Form 6-K AGNICO EAGLE MINES LTD For: Dec 31

QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2015.

Commission File Number 001-13422

AGNICO EAGLE MINES LIMITED |

145 King Street East, Suite 400, Toronto, Ontario M5C 2Y7 |

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F |

o | Form 40-F | ý |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101 (b)(1):

Note: Regulation S-T Rule 101 (b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101 (b)(7):

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant's "home country"), or under the rules of the home country exchange on which the registrant's securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant's security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes o No ý

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- (b)(7): .

Exhibit No.

|

Exhibit Description

|

|

|---|---|---|

99.1 |

Agnico Eagle Mines Limited's Notice of Annual and Special Meeting of Shareholders and Management Information Circular dated March 12, 2015 | |

99.2 |

Form of Proxy |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

AGNICO EAGLE MINES LIMITED (Registrant) |

|||

|

||||

Date: March 27, 2015 |

By: |

/s/ R. GREGORY LAING |

||

Exhibit Number 99.1 and 99.2 submitted with this Form 6-K is hereby incorporated by reference into Agnico Eagle Mines Limited's Registration Statements on Form F-10 (Reg. No. 333-189715), Form F-3D (Reg. No. 333-183723 and 333-190888) and Form S-8 (Reg. Nos. 333-130339 and 333-152004).

EXHIBITS

SIGNATURES

QuickLinks -- Click here to rapidly navigate through this document

Notice of Annual and Special Meeting

of Shareholders

Friday, May 1, 2015

Management Information Circular

AGNICO EAGLE MINES LIMITED

Suite 400

145 King Street East

Toronto, Ontario

M5C 2Y7

NOTICE OF 2015 ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

Date: |

Friday, May 1, 2015 | |||

Time: |

11:00 a.m. (Toronto time) |

|||

Place: |

Sheraton Centre Toronto Hotel, Dominion Ballroom, 123 Queen St. West, Toronto, Ontario |

|||

Business of the Meeting: |

1. |

Receipt of the financial statements of Agnico Eagle Mines Limited ("the Company") for the year ended December 31, 2014 and the auditors' report on the statements; |

||

|

2. |

Election of directors; |

||

|

3. |

Appointment of auditors; |

||

|

4. |

Consideration of and, if deemed advisable, the passing of an ordinary resolution approving an amendment to the Company's Stock Option Plan; |

||

|

5. |

Consideration of and, if deemed advisable, the passing of an ordinary resolution approving an amendment to the Company's Incentive Share Purchase Plan; |

||

|

6. |

Consideration of and, if deemed advisable, the passing of a non-binding, advisory resolution accepting the Company's approach to executive compensation; and |

||

|

7. |

Consideration of any other business which may be properly brought before the Annual and Special Meeting of Shareholders. |

||

|

By order of the Board of Directors |

|

|

R. GREGORY LAING General Counsel, Senior Vice-President, Legal and Corporate Secretary March 12, 2015 |

To be effective at the meeting, proxies must be deposited with Computershare Trust Company of Canada no later than 48 hours prior to the commencement of the meeting.

MANAGEMENT INFORMATION CIRCULAR

This Management Information Circular (the "Circular") is provided in connection with the solicitation by the management of Agnico Eagle Mines Limited (the "Company") of proxies for use at the Annual and Special Meeting of Shareholders. Unless otherwise stated, all information in this Circular is given as at March 12, 2015 and all dollar amounts are stated in Canadian dollars.

For information about certain measures used in this Circular such as "total cash costs per ounce", "all-in sustaining costs per ounce" and "minesite costs per tonne", please refer to the Company's management's discussion and analysis for the year ended December 31, 2014. For scientific and technical information about the Company's mines and projects, please refer to the Company's annual information form dated as of March 12, 2015.

TABLE OF CONTENTS

| |

|

Page | ||

|---|---|---|---|---|

SECTION 1: |

VOTING INFORMATION | 2 | ||

SECTION 2: |

BUSINESS OF THE MEETING |

4 |

||

|

Election of Directors | 4 | ||

|

Compensation of Directors and Other Information | 11 | ||

|

Appointment of Auditors | 17 | ||

|

Financial Statements | 18 | ||

|

Amendments to the Stock Option Plan | 18 | ||

|

Amendment to Incentive Share Purchase Plan | 18 | ||

|

Advisory Vote on Approach to Executive Compensation | 19 | ||

SECTION 3: |

COMPENSATION AND OTHER INFORMATION |

20 |

||

|

Compensation Discussion & Analysis | 20 | ||

|

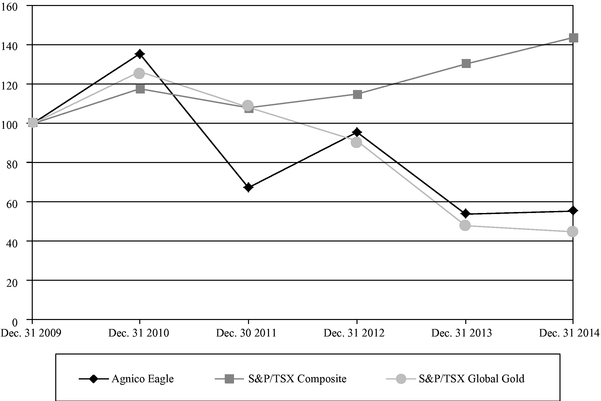

Performance Graph | 31 | ||

|

Compensation of Officers | 31 | ||

|

Indebtedness of Directors and Officers | 41 | ||

|

Additional Items | 41 | ||

APPENDIX A: |

STATEMENT OF CORPORATE GOVERNANCE PRACTICES |

A-1 |

||

APPENDIX B: |

STOCK OPTION PLAN RESOLUTION |

B-1 |

||

APPENDIX C: |

AMENDED AND RESTATED STOCK OPTION PLAN |

C-1 |

||

APPENDIX D: |

INCENTIVE SHARE PURCHASE PLAN RESOLUTION |

D-1 |

||

APPENDIX E: |

AMENDED AND RESTATED INCENTIVE SHARE PURCHASE PLAN |

E-1 |

||

APPENDIX F: |

ADVISORY RESOLUTION ON APPROACH TO EXECUTIVE COMPENSATION |

F-1 |

Who is soliciting my proxy?

The management of the Company is soliciting your proxy for use at the Annual and Special Meeting of Shareholders.

What will I be voting on?

You will be voting on:

- •

- the election of directors (page 4);

- •

- the appointment of Ernst & Young LLP as the Company's auditors (page 17);

- •

- an amendment to the Company's Stock Option Plan (the "Stock Option Plan") (page 18);

- •

- an amendment to the Company's Incentive Share Purchase Plan (the "Incentive Share Purchase Plan") (page 18);

- •

- on a non-binding, advisory basis, whether to accept the Company's approach to executive compensation (page 19); and

- •

- other business brought before the meeting if any other matter is put to a vote.

What else will happen at the meeting?

The financial statements for the year ended December 31, 2014 together with the auditors' report on these statements will be presented at the meeting.

How will these matters be decided at the meeting?

A majority of votes cast, by proxy or in person, will constitute approval of each of the matters specified in this Circular, except for the proposed amendment to the Incentive Share Purchase Plan, which requires the approval of a majority of votes cast by disinterested shareholders (as further described on page 18).

How many votes do I have?

You will have one vote for each common share of the Company you own at the close of business on March 12, 2015, the record date for the meeting. To vote common shares that you acquired after the record date, you must, no later than the commencement of the meeting:

- •

- request that the Company add your name to the list of voters; and

- •

- properly establish ownership of the common shares or produce properly endorsed share certificates evidencing that the common shares have been transferred.

How many shares are eligible to vote?

At the close of business on March 12, 2015 there were 215,528,460 common shares of the Company outstanding. Each common share held at that date entitles you to one vote. To the knowledge of the directors and officers of the Company, no person or corporation owns or exercises control or direction over 10% or more of the outstanding common shares.

How do I vote?

If you are eligible to vote and your common shares are registered in your name, you can vote your common shares in person at the meeting or by proxy, as explained below. If your common shares are registered in the name of an intermediary, such as a bank, trust company, securities broker or other financial institution, please see the instructions below under the heading "How can a non-registered shareholder vote?"

How can a registered shareholder vote by proxy?

In addition to voting in person at the meeting, you may vote by mail by completing the form of proxy and returning it in the enclosed envelope to Computershare Trust Company of Canada (the "Depositary"). You may

2

also appoint a person (who need not be a shareholder), other than one of the directors or officers named in the proxy, to represent you at the meeting by inserting the person's name in the blank space provided in the proxy and returning the proxy to the Depositary no later than 48 hours prior to the commencement of the meeting.

You may also vote by phone or via the Internet. To vote by phone, in Canada and the United States only, call the toll-free number listed on the proxy from a touch tone phone. When prompted, enter your Holder Account Number and Proxy Access Number listed on the proxy and follow the voting instructions. To vote via the Internet, go to the website specified on the proxy and enter your Holder Account Number and Proxy Access Number listed on the proxy and follow the voting instructions on the screen. If you vote by telephone or via the Internet, do not complete or return the proxy form.

How will my proxy be voted?

On the form of proxy, you can indicate how you would like your proxyholder to vote your common shares for any matter put to a vote at the meeting and on any ballot, and your common shares will be voted accordingly. If you do not indicate how you want your common shares to be voted, the persons named in the proxy intend to vote your common shares in the following manner:

- (i)

- for the election of management's nominees as directors;

- (ii)

- for the appointment of management's nominees, Ernst & Young LLP, as the auditors and the authorization of the

directors to fix the remuneration of the auditors;

- (iii)

- for the proposed amendment to the Stock Option Plan;

- (iv)

- for the proposed amendment to the Incentive Share Purchase Plan;

- (v)

- for the acceptance of the Company's approach to executive compensation; and

- (vi)

- for management's proposals generally.

What if I want to revoke my proxy?

You can revoke your proxy at any time prior to its use. You may revoke your proxy by requesting, or having your authorized attorney request, in writing to revoke your proxy. This request must be delivered to the Company's address (as listed in this Circular) before the last business day preceding the day of the meeting or to the Chairman of the meeting on the day of the meeting or any adjournment.

How are proxies solicited?

The solicitation of proxies will be primarily by mail; however, proxies may be solicited personally or by telephone by directors, officers and regular employees of the Company. The cost of this solicitation will be paid by the Company.

How can a non-registered shareholder vote?

If your common shares are not registered in your name, they will be held by an intermediary such as a bank, trust company, securities broker or other financial institution. Each intermediary has its own procedures that should be carefully followed by non-registered shareholders to ensure that their common shares are voted at the meeting, including when and where the proxy or voting instruction form is to be delivered. If you are a non-registered shareholder, you should have received this Circular, together with either (a) the voting instruction form from your intermediary to be completed and signed by you and returned to the intermediary in accordance with the instructions provided by the intermediary, or (b) a form of proxy, which has already been signed by the intermediary and is restricted as to the number of common shares beneficially owned by you, to be completed by you and returned to the Depositary no later than 48 hours prior to the commencement of the meeting. To vote in person at the meeting, a non-registered shareholder should, in the case of a voting instruction form, follow the instructions set out on the voting instruction form and, in the case of a form of proxy, insert his or her name in the blank space provided and return the form of proxy to the Depositary no later than 48 hours prior to the commencement of the meeting.

3

SECTION 2: BUSINESS OF THE MEETING

Election of Directors

The articles of the Company provide for a minimum of five and a maximum of fifteen directors. By special resolution of the shareholders of the Company approved at the annual and special meeting of the Company held on June 27, 1996, the shareholders authorized the board of directors of the Company (the "Board of Directors" or the "Board") to determine the number of directors within the minimum and maximum. The number of directors to be elected is twelve, as determined by the Board of Directors by resolution passed on March 5, 2015. The names of the proposed nominees for election as directors are set out below. Each director nominee is presently a member of the Board of Directors, and has consented to serve as a director if elected and will hold office until the next annual meeting of shareholders of the Company or until their successors are elected or appointed or the position is vacated. Management of the Company does not currently know of any reason why any director nominee will be unable to serve as a director but, if any nominee should be unable to serve for any reason prior to the meeting, the persons named on the enclosed form of proxy reserve the right to vote in their discretion for other nominees as directors.

The Board of Directors does not have a mandatory retirement policy for directors based solely on age nor does it have any term limits or similar mechanisms in place for forcing the renewal or replacement of directors. Rather, while there are benefits to adding new perspectives to the Board of Directors from time to time, which the Company believes can happen naturally without forcing the issue through term limits, there are also benefits that result from continuity and the experience and knowledge that comes from longer service on a board. Due in part to the Company's practice of conducting annual evaluations of the Board of Directors, committees and individual directors, the Board of Directors approved and adopted a resignation policy primarily based on the directors' performance, commitment, skills and experience. As set out in greater detail under "Board of Directors Governance Matters" and "Appendix A: Statement of Corporate Governance Practices — Assessment of Directors" below, each of the directors' performances will continue to be evaluated annually and the Company will use a rigorous identification and selection process for any new director nominees, and consider a variety of factors, including diversity and the desired skills, competencies and qualifications needed for potential nominees having regard to the strategies, needs and best interests of the Company and its Board of Directors and Committees.

Majority Voting Policy

As part of its ongoing review of corporate governance practices, on February 20, 2008 the Board of Directors adopted a policy providing that in an uncontested election of directors, any nominee who receives a greater number of votes "withheld" than votes "for" will tender his or her resignation to the Chairman of the Board of Directors promptly following the shareholders' meeting. This policy was updated by the Board of Directors on February 11, 2015. Under the updated policy, the Corporate Governance Committee will consider the offer of resignation and will make a recommendation to the Board of Directors on whether to accept it. The Board of Directors will accept the resignation absent exceptional circumstances that would warrant the director continuing to serve on the Board of Directors, as determined by the Board of Directors in accordance with its fiduciary duties to the Company. The Board of Directors will make its final decision and announce it in a press release within 90 days following the shareholders' meeting. A director who tenders his or her resignation pursuant to this policy will not participate in any meeting of the Board of Directors or the Corporate Governance Committee at which the resignation is considered.

The persons named on the enclosed form of proxy intend to VOTE FOR the election of each of the proposed nominees whose names are set out below and who are all currently directors of the Company unless a shareholder has specified in his or her proxy that his or her common shares are to be withheld from voting for the election of a proposed nominee. The security ownership amounts presented in the table reflect ownership of common shares, options to purchase common shares ("Options") under the Stock Option Plan (as described below) and Restricted Share Units ("RSUs") under the Company's Restricted Share Unit Plan (the "RSU Plan") (as described below), as at March 12, 2015. The common share ownership amounts set out below do not include common shares underlying immediately exercisable Options or RSUs.

4

NOMINEES FOR ELECTION TO THE BOARD OF DIRECTORS

|

| Dr. Leanne M. Baker | Age: 62 | Independent | ||||

| Sebastopol, California | 2014 Voting Results: 99.74% | Director since 2003 | ||||

|

Dr. Baker is a consultant to, and board member in, the metals and mining industry since 2002 and she was the President and Chief Executive Officer of Sutter Gold Mining Inc. from November 2011 — June 2013. Previously, Dr. Baker was employed by Salomon Smith Barney where she was one of the top-ranked mining sector equity analysts in the United States. Dr. Baker is a graduate of the Colorado School of Mines (M.S. and Ph.D. in mineral economics). |

|||||

| Value of At-Risk Investment(1) $488,312 |

Board/Committee Memberships |

Attendance at Meetings during 2014 |

||

|---|---|---|---|---|

8,476 Common Shares |

Board of Directors Audit Committee (Chair) |

8/8 (100%) 5/5 (100%) |

||

| Area of Expertise |

Other Public Board Directorships |

Other Public Board Committee Memberships |

||

|---|---|---|---|---|

| Corporate Finance and Mineral Economics | Sutter Gold Mining Inc. | — | ||

| Reunion Gold Corporation | Audit Committee Compensation and Corporate Governance Committee |

|||

| McEwen Mining Inc. | Audit Committee | |||

|

| Sean Boyd, CA | Age: 56 | |||||

| Toronto, Ontario | 2014 Voting Results: 99.65% | Director since 1998 | ||||

|

Mr. Boyd is the Vice-Chairman, President and Chief Executive Officer and a director of the Company. Mr. Boyd has been with the Company since 1985. Prior to his appointment as Vice-Chairman, President and Chief Executive Officer in February 2012, Mr. Boyd served as Vice-Chairman and Chief Executive Officer from 2005 to 2012 and as President and Chief Executive Officer from 1998 to 2005, Vice-President and Chief Financial Officer from 1996 to 1998, Treasurer and Chief Financial Officer from 1990 to 1996, Secretary Treasurer during a portion of 1990 and Comptroller from 1985 to 1990. Prior to joining the Company in 1985, he was a staff accountant with Clarkson Gordon (Ernst & Young). Mr. Boyd is a Chartered Accountant and a graduate of the University of Toronto (B.Comm.). |

|||||

| Value of At-Risk Investment(1) $12,834,458 |

Board/Committee Memberships |

Attendance at Meetings during 2014 |

||

|---|---|---|---|---|

54,100 Common Shares |

Board of Directors | 8/8 (100%) | ||

| Area of Expertise |

Other Public Board Directorships |

Other Public Board Committee Memberships |

||

|---|---|---|---|---|

| Executive Management and Finance | — | — | ||

5

|

| Martine A. Celej | Age: 49 | Independent | ||||

| Toronto, Ontario | 2014 Voting Results: 99.30% | Director since 2011 | ||||

|

Ms. Celej is a Vice-President, Investment Advisor with RBC Dominion Securities and has been in the investment industry since 1989. She is a graduate of Victoria College at the University of Toronto (B.A. (Honours)). |

|||||

| Value of At-Risk Investment(1) $455,704 |

Board/Committee Memberships |

Attendance at Meetings during 2014 |

||

|---|---|---|---|---|

3,576 Common Shares |

Board of Directors Compensation Committee |

8/8 (100%) 5/5 (100%) |

||

| Area of Expertise |

Other Public Board Directorships |

Other Public Board Committee Memberships |

||

|---|---|---|---|---|

| Investment Management | — | — | ||

|

| Robert J. Gemmell | Age: 58 | Independent | ||||

| Toronto, Ontario | 2014 Voting Results: 83.99% | Director since 2011 | ||||

|

Mr. Gemmell, now retired, spent 25 years as an investment banker in the United States and in Canada. Most recently, he was President and Chief Executive Officer of Citigroup Global Markets Canada and its predecessor companies (Salomon Brothers Canada and Salomon Smith Barney Canada) from 1996 to 2008. In addition, he was a member of the Global Operating Committee of Citigroup Global Markets from 2006 to 2008. Mr. Gemmell is a graduate of Cornell University (B.A.), Osgoode Hall Law School (LL.B) and the Schulich School of Business (MBA). |

|||||

| Value of At-Risk Investment(1) $745,224 |

Board/Committee Memberships |

Attendance at Meetings during 2014 |

||

|---|---|---|---|---|

11,576 Common Shares |

Board of Directors Compensation Committee (Chair) |

8/8 (100%) 5/5 (100%) |

||

| Area of Expertise |

Other Public Board Directorships |

Other Public Board Committee Memberships |

||

|---|---|---|---|---|

| Corporate Finance and Business Strategy | — | — | ||

6

|

| Bernard Kraft, CA | Age: 84 | Independent | ||||

| Toronto, Ontario | 2014 Voting Results: 99.21% | Director since 1992 | ||||

|

Mr. Kraft is a retired senior partner of the Toronto accounting firm Kraft, Berger LLP, Chartered Accountants and now serves as a consultant to that firm. He is also a principal in Kraft Yabrov Valuations Inc. Mr. Kraft is recognized as a Designated Specialist in Investigative and Forensic Accounting by the Canadian Institute of Chartered Accountants. Mr. Kraft is a member of the Canadian Institute of Chartered Business Valuators, the Association of Certified Fraud Examiners and the American Society of Appraisers. |

|||||

| Value of At-Risk Investment(1) $549,618 |

Board/Committee Memberships |

Attendance at Meetings during 2014 |

||

|---|---|---|---|---|

12,182 Common Shares |

Board of Directors Audit Committee Corporate Governance Committee |

8/8 (100%) 5/5 (100%) 4/4 (100%) |

||

| Area of Expertise |

Other Public Board Directorships |

Other Public Board Committee Memberships |

||

|---|---|---|---|---|

| Audit and Accounting | Harte Gold Corp. | Audit Committee | ||

|

| Mel Leiderman, FCPA, FCA, TEP, ICD.D | Age: 62 | Independent | ||||

| Toronto, Ontario | 2014 Voting Results: 99.71% | Director since 2003 | ||||

|

Mr. Leiderman is the senior partner of the Toronto accounting firm Lipton LLP, Chartered Accountants. He is a graduate of the University of Windsor (B.A.) and is a certified director of the Institute of Corporate Directors (ICD.D). |

|||||

| Value of At-Risk Investment(1) $455,704 |

Board/Committee Memberships |

Attendance at Meetings during 2014 |

||

|---|---|---|---|---|

7,576 Common Shares |

Board of Directors Audit Committee |

8/8 (100%) 5/5 (100%) |

||

| Area of Expertise |

Other Public Board Directorships |

Other Public Board Committee Memberships |

||

|---|---|---|---|---|

| Audit and Accounting | Morguard North American Residential REIT | Audit Committee | ||

7

|

| Deborah McCombe, P. Geo. Age: 62 | Independent | |||||||

| Toronto, Ontario | 2014 Voting Results: 99.65% | Director since 2014 | ||||||

|

Ms. McCombe, P. Geo., is the President and CEO of Roscoe Postle Associates Inc. ("RPA"). She has over 30 years' experience in exploration project management, feasibility studies, reserve estimation, due diligence studies and valuation studies. Prior to joining RPA, Ms. McCombe was Chief Mining Consultant for the Ontario Securities Commission and was involved in the development and implementation of National Instrument 43-101 — Standards of Disclosure for Mineral Projects ("NI 43-101"). She is actively involved in industry associations as Chair of Committee for Mineral Reserves International Reporting Standards — (Canadian Institute of Mining, Metallurgy and Petroleum ("CIM")), President of the Association of Professional Geoscientists of Ontario (2010 — 2011); a Director of the Prospectors and Developers Association of Canada (1999 — 2011); a CIM Distinguished Lecturer on NI 43-101; a member of the CIM Standing Committee on Reserve Definitions; and is a member of the Canadian Securities Administrators Mining Technical Advisory and Monitoring Committee. Ms. McCombe holds a degree from the University of Western Ontario (Geology). |

|||||||

| Value of At-Risk Investment(1) $217,140 |

Board/Committee Memberships |

Attendance at Meetings during 2014 |

||

|---|---|---|---|---|

6,000 RSUs |

Board of Directors Health, Safety, Environment and Sustainable Development (Chair) |

8/8 (100%) 4/4 (100%) |

||

| Area of Expertise |

Other Public Board Directorships |

Other Public Board Committee Memberships |

||

|---|---|---|---|---|

| Executive Management and Mining | — | — | ||

|

| James D. Nasso, ICD.D | Age: 81 | Independent | ||||

| Toronto, Ontario | 2014 Voting Results: 98.20% | Director since 1986 | ||||

|

Mr. Nasso is now retired and is a graduate of St. Francis Xavier University (B.Comm.). |

|||||

| Value of At-Risk Investment(1) $991,425 |

Board/Committee Memberships |

Attendance at Meetings during 2014 |

||

|---|---|---|---|---|

19,390 Common Shares |

Chairman of the Board of Directors Corporate Governance Committee Health, Safety, Environment and Sustainable Development Committee |

8/8 (100%) 4/4 (100%) 4/4 (100%) |

||

| Area of Expertise |

Other Public Board Directorships |

Other Public Board Committee Memberships |

||

|---|---|---|---|---|

| Management and Business Strategy | — | — | ||

8

|

| Dr. Sean Riley | Age: 61 | Independent | ||||

| Antigonish, Nova Scotia | 2014 Voting Results: 99.70% | Director since 2011 | ||||

|

Dr. Riley, now retired, served as President of St. Francis Xavier University from 1996 to 2014. Prior to 1996, his career was in finance and management, first in corporate banking and later in manufacturing. Dr. Riley is a graduate of St. Francis Xavier University (B.A. (Honours)) and of Oxford University (M. Phil, D. Phil, International Relations). |

|||||

| Value of At-Risk Investment(1) $451,687 |

Board/Committee Memberships |

Attendance at Meetings during 2014 |

||

|---|---|---|---|---|

3,465 Common Shares |

Board of Directors Audit Committee |

8/8 (100%) 5/5 (100%) |

||

| Area of Expertise |

Other Public Board Directorships |

Other Public Board Committee Memberships |

||

|---|---|---|---|---|

| Management and Business Strategy | — | — | ||

|

| J. Merfyn Roberts, CA | Age: 64 | Independent | ||||

| London, England | 2014 Voting Results: 94.26% | Director since 2008 | ||||

|

Mr. Roberts was a fund manager and investment advisor for more than 25 years and has been closely associated with the mining industry. From 2007 until his retirement in 2011, he was a senior fund manager with CQS Management Ltd. in London. Mr. Roberts is a graduate of Liverpool University (B.Sc., Geology) and Oxford University (M.Sc., Geochemistry) and is a member of the Institute of Chartered Accountants in England and Wales. |

|||||

| Value of At-Risk Investment(1) $642,590 |

Board/Committee Memberships |

Attendance at Meetings during 2014 |

||

|---|---|---|---|---|

8,740 Common Shares |

Board of Directors Corporate Governance Committee Compensation Committee (was appointed to the Committee on May 2, 2014) |

8/8 (100%) 4/4 (100%) 3/3 (100%) |

||

| Area of Expertise |

Other Public Board Directorships |

Other Public Board Committee Memberships |

||

|---|---|---|---|---|

| Investment Management | Eastern Platinum Limited | Audit Committee | ||

| Blackheath Resources Inc. | — | |||

| Newport Exploration Limited | Audit Committee | |||

9

|

| Howard R. Stockford, P. Eng. Age: 73 | Independent | |||||||

| Toronto, Ontario | 2014 Voting Results: 99.33% | Director since 2005 | ||||||

|

Mr. Stockford is a retired mining executive with over 50 years of experience in the industry. Most recently, he was Executive Vice-President of Aur Resources Inc. ("Aur") and a director of Aur from 1984 until August 2007, when it was taken over by Teck Cominco Limited. Mr. Stockford has previously served as President of the CIM and is a member of the Association of Professional Engineers of Ontario, the Prospectors and Developers Association of Canada and the Society of Economic Geologists. Mr. Stockford is a graduate of the Royal School of Mines, Imperial College, London University, U.K. (B.Sc., Mining Geology). |

|||||||

| Value of At-Risk Investment(1) $493,957 |

Board/Committee Memberships |

Attendance at Meetings during 2014 |

||

|---|---|---|---|---|

8,644 Common Shares |

Board of Directors Compensation Committee Health, Safety, Environment and Sustainable Development Committee |

8/8 (100%) 5/5 (100%) 4/4 (100%) |

||

| Area of Expertise |

Other Public Board Directorships |

Other Public Board Committee Memberships |

||

|---|---|---|---|---|

| Executive Management and Mining | — | — | ||

|

| Pertti Voutilainen, M.Sc., M. Eng. | Age: 74 | Independent | ||||||

| Espoo, Finland | 2014 Voting Results: 99.73% |

Director since 2005 | ||||||

|

Mr. Voutilainen is a mining industry veteran. Until 2005, he was the Chairman of the board of directors of Riddarhyttan Resources AB. Previously, Mr. Voutilainen was the Chairman of the board of directors and Chief Executive Officer of Kansallis Banking Group and President after its merger with Union Bank of Finland until his retirement in 2000. He was also employed by Outokumpu Corp., Finland's largest mining and metals company, for 26 years, including as Chief Executive Officer for 11 years. Mr. Voutilainen holds the honorary title of Mining Counselor (Bergsrad), which was awarded to him by the President of the Republic of Finland in 2003. Mr. Voutilainen is a graduate of Helsinki University of Technology (M.Sc.), Helsinki University of Business Administration (M.Sc.) and Pennsylvania State University (M. Eng.). |

|||||||

| Value of At-Risk Investment(1) $785,974 |

Board/Committee Memberships |

Attendance at Meetings during 2014 |

||

|---|---|---|---|---|

15,713 Common Shares |

Board of Directors Corporate Governance Committee (Chair) |

8/8 (100%) 4/4 (100%) |

||

| Area of Expertise |

Other Public Board Directorships |

Other Public Board Committee Memberships |

||

|---|---|---|---|---|

| Mining and Finance | — | — | ||

- (1)

- Indicates the total market value of common shares and RSUs held by a director based on the closing price of the Company's common shares on the Toronto Stock Exchange (the "TSX") of $36.19 on March 12, 2015.

10

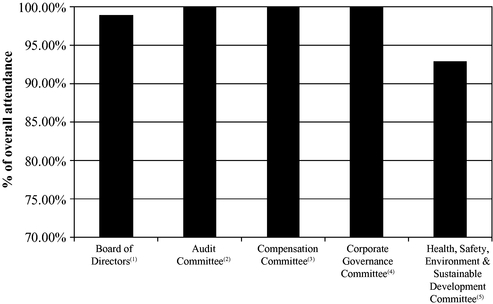

Overall Meeting Attendance

The attendance by each nominee for election as director at Board of Directors and Committee meetings in 2014 is indicated in the biography of each individual director. The overall meeting attendance in 2014 is set out below.

2014 Board of Directors and Committee Meetings

- (1)

- Board

of Directors: 13 members for 6 meetings; 12 members for 2 meetings (99% attendance)*

- (2)

- Audit

Committee: 4 members for 5 meetings (100% attendance)

- (3)

- Compensation

Committee: 4 members for 3 meetings; 3 members for 2 meetings (100% attendance)

- (4)

- Corporate

Governance Committee: 4 members for 4 meetings (100% attendance)

- (5)

- Health,

Safety, Environment and Sustainable Development Committee: 4 members for 3 meetings; 3 members for 1 meeting (93%

attendance)*

- *

- Mr. Clifford J. Davis, a member of the Board of Directors and Health, Safety, Environment and Sustainable Development Committee, resigned due to health reasons in August 2014.

Compensation of Directors and Other Information

Mr. Boyd, who is a director and the Vice-Chairman, President and Chief Executive Officer of the Company, does not receive any remuneration for his services as director of the Company.

The table below sets out the annual retainers (annual retainers for the Chairs of the Board of Directors and other Committees are in addition to the base annual retainer) paid to the directors during the year ended December 31, 2014. Directors do not receive meeting attendance fees.

| |

Compensation during the year ending December 31, 2014 |

|||

|---|---|---|---|---|

Annual Board of Directors retainer (base) |

$ | 120,000 | ||

Additional Annual retainer for Chairman of the Board of Directors |

$ | 120,000 | ||

Additional Annual retainer for Chairman of the Audit Committee |

$ | 25,000 | ||

Additional Annual retainer for Chairs of other Board Committees |

$ | 10,000 | ||

Effective as of July 1, 2011, director compensation was amended to more closely align the equity component of director compensation with shareholder interests by discontinuing the former practice of granting Options to non-executive directors and replacing such Option grants with grants of RSUs. As the value of RSUs tracks the

11

value of the Company's common shares, the equity value of director compensation will now correspond directly with share price movements, thereby more closely aligning director and shareholder interests.

In January of each year since 2012, each non-executive director was entitled to receive an annual grant of 3,000 RSUs (the Chairman of the Board of Directors was entitled to receive 5,000 RSUs; increased to 6,000 RSUs effective January, 2015). However, if a director meets the minimum common share ownership requirement (as described under "Director Shareholding Guidelines" below), he or she can elect to receive cash in lieu of a portion of the RSUs to be granted, subject to receipt of a minimum annual grant of 1,000 RSUs.

Director Shareholding Guidelines

To more closely align the interests of directors with those of shareholders, directors (other than Mr. Boyd, who is subject to the Chief Executive Officer ("CEO") shareholding requirements set out under "Share Ownership" on page 30 of this Circular) are required to own a minimum of 10,000 common shares of the Company and/or RSUs. Directors have a period of the later of: (i) two years from the date of adoption of this policy (that is, a compliance date of August 24, 2015) or (ii) five years from the date of joining the Board of Directors, to achieve this ownership level through open market purchases of common shares, grants of RSUs or the exercise of Options held.

As of March 12, 2015, all of the directors have satisfied the minimum common share ownership requirement, other than Ms. McCombe, who has until February 12, 2019 (five years from the date of becoming a director) to satisfy the minimum common share ownership requirement.

The following table sets out the number and the value of common shares and RSUs held by each director of the Company.

| |

Aggregate common shares and RSUs owned by each director and aggregate value thereof as of March 12, 2015 |

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Name

|

Aggregate Number of Common Shares |

Aggregate Value of Common Shares(1) |

Aggregate Number of RSUs |

Aggregate Value of RSUs(1) |

Deadline to meet Guideline |

|||||||||

| |

(#) |

($) |

(#) |

($) |

|

|||||||||

Leanne M. Baker |

8,476 | 306,746 | 5,017 | 181,565 | Meets Guideline | |||||||||

Sean Boyd |

54,100 | 1,957,879 | 300,541 | 10,876,579 | Meets CEO Guideline(2) | |||||||||

Martine A. Celej |

3,576 | 129,415 | 9,016 | 326,289 | Meets Guideline | |||||||||

Clifford J. Davis(3) |

6,000 | 217,140 | 7,032 | 254,488 | Meets Guideline | |||||||||

Robert J. Gemmell |

11,576 | 418,935 | 9,016 | 326,289 | Meets Guideline | |||||||||

Bernard Kraft |

12,182 | 440,867 | 3,005 | 108,751 | Meets Guideline | |||||||||

Mel Leiderman |

7,576 | 274,175 | 5,016 | 181,529 | Meets Guideline | |||||||||

Deborah McCombe(4) |

nil | nil | 6,000 | 217,140 | February 12, 2019 | |||||||||

James D. Nasso |

19,390 | 701,724 | 8,005 | 289,701 | Meets Guideline | |||||||||

Sean Riley |

3,465 | 125,398 | 9,016 | 326,289 | Meets Guideline | |||||||||

John Merfyn Roberts |

8,740 | 316,301 | 9,016 | 326,289 | Meets Guideline | |||||||||

Howard R. Stockford |

8,644 | 312,826 | 5,005 | 181,131 | Meets Guideline | |||||||||

Pertti Voutilainen |

15,713 | 568,653 | 6,005 | 217,321 | Meets Guideline | |||||||||

- (1)

- The

valuation is calculated based on the closing price of the Company's common shares on the TSX of $36.19 on March 12, 2015.

- (2)

- Mr. Boyd

is subject to the CEO shareholding requirements set out under "Share Ownership" on page 30 of this Circular.

- (3)

- Mr. Davis

resigned in August, 2014.

- (4)

- Ms. McCombe joined the Board of Directors on February 12, 2014.

12

The following table sets out the compensation provided to the members of the Board of Directors, other than Mr. Boyd, for the Company's most recently completed financial year.

Director Compensation Table — 2014

Name

|

Fees Earned | Share-Based Awards(1) |

Option-Based Awards(2) |

Non-Equity Incentive Plan Compensation(3) |

Pension Value |

All Other Compensation |

Total(4) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

($) |

($) |

($) |

($) |

($) |

($) |

($) |

|||||||||||

Leanne M. Baker |

145,000 | 29,630 | n/a | 54,340 | n/a | n/a | 228,970 | |||||||||||

Martine A. Celej |

120,000 | 88,890 | n/a | n/a | n/a | n/a | 208,890 | |||||||||||

Clifford J. Davis(5) |

80,401 | 29,630 | n/a | 54,340 | n/a | n/a | 164,371 | |||||||||||

Robert Gemmell |

130,000 | 88,890 | n/a | n/a | n/a | n/a | 218,890 | |||||||||||

Bernard Kraft |

120,000 | 29,630 | n/a | 54,340 | n/a | n/a | 203,970 | |||||||||||

Mel Leiderman |

120,000 | 29,630 | n/a | 54,340 | n/a | n/a | 203,970 | |||||||||||

Deborah McCombe(6) |

109,167 | 110,310 | n/a | n/a | n/a | n/a | 219,477 | |||||||||||

James D. Nasso |

240,000 | 29,630 | n/a | 108,680 | n/a | n/a | 378,310 | |||||||||||

John Merfyn Roberts |

120,000 | 88,890 | n/a | n/a | n/a | n/a | 208,890 | |||||||||||

Sean Riley |

120,000 | 88,890 | n/a | n/a | n/a | n/a | 208,890 | |||||||||||

Howard R. Stockford |

120,000 | 29,630 | n/a | 54,340 | n/a | n/a | 203,970 | |||||||||||

Pertti Voutilainen |

130,000 | 88,890 | n/a | n/a | n/a | n/a | 218,890 | |||||||||||

- (1)

- The

valuation of the grants of RSUs was calculated based on the simple average of the high and low trading prices of the Company's common shares on the TSX

for the 5 day trading period immediately prior to the grant date. For each director other than Ms. McCombe, RSUs were granted on January 2, 2014 with a valuation of $29.63 per

RSU. For Ms. McCombe, RSU's were granted on March 5, 2014 with a valuation of $36.77 per RSU.

- (2)

- Option-based

awards are no longer granted to non-executive directors.

- (3)

- A

director who satisfies the minimum shareholding requirement may elect to receive cash in lieu of a portion of his or her grant of RSUs.

- (4)

- Set

out in Canadian dollars. On December 31, 2014 the noon buying rate as reported by the Bank of Canada (the "Noon Buying Rate") was C$1.00

equals US$0.8620.

- (5)

- Mr. Davis

resigned in August, 2014.

- (6)

- Ms. McCombe did not become a Director until February 12, 2014.

The following table sets out the value vested during the most recently completed financial year of the Company of incentive plan awards granted to the directors of the Company, other than Mr. Boyd.

Incentive Plan Awards Table — Value Vested During Fiscal Year 2014

Name

|

Option-Based Awards — Value Vested During the Year |

Share-Based Awards — Value Vested During the Year |

Non-Equity Incentive Plan Compensations — Value Earned During the Year |

|||

|---|---|---|---|---|---|---|

| |

($) |

($) |

($) |

|||

Leanne M. Baker |

nil | 87,223 | n/a | |||

Martine A. Celej |

nil | 87,223 | n/a | |||

Clifford J. Davis(1) |

nil | 301,473 | n/a | |||

Robert Gemmell |

nil | 87,223 | n/a | |||

Bernard Kraft |

nil | 29,065 | n/a | |||

Mel Leiderman |

nil | 87,223 | n/a | |||

Deborah McCombe(2) |

nil | nil | n/a | |||

James D. Nasso |

nil | 116,316 | n/a | |||

Sean Riley |

nil | 87,223 | n/a | |||

John Merfyn Roberts |

nil | 87,223 | n/a | |||

Howard R. Stockford |

nil | 87,223 | n/a | |||

Pertti Voutilainen |

nil | 29,065 | n/a |

- (1)

- Mr. Davis

resigned in August, 2014. In accordance with the RSU Plan, all RSUs held by Mr. Davis vested upon his resignation.

- (2)

- Ms. McCombe did not become a Director until February 12, 2014.

13

The following table sets out the outstanding Option awards and RSUs of the directors of the Company, other than Mr. Boyd, as at December 31, 2014.

Outstanding Incentive Plan Awards Table — 2014

| |

Option-Based Awards | Share-Based Awards | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Name

|

Number of Securities Underlying Unexercised Options |

Option Exercise Price |

Option Expiration Date |

Value of Unexercised In-The-Money Options(1) |

Number of Shares or Units of Shares that have not Vested |

Market or Payout Value of Share-Based Awards that have not Vested(1) |

||||||||||||

| |

(#) |

($) |

|

($) |

(#) |

($) |

||||||||||||

Leanne M. Baker(2) |

6,120 | 54.00 | 1/4/2015 | nil | 4,016 | 99,958 | ||||||||||||

|

5,824 | 76.70 | 1/4/2016 | |||||||||||||||

Martine A. Celej |

4,721 | 70.26 | 2/21/2016 | nil | 6,016 | 173,983 | ||||||||||||

Clifford J. Davis(3) |

6,120 | 56.92 | 1/4/2015 | nil | nil | nil | ||||||||||||

|

5,824 | 76.60 | 1/4/2016 | |||||||||||||||

Robert Gemmell |

5,824 | 76.60 | 1/4/2016 | nil | 6,016 | 173,983 | ||||||||||||

Bernard Kraft |

6,120 | 56.92 | 1/4/2015 | nil | 2,005 | 57,985 | ||||||||||||

|

5,824 | 76.60 | 1/4/2016 | |||||||||||||||

Mel Leiderman |

6,120 | 56.92 | 1/4/2015 | nil | 4,016 | 116,143 | ||||||||||||

|

5,824 | 76.60 | 1/4/2016 | |||||||||||||||

Deborah McCombe |

nil | nil | nil | nil | 3,000 | 86,760 | ||||||||||||

James D. Nasso |

6,120 | 56.92 | 1/4/2015 | nil | 2,005 | 57,985 | ||||||||||||

|

5,824 | 76.60 | 1/4/2016 | |||||||||||||||

Sean Riley |

5,824 | 76.60 | 1/4/2016 | nil | 6,016 | 173,983 | ||||||||||||

John Merfyn Roberts |

5,824 | 76.60 | 1/4/2016 | nil | 6,016 | 173,983 | ||||||||||||

Howard R. Stockford |

6,120 | 56.92 | 1/4/2015 | nil | 2,005 | 57,985 | ||||||||||||

|

5,824 | 76.60 | 1/4/2016 | |||||||||||||||

Pertti Voutilainen |

6,120 | 56.92 | 1/4/2015 | nil | 4,005 | 115,825 | ||||||||||||

|

5,824 | 76.60 | 1/4/2016 | |||||||||||||||

- (1)

- Based

on a closing price of the Company's common shares on the TSX of $28.92 on December 31, 2014.

- (2)

- The

value of Dr. Baker's awards is in United States dollars and based on a closing price of the Company's common shares on the New York

Stock Exchange (the "NYSE") of US$24.89 on December 31, 2014.

- (3)

- Mr. Davis resigned in August, 2014.

In 2009, shareholders of the Company approved an amendment to the Incentive Share Purchase Plan to prohibit participation by non-executive directors. If the proposed amendments to the Stock Option Plan are approved at the meeting, non-executive directors would no longer formally be eligible to receive Options. No Options have been granted to non-executive directors since 2011.

14

The following table sets out the attendance of each of the directors to the Board of Directors meetings and the Board Committee meetings held in 2014.

Director

|

Board Meetings Attended |

Committee Meetings Attended |

|||||

|---|---|---|---|---|---|---|---|

Leanne M. Baker |

8 of 8 | 5 of 5 | |||||

Sean Boyd |

8 of 8 | n/a | |||||

Martine A. Celej |

8 of 8 | 5 of 5 | |||||

Clifford J. Davis(1) |

6 of 8 | 2 of 4 | |||||

Robert Gemmell |

8 of 8 | 5 of 5 | |||||

Bernard Kraft |

8 of 8 | 9 of 9 | |||||

Mel Leiderman |

8 of 8 | 5 of 5 | |||||

Deborah McCombe |

8 of 8 | 4 of 4 | |||||

James D. Nasso |

8 of 8 | 8 of 8 | |||||

John Merfyn Roberts |

8 of 8 | 4 of 4 | |||||

Sean Riley |

7 of 8 | 5 of 5 | |||||

Howard R. Stockford |

8 of 8 | 9 of 9 | |||||

Pertti Voutilainen |

8 of 8 | 4 of 4 | |||||

- (1)

- Mr. Davis resigned in August, 2014.

Cease Trade Orders and Bankruptcies

To the Company's knowledge, as at March 12, 2015 or within the last ten years, no proposed director of the Company is or has been:

- (a)

- a

director, chief executive officer or chief financial officer of any company (including the Company):

- (i)

- subject

to an order (including a cease trade order, an order similar to a cease àtrade order or an order that denied the relevant company

access to any exemption under securities legislation) for a period of more than 30 consecutive days, that was issued while the proposed director was acting in the capacity as director, chief

executive officer or chief financial officer; or

- (ii)

- subject

to an order (including a cease trade order, an order similar to a cease trade order or an order that denied the relevant company access to any

exemption under securities legislation) for a period of more than 30 consecutive days, that was issued after the proposed director ceased to be a director, chief executive officer or chief

financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer; or

- (b)

- a director or executive officer of any company (including the Company), that while that person was acting in that capacity or within a year of the person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets,

except as follows:

Mr. Leiderman, a director of the Company, was a director of Colossus Minerals Inc. ("Colossus") from August 1, 2013 until his resignation on November 13, 2013. On February 7, 2014, Colossus filed a proposal to its creditors under the Bankruptcy and Insolvency Act (Canada). On February 25, 2014, the resolution approving an amended proposal was approved by the requisite majority of Colossus' creditors.

15

Board of Directors Governance Matters

Diversity

The Board of Directors recognizes that diversity is important to ensuring that the Board as a whole possesses the qualities, attributes, experience and skills to effectively oversee the strategic direction and management of the Company. The Board recognizes and embraces the benefits of being diverse, and has identified diversity within the Board as an essential element in attracting high caliber directors and maintaining a high functioning Board. The Board considers diversity to include different genders, ages, cultural backgrounds, race/ethnicity, geographic areas and other characteristics of its stakeholders and the communities in which the Company is present and conducts its business. To that end, in February 2015, the Board considered and, on the recommendation of the Corporate Governance Committee, adopted a Board of Directors Diversity Policy, setting out various diversity criteria the Board and Corporate Governance Committee will consider in identifying, assessing and selecting potential nominees for the Board. Pursuant to the Policy, "diversity" includes the characteristics outlined above, and provides a framework and criteria for the Corporate Governance Committee and the Board to review and assess the composition of the Board and its Committees and to identify, evaluate and recommend potential new directors. In new director appointments and ongoing evaluations of the effectiveness of the Board, its Committees and each director, the Corporate Governance Committee and the Board will take into consideration diversity as one of the many factors in order to maintain an appropriate mix and balance of diversity, attributes, skills, experience and background on the Board of Directors and its Committees. Ultimately, Board appointments are based on merit against objective criteria and with due regard to the benefits of diversity in board composition and the desire to maximize the effectiveness of corporate decision-making, having regard to the best interests of the Company and its strategies and objectives, including the interests of its shareholders and other stakeholders. The Corporate Governance Committee is charged with overseeing the implementation of the Policy and monitoring and annually reporting to the Board of Directors on the diversity of the Board and its Committees to determine the Policy's effectiveness and the Company's progress is fostering diversity at the board level.

The Board does not set any fixed percentages for any specific selection criteria as it believes that quotas or strict rules do not necessarily result in the identification or selection of the best candidates but, rather, all factors should be considered when assessing and determining the merits of an individual director and the composition of a high functioning Board. The proportion of women on the Board is currently 27% (3 of 11) of the non-executive directors, the proportion of non-resident Canadians is currently 27% (3 of 11) of the non-executive directors, the proportion of women on the entire Board of Directors is currently 25% (3 of 12) of all directors and the proportion of women committee chairs is currently 50% (2 of 4). The Board believes that the diversity represented by the directors seeking election at the meeting in terms of gender, age, education, skills, geographic representation and competencies supports an efficient and effective Board.

The Board does not currently have a director term limit policy or similar mechanisms in place for forcing the renewal or replacement of its directors. Rather, it has determined that the best means of ensuring director effectiveness is through rigorous annual performance evaluations. The Corporate Governance Committee will continue to monitor, evaluate and assess best corporate governance practices and proposals with respect to board renewal mechanisms having regard to, among other things, the performance of individual directors, the Board and to the best interests of the Company. As discussed in greater detail under "Appendix A: Statement of Corporate Governance Practices — Assessment of Directors", the Board has adopted a resignation policy primarily based on the directors' performance, commitment, skills and experience in order to foster an appropriate level of renewal and diversity of perspectives at the board level.

Women in Leadership

The Board and executive management view diversity and inclusion as essential to the growth and success of the Company. Creating an inclusive environment where the diversity of perspectives, experiences, cultures, genders, age and skills of employees can be leveraged at every level is critical and the Company believes that one of its strengths lies in its ability to leverage the diversity of its employees to drive innovation and to quickly adapt to the ongoing changes in the global market and the gold mining industry.

With this in mind, executive management has identified increasing the number of women in leadership positions within the Company as a priority to be achieved by focusing on the preparation and support of women

16

in leadership positions, rather than the attainment of quotas. In 2014, the Company's focus was on ensuring that internal development opportunities in the form of training or assignments took into consideration the need for preparing women for future leadership roles. As a result, development assignments on key initiatives and formal training in Change Management, Coaching and Advanced Leadership included a number of high potential women from across various functions within the Company. In addition, the Company's talent acquisition efforts such as at campus recruitment fairs and industry specific events included strategies to increase the Company's visibility as an employer of choice for young women contemplating careers in the mining industry.

Going forward, the Company is developing a plan for a formal leadership council focused on the objective of increasing women in leadership positions. The focus of this council will be threefold: (i) identify any systematic barriers that may exist for women within the Company and barriers that may prevent Agnico Eagle from attracting key talent to join the Company; (ii) develop a sustainable network that engages women in the workplace; and (iii) support the development and implementation of strategies to increase the number of women in leadership positions in the Company. The leadership council will oversee the implementation of and monitor progress made in achieving the foregoing objectives, which will be revisited and evaluated on an ongoing basis, and will report to the Board on workplace diversity matters.

Appointment of Auditors

The persons named in the enclosed form of proxy intend to VOTE FOR the appointment of Ernst & Young LLP as the Company's auditors, and for the directors to fix the remuneration of the auditors unless a shareholder has specified in his or her proxy that his or her common shares are to be withheld from voting for the appointment of Ernst & Young LLP as the Company's auditors. Representatives of Ernst & Young LLP are expected to be present at the meeting to respond to appropriate questions and make a statement if they wish to do so. Ernst & Young LLP became the Company's auditors in 1983. Fees paid to Ernst & Young LLP for 2014 and 2013 are set out below.

| |

Year ended December 31, 2014 |

Year ended December 31, 2013 |

|||||

|---|---|---|---|---|---|---|---|

| |

($ thousands) |

($ thousands) |

|||||

Audit fees |

2,489 | 2,118 | |||||

Audit related fees |

23 | 23 | |||||

Tax consulting fees |

1,475 | 293 | |||||

All other fees |

752 | 56 | |||||

Total |

4,739 | 2,490 | |||||

Audit fees were paid for professional services rendered by the auditors for the audit of the Company's annual financial statements and related statutory and regulatory filings and for the quarterly review of the Company's interim financial statements. Audit fees also include prospectus-related fees for professional services rendered by the auditors in connection with corporate financing activities. These services consisted of the audit or review, as required, of financial statements included in the prospectuses, the review of documents filed with securities regulatory authorities, correspondence with securities regulatory authorities and all other services required by regulatory authorities in connection with the filing of these documents.

Audit-related fees consist of fees paid for assurance and related services performed by the auditors that are reasonably related to the performance of the audit of the Company's financial statements. This includes consultation with respect to financial reporting, accounting standards and compliance with Section 404 of the Sarbanes-Oxley Act of 2002 ("SOX").

Tax fees were paid for professional services relating to tax compliance, tax advice and tax planning. These services included the review of tax returns and tax planning and advisory services in connection with international and domestic taxation issues.

All other fees were paid for services other than the services described above and include fees for professional services rendered by the auditors in connection with the conversion to IFRS as well as the translation of securities regulatory filings required to comply with securities laws in certain Canadian jurisdictions.

No other fees were paid to auditors in the previous two years.

17

The Audit Committee has adopted a policy that requires the pre-approval of all fees paid to Ernst & Young LLP prior to the commencement of the specific engagement, and all fees referred to above were pre-approved in accordance with such policy.

Financial Statements

The audited annual financial statements for the year ended December 31, 2014 have been mailed to the Company's shareholders with this Circular.

Amendments to the Stock Option Plan

To more closely align the interests of directors with those of shareholders, effective as of July 1, 2011, the Company ceased granting Options to non-executive directors and replaced the equity component of director compensation with RSUs. However, the Stock Option Plan still makes reference to directors being eligible to receive Options. The Board of Directors has determined that it would be advisable to amend the Stock Option Plan to preclude the granting of Options to non-executive directors under the Stock Option Plan. References in the Stock Option Plan to directors will be removed or changed to the new defined term "Grandfathered Director" which means a director who is not otherwise an officer or employee of the Company and who was granted Options under the Stock Option Plan prior to July 1, 2011.

At the meeting, shareholders will be asked to consider an ordinary resolution (attached to the Circular as Appendix B) to approve the above amendments to the Stock Option Plan. A copy of the Stock Option Plan which has been amended and restated to reflect the proposed amendments is attached to this Circular as Appendix C.

The TSX requires that the resolution amending the Stock Option Plan be passed by the affirmative vote of at least a majority of the votes cast, by proxy or in person. In addition to shareholder approval, the proposed amendments are subject to regulatory approval. If you do not indicate how you want your common shares to be voted, the persons named in the proxy intend to vote your common shares for the proposed amendments to the Company's Stock Option Plan.

Amendment to Incentive Share Purchase Plan

The Company's Incentive Share Purchase Plan provides participants with an incentive to enhance shareholder value by providing a form of compensation that is tied to increases in the market value of the Company's common shares. Details on the Incentive Share Purchase Plan can be found on page 37 of this circular.

The Company currently has reserved 6,100,000 common shares for issuance under the Incentive Share Purchase Plan. The Compensation Committee considers the Incentive Share Purchase Plan to be an integral part of overall compensation in order to attract and retain employees with the skills and commitment needed to lead and grow the Company's business. The need to attract and retain skilled employees remains important in the competitive mining market. Accordingly, the Compensation Committee has recommended increasing the number of common shares reserved for issuance under the Incentive Share Purchase Plan by 1,000,000 common shares to 7,100,000 common shares. As at March 12, 2015, 4,687,814 common shares had been issued under the Incentive Share Purchase Plan, representing 2.4% of the 215,528,460 common shares issued and outstanding as of March 12, 2015. Accordingly, if the increase is approved, the number of common shares available for future common share issuances will be 2,412,186, representing 1.1% of the 215,528,460 common shares issued and outstanding as of March 12, 2015.

At the meeting, shareholders will be asked to consider an ordinary resolution (attached to this Circular as Appendix D) to approve the above amendments to the Incentive Share Purchase Plan. A copy of the Incentive Share Purchase Plan which has been amended and restated to reflect the proposed amendments is attached to this Circular as Appendix E.

The Incentive Share Purchase Plan does not limit the participation of insiders other than non-executive directors who are prohibited from participating in the Incentive Share Purchase Plan. The maximum amount a participant is permitted to contribute to the Incentive Share Purchase Plan is 10% of the participant's base salary and the Company is permitted to make a matching contribution of up to 50% of the participant's contributions. The aggregate number of the Company's common shares: (i) issued to insiders within any one

18

year period, and (ii) issuable to insiders at any time under the Incentive Share Purchase Plan, could theoretically exceed 10% of the Company's issued and outstanding common shares and consequently TSX Rules provide that the votes attached to the securities held by all insiders eligible to participate in the Incentive Share Purchase Plan and their associates and affiliates (the "Eligible Insiders") must be excluded from the vote to on the Incentive Share Purchase Plan resolution. Accordingly, shareholders of the Company, other than the Eligible Insiders, are being asked to approve the increase by a majority of the vote cast, by proxy or in person. As of March 12, 2015, 262,514 common shares were held by Eligible Insiders and will be excluded from the vote. In addition to shareholder approval, the increase in common shares available for future grants under the Incentive Share Purchase Plan is subject to regulatory approval. If you do not indicate how you want your common shares to be voted, the persons named in the proxy intend to vote your common shares for the proposed amendment to the Company's Incentive Share Purchase Plan.

The Company has two security based compensation arrangements pursuant to which common shares may be issued from treasury:

- 1.

- the

Stock Option Plan pursuant to which 15,172,913 common shares are issuable representing 7.0% of the Company's issued and outstanding common shares

as of March 12, 2015; and

- 2.

- the Incentive Share Purchase Plan pursuant to which 2,412,186 common shares will be issuable, if the resolution is approved, representing 1.1% of the Company's issued and outstanding common shares as of March 12, 2015.

Accordingly, if the resolution is approved, an aggregate number of 17,585,099 common shares will be issuable under all security based compensation arrangements of the Company, representing 8.2% of the Company's issued and oustanding common shares as of March 12, 2015.

Advisory Vote on Approach to Executive Compensation

The Board of Directors believes that the Company's compensation program must be competitive with companies in its peer group, provide a strong incentive to its executives to achieve the Company's goals and align the interests of management with the interests of the Company's shareholders. A detailed discussion of the Company's executive compensation program is provided under "Compensation Discussion & Analysis" starting on page 20 of this Circular. In line with recent developments and emerging governance trends in respect of executive compensation, commonly known as "Say on Pay", the Board of Directors has determined to provide shareholders with a "Say on Pay" advisory vote at the meeting to endorse or not endorse the Company's approach to executive compensation. At the Company's last annual and special meeting of shareholders held on May 1, 2014, 76.86% of shareholders voted in favour of the Company's non-binding resolution on executive compensation (down from 81.21% at the April 26, 2013 meeting), indicating a decrease in support for the Company's approach to executive compensation. The Company has made adjustments to its compensation program based on the feedback it has received and believes the compensation program adopted properly incorporates the concept of reward for performance and the objective of more directly aligning the interests of management with the interests of shareholders. The Company will endeavor to refine this approach in an effort to continue to make the executive compensation practices of the Company acceptable to shareholders.

At the meeting, shareholders will be asked to consider the following resolution, which is also attached to this Circular as Appendix F:

BE IT RESOLVED THAT, on an advisory basis and not to diminish the role and responsibilities of the Board of Directors of the Company, the shareholders accept the approach to executive compensation disclosed in this Circular.

Because this vote is advisory, it will not be binding upon the Board of Directors. However, the Board of Directors and the Compensation Committee will take the outcome of the vote into account in their ongoing review of executive compensation.

19

SECTION 3: COMPENSATION AND OTHER INFORMATION

Compensation Discussion & Analysis

A key compensation objective of the Company is that compensation should be aligned with performance. In 2014, the Company, among other things,:

- •

- produced a record number of gold ounces (1,429,288) — the third consecutive year in

which gold production exceeded one million ounces and exceeded the operating budget and original guidance for the year;

- •

- produced these ounces at total cash costs per ounce of $637 (below original guidance of total cash costs per ounce of $663

and the operating budget);

- •

- completed two significant acquisitions: (i) the joint acquisition of Osisko Mining Corporation ("Osisko") with

Yamana Gold Inc. ("Yamana") which resulted in the Company owning a 50% interest in the Canadian Malartic mine (one of the largest gold mines in Canada) and, among other things, the

Kirkland Lake and Hammond Reef projects; and (ii) Cayden Resources Inc. ("Cayden"), which resulted in the Company owning 100% of the El Barqueño project in Mexico;

- •

- announced the discovery of the Amaruq deposit in Nunavut, which is expected to be developed as a satellite deposit to the

Meadowbank mine and could extend Meadowbank's mine life;

- •

- completed the Kittila mill expansion (six months ahead of schedule); and

- •

- achieved record safety performance.

The Compensation Committee begins to review corporate and management performance in October of each year and, after several meetings over the succeeding months, finalizes its review and analyses in early December and submits its compensation adjustment recommendations to the Board of Directors in mid-December. The Board of Directors considers the recommendations and, traditionally, compensation adjustments are made as follows: (i) base salary — any adjustment becomes effective on January 1 of the next calendar year; (ii) bonus — any bonus payment is made within that calendar year (which reflects performance relating to that year); and (iii) any long term incentive grants (RSUs or options) relating to performance in the current year are awarded early in January of the next calendar year. In last year's circular, there was discussion with respect to changing the timing of the annual RSU grants to award RSUs at the end of the applicable performance year. Upon further review by the Compensation Committee, it has been determined that such a change would have minimal impact on the alignment of timing of compensation and performance for a given year. Accordingly, the timing of the award of RSU grants will not change from past practice.

Compensation Program Philosophy

The executives of the Company have a significant influence on corporate performance and creating shareholder value. With this in mind, the Company's philosophy regarding compensation is that it must:

- •

- align the interests of management with the interests of the Company's shareholders;

- •

- be competitive in order to attract and retain employees with the skills and commitment needed to lead and grow the

Company's business; and

- •

- provide a strong incentive to achieve the Company's goals.

Elements of Compensation

The compensation paid to the Company's executives has four components:

- •

- base salary and benefits;

20

- •

- annual incentive compensation (bonuses);

- •

- long-term incentive compensation through the grant of RSUs and Options and participation in the Incentive Share Purchase

Plan; and

- •

- career compensation in the form of retirement benefits.

The Compensation Committee reviews each component of compensation for each officer and makes compensation recommendations to the Board of Directors. In its evaluation of each officer, the Compensation Committee considers, among other things, executive compensation surveys, recommendations by any executive compensation consultant retained by the Compensation Committee, evaluations prepared by the Vice-Chairman, President and Chief Executive Officer, as applicable, for each officer other than the Vice-Chairman, President and Chief Executive Officer and an evaluation prepared by the Chairman for the Vice-Chairman, President and Chief Executive Officer. The Board of Directors reviews the recommendations and gives final approval on the compensation of the Company's officers. The Board of Directors has complete discretion over the amount and composition of each officer's compensation.

In 2013, the Company's Human Resources department conducted an internal market analysis using publicly available information from the Company's peer group and surveys provided by different compensation firms, notably the Mercer Mining Industry Compensation Survey "Mining Industry Salary Survey — Corporate Report" (the "Mercer Mining Survey"). The information was used by the Compensation Committee and the Board of Directors in recommending and approving the salary adjustments to market and the bonus targets for the Company's officers.

No compensation consultants were retained by the Company (or by the Compensation Committee) in 2013. The Compensation Committee retained Meridian Compensation Partners in 2014 to provide general advice regarding incentive pay practices and related technical, administrative and governance matters.

Executive Compensation-Related Fees

Name of Firm

|

Year | Amount Paid for Compensation-Related Services ($) |

||

|---|---|---|---|---|

(None) |

2013 | (N/A) | ||

Meridian Compensation Partners |

2014 | 2,715 |

The Company's total compensation plan is designed to drive long-term increases in shareholder value. The creation of an appropriate plan requires an understanding of the Company's objectives and the individuals charged with delivering the expected results. The Company strives to design its total compensation plan so that the plan does not result in behavior that is inconsistent with the goals and objectives of the Company.

During 2014, the Compensation Committee considered the implications of the risks (with specific regard to retention) associated with the Company's compensation policies and practices and looked at the long-term incentive structure for the Company's executives and confirmed that RSUs should continue to be a significant element in the long-term incentive component of executive compensation going forward.

All directors and executives of the Company are prohibited from short-selling and trading in derivatives of the Company's securities.

A description of the retirement benefits made available to the Company's executives is set out under "Pension Plan Benefits" beginning on page 38 of this Circular.

Industry Positioning and Competitive Environment

The Company is continuing to experience changes in production, mineral reserves, operations, employees and the international scope of its business. The success of the Company in delivering value for shareholders is largely determined by the quality and consistency of its strategy and the execution thereof. In this regard, it is

21

very important to ensure that compensation programs are designed to attract, motivate and retain key employees in order to achieve or exceed the strategic objectives of the Company.

The Company has worked strategically over the last several years to upgrade its physical asset base and its human resources. One of the clear competitive advantages the Company needs to maintain in the gold mining industry is a high quality, experienced executive management team that works together to create value for its shareholders.

With the current volatility in the gold industry, the competition for high quality executive talent remains intense. The Company competes for executive talent primarily with other North American gold mining companies. In response, the Company has strived to, and needs to continue to, create an environment where employees want to work and take on increasing responsibility. Retaining certain key executives of the Company, who may have otherwise been receptive to other employment opportunities, has been particularly important in the context of the Company's execution of it strategic plans.

To continue its record of success in a very tight and competitive labour market, it is important that the executive management group has the proper incentives to remain focused on achieving corporate objectives. In this regard, the compensation policy aims to target competitive base salaries paid to executives having comparable responsibilities and experience at other North American companies engaged in the same or similar lines of business as the Company.

Base Salary

To retain a competent, strong and effective executive management group, the salaries paid by the Company must be competitive with others in the industry generally, as well as within the regional markets in which the executive is located. Base salary levels take into account the executives' individual responsibilities, experience, performance and contribution to enhancing shareholder value.