Form 10-Q MOMENTA PHARMACEUTICALS For: Sep 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

(MARK ONE)

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2016

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from to

Commission File Number 000-50797

Momenta Pharmaceuticals, Inc.

(Exact Name of Registrant as Specified in Its Charter)

Delaware | 04-3561634 | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

675 West Kendall Street, Cambridge, MA | 02142 | |

(Address of Principal Executive Offices) | (Zip Code) | |

(617) 491-9700

(Registrant’s Telephone Number, Including Area Code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x | Accelerated filer ¨ | |

Non-accelerated filer ¨ | Smaller reporting company ¨ | |

(Do not check if a smaller reporting company) | ||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of October 31, 2016, there were 71,021,528 shares of the registrant’s common stock, par value $0.0001 per share, outstanding.

MOMENTA PHARMACEUTICALS, INC.

Page | ||

Our logo, trademarks and service marks are the property of Momenta Pharmaceuticals, Inc. Other trademarks or service marks appearing in this Quarterly Report on Form 10-Q are the property of their respective holders.

2

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Statements contained in this Quarterly Report on Form 10-Q that are about future events or future results, or are otherwise not statements of historical fact, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements are based on current expectations, estimates, forecasts, projections, intentions, goals, strategies, plans, prospects and the beliefs and assumptions of our management. In some cases, these statements can be identified by words such as “anticipate,” “approach,” “believe,” “can,” “contemplate,” “continue,” “could,” “ensure,” “estimate,” “expect,” “intend,” “likely,” “may,” “might,” “objective,” “opportunity,” “plan,” “potential”, “predict,” “project,” “pursue,” “seek,” “schedule,” “should,” “strategy,” “target,” “typically,” “will,” “would,” and other similar words or expressions, or the negative of these words or similar words or expressions. These statements include, but are not limited to, statements regarding our expectations regarding the development and utility of our products and product candidates; development, manufacture and commercialization of our products and product candidates; efforts to seek and manage relationships with collaboration partners, including without limitation for our biosimilar programs; the timing of clinical trials and the availability of results; the timing of launch of products and product candidates; GLATOPA® (glatiramer acetate injection) market share, market potential and product revenues; M356 launch timing and market potential; the timing, merits, strategy, impact and outcome of litigation and legal proceedings; collaboration revenues and research and development revenues; manufacturing, including but not limited to our intent to rely on contract manufacturers; regulatory filings, reviews and approvals; the sufficiency of our current capital resources and projected milestone payments and product revenues for future operations; our future financial position, including but not limited to our future operating losses, our potential future profitability, our future expenses, the composition and mix of our cash, cash equivalents and marketable securities, our future revenues and our future liabilities; our funding transactions and our intended uses of proceeds thereof; Enoxaparin Sodium Injection product revenues and market potential; product candidate development costs; receipt of contingent milestone payments; accounting policies, estimates and judgments; our estimates regarding the fair value of our investment portfolio; the market risk of our cash equivalents, marketable securities, and derivative, foreign currency and other financial instruments; rights, obligations, terms, conditions and allocation of responsibilities and decision making under our collaboration agreements; the regulatory pathway for biosimilars; our strategy, including but not limited to our regulatory strategy, and scientific approach; the importance of key customer distribution arrangements; market potential and acceptance of our products and product candidates; future capital requirements; reliance on our collaboration partners and other third parties; the competitive landscape; changes in, impact of and compliance with laws, rules and regulations; product reimbursement policies and trends; pricing of pharmaceutical products, including our products and product candidates; our stock price; our intellectual property strategy and position; sufficiency of insurance; attracting and retaining qualified personnel; our internal controls and procedures; acquisitions or investments in companies, products and technologies; entering into license arrangements; marketing plans; financing our planned operating and capital expenditure; leasing additional facilities; materials used in our research and development; transfer of regulatory, development, manufacturing and commercialization activities and related records for M923; the assignment of third party agreements relating to M923; the grant of licenses and the payment of a royalty on net sales relating to M923; Baxalta’s continuing to perform development and manufacturing activities for M923; dilution; royalty rates; and vesting of equity awards.

Any forward-looking statements in this Quarterly Report on Form 10-Q involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements. Important factors that may cause actual results to differ materially from current expectations include, among other things, those listed under Part II, Item 1A. “Risk Factors” and discussed elsewhere in this Quarterly Report on Form 10-Q. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Except as required by law, we assume no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future.

3

PART I. FINANCIAL INFORMATION

Item 1. FINANCIAL STATEMENTS

MOMENTA PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except per share amounts)

(unaudited)

September 30, 2016 | December 31, 2015 | ||||||

Assets | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 106,279 | $ | 61,461 | |||

Marketable securities | 202,679 | 288,583 | |||||

Collaboration receivable | 45,752 | 21,185 | |||||

Prepaid expenses and other current assets | 4,816 | 3,479 | |||||

Total current assets | 359,526 | 374,708 | |||||

Property and equipment, net | 20,976 | 21,896 | |||||

Restricted cash | 21,761 | 20,660 | |||||

Intangible assets, net | 5,478 | 3,528 | |||||

Other long-term assets | 1,369 | 248 | |||||

Total assets | $ | 409,110 | $ | 421,040 | |||

Liabilities and Stockholders’ Equity | |||||||

Current liabilities: | |||||||

Accounts payable | $ | 9,801 | $ | 4,053 | |||

Accrued expenses | 16,539 | 24,499 | |||||

Deferred revenue | 21,740 | 9,770 | |||||

Other current liabilities | 83 | 460 | |||||

Total current liabilities | 48,163 | 38,782 | |||||

Deferred revenue, net of current portion | 33,310 | 12,213 | |||||

Other long-term liabilities | 1,858 | 69 | |||||

Total liabilities | 83,331 | 51,064 | |||||

Commitments and contingencies (Note 8) | |||||||

Stockholders’ Equity: | |||||||

Preferred stock, $0.01 par value per share; 5,000 shares authorized, 100 shares of Series A Junior Participating Preferred Stock, $0.01 par value per share designated and no shares issued and outstanding | — | — | |||||

Common stock, $0.0001 par value per share; 100,000 shares authorized, 71,246 shares issued and 71,017 shares outstanding at September 30, 2016 and 69,077 shares issued and 68,958 outstanding at December 31, 2015 | 7 | 7 | |||||

Additional paid-in capital | 843,549 | 824,385 | |||||

Accumulated other comprehensive income | 250 | 4 | |||||

Accumulated deficit | (514,914 | ) | (452,372 | ) | |||

Treasury stock, at cost, 229 shares at September 30, 2016 and 119 shares at December 31, 2015 | (3,113 | ) | (2,048 | ) | |||

Total stockholders’ equity | 325,779 | 369,976 | |||||

Total liabilities and stockholders’ equity | $ | 409,110 | $ | 421,040 | |||

The accompanying notes are an integral part of these unaudited, condensed consolidated financial statements.

4

MOMENTA PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(in thousands, except per share amounts)

(unaudited)

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2016 | 2015 | 2016 | 2015 | ||||||||||||

Collaboration revenues: | |||||||||||||||

Product revenue | $ | 23,339 | $ | 8,666 | $ | 58,831 | $ | 30,693 | |||||||

Research and development revenue | 5,805 | 5,129 | 16,593 | 36,565 | |||||||||||

Total collaboration revenue | 29,144 | 13,795 | 75,424 | 67,258 | |||||||||||

Operating expenses: | |||||||||||||||

Research and development* | 31,568 | 31,733 | 93,498 | 88,466 | |||||||||||

General and administrative* | 15,758 | 12,459 | 46,301 | 33,678 | |||||||||||

Total operating expenses | 47,326 | 44,192 | 139,799 | 122,144 | |||||||||||

Operating loss | (18,182 | ) | (30,397 | ) | (64,375 | ) | (54,886 | ) | |||||||

Other income | 638 | 347 | 1,833 | 737 | |||||||||||

Net loss | $ | (17,544 | ) | $ | (30,050 | ) | $ | (62,542 | ) | $ | (54,149 | ) | |||

Basic and diluted net loss per share | $ | (0.26 | ) | $ | (0.44 | ) | $ | (0.91 | ) | $ | (0.88 | ) | |||

Weighted average shares used in computing basic and diluted net loss per share | 68,799 | 68,004 | 68,540 | 61,442 | |||||||||||

Comprehensive loss: | |||||||||||||||

Net loss | $ | (17,544 | ) | $ | (30,050 | ) | $ | (62,542 | ) | $ | (54,149 | ) | |||

Net unrealized holding (losses) gains on available-for-sale marketable securities | (36 | ) | (4 | ) | 246 | 32 | |||||||||

Comprehensive loss | $ | (17,580 | ) | $ | (30,054 | ) | $ | (62,296 | ) | $ | (54,117 | ) | |||

* Non-cash share-based compensation expense included in operating expenses is as follows:

Research and development | $ | 2,042 | $ | 2,122 | $ | 6,426 | $ | 3,031 | |||||||

General and administrative | $ | 2,897 | $ | 2,435 | $ | 8,330 | $ | 3,756 | |||||||

The accompanying notes are an integral part of these unaudited, condensed consolidated financial statements.

5

MOMENTA PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

Nine Months Ended September 30, | |||||||

2016 | 2015 | ||||||

Cash Flows from Operating Activities: | |||||||

Net loss | $ | (62,542 | ) | $ | (54,149 | ) | |

Adjustments to reconcile net loss to net cash used in operating activities: | |||||||

Depreciation and amortization | 5,726 | 5,799 | |||||

Share-based compensation expense | 14,756 | 6,787 | |||||

Amortization of premium on investments | 524 | 987 | |||||

Amortization of intangibles | 1,240 | 796 | |||||

Changes in operating assets and liabilities: | |||||||

Collaboration receivable | (24,567 | ) | (2,693 | ) | |||

Prepaid expenses and other current assets | (1,337 | ) | 136 | ||||

Restricted cash | (1,101 | ) | 59 | ||||

Other long-term assets | (1,121 | ) | — | ||||

Accounts payable | 5,748 | (1,714 | ) | ||||

Accrued expenses | (7,960 | ) | 3,779 | ||||

Deferred revenue | 33,067 | (6,572 | ) | ||||

Other current liabilities | (377 | ) | 25 | ||||

Other long-term liabilities | 1,789 | (422 | ) | ||||

Net cash used in operating activities | (36,155 | ) | (47,182 | ) | |||

Cash Flows from Investing Activities: | |||||||

Purchases of property and equipment | (4,806 | ) | (2,747 | ) | |||

Purchases of marketable securities | (264,905 | ) | (281,500 | ) | |||

Proceeds from maturities of marketable securities | 350,531 | 105,844 | |||||

Net cash provided by (used in) investing activities | 80,820 | (178,403 | ) | ||||

Cash Flows from Financing Activities: | |||||||

Proceeds from public offering of common stock, net of issuance costs | — | 148,439 | |||||

Net proceeds from issuance of common stock under ATM facilities | — | 64,503 | |||||

Proceeds from issuance of common stock under stock plans | 1,218 | 23,329 | |||||

Repurchase of common stock pursuant to share surrender | (1,065 | ) | (2,048 | ) | |||

Net cash provided by financing activities | 153 | 234,223 | |||||

Increase in cash and cash equivalents | 44,818 | 8,638 | |||||

Cash and cash equivalents, beginning of period | 61,461 | 61,349 | |||||

Cash and cash equivalents, end of period | $ | 106,279 | $ | 69,987 | |||

Non-Cash Investing Activity: | |||||||

Common shares issued to Parivid to settle milestone payment | $ | 3,190 | $ | — | |||

The accompanying notes are an integral part of these unaudited, condensed consolidated financial statements.

6

MOMENTA PHARMACEUTICALS, INC.

NOTES TO UNAUDITED, CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1. The Company

Business

Momenta Pharmaceuticals, Inc., or the Company or Momenta, was incorporated in the state of Delaware in May 2001 and began operations in early 2002. Its facilities are located in Cambridge, Massachusetts. Momenta is a biotechnology company focused on developing generic versions of complex drugs, biosimilars and novel therapeutics for autoimmune diseases. The Company presently derives all of its revenue from its collaborations.

2. Summary of Significant Accounting Policies

Basis of Presentation and Principles of Consolidation

The Company’s accompanying condensed consolidated financial statements are unaudited and have been prepared in accordance with accounting principles generally accepted in the United States of America, or GAAP, applicable to interim periods and, in the opinion of management, include all normal and recurring adjustments that are necessary to state fairly the results of operations for the reported periods. The Company’s condensed consolidated financial statements have also been prepared on a basis substantially consistent with, and should be read in conjunction with, the Company’s audited consolidated financial statements for the year ended December 31, 2015, which were included in the Company’s Annual Report on Form 10-K that was filed with the Securities and Exchange Commission, or SEC, on February 26, 2016. The year-end condensed consolidated balance sheet data was derived from audited financial statements, but does not include all disclosures required by GAAP. The results of the Company’s operations for any interim period are not necessarily indicative of the results of the Company’s operations for any other interim period or for a full fiscal year.

The accompanying condensed consolidated financial statements reflect the operations of the Company and the Company’s wholly-owned subsidiary, Momenta Pharmaceuticals Securities Corporation. All significant intercompany accounts and transactions have been eliminated.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. On an ongoing basis, the Company evaluates its estimates and judgments, including those related to revenue recognition, accrued expenses, and share-based payments. The Company bases its estimates on historical experience and on various other assumptions that are believed to be reasonable, the results of which form the basis for making judgments about the carrying values of assets and liabilities. Actual results could differ from those estimates.

Revenue Recognition

The Company recognizes revenue when persuasive evidence of an arrangement exists; services have been performed or products have been delivered; the fee is fixed or determinable; and collection is reasonably assured.

The Company has entered into collaboration and license agreements with pharmaceutical companies for the development and commercialization of certain of its product candidates. The Company’s performance obligations under the terms of these agreements may include (i) transfer of intellectual property rights (licenses), (ii) providing research and development services, and (iii) participation on joint steering committees with the collaborators. Non-refundable payments to the Company under these agreements may include up-front license fees, payments for research and development activities, payments based upon the achievement of defined collaboration objectives and profit share or royalties on product sales.

At September 30, 2016, the Company had collaboration and license agreements with Sandoz AG (formerly Sandoz N.V. and Biochemie West Indies, N.V.), an affiliate of Novartis Pharma AG, and Sandoz Inc. (formerly Geneva Pharmaceuticals, Inc.), collectively referred to as Sandoz; Sandoz AG; Baxalta U.S. Inc., Baxalta GmbH and Baxalta Incorporated, collectively referred to as Baxalta; and Mylan Ireland Limited, a wholly-owned, indirect subsidiary of Mylan N.V., or Mylan.

7

The Company evaluates multiple element agreements under the Financial Accounting Standards Board’s, or FASB, Accounting Standards Update, or ASU, No. 2009-13, Multiple-Deliverable Revenue Arrangements, or ASU 2009-13. When evaluating multiple element arrangements under ASU 2009-13, the Company identifies the deliverables included within the agreement and determines whether the deliverables under the arrangement represent separate units of accounting. Deliverables under the arrangement are a separate unit of accounting if (i) the delivered item has value to the customer on a standalone basis and (ii) if the arrangement includes a general right of return relative to the delivered item and delivery or performance of the undelivered items are considered probable and substantially within the Company’s control. This evaluation requires subjective determinations and requires management to make judgments about the individual deliverables and whether such deliverables are separable from the other aspects of the contractual relationship. In determining the units of accounting, management evaluates certain criteria, including whether the deliverables have standalone value, based on the consideration of the relevant facts and circumstances for each arrangement. The Company considers whether the collaborator can use the license or other deliverables for their intended purpose without the receipt of the remaining elements, and whether the value of the deliverable is dependent on the undelivered items and whether there are other vendors that can provide the undelivered items.

Arrangement consideration generally includes up-front license fees and non-substantive options to purchase additional products or services. The Company determines how to allocate arrangement consideration to identified units of accounting based on the selling price hierarchy provided under the relevant guidance. The Company determines the estimated selling price for deliverables using vendor-specific objective evidence, or VSOE, of selling price, if available, third-party evidence, or TPE, of selling price if VSOE is not available, or best estimate of selling price, or BESP, if neither VSOE nor TPE is available. Determining the BESP for a deliverable requires significant judgment. The Company uses BESP to estimate the selling price for licenses to the Company’s proprietary technology, since the Company often does not have VSOE or TPE of selling price for these deliverables. In those circumstances where the Company utilizes BESP to determine the estimated selling price of a license to the Company’s proprietary technology, the Company considers entity specific factors, including those factors contemplated in negotiating the agreements as well as the license fees negotiated in similar license arrangements. Management may be required to exercise considerable judgment in estimating the selling prices of identified units of accounting under its agreements. In validating the Company’s BESP, the Company evaluates whether changes in the key assumptions used to determine the BESP will have a significant effect on the allocation of arrangement consideration between multiple deliverables.

Up-Front License Fees

Up-front payments received in connection with licenses of the Company’s technology rights are deferred if facts and circumstances dictate that the license does not have stand-alone value. When management believes the license to its intellectual property does not have stand-alone value from the other deliverables to be provided in the arrangement, it is combined with other deliverables and the revenue of the combined unit of accounting is recorded based on the method appropriate for the last delivered item. The Company recognizes revenue from non-refundable, up-front license fees on a straight-line basis over the contracted or estimated period of performance, which is typically the period over which the research and development services are expected to occur. Accordingly, the Company is required to make estimates regarding the development timelines for product candidates being developed pursuant to any applicable agreement. The determination of the length of the period over which to recognize the revenue is subject to judgment and estimation and can have an impact on the amount of revenue recognized in a given period. Quarterly, the Company reassesses its period of substantial involvement over which the Company amortizes its up-front license fees and makes adjustments as appropriate. The Company’s estimates regarding the period of performance under its collaborative research and development and licensing agreements have changed in the past and may change in the future. Any change in the Company’s estimates could result in changes to the Company’s results for the period over which the revenues from an up-front license fee are recognized.

Milestones

At the inception of each arrangement that includes milestone payments, the Company evaluates whether each milestone is substantive, in accordance with ASU No. 2010-17, Revenue Recognition—Milestone Method. A milestone is defined as an event that can only be achieved based on the Company’s performance, and there is substantive uncertainty about whether the event will be achieved at the inception of the arrangement. Events that are contingent only on the passage of time or only on counterparty performance are not considered milestones under accounting guidance. This evaluation includes an assessment of whether (a) the consideration is commensurate with either (1) the Company’s performance to achieve the milestone, or (2) the enhancement of the value of the delivered item(s) as a result of a specific outcome resulting from the Company’s performance to achieve the milestone, (b) the consideration relates solely to past performance (c) the consideration is reasonable relative to all of the deliverables and payment terms within the arrangement and (d) the milestone fee is refundable or adjusts based on future performance or non-performance. The Company evaluates factors such as the scientific, clinical, regulatory, commercial and other risks that must be overcome to achieve the respective milestone, the level of effort and investment required to achieve the respective milestone and whether the milestone consideration is reasonable relative to all deliverables and payment terms in

8

the arrangement in making this assessment. Payments that are contingent upon the achievement of a substantive milestone are recognized in their entirety in the period in which the milestone is achieved, assuming all other revenue recognition criteria are met.

Sales-based and commercial milestones are accounted for as royalties and are recorded as revenue upon achievement of the milestone, assuming all other revenue recognition criteria are met.

Profit Share and Royalties on Sandoz’ Sales of Enoxaparin Sodium Injection® and GLATOPA®

Profit share and royalty revenue is reported as product revenue and is recognized based upon net sales or contractual profit of licensed products in licensed territories in the period the sales occur as provided by the collaboration agreement. The amount of net sales or contractual profit is determined based on amounts provided by the collaborator and involve the use of estimates and judgments, such as product sales allowances and accruals related to prompt payment discounts, chargebacks, governmental and other rebates, distributor, wholesaler and group purchasing organizations fees, product returns, and co-payment assistance costs, which could be adjusted based on actual results in the future. The Company is highly dependent on its collaborators for timely and accurate information regarding any net revenues realized from sales of Enoxaparin Sodium Injection and GLATOPA in order to accurately report its results of operations.

Research and Development Revenue under Collaborations with Sandoz and Baxalta

Under its collaborations with Sandoz and Baxalta, the Company is reimbursed at a contractual full-time equivalent, or FTE, rate for any FTE employee expenses as well as any external costs incurred for commercial and related activities. The Company recognizes research and development revenue from FTE services and external costs upon completion of the performance requirements (i.e., as the services are performed and the reimbursable costs are incurred). Revenues are recorded on a gross basis as the Company contracts directly with, manages the work of and is responsible for payments to third-party vendors for such commercial and related services.

Collaboration Receivable

Collaboration receivable represents:

• | Amounts due to the Company for profit share on Sandoz’ sales of Enoxaparin Sodium Injection and GLATOPA; |

• | Amounts due to the Company for reimbursement of research and development services and external costs under the collaborations with Sandoz and Baxalta; and |

• | The net amount due from Mylan for its 50% share of collaboration expenses under the cost-sharing arrangement. |

The Company has not recorded any allowance for uncollectible accounts or bad debt write-offs and it monitors its receivables to facilitate timely payment.

Deferred Revenue

Deferred revenue represents consideration received from collaborators in advance of achieving certain criteria that must be met for revenue to be recognized in conformity with GAAP.

Net Loss Per Common Share

The Company computes basic net loss per common share by dividing net loss by the weighted average number of common shares outstanding, which includes common stock issued and outstanding and excludes unvested shares of restricted common stock. The Company computes diluted net loss per common share by dividing net loss by the weighted average number of common shares and potential shares from outstanding stock options and unvested restricted stock determined by applying the treasury stock method.

The following table presents anti-dilutive shares for the three and nine months ended September 30, 2016 and 2015 (in thousands):

9

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||

2016 | 2015 | 2016 | 2015 | ||||||||

Weighted-average anti-dilutive shares related to: | |||||||||||

Outstanding stock options | 6,826 | 2,690 | 6,880 | 4,341 | |||||||

Restricted stock awards | 1,500 | 457 | 1,052 | 547 | |||||||

Since the Company had a net loss for all periods presented, the effect of all potentially dilutive securities is anti-dilutive. Accordingly, basic and diluted net loss per share is the same for the three and nine months ended September 30, 2016 and 2015. Anti-dilutive shares comprise the impact of the number of shares that would have been dilutive had the Company had net income plus the number of common stock equivalents that would be anti-dilutive had the Company had net income. Furthermore, 1,439,985 performance-based restricted common stock awards that were granted between April and September 30, 2016 had not vested as of September 30, 2016, and were excluded from diluted shares outstanding as the vesting conditions for the awards, discussed further in Note 6 “Share-Based Payments - Restricted Stock Awards,” had not been met as of September 30, 2016.

Fair Value Measurements

The tables below present information about the Company’s assets that are regularly measured and carried at fair value as of September 30, 2016 and December 31, 2015, and indicate the level within the fair value hierarchy of the valuation techniques utilized to determine such fair value (in thousands):

Description | Balance as of September 30, 2016 | Quoted Prices in Active Markets (Level 1) | Significant Other Observable Inputs (Level 2) | Significant Other Unobservable Inputs (Level 3) | ||||||||||||

Assets: | ||||||||||||||||

Cash equivalents: | ||||||||||||||||

Money market funds and overnight repurchase agreements | $ | 103,808 | $ | 80,808 | $ | 23,000 | $ | — | ||||||||

Marketable securities: | ||||||||||||||||

Corporate debt securities | 14,170 | — | 14,170 | — | ||||||||||||

Commercial paper obligations | 88,010 | — | 88,010 | — | ||||||||||||

Asset-backed securities | 100,499 | — | 100,499 | — | ||||||||||||

Total | $ | 306,487 | $ | 80,808 | $ | 225,679 | $ | — | ||||||||

Description | Balance as of December 31, 2015 | Quoted Prices in Active Markets (Level 1) | Significant Other Observable Inputs (Level 2) | Significant Other Unobservable Inputs (Level 3) | ||||||||||||

Assets: | ||||||||||||||||

Cash equivalents: | ||||||||||||||||

Money market funds and overnight repurchase agreements | $ | 54,077 | $ | 30,077 | $ | 24,000 | $ | — | ||||||||

Marketable securities: | ||||||||||||||||

U.S. government-sponsored enterprise securities | 24,290 | — | 24,290 | — | ||||||||||||

Corporate debt securities | 73,651 | — | 73,651 | — | ||||||||||||

Commercial paper obligations | 125,805 | — | 125,805 | — | ||||||||||||

Asset-backed securities | 64,837 | — | 64,837 | — | ||||||||||||

Total | $ | 342,660 | $ | 30,077 | $ | 312,583 | $ | — | ||||||||

10

There have been no impairments of the Company’s assets measured and carried at fair value during the three and nine months ended September 30, 2016 and 2015. In addition, there were no changes in valuation techniques or transfers between the fair value measurement levels during the three and nine months ended September 30, 2016. The fair value of Level 2 instruments classified as marketable securities were determined through third party pricing services. For a description of the Company’s validation procedures related to prices provided by third party pricing services, refer to Note 2 “Summary of Significant Accounting Policies: Fair Value Measurements” to the Company’s consolidated financial statements in its Annual Report on Form 10-K for the year ended December 31, 2015. The carrying amounts reflected in the Company’s accompanying condensed consolidated balance sheets for cash, accounts receivable, unbilled receivables, other current assets, accounts payable and accrued expenses approximate fair value due to their short-term maturities.

Cash, Cash Equivalents and Marketable Securities

The Company’s cash equivalents are primarily composed of money market funds carried at fair value, which approximate cost at September 30, 2016 and December 31, 2015. The Company classifies corporate debt securities, commercial paper, asset-backed securities and U.S. government-sponsored enterprise securities as short-term and long-term marketable securities in its consolidated financial statements. See Note 2 “Summary of Significant Accounting Policies: Cash, Cash Equivalents and Marketable Securities” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2015 for a discussion of the Company’s accounting policies.

The following tables summarize the Company’s cash, cash equivalents and marketable securities as of September 30, 2016 and December 31, 2015 (in thousands):

As of September 30, 2016 | Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Fair Value | ||||||||||||

Cash, money market funds and overnight repurchase agreements | $ | 106,279 | $ | — | $ | — | $ | 106,279 | ||||||||

Corporate debt securities due in one year or less | 14,172 | 2 | (4 | ) | 14,170 | |||||||||||

Commercial paper obligations due in one year or less | 87,773 | 237 | — | 88,010 | ||||||||||||

Asset-backed securities due in one year or less | 100,484 | 16 | (1 | ) | 100,499 | |||||||||||

Total | $ | 308,708 | $ | 255 | $ | (5 | ) | $ | 308,958 | |||||||

Reported as: | ||||||||||||||||

Cash and cash equivalents | $ | 106,279 | $ | — | $ | — | $ | 106,279 | ||||||||

Marketable securities | 202,429 | 255 | (5 | ) | 202,679 | |||||||||||

Total | $ | 308,708 | $ | 255 | $ | (5 | ) | $ | 308,958 | |||||||

11

As of December 31, 2015 | Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Fair Value | ||||||||||||

Cash, money market funds and overnight repurchase agreements | $ | 61,461 | $ | — | $ | — | $ | 61,461 | ||||||||

U.S. government-sponsored enterprise securities due in one year or less | 24,285 | 5 | — | 24,290 | ||||||||||||

Corporate debt securities due in one year or less | 73,735 | 1 | (84 | ) | 73,652 | |||||||||||

Commercial paper obligations due in one year or less | 125,693 | 120 | (8 | ) | 125,805 | |||||||||||

Asset-backed securities due in one year or less | 64,866 | — | (30 | ) | 64,836 | |||||||||||

Total | $ | 350,040 | $ | 126 | $ | (122 | ) | $ | 350,044 | |||||||

Reported as: | ||||||||||||||||

Cash and cash equivalents | $ | 61,461 | $ | — | $ | — | $ | 61,461 | ||||||||

Marketable securities | 288,579 | 126 | (122 | ) | 288,583 | |||||||||||

Total | $ | 350,040 | $ | 126 | $ | (122 | ) | $ | 350,044 | |||||||

At September 30, 2016 and December 31, 2015, the Company held 11 and 66 marketable securities, respectively, that were in a continuous unrealized loss position for less than one year. At September 30, 2016 and December 31, 2015, there were no securities in a continuous unrealized loss position for greater than one year. The Company believes the unrealized losses were caused by fluctuations in interest rates.

The following table summarizes the aggregate fair value of these securities as of September 30, 2016 and December 31, 2015 (in thousands):

As of September 30, 2016 | As of December 31, 2015 | |||||||||||||||

Aggregate Fair Value | Unrealized Losses | Aggregate Fair Value | Unrealized Losses | |||||||||||||

Corporate debt securities due in one year or less | $ | 7,167 | $ | (4 | ) | $ | 70,657 | $ | (84 | ) | ||||||

Commercial paper obligations due in one year or less | $ | — | $ | — | $ | 33,734 | $ | (8 | ) | |||||||

Asset-backed securities due in one year or less | $ | 21,684 | $ | (1 | ) | $ | 61,337 | $ | (30 | ) | ||||||

Treasury Stock

Treasury stock represents common stock currently owned by the Company as a result of shares withheld from the vesting of performance-based restricted common stock to satisfy minimum tax withholding requirements.

Comprehensive Income (Loss)

Comprehensive income (loss) is the change in equity of a company during a period from transactions and other events and circumstances, excluding transactions resulting from investments by owners and distributions to owners. Comprehensive income (loss) includes net (loss) income and the change in accumulated other comprehensive income (loss) for the period. Accumulated other comprehensive income (loss) consists entirely of unrealized gains and losses on available-for-sale marketable securities for all periods presented.

New Accounting Pronouncements

In May 2014, the FASB issued ASU No. 2014-09, Revenue from Contracts with Customers (Topic 606), which supersedes all existing revenue recognition requirements, including most industry-specific guidance. The new standard requires a company to recognize revenue when it transfers goods or services to customers in an amount that reflects the consideration that the company expects to receive for those goods or services. In August 2015, the FASB issued ASU No. 2015-14, Revenue

12

from Contracts with Customers (Topic 606): Deferral of the Effective Date, which delayed the effective date of the new standard from January 1, 2017 to January 1, 2018. The FASB also agreed to allow entities to choose to adopt the standard as of the original effective date. In March 2016, the FASB issued ASU No. 2016-08, Revenue from Contracts with Customers (Topic 606): Principal versus Agent Considerations, which clarifies the implementation guidance on principal versus agent considerations. In April 2016, the FASB issued ASU No. 2016-10, Revenue from Contracts with Customers (Topic 606): Identifying Performance Obligations and Licensing, which clarifies certain aspects of identifying performance obligations and licensing implementation guidance. In May 2016, the FASB issued ASU No. 2016-12, Revenue from Contracts with Customers (Topic 606): Narrow-Scope Improvements and Practical Expedients related to disclosures of remaining performance obligations, as well as other amendments to guidance on collectibility, non-cash consideration and the presentation of sales and other similar taxes collected from customers. These standards have the same effective date and transition date of January 1, 2018. The Company is currently evaluating the method of adoption and the potential impact that these standards may have on its financial position and results of operations.

In August 2014, the FASB issued ASU No. 2014-15, Presentation of Financial Statements—Going Concern (Subtopic 205-40). The ASU requires all entities to evaluate for the existence of conditions or events that raise substantial doubt about the entity’s ability to continue as a going concern within one year after the issuance date of its financial statements. The accounting standard is effective for interim and annual periods after December 15, 2016, and will not have a material impact on the consolidated financial statements, but may impact the Company’s footnote disclosures regarding liquidity.

In November 2015, the FASB issued ASU No. 2015-17, Income Taxes, Balance Sheet Classification of Deferred Taxes (Topic 740). The new standard requires that deferred tax assets and liabilities be classified as noncurrent in a classified statement of financial position. The adoption of this standard in the first quarter of 2016 did not have a material impact on the Company’s financial position or results of operations as its net deferred tax assets have been fully offset by a valuation allowance.

In February 2016, the FASB issued ASU No. 2016-02, Leases (Topic 842). The new standard requires that all lessees recognize the assets and liabilities that arise from leases on the balance sheet and disclose qualitative and quantitative information about its leasing arrangements. The new standard will be effective for the Company on January 1, 2019. The Company is currently evaluating the impact of adopting this new accounting standard on its financial position and results of operations.

In March 2016, the FASB issued ASU No. 2016-09, Compensation-Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting. Under the new standard all excess tax benefits and tax deficiencies should be recognized as income tax expense or benefit in the income statement. The tax effects of exercised or vested awards should be treated as discrete items in the reporting period in which they occur. An entity also should recognize excess tax benefits regardless of whether the benefit reduces taxes payable in the current period. The new standard also provides for companies to make an entity-wide accounting policy election on how to account for award forfeitures. Entities can either estimate the number of awards that are expected to vest (current GAAP) or account for forfeitures when they occur. The accounting standard is effective for interim and annual periods after December 15, 2016. Early adoption is permitted for any entity in any interim or annual period. The Company is currently evaluating the impact of adopting this new accounting standard on its financial position and results of operations.

3. Intangible Assets

In April 2007, the Company entered into an asset purchase agreement with Parivid, LLC, or Parivid, a provider of data integration and analysis services, and S. Raguram, the principal owner of Parivid. Pursuant to the asset purchase agreement, the Company acquired certain of the assets and assumed certain of the liabilities of Parivid related to the acquired assets in exchange for $2.5 million in cash paid at closing and certain contingent milestone payments in a combination of cash and/or stock in the manner and on the terms and conditions set forth in the asset purchase agreement if certain milestones were achieved within fifteen years of the date of the asset purchase agreement. The asset purchase agreement was amended in August 2009 and in July 2011. Between 2009 and 2011, the Company made cash payments to Parivid of $7.3 million and issued 91,576 shares of its common stock valued at $10.92 per share to Parivid in satisfaction of certain Enoxaparin Sodium Injection-related milestones under the amended asset purchase agreement. As of June 18, 2016, the one-year anniversary of the commercial launch of GLATOPA, GLATOPA remained the sole generic COPAXONE 20 mg/mL product on the U.S. market, triggering the final milestone payment under the amended asset purchase agreement. In connection with the final milestone, in June 2016, the Company recorded an intangible asset and a non-current liability of $2.9 million. On August 10, 2016, the Company issued 265,605 shares of its common stock to Parivid to satisfy the GLATOPA-related milestone. The Company

13

recorded $3.2 million as an intangible asset based on the number of shares issued and the closing price of the Company’s common stock on the date the shares were issued to Parivid.

Intangible assets consist solely of the core developed technology assets acquired from Parivid. The intangible assets are being amortized using the straight-line method over the estimated useful life of GLATOPA of approximately six years through June 2021. As of September 30, 2016 and December 31, 2015, intangible assets, net of accumulated amortization, were as follows (in thousands):

September 30, 2016 | December 31, 2015 | |||||||||||||||||||||||

Gross Carrying Amount | Accumulated Amortization | Net Carrying Value | Gross Carrying Amount | Accumulated Amortization | Net Carrying Value | |||||||||||||||||||

Total intangible assets for core and developed technology and non-compete agreement | $ | 13,617 | $ | (8,139 | ) | $ | 5,478 | $ | 10,427 | $ | (6,899 | ) | $ | 3,528 | ||||||||||

The weighted-average amortization period for the Company’s intangible assets is six years. Amortization expense was approximately $0.3 million for each of the three months ended September 30, 2016 and 2015. Amortization expense was approximately $1.2 million and $0.8 million for the nine months ended September 30, 2016 and 2015, respectively.

The Company expects to incur amortization expense of approximately $1.2 million per year for each of the next four years and approximately $0.9 million in the fifth year.

4. Restricted Cash

The Company designated $17.5 million as collateral for a security bond posted in the litigation against Amphastar, International Medical Systems, Ltd., a wholly owned subsidiary of Amphastar Pharmaceuticals, Inc. and Actavis, Inc. (formerly Watson Pharmaceuticals, Inc.), or Actavis, as discussed within Note 8, “Commitments and Contingencies”. Amphastar, International Medical Systems, Ltd. and Amphastar Pharmaceuticals, Inc. are collectively referred to as Amphastar. The $17.5 million is held in an escrow account by Hanover Insurance. The Company classified this restricted cash as long-term as the timing of a final decision in the Enoxaparin Sodium Injection patent litigation is not known.

The Company designated $2.4 million as collateral for a letter of credit related to the lease of office and laboratory space located at 675 West Kendall Street in Cambridge, Massachusetts. This balance will remain restricted through April 2018 and therefore is classified as non-current in the Company’s consolidated balance sheet. The Company will earn interest on the balance.

The Company designated $0.7 million as collateral for a letter of credit related to the lease of office and laboratory space located at 320 Bent Street in Cambridge, Massachusetts. This balance will remain restricted through February 2027 and during any lease term extensions and therefore is classified as non-current in the Company’s consolidated balance sheet. The Company will earn interest on the balance.

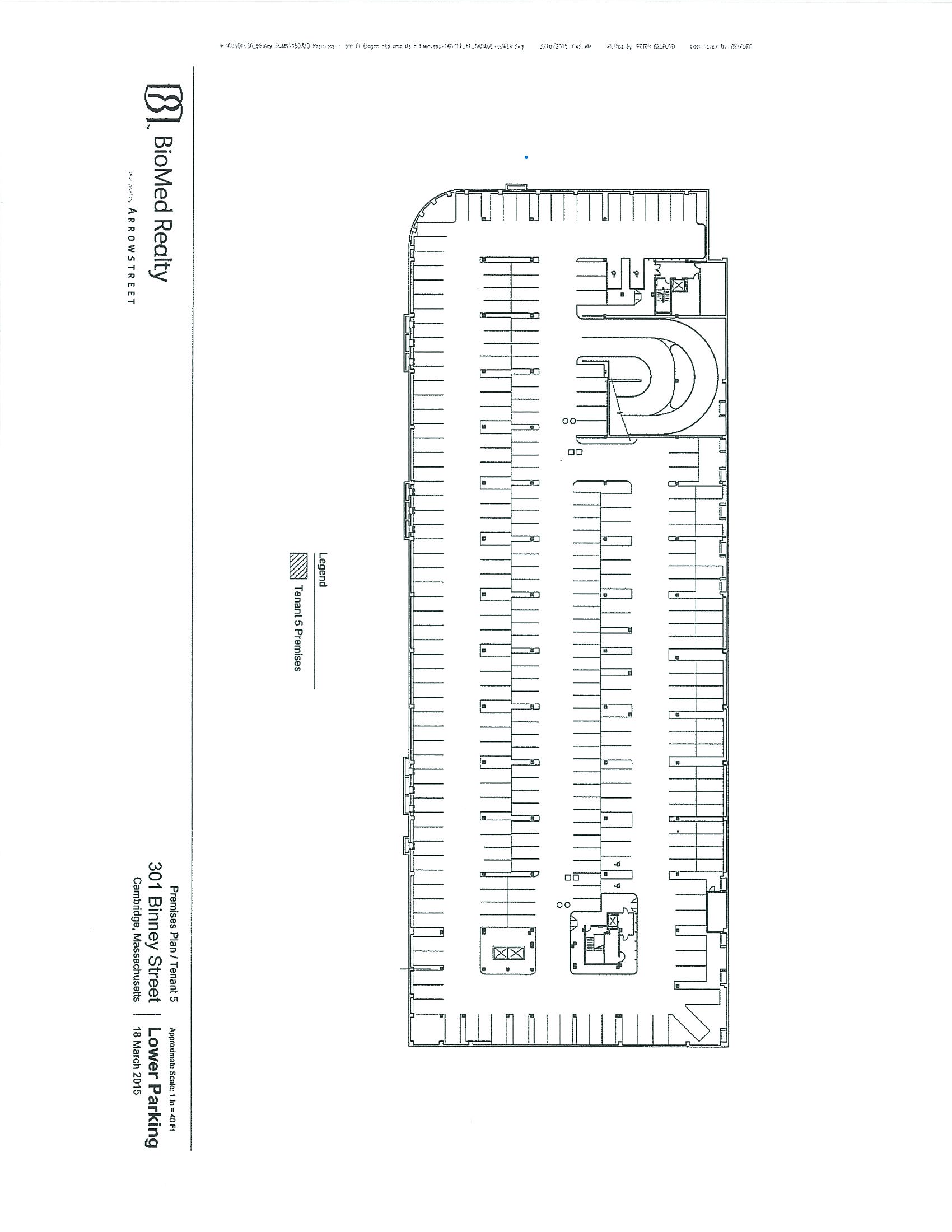

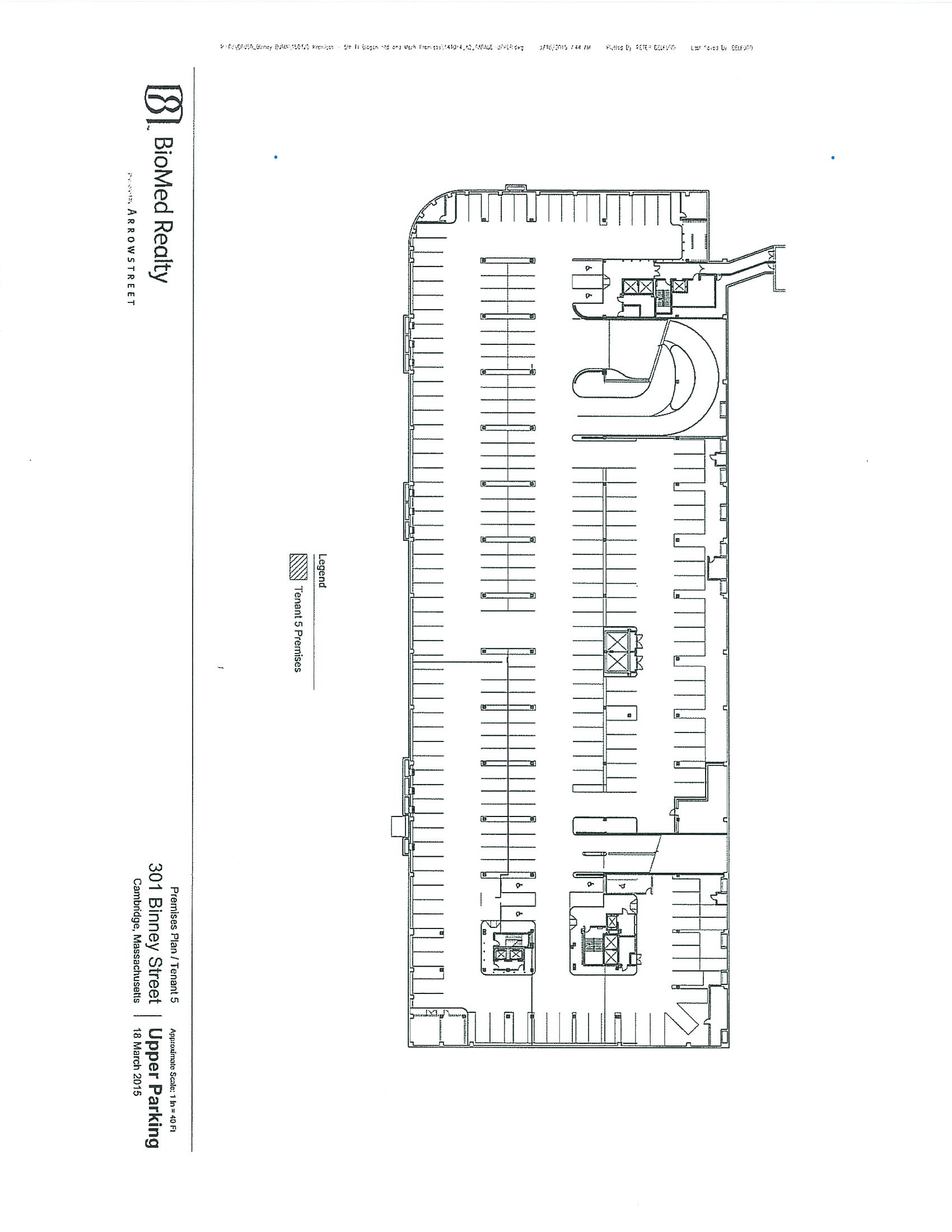

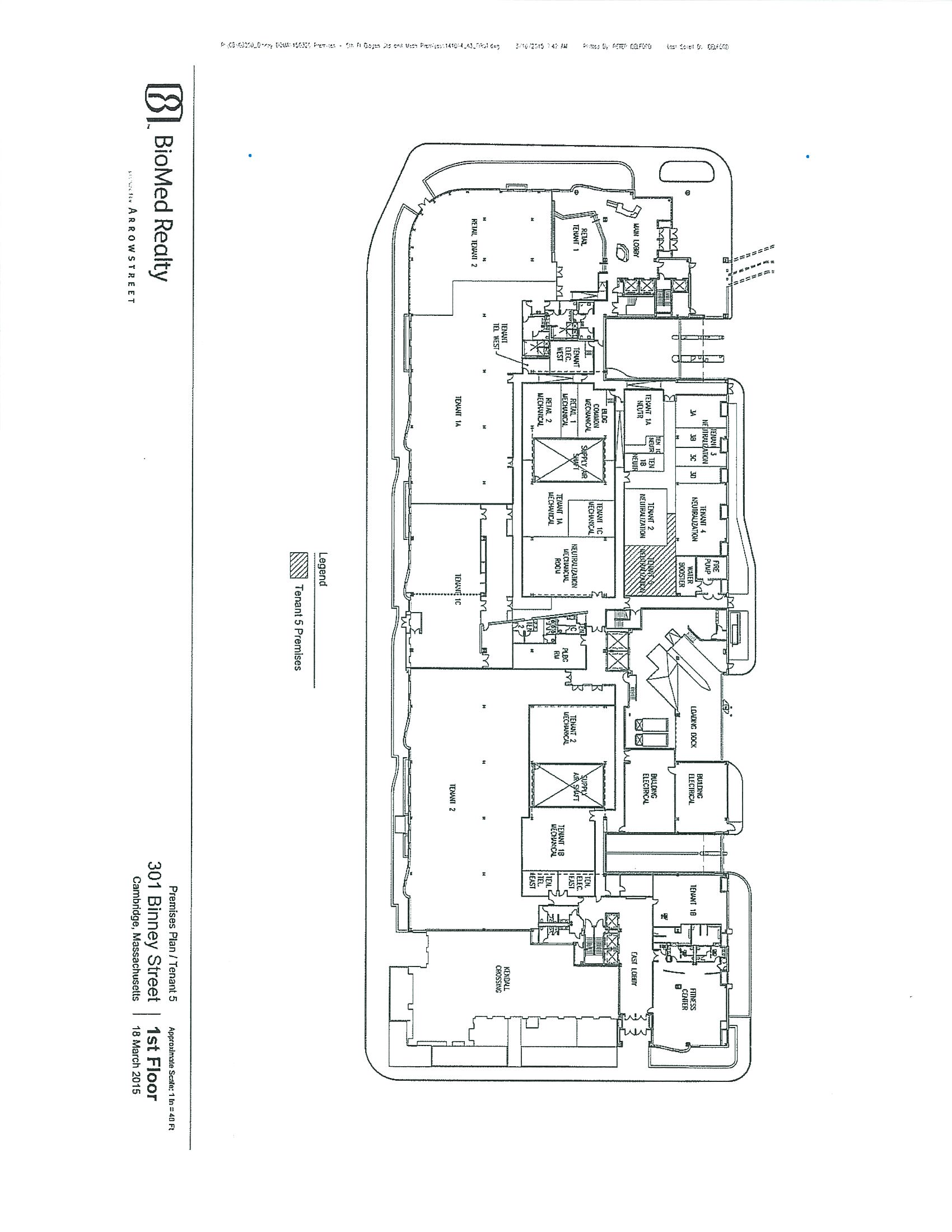

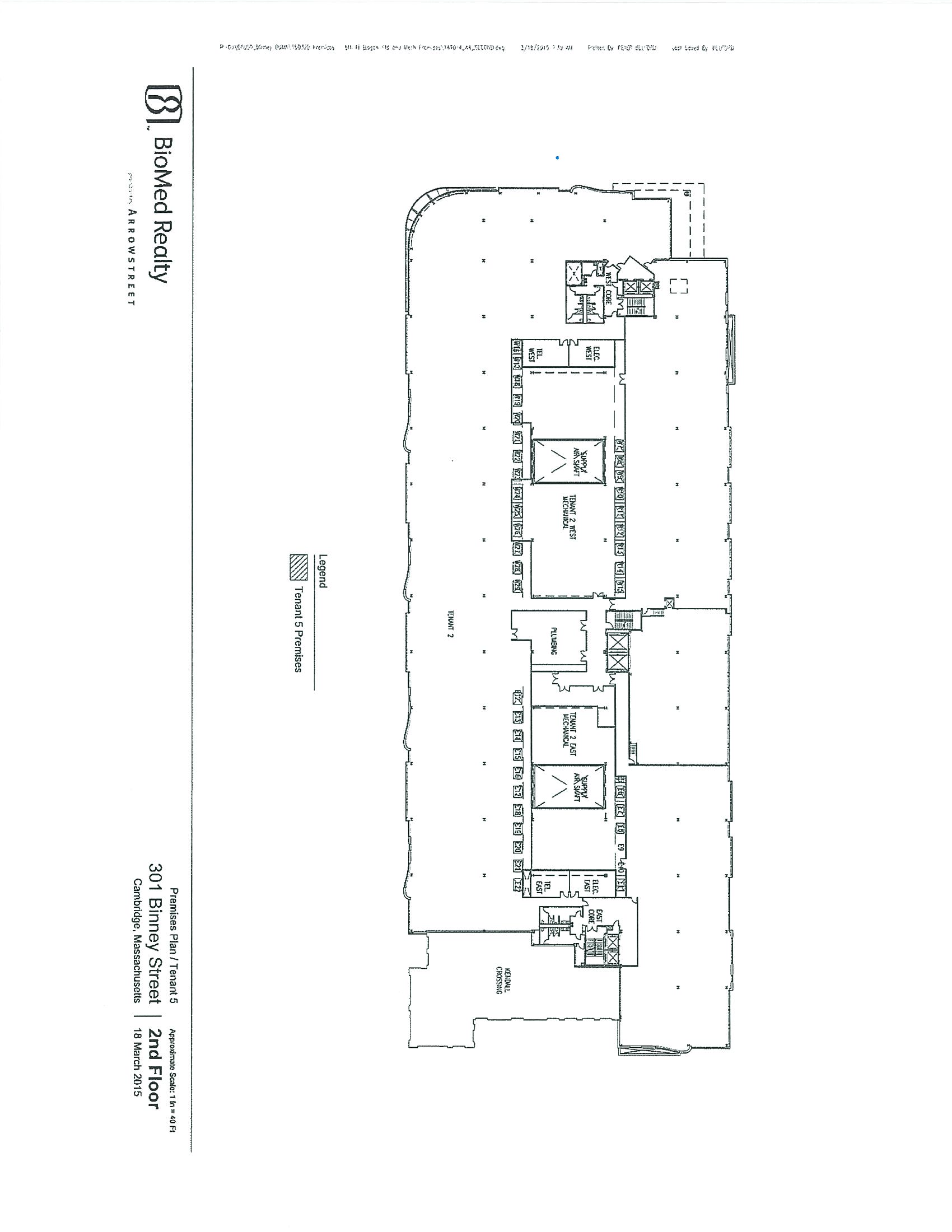

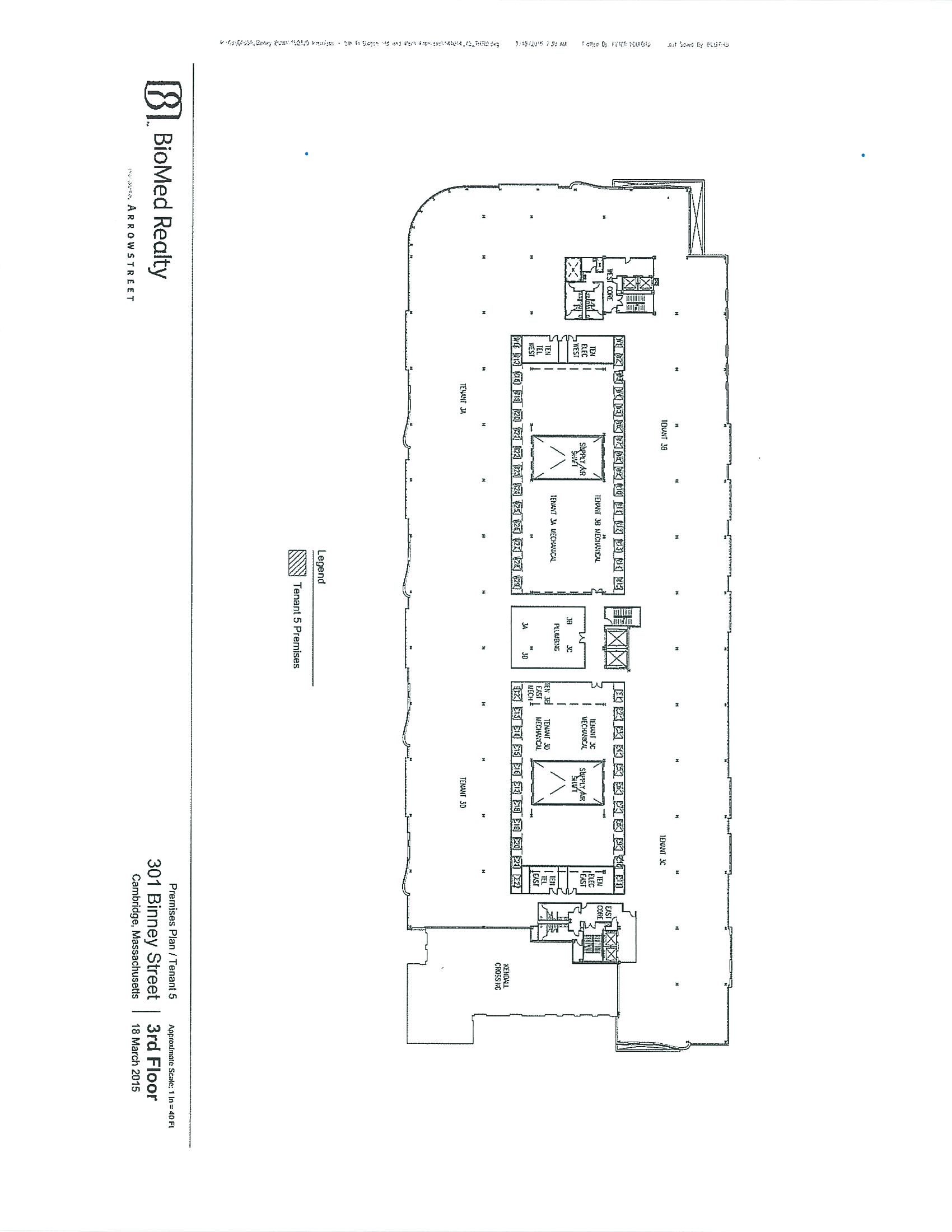

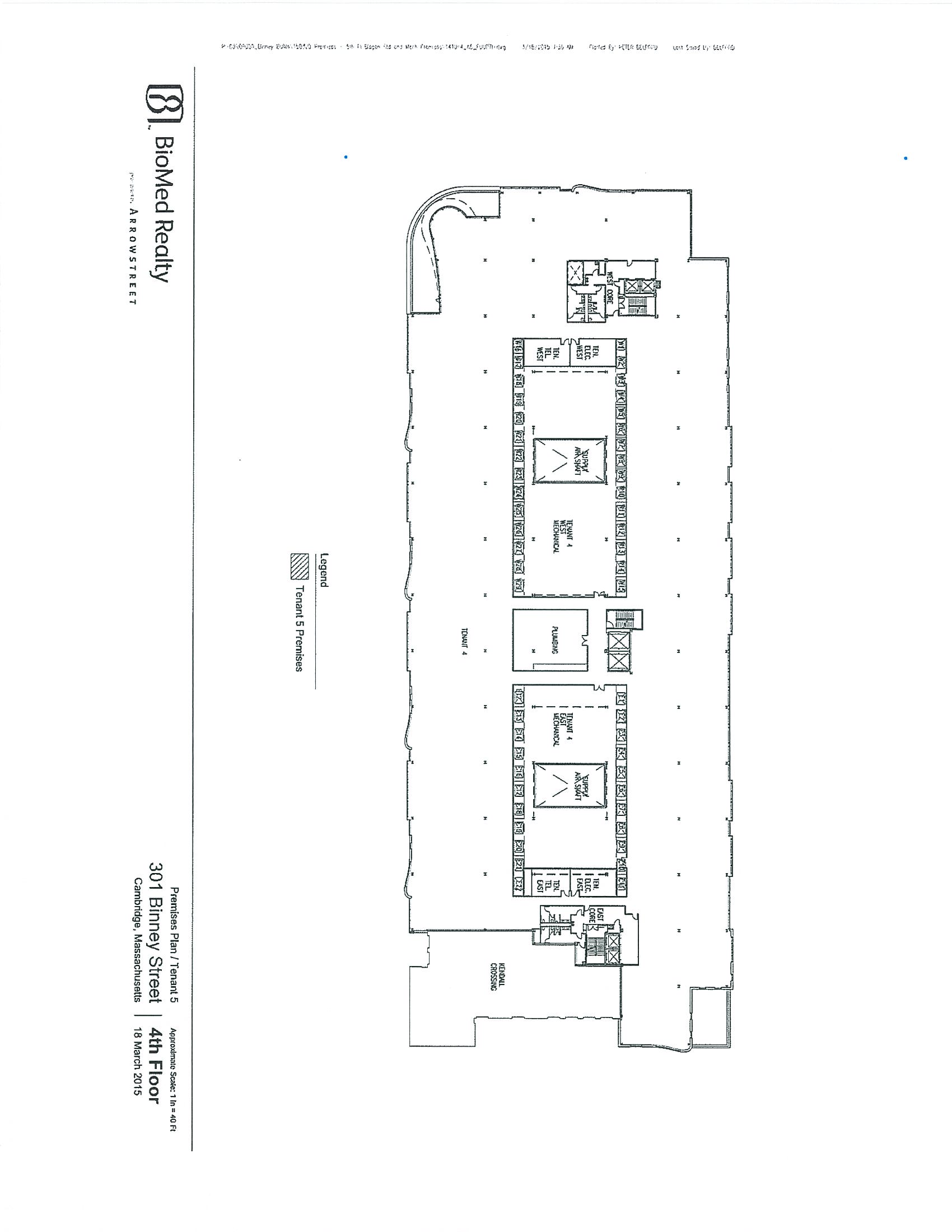

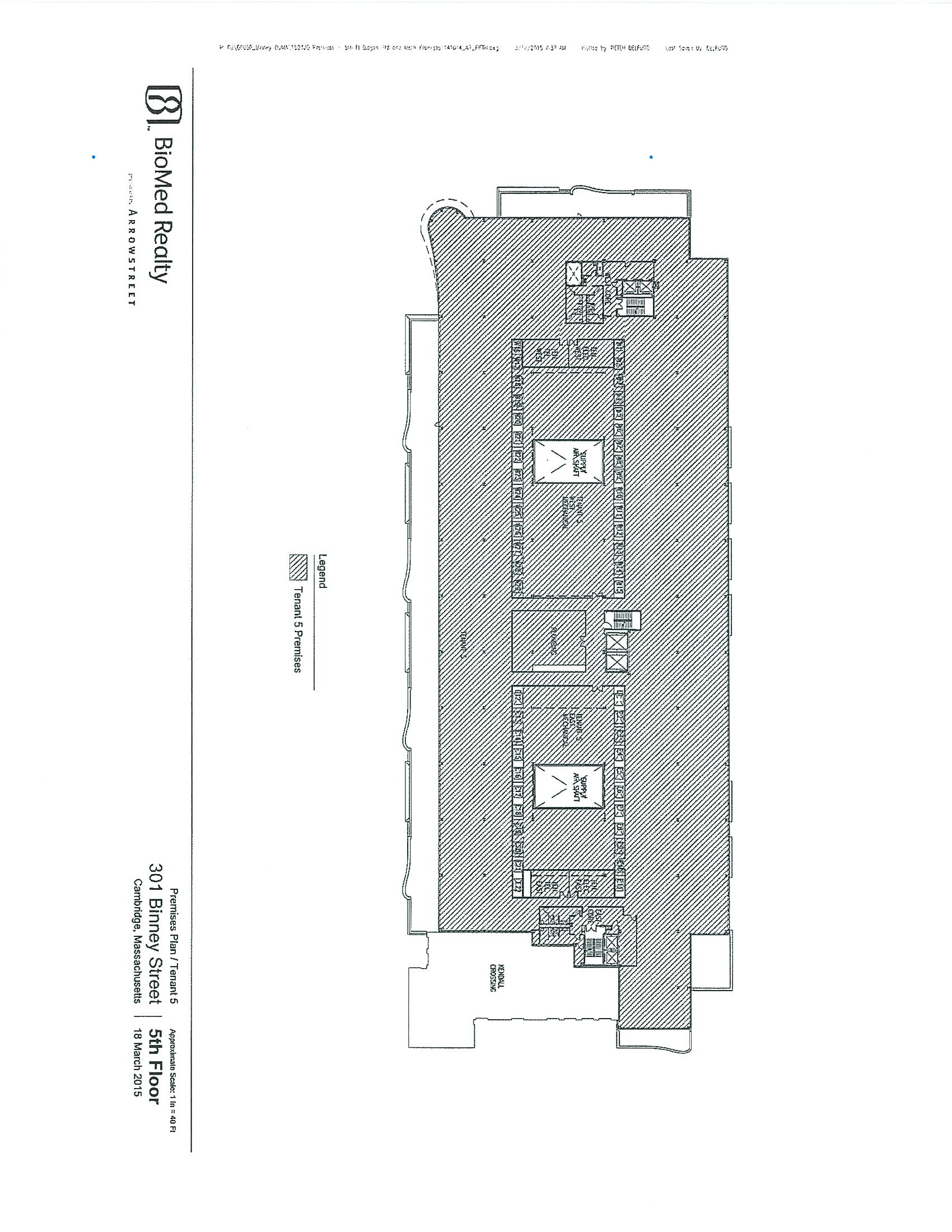

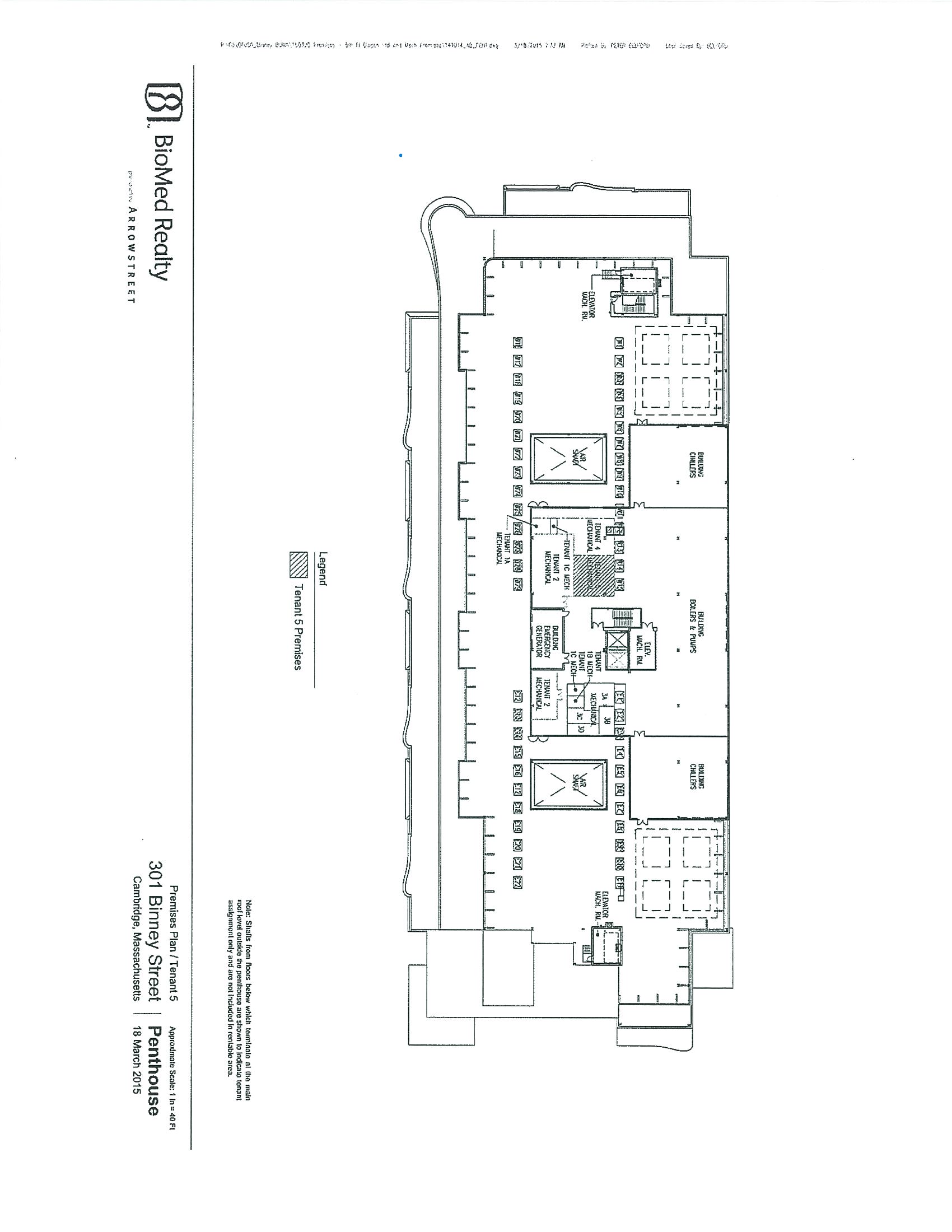

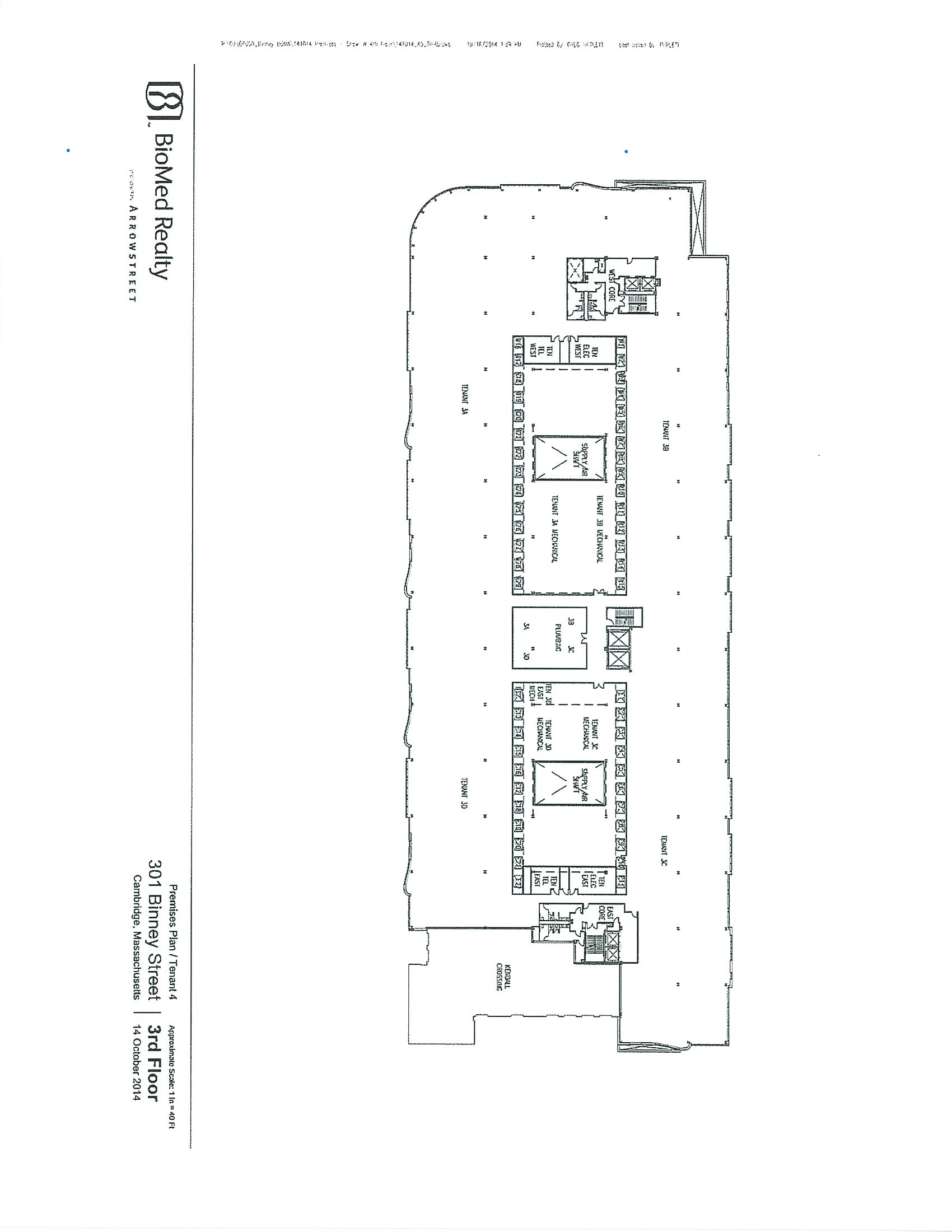

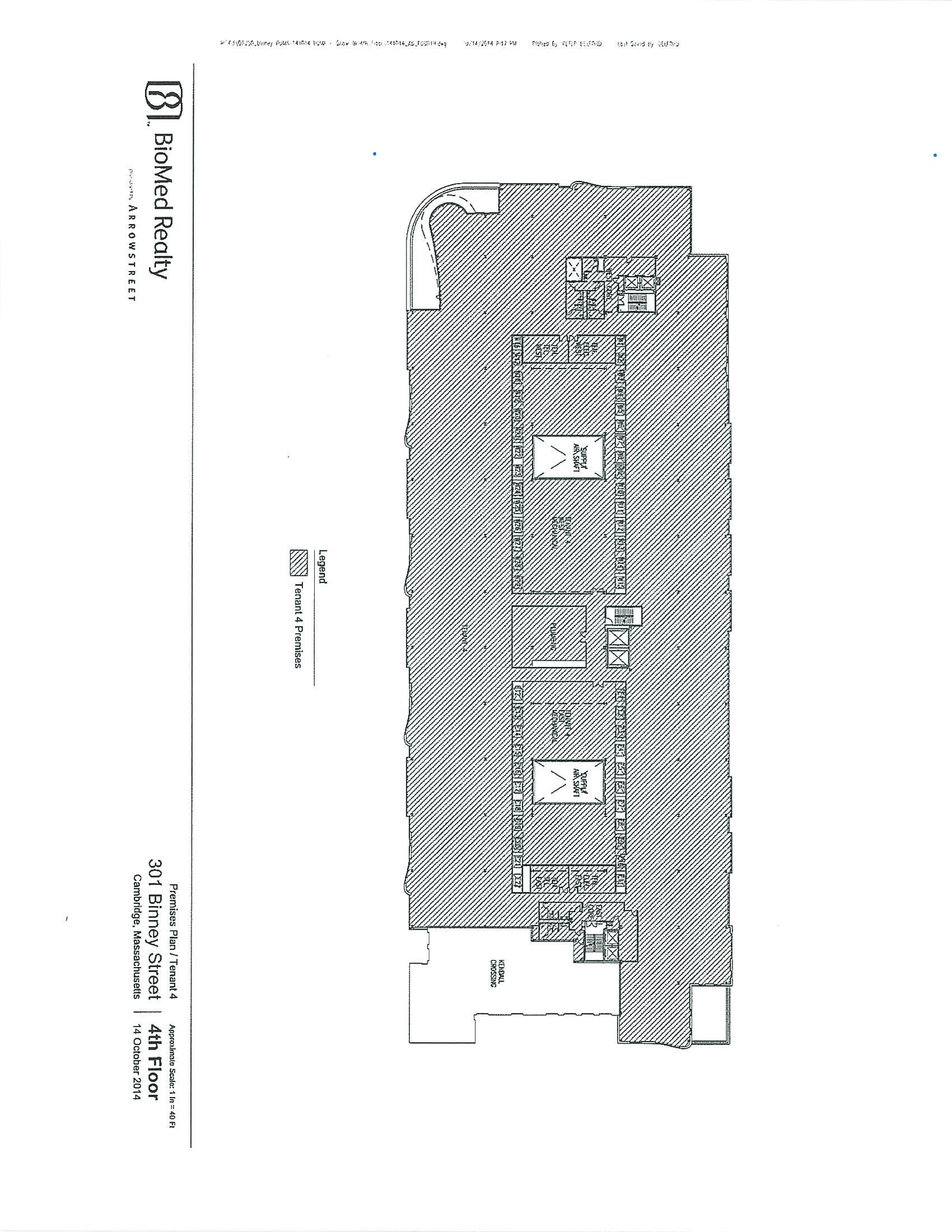

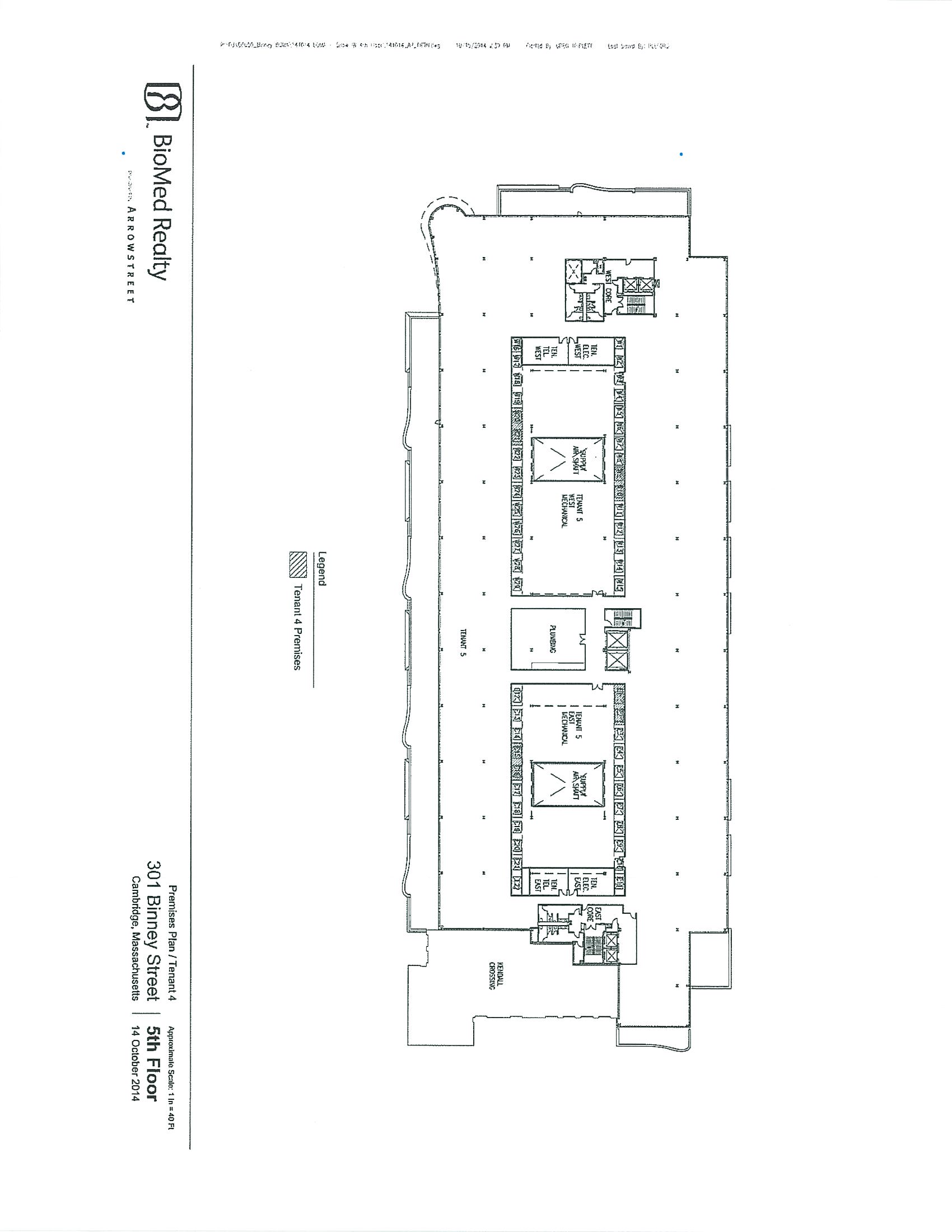

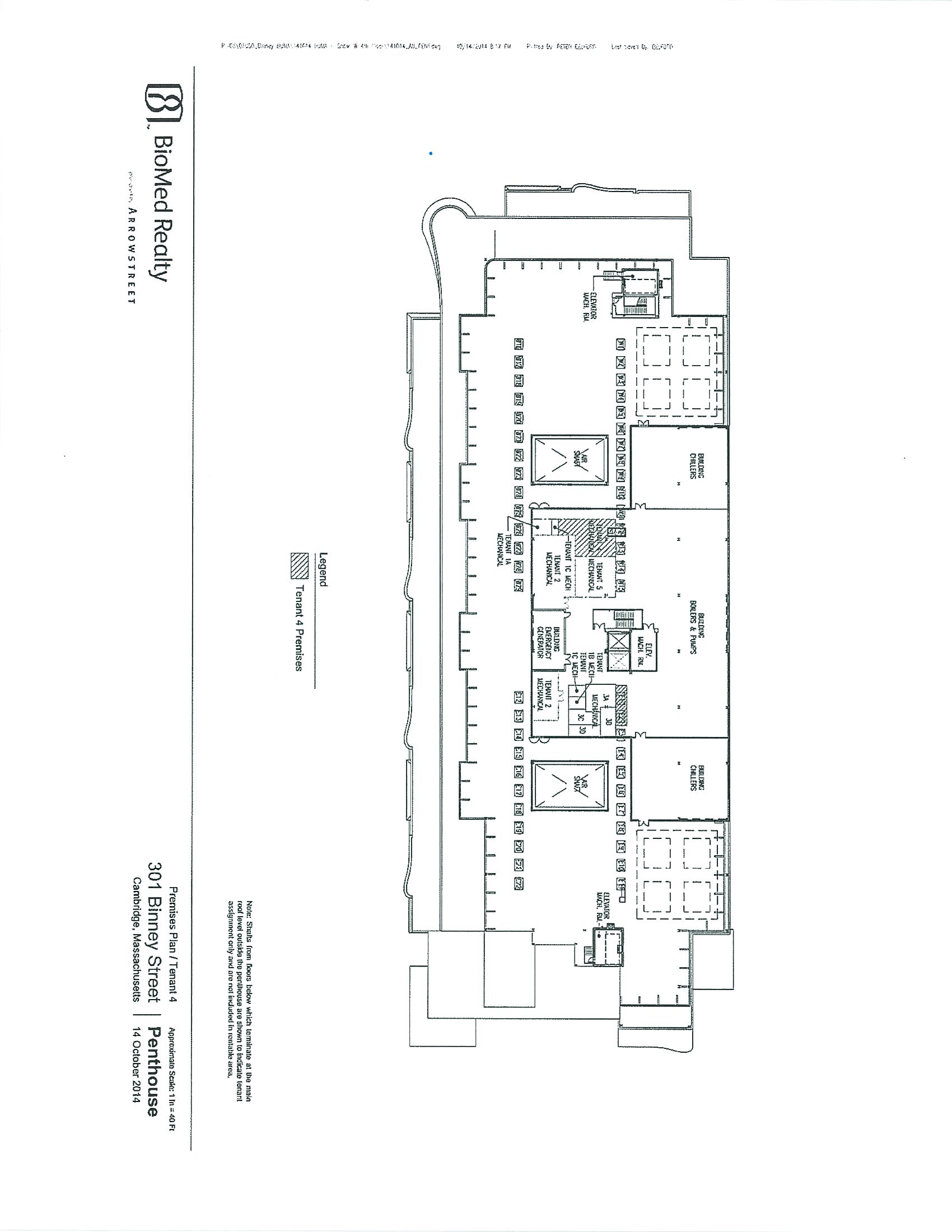

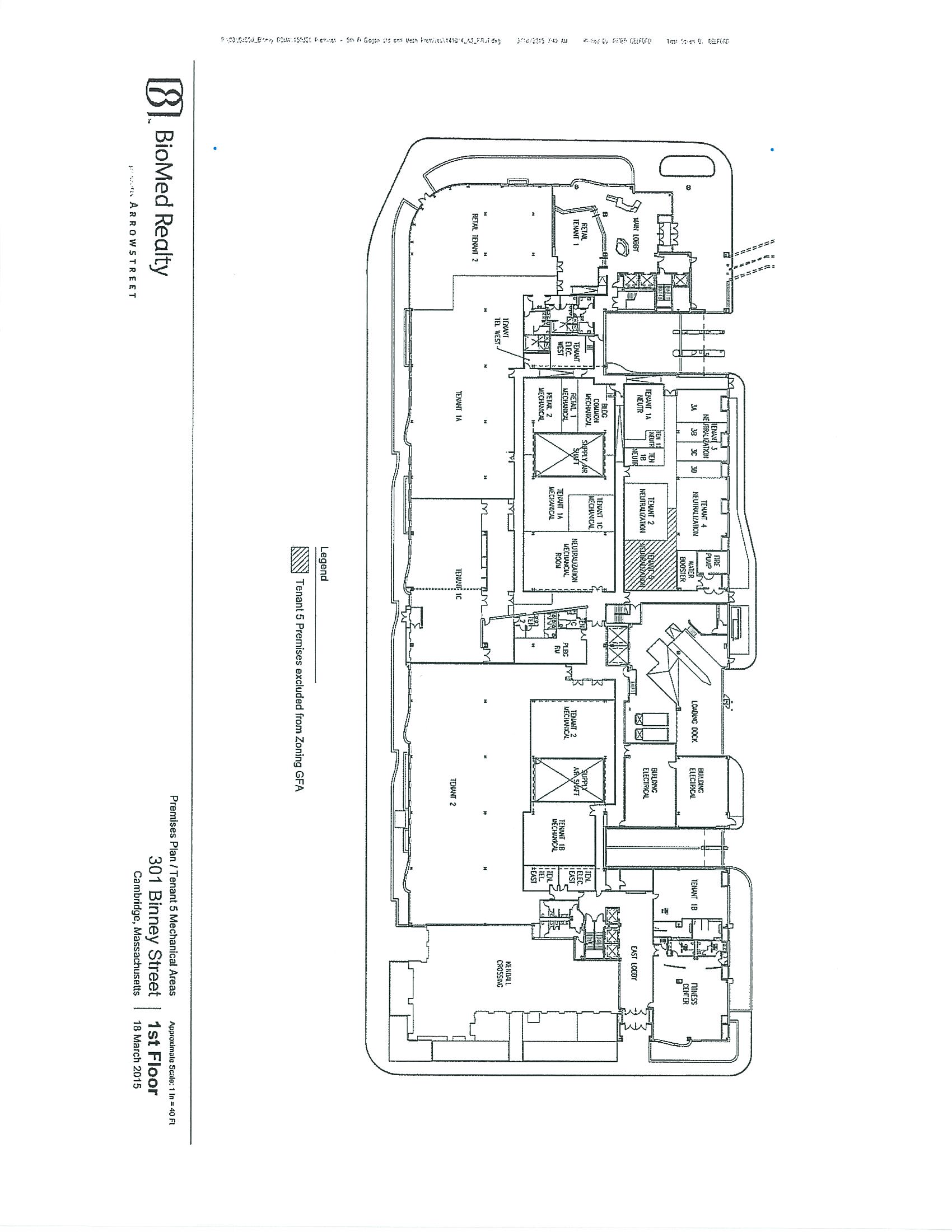

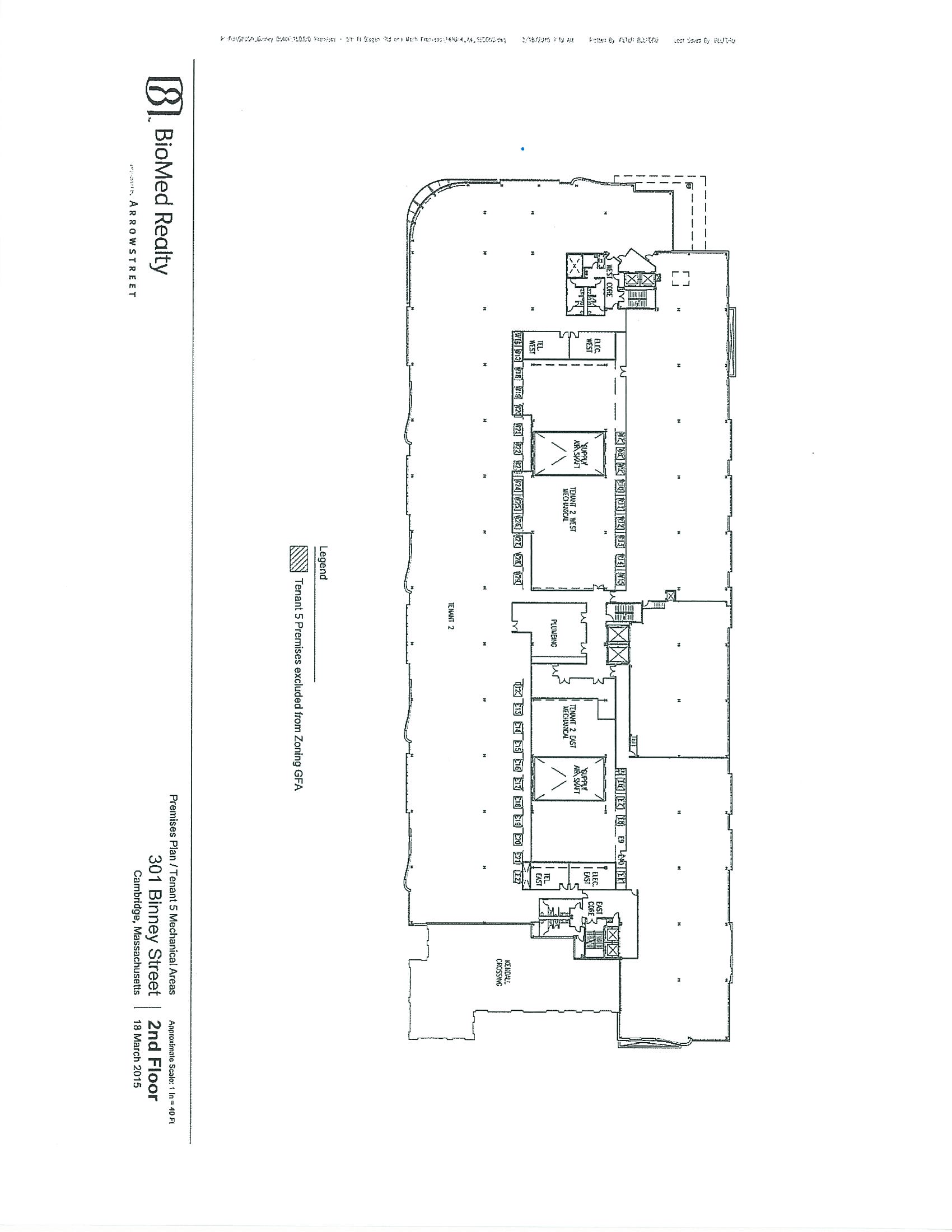

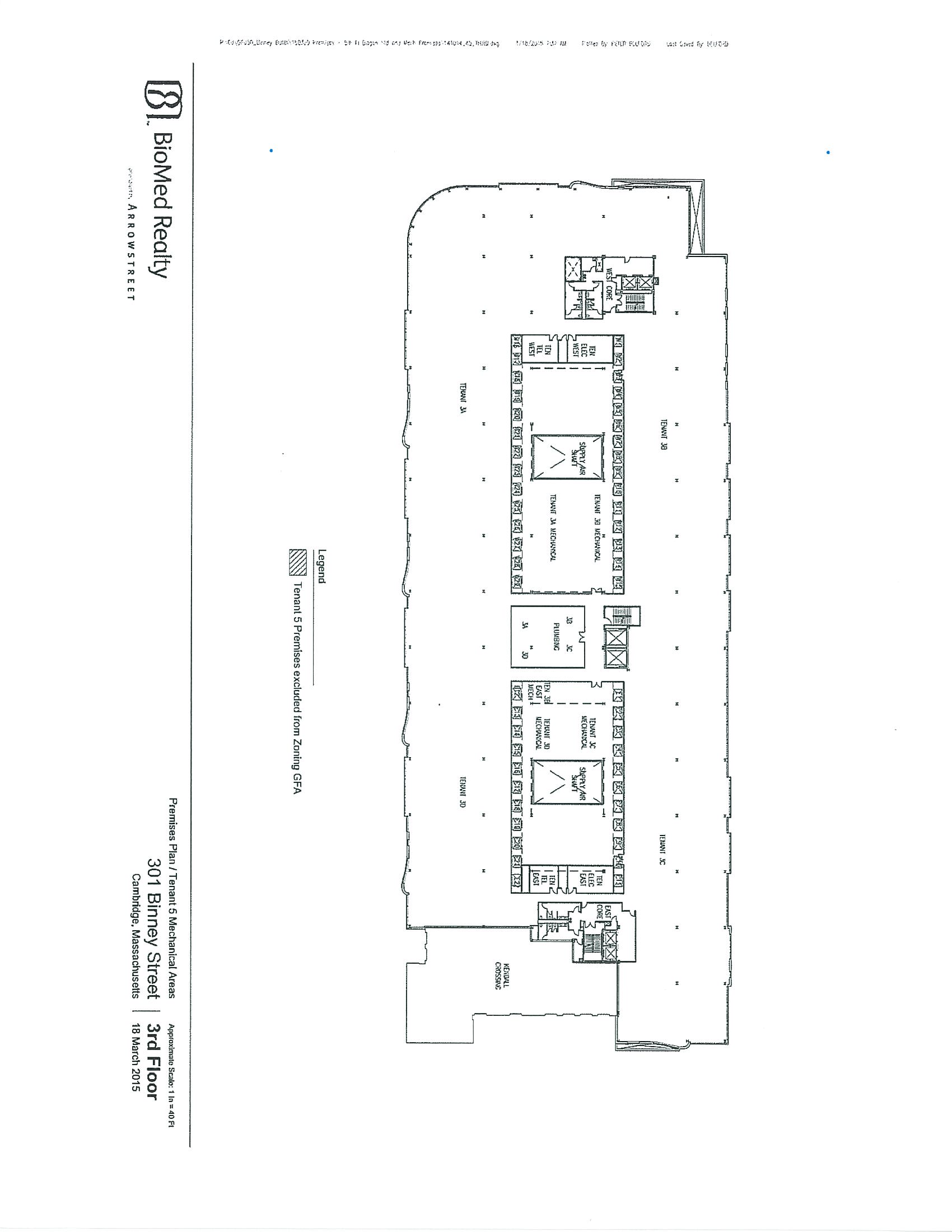

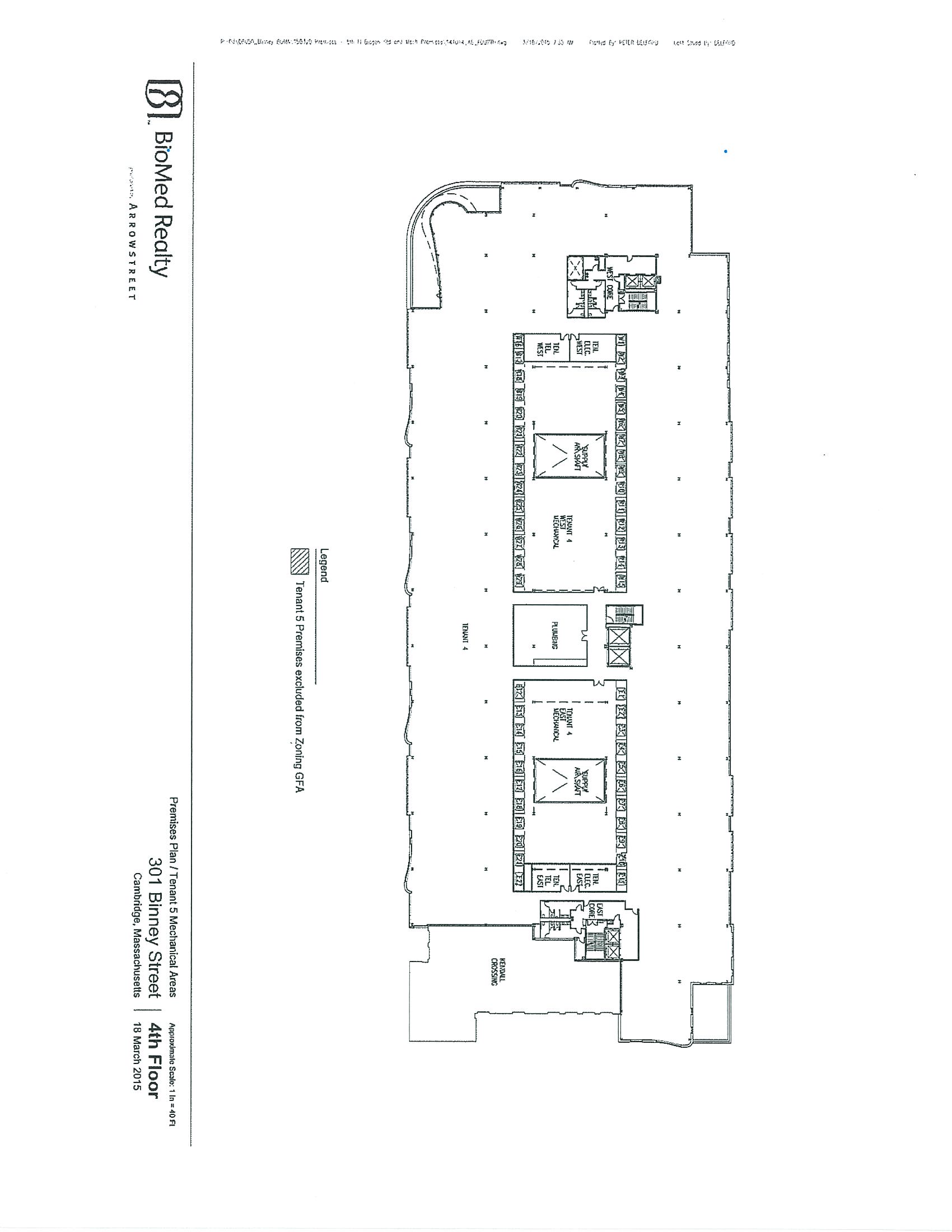

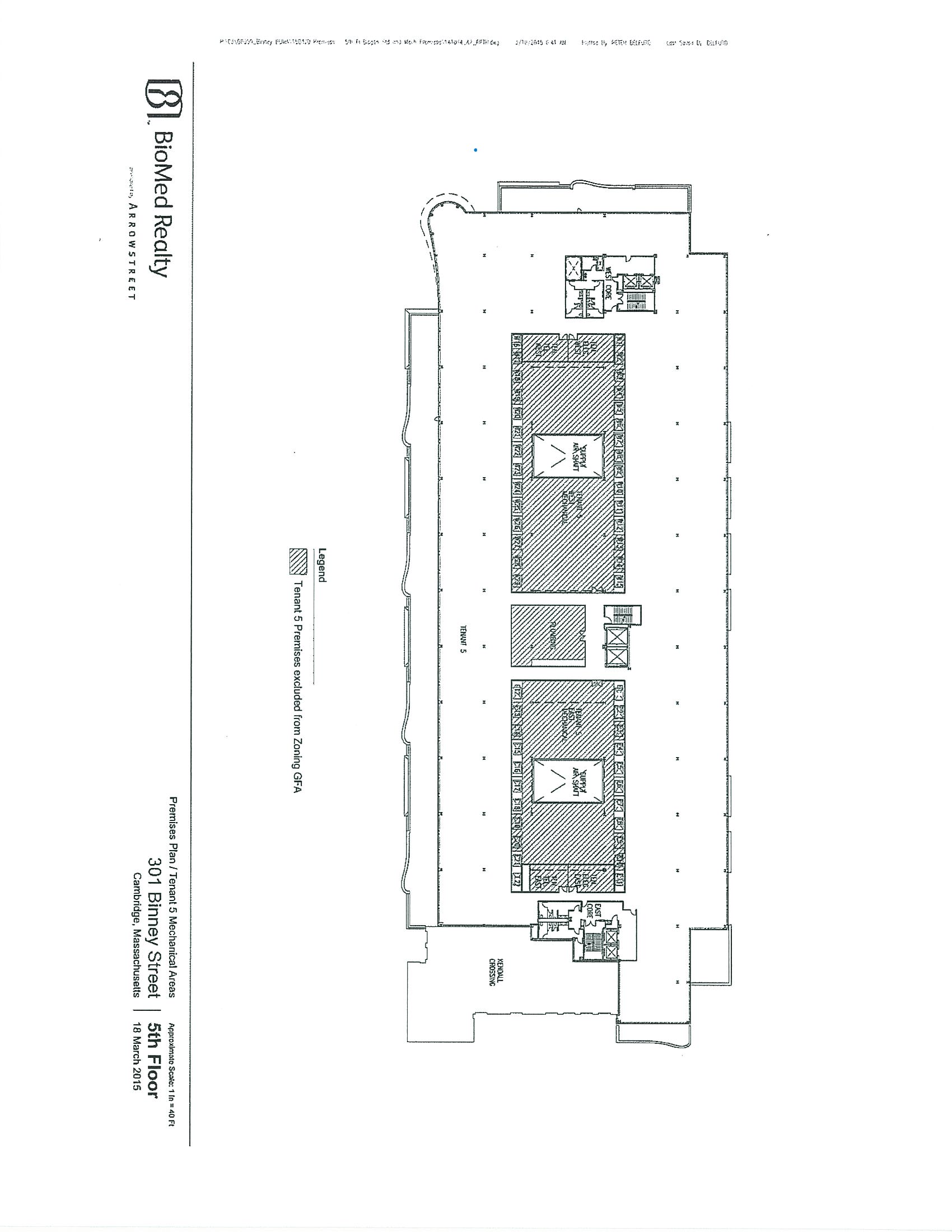

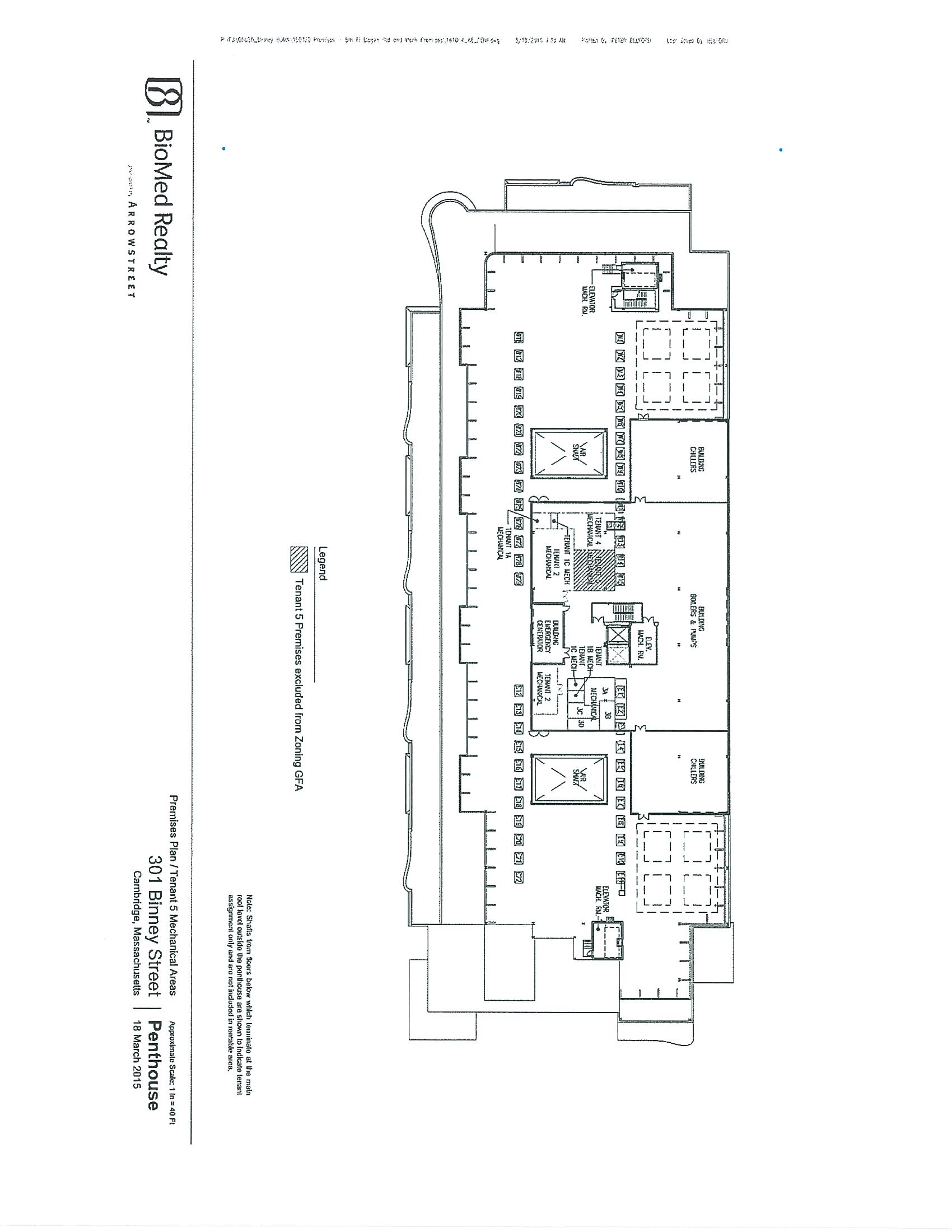

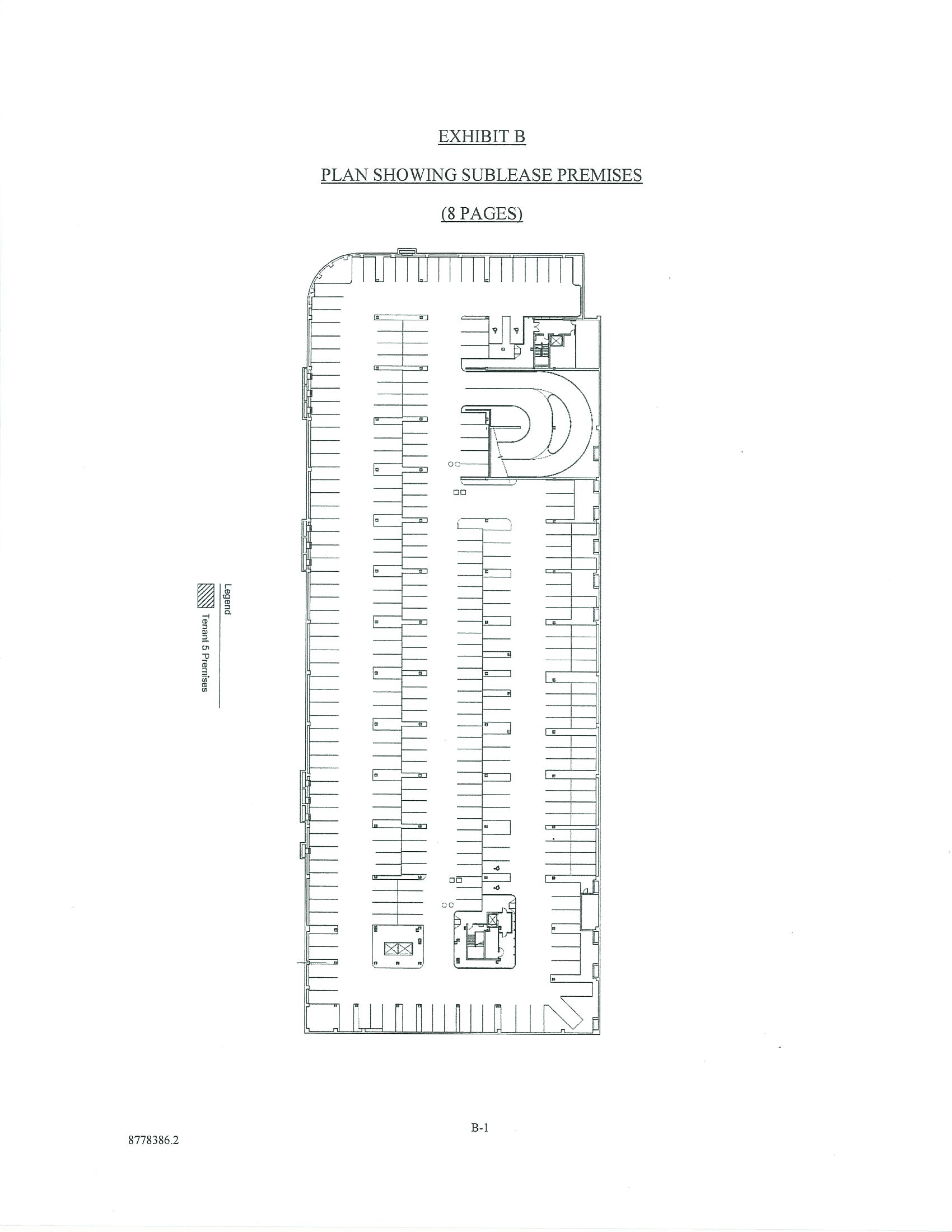

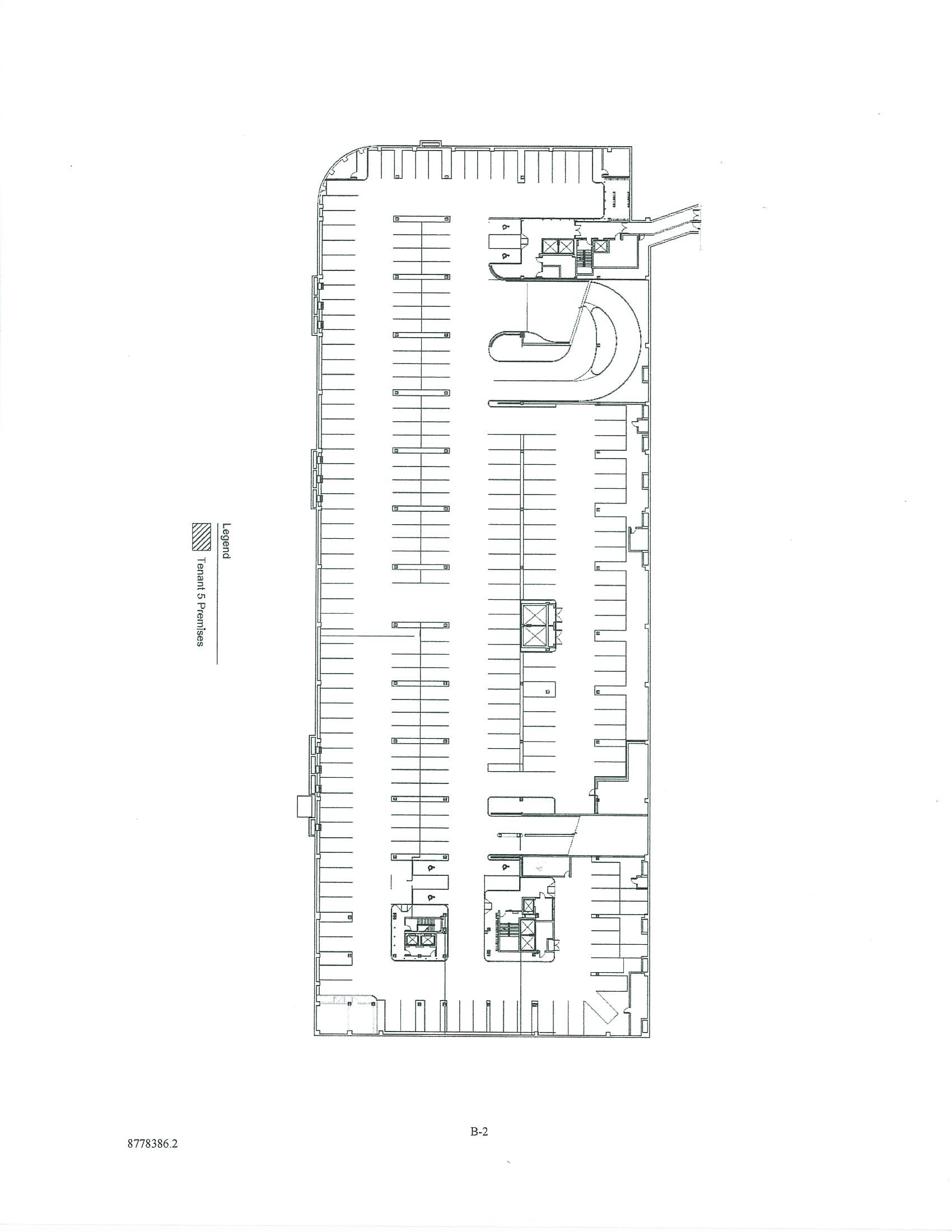

Simultaneous with the execution of the lease of office and laboratory space located at 301 Binney Street in Cambridge, Massachusetts in September 2016, the Company is obligated to deliver to the lessor a security deposit in the form of an irrevocable standby letter of credit in the amount of approximately two months of the monthly base rent, or $1.1 million. Although the letter of credit was issued in October 2016, the Company considers this amount restricted as of September 30, 2016. This balance will remain restricted through June 2025 and during any lease term extensions and therefore is classified as non-current in the Company’s consolidated balance sheet. The Company will earn interest on the balance.

5. Collaboration and License Agreements

At September 30, 2016, the Company had collaboration and license agreements with Sandoz, Sandoz AG, Baxalta and Mylan.

The Company records product revenue based on Sandoz’ sales of Enoxaparin Sodium Injection and GLATOPA.

14

Research and development revenue generally consists of amounts earned by us under our collaborations for technical development, regulatory and commercial milestones; reimbursement of research and development services and reimbursement of development costs under our collaborative arrangements with Sandoz and Baxalta; and recognition of the arrangement consideration under the collaborations with Baxalta and Mylan.

The collaboration with Mylan is a cost-sharing arrangement pursuant to which reimbursement for Mylan’s 50% share of collaboration expenses is recorded as a reduction to research and development expense and general and administrative expense depending on the nature of the activities.

The following tables provide amounts by period indicated and by line item included in the Company’s accompanying condensed consolidated statements of operations and comprehensive loss attributable to transactions arising from its significant collaborative arrangements and all other arrangements, as defined in the Financial Accounting Standards Board’s Accounting Standards Codification Topic 808, Collaborative Arrangements. The dollar amounts in the tables below are in thousands.

For the Three Months Ended September 30, 2016 | ||||||||||||||||||||

2003 Sandoz Collaboration Agreement | 2006 Sandoz Collaboration Agreement | Baxalta Collaboration Agreement | Mylan Collaboration Agreement (1) | Total Collaborations | ||||||||||||||||

Collaboration revenues: | ||||||||||||||||||||

Product revenue | $ | — | $ | 23,339 | $ | — | $ | — | $ | 23,339 | ||||||||||

Research and development revenue: | ||||||||||||||||||||

Recognition of upfront payments and license payments | — | — | 2,498 | 1,785 | 4,283 | |||||||||||||||

Research and development services and external costs | 128 | 494 | 900 | — | 1,522 | |||||||||||||||

Total research and development revenue | $ | 128 | $ | 494 | $ | 3,398 | $ | 1,785 | $ | 5,805 | ||||||||||

Total collaboration revenues | $ | 128 | $ | 23,833 | $ | 3,398 | $ | 1,785 | $ | 29,144 | ||||||||||

Operating expenses: | ||||||||||||||||||||

Research and development expense(2)(3) | $ | 1 | $ | 349 | $ | 402 | $ | 8,809 | $ | 9,561 | ||||||||||

General and administrative expense(2)(3) | $ | 332 | $ | 66 | $ | — | $ | 847 | $ | 1,245 | ||||||||||

Total operating expenses | $ | 333 | $ | 415 | $ | 402 | $ | 9,656 | $ | 10,806 | ||||||||||

For the Three Months Ended September 30, 2015 | ||||||||||||||||

2003 Sandoz Collaboration Agreement | 2006 Sandoz Collaboration Agreement | Baxalta Collaboration Agreement | Total Collaborations | |||||||||||||

Collaboration revenues: | ||||||||||||||||

Product revenue | $ | — | $ | 8,666 | $ | — | $ | 8,666 | ||||||||

Research and development revenue: | ||||||||||||||||

Milestone payments | — | — | — | — | ||||||||||||

Recognition of upfront payments and license payments | — | — | 2,442 | 2,442 | ||||||||||||

Research and development services and external costs | 69 | 742 | 1,876 | 2,687 | ||||||||||||

Total research and development revenue | $ | 69 | $ | 742 | $ | 4,318 | $ | 5,129 | ||||||||

Total collaboration revenues | $ | 69 | $ | 9,408 | $ | 4,318 | $ | 13,795 | ||||||||

Operating expenses: | ||||||||||||||||

Research and development expense(2) | $ | — | $ | 274 | $ | 251 | $ | 525 | ||||||||

General and administrative expense(2) | $ | 104 | $ | 38 | $ | 166 | $ | 308 | ||||||||

Total operating expenses | $ | 104 | $ | 312 | $ | 417 | $ | 833 | ||||||||

(1) | The Mylan Collaboration Agreement, as defined below, became effective on February 9, 2016. |

15

(2) | The amounts generally represent external expenditures, including amortization of an intangible asset, and exclude salaries and benefits, share-based compensation, facilities, depreciation and laboratory supplies, as the majority of such costs are not directly charged to programs. |

(3) | As a result of the cost-sharing provisions of the Mylan Collaboration Agreement, the Company offset approximately $7.7 million against research and development costs and $0.4 million against general and administrative costs during the three months ended September 30, 2016. |

For the Nine Months Ended September 30, 2016 | ||||||||||||||||||||

2003 Sandoz Collaboration Agreement | 2006 Sandoz Collaboration Agreement | Baxalta Collaboration Agreement | Mylan Collaboration Agreement (1) | Total Collaborations | ||||||||||||||||

Collaboration revenues: | ||||||||||||||||||||

Product revenue | $ | — | $ | 58,831 | $ | — | $ | — | $ | 58,831 | ||||||||||

Research and development revenue: | ||||||||||||||||||||

Recognition of upfront payments and license payments | — | — | 7,382 | 4,550 | 11,932 | |||||||||||||||

Research and development services and external costs | 266 | 1,878 | 2,517 | — | 4,661 | |||||||||||||||

Total research and development revenue | $ | 266 | $ | 1,878 | $ | 9,899 | $ | 4,550 | $ | 16,593 | ||||||||||

Total collaboration revenues | $ | 266 | $ | 60,709 | $ | 9,899 | $ | 4,550 | $ | 75,424 | ||||||||||

Operating expenses: | ||||||||||||||||||||

Research and development expense(2)(3) | $ | 1 | $ | 1,643 | $ | 880 | $ | 20,897 | $ | 23,421 | ||||||||||

General and administrative expense(2)(3) | $ | 1,865 | $ | 341 | $ | 316 | $ | 1,411 | $ | 3,933 | ||||||||||

Total operating expenses | $ | 1,866 | $ | 1,984 | $ | 1,196 | $ | 22,308 | $ | 27,354 | ||||||||||

For the Nine Months Ended September 30, 2015 | ||||||||||||||||

2003 Sandoz Collaboration Agreement | 2006 Sandoz Collaboration Agreement | Baxalta Collaboration Agreement | Total Collaborations | |||||||||||||

Collaboration revenues: | ||||||||||||||||

Product revenue | $ | 2,843 | $ | 27,850 | $ | — | $ | 30,693 | ||||||||

Research and development revenue: | ||||||||||||||||

Milestone payments | — | 20,000 | — | 20,000 | ||||||||||||

Recognition of upfront payments and license payments | — | — | 6,572 | 6,572 | ||||||||||||

Research and development services and external costs | 450 | 2,220 | 7,323 | 9,993 | ||||||||||||

Total research and development revenue | $ | 450 | $ | 22,220 | $ | 13,895 | $ | 36,565 | ||||||||

Total collaboration revenues | $ | 3,293 | $ | 50,070 | $ | 13,895 | $ | 67,258 | ||||||||

Operating expenses: | ||||||||||||||||

Research and development expense(2) | $ | 208 | $ | 703 | $ | 1,376 | $ | 2,287 | ||||||||

General and administrative expense(2) | $ | 326 | $ | 149 | $ | 798 | $ | 1,273 | ||||||||

Total operating expenses | $ | 534 | $ | 852 | $ | 2,174 | $ | 3,560 | ||||||||

(1) | The Mylan Collaboration Agreement, as defined below, became effective on February 9, 2016. |

(2) | The amounts generally represent external expenditures, including amortization of an intangible asset, and exclude salaries and benefits, share-based compensation, facilities, depreciation and laboratory supplies, as the majority of such costs are not directly charged to programs. |

16

(3) | As a result of the cost-sharing provisions of the Mylan Collaboration Agreement, the Company offset approximately $19.8 million against research and development costs and $1.0 million against general and administrative costs during the nine months ended September 30, 2016. |

2003 Sandoz Collaboration Agreement

In 2003, the Company entered into a collaboration and license agreement, or the 2003 Sandoz Collaboration Agreement, with Sandoz to jointly develop, manufacture and commercialize Enoxaparin Sodium Injection, a generic version of LOVENOX®, in the United States. Under the terms of the 2003 Sandoz Collaboration Agreement, the Company and Sandoz agreed to exclusively work with each other to develop and commercialize Enoxaparin Sodium Injection for any and all medical indications within the United States. In addition, the Company granted Sandoz an exclusive license under its intellectual property rights to develop and commercialize injectable enoxaparin for all medical indications within the United States.

Sandoz began selling Enoxaparin Sodium Injection in July 2010. For the three months ended March 2015, the Company received a 10% royalty on net sales. In June 2015, the Company and Sandoz amended the 2003 Sandoz Collaboration Agreement, effective April 1, 2015, to provide that Sandoz would pay the Company 50% of contractually-defined profits on sales. For the nine months ended September 30, 2015, the Company earned $2.8 million in product revenue consisting of $0.1 million in profits from Sandoz' sales of Enoxaparin in the second quarter of 2015, net of a claw-back adjustment of $0.1 million, and $2.7 million in royalties from Sandoz' sales of Enoxparin in the first quarter of 2015. Sandoz did not record any profit on sales of Enoxaparin Sodium Injection in the three months ended September 30, 2016, three months ended September 30, 2015 or the nine months ended September 30, 2016, and therefore the Company did not record product revenue for Enoxaparin Sodium Injection in those periods.

A portion of Enoxaparin Sodium Injection development expenses and certain legal expenses, which in the aggregate have exceeded a specified amount, are offset against profit-sharing amounts, royalties and milestone payments. The Company’s contractual share of such development and legal expenses is subject to an annual claw-back adjustment at the end of each of the first five product years, with the product year beginning on July 1 and ending on June 30. The annual adjustment can only reduce the Company’s profits, royalties and milestones by up to 50% in a given calendar quarter and any excess amount due will be carried forward into future quarters and reduce any profits in those future periods until it is paid in full. Annual adjustments, including amounts carried forward into future periods, are recorded as a reduction in product revenue.

2006 Sandoz Collaboration Agreement

In 2006 and 2007, the Company entered into a series of agreements, including a collaboration and license agreement, as amended, or the 2006 Sandoz Collaboration Agreement, with Sandoz AG; and a stock purchase agreement and an investor rights agreement, with Novartis Pharma AG. Under the 2006 Sandoz Collaboration Agreement, the Company and Sandoz AG agreed to exclusively collaborate on the development and commercialization of GLATOPA and M356, among other products. Costs, including development costs and the costs of clinical studies, will be borne by the parties in varying proportions depending on the type of expense. For GLATOPA and M356, the Company is generally responsible for all of the development costs in the United States. For GLATOPA and M356 outside of the United States, the Company shares development costs in proportion to its profit sharing interest. The Company is reimbursed at a contractual FTE rate for any FTE employee expenses as well as any external costs incurred in the development of products to the extent development costs are born by Sandoz. All commercialization costs are borne by Sandoz.

Sandoz commenced sales of GLATOPA in the United States on June 18, 2015. Under the 2006 Sandoz Collaboration Agreement, the Company earns 50% of contractually-defined profits on Sandoz’ worldwide net sales of GLATOPA. The Company is entitled to earn 50% of contractually-defined profits on Sandoz’ worldwide net sales of M356, if M356 is commercialized. Profits on net sales of GLATOPA and M356 are calculated by deducting from net sales the costs of goods sold and an allowance for selling, general and administrative costs, which is a contractual percentage of net sales. Sandoz is responsible for funding all of the legal expenses incurred under the 2006 Sandoz Collaboration Agreement; however, a portion of certain legal expenses, including any patent infringement damages, can be offset against the profit-sharing amounts in proportion to the Company’s 50% profit sharing interest.

For the three months ended September 30, 2016, the Company recorded $23.3 million in product revenues from Sandoz’ sales of GLATOPA. For the nine months ended September 30, 2016, the Company recorded $58.8 million in product revenues from Sandoz’ sales of GLATOPA. The Company is eligible to receive in the aggregate up to $120 million in additional milestone payments upon the achievement of certain commercial and sales-based milestones for GLATOPA and M356 in the United States. None of these payments, once received, is refundable and there are no general rights of return in the

17

arrangement. Sandoz AG has agreed to indemnify the Company for various claims, and a certain portion of such costs may be offset against certain future payments received by the Company.

The term of the 2006 Sandoz Collaboration Agreement extends throughout the development and commercialization of the products until the last sale of the products, unless earlier terminated by either party pursuant to the provisions of the 2006 Sandoz Collaboration Agreement. The 2006 Sandoz Collaboration Agreement may be terminated if either party breaches the 2006 Sandoz Collaboration Agreement or files for bankruptcy. In addition, either the Company or Sandoz AG may terminate the 2006 Sandoz Collaboration Agreement with respect to M356, if clinical trials are required for regulatory approval of M356.

Baxalta Collaboration Agreement

The Company and Baxter International Inc., Baxter Healthcare Corporation and Baxter Healthcare SA, collectively referred to as Baxter, entered into a global collaboration and license agreement effective February 2012, or the Baxter Collaboration Agreement, to develop and commercialize biosimilars, including M923. In connection with Baxter’s internal corporate restructuring in July 2015, Baxter assigned all of its rights and obligations under the Baxter Collaboration Agreement to Baxalta. In light of the assignment, all references to Baxter and the Baxter Collaboration Agreement have been replaced with references to Baxalta and the Baxalta Collaboration Agreement, respectively. On June 3, 2016, Baxalta Incorporated and Shire plc, or Shire, announced the completion of the combination of Baxalta Incorporated and Shire. As a result of the combination, Baxalta Incorporated is a wholly-owned subsidiary of Shire. On September 27, 2016, Baxalta gave the Company twelve months’ prior written notice of the exercise of its right to terminate for its convenience the Baxalta Collaboration Agreement.

Under the Baxalta Collaboration Agreement, the Company and Baxalta agreed to collaborate, on a world-wide basis, on the development and commercialization of M923, the Company’s biosimilar HUMIRA® (adalimumab) candidate, and M834, the Company’s biosimilar ORENCIA® (abatacept) candidate, and Baxalta had the right to select four additional reference products to target for biosimilar development under the collaboration. In July 2012, Baxalta selected an additional product: M511, the Company’s biosimilar AVASTIN® (bevacizumab) candidate. In December 2013, Baxalta terminated its option to license M511 under the Baxalta Collaboration Agreement following an internal portfolio review. In February 2015, Baxalta’s right to select additional programs expired without being exercised. Also in February 2015, Baxalta terminated in part the Baxalta Collaboration Agreement as it relates specifically to M834 and all worldwide development and commercialization rights for M834 reverted to the Company.

Under the Baxalta Collaboration Agreement, each party granted the other an exclusive license under its intellectual property rights to develop and commercialize M923 for all therapeutic indications. The Company agreed to provide development and related services on a commercially reasonable basis through the filing of an Investigational New Drug application, or IND, or equivalent application in the European Union for M923. Development and related services include high-resolution analytics, characterization, and product and process development. Baxalta is responsible for clinical development, manufacturing and commercialization activities and will exclusively distribute and market M923. The Company has the right to participate in a joint steering committee, consisting of an equal number of members from the Company and Baxalta, to oversee and manage the development and commercialization of M923 under the collaboration. Costs, including development costs, payments to third parties for intellectual property licenses, and expenses for legal proceedings, including the patent exchange process pursuant to the Biologics Price Competition and Innovation Act of 2009, will be borne by the parties in varying proportions, depending on the type of expense and the stage of development. The Company is reimbursed at a contractual FTE rate for any FTE employee expenses and external development costs for reimbursable activities related to M923.

Under the terms of the Baxalta Collaboration Agreement, the Company received an initial cash payment of $33 million, a $7 million license payment for achieving pre-defined “minimum development criteria” for M834, and $12 million in technical and development milestone payments in connection with the UK Medicines and Healthcare Products Regulatory Agency’s acceptance of Baxalta’s clinical trial application to initiate a pharmacokinetic clinical trial for M923.

Under the terms of the Baxalta Collaboration Agreement, the effective date of the termination is twelve months following the date Baxalta gave the termination notice, as more particularly set forth in the Baxalta Collaboration Agreement, or the Effective Date. As of the Effective Date, (i) Baxalta is obligated to transfer to the Company all ongoing regulatory, development, manufacturing and commercialization activities and related records for M923 and, at the Company’s request, assign to the Company any third party agreements reasonably necessary for and primarily related to the development, manufacture, and commercialization of M923 to the extent permitted by the agreements' terms, (ii) the licenses granted pursuant to the Baxalta Collaboration Agreement by the Company to Baxalta under the Company’s intellectual property rights relating to M923 will terminate, the licenses granted pursuant to the Baxalta Collaboration Agreement by Baxalta to the

18

Company under Baxalta’s intellectual property rights relating to M923 will survive, and Baxalta is obligated to grant to the Company additional licenses under Baxalta’s intellectual property rights relating to M923 existing as of the Effective Date, and (iii) the Company is obligated to pay to Baxalta a royalty of 5% of net sales, as such term is defined in the Baxalta Collaboration Agreement, until Baxalta’s development expenses and commercialization costs, as such terms are defined in the Baxalta Collaboration Agreement, occurring through the Effective Date are reimbursed. Following receipt of the termination notice, the Company is no longer eligible to receive any regulatory milestone payments under the Baxalta Collaboration Agreement. Prior to the Effective Date, Baxalta is obligated to continue to perform development and manufacturing activities for M923, which is currently in a pivotal clinical trial from which data is expected to be reported in 2016.

In accordance with FASB’s ASU No. 2009-13: Multiple-Deliverable Revenue Arrangements (Topic 615), the Company identified the deliverables at the inception of the Baxalta Collaboration Agreement. The deliverables were determined to include (i) six development and product licenses, for each of M923, M834 and the four additional collaboration products, (ii) research and development services related to each of M923, M834 and the four additional collaboration products and (iii) the Company’s participation in a joint steering committee. The Company determined that each of the license deliverables does not have stand-alone value apart from the related research and development services deliverables because (1) there are no other vendors selling similar, competing products on a stand-alone basis, (2) Baxalta does not have the contractual right to resell the license, and (3) Baxalta is unable to use the license for its intended purpose without the Company’s performance of research and development services. As such, the Company determined that with respect to this arrangement separate units of accounting exist for each of the six licenses together with the related research and development services, as well as the one unit of accounting for the joint steering committee. The estimated selling price for these units of accounting was determined based on similar license arrangements and the nature of the research and development services to be performed for Baxalta and market rates for similar services. At the inception of the Baxalta Collaboration Agreement, arrangement consideration of $61 million, which included the $33 million upfront payment and aggregate option payments for the four additional collaboration products of $28.0 million, was allocated to the units of accounting based on the relative selling price method. Of the $61 million, $10.3 million was allocated to the M923 product license together with the related research and development services, $10.3 million to each of the four additional collaboration product licenses with the related research and development services, $9.4 million was allocated to the M834 product license together with the related research and development services due to that product’s stage of development at the time the license was delivered, and $114,000 was allocated to the joint steering committee unit of accounting.

At the inception of the Baxalta Collaboration Agreement, the Company delivered development and product licenses for M923 and M834 and commenced revenue recognition of the arrangement consideration allocated to those products. In addition, the Company began revenue recognition for the arrangement consideration allocated to the joint steering committee unit of accounting. Baxalta’s termination of its option to license M511 in December 2013 as well as its termination of M834 and the lapsing of its right to select additional products in February 2015 reduced the number of deliverables from seven to two and decreased the total consideration from $61 million to $40 million. The Company determined that the change in total consideration received and total deliverables under the arrangement represented a change in estimate and, as a result, the Company reallocated the revised total consideration of $40 million to the remaining deliverables under the agreement using the original best estimate of selling price. The remaining deliverables are the combined unit of account for the M923 license and the related research and development services and the Company’s participation on the joint steering committee. Of the $40 million, $39.6 million was allocated to the M923 product license together with the related research and development services and $0.4 million was allocated to the joint steering committee unit of accounting. The Company recognized the resulting change in revenue as a result of the decrease in deliverables and expected consideration on a prospective basis. The Company recorded this revenue on a straight-line basis over the applicable performance period, which began with delivery of the development and product license and ends upon FDA approval of the product.

As a result of Baxalta's termination notice, the Company's performance period for M923 and the joint steering committee will end on the Effective Date, as defined above; therefore, the Company will recognize the remaining deferred revenue balance as of September 30, 2016 of $14.6 million ratably as revenue over the remaining performance period of twelve months, with quarterly amortization of $3.7 million for the next three quarters and $3.5 million in the third quarter of 2017. The impact of this change in estimate on the Company's net loss and net loss per share was immaterial for the three and nine months ended September 30, 2016.

Mylan Collaboration Agreement

On January 8, 2016, the Company and Mylan entered into a collaboration agreement, or the Mylan Collaboration Agreement, which became effective on February 9, 2016, pursuant to which the Company and Mylan agreed to collaborate exclusively, on a world-wide basis, to develop, manufacture and commercialize six of the Company’s biosimilar candidates, including M834.

19

Under the terms of the Mylan Collaboration Agreement, Mylan agreed to pay the Company a non-refundable upfront payment of $45 million. In addition, the Company and Mylan share equally costs (including development, manufacturing, commercialization and certain legal expenses) and profits (losses) with respect to such product candidates, with Mylan funding its share of collaboration expenses incurred by the Company, in part, through up to six contingent milestone payments, totaling up to $200 million across the six product candidates.

For each product candidate other than M834, at a specified stage of early development, the Company and Mylan will each decide, based on the product candidate’s development progress and commercial considerations, whether to continue the development, manufacture and commercialization of such product candidate under the collaboration or to terminate the collaboration with respect to such product candidate.

Under the Mylan Collaboration Agreement, the Company granted Mylan an exclusive license under the Company’s intellectual property rights to develop, manufacture and commercialize the product candidates for all therapeutic indications, and Mylan granted the Company a co-exclusive license under Mylan’s intellectual property rights for the Company to perform its development and manufacturing activities under the product work plans agreed by the parties, and to perform certain commercialization activities to be agreed by the joint steering committee for such product candidates if the Company exercises its co-commercialization option described below. The Company and Mylan established a joint steering committee consisting of an equal number of members from the Company and Mylan to oversee and manage the development, manufacture and commercialization of product candidates under the collaboration. Unless otherwise determined by the joint steering committee, it is anticipated that, in collaboration with the other party, (a) the Company will be primarily responsible for nonclinical development activities and initial clinical development activities for product candidates; additional (pivotal or Phase 3 equivalent) clinical development activities for M834; and regulatory activities for product candidates in the United States through regulatory approval; and (b) Mylan will be primarily responsible for additional (pivotal or Phase 3 equivalent) clinical development activities for product candidates other than M834; regulatory activities for the product candidates outside the United States; and regulatory activities for products in the United States after regulatory approval, when all marketing authorizations for the products in the United States will be transferred to Mylan. Mylan will commercialize any approved products, with the Company having an option to co-commercialize, in a supporting commercial role, any approved products in the United States. The joint steering committee is responsible for allocating responsibilities for other activities under the collaboration.

The term of the collaboration will continue throughout the development and commercialization of the product candidates, on a product-by-product and country-by-country basis, until development and commercialization by or on behalf of the Company and Mylan pursuant to the Mylan Collaboration Agreement has ceased for a continuous period of two years for a given product candidate in a given country, unless earlier terminated by either party pursuant to the terms of the Mylan Collaboration Agreement.

The Mylan Collaboration Agreement may be terminated by either party for breach by, or bankruptcy of, the other party; for its convenience; or for certain activities involving competing products or the challenge of certain patents. Other than in the case of a termination for convenience, the terminating party will have the right to continue the development, manufacture and commercialization of the terminated products in the terminated countries. In the case of a termination for convenience, the other party will have the right to continue. If a termination occurs, the licenses granted to the non-continuing party for the applicable product will terminate for the terminated country. Subject to certain terms and conditions, the party that has the right to continue the development or commercialization of a given product candidate may retain royalty-bearing licenses to certain intellectual property rights, and rights to certain data, for the continued development and sale of the applicable product in the country or countries for which termination applies.