Form 425 APPLIED MICRO CIRCUITS Filed by: MACOM Technology Solutions Holdings, Inc.

MACOM Announces Definitive Agreement to Acquire AppliedMicro November 21, 2016 Filed by MACOM Technology Solutions Holdings, Inc. pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14d-2 under the Securities Exchange Act of 1934 Subject Company: AppliedMicro Circuits Corporation Commission File No: 000-23193 |

Company

Confidential 2

Forward-Looking Statement Safe Harbor

and Use of Non-GAAP Financial Measures

This presentation contains forward-looking statements based on management’s

beliefs and assumptions and on information currently available to our

management. Forward-looking statements include, among others, statements concerning the AppliedMicro transaction, including those regarding the potential date of closing of the transaction, the

price of the transaction, the consideration used in the transaction, the likelihood

that the transaction is consummated on a timely basis or at all,

including whether the conditions required to complete the transaction will be met, and any potential benefits and synergies, strategic plans, divestitures, restructuring, cost savings, accretion, revenue, margins,

market share capture, competitive position, and financial and business expectations

associated with the acquisition, as well as any other statements

regarding our plans, beliefs or expectations regarding the transaction or its future business or financial results. Forward-looking statements include all statements that are not historical facts and generally may be

identified by terms such as "anticipates," "believes," "could,"

"estimates," "expects," "intends," "may," "plans," "potential,” "predicts," "projects," "seeks," "should," "will," "would" or similar

expressions and the negatives of those terms.

Our forward-looking statements are subject to assumptions, risks and uncertainties,

and are not guarantees of future results. Actual results may differ

materially from the outcomes stated or implied by our forward-looking statements based on any assumptions and risk factors we may mention today or otherwise, including the factors set forth in the

press release we issued today related to the AppliedMicro

acquisition, in the case of MACOM, our Annual Report on

Form 10-K filed with the SEC on November 17, 2016, and in the case of AppliedMicro,

its Quarterly Report on Form 10- Q filed with the SEC on November 2,

2016, along with any other information we or AppliedMicro file with the

SEC, which are publicly-available on the SEC's EDGAR database located

at www.sec.gov. All projections in this presentation are made as of

November 21, 2016 only, and neither MACOM nor AppliedMicro undertakes any

obligation to update any statements made herein at a later date.

We make references in this presentation to certain financial information

calculated on a basis other than in accordance with accounting principles

generally accepted in the United States (GAAP) including non-GAAP revenue, non-GAAP gross margin, non-GAAP operating margin and non-GAAP EPS. These non-GAAP measures are provided to enhance

the user’s overall understanding of the potential impact of the

AppliedMicro transaction. We are unable to provide a

quantitative reconciliation of these non-GAAP measures to the most directly

comparable GAAP measure because we cannot reliably forecast transaction,

integration and other costs related to the AppliedMicro transaction,

which are difficult to predict and estimate.

Our fiscal year end is the Friday closest to September 30th. Fiscal year 2017 will be a

52-week year and the first quarter of fiscal year 2017 will have 13

weeks. |

Company

Confidential 3

Offer Information

The exchange offer for the outstanding shares of common stock of

AppliedMicro described in this communication has

not yet commenced. This presentation is for informational purposes only and is neither

an offer to purchase nor a solicitation of an offer to sell shares, nor

is it a substitute for any materials that MACOM and its offering subsidiary, Montana Merger Sub I, Inc. (“Offeror”), will file with the SEC. Offeror plans to file a tender offer statement on Schedule TO, together with other related exchange offer documents,

including a letter of transmittal, in connection with the offer;

AppliedMicro plans to file a Recommendation Statement on

Schedule 14D-9 in connection with the offer; and MACOM plans to file a registration

statement on Form S-4 that will serve as a prospectus for MACOM

shares to be issued as consideration in the offer and merger. These documents will contain important information about MACOM, AppliedMicro and the transactions. AppliedMicro stockholders are urged to read these documents carefully and in their entirety when they become available before making any decision

regarding exchanging their shares. These documents will be made available to

AppliedMicro stockholders at no

expense to them and will also be available for free at the SEC's website at

www.sec.gov. Additional copies may be obtained for free by contacting

MACOM’s investor relations department at 949-224-3874 or AppliedMicro’s investor relations department at 415-217-4962 In addition to the SEC filings made in connection with the transaction, each of MACOM and AppliedMicro

files annual, quarterly and current reports and other information with the SEC. You may read and copy any reports or other such

filed information at the SEC public reference room at 100 F Street, N.E., Washington,

D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further

information on the public reference room. MACOM’s and AppliedMicro’s filings with the SEC are also available to the public from commercial document-retrieval services and at the website maintained by the

SEC at http://www.sec.gov. |

Company

Confidential 4

> Strategically and financially compelling transaction > Retaining highly complementary Connectivity business > Accelerates and expands breakout growth with Cloud Service Providers and Enterprise Network customers > Plan to divest well-positioned but non-strategic Compute business MACOM to Acquire AppliedMicro |

Company

Confidential 5

Transaction Summary:

MACOM to Acquire AppliedMicro

MACOM to acquire AppliedMicro

(NASDAQ: AMCC) – Highly complementary Connectivity business servicing high growth Data Center market

– Plan to divest non-strategic Compute business (known interested buyers) Cash/stock offer of $8.36 per share of AppliedMicro common stock, a 15.4% premium to Friday’s closing AppliedMicro share price $3.25 in cash and 0.1089 MACOM shares per share of AppliedMicro ~$770mm total consideration, or ~$688mm net of AppliedMicro’s $82mm of net cash Combination of ~$290mm of cash and ~10mm new shares AMCC shareholders will own ~15% of MACOM pro forma for the transaction Targeted close in first calendar quarter of 2017 Expected to enhance MACOM’s revenue growth as well as non-GAAP gross margin and

operating margin Expected to be accretive to non-GAAP EPS (fully diluted) in FY2017 AppliedMicro NOLs can be utilized subject to Section 382 limitations Transaction Financing Financial Impact (1) Timing ___________________________ Assumes transaction closes in first calendar quarter of 2017. Financials exclude Compute business and assumes targeted synergies

achieved. Price /

Consideration |

Company

Confidential 6

MACOM and AppliedMicro

Overview

LTM revenue: $544 million

LTM non-GAAP gross margin: 58%

Connectivity LTM revenue: $99 million

($165 million of LTM revenue including Compute business to be divested) Connectivity LTM non-GAAP gross margin well in excess of MACOM’s long term target operating model Leadership in high performance analog

and photonic semiconductor components

Leadership in high-performance

mixed-signal semiconductor components. 2.5G to 400G lasers, drivers, TIA, CDR,

silicon photonics and optical sub assemblies 100G to 400G PHYs

including MACSec and single lambda PAM-4 Sticky, value-added technologies including lasers, amplifiers and silicon photonics,

industry-leading

engineering competencies and long product lifecycles

Sticky, value-added technologies including SerDes, high

speed A/D and D/A, industry-leading engineering competencies and long product lifecycles R&D focused on high growth, high margin products using compound semiconductor

technologies R&D focused on high growth, high margin products using deep submicron SoC technologies Deep relationships with blue chip

Telecommunications and Aerospace/Defense customers Deep relationships with blue chip

Cloud Service Providers and Enterprise Networking

customers NASDAQ: MTSI

NASDAQ: AMCC ___________________________ Note: LTM Non-GAAP financials as of 9/30/16 |

Company

Confidential 7

Accelerates Breakout Growth in

Data Centers

Service Provider Networks

Metro/Long Haul OTN Framer, Mapper MACsec Secure Ethernet Cisco ASR9k Cisco NCS6k Routers Juniper MX3D Coherent Driver TIA Transport, DCI Cisco ONS 15454 Nokia 1830 Infinera Cloud Xpress Cloud Service Provider Enterprise Data Centers Optical Modules Arista 7500 Cisco Nexus 7K, ASR SFP QSFP DC Switches & Routers Facebook OCP CFP Modules PAM4 PHY MACsec Secure Ethernet CDR, TIA, Laser Driver, Laser, Silicon Photonics, OSA OSA ___________________________ Note: CSP: Cloud Service Providers Networking equipment models shown are for illustrative purposes, however we do have design wins in some of these

|

Company

Confidential 8

APM Connectivity Increases MACOM’s Addressable

Market by Approximately $500million in

2019 Optical

Non-Optical Addition of PHY enhances share capture across all content in Data Centers MACOM AppliedMicro ___________________________ Source: IHS; Yole, AppliedMicro and MACOM estimates PAM4 PHY $150mm 15% Analog $250mm 25% Photonics $250mm 25% OTN / MACsec $350mm 35% Expected 2019 Available Market: $1B |

Company

Confidential 9

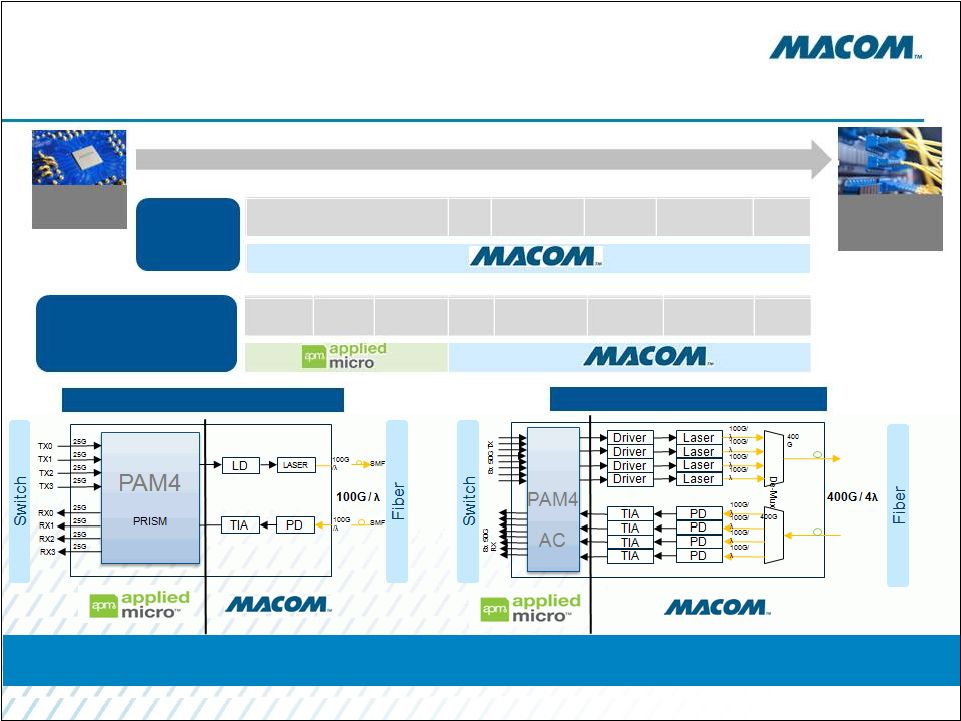

Completes Protocol Agnostic

“Switch to Fiber” Data Center Portfolio

CDR TIA Laser Driver Laser Silicon Photonics OSA 25G, 100G NRZ Single Lambda 100G, 400G PAM4 SerDes PAM4 DSP A/D D/A TIA Laser Driver Laser Silicon Photonics OSA Switch Fiber Cable 100G PAM4 Module 400G PAM4 CWDM Module IEEE standards body recommended the adoption of single lambda PAM4 to be an industry standard enabling 100G and 400G transceivers |

Company

Confidential 10

Highly Complementary Market and

Product Position

Immediately establishes incumbent position

supplying strategic components to first tier Cloud Service Providers

and Enterprise Networking customers Consistent with MACOM’s differentiated, high growth business model – high margins,

long product lifecycles and sticky customer relationships

Complements MACOM’s analog

and photonic business by adding

mixed-signal

PHYs

Expands addressable market with high-growth, high-margin networking products

and technologies

Expected to be accretive

to non-GAAP revenue

growth, non-GAAP gross margin, non- GAAP operating margin and non-GAAP EPS in FY17 (1) + ___________________________ 1. Q2 FY17 non-GAAP financials exclude Compute business and assumes targeted synergies achieved |

Company

Confidential 11

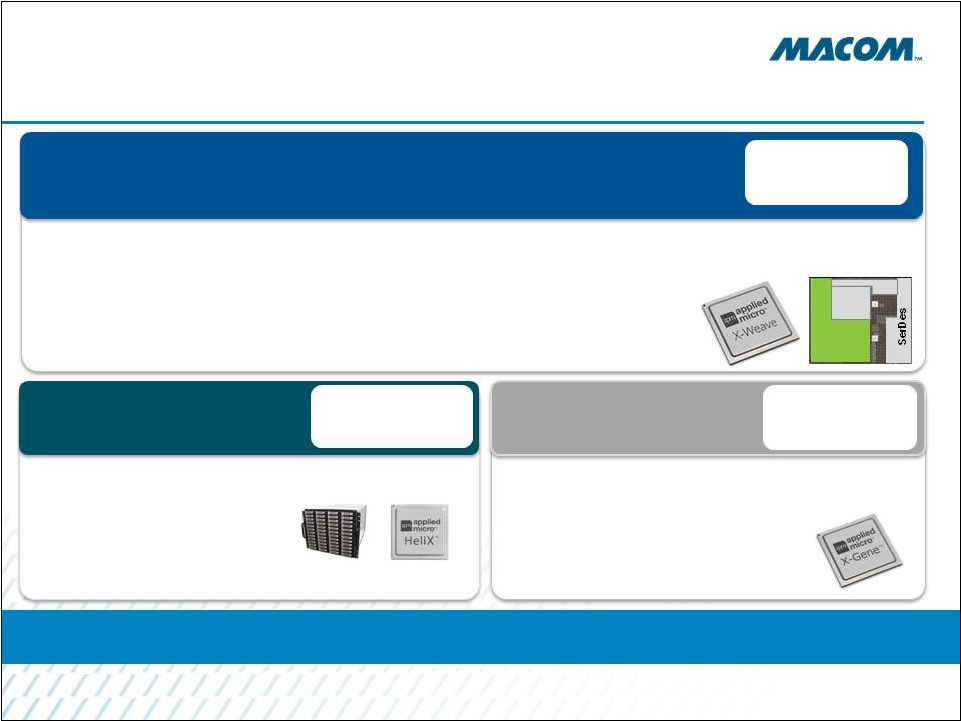

AppliedMicro

Business Overview

___________________________

Note: Figures based on Non-GAAP financials for quarter ending 9/30/16

1. Quarter ending 9/30/16 annualized

Connectivity Strong Growth and High Margins 72% of Revenue 49% of Opex $40mm Profitability (1) Market-leading product portfolio • OTN framers, mappers, PHYs • 100G MACsec PHY for secure Ethernet communication • PAM4 single lambda 100, 200 and 400G PHYs for datacenter Adds key building blocks and core IP • Complementary to MACOM’s existing IP – SerDes and high speed A/D, D/A • 294 patents issued and 60 pending Embedded Processing Solid Cash Flow Business Compute Active Sale Process to Divest 27% of Revenue 0% Opex $22mm Profitability (1) 1% of Revenue 51% of Opex $55mm Loss (1) Transitioning from Power PC to ARM Technology leadership Strong design wins Minimal operating expenses Data Center server processors Three generations of proven technology leadership X-Gene 3 taped out in October Solid roadmap and customer engagements Power PC After the sale of the Compute business, the multiple paid for AMCC Connectivity is expected to be consistent with MTSI’s current multiple Customer IP ADC PLL Expected to be accretive in FY 2017 |

Company

Confidential 12

Combination Strengthens Relationships

with Market Leaders and Expands Customer Base

ASR9K NCS6K 15464 Cat6k 7500 |

Company

Confidential 13

Key Takeaways

Expands addressable market

with high-growth, high-margin portfolio Aligns with core growth strategy

in networking and optical markets

Enhances MACOM’s analog business model

– high margins,

long lifecycles and sticky customer relationships Expected to be immediately accretive to non-GAAP revenue growth, non-GAAP gross margin, non-GAAP operating margin and non-GAAP EPS (1) ___________________________ 1. Assumes transaction closes in first calendar quarter of 2017. Non-GAAP financials exclude Compute business and assumes targeted synergies

achieved. |

Company

Confidential 14

Boston > Wednesday, November 30 > Time: 11:30 am – 1:00 pm > Boston Harbor Hotel 70 Rowes Wharf New York City > Thursday, December 1 > Time: 11:30 am – 1:00 pm > Millennium Broadway Hotel 145 W 44th Street San Francisco > Friday, December 2 > Time: 11:30 am – 1:00 pm > InterContinental Hotel 888 Howard Street Upcoming Roadshow Please RSVP ir@macom.com Please RSVP ir@macom.com John Croteau President, CEO MACOM Bob McMullan SVP & CFO MACOM Preet Virk SVP & GM, Networks MACOM Paramesh Gopi President, CEO AppliedMicro Vivek Rajgarhia VP & GM, Lightwave MACOM |

Thank You |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- REGENT Advances the Future of Coastal Transportation in Abu Dhabi

- Alchimie Announces Its 2023 Annual Results

- Fingerprint Cards AB (publ) publishes annual report for 2023

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share