593.4 | 1,434.2 | ||||||||||

Total liabilities | 4,712.7 | 4,560.7 | 4,906.2 | 4,840.2 | 5,154.3 | ||||||||||

Total shareholders’ equity | 7,962.6 | 8,144.9 | 8,388.8 | 8,303.4 | 8,149.2 | ||||||||||

Total liabilities and shareholders’ equity | 12,675.3 | 12,705.6 | 13,295.0 | 13,143.6 | 13,303.5 | ||||||||||

ASML - Quarterly Summary US GAAP Consolidated Statements of Cash Flows 1,2

Three months ended, | |||||||||||||||

Jun 28, | Sep 27, | Dec 31, | Apr 3, | Jul 3, | |||||||||||

2015 | 2015 | 2015 | 2016 | 2016 | |||||||||||

(in millions EUR) | |||||||||||||||

CASH FLOWS FROM OPERATING ACTIVITIES | |||||||||||||||

Net income | 369.7 | 322.4 | 292.4 | 198.0 | 353.8 | ||||||||||

Adjustments to reconcile net income to net cash flows from operating activities: | |||||||||||||||

Depreciation and amortization | 72.8 | 77.5 | 80.5 | 82.0 | 84.1 | ||||||||||

Impairment | 0.6 | 0.2 | 1.5 | 0.5 | 0.4 | ||||||||||

Loss on disposal of property, plant and equipment | 0.4 | 0.3 | — | 1.2 | 0.9 | ||||||||||

Share-based payments | 15.0 | 14.8 | 14.7 | 13.2 | 10.9 | ||||||||||

Allowance for doubtful receivables | 1.7 | 0.6 | 1.2 | 0.9 | 0.8 | ||||||||||

Allowance for obsolete inventory | 60.3 | 56.3 | 58.2 | 36.6 | 22.5 | ||||||||||

Deferred income taxes | (9.4 | ) | 41.0 | (2.8 | ) | (4.5 | ) | (6.6 | ) | ||||||

Changes in assets and liabilities | (227.3 | ) | (93.3 | ) | 539.0 | (333.7 | ) | 14.3 | |||||||

Net cash provided by (used in) operating activities | 283.8 | 419.8 | 984.7 | (5.8 | ) | 481.1 | |||||||||

CASH FLOWS FROM INVESTING ACTIVITIES | |||||||||||||||

Purchase of property, plant and equipment | (79.2 | ) | (86.5 | ) | (120.5 | ) | (55.2 | ) | (98.9 | ) | |||||

Purchase of intangible assets | — | — | — | (3.6 | ) | (1.3 | ) | ||||||||

Purchase of available for sale securities | — | — | (950.0 | ) | (350.0 | ) | (350.0 | ) | |||||||

Maturity of available for sale securities | 35.0 | 25.0 | — | 225.0 | 425.0 | ||||||||||

Cash from (used for) derivative financial instruments | (63.0 | ) | (37.8 | ) | (7.1 | ) | 1.1 | 7.7 | |||||||

Loans issued and other investments | — | — | — | — | (6.0 | ) | |||||||||

Net cash provided by (used in) investing activities | (107.2 | ) | (99.3 | ) | (1,077.6 | ) | (182.7 | ) | (23.5 | ) | |||||

CASH FLOWS FROM FINANCING ACTIVITIES | |||||||||||||||

Dividend paid | (302.3 | ) | — | — | — | (445.9 | ) | ||||||||

Purchase of shares | (165.6 | ) | (141.5 | ) | (140.7 | ) | (213.5 | ) | (171.9 | ) | |||||

Net proceeds from issuance of shares | 10.1 | 9.0 | 9.7 | 10.6 | 12.1 | ||||||||||

Repayment of debt | (0.7 | ) | (1.0 | ) | (1.1 | ) | (1.2 | ) | (1.2 | ) | |||||

Tax benefit from share-based payments | 0.6 | 0.5 | 0.8 | — | 0.1 | ||||||||||

Net cash provided by (used in) financing activities | (457.9 | ) | (133.0 | ) | (131.3 | ) | (204.1 | ) | (606.8 | ) | |||||

Net cash flows | (281.3 | ) | 187.5 | (224.2 | ) | (392.6 | ) | (149.2 | ) | ||||||

Effect of changes in exchange rates on cash | (2.2 | ) | (1.6 | ) | 2.0 | (2.7 | ) | 11.9 | |||||||

Net increase (decrease) in cash and cash equivalents | (283.5 | ) | 185.9 | (222.2 | ) | (395.3 | ) | (137.3 | ) | ||||||

Notes to the Summary US GAAP Consolidated Financial Statements

Basis of Preparation

The accompanying Consolidated Financial Statements are stated in millions of euros unless indicated otherwise. The accompanying Consolidated Financial Statements have been prepared in conformity with accounting principles generally accepted in the United States of America ("US GAAP"). Further disclosures, as required under US GAAP in annual reports, are not included in the summary consolidated financial statements.

Use of Estimates

The preparation of our Consolidated Financial Statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities on the balance sheet dates, and the reported amounts of net sales and costs during the reported periods. Actual results could differ from those estimates.

Principles of Consolidation

The Consolidated Financial Statements include the Financial Statements of ASML Holding N.V. and all of its subsidiaries and the variable interest entity of which ASML is the primary beneficiary (referred to as "ASML"). All intercompany profits, balances and transactions have been eliminated in the consolidation. Subsidiaries are all entities over which ASML has the power to govern financial and operating policies generally accompanying a shareholding of more than 50 percent of the outstanding voting rights. As from the date that these criteria are met, the financial data of the relevant subsidiaries are included in the consolidation.

Revenue Recognition

ASML recognizes revenue when all four revenue recognition criteria are met: persuasive evidence of an arrangement exists; delivery has occurred or services have been rendered; seller‘s price to buyer is fixed or determinable; and collectability is reasonably assured. At ASML this policy generally results in revenue recognition from the sale of a system upon shipment. The revenue from the installation of a system is generally recognized upon completion of that installation at the customer site. Prior to shipment, systems undergo a "Factory Acceptance Test" in our cleanroom facilities, effectively replicating the operating conditions that will be present on the customer’s site, in order to verify whether the system will meet its standard specifications and any additional technical and performance criteria agreed with the customer. A system is shipped, and revenue is recognized, only after all contractual specifications are met and customer sign-off is received or waived. In case not all specifications are met and the remaining performance obligation is not essential to the functionality of the system but is substantive rather than inconsequential or perfunctory, a portion of the sales price is deferred. Although each system’s performance is re-tested upon installation at the customer’s site, we have never failed to successfully complete installation of a system at a customer’s premises.

In connection with the introduction of new technology, such as NXE:3300B and NXE:3350B, we initially defer revenue recognition until acceptance of the new technology based system and completion of installation at the customer’s premises. As our systems are based largely on two product platforms that permit incremental, modular upgrades, the introduction of genuinely "new" technology occurs infrequently, and in the past 15 years, has occurred on only 2 occasions: 2000 (TWINSCAN) and 2010 (EUV).

We offer customers discounts in the normal course of sales negotiations. These discounts are directly deducted from the gross sales price at the moment of revenue recognition. From time to time, we offer free or discounted products or services (award credits) to our customers as part of a volume purchase agreement. In some instances these volume discounts can be used to purchase field options (system enhancements) and services. The related amount is recorded as a reduction in net sales at time of system shipment. The sales transaction that gives rise to these award credits is accounted for as a multiple element sales transaction as the agreements involve the delivery of multiple products. The consideration received from the sales transaction is allocated between the award credits and the other elements of the sales transaction. The consideration allocated to the award credits is recognized as deferred revenue until award credits are delivered to the customer and earned. The amount allocable to a delivered item is limited to the amount that is not contingent upon the delivery of additional items or meeting other specified performance conditions (the non-contingent amount).

The main portion of our net sales is derived from contractual arrangements with our customers that have multiple deliverables (elements), which mainly include the sale of our systems, installation and training services and extended and enhanced (optic) warranty contracts. The requirements for establishing separate units of accounting in a multiple element arrangement require that the allocation of arrangement consideration to each deliverable is based on the relative selling price of the deliverable.

For each of the specified deliverables ASML determines the selling price by using either vendor specific objective evidence (‘VSOE’), third party evidence (‘TPE’) or by best estimate of the selling price (‘BESP’). When we are unable to establish relative selling price using VSOE or TPE, ASML uses BESP in its allocation of arrangement consideration. The total arrangement consideration is allocated at inception of the arrangement to all deliverables on the basis of their relative selling price. The revenue relating to the undelivered elements of the arrangements is deferred at their relative selling prices until delivery of these elements. Revenue from installation and training services is recognized when the services are completed. Revenue from prepaid extended and enhanced (optic) warranty contracts is recognized over the term of the contract.

For our NXE:3300B and NXE:3350B systems, we are unable to determine VSOE for extended, enhanced (optic) warranty contracts and installation. We determined for NXE:3300B and NXE:3350B systems that BESP is the appropriate reference in the fair value hierarchy for extended and enhanced (optic) warranty contracts. We review selling prices periodically and maintain internal controls over the establishment and updates of these elements.

Foreign currency risk management

Our sales are predominately denominated in euros. Exceptions may occur on a customer by customer basis. Our cost of sales and other expenses are mainly denominated in euros, to a certain extent in US dollars, Taiwanese dollars and Japanese yen and to a limited extent in other currencies. Therefore, we are exposed to foreign currency exchange risks.

It is our policy to hedge material transaction exposures, such as forecasted sales and purchase transactions, and material net remeasurement exposures, such as accounts receivable and payable. We hedge these exposures through the use of foreign exchange contracts.

ASML – Reconciliation US GAAP – IFRS 1,2

Net income | Three months ended, | Six months ended, | |||||||

Jun 28, | Jul 3, | Jun 28, | Jul 3, | ||||||

2015 | 2016 | 2015 | 2016 | ||||||

(in millions EUR) | |||||||||

Net income based on US GAAP | 369.7 | 353.8 | 772.4 | 551.8 | |||||

Development expenditures (see Note 1) | 62.9 | 80.3 | 132.4 | 125.2 | |||||

Share-based payments (see Note 2) | 0.8 | (0.9 | ) | 2.0 | 0.7 | ||||

Income taxes (see Note 3) | (12.1 | ) | (62.8 | ) | (15.5 | ) | (76.5 | ) | |

Net income based on IFRS | 421.3 | 370.4 | 891.3 | 601.2 | |||||

Shareholders' equity | Jun 28, | Sep 27, | Dec 31, | Apr 3, | Jul 3, | |||||

2015 | 2015 | 2015 | 2016 | 2016 | ||||||

(in millions EUR) | ||||||||||

Shareholders' equity based on US GAAP | 7,962.6 | 8,144.9 | 8,388.8 | 8,303.4 | 8,149.2 | |||||

Development expenditures (see Note 1) | 937.9 | 995.7 | 1,054.5 | 1,091.1 | 1,178.2 | |||||

Share-based payments (see Note 2) | 22.0 | 18.3 | 16.5 | 17.8 | 17.0 | |||||

Income taxes (see Note 3) | 29.1 | 32.9 | 31.4 | 17.1 | (44.9 | ) | ||||

Equity based on IFRS | 8,951.6 | 9,191.8 | 9,491.2 | 9,429.4 | 9,299.5 | |||||

Notes to the reconciliation from US GAAP to IFRS

Note 1 Development expenditures

Under US GAAP, ASML applies ASC 730, "Research and Development". In accordance with ASC 730, ASML charges costs relating to research and development to operating expense as incurred.

Under IFRS, ASML applies IAS 38, "Intangible Assets". In accordance with IAS 38, ASML capitalizes certain development expenditures that are amortized over the expected useful life of the related product generally ranging between one and five years. Amortization starts when the developed product is ready for volume production.

Note 2 Share-based Payments

Under US GAAP, ASML applies ASC 718 "Compensation - Stock Compensation" which requires companies to recognize the cost of employee services received in exchange for awards of equity instruments based upon the grant-date fair value of those instruments. ASC 718’s general principle is that a deferred tax asset is established as we recognize compensation costs for commercial purposes for awards that are expected to result in a tax deduction under existing tax law. Under US GAAP, the deferred tax recorded on share-based compensation is computed on the basis of the expense recognized in the financial statements. Therefore, changes in ASML’s share price do not affect the deferred tax asset recorded in our financial statements.

Under IFRS, ASML applies IFRS 2, "Share-based Payments". In accordance with IFRS 2, ASML records as an expense the fair value of its share-based payments with respect to stock options and shares granted to its employees. Under IFRS, at period end a deferred tax asset is computed on the basis of the tax deduction for the share-based payments under the applicable tax law and is recognized to the extent it is probable that future taxable profit will be available against which these deductible temporary differences will be utilized. Therefore, changes in ASML’s share price do affect the deferred tax asset at period-end and result in adjustments to the deferred tax asset.

Note 3 Income taxes

Under US GAAP, the elimination of unrealized net income from intercompany transactions that are eliminated from the carrying amount of assets in consolidation give rise to a temporary difference for which prepaid taxes must be recognized in consolidation. Contrary to IFRS, the prepaid taxes under US GAAP are calculated based on the tax rate applicable in the seller’s rather than the purchaser’s tax jurisdiction.

Under IFRS, ASML applies IAS 12, "Income Taxes". In accordance with IAS 12 unrealized net income resulting from intercompany transactions that are eliminated from the carrying amount of assets in consolidation give rise to a temporary difference for which deferred taxes must be recognized in consolidation. The deferred taxes are calculated based on the tax rate applicable in the purchaser’s tax jurisdiction.

This document contains statements relating to certain projections and business trends that are forward-looking, including statements with respect to our outlook, including expected customer demand in specified market segments including memory, logic and foundry, expected trends and outlook, including expected levels of service sales, systems backlog, expected financial results for the third quarter and full year 2016, including expected sales, other income, gross margin, R&D and SG&A expenses and effective annualized tax rate, annual revenue opportunity for ASML and EPS potential by end of decade, productivity of our tools and systems performance, including EUV system performance (such as endurance tests), expected industry trends and expected trends in the business environment, statements with respect to the acquisition of HMI by ASML, the expected benefits of the acquisition of HMI by ASML, including expected earnings accretion, enhancement of ASML’s existing product portfolio, the creation of a new class of products which improves yield and time to market, the accelerated introduction of reticle defect detection to support future EUV ramp and related opportunity in 2020, improvement in ASML and HMI’s metrology technologies and support of EUV technologies, the benefits of the acquisition to ASML’s holistic lithography strategy, the growth opportunity represented by patterning control and expansion of market opportunity by 2020 and expected timing of completion of HMI acquisition, statements with respect to EUV targets, including availability, productivity and shipments, including the number of EUV systems expected to be shipped and timing of shipments, and roadmaps, shrink being key driver to industry growth, expected industry adoption of EUV and statements with respect to the intent of customers to insert EUV into production, the expected continuation of Moore's law and that EUV will continue to enable Moore’s law and drive long term value, goals for holistic lithography, intention to return excess cash to shareholders, and statements about our proposed dividend, dividend policy and intention to repurchase shares. You can generally identify these statements by the use of words like "may", "will", "could", "should", "project", "believe", "anticipate", "expect", "plan", "estimate", "forecast", "potential", "intend", "continue" and variations of these words or comparable words. These statements are not historical facts, but rather are based on current expectations, estimates, assumptions and projections about the business and our future financial results and readers should not place undue reliance on them. Forward-looking statements do not guarantee future performance and involve risks and uncertainties. These risks and uncertainties include, without limitation, economic conditions, product demand and semiconductor equipment industry capacity, worldwide demand and manufacturing capacity utilization for semiconductors (the principal product of our customer base), including the impact of general economic conditions on consumer confidence and demand for our customers' products, competitive products and pricing, the impact of any manufacturing efficiencies and capacity constraints, performance of our systems, the continuing success of technology advances and the related pace of new product development and customer acceptance of new products including EUV, the number and timing of EUV systems expected to be shipped and recognized in revenue, delays in EUV systems production and development, our ability to enforce patents and protect intellectual property rights, the risk of intellectual property litigation, availability of raw materials and critical manufacturing equipment, trade environment, changes in exchange rates, changes in tax rates, available cash and liquidity, our ability to refinance our indebtedness, distributable reserves for dividend payments and share repurchases, and other risks indicated in the risk factors included in ASML's Annual Report on Form 20-F and other filings with the US Securities and Exchange Commission. These forward-looking statements are made only as of the date of this document. We do not undertake to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

1 | These financial statements are unaudited. |

2 | Numbers have been rounded. |

3 | The calculation of diluted net income per ordinary share assumes the exercise of options issued under ASML stock option plans and the issuance of shares under ASML share plans for periods in which exercises or issuances would have a dilutive effect. The calculation of diluted net income per ordinary share does not assume exercise of such options or issuance of shares when such exercises or issuance would be anti-dilutive. |

4 | Our systems backlog and net bookings include all system sales orders for which written authorizations have been accepted (for EUV starting as of the NXE:3350B). |

5 | As of January 1, 2016 ASML early adopted the amendment to ASC 740 “Income taxes (Topic 740): Balance Sheet Classification of Deferred Taxes”, which requires that deferred tax liabilities and assets are classified as non-current in the consolidated balance sheets. The comparative figures have not been adjusted to reflect this change in accounting policy. |

Exhibit 99.4

ASML - Summary IFRS Consolidated Statement of Profit or Loss 1,2

Three months ended, | Six months ended, | |||||||||||

Jun 28, | Jul 3, | Jun 28, | Jul 3, | |||||||||

2015 | 2016 | 2015 | 2016 | |||||||||

(in millions EUR) | ||||||||||||

Net system sales | 1,134.5 | 1,254.1 | 2,381.0 | 2,109.9 | ||||||||

Net service and field option sales | 519.6 | 485.5 | 923.0 | 962.9 | ||||||||

Total net sales | 1,654.1 | 1,739.6 | 3,304.0 | 3,072.8 | ||||||||

Total cost of sales | (916.7 | ) | (1,018.1 | ) | (1,802.1 | ) | (1,802.5 | ) | ||||

Gross profit | 737.4 | 721.5 | 1,501.9 | 1,270.3 | ||||||||

Other income | 20.8 | 23.5 | 41.6 | 46.9 | ||||||||

Research and development costs | (176.8 | ) | (151.9 | ) | (340.9 | ) | (351.0 | ) | ||||

Selling, general and administrative costs | (87.9 | ) | (90.3 | ) | (170.6 | ) | (179.0 | ) | ||||

Operating income | 493.5 | 502.8 | 1,032.0 | 787.2 | ||||||||

Interest and other, net | (1.1 | ) | — | (2.0 | ) | (0.3 | ) | |||||

Income before income taxes | 492.4 | 502.8 | 1,030.0 | 786.9 | ||||||||

Income tax expense | (71.1 | ) | (132.4 | ) | (138.7 | ) | (185.7 | ) | ||||

Net income | 421.3 | 370.4 | 891.3 | 601.2 | ||||||||

ASML - Summary IFRS Consolidated Statement of Financial Position 1,2

Dec 31, | Jul 3, | |||||

2015 | 2016 | |||||

(in millions EUR) | ||||||

ASSETS | ||||||

Property, plant and equipment | 1,620.7 | 1,608.9 | ||||

Goodwill | 2,647.8 | 2,626.8 | ||||

Other intangible assets | 2,018.5 | 2,153.0 | ||||

Deferred tax assets | 139.6 | 165.2 | ||||

Finance receivables | 124.0 | 105.7 | ||||

Derivative financial instruments | 81.8 | 121.5 | ||||

Other assets | 369.1 | 367.5 | ||||

Total non-current assets | 7,001.5 | 7,148.6 | ||||

Inventories | 2,573.7 | 2,715.3 | ||||

Current tax assets | 19.1 | 178.0 | ||||

Derivative financial instruments | 52.0 | 43.0 | ||||

Finance receivables | 280.5 | 524.0 | ||||

Accounts receivable | 803.7 | 732.4 | ||||

Other assets | 375.6 | 395.0 | ||||

Short-term investments | 950.0 | 1,000.0 | ||||

Cash and cash equivalents | 2,458.7 | 1,926.1 | ||||

Total current assets | 7,513.3 | 7,513.8 | ||||

Total assets | 14,514.8 | 14,662.4 | ||||

EQUITY AND LIABILITIES | ||||||

Equity | 9,491.2 | 9,299.5 | ||||

Long-term debt | 1,125.5 | 901.9 | ||||

Derivative financial instruments | 1.9 | 1.2 | ||||

Deferred and other tax liabilities | 376.5 | 405.0 | ||||

Provisions | 2.4 | 12.6 | ||||

Accrued and other liabilities | 412.5 | 322.1 | ||||

Total non-current liabilities | 1,918.8 | 1,642.8 | ||||

Provisions | 2.4 | 2.9 | ||||

Derivative financial instruments | 19.0 | 34.3 | ||||

Current portion of long-term debt | 4.2 | 253.6 | ||||

Current and other tax liabilities | 3.7 | 170.9 | ||||

Accrued and other liabilities | 2,547.6 | 2,524.2 | ||||

Accounts payable | 527.9 | 734.2 | ||||

Total current liabilities | 3,104.8 | 3,720.1 | ||||

Total equity and liabilities | 14,514.8 | 14,662.4 | ||||

ASML - Summary IFRS Consolidated Statement of Cash Flows 1,2

Three months ended, | Six months ended, | |||||||||||

Jun 28, | Jul 3, | Jun 28, | Jul 3, | |||||||||

2015 | 2016 | 2015 | 2016 | |||||||||

(in millions EUR) | ||||||||||||

CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||||||

Net income | 421.3 | 370.4 | 891.3 | 601.2 | ||||||||

Adjustments to reconcile net income to net cash flows from operating activities: | ||||||||||||

Depreciation and amortization | 89.3 | 103.9 | 169.6 | 205.2 | ||||||||

Impairment | 0.6 | 0.4 | 0.6 | 0.9 | ||||||||

Loss on disposal of property, plant and equipment | 0.4 | 0.9 | 1.3 | 2.1 | ||||||||

Share-based payments | 14.2 | 10.5 | 27.6 | 24.1 | ||||||||

Allowance for doubtful receivables | 1.7 | 0.8 | 2.1 | 1.7 | ||||||||

Allowance for obsolete inventory | 60.3 | 22.5 | 97.3 | 59.1 | ||||||||

Deferred income taxes | 14.8 | 81.9 | 54.9 | 105.0 | ||||||||

Changes in assets and liabilities | (223.8 | ) | 11.9 | (426.4 | ) | (323.3 | ) | |||||

Net cash provided by (used in) operating activities | 378.8 | 603.2 | 818.3 | 676.0 | ||||||||

CASH FLOWS FROM INVESTING ACTIVITIES | ||||||||||||

Purchase of property, plant and equipment | (79.2 | ) | (98.9 | ) | (164.8 | ) | (154.1 | ) | ||||

Purchase of intangible assets | (94.4 | ) | (123.3 | ) | (196.0 | ) | (205.5 | ) | ||||

Purchase of available for sale securities | — | (350.0 | ) | — | (700.0 | ) | ||||||

Maturity of available for sale securities | 35.0 | 425.0 | 309.9 | 650.0 | ||||||||

Cash from (used for) derivative financial instruments | (63.0 | ) | 7.7 | (127.0 | ) | 8.8 | ||||||

Loans issued and other investments | — | (6.0 | ) | — | (6.0 | ) | ||||||

Net cash provided by (used in) investing activities | (201.6 | ) | (145.5 | ) | (177.9 | ) | (406.8 | ) | ||||

CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||||||

Dividend paid | (302.3 | ) | (445.9 | ) | (302.3 | ) | (445.9 | ) | ||||

Purchase of shares | (165.6 | ) | (171.9 | ) | (282.7 | ) | (385.4 | ) | ||||

Net proceeds from issuance of shares | 10.1 | 12.1 | 14.5 | 22.7 | ||||||||

Repayment of debt | (0.7 | ) | (1.2 | ) | (1.5 | ) | (2.4 | ) | ||||

Net cash provided by (used in) financing activities | (458.5 | ) | (606.9 | ) | (572.0 | ) | (811.0 | ) | ||||

Net cash flows | (281.3 | ) | (149.2 | ) | 68.4 | (541.8 | ) | |||||

Effect of changes in exchange rates on cash | (2.2 | ) | 11.9 | 7.1 | 9.2 | |||||||

Net increase (decrease) in cash and cash equivalents | (283.5 | ) | (137.3 | ) | 75.5 | (532.6 | ) | |||||

ASML - Quarterly Summary IFRS Consolidated Statement of Profit or Loss 1,2

Three months ended, | |||||||||||||||

Jun 28, | Sep 27, | Dec 31, | Apr 3, | Jul 3, | |||||||||||

2015 | 2015 | 2015 | 2016 | 2016 | |||||||||||

(in millions EUR) | |||||||||||||||

Net system sales | 1,134.5 | 975.3 | 880.9 | 855.8 | 1,254.1 | ||||||||||

Net service and field option sales | 519.6 | 573.9 | 553.3 | 477.4 | 485.5 | ||||||||||

Total net sales | 1,654.1 | 1,549.2 | 1,434.2 | 1,333.2 | 1,739.6 | ||||||||||

Total cost of sales | (916.7 | ) | (860.0 | ) | (792.2 | ) | (784.4 | ) | (1,018.1 | ) | |||||

Gross profit | 737.4 | 689.2 | 642.0 | 548.8 | 721.5 | ||||||||||

Other income | 20.8 | 20.8 | 20.8 | 23.4 | 23.5 | ||||||||||

Research and development costs | (176.8 | ) | (179.5 | ) | (189.8 | ) | (199.1 | ) | (151.9 | ) | |||||

Selling, general and administrative costs | (87.9 | ) | (85.2 | ) | (89.5 | ) | (88.7 | ) | (90.3 | ) | |||||

Operating income | 493.5 | 445.3 | 383.5 | 284.4 | 502.8 | ||||||||||

Interest and other, net | (1.1 | ) | (4.3 | ) | 1.6 | (0.3 | ) | — | |||||||

Income before income taxes | 492.4 | 441.0 | 385.1 | 284.1 | 502.8 | ||||||||||

Income tax expense | (71.1 | ) | (57.1 | ) | (40.8 | ) | (53.3 | ) | (132.4 | ) | |||||

Net income | 421.3 | 383.9 | 344.3 | 230.8 | 370.4 | ||||||||||

ASML - Quarterly Summary IFRS Consolidated Statement of Financial Position 1,2

Jun 28, | Sep 27, | Dec 31, | Apr 3, | Jul 3, | |||||||||||

2015 | 2015 | 2015 | 2016 | 2016 | |||||||||||

(in millions EUR) | |||||||||||||||

ASSETS | |||||||||||||||

Property, plant and equipment | 1,518.9 | 1,532.6 | 1,620.7 | 1,580.3 | 1,608.9 | ||||||||||

Goodwill | 2,592.2 | 2,596.8 | 2,647.8 | 2,560.3 | 2,626.8 | ||||||||||

Other intangible assets | 1,881.9 | 1,942.7 | 2,018.5 | 2,033.0 | 2,153.0 | ||||||||||

Deferred tax assets | 146.8 | 147.2 | 139.6 | 123.4 | 165.2 | ||||||||||

Finance receivables | 55.7 | 49.8 | 124.0 | 102.2 | 105.7 | ||||||||||

Derivative financial instruments | 87.0 | 82.9 | 81.8 | 118.2 | 121.5 | ||||||||||

Other assets | 348.0 | 346.5 | 369.1 | 365.6 | 367.5 | ||||||||||

Total non-current assets | 6,630.5 | 6,698.5 | 7,001.5 | 6,883.0 | 7,148.6 | ||||||||||

Inventories | 2,592.1 | 2,537.0 | 2,573.7 | 2,750.0 | 2,715.3 | ||||||||||

Current tax assets | 52.3 | 42.8 | 19.1 | 96.0 | 178.0 | ||||||||||

Derivative financial instruments | 51.0 | 52.1 | 52.0 | 56.8 | 43.0 | ||||||||||

Finance receivables | 251.2 | 453.7 | 280.5 | 446.5 | 524.0 | ||||||||||

Accounts receivable | 1,282.3 | 1,089.4 | 803.7 | 753.2 | 732.4 | ||||||||||

Other assets | 320.4 | 302.7 | 375.6 | 386.3 | 395.0 | ||||||||||

Short-term investments | 25.0 | — | 950.0 | 1,075.0 | 1,000.0 | ||||||||||

Cash and cash equivalents | 2,495.0 | 2,680.9 | 2,458.7 | 2,063.4 | 1,926.1 | ||||||||||

Total current assets | 7,069.3 | 7,158.6 | 7,513.3 | 7,627.2 | 7,513.8 | ||||||||||

Total assets | 13,699.8 | 13,857.1 | 14,514.8 | 14,510.2 | 14,662.4 | ||||||||||

EQUITY AND LIABILITIES | |||||||||||||||

Equity | 8,951.6 | 9,191.8 | 9,491.2 | 9,429.4 | 9,299.5 | ||||||||||

Long-term debt | 1,115.8 | 1,125.3 | 1,125.5 | 1,144.3 | 901.9 | ||||||||||

Derivative financial instruments | 2.3 | 2.1 | 1.9 | 1.4 | 1.2 | ||||||||||