Form 425 FAIRPOINT COMMUNICATIONS Filed by: FAIRPOINT COMMUNICATIONS INC

Filed by FairPoint Communications, Inc.

Pursuant to Rule 425 under

the Securities Act of 1933, as amended,

and deemed filed pursuant to Rule 14a-12 under

the Securities Exchange Act of 1934, as amended

Subject Company: FairPoint Communications, Inc.

Exchange Act File No.: 001-32408

The following presentation regarding Consolidated Communications Holdings, Inc. was first made available on the FairPoint Communications, Inc. corporate website on

December 5, 2016:

About Consolidated Communications

December 2016

Safe Harbor

The Securities and Exchange Commission (“SEC”) encourages companies to disclose forward-looking information so that investors can better understand a

company’s future prospects and make informed investment decisions. Certain statements in this filing are forward-looking statements and are made pursuant

to the safe harbor provisions of the Securities Litigation Reform Act of 1995. These forward-looking statements reflect, among other things, current

expectations, plans, strategies, and anticipated financial results of the Consolidated Communications Holdings, Inc. (“Consolidated”) and FairPoint

Communications, Inc. (“FairPoint”), both separately and as a combined entity. There are a number of risks, uncertainties, and conditions that may cause the

actual results of Consolidated and FairPoint, both separately and as a combined entity, to differ materially from those expressed or implied by these forward-

looking statements. These risks and uncertainties include the timing and ability to complete the proposed acquisition of FairPoint by Consolidated, the

expected benefits of the integration of the two companies and successful integration of FairPoint’s operations with those of Consolidated and realization of the

synergies from the integration, as well as a number of factors related to the respective businesses of Consolidated and FairPoint, including economic and

financial market conditions generally and economic conditions in Consolidated’s and FairPoint’s service areas; various risks to stockholders of not receiving

dividends and risks to Consolidated’s ability to pursue growth opportunities if Consolidated continues to pay dividends according to the current dividend policy;

various risks to the price and volatility of Consolidated’s common stock; changes in the valuation of pension plan assets; the substantial amount of debt and

Consolidated’s ability to repay or refinance it or incur additional debt in the future; Consolidated’s need for a significant amount of cash to service and repay

the debt and to pay dividends on the common stock; restrictions contained in the debt agreements that limit the discretion of management in operating the

business; legal or regulatory proceedings or other matters that impact the timing or ability to complete the acquisition as contemplated, regulatory changes,

including changes to subsidies, rapid development and introduction of new technologies and intense competition in the telecommunications industry; risks

associated with Consolidated’s possible pursuit of acquisitions; system failures; losses of large customers or government contracts; risks associated with the

rights-of-way for the network; disruptions in the relationship with third party vendors; losses of key management personnel and the inability to attract and retain

highly qualified management and personnel in the future; changes in the extensive governmental legislation and regulations governing telecommunications

providers and the provision of telecommunications services; telecommunications carriers disputing and/or avoiding their obligations to pay network access

charges for use of Consolidated’s and FairPoint’s network; high costs of regulatory compliance; the competitive impact of legislation and regulatory changes in

the telecommunications industry; liability and compliance costs regarding environmental regulations; the possibility of disruption from the integration of the two

companies making it more difficult to maintain business and operational relationships; the possibility that the acquisition is not consummated, including, but not

limited to, due to the failure to satisfy the closing conditions; the possibility that the merger may be more expensive to complete than anticipated, including as a

result of unexpected factors or events; and diversion of management’s attention from ongoing business operations and opportunities. A detailed discussion of

risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements are discussed in more detail in

Consolidated’s and FairPoint’s respective filings with the SEC, including the Annual Report on Form 10-K of Consolidated for the year ended December 31,

2015, which was filed with the SEC on February 29, 2016, under the heading “Item 1A—Risk Factors,” and the Annual Report on Form 10-K of FairPoint for

the year ended December 31, 2015, which was filed with the SEC on March 2, 2016, under the heading “Item 1A—Risk Factors,” and in subsequent reports

on Forms 10-Q and 8-K and other filings made with the SEC by each of Consolidated and FairPoint. Many of these circumstances are beyond the ability of

Consolidated and FairPoint to control or predict. Moreover, forward-looking statements necessarily involve assumptions on the part of Consolidated and

FairPoint. These forward-looking statements generally are identified by the words “believe”, “expect”, “anticipate”, “estimate”, “project”, “intend”, “plan”,

“should”, “may”, “will”, “would”, “will be”, “will continue” or similar expressions. Such forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause actual results, performance or achievements of Consolidated and FairPoint, and their respective subsidiaries,

both separately and as a combined entity to be different from those expressed or implied in the forward-looking statements. All forward-looking statements

attributable to us or persons acting on the respective behalf of Consolidated or FairPoint are expressly qualified in their entirety by the cautionary statements

that appear throughout this filing. Furthermore, forward-looking statements speak only as of the date they are made. Except as required under the federal

securities laws or the rules and regulations of the SEC, each of Consolidated and FairPoint disclaim any intention or obligation to update or revise publicly any

forward-looking statements. You should not place undue reliance on forward-looking statements.

Important Merger Information and Additional

Information

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In

connection with the proposed transaction, Consolidated and FairPoint will file relevant materials with the SEC. Consolidated will file a Registration

Statement on Form S-4 that includes a joint proxy statement of Consolidated and FairPoint and which also constitutes a prospectus of Consolidated.

Consolidated and FairPoint will mail the final joint proxy statement/prospectus to their respective stockholders. Investors are urged to read the joint

proxy statement/prospectus regarding the proposed transaction when it becomes available, because it will contain important information.

The joint proxy statement/prospectus and other relevant documents that have been or will be filed by Consolidated and FairPoint with the SEC are or

will be available free of charge at the SEC’s website, www.sec.gov, or by directing a request when such a filing is made to Consolidated

Communications Holdings, Inc., 121 South 17th Street, Mattoon, IL 61938, Attention: Investor Relations or to FairPoint Communications, Inc., 521 East

Morehead Street, Suite 500, Charlotte, North Carolina 28202, Attention: Secretary.

Consolidated, FairPoint and certain of their respective directors, executive officers and other members of management and employees may be

considered participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive

officers of Consolidated is set forth in its definitive proxy statement, which was filed with the SEC on March 28, 2016. Information about the

directors and executive officers of FairPoint is set forth in its definitive proxy statement, which was filed with the SEC on March 25, 2016.

These documents can be obtained free of charge from the sources listed above. Investors may obtain additional information regarding the interests of

such participants by reading the joint proxy statement/prospectus Consolidated and FairPoint will file with the SEC when it becomes available.

Consolidated at a Glance

Experienced Team

1,800 employees

average 12 years of experience

11-state fiber network

spanning 14,100 miles and

more than 1 million connections

Financially Secure

public Company (NASDAQ: CNSL)

122 years of innovation and growth

Responsive, Local, Committed

$1.3 million charitable contributions

37,000 employee volunteer hours

Vision, Mission and Values

1997 1998 20001894 1924 2002 2004 2007 2008 2012 2014

Mattoon

Telephone

Co. founded

Illinois

Consolidated

Telephone

Company

(ICTC)

formed

ICTC

merged with

McLeodUSA

CLEC &

ISP

Expansion

DSL

Service

launched

CCI acquisition

from

McLeodUSA

TXU

acquired

North

Pittsburgh

acquired

IPTV

launched in

PA

SureWest

acquired

Enventis

acquired

Cloud

Services

expansion

2005

CNSL

goes

public

IPTV

launched

1 GB

consumer

services

History & Transformation

2015

4

2016

CTC

acquired

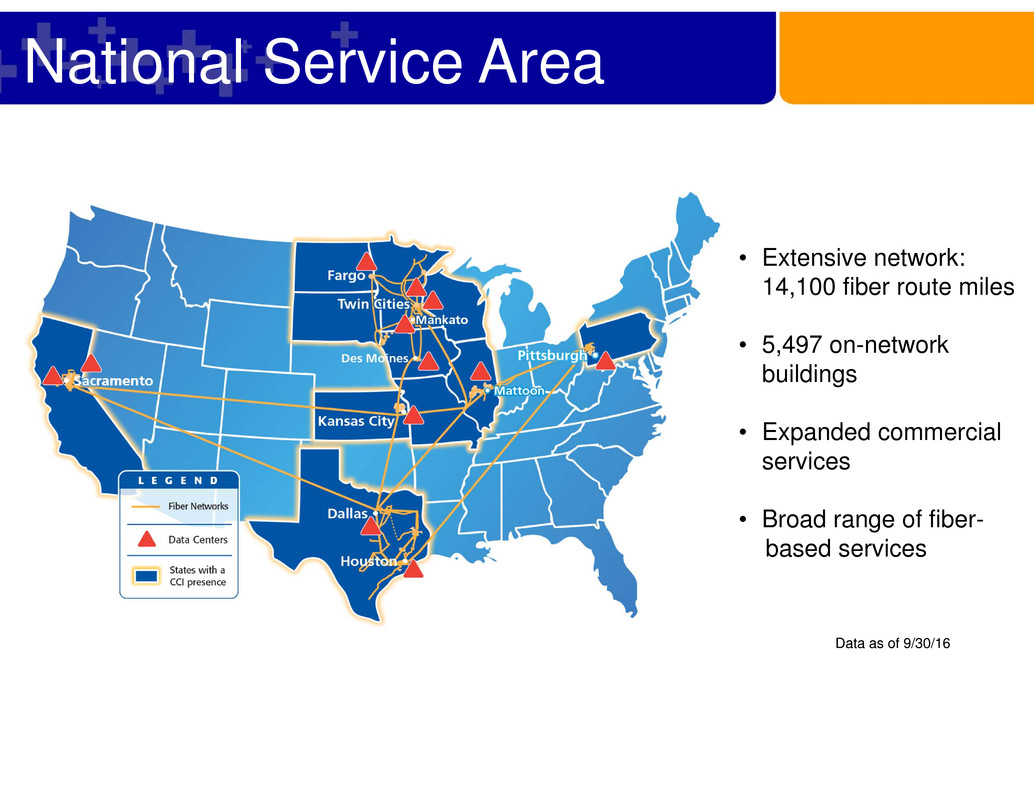

National Service Area

• Extensive network:

14,100 fiber route miles

• 5,497 on-network

buildings

• Expanded commercial

services

• Broad range of fiber-

based services

Data as of 9/30/16

Business & Carrier Services

Local, Regional and National Communication Solutions

Broad Range of Fiber-based Services

• Fiber Services

• Ethernet

• Dedicated and High-Speed

Internet

• DSL

• Data Center

• Private Line

• Cloud Services

• Phone and VoIP

• Digital TV

• Multiple Dwelling Unit

(MDU) Solutions

Residential Services

Competitive Broadband Solutions

Broad Range of Residential Services

• High-Speed Internet

• Digital TV

• Phone

• Home Automation & Security

Community Focus

Committed to building a stronger community!

Annual Special Olympics Family Festival

Consolidated hosts the largest event of its kind in

the country bringing together 800 Special Olympic

Athletes and 1,200 volunteers for the past 32 years

Employees

Volunteered

37,000 Hours

in 2015

$1.3 Million

in Giving in

2015

$660 Per

Employee in

Giving in 2015

Key Strategic Imperatives

Grow

Commerci

al

Services,

expand

Cloud

offering

Leverage

and

expand

fiber

access

networks

Enhance

Consumer

Broadban

d

Services,

accelerate

OTT

Sustain

and grow

cash flow,

long-term

sustainabl

e growth

Focus on reducing customer pain points secures our future

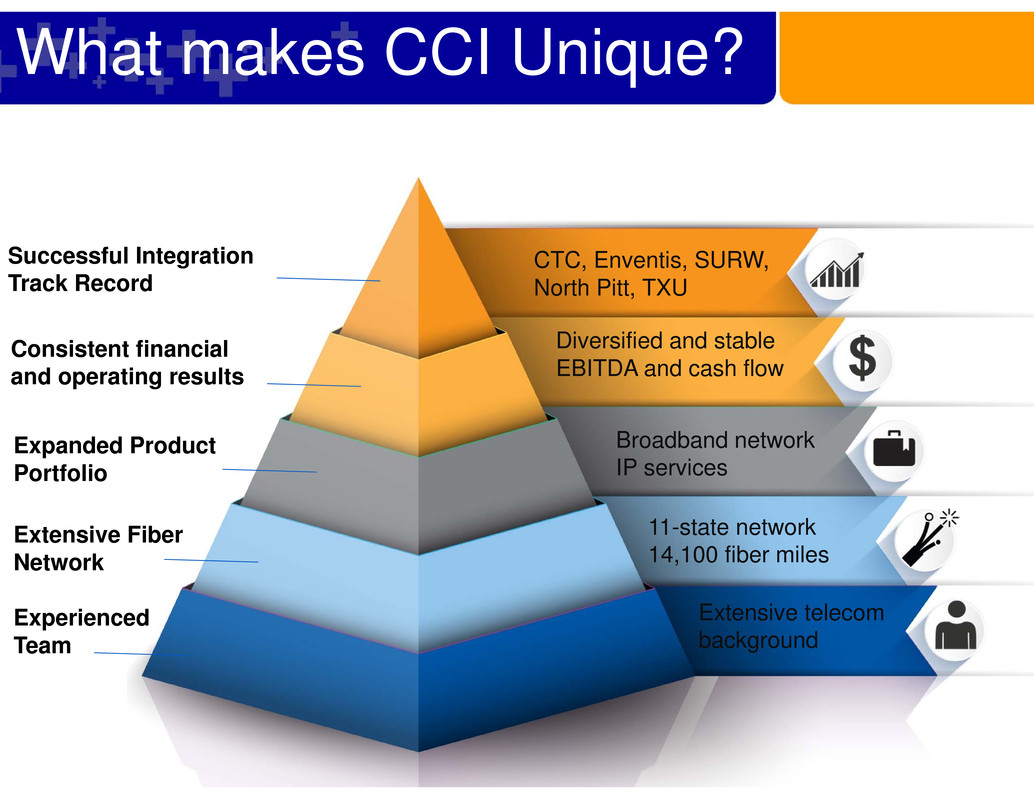

What makes CCI Unique?

Diversified and stable

EBITDA and cash flow

11-state network

14,100 fiber miles

CTC, Enventis, SURW,

North Pitt, TXU

Broadband network

IP services

Extensive telecom

background

Consistent financial

and operating results

Extensive Fiber

Network

Successful Integration

Track Record

Expanded Product

Portfolio

Experienced

Team

Learn more at consolidated.com

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Greenlane Receives Nasdaq Notification of Non-Compliance with Listing Rule 5250(c)(1)

- Kartoon Studios Inc. Completes First Tranche of Registered Direct Offering of Common Stock and Pre-Funded Warrants for up to $7.0 Million; Closes Initial Purchase of $4.0 Million of Common Stock and P

- Rush Enterprises, Inc. Reports First Quarter 2024 Results, Announces $0.17 Per Share Dividend

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share