Form 10-Q PACIFIC BIOSCIENCES OF For: Jun 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Mark One)

☒QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2015

Or

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 001-34899

Pacific Biosciences of California, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

Delaware |

16-1590339 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

1380 Willow Road Menlo Park, CA 94025 |

94025 |

|

(Address of principal executive offices) |

(Zip Code) |

(650) 521-8000

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

Large accelerated filer |

☐ |

Accelerated filer |

☒ |

|

Non-accelerated filer |

☐ (Do not check if a smaller reporting company) |

Smaller reporting company |

☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Number of shares outstanding of the issuer’s common stock as of July 31, 2015: 74,968,648

|

PAGE No. |

|

|

PART I. FINANCIAL INFORMATION |

|

|

Condensed Consolidated Balance Sheets as of June 30, 2015 and December 31, 2014 |

3 |

| 4 | |

| 5 | |

| 6 | |

|

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations |

13 |

|

Item 3. Quantitative and Qualitative Disclosures About Market Risk |

21 |

| 21 | |

|

PART II. OTHER INFORMATION |

|

| 22 | |

| 22 | |

|

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds |

35 |

| 35 | |

| 35 | |

| 35 | |

| 35 | |

| 37 |

2

PACIFIC BIOSCIENCES OF CALIFORNIA, INC.

Condensed Consolidated Balance Sheets

(Unaudited)

|

June 30, |

December 31, |

||||

|

(in thousands except par value amounts) |

2015 |

2014 |

|||

|

Assets |

|||||

|

Current assets |

|||||

|

Cash and cash equivalents |

$ |

25,930 |

$ |

36,449 | |

|

Investments |

46,744 | 64,899 | |||

|

Accounts receivable |

3,950 | 3,406 | |||

|

Inventory |

11,978 | 11,335 | |||

|

Prepaid expenses and other current assets |

1,587 | 1,671 | |||

|

Total current assets |

90,189 | 117,760 | |||

|

Property and equipment, net |

6,428 | 6,601 | |||

|

Other long-term assets |

153 | 162 | |||

|

Total assets |

$ |

96,770 |

$ |

124,523 | |

|

Liabilities and Stockholders’ Equity |

|||||

|

Current liabilities |

|||||

|

Accounts payable |

$ |

5,818 |

$ |

5,608 | |

|

Accrued expenses |

11,316 | 11,441 | |||

|

Deferred service revenue, current |

6,507 | 6,121 | |||

|

Deferred contractual revenue, current |

14,385 | 6,785 | |||

|

Other liabilities, current |

991 | 1,534 | |||

|

Total current liabilities |

39,017 | 31,489 | |||

|

Deferred service revenue, non-current |

1,316 | 1,129 | |||

|

Deferred contractual revenue, non-current |

4,943 | 19,735 | |||

|

Other liabilities, non-current |

2,192 | 2,153 | |||

|

Notes payable |

14,567 | 14,124 | |||

|

Financing derivative |

899 | 944 | |||

|

Total liabilities |

62,934 | 69,574 | |||

|

Commitments and contingencies |

|||||

|

Stockholders’ equity |

|||||

|

Preferred Stock, $0.001 par value: |

|||||

|

Authorized 50,000 shares; No shares issued or outstanding |

— |

— |

|||

|

Common Stock, $0.001 par value: |

|||||

|

Authorized 1,000,000 shares; Issued and outstanding 74,943 shares at June 30, 2015 and 73,927 shares at December 31, 2014 |

75 | 74 | |||

|

Additional paid-in capital |

747,330 | 736,339 | |||

|

Accumulated other comprehensive income |

12 | 9 | |||

|

Accumulated deficit |

(713,581) | (681,473) | |||

|

Total stockholders’ equity |

33,836 | 54,949 | |||

|

Total liabilities and stockholders’ equity |

$ |

96,770 |

$ |

124,523 | |

See accompanying notes to the condensed consolidated financial statements.

3

PACIFIC BIOSCIENCES OF CALIFORNIA, INC.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(Unaudited)

|

Three-Month Periods Ended June 30, |

Six-Month Periods Ended June 30, |

||||||||||||||

|

(in thousands, except per share amounts) |

2015 |

2014 |

2015 |

2014 |

|||||||||||

|

Revenue: |

|||||||||||||||

|

Product revenue |

$ |

8,825 |

$ |

7,749 |

$ |

20,133 |

$ |

15,614 | |||||||

|

Service and other revenue |

2,518 | 1,980 | 5,259 | 4,061 | |||||||||||

|

Contractual revenue |

13,596 | 1,696 | 17,192 | 3,392 | |||||||||||

|

Total revenue |

24,939 | 11,425 | 42,584 | 23,067 | |||||||||||

|

Cost of Revenue: |

|||||||||||||||

|

Cost of product revenue |

8,438 | 6,271 | 18,170 | 13,440 | |||||||||||

|

Cost of service and other revenue |

1,995 | 2,028 | 3,981 | 3,825 | |||||||||||

|

Total cost of revenue |

10,433 | 8,299 | 22,151 | 17,265 | |||||||||||

|

Gross profit |

14,506 | 3,126 | 20,433 | 5,802 | |||||||||||

|

Operating Expense: |

|||||||||||||||

|

Research and development |

15,043 | 12,435 | 29,526 | 24,206 | |||||||||||

|

Sales, general and administrative |

10,821 | 8,993 | 21,593 | 18,143 | |||||||||||

|

Total operating expense |

25,864 | 21,428 | 51,119 | 42,349 | |||||||||||

|

Operating loss |

(11,358) | (18,302) | (30,686) | (36,547) | |||||||||||

|

Interest expense |

(715) | (701) | (1,412) | (1,387) | |||||||||||

|

Other income (expense), net |

138 | (133) | (10) | (88) | |||||||||||

|

Net loss |

(11,935) | (19,136) | (32,108) | (38,022) | |||||||||||

|

Other comprehensive income (loss): |

|||||||||||||||

|

Unrealized gain (loss) on investments |

(4) | 24 | 3 | 28 | |||||||||||

|

Comprehensive loss |

$ |

(11,939) |

$ |

(19,112) |

$ |

(32,105) |

$ |

(37,994) | |||||||

|

Net loss per share: |

|||||||||||||||

|

Basic and diluted net loss per share |

$ |

(0.16) |

$ |

(0.27) |

$ |

(0.43) |

$ |

(0.55) | |||||||

|

Shares used in computing basic and diluted net loss per share |

74,733 | 70,515 | 74,442 | 69,195 | |||||||||||

See accompanying notes to the condensed consolidated financial statements.

4

PACIFIC BIOSCIENCES OF CALIFORNIA, INC.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

|

Six-Month Periods Ended June 30, |

|||||

|

(in thousands) |

2015 |

2014 |

|||

|

Cash flows from operating activities |

|||||

|

Net loss |

$ |

(32,108) |

$ |

(38,022) | |

|

Adjustments to reconcile net loss to net cash used in operating activities |

|||||

|

Depreciation |

1,846 | 2,311 | |||

|

Amortization of debt discount and financing costs |

453 | 375 | |||

|

Stock-based compensation |

6,575 | 4,492 | |||

|

Other items |

(22) | 197 | |||

|

Changes in assets and liabilities |

|||||

|

Accounts receivable |

(544) | (1,509) | |||

|

Inventory |

(643) | 610 | |||

|

Prepaid expenses and other assets |

83 | (34) | |||

|

Accounts payable |

203 | 3,662 | |||

|

Accrued expenses |

(125) | 459 | |||

|

Deferred service revenue |

573 | 1,582 | |||

|

Deferred contractual revenue |

(7,192) | (3,392) | |||

|

Other liabilities |

(504) | (607) | |||

|

Net cash used in operating activities |

(31,405) | (29,876) | |||

|

Cash flows from investing activities |

|||||

|

Purchase of property and equipment |

(1,672) | (942) | |||

|

Disposal of property and equipment |

6 |

— |

|||

|

Purchase of investments |

(40,580) | (66,876) | |||

|

Sales of investments |

6,817 |

— |

|||

|

Maturities of investments |

51,898 | 76,195 | |||

|

Net cash provided by investing activities |

16,469 | 8,377 | |||

|

Cash flows from financing activities |

|||||

|

Proceeds from issuance of common stock from equity plans |

2,984 | 2,691 | |||

|

Proceeds from issuance of common stock from at-the-market equity offering, net of issuance costs |

1,433 | 20,646 | |||

|

Net cash provided by financing activities |

4,417 | 23,337 | |||

|

Net increase (decrease) in cash and cash equivalents |

(10,519) | 1,838 | |||

|

Cash and cash equivalents at beginning of period |

36,449 | 26,362 | |||

|

Cash and cash equivalents at end of period |

$ |

25,930 |

$ |

28,200 | |

See accompanying notes to the condensed consolidated financial statements.

5

PACIFIC BIOSCIENCES OF CALIFORNIA, INC.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

NOTE 1. OVERVIEW

Pacific Biosciences of California, Inc. (“Pacific Biosciences”, the “Company”, “we”, “us”) has commercialized the PacBio RS II Sequencing System to help scientists solve genetically complex problems. Based on our novel Single Molecule, Real-Time (SMRT®) technology, our products enable: de novo genome assembly to finish genomes in order to more fully identify, annotate and decipher genomic structures; full-length transcript analysis to improve annotations in reference genomes, characterize alternatively spliced isoforms and find novel genes; targeted sequencing to more comprehensively characterize genetic variations; and DNA base modification identification to help characterize epigenetic regulation and DNA damage. Our technology combines very high consensus accuracy and long read lengths with the ability to detect real-time kinetic information.

The names “Pacific Biosciences,” “PacBio,” “SMRT,” “SMRTbell” and our logo are our trademarks.

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

In the opinion of management, the accompanying unaudited Condensed Consolidated Financial Statements (“Financial Statements”) of Pacific Biosciences of California, Inc. have been prepared on a consistent basis with our December 31, 2014 audited Consolidated Financial Statements and include all adjustments, consisting of only normal recurring adjustments, necessary to fairly state the information set forth herein. Certain prior year amounts in the Financial Statements and notes thereto have been reclassified to conform to the current year presentation. The Financial Statements have been prepared in accordance with the rules and regulations of the Securities and Exchange Commission (“SEC”) and, as permitted by such rules and regulations, omit certain information and footnote disclosures necessary to present the statements in accordance with U.S. generally accepted accounting principles (“GAAP”). These Financial Statements should be read in conjunction with the audited consolidated financial statements and notes thereto included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2014. The results of operations for the first six-month period of 2015 are not necessarily indicative of the results to be expected for the entire fiscal year or any future periods.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires us to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes to the financial statements. Our estimates include, but are not limited to, the valuation of inventory, revenue valuation, the valuation of a financing derivative and long-term notes, the valuation and recognition of share-based compensation, the delivery period for collaboration agreements, the useful lives assigned to long-lived assets, and the computation provisions for income taxes. Actual results could differ materially from these estimates.

During the first quarter of 2015, we revised the estimated period over which the delivery of elements pursuant to the Development, Commercialization and License Agreement (the “Roche Agreement”) with F. Hoffman-La Roche Ltd (“Roche”) is expected to occur, due to an increased level of certainty regarding the development period. As a result, we are, on a prospective basis, recognizing the remaining deferred contractual revenue associated with the upfront payment received under the Roche Agreement over the revised estimated remaining development period. For the three- and six-month periods ended June 30, 2015, this change in estimate increased contractual revenue by $1.9 million and $3.8 million, respectively, and decreased loss per share by $0.03 and $0.05, respectively. There have been no other material changes to the critical accounting policies and estimates discussed in our Annual Report on Form 10-K for the year ended December 31, 2014.

Reclassifications

In the condensed consolidated statement of cash flows for the six months ended June 30, 2014, certain immaterial reclassifications were made from “Prepaid expenses and other assets” to the “Other items” in order to conform to current period presentation. Such reclassifications did not impact our financial position, net loss, or cash used in operations in the condensed consolidated statement of cash flows.

6

Fair Value of Financial Instruments

Assets and liabilities measured at fair value on a recurring basis

The following table sets forth the fair value of our financial assets and liabilities measured on a recurring basis as of June 30, 2015 and December 31, 2014:

|

(in thousands) |

June 30, 2015 |

December 31, 2014 |

|||||||||||||||||||||

|

Level 1 |

Level 2 |

Level 3 |

Total |

Level 1 |

Level 2 |

Level 3 |

Total |

||||||||||||||||

|

Assets |

|||||||||||||||||||||||

|

Cash and cash equivalents: |

|||||||||||||||||||||||

|

Cash and money market funds |

$ |

18,882 |

$ |

— |

$ |

— |

$ |

18,882 |

$ |

21,952 |

$ |

— |

$ |

— |

$ |

21,952 | |||||||

|

Commercial paper |

— |

7,048 |

— |

7,048 |

— |

14,497 |

— |

14,497 | |||||||||||||||

|

Total cash and cash equivalents |

18,882 | 7,048 |

— |

25,930 | 21,952 | 14,497 |

— |

36,449 | |||||||||||||||

|

Investments: |

|||||||||||||||||||||||

|

Commercial paper |

— |

26,024 |

— |

26,024 |

— |

43,653 |

— |

43,653 | |||||||||||||||

|

Corporate debt securities |

— |

8,114 |

— |

8,114 |

— |

8,173 |

— |

8,173 | |||||||||||||||

|

Asset backed securities |

— |

12,606 |

— |

12,606 |

— |

13,073 |

— |

13,073 | |||||||||||||||

|

Total investments |

— |

46,744 |

— |

46,744 |

— |

64,899 |

— |

64,899 | |||||||||||||||

|

Total assets measured at fair value |

$ |

18,882 |

$ |

53,792 |

$ |

— |

$ |

72,674 |

$ |

21,952 |

$ |

79,396 |

$ |

— |

$ |

101,348 | |||||||

|

Liabilities |

|||||||||||||||||||||||

|

Financing derivative |

$ |

— |

$ |

— |

$ |

899 |

$ |

899 |

$ |

— |

$ |

— |

$ |

944 |

$ |

944 | |||||||

We classify our cash deposits and money market funds within Level 1 of the fair value hierarchy because they are valued using bank balances or quoted market prices. We classify our investments as Level 2 instruments based on market pricing and other observable inputs. We did not classify any of our investments within Level 3 of the fair value hierarchy.

During the six-month periods ended June 30, 2015 and 2014, there were no impairments of our investments.

The estimated fair value of the Financing Derivative liability (as defined in Note 6 Notes Payable) was determined using Level 3 inputs, or significant unobservable inputs. Changes to the estimated fair value of the Financing Derivative are recorded in “Other income (expense), net” in the condensed consolidated statements of operations and comprehensive loss. The following table provides the changes in the estimated fair value of the Financial Derivative during the six-month period ended June 30, 2015 (in thousands):

|

Financial Derivative |

Amount |

|

|

Balance as of December 31, 2014 |

$ |

944 |

|

Gain on change in estimated fair value |

(45) | |

|

Balance as of June 30, 2015 |

$ |

899 |

During the six-month period ended June 30, 2015 there were no transfers between Level 1, Level 2, or Level 3 assets or liabilities reported at fair value on a recurring basis and the valuation techniques used did not change compared to our established practice.

Financial assets and liabilities not measured at fair value on a recurring basis

The carrying amount of our accounts receivable, prepaid expenses, other current assets, accounts payable, accrued expenses and other liabilities, current, approximate fair value due to their short maturities. The carrying value of our other liabilities, non-current, approximates fair value due to the time to maturity and prevailing market rates.

We determined the estimated fair value of the Notes (as defined in Note 6 Notes Payable) from the debt facility using Level 3 inputs, or significant unobservable inputs. The estimated fair value of the Notes was determined by comparing the difference between the estimated fair value of the Notes with and without the Financing Derivative by calculating the respective present values from future cash flows using a weighted average market yield of 18.4% and 19.5% at June 30, 2015 and December 31, 2014, respectively.

7

The estimated fair value and carrying value of the Notes are as follows (in thousands):

|

June 30, 2015 |

December 31, 2014 |

||||||||||

|

Fair Value |

Carrying Value |

Fair Value |

Carrying Value |

||||||||

|

Notes payable |

$ |

15,406 |

$ |

14,567 |

$ |

14,817 |

$ |

14,124 | |||

Net Loss per Share

The following table presents the computation of our basic and diluted net loss per share (in thousands, except per share amounts):

|

Three-Month Periods Ended June 30, |

Six-Month Periods Ended June 30, |

||||||||||||

|

2015 |

2014 |

2015 |

2014 |

||||||||||

|

Net loss per share |

|||||||||||||

|

Numerator: |

|||||||||||||

|

Net loss |

$ |

(11,935) |

$ |

(19,136) |

$ |

(32,108) |

$ |

(38,022) | |||||

|

Denominator: |

|||||||||||||

|

Weighted average shares used in computation of basic and diluted net loss per share |

74,733 | 70,515 | 74,442 | 69,195 | |||||||||

|

Basic and diluted net loss per share |

$ |

(0.16) |

$ |

(0.27) |

$ |

(0.43) |

$ |

(0.55) | |||||

The following were excluded from the computation of our diluted net loss per share for the periods presented because including them would have had an anti-dilutive effect:

|

As of June 30, |

|||

|

(in thousands) |

2015 |

2014 |

|

|

Options outstanding |

18,768 | 15,659 | |

|

Warrants to purchase common stock |

5,500 | 5,500 | |

Recent Accounting Pronouncements

On May 28, 2014, the Financial Accounting Standards Board (“FASB”) issued ASU No. 2014-09, Revenue from Contracts with Customers, requiring an entity to recognize the amount of revenue to which it expects to be entitled for the transfer of promised goods or services to customers. The updated standard will replace most existing revenue recognition guidance in U.S. GAAP when it becomes effective and permits the use of either the retrospective or cumulative effect transition method. Early adoption is not permitted. The updated standard would have been effective for us in the first quarter of fiscal 2017. However, in July 2015 the FASB decided to delay the effective date of the new revenue standard by one year. Reporting entities may choose to adopt the standard as of the original effective date. We are currently evaluating the effect that the updated standard will have on our consolidated financial statements and related disclosures.

In August 2014, the FASB issued ASU No. 2014-15, Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern. This ASU introduces an explicit requirement for management to assess if there is substantial doubt about an entity’s ability to continue as a going concern, and to provide related footnote disclosures in certain circumstances. Disclosures are required if conditions give rise to substantial doubt. This ASU is effective for us in the first quarter of fiscal 2017. We are currently in the process of evaluating the impact of adopting this ASU on our financial statements and related disclosures.

In April 2015, the FASB issued ASU 2015-03, Simplifying the Presentation of Debt Issuance Costs, which changes the presentation of debt issuance costs in financial statements. This ASU requires an entity to present such costs in the balance sheet as a direct deduction from the related debt liability rather than as an asset. Amortization of the costs will continue to be reported as interest expense. This ASU is effective for the Company’s annual report periods beginning after December 15, 2016 and is effective for us in the first quarter of fiscal 2017. Early adoption is permitted. The new guidance will be applied retrospectively to each prior period presented. We are currently in the process of evaluating the impact of adopting this ASU on our financial statements and related disclosures.

8

NOTE 3. CONTRACTUAL REVENUE

During September 2013, we entered into a Development, Commercialization and License Agreement (the “Roche Agreement”) with F. Hoffman-La Roche Ltd (“Roche”), pursuant to which we account for, and recognize as revenue, the up-front payment received thereunder using the proportional performance method over the periods in which the delivery of elements pursuant to the agreement occurs. We recognize revenue using a straight-line convention over the service periods of the deliverables as this method approximates our performance of services pursuant to the agreement. Out of the $35.0 million upfront cash payment received, quarterly amortization of $1.7 million has been recognized as contractual revenue from the fourth quarter of 2013 to the fourth quarter of 2014. Beginning in the three-month period ended March 31, 2015, we revised the estimated development period related to our contractual revenue amortization based on increasing certainty of the development time on a prospective approach. This change in estimate resulted in $1.9 million of additional contractual revenue being recognized per quarter and a total of $3.6 million as quarterly amortization.

We recognized a total of $3.6 million and $7.2 million of amortization for the three- and six-month periods ended June 30, 2015, respectively. The additional contractual revenue due to the revision had a 100% margin and decreased our net loss for the three- and six-month periods ended June 30, 2015 by $1.9 million and $3.8 million, respectively, and decreased our net loss per share for three- and six-month periods ended June 30, 2015 by $0.03 per share and $0.05 per share, respectively. At June 30, 2015, going forward, on a prospective basis, we will recognize the remaining deferred contractual revenue of $19.3 million associated with upfront payment received under the Roche Agreement over the revised estimated remaining development period.

In addition to the deliverables above, the Roche Agreement provides for additional payments totaling up to $40.0 million upon the achievement of certain development milestones. During August 2014, we achieved the first such development milestone and we recognized the related $10.0 million as contractual revenue for the quarter ended September 30, 2014. During April 2015, we achieved the second development milestone and we recognized the related $10.0 million as contractual revenue for the quarter ended June 30, 2015.

NOTE 4. CASH, CASH EQUIVALENTS AND INVESTMENTS

The following tables summarize our cash, cash equivalents and investments as of June 30, 2015 and December 31, 2014 (in thousands):

|

June 30, 2015 |

|||||||||||

|

Gross |

Gross |

||||||||||

|

Amortized |

unrealized |

unrealized |

Fair |

||||||||

|

Cost |

gains |

losses |

Value |

||||||||

|

Cash and cash equivalents: |

|||||||||||

|

Cash and money market funds |

$ |

18,882 |

$ |

— |

$ |

— |

$ |

18,882 | |||

|

Commercial paper |

7,048 |

— |

— |

7,048 | |||||||

|

Total cash and cash equivalents |

25,930 |

— |

— |

25,930 | |||||||

|

Investments: |

|||||||||||

|

Commercial paper |

26,020 | 4 |

— |

26,024 | |||||||

|

Corporate debt securities |

8,107 | 7 |

— |

8,114 | |||||||

|

Asset backed securities |

12,605 | 1 |

— |

12,606 | |||||||

|

Total investments |

46,732 | 12 |

— |

46,744 | |||||||

|

Total cash, cash equivalents and investments |

$ |

72,662 |

$ |

12 |

$ |

— |

$ |

72,674 | |||

|

December 31, 2014 |

|||||||||||

|

Gross |

Gross |

||||||||||

|

Amortized |

unrealized |

unrealized |

Fair |

||||||||

|

Cost |

gains |

losses |

Value |

||||||||

|

Cash and cash equivalents: |

|||||||||||

|

Cash and money market funds |

$ |

21,952 |

$ |

— |

$ |

— |

$ |

21,952 | |||

|

Commercial paper |

14,496 | 1 |

— |

14,497 | |||||||

|

Total cash and cash equivalents |

36,448 | 1 |

— |

36,449 | |||||||

|

Investments: |

|||||||||||

|

Commercial paper |

43,648 | 5 |

— |

43,653 | |||||||

|

Corporate debt securities |

8,170 | 7 | (4) | 8,173 | |||||||

|

Asset backed securities |

13,073 | 4 | (4) | 13,073 | |||||||

|

Total investments |

64,891 | 16 | (8) | 64,899 | |||||||

9

|

Total cash, cash equivalents and investments |

$ |

101,339 |

$ |

17 |

$ |

(8) |

$ |

101,348 |

The following table summarizes the contractual maturities of our cash equivalents and available-for-sale investments, excluding money market funds, as of June 30, 2015:

|

(in thousands) |

Fair Value |

|

|

Due in one year or less |

$ |

53,792 |

Actual maturities may differ from contractual maturities because issuers may have the right to call or prepay obligations without call or prepayment penalties.

NOTE 5. INVENTORY

Inventory

As of June 30, 2015 and December 31, 2014, inventory consisted of the following components:

|

June 30, |

December 31, |

||||

|

(in thousands) |

2015 |

2014 |

|||

|

Purchased materials |

$ |

1,081 |

$ |

3,150 | |

|

Work in process |

6,997 | 6,115 | |||

|

Finished goods |

3,900 | 2,070 | |||

|

Inventory |

$ |

11,978 |

$ |

11,335 | |

NOTE 6. NOTES PAYABLE

Pursuant to a Facility Agreement (the “Facility Agreement”) we entered into with entities affiliated with Deerfield Management Company, L.P. (collectively, “Deerfield”) during February 2013, we issued promissory notes in the aggregate principal amount of $20.5 million (the “Notes”). The Notes bear simple interest at a rate of 8.75% per annum, payable quarterly in arrears commencing on April 1, 2013. In connection with the execution of the Facility Agreement, we issued warrants to purchase an aggregate of 5,500,000 shares of common stock immediately exercisable at an exercise price per share initially equal to $2.63 (the “Warrants”). In addition, the Facility Agreement requires us to maintain consolidated cash and cash equivalents on the last day of each calendar quarter of not less than $2.0 million. As security for our repayment of our obligations under the Facility Agreement, we granted to Deerfield a security interest in substantially all of our property.

Financing Derivative

A number of features embedded in the Notes to the Facility Agreement required accounting for as a derivative, including the indemnification of certain withholding taxes and the acceleration of debt upon (i) a qualified financing, (ii) an Event of Default, (iii) a Major Transaction, and (iv) the exercise of the warrant via offset to debt principal. These features represent a single derivative (the “Financing Derivative”) that was bifurcated from the debt instrument and accounted for as a liability at fair value, with changes in fair value between reporting periods recorded in other income (expense), net.

The estimated fair value of the Financing Derivative was determined by comparing the difference between the fair value of the Notes with and without the Financing Derivative by calculating the respective present values from future cash flows using an 18.4% and 19.5% weighted average market yield at June 30, 2015 and December 31, 2014, respectively. The estimated fair value of the Financing Derivative as of both June 30, 2015 and December 31, 2014 was $0.9 million.

Notes

We initially recorded the Notes and Warrants at $14.1 million and $6.4 million, respectively, based upon the relative fair value allocation of the $20.5 million of proceeds. The carrying value of the Notes at the inception of the debt was $12.8 million, resulting in an original issue discount of $7.7 million. As of June 30, 2015 and December 31, 2014, debt discount of $5.9 million and $6.4 million, respectively, remained to be amortized through February 2020, the maturity of the Notes.

10

NOTE 7. STOCKHOLDERS’ EQUITY AND SHARE-BASED COMPENSATION

Equity Offering

During the six-month period ended June 30, 2015, we issued 240,843 shares of our common stock at an average price of $6.13 per share through our “at-the-market” offering program, resulting in net proceeds of $1.4 million. As of June 30, 2015, $28.5 million of common stock remained available for future sales; however, we are not obligated to make any sales under this program.

Warrants

As of June 30, 2015, we had outstanding warrants to purchase an aggregate of 5,500,000 shares of our common stock.

Equity Plans

As of June 30, 2015, we had three active equity compensation plans: the 2010 Equity Incentive Plan, the 2010 Outside Director Equity Incentive Plan, and the 2010 Employee Stock Purchase Plan (“ESPP”).

The following table summarizes stock option activity for all stock option plans for the six-month period ended June 30, 2015 (in thousands, except per share amounts):

|

Stock Options Outstanding |

|||||||||

|

Weighted |

|||||||||

|

Shares available |

Number |

average |

|||||||

|

for grant |

of shares |

Exercise price |

exercise price |

||||||

|

Balances, December 31, 2014 |

4,874 | 16,491 |

$ |

0.70 – 16.00 |

$ |

5.10 | |||

|

Additional shares reserved |

4,435 | ||||||||

|

Options granted |

(2,806) | 2,806 |

5.43 – 7.59 |

6.46 | |||||

|

Options exercised |

— |

(224) |

0.70 – 5.18 |

3.14 | |||||

|

Options canceled |

305 | (305) |

1.16 – 15.98 |

5.89 | |||||

|

Balances, June 30, 2015 |

6,808 | 18,768 |

$ |

0.70 – 16.00 |

$ |

5.32 | |||

Shares issued under our ESPP totaled 532,217 and 1,048,604 shares during the six-month periods ended June 30, 2015 and 2014, respectively. As of June 30, 2015, 946,329 shares of our common stock remain available for issuance under our ESPP.

Stock-based Compensation

Total stock-based compensation expense consists of the following (in thousands):

|

Three-Month Periods Ended June 30, |

Six-Month Periods Ended June 30, |

|||||||||||

|

2015 |

2014 |

2015 |

2014 |

|||||||||

|

Cost of revenue |

$ |

291 |

$ |

121 |

$ |

589 |

$ |

262 | ||||

|

Research and development |

1,235 | 822 | 2,490 | 1,708 | ||||||||

|

Sales, general and administrative |

1,794 | 1,279 | 3,496 | 2,522 | ||||||||

|

Total stock-based compensation expense |

$ |

3,320 |

$ |

2,222 |

$ |

6,575 |

$ |

4,492 | ||||

We estimated the fair value of employee stock options on the grant date using the Black-Scholes option pricing model. The estimated fair value of employee stock options is amortized on a straight-line basis over the requisite service period of the awards. The fair value of employee stock options was estimated using the following weighted average assumptions:

|

Three-Month Periods Ended June 30, |

Six-Month Periods Ended June 30, |

||||||||

|

Stock Option |

2015 |

2014 |

2015 |

2014 |

|||||

|

Expected term in years |

6.1 |

6.1 |

6.1 |

6.1 |

|||||

|

Expected volatility |

70% |

70% |

70% |

70% |

|||||

|

Risk-free interest rate |

1.7% |

1.9% |

1.6% |

1.9% |

|||||

|

Dividend yield |

— |

— |

— |

— |

|||||

11

We estimate the value of the employee stock purchase rights on the grant date using the Black-Scholes option pricing model. The fair value of ESPP was estimated using the following assumptions:

|

Three-Month Periods Ended June 30, |

Six-Month Periods Ended June 30, |

|||||||

|

ESPP |

2015 |

2014 |

2015 |

2014 |

||||

|

Expected term in years |

0.5-2.0 |

0.5-2.0 |

0.5-2.0 |

0.5-2.0 |

||||

|

Expected volatility |

70% |

70% |

70% |

70% |

||||

|

Risk-free interest rate |

0.1%-0.6% |

0.1%-0.3% |

0.1%-0.6% |

0.1%-0.3% |

||||

|

Dividend yield |

— |

— |

— |

— |

||||

NOTE 8. SUBSEQUENT EVENTS

Lease Amendment Agreement

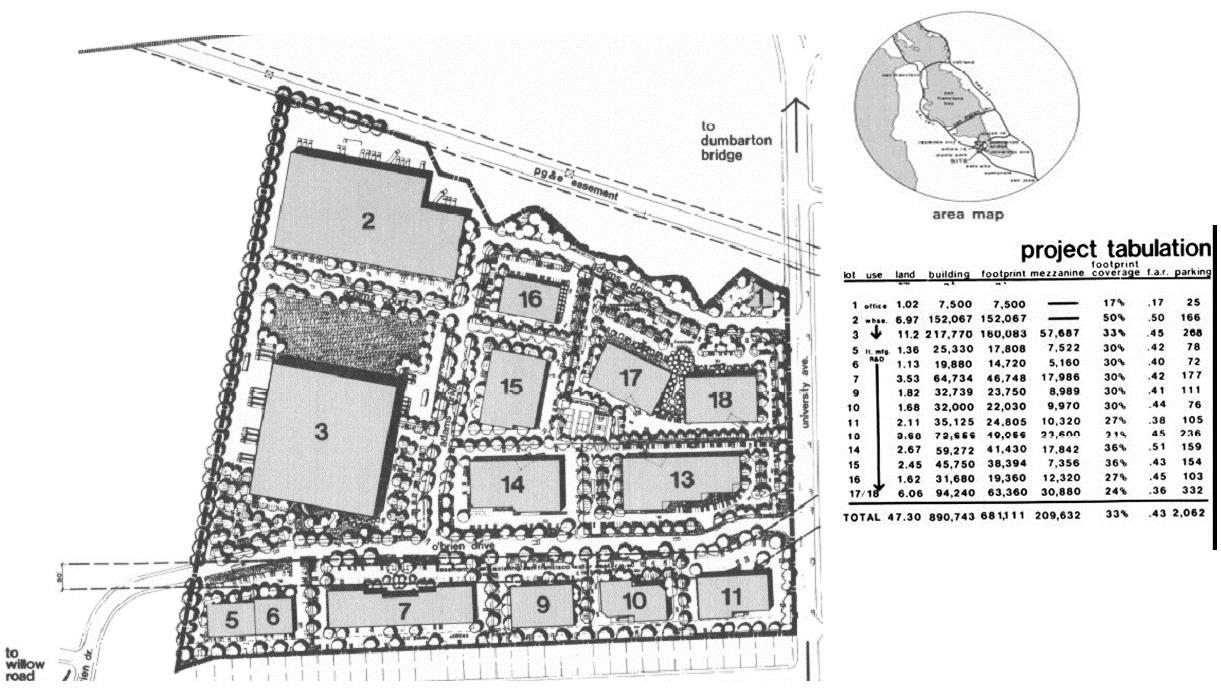

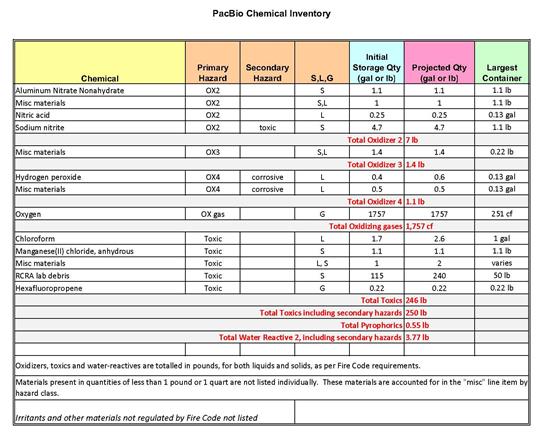

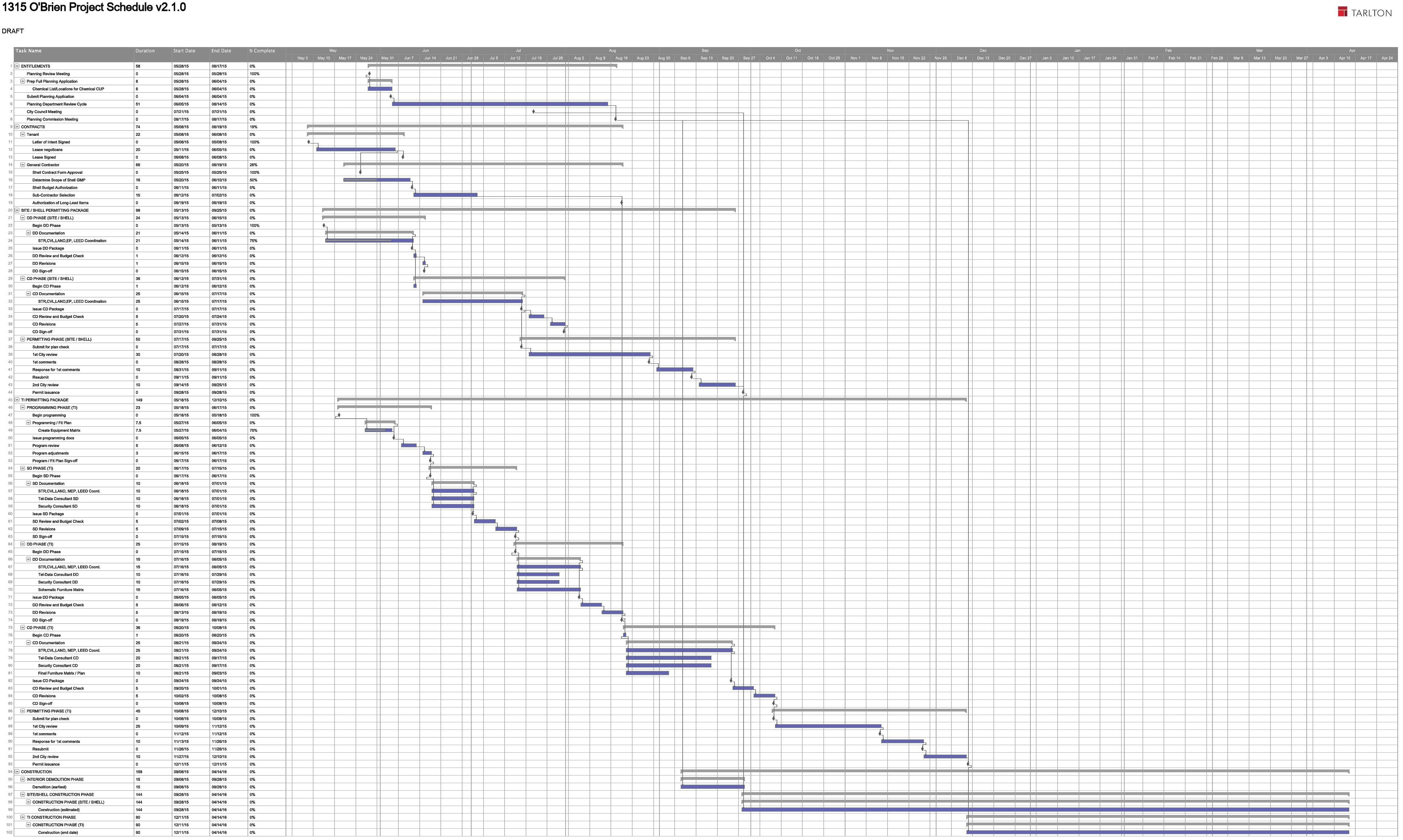

On July 23, 2015, we entered into a Lease Amendment Agreement (the “Lease Amendment Agreement”) with Peninsula Innovation Partners, LLC (the “Existing Landlord”), which amends the terms and conditions of certain of our existing real property leases. The Lease Amendment Agreement provides for, among other things, amendments of the term for certain of the existing leases, the termination of all renewal, expansion and extension rights contained in any of the existing leases (including our options to extend the terms for certain of the existing leases for two consecutive five-year periods), as well as rent abatement for a specified period of time. As consideration for our agreement to amend the existing leases pursuant to the Lease Amendment Agreement, and subject to the terms and conditions contained therein, we shall be eligible to receive up to four payments of $5,000,000 each from the Existing Landlord over time, and rent abatement through September 2017. If we do not obtain or waive receipt of an architectural approval and a change of use permit with respect to our proposed new premises at 1315 O’Brien Drive, Menlo Park, California (collectively, the “Use CUPs”) by September 30, 2015, (i) the Existing Landlord shall have no obligation to make the Existing Landlord payments, (ii) the amendments of the term for the existing leases shall be of no further force or effect, (iii) the period for our delivery of option notices with respect to extended terms in the applicable existing leases shall be extended until October 15, 2015, (iv) the rent abatement shall be terminated and repaid by us, and (v) certain related terms and conditions of the Lease Amendment Agreement shall be of no further force or effect.

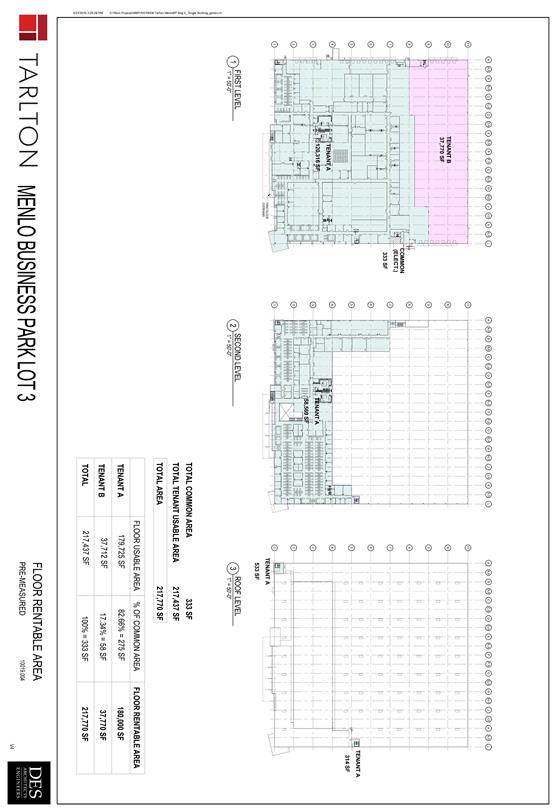

O’Brien Lease Agreement

On July 22, 2015, we entered into a new lease agreement (the “O’Brien Lease”) with Menlo Park Portfolio II, LLC (the “O’Brien Landlord”) for premises consisting of approximately one hundred eighty thousand (180,000) rentable square feet located at 1315 O’Brien Drive, Menlo Park, California (the “O’Brien Premises”).

The term of the O’Brien Lease is one hundred thirty-two (132) months, commencing on the date that is the later of April 15, 2016 or the date O’Brien Landlord has substantially completed certain shell improvements and tenant improvements. Base monthly rent shall be abated for the first six (6) months of the O’Brien Lease term and thereafter will be $540,000 per month during the first year of the lease term, with specified annual increases thereafter until reaching $711,000 per month during the last twelve (12) months of the lease term. We are required to pay $2,340,000 in prepaid rent which will be applied to the monthly rent installments due for the first to fourth months, and the operating expenses for the first month, after the rent abatement period. In addition, we are required to provide the O’Brien Landlord with a security deposit under the O’Brien Lease in the amount of $4,500,000, which security deposit initially will be in the form of a letter of credit. The O’Brien Landlord is obligated to construct certain shell improvements at the O’Brien Landlord’s cost and expense and provide us with improvement allowances in the amount of $70.00 per rentable square foot of the Premises, which may be applied towards the costs of construction of the initial improvements in the Premises. We are required to reimburse the O’Brien Landlord for certain improvement costs in excess of the foregoing allowances.

Under the O’Brien Lease, we expect to pay approximately $80 million in rent and $24 million in operating expenses over the expected lease term. In addition to the lease payments, we are also required to reimburse the O’Brien Landlord for certain improvement costs in excess of the tenant improvement allowances provided. These improvement costs, along with the costs associated with the anticipated move to the O’Brien Premises, are expected to be substantial in nature.

We have reserved the right to terminate the O’Brien Lease if the Use CUPs are not obtained by September 30, 2015, and, the O’Brien Landlord has a similar right to terminate the O’Brien Lease for failure to obtain the Use CUPs.

12

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

You should read the following discussion and analysis of our financial condition and results of operations together with our condensed consolidated financial statements and the related notes included in this Quarterly Report on Form 10-Q and those in our Annual Report on Form 10-K for the fiscal year ended December 31, 2014. Some of the information contained in this discussion and analysis or set forth elsewhere in this report, including information with respect to our plans and strategy for our business and related financing, includes forward-looking statements that involve risks and uncertainties, including statements regarding our expected financial results in future periods. You should read the “Risk Factors” section of this Quarterly Report on Form 10-Q for a discussion of important factors that could cause actual results to differ materially from the results described in or implied by the forward-looking statements contained in the following discussion and analysis.

Overview

We design, develop and manufacture the PacBio® RS II Sequencing System to help scientists resolve genetically complex problems. Based on our novel Single Molecule, Real-Time (SMRT®) technology, our products enable: de novo genome assembly to finish genomes in order to more fully identify, annotate and decipher genomic structures; full-length transcript analysis to improve annotations in reference genomes, characterize alternatively spliced isoforms and find novel genes; targeted sequencing to more comprehensively characterize genetic variations; and DNA base modification identification to help characterize epigenetic regulation and DNA damage. Our technology combines very high consensus accuracy and long read lengths with the ability to detect real-time kinetic information.

During September 2013, we entered into a Development, Commercialization and License Agreement (the “Roche Agreement”) with F. Hoffman-La Roche Ltd (“Roche”), pursuant to which we account for, and recognize as revenue, the $35.0 million up-front payment using the proportional performance method over the periods in which the delivery of elements pursuant to the agreement occurs. We recognize revenue using a straight-line convention over the service periods of the deliverables as this method approximates our performance of services pursuant to the contract. In addition to the above upfront payment, the Roche agreement provides for additional payments totaling up to $40.0 million upon the achievement of certain milestones. During August 2014, we achieved the first such development milestone and we recorded the related $10.0 million as contractual revenue for the quarter ended September 30, 2014. During April 2015 we achieved the second development milestone and we recorded the related $10.0 million as contractual revenue for the quarter ended June 30, 2015.

Basis of Presentation

Revenue

During the three- and six-month periods ended June 30, 2015 and 2014, product revenue was primarily derived from the sale of PacBio RS II instruments and associated consumables. Service and other revenue was primarily derived from product maintenance agreements sold on our installed instruments. Contractual revenue was derived from the quarterly amortization from the non-refundable up-front payment of $35.0 million that we received in September 2013 pursuant to the Roche Agreement. In addition, we achieved the second development milestone under the Roche Agreement in April 2015 and we recorded the related $10.0 million as contractual revenue for the quarter ended June 30, 2015.

Cost of Revenue

Cost of revenue reflects the direct cost of product components, third-party manufacturing services and our internal manufacturing overhead and customer service infrastructure costs incurred to produce, deliver, maintain and support our instruments, consumables, and services. There are no incremental costs associated with our contractual revenue; all product development costs are reflected in research and development expense.

Manufacturing overhead is predominantly comprised of labor costs. We determine and capitalize manufacturing overhead into inventory based on a standard cost model that approximates actual costs. Prior to achieving manufacturing volumes that correlated with our estimated normal capacity (the production levels expected to be achieved over a number of periods under normal circumstances with available resources), we based our capitalized overhead relative to our normal capacity. Prior to achieving normal capacity, excess manufacturing resources were engaged in research and development activities, including: next generation products, internal use research products, and general support activities. As such, manufacturing costs in excess of amounts reflected in inventory were expensed as a component of research and development expense. During 2014, manufacturing volumes trended towards and then approximated normal capacity, and excess manufacturing resources contributing to research and development activities declined significantly.

Service costs include the direct costs of components used in support, repair and maintenance of customer instruments as well as the cost of personnel, materials, shipping and support infrastructure necessary to support the installed customer base.

13

Research and Development Expense

Research and development expense consists primarily of expenses for personnel engaged in the development of our SMRT technology, the design and development of our future products and current product enhancements. These expenses also include prototype-related expenditures, development equipment and supplies, facilities costs and other related overhead. We expense research and development costs during the period in which the costs are incurred. However, we defer and capitalize non-refundable advance payments made for research and development activities until the related goods are received or the related services are rendered.

Sales, General and Administrative Expense

Selling, general and administrative expenses include costs for sales, marketing and administrative personnel, sales and marketing activities, tradeshow expenses, legal expenses and general corporate expenses.

Interest Expense

Interest expense is primarily related to our debt facility and includes the amortization of debt discount and other related costs. To a lesser extent, amounts also include interest expense relating to our facility financing obligations resulting from a lease agreement entered into in 2010. We expect interest expense to increase during future periods as the recorded value of our debt facility accretes to the amount due at maturity.

Other Income (Expense), Net

Other income (expense), net consists primarily of interest income earned on cash and investments, accretion of discounts and amortization of premiums related to investments, net gains or losses on foreign currency transactions, net gains or losses resulting from changes in the estimated fair value of the financing derivative and foreign income taxes.

Income Taxes

Since inception, we have incurred net losses and have not recorded any U.S. federal or state income tax benefits for such losses as they have been fully offset by valuation allowances.

Critical Accounting Policies and Estimates

The discussion and analysis of our financial condition and results of operations are based upon our unaudited financial statements, which have been prepared in accordance with the rules and regulations of the Securities and Exchange Commission (“SEC”). The preparation of these Financial Statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses. On an ongoing basis, we evaluate our critical accounting policies and estimates. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

During the first quarter of 2015, we revised the estimated period over which the delivery of elements pursuant to the Development, Commercialization and License Agreement (the “Roche Agreement”) with F. Hoffman-La Roche Ltd (“Roche”) is expected to occur, due to an increased level of certainty regarding the development period. As a result, we are, on a prospective basis, recognizing the remaining deferred contractual revenue associated with the upfront payment received under the Roche Agreement over the revised estimated remaining development period. For the three- and six-month periods ended June 30, 2015, this change in estimate increased contractual revenue by $1.9 million and $3.8 million, respectively, and decreased loss per share by $0.03 and $0.05, respectively. There have been no other material changes to the critical accounting policies and estimates discussed in our Annual Report on Form 10-K for the year ended December 31, 2014.

14

Results of Operations

Comparison of the Three-month Periods Ended June 30, 2015 and 2014

|

Three-Month Periods Ended June 30, |

$ Change |

% Change |

||||||||

|

(in thousands, except percentages) |

2015 |

2014 |

||||||||

|

(unaudited) |

||||||||||

|

Revenue: |

||||||||||

|

Product revenue |

$ |

8,825 |

$ |

7,749 |

$ |

1,076 | 14% | |||

|

Service and other revenue |

2,518 | 1,980 | 538 | 27% | ||||||

|

Contractual revenue |

13,596 | 1,696 | 11,900 | 702% | ||||||

|

Total revenue |

24,939 | 11,425 | 13,514 | 118% | ||||||

|

Cost of Revenue: |

||||||||||

|

Cost of product revenue |

8,438 | 6,271 | 2,167 | 35% | ||||||

|

Cost of service and other revenue |

1,995 | 2,028 | (33) | (2%) | ||||||

|

Total cost of revenue |

10,433 | 8,299 | 2,134 | 26% | ||||||

|

Gross profit |

14,506 | 3,126 | 11,380 | 364% | ||||||

|

Operating Expense: |

||||||||||

|

Research and development |

15,043 | 12,435 | 2,608 | 21% | ||||||

|

Sales, general and administrative |

10,821 | 8,993 | 1,828 | 20% | ||||||

|

Total operating expense |

25,864 | 21,428 | 4,436 | 21% | ||||||

|

Operating loss |

(11,358) | (18,302) | 6,944 | 38% | ||||||

|

Interest expense |

(715) | (701) | (14) | (2%) | ||||||

|

Other income (expense), net |

138 | (133) | 271 | 204% | ||||||

|

Net loss |

$ |

(11,935) |

$ |

(19,136) |

$ |

7,201 | 38% | |||

Revenue

Total revenue for the three-month period ended June 30, 2015 was $24.9 million compared to $11.4 million for the same period during 2014.

Product revenue during the three-month period ended June 30, 2015 consisted of $4.3 million from sales of PacBio RS II instruments and $4.5 million from sales of consumables, compared to $4.7 million from sales of instruments and $3.0 million from sales of consumables for the same period during 2014. The increase in consumable sales is primarily attributable to a larger installed base and higher utilization of installed instruments by our customers.

Service and other revenue of $2.5 million and $2.0 million for the three-month periods ended June 30, 2015 and 2014, respectively, was primarily derived from product maintenance agreements sold on our installed instruments. The increase in service and other revenue year over year was primarily attributable to more service contracts and higher installed base of instruments.

Contractual revenue relates to the quarterly amortization of $3.6 million and $1.7 million for the three-month period ended June 30, 2015 and 2014, respectively, from the non-refundable up-front payment of $35.0 million we received during September 2013 pursuant to the Roche Agreement. The additional revenue of $1.9 million recognized for the three-month period ended June 30, 2015 reflects the increased certainty of the estimated development time period. In addition we achieved the second development milestone under the Roche Agreement and we recorded the related $10.0 million as contractual revenue for the quarter ended June 30, 2015. We may receive up to an additional $20.0 million in milestone revenue in the future; however, there can be no assurance that we will be able to achieve such additional milestone revenue.

Gross Profit

Gross profit increased by $11.4 million to $14.5 million for the three-month period ended June 30, 2015, resulting in a gross margin of 58.2%, compared to gross profit of $3.1 million and a gross margin of 27.4% for the three-month period ended June 30, 2014. The increase of $11.9 million in contractual revenue at 100% margin led to the increase in gross profit and gross margin.

Cost of product revenue increased to $8.4 million for the three-month period ended June 30, 2015, compared to cost of product revenue of $6.3 million for the same period during 2014. The increase of $2.1 million was primarily due to the higher amount of consumables shipped and due to $0.9 million in charges taken for excess inventory accumulated during the three-month period ended June 30, 2015.

Cost of service and other revenue for the three-month period ended June 30, 2015 remained flat compared to the same period during 2014, as the cost of service per machine has decreased year over year.

15

For the remainder of 2015, gross margin is expected to return to the mid-thirty percent range, but may vary depending on revenue mix.

Research and Development Expense

During the three-month period ended June 30, 2015, research and development expense increased by $2.6 million, or 21%, compared to the same period during 2014. The increase in research and development expense was primarily attributed to an increase of $1.7 million in product development costs and an increase of $1.3 million in compensation related expenses resulting from increased headcount. Research and development expense included stock-based compensation expense of $1.2 million and $0.8 million during the three-month periods ended June 30, 2015 and 2014, respectively.

We anticipate the current level of quarterly research and development expenses to continue for the remainder of 2015, but such quarterly levels may vary if certain research and development projects are accelerated among other factors.

Sales, General and Administrative Expense

During the three-month period ended June 30, 2015, selling, general and administrative expense increased by $1.8 million, or 20%, compared to the same period during 2014. The increase in sales, general and administrative expense was primarily attributed to an increase of $1.2 million for higher compensation related expenses resulting from increased headcount, and an increase of $0.7 million in professional fees primarily relating to fees associated with the Roche milestone payment of $10.0 million recognized during the three-month period ended June 30, 2015. Sales, general and administrative expense included stock-based compensation expense of $1.8 million and $1.3 million during the three-month periods ended June 30, 2015 and 2014, respectively.

We anticipate the current level of quarterly sales, general and administrative expenses to continue for the remainder of 2015, but such quarterly levels may vary depending on timing of sales, general and administrative headcount increases among other factors and may be affected by costs associated with the anticipated transition to our proposed new headquarters in Menlo Park, California.

Interest Expense

Interest expense for the three-month period ended June 30, 2015 remained flat compared to the same period during 2014. Interest expense related primarily to the debt facility entered into in February 2013.

Comparison of the Six-month Periods Ended June 30, 2015 and 2014

|

Six-Month Periods Ended June 30, |

$ Change |

% Change |

||||||||

|

(in thousands, except percentages) |

2015 |

2014 |

||||||||

|

(unaudited) |

||||||||||

|

Revenue: |

||||||||||

|

Product revenue |

$ |

20,133 |

$ |

15,614 |

$ |

4,519 | 29% | |||

|

Service and other revenue |

5,259 | 4,061 | 1,198 | 30% | ||||||

|

Contractual revenue |

17,192 | 3,392 | 13,800 | 407% | ||||||

|

Total revenue |

42,584 | 23,067 | 19,517 | 85% | ||||||

|

Cost of Revenue: |

||||||||||

|

Cost of product revenue |

18,170 | 13,440 | 4,730 | 35% | ||||||

|

Cost of service and other revenue |

3,981 | 3,825 | 156 | 4% | ||||||

|

Total cost of revenue |

22,151 | 17,265 | 4,886 | 28% | ||||||

|

Gross profit |

20,433 | 5,802 | 14,631 | 252% | ||||||

|

Operating Expense: |

||||||||||

|

Research and development |

29,526 | 24,206 | 5,320 | 22% | ||||||

|

Sales, general and administrative |

21,593 | 18,143 | 3,450 | 19% | ||||||

|

Total operating expense |

51,119 | 42,349 | 8,770 | 21% | ||||||

|

Operating loss |

(30,686) | (36,547) | 5,861 | 16% | ||||||

|

Interest expense |

(1,412) | (1,387) | (25) | (2%) | ||||||

|

Other income (expense), net |

(10) | (88) | 78 | 89% | ||||||

|

Net loss |

$ |

(32,108) |

$ |

(38,022) |

$ |

5,914 | 16% | |||

Revenue

Total revenue for the six-month period ended June 30, 2015 was $42.6 million compared to $23.1 million for the same period during 2014.

16

Product revenue during the six-month period ended June 30, 2015 consisted of $11.3 million from sales of PacBio RS II instruments and $8.8 million from sales of consumables, compared to $10.0 million from sales of instruments and $5.6 million from sales of consumables for the same period during 2014. The increase in instrument sales is primarily attributable to a larger number of new installations. The increase in consumable sales is primarily attributable to a larger installed instrument base and higher utilization of installed instruments by our customers.

Service and other revenue of $5.3 million and $4.1 million for the six-month periods ended June 30, 2015 and 2014, respectively, was primarily derived from product maintenance agreements sold on our installed instruments. The increase in service and other revenue year over year was primarily attributable to a larger installed base of instruments.

Contractual revenue includes $7.2 million and $3.4 million for the six-month periods ended June 30, 2015 and 2014, respectively, from the amortization of the non-refundable up-front payment of $35.0 million we received during September 2013 pursuant to the Roche Agreement. This reflects two quarters of amortization where the additional revenue of $3.8 million for the six-month period ended June 30, 2015 reflects the increased certainty of the estimated development time period. In addition, we achieved the second development milestone under the Roche Agreement and we recorded the related $10.0 million as contractual revenue for the quarter ended June 30, 2015. We may receive up to an additional $20.0 million based on additional milestone achievement in the future; however, there can be no assurance that we will be able to achieve such additional milestone revenue.

Gross Profit

Gross profit increased by $14.6 million to $20.4 million for the six-month period ended June 30, 2015, resulting in a gross margin of 48.0%, compared to gross profit of $5.8 million and a gross margin of 25.2% for the six-month period ended June 30, 2014. The increase of $13.8 million in contractual revenue at 100% margin led to the increase in gross profit and gross margin.

Cost of product revenue increased to $18.2 million for the six-month period ended June 30, 2015, compared to cost of product revenue of $13.4 million for the same period during 2014. The increase of $4.7 million was primarily due to the higher number of instruments and consumables shipped and due to $1.3 million in charges taken for excess inventory accumulated during the six-month period ended June 30, 2015.

Cost of service and other revenue for the six-month period ended June 30, 2015 remained flat compared to the same period during 2014, as the cost of service per machine has decreased year over year.

Research and Development Expense

During the six-month period ended June 30, 2015, research and development expense increased by $5.3 million, or 22%, compared to the same period during 2014. The increase in research and development expense was primarily attributed to an increase of $2.8 million for higher compensation related expenses resulting from increased headcount, and an increase of $2.8 million in product development costs. Research and development expense included stock-based compensation expense of $2.5 million and $1.7 million during the six-month periods ended June 30, 2015 and 2014, respectively.

Sales, General and Administrative Expense

During the six-month period ended June 30, 2015, selling, general and administrative expense increased by $3.5 million, or 19%, compared to the same period during 2014. The increase in sales, general and administrative expense was primarily attributed to an increase of $2.5 million for higher compensation related expenses resulting from increased headcount, and an increase of $1.0 million in professional fees primarily relating to fees associated with the Roche milestone payment of $10.0 million recognized during the three-month period ended June 30, 2015. Sales, general and administrative expense included stock-based compensation expense of $3.5 million and $2.5 million during the six-month periods ended June 30, 2015 and 2014, respectively.

Interest Expense

Interest expense for the six-month period ended June 30, 2015 remained flat compared to the same period during 2014. Interest expense related primarily to the debt facility entered into in February 2013.

17

Liquidity and Capital Resources

Liquidity

Since our inception, we have financed our operations primarily through product sales, issuance of common stock and convertible preferred stock, including our current “at-the-market” offering program, in addition to our debt facility and payments from Roche pursuant to the terms of the Roche Agreement. Cash and investments at June 30, 2015 totaled $72.7 million, compared to $101.3 million at December 31, 2014.

We believe that our existing cash, cash equivalents and investments will be sufficient to fund our projected operating requirements for at least 12 months; however, we plan to raise additional capital in the future. These expectations are based on our current operating and financing plans, which are subject to change. Factors that may affect our capital needs include, but are not limited to, slower than expected adoption of our products resulting in lower sales of our products and services; future acquisitions; our ability to maintain new collaboration and customer arrangements; the progress of our research and development programs; initiation or expansion of research programs and collaborations; the costs involved in preparing, filing, prosecuting, defending and enforcing intellectual property rights; the purchase of patent licenses; the costs associated with the anticipated transition to our proposed new headquarters in Menlo Park, California; and other factors.

To the extent we raise additional funds through the sale of equity or convertible debt securities, the issuance of such securities will result in dilution to our stockholders. There can be no assurance that such funds will be available on favorable terms, or at all. If adequate funds are not available, we may be required to curtail operations significantly or to obtain funds by entering into collaboration agreements on unattractive terms. Our inability to raise capital could have a material adverse effect on our business, financial condition and results of operations.

Operating Activities

Our primary uses of cash in operating activities are for the development of ongoing product enhancements and future product manufacturing and sale of PacBio RS II instruments and consumables, and support functions related to our selling, general and administrative activities. The net cash used for the six-month periods ended June 30, 2015 and 2014 primarily reflects the net loss for those periods, partially offset by non-cash operating expenses including depreciation, stock-based compensation and also reflects changes in working capital.

We used $31.4 million of cash from operating activities for the six-month period ended June 30, 2015, compared to cash usage of $29.9 million for the corresponding period in 2014. The cash used in operating activities for the six-month period ended June 30, 2015 was due primarily to a net loss of $32.1 million, a reduction in deferred contractual revenue of $7.2 million, an increase in inventory of $0.6 million, an increase in accounts receivable of $0.5 million and a decrease in other liabilities of $0.5 million, partially offset by stock-based compensation of $6.6 million, depreciation of $1.8 million and an increase in deferred service revenue of $0.6 million. The cash used in operating activities for the six-month period ended June 30, 2014 was due primarily to a net loss of $38.0 million, partially offset by a $0.8 million change in working capital, stock-based compensation of $4.5 million, depreciation of $2.3 million and amortization of debt discount and financing costs of $0.4 million.

Investing Activities

Our investing activities consist primarily of capital expenditures and investment purchases and maturities. We received $16.5 million and $8.4 million of cash from investing activities for the six-month periods ended June 30, 2015 and 2014, respectively. The receipt of cash of $16.5 million from investing activities for the six-month period ended June 30, 2015 was due primarily to net sales and maturities of investments of $18.1 million, partially offset by net purchases of property and equipment of $1.7 million. The receipt of cash of $8.4 million from investing activities for the six-month period ended June 30, 2014 was due primarily to net maturities of investments of $9.3 million, partially offset by purchases of property and equipment of $0.9 million.

Financing Activities

We received $4.4 million and $23.3 million of cash from financing activities during the six-month periods ended June 30, 2015 and 2014, respectively. The receipt of cash of $4.4 million from financing activities during the six-month period ended June 30, 2015 was due primarily to $3.0 million from the issuance of common stock through our equity compensation plans and net proceeds of $1.4 million from our common stock “at-the-market” offering program. The receipt of cash of $23.3 million from financing activities during the six-month period ended June 30, 2014 was due primarily to net proceeds of $20.6 million from our common stock “at-the-market” offering program and $2.7 million from the issuance of common stock through our equity compensation plans. As of June 30, 2015, $28.5 million of common stock remained available for future sales under our common stock “at-the-market” offering program; however, we are not obligated to make any sales under this program.

18

Capital Resources

In November 2014, we filed a shelf registration statement on Form S-3 with the SEC pursuant to which we may, from time to time, sell up to an aggregate of $150 million of our common stock, preferred stock, depositary shares, warrants, units or debt securities. On November 21, 2014, the registration statement was declared effective by the SEC, which will allow us to access the capital markets for the three-year period following the effective date. As of June 30, 2015, $28.5 million of common stock remained available for future sales under our common stock “at-the-market” offering program; however, we are not obligated to make any sales under this program.

Debt Facility Agreement

Under the terms of our February 2013 debt agreement with Deerfield (the “Facility Agreement”), we received $20.5 million and we issued promissory notes in the aggregate principal amount of $20.5 million (the “Notes”). The Notes bear simple interest at a rate of 8.75% per annum, payable quarterly in arrears commencing on April 1, 2013 and on the first business day of each January, April, July and October thereafter. We received net proceeds of $20.0 million, representing $20.5 million of gross proceeds, less a $500,000 facility fee, before deducting other expenses of the transaction.

The Facility Agreement also contains various representations and warranties, and affirmative and negative covenants, customary for financings of this type, including restrictions on our ability to incur additional indebtedness or liens on our assets, except as permitted under the Facility Agreement. In addition, the Facility Agreement requires us to maintain consolidated cash and cash equivalents on the last day of each calendar quarter of not less than $2.0 million. As security for our repayment of our obligations under the Facility Agreement, we granted a security interest in substantially all of our property and interests in property.

Contractual Obligations

In March 2015, we entered into lease amendments with respect to our seven Menlo Park headquarters real property leases, which provide for, among other things, extensions of the periods for our delivery of option notices with respect to extended terms, as well as a rent abatement for a certain period of time.

As discussed in Note 8. Subsequent Events, on July 23, 2015, we entered into a lease amendment agreement (the “Lease Amendment Agreement”) relating to our seven Menlo Park headquarters real property leases, which provides for, among other things, amendments of the term for certain of the existing leases, the termination of all renewal, expansion and extension rights contained in any of the existing leases (including our options to extend the terms for certain of the existing leases for two consecutive five-year periods), as well as rent abatement for a specified period of time. As consideration for our agreement to amend the existing leases pursuant to the Lease Amendment Agreement, and subject to the terms and conditions contained therein, we shall be eligible to receive up to four payments of $5,000,000 each from the landlord over time, and rent abatement through September 2017. The terms of the Lease Amendment Agreement are contingent on us obtaining or waiving receipt of architectural approval and a change of use permit (the “Use CUPS”) with respect to our proposed new premises located at 1315 O’Brien Drive, Menlo Park, California (the “O’Brien Premises”) by September 30, 2015.

On July 22, 2015, we entered into a new lease agreement (the “O’Brien Lease”) with respect to the O’Brien Premises. The term of the O’Brien Lease is one hundred thirty-two (132) months, commencing on the date that is the later of April 15, 2016 or the date O’Brien Premises landlord has substantially completed certain shell improvements and tenant improvements. Base monthly rent shall be abated for the first six (6) months of the lease term and thereafter will be $540,000 per month during the first year of the lease term, with specified annual increases thereafter until reaching $711,000 per month during the last twelve (12) months of the lease term. We are required to pay $2,340,000 in prepaid rent which will be applied to the monthly rent installments due for the first to fourth months, and the operating expenses for the first month, after the rent abatement period. The landlord is obligated to construct certain shell improvements at the landlord’s cost and expense and provide us with improvement allowances in the amount of $70.00 per rentable square foot of the O’Brien Premises, which may be applied towards the costs of construction of the initial improvements in the O’Brien Premises.

Under the O’Brien Lease, we expect to pay approximately $80 million in rent and $24 million in operating expenses over the expected lease term. In addition to the lease payments, we are also required to reimburse the landlord for certain improvement costs in excess of the tenant improvement allowances provided. These improvement costs, along with the costs associated with the anticipated move to the O’Brien Premises, are expected to be substantial in nature.

We have reserved the right to terminate the O’Brien Lease if the Use CUPs are not obtained by September 30, 2015, and the landlord has a similar right to terminate the lease for the O’Brien Premises for failure to obtain the Use CUPs.

Off-Balance Sheet Arrangements

As of June 30, 2015, we did not have any off-balance sheet arrangements.

In the ordinary course of business, we enter into standard indemnification arrangements. Pursuant to these arrangements, we indemnify, hold harmless, and agree to reimburse the indemnified parties for losses suffered or incurred by the indemnified party in

19

connection with any trade secret, copyright, patent or other intellectual property infringement claim by any third party with respect to its technology, or from claims relating to our performance or non-performance under a contract, any defective products supplied by us, or any negligent acts or omissions, or willful misconduct, committed by us or any of our employees, agents or representatives. The term of these indemnification agreements is generally perpetual after the execution of the agreement. The maximum potential amount of future payments we could be required to make under these agreements is not determinable because it involves claims that may be made against us in future periods, but have not yet been made. To date, we have not incurred costs to defend lawsuits or settle claims related to these indemnification agreements.

We also enter and have entered into indemnification agreements with our directors and officers that may require us to indemnify them against liabilities that arise by reason of their status or service as directors or officers, except as prohibited by applicable law. In addition, we may have obligations to hold harmless and indemnify third parties involved with our fund raising efforts and their respective affiliates, directors, officers, employees, agents or other representatives against any and all losses, claims, damages and liabilities related to claims arising against such parties pursuant to the terms of agreements entered into between such third parties and the Company in connection with such fund raising efforts. No additional liability associated with such indemnification agreements has been recorded as of June 30, 2015.

20

Item 3.Quantitative and Qualitative Disclosures About Market Risk