Form 6-K AGNICO EAGLE MINES LTD For: Dec 31

QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2016.

Commission File Number 001-13422

AGNICO EAGLE MINES LIMITED

(Translation of registrant's name into English)

145 King Street East, Suite 400, Toronto, Ontario M5C 2Y7

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F o Form 40-F ý

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101 (b)(1):

Note: Regulation S-T Rule 101 (b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101 (b)(7):

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant's "home country"), or under the rules of the home country exchange on which the registrant's securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant's security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes o No ý

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b) : 82- .

| Exhibit No. | Exhibit Description | ||

|---|---|---|---|

99.1 |

Agnico Eagle Mines Limited's Notice of Annual and Special Meeting of Shareholders and Management Information Circular dated March 11, 2016 | ||

99.2 |

Form of Proxy |

||

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| AGNICO EAGLE MINES LIMITED (Registrant) |

||||

| Date: March 24, 2016 | By: | /s/ R. Gregory Laing R. Gregory Laing General Counsel, Sr. Vice-President, Legal and Corporate Secretary |

||

Exhibit Number 99.1 submitted with this Form 6-K is hereby incorporated by reference into Agnico Eagle Mines Limited's Registration Statements on Form F-10 (Reg. No. 333-189715), Form F-3D (Reg. Nos. 333-183723 and 333-190888) and Form S-8 (Reg. Nos. 333-130339 and 333-152004).

EXHIBITS

SIGNATURES

QuickLinks -- Click here to rapidly navigate through this document

Notice of Annual and Special Meeting

of Shareholders

Friday, April 29, 2016

Management Information Circular

AGNICO EAGLE MINES LIMITED

Suite 400

145 King Street East

Toronto, Ontario

M5C 2Y7

NOTICE OF 2016 ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

Date: |

Friday, April 29, 2016 | |||

Time: |

11:00 a.m. (Toronto time) |

|||

Place: |

Sheraton Centre Toronto Hotel, Dominion Ballroom, 123 Queen St. West, Toronto, Ontario |

|||

Business of the Meeting: |

1. |

Receipt of the financial statements of Agnico Eagle Mines Limited ("the Company") for the year ended December 31, 2015 and the auditors' report on the statements; |

||

|

2. |

Election of directors; |

||

|

3. |

Appointment of auditors; |

||

|

4. |

Consideration of and, if deemed advisable, the passing of an ordinary resolution approving an amendment to the Company's Stock Option Plan; |

||

|

5. |

Consideration of and, if deemed advisable, the passing of a non-binding, advisory resolution accepting the Company's approach to executive compensation; and |

||

|

6. |

Consideration of any other business which may be properly brought before the Annual and Special Meeting of Shareholders. |

||

|

By order of the Board of Directors |

|

|

R. GREGORY LAING General Counsel, Senior Vice-President, Legal and Corporate Secretary March 11, 2016 |

To be effective at the meeting, proxies must be deposited with Computershare Trust Company of Canada no later than 48 hours prior to the commencement of the meeting.

MANAGEMENT INFORMATION CIRCULAR

This Management Information Circular (the "Circular") is provided in connection with the solicitation by the management of Agnico Eagle Mines Limited ("Agnico" or the "Company") of proxies for use at the Annual and Special Meeting of Shareholders. Unless otherwise stated, all information in this Circular is given as at March 11, 2016 and all dollar amounts are stated in Canadian dollars.

For purposes of the meeting, the Company is not: (a) relying on "notice and access" to make proxy-related materials electronically available under applicable securities laws or (b) directly mailing proxy materials to non-registered shareholders. Rather, the Company will rely on the intermediaries to deliver proxy-related materials by mail to non-registered shareholders who have not waived the right to receive them.

For information about certain measures used in this Circular such as "total cash costs per ounce", "all-in sustaining costs per ounce" and "minesite costs per tonne", please refer to the Company's management's discussion and analysis for the year ended December 31, 2015. For scientific and technical information about the Company's mines and projects, please refer to the Company's annual information form dated as of March 11, 2016.

TABLE OF CONTENTS

| |

|

Page | ||

|---|---|---|---|---|

SECTION 1: |

VOTING INFORMATION | 2 | ||

SECTION 2: |

BUSINESS OF THE MEETING |

4 |

||

|

Election of Directors | 4 | ||

|

Compensation of Directors and Other Information | 11 | ||

|

Appointment of Auditors | 17 | ||

|

Financial Statements | 18 | ||

|

Amendments to the Stock Option Plan | 18 | ||

|

Advisory Vote on Approach to Executive Compensation | 19 | ||

SECTION 3: |

COMPENSATION AND OTHER INFORMATION |

20 |

||

|

Compensation Discussion & Analysis | 22 | ||

|

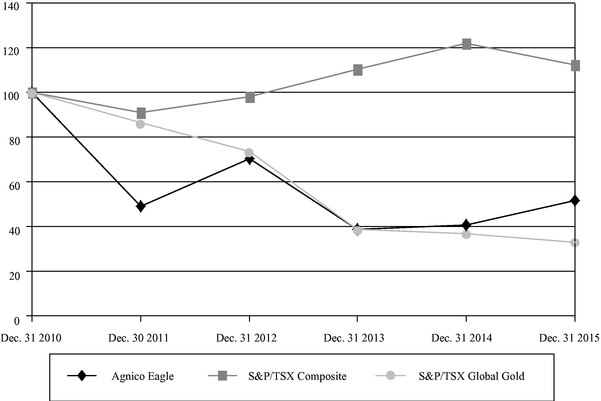

Performance Graph | 33 | ||

|

Compensation of Officers | 33 | ||

|

Indebtedness of Directors and Officers | 44 | ||

|

Additional Items | 44 | ||

APPENDIX A: |

STATEMENT OF CORPORATE GOVERNANCE PRACTICES |

A-1 |

||

APPENDIX B: |

STOCK OPTION PLAN RESOLUTION |

B-1 |

||

APPENDIX C: |

AMENDED AND RESTATED STOCK OPTION PLAN |

C-1 |

||

APPENDIX D: |

ADVISORY RESOLUTION ON APPROACH TO EXECUTIVE COMPENSATION |

D-1 |

Who is soliciting my proxy?

The management of the Company is soliciting your proxy for use at the Annual and Special Meeting of Shareholders.

What will I be voting on?

You will be voting on:

- •

- the election of each of the directors (page 4);

- •

- the appointment of Ernst & Young LLP as the Company's auditors (page 17);

- •

- an amendment to the Company's Stock Option Plan (the "Stock Option Plan") (page 18);

- •

- a non-binding, advisory basis, accepting the Company's approach to executive compensation (page 19); and

- •

- other business brought before the meeting if any other matter is put to a vote.

What else will happen at the meeting?

The financial statements for the year ended December 31, 2015 together with the auditors' report on these statements will be presented at the meeting.

How will these matters be decided at the meeting?

A majority of votes cast, by proxy or in person, will constitute approval of each of the matters specified in this Circular.

How many votes do I have?

You will have one vote for each common share of the Company you own at the close of business on March 11, 2016, the record date for the meeting. To vote common shares that you acquired after the record date, you must, no later than the commencement of the meeting:

- •

- request that the Company add your name to the list of voters; and

- •

- properly establish ownership of the common shares or produce properly endorsed share certificates evidencing that the common shares have been transferred.

How many shares are eligible to vote?

At the close of business on March 11, 2016 there were 220,906,030 common shares of the Company outstanding. Each common share held at that date entitles you to one vote. To the knowledge of the directors and officers of the Company, no person or corporation owns or exercises control or direction over 10% or more of the outstanding common shares.

How do I vote?

If you are eligible to vote and your common shares are registered in your name, you can vote your common shares in person at the meeting or by proxy, as explained below. If your common shares are registered in the name of an intermediary, such as a bank, trust company, securities broker or other financial institution, please see the instructions below under the heading "How can a non-registered shareholder vote?"

How can a registered shareholder vote by proxy?

In addition to voting in person at the meeting, you may vote by mail by completing the form of proxy and returning it in the enclosed envelope to Computershare Trust Company of Canada (the "Depositary"). You may also appoint a person (who need not be a shareholder), other than one of the directors or officers named in the proxy, to represent you at the meeting by inserting the person's name in the blank space provided in the proxy and returning the proxy to the Depositary no later than 48 hours prior to the commencement of the meeting.

2

You may also vote by phone or via the Internet. To vote by phone, in Canada and the United States only, call the toll-free number listed on the proxy from a touch tone phone. When prompted, enter your Holder Account Number and Proxy Access Number listed on the proxy and follow the voting instructions. To vote via the Internet, go to the website specified on the proxy and enter your Holder Account Number and Proxy Access Number listed on the proxy and follow the voting instructions on the screen. If you vote by telephone or via the Internet, do not complete or return the proxy form.

How will my proxy be voted?

On the form of proxy, you can indicate how you would like your proxyholder to vote your common shares for any matter put to a vote at the meeting and on any ballot, and your common shares will be voted accordingly. If you do not indicate how you want your common shares to be voted, the persons named in the proxy intend to vote your common shares in the following manner:

- (i)

- for the election of each of management's nominees as directors;

- (ii)

- for the appointment of management's nominee, Ernst & Young LLP, as the auditors and the authorization of the

directors to fix the remuneration of the auditors;

- (iii)

- for the proposed amendment to the Stock Option Plan;

- (iv)

- for the acceptance of the Company's approach to executive compensation; and

- (v)

- for management's proposals generally.

What if I want to revoke my proxy?

You can revoke your proxy at any time prior to its use. If you are a registered shareholder you may revoke your proxy by requesting, or having your authorized attorney request, in writing to revoke your proxy. This request must be delivered to the Company's address (as listed in this Circular) before the last business day preceding the day of the meeting or to the Chairman of the meeting on the day of the meeting or any adjournment. If your common shares are not registered in your name and you are therefore a non-registered shareholder, you must arrange for the intermediary in whose name your shares are registered to revoke the proxy on your behalf in accordance with the intermediary's instructions.

How are proxies solicited?

The solicitation of proxies will be primarily by mail; however, proxies may be solicited personally, by telephone, by e-mail, internet, facsimile or other means of communication by directors, officers, regular employees and agents of the Company. The cost of this solicitation will be paid by the Company.

How can a non-registered shareholder vote?

If your common shares are not registered in your name, they will be held by an intermediary such as a bank, trust company, securities broker or other financial institution. Each intermediary has its own procedures that should be carefully followed by non-registered shareholders to ensure that their common shares are voted at the meeting, including when and where the proxy or voting instruction form is to be delivered. If you are a non-registered shareholder, you should have received this Circular, together with either (a) the voting instruction form from your intermediary to be completed and signed by you and returned to the intermediary in accordance with the instructions provided by the intermediary, or (b) a form of proxy, which has already been signed by the intermediary and is restricted as to the number of common shares beneficially owned by you, to be completed by you and returned to the Depositary no later than 48 hours prior to the commencement of the meeting. To vote in person at the meeting, a non-registered shareholder should, in the case of a voting instruction form, follow the instructions set out on the voting instruction form and, in the case of a form of proxy, insert his or her name in the blank space provided and return the form of proxy to the Depositary no later than 48 hours prior to the commencement of the meeting.

3

SECTION 2: BUSINESS OF THE MEETING

Election of Directors

The articles of the Company provide for a minimum of five and a maximum of fifteen directors. By special resolution of the shareholders of the Company approved at the annual and special meeting of the Company held on June 27, 1996, the shareholders authorized the board of directors of the Company (the "Board of Directors" or the "Board") to determine the number of directors within the minimum and maximum. The number of directors to be elected at the meeting is twelve, as determined by the Board of Directors by resolution passed on March 5, 2015. The names of the proposed nominees for election as directors are set out below. Each director nominee is presently a member of the Board of Directors, and has consented to serve as a director if elected and will hold office until the next annual meeting of shareholders of the Company or until their successors are elected or appointed or the position is vacated. Management of the Company does not currently know of any reason why any director nominee will be unable to serve as a director but, if any nominee should be unable to serve for any reason prior to the meeting, the persons named on the enclosed form of proxy reserve the right to vote in their discretion for other nominees as directors.

The Board of Directors does not have a mandatory retirement policy for directors based solely on age nor does it have any term limits or similar mechanisms in place for forcing the renewal or replacement of directors. Rather, while there are benefits to adding new perspectives to the Board of Directors from time to time, which the Company believes can happen naturally without forcing the issue through term limits, there are also benefits that result from continuity and the experience and knowledge that comes from longer service on a board. Due in part to the Company's practice of conducting annual evaluations of the Board of Directors, committees and individual directors, the Board of Directors approved and adopted a resignation policy primarily based on the directors' performance, commitment, skills and experience. As set out in greater detail under "Board of Directors Governance Matters" and "Appendix A: Statement of Corporate Governance Practices — Assessment of Directors" below, each of the directors' performances will continue to be evaluated annually and the Company will use a rigorous identification and selection process for any new director nominees, and consider a variety of factors, including diversity and the desired skills, competencies and qualifications needed for potential nominees having regard to the strategies, needs and best interests of the Company and its Board of Directors and Committees.

Majority Voting Policy

As part of its ongoing review of corporate governance practices, on February 20, 2008 the Board of Directors adopted a policy providing that in an uncontested election of directors, any nominee who receives a greater number of votes "withheld" than votes "for" will tender his or her resignation to the Chairman of the Board of Directors promptly following the shareholders' meeting. This policy was updated by the Board of Directors on February 11, 2015. Under the updated policy, the Corporate Governance Committee will consider the offer of resignation and will make a recommendation to the Board of Directors on whether to accept it. The Board of Directors will accept the resignation absent exceptional circumstances that would warrant the director continuing to serve on the Board of Directors, as determined by the Board of Directors in accordance with its fiduciary duties to the Company. The Board of Directors will make its final decision and announce it in a press release within 90 days following the shareholders' meeting. A director who tenders his or her resignation pursuant to this policy will not participate in any meeting of the Board of Directors or the Corporate Governance Committee at which the resignation is considered.

The persons named on the enclosed form of proxy intend to VOTE FOR the election of each of the proposed nominees whose names are set out below and who are all currently directors of the Company unless a shareholder has specified in his or her proxy that his or her common shares are to be withheld from voting for the election of a proposed nominee. The security ownership amounts presented in the table reflect ownership of common shares and Restricted Share Units ("RSUs") under the Company's Restricted Share Unit Plan (the "RSU Plan") (as described below), as at March 11, 2016. The common share ownership amounts set out below do not include common shares underlying unvested RSUs.

4

NOMINEES FOR ELECTION TO THE BOARD OF DIRECTORS

|

| Dr. Leanne M. Baker | Age: 63 | Independent | ||||

| Sebastopol, California | 2015 Voting Results: 96.99% | Director since 2003 | ||||

|

Dr. Baker is a consultant to, and board member in, the metals and mining industry since 2002 and she was the President and Chief Executive Officer of Sutter Gold Mining Inc. from November 2011 — June 2013. Previously, Dr. Baker was employed by Salomon Smith Barney where she was one of the top-ranked mining sector equity analysts in the United States. Dr. Baker is a graduate of the Colorado School of Mines (M.S. and Ph.D. in mineral economics). |

|||||

| Value of At-Risk Investment(1) $560,740 |

Board/Committee Memberships |

Attendance at Meetings during 2015 |

||

|---|---|---|---|---|

8,864 Common Shares |

Board of Directors Audit Committee (Chair) |

7/7 (100%) 5/5 (100%) |

||

| Area of Expertise |

Other Public Board Directorships |

Other Public Board Committee Memberships |

||

|---|---|---|---|---|

| Corporate Finance and Mineral Economics | Sutter Gold Mining Inc. | — | ||

| Reunion Gold Corporation | Audit Committee Compensation and Corporate Governance Committee |

|||

| McEwen Mining Inc. | Audit Committee Nominating and Corporate Governance Committee |

|||

|

| Sean Boyd, CPA, CA | Age: 57 | Non-Independent | ||||

| Toronto, Ontario | 2015 Voting Results: 99.67% | Director since 1998 | ||||

|

Mr. Boyd is the Vice-Chairman and Chief Executive Officer and a director of the Company. Mr. Boyd has been with the Company since 1985. Prior to his appointment as Vice-Chairman and Chief Executive Officer in April, 2015, he served as Vice-Chairman, President and Chief Executive Officer since February 2012; Mr. Boyd served as Vice-Chairman and Chief Executive Officer from 2005 to 2012 and as President and Chief Executive Officer from 1998 to 2005, Vice-President and Chief Financial Officer from 1996 to 1998, Treasurer and Chief Financial Officer from 1990 to 1996, Secretary Treasurer during a portion of 1990 and Comptroller from 1985 to 1990. Prior to joining the Company in 1985, he was a staff accountant with Clarkson Gordon (Ernst & Young). Mr. Boyd is a Chartered Accountant and a graduate of the University of Toronto (B.Comm.). |

|||||

| Value of At-Risk Investment(1) $15,889,332 |

Board/Committee Memberships |

Attendance at Meetings during 2015 |

||

|---|---|---|---|---|

86,210 Common Shares |

Board of Directors | 7/7 (100%) | ||

| Area of Expertise |

Other Public Board Directorships |

Other Public Board Committee Memberships |

||

|---|---|---|---|---|

| Executive Management and Finance | — | — | ||

5

|

| Martine A. Celej | Age: 50 | Independent | ||||

| Toronto, Ontario | 2015 Voting Results: 98.79% | Director since 2011 | ||||

|

Ms. Celej is a Vice-President, Investment Advisor with RBC Dominion Securities and has been in the investment industry since 1989. She is a graduate of Victoria College at the University of Toronto (B.A. (Honours)). |

|||||

| Value of At-Risk Investment(1) $670,572 |

Board/Committee Memberships |

Attendance at Meetings during 2015 |

||

|---|---|---|---|---|

5,189 Common Shares |

Board of Directors Compensation Committee |

7/7 (100%) 6/6 (100%) |

||

| Area of Expertise |

Other Public Board Directorships |

Other Public Board Committee Memberships |

||

|---|---|---|---|---|

| Investment Management | — | — | ||

|

| Robert J. Gemmell | Age: 59 | Independent | ||||

| Toronto, Ontario | 2015 Voting Results: 98.81% | Director since 2011 | ||||

|

Mr. Gemmell, now retired, spent 25 years as an investment banker in the United States and in Canada. Most recently, he was President and Chief Executive Officer of Citigroup Global Markets Canada and its predecessor companies (Salomon Brothers Canada and Salomon Smith Barney Canada) from 1996 to 2008. In addition, he was a member of the Global Operating Committee of Citigroup Global Markets from 2006 to 2008. Mr. Gemmell is a graduate of Cornell University (B.A.), Osgoode Hall Law School (LL.B) and the Schulich School of Business (MBA). |

|||||

| Value of At-Risk Investment(1) $1,047,707 |

Board/Committee Memberships |

Attendance at Meetings during 2015 |

||

|---|---|---|---|---|

13,169 Common Shares |

Board of Directors Compensation Committee (Chair) |

7/7 (100%) 6/6 (100%) |

||

| Area of Expertise |

Other Public Board Directorships |

Other Public Board Committee Memberships |

||

|---|---|---|---|---|

| Corporate Finance and Business Strategy | Newalta Corporation | Audit Committee Compensation Committee |

||

6

|

| Mel Leiderman, FCPA, FCA, TEP, ICD.D | Age: 63 | Independent | ||||

| Toronto, Ontario | 2015 Voting Results: 99.48% | Director since 2003 | ||||

|

Mr. Leiderman is the senior partner of the Toronto accounting firm Lipton LLP, Chartered Accountants. He is a graduate of the University of Windsor (B.A.) and is a certified director of the Institute of Corporate Directors (ICD.D). |

|||||

| Value of At-Risk Investment(1) $575,107 |

Board/Committee Memberships |

Attendance at Meetings during 2015 |

||

|---|---|---|---|---|

9,169 Common Shares |

Board of Directors Audit Committee |

7/7 (100%) 5/5 (100%) |

||

| Area of Expertise |

Other Public Board Directorships |

Other Public Board Committee Memberships |

||

|---|---|---|---|---|

| Audit and Accounting | Morguard North American Residential REIT | Audit Committee | ||

|

| Deborah McCombe, P. Geo. Age: 63 | Independent | |||||||

| Toronto, Ontario | 2015 Voting Results: 97.92% | Director since 2014 | ||||||

|

Ms. McCombe, P. Geo., is the President and CEO of Roscoe Postle Associates Inc. ("RPA"). She has over 30 years' international experience in exploration project management, feasibility studies, reserve estimation, due diligence studies and valuation studies. Prior to joining RPA, Ms. McCombe was Chief Mining Consultant for the Ontario Securities Commission and was involved in the development and implementation of National Instrument 43-101 — Standards of Disclosure for Mineral Projects ("NI 43-101"). She is actively involved in industry associations as a member of Committee for Mineral Reserves International Reporting Standards — (Canadian Institute of Mining, Metallurgy and Petroleum ("CIM")), President of the Association of Professional Geoscientists of Ontario (2010 — 2011); a Director of the Prospectors and Developers Association of Canada (1999 — 2011); a CIM Distinguished Lecturer on NI 43-101; a member of the CIM Standing Committee on Reserve Definitions; and is a member of the Canadian Securities Administrators Mining Technical Advisory and Monitoring Committee and is a Guest Lecturer at the Schulich School of Business, MBA in Global Mine Management at York University. Ms. McCombe holds a degree from the University of Western Ontario (Geology). |

|||||||

| Value of At-Risk Investment(1) $470,946 |

Board/Committee Memberships |

Attendance at Meetings during 2015 |

||

|---|---|---|---|---|

965 Common Shares |

Board of Directors Health, Safety, Environment and Sustainable Development (Chair) |

7/7 (100%) 4/4 (100%) |

||

| Area of Expertise |

Other Public Board Directorships |

Other Public Board Committee Memberships |

||

|---|---|---|---|---|

| Executive Management and Mining | — | — | ||

7

|

| James D. Nasso, ICD.D | Age: 82 | Independent | ||||

| Toronto, Ontario | 2015 Voting Results: 97.85% | Director since 1986 | ||||

|

Mr. Nasso is now retired and is a graduate of St. Francis Xavier University (B.Comm.). |

|||||

| Value of At-Risk Investment(1) $1,215,622 |

Board/Committee Memberships |

Attendance at Meetings during 2015 |

||

|---|---|---|---|---|

12,722 Common Shares |

Chairman of the Board of Directors Corporate Governance Committee Health, Safety, Environment and Sustainable Development Committee |

7/7 (100%) 4/4 (100%) 4/4 (100%) |

||

| Area of Expertise |

Other Public Board Directorships |

Other Public Board Committee Memberships |

||

|---|---|---|---|---|

| Management and Business Strategy | — | — | ||

|

| Dr. Sean Riley | Age: 62 | Independent | ||||

| Antigonish, Nova Scotia | 2015 Voting Results: 99.59% | Director since 2011 | ||||

|

Dr. Riley, now retired, served as President of St. Francis Xavier University from 1996 to 2014. Prior to 1996, his career was in finance and management, first in corporate banking and later in manufacturing. Dr. Riley is a graduate of St. Francis Xavier University (B.A. (Honours)) and of Oxford University (M. Phil, D. Phil, International Relations). |

|||||

| Value of At-Risk Investment(1) $653,370 |

Board/Committee Memberships |

Attendance at Meetings during 2015 |

||

|---|---|---|---|---|

4,825 Common Shares |

Board of Directors Audit Committee |

7/7 (100%) 5/5 (100%) |

||

| Area of Expertise |

Other Public Board Directorships |

Other Public Board Committee Memberships |

||

|---|---|---|---|---|

| Management and Business Strategy | — | — | ||

8

|

| J. Merfyn Roberts, CA | Age: 65 | Independent | ||||

| London, England | 2015 Voting Results: 98.63% | Director since 2008 | ||||

|

Mr. Roberts was a fund manager and investment advisor for more than 25 years and has been closely associated with the mining industry. From 2007 until his retirement in 2011, he was a senior fund manager with CQS Management Ltd. in London. Mr. Roberts is a graduate of Liverpool University (B.Sc., Geology) and Oxford University (M.Sc., Geochemistry) and is a member of the Institute of Chartered Accountants in England and Wales. |

|||||

| Value of At-Risk Investment(1) $916,277 |

Board/Committee Memberships |

Attendance at Meetings during 2015 |

||

|---|---|---|---|---|

11,388 Common Shares |

Board of Directors Corporate Governance Committee Compensation Committee |

7/7 (100%) 4/4 (100%) 6/6 (100%) |

||

| Area of Expertise |

Other Public Board Directorships |

Other Public Board Committee Memberships |

||

|---|---|---|---|---|

| Investment Management | Eastern Platinum Limited | Audit Committee | ||

| Blackheath Resources Inc. | — | |||

| Newport Exploration Limited | Audit Committee | |||

|

| Jamie C. Sokalsky, CPA, CA | Age: 58 | Independent | ||||

| Toronto, Ontario | 2015 Voting Results: N/A | Director since 2015 | ||||

|

Mr. Sokalsky served as the Chief Executive Officer and President of Barrick Gold Corporation from June 2012 to September 2014. He served as the Chief Financial Officer of Barrick Gold from 1999 to June 2012, and its Executive Vice President from April 2004 to June 2012. He has over 20 years of experience as a senior executive in the mining industry (in various positions of increasing responsibility at Barrick Gold), including finance, corporate strategy, project development and mergers, acquisitions and divestitures. He also served for 10 years at George Weston Limited and he began his Professional career at Ernst & Whinney Chartered Accountants, a predecessor of KPMG. Mr. Sokalsky received his CA designation in 1982 and his B. Comm is from Lakehead University. |

|||||

| Value of At-Risk Investment(1) $283,560 |

Board/Committee Memberships |

Attendance at Meetings during 2015 |

||

|---|---|---|---|---|

nil — Common Shares |

Board of Directors Audit Committee (was appointed to the Board and Audit Committee on June 2, 2015) |

3/3 (100%) 2/2 (100%) (was appointed to the Board and Audit Committee on June 2, 2015) |

||

| Area of Expertise |

Other Public Board Directorships |

Other Public Board Committee Memberships |

||

|---|---|---|---|---|

| Executive Management, Finance and Accounting | Probe Metals Inc. | Audit Committee Nominating and Corporate Governance Committee (Chair) |

||

| Pengrowth Energy Corporation | Audit Committee Reserves, Health, Safety & Environment |

|||

| Royal Gold Inc. | Audit Committee | |||

9

|

| Howard R. Stockford, P. Eng. Age: 74 | Independent | |||||||

| Toronto, Ontario | 2015 Voting Results: 98.73% | Director since 2005 | ||||||

|

Mr. Stockford is a retired mining executive with over 50 years of experience in the industry. Most recently, he was Executive Vice-President of Aur Resources Inc. ("Aur") and a director of Aur from 1984 until August 2007, when it was taken over by Teck Cominco Limited. Mr. Stockford has previously served as President of the CIM and is a member of the Association of Professional Engineers of Ontario, the Prospectors and Developers Association of Canada and the Society of Economic Geologists. Mr. Stockford is a graduate of the Royal School of Mines, Imperial College, London University, U.K. (B.Sc., Mining Geology). |

|||||||

| Value of At-Risk Investment(1) $669,911 |

Board/Committee Memberships |

Attendance at Meetings during 2015 |

||

|---|---|---|---|---|

9,175 Common Shares |

Board of Directors Compensation Committee Health, Safety, Environment and Sustainable Development Committee |

7/7 (100%) 6/6 (100%) 4/4 (100%) |

||

| Area of Expertise |

Other Public Board Directorships |

Other Public Board Committee Memberships |

||

|---|---|---|---|---|

| Executive Management and Mining | — | — | ||

|

| Pertti Voutilainen, M.Sc., M. Eng. | Age: 75 | Independent | ||||

| Espoo, Finland | 2015 Voting Results: 97.62% | Director since 2005 | ||||

|

Mr. Voutilainen is a mining industry veteran. Until 2005, he was the Chairman of the board of directors of Riddarhyttan Resources AB. Previously, Mr. Voutilainen was the Chairman of the board of directors and Chief Executive Officer of Kansallis Banking Group and President after its merger with Union Bank of Finland until his retirement in 2000. He was also employed by Outokumpu Corp., Finland's largest mining and metals company, for 26 years, including as Chief Executive Officer for 11 years. Mr. Voutilainen holds the honorary title of Mining Counselor (Bergsrad), which was awarded to him by the President of the Republic of Finland in 2003. Mr. Voutilainen is a graduate of Helsinki University of Technology (M.Sc.), Helsinki University of Business Administration (M.Sc.) and Pennsylvania State University (M. Eng.). |

|||||

| Value of At-Risk Investment(1) $756,160 |

Board/Committee Memberships |

Attendance at Meetings during 2015 |

||

|---|---|---|---|---|

10,000 Common Shares |

Board of Directors Corporate Governance Committee (Chair) |

7/7 (100%) 4/4 (100%) |

||

| Area of Expertise |

Other Public Board Directorships |

Other Public Board Committee Memberships |

||

|---|---|---|---|---|

| Mining and Finance | — | — | ||

- (1)

- Indicates the total market value of common shares and RSUs held by a director based on the closing price of the Company's common shares on the Toronto Stock Exchange (the "TSX") of $47.26 on March 11, 2016, the record date for the Meeting.

10

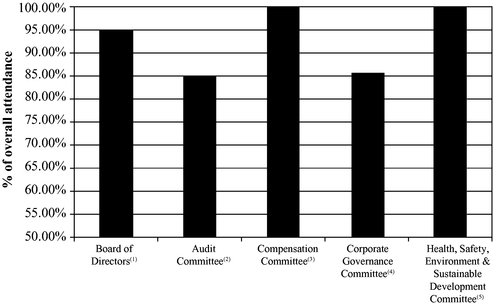

Overall Meeting Attendance

The attendance by each nominee for election as director at Board of Directors and Committee meetings in 2015 is indicated in the biography of each individual director. The overall meeting attendance in 2015 is set out below.

2015 Board and Committee Meetings

- (1)

- Board

of Directors: 12 members for 7 meetings (95% attendance)*

- (2)

- Audit

Committee: 4 members for 5 meetings (85% attendance)*

- (3)

- Compensation

Committee: 4 members for 6 meetings (100% attendance)

- (4)

- Corporate

Governance Committee: 4 members for 2 meetings; 3 members for 2 meetings (86% attendance)*

- (5)

- Health,

Safety, Environment and Sustainable Development Committee: 3 members for 4 meetings (100% attendance)

- *

- Mr. Bernard Kraft, a member of the Board of Directors and Audit and Corporate Governance Committees, resigned due to health reasons in June 2015 and was the only Director to miss any Board or Committee meetings in 2015. Mr. Jamie Sokalsky was appointed to the Board of Directors and the Audit Committee on June 2, 2015.

Compensation of Directors and Other Information

Mr. Boyd, who is a director and the Vice-Chairman and Chief Executive Officer of the Company, does not receive any remuneration for his services as director of the Company.

The table below sets out the annual retainers (annual retainers for the Chairs of the Board of Directors and other Committees are in addition to the base annual retainer) paid to the directors during the year ended December 31, 2015. Directors do not receive meeting attendance fees.

| |

Compensation during the year ending December 31, 2015 |

|||

|---|---|---|---|---|

Annual Board of Directors retainer (base) |

$ | 120,000 | ||

Additional Annual retainer for Chairman of the Board of Directors |

$ | 120,000 | ||

Additional Annual retainer for Chairman of the Audit Committee |

$ | 25,000 | ||

Additional Annual retainer for Chairs of other Board Committees |

$ | 10,000 | ||

Effective as of July 1, 2011, director compensation was amended to more closely align the equity component of director compensation with shareholder interests by discontinuing the former practice of granting Options to non-executive directors and replacing such Option grants with grants of RSUs. As the value of RSUs tracks the

11

value of the Company's common shares, the equity value of director compensation now corresponds directly with share price movements, thereby more closely aligning director and shareholder interests.

In January of each year since 2012, each non-executive director was entitled to receive an annual grant of 3,000 RSUs (the Chairman of the Board of Directors was entitled to receive 5,000 RSUs; increased to 6,000 RSUs effective January, 2015). However, if a director meets the minimum common share ownership requirement (as described under "Director Shareholding Guidelines" below), he or she can elect to receive cash in lieu of a portion of the RSUs to be granted, subject to receipt of a minimum annual grant of 1,000 RSUs.

Director Shareholding Guidelines

To more closely align the interests of directors with those of shareholders, directors (other than Mr. Boyd, who is subject to the Chief Executive Officer ("CEO") shareholding requirements set out under "Share Ownership" on page 32 of this Circular) are required to own a minimum of 10,000 common shares of the Company and/or RSUs. Directors have a period of the later of: (i) two years from the date of adoption of this policy (that is, a compliance date of August 24, 2015) or (ii) five years from the date of joining the Board of Directors, to achieve this ownership level through open market purchases of common shares or grants of RSUs.

As of March 11, 2016, all of the directors have satisfied the minimum common share ownership requirement, other than Ms. McCombe, who has until February 12, 2019 and Mr. Sokalsky, who has until June 2, 2020 (being five years from the date of each respectively becoming a director), to satisfy the minimum common share ownership requirement.

The following table sets out the number and the value of common shares and RSUs held by each director of the Company.

| |

Aggregate common shares and RSUs owned by each director and aggregate value thereof as of March 11, 2016 |

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Name

|

Aggregate Number of Common Shares |

Aggregate Value of Common Shares(1) |

Aggregate Number of RSUs |

Aggregate Value of RSUs(1) |

Deadline to meet Guideline |

|||||||||

| |

(#) |

($) |

(#) |

($) |

|

|||||||||

Leanne M. Baker |

8,864 | 418,913 | 3,001 | 141,827 | Meets Guideline | |||||||||

Sean Boyd |

86,210 | 4,074,285 | 250,001 | 11,815,047 | Meets CEO Guideline(2) | |||||||||

Martine A. Celej |

5,189 | 245,232 | 9,000 | 425,340 | Meets Guideline | |||||||||

Robert J. Gemmell |

13,169 | 622,367 | 9,000 | 425,340 | Meets Guideline | |||||||||

Mel Leiderman |

9,169 | 433,327 | 3,000 | 141,780 | Meets Guideline | |||||||||

Deborah McCombe(3) |

965 | 45,606 | 9,000 | 425,340 | February 12, 2019 | |||||||||

James D. Nasso |

12,722 | 601,242 | 13,000 | 614,380 | Meets Guideline | |||||||||

Sean Riley |

4,825 | 228,030 | 9,000 | 425,340 | Meets Guideline | |||||||||

John Merfyn Roberts |

11,388 | 538,197 | 8,000 | 378,080 | Meets Guideline | |||||||||

Jamie C. Sokalsky(4) |

nil | nil | 6,000 | 283,560 | June 2, 2020 | |||||||||

Howard R. Stockford |

9,175 | 433,611 | 5,000 | 236,300 | Meets Guideline | |||||||||

Pertti Voutilainen |

10,000 | 472,600 | 6,000 | 283,560 | Meets Guideline | |||||||||

- (1)

- The

valuation is calculated based on the closing price of the Company's common shares on the TSX of $47.26 on March 11, 2016.

- (2)

- Mr. Boyd

is subject to the CEO shareholding requirements set out under "Share Ownership" on page 32 of this Circular.

- (3)

- Ms. McCombe

joined the Board of Directors on February 12, 2014.

- (4)

- Mr. Sokalsky joined the Board of Directors on June 2, 2015

12

The following table sets out the compensation provided to the members of the Board of Directors, other than Mr. Boyd, for the Company's most recently completed financial year.

Director Compensation Table — 2015

Name

|

Fees Earned | Share-Based Awards(1) |

Option-Based Awards(2) |

Non-Equity Incentive Plan Compensation(3) |

Pension Value |

All Other Compensation |

Total(4) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

($) |

($) |

($) |

($) |

($) |

($) |

($) |

|||||||||||

Leanne M. Baker |

145,000 | 27,910 | n/a | 55,820 | n/a | n/a | 228,730 | |||||||||||

Martine A. Celej |

120,000 | 83,730 | n/a | nil | n/a | n/a | 203,730 | |||||||||||

Robert Gemmell |

130,000 | 83,730 | n/a | nil | n/a | n/a | 213,730 | |||||||||||

Bernard Kraft(5) |

120,000 | 27,910 | n/a | 55,820 | n/a | n/a | 203,730 | |||||||||||

Mel Leiderman |

120,000 | 27,910 | n/a | 55,820 | n/a | n/a | 203,730 | |||||||||||

Deborah McCombe |

130,000 | 83,730 | n/a | nil | n/a | n/a | 213,730 | |||||||||||

James D. Nasso |

240,000 | 167,460 | n/a | nil | n/a | n/a | 407,460 | |||||||||||

Sean Riley |

120,000 | 83,730 | n/a | nil | n/a | n/a | 203,730 | |||||||||||

John Merfyn Roberts |

120,000 | 83,730 | n/a | nil | n/a | n/a | 203,730 | |||||||||||

Jamie C. Sokalsky(6) |

70,000 | 114,840 | n/a | nil | n/a | n/a | 184,840 | |||||||||||

Howard R. Stockford |

120,000 | 83,730 | n/a | nil | n/a | n/a | 203,730 | |||||||||||

Pertti Voutilainen |

130,000 | 55,820 | n/a | 27,910 | n/a | n/a | 213,730 | |||||||||||

- (1)

- The

valuation of the grants of RSUs was calculated based on the simple average of the high and low trading prices of the Company's common shares on the TSX

for the 5 day trading period immediately prior to the grant date. For each director other than Mr. Sokalsky, RSUs were granted on January 4, 2015 with a valuation of $27.91 per

RSU. For Mr. Sokalsky, RSUs were granted on June 15, 2015 with a valuation of $38.28 per RSU.

- (2)

- Option-based

awards are no longer granted to non-executive directors.

- (3)

- A

director who satisfies the minimum shareholding requirement may elect to receive cash in lieu of a portion of his or her grant of RSUs.

- (4)

- Set

out in Canadian dollars. On December 31, 2015 the noon buying rate as reported by the Bank of Canada (the "Noon Buying Rate") was C$1.00

equals US$1.3840.

- (5)

- Mr. Kraft

resigned in June, 2015.

- (6)

- Mr. Sokalsky did not become a Director until June 2, 2015.

The following table sets out the value vested during the most recently completed financial year of the Company of incentive plan awards granted to the directors of the Company, other than Mr. Boyd.

Incentive Plan Awards Table — Value Vested During Fiscal Year 2015

Name

|

Option-Based Awards — Value Vested During the Year |

Share-Based Awards — Value Vested During the Year |

Non-Equity Incentive Plan Compensation — Value Earned During the Year |

|||

|---|---|---|---|---|---|---|

| |

($) |

($) |

($) |

|||

Leanne M. Baker |

nil | 75,292 | 55,820 | |||

Martine A. Celej |

nil | 109,692 | nil | |||

Robert Gemmell |

nil | 109,692 | nil | |||

Bernard Kraft(1) |

nil | 109,291 | 55,820 | |||

Mel Leiderman |

nil | 109,692 | 55,820 | |||

Deborah McCombe(2) |

nil | nil | nil | |||

James D. Nasso |

nil | 36,552 | nil | |||

Sean Riley |

nil | 109,692 | nil | |||

John Merfyn Roberts |

nil | 109,692 | nil | |||

Jamie Sokalsky(3) |

nil | nil | nil | |||

Howard R. Stockford |

nil | 36,552 | nil | |||

Pertti Voutilainen |

nil | 36,552 | 27,910 |

- (1)

- Mr. Kraft

resigned in June, 2015. In accordance with the provisions of the RSU Plan, all RSUs held by Mr. Kraft vested upon his resignation.

- (2)

- Ms. McCombe

joined the Board of Directors on February 12, 2014 and did not hold any RSUs which vested in 2015.

- (3)

- Mr. Sokalsky did not become a Director until June 2, 2015 and did not hold any RSUs which vested in 2015.

13

The following table sets out the outstanding Option awards and RSUs of the directors of the Company, other than Mr. Boyd, as at December 31, 2015.

Outstanding Incentive Plan Awards Table — 2015

| |

Option-Based Awards | Share-Based Awards | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Name

|

Number of Securities Underlying Unexercised Options |

Option Exercise Price |

Option Expiration Date |

Value of Unexercised In-The-Money Options(1) |

Number of Shares or Units of Shares that have not Vested |

Market or Payout Value of Share-Based Awards that have not Vested(1) |

||||||||||||

| |

(#) |

($) |

|

($) |

(#) |

($) |

||||||||||||

Leanne M. Baker(2) |

5,824 | 76.70 | 1/4/2016 | nil | 2,000 | 52,560 | ||||||||||||

Martine A. Celej |

4,721 | 70.26 | 2/21/2016 | nil | 6,000 | 218,220 | ||||||||||||

Robert Gemmell |

5,824 | 76.60 | 1/4/2016 | nil | 6,000 | 218,220 | ||||||||||||

Bernard Kraft(3) |

5,824 | 76.60 | 1/4/2016 | nil | nil | nil | ||||||||||||

Mel Leiderman |

5,824 | 76.60 | 1/4/2016 | nil | 2,000 | 72,740 | ||||||||||||

Deborah McCombe |

nil | nil | nil | nil | 6,000 | 218,220 | ||||||||||||

James D. Nasso |

5,824 | 76.60 | 1/4/2016 | nil | 7,000 | 254,590 | ||||||||||||

Sean Riley |

5,824 | 76.60 | 1/4/2016 | nil | 6,000 | 218,220 | ||||||||||||

John Merfyn Roberts |

5,824 | 76.60 | 1/4/2016 | nil | 6,000 | 218,220 | ||||||||||||

Jamie Sokalsky |

nil | nil | nil | nil | 3,000 | 109,110 | ||||||||||||

Howard R. Stockford |

5,824 | 76.60 | 1/4/2016 | nil | 4,000 | 145,480 | ||||||||||||

Pertti Voutilainen |

5,824 | 76.60 | 1/4/2016 | nil | 5,000 | 181,850 | ||||||||||||

- (1)

- Based

on a closing price of the Company's common shares on the TSX of $36.37 on December 31, 2015. On December 31, 2015 the noon buying rate

was C$1.00 equals to US$1.3840.

- (2)

- The

value of Dr. Baker's awards is in United States dollars and based on a closing price of the Company's common shares on the New York

Stock Exchange (the "NYSE") of US$26.28 on December 31, 2015.

- (3)

- Mr. Kraft resigned in June, 2015.

In 2009, shareholders of the Company approved an amendment to the Incentive Share Purchase Plan to prohibit participation by non-executive directors. In 2015, shareholders of the Company approved an amendment to the Stock Option Plan providing that non-executive directors would no longer be eligible to receive Options. No Options have been granted to non-executive directors since 2011.

14

The following table sets out the attendance of each of the directors to the Board of Directors meetings and the Board Committee meetings held in 2015.

Director

|

Board Meetings Attended |

Committee Meetings Attended |

|||||

|---|---|---|---|---|---|---|---|

Leanne M. Baker |

7 of 7 | 5 of 5 | |||||

Sean Boyd |

7 of 7 | n/a | |||||

Martine A. Celej |

7 of 7 | 6 of 6 | |||||

Robert Gemmell |

7 of 7 | 6 of 6 | |||||

Bernard Kraft(1) |

0 of 3 | 0 of 5 | |||||

Mel Leiderman |

7 of 7 | 5 of 5 | |||||

Deborah McCombe |

7 of 7 | 4 of 4 | |||||

James D. Nasso |

7 of 7 | 8 of 8 | |||||

John Merfyn Roberts |

7 of 7 | 4 of 4 | |||||

Sean Riley |

7 of 7 | 5 of 5 | |||||

Jamie Sokalsky(2) |

3 of 3 | 2 of 2 | |||||

Howard R. Stockford |

7 of 7 | 10 of 10 | |||||

Pertti Voutilainen |

7 of 7 | 4 of 4 | |||||

- (1)

- Mr. Kraft

resigned due to health reasons in June, 2015.

- (2)

- Mr. Sokalsky became a Director and a Member of the Audit Committee on June 2, 2015.

Cease Trade Orders and Bankruptcies

To the Company's knowledge, as at March 11, 2016 or within the last ten years, no proposed director of the Company is or has been:

- (a)

- a

director, chief executive officer or chief financial officer of any company (including the Company):

- (i)

- subject

to an order (including a cease trade order, an order similar to a cease a trade order or an order that denied the relevant company access to any

exemption under securities legislation) for a period of more than 30 consecutive days, that was issued while the proposed director was acting in the capacity as director, chief executive

officer or chief financial officer; or

- (ii)

- subject

to an order (including a cease trade order, an order similar to a cease trade order or an order that denied the relevant company access to any

exemption under securities legislation) for a period of more than 30 consecutive days, that was issued after the proposed director ceased to be a director, chief executive officer or chief

financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer; or

- (b)

- a director or executive officer of any company (including the Company), that while that person was acting in that capacity or within a year of the person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets,

except as follows:

Mr. Leiderman, a director of the Company, was a director of Colossus Minerals Inc. ("Colossus") from August 1, 2011 until his resignation on November 13, 2013. On February 7, 2014, Colossus filed a proposal to its creditors under the Bankruptcy and Insolvency Act (Canada). On April 30, 2014, Colossus Minerals Inc. announced that it had completed the implementation of the previously announced court-approved proposal and plan of reorganization filed under the Bankruptcy and Insolvency Act (Canada).

15

Board of Directors Governance Matters

Diversity

The Board of Directors recognizes that diversity is important to ensuring that the Board as a whole possesses the qualities, attributes, experience and skills to effectively oversee the strategic direction and management of the Company. The Board recognizes and embraces the benefits of being diverse, and has identified diversity within the Board as an essential element in attracting high caliber directors and maintaining a high functioning Board. The Board considers diversity to include different genders, ages, cultural backgrounds, race/ethnicity, geographic areas and other characteristics of its stakeholders and the communities in which the Company is present and conducts its business. To that end, in February 2015, the Board considered and, on the recommendation of the Corporate Governance Committee, adopted a Board of Directors Diversity Policy, setting out various diversity criteria the Board and Corporate Governance Committee will consider in identifying, assessing and selecting potential nominees for the Board. Pursuant to the Policy, "diversity" includes gender and the other characteristics outlined above, and provides a framework and criteria for the Corporate Governance Committee and the Board to review and assess the composition of the Board and its Committees and to identify, evaluate and recommend potential new directors. In new director appointments and ongoing evaluations of the effectiveness of the Board, its Committees and each director, the Corporate Governance Committee and the Board will take into consideration diversity as one of many factors in order to maintain an appropriate mix and balance of diversity, attributes, skills, experience and background on the Board of Directors and its Committees. Ultimately, Board appointments are based on merit against objective criteria and with due regard to the benefits of diversity in board composition and the desire to maximize the effectiveness of corporate decision-making, having regard to the best interests of the Company and its strategies and objectives, including the interests of its shareholders and other stakeholders. The Corporate Governance Committee is charged with overseeing the implementation of the Policy and monitoring and annually reporting to the Board of Directors on the diversity of the Board and its Committees to determine the Policy's effectiveness and the Company's progress is fostering diversity at the board level.

The Board has not set any fixed percentages for any specific selection criteria as it believes that quotas or strict rules do not necessarily result in the identification or selection of the best candidates but, rather, all factors should be considered when assessing and determining the merits of an individual director and the composition of a high functioning Board. The proportion of women on the Board is currently 27% (3 of 11) of the non-executive directors, the proportion of non-resident Canadians is currently 27% (3 of 11) of the non-executive directors, the proportion of women on the entire Board of Directors is currently 25% (3 of 12) of all directors and the proportion of women committee chairs is currently 50% (2 of 4). The Board believes that the diversity represented by the directors seeking election at the meeting in terms of gender, age, education, skills, geographic representation and competencies supports an efficient and effective Board and best complement the Company's strategies and objectives.

The Board does not currently have a director term limit policy or similar mechanisms in place for forcing the renewal or replacement of its directors. Rather, it has determined that the best means of ensuring director effectiveness is through rigorous annual performance evaluations. The Corporate Governance Committee will continue to monitor, evaluate and assess best corporate governance practices and proposals with respect to board renewal mechanisms having regard to, among other things, the performance of individual directors, the Board and to the best interests of the Company. As discussed in greater detail under "Appendix A: Statement of Corporate Governance Practices — Assessment of Directors", the Board has adopted a resignation policy primarily based on the directors' performance, commitment, skills and experience in order to foster an appropriate level of renewal and diversity of perspectives at the board level.

Women in Leadership

The Board and executive management view diversity and inclusion as essential to the growth and success of the Company. In support of this view, we have included a clear statement on the value of diversity in our sustainable development policy.

16

Creating an inclusive environment where the diversity of perspectives, experiences, cultures, genders, age and skills of employees can be leveraged at every level is critical and the Company believes that one of its strengths lies in its ability to leverage the diversity of its employees to drive innovation and to quickly adapt to the ongoing changes in the global market and the gold mining industry. With this in mind, executive management has identified increasing the number of women in leadership positions within the Company as a priority to be achieved by focusing on the preparation and support of women in leadership positions, rather than the attainment of quotas.

In 2015, we participated in a number of industry forums on the subject of women in mining, providing us with insight into the challenges faced by the industry and some best practices in addressing these challenges.

We have since partnered with the Mining Industry Human Resources Council on a Gender Equity in Mining (GEM) Project that will identify and work to mitigate the systemic barriers to the participation and advancement of women in the mining industry in Canada. Agnico has acted as an advisory partner in developing the toolkit and training that will be used to assess and address these barriers, and we have identified an internal Gender Equity Change Agent that will pilot this project in our Northern Operations.

We have also continued our efforts to increase the number of women entering our workforce particularly in our professional technical roles. In 2015, women represented 30% of our hires in this category globally as compared to 19% in 2014 and 9% in 2013. In Finland, we participated in a project with Lapland Vocational College which was executed under the authority of Lapland's Centre of Economic Development, Transport and the Environment, where women were specifically trained for positions typically occupied by men. Agnico participated by providing internship opportunities for women in the program, and subsequently hired four participants to work in our underground operations.

Over the short term, we will take what we have learned from the pilot Gender Equity in Mining (GEM) Project for application in other parts of our business. We will also begin to raise awareness, particularly at our management level on the subject of diversity and gender equity and what we can do internally to promote a more inclusive work experience for everyone.

Appointment of Auditors

The persons named in the enclosed form of proxy intend to VOTE FOR the appointment of Ernst & Young LLP as the Company's auditors, and for the directors to fix the remuneration of the auditors unless a shareholder has specified in his or her proxy that his or her common shares are to be withheld from voting for the appointment of Ernst & Young LLP as the Company's auditors. Representatives of Ernst & Young LLP are expected to be present at the meeting to respond to appropriate questions and make a statement if they wish to do so. Ernst & Young LLP became the Company's auditors in 1983. Fees paid to Ernst & Young LLP for 2015 and 2014 are set out below.

| |

Year ended December 31, 2015 |

Year ended December 31, 2014 |

|||||

|---|---|---|---|---|---|---|---|

| |

($ thousands) |

($ thousands) |

|||||

Audit fees |

2,305 | 2,489 | |||||

Audit related fees |

222 | 23 | |||||

Tax consulting fees |

308 | 1,475 | |||||

All other fees |

214 | 752 | |||||

Total |

3,049 | 4,739 | |||||

Audit fees were paid for professional services rendered by the auditors for the audit of the Company's annual financial statements and related statutory and regulatory filings and for the quarterly review of the Company's interim financial statements. Audit fees also include prospectus- related fees for professional services rendered by the auditors in connection with corporate financing activities. These services consisted of the audit or review, as required, of financial statements included in the prospectuses, the review of documents filed with

17

securities regulatory authorities, correspondence with securities regulatory authorities and all other services required by regulatory authorities in connection with the filing of these documents.

Audit-related fees consist of fees paid for assurance and related services performed by the auditors that are reasonably related to the performance of the audit of the Company's financial statements. This includes consultation with respect to financial reporting, accounting standards and compliance with Section 404 of the Sarbanes-Oxley Act of 2002 ("SOX").

Tax fees were paid for professional services relating to tax compliance, tax advice and tax planning. These services included the review of tax returns and tax planning and advisory services in connection with international and domestic taxation issues.

All other fees were paid for services other than the services described above and include fees for professional services rendered by the auditors in connection with the conversion to IFRS and for the translation of securities regulatory filings required to comply with securities laws in certain Canadian jurisdictions.

No other fees were paid to auditors in the previous two years.

The Audit Committee has adopted a policy that requires the pre-approval of all fees paid to Ernst & Young LLP prior to the commencement of the specific engagement, and all fees referred to above were pre-approved in accordance with such policy.

Financial Statements

The audited annual financial statements for the year ended December 31, 2015 have been mailed to the Company's shareholders with this Circular.

Amendments to the Stock Option Plan

The Stock Option Plan provides participants with an incentive to enhance shareholder value by providing a form of compensation that is tied to increases in the market value of the Company's common shares. Details on the Stock Option Plan can be found on page 37 of this Circular.

Currently, the Company has reserved 27,800,000 common shares for issuance under the Stock Option Plan. As at March 11, 2016, 25,103,979 Options have been granted under the Stock Option Plan (not including Options that were granted but subsequently cancelled or expired), with 2,696,021 Options available for future grants, representing 11.4% and 1.2%, respectively, of the 220,906,030 common shares issued and outstanding as at March 11, 2016. As at March 11, 2016, 9,561,989 Options granted under the Stock Option Plan were unexercised and 15,541,990 Options granted under the Stock Option Plan had been exercised, representing 4.3% and 7.1%, respectively, of the 220,906,030 common shares issued and outstanding as at such date.

The need to attract and retain skilled employees remains particularly important at this time, as the Company continues to optimize and attempts to expand its multi-mine platform. The Company considers grants of Options under the Stock Option Plan to be a key factor in its ability to attract and retain skilled and experienced personnel at many levels. This is reflected by the granting of Options not only to officers, but also to a large number of other employees to enhance their incentive to continue to grow per share value. In 2015, 192 employees were granted Options (162 in 2014; 164 in 2013).

The Company's practice of granting Options to employees even at a mid-level of management is a fundamental compensation tenet and it is important that the number of Options available to be granted under the Stock Option Plan be increased to maintain this practice and thereby fostering the growth and performance of the Company.

The aggregate number of outstanding Options as at December 31, 2015 was 12,082,212, representing 5.6% of the common shares issued and outstanding as at December 31, 2015, and 3,068,080 Options were granted in 2015 representing 1.4% of all common shares issued and outstanding as at December 31, 2015.

The Compensation Committee is recommending to increase the number of common shares reserved for issuance under the Stock Option Plan by 3,500,000 common shares from 27,800,000 common shares to

18

31,300,000 common shares, representing 1.6%, 12.6% and 14.2%, respectively, of the 220,906,030 common shares issued and outstanding as at March 11, 2016. At the meeting, shareholders will be asked to consider an ordinary resolution (attached to this Circular as Appendix B) to approve this proposed amendment to the Stock Option Plan. If the resolution is approved, the number of common shares available for future Option grants will be 6,196,021, representing 2.8% of the 220,906,030 common shares issued and outstanding as at March 11, 2016.

The TSX requires that the resolution amending the Stock Option Plan be passed by the affirmative vote of at least a majority of the votes cast, by proxy or in person. In addition to shareholder approval, the proposed amendments are subject to regulatory approval. If you do not indicate how you want your common shares to be voted, the persons named in the enclosed form of proxy intend to vote your common shares FOR the proposed amendments to the Stock Option Plan.

The Company has two security based compensation arrangements pursuant to which common shares may be issued from treasury:

- 1.

- the

Stock Option Plan pursuant to which 15,758,010 common shares are issuable, if the resolution is approved, representing 7.1% of the Company's

issued and outstanding common shares as of March 11, 2016; and

- 2.

- the Incentive Share Purchase Plan pursuant to which 1,899,748 common shares are issuable, representing 0.9% of the Company's issued and outstanding common shares as of March 11, 2016.

Accordingly, if the resolution is approved, an aggregate number of 17,657,758 common shares will be issuable under all security based compensation arrangements of the Company, representing 8.0% of the Company's issued and outstanding common shares as of March 11, 2016.

Advisory Vote on Approach to Executive Compensation

The Board of Directors believes that the Company's compensation program must be competitive with companies in its peer group, provide a strong incentive to its executives to achieve the Company's goals and align the interests of management with the interests of the Company's shareholders. A detailed discussion of the Company's executive compensation program is provided under "Compensation Discussion & Analysis" starting on page 22 of this Circular. In line with recent developments and emerging governance trends in respect of executive compensation, commonly known as "Say on Pay", the Board of Directors has determined to provide shareholders with a "Say on Pay" advisory vote at the meeting to endorse or not endorse the Company's approach to executive compensation. At the Company's last annual and special meeting of shareholders held on May 1, 2015, 77.16% of shareholders voted in favour of the Company's non-binding resolution on executive compensation (up from 76.86% at the May 1, 2014 meeting), indicating a slight increase in support for the Company's approach to executive compensation. The Company has made adjustments to its compensation program (most notably, the adoption of performance share units and the reduction of the severance multiple from 2.5 times to 2.0 times relating to severance payments in executive employment agreements) based on the feedback it has received and believes the compensation program adopted properly incorporates the concept of reward for performance and the objective of more directly aligning the interests of management with the interests of shareholders. The Company will endeavor to assess and refine this approach in an effort to continue to make the executive compensation practices of the Company acceptable to shareholders.

At the meeting, shareholders will be asked to consider the following resolution, which is also attached to this Circular as Appendix D:

BE IT RESOLVED THAT, on an advisory basis and not to diminish the role and responsibilities of the Board of Directors of the Company, the shareholders accept the approach to executive compensation disclosed in this Circular.

Because this vote is advisory, it will not be binding upon the Board of Directors. However, the Board of Directors and the Compensation Committee will take the outcome of the vote into account in their ongoing review of executive compensation.

19

SECTION 3: COMPENSATION AND OTHER INFORMATION

Letter from the Compensation Committee

March 11, 2016

Dear Fellow Shareholders

"Pay-for-performance" and "alignment with shareholders" are two philosophies which traditionally have formed the foundation of our executive compensation practices. While our performance in 2015 compared to our peer group was strong (and has been for many years), we continue to take a measured approach to compensation to reflect not only our absolute and relative performance but the realities of prevailing market conditions.

This letter describes the performance of the Company in 2015, how the Compensation Committee assesses performance and compensation and what steps the Compensation Committee and Board have taken to more fully align the Company's compensation programs with best market practices and shareholder interests.

2015 Performance

While the gold market in general suffered a difficult year in 2015, the Company outperformed its peers. Record gold production of 1,671,340 ounces was achieved with total cash costs per ounce and all-in sustaining costs per ounce below guidance. In addition to record gold production, record safety performance was also achieved, demonstrating that the mines were well managed and met expectations while still maintaining a focus on the safety of our people. Net debt was reduced by US$190 million and the pipeline of potential future production was strengthened, including a 119% increase in inferred mineral resources at Amaruq and the discovery of the Sisar Zone at Kittila. This performance contributed to the Company having a Total Shareholder Return in 2015 of 27%, compared to the average of -24% for our peer group.

2015 Compensation

While the Company performed very well in 2015, we are conscious of the difficulties generally being experienced by shareholders in the gold industry. Accordingly, we have strived to achieve a measured approach in rewarding management performance in such a challenging environment. We think that the total compensation awarded to the Named Executive Officers ("NEOs") in 2015 is supported by the performance in a year in which Total Shareholder Return exceeded the peer group average by 51% (27% compared to -24%) and the market capitalization of the Company increased by more than $1.7 billion.

2016 Compensation Adjustments

Several years ago, we began a phased program of replacing the granting of options with the granting of restricted share units to more closely align executive interests with shareholder interests. While the quantum of the Company's compensation had not been an issue, the lack of performance hurdles in long term incentive awards was a source of concern for certain of our shareholders and we have now addressed this. After discussions with certain of our shareholders and upon review of the preferred policies of certain corporate governance groups, we have now introduced performance share units ("PSUs") to increase the "at risk" element in long term incentive awards. In 2016, the long term incentive awards granted to the Chief Executive Officer were allocated fifty percent to PSUs and fifty percent to RSUs.

We believe our approach in setting the performance hurdles and metrics of the PSUs is a good balance between market performance (75% allocation) and achieving internal objectives (25% allocation). 2016 is our first year of granting PSUs and we will monitor and assess the allocation balance and hurdle metrics to ensure that appropriate criteria are being applied.

Certain corporate governance groups have also advocated that severance multiples should not exceed 2.0 times. Notwithstanding that the severance multiple of 2.5 times had been set out in the employment

20

agreements of our NEOs for, in some cases, more than 20 years, we have amended the executive employment agreements to reduce the multiple to 2.0 times.

Conclusion

The Board and Compensation Committee believe that the compensation practices of the Company achieve the objectives of "pay-for-performance" and "alignment with shareholders". The Board and management remains committed to delivering superior performance in a challenging environment, for the benefit of you, our owners.

We trust that you agree with our approach and we look forward to continuing to deliver value to you.

|

|

|

|

|||

Robert Gemmell (Chair) |

Martine Celej | J. Merfyn Roberts | Howard Stockford |

21

Compensation Discussion & Analysis

A key compensation objective of the Company is that compensation should be aligned with performance. In 2015, the Company, among other things,:

- •

- produced a record number of gold ounces (1,671,340) — the fourth consecutive year in

which gold production exceeded the original guidance for the year;

- •

- produced these ounces at total cash costs per ounce of US$567 (below original guidance of total cash costs per ounce of

US$620 and the operating budget);

- •

- increased gold reserve grades at LaRonde, Canadian Malartic, Goldex and La India; inferred mineral resources increased

by 23%;

- •

- inferred mineral resources increased by 119% at Amaruq (Nunavut);

- •

- initial inferred gold resources declared at El Barqueño (Mexico) and at the Sisar Zone at Kittila

(Finland);

- •

- acquisitions and investments made and a joint venture entered into to strengthen the project pipeline;

- •

- reduced net debt by US$190 million; and

- •

- achieved record safety performance.

The Compensation Committee begins to review corporate and management performance in October of each year and, after several meetings over the succeeding months, finalizes its review and analyses in early December and submits its compensation adjustment recommendations to the Board of Directors in mid-December. The Board of Directors considers the recommendations and, traditionally, compensation adjustments are made as follows: (i) base salary — any adjustment becomes effective on January 1 of the next calendar year; (ii) bonus — any bonus payment is made within that calendar year (which reflects performance relating to that year); and (iii) any long term incentive grants (RSUs, PSUs or options) relating to performance in the current year are awarded early in January of the next calendar year.

Compensation Program Philosophy

The executives of the Company have a significant influence on corporate performance and creating shareholder value. With this in mind, the Company's philosophy regarding compensation is that it must:

- •

- align the interests of management with the interests of the Company's shareholders;

- •

- be competitive in order to attract and retain employees with the skills and commitment needed to lead and grow the

Company's business; and

- •

- provide a strong incentive to achieve the Company's goals.

Elements of Compensation

The compensation paid to the Company's executives has four components:

- •

- base salary and benefits;

- •

- annual incentive compensation (bonuses);

- •

- long-term incentive compensation through the grant of RSUs, PSUs and Options and participation in the Incentive Share

Purchase Plan; and

- •

- career compensation in the form of retirement benefits.

The Compensation Committee reviews each component of compensation for each officer and makes compensation recommendations to the Board of Directors. In its evaluation of each officer, the Compensation Committee considers, among other things, executive compensation surveys, recommendations by any executive compensation consultant retained by the Compensation Committee, evaluations prepared by the Vice-Chairman

22

and Chief Executive Officer, as applicable, for each officer other than the Vice-Chairman and Chief Executive Officer and an evaluation prepared by the Chairman for the Vice-Chairman and Chief Executive Officer. The Board of Directors reviews the recommendations and gives final approval on the compensation of the Company's officers. The Board of Directors has complete discretion over the amount and composition of each officer's compensation.

In 2015, the Company's Human Resources department conducted an internal market analysis using publicly available information from the Company's peer group and surveys provided by different compensation firms, notably the 2015 Mercer Mining Industry Compensation Survey "Mining Industry Salary Survey — Corporate Report" (the "Mercer Mining Survey"). The information was used by the Compensation Committee and the Board of Directors in recommending and approving the salary adjustments to market and the bonus targets for the Company's officers.