Form 425 Biodel Inc Filed by: Biodel Inc

UNITED

STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): May 24, 2016

BIODEL

INC.

(Exact name of registrant

as specified in its charter)

| Delaware | 001-33451 | 90-0136863 | ||

| (State or other jurisdiction | (Commission File Number) | (IRS Employer Identification No.) | ||

| of incorporation) | ||||

| 100 Saw Mill Road | ||||

| Danbury, Connecticut | 06810 | |||

| (Address of principal executive | ||||

| offices) | (Zip Code) | |||

(203)

796-5000

(Registrant’s

telephone number, including area code)

| Not Applicable |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |

Item 8.01 Other Events.

On May 24, 2016, Biodel Inc. (the “Company”) issued a press release announcing the execution of a share exchange agreement (the “Exchange Agreement”) with Albireo Limited, a company registered in England and Wales (“Albireo”) and the Albireo stockholders, pursuant to which, subject to the satisfaction or waiver of the conditions set forth in the Exchange Agreement, the Company will acquire the entire issued share capital of Albireo in exchange for newly issued shares of the Company’s common stock (the “Exchange”). The press release is attached hereto as Exhibit 99.1, and is incorporated herein by reference.

The Company and Albireo hosted a joint conference call on May 25 at 8:30 am Eastern Time to discuss the Exchange and provide a business overview. The script for the joint conference call is attached hereto as Exhibit 99.2 and incorporated by reference herein. An archived version of the audio webcast will be available on the Company’s website at www.biodel.com. An audio replay will be available by dialing (877) 660-6853 (US) or (201) 612-7415 (International) and entering conference ID number 13588552.

The Company expects to present the materials attached hereto as Exhibit 99.3 from time to time, which will be made available by the Company on its website or distributed by the parties in hardcopy or electronic form, and are incorporated by reference herein.

By filing the information in this Item 8.01 of this Current Report on Form 8-K, the Company makes no admission as to the materiality of any information in this report. The information contained in the script is summary information that is intended to be considered in the context of the Company’s filings with the Securities and Exchange commission (“SEC”) and other public announcements that the Company makes, by press release or otherwise, from time to time. The Company undertakes no duty or obligation to publicly update or revise the information contained in this report, although it may do so from time to time as its management believes is appropriate. Any such updating may be made through the filing of other reports or documents with the SEC, through press releases or through other public disclosure.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit Number | Description | |

| 99.1 | Press Release of Biodel Inc. dated May 24, 2016. | |

| 99.2 | Conference call script for May 25, 2016 at 8:30 a.m. Eastern Time. | |

| 99.3 | Presentation Materials |

Additional Information and Where You Can Find It

The Company will file with the SEC a registration statement containing a proxy statement of the Company that will also constitute a prospectus of the Company. The Company will mail the proxy statement/prospectus to the Company’s stockholders, and the securities may not be sold or exchanged until the registration statement becomes effective. The Company urges investors and stockholders to read the proxy statement/prospectus regarding the proposed transaction when it becomes available, as well as other documents filed or that will be filed with the SEC, because they contain or will contain important information about the proposed transaction. This communication is not a substitute for the registration statement, definitive proxy statement/prospectus or any other documents that the Company may file with the SEC or send to the Company’s stockholders in connection with the proposed transaction. Before making any voting decision, investors and security holders are urged to read the registration statement, proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed transaction as they become available because they will contain important information about the proposed transaction and related matters.

You may obtain free copies of the proxy statement/prospectus and all other documents filed or that will be filed with the SEC regarding the proposed transaction at the website maintained by the SEC www.sec.gov. Once they are filed, copies of the registration statement and proxy statement/prospectus will be available free of charge on the Company’s website at www.biodel.com or by contacting the Company’s Corporate Secretary at 203-796-5000 or by mail at Investor Relations, Biodel, Inc., 100 Saw Mill Road, Danbury, Connecticut 06810.

Participants in Solicitation

The Company, Albireo and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the holders of the Company’s common stock in connection with the proposed transaction. Information about the Company’s directors and executive officers is set forth in the Company’s Annual Report on Form 10-K/A for the period ended September 30, 2015, which was filed with the SEC on January 28, 2016. Other information regarding the interests of such individuals, as well as information regarding Albireo’s directors and executive officers and other persons who may be deemed participants in the proposed transaction, will be set forth in the proxy statement/prospectus, which will be included in the Company’s registration statement when it is filed with the SEC. You may obtain free copies of these documents as described in the preceding paragraph.

Non-Solicitation

This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| BIODEL INC. | |||

| By: | /s/ Paul S. Bavier | ||

| Paul S. Bavier | |||

| General Counsel | |||

Date: May 24, 2016

Exhibit Index

| Exhibit Number | Description | |

| 99.1 | Press Release of Biodel Inc. dated May 24, 2016. | |

| 99.2 | Conference call script for May 25, 2016 at 8:30 a.m. Eastern Time. | |

| 99.3 | Presentation Materials |

Biodel Inc. and Albireo Limited Agree to Combine

—Transaction to result in NASDAQ-listed company focused in orphan pediatric liver diseases—

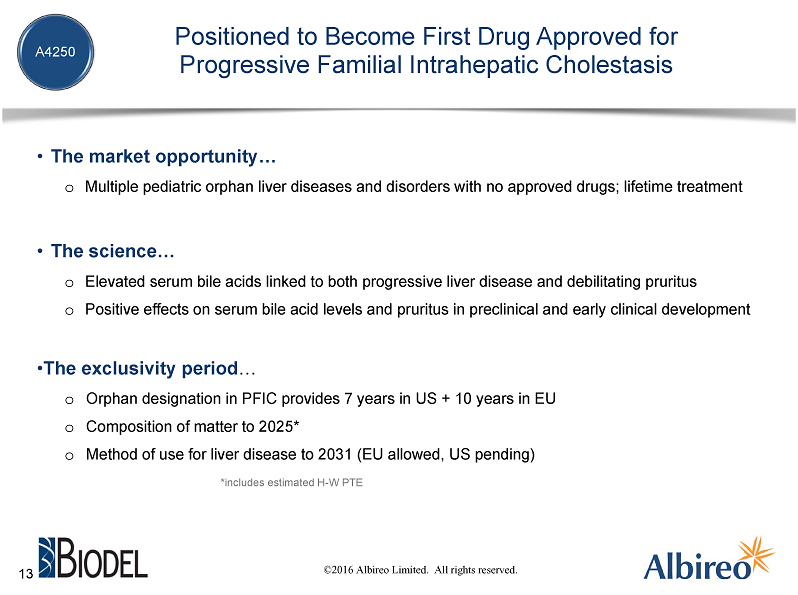

—Albireo brings wholly owned, Phase 2 lead asset A4250 to treat Progressive Familial Intrahepatic Cholestasis (PFIC), an orphan pediatric liver disease with no approved drug treatment—

—Combined company expected to be sufficiently capitalized to support advancement of A4250 through planned pivotal trial in PFIC—

—Second Albireo clinical asset, elobixibat, currently being studied by Japanese licensee in Phase 3 clinical trials for treatment of chronic constipation—

—Conference call on Wednesday, May 25, 2016 at 8:30 a.m. ET—

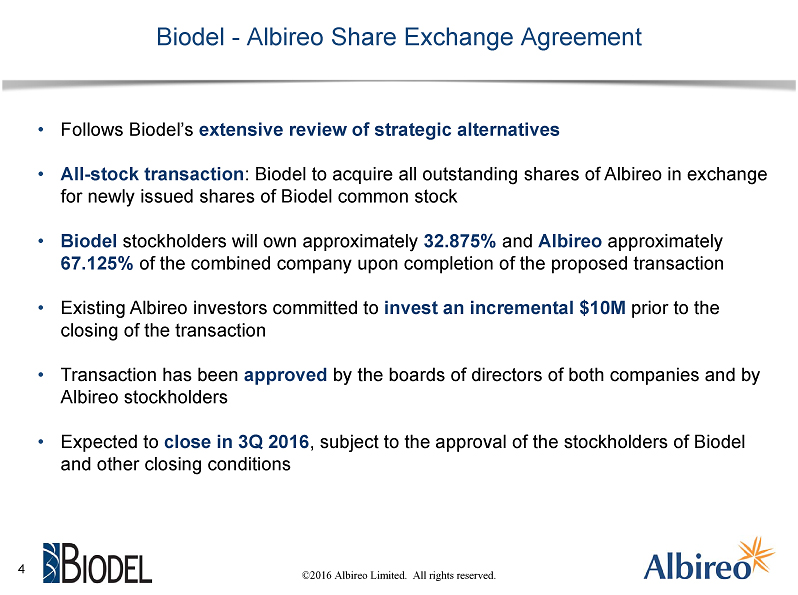

Danbury, CT and Boston, MA, May 24, 2016 - Biodel Inc. (Nasdaq: BIOD) and Albireo Limited, a privately held biopharmaceutical company, today announced that the companies, together with Albireo’s stockholders, have entered into a definitive share exchange agreement. The transaction will result in a combined company focused on the development of novel bile acid modulators to treat orphan pediatric liver diseases, as well as other liver and gastrointestinal diseases and disorders. A syndicate of existing Albireo investors, including Phase4 Ventures, TPG Biotech, TVM Capital Life Science and AstraZeneca,has committed to invest an additional $10 million prior to the closing of the transaction.

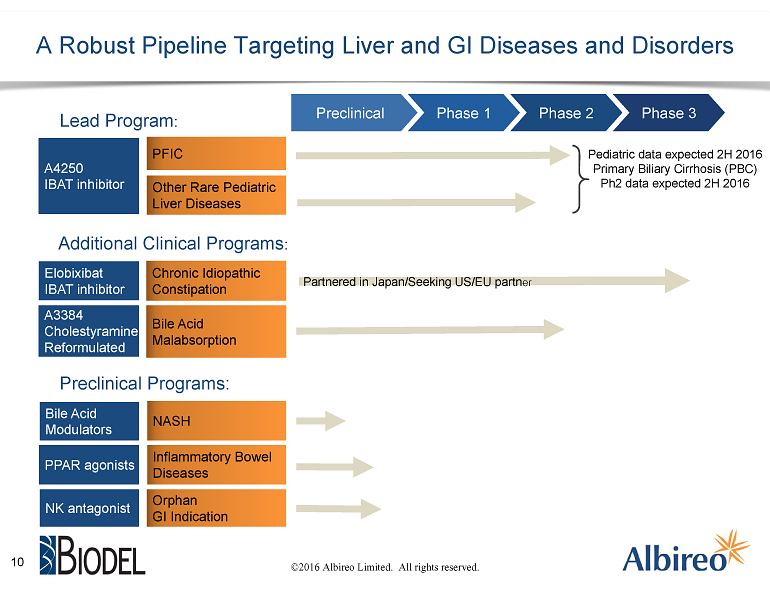

Albireo is developing its lead product candidate, A4250, initially for the treatment of Progressive Familial Intrahepatic Cholestasis (PFIC), which is a life threatening, orphan liver disease that affects young children. A4250 is currently being studied in a Phase 2 clinical trial in children with cholestatic liver disease that is designed to support Albireo’s planned future pivotal development in PFIC.

Under the terms of the share exchange agreement, Albireo stockholders have agreed to exchange their shares of Albireo for newly issued shares of Biodel common stock. On a pro forma basis, Biodel stockholders are expected to own approximately 33%, and Albireo stockholders are expected to own approximately 67%, of the combined company, subject to certain adjustments based on net cash of Biodel and Albireo prior to closing. The transaction is subject to the approval of the stockholders of Biodel and other customary closing conditions.

Upon closing of the transaction, Biodel will change its name to Albireo Pharma, Inc. and plans to change its ticker symbol on the NASDAQ Capital Market to ALBO. Ron Cooper, Albireo’s President and Chief Executive Officer, will become President and Chief Executive Officer of the combined company.

“This transaction with Biodel and concurrent financing is expected to provide Albireo with sufficient capital to advance our lead product candidate, A4250, through an important Phase 2 clinical readout later this year and a subsequent planned pivotal trial in PFIC,” said Mr. Cooper. “We believe A4250 has potential to greatly benefit patients suffering from a devastating orphan pediatric liver disease with no approved drug treatment options.”

“Following an extensive and thorough review of strategic alternatives, we concluded that the transaction with Albireo provides Biodel stockholders with a significant equity stake in a biopharmaceutical company with promising clinical assets and substantial upside opportunity,” said Gary Gemignani, Chief Executive Officer of Biodel. “We are optimistic that the promise of Albireo’s pipeline and the strength of its leadership team, coupled with Biodel’s cash resources, will enable the combined company to reach significant milestones.”

About the Proposed Transaction

The proposed transaction has been approved by the boards of directors of both companies and by the Albireo stockholders. It is expected to close in the third calendar quarter of 2016, subject to the approval of the Biodel stockholders and other customary conditions. The share exchange agreement contains further details with respect to the proposed transaction.

Biodel’s financial advisor for the transaction is Ladenburg Thalmann & Co. Inc., and Biodel’s legal counsel is Cooley LLP. Albireo’s financial advisor for the transaction is Guggenheim Securities, and Albireo’s legal counsels are Ropes & Gray LLP, Mintz Levin Cohn Ferris Glovsky and Popeo PC and Bristows LLP.

Management and Organization

Ron Cooper will serve as the President and Chief Executive Officer of the combined company, with David Chiswell serving as the Chairman of the board of directors. The board of directors of the combined company will be comprised of seven members, including five members to be designated by Albireo and two members of Biodel’s current board of directors.

Conference Call and Webcast

Mr. Gemignani and Mr. Cooper will host a conference call and webcast to discuss the proposed transaction on May 25, 2016, at 8:30 a.m. Eastern Time.

Live audio of the conference call will be available to investors, members of the news media and the general public by dialing +1 (877) 407-7181 (United States) or +1 (201) 689-8047 (international). To access the call by live audio webcast, please log on to the investor section of the company's website at www.biodel.com. An archived version of the audio webcast will be available on Biodel's website. Interested parties may also access an audio replay by dialing (877) 660-6853 (US) or (201) 612-7415 (International) and entering conference ID number 13588552.

About Albireo

Albireo Limited is a holding company for Albireo AB, a clinical-stage biopharmaceutical company focused on the development of novel bile acid modulators to treat orphan pediatric liver diseases and other liver and gastrointestinal diseases and disorders. Albireo’s clinical pipeline includes two Phase 2 product candidates and one Phase 3 product candidate. Albireo was spun out from AstraZeneca in 2008 and is backed by top-tier life science investors such as Phase4 Ventures, TPG Biotech, TVM Capital Life Science and Aberdeen Asset Management, as well as AstraZeneca.

Albireo Limited is incorporated and registered in England and Wales, and its wholly owned subsidiaries are located in Gothenburg, Sweden and Boston, Massachusetts. For more information on Albireo, please visit www.albireopharma.com.

About Lead Product Candidate A4250

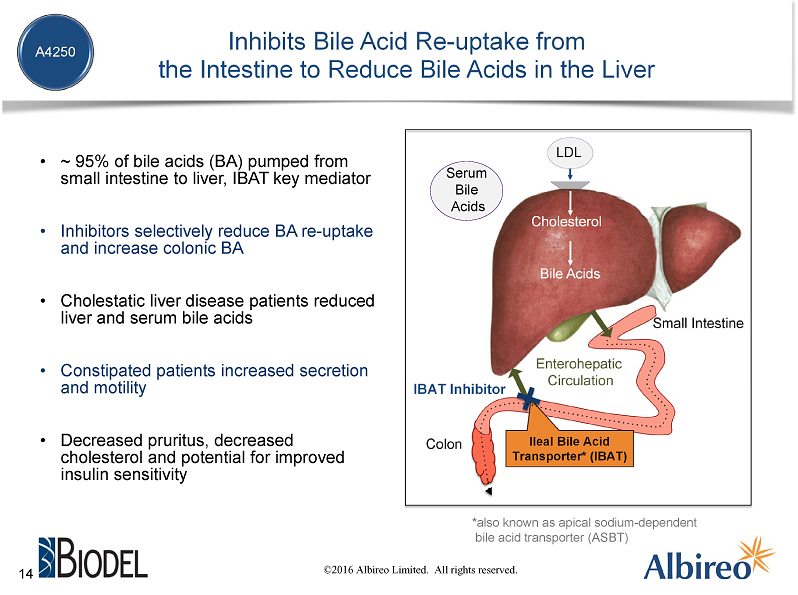

A4250 is a first-in-class product candidate being developed by Albireo to treat rare pediatric cholestatic liver diseases, including Progressive Familial Intrahepatic Cholestasis (PFIC). A4250 is a potent and selective inhibitor of the ileal bile acid transporter (IBAT) that acts locally in the gut and has minimal systemic side effects, lessening the risk of undesirable drug-drug interactions. A4250, which is currently being evaluated in an open label Phase 2 clinical trial in pediatric cholestatic liver disease and an investigator-initiated Phase 2 clinical trial in an adult liver disease, has been granted orphan drug designation in the United States and the European Union for PFIC, as well as certain other cholestatic liver diseases.

About Cholestasis and IBAT Inhibition

Cholestasis refers to a condition occurring when the flow of bile from the liver stops or is disrupted,leading to the accumulation of bile acids in the liver. Elevated bile acid levels in the liver and serum are primary characteristics of cholestatic liver disease and have been linked to severe pruritus as well as progressive liver damage. The IBAT is primarily responsible for mediating the uptake of bile acids from the small intestine to the liver. Typically, approximately 95% of bile acids are recirculated via the IBAT to the liver. Accordingly, a product capable of inhibiting the IBAT would lead to lower levels of bile acids returning to the liver and represent a promising approach for treating cholestatic liver diseases.

In addition to the effects on liver and serum bile acids, IBAT inhibition has also been shown in the clinic to be associated with decreased LDL cholesterol and increased GLP-1 secretion (which is linked to decreased insulin resistance) and in preclinical models with decreased pro-inflammatory and profibrotic markers in the liver.

About Elobixibat

Elobixibat, a first-in-class product candidate to treat chronic idiopathic constipation, is currently being evaluated in a Phase 3 clinical trial in Japan conducted by EA Pharma (recently formed by the combination of Eisai’s gastrointestinal (GI) business with Ajinomoto Pharmaceuticals). EA Pharma is the exclusive licensee of GI rights to elobixibat in Japan and other select markets in Asia, and Albireo has commercial rights to elobixibat in the rest of the world. Elobixibat inhibits the IBAT in the terminal ileum to increase secretion and motility in the large bowel without negatively affecting the small intestine. Elobixibat has been evaluated in over 900 healthy volunteers and chronic constipation patients to date worldwide.

About Biodel

Biodel Inc. is a specialty biopharmaceutical company focused on the development and commercialization of innovative treatments for diabetes that may be safer, more effective and more convenient for patients. Biodel's product candidates are developed by applying proprietary technologies to existing drugs in order to improve their therapeutic profiles. More information about Biodel is available at www.biodel.com.

Important Information For Investors And Stockholders

This communication may be deemed to be solicitation material in respect of the proposed transaction between Biodel Inc. (Biodel) and Albireo Limited (Albireo) and Albireo stockholders. In connection with the proposed transaction between Biodel and Albireo and its stockholders, Biodel will file with the Securities and Exchange Commission (SEC) a registration statement containing a proxy statement of Biodel that will also constitute a prospectus of Biodel. Biodel will mail the proxy statement/prospectus to Biodel stockholders, and the securities may not be sold or exchanged until the registration statement becomes effective. BIODEL URGES INVESTORS AND STOCKHOLDERS TO READ THE PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED TRANSACTION WHEN IT BECOMES AVAILABLE,AS WELL AS OTHER DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC, BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. This communication is not a substitute for the registration statement, definitive proxy statement/prospectus or any other documents that Biodel may file with the SEC or send to Biodel stockholders in connection with the proposed transaction. Before making any voting decision, investors and security holders are urged to read the registration statement, proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed transaction as they become available because they will contain important information about the proposed transaction and related matters.

You may obtain free copies of the proxy statement/prospectus and all other documents filed or that will be filed with the SEC regarding the proposed transaction at the website maintained by the SEC www.sec.gov. Once they are filed, copies of the registration statement and proxy statement/prospectus will be available free of charge on Biodel’s website at www.biodel.com or by contacting Biodel’s Corporate Secretary at 203-796-5000 or by mail at Investor Relations, Biodel Inc., 100 Saw Mill Road,Danbury, Connecticut 06810.

Participants in Solicitation

Biodel, Albireo and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the holders of Biodel common stock in connection with the proposed transaction. Information about Biodel’s directors and executive officers is set forth in Biodel’s Annual Report on Form 10-K/A for the period ended September 30, 2015, which was filed with the SEC on January 28, 2016. Other information regarding the interests of such individuals, as well as information regarding Albireo’s directors and executive officers and other persons who may be deemed participants in the proposed transaction, will be set forth in the proxy statement/prospectus, which will be included in Biodel’s registration statement when it is filed with the SEC. You may obtain free copies of these documents as described in the preceding paragraph.

Non-Solicitation

This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Cautionary Statement Regarding Forward-Looking Statements

Certain statements contained in this communication regarding matters that are not historical facts, are forward-looking statements within the meaning of Section 21E of the Securities and Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, known as the PSLRA. These include statements regarding management’s intentions, plans, beliefs, expectations or forecasts for the future, and, therefore, you are cautioned not to place undue reliance on them. No forward-looking statement can be guaranteed, and actual results may differ materially from those projected. Biodel and Albireo undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise, except to the extent required by law. We use words such as “anticipates,” “believes,” “plans,” “expects,” “projects,” “future,” “intends,” “may,” “will,” “should,” “could,” “estimates,” “predicts,” “potential,” “continue,” “guidance,” and similar expressions to identify these forward-looking statements that are intended to be covered by the Safe-harbor provisions of the PSLRA. Such forward-looking statements are based on our expectations and involve risks and uncertainties; consequently, actual results may differ materially from those expressed or implied in the statements due to a number of factors, including, but not limited to, those described in the documents Biodel has filed with the SEC as well as the possibility that Biodel may be unable to obtain stockholder approval required for the proposed transaction, the expected timing and likelihood of completion of the proposed transaction, the inability to successfully integrate the businesses or the risk that such integration may be more difficult, time-consuming or costly than expected, the occurrence of any event, change or other circumstances that could give rise to the termination of the share exchange agreement, the inability of the parties to meet expectations regarding the accounting and tax treatments of the proposed transaction, the potential for the proposed transaction to involve unexpected costs, the risk that the parties may not be able to satisfy the conditions to the proposed transaction in a timely manner or at all, risks related to disruption of management time from ongoing business operations due to the proposed transaction, the risk that the expected benefits of the proposed combination are not realized, and the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of Biodel’s common stock. Risks and uncertainties related to Albireo that may cause actual results to differ materially from those expressed or implied in any forward-looking statement include, but are not limited to: whether the preliminary observations regarding the performance of A4250 in the ongoing Phase 2 trial in pediatric cholestatic liver disease will be confirmed following completion of the data verification procedures to be performed upon database lock; whether the ongoing Phase 2 trial of A4250 in pediatric cholestatic liver disease will be sufficient to support advancement into a pivotal trial in Progressive Familial Intrahepatic Cholestasis (PFIC); the timing and outcome of the planned meeting with the FDA regarding the anticipated pivotal program for A4250 in PFIC; the designs, endpoints, numbers of patients and treatment periods for trials that will be required to support approval of A4250 to treat PFIC or any other orphan pediatric liver disease; whether the cash resources of Biodel and proceeds from the planned concurrent financing will be sufficient to advance A4250 through completion of a planned pivotal trial in PFIC; the timing for initiation or completion of, or availability of data from, ongoing or future trials of A4250, including a planned pivotal trial in PFIC, or elobixibat and the outcomes of such trials; whether results of the first cohort of patients in the ongoing Phase 2 trial of A4250 in primary biliary cirrhosis will be predictive of similar or better results in the trial's second cohort; delays or other challenges in the recruitment of patients for current or future trials of any Albireo product candidate; the medical benefit that may be derived from A4250, elobixibat, A3384 or any other Albireo product candidate; the ability to establish a strategic alliance, collaboration or licensing or other comparable arrangement on favorable terms for elobixibat in the United States and Europe; the extent to which Albireo's agreement with EA Pharma for elobixibat generates nondilutive income to Albireo; whether the FDA will consider a single additional trial sufficient to establish the efficacy of elobixibat to support approval for the treatment of chronic idiopathic constipation in the United States; Albireo's ability to protect its intellectual property; the competitive environment and commercial opportunity for a potential treatment for PFIC and other orphan pediatric cholestatic liver diseases; whether findings from nonclinical studies and clinical trials of IBAT inhibitors will be predictive of future clinical success for an Albireo IBAT inhibitor in the treatment of nonalcoholic steatohepatitis (NASH); and the timing and success of submission, acceptance and approval of regulatory filings.

New factors emerge from time to time and it is not possible for us to predict all such factors, nor can we assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. These risks, as well as other risks associated with the combination, will be more fully discussed in the proxy statement/prospectus that will be included in the registration statement that will be filed with the SEC in connection with the proposed transaction. Additional risks and uncertainties are identified and discussed in the “Risk Factors” section of Biodel’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other documents filed from time to time with the SEC. Forward-looking statements included in this release are based on information available to Biodel and Albireo as of the date of this release. Neither Biodel nor Albireo undertakes any obligation to update such forward-looking statements to reflect events or circumstances after the date of this release.

CONTACT:

For Biodel:

Gary Gemignani

Chief Executive Officer

Tel: 203-796-5000

[email protected]

For Albireo:

Ron Cooper

President and CEO

Tel: 732-687-4238

[email protected]

*** CONFIDENTIAL SCRIPT ***

Biodel / Albireo Transaction Conference Call

May 25, 2016, 8:30 AM ET

Conference Call and Webcast Information:

Biodel / Albireo Transaction Conference Call

| ● | Conference ID: 13588552 |

| ● | Date of Call: 05/25/2016 |

| ● | Time of Call: 8:30 AM Eastern Time |

Dial-In Numbers:

| ● | Participant Toll-Free Dial-In Number: (877) 407-7181 |

| ● | Participant International Dial-In Number: (201) 689-8047 |

Operator:

Ladies and gentlemen, thank you for standing by. Welcome to the Biodel / Albireo Transaction conference call. At this time, all participants are in a listen-only mode. After opening remarks we will open up the call for your questions. Instructions for queuing up will be provided at that time. I would also like to remind you that this call is being recorded for replay.

I will now turn the conference call over to Paul Bavier, Biodel’s President and General Counsel.

1

Paul Bavier:

Thank you. Good morning and welcome to the Biodel / Albireo transaction conference call. The speakers on the call we will be making forward-looking statements covered under the Private Securities Litigation Reform Act of 1995. These statements may involve risks and uncertainties that are described more fully in our filings with the SEC, which are available on our website. We also direct your attention to certain additional risks specific to the proposed transaction which are described in further detail in yesterday’s press release announcing the transaction.

Forward-looking statements represent our views only as of today and should not be relied upon as representing our views as of any subsequent date. While we may elect to update forward-looking statements at some point in the future, we disclaim any obligation to do so, even if our expectations or estimates change.

I would also like to note that in connection with the proposed business combination of Biodel and Albireo, Biodel will be filing with the SEC a registration statement on Form S-4 containing a combined proxy statement/prospectus. We encourage you to read it and the other relevant materials filed by Biodel with the SEC because these documents have, or will have, important information about the proposed transaction.

2

Joining me on today’s call are Gary Gemignani, Biodel’s Chief Executive Officer, and Ron Cooper, Albireo’s President and Chief Executive Officer, who will become the President and Chief Executive Officer of the combined company following the anticipated close of this transaction.

Now I’ll turn the call over to Gary.

Gary Gemignani:

Thanks Paul. Good morning everyone, and thank you for joining our call. Today we will discuss the share exchange agreement that we have entered into for a transaction to combine Biodel and Albireo and provide you with an overview of Albireo and its pipeline. This transaction is one that the Biodel board and management team are very excited about for several reasons, which we will outline in a moment. Following our remarks, we’ll open the call for your questions.

3

As you know, yesterday afternoon we issued a press release announcing that Biodel has entered into a definitive share exchange agreement with privately-held Albireo Limited and its stockholders. The proposed transaction will result in a combined company focused on the development of novel bile acid modulators to treat orphan pediatric liver diseases, as well as other liver and gastrointestinal diseases and disorders, under the leadership of Ron Cooper, Albireo’s President and Chief Executive Officer.

Under the terms of the agreement, Albireo stockholders have agreed to exchange their shares of Albireo for newly issued shares of Biodel common stock. On a pro forma basis, current Biodel stockholders are expected to own approximately 33% of the combined company, and current Albireo stockholders are expected to own approximately 67% of the combined company, in each case subject to certain adjustments based on net cash of Biodel and Albireo prior to closing. The transaction has been approved by the boards of directors of both companies and by the Albireo stockholders and is expected to close in the third calendar quarter of 2016, subject to the approval of Biodel stockholders and other customary conditions.

4

A syndicate of existing Albireo investors, including Phase IV Ventures, TPG Biotech, TVM Capital Life Science and AstraZeneca, has committed to invest an additional $10 million prior to the closing of the transaction. Upon closing, the combined company will be known as Albireo Pharma and plans to change its ticker symbol on the NASDAQ Capital Market to ALBO. The combined company will be headquartered in the Boston area, and its board of directors will be comprised of seven representatives: two from Biodel and five from Albireo.

The decision to pursue this agreement with Albireo follows an extensive review of strategic alternatives by the board and management of Biodel. We believe that the transaction offers stockholders a very compelling opportunity for long-term value creation.

And to tell you more about Albireo, let me now introduce Ron Cooper and turn the call over to him.

5

Ron Cooper:

Gary, thanks very much, and appreciate all of you joining this morning's call. At Albireo, we’re working hard to bring hope to children suffering from rare, life-threatening liver diseases. That’s what drives our team.

Before I detail our programs for you, let me first begin with a brief overview of our company. The Albireo story begins with our expertise in bile acids. The founders of our company began working in this space almost two decades ago and over that period Albireo has established itself as a leader in the field. Our clinical pipeline currently includes 3 promising product candidates, including our lead compound, A4250, which has received orphan drug designation in the United States and Europe for multiple pediatric cholestatic liver diseases. In addition, as you may be aware, there are opportunities in the pediatric space to receive a priority review voucher, for which we expect A4250 to be eligible, upon regulatory approval in the United States. If earned, these priority review vouchers have in the past been transferred for considerable sums.

Albireo was born in 2008 when AstraZeneca made the strategic decision to leave the early GI space and spun our company out to a syndicate of leading life science investors, including Phase 4, TPG and TVM. From inception, our investors have backed Albireo, and, as Gary said, have in fact committed to investing an additional $10 million of new capital prior to closing of our transaction with Biodel.

6

I should also highlight that members of Albireo’s management team have been involved in developing and commercializing some of the world's most successful drugs. What we have at Albireo is a deep understanding of bile acid modulation, a clinical pipeline, a longstanding, supportive investor base, an experienced team with a track record of execution and multiple potential near-term inflection opportunities.

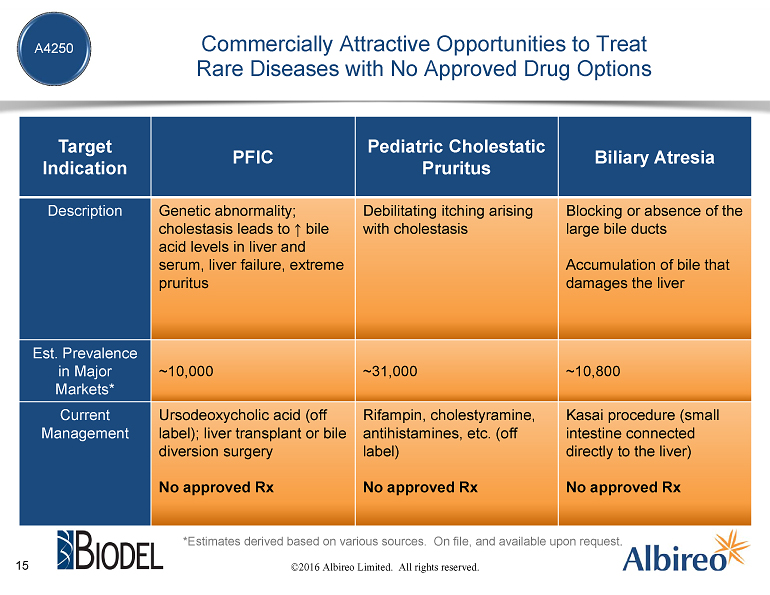

Let me now speak about our programs, beginning with our lead compound, A4250, for which we have worldwide rights. We are developing A4250 initially for a genetic disease called Progressive Familial Intrahepatic Cholestasis, or PFIC, that affects young children and, if untreated, can be fatal. Unfortunately, the treatment options for these children are not good. First-line treatment is commonly an off-label drug called ursodeoxycholic acid, but many children with PFIC do not respond well to this drug and will require life-altering and highly undesirable surgical intervention — either a procedure where bile is drained outside the body to a stoma bag that the child must wear or, often, a liver transplant.

7

We estimate there to be approximately 10,000 patients with PFIC around the world and we believe A4250 has the potential to make a real difference in their lives. The capital that will become available to Albireo from the transaction with Biodel and the concurrent investment from current Albireo investors is planned to fund our PFIC program for A4250 and should be sufficient to generate pivotal data.

So how does A4250 work? It's a very simple, elegant mechanism of action. When you eat, your liver dumps bile acids into your small intestine, where they play a key role in digestion and the absorption of fats and certain vitamins. At the end of the small intestine, there is a transporter known as the ileal bile acid transporter, or IBAT, that initiates a process to recirculate about 95% of the bile acids back to the liver. However in cholestatic liver disease, there is a disruption in the flow of bile acids, which leads to elevated levels in the liver and serum that have been linked to the progression of liver disease and severe and debilitating itching, which is often referred to as pruritus. A4250 partially inhibits the IBAT to lessen the reuptake of bile acids, which is importantly is expected to reduce serum bile acid levels. Moreover, A4250 acts locally in the gut and has minimal systemic effects, lessening the risk of unwanted drug-drug interactions.

8

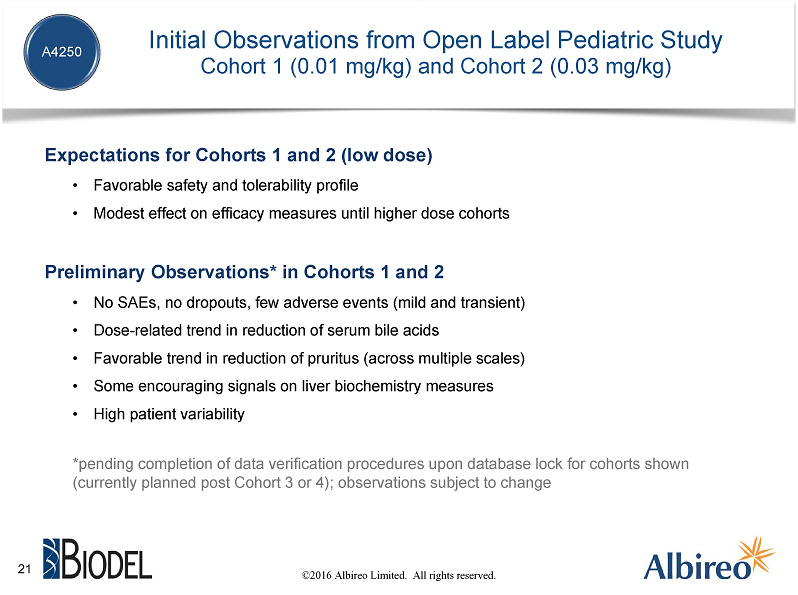

A4250 is currently being studied in two Phase 2 clinical trials, including in particular an open label, dose escalation study in children with various different cholestatic liver diseases. We began this study at a low, sub-therapeutic dose, which we are then steadily increasing on a cohort-by-cohort basis. We are now in the third cohort, which includes the study’s first PFIC patients. Because this is an open label study, we have been able to make some preliminary observations from the two completed cohorts.

We expected the early cohorts of this study to demonstrate a favorable tolerability profile of A4250 in children, without a safety signal, but likely with only modest effects on efficacy measures until we progressed into the higher doses. What we have seen to date appears to be generally consistent with our pre-trial expectations. In particular, we've had only a few adverse events, which were mild and transient, and no SAEs. On the study’s various efficacy measures, there's been somewhat high patient variability, but we have been pleased overall with what we’ve seen at these low doses on key measures like reduction in serum bile acids and in pruritus, as well as effects on liver biochemistry in some patients.

As I said before, these are preliminary observations that are pending completion of our data verification procedures upon database lock, which is currently planned for these cohorts after Cohort 3 or 4. We expect the full data from this study to be available in the second half of this year.

9

In addition to the pediatric study, A4250 is also being studied in an investigator-initiated Phase 2 clinical trial in adults with a liver disease known as primary biliary cirrhosis, or PBC. Although we are emphasizing pediatric indications for A4250 and do not intend to pursue future development in PBC, this study was embarked upon to generate data for A4250 in adults to support the planned future transition into pediatric development.

Our plan is to take results of the 2 ongoing Phase 2 studies of A4250 and request a meeting with the FDA in regard to the anticipated design of a pivotal program in PFIC. Our current intent is to demonstrate efficacy of A4250 in PFIC based on a single pivotal trial, potentially using a surrogate endpoint such as pruritus. We anticipate the meeting with the FDA to occur in the 4th quarter of this year.

Beyond PFIC, our future plans for A4250 include development for children with other cholestatic liver diseases and conditions, including cholestatic pruritus generally, which we estimate affects over 30,000 people around the world, and a disease known as biliary atresia in which bile ducts are blocked or missing that we estimate affects over 10,000 people worldwide.

10

We're excited about the overall profile of A4250 – targeting multiple rare diseases with no approved drug options, the opportunity for attractive pricing and reimbursement and a favorable competitive environment that creates potential for strong impact on market share.

Now I will say a few words about our pipeline programs, beginning with elobixibat -- our first-in-class product candidate to treat chronic constipation. Elobixibat is also an IBAT inhibitor, and we believe it has potential to become the first constipation product that acts directly in the large bowel and with a unique dual action, improving BOTH secretion and motility.

Where are we with elobixibat? In Japan we're making great progress. Our strategic partner, Eisai Ajinomoto, or EA, Pharma, is currently conducting two Phase 3 clinical trials, one efficacy study and one safety study, which based on our discussions with EA Pharma we expect to read out in the 4th quarter of this year. Our agreement for elobixibat provides the potential for nondilutive capital to come into Albireo, in the form of contingent milestones and royalties, over the next several years to support our programs.

11

For the rest of the world outside of EA’s licensed territory, we are in the process of planning for potential additional Phase 3 development and are seeking a partner. We do not anticipate that we will conduct Phase 3 development in the U.S. or Europe on our own.

Our third clinical-stage product candidate is A3384, which is a proprietary reformulation of a well characterized bile acid sequestrant called cholestyramine. We are targeting A3384 as a treatment for bile acid malabsorption, another disease with no approved drug option. There are an estimated 4 million people with bile acid malabsorption around the world, and these poor folks are in the restrooms constantly with chronic diarrhea. These patients often use off-label products such as cholestyramine. However, conventional cholestyramine is not well tolerated and it's also physiologically challenging in that it’s associated with unwanted drug-drug interactions. A3384 is formulated specifically to deliver cholestyramine to the large bowel and avoid interactions in the small intestine. We’ve previously shown in the clinic encouraging effects on GI parameters with a prototype of A3384 and we have since developed two new formulations, which we think are better than the prototype, to evaluate in the clinic.

In addition to our clinical assets, we have a number of preclinical programs that we’re enthusiastic about. In particular, based on a body of clinical and preclinical data indicating beneficial effects of IBAT inhibition on the various principal hallmarks of the adult liver disease NASH, we are working to leverage our expertise to progress a novel bile acid modulator toward the clinic in this important indication.

12

To summarize, as we look forward, we have a number of important milestones that we project in the near term, including:

| ● |

results from our Phase 2 pediatric trial of A4250, which we expect to announce in the second half of the year; |

| ● |

the outcome of our anticipated FDA meeting regarding pivotal PFIC development planned for the fourth quarter; and |

| ● |

also in the 4th quarter, EA Pharma reporting Phase 3 data for elobixibat in Japan. |

Let me wrap up my comments with this. What does Albireo bring to this transaction with Biodel?

| ● |

world-class expertise in bile acid modulation; |

| ● |

3 promising clinical product candidates; |

13

| ● |

a cash position post-transaction that we expect to be sufficient to achieve pivotal data for our lead product candidate in an orphan pediatric liver disease with no approved drug treatment; |

| ● |

a licensing deal in Japan for a product candidate in Phase 3 development; |

| ● |

several potential near-term inflection points; and |

| ● |

a talented and committed management team dedicated to giving hope to children with orphan liver diseases. |

Thank you again for your attention, and I'll be happy to take any questions after Gary’s closing remarks. Gary…

Gary Gemignani:

Thanks, Ron. That’s a nice summary of the reasons why we are excited to bring this opportunity to our stockholders. So let’s open the call up for questions.

Operator: That concludes the Q&A portion of the call. I’ll now turn the call back to Mr. Gemignani.

Gary (closing): Thank you for your questions and for joining us this morning.

14

Important Information For Investors And Stockholders

This communication may be deemed to be solicitation material in respect of the proposed transaction between Biodel Inc. (Biodel) and Albireo Limited (Albireo) and Albireo stockholders. In connection with the proposed transaction between Biodel and Albireo and its stockholders, Biodel will file with the Securities and Exchange Commission (SEC) a registration statement containing a proxy statement of Biodel that will also constitute a prospectus of Biodel. Biodel will mail the proxy statement/prospectus to Biodel stockholders, and the securities may not be sold or exchanged until the registration statement becomes effective. BIODEL URGES INVESTORS AND STOCKHOLDERS TO READ THE PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED TRANSACTION WHEN IT BECOMES AVAILABLE, AS WELL AS OTHER DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC, BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. This communication is not a substitute for the registration statement, definitive proxy statement/prospectus or any other documents that Biodel may file with the SEC or send to Biodel stockholders in connection with the proposed transaction. Before making any voting decision, investors and security holders are urged to read the registration statement, proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed transaction as they become available because they will contain important information about the proposed transaction and related matters.

You may obtain free copies of the proxy statement/prospectus and all other documents filed or that will be filed with the SEC regarding the proposed transaction at the website maintained by the SEC www.sec.gov. Once they are filed, copies of the registration statement and proxy statement/prospectus will be available free of charge on Biodel’s website at www.biodel.com or by contacting Biodel’s Corporate Secretary at 203-796-5000 or by mail at Investor Relations, Biodel, Inc., 100 Saw Mill Road, Danbury, Connecticut 06810.

Participants in Solicitation

Biodel, Albireo and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the holders of Biodel common stock in connection with the proposed transaction. Information about Biodel’s directors and executive officers is set forth in Biodel’s Annual Report on Form 10-K/A for the period ended September 30, 2015, which was filed with the SEC on January 28, 2016. Other information regarding the interests of such individuals, as well as information regarding Albireo’s directors and executive officers and other persons who may be deemed participants in the proposed transaction, will be set forth in the proxy statement/prospectus, which will be included in Biodel’s registration statement when it is filed with the SEC. You may obtain free copies of these documents as described in the preceding paragraph.

15

Non-Solicitation

This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Cautionary Statement Regarding Forward-Looking Statements

Certain statements contained in this communication regarding matters that are not historical facts, are forward-looking statements within the meaning of Section 21E of the Securities and Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, known as the PSLRA. These include statements regarding management’s intentions, plans, beliefs, expectations or forecasts for the future, and, therefore, you are cautioned not to place undue reliance on them. No forward-looking statement can be guaranteed, and actual results may differ materially from those projected. Biodel and Albireo undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise, except to the extent required by law. We use words such as “anticipates,” “believes,” “plans,” “expects,” “projects,” “future,” “intends,” “may,” “will,” “should,” “could,” “estimates,” “predicts,” “potential,” “continue,” “guidance,” and similar expressions to identify these forward-looking statements that are intended to be covered by the Safe-harbor provisions of the PSLRA. Such forward-looking statements are based on our expectations and involve risks and uncertainties; consequently, actual results may differ materially from those expressed or implied in the statements due to a number of factors, including, but not limited to, those described in the documents Biodel has filed with the SEC as well as the possibility that Biodel may be unable to obtain stockholder approval required for the proposed transaction, the expected timing and likelihood of completion of the proposed transaction, the inability to successfully integrate the businesses or the risk that such integration may be more difficult, time-consuming or costly than expected, the occurrence of any event, change or other circumstances that could give rise to the termination of the share exchange agreement, the inability of the parties to meet expectations regarding the accounting and tax treatments of the proposed transaction, the potential for the proposed transaction to involve unexpected costs, the risk that the parties may not be able to satisfy the conditions to the proposed transaction in a timely manner or at all, risks related to disruption of management time from ongoing business operations due to the proposed transaction, the risk that the expected benefits of the proposed combination are not realized, and the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of Biodel’s common stock. Risks and uncertainties related to Albireo that may cause actual results to differ materially from those expressed or implied in any forward-looking statement include, but are not limited to: whether the preliminary observations regarding the performance of A4250 in the ongoing Phase 2 trial in pediatric cholestatic liver disease will be confirmed following completion of the data verification procedures to be performed upon database lock; whether the ongoing Phase 2 trial of A4250 in pediatric cholestatic liver disease will be sufficient to support advancement into a pivotal trial in Progressive Familial Intrahepatic Cholestasis (PFIC); the timing and outcome of the planned meeting with the FDA regarding the anticipated pivotal program for A4250 in PFIC; the designs, endpoints, numbers of patients and treatment periods for trials that will be required to support approval of A4250 to treat PFIC or any other orphan pediatric liver disease; whether the cash resources of Biodel and proceeds from the planned concurrent financing will be sufficient to advance A4250 through completion of a planned pivotal trial in PFIC; the timing for initiation or completion of, or availability of data from, ongoing or future trials of A4250, including a planned pivotal trial in PFIC, or elobixibat and the outcomes of such trials; whether results of the first cohort of patients in the ongoing Phase 2 trial of A4250 in primary biliary cirrhosis will be predictive of similar or better results in the trial's second cohort; delays or other challenges in the recruitment of patients for current or future trials of any Albireo product candidate; the medical benefit that may be derived from A4250, elobixibat, A3384 or any other Albireo product candidate; the ability to establish a strategic alliance, collaboration or licensing or other comparable arrangement on favorable terms for elobixibat in the United States and Europe; the extent to which Albireo's agreement with EA Pharma for elobixibat generates nondilutive income to Albireo; whether the FDA will consider a single additional trial sufficient to establish the efficacy of elobixibat to support approval for the treatment of chronic idiopathic constipation in the United States; Albireo's ability to protect its intellectual property; the competitive environment and commercial opportunity for a potential treatment for PFIC and other orphan pediatric cholestatic liver diseases; whether findings from nonclinical studies and clinical trials of IBAT inhibitors will be predictive of future clinical success for an Albireo IBAT inhibitor in the treatment of nonalcoholic steatohepatitis (NASH); and the timing and success of submission, acceptance and approval of regulatory filings.

16

New factors emerge from time to time and it is not possible for us to predict all such factors, nor can we assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. These risks, as well as other risks associated with the combination, will be more fully discussed in the proxy statement/prospectus that will be included in the registration statement that will be filed with the SEC in connection with the proposed transaction. Additional risks and uncertainties are identified and discussed in the “Risk Factors” section of Biodel’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other documents filed from time to time with the SEC. Forward-looking statements included in this release are based on information available to Biodel and Albireo as of the date of this release. Neither Biodel nor Albireo undertakes any obligation to update such forward-looking statements to reflect events or circumstances after the date of this release.

CONTACT:

For Biodel:

Gary Gemignani

Chief

Executive Officer

Tel: 203-796-5000

[email protected]

For Albireo:

Ron Cooper

President and CEO

Tel: 732-687-4238

[email protected]

17

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Snowline Gold Completes Oversubscribed C$31.9 Million Financing

- Decisions of Sampo plc’s Annual General Meeting

- Exegenesis Bio to Present 9-Patient Data from a Phase 1/2 Clinical Trial of EXG001-037, a Novel rAAV Gene Therapy for Spinal Muscular Atrophy (SMA) Type 1: Improved Head Control and Sitting Without Ex

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share