Form 425 CASCADE MICROTECH INC Filed by: FORMFACTOR INC

Filed by FormFactor, Inc.

Pursuant to Rule 425 of the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Cascade Microtech, Inc.

(Commission File No.: 000-51072)

MAY 2016 Investor Presentation Transitioning from Semiconductor Test Supplier To Broader Test and Measurement MARKET Leader ©2016 FormFactor Inc.

Cautions Regarding Forward-Looking Statements Forward-Looking Statements This communication contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including with respect to the anticipated timing, completion and effects of the proposed merger between FormFactor and Cascade Microtech. These statements are based on management’s current expectations and beliefs, and are subject to a number of factors and uncertainties, many of which are beyond FormFactor’s and Cascade Microtech’s control, that could cause actual results to differ materially from those described in the forward-looking statements. These forward-looking statements include, but are not limited to, statements about: future financial and operating results; benefits of the transaction to customers, shareholders and employees; potential synergies and cost savings; the ability of the combined company to drive growth and expand customer and partner relationships; and other statements regarding the proposed transaction. Forward-looking statements may contain words such as “may,” “might,” “will,” “could,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “intend” and “continue,” the negative or plural of these words and similar expressions, and include the assumptions that underlie such statements. The following factors, among others, could cause actual results to differ materially from those described in the forward-looking statements: the timing to consummate the proposed merger; failure of the Cascade Microtech shareholders to approve the proposed merger; the terms and availability of the proposed financing arrangements; the risk that a condition to closing of the merger may not be satisfied; the challenges and costs of closing, integrating, restructuring and achieving anticipated synergies; the ability to retain key employees, customers and suppliers; the diversion of management time on merger-related issues; and changes in FormFactor’s or Cascade Microtech’s future cash requirements, capital requirements, results of operations, financial conditions and/or cash flows, and other factors, including those set forth in the proxy statement/prospectus included in FormFactor’s registration statement on Form S-4 (File No. 333-210549), including Amendments No. 1 and 2 thereto, and in the most current Annual Report on Form 10-K, Quarterly Report on Form 10-Q and Current Reports on Form 8-K filed by each of FormFactor and Cascade Microtech with the U.S. Securities and Exchange Commission (the “SEC”), under the caption “Risk Factors” and elsewhere. All forward-looking statements are based on management’s estimates, projections and assumptions as of the date hereof. No assurances can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what impact they will have on the results of operations or financial condition of FormFactor or Cascade Microtech. Unless required by law, FormFactor and Cascade Microtech are under no obligation (and expressly disclaim any such obligation) to update or revise their forward-looking statements whether as a result of new information, future events, or otherwise. ©2016 FormFactor Inc.

Additional Information and Where to Find It; Participants in the Solicitation No Offer or Solicitation This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval with respect to the proposed merger or otherwise. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Additional Information and Where to Find It In connection with the proposed merger, FormFactor has filed a registration statement on Form S-4 (File No. 333-210549), including Amendments No. 1 and 2 thereto, which includes a prospectus of FormFactor and contains a proxy statement of Cascade Microtech, and other documents concerning the proposed merger with the SEC. The registration statement was declared effective on May 19, 2016 and Cascade Microtech commenced mailing of the proxy statement/prospectus to Cascade Microtech’s shareholders on May 23, 2016. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, THE DEFINITIVE PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT FORMFACTOR, CASCADE MICROTECH, AND THE PROPOSED MERGER. Investors and security holders are able to obtain free copies of the registration statement and the proxy statement/prospectus (when they are available) and any other documents filed by FormFactor and Cascade Microtech with the SEC at the SEC’s website at www.sec.gov. Copies of documents filed with the SEC by FormFactor may also be obtained for free by contacting FormFactor Investor Relations by mail at FormFactor Inc., Investor Relations, 7005 Southfront St., Livermore, California 94551, Attention: Investor Relations or by going to FormFactor’s Investor Relations page on its corporate web site at www.formfactor.com, and copies of documents filed with the SEC by Cascade Microtech may also be obtained for free by contacting Cascade Microtech Investor Relations by mail at Cascade Microtech, Inc., 9100 SW Gemini Drive, Beaverton, Oregon 97008, Attention: Investor Relations or by going to Cascade Microtech’s Investor Relations page on its corporate web site at www.CascadeMicrotech.com. The contents of the websites referenced above are not deemed to be incorporated by reference into the registration statement or the proxy statement/prospectus. Participants in the Solicitation Cascade Microtech and FormFactor and their respective executive officers and directors may be deemed to be participants in the solicitation of proxies from Cascade Microtech shareholders with respect to the transactions contemplated by the merger agreement. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of Cascade Microtech security holders in connection with the proposed merger will be set forth in the registration statement and the proxy statement/prospectus when filed with the SEC. Information regarding Cascade Microtech’s executive officers and directors is included in Cascade Microtech’s Annual Report on Form 10-K for the year ended December 31, 2015, filed with the SEC on March 7, 2016, and as amended by Amendment No. 1 on Form 10-K/A, filed with the SEC on April 25, 2016. Information regarding FormFactor’s executive officers and directors is included in FormFactor’s Annual Report on Form 10-K for the year ended December 26, 2015, filed with the SEC on March 4, 2015, its proxy statement for its 2016 annual meeting of shareholders, filed with the SEC on April 6, 2016 and its Current Report on Form 8-K, filed with the SEC on May 23, 2016. Copies of the foregoing documents may be obtained as provided above. Certain executive officers and directors of Cascade Microtech have interests in the transaction that may differ from the interests of Cascade Microtech shareholders generally. These interests are described in the proxy statement/prospectus and other relevant materials filed or to be filed with the SEC when they become available. ©2016 FormFactor Inc.

Largest supplier of semiconductor probe cards, gaining share and outpacing market growth INVESTMENT THEMES ©2016 FormFactor Inc. Aligned with technology trends in mobility, connectivity and enterprise infrastructure Technology leadership enables customers’ most critical roadmap advancements Structurally profitable financial model delivering earnings growth and positive cash flow Cascade Microtech acquisition provides scale & diversification; accelerates earnings growth

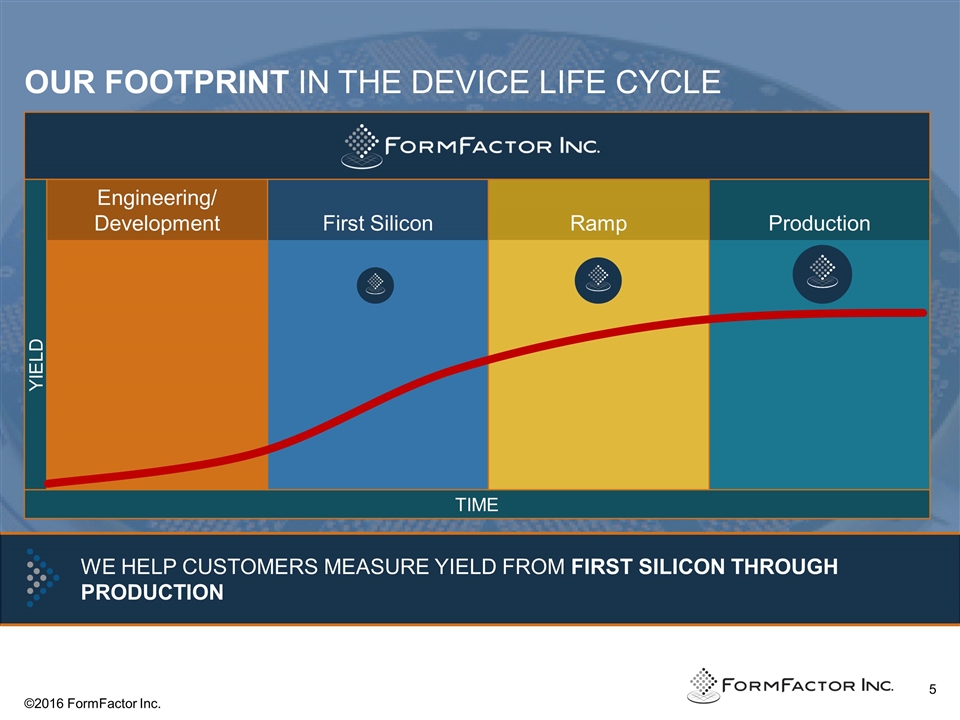

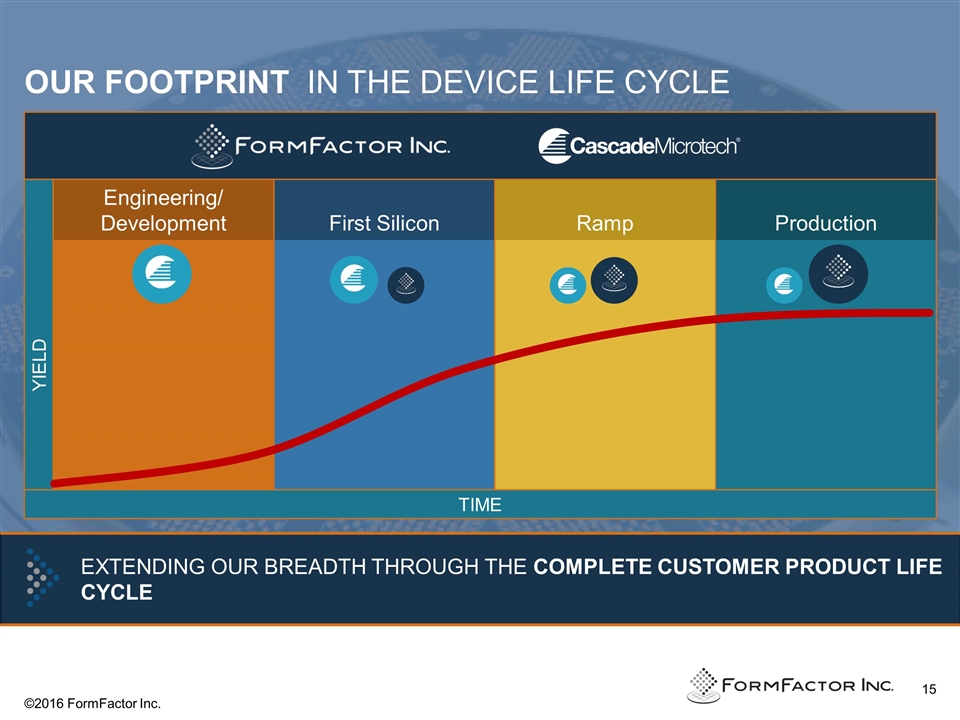

Engineering/ Development First Silicon Ramp Production YIELD TIME OUR FOOTPRINT in the Device Life Cycle ©2016 FormFactor Inc. We Help customers MEASURE Yield from First SILICON through Production

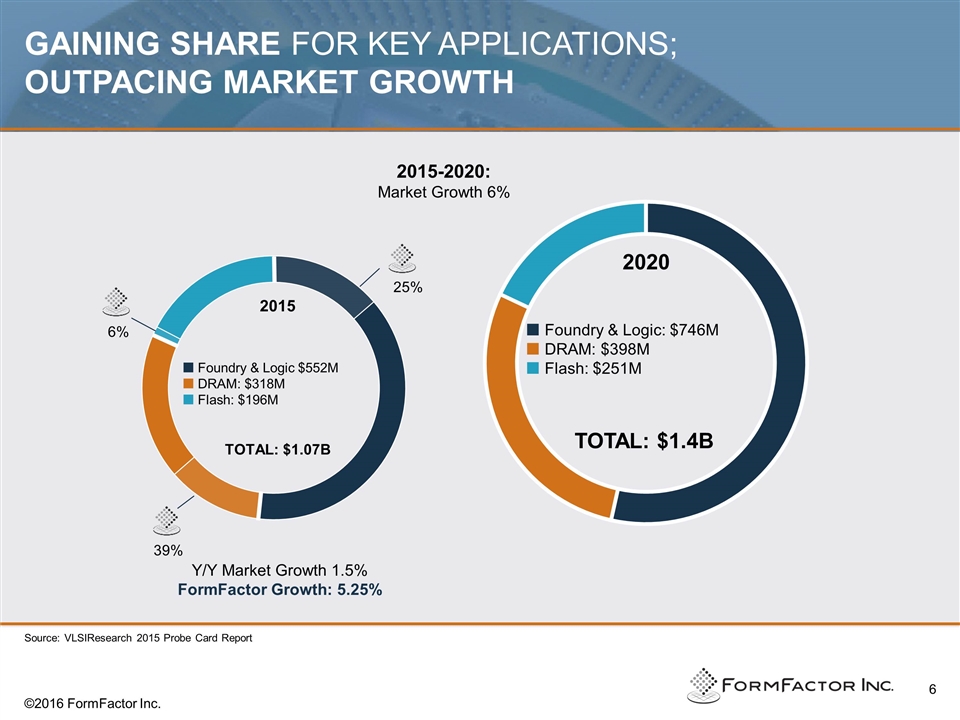

Gaining Share for Key Applications; Outpacing Market Growth Source: VLSIResearch 2015 Probe Card Report ©2016 FormFactor Inc. 2015-2020: Market Growth 6% 25% ¢ Foundry & Logic $552M ¢ DRAM: $318M ¢ Flash: $196M TOTAL: $1.07B 2015 ¢ Foundry & Logic: $746M ¢ DRAM: $398M ¢ Flash: $251M TOTAL: $1.4B 2020 39% 6% Y/Y Market Growth 1.5% FormFactor Growth: 5.25%

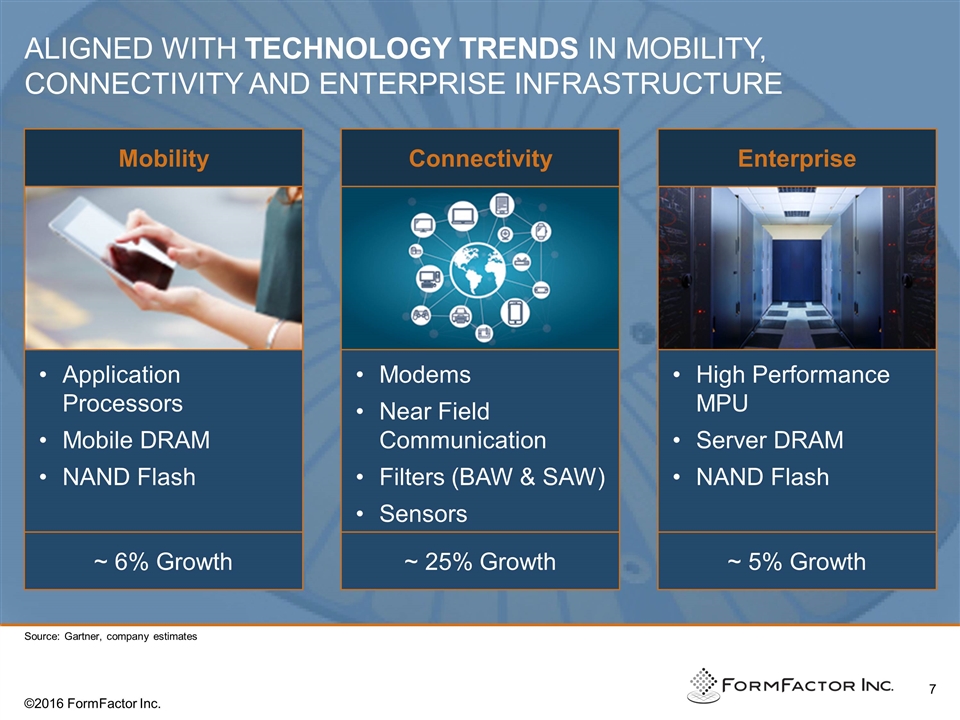

Aligned with Technology Trends in Mobility, Connectivity and Enterprise infrastructure Mobility Application Processors Mobile DRAM NAND Flash ~ 6% Growth Connectivity Modems Near Field Communication Filters (BAW & SAW) Sensors ~ 25% Growth Enterprise High Performance MPU Server DRAM NAND Flash ~ 5% Growth ©2016 FormFactor Inc. Source: Gartner, company estimates

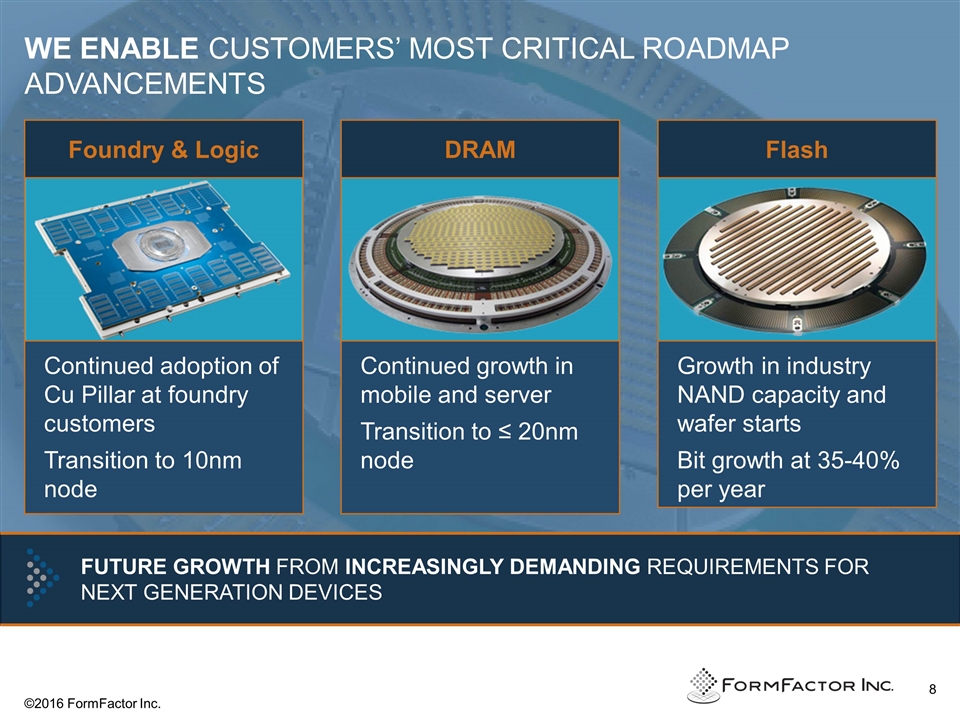

Foundry & Logic Continued adoption of Cu Pillar at foundry customers Transition to 10nm node We Enable Customers’ Most Critical Roadmap Advancements Flash Growth in industry NAND capacity and wafer starts Bit growth at 35-40% per year DRAM Continued growth in mobile and server Transition to ≤ 20nm node FUTURE GROWTH FROM INCREASINGLY DEMANDING REQUIREMENTS FOR NEXT GENERATION DEVICES ©2016 FormFactor Inc.

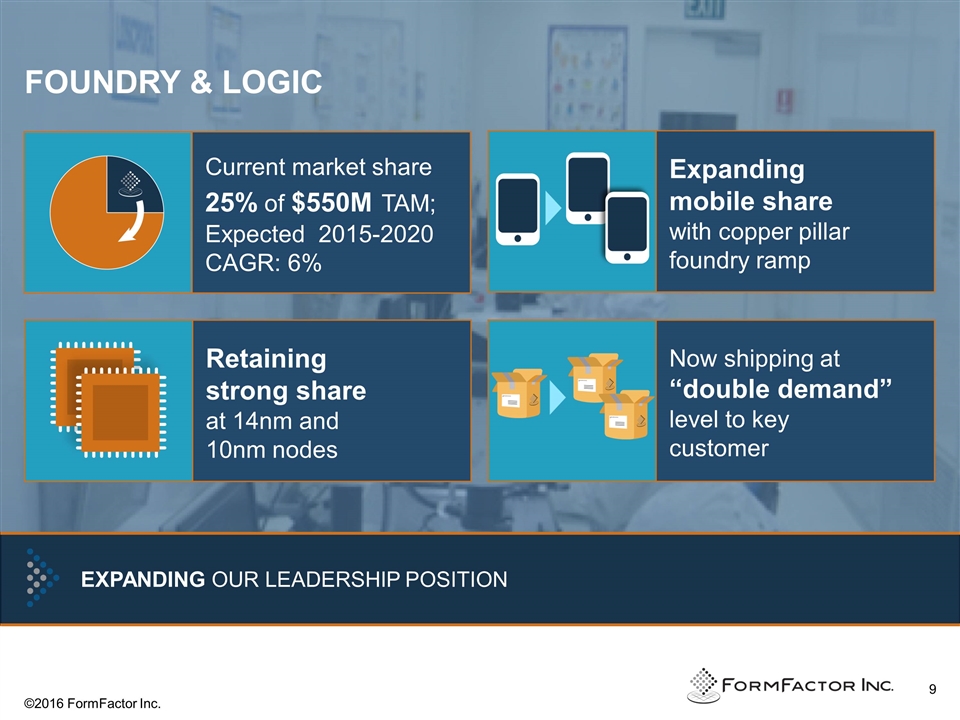

Current market share 25% of $550M TAM; Expected 2015-2020 CAGR: 6% Retaining strong share at 14nm and 10nm nodes Now shipping at “double demand” level to key customer Expanding mobile share with copper pillar foundry ramp Foundry & Logic Expanding our Leadership Position ©2016 FormFactor Inc.

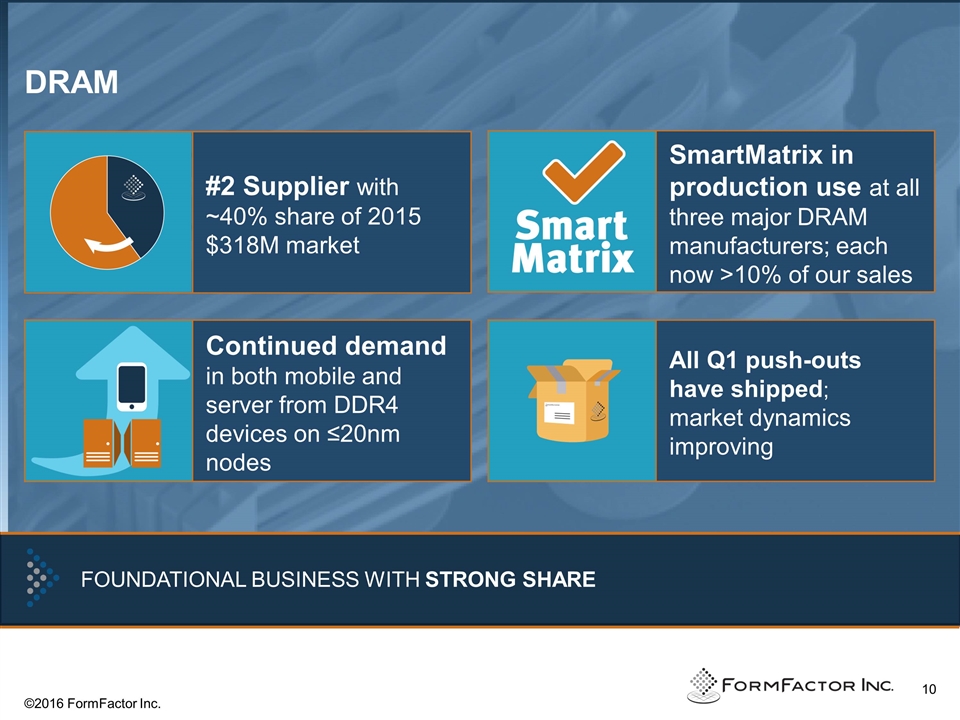

To be replaced #2 Supplier with ~40% share of 2015 $318M market Continued demand in both mobile and server from DDR4 devices on ≤20nm nodes All Q1 push-outs have shipped; market dynamics improving SmartMatrix in production use at all three major DRAM manufacturers; each now >10% of our sales DRAM ©2016 FormFactor Inc. Foundational business with Strong Share

To be replaced Currently hold less than 10% share of $200M market Continued industry growth in bits and wafer starts Vector qualified at two major NAND flash manufacturers Leveraging FormFactor technology & scale in NAND-optimized Vector product NAND FLASH ©2016 FormFactor Inc. Entry Point for new Growth Component

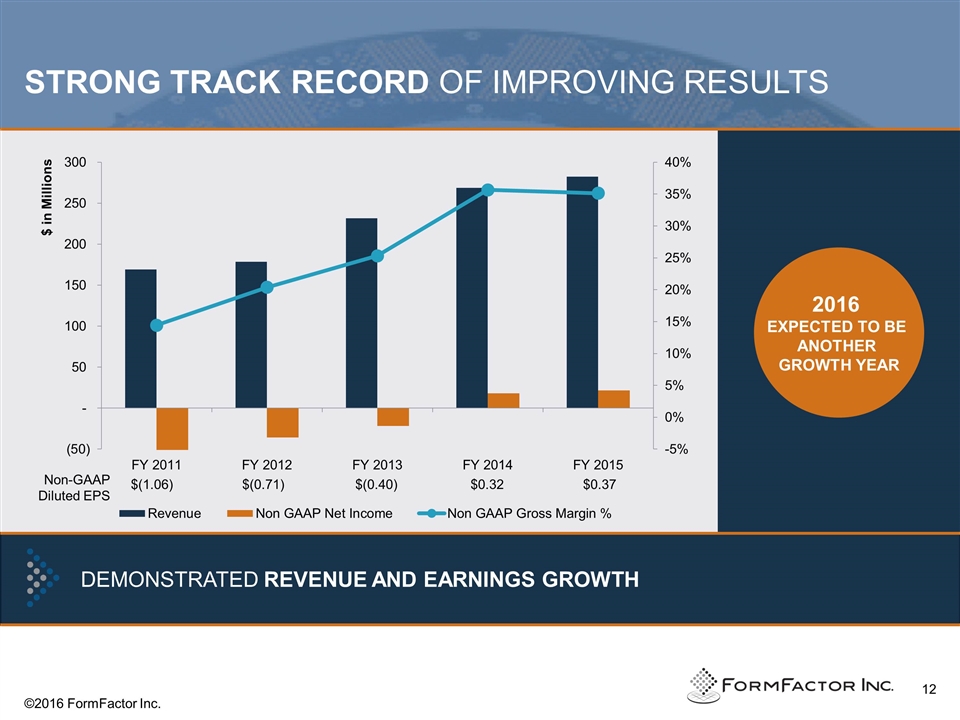

Strong Track Record of Improving Results ©2016 FormFactor Inc. 2016 EXPECTED TO BE ANOTHER GROWTH YEAR DEMONSTRATED REVENUE AND EARNINGS GROWTH Non-GAAP Diluted EPS $(1.06) $(0.71) $(0.40) $0.32 $0.37

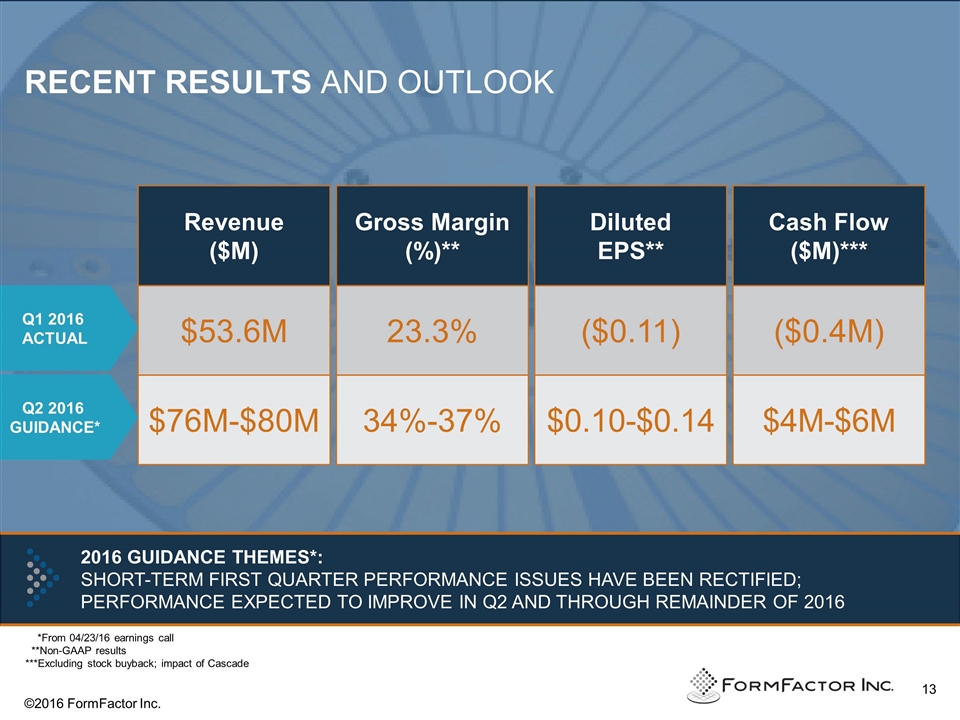

Recent Results and Outlook *From 04/23/16 earnings call **Non-GAAP results ***Excluding stock buyback; impact of Cascade ©2016 FormFactor Inc. 2016 guidance themes*: Short-term first quarter performance issues have been rectified; Performance expected to improve in Q2 and through remainder of 2016 Revenue ($M) $53.6M $76M-$80M Gross Margin (%)** 23.3% 34%-37% Diluted EPS** ($0.11) $0.10-$0.14 Cash Flow ($M)*** ($0.4M) $4M-$6M Q1 2016 ACTUAL Q2 2016 GUIDANCE*

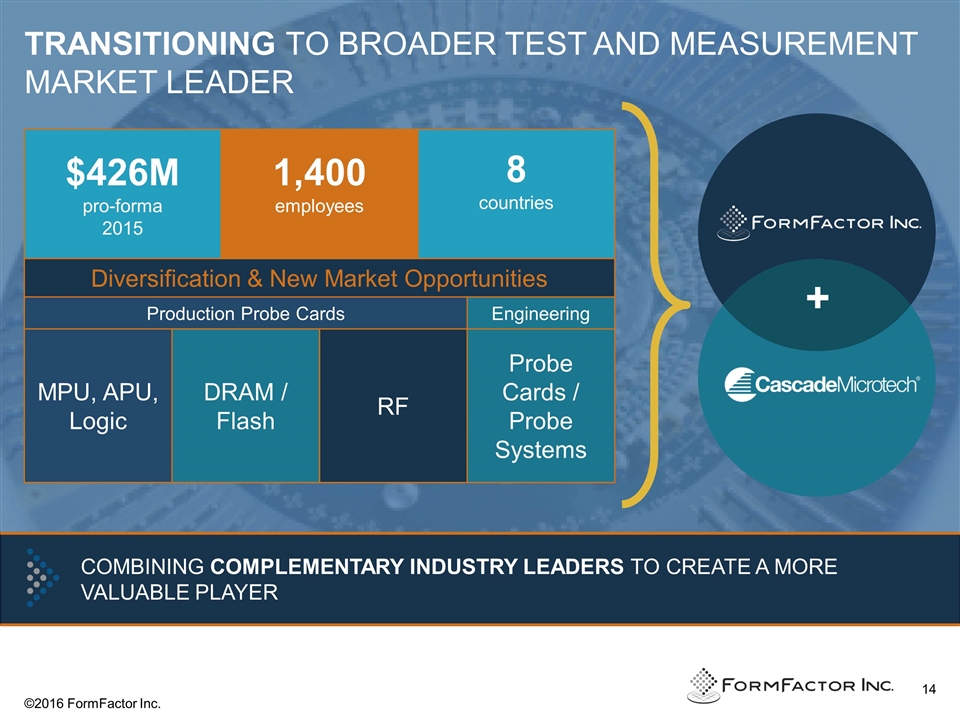

$426M pro-forma 2015 1,400 employees 8 countries Diversification & New Market Opportunities Production Probe Cards Engineering MPU, APU, Logic DRAM / Flash RF Probe Cards / Probe Systems Combining Complementary Industry Leaders to Create A More Valuable Player Transitioning to Broader Test and Measurement MARKET Leader ©2016 FormFactor Inc. +

Engineering/ Development First Silicon Ramp Production YIELD TIME OUR FOOTPRINT in the Device Life Cycle ©2016 FormFactor Inc. Extending our Breadth through the Complete customer Product LIFE Cycle

Expanding into adjacent and growing RF Space Building on our Foundry & Logic Leadership ©2016 FormFactor Inc. RF FILTERS PER HANDSET 2015 2020 2020 50 Filters 100 Filters Source: Linley Group, June 2015

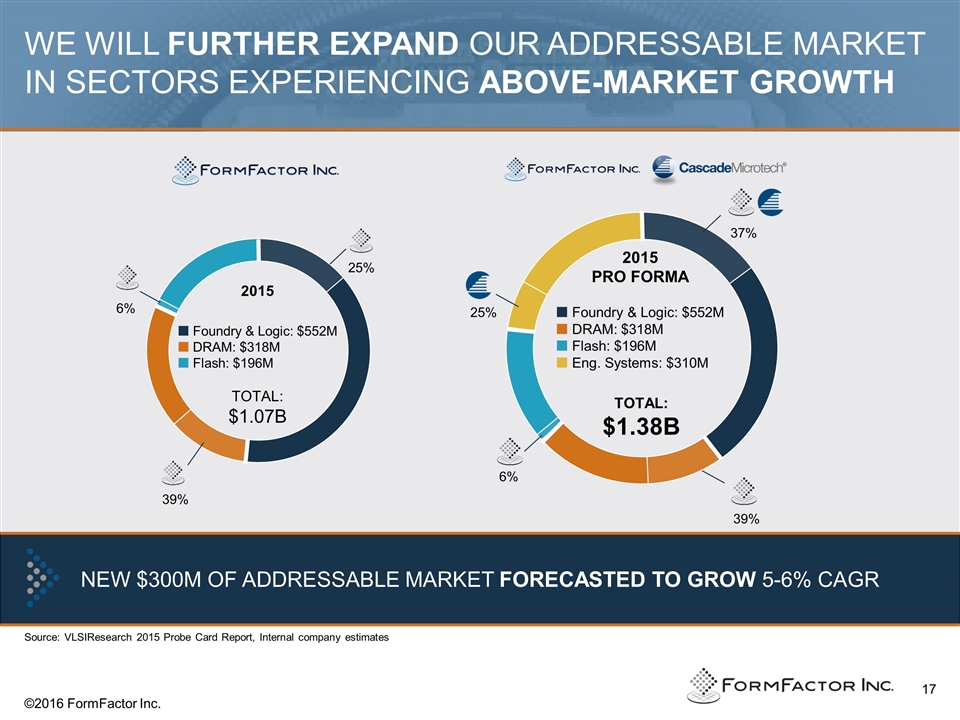

We will Further expand our ADDRESSABLE MARKET in Sectors Experiencing Above-Market Growth ©2016 FormFactor Inc. Source: VLSIResearch 2015 Probe Card Report, Internal company estimates New $300M of ADDRESSABLE MARKET Forecasted to grow 5-6% CAGR ¢ Foundry & Logic: $552M ¢ DRAM: $318M ¢ Flash: $196M ¢ Eng. Systems: $310M TOTAL: $1.38B 2015 PRO FORMA 25% ¢ Foundry & Logic: $552M ¢ DRAM: $318M ¢ Flash: $196M 39% 25% 6% 37% 39% 6%

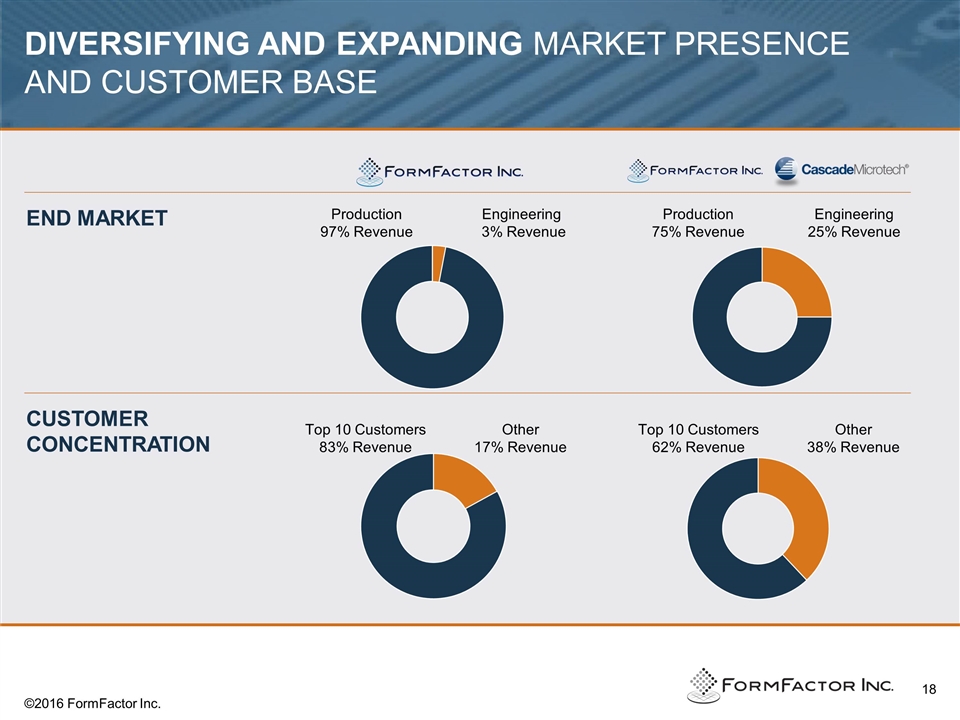

Diversifying and Expanding Market Presence and Customer Base Engineering Production Engineering Production CUSTOMER CONCENTRATION END MARKET Production 97% Revenue Engineering 3% Revenue Top 10 Customers 83% Revenue Other 17% Revenue Production 75% Revenue Engineering 25% Revenue Top 10 Customers 62% Revenue Other 38% Revenue ©2016 FormFactor Inc.

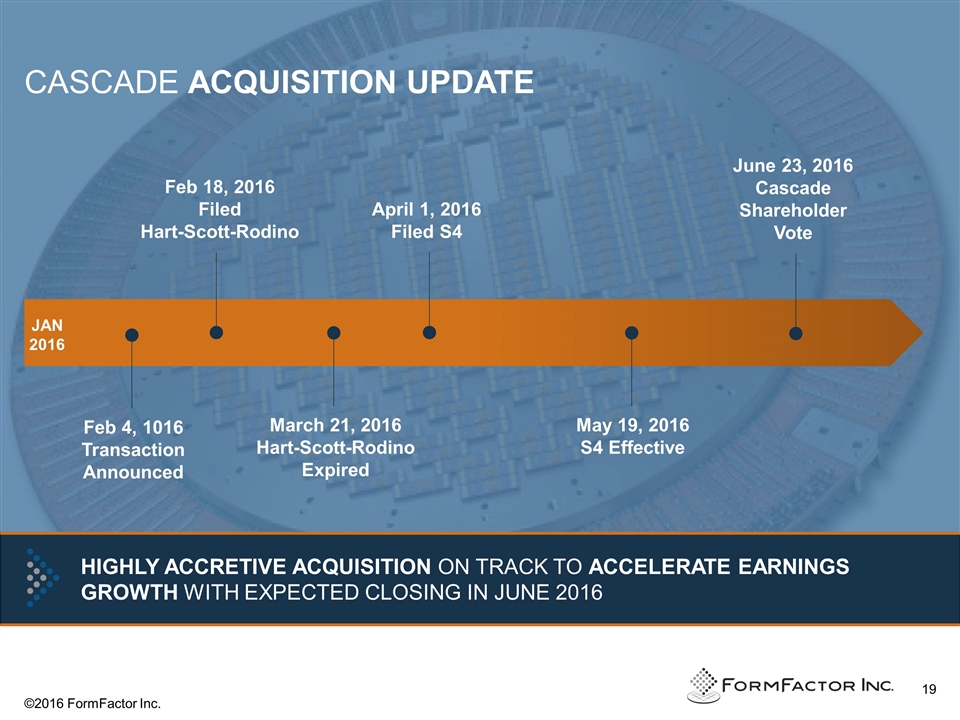

Cascade acquisition Update Feb 18, 2016 Filed Hart-Scott-Rodino April 1, 2016 Filed S4 March 21, 2016 Hart-Scott-Rodino Expired May 19, 2016 S4 Effective JAN 2016 Highly Accretive Acquisition on Track to Accelerate Earnings Growth with expected closing in June 2016 ©2016 FormFactor Inc. June 23, 2016 Cascade Shareholder Vote Feb 4, 1016 Transaction Announced

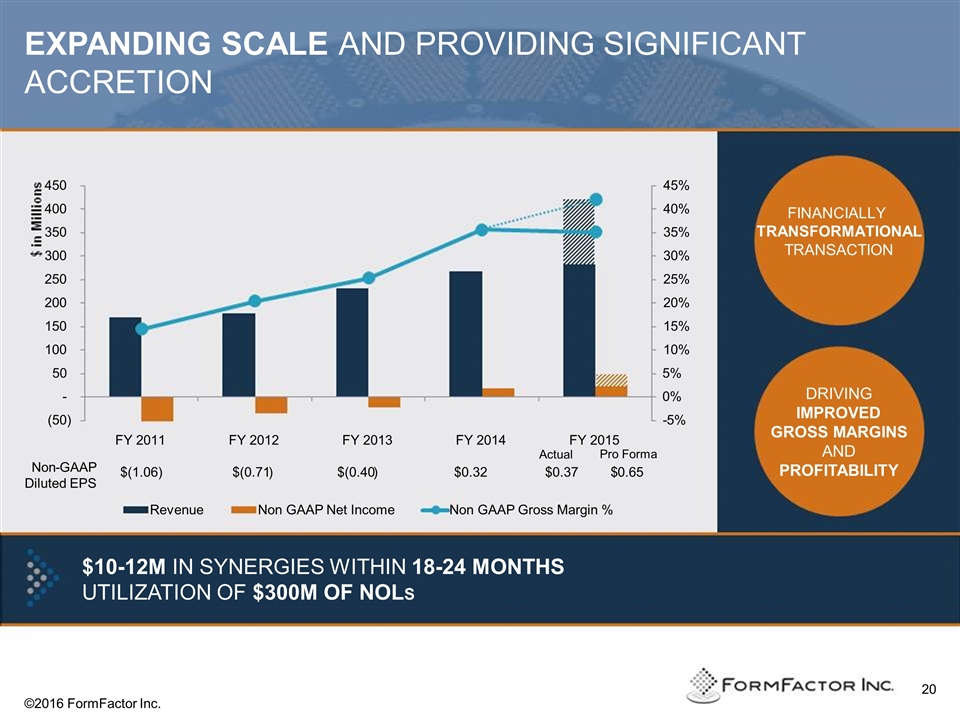

Expanding Scale and Providing Significant Accretion ©2016 FormFactor Inc. Financially Transformational Transaction Driving Improved Gross Margins AND PROFITABILITY - 5% 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% (50) - 50 100 150 200 250 300 350 400 450 FY 2011 FY 2012 FY 2013 FY 2014 FY 2015 Revenue Non GAAP Net Income Non GAAP Gross Margin % Non - GAAP Diluted EPS $(1.06) $(0.71 ) $(0.40 ) $0.32 $0.37 $ 0.65 Actual Pro Forma $10-12M in SYNERGIES within 18-24 months UTILIZATION of $300M oF NOLS

Leadership in core markers Continue share gains along “line of sight” components in Foundry & Logic, DRAM and Flash Leveraging existing key roadmap technologies and investments across all markets Enter adjacent markets Diversify revenue stream and customer mix by leading M&A in test, measurement and yield enhancement market segments Profitability Drive greater operating efficiency by gaining economies of scale Continue cost controls as we position the company for long term growth Strategic Focus Areas ©2016 FormFactor Inc.

APPENDIX ©2016 FormFactor Inc.

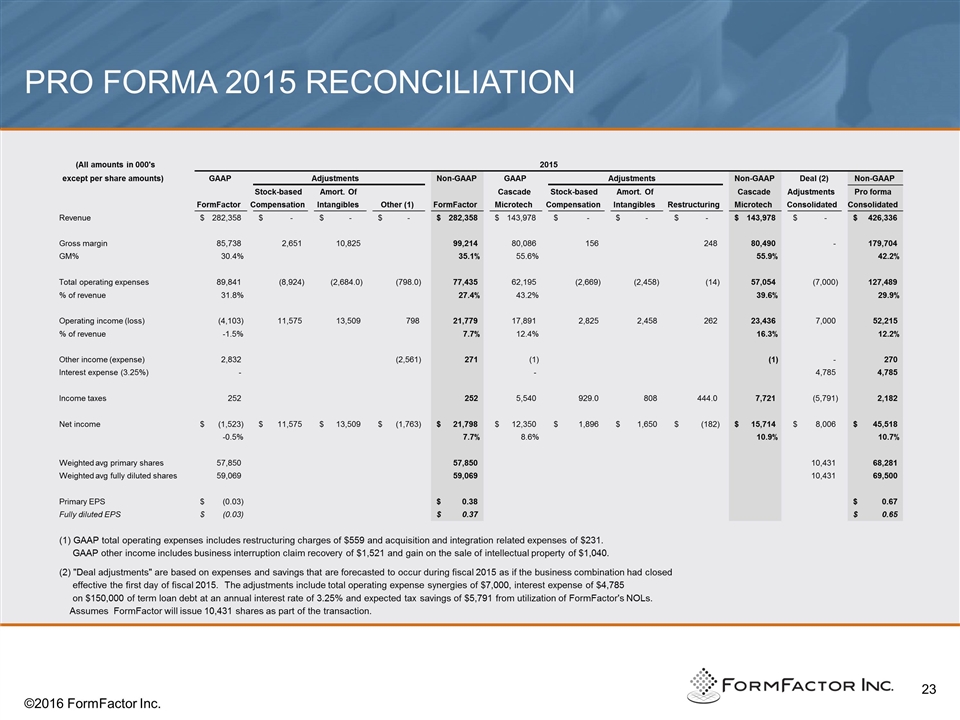

Pro forma 2015 Reconciliation ©2016 FormFactor Inc. (All amounts in 000's except per share amounts) GAAP Non-GAAP GAAP Non-GAAP Deal (2) Non-GAAP Stock-based Amort. Of Cascade Stock-based Amort. Of Cascade Adjustments Pro forma FormFactor Compensation Intangibles Other (1) FormFactor Microtech Compensation Intangibles Restructuring Microtech Consolidated Consolidated Revenue 282,358 $ - $ - $ - $ 282,358 $ 143,978 $ - $ - $ - $ 143,978 $ - $ 426,336 $ Gross margin 85,738 2,651 10,825 99,214 80,086 156 248 80,490 - 179,704 GM% 30.4% 35.1% 55.6% 55.9% 42.2% Total operating expenses 89,841 (8,924) (2,684.0) (798.0) 77,435 62,195 (2,669) (2,458) (14) 57,054 (7,000) 127,489 % of revenue 31.8% 27.4% 43.2% 39.6% 29.9% Operating income (loss) (4,103) 11,575 13,509 798 21,779 17,891 2,825 2,458 262 23,436 7,000 52,215 % of revenue -1.5% 7.7% 12.4% 16.3% 12.2% Other income (expense) 2,832 (2,561) 271 (1) (1) - 270 Interest expense (3.25%) - - 4,785 4,785 Income taxes 252 252 5,540 929.0 808 444.0 7,721 (5,791) 2,182 Net income (1,523) $ 11,575 $ 13,509 $ (1,763) $ 21,798 $ 12,350 $ 1,896 $ 1,650 $ (182) $ 15,714 $ 8,006 $ 45,518 $ -0.5% 7.7% 8.6% 10.9% 10.7% Weighted avg primary shares 57,850 57,850 10,431 68,281 Weighted avg fully diluted shares 59,069 59,069 10,431 69,500 Primary EPS (0.03) $ 0.38 $ 0.67 $ Fully diluted EPS (0.03) $ 0.37 $ 0.65 $ (1) GAAP total operating expenses includes restructuring charges of $559 and acquisition and integration related expenses of $231. GAAP other income includes business interruption claim recovery of $1,521 and gain on the sale of intellectual property of $1,040. (2) "Deal adjustments" are based on expenses and savings that are forecasted to occur during fiscal 2015 as if the business combination had closed effective the first day of fiscal 2015. The adjustments include total operating expense synergies of $7,000, interest expense of $4,785 on $150,000 of term loan debt at an annual interest rate of 3.25% and expected tax savings of $5,791 from utilization of FormFactor's NOLs. Assumes FormFactor will issue 10,431 shares as part of the transaction. 2015 Adjustments Adjustments

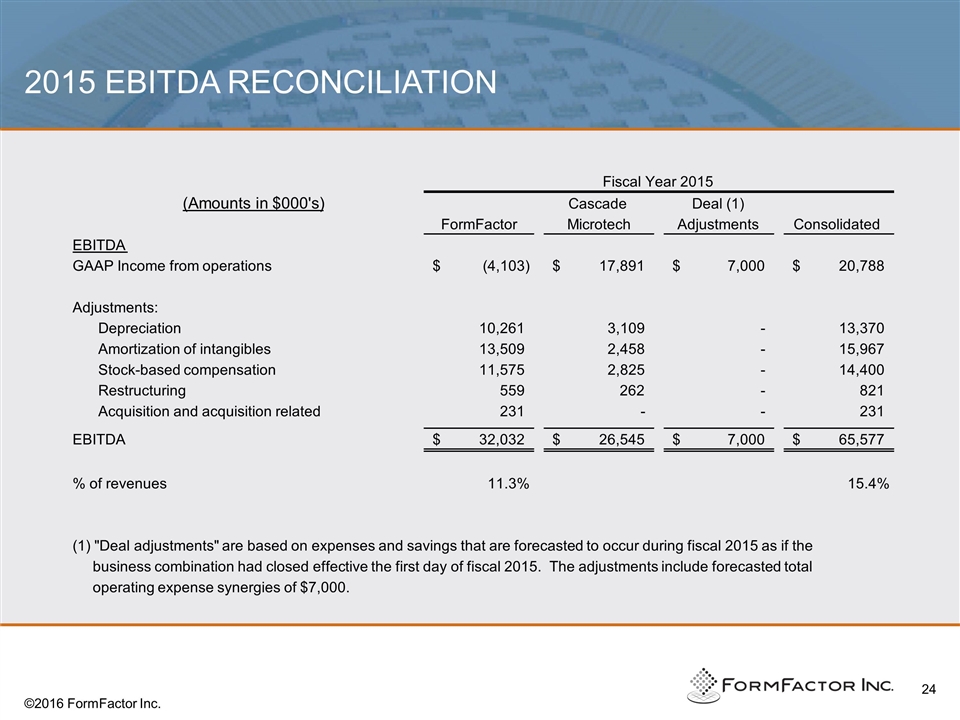

2015 EBITDA Reconciliation ©2016 FormFactor Inc. (Amounts in $000's) Cascade Deal (1) FormFactor Microtech Adjustments Consolidated EBITDA GAAP Income from operations (4,103) $ 17,891 $ 7,000 $ 20,788 $ Adjustments: Depreciation 10,261 3,109 - 13,370 Amortization of intangibles 13,509 2,458 - 15,967 Stock-based compensation 11,575 2,825 - 14,400 Restructuring 559 262 - 821 Acquisition and acquisition related 231 - - 231 EBITDA 32,032 $ 26,545 $ 7,000 $ 65,577 $ % of revenues 11.3% 15.4% (1) "Deal adjustments" are based on expenses and savings that are forecasted to occur during fiscal 2015 as if the business combination had closed effective the first day of fiscal 2015. The adjustments include forecasted total operating expense synergies of $7,000. Fiscal Year 2015

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- UPS Releases 1Q 2024 Earnings

- Banc of California, Inc. Reports First Quarter 2024 Financial Results with Improved Profitability and Strengthened Balance Sheet

- Bayridge Announces Marketing Campaign

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share