Form 497K Advantage Funds, Inc.

|

|

Dreyfus Global Real Return Fund | |||||

|

Summary Prospectus September 6, 2016 |

||||||

|

Class Ticker A DRRAX | ||||||

Before you invest, you may want to review the fund's prospectus, which contains more information about the fund and its risks. You can find the fund's prospectus and other information about the fund, including the statement of additional information and most recent reports to shareholders, online at www.dreyfus.com/funddocuments. You can also get this information at no cost by calling 1-800-DREYFUS (inside the U.S. only) or by sending an e-mail request to [email protected]. The fund's prospectus and statement of additional information, dated March 1, 2016 (each as revised or supplemented), are incorporated by reference into this summary prospectus.

The fund seeks total return (consisting of capital appreciation and income).

This table describes the fees and expenses that you may pay if you buy and hold shares of the fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the fund or certain other funds in the Dreyfus Family of Funds. More information about these and other discounts is available from your financial professional and in the Shareholder Guide section beginning on page 16 of the prospectus and in the How to Buy Shares section and the Additional Information About How to Buy Shares section beginning on page II-1 and page III-1, respectively, of the fund's Statement of Additional Information.

|

Shareholder Fees (fees paid directly from your investment) |

||||

|

Class A |

Class C |

Class I |

Class Y | |

|

Maximum sales charge (load) imposed on purchases |

5.75 |

none |

none |

none |

|

Maximum deferred sales charge (load) |

none* |

1.00 |

none |

none |

|

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

||||

|

|

|

|

| |

|

Class A |

Class C |

Class I |

Class Y | |

|

Management fees |

.75 |

.75 |

.75 |

.75 |

|

Distribution (12b-1) fees |

none |

.75 |

none |

none |

|

Other expenses (including shareholder services fees) |

.40 |

.41 |

.11 |

.08 |

|

Total annual fund operating expenses |

1.15 |

1.91 |

.86 |

.83 |

|

Fee waiver and/or expense reimbursement** |

- |

(.01) |

- |

- |

|

Total annual fund operating expenses (after fee waiver and/or expense reimbursement) |

1.15 |

1.90 |

.86 |

.83 |

|

*Class A shares bought without an initial sales charge as part of an investment of $1 million or more may be charged a deferred sales charge of 1.00% if redeemed within one year. **The fund's investment adviser, The Dreyfus Corporation, has contractually agreed, until March 1, 2017, to waive receipt of its fees and/or assume the direct expenses of the fund so that the expenses of none of the classes (excluding Rule 12b-1 fees, shareholder services fees, taxes, interest, brokerage commissions, commitment fees on borrowings and extraordinary expenses) exceed .90%. On or after March 1, 2017, The Dreyfus Corporation may terminate this expense limitation at any time. | ||||

|

|

|

Example

The Example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the fund's operating expenses remain the same. The one-year example and the first year of the three-, five- and ten-years examples are based on net operating expenses, which reflect the expense limitation by The Dreyfus Corporation. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

1 Year |

3 Years |

5 Years |

10 Years | |

|

Class A |

$685 |

$919 |

$1,172 |

$1,892 |

|

Class C |

$293 |

$599 |

$1,031 |

$2,232 |

|

Class I |

$88 |

$274 |

$477 |

$1,061 |

|

Class Y |

$85 |

$265 |

$460 |

$1,025 |

You would pay the following expenses if you did not redeem your shares:

|

1 Year |

3 Years |

5 Years |

10 Years | |

|

Class A |

$685 |

$919 |

$1,172 |

$1,892 |

|

Class C |

$193 |

$599 |

$1,031 |

$2,232 |

|

Class I |

$88 |

$274 |

$477 |

$1,061 |

|

Class Y |

$85 |

$265 |

$460 |

$1,025 |

Portfolio Turnover

The fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the fund's performance. During the most recent fiscal year, the fund's portfolio turnover rate was 68.92% of the average value of its portfolio.

To pursue its goal, the fund uses an actively-managed multi-asset strategy to produce absolute or real returns with less volatility than major equity markets over a complete market cycle, typically a period of five years. The fund is not managed to a benchmark index. Rather than managing to track a benchmark index, the fund seeks to provide returns that are largely independent of market moves.

The fund allocates its investments among global equities, bonds and cash, and, generally to a lesser extent, other asset classes, including real estate, commodities, currencies and alternative or non-traditional asset classes and strategies, primarily those accessed through derivative instruments. The fund may invest in, or otherwise have investment exposure to, the securities of companies of any market capitalization. The fund obtains investment exposure to these asset classes by investing in securities and through derivative instruments.

The fund's portfolio managers combine a top-down approach, emphasizing economic trends and current investment themes on a global basis, with bottom-up security selection based on fundamental research to allocate the fund's investments among and within asset classes. In choosing investments, the portfolio managers consider: key trends in global economic variables, such as gross domestic product, inflation and interest rates; investment themes, such as changing demographics, the impact of new technologies and the globalization of industries and brands; relative valuations of equity securities, bonds and cash; long-term trends in currency movements; and company fundamentals. Within markets and sectors determined to be attractive in absolute terms, the fund's portfolio managers seek what they believe to be attractively priced companies that possess a sustainable competitive advantage in their market or sector and invest in such companies across their capital structures. The portfolio managers generally will sell investments when themes change or when the portfolio managers determine that a particular market or sector is no longer considered attractive in absolute terms, a company's prospects have changed or the investment is fully valued by the market.

The fund's investments will be focused globally among the developed and emerging capital markets of the world. The portfolio managers have considerable latitude in allocating the fund's investments and in selecting securities and derivative instruments to implement the fund's investment approach, although the fund must invest at least 10% of the value of its total assets in equity securities and at least 10% of the value of its total assets in fixed-income securities. Subject to such requirements, the fund is not otherwise limited in its ability to use derivative instruments. The fund may invest in bonds and other fixed-income securities of any maturity or duration. A bond's maturity is the length of time until the principal must be fully repaid with interest. Average

|

Dreyfus Global Real Return Fund Summary |

2 |

effective portfolio maturity is an average of the maturities of bonds held by the fund directly and the bonds underlying derivative instruments entered into by the fund, if any, adjusted to reflect provisions or market conditions that may cause a bond's principal to be repaid earlier than at its stated maturity. Duration is an indication of an investment's "interest rate risk," or how sensitive a bond or the fund's portfolio may be to changes in interest rates.

The fund may use to a significant degree derivative instruments, such as options, futures and options on futures (including those relating to securities, indexes, foreign currencies and interest rates), forward contracts, swap agreements and structured notes, as a substitute for investing directly in equities, bonds, currencies and other asset classes in connection with its investment strategy. The fund also may use such derivatives as part of a hedging strategy or for other purposes related to the management of the fund.

The fund's portfolio will not have the same characteristics as its designated performance baseline benchmark — U.S.$ 1-Month LIBOR — or its designated broad-based securities market index — the Citi 1-Month U.S. Treasury Bill Index. Although the fund is not managed to a benchmark index, the fund seeks to provide a minimum average annual total return of U.S.$ 1-Month LIBOR plus 4%, before fees and expenses, over a five-year period. There can be no assurance the fund will be able to provide such returns.

An investment in the fund is not a bank deposit. It is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. It is not a complete investment program. The fund's share price fluctuates, sometimes dramatically, which means you could lose money.

· Allocation risk. The ability of the fund to achieve its investment goal depends, in part, on the ability of the fund's portfolio manager to allocate effectively the fund's assets among the global equities, bonds and cash, and other asset classes. There can be no assurance that the actual allocations will be effective in achieving the fund's investment goal.

· Correlation risk. Because the fund allocates its investments among different asset classes, the fund is subject to correlation risk. Although the prices of equity securities and fixed-income securities, as well as other asset classes, often rise and fall at different times so that a fall in the price of one may be offset by a rise in the price of the other, in down markets the prices of these securities and asset classes can also fall in tandem.

· Risks of stock investing. Stocks generally fluctuate more in value than bonds and may decline significantly over short time periods. There is the chance that stock prices overall will decline because stock markets tend to move in cycles, with periods of rising prices and falling prices. The market value of a stock may decline due to general market conditions or because of factors that affect the particular company or the company's industry.

· Market sector risk. The fund may significantly overweight or underweight certain countries, companies, industries or market sectors, which may cause the fund's performance to be more or less sensitive to developments affecting those countries, companies, industries or sectors.

· Foreign investment risk. To the extent the fund invests in foreign securities, the fund's performance will be influenced by political, social and economic factors affecting investments in foreign issuers. Special risks associated with investments in foreign issuers include exposure to currency fluctuations, less liquidity, less developed or less efficient trading markets, lack of comprehensive company information, political and economic instability and differing auditing and legal standards. Investments denominated in foreign currencies are subject to the risk that such currencies will decline in value relative to the U.S. dollar and affect the value of these investments held by the fund. To the extent the fund's investments are focused in a limited number of foreign countries, the fund's performance could be more volatile than that of more geographically diversified funds.

· Emerging market risk. The securities of issuers located or doing substantial business in emerging market countries tend to be more volatile and less liquid than the securities of issuers located in countries with more mature economies. Emerging markets generally have less diverse and less mature economic structures and less stable political systems than those of developed countries. Investments in these countries may be subject to political, economic, legal, market and currency risks. The risks may include less protection of property rights and uncertain political and economic policies, the imposition of capital controls and/or foreign investment limitations by a country, nationalization of businesses and the imposition of sanctions by other countries, such as the United States.

· Foreign currency risk. Investments in foreign currencies are subject to the risk that those currencies will decline in value relative to the U.S. dollar or, in the case of hedged positions, that the U.S. dollar will decline relative to the currency being hedged. Currency exchange rates may fluctuate significantly over short periods of time. Foreign currencies, particularly the currencies of emerging market countries, are also subject to risks caused by inflation, interest rates, budget deficits and low savings rates, political factors and government intervention and controls.

|

Dreyfus Global Real Return Fund Summary |

3 |

· Large cap stock risk. To the extent the fund invests in large capitalization stocks, the fund may underperform funds that invest primarily in the stocks of lower quality, smaller capitalization companies during periods when the stocks of such companies are in favor.

· Small and midsize company risk. Small and midsize companies carry additional risks because the operating histories of these companies tend to be more limited, their earnings and revenues less predictable (and some companies may be experiencing significant losses), and their share prices more volatile than those of larger, more established companies. The shares of smaller companies tend to trade less frequently than those of larger, more established companies, which can adversely affect the pricing of these securities and the fund's ability to sell these securities.

· Commodity sector risk. Exposure to the commodities markets may subject the fund to greater volatility than investments in traditional securities. The values of commodities and commodity-linked investments are affected by events that might have less impact on the values of stocks and bonds. Investments linked to the prices of commodities are considered speculative. Because the value of a commodity-linked derivative instrument, such as a structured note, typically is based upon the price movements of physical commodities, the value of these securities will rise or fall in response to changes in the underlying commodities or related index of investment. Prices of commodities and commodity-linked investments may fluctuate significantly over short periods for a variety of factors, including: changes in supply and demand relationships, weather, agriculture, trade, fiscal, monetary and exchange control programs, disease, pestilence, acts of terrorism, embargoes, tariffs and international economic, political, military and regulatory developments.

· Real estate sector risk. The securities of issuers that are principally engaged in the real estate sector may be subject to risks similar to those associated with the direct ownership of real estate. These include: declines in real estate values; defaults by mortgagors or other borrowers and tenants; increases in property taxes and operating expenses; overbuilding; fluctuations in rental income; changes in interest rates; possible lack of availability of mortgage funds or financing; extended vacancies of properties; changes in tax and regulatory requirements (including zoning laws and environmental restrictions); losses due to costs resulting from the clean-up of environmental problems; liability to third parties for damages resulting from environmental problems; and casualty or condemnation losses. In addition, the performance of the economy in each of the regions and countries in which the real estate owned by a portfolio company is located affects occupancy, market rental rates and expenses and, consequently, has an impact on the income from such properties and their underlying values. Moreover, certain real estate investments may be illiquid and, therefore, the ability of real estate companies to reposition their portfolios promptly in response to changes in economic or other conditions is limited.

· Derivatives risk. A small investment in derivatives could have a potentially large impact on the fund's performance. The use of derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in the underlying assets, and the fund's use of derivatives may result in losses to the fund. Derivatives in which the fund may invest can be highly volatile, illiquid and difficult to value, and there is the risk that changes in the value of a derivative held by the fund will not correlate with the underlying instruments or the fund's other investments in the manner intended. Certain types of derivatives, including structured notes, swap agreements, forward contracts, over-the-counter options and other over-the-counter transactions, involve greater risks than the underlying obligations because, in addition to general market risks, they are subject to illiquidity risk, counterparty risk, credit risk and pricing risk. Because many derivatives have a leverage component, adverse changes in the value or level of the underlying asset, reference rate or index can result in a loss substantially greater than the amount invested in the derivative itself. Certain derivatives have the potential for unlimited loss, regardless of the size of the initial investment. The fund may be required to segregate liquid assets, or otherwise cover its obligations, relating to the fund's transactions in derivatives.

· Fixed-income market risk. The market value of a fixed-income security may decline due to general market conditions that are not specifically related to a particular company, such as real or perceived adverse economic conditions, changes in the outlook for corporate earnings, changes in interest or currency rates or adverse investor sentiment generally. The fixed-income securities market can be susceptible to increases in volatility and decreases in liquidity. Liquidity can decline unpredictably in response to overall economic conditions or credit tightening. Increases in volatility and decreases in liquidity may be caused by a rise in interest rates (or the expectation of a rise in interest rates), which currently are at or near historic lows in the United States and in other countries. An unexpected increase in fund redemption requests, including requests from shareholders who may own a significant percentage of the fund's shares, which may be triggered by market turmoil or an increase in interest rates, could cause the fund to sell its holdings at a loss or at undesirable prices and adversely affect the fund's share price and increase the fund's liquidity risk, fund expenses and/or taxable distributions.

· Interest rate risk. Prices of bonds and other fixed rate fixed-income securities tend to move inversely with changes in interest rates. Typically, a rise in rates will adversely affect fixed-income securities and, accordingly, will cause the value of the fund's investments in these securities to decline. During periods of very low interest rates, which occur from time to time due to market forces or actions of governments and/or their central banks, including the Board of Governors of the Federal Reserve System in the U.S., the fund may be subject to a greater risk of principal decline from rising interest rates. When interest rates fall, the values of already-issued fixed rate fixed-income securities generally rise. However, when interest rates fall, the fund's

|

Dreyfus Global Real Return Fund Summary |

4 |

investments in new securities may be at lower yields and may reduce the fund's income. The magnitude of these fluctuations in the market price of fixed-income securities is generally greater for securities with longer effective maturities and durations because such instruments do not mature, reset interest rates or become callable for longer periods of time. The change in the value of a fixed-income security or portfolio can be approximated by multiplying its duration by a change in interest rates. For example, the market price of a fixed-income security with a duration of three years would be expected to decline 3% if interest rates rose 1%. Conversely, the market price of the same security would be expected to increase 3% if interest rates fell 1%. Risks associated with rising interest rates are heightened given that interest rates in the United States and other countries currently are at or near historic lows. Risks associated with rising interest rates are heightened given that interest rates in the United States and other countries are at or near historic lows.

· Credit risk. Failure of an issuer of a security to make timely interest or principal payments when due, or a decline or perception of a decline in the credit quality of the security, can cause the security's price to fall, lowering the value of the fund's investment in such security. The lower a security's credit rating, the greater the chance that the issuer of the security will default or fail to meet its payment obligations.

· High yield securities risk. High yield ("junk") securities involve greater credit risk, including the risk of default, than investment grade securities, and are considered predominantly speculative with respect to the issuer's ability to make principal and interest payments. The prices of high yield securities can fall in response to bad news about the issuer or its industry, or the economy in general, to a greater extent than those of higher rated securities. Securities rated investment grade when purchased by the fund may subsequently be downgraded.

· Liquidity risk. When there is little or no active trading market for specific types of securities, it can become more difficult to sell the securities in a timely manner at or near their perceived value. In such a market, the value of such securities and the fund's share price may fall dramatically, even during periods of declining interest rates.

· Issuer risk. A security's market value may decline for a number of reasons which directly relate to the issuer, such as management performance, financial leverage and reduced demand for the issuer's products or services, or factors that affect the issuer's industry, such as labor shortages or increased production costs and competitive conditions within an industry.

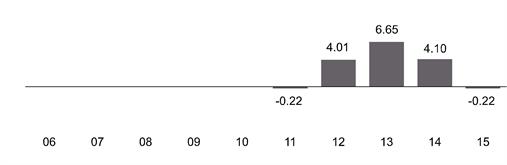

The following bar chart and table provide some indication of the risks of investing in the fund. The bar chart shows changes in the performance of the fund's Class A shares from year to year. The table compares the average annual total returns of the fund's Class A shares to those of a broad measure of market performance. The fund's past performance (before and after taxes) is not necessarily an indication of how the fund will perform in the future. Sales charges, if any, are not reflected in the bar chart, and if those charges were included, returns would have been less than those shown. More recent performance information may be available at www.dreyfus.com.

|

Year-by-Year Total Returns as of 12/31 each year (%) Class A | |

|

|

Best Quarter Worst Quarter |

After-tax performance is shown only for Class A shares. After-tax performance of the fund's other share classes will vary. After-tax returns are calculated using the historical highest individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor's tax situation and may differ from those shown, and the after-tax returns shown are not relevant to investors who hold their shares through U.S. tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

|

Dreyfus Global Real Return Fund Summary |

5 |

For the fund’s Class Y shares, periods prior to the inception date reflect the performance of the fund’s Class A shares, not reflecting the applicable sales charges for Class A shares. Such performance figures have not been adjusted to reflect applicable class fees and expenses.

|

Average Annual Total Returns (as of 12/31/15) | |||

|

Class (Inception Date) |

1 Year |

5 Year |

Since Inception |

|

Class A (5/12/10) returns before taxes |

-5.98% |

1.62% |

2.90% |

|

Class A returns after taxes on distributions |

-7.26% |

0.95% |

2.30% |

|

Class A returns after taxes on distributions and sale of fund shares |

-3.06% |

1.05% |

2.19% |

|

Class C (5/12/10) returns before taxes |

-1.92% |

2.02% |

3.22% |

|

Class I (5/12/10) returns before taxes |

0.00% |

3.10% |

4.26% |

|

Class Y (7/1/13) returns before taxes |

0.09% |

3.04% |

4.17% |

|

U.S. $ 1-Month LIBOR reflects no deduction for fees, expenses or taxes |

0.19% |

0.20% |

0.22%* |

|

Citi 1-Month U.S. Treasury Bill Index reflects no deduction for fees, expenses or taxes |

0.02% |

0.04% |

0.05%* |

|

*For comparative purposes, the value of the index on April 30, 2010 is used as the beginning value on May 12, 2010. | |||

The fund's investment adviser is The Dreyfus Corporation (Dreyfus). Dreyfus has engaged its affiliate, Newton Capital Management Limited (Newton), to serve as the fund's sub-investment adviser.

Suzanne Hutchins and Aron Pataki are the fund's primary portfolio managers, positions they have held since December 2010 and December 2015, respectively. Ms. Hutchins, the fund's lead portfolio manager, is a global investment manager and a member of the real return team at Newton. Mr. Pataki is a global investment manager and a member of the real return team at Newton.

In general, for each share class, other than Class Y, the fund's minimum initial investment is $1,000 and the minimum subsequent investment is $100. For Class Y shares, the minimum initial investment generally is $1,000,000, with no minimum subsequent investment. You may sell (redeem) your shares on any business day by calling 1-800-DREYFUS (inside the U.S. only) or by visiting www.dreyfus.com. If you invested in the fund through a third party, such as a bank, broker-dealer or financial adviser, or through a Retirement Plan (as defined below), you may mail your request to sell shares to Dreyfus Institutional Department, P.O. Box 9882, Providence, Rhode Island 02940-8082. If you invested directly through the fund, you may mail your request to sell shares to Dreyfus Shareholder Services, P.O. Box 9879, Providence, Rhode Island 02940-8079. If you are an Institutional Direct accountholder, please contact your BNY Mellon relationship manager for instructions. Retirement Plans include qualified or non-qualified employee benefit plans, such as 401(k), 403(b)(7), Keogh, pension, profit-sharing and other deferred compensation plans, whether established by corporations, partnerships, sole proprietorships, non-profit entities, trade or labor unions, or state and local governments, but do not include IRAs (including, without limitation, traditional IRAs, Roth IRAs, Coverdell Education Savings Accounts, IRA "Rollover Accounts" or IRAs set up under Simplified Employee Pension Plans (SEP-IRAs), Salary Reduction Simplified Employee Pension Plans (SARSEPs) or Savings Incentive Match Plans for Employees (SIMPLE IRAs)).

The fund's distributions are taxable as ordinary income or capital gains, except when your investment is through an IRA, Retirement Plan or other U.S. tax-advantaged investment plan (in which case you may be taxed upon withdrawal of your investment from such account).

If you purchase shares (other than Class Y shares) through a broker-dealer or other financial intermediary (such as a bank), the fund and its related companies may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the fund over another investment. Ask your salesperson or visit your financial intermediary's website for more information.

This prospectus does not constitute an offer or solicitation in any state or jurisdiction in which, or to any person to whom, such offering or solicitation may not lawfully be made.

|

Dreyfus Global Real Return Fund Summary |

6 |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Bank of New York Mellon (BK) PT Raised to $68 at Jefferies

- Relevate Power Announces Rebranding and Launches Equity Raise to Accelerate M&A Growth

- NeoGames and Aristocrat Receive Final Regulatory Approvals on Proposed Acquisition

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share