Form 425 CASH AMERICA INTERNATION Filed by: CASH AMERICA INTERNATIONAL INC

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (Date of Earliest Event Reported):

April 28, 2016

CASH AMERICA INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

| Texas | 001-09733 | 75-2018239 | ||

| (State of incorporation) | (Commission File No.) | (IRS Employer Identification No.) |

1600 West 7th Street

Fort Worth, Texas 76102

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (817) 335-1100

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| ITEM 2.02 | RESULTS OF OPERATIONS AND FINANCIAL CONDITION |

On April 28, 2016, Cash America International, Inc., a Texas corporation (the “Company” or “Cash America”), issued a press release to announce its consolidated financial results for the three months ended March 31, 2016. A copy of the Company’s press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The press release includes non-GAAP financial measures as that term is defined in Regulation G. The press release also includes the most directly comparable financial measures calculated and presented in accordance with accounting principles generally accepted in the United States (“GAAP”), information reconciling the non-GAAP financial measures to the GAAP financial measures, and a discussion of the reasons why the Company’s management believes that presentation of the non-GAAP financial measures provides useful information to investors regarding the Company’s financial condition and results of operations. The non-GAAP financial information presented therein should be considered in addition to, not as a substitute for, or superior to, financial measures calculated and presented in accordance with GAAP.

| ITEM 7.01 | REGULATION FD DISCLOSURE |

See Item 2.02 Results of Operations and Financial Condition.

On April 28, 2016, the Company announced that its Board of Directors, at its regularly scheduled quarterly meeting, declared a $0.08 (8 cents) per share cash dividend on the Company’s outstanding common shares. The dividend will be paid at the close of business on May 25, 2016 to shareholders of record on May 11, 2016. A copy of the Company’s press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

On April 28, 2016, the Company also made available an additional audio commentary regarding the financial results for the quarter ended March 31, 2016 on the Investor Relations section of the Company’s corporate website at www.cashamerica.com, and the transcript for which is furnished as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated herein by reference.

| ITEM 8.01 | OTHER EVENTS |

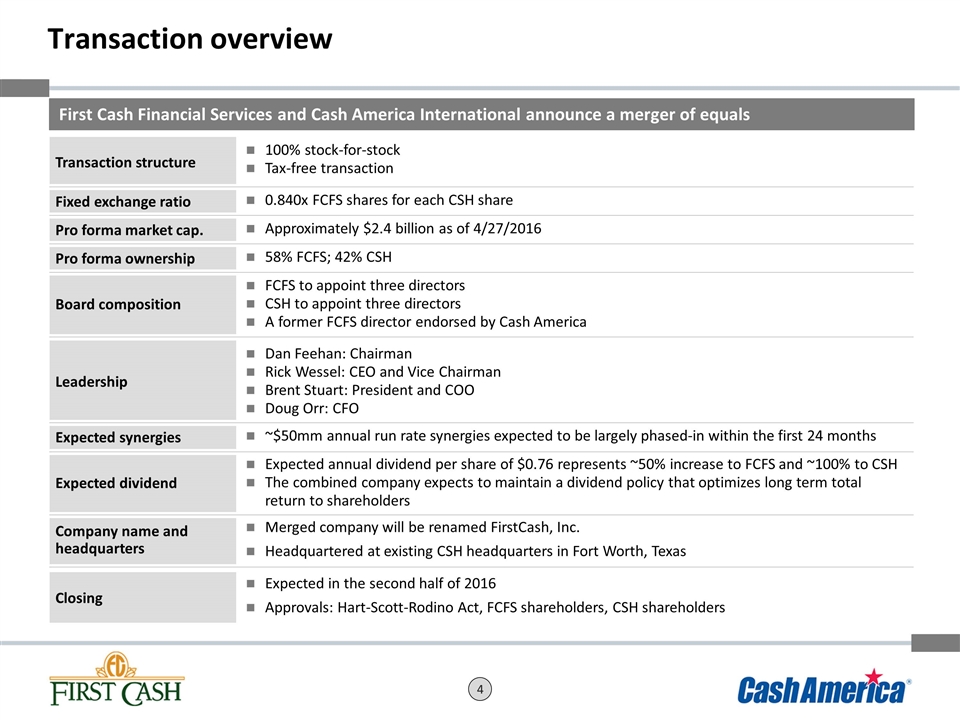

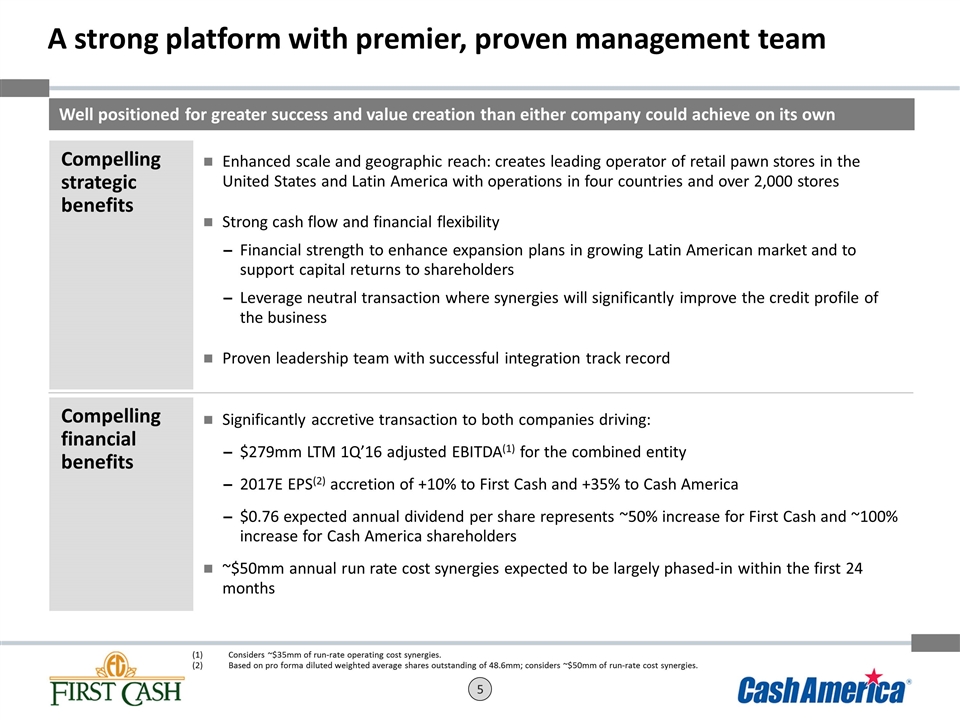

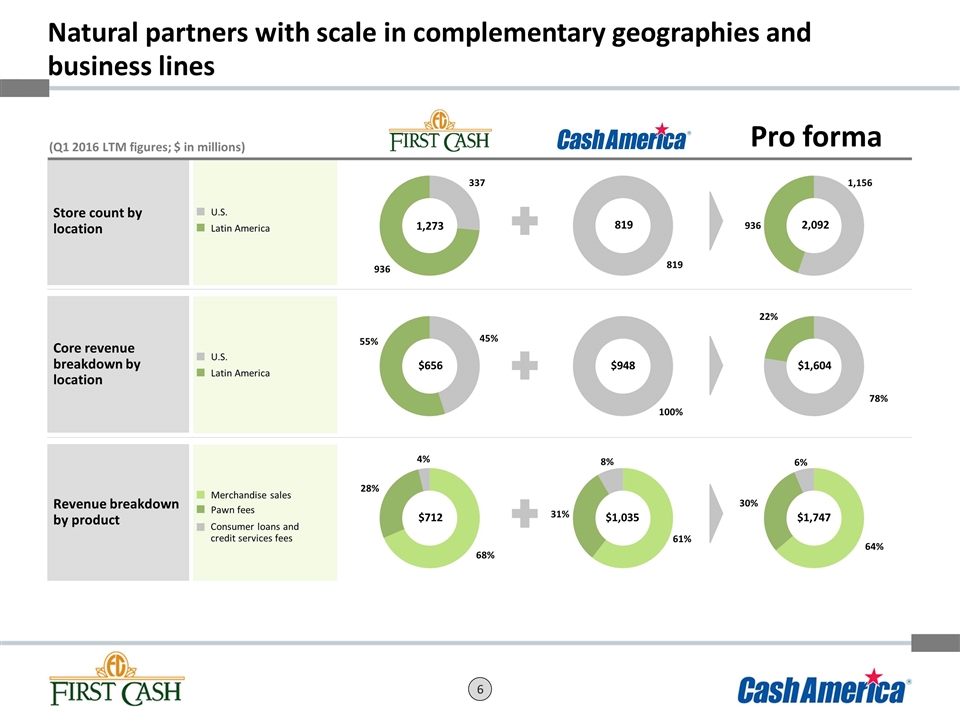

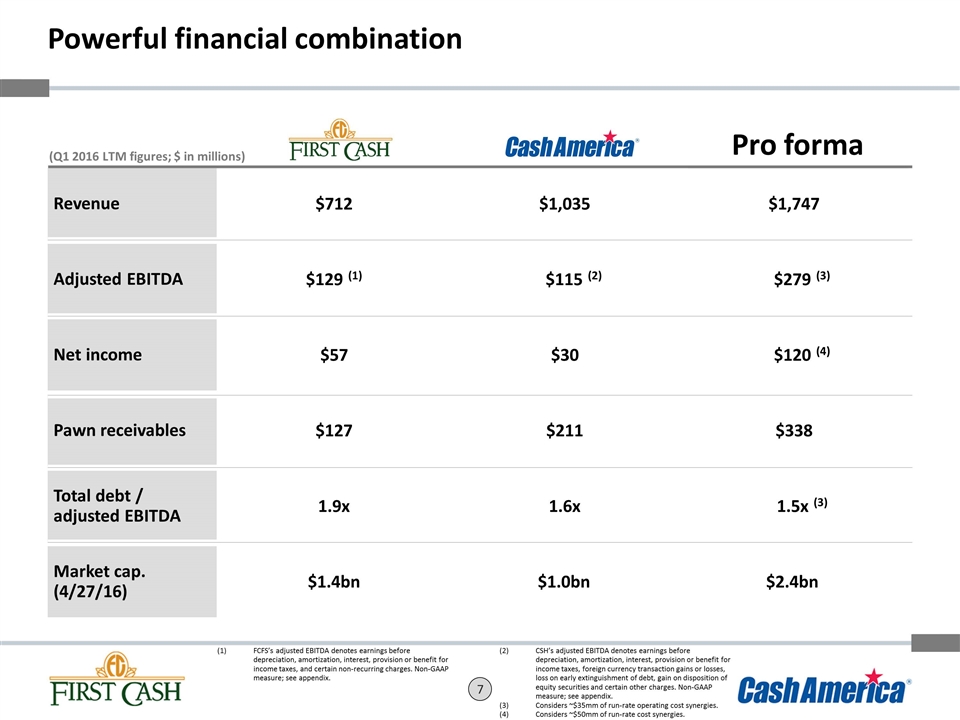

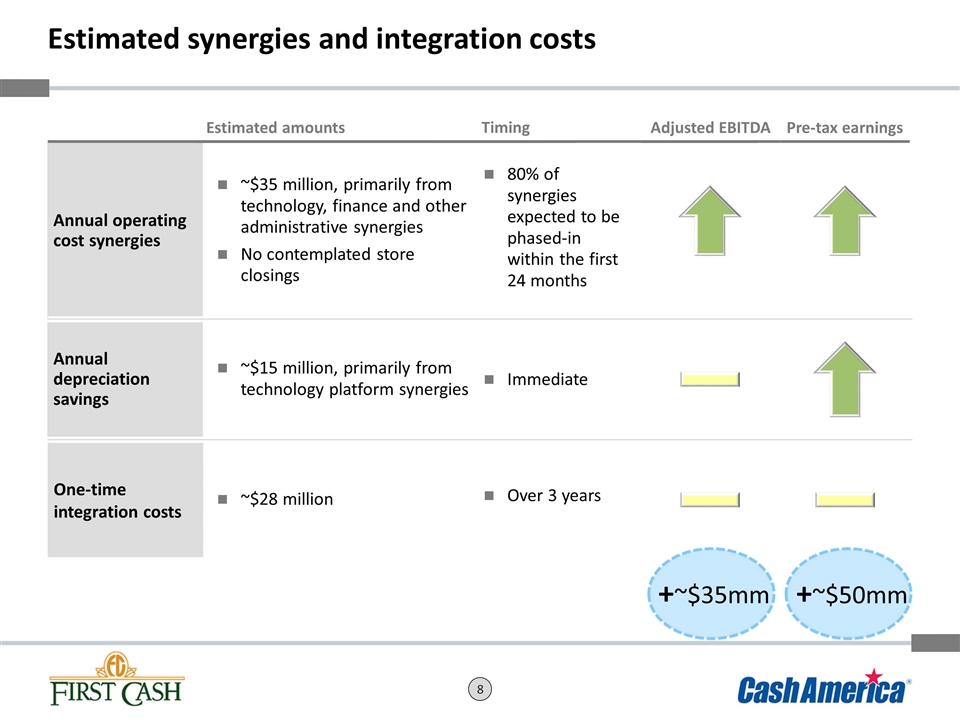

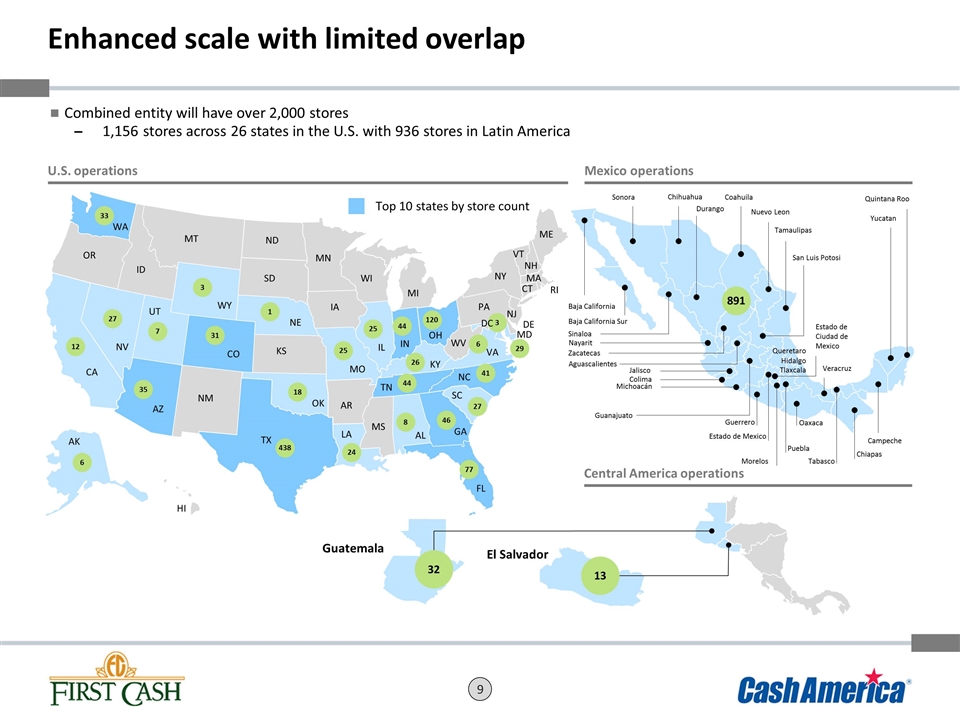

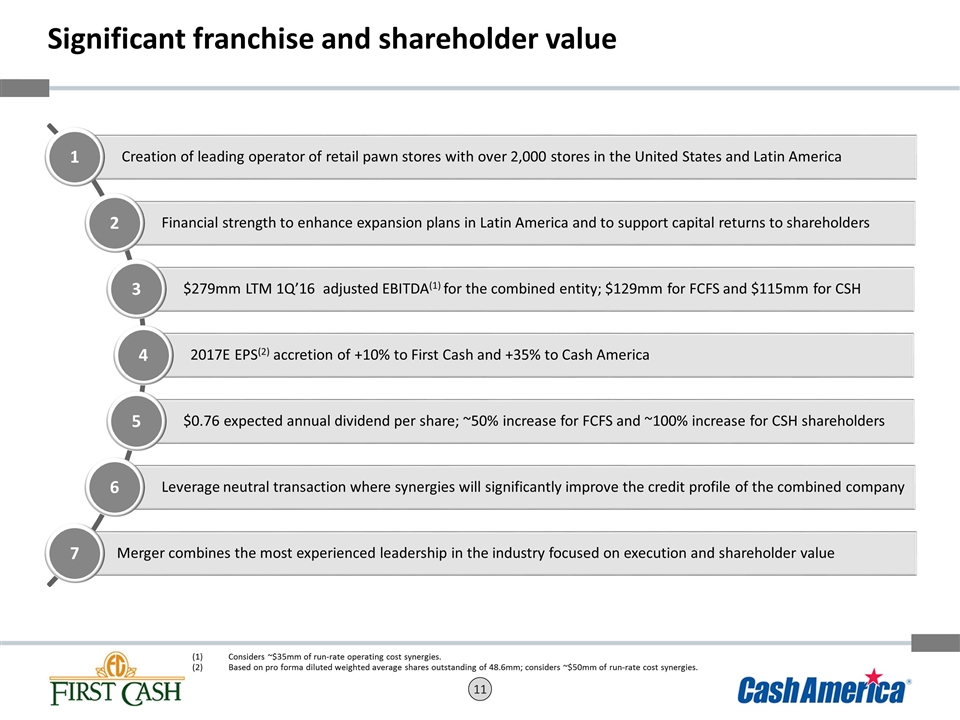

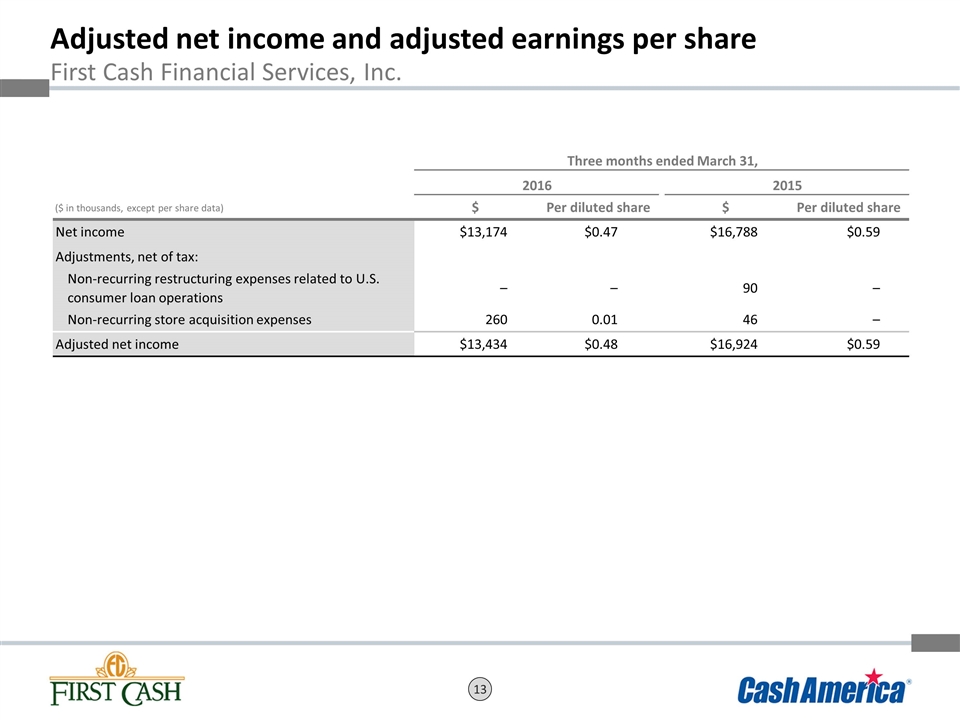

On April 28, 2016, Cash America and First Cash Financial Services, Inc., a Delaware corporation (“First Cash”), issued a joint press release announcing the execution of an Agreement and Plan of Merger (the “Merger Agreement”) entered into among Cash America, First Cash and Frontier Merger Sub, LLC, a Texas limited liability company and a direct wholly owned subsidiary of First Cash, pursuant to which the companies will combine in an all-stock merger of equals. A copy of the press release is attached hereto as Exhibit 99.3 and is incorporated herein by reference.

In addition, on April 28, 2016, Cash America and First Cash will hold a joint investor conference call (with simultaneous webcast) to announce the execution of the Merger Agreement. A copy of the investor presentation used on the conference call regarding the proposed transaction is attached hereto as Exhibit 99.4 and is incorporated herein by reference.

The information required by Item 1.01, including a copy of the Merger Agreement, will be filed in a separate Current Report on Form 8-K.

Forward Looking Statements

This communication, and the documents incorporated herein by reference, contain “forward-looking statements” (as defined in the Securities Litigation Reform Act of 1995) regarding, among other things, future events or the future financial performance of First Cash and Cash America. Words such as “anticipate,” “expect,” “project,” “intend,” “believe,” “will,” “estimates,” “may,” “could,” “should” and words and terms of similar substance used in connection with any discussion of future plans, actions or events identify forward-looking statements. The closing of the proposed transaction is subject to the approval of the stockholders of First Cash and Cash America, regulatory approvals and other customary closing conditions. There is no assurance that such conditions will be met or that the proposed transaction will be consummated within the expected time frame, or at all. Forward-looking statements relating to the proposed transaction include, but are not limited to: statements about the benefits of the proposed transaction, including anticipated synergies and cost savings and future financial and operating results; future capital returns to stockholders of the combined company; First Cash’s and Cash America’s plans, objectives, expectations, projections and intentions; the expected timing of completion of the proposed transaction; and other statements relating to the transaction that are not historical facts. Forward-looking statements are based on information currently available to First Cash and Cash America and involve estimates, expectations and projections. Investors are cautioned that all such forward-looking statements are subject to risks and uncertainties, and important factors could cause actual events or results to differ materially from those indicated by such forward-looking statements. With respect to the proposed transaction, these risks, uncertainties and factors include, but are not limited to: the risk that First Cash or Cash America may be unable to obtain governmental and regulatory approvals required for the transaction, or that required governmental and regulatory approvals may delay the transaction or result in the imposition of conditions that could reduce the anticipated benefits from the proposed transaction or cause the parties to abandon the proposed transaction; the risk that required stockholder approvals may not be obtained; the risks that condition(s) to closing of the transaction may not be satisfied; the length of time necessary to consummate the proposed transaction, which may be longer than anticipated for various reasons; the risk that the businesses will not be integrated successfully; the risk that the cost savings, synergies and growth from the proposed transaction may not be fully realized or may take longer to realize than expected; the diversion of management time on transaction-related issues; the risk that costs associated with the integration of the businesses are higher than anticipated; and litigation risks related to the transaction. With respect to the businesses of First Cash and/or Cash America, including if the proposed transaction is consummated, these risks, uncertainties and factors include, but are not limited to: the effect of future regulatory or legislative

actions on the companies or the industries in which they operate and the effect of compliance with enforcement actions, orders or agreements issued by applicable regulators; the risk that the credit ratings of the combined company or its subsidiaries may be different from what the companies expect and/or risks related to the ability to obtain financing; economic and foreign exchange rate volatility, particularly in Latin American markets; adverse gold market or exchange rate fluctuations; increased competition from banks, credit unions, internet-based lenders, other short-term consumer lenders and other entities offering similar financial services as well as retail businesses that offer products and services offered by First Cash and Cash America; decrease in demand for First Cash’s or Cash America’s products and services; public perception of First Cash’s and Cash America’s business and business practices; changes in the general economic environment, or social or political conditions, that could affect the businesses; the potential impact of the announcement or consummation of the proposed transaction on relationships with customers, suppliers, competitors, management and other employees; risks related to any current or future litigation proceedings; the ability to attract new customers and retain existing customers in the manner anticipated; the ability to hire and retain key personnel; reliance on and integration of information technology systems; ability to protect intellectual property rights; impact of security breaches, cyber-attacks or fraudulent activity on First Cash’s or Cash America’s reputation; the risks associated with assumptions the parties make in connection with the parties’ critical accounting estimates and legal proceedings; and the potential of international unrest, economic downturn or effects of currencies, tax assessments or tax positions taken, risks related to goodwill and other intangible asset impairment, tax adjustments, anticipated tax rates, benefit or retirement plan costs, or other regulatory compliance costs.

Additional information concerning other risk factors is also contained in First Cash’s and Cash America’s most recently filed Annual Reports on Form 10-K, subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other Securities and Exchange Commission (“SEC”) filings.

Many of these risks, uncertainties and assumptions are beyond First Cash’s or Cash America’s ability to control or predict. Because of these risks, uncertainties and assumptions, you should not place undue reliance on these forward-looking statements. Furthermore, forward-looking statements speak only as of the information currently available to the parties on the date they are made, and neither First Cash nor Cash America undertakes any obligation to update publicly or revise any forward-looking statements to reflect events or circumstances that may arise after the date of this communication. Neither First Cash nor Cash America gives any assurance (1) that either First Cash or Cash America will achieve its expectations, or (2) concerning any result or the timing thereof. All subsequent written and oral forward-looking statements concerning First Cash, Cash America, the proposed transaction, the combined company or other matters and attributable to First Cash or Cash America or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above.

Additional Information and Where to Find It

This communication is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval with respect to the proposed transaction between First Cash and Cash America or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. The proposed transaction between First Cash and Cash America will be submitted to the respective stockholders of First Cash and Cash America for their consideration. First Cash will file with the SEC a registration statement on Form S-4 that will include a joint proxy statement of First Cash and Cash America that also constitutes a prospectus of First Cash. First Cash and Cash America will deliver the joint proxy statement/prospectus to their respective stockholders as required by applicable law. First Cash and Cash America also plan to file other documents with the SEC regarding the proposed transaction. This communication is not a substitute for any prospectus, proxy statement or any other document which First Cash or Cash America may file with the SEC in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF FIRST CASH AND CASH AMERICA ARE URGED TO READ

THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT FIRST CASH, CASH AMERICA, THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and stockholders will be able to obtain free copies of the joint proxy statement/prospectus and other documents containing important information about First Cash and Cash America, once such documents are filed with the SEC, through the website maintained by the SEC at www.sec.gov. First Cash and Cash America make available free of charge at www.firstcash.com and www.cashamerica.com, respectively (in the “Investor” or “Investor Relations” section, as applicable), copies of materials they file with, or furnish to, the SEC.

Participants in the Merger Solicitation

First Cash, Cash America, and certain of their respective directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from the stockholders of First Cash and Cash America in connection with the proposed transaction. Information about the directors and executive officers of First Cash is set forth in its proxy statement for its 2015 annual meeting of stockholders, which was filed with the SEC on April 30, 2015. Information about the directors of Cash America is set forth in its proxy statement for its 2016 annual meeting of shareholders, which was filed with the SEC on April 7, 2016, and information about the executive officers of Cash America is set forth in Cash America’s Annual Report on Form 10-K, which was filed with the SEC on February 26, 2016. These documents can be obtained free of charge from the sources indicated above. Other information regarding those persons who are, under the rules of the SEC, participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

| ITEM 9.01 | FINANCIAL STATEMENTS AND EXHIBITS |

| Exhibit |

Description | |

| 99.1 | Cash America International, Inc. press release dated April 28, 2016 (Financial Results and Dividend Announcement) | |

| 99.2 | Cash America International, Inc. transcript of audio commentary regarding the financial results for the quarter ended March 31, 2016 | |

| 99.3 | Joint Press Release of Cash America International, Inc. and First Cash Financial Services, Inc., issued April 28, 2016 | |

| 99.4 | Investor Presentation, dated April 28, 2016 | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| CASH AMERICA INTERNATIONAL, INC. | ||||||

| Date: April 28, 2016 |

By: | /s/ J. Curtis Linscott | ||||

| J. Curtis Linscott | ||||||

| Executive Vice President, | ||||||

| General Counsel & Secretary | ||||||

EXHIBIT INDEX

| Exhibit |

Description | |

| 99.1 | Cash America International, Inc. press release dated April 28, 2016 (Financial Results and Dividend Announcement) | |

| 99.2 | Cash America International, Inc. transcript of audio commentary regarding the financial results for the quarter ended March 31, 2016 | |

| 99.3 | Joint Press Release of Cash America International, Inc. and First Cash Financial Services, Inc., issued April 28, 2016 | |

| 99.4 | Investor Presentation, dated April 28, 2016 | |

Exhibit 99.1

| Additional Information: | For Immediate Release | |

| Thomas A. Bessant, Jr. | ||

| (817)335-1100 |

******************************************************************************************************

CASH AMERICA ANNOUNCES INCREASE IN FIRST QUARTER EARNINGS

AND DECLARES DIVIDEND

******************************************************************************************************

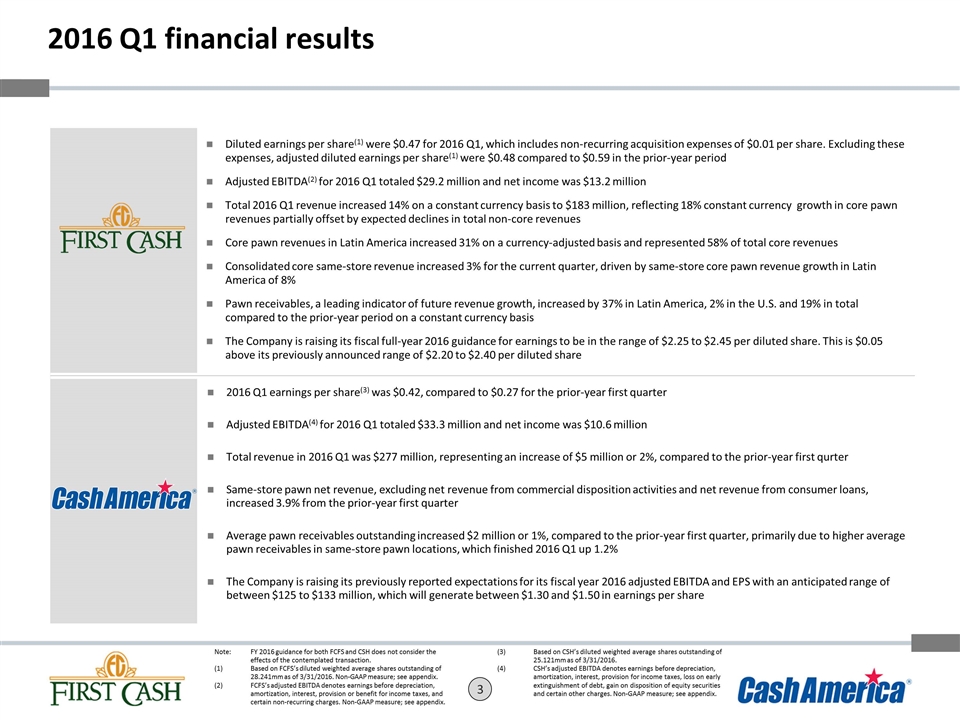

Fort Worth, Texas (April 28, 2016) — Cash America International, Inc. (NYSE: CSH), a leading provider of pawn lending and related services in the United States, announced today that net income and net income per share for the first quarter of 2016 increased 36% and 56%, respectively to $10,633,000 (42 cents per share) compared to net income of $7,845,000 (27 cents per share) for the first quarter of 2015. The prior year first quarter included reorganization expenses and a gain on disposition of equity securities, which in aggregate would increase prior year earnings when added back, to create adjusted net income, a non-GAAP measure, of $8.3 million (29 cents per share) for the first quarter of 2015. Cash America’s earnings per share for the first quarter of 2016 of 42 cents was an increase of 45%, compared to adjusted net income per share of 29 cents for the first quarter of 2015 and exceeded Cash America’s published guidance range of between $0.35 and $0.41 from its press release dated January 28, 2016.

Commenting on the first quarter results, T. Brent Stuart, President and Chief Executive Officer of Cash America, said, “We are very pleased with our success in the first quarter, and we are also very excited about the important announcement made this morning regarding Cash America’s proposed merger with First Cash Financial Services. We believe that the merger of equals will provide great benefit to our shareholders by combining two leaders in the pawn industry. We look forward to providing additional details about the merger as it progresses.”

Consolidated total revenue increased 2% to $277.2 million for the three-month period ended March 31, 2016, compared to

$271.8 million in the same period in 2015. Consolidated net revenue was $144.0 million for the first quarter of 2016 compared to $147.1 million for the first quarter of 2015. While net revenue for the first quarter of 2016 was slightly below the prior year’s first quarter results, management’s emphasis on improvement in marginal profitability produced a 22% increase in income from operations, which was $19.7 million for the first quarter of 2016, compared to $16.2 million for the first quarter of 2015.

Mr. Stuart further commented on the first quarter results and said, “Our operations team placed significant emphasis on improving our operating margin and executing a strategy of in store retail sales activities. I am pleased to report that we were able to successfully achieve both objectives in the first quarter of 2016. Our in store retail sales activities posted a year-over-year increase of 1.7% with a higher retail gross profit margin of 32.9% compared to 31.7% last year, which generated an increase in retail gross profit dollars of 5.6%. We were also very excited to see that same store pawn loan balances turned the corner and finished the first quarter up 1.2% above the prior year.”

Additionally, Cash America International, Inc. (the “Company” or “Cash America”) announced that its Board of Directors, at a regularly scheduled quarterly meeting, declared a $0.08 (8 cents) per share cash dividend on common shares outstanding. The dividend will be paid at the close of business on May 25, 2016 to shareholders of record on May 11, 2016.

The Company will host a conference call to discuss the first quarter results as well as the proposed merger of equals with First Cash Financial Services, Inc. (“First Cash”) on Thursday, April 28, 2016, at 7:00 AM CDT (8:00 AM EDT). A live webcast of the call will be available on the Investor Relations section of the Company’s corporate website http://www.cashamerica.com. The dial-in number is (212) 231-2930. Participants should dial in 10 minutes prior to the scheduled start time.

A link to the live webcast of the conference call will be available on the Investor Relations section of the Company’s website at www.cashamerica.com.

A webcast replay will be available shortly after the call concludes and will be available on the Company’s website. A replay may also be accessed by dialing toll-free: (800) 633-8284. The replay confirmation code is 21776991.

An additional audio commentary on the financial results for the quarter will also be available on the Investor Relations section of the Company’s corporate website at www.cashamerica.com and a transcript for the audio commentary has been filed with the Securities and Exchange Commission (the “SEC”).

First Quarter of 2016 Results

The Company’s financial results for the three months ended March 31, 2016 (the “current quarter”) compared to the three months ended March 31, 2015 (the “prior year quarter”) are summarized below.

Highlights

| • | Total revenue was $277.2 million for the current quarter, representing an increase of $5.4 million, or 2.0%, compared to the prior year quarter. Net revenue decreased $3.0 million, or 2.1%, to $144.0 million for the current quarter compared to the prior year quarter. |

| • | Same-store net revenue decreased 1.8% for the current quarter compared to the prior year quarter. Same-store net revenue, excluding net revenue from commercial disposition activities and net revenue from consumer loans, increased 3.9% for the current quarter compared to the prior year quarter. In comparison to pawn lending and the retail disposition of merchandise, commercial disposition activities and consumer lending activities represent sources of net revenue that are much less central to the Company’s core operations and strategy. |

| • | Income from operations was $19.7 million for the current quarter, representing an increase of $3.5 million, or 21.6%, compared to the prior year quarter, primarily due to a $5.5 million decrease in operations and administration expenses. |

| • | Net income was $10.6 million for the current quarter, representing an increase of $2.8 million, or 35.5%, compared to the prior year quarter. Diluted net income per share was $0.42 for the current quarter compared to $0.27 for the prior year quarter. Net income and net income per share were affected by certain income and expense items in the current quarter and prior year quarter. See the Non-GAAP Disclosure section for Adjusted Earnings and Adjusted Earnings Per Share included in the attachments to this press release for additional information regarding these items. |

Pawn Lending Activities

| • | Average pawn loan balances outstanding increased $2.1 million, or 0.9%, in the current quarter compared to the prior year quarter, primarily due to higher average pawn loan balances in same-store pawn locations. Partially offsetting this increase, average pawn loan balances outstanding decreased due to a decrease in the number of stores offering pawn loans following the closure or sale of certain less profitable store locations. Same-store pawn loan balances were 1.2% higher at March 31, 2016 compared to March 31, 2015. |

| • | Pawn loan fees and service charges increased by $2.4 million, or 3.1%, in the current quarter compared to the prior year quarter. This increase was primarily driven by higher average pawn loan balances in the current quarter compared to the prior year quarter, as well as a higher pawn loan yield of 138.1% in the current quarter compared to 136.4% in the prior year quarter, primarily due to a shift in the geographic concentrations of pawn loans into states with higher statutory pawn loan yields and, to a lesser extent, an increase in the permitted statutory loan fees in some markets. |

Merchandise Disposition Activities

| • | Proceeds from disposition for pawn operations increased $6.1 million, or 3.5%, from the prior year quarter to the current quarter. Retail proceeds from disposition comprised $2.6 million of the total increase, primarily due to an increase in jewelry sales in the Company’s storefront locations. The Company’s merchandise turnover ratio remained relatively stable at 2.2 times in the current quarter compared to 2.3 times in the prior year quarter. |

| • | Total gross profit on disposition for pawn operations decreased $3.3 million, or 6.2%, from the prior year quarter to the current quarter, due to a $5.9 million decrease in gross profit on commercial dispositions mainly as a result of lower gold and diamond yields, which produced a negative gross profit margin on commercial dispositions in the current quarter. Partially offsetting the loss on commercial dispositions was a $2.6 million, or 5.6%, increase in gross profit on retail dispositions, primarily due to the Company’s emphasis on retail jewelry sales in storefront locations. The gross profit margin on retail dispositions increased to 32.9% in the current quarter, compared to 31.7% in the prior year quarter. |

| • | Merchandise held for disposition, net of allowance, increased $27.6 million, or 14.1%, from March 31, 2015 to March 31, 2016. The increase was primarily due to an increase in jewelry inventory as a result of the Company’s continued emphasis on retail disposition of jewelry in stores and efforts to place less reliance on the commercial disposition of jewelry. Inventory held for over one year decreased to 4.9% of total merchandise compared to 5.3% in the prior year quarter, and included a greater mix of jewelry inventory to general merchandise inventory in the current quarter compared to the prior year quarter. |

Consumer Loan Activities

| • | Consumer loan fees represented only 7% of consolidated total revenue for the current quarter, compared to 8% of consolidated total revenue for the prior year quarter, due to the continuation of the Company’s strategy to eliminate consumer lending activities in many of its locations. Consumer loan fees, net of the loss provision, decreased $1.4 million, or 8.8%, in the current quarter compared to the prior year quarter, primarily due to a $2.2 million, or 10.9%, decrease in consumer loan fees. The decrease in consumer loan fees was primarily due to a decrease in short-term consumer loan fees of $5.4 million, or 31.8%, as a result of the closure and sale of certain store locations and the Company’s strategic decision to deemphasize and eliminate short-term consumer lending activities in many of its locations. |

| • | The consumer loan loss provision as a percentage of consumer loan fees decreased to 21.8% in the current quarter compared to 23.6% in the prior year quarter. |

Expenses

| • | Consolidated operations and administration expenses decreased $5.5 million, or 4.8%, in the current quarter compared to the prior year quarter. This overall decline in expenses is consistent with management’s strategy and related initiatives to improve marginal profitability by optimizing the Company’s overall cost structure. |

| • | Depreciation and amortization expenses decreased $1.0 million for the current quarter compared to the prior year quarter, primarily due to a reduced number of pawn and consumer lending locations as a result of store closures and sales and a reduced level of capital investment related to the remodeling of stores. |

| • | Interest expense, net of interest income, increased $0.3 million, or 7.1%, in the current quarter compared to the prior year quarter, primarily due to interest expense accrued as part of a settlement of an income tax matter related to the 2011 and 2012 tax years. |

| • | The Company’s effective tax rate was 33.4% in the current quarter as compared to the effective tax rate of 38.5% in the prior year quarter. The effective tax rate in the current quarter was lower due to lower state income taxes and a $0.6 million excess income tax benefit from stock compensation that reduced the income tax provision as a result of the prospective adoption of Accounting Standards Update 2016-09. |

Liquidity

| • | During the first quarter of 2016, the Company repurchased 844,000 shares under its 3.0 million share repurchase authorization announced on October 29, 2015. These repurchased shares represented approximately 3.3% of the fully diluted shares as of the end of December 31, 2015. |

| • | Net cash provided by operating activities was $45.4 million for the current quarter, which represented an increase of $5.6 million, or 14.0%, from $39.8 million in the prior year quarter. |

| • | The Company finished the quarter with $48.3 million in cash and had no borrowings under its $280 million line of credit. |

| • | The net debt balance, defined as total debt less cash, as of March 31, 2016 was $131 million resulting in a net debt to capital ratio of 11% and a net debt to Adjusted EBITDA ratio for the trailing 12 months ended March 31, 2016 of 1.1 times. |

| • | With respect to the Enova shares retained by the Company in connection with the spin-off of Enova International, Inc. (“Enova”) that occurred in November 2014, the Company has agreed, pursuant to a private letter ruling and a supplemental request, which was approved by the Internal Revenue Service during the quarter and extended the date for the required sale of Enova shares, to dispose of its Enova shares (other than shares retained for delivery under the Company’s long-term incentive plans) before September 15, 2017. The sale of the Enova shares will generate additional cash flows. The Company’s investment in Enova common stock was $40.4 million as of March 31, 2016 based on a quoted market price per share of $6.31. |

Locations

| • | The Company ended the first quarter with 819 lending locations in 20 states in the United States. During the twelve months ended March 31, 2016, the Company closed or sold 30 locations. Consistent with the Company’s strategy to deemphasize its consumer lending activities, 21 of the locations closed or sold were locations that offered consumer loans, of which 19 of those locations offered consumer loans as their primary product. The closed or sold locations also included nine less profitable, pawn-lending-only locations that were closed during the twelve months ended March 31, 2016. In addition, the Company eliminated the consumer loan product in 36 of its pawn lending locations during the twelve months ended March 31, 2016. Including consumer-loan-lending locations closed or sold and locations where the consumer loan product was eliminated, consumer lending activities were discontinued in 57 of the Company’s locations during the twelve months ended March 31, 2016. |

| • | During the current quarter, the Company closed three locations, of which one location offered consumer loans. In addition, the Company eliminated the consumer loan product in 28 of its pawn lending locations during the current quarter. The Company expects to eliminate consumer lending activities in approximately 18 locations in the second quarter of 2016 as it continues to deemphasize the consumer loan product and continue its focus on pawn lending. |

Outlook for the Second Quarter of 2016 and the 2016 Fiscal Year

Management believes that the opportunities for growth in revenue and earnings will be largely associated with customer demand for the products and services provided by the Company, which primarily take the form of pawn loans, and its ability to profitably liquidate merchandise obtained primarily from unredeemed pawn loans. During the first quarter of 2016, the typical seasonal decline in loan balances was consistent with what the Company experienced during the first quarter of 2015, even though management believes that the Federal Income Tax refund season began a few weeks later than the Company anticipated. Typically, customers use a portion of these refunds to pay back existing loans and for the purchase of merchandise. At the outset of the second quarter the Company expects loan balances to begin to recover, consistent with routine seasonal business trends. The rate of this increase and the timing of the increase in pawn loan balances has a significant influence on future financial results.

Based on management’s views and on the preceding factors, management expects net income for the second quarter of 2016 to be between 12 cents to 18 cents per share, compared to net income of 8 cents per share for the second quarter of 2015. Net income for the second quarter of 2015 of $2.1 million ($0.08 per share) included a $1.1 million (before taxes) gain on disposition of equity securities and a $0.6 million (before taxes) loss on the early extinguishment of debt. Excluding these non-operating items, which in aggregate increased income by $0.5 million before taxes ($0.4 million, or $0.02 per share after taxes), adjusted net income, a non-GAAP measure, was $1.7 million ($0.06 per share) for the second quarter of 2015.

At this time, management also increases its previously reported expectations for its fiscal year 2016 adjusted EBITDA with an anticipated range of between $125 to $133 million, which management estimates will generate between $1.30 and $1.50 in net income per share. This compares to reported net income of $1.01 per share for fiscal year 2015.

The outlook for the second quarter and remainder of 2016 included in this press release do not take into account the pending merger of equals with First Cash that was announced today, and the Company’s guidance is based solely on the Company’s operations.

About the Company

As of March 31, 2016, Cash America International, Inc. (the “Company” or “Cash America”) operated 892 total locations in the United States offering pawn lending and related services to consumers and included the following:

| • | 819 lending locations in 20 states in the United States primarily under the names “Cash America Pawn,” “SuperPawn,” “Cash America Payday Advance,” and “Cashland;” and |

| • | 73 check cashing centers (all of which are unconsolidated franchised check cashing centers) operating in 12 states in the United States under the name “Mr. Payroll.” |

For additional information regarding the Company and the services it provides, visit the Company’s website located at

http://www.cashamerica.com or download the Cash America mobile app without cost from the App StoreSM and on Google PlayTM.

App Store is a service mark of Apple Inc., and Google Play is a trademark of Google Inc.

Non-GAAP Measures

The Non-GAAP Disclosure sections included in the attachments to this press release contain a reconciliation of non-GAAP information and a discussion of the reasons why the Company’s management believes that presentation of the non-GAAP financial measures discussed above provide useful information to investors regarding the Company’s financial condition and results of operations.

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995

This release contains forward-looking statements about the business, financial condition, operations and prospects of the Company and the proposed business combination with First Cash. The actual results of the Company could differ materially from those indicated by the forward-looking statements because of various risks and uncertainties including, without limitation: the effect of, compliance with or changes in laws, rules and regulations applicable to the Company’s business or changes in the interpretation or enforcement thereof; the regulatory and examination authority of the Consumer Financial Protection Bureau; the effect of any current or future litigation proceedings, including an unfavorable outcome in an outstanding lawsuit relating to the Company’s 5.75% Senior Notes due 2018 even though the Company believes the lawsuit is without merit and will vigorously defend its position, and any judicial decisions or rule-making that affects the Company, its products or the legality or enforceability of its arbitration agreements; decreased demand for the Company’s products and services and changes in competition; fluctuations in the price of gold and changes in economic conditions; public perception of the Company’s business and the Company’s business practices; accounting and income tax risks related to goodwill and other intangible asset impairment, certain tax positions taken by the Company and other accounting matters that require the judgment of management; the Company’s ability to attract and retain qualified executive officers; risks related to the Company’s financing, such as compliance with financial covenants in the Company’s debt agreements, the Company’s ability to satisfy its outstanding debt obligations, to refinance existing debt obligations or to obtain new capital; risks related to interruptions to the Company’s business operations, such as a prolonged interruption in the Company’s operations of its facilities, systems or business functions, cyber-attacks or security breaches or the actions of third parties who provide, acquire or offer products and services to, from or for the Company; risks related to the expansion and growth of the Company’s business, including the Company’s ability to open new locations in accordance with plans or to successfully integrate newly acquired businesses into its operations; risks related to the 2014 spin-off of the Company’s former E-Commerce Division that comprised its e-commerce segment, Enova International, Inc.; fluctuations in the price of the Company’s common stock; the effect of any of the above changes on the Company’s business or the markets in which the Company operates; and other risks and uncertainties indicated in the Company’s filings with the SEC. The closing of the proposed business combination with First Cash is subject to the

approval of the stockholders of First Cash and the Company, regulatory approvals and other customary closing conditions. There is no assurance that such conditions will be met or that the proposed transaction will be consummated within the expected time frame, or at all, or that the benefits of the business combination will be achieved. These risks and uncertainties are beyond the ability of the Company to control, nor can the Company predict, in many cases, all of the risks and uncertainties that could cause its actual results to differ materially from those indicated by the forward-looking statements. When used in this release, terms such as “believes,” “estimates,” “should,” “could,” “would,” “plans,” “expects,” “intends,” “anticipates,” “may,” “forecasts,” “projects” and similar expressions and variations as they relate to the Company or its management are intended to identify forward-looking statements. Additional information concerning risks related to the business, the proposed business combination with First Cash and other risk factors is also contained in the Company’s recently filed Annual Reports on Form 10-K, subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other SEC filings. The Company disclaims any intention or obligation to update or revise any forward-looking statements to reflect events or circumstances occurring after the date of this release.

Additional Information and Where to Find It

This communication is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval with respect to the proposed transaction between First Cash and Cash America or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. The proposed transaction between First Cash and Cash America will be submitted to the respective stockholders of First Cash and Cash America for their consideration. First Cash will file with the SEC a registration statement on Form S-4 that will include a joint proxy statement of First Cash and Cash America that also constitutes a prospectus of First Cash. First Cash and Cash America will deliver the joint proxy statement/prospectus to their respective stockholders as required by applicable law. First Cash and Cash America also plan to file other documents with the SEC regarding the proposed transaction. This communication is not a substitute for any prospectus, proxy statement or any other document which First Cash or Cash America may file with the SEC in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF FIRST CASH AND CASH AMERICA ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT FIRST CASH, CASH AMERICA, THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and stockholders will be able to obtain free copies of the joint proxy statement/prospectus and other documents containing important information about First Cash and Cash America, once such documents are filed with the SEC, through the website maintained by the SEC at www.sec.gov. First Cash and Cash America make available free of charge at www.firstcash.com and www.cashamerica.com, respectively (in the “Investor” or “Investor Relations” section, as applicable), copies of materials they file with, or furnish to, the SEC.

Participants in the Merger Solicitation

First Cash, Cash America, and certain of their respective directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from the stockholders of First Cash and Cash America in connection with the proposed transaction. Information about the directors and executive officers of First Cash is set forth in its proxy statement for its 2015 annual meeting of stockholders, which was filed with the SEC on April 30, 2015. Information about the directors of Cash America is set forth in its proxy statement for its 2016 annual meeting of shareholders, which was filed with the SEC on April 7, 2016, and information about the executive officers of Cash America is set forth in Cash America’s Annual Report on Form 10-K, which was filed with the SEC on February 26, 2016. These documents can be obtained free of charge from the sources indicated above. Other information regarding those persons who are, under the rules of the SEC, participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

* * *

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES

HIGHLIGHTS OF CONSOLIDATED RESULTS OF OPERATIONS

(dollars in thousands, except per share data)

(Unaudited)

| Three Months Ended | ||||||||

| March 31, | ||||||||

| 2016 | 2015 | |||||||

| Consolidated Operations: |

||||||||

| Total Revenue |

$ | 277,205 | $ | 271,762 | ||||

| Net Revenue |

144,044 | 147,091 | ||||||

| Total Expenses |

124,296 | 130,857 | ||||||

|

|

|

|

|

|||||

| Income from Operations |

$ | 19,748 | $ | 16,234 | ||||

| Income before Income Taxes |

15,955 | 12,757 | ||||||

| Net Income |

$ | 10,633 | $ | 7,845 | ||||

|

|

|

|

|

|||||

| Earnings Per Share: |

||||||||

| Net Income: |

||||||||

| Basic |

$ | 0.43 | $ | 0.27 | ||||

| Diluted |

$ | 0.42 | $ | 0.27 | ||||

| Weighted average common shares outstanding: |

||||||||

| Basic |

24,811 | 28,692 | ||||||

| Diluted |

25,121 | 28,780 | ||||||

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(dollars in thousands, except per share data)

(Unaudited)

| March 31, | December 31, | |||||||||||

| 2016 | 2015 | 2015 | ||||||||||

| Assets |

||||||||||||

| Current assets: |

||||||||||||

| Cash and cash equivalents |

$ | 48,321 | $ | 120,058 | $ | 23,153 | ||||||

| Pawn loans |

210,724 | 210,060 | 248,713 | |||||||||

| Merchandise held for disposition, net |

223,660 | 196,024 | 241,549 | |||||||||

| Pawn loan fees and service charges receivable |

44,942 | 43,784 | 52,798 | |||||||||

| Consumer loans, net |

23,986 | 31,897 | 31,291 | |||||||||

| Income taxes receivable |

— | 2,990 | — | |||||||||

| Prepaid expenses and other assets |

21,828 | 25,589 | 22,642 | |||||||||

| Investment in equity securities |

40,368 | 116,261 | 42,613 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total current assets |

613,829 | 746,663 | 662,759 | |||||||||

| Property and equipment, net |

164,245 | 191,749 | 171,598 | |||||||||

| Goodwill |

488,022 | 487,569 | 488,022 | |||||||||

| Intangible assets, net |

38,000 | 44,194 | 39,536 | |||||||||

| Other assets |

6,719 | 5,815 | 6,823 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total assets |

$ | 1,310,815 | $ | 1,475,990 | $ | 1,368,738 | ||||||

|

|

|

|

|

|

|

|||||||

| Liabilities and Equity |

||||||||||||

| Current liabilities: |

||||||||||||

| Accounts payable and accrued expenses |

$ | 60,554 | $ | 63,214 | $ | 74,586 | ||||||

| Customer deposits |

21,555 | 19,828 | 18,864 | |||||||||

| Income taxes currently payable |

3,524 | — | 3,063 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total current liabilities |

85,633 | 83,042 | 96,513 | |||||||||

| Deferred tax liabilities |

66,631 | 93,832 | 64,372 | |||||||||

| Other liabilities |

653 | 927 | 723 | |||||||||

| Long-term debt |

179,173 | 192,838 | 208,971 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total liabilities |

$ | 332,090 | $ | 370,639 | $ | 370,579 | ||||||

|

|

|

|

|

|

|

|||||||

| Equity: |

||||||||||||

| Common stock, $0.10 par value per share, 80,000,000 shares authorized, 30,235,164 shares issued |

3,024 | 3,024 | 3,024 | |||||||||

| Additional paid-in capital |

82,620 | 84,650 | 86,557 | |||||||||

| Retained earnings |

1,061,221 | 1,036,794 | 1,052,567 | |||||||||

| Accumulated other comprehensive income |

13,492 | 62,099 | 14,842 | |||||||||

| Treasury shares, at cost (6,080,997 shares, 2,525,192 shares and 5,362,684 shares as of March 31, 2016 and 2015, and as of December 31, 2015, respectively) |

(181,632 | ) | (81,216 | ) | (158,831 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Total equity |

978,725 | 1,105,351 | 998,159 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total liabilities and equity |

$ | 1,310,815 | $ | 1,475,990 | $ | 1,368,738 | ||||||

|

|

|

|

|

|

|

|||||||

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

(dollars in thousands, except per share data)

(Unaudited)

| Three Months Ended March 31, |

||||||||

| 2016 | 2015 | |||||||

| Revenue |

||||||||

| Pawn loan fees and service charges |

$ | 79,685 | $ | 77,313 | ||||

| Proceeds from disposition of merchandise |

178,297 | 172,213 | ||||||

| Consumer loan fees |

18,107 | 20,319 | ||||||

| Other |

1,116 | 1,917 | ||||||

|

|

|

|

|

|||||

| Total Revenue |

277,205 | 271,762 | ||||||

|

|

|

|

|

|||||

| Cost of Revenue |

||||||||

| Disposed merchandise |

129,218 | 119,884 | ||||||

| Consumer loan loss provision |

3,943 | 4,787 | ||||||

|

|

|

|

|

|||||

| Total Cost of Revenue |

133,161 | 124,671 | ||||||

|

|

|

|

|

|||||

| Net Revenue |

144,044 | 147,091 | ||||||

|

|

|

|

|

|||||

| Expenses |

||||||||

| Operations and administration |

110,791 | 116,338 | ||||||

| Depreciation and amortization |

13,505 | 14,519 | ||||||

|

|

|

|

|

|||||

| Total Expenses |

124,296 | 130,857 | ||||||

|

|

|

|

|

|||||

| Income from Operations |

19,748 | 16,234 | ||||||

| Interest expense |

(3,919 | ) | (3,644 | ) | ||||

| Interest income |

20 | 2 | ||||||

| Foreign currency transaction gain |

— | 39 | ||||||

| Loss on early extinguishment of debt |

(11 | ) | — | |||||

| Gain on disposition of equity securities |

117 | 126 | ||||||

|

|

|

|

|

|||||

| Income before Income Taxes |

15,955 | 12,757 | ||||||

| Provision for income taxes |

5,322 | 4,912 | ||||||

|

|

|

|

|

|||||

| Net Income |

$ | 10,633 | $ | 7,845 | ||||

|

|

|

|

|

|||||

| Earnings Per Share: |

||||||||

| Net Income: |

||||||||

| Basic |

$ | 0.43 | $ | 0.27 | ||||

| Diluted |

$ | 0.42 | $ | 0.27 | ||||

| Weighted average common shares outstanding: |

||||||||

| Basic |

24,811 | 28,692 | ||||||

| Diluted |

25,121 | 28,780 | ||||||

| Dividends declared per common share |

$ | 0.080 | $ | 0.050 | ||||

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES

PAWN LOAN METRICS

The following tables outline certain data related to pawn loan activities for the Company as of and for the three months ended March 31, 2016 and 2015 (dollars in thousands except where otherwise noted):

| As of March 31, | ||||||||||||||||

| 2016 | 2015 | $ Change | % Change | |||||||||||||

| Ending pawn loan balances |

$ | 210,724 | $ | 210,060 | $ | 664 | 0.3 | % | ||||||||

| Ending merchandise balance, net |

$ | 223,660 | $ | 196,024 | $ | 27,636 | 14.1 | % | ||||||||

| Three Months Ended March 31, | ||||||||||||||||

| 2016 | 2015 | $ Change | % Change | |||||||||||||

| Pawn loan fees and service charges |

$ | 79,685 | $ | 77,313 | $ | 2,372 | 3.1 | % | ||||||||

| Average pawn loan balance outstanding |

$ | 232,080 | $ | 229,935 | $ | 2,145 | 0.9 | % | ||||||||

| Amount of pawn loans written and renewed |

$ | 228,353 | $ | 222,176 | $ | 6,177 | 2.8 | % | ||||||||

| Average amount per pawn loan (in ones) |

$ | 130 | $ | 127 | $ | 3 | 2.4 | % | ||||||||

| Annualized yield on pawn loans |

138.1 | % | 136.4 | % | ||||||||||||

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES

MERCHANDISE DISPOSITION, GROSS PROFIT AND INVENTORY OPERATING DATA

Profit from the disposition of merchandise represents the proceeds received from the disposition of merchandise in excess of the cost of disposed merchandise, which is generally the principal amount loaned on an item or the amount paid for purchased merchandise. The following table summarizes the proceeds from the disposition of merchandise and the related gross profit for the three months ended March 31, 2016 and 2015 (dollars in thousands):

| Three Months Ended March 31, | ||||||||||||||||||||||||

| 2016 | 2015 | |||||||||||||||||||||||

| Retail | Commercial | Total | Retail | Commercial | Total | |||||||||||||||||||

| Proceeds from disposition |

$ | 150,727 | $ | 27,570 | $ | 178,297 | $ | 148,149 | $ | 24,064 | $ | 172,213 | ||||||||||||

| Gross profit on disposition |

$ | 49,600 | $ | (521 | ) | $ | 49,079 | $ | 46,956 | $ | 5,373 | $ | 52,329 | |||||||||||

| Gross profit margin |

32.9 | % | (1.9 | )% | 27.5 | % | 31.7 | % | 22.3 | % | 30.4 | % | ||||||||||||

| Percentage of total gross profit |

101.1 | % | (1.1 | )% | 100.0 | % | 89.7 | % | 10.3 | % | 100.0 | % | ||||||||||||

The table below summarizes the age of merchandise held for disposition related to the Company’s pawn lending operations as of March 31, 2016 and 2015, and December 31, 2015 (dollars in thousands):

| As of March 31, | As of December 31, | |||||||||||||||||||||||

| 2016 | 2015 | 2015 | ||||||||||||||||||||||

| Amount | % | Amount | % | Amount | % | |||||||||||||||||||

| Jewelry - held for one year or less |

$ | 131,340 | 58.0 | % | $ | 110,993 | 55.9 | % | $ | 135,215 | 55.3 | % | ||||||||||||

| Other merchandise - held for one year or less |

84,119 | 37.1 | % | 76,902 | 38.8 | % | 93,498 | 38.3 | % | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total merchandise held for one year or less |

215,459 | 95.1 | % | 187,895 | 94.7 | % | 228,713 | 93.6 | % | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Jewelry - held for more than one year |

6,593 | 2.9 | % | 4,682 | 2.4 | % | 8,935 | 3.7 | % | |||||||||||||||

| Other merchandise - held for more than one year |

4,558 | 2.0 | % | 5,847 | 2.9 | % | 6,701 | 2.7 | % | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total merchandise held for more than one year |

11,151 | 4.9 | % | 10,529 | 5.3 | % | 15,636 | 6.4 | % | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Merchandise held for disposition, gross |

$ | 226,610 | 100.0 | % | $ | 198,424 | 100.0 | % | $ | 244,349 | 100.0 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Less: Inventory valuation allowance |

$ | (2,950 | ) | $ | (2,400 | ) | $ | (2,800 | ) | |||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Merchandise held for disposition, net of allowance |

$ | 223,660 | $ | 196,024 | $ | 241,549 | ||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES

CONSUMER LOAN METRICS AND BALANCES

The following table sets forth interest and fees on consumer loans, the consumer loan loss provision and consumer loan fees, net of the loss provision, related to consumer loan activities for the Company for the three months ended March 31, 2016 and 2015 (dollars in thousands except where otherwise noted):

| Three Months Ended March 31, | ||||||||||||||||||||||||

| 2016 | 2015 | |||||||||||||||||||||||

| Short-term loans |

Installment loans |

Total | Short-term loans |

Installment loans |

Total | |||||||||||||||||||

| Consumer loan fees |

$ | 11,631 | $ | 6,476 | $ | 18,107 | $ | 17,063 | $ | 3,256 | $ | 20,319 | ||||||||||||

| Less: consumer loan loss provision |

2,367 | 1,576 | 3,943 | 3,119 | 1,668 | 4,787 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Consumer loan fees, net of loss provision |

$ | 9,264 | $ | 4,900 | $ | 14,164 | $ | 13,944 | $ | 1,588 | $ | 15,532 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Year-over-year change - $ |

$ | (4,680 | ) | $ | 3,312 | $ | (1,368 | ) | $ | (2,610 | ) | $ | (19 | ) | $ | (2,629 | ) | |||||||

| Year-over-year change - % |

(33.6 | )% | 208.6 | % | (8.8 | )% | (15.8 | )% | (1.2 | )% | (14.5 | )% | ||||||||||||

| Consumer loan loss provision as a % of consumer loan fees |

20.4 | % | 24.3 | % | 21.8 | % | 18.3 | % | 51.2 | % | 23.6 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

In addition to reporting consumer loans owned by the Company and consumer loans guaranteed by the Company, which are either items accounted for in accordance with generally accepted accounting principals (“GAAP”) or disclosures required by GAAP, the Company has provided combined consumer loans, which is a non-GAAP measure that combines the consumer loans owned by the Company and those guaranteed by the Company. In addition, the Company has reported combined consumer loans written and renewed, which is statistical data that is not included in the Company’s financial statements.

Management believes these measures provide investors with important information needed to evaluate the magnitude of potential loan losses and the opportunity for revenue performance of the consumer loan portfolio on an aggregate basis. Management also believes that the comparison of the aggregate amounts from period to period is more meaningful than comparing only the amounts reflected on the Company’s balance sheet since both revenue and the loss provision for consumer loans are impacted by the aggregate amount of consumer loans owned by the Company and those guaranteed by the Company as reflected in its financial statements.

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES

CONSUMER LOAN METRICS AND BALANCES

The following tables provide additional information related to each of the Company’s consumer loan products as of and for the three months ended March 31, 2016 and 2015 (dollars in thousands):

| Three Months Ended March 31, | ||||||||||||||||||||||||

| 2016 | 2015 | |||||||||||||||||||||||

| Short-term loans |

Installment loans |

Total | Short-term loans |

Installment loans |

Total | |||||||||||||||||||

| Consumer loans written and renewed(a) |

||||||||||||||||||||||||

| Company owned |

$ | 92,214 | $ | 1,196 | $ | 93,410 | $ | 134,477 | $ | 1,448 | $ | 135,925 | ||||||||||||

| Guaranteed by the Company(b) |

4,210 | 8,629 | 12,839 | 8,057 | 14,003 | 22,060 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Combined consumer loans written and renewed |

$ | 96,424 | $ | 9,825 | $ | 106,249 | $ | 142,534 | $ | 15,451 | $ | 157,985 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| As of March 31, | ||||||||||||||||||||||||

| 2016 | 2015 | |||||||||||||||||||||||

| Ending consumer loan balances, gross |

||||||||||||||||||||||||

| Company owned |

$ | 22,853 | $ | 3,384 | $ | 26,237 | $ | 30,308 | $ | 4,814 | $ | 35,122 | ||||||||||||

| Guaranteed by the Company(b) |

773 | 6,914 | 7,687 | 1,717 | 6,980 | 8,697 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Combined ending consumer loan balances, gross(d) |

$ | 23,626 | $ | 10,298 | $ | 33,924 | $ | 32,025 | $ | 11,794 | $ | 43,819 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Allowance and liability for losses |

||||||||||||||||||||||||

| Company owned |

$ | 1,164 | $ | 1,087 | $ | 2,251 | $ | 2,034 | $ | 1,191 | $ | 3,225 | ||||||||||||

| Guaranteed by the Company(b) |

26 | 494 | 520 | 215 | 1,026 | 1,241 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Combined allowance and liability for losses |

$ | 1,190 | $ | 1,581 | $ | 2,771 | $ | 2,249 | $ | 2,217 | $ | 4,466 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ending consumer loan balances, net |

||||||||||||||||||||||||

| Company owned |

$ | 21,689 | $ | 2,297 | $ | 23,986 | $ | 28,274 | $ | 3,623 | $ | 31,897 | ||||||||||||

| Guaranteed by the Company(b) |

747 | 6,420 | 7,167 | 1,502 | 5,954 | 7,456 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Combined ending consumer loan balances, net(d) |

$ | 22,436 | $ | 8,717 | $ | 31,153 | $ | 29,776 | $ | 9,577 | $ | 39,353 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Average amount outstanding per consumer loan (in ones)(a)(c) |

$ | 446 | $ | 1,180 | $ | 466 | $ | 1,556 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Consumer loan ratios: |

||||||||||||||||||||||||

| Allowance and liability for losses as a % of combined ending consumer loan balance, gross(d) |

5.0 | % | 15.4 | % | 8.2 | % | 7.0 | % | 18.8 | % | 10.2 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (a) | The disclosure regarding the amount of consumer loans written and renewed and the average amount per consumer loan is statistical data that is not included in the Company’s financial statements. |

| (b) | The consumer loan balances guaranteed by the Company represent loans originated by third-party lenders through the credit services organization and credit access business programs, so these balances are not recorded in the Company’s financial statements. However, the Company has established a liability for estimated losses in support of its guarantee of these loans, which is reflected in the table above and included in the Company’s consolidated balance sheets. |

| (c) | The average amount outstanding per consumer loan is calculated as the total amount of combined consumer loans outstanding as of the end of the period divided by the total number of combined consumer loans outstanding as of the end of the period. |

| (d) | Non-GAAP measure. |

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES

LOCATION INFORMATION

Locations

The following table sets forth, as of March 31, 2016 and 2015, the number of Company-operated locations that offered pawn lending, consumer lending, and other services, in addition to franchised locations that offered check cashing services. The Company provides these services in the United States primarily under the names “Cash America Pawn,” “SuperPawn,” “Cash America Payday Advance,” “Cashland” and “Mr. Payroll.” The Company’s pawn and consumer lending locations operated in 20 and 21 states in the United States as of March 31, 2016 and 2015, respectively. As of both March 31, 2016 and 2015, the franchised check cashing centers operated in 12 states.

| As of March 31, | ||||||||

| 2016 | 2015 | |||||||

| Company-operated locations offering: |

||||||||

| Pawn lending only |

574 | 545 | ||||||

| Both pawn and consumer lending |

224 | 271 | ||||||

| Consumer lending only |

21 | 31 | ||||||

|

|

|

|

|

|||||

| Total Company-operated locations |

819 | 847 | ||||||

| Franchised check cashing centers |

73 | 80 | ||||||

|

|

|

|

|

|||||

| Total |

892 | 927 | ||||||

|

|

|

|

|

|||||

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES

NON-GAAP DISCLOSURE

Non-GAAP Disclosure

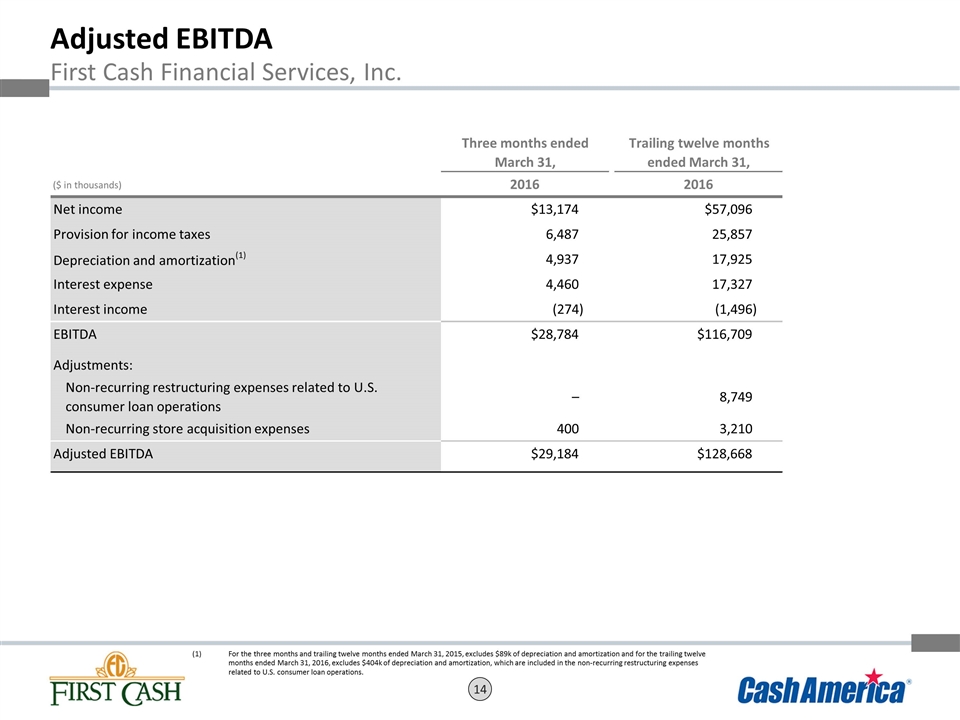

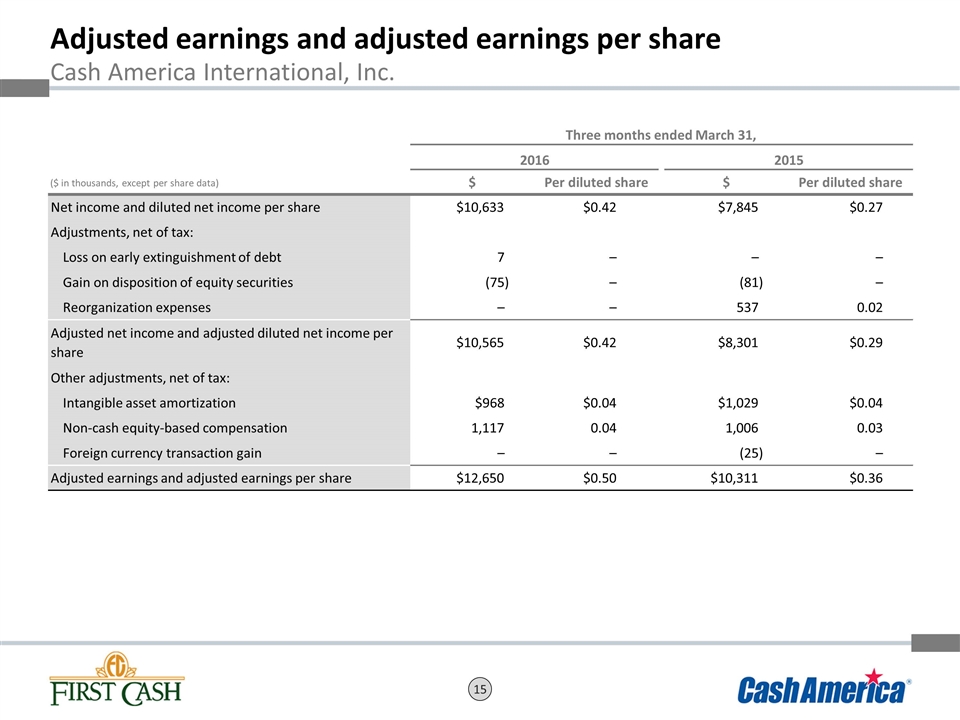

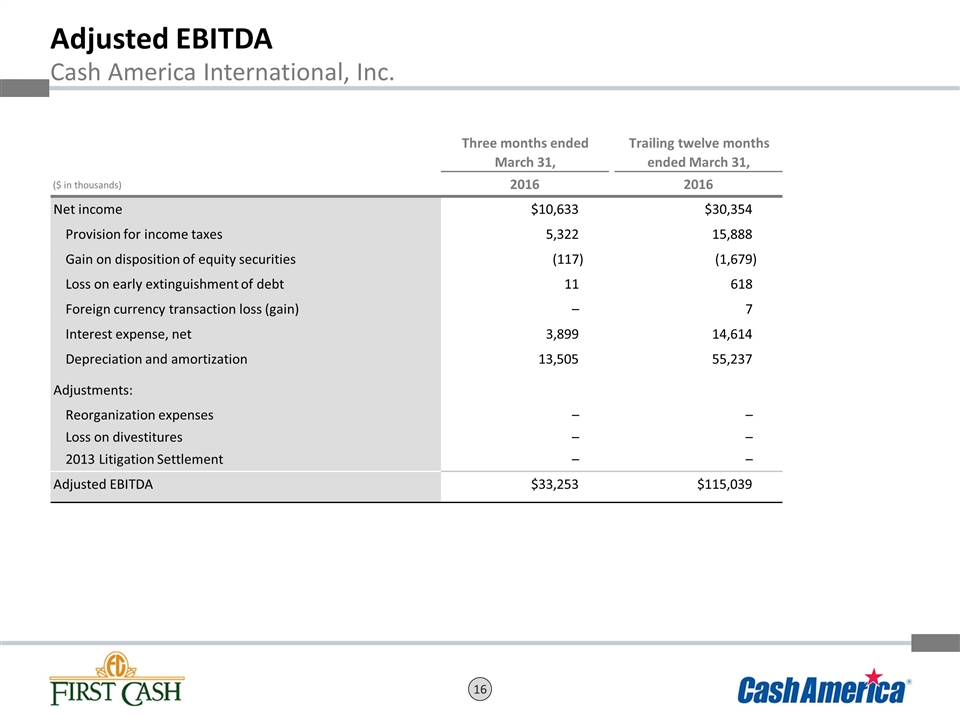

In addition to the financial information prepared in conformity with GAAP, the Company has provided certain historical non-GAAP measures in the tables below, including (i) adjusted net income, adjusted diluted net income per share, adjusted earnings, adjusted earnings per share and adjusted income from operations (collectively, the “Adjusted Earnings Measures”), and (ii) adjusted EBITDA, which the Company defines as earnings excluding depreciation, amortization, interest, foreign currency transaction gains or losses, loss on early extinguishment of debt, gain on disposition of equity securities and provision or benefit for income taxes. Management also provides estimated adjusted EBITDA and estimated free cash flow per share, which are non-GAAP measures. Management defines estimated free cash flow per share as estimated earnings per share excluding estimated depreciation and amortization, less estimated cash paid for capital expenditures.

Management believes that the presentation of these measures provides users of the financial statements with greater transparency and facilitates a more meaningful comparison of operating results across a broad spectrum of companies with varying capital structures, compensation strategies, derivative instruments and depreciation and amortization methods. In addition, management believes this information provides a more in-depth and complete view of the Company’s financial performance, competitive position and prospects for the future and may highlight trends in the Company’s business that may not otherwise be apparent when relying on financial measures calculated in accordance with GAAP. Management also believes that non-GAAP measures are frequently used by analysts and investors to analyze operating performance, evaluate the Company’s ability to incur and service debt and its capacity for making capital investments, and to help assess the Company’s estimated enterprise value.

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES

NON-GAAP DISCLOSURE

Management believes the non-GAAP measures included herein, including the adjustments shown, provide more meaningful information regarding the ongoing operating performance, provide more useful period-to-period comparisons of operating results, both internally and in relation to operating results of competitors, enhance analysts’ and investors’ understanding of the core operating results of the business and provide a more accurate indication of the Company’s ability to generate cash flows from operations. Therefore, management believes it is important to clearly identify these measures for investors.

In calculating adjusted earnings and adjusted earnings per share, management excludes intangible asset amortization, non-cash equity based compensation and foreign currency transaction gains or losses. In addition, management has determined that the adjustments to the Adjusted Earnings Measures and adjusted EBITDA, as applicable, included in the tables below are useful to analysts and investors in order to allow them to compare the Company’s financial results for the current period with the comparative period without the effect of the below items, which management believes are less frequent in nature:

| • | the loss on early extinguishment of debt; |

| • | the gain on disposition of equity securities; |

| • | severance and other employee-related costs for administrative and operations staff reductions in connection with the Company’s reorganization to better align the corporate and operating cost structure with its remaining storefront operations (the “Reorganization”) after the Company completed the distribution of approximately 80% of the outstanding shares of Enova International, Inc. common stock to the Company’s shareholders in 2014; |

| • | the loss on significant divestitures of non-strategic operations; and |

| • | charges related to a significant litigation settlement in 2013 (the “2013 Litigation Settlement”). |

In addition to the presentation of Adjusted EBITDA for the three months ended March 31, 2016 and 2015, Adjusted EBITDA is presented for the trailing twelve months ended March 31, 2016 and 2015. Therefore, certain adjusting items that occurred in the second, third and fourth quarters of 2015 and 2014 are presented in the adjusted EBITDA table for the trailing twelve months ended March 31, 2016 and 2015.

Management provides non-GAAP financial information for informational purposes and to enhance understanding of the Company’s GAAP consolidated financial statements. Readers should consider the information in addition to, but not instead of or superior to, its financial statements prepared in accordance with GAAP. This non-GAAP financial information may be determined or calculated differently by other companies, limiting the usefulness of those measures for comparative purposes.

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES

NON-GAAP DISCLOSURE

ADJUSTED EARNINGS MEASURES AND ADJUSTED EBITBDA

The following table provides a reconciliation for the three months ended March 31, 2016 and 2015, between net income and diluted net income per share calculated in accordance with GAAP to the Adjusted Earnings Measures, which are shown net of tax (dollars in thousands, except per share data):

| Three Months Ended March 31, | ||||||||||||||||

| 2016 | 2015 | |||||||||||||||

| $ | Per Diluted Share(a) |

$ | Per Diluted Share(a) |

|||||||||||||

| Net income and diluted net income per share |

$ | 10,633 | $ | 0.42 | $ | 7,845 | $ | 0.27 | ||||||||

| Adjustments (net of tax): |

||||||||||||||||

| Loss on early extinguishment of debt |

7 | — | — | — | ||||||||||||

| Gain on disposition of equity securities |

(75 | ) | — | (81 | ) | — | ||||||||||

| Reorganization expenses |

— | — | 537 | 0.02 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Adjusted net income and adjusted diluted net income per share |

10,565 | 0.42 | 8,301 | 0.29 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other adjustments (net of tax): |

||||||||||||||||

| Intangible asset amortization |

968 | 0.04 | 1,029 | 0.04 | ||||||||||||

| Non-cash equity-based compensation |

1,117 | 0.04 | 1,006 | 0.03 | ||||||||||||

| Foreign currency transaction gain |

— | — | (25 | ) | — | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Adjusted earnings and adjusted earnings per share |

$ | 12,650 | $ | 0.50 | $ | 10,311 | $ | 0.36 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (a) | Diluted shares are calculated by giving effect to the potential dilution that could occur if securities or other contracts to issue common shares were exercised and converted into common shares during the period. |

The following table provides a reconciliation for the three months ended March 31, 2016 and 2015, between net income calculated in accordance with GAAP to adjusted income from operations and adjusted EBITDA (dollars in thousands):

| Three Months Ended March 31, | ||||||||

| 2016 | 2015 | |||||||

| Net income |

$ | 10,633 | $ | 7,845 | ||||

| Provision for income taxes |

5,322 | 4,912 | ||||||

| Gain on disposition of equity securities |

(117 | ) | (126 | ) | ||||

| Loss on early extinguishment of debt |

11 | — | ||||||

| Foreign currency transaction gain |

— | (39 | ) | |||||

| Interest expense, net |

3,899 | 3,642 | ||||||

| Adjustments: |

||||||||

| Reorganization expenses |

— | 853 | ||||||

|

|

|

|

|

|||||

| Adjusted income from operations |

19,748 | 17,087 | ||||||

|

|

|

|

|

|||||

| Depreciation and amortization expenses |

13,505 | 14,519 | ||||||

|

|

|

|

|

|||||

| Adjusted EBITDA |

$ | 33,253 | $ | 31,606 | ||||

|

|

|

|

|

|||||

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES

NON-GAAP DISCLOSURE

ADJUSTED EARNINGS MEASURES AND ADJUSTED EBITBDA

The table below outlines the gross amounts, the impact of income taxes and the net amounts for each of the adjustments included in the previous tables (dollars in thousands):

| Three Months Ended March 31, | ||||||||||||||||||||||||

| 2016 | 2015 | |||||||||||||||||||||||

| Pre-tax | Tax | After-tax | Pre-tax | Tax | After-tax | |||||||||||||||||||

| Loss on early extinguishment of debt |

$ | 11 | $ | 4 | $ | 7 | $ | — | $ | — | $ | — | ||||||||||||

| Gain on disposition of equity securities |

(117 | ) | (42 | ) | (75 | ) | (126 | ) | (45 | ) | (81 | ) | ||||||||||||

| Reorganization expenses |

— | — | — | 853 | 316 | 537 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Adjustments |

$ | (106 | ) | $ | (38 | ) | $ | (68 | ) | $ | 727 | $ | 271 | $ | 456 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES

NON-GAAP DISCLOSURE

ADJUSTED EBITDA

The following table provides a reconciliation between net income (loss), which is the nearest GAAP measure presented in the Company’s financial statements, to adjusted EBITDA (dollars in thousands):

| Trailing 12 Months Ended | ||||||||

| March 31, | ||||||||

| 2016 | 2015 | |||||||

| Net income (loss) |

$ | 30,354 | $ | (5,779 | ) | |||

| Provision for income taxes |

15,888 | 3,131 | ||||||

| Gain on disposition of equity securities |

(1,679 | ) | (126 | ) | ||||

| Loss on early extinguishment of debt |

618 | 21,007 | ||||||

| Foreign currency transaction loss (gain) |

7 | (154 | ) | |||||

| Interest expense, net |

14,614 | 17,211 | ||||||

| Depreciation and amortization expenses |

55,237 | 60,318 | ||||||

| Adjustments: |

||||||||

| Reorganization expenses |

— | 8,391 | ||||||

| Loss on divestitures |

— | 5,176 | ||||||

| 2013 Litigation Settlement |

— | 375 | ||||||

|

|

|

|

|

|||||

| Adjusted EBITDA |

$ | 115,039 | $ | 109,550 | ||||

|

|

|

|

|

|||||

| Adjusted EBITDA margin calculated as follows: |

||||||||

| Total revenue |

$ | 1,034,934 | $ | 1,081,823 | ||||

| Adjusted EBITDA |

$ | 115,039 | $ | 109,550 | ||||

|

|

|

|

|

|||||

| Adjusted EBITDA as a percentage of total revenue |

11.1 | % | 10.1 | % | ||||

|

|

|

|

|

|||||

The table below outlines the gross amounts, the impact of income taxes and the net amounts for each of the adjustments included in the previous table (dollars in thousands):

| Trailing 12 Months Ended March 31, | ||||||||||||||||||||||||

| 2016 | 2015 | |||||||||||||||||||||||

| Pre-tax | Tax | After-tax | Pre-tax | Tax | After-tax | |||||||||||||||||||

| Gain on disposition of equity securities |

$ | (1,679 | ) | $ | (596 | ) | $ | (1,083 | ) | $ | (126 | ) | $ | (45 | ) | $ | (81 | ) | ||||||

| Loss on early extinguishment of debt |

618 | 229 | 389 | 21,007 | 7,773 | 13,234 | ||||||||||||||||||

| Reorganization expenses |

— | — | — | 8,391 | 3,105 | 5,286 | ||||||||||||||||||

| Loss on divestitures |

— | — | — | 5,176 | (1,268 | ) | 6,444 | |||||||||||||||||

| 2013 Litigation Settlement |

— | — | — | 375 | 139 | 236 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Adjustments |

$ | (1,061 | ) | $ | (367 | ) | $ | (694 | ) | $ | 34,823 | $ | 9,704 | $ | 25,119 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES

NON-GAAP DISCLOSURE

ESTIMATED ADJUSTED EBITDA

The following table reconciles estimated income before income taxes to estimated Adjusted EBITDA, a non-GAAP measure (dollars in thousands):

| Estimated Results (a) | ||||||||

| For Year Ended December 31, 2016 | ||||||||

| Low | High | |||||||

| (Unaudited) | ||||||||

| Estimated income before income taxes |

$ | 53,000 | $ | 61,000 | ||||

| Interest expense |

16,000 | 16,000 | ||||||

| Depreciation and amortization |

56,000 | 56,000 | ||||||

|

|

|

|

|

|||||

| Estimated Adjusted EBITDA |

$ | 125,000 | $ | 133,000 | ||||

|

|

|

|

|

|||||

| (a) | As of the Company press release dated April 28, 2016. |

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES

NON-GAAP DISCLOSURE

ESTIMATED EARNINGS PER SHARE AND ESTIMATED FREE CASH FLOW PER SHARE