Form 497K Claymore Exchange-Traded

BSJG | Exchange Traded Funds | | | 9.28.2016 | |||

Guggenheim ETFs Summary Prospectus | ||||||

NYSE ARCA, Inc. Ticker Symbol | Fund Name |

BSJG | Guggenheim BulletShares 2016 High Yield Corporate Bond ETF |

Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus and other information about the Fund online at guggenheiminvestments.com. You can also get this information at no cost by calling 800.820.0888 or by sending an e-mail request to [email protected]. The Fund’s prospectus and statement of additional information, each dated September 28, 2016, are incorporated by reference into (and are considered part of) this Summary Prospectus.

Sku # ETF-SUMPRO-BSJG | guggenheiminvestments.com |

Guggenheim BulletShares 2016 High Yield Corporate Bond ETF (BSJG)

INVESTMENT OBJECTIVE

The Guggenheim BulletShares 2016 High Yield Corporate Bond ETF (the "Fund") seeks investment results that correspond generally to the performance, before the Fund’s fees and expenses, of a high yield corporate bond index called the Nasdaq BulletShares® USD High Yield Corporate Bond 2016 Index (the “High Yield 2016 Index” or the “Index”).

FEES AND EXPENSES OF THE FUND

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund (“Shares”). Investors purchasing Shares in the secondary market may be subject to costs (including customary brokerage commissions) charged by their broker.

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | ||

Management Fees (comprehensive management fee) | 0.42 | % |

Other Expenses | 0.00 | % |

Total Annual Fund Operating Expenses | 0.42 | % |

EXAMPLE

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The Example does not take into account brokerage commissions that you may pay when purchasing or selling Shares.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your Shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

One Year | Three Years | Five Years | Ten Years |

$43 | $189 | $348 | $811 |

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 41% of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGIES

The Fund, using a “passive” or “indexing” investment approach, seeks investment results that correspond generally to the performance, before the Fund’s fees and expenses, of the High Yield 2016 Index. The High Yield 2016 Index is a rules-based index (i.e., an index constructed using specified criteria) comprised of, as of August 31, 2016, approximately 25 high yield corporate bonds (which also may be known as "junk bonds") with effective maturities in the year 2016. The High Yield 2016 Index is designed to represent the performance of a held-to-maturity portfolio of U.S. dollar-denominated high yield corporate bonds with effective maturities in the year 2016. The effective maturity of an eligible corporate bond is determined by its actual maturity or, in the case of callable securities, the effective maturity of the security is determined in accordance with a rules-based methodology developed by Accretive Asset Management, LLC (“Accretive” or the “Index Provider”). The actual maturity of a callable security may change because an issuer of a callable security may "call" or repay the amount owed under the security before its stated maturity. As of the date of this Prospectus, the expected duration of the High Yield 2016 Index, and thus of the Fund, is 0 to 0.25 years. Accretive is affiliated with Guggenheim Funds Investment

SUMMARY PROSPECTUS |2

Advisors, LLC, the Fund's investment adviser (the "Investment Adviser"), and Guggenheim Funds Distributors, LLC, the Fund's distributor (the "Distributor").

The Fund has a designated year of maturity of 2016 and will terminate on or about December 31, 2016. In connection with such termination, the Fund will make a cash distribution to then-current shareholders of its net assets after making appropriate provisions for any liabilities of the Fund. The Fund does not seek to distribute any predetermined amount at maturity. The Fund will invest at least 80% of its total assets in component securities that comprise the Index. Under normal circumstances, the Fund will invest at least 80% of its net assets in high yield securities, which are debt securities that are rated below investment grade by nationally recognized statistical rating organizations, or are unrated securities that the Investment Adviser believes are of comparable quality. The Fund has adopted a policy that requires the Fund to provide shareholders with at least 60 days notice prior to any material change in this policy or the Index. There are no minimum credit rating requirements for securities that the Fund may purchase; however, the Fund will not purchase securities that are in default. As the Fund is in the final year of its operations, the bonds in the High Yield 2016 Index are maturing, and the Fund’s portfolio is in the process of transitioning to cash and cash equivalents, including without limitation U.S. Treasury Bills and investment grade commercial paper. The Fund will terminate on or about December 31, 2016 without requiring additional approval by the Board of Trustees (the “Board”) of Claymore Exchange-Traded Fund Trust (the "Trust") or Fund shareholders. The Board may change the termination date to an earlier or later date without shareholder approval if a majority of the Board determines the change to be in the best interest of the Fund. The Board may change the Fund’s investment strategy and other policies without shareholder approval, except as otherwise indicated.

The Fund expects to use a sampling approach in seeking to achieve its investment objective. Sampling means that the Investment Adviser uses quantitative analysis to select securities from the Index universe to obtain a representative sample of securities that resemble the Index in terms of key risk factors, performance attributes and other characteristics. These characteristics include maturity, credit quality, sector, duration and other financial characteristics of fixed income instruments. The quantity of holdings in the Fund will be based on a number of factors, including the asset size of the Fund, potential transaction costs in acquiring particular securities, the anticipated impact of particular Index components on the performance of the Index and the availability of particular securities in the secondary market. However, the Fund may use replication to seek to achieve its objective if practicable. A replication strategy involves generally investing in all of the securities in the Index with the same weights as the Index. There may also be instances when the Investment Adviser may choose to overweight another security in the Index or purchase (or sell) securities not in the Index, which the Investment Adviser believes are appropriate to substitute for one or more Index components in seeking to accurately track the Index, such as: (i) regulatory requirements possibly affecting the Fund’s ability to hold a security in the Index or (ii) liquidity concerns possibly affecting the Fund’s ability to purchase or sell a security in the Index. In addition, from time to time, securities are added to or removed from the Index. The Fund may sell securities that are represented in the Index or purchase securities that are not yet represented in the Index in anticipation of their removal from or addition to the Index pursuant to scheduled reconstitutions and rebalancings of the Index. The Fund will concentrate its investments (i.e., invest 25% or more of its assets) in securities issued by companies whose principal business activities are in the same industry or group of industries to the extent the Index is so concentrated. As of May 31, 2016, no sector represented a substantial portion of the Index.

PRINCIPAL RISKS

Investors should consider the principal risks associated with investing in the Fund, which are summarized below. The value of an investment in the Fund will fluctuate and you could lose money by investing in the Fund. The Fund may not achieve its investment objective.

Asset Class Risk—The securities in the Fund’s portfolio may underperform the returns of other securities or indices that track other industries, markets, asset classes or sectors.

Concentration Risk—If the Index concentrates in an industry or group of industries, the Fund’s investments will be concentrated accordingly. In such event, the value of the Fund’s Shares may rise and fall more than the value of shares of a fund that invests in securities of companies in a broader range of industries.

Credit Risk—The Fund could lose money if the issuer or guarantor of a fixed-income instrument or a counterparty to a transaction is unable or unwilling, or perceived to be unable or unwilling, to pay interest or repay principal on

SUMMARY PROSPECTUS |3

time or defaults. The issuer, guarantor or counterparty could also suffer a rapid decrease in credit quality rating, which would adversely affect the volatility of the value and liquidity of the instrument.

Declining Yield Risk—As the Fund is in the final year of its operations, the bonds held by the Fund are maturing and the Fund’s portfolio is transitioning to cash and cash equivalents. Accordingly, the Fund’s yield will generally tend to move toward the yield of cash and cash equivalents and thus may be lower than the yields of the bonds previously held by the Fund and/or prevailing yields for bonds in the market.

Extension Risk—During periods of rising interest rates, an issuer may exercise its right to pay principal on an obligation later than expected, resulting in a decrease in the value of the obligation and in a decline in the Fund’s income.

Fluctuation of Yield and Liquidation Amount Risk—The Fund, unlike a direct investment in a bond that has a level coupon payment and a fixed payment at maturity, will make distributions of income that vary over time. Unlike a direct investment in bonds, the breakdown of returns between Fund distributions and liquidation proceeds are not predictable at the time of your investment. For example, at times during the Fund’s existence, it may make distributions at a greater (or lesser) rate than the coupon payments received on the Fund’s portfolio, which will result in the Fund returning a lesser (or greater) amount on liquidation than would otherwise be the case. The rate of Fund distribution payments may adversely affect the tax characterization of your returns from an investment in the Fund relative to a direct investment in corporate bonds. If the amount you receive as liquidation proceeds upon the Fund’s termination is higher or lower than your cost basis, you may experience a gain or loss for tax purposes.

Foreign Issuers Risk—The Fund may invest in U.S. registered, dollar-denominated bonds of foreign corporations, which have different risks than investing in U.S. companies. These include differences in accounting, auditing and financial reporting standards, the possibility of expropriation or confiscatory taxation, adverse changes in investment or exchange control regulations, political instability which could affect U.S. investments in foreign countries and potential restrictions of the flow of international capital.

High Yield and Unrated Securities Risk—High yield, below investment grade and unrated high risk debt securities (which also may be known as "junk bonds") may present additional risks because these securities may be less liquid, and therefore more difficult to value accurately and sell at an advantageous price or time, present more credit risk than investment grade bonds and subject to greater risk of default. The price of high yield securities tends to be subject to greater volatility due to issuer-specific operating results and outlook and to real or perceived adverse economic and competitive industry conditions.

Income Risk—The Fund's income may decline during period of falling interest rates or when the Fund experiences defaults on debt securities it holds. The amount and rate of distributions that the Fund's shareholders receive are affected by the income that the Fund receives from its portfolio holdings. If the income is reduced, distributions by the Fund to shareholders may be less.

Interest Rate Risk—Investments in fixed-income securities are subject to the possibility that interest rates could rise sharply, causing the value of the Fund’s securities and share price to decline. The risks associated with rising interest rates are heightened given the historically low interest rate environment. Fixed-income securities with longer durations are subject to more volatility than those with shorter durations.

Issuer-Specific Changes Risk—The value of an individual security or particular type of security can be more volatile than the market as a whole and can perform differently from the value of the market as a whole. The value of securities of smaller issuers can be more volatile than those of larger issuers.

Liquidity and Valuation Risk—In certain circumstances, it may be difficult for the Fund to purchase and sell particular investments within a reasonable time at a fair price, or the price at which it has been valued by the Investment Adviser for purposes of the Fund’s net asset value ("NAV"), causing the Fund to be less liquid and unable to realize what the Investment Adviser believes should be the price of the investment.

Market Price Risk—Shares are listed for trading on NYSE Arca, Inc. ("NYSE Arca") and are bought and sold in the secondary market at market prices. The market prices of Shares may fluctuate continuously during trading hours, in some cases materially, in response to changes in the NAV and supply and demand for Shares, among other factors. Although it is expected that the market price of Shares typically will remain closely correlated to the NAV,

SUMMARY PROSPECTUS |4

the market price will generally differ from the NAV because of timing reasons, supply and demand imbalances and other factors. As a result, the trading prices of Shares may deviate significantly from NAV during certain periods, especially those of market volatility. The Investment Adviser cannot predict whether Shares will trade above (premium), below (discount) or at their NAV. Thus, an investor may pay more than NAV when buying Shares in the secondary market and receive less than NAV when selling Shares in the secondary market.

Market Risk—The value of, or income generated by, the securities held by the Fund may fluctuate rapidly and unpredictably as a result of factors affecting individual companies or changing economic, political, social or financial market conditions throughout the world because of the interconnected global economies and financial markets.

Non-Correlation Risk—The Fund’s return may not match the return of the Index for a number of reasons. For example, the Fund incurs a number of operating expenses not applicable to the Index, and incurs costs in buying and selling securities, especially when rebalancing the Fund’s securities holdings to reflect changes in the composition of the Index. Since the Index constituents may vary on a monthly basis, the Fund’s costs associated with rebalancing may be greater than those incurred by other exchange-traded funds ("ETFs") that track indices whose composition changes less frequently. In addition, the performance of the Fund and the Index may vary due to asset valuation differences and differences between the Fund's portfolio and the Index resulting from legal restrictions, cash flows or operational inefficiencies.

Passive Management Risk—Unlike many investment companies, the Fund is not “actively” managed. Therefore, it would not necessarily sell a security because the security’s issuer was in financial trouble or defaulted on its obligations under the security, or whose credit rating was downgraded, unless that security is removed from the Index. In addition, the Fund will not otherwise take defensive positions in declining markets unless such positions are reflected in the Index.

Prepayment Risk—Securities subject to prepayment risk generally offer less potential for gains when interest rates decline, because issuers of the securities may be able to prepay the principal due on the securities. These securities generally offer less potential for gains when interest rates decline and may offer a greater potential for loss when interest rates rise.

Regulatory and Legal Risk—U.S. and other regulators and governmental agencies may implement additional regulations and legislators may pass new laws that affect the investments held by the Fund, the strategies used by the Fund or the level of regulation applying to the Fund. These may impact the investment strategies, performance, costs and operations of the Fund.

Restricted Securities Risk—Restricted securities generally cannot be sold to the public and may involve a high degree of business, financial and liquidity risk, which may result in substantial losses to the Fund.

Risk of Cash Transactions—In certain instances, unlike most ETFs, the Fund may effect creations and redemptions for cash, rather than in-kind. As a result, an investment in the Fund may be less tax-efficient than an investment in a more conventional ETF.

PERFORMANCE INFORMATION

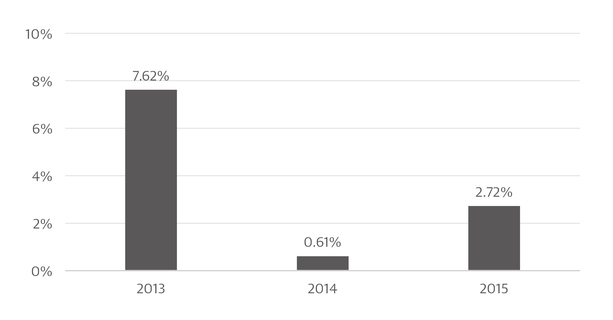

The following chart and table provide some indication of the risks of investing in the Fund by showing the Fund’s performance from year to year and average annual returns for the one year and since inception periods compared to those of the Index and a broad measure of market performance. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance information for the Fund is available at guggenheiminvestments.com.

SUMMARY PROSPECTUS |5

Calendar Year Total Return as of 12/31

The Fund’s year-to-date total return was 1.18% as of June 30, 2016.

Highest Quarter Return Q3 2013 3.18% | Lowest Quarter Return Q3 2014 -1.71% | |

Average Annual Total Returns (for the periods ended December 31, 2015)

After-tax returns shown in the table are calculated using the historical highest individual federal marginal income

tax rates and do not reflect the impact of any state or local tax. Actual after-tax returns depend on an investor's

tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold Shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (IRAs).

Average Annual Total Returns for the Periods Ended December 31, 2015 | 1 year | Since Inception (4/25/2012) |

Returns Before Taxes | 2.72% | 5.03% |

Returns After Taxes on Distributions | 1.26% | 3.33% |

Returns After Taxes on Distributions and Sale of Fund Shares | 1.53% | 3.12% |

Nasdaq BulletShares® USD High Yield Corporate Bond 2016 Index (reflects no deduction for fees,expenses or taxes) | 3.36% | 5.33% |

Bloomberg Barclays U.S. Corporate High Yield Index (reflects no deduction for fees, expenses or taxes) | -4.47% | 3.86% |

MANAGEMENT OF THE FUND

Guggenheim Funds Investment Advisors, LLC serves as the investment adviser of the Fund. The portfolio managers who are currently responsible for the day-to-day management of the Fund’s portfolio are Michael P. Byrum, CFA, Senior Managing Director and Portfolio Manager, James R. King, CFA, Managing Director and Portfolio Manager, and Jeremy Neisewander, Portfolio Manager. Messrs. Byrum and King have each managed the Fund’s portfolio since December 2013. Mr. Neisewander has managed the Fund’s portfolio since May 2016.

PURCHASE AND SALE OF FUND SHARES

The Fund will issue and redeem Shares at NAV only in a large specified number of Shares called a “Creation Unit” or multiples thereof with certain large institutional investors. A Creation Unit consists of 100,000 Shares. Creation Unit transactions are typically constructed in exchange for the deposit or delivery of securities specified by the

SUMMARY PROSPECTUS |6

Fund and/or cash. Except when aggregated in Creation Units, the Shares are not redeemable securities of the Fund. Individual Shares of the Fund may only be purchased and sold in secondary market transactions through brokers and may not be purchased or redeemed directly with the Fund. Shares of the Fund are listed for trading on NYSE Arca and, because Shares trade at market prices rather than NAV, Shares of the Fund may trade at a price greater than (premium) or less than (discount) NAV.

TAX INFORMATION

The Fund’s distributions are taxable and will generally be taxed as ordinary income or capital gains.

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase Shares of the Fund through a broker-dealer or other financial intermediary, the Investment Adviser or other related companies may pay the intermediary for the sale of Shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

SUMMARY PROSPECTUS |7

|

227 West Monroe Street Chicago, Illinois 60606 800.820.0888 guggenheiminvestments.com |

SUMMARY PROSPECTUS |8

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Residents, Community Officials Celebrate Aya Tower in East Point following $24 Million Redevelopment

- Utility Concierge Rebrands as Move Concierge

- Dental Practice Management Software Market to Surpass USD 5.54 Billion by 2031 Owing to Rising Dental Visits and Technological Advancements

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share