Form 425 TIVO INC Filed by: Rovi Corp

Filed by Rovi Corporation Pursuant to

Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Companies:

Rovi Corporation (Commission File No. 000-53413),

TiVo Inc. (Commission File No. 000-27141), and

Titan Technologies Corporation (Commission File No. 000-53413)

On or about May 3, 2016, Rovi Corporation posted the following slides on its website and distributed such slides to certain investors as an attachment to the below email.

Subject: Details on the ROVI/TIVO two-way collar mechanism

[Name],

Rovi has filed the attached slide detailing the two-way collar mechanism.

Please reply to this email to let me know if you have questions or would like a call.

Regards,

Peter

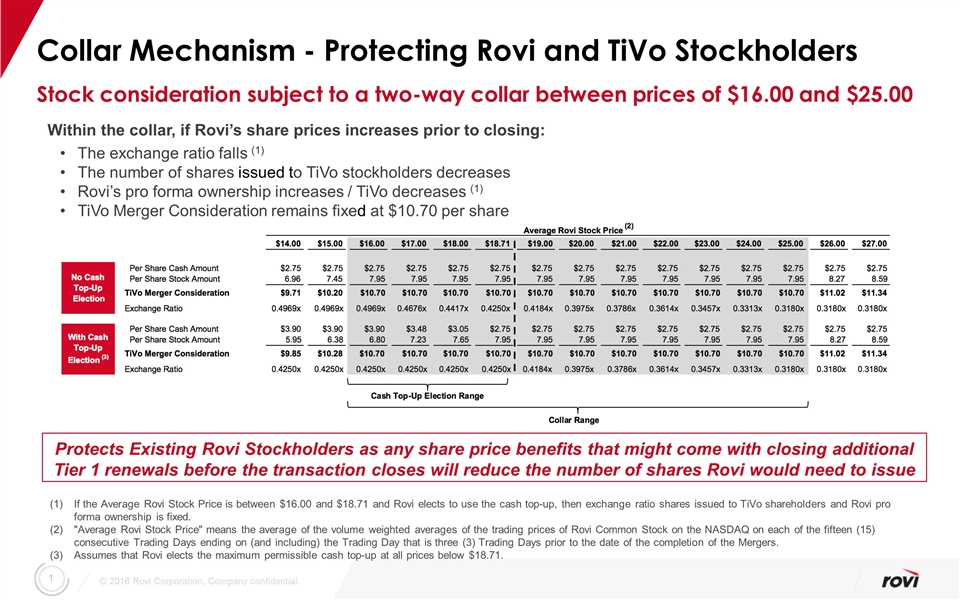

Collar Mechanism - Protecting Rovi and TiVo Stockholders If the Average Rovi Stock Price is between $16.00 and $18.71 and Rovi elects to use the cash top-up, then exchange ratio shares issued to TiVo shareholders and Rovi pro forma ownership is fixed. "Average Rovi Stock Price" means the average of the volume weighted averages of the trading prices of Rovi Common Stock on the NASDAQ on each of the fifteen (15) consecutive Trading Days ending on (and including) the Trading Day that is three (3) Trading Days prior to the date of the completion of the Mergers. Assumes that Rovi elects the maximum permissible cash top-up at all prices below $18.71. Protects Existing Rovi Stockholders as any share price benefits that might come with closing additional Tier 1 renewals before the transaction closes will reduce the number of shares Rovi would need to issue Within the collar, if Rovi’s share prices increases prior to closing: The exchange ratio falls (1) The number of shares issued to TiVo stockholders decreases Rovi’s pro forma ownership increases / TiVo decreases (1) TiVo Merger Consideration remains fixed at $10.70 per share Stock consideration subject to a two-way collar between prices of $16.00 and $25.00

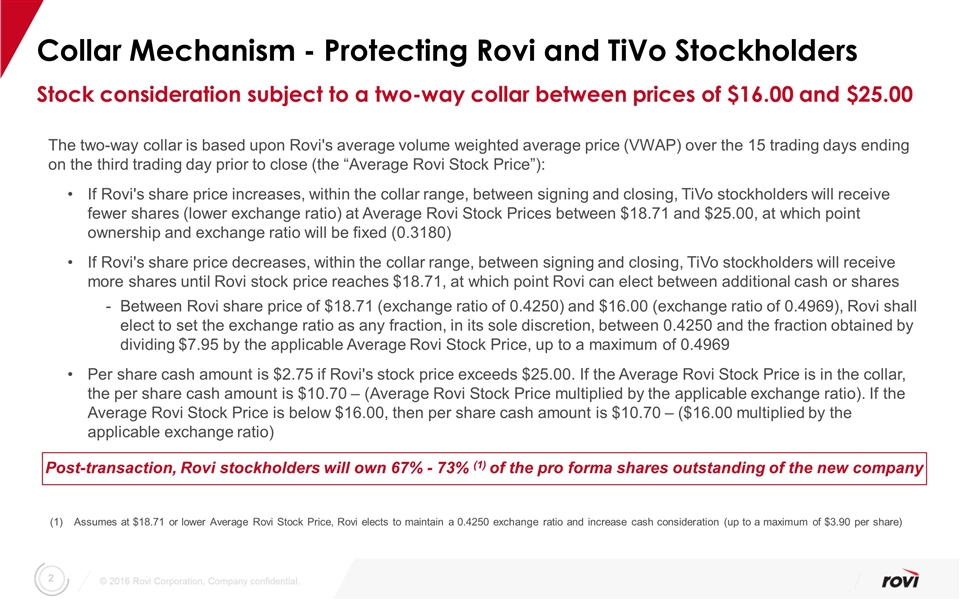

Collar Mechanism - Protecting Rovi and TiVo Stockholders Assumes at $18.71 or lower Average Rovi Stock Price, Rovi elects to maintain a 0.4250 exchange ratio and increase cash consideration (up to a maximum of $3.90 per share) The two-way collar is based upon Rovi's average volume weighted average price (VWAP) over the 15 trading days ending on the third trading day prior to close (the “Average Rovi Stock Price”): If Rovi's share price increases, within the collar range, between signing and closing, TiVo stockholders will receive fewer shares (lower exchange ratio) at Average Rovi Stock Prices between $18.71 and $25.00, at which point ownership and exchange ratio will be fixed (0.3180) If Rovi's share price decreases, within the collar range, between signing and closing, TiVo stockholders will receive more shares until Rovi stock price reaches $18.71, at which point Rovi can elect between additional cash or shares Between Rovi share price of $18.71 (exchange ratio of 0.4250) and $16.00 (exchange ratio of 0.4969), Rovi shall elect to set the exchange ratio as any fraction, in its sole discretion, between 0.4250 and the fraction obtained by dividing $7.95 by the applicable Average Rovi Stock Price, up to a maximum of 0.4969 Per share cash amount is $2.75 if Rovi's stock price exceeds $25.00. If the Average Rovi Stock Price is in the collar, the per share cash amount is $10.70 – (Average Rovi Stock Price multiplied by the applicable exchange ratio). If the Average Rovi Stock Price is below $16.00, then per share cash amount is $10.70 – ($16.00 multiplied by the applicable exchange ratio) Post-transaction, Rovi stockholders will own 67% - 73% (1) of the pro forma shares outstanding of the new company Stock consideration subject to a two-way collar between prices of $16.00 and $25.00

Forward-Looking Statements; No Offer or Solicitation Please review our SEC filings, including forms 10-Q and 10-K Forward-Looking Statements This presentation contains "forward-looking" statements as that term is defined in the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements regarding the proposed acquisition of TiVo, the collar mechanism for the exchange of shares in the transaction, and the impact of Average Rovi Stock Price (as defined in the presentation) changes on both (i) the cash and stock portions of the purchase price paid to TiVo stockholders and (ii) the total merger consideration paid to TiVo stockholders. A number of factors could cause actual results to differ from anticipated results expressed in such forward-looking statements. Such factors include, among others, 1) uncertainties as to the timing of the consummation of the transaction and the ability of each party to consummate the transaction; 2) uncertainty as to the actual premium that will be realized by TiVo stockholders in connection with the proposed transaction; and 3) events and occurrences that may affect the Average Rovi Stock Price (as defined in the presentation), which include Tier 1 renewals and the timing thereof, operating results, and other events that may cause Rovi’s stock price to fluctuate from time to time. The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included herein and elsewhere, including the Risk Factors included in Rovi’s Annual Report on Form 10-K for the period ended December 31, 2015, Rovi’s Quarterly Report on Form 10-Q for the period ended March 31, 2016, and other Rovi securities filings which are on file with the Securities and Exchange Commission (available at www.sec.gov). Rovi assumes no obligation to update any forward-looking statements except as required by law. No Offer or Solicitation The information in this communication is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the proposed transactions or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

ADDITIONAL INFORMATION ABOUT THE PROPOSED TRANSACTION AND WHERE TO FIND IT This communication is not a solicitation of a proxy from any stockholder of Rovi, Titan Technologies Corporation or TiVo. In connection with the Agreement and Plan of Merger among Rovi, TiVo, Titan Technologies Corporation (“Parent”), Nova Acquisition Sub, Inc. and Titan Acquisition Sub, Inc., Rovi, TiVo and Parent intend to file relevant materials with the SEC, including a Registration Statement on Form S-4 filed by Parent that will contain a joint proxy statement/prospectus. ROVI AND TIVO STOCKHOLDERS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED TRANSACTION WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION ABOUT ROVI, TIVO, PARENT AND THE PROPOSED TRANSACTION. Stockholders may obtain a free copy of the joint proxy statement/prospectus (when it becomes available), as well as any other documents filed by Rovi, Parent and TiVo with the Securities and Exchange Commission, at the Securities and Exchange Commission’s Web site at http://www.sec.gov. Stockholders may also obtain a free copy of the joint proxy statement/prospectus and the filings with the SEC that will be incorporated by reference in the joint proxy statement/prospectus from Rovi by directing a request to Rovi Investor Relations at +1-818-565-5200 and from TiVo by directing a request to MacKenzie Partners, Inc., 105 Madison Avenue, New York, New York, 10016, (212) 929-5500, [email protected]. PARTICIPANTS IN THE SOLICITATION Rovi, Parent, TiVo and their respective directors and executive officers and other members of their management and employees may be deemed, under Securities and Exchange Commission rules, to be participants in the solicitation of proxies in connection with the proposed transaction. Information regarding Rovi’s directors and officers can be found in its proxy statement filed with the Securities and Exchange Commission on March 10, 2016 and information regarding TiVo’s directors and officers can be found in its proxy statement filed with the Securities and Exchange Commission on June 1, 2015. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests in the transaction, by security holdings or otherwise, will be contained in the Form S-4 and the joint proxy statement/prospectus that Parent will file with the Securities and Exchange Commission when it becomes available. Stockholders may obtain a free copy of these documents as described in the preceding paragraph. ADDITIONAL INFORMATION ABOUT THE PROPOSED TRANSACTION AND WHERE TO FIND IT; PARTICIPANTS IN THE SOLICITATION

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Tines Announces $50 Million in New Financing

- Owens Corning Delivers Net Sales of $2.3 Billion; Generates Net Earnings of $299 Million and Adjusted EBIT of $438 Million

- Thermo Fisher Scientific to Host Investor Day

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share