Form 6-K ASML HOLDING NV For: Jan 18

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

______________________

FORM 6-K

REPORT OF A FOREIGN ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For January 18, 2017

______________________

ASML Holding N.V.

De Run 6501

5504 DR Veldhoven

The Netherlands

(Address of principal executive offices)

______________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No x

If ‘‘Yes’’ is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

EXHIBITS 99.1, 99.3, AND 99.4 TO THIS REPORT ON FORM 6-K ARE INCORPORATED BY REFERENCE IN THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-116337), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-126340), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-136362), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-141125), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-142254), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-144356), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-147128), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-153277), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-162439), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-170034), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-188938), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-190023), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-192951) AND THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-203390) OF ASML HOLDING N.V. AND IN THE OUTSTANDING PROSPECTUSES CONTAINED IN SUCH REGISTRATION STATEMENTS.

Exhibits

99.1 | “ASML reports record full-year 2016 net sales and net income. Orders for EUV lithography systems show strong customer commitment for production insertion”, press release dated January 18, 2017 |

99.2 | “ASML reports record 2016 net sales and net income. EUV orders show strong customer commitment to production insertion”, presentation dated January 18, 2017 |

99.3 | Summary US GAAP Consolidated Financial Statements |

99.4 | Summary IFRS Consolidated Financial Statements |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

ASML HOLDING N.V. (Registrant)

Date: January 18, 2017 By: /s/ Peter T.F.M. Wennink

Peter T.F.M. Wennink

Chief Executive Officer

Exhibit 99.1

Media Relations Contacts

Lucas van Grinsven - Corporate Communications - +31 6 101 99 532 - Veldhoven, the Netherlands

Niclas Mika - Corporate Communications - +31 6 201 528 63 - Veldhoven, the Netherlands

Investor Relations Contacts

Craig DeYoung - Investor Relations - +1 480 696 2762 - Chandler, Arizona, USA

Marcel Kemp - Investor Relations - +31 40 268 6494 - Veldhoven, the Netherlands

ASML reports record full-year 2016 net sales and net income

Orders for EUV lithography systems show strong customer commitment for production insertion

VELDHOVEN, the Netherlands, January 18, 2017 - ASML Holding N.V. (ASML) today publishes its 2016 fourth-quarter and full-year results.

• | Q4 net sales of EUR 1.91 billion, gross margin 47.2 percent, including the effects of purchase price allocation for the HMI acquisition, which closed as planned in Q4 |

• | Full-year net sales EUR 6.79 billion, gross margin 44.8 percent, net income EUR 1.47 billion |

• | ASML proposes a dividend of EUR 1.20 per share, a 14 percent increase from the previous year |

• | ASML took orders for six NXE:3400 Extreme Ultraviolet (EUV) systems in the fourth quarter, bringing the EUV backlog to 18 systems for a value of around EUR 2 billion |

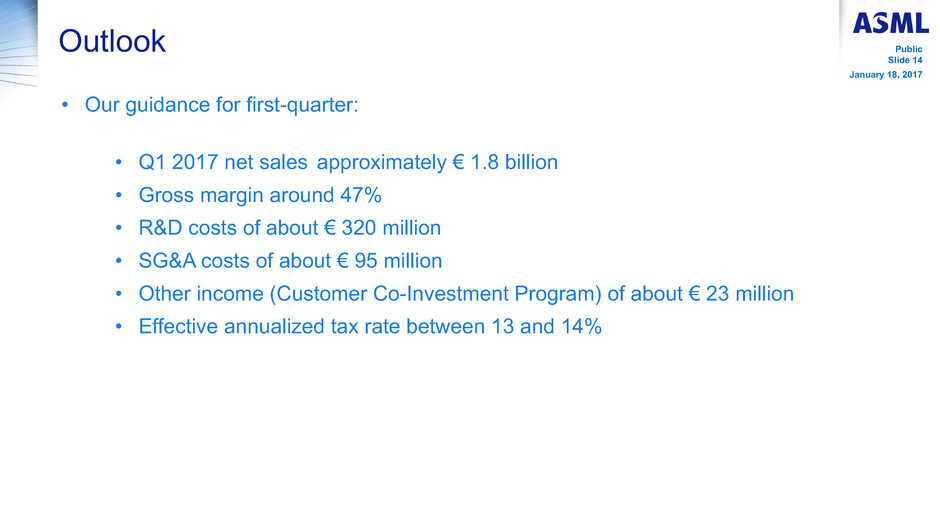

• | ASML guides Q1 2017 net sales approximately EUR 1.8 billion and a gross margin around 47 percent |

(Figures in millions of euros unless otherwise indicated) | Q3 2016 | Q4 2016 | FY 2015 | FY 2016 | |

Net sales | 1,815 | 1,907 | 6,287 | 6,795 | |

...of which service and field option sales | 577 | 684 | 2,050 | 2,224 | |

Other income (Co-Investment Program) | 23 | 23 | 83 | 94 | |

New systems sold (units) | 38 | 34 | 144 | 139 | |

Used systems sold (units) | 2 | 4 | 25 | 18 | |

Average Selling Price (ASP) of net system sales | 31.0 | 32.2 | 25.1 | 29.1 | |

Net bookings | 1,415 | 1,580 | 4,639 | 5,396 | |

Systems backlog | 3,462 | 3,961 | 3,184 | 3,961 | |

Gross profit | 834 | 901 | 2,896 | 3,044 | |

Gross margin (%) | 46.0 | 47.2 | 46.1 | 44.8 | |

Net income | 396 | 524 | 1,387 | 1,472 | |

EPS (basic; in euros) | 0.93 | 1.23 | 3.22 | 3.46 | |

End-quarter cash and cash equivalents and short-term investments | 4,313 | 4,057 | 3,409 | 4,057 | |

A complete summary of US GAAP Consolidated Statements of Operations is published on www.asml.com

1

CEO Statement

"2016 has been a remarkable year for ASML on many fronts. We delivered record financial performance, with contributions from each of our wide range of product offerings, notably Deep Ultraviolet (DUV) and Holistic Lithography. It was also the year when the industry turned the corner on the introduction of EUV. We laid the foundation for further expansion of our pattern fidelity strategy with the acquisition of Hermes Microvision Inc. We strengthened our partnership with Zeiss by agreeing to acquire a minority stake in Carl Zeiss SMT to secure the extension of EUV beyond the next decade. All of this has further anchored our leadership position in the semiconductor equipment market," ASML President and Chief Executive Officer Peter Wennink said.

"Logic chip manufacturers have built up capacity for the 10 nanometer node in 2016, and we also saw healthy demand from memory manufacturers both for DRAM and 3D NAND production. Together with solid growth in net service and field option sales, this has led to record 2016 net sales of EUR 6.8 billion. These trends are expected to continue into 2017, as evidenced by our first-quarter guidance.

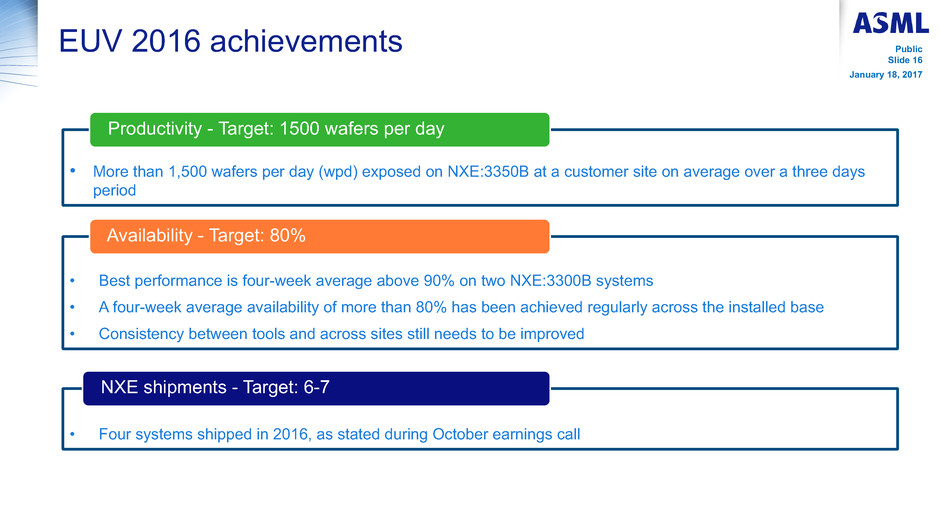

"Regarding EUV, we executed on the customer-aligned productivity and availability targets, which gave customers the confidence to place a significant number of orders, leading to an EUV backlog of about EUR 2 billion. These orders show that they are committed to take EUV into production, and we expect that the first customers will start volume manufacturing with EUV at the 7 nanometer logic node and the mid-10 nanometer DRAM node. We are now moving to the next phase of EUV industrialization. We remain committed to deliver the performance requirements for customer volume manufacturing, while continuing to build up our manufacturing, supply chain and service capabilities," Wennink said.

Product and Business Highlights

• | In DUV lithography, we shipped 15 TWINSCAN NXT:1980 systems in the quarter, supporting the ramp of the 10 nanometer node as well as process development for the 7 nanometer foundry node. With the introduction of the NXT:1980, we have shortened the time to maturity, enabling a faster, more cost-effective node ramp. More customers are now recognizing the value of upgrading their existing NXT systems to the latest performance, which has supported our field upgrade sales. We also continue to support our XT and NXT systems with productivity upgrades and as part of the transition from planar to 3D NAND, we have supported a large additional number of system relocations, helping customers to optimize their ramp plans. |

• | In Holistic Lithography, we successfully completed the acquisition of Hermes Microvision Inc. (HMI) and began the integration of HMI's e-beam systems into our Holistic Lithography portfolio. |

• | In EUV lithography, we took orders for six TWINSCAN NXE:3400 systems in the fourth quarter. Our backlog now includes 18 EUV systems, worth almost EUR 2 billion, or about half of the total backlog. |

Outlook

For the first-quarter of 2017, ASML expects net sales at approximately EUR 1.8 billion, a gross margin of around 47 percent, R&D costs of about EUR 320 million, other income of about EUR 23 million -- which consists of contributions from participants of the Customer Co-Investment Program, SG&A costs of about EUR 95 million and an effective annualized tax rate between 13 and 14 percent.

Dividend Proposal

ASML will submit a proposal to the 2017 Annual General Meeting of Shareholders to declare a dividend in respect of 2016 of EUR 1.20 per ordinary share (for a total amount of approximately EUR 515 million), compared with a dividend of EUR 1.05 per ordinary share paid in respect of 2015.

Update Share Buyback Program

As part of ASML's financial policy to return excess cash to shareholders through dividends and regularly timed share buyback programs, ASML in January 2016 announced its intention to purchase up to EUR 1.5 billion of shares to be executed within the 2016-2017 time frame. ASML intends to cancel the shares upon repurchase.

Through December 31, 2016, ASML has acquired 4.8 million shares under this program for a total consideration of EUR 400 million.

As announced on November 3, 2016, the share buyback program is currently paused. As a result, the 2016–2017 program may not be completed for the full amount. Otherwise, the current program will remain in place, yet it may be further suspended, modified or discontinued at any time. Any transactions under this program will be published on ASML's website (www.asml.com/investors) on a weekly basis.

2

About ASML

ASML is one of the world’s leading manufacturers of chip-making equipment. Our vision is to enable affordable microelectronics that improve the quality of life. To achieve this, our mission is to invent, develop, manufacture and service advanced technology for high-tech lithography, metrology and software solutions for the semiconductor industry. ASML's guiding principle is continuing Moore's Law towards ever smaller, cheaper, more powerful and energy-efficient semiconductors. This results in increasingly powerful and capable electronics that enable the world to progress within a multitude of fields, including healthcare, technology, communications, energy, mobility, and entertainment. ASML is a multinational company with offices in 60 cities in 16 countries, headquartered in Veldhoven, the Netherlands. We employ more than 16,500 people on payroll and flexible contracts (expressed in full time equivalents). ASML is traded on Euronext Amsterdam and NASDAQ under the symbol ASML. More information about ASML, our products and technology, and career opportunities is available on www.asml.com.

Press Conference and Investor Conference Call

CEO Peter Wennink and CFO Wolfgang Nickl will host a press conference at 11:00 AM Central European Time, which will be webcast live on www.asml.com.

A conference call for investors and media will be hosted by CEO Peter Wennink and CFO Wolfgang Nickl at 15:00 PM Central European Time / 09:00 AM U.S. Eastern time. To register for the call and receive dial-in information, go to www.asml.com/qresultscall. Listen-only access is also available via www.asml.com.

2016 Annual Reports

ASML will publish its 2016 Integrated Report, Annual Report on Form 20-F and Statutory Annual Report on February 8, 2017. The reports will be published on our website at www.asml.com.

US GAAP and IFRS Financial Reporting

ASML's primary accounting standard for quarterly earnings releases and annual reports is US GAAP, the accounting principles generally accepted in the United States of America. Quarterly US GAAP consolidated statements of operations, consolidated statements of cash flows and consolidated balance sheets, and a reconciliation of net income from US GAAP to IFRS as adopted by the EU (‘IFRS’) are available on www.asml.com.

In addition to reporting financial figures in accordance with US GAAP, ASML also reports financial figures in accordance with IFRS for statutory purposes. The most significant differences between US GAAP and IFRS that affect ASML concern the capitalization of certain product development costs and the accounting of income taxes. ASML’s quarterly IFRS consolidated statement of profit or loss, consolidated statement of cash flows, consolidated statement of financial position and a reconciliation of net income from US GAAP to IFRS are available on www.asml.com.

The consolidated balance sheets of ASML Holding N.V. as of December 31, 2016, the related consolidated statements of operations and consolidated statements of cash flows for the quarter ended December 31, 2016 as presented in this press release are unaudited.

Regulated Information

This press release contains inside information within the meaning of Article 7(1) of the EU Market Abuse Regulation.

Forward Looking Statements

This document contains statements relating to certain projections and business trends that are forward-looking, including statements with respect to expected trends and outlook, including expected customer insertion of EUV in volume manufacturing, including expected volume orders, systems backlog, expected financial results and trends for the first quarter of 2017, including expected sales, other income, gross margin, R&D and SG&A expenses and effective annualized tax rate, annual revenue opportunity for ASML and EPS potential by 2020, including further growth potential into the next decade, expected industry trends and expected trends in the business environment, statements with respect to the proposed minority stake in Carl Zeiss SMT, including statements that such investment will secure the extension of EUV beyond the next decade and funding for next generation EUV technology, statements with respect to EUV targets, manufacturing, supply chain and service capabilities, and ASML’s commitment to secure system performance, shipments and support for volume manufacturing, including availability, productivity, throughput and shipments, including timing of shipments and the ability to support a larger installed base, shrink being a key driver supporting innovation and providing long-term industry growth, lithography enabling affordable shrink and delivering value to customers, expected industry adoption of EUV and statements with respect to the intent of customers to insert EUV into production, the extension of EUV beyond the next decade, the expected continuation of Moore's law and that EUV will continue to enable Moore’s law and drive long term value, intention to return excess cash to shareholders, and statements about our proposed dividend, dividend policy and intention to repurchase shares and statements with respect to the share repurchase plan. You can generally identify these statements by the use of words like "may", "will", "could", "should", "project", "believe", "anticipate", "expect", "plan", "estimate", "forecast", "potential", "intend", "continue", "targets", "commits to secure" and variations of these words or comparable words. These statements are not historical facts, but rather are based on current expectations, estimates, assumptions and projections about the business and our future financial results and readers should not place undue reliance on them. Forward-looking statements do not guarantee future performance and involve risks and uncertainties. These risks and uncertainties include, without limitation, economic conditions, product demand and semiconductor equipment industry capacity, worldwide demand and manufacturing capacity utilization for semiconductors (the principal product of our customer base), including the impact of general economic conditions on consumer confidence and demand for our customers' products, competitive products and pricing, the impact of any manufacturing efficiencies and capacity constraints, performance of our systems, the continuing success of technology advances and the related pace of new product development and customer acceptance of new products including EUV, the number and timing of EUV systems expected to be shipped and recognized in revenue, delays in EUV systems production and development and volume production by customers, including meeting development requirements for volume production, our ability to enforce patents and protect intellectual property rights, the risk of intellectual property litigation, availability of raw materials and critical manufacturing equipment, trade environment, changes in exchange rates, changes in tax rates, available cash and liquidity, our ability to refinance our indebtedness, distributable reserves for dividend payments and share repurchases and timing of resumption of the share repurchase plan, and other risks indicated in the risk factors included in ASML's Annual Report on Form 20-F and other filings with the US Securities and Exchange Commission. These forward-looking statements are made only as of the date of this document. We do not undertake to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

3

ASML reports record 2016 net sales and net income

EUV orders show strong customer commitment to production insertion

ASML 2016 Fourth-Quarter Results

Veldhoven, the Netherlands

January 18, 2017

Public

Public

Slide 2

January 18, 2017

Agenda

• Investor key messages

• Business highlights

• Outlook

• EUV highlights

• Financial statements

Public

Slide 3

January 18, 2017

Investor key messages

Public

Slide 4

January 18, 2017

Investor key messages

• Shrink is a key industry driver supporting innovation and providing long term industry growth

• Lithography enables affordable shrink and therefore delivers compelling value for our customers

• EUV will enable continuation of Moore’s Law and will drive long term value for ASML beyond the

next decade

• DUV, Holistic Litho and EUV are highly differentiated products providing unique value drivers for our

customers and ASML

• ASML models a 2020 annual revenue opportunity of €11 billion with an EPS > €9, with significant

further growth potential into the next decade

• HMI provides market leading e-beam metrology capability which expands our integrated Holistic

Lithography solutions to include a new class of pattern fidelity control

• We expect to continue to return excess cash to our shareholders through stable or growing

dividends and regularly timed share buybacks in line with our policy

Public

Slide 5

January 18, 2017

Business highlights

Public

Slide 6

January 18, 2017

2016 - highlights

• Record net sales of € 6.79 billion, including record net service and options sales

of € 2.22 billion, gross margin 44.8%, net income € 1.47 billion and EPS € 3.46

• EUV lithography: demonstrated our productivity and availability targets, exiting

the year with a backlog of 18 systems with a value of around € 2 billion

• EUV lithography: announced proposed minority stake in Carl Zeiss SMT and

funding for next generation EUV technology

• DUV lithography: successfully ramped our latest immersion system, shipped 46

TWINSCAN NXT:1980s

• Holistic lithography: growing existing product portfolio and adoption, completed

HMI acquisition

• Capital return: returned € 846 million cash to shareholders through dividends

and share buybacks

Public

Slide 7

January 18, 2017

Q4 results summary

• Net sales of € 1,907 million, 38 litho systems sold valued at € 1,223 million, net

service and field option sales at € 684 million, including HMI

• Average selling price of € 32.2 million per system

• Gross margin of 47.2%, including the effects of purchase price allocation for the

HMI acquisition

• Operating margin of 27.8%

• Net bookings of € 1,580 million, including 6 new EUV systems

• Backlog at € 3,961 million, including 18 EUV systems

Public

Slide 8

January 18, 2017

EUV ArF i ArFdry KrF I-Line

1

19

1

14

5

Sales in Units

EUV ArF i ArFdry KrF I-Line

1

17

1

15

4

Net system sales breakdown in value

End-Use

Memory

39%

Foundry

35%

IDM

26%

Q4’16

total value

€ 1,223

million

Q3’16

total value

€ 1,238

million

EUV 7%

ArF

Immersion

77%

ArF Dry 2%

KrF

12%

I-line 2%

Memory

16%

Foundry

66%

IDM

18%

Region (ship to location)

USA

19%Korea22%

Taiwan

36%

China 3%

Japan 2%

EMEA 18%

USA 9%

Korea 10%

Taiwan

55%

China 6%

Japan 5%

Rest of Asia 7%

EMEA 8%

Technology

EUV 12%ArF

Immersion

74%

ArF Dry 2%

KrF

11% I-line 1%

Public

Slide 9

January 18, 2017

8,000

7,000

6,000

5,000

4,000

3,000

2,000

1,000

0

N

et

Sa

le

s

2012 2013 2014 2015 2016

935

1,489

2,225 2,115

1,471

588

440

831

514

945

2,279

2,064

1,186 1,608 2,155

930

4,732

1,252

5,245

1,614

5,856

2,050

6,287

2,224

6,795

Service & Options

Foundry

IDM

Memory

Total net sales million € by End-use

Public

Slide 10

January 18, 2017

Bookings activity by sector

Q4’16 total value

€ 1,580 million

New

systems

Used

systems

Units 39 5

Value M€ 1,549 31

New

systems

Used

systems

Units 37 6

Value M€ 1,396 19

Q3’16 total value

€ 1,415 million

Memory

34%

Foundry

51%

IDM

15%

Memory

36%

Foundry

52%

IDM

12%

Public

Slide 11

January 18, 2017

System backlog in value

Technology

EUV

50%

ArF

Immersion

37%

ArF Dry 3%

KrF 9%

I-line 1%

Region (ship to location)

USA

26%Korea25%

Taiwan

33%

China 8%

Rest of Asia 1%

EMEA 7%

End-Use

Memory

31%

Foundry

46%

IDM

23%

Q4’16

total value

€ 3,961

million

Q3’16

total value

€ 3,462

million

Memory

31%

Foundry

40%

IDM

29% USA

29%

Korea

27%

Taiwan

28%

China 5%

Rest of Asia 1%

EMEA 10%

New

systems

Used

systems

Units 70 13

Value M€ 3,908 53

New

systems

Used

systems

Units 64 12

Value M€ 3,426 36

EUV

38%

ArF

Immersion

51%

ArF Dry 2%

KrF 8%

I-line 1%

Public

Slide 12

January 18, 2017

Capital return to shareholders

• Paid € 446 million of dividend and purchased € 400 million worth of our own

shares in 2016

• Propose to 2017 Annual General Meeting of Shareholders to declare a dividend

of € 1.20 per ordinary share

• Share buyback program is currently paused

Dividend history

1.4

1.2

1.0

0.8

0.6

0.4

0.2

0.0

D

iv

id

en

d

(e

ur

o)

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

0.25 0.20 0.20

0.40 0.46

0.53 0.61

0.70

1.05

1.20

Cumulative capital return

8,000

6,000

4,000

2,000

0

€

m

illi

on

up to 2008 2009 2010 2011 2012 2013 2014 2015 2016

Dividend

Share buyback

The dividend for a year is paid in the subsequent year

proposed 2007

Public

Slide 13

January 18, 2017

Outlook

Public

Slide 14

January 18, 2017

Outlook

• Q1 2017 net sales approximately € 1.8 billion

• Gross margin around 47%

• R&D costs of about € 320 million

• SG&A costs of about € 95 million

• Other income (Customer Co-Investment Program) of about € 23 million

• Effective annualized tax rate between 13 and 14%

• Our guidance for first-quarter:

Public

Slide 15

January 18, 2017

EUV highlights

Public

Slide 16

January 18, 2017

EUV 2016 achievements

• More than 1,500 wafers per day (wpd) exposed on NXE:3350B at a customer site on average over a three days

period

• Best performance is four-week average above 90% on two NXE:3300B systems

• A four-week average availability of more than 80% has been achieved regularly across the installed base

• Consistency between tools and across sites still needs to be improved

• Four systems shipped in 2016, as stated during October earnings call

Productivity - Target: 1500 wafers per day

Availability - Target: 80%

NXE shipments - Target: 6-7

Public

Slide 17

January 18, 2017

Commitments to EUV production insertion

Initial customer manufacturing targeted for 7 nm logic and mid-10 nm DRAM node

Customers

show commitment to insert EUV in

volume manufacturing by ordering

systems

ASML

commits to securing system

performance, shipments and support

required for volume manufacturing

• Six NXE:3400s orders received in Q4

• Backlog now 18 EUV systems, value around

€ 2 billion

• Further volume orders expected in Q1 2017

For volume manufacturing of logic and memory,

ASML remains committed to deliver:

• Throughput of >125 wafers per hour

• Availability of >90% on average

• Shipments on time in sufficient volume

• Ability to support a larger installed base

Public

Slide 18

January 18, 2017

Financial statements

Public

Slide 19

January 18, 2017

Consolidated statements of operations M€

2012 2013 2014 2015 2016

Net sales 4,732 5,245 5,856 6,287 6,795

Gross profit 2,005 2,177 2,596 2,896 3,044

Gross margin % 42.4% 41.5% 44.3% 46.1% 44.8%

Other income* — 64 81 83 94

R&D costs (589) (882) (1,074) (1,068) (1,106)

SG&A costs (259) (312) (321) (346) (375)

Income from operations 1,157 1,048 1,282 1,565 1,658

Operating income % 24.4% 20.0% 21.9% 24.9% 24.4%

Net income 1,146 1,016 1,197 1,387 1,472

Net income as a % of net sales 24.2% 19.4% 20.4% 22.1% 21.7%

Earnings per share (basic) € 2.70 2.36 2.74 3.22 3.46

Earnings per share (diluted) € 2.68 2.34 2.72 3.21 3.44

Litho units sold 170 157 136 169 157

ASP new litho systems 24.8 27.4 35.6 28.5 32.4

Net booking value 3,312 4,644 4,902 4,639 5,396

* Customer Co-Investment Program (CCIP)

These numbers have been prepared in conformity with accounting policies

generally accepted in the United States of America ("US GAAP")

Public

Slide 20

January 18, 2017

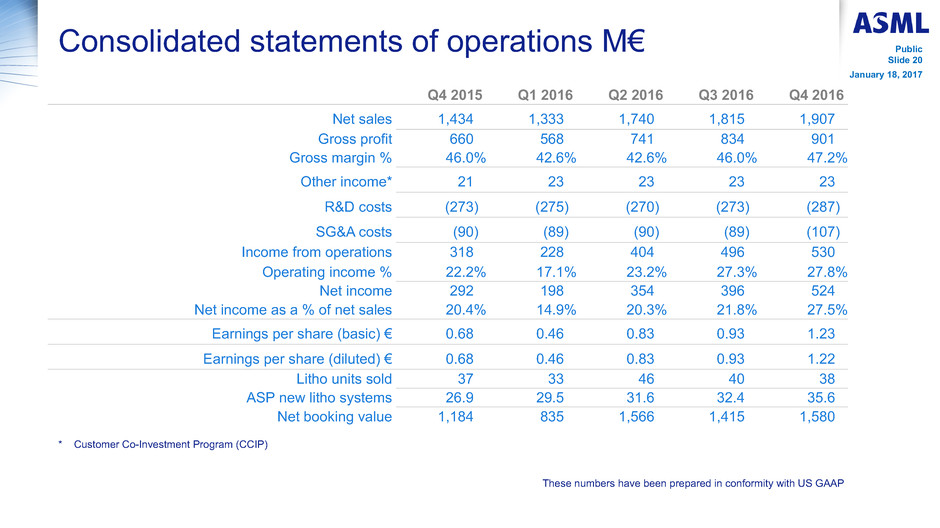

Consolidated statements of operations M€

Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016

Net sales 1,434 1,333 1,740 1,815 1,907

Gross profit 660 568 741 834 901

Gross margin % 46.0% 42.6% 42.6% 46.0% 47.2%

Other income* 21 23 23 23 23

R&D costs (273) (275) (270) (273) (287)

SG&A costs (90) (89) (90) (89) (107)

Income from operations 318 228 404 496 530

Operating income % 22.2% 17.1% 23.2% 27.3% 27.8%

Net income 292 198 354 396 524

Net income as a % of net sales 20.4% 14.9% 20.3% 21.8% 27.5%

Earnings per share (basic) € 0.68 0.46 0.83 0.93 1.23

Earnings per share (diluted) € 0.68 0.46 0.83 0.93 1.22

Litho units sold 37 33 46 40 38

ASP new litho systems 26.9 29.5 31.6 32.4 35.6

Net booking value 1,184 835 1,566 1,415 1,580

* Customer Co-Investment Program (CCIP)

These numbers have been prepared in conformity with US GAAP

Public

Slide 21

January 18, 2017

Consolidated statements of Cash flows M€

2012 2013 2014 2015 2016

Net income 1,146 1,016 1,197 1,387 1,472

Net cash provided by (used in) operating activities 704 1,054 1,025 2,026 1,666

Net cash provided by (used in) investing activities (1,120) (368) (16) (1,160) (3,188)

Net cash provided by (used in) financing activities (546) (113) (928) (834) 1,964

Net increase (decrease) in cash & cash equivalents (964) 563 89 39 448

Free cash flow* 524 839 664 1,653 1,341

Cash and cash equivalents and short-term investments 2,698 3,011 2,754 3,409 4,057

* Free cash flow is defined as net cash provided by (used in) operating activities minus investments in Capex (Purchase of Property,

plant and equipment and intangibles), see US GAAP Consolidated Financial Statements

These numbers have been prepared in conformity with US GAAP

Public

Slide 22

January 18, 2017

Consolidated statements of Cash flows M€

Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016

Net income 292 198 354 396 524

Net cash provided by (used in) operating activities 985 (6) 481 (3) 1,193

Net cash provided by (used in) investing activities (1,078) (183) (24) (484) (2,498)

Net cash provided by (used in) financing activities (131) (204) (607) 1,481 1,293

Net increase (decrease) in cash & cash equivalents (222) (395) (137) 987 (6)

Free cash flow* 864 (65) 381 (72) 1,097

Cash and cash equivalents and short-term investments 3,409 3,138 2,926 4,313 4,057

* Free cash flow is defined as net cash provided by (used in) operating activities minus investments in Capex (Purchase of Property,

plant and equipment and intangibles), see US GAAP Consolidated Financial Statements

These numbers have been prepared in conformity with US GAAP

Public

Slide 23

January 18, 2017

Consolidated Balance sheets M€

Assets 2012 2013 2014 2015 2016

Cash & cash equivalents and short-term investments 2,698 3,011 2,754 3,409 4,057

Net accounts receivable and finance receivables 909 1,175 1,304 1,208 1,264

Inventories, net 1,857 2,393 2,550 2,574 2,781

Other assets 558 635 835 940 1,173

Tax assets 200 296 232 181 47

Goodwill 149 2,089 2,358 2,624 4,874

Other intangible assets 10 697 724 738 1,323

Property, plant and equipment 1,030 1,218 1,447 1,621 1,687

Total assets 7,411 11,514 12,204 13,295 17,206

Liabilities and shareholders' equity

Current liabilities 2,087 2,869 2,889 3,107 3,281

Non-current liabilities 1,257 1,723 1,802 1,799 4,105

Shareholders' equity 4,067 6,922 7,513 8,389 9,820

Total liabilities and shareholders' equity 7,411 11,514 12,204 13,295 17,206

As of January 1, 2016 ASML early adopted the amendment to ASC 740 “Income taxes (Topic 740): Balance Sheet Classification of Deferred Taxes”, which requires that deferred

tax liabilities and assets are classified as non-current in the consolidated balance sheets. The comparative figures have not been adjusted to reflect this change in accounting

policy.

These numbers have been prepared in conformity with US GAAP

Public

Slide 24

January 18, 2017

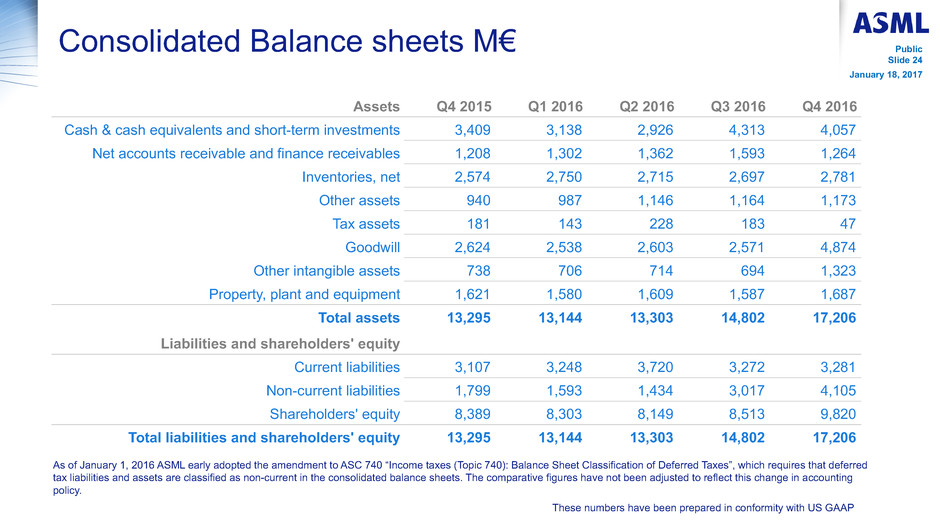

Consolidated Balance sheets M€

Assets Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016

Cash & cash equivalents and short-term investments 3,409 3,138 2,926 4,313 4,057

Net accounts receivable and finance receivables 1,208 1,302 1,362 1,593 1,264

Inventories, net 2,574 2,750 2,715 2,697 2,781

Other assets 940 987 1,146 1,164 1,173

Tax assets 181 143 228 183 47

Goodwill 2,624 2,538 2,603 2,571 4,874

Other intangible assets 738 706 714 694 1,323

Property, plant and equipment 1,621 1,580 1,609 1,587 1,687

Total assets 13,295 13,144 13,303 14,802 17,206

Liabilities and shareholders' equity

Current liabilities 3,107 3,248 3,720 3,272 3,281

Non-current liabilities 1,799 1,593 1,434 3,017 4,105

Shareholders' equity 8,389 8,303 8,149 8,513 9,820

Total liabilities and shareholders' equity 13,295 13,144 13,303 14,802 17,206

As of January 1, 2016 ASML early adopted the amendment to ASC 740 “Income taxes (Topic 740): Balance Sheet Classification of Deferred Taxes”, which requires that deferred

tax liabilities and assets are classified as non-current in the consolidated balance sheets. The comparative figures have not been adjusted to reflect this change in accounting

policy.

These numbers have been prepared in conformity with US GAAP

Public

Slide 25

January 18, 2017

This document contains statements relating to certain projections and business trends that are forward-looking, including statements with respect to expected

trends and outlook, including expected customer insertion of EUV in volume manufacturing, including expected volume orders, systems backlog, expected

financial results and trends for the first quarter of 2017, including expected sales, other income, gross margin, R&D and SG&A expenses and effective annualized

tax rate, annual revenue opportunity for ASML and EPS potential by 2020, including further growth potential into the next decade, expected industry trends and

expected trends in the business environment, statements with respect to the proposed minority stake in Carl Zeiss SMT, including statements that such

investment will secure the extension of EUV beyond the next decade and funding for next generation EUV technology, statements with respect to EUV targets,

manufacturing, supply chain and service capabilities, and ASML’s commitment to secure system performance, shipments and support for volume manufacturing,

including availability, productivity, throughput and shipments, including timing of shipments and the ability to support a larger installed base, shrink being a key

driver supporting innovation and providing long-term industry growth, lithography enabling affordable shrink and delivering value to customers, expected industry

adoption of EUV and statements with respect to the intent of customers to insert EUV into production, the extension of EUV beyond the next decade, the

expected continuation of Moore's law and that EUV will continue to enable Moore’s law and drive long term value, intention to return excess cash to shareholders,

and statements about our proposed dividend, dividend policy and intention to repurchase shares and statements with respect to the share repurchase plan. You

can generally identify these statements by the use of words like "may", "will", "could", "should", "project", "believe", "anticipate", "expect", "plan", "estimate",

"forecast", "potential", "intend", "continue", "targets", "commits to secure" and variations of these words or comparable words.

These statements are not historical facts, but rather are based on current expectations, estimates, assumptions and projections about the business and our future

financial results and readers should not place undue reliance on them. Forward-looking statements do not guarantee future performance and involve risks and

uncertainties. These risks and uncertainties include, without limitation, economic conditions, product demand and semiconductor equipment industry capacity,

worldwide demand and manufacturing capacity utilization for semiconductors (the principal product of our customer base), including the impact of general

economic conditions on consumer confidence and demand for our customers' products, competitive products and pricing, the impact of any manufacturing

efficiencies and capacity constraints, performance of our systems, the continuing success of technology advances and the related pace of new product

development and customer acceptance of new products including EUV, the number and timing of EUV systems expected to be shipped and recognized in

revenue, delays in EUV systems production and development and volume production by customers, including meeting development requirements for volume

production, our ability to enforce patents and protect intellectual property rights, the risk of intellectual property litigation, availability of raw materials and critical

manufacturing equipment, trade environment, changes in exchange rates, changes in tax rates, available cash and liquidity, our ability to refinance our

indebtedness, distributable reserves for dividend payments and share repurchases and timing of resumption of the share repurchase plan, and other risks

indicated in the risk factors included in ASML's Annual Report on Form 20-F and other filings with the US Securities and Exchange Commission. These forward-

looking statements are made only as of the date of this document. We do not undertake to update or revise the forward-looking statements, whether as a result of

new information, future events or otherwise.

Forward looking statements

Exhibit 99.3

ASML - Summary US GAAP Consolidated Statements of Operations 1,2

Three months ended, | Twelve months ended, | |||||||||||

Dec 31, | Dec 31, | Dec 31, | Dec 31, | |||||||||

2015 | 2016 | 2015 | 2016 | |||||||||

(in millions EUR, except per share data) | ||||||||||||

Net system sales | 880.9 | 1,223.0 | 4,237.2 | 4,571.1 | ||||||||

Net service and field option sales | 553.3 | 684.4 | 2,050.2 | 2,223.7 | ||||||||

Total net sales | 1,434.2 | 1,907.4 | 6,287.4 | 6,794.8 | ||||||||

Total cost of sales | (774.4 | ) | (1,006.8 | ) | (3,391.7 | ) | (3,750.3 | ) | ||||

Gross profit | 659.8 | 900.6 | 2,895.7 | 3,044.5 | ||||||||

Other income | 20.8 | 23.5 | 83.2 | 93.8 | ||||||||

Research and development costs | (273.0 | ) | (287.4 | ) | (1,068.1 | ) | (1,105.8 | ) | ||||

Selling, general and administrative costs | (89.5 | ) | (106.8 | ) | (345.7 | ) | (374.8 | ) | ||||

Income from operations | 318.1 | 529.9 | 1,565.1 | 1,657.7 | ||||||||

Interest and other, net | (4.6 | ) | 74.8 | (16.5 | ) | 33.7 | ||||||

Income before income taxes | 313.5 | 604.7 | 1,548.6 | 1,691.4 | ||||||||

Benefit from (provision for) income taxes | (21.1 | ) | (80.5 | ) | (161.4 | ) | (219.5 | ) | ||||

Net income | 292.4 | 524.2 | 1,387.2 | 1,471.9 | ||||||||

Basic net income per ordinary share | 0.68 | 1.23 | 3.22 | 3.46 | ||||||||

Diluted net income per ordinary share 3 | 0.68 | 1.22 | 3.21 | 3.44 | ||||||||

Weighted average number of ordinary shares used in computing per share amounts (in millions): | ||||||||||||

Basic | 428.8 | 427.1 | 430.6 | 425.6 | ||||||||

Diluted 3 | 430.8 | 429.2 | 432.6 | 427.7 | ||||||||

ASML - Ratios and Other Data 1,2

Three months ended, | Twelve months ended, | |||||||||||

Dec 31, | Dec 31, | Dec 31, | Dec 31, | |||||||||

2015 | 2016 | 2015 | 2016 | |||||||||

(in millions EUR, except otherwise indicated) | ||||||||||||

Gross profit as a percentage of net sales | 46.0 | % | 47.2 | % | 46.1 | % | 44.8 | % | ||||

Income from operations as a percentage of net sales | 22.2 | % | 27.8 | % | 24.9 | % | 24.4 | % | ||||

Net income as a percentage of net sales | 20.4 | % | 27.5 | % | 22.1 | % | 21.7 | % | ||||

Income taxes as a percentage of income before income taxes | 6.7 | % | 13.3 | % | 10.4 | % | 13.0 | % | ||||

Shareholders’ equity as a percentage of total assets | 63.1 | % | 57.1 | % | 63.1 | % | 57.1 | % | ||||

Sales of systems (in units) | 37 | 38 | 169 | 157 | ||||||||

Average selling price of system sales (EUR millions) | 23.8 | 32.2 | 25.1 | 29.1 | ||||||||

Value of systems backlog (EUR millions) 4 | 3,184 | 3,961 | 3,184 | 3,961 | ||||||||

Systems backlog (in units) 4 | 79 | 83 | 79 | 83 | ||||||||

Average selling price of systems backlog (EUR millions) 4 | 40.3 | 47.7 | 40.3 | 47.7 | ||||||||

Value of booked systems (EUR millions) 4 | 1,184 | 1,580 | 4,639 | 5,396 | ||||||||

Net bookings (in units) 4 | 44 | 44 | 165 | 160 | ||||||||

Average selling price of booked systems (EUR millions) 4 | 26.9 | 35.9 | 28.1 | 33.7 | ||||||||

Number of payroll employees in FTEs | 12,168 | 13,991 | 12,168 | 13,991 | ||||||||

Number of temporary employees in FTEs | 2,513 | 2,656 | 2,513 | 2,656 | ||||||||

ASML - Summary US GAAP Consolidated Balance Sheets 1,2

Dec 31, | Dec 31, | |||||

2015 | 2016 | |||||

(in millions EUR) | ||||||

ASSETS | ||||||

Cash and cash equivalents | 2,458.7 | 2,906.9 | ||||

Short-term investments | 950.0 | 1,150.0 | ||||

Accounts receivable, net | 803.7 | 700.2 | ||||

Finance receivables, net | 280.5 | 447.4 | ||||

Current tax assets | 19.1 | 11.6 | ||||

Inventories, net | 2,573.7 | 2,780.9 | ||||

Deferred tax assets 5 | 133.1 | — | ||||

Other assets | 488.8 | 560.4 | ||||

Total current assets | 7,707.6 | 8,557.4 | ||||

Finance receivables, net | 124.0 | 117.2 | ||||

Deferred tax assets 5 | 29.0 | 34.9 | ||||

Other assets | 450.9 | 612.3 | ||||

Goodwill | 2,624.6 | 4,873.9 | ||||

Other intangible assets, net | 738.2 | 1,323.0 | ||||

Property, plant and equipment, net | 1,620.7 | 1,687.2 | ||||

Total non-current assets | 5,587.4 | 8,648.5 | ||||

Total assets | 13,295.0 | 17,205.9 | ||||

LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||

Total current liabilities 5 | 3,107.2 | 3,280.6 | ||||

Long-term debt | 1,125.5 | 3,071.8 | ||||

Deferred and other tax liabilities 5 | 256.7 | 396.9 | ||||

Provisions | 2.4 | 20.5 | ||||

Accrued and other liabilities | 414.4 | 615.7 | ||||

Total non-current liabilities | 1,799.0 | 4,104.9 | ||||

Total liabilities | 4,906.2 | 7,385.5 | ||||

Total shareholders’ equity | 8,388.8 | 9,820.4 | ||||

Total liabilities and shareholders’ equity | 13,295.0 | 17,205.9 | ||||

ASML - Summary US GAAP Consolidated Statements of Cash Flows 1,2

Three months ended, | Twelve months ended, | |||||||||||

Dec 31, | Dec 31, | Dec 31, | Dec 31, | |||||||||

2015 | 2016 | 2015 | 2016 | |||||||||

(in millions EUR) | ||||||||||||

CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||||||

Net income | 292.4 | 524.2 | 1,387.2 | 1,471.9 | ||||||||

Adjustments to reconcile net income to net cash flows from operating activities: | ||||||||||||

Depreciation and amortization | 80.5 | 103.1 | 296.9 | 356.9 | ||||||||

Impairment | 1.5 | 1.2 | 2.3 | 3.5 | ||||||||

Loss on disposal of property, plant and equipment | — | 1.4 | 1.6 | 5.2 | ||||||||

Share-based payments | 14.7 | 12.0 | 59.1 | 47.7 | ||||||||

Allowance for doubtful receivables | 1.2 | 0.8 | 3.9 | 3.2 | ||||||||

Allowance for obsolete inventory | 58.2 | 11.0 | 211.8 | 73.0 | ||||||||

Deferred income taxes | (2.8 | ) | (26.7 | ) | 45.3 | (0.6 | ) | |||||

Changes in assets and liabilities | 539.0 | 566.3 | 17.4 | (294.9 | ) | |||||||

Net cash provided by (used in) operating activities | 984.7 | 1,193.3 | 2,025.5 | 1,665.9 | ||||||||

CASH FLOWS FROM INVESTING ACTIVITIES | ||||||||||||

Purchase of property, plant and equipment | (120.5 | ) | (95.9 | ) | (371.8 | ) | (316.3 | ) | ||||

Purchase of intangible assets | — | (0.9 | ) | (1.1 | ) | (8.4 | ) | |||||

Purchase of available for sale securities | (950.0 | ) | (1,050.0 | ) | (950.0 | ) | (2,520.0 | ) | ||||

Maturity of available for sale securities | — | 1,300.0 | 334.9 | 2,320.0 | ||||||||

Cash from (used for) derivative financial instruments | (7.1 | ) | (9.4 | ) | (171.9 | ) | (15.0 | ) | ||||

Loans issued and other investments | — | (0.2 | ) | — | (7.4 | ) | ||||||

Acquisition of subsidiaries (net of cash acquired) | — | (2,641.3 | ) | — | (2,641.3 | ) | ||||||

Net cash provided by (used in) investing activities | (1,077.6 | ) | (2,497.7 | ) | (1,159.9 | ) | (3,188.4 | ) | ||||

CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||||||

Dividend paid | — | — | (302.3 | ) | (445.9 | ) | ||||||

Purchase of shares | (140.7 | ) | — | (564.9 | ) | (400.0 | ) | |||||

Net proceeds from issuance of shares | 9.7 | 548.3 | 33.2 | 582.7 | ||||||||

Net proceeds from issuance of notes | — | 745.9 | — | 2,230.6 | ||||||||

Repayment of debt | (1.1 | ) | (1.2 | ) | (3.6 | ) | (4.7 | ) | ||||

Tax benefit from share-based payments | 0.8 | 0.3 | 3.7 | 0.9 | ||||||||

Net cash provided by (used in) financing activities | (131.3 | ) | 1,293.3 | (833.9 | ) | 1,963.6 | ||||||

Net cash flows | (224.2 | ) | (11.1 | ) | 31.7 | 441.1 | ||||||

Effect of changes in exchange rates on cash | 2.0 | 5.0 | 7.5 | 7.1 | ||||||||

Net increase (decrease) in cash and cash equivalents | (222.2 | ) | (6.1 | ) | 39.2 | 448.2 | ||||||

ASML - Quarterly Summary US GAAP Consolidated Statements of Operations 1,2

Three months ended, | |||||||||||||||

Dec 31, | Apr 3, | Jul 3, | Oct 2, | Dec 31, | |||||||||||

2015 | 2016 | 2016 | 2016 | 2016 | |||||||||||

(in millions EUR, except per share data) | |||||||||||||||

Net system sales | 880.9 | 855.8 | 1,254.1 | 1,238.2 | 1,223.0 | ||||||||||

Net service and field option sales | 553.3 | 477.4 | 485.5 | 576.4 | 684.4 | ||||||||||

Total net sales | 1,434.2 | 1,333.2 | 1,739.6 | 1,814.6 | 1,907.4 | ||||||||||

Total cost of sales | (774.4 | ) | (765.1 | ) | (998.2 | ) | (980.2 | ) | (1,006.8 | ) | |||||

Gross profit | 659.8 | 568.1 | 741.4 | 834.4 | 900.6 | ||||||||||

Other income | 20.8 | 23.4 | 23.5 | 23.4 | 23.5 | ||||||||||

Research and development costs | (273.0 | ) | (274.7 | ) | (270.3 | ) | (273.4 | ) | (287.4 | ) | |||||

Selling, general and administrative costs | (89.5 | ) | (88.8 | ) | (90.4 | ) | (88.8 | ) | (106.8 | ) | |||||

Income from operations | 318.1 | 228.0 | 404.2 | 495.6 | 529.9 | ||||||||||

Interest and other, net | (4.6 | ) | (3.6 | ) | (3.6 | ) | (33.9 | ) | 74.8 | ||||||

Income before income taxes | 313.5 | 224.4 | 400.6 | 461.7 | 604.7 | ||||||||||

Benefit from (provision for) income taxes | (21.1 | ) | (26.4 | ) | (46.8 | ) | (65.8 | ) | (80.5 | ) | |||||

Net income | 292.4 | 198.0 | 353.8 | 395.9 | 524.2 | ||||||||||

Basic net income per ordinary share | 0.68 | 0.46 | 0.83 | 0.93 | 1.23 | ||||||||||

Diluted net income per ordinary share 3 | 0.68 | 0.46 | 0.83 | 0.93 | 1.22 | ||||||||||

Weighted average number of ordinary shares used in computing per share amounts (in millions): | |||||||||||||||

Basic | 428.8 | 427.0 | 424.5 | 423.8 | 427.1 | ||||||||||

Diluted 3 | 430.8 | 429.1 | 426.5 | 425.8 | 429.2 | ||||||||||

ASML - Quarterly Summary Ratios and other data 1,2

Dec 31, | Apr 3, | Jul 3, | Oct 2, | Dec 31, | |||||||||||

2015 | 2016 | 2016 | 2016 | 2016 | |||||||||||

(in millions EUR, except otherwise indicated) | |||||||||||||||

Gross profit as a percentage of net sales | 46.0 | % | 42.6 | % | 42.6 | % | 46.0 | % | 47.2 | % | |||||

Income from operations as a percentage of net sales | 22.2 | % | 17.1 | % | 23.2 | % | 27.3 | % | 27.8 | % | |||||

Net income as a percentage of net sales | 20.4 | % | 14.9 | % | 20.3 | % | 21.8 | % | 27.5 | % | |||||

Income taxes as a percentage of income before income taxes | 6.7 | % | 11.7 | % | 11.7 | % | 14.2 | % | 13.3 | % | |||||

Shareholders’ equity as a percentage of total assets | 63.1 | % | 63.2 | % | 61.3 | % | 57.5 | % | 57.1 | % | |||||

Sales of systems (in units) | 37 | 33 | 46 | 40 | 38 | ||||||||||

Average selling price of system sales (EUR millions) | 23.8 | 25.9 | 27.3 | 31.0 | 32.2 | ||||||||||

Value of systems backlog (EUR millions) 4 | 3,184 | 3,018 | 3,371 | 3,462 | 3,961 | ||||||||||

Systems backlog (in units) 4 | 79 | 76 | 73 | 76 | 83 | ||||||||||

Average selling price of systems backlog (EUR millions) 4 | 40.3 | 39.7 | 46.2 | 45.5 | 47.7 | ||||||||||

Value of booked systems (EUR millions) 4 | 1,184 | 835 | 1,566 | 1,415 | 1,580 | ||||||||||

Net bookings (in units) 4 | 44 | 30 | 43 | 43 | 44 | ||||||||||

Average selling price of booked systems (EUR millions) 4 | 26.9 | 27.8 | 36.4 | 32.9 | 35.9 | ||||||||||

Number of payroll employees in FTEs | 12,168 | 12,407 | 12,598 | 12,933 | 13,991 | ||||||||||

Number of temporary employees in FTEs | 2,513 | 2,492 | 2,569 | 2,599 | 2,656 | ||||||||||

ASML - Quarterly Summary US GAAP Consolidated Balance Sheets 1,2

Dec 31, | Apr 3, | Jul 3, | Oct 2, | Dec 31, | |||||||||||

2015 | 2016 | 2016 | 2016 | 2016 | |||||||||||

(in millions EUR) | |||||||||||||||

ASSETS | |||||||||||||||

Cash and cash equivalents | 2,458.7 | 2,063.4 | 1,926.1 | 2,913.0 | 2,906.9 | ||||||||||

Short-term investments | 950.0 | 1,075.0 | 1,000.0 | 1,400.0 | 1,150.0 | ||||||||||

Accounts receivable, net | 803.7 | 753.2 | 732.4 | 858.4 | 700.2 | ||||||||||

Finance receivables, net | 280.5 | 446.5 | 524.0 | 663.5 | 447.4 | ||||||||||

Current tax assets | 19.1 | 96.0 | 178.0 | 143.5 | 11.6 | ||||||||||

Inventories, net | 2,573.7 | 2,750.0 | 2,715.3 | 2,696.9 | 2,780.9 | ||||||||||

Deferred tax assets 5 | 133.1 | — | — | — | — | ||||||||||

Other assets | 488.8 | 502.1 | 504.7 | 540.4 | 560.4 | ||||||||||

Total current assets | 7,707.6 | 7,686.2 | 7,580.5 | 9,215.7 | 8,557.4 | ||||||||||

Finance receivables, net | 124.0 | 102.2 | 105.7 | 71.8 | 117.2 | ||||||||||

Deferred tax assets 5 | 29.0 | 47.4 | 50.0 | 39.1 | 34.9 | ||||||||||

Other assets | 450.9 | 483.8 | 641.2 | 623.2 | 612.3 | ||||||||||

Goodwill | 2,624.6 | 2,537.7 | 2,603.7 | 2,571.0 | 4,873.9 | ||||||||||

Other intangible assets, net | 738.2 | 706.0 | 713.5 | 694.0 | 1,323.0 | ||||||||||

Property, plant and equipment, net | 1,620.7 | 1,580.3 | 1,608.9 | 1,587.4 | 1,687.2 | ||||||||||

Total non-current assets | 5,587.4 | 5,457.4 | 5,723.0 | 5,586.5 | 8,648.5 | ||||||||||

Total assets | 13,295.0 | 13,143.6 | 13,303.5 | 14,802.2 | 17,205.9 | ||||||||||

LIABILITIES AND SHAREHOLDERS’ EQUITY | |||||||||||||||

Total current liabilities 5 | 3,107.2 | 3,246.8 | 3,720.1 | 3,272.2 | 3,280.6 | ||||||||||

Long-term debt | 1,125.5 | 1,144.3 | 901.9 | 2,390.6 | 3,071.8 | ||||||||||

Deferred and other tax liabilities 5 | 256.7 | 138.0 | 196.4 | 222.1 | 396.9 | ||||||||||

Provisions | 2.4 | — | 12.6 | 16.5 | 20.5 | ||||||||||

Accrued and other liabilities | 414.4 | 311.1 | 323.3 | 387.6 | 615.7 | ||||||||||

Total non-current liabilities | 1,799.0 | 1,593.4 | 1,434.2 | 3,016.8 | 4,104.9 | ||||||||||

Total liabilities | 4,906.2 | 4,840.2 | 5,154.3 | 6,289.0 | 7,385.5 | ||||||||||

Total shareholders’ equity | 8,388.8 | 8,303.4 | 8,149.2 | 8,513.2 | 9,820.4 | ||||||||||

Total liabilities and shareholders’ equity | 13,295.0 | 13,143.6 | 13,303.5 | 14,802.2 | 17,205.9 | ||||||||||

ASML - Quarterly Summary US GAAP Consolidated Statements of Cash Flows 1,2

Three months ended, | |||||||||||||||

Dec 31, | Apr 3, | Jul 3, | Oct 2, | Dec 31, | |||||||||||

2015 | 2016 | 2016 | 2016 | 2016 | |||||||||||

(in millions EUR) | |||||||||||||||

CASH FLOWS FROM OPERATING ACTIVITIES | |||||||||||||||

Net income | 292.4 | 198.0 | 353.8 | 395.9 | 524.2 | ||||||||||

Adjustments to reconcile net income to net cash flows from operating activities: | |||||||||||||||

Depreciation and amortization | 80.5 | 82.0 | 84.1 | 87.7 | 103.1 | ||||||||||

Impairment | 1.5 | 0.5 | 0.4 | 1.4 | 1.2 | ||||||||||

Loss on disposal of property, plant and equipment | — | 1.2 | 0.9 | 1.7 | 1.4 | ||||||||||

Share-based payments | 14.7 | 13.2 | 10.9 | 11.6 | 12.0 | ||||||||||

Allowance for doubtful receivables | 1.2 | 0.9 | 0.8 | 0.7 | 0.8 | ||||||||||

Allowance for obsolete inventory | 58.2 | 36.6 | 22.5 | 2.9 | 11.0 | ||||||||||

Deferred income taxes | (2.8 | ) | (4.5 | ) | (6.6 | ) | 37.2 | (26.7 | ) | ||||||

Changes in assets and liabilities | 539.0 | (333.7 | ) | 14.3 | (541.8 | ) | 566.3 | ||||||||

Net cash provided by (used in) operating activities | 984.7 | (5.8 | ) | 481.1 | (2.7 | ) | 1,193.3 | ||||||||

CASH FLOWS FROM INVESTING ACTIVITIES | |||||||||||||||

Purchase of property, plant and equipment | (120.5 | ) | (55.2 | ) | (98.9 | ) | (66.3 | ) | (95.9 | ) | |||||

Purchase of intangible assets | — | (3.6 | ) | (1.3 | ) | (2.6 | ) | (0.9 | ) | ||||||

Purchase of available for sale securities | (950.0 | ) | (350.0 | ) | (350.0 | ) | (770.0 | ) | (1,050.0 | ) | |||||

Maturity of available for sale securities | — | 225.0 | 425.0 | 370.0 | 1,300.0 | ||||||||||

Cash from (used for) derivative financial instruments | (7.1 | ) | 1.1 | 7.7 | (14.4 | ) | (9.4 | ) | |||||||

Loans issued and other investments | — | — | (6.0 | ) | (1.2 | ) | (0.2 | ) | |||||||

Acquisition of subsidiaries | — | — | — | — | (2,641.3 | ) | |||||||||

Net cash provided by (used in) investing activities | (1,077.6 | ) | (182.7 | ) | (23.5 | ) | (484.5 | ) | (2,497.7 | ) | |||||

CASH FLOWS FROM FINANCING ACTIVITIES | |||||||||||||||

Dividend paid | — | — | (445.9 | ) | — | — | |||||||||

Purchase of shares | (140.7 | ) | (213.5 | ) | (171.9 | ) | (14.6 | ) | — | ||||||

Net proceeds from issuance of shares | 9.7 | 10.6 | 12.1 | 11.7 | 548.3 | ||||||||||

Net proceeds from issuance of notes | — | — | — | 1,484.7 | 745.9 | ||||||||||

Repayment of debt | (1.1 | ) | (1.2 | ) | (1.2 | ) | (1.1 | ) | (1.2 | ) | |||||

Tax benefit from share-based payments | 0.8 | — | 0.1 | 0.5 | 0.3 | ||||||||||

Net cash provided by (used in) financing activities | (131.3 | ) | (204.1 | ) | (606.8 | ) | 1,481.2 | 1,293.3 | |||||||

Net cash flows | (224.2 | ) | (392.6 | ) | (149.2 | ) | 994.0 | (11.1 | ) | ||||||

Effect of changes in exchange rates on cash | 2.0 | (2.7 | ) | 11.9 | (7.1 | ) | 5.0 | ||||||||

Net increase (decrease) in cash and cash equivalents | (222.2 | ) | (395.3 | ) | (137.3 | ) | 986.9 | (6.1 | ) | ||||||

Notes to the Summary US GAAP Consolidated Financial Statements

Basis of Preparation

The accompanying Summary Consolidated Financial Statements are stated in millions of euros unless indicated otherwise. The accompanying Summary Consolidated Financial Statements have been prepared in conformity with accounting principles generally accepted in the United States of America ("US GAAP"). For further details on our Summary of Significant Accounting Policies refer to the Notes to the Consolidated Financial Statements as recorded in our Annual Report on Form 20-F which is available on www.asml.com. Further disclosures, as required under US GAAP in annual reports, are not included in the Summary Consolidated Financial Statements.

ASML – Reconciliation US GAAP – IFRS 1,2

Net income | Three months ended, | Twelve months ended, | |||||||

Dec 31, | Dec 31, | Dec 31, | Dec 31, | ||||||

2015 | 2016 | 2015 | 2016 | ||||||

(in millions EUR) | |||||||||

Net income based on US GAAP | 292.4 | 524.2 | 1,387.2 | 1,471.9 | |||||

Development expenditures (see Note 1) | 55.0 | 16.8 | 244.7 | 190.6 | |||||

Income taxes (see Note 2) | (2.8 | ) | (10.8 | ) | (14.5 | ) | (106.4 | ) | |

Other | (0.3 | ) | — | 2.1 | 0.8 | ||||

Net income based on IFRS | 344.3 | 530.2 | 1,619.5 | 1,556.9 | |||||

Notes to the reconciliation from US GAAP to IFRS

Note 1 Development expenditures

Under US GAAP, ASML applies ASC 730, "Research and Development". In accordance with ASC 730, ASML charges costs relating to research and development to operating expense as incurred.

Under IFRS, ASML applies IAS 38, "Intangible Assets". In accordance with IAS 38, ASML capitalizes certain development expenditures that are amortized over the expected useful life of the related product generally ranging between one and five years. Amortization starts when the developed product is ready for volume production.

Note 2 Income taxes

Under US GAAP, the elimination of unrealized net income from intercompany transactions that are eliminated from the carrying amount of assets in consolidation give rise to a temporary difference for which prepaid taxes must be recognized in consolidation. Contrary to IFRS, the prepaid taxes under US GAAP are calculated based on the tax rate applicable in the seller’s rather than the purchaser’s tax jurisdiction.

Under IFRS, ASML applies IAS 12, "Income Taxes". In accordance with IAS 12 unrealized net income resulting from intercompany transactions that are eliminated from the carrying amount of assets in consolidation give rise to a temporary difference for which deferred taxes must be recognized in consolidation. The deferred taxes are calculated based on the tax rate applicable in the purchaser’s tax jurisdiction.

This document contains statements relating to certain projections and business trends that are forward-looking, including statements with respect to expected trends and outlook, including expected customer insertion of EUV in volume manufacturing, including expected volume orders, systems backlog, expected financial results and trends for the first quarter of 2017, including expected sales, other income, gross margin, R&D and SG&A expenses and effective annualized tax rate, annual revenue opportunity for ASML and EPS potential by 2020, including further growth potential into the next decade, expected industry trends and expected trends in the business environment, statements with respect to the proposed minority stake in Carl Zeiss SMT, including statements that such investment will secure the extension of EUV beyond the next decade and funding for next generation EUV technology, statements with respect to EUV targets, manufacturing, supply chain and service capabilities, and ASML’s commitment to secure system performance, shipments and support for volume manufacturing, including availability, productivity, throughput and shipments, including timing of shipments and the ability to support a larger installed base, shrink being a key driver supporting innovation and providing long-term industry growth, lithography enabling affordable shrink and delivering value to customers, expected industry adoption of EUV and statements with respect to the intent of customers to insert EUV into production, the extension of EUV beyond the next decade, the expected continuation of Moore's law and that EUV will continue to enable Moore’s law and drive long term value, intention to return excess cash to shareholders, and statements about our proposed dividend, dividend policy and intention to repurchase shares and statements with respect to the share repurchase plan. You can generally identify these statements by the use of words like "may", "will", "could", "should", "project", "believe", "anticipate", "expect", "plan", "estimate", "forecast", "potential", "intend", "continue", "targets", "commits to secure" and variations of these words or comparable words. These statements are not historical facts, but rather are based on current expectations, estimates, assumptions and projections about the business and our future financial results and readers should not place undue reliance on them. Forward-looking statements do not guarantee future performance and involve risks and uncertainties. These risks and uncertainties include, without limitation, economic conditions, product demand and semiconductor equipment industry capacity, worldwide demand and manufacturing capacity utilization for semiconductors (the principal product of our customer base), including the impact of general economic conditions on consumer confidence and demand for our customers' products, competitive products and pricing, the impact of any manufacturing efficiencies and capacity constraints, performance of our systems, the continuing success of technology advances and the related pace of new product development and customer acceptance of new products including EUV, the number and timing of EUV systems expected to be shipped and recognized in revenue, delays in EUV systems production and development and volume production by customers, including meeting development requirements for volume production, our ability to enforce patents and protect intellectual property rights, the risk of intellectual property litigation, availability of raw materials and critical manufacturing equipment, trade environment, changes in exchange rates, changes in tax rates, available cash and liquidity, our ability to refinance our indebtedness, distributable reserves for dividend payments and share repurchases and timing of resumption of the share repurchase plan, and other risks indicated in the risk factors included in ASML's Annual Report on Form 20-F and other filings with the US Securities and Exchange Commission. These forward-looking statements are made only as of the date of this document. We do not undertake to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

1 | These financial statements are unaudited. |

2 | Numbers have been rounded. |

3 | The calculation of diluted net income per ordinary share assumes the exercise of options issued under ASML stock option plans and the issuance of shares under ASML share plans for periods in which exercises or issuances would have a dilutive effect. The calculation of diluted net income per ordinary share does not assume exercise of such options or issuance of shares when such exercises or issuance would be anti-dilutive. |

4 | Our systems backlog and net bookings include all system sales orders for which written authorizations have been accepted (for EUV starting as of the NXE:3350B). |

5 | As of January 1, 2016 ASML early adopted the amendment to ASC 740 “Income taxes (Topic 740): Balance Sheet Classification of Deferred Taxes”, which requires that deferred tax liabilities and assets are classified as non-current in the consolidated balance sheets. The comparative figures have not been adjusted to reflect this change in accounting policy. |

Exhibit 99.4

ASML - Summary IFRS Consolidated Statement of Profit or Loss 1,2

Three months ended, | Twelve months ended, | |||||||||||

Dec 31, | Dec 31, | Dec 31, | Dec 31, | |||||||||

2015 | 2016 | 2015 | 2016 | |||||||||

(in millions EUR) | ||||||||||||

Net system sales | 880.9 | 1,223.0 | 4,237.2 | 4,571.1 | ||||||||

Net service and field option sales | 553.3 | 684.4 | 2,050.2 | 2,223.7 | ||||||||

Total net sales | 1,434.2 | 1,907.4 | 6,287.4 | 6,794.8 | ||||||||

Total cost of sales | (792.2 | ) | (1,078.1 | ) | (3,454.3 | ) | (3,897.0 | ) | ||||

Gross profit | 642.0 | 829.3 | 2,833.1 | 2,897.8 | ||||||||

Other income | 20.8 | 23.5 | 83.2 | 93.8 | ||||||||

Research and development costs | (189.8 | ) | (191.4 | ) | (710.2 | ) | (718.8 | ) | ||||

Selling, general and administrative costs | (89.5 | ) | (106.8 | ) | (345.3 | ) | (374.6 | ) | ||||

Operating income | 383.5 | 554.6 | 1,860.8 | 1,898.2 | ||||||||

Interest and other, net | 1.6 | 77.1 | (4.7 | ) | 46.7 | |||||||

Income before income taxes | 385.1 | 631.7 | 1,856.1 | 1,944.9 | ||||||||

Income tax expense | (40.8 | ) | (101.5 | ) | (236.6 | ) | (388.0 | ) | ||||

Net income | 344.3 | 530.2 | 1,619.5 | 1,556.9 | ||||||||

ASML - Summary IFRS Consolidated Statement of Financial Position 1,2

Dec 31, | Dec 31, | |||||

2015 | 2016 | |||||

(in millions EUR) | ||||||

ASSETS | ||||||

Property, plant and equipment | 1,620.7 | 1,687.2 | ||||

Goodwill | 2,647.8 | 4,898.3 | ||||

Other intangible assets | 2,018.5 | 2,882.3 | ||||

Deferred tax assets | 139.6 | 181.6 | ||||

Finance receivables | 124.0 | 117.2 | ||||

Derivative financial instruments | 81.8 | 89.5 | ||||

Other assets | 369.1 | 377.6 | ||||

Total non-current assets | 7,001.5 | 10,233.7 | ||||

Inventories | 2,573.7 | 2,780.9 | ||||

Current tax assets | 19.1 | 11.6 | ||||

Derivative financial instruments | 52.0 | 44.5 | ||||

Finance receivables | 280.5 | 447.4 | ||||

Accounts receivable | 803.7 | 700.2 | ||||

Other assets | 375.6 | 441.6 | ||||

Short-term investments | 950.0 | 1,150.0 | ||||

Cash and cash equivalents | 2,458.7 | 2,906.9 | ||||

Total current assets | 7,513.3 | 8,483.1 | ||||

Total assets | 14,514.8 | 18,716.8 | ||||

EQUITY AND LIABILITIES | ||||||

Equity | 9,491.2 | 11,028.7 | ||||

Long-term debt | 1,125.5 | 3,071.8 | ||||

Derivative financial instruments | 1.9 | 38.1 | ||||

Deferred and other tax liabilities | 376.5 | 699.5 | ||||

Provisions | 2.4 | 20.5 | ||||

Accrued and other liabilities | 412.5 | 577.6 | ||||

Total non-current liabilities | 1,918.8 | 4,407.5 | ||||

Provisions | 2.4 | 1.8 | ||||

Derivative financial instruments | 19.0 | 75.8 | ||||

Current portion of long-term debt | 4.2 | 247.7 | ||||

Current and other tax liabilities | 3.7 | 201.9 | ||||

Accrued and other liabilities | 2,547.6 | 2,160.2 | ||||

Accounts payable | 527.9 | 593.2 | ||||

Total current liabilities | 3,104.8 | 3,280.6 | ||||

Total equity and liabilities | 14,514.8 | 18,716.8 | ||||

ASML - Summary IFRS Consolidated Statement of Cash Flows 1,2

Three months ended, | Twelve months ended, | |||||||||||

Dec 31, | Dec 31, | Dec 31, | Dec 31, | |||||||||

2015 | 2016 | 2015 | 2016 | |||||||||

(in millions EUR) | ||||||||||||

CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||||||

Net income | 344.3 | 530.2 | 1,619.5 | 1,556.9 | ||||||||

Adjustments to reconcile net income to net cash flows from operating activities: | ||||||||||||

Depreciation and amortization | 98.4 | 174.4 | 359.9 | 503.6 | ||||||||

Impairment | 1.5 | 1.2 | 2.3 | 3.5 | ||||||||

Loss on disposal of property, plant and equipment | — | 1.4 | 1.6 | 5.2 | ||||||||

Share-based payments | 12.6 | 12.2 | 50.1 | 48.9 | ||||||||

Allowance for doubtful receivables | 1.2 | 0.8 | 3.9 | 3.2 | ||||||||

Allowance for obsolete inventory | 58.2 | 11.0 | 211.8 | 73.0 | ||||||||

Deferred income taxes | 20.5 | 0.3 | 134.8 | 172.4 | ||||||||

Changes in assets and liabilities | 537.8 | 560.4 | 15.6 | (300.2 | ) | |||||||

Net cash provided by (used in) operating activities | 1,074.5 | 1,291.9 | 2,399.5 | 2,066.5 | ||||||||

CASH FLOWS FROM INVESTING ACTIVITIES | ||||||||||||

Purchase of property, plant and equipment | (120.5 | ) | (95.9 | ) | (371.8 | ) | (316.3 | ) | ||||

Purchase of intangible assets | (89.0 | ) | (99.2 | ) | (371.4 | ) | (408.1 | ) | ||||

Purchase of available for sale securities | (950.0 | ) | (1,050.0 | ) | (950.0 | ) | (2,520.0 | ) | ||||

Maturity of available for sale securities | — | 1,300.0 | 334.9 | 2,320.0 | ||||||||

Cash from (used for) derivative financial instruments | (7.1 | ) | (9.4 | ) | (171.9 | ) | (15.0 | ) | ||||

Loans issued and other investments | — | (0.2 | ) | — | (7.4 | ) | ||||||

Acquisition of subsidiaries (net of cash acquired) | — | (2,641.3 | ) | — | (2,641.3 | ) | ||||||

Net cash provided by (used in) investing activities | (1,166.6 | ) | (2,596.0 | ) | (1,530.2 | ) | (3,588.1 | ) | ||||

CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||||||

Dividend paid | — | — | (302.3 | ) | (445.9 | ) | ||||||

Purchase of shares | (140.7 | ) | — | (564.9 | ) | (400.0 | ) | |||||

Net proceeds from issuance of shares | 9.7 | 548.3 | 33.2 | 582.7 | ||||||||

Net proceeds from issuance of notes | — | 745.9 | — | 2,230.6 | ||||||||

Repayment of debt | (1.1 | ) | (1.2 | ) | (3.6 | ) | (4.7 | ) | ||||

Net cash provided by (used in) financing activities | (132.1 | ) | 1,293.0 | (837.6 | ) | 1,962.7 | ||||||

Net cash flows | (224.2 | ) | (11.1 | ) | 31.7 | 441.1 | ||||||

Effect of changes in exchange rates on cash | 2.0 | 5.0 | 7.5 | 7.1 | ||||||||

Net increase (decrease) in cash and cash equivalents | (222.2 | ) | (6.1 | ) | 39.2 | 448.2 | ||||||

ASML - Quarterly Summary IFRS Consolidated Statement of Profit or Loss 1,2

Three months ended, | |||||||||||||||

Dec 31, | Apr 3, | Jul 3, | Oct 2, | Dec 31, | |||||||||||

2015 | 2016 | 2016 | 2016 | 2016 | |||||||||||

(in millions EUR) | |||||||||||||||

Net system sales | 880.9 | 855.8 | 1,254.1 | 1,238.2 | 1,223.0 | ||||||||||

Net service and field option sales | 553.3 | 477.4 | 485.5 | 576.4 | 684.4 | ||||||||||

Total net sales | 1,434.2 | 1,333.2 | 1,739.6 | 1,814.6 | 1,907.4 | ||||||||||

Total cost of sales | (792.2 | ) | (784.4 | ) | (1,018.1 | ) | (1,016.4 | ) | (1,078.1 | ) | |||||

Gross profit | 642.0 | 548.8 | 721.5 | 798.2 | 829.3 | ||||||||||

Other income | 20.8 | 23.4 | 23.5 | 23.4 | 23.5 | ||||||||||

Research and development costs | (189.8 | ) | (199.1 | ) | (151.9 | ) | (176.4 | ) | (191.4 | ) | |||||

Selling, general and administrative costs | (89.5 | ) | (88.7 | ) | (90.3 | ) | (88.8 | ) | (106.8 | ) | |||||

Operating income | 383.5 | 284.4 | 502.8 | 556.4 | 554.6 | ||||||||||

Interest and other, net | 1.6 | (0.3 | ) | — | (30.1 | ) | 77.1 | ||||||||

Income before income taxes | 385.1 | 284.1 | 502.8 | 526.3 | 631.7 | ||||||||||

Income tax expense | (40.8 | ) | (53.3 | ) | (132.4 | ) | (100.8 | ) | (101.5 | ) | |||||

Net income | 344.3 | 230.8 | 370.4 | 425.5 | 530.2 | ||||||||||

ASML - Quarterly Summary IFRS Consolidated Statement of Financial Position 1,2

Dec 31, | Apr 3, | Jul 3, | Oct 2, | Dec 31, | |||||||||||

2015 | 2016 | 2016 | 2016 | 2016 | |||||||||||

(in millions EUR) | |||||||||||||||

ASSETS | |||||||||||||||

Property, plant and equipment | 1,620.7 | 1,580.3 | 1,608.9 | 1,587.4 | 1,687.2 | ||||||||||

Goodwill | 2,647.8 | 2,560.3 | 2,626.8 | 2,593.8 | 4,898.3 | ||||||||||

Other intangible assets | 2,018.5 | 2,033.0 | 2,153.0 | 2,192.5 | 2,882.3 | ||||||||||

Deferred tax assets | 139.6 | 123.4 | 165.2 | 168.6 | 181.6 | ||||||||||

Finance receivables | 124.0 | 102.2 | 105.7 | 71.8 | 117.2 | ||||||||||

Derivative financial instruments | 81.8 | 118.2 | 121.5 | 104.8 | 89.5 | ||||||||||

Other assets | 369.1 | 365.6 | 367.5 | 369.7 | 377.6 | ||||||||||

Total non-current assets | 7,001.5 | 6,883.0 | 7,148.6 | 7,088.6 | 10,233.7 | ||||||||||

Inventories | 2,573.7 | 2,750.0 | 2,715.3 | 2,696.9 | 2,780.9 | ||||||||||

Current tax assets | 19.1 | 96.0 | 178.0 | 143.5 | 11.6 | ||||||||||

Derivative financial instruments | 52.0 | 56.8 | 43.0 | 48.4 | 44.5 | ||||||||||

Finance receivables | 280.5 | 446.5 | 524.0 | 663.5 | 447.4 | ||||||||||

Accounts receivable | 803.7 | 753.2 | 732.4 | 858.4 | 700.2 | ||||||||||

Other assets | 375.6 | 386.3 | 395.0 | 417.5 | 441.6 | ||||||||||

Short-term investments | 950.0 | 1,075.0 | 1,000.0 | 1,400.0 | 1,150.0 | ||||||||||

Cash and cash equivalents | 2,458.7 | 2,063.4 | 1,926.1 | 2,913.0 | 2,906.9 | ||||||||||

Total current assets | 7,513.3 | 7,627.2 | 7,513.8 | 9,141.2 | 8,483.1 | ||||||||||

Total assets | 14,514.8 | 14,510.2 | 14,662.4 | 16,229.8 | 18,716.8 | ||||||||||

EQUITY AND LIABILITIES | |||||||||||||||

Equity | 9,491.2 | 9,429.4 | 9,299.5 | 9,690.6 | 11,028.7 | ||||||||||

Long-term debt | 1,125.5 | 1,144.3 | 901.9 | 2,390.6 | 3,071.8 | ||||||||||

Derivative financial instruments | 1.9 | 1.4 | 1.2 | 0.8 | 38.1 | ||||||||||

Deferred and other tax liabilities | 376.5 | 378.6 | 405.0 | 472.4 | 699.5 | ||||||||||

Provisions | 2.4 | — | 12.6 | 16.5 | 20.5 | ||||||||||

Accrued and other liabilities | 412.5 | 309.7 | 322.1 | 386.7 | 577.6 | ||||||||||

Total non-current liabilities | 1,918.8 | 1,834.0 | 1,642.8 | 3,267.0 | 4,407.5 | ||||||||||

Provisions | 2.4 | 4.0 | 2.9 | 2.4 | 1.8 | ||||||||||

Derivative financial instruments | 19.0 | 24.8 | 34.3 | 29.8 | 75.8 | ||||||||||

Current portion of long-term debt | 4.2 | 4.2 | 253.6 | 250.4 | 247.7 | ||||||||||

Current and other tax liabilities | 3.7 | 8.6 | 170.9 | 131.1 | 201.9 | ||||||||||

Accrued and other liabilities | 2,547.6 | 2,560.7 | 2,524.2 | 2,227.2 | 2,160.2 | ||||||||||

Accounts payable | 527.9 | 644.5 | 734.2 | 631.3 | 593.2 | ||||||||||

Total current liabilities | 3,104.8 | 3,246.8 | 3,720.1 | 3,272.2 | 3,280.6 | ||||||||||

Total equity and liabilities | 14,514.8 | 14,510.2 | 14,662.4 | 16,229.8 | 18,716.8 | ||||||||||

ASML - Quarterly Summary IFRS Consolidated Statement of Cash Flows 1,2

Three months ended, | |||||||||||||||

Dec 31, | Apr 3, | Jul 3, | Oct 2, | Dec 31, | |||||||||||

2015 | 2016 | 2016 | 2016 | 2016 | |||||||||||

(in millions EUR) | |||||||||||||||

CASH FLOWS FROM OPERATING ACTIVITIES | |||||||||||||||

Net income | 344.3 | 230.8 | 370.4 | 425.5 | 530.2 | ||||||||||

Adjustments to reconcile net income to net cash flows from operating activities: | |||||||||||||||

Depreciation and amortization | 98.4 | 101.3 | 103.9 | 124.0 | 174.4 | ||||||||||

Impairment | 1.5 | 0.5 | 0.4 | 1.4 | 1.2 | ||||||||||

Loss on disposal of property, plant and equipment | — | 1.2 | 0.9 | 1.7 | 1.4 | ||||||||||

Share-based payments | 12.6 | 13.6 | 10.5 | 12.6 | 12.2 | ||||||||||

Allowance for doubtful receivables | 1.2 | 0.9 | 0.8 | 0.7 | 0.8 | ||||||||||

Allowance for obsolete inventory | 58.2 | 36.6 | 22.5 | 2.9 | 11.0 | ||||||||||

Deferred income taxes | 20.5 | 23.1 | 81.9 | 67.1 | 0.3 | ||||||||||

Changes in assets and liabilities | 537.8 | (335.2 | ) | 11.9 | (537.3 | ) | 560.4 | ||||||||

Net cash provided by (used in) operating activities | 1,074.5 | 72.8 | 603.2 | 98.6 | 1,291.9 | ||||||||||

CASH FLOWS FROM INVESTING ACTIVITIES | |||||||||||||||

Purchase of property, plant and equipment | (120.5 | ) | (55.2 | ) | (98.9 | ) | (66.3 | ) | (95.9 | ) | |||||

Purchase of intangible assets | (89.0 | ) | (82.2 | ) | (123.3 | ) | (103.4 | ) | (99.2 | ) | |||||

Purchase of available for sale securities | (950.0 | ) | (350.0 | ) | (350.0 | ) | (770.0 | ) | (1,050.0 | ) | |||||

Maturity of available for sale securities | — | 225.0 | 425.0 | 370.0 | 1,300.0 | ||||||||||

Cash from (used for) derivative financial instruments | (7.1 | ) | 1.1 | 7.7 | (14.4 | ) | (9.4 | ) | |||||||

Loans issued and other investments | — | — | (6.0 | ) | (1.2 | ) | (0.2 | ) | |||||||

Acquisition of subsidiaries | — | — | — | — | (2,641.3 | ) | |||||||||

Net cash provided by (used in) investing activities | (1,166.6 | ) | (261.3 | ) | (145.5 | ) | (585.3 | ) | (2,596.0 | ) | |||||

CASH FLOWS FROM FINANCING ACTIVITIES | |||||||||||||||

Dividend paid | — | — | (445.9 | ) | — | — | |||||||||

Purchase of shares | (140.7 | ) | (213.5 | ) | (171.9 | ) | (14.6 | ) | — | ||||||

Net proceeds from issuance of shares | 9.7 | 10.6 | 12.1 | 11.7 | 548.3 | ||||||||||

Net proceeds from issuance of notes | — | — | — | 1,484.7 | 745.9 | ||||||||||

Repayment of debt | (1.1 | ) | (1.2 | ) | (1.2 | ) | (1.1 | ) | (1.2 | ) | |||||

Net cash provided by (used in) financing activities | (132.1 | ) | (204.1 | ) | (606.9 | ) | 1,480.7 | 1,293.0 | |||||||

Net cash flows | (224.2 | ) | (392.6 | ) | (149.2 | ) | 994.0 | (11.1 | ) | ||||||

Effect of changes in exchange rates on cash | 2.0 | (2.7 | ) | 11.9 | (7.1 | ) | 5.0 | ||||||||

Net increase (decrease) in cash and cash equivalents | (222.2 | ) | (395.3 | ) | (137.3 | ) | 986.9 | (6.1 | ) | ||||||

Notes to the Summary IFRS Consolidated Financial Statements

Basis of Preparation

The accompanying Summary Consolidated Financial Statements are stated in millions of euros unless indicated otherwise. The accompanying Summary Consolidated Financial Statements have been prepared in conformity with International Financial Reporting Standards as adopted by the EU (“IFRS”) accounting principles generally accepted in the Netherlands for companies quoted on Euronext Amsterdam. For further details on our Summary of Significant Accounting Policies refer to the Notes to the Consolidated Financial Statements as recorded in our Statutory Annual Report which is available on www.asml.com. Further disclosures, as required under IFRS in annual reports and interim reporting (IAS 34), are not included in the Summary Consolidated Financial Statements.

For internal and external reporting purposes, we apply accounting principles generally accepted in the United States of America ("US GAAP"). US GAAP is our primary accounting standard for the setting of financial and operational performance targets.

ASML – Reconciliation US GAAP – IFRS 1,2

Net income | Three months ended, | Twelve months ended, | |||||||

Dec 31, | Dec 31, | Dec 31, | Dec 31, | ||||||

2015 | 2016 | 2015 | 2016 | ||||||

(in millions EUR) | |||||||||

Net income based on US GAAP | 292.4 | 524.2 | 1,387.2 | 1,471.9 | |||||

Development expenditures (see Note 1) | 55.0 | 16.8 | 244.7 | 190.6 | |||||

Income taxes (see Note 2) | (2.8 | ) | (10.8 | ) | (14.5 | ) | (106.4 | ) | |

Other | (0.3 | ) | — | 2.1 | 0.8 | ||||

Net income based on IFRS | 344.3 | 530.2 | 1,619.5 | 1,556.9 | |||||

Notes to the reconciliation from US GAAP to IFRS

Note 1 Development expenditures

Under US GAAP, ASML applies ASC 730, "Research and Development". In accordance with ASC 730, ASML charges costs relating to research and development to operating expense as incurred.