Form 10-Q EXA CORP For: Jul 31

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended July 31, 2015

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 001-35584

EXA CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 04-3139906 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

55 Network Drive

Burlington, MA 01803

(Address of Principal Executive Offices, Including Zip Code)

(781) 564-0200

(Registrant’s Telephone Number, Including Area Code)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of August 28, 2015, 14,604,254 shares of the registrant’s outstanding common stock, $0.001 par value per share, were outstanding.

Table of Contents

FORM 10-Q

FOR THE QUARTER ENDED July 31, 2015

TABLE OF CONTENTS

2

Table of Contents

EXA CORPORATION

(Unaudited)

(in thousands, except share and per share data)

| July 31, 2015 |

January 31, 2015 |

|||||||

| ASSETS |

||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 30,406 | $ | 21,785 | ||||

| Accounts receivable |

6,303 | 27,462 | ||||||

| Prepaid expenses and other current assets |

3,375 | 3,098 | ||||||

|

|

|

|

|

|||||

| Total current assets |

40,084 | 52,345 | ||||||

| Property and equipment, net |

6,208 | 6,961 | ||||||

| Intangible assets, net |

2,220 | 2,395 | ||||||

| Deferred tax assets |

261 | 260 | ||||||

| Other assets |

1,024 | 1,092 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 49,797 | $ | 63,053 | ||||

|

|

|

|

|

|||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

||||||||

| Current liabilities: |

||||||||

| Accounts payable |

$ | 1,731 | $ | 1,620 | ||||

| Accrued expenses |

6,345 | 10,585 | ||||||

| Current portion of deferred revenue |

19,575 | 26,863 | ||||||

| Current portion of capital lease obligations |

1,824 | 2,390 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

29,475 | 41,458 | ||||||

| Deferred revenue |

25 | 38 | ||||||

| Capital lease obligations |

862 | 1,602 | ||||||

| Deferred rent |

871 | 472 | ||||||

| Other long-term liabilities |

498 | 592 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

31,731 | 44,162 | ||||||

|

|

|

|

|

|||||

| Commitments and contingencies (Note 9) |

||||||||

| Stockholders’ equity: |

||||||||

| Preferred stock, $0.001 par value; 5,000,000 shares authorized; no shares issued and outstanding |

— | — | ||||||

| Common stock, $0.001 par value; 30,000,000 shares authorized; 14,636,756 and 13,874,744 shares issued, respectively; 14,604,254 and 13,842,242 shares outstanding, respectively |

15 | 14 | ||||||

| Additional paid-in capital |

90,410 | 88,181 | ||||||

| Accumulated deficit |

(71,961 | ) | (68,878 | ) | ||||

| Treasury stock (32,502 common shares, at cost) |

0 | 0 | ||||||

| Accumulated other comprehensive loss |

(398 | ) | (426 | ) | ||||

|

|

|

|

|

|||||

| Total stockholders’ equity |

18,066 | 18,891 | ||||||

|

|

|

|

|

|||||

| Total liabilities and stockholders’ equity |

$ | 49,797 | $ | 63,053 | ||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of the consolidated financial statements

3

Table of Contents

EXA CORPORATION

Consolidated Statements of Operations and Comprehensive Loss

(Unaudited)

(in thousands, except share and per share data)

| Three Months Ended July 31, | Six Months Ended July 31, | |||||||||||||||

| 2015 | 2014 | 2015 | 2014 | |||||||||||||

| Revenue: |

||||||||||||||||

| License revenue |

$ | 12,977 | $ | 12,316 | $ | 25,219 | $ | 23,976 | ||||||||

| Project revenue |

2,478 | 2,527 | 5,004 | 4,637 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenues |

15,455 | 14,843 | 30,223 | 28,613 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating expenses: |

||||||||||||||||

| Cost of revenues |

4,755 | 4,632 | 9,398 | 9,228 | ||||||||||||

| Sales and marketing |

2,440 | 2,509 | 4,928 | 5,076 | ||||||||||||

| Research and development |

5,952 | 5,404 | 12,122 | 10,506 | ||||||||||||

| General and administrative |

3,126 | 3,217 | 6,393 | 6,339 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

16,273 | 15,762 | 32,841 | 31,149 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from operations |

(818 | ) | (919 | ) | (2,618 | ) | (2,536 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other (expense) income, net: |

||||||||||||||||

| Foreign exchange (loss) gain |

(171 | ) | 175 | (223 | ) | 131 | ||||||||||

| Interest expense |

(54 | ) | (94 | ) | (119 | ) | (177 | ) | ||||||||

| Interest income |

2 | 2 | 5 | 6 | ||||||||||||

| Other income, net |

— | 3 | — | 3 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other (expense) income, net |

(223 | ) | 86 | (337 | ) | (37 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss before income taxes |

(1,041 | ) | (833 | ) | (2,955 | ) | (2,573 | ) | ||||||||

| Provision for income taxes |

(154 | ) | (176 | ) | (128 | ) | (15,656 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss |

$ | (1,195 | ) | $ | (1,009 | ) | $ | (3,083 | ) | $ | (18,229 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss per share: |

||||||||||||||||

| Basic |

$ | (0.08 | ) | $ | (0.07 | ) | $ | (0.21 | ) | $ | (1.34 | ) | ||||

| Diluted |

$ | (0.08 | ) | $ | (0.07 | ) | $ | (0.21 | ) | $ | (1.34 | ) | ||||

| Weighted average shares outstanding used in computing net loss per share: |

||||||||||||||||

| Basic |

14,535,539 | 13,775,250 | 14,420,562 | 13,639,866 | ||||||||||||

| Diluted |

14,535,539 | 13,775,250 | 14,420,562 | 13,639,866 | ||||||||||||

| Comprehensive loss: |

||||||||||||||||

| Net loss |

$ | (1,195 | ) | $ | (1,009 | ) | $ | (3,083 | ) | $ | (18,229 | ) | ||||

| Foreign currency translation adjustments |

(12 | ) | (75 | ) | 28 | (34 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Comprehensive loss |

$ | (1,207 | ) | $ | (1,084 | ) | $ | (3,055 | ) | $ | (18,263 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

The accompanying notes are an integral part of the consolidated financial statements

4

Table of Contents

EXA CORPORATION

Consolidated Statements of Cash Flows

(Unaudited)

(in thousands)

| Six Months Ended July 31, | ||||||||

| 2015 | 2014 | |||||||

| Cash flows provided by operating activities: |

||||||||

| Net loss |

$ | (3,083 | ) | $ | (18,229 | ) | ||

| Adjustments to reconcile net loss to net cash provided by operating activities: |

||||||||

| Depreciation and amortization |

1,528 | 1,394 | ||||||

| Stock-based compensation expense |

1,105 | 870 | ||||||

| Deferred rent expense |

(179 | ) | (187 | ) | ||||

| Deferred income taxes |

— | 15,215 | ||||||

| Net change in operating assets and liabilities: |

||||||||

| Accounts receivable |

21,302 | 19,403 | ||||||

| Prepaid expenses and other current assets |

(276 | ) | (374 | ) | ||||

| Other assets |

68 | (35 | ) | |||||

| Accounts payable |

112 | 181 | ||||||

| Accrued expenses |

(3,635 | ) | (4,058 | ) | ||||

| Other liabilities |

(93 | ) | 2 | |||||

| Deferred revenue |

(7,251 | ) | (9,387 | ) | ||||

|

|

|

|

|

|||||

| Net cash provided by operating activities |

9,598 | 4,795 | ||||||

|

|

|

|

|

|||||

| Cash flows used in investing activities: |

||||||||

| Purchases of property and equipment |

(626 | ) | (577 | ) | ||||

|

|

|

|

|

|||||

| Net cash used in investing activities |

(626 | ) | (577 | ) | ||||

|

|

|

|

|

|||||

| Cash flows used in financing activities: |

||||||||

| Proceeds from stock option and warrant exercises |

1,130 | 416 | ||||||

| Payments of capital lease obligations |

(1,301 | ) | (1,358 | ) | ||||

|

|

|

|

|

|||||

| Net cash used in financing activities |

(171 | ) | (942 | ) | ||||

|

|

|

|

|

|||||

| Effect of exchange rate changes on cash |

(180 | ) | (61 | ) | ||||

|

|

|

|

|

|||||

| Net increase in cash and cash equivalents |

8,621 | 3,215 | ||||||

| Cash and cash equivalents, beginning of period |

21,785 | 28,753 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents, end of period |

$ | 30,406 | $ | 31,968 | ||||

|

|

|

|

|

|||||

| Supplemental cash flow disclosures: |

||||||||

| Cash paid for interest |

$ | 119 | $ | 177 | ||||

| Cash paid for income taxes |

$ | 1,043 | $ | 1,149 | ||||

| Supplemental disclosure of non-cash investing and financing activities: |

||||||||

| Acquisition of equipment through capital leases |

$ | — | $ | 1,700 | ||||

The accompanying notes are an integral part of the consolidated financial statements

5

Table of Contents

Notes to Consolidated Financial Statements (Unaudited)

(Dollars in thousands except per share amounts)

1. Description of Business

Exa Corporation (the “Company” or “Exa”), a Delaware corporation, develops, sells and supports simulation software and services used primarily by vehicle manufacturers to enhance the performance of their products, reduce product development costs and improve the efficiency of their design and engineering processes. The Company’s solutions enable engineers and designers to augment or replace conventional methods of evaluating designs that rely on expensive and inefficient physical prototypes and test facilities with accurate digital simulations that are more useful, cost effective and timely. The Company’s simulation solutions enable customers to gain crucial insights about design performance early in the design cycle, reducing the likelihood of expensive redesigns and late-stage engineering changes, which result in cost savings and fundamental improvements in the development process. The Company is primarily focused on the ground transportation market, but is also exploring the application of its capabilities in the aerospace, oil and gas production, chemical processing, architecture, engineering and construction, power generation, biomedical and electronics industries.

Exa has offices and sells directly in the United States and through subsidiaries in France, Germany, Italy, Japan, Korea, China, and the United Kingdom. The Company also conducts business in Sweden, India, Brazil, Russia, Canada, Finland, Spain and Australia.

2. Summary of Significant Accounting Policies

Applicable Accounting Guidance

Any reference in these notes to applicable accounting guidance is meant to refer to the authoritative United States generally accepted accounting principles (“GAAP”) as found in the Financial Accounting Standards Board’s (“FASB”) Accounting Standards Codification (“ASC”).

Basis of Presentation

The accompanying unaudited consolidated financial statements have been prepared by the Company in accordance with GAAP for interim financial information and pursuant to the rules and regulations of the Securities and Exchange Commission regarding interim financial reporting. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements and should be read in conjunction with the audited consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended January 31, 2015. These financial statements reflect all adjustments (consisting solely of normal, recurring adjustments) that are, in the opinion of management, necessary for a fair statement of results for the interim periods presented.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make significant estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Changes in estimates are recorded in the period in which they become known. The Company bases its estimates on historical experience and various other assumptions that it believes to be reasonable under the circumstances. Actual results could differ from management’s estimates if future events differ substantially from past experience, or other assumptions, which reasonable when made, do not turn out to be substantially accurate.

6

Table of Contents

Recent Accounting Pronouncements

In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers, which supersedes nearly all existing revenue recognition guidance under GAAP. The core principle of ASU 2014-09 is to recognize revenues when promised goods or services are transferred to customers in an amount that reflects the consideration to which an entity expects to be entitled for those goods or services. ASU 2014-09 defines a five-step process to achieve this core principle and, as a result of which, more judgment and estimates may be required within the revenue recognition process than are required under existing GAAP. The standard is effective for annual periods beginning after December 15, 2016, and interim periods therein. However, in July 2015, the FASB approved a one-year deferral that does not require adoption until calendar year 2018 (fiscal 2019 for the Company). The two permitted transition methods under the new standard are: (i) a full retrospective approach reflecting the application of the standard in each prior reporting period with the option to elect certain practical expedients, or (ii) a retrospective approach with the cumulative effect of initially adopting ASU 2014-09 recognized at the date of adoption (which includes additional footnote disclosures). The Company is currently evaluating the impact of its pending adoption of ASU 2014-09 on its consolidated financial statements and has not yet determined the method by which it will adopt the standard when it becomes effective.

In June 2014, the FASB issued ASU 2014-12, Stock Compensation, which is a standards update on accounting for share-based payments when the terms of the award provide that a performance target could be achieved after a requisite service period. The standard is effective for annual periods beginning after December 31, 2015, and interim periods therein, with early adoption permitted. This ASU is not expected to have an impact on the Company’s financial statements or disclosures.

In August 2014, the FASB issued ASU No. 2014-15, Presentation of Financial Statements – Going Concern (Subtopic 205-40): Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern. Under the new guidance, management will be required to assess an entity’s ability to continue as a going concern, and to provide related footnote disclosures in certain circumstances. The provisions of this ASU are effective for annual periods beginning after December 15, 2016, and for interim periods therein. This ASU is not expected to have an impact on the Company’s financial statements or disclosures.

In April 2015, the FASB issued ASU No. 2015-05, Intangibles – Goodwill and Other – Internal-Use Software: Customer’s Accounting for Fees Paid in a Cloud Computing Arrangement. The guidance clarifies the circumstances under which a cloud computing customer would account for the arrangement as a license of internal-use software. The standard will be effective for annual reporting periods beginning after December 15, 2016, and for interim periods therein. Early adoption is permitted. The Company does not believe the guidance will have a material impact on its consolidated financial statements.

3. Computation of Net Loss Per Share

Net loss per share has been computed using the weighted average number of shares of common stock outstanding during each period. Diluted amounts per share include the impact of the Company’s outstanding potential common shares, such as shares issuable upon exercise of in-the-money stock options or warrants, when dilutive. Potential common shares that are anti-dilutive are excluded from the calculation of diluted net loss per common share.

The following summarizes the calculation of basic and diluted net loss per share:

| Three Months Ended July 31, | Six Months Ended July 31, | |||||||||||||||

| 2015 | 2014 | 2015 | 2014 | |||||||||||||

| Numerator: |

||||||||||||||||

| Net loss |

$ | (1,195 | ) | $ | (1,009 | ) | $ | (3,083 | ) | $ | (18,229 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Denominator: |

||||||||||||||||

| Weighted average common shares, basic and diluted |

14,535,539 | 13,775,250 | 14,420,562 | 13,639,866 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Basic and diluted net loss per share |

$ | (0.08 | ) | $ | (0.07 | ) | $ | (0.21 | ) | $ | (1.34 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

7

Table of Contents

All of the Company’s outstanding stock options and unvested restricted stock unit awards were excluded from the computation of diluted net loss per share for the three and six months ended July 31, 2015 and 2014 because including them would have had an anti-dilutive effect due to the net loss position of the Company. At July 31, 2015 and 2014, the Company had outstanding options, unvested restricted stock unit awards and warrants of 2,471,058 and 2,754,044, respectively.

4. Property and Equipment, net

Property and equipment, net consists of the following:

| July 31, 2015 |

January 31, 2015 |

|||||||

| Computer software and equipment |

$ | 20,910 | $ | 20,637 | ||||

| Office equipment and furniture |

426 | 422 | ||||||

| Leasehold improvements |

2,588 | 2,593 | ||||||

|

|

|

|

|

|||||

| Total property and equipment |

23,924 | 23,652 | ||||||

| Less: accumulated depreciation |

(17,716 | ) | (16,691 | ) | ||||

|

|

|

|

|

|||||

| Property and equipment, net |

$ | 6,208 | $ | 6,961 | ||||

|

|

|

|

|

|||||

For the three and six months ended July 31, 2015, depreciation expense was $690 and $1,353, respectively. For the three and six months ended July 31, 2014, depreciation expense was $643 and $1,219, respectively. Included in computer software and equipment and office equipment and furniture is equipment held pursuant to capital leases with costs of $18,047 and $18,409 and accumulated depreciation of $13,415 and $11,858 as of July 31, 2015 and 2014, respectively.

During the three and six months ended July 31, 2015, the Company disposed of $11 and $281, respectively, worth of fully-depreciated computer equipment. No gain or loss on the disposals of these assets was recognized.

5. Accrued Expenses

Accrued expenses consist of the following:

| July 31, 2015 |

January 31, 2015 |

|||||||

| Accrued payroll |

$ | 2,164 | $ | 1,695 | ||||

| Accrued commissions and bonuses |

1,406 | 3,150 | ||||||

| Sales and withholding taxes |

660 | 2,427 | ||||||

| Accrued income taxes payable |

436 | 597 | ||||||

| Legal and professional |

530 | 275 | ||||||

| Deferred rent, current portion |

37 | 597 | ||||||

| Other accrued expenses |

1,112 | 1,844 | ||||||

|

|

|

|

|

|||||

| Total accrued expenses |

$ | 6,345 | $ | 10,585 | ||||

|

|

|

|

|

|||||

8

Table of Contents

6. Deferred Rent

Payment escalations, rent holidays and lease incentives specified in the Company’s non-cancelable operating lease and hosting agreements are recognized on a straight-line basis over the terms of the agreements. The differences arising from straight-line expense recognition and cash payments are recorded as deferred rent in the accompanying consolidated balance sheets. Tenant leasehold improvement allowances received from landlords are recorded as leasehold improvements and deferred rent and are amortized as operating expense over the applicable lease terms. Deferred rent consists of the following:

| July 31, 2015 |

January 31, 2015 |

|||||||

| Leasehold improvement incentive |

$ | 196 | $ | 308 | ||||

| Non-cash rent expense |

712 | 761 | ||||||

|

|

|

|

|

|||||

| Total deferred rent |

908 | 1,069 | ||||||

| Less: current portion included in accrued expenses |

(37 | ) | (597 | ) | ||||

|

|

|

|

|

|||||

| Deferred rent, net of current portion |

$ | 871 | $ | 472 | ||||

|

|

|

|

|

|||||

7. Fair Value Measurements

Financial instruments consist primarily of cash and cash equivalents, accounts receivable and capital lease obligations. As of July 31, 2015 and January 31, 2015, the carrying amounts of these instruments approximate their fair values. The estimated fair values have been determined from information obtained from market sources and management estimates.

In determining the fair value of its financial assets and liabilities, the Company uses various valuation approaches. ASC 820, Fair Value Measurements and Disclosures, establishes a hierarchy of inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that observable inputs be used when available. Observable inputs are inputs that market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Company. Unobservable inputs are inputs that reflect the Company’s assumptions about the inputs that market participants would use in pricing the asset or liability, and are developed based on the best information available in the circumstances. The fair value hierarchy is broken down into three levels based on the source of inputs as follows:

Level 1 – Valuations based on unadjusted quoted prices in active markets for identical assets or liabilities that the Company has the ability to access.

Level 2 – Valuations based on quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not active and models for which all significant inputs are observable, either directly or indirectly.

Level 3 – Valuations based on inputs that are unobservable and significant to the overall fair value measurement and that are based on management’s best estimate of inputs market participants would use for pricing the asset or liability at the measurement date, including assumptions about risk.

The following table summarizes the Company’s fair value hierarchy for its financial assets and liabilities measured at fair value as of July 31, 2015:

| Total | Level 1 | Level 2 | Level 3 | |||||||||||||

| Assets: |

||||||||||||||||

| Money market funds |

$ | 12,516 | $ | 12,516 | $ | — | $ | — | ||||||||

9

Table of Contents

The following table summarizes the Company’s fair value hierarchy for its financial assets and liabilities measured at fair value as of January 31, 2015:

| Total | Level 1 | Level 2 | Level 3 | |||||||||||||

| Assets: |

||||||||||||||||

| Money market funds |

$ | 12,514 | $ | 12,514 | $ | — | $ | — | ||||||||

The availability of observable inputs can vary among the various types of financial assets and liabilities. To the extent that the valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for financial statement disclosure purposes, the level in the fair value hierarchy within which the fair value measurement is categorized is based on the lowest level input that is significant to the overall fair value measurement.

8. Acquired Intangible Assets

Intangible assets acquired in a business combination are recorded under the purchase method of accounting at their estimated fair values at the date of acquisition. The Company amortizes acquired intangible assets over their estimated useful lives.

The following table reflects the carrying value of intangible assets as of July 31, 2015:

| July 31, 2015 | ||||||||||||

| Cost | Accumulated Amortization |

Net Book Value |

||||||||||

| Intellectual property |

$ | 3,505 | $ | (1,285 | ) | $ | 2,220 | |||||

| Access to facilities contract |

38 | (38 | ) | — | ||||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 3,543 | $ | (1,323 | ) | $ | 2,220 | |||||

|

|

|

|

|

|

|

|||||||

The following table reflects the carrying value of intangible assets as of January 31, 2015:

| January 31, 2015 | ||||||||||||

| Cost | Accumulated Amortization |

Net Book Value |

||||||||||

| Intellectual property |

$ | 3,505 | $ | (1,110 | ) | $ | 2,395 | |||||

| Access to facilities contract |

38 | (38 | ) | — | ||||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 3,543 | $ | (1,148 | ) | $ | 2,395 | |||||

|

|

|

|

|

|

|

|||||||

For the three and six months ended July 31, 2015, amortization expense of intangible assets was $87 and $175, respectively. For the three and six months ended July 31, 2014, amortization expense of intangible assets was $88 and $175, respectively.

9. Commitments and Contingencies

Legal Contingencies

From time to time the Company is involved in legal proceedings arising in the ordinary course of business. There is no litigation pending that could, individually or in the aggregate, be reasonably expected to have a material adverse effect on the Company’s financial position, results of operations, or cash flows.

10

Table of Contents

Guarantees and Indemnification Obligations

The Company enters into standard indemnification agreements in the ordinary course of business. Pursuant to these agreements, the Company indemnifies, holds harmless, and agrees to reimburse the indemnified party for losses suffered or incurred by the indemnified party, generally the Company’s business partners or customers, in connection with any United States patent, or any copyright or other intellectual property infringement claim by any third party with respect to the Company’s products. The term of these indemnification provisions is generally perpetual after execution of the agreement. The maximum potential amount of future payments the Company could be required to make under these agreements is unlimited.

Based on historical experience and information known as of July 31, 2015 and January 31, 2015, the Company has not recorded any liabilities for the above guarantees and indemnities.

Operating Leases

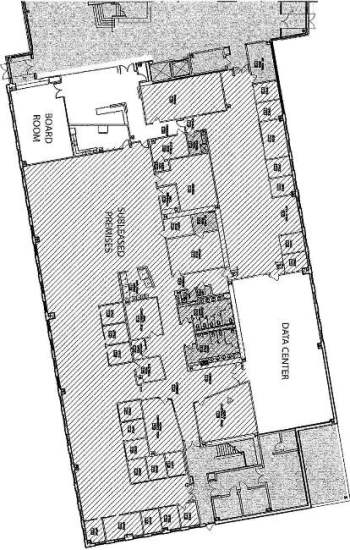

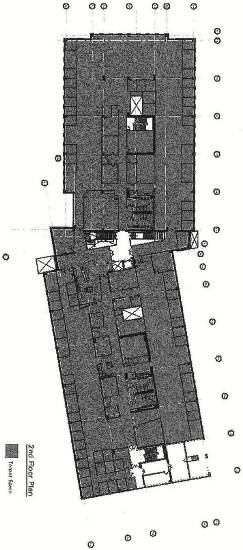

Effective July 1, 2015, the Company amended the lease for its corporate headquarters space in Burlington, Massachusetts. Originally set to expire in March 2016, the amendment extends the lease term through March 2023 and reduces the leased space from 65,941 square feet to 44,241 square feet. The 21,700 square foot reduction primarily relates to first floor space that had been subleased by the Company to a subtenant, and under the terms of the amendment, the landlord assumed the sublease effective July 1, 2015. The amendment also provides for a tenant improvement allowance of up to $1,681 to cover renovations that will be made to the retained second floor space over the remainder of fiscal year 2016. Management believes that the renovated space will be suitable and adequate to meet the Company’s planned growth needs at its headquarters over the next several years.

In conjunction with the relinquishment of the first floor space, the amendment reduces the Company’s required security deposit letter of credit from $525 to $352, and accordingly, management plans to reduce the restricted cash account securing the letter of credit to $352 in the third quarter of fiscal 2016. As of July 31, 2015, restricted cash of $352 is included in other long-term assets and $173 is included in other current assets in the accompanying consolidated balance sheet.

As of July 31, 2015, future minimum lease payments under the amended headquarters lease are as follows:

| Fiscal year ended January 31, | ||||

| 2016 (remainder as of July 31, 2015) |

$ | 780 | ||

| 2017 |

1,541 | |||

| 2018 |

1,574 | |||

| 2019 |

1,618 | |||

| 2020 |

1,663 | |||

| 2021 |

1,707 | |||

| Thereafter |

3,847 | |||

|

|

|

|||

| $ | 12,730 | |||

|

|

|

|||

Purchase Obligations

In July 2015, the Company entered into a commitment to lease $4,351 of computer processor equipment for its high performance computing data center in New Jersey. This capital investment will significantly expand the Company’s computing capacity to address current and anticipated demand. It is also expected to improve project simulation cycle times. The equipment, which is expected to be delivered by September 2015, will be financed over three years under an arrangement with IBM that will qualify for capital lease accounting treatment.

11

Table of Contents

10. Stockholders’ Equity and Stock-Based Compensation

Warrants Exercised

On July 29, 2015, Massachusetts Capital Resource Company exercised warrants to purchase 21,538 shares of common stock at a cash exercise price of $6.11 per share. The Company has no remaining outstanding warrants as of July 31, 2015.

Stock-Based Compensation Expense

The fair value of common stock service-based options for employees and directors is estimated on the date of grant using the Black-Scholes option-pricing model with the following weighted average assumptions used:

| Six Months Ended July 31, |

||||||||

| 2015 | 2014 | |||||||

| Estimated dividend yield |

0 | % | 0 | % | ||||

| Expected stock price volatility |

38.1 | % | 47.7 | % | ||||

| Weighted-average risk-free interest rate |

2.0 | % | 2.2 | % | ||||

| Expected life of options (in years) |

6.25 | 6.25 | ||||||

The weighted average grant date fair value per share for service-based stock options granted in the three and six months ended July 31, 2015 was $4.53 and $4.44, respectively. The weighted average grant date fair value per share for service-based stock options granted in the three and six months ended July 31, 2014 was $4.32 and $5.54, respectively.

For standard service-based stock options, the Company records stock-based compensation expense over the estimated service/vesting period. The amount of stock-based compensation expense recognized during a period is based on the value of the portion of the awards that are ultimately expected to vest.

Performance-based stock options are recognized as expense over the requisite service period when it becomes probable that performance measures triggering vesting will be met. Certain grants vested during the first quarter of fiscal year 2016 based on achieved performance metrics. As of July 31, 2015, the Company has concluded that it is not probable that the remaining unvested options will achieve the required metrics for vesting. As a result, the Company has not recognized any additional share-based compensation expense associated with the unvested portion of these performance-based options.

Total stock-based compensation expense related to stock options and restricted stock units issued by the Company is as follows:

| Three Months Ended July 31, |

Six Months Ended July 31, |

|||||||||||||||

| 2015 | 2014 | 2015 | 2014 | |||||||||||||

| Cost of revenues |

$ | 53 | $ | 44 | $ | 122 | $ | 82 | ||||||||

| Sales and marketing |

85 | 86 | 200 | 161 | ||||||||||||

| Research and development |

185 | 191 | 426 | 347 | ||||||||||||

| General and administrative |

168 | 179 | 357 | 280 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 491 | $ | 500 | $ | 1,105 | $ | 870 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The total unrecognized compensation cost related to outstanding service-based stock options is $3,057 at July 31, 2015. This amount is expected to be recognized over a weighted-average period of 2.47 years.

12

Table of Contents

11. Income Taxes

For the three and six months ended July 31, 2015, the Company’s income tax provision was $154 and $128, respectively. The provision for both periods primarily consists of the tax effects of foreign operating results and foreign withholding taxes. For the three and six months ended July 31, 2014, the income tax provision was $176 and $15,656, respectively. The provision for the six months ended July 31, 2014 includes a $14,506 non-cash charge to record a valuation allowance against the Company’s United States net deferred tax assets and a $700 non-cash write-off of state deferred tax assets.

In determining the realizability of the net United States federal and state deferred tax assets, the Company considers numerous factors including historical profitability, estimated future taxable income, prudent and feasible tax planning strategies and the industry in which it operates. Management reassesses the realization of the deferred tax assets each reporting period, which resulted in a full valuation allowance against the Company’s United States deferred tax assets in the first quarter of fiscal year 2015. To the extent that the financial results of the United States operations improve in the future and the deferred tax assets become realizable, the Company will reduce the valuation allowance through earnings.

The Company does not expect that its unrecognized tax benefit will change significantly within the next twelve months. The Company and one or more of its subsidiaries file United States federal income tax returns and tax returns in various state and foreign jurisdictions. With limited exceptions, the Company is no longer subject to federal, state, local or foreign examinations for years prior to January 31, 2011. However, carryforward attributes that were generated in tax years ending prior to January 31, 2012 may still be adjusted upon examination by state or local tax authorities if they either have been or will be used in a future period.

Under Section 382 of the Internal Revenue Code of 1986, as amended, substantial changes in the Company’s ownership may limit the amount of net operating loss carryforwards that could be utilized annually in the future to offset its taxable income. Specifically, this limitation may arise in the event of a cumulative change in ownership of the Company of more than 50% within a three-year period. During the first quarter of fiscal year 2015, management determined that the Company had experienced an ownership change for purposes of Section 382. This ownership change resulted in annual limitations to the amount of net operating loss carryforwards that can be utilized to offset future taxable income, if any, at the federal level. The Company’s management has determined that, as of July 31, 2015, it had not experienced another ownership change for purposes of Section 382. However, future transactions in the Company’s common stock could trigger an ownership change for purposes of Section 382, which could limit the amount of net operating loss carryforwards that could be utilized annually in the future to offset the Company’s taxable income, if any. Any such limitation, whether as the result of sales of common stock by the Company’s existing stockholders or sales of common stock by the Company, could have a material adverse effect on the Company’s results of operations in future years.

13

Table of Contents

12. Geographic Information

Revenue is attributed to individual countries based upon location of the external customer. Revenue by geographic area is as follows:

| Three Months Ended July 31, |

Six Months Ended July 31, |

|||||||||||||||

| 2015 | 2014 | 2015 | 2014 | |||||||||||||

| United States |

$ | 4,298 | $ | 3,412 | $ | 8,141 | $ | 6,285 | ||||||||

| Japan |

2,138 | 2,147 | 4,479 | 4,518 | ||||||||||||

| Germany |

2,461 | 2,838 | 4,650 | 5,529 | ||||||||||||

| United Kingdom |

1,842 | 1,266 | 3,703 | 2,388 | ||||||||||||

| France |

1,841 | 2,252 | 3,620 | 4,236 | ||||||||||||

| Korea |

1,412 | 1,419 | 2,705 | 2,655 | ||||||||||||

| Sweden |

482 | 651 | 957 | 1,345 | ||||||||||||

| Other |

981 | 858 | 1,968 | 1,657 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 15,455 | $ | 14,843 | $ | 30,223 | $ | 28,613 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Net long-lived assets, consisting of net property and equipment, are subject to geographic risks because they are generally difficult to move and to effectively utilize in another geographic area in a reasonable time period and because they are relatively illiquid. Net long-lived assets by principal geographic areas were as follows:

| July 31, 2015 |

January 31, 2015 |

|||||||

| United States |

$ | 5,477 | $ | 6,080 | ||||

| France |

474 | 590 | ||||||

| Germany |

129 | 132 | ||||||

| Japan |

56 | 91 | ||||||

| Other |

72 | 68 | ||||||

|

|

|

|

|

|||||

| Total property and equipment, net |

$ | 6,208 | $ | 6,961 | ||||

|

|

|

|

|

|||||

14

Table of Contents

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our financial statements and related notes and Management’s Discussion and Analysis of Financial Condition and Result of Operations appearing in our Annual Report on Form 10-K, filed with the SEC on March 24, 2015. In addition to historical financial information, the following discussion contains forward-looking statements that reflect our plans, estimates, assumptions and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to these differences include those discussed below and elsewhere in this report. Forward-looking statements include information concerning our possible or assumed future results of operations, business strategies and operations, financing plans, potential growth opportunities, potential market opportunities and the effects of competition. Forward-looking statements include all statements that are not historical facts and can be identified by terms such as “anticipates,” “believes,” “could,” “seeks,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or similar expressions and the negatives of those terms. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Also, forward-looking statements represent our management’s plans, estimates, assumptions and beliefs only as of the date of this report. Except as required by law, we assume no obligation to update these forward-looking statements publicly or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

As used herein, except as otherwise indicated by context, references to “we,” “us,” “our,” or the “Company” refer to Exa Corporation.

Overview

We develop, sell and support simulation software and services that manufacturers use to enhance the performance of their products, reduce product development costs and improve the efficiency of their design and engineering processes. Our solutions enable engineers and designers to augment or replace conventional methods of evaluating design alternatives that rely on expensive and inefficient physical prototypes and test facilities, such as wind tunnels used in vehicle design, with accurate digital simulations that are more useful and timely. Our simulation solutions enable our customers to gain crucial insights about design performance early in the design cycle, reducing the likelihood of expensive redesigns and late-stage engineering changes. As a result, our customers realize significant cost savings and fundamental improvements in their vehicle development process.

We currently focus primarily on the ground transportation market, including manufacturers in the passenger vehicle, highway truck, off-highway vehicle and train markets, as well as their suppliers. Over 125 manufacturers currently utilize our products and services, including 14 of the global top 15 passenger vehicle manufacturer groups. We are also beginning to explore other markets in which we believe the capabilities of our solutions have broad application, such as the aerospace, oil and gas production, chemical processing, architecture, engineering and construction, power generation, biomedical and electronics industries.

One of the most critical challenges for our customers in their vehicle development processes is measuring or predicting how a vehicle feature or a mechanical system will interact with air, water or other fluids. For example, developing vehicles with reduced aerodynamic drag is critical to achieving the improvements in fuel efficiency that are increasingly desired by customers and mandated by government regulations. Our core product, PowerFLOW, is an innovative software solution for simulating complex fluid flow problems, including aerodynamics, thermal management, and aeroacoustics, or wind noise. PowerFLOW relies upon proprietary technology that enables it to predict complex fluid flows with a level of reliability comparable to or better than physical testing. The combination of PowerFLOW’s accuracy and timeliness provides results that are superior to those of alternative computational fluid dynamics, or CFD, methods.

We derive our revenue primarily from the sale of our simulation software, using an annual capacity-based licensing model. Our customers usually purchase PowerFLOW simulation capacity under one-year licenses, with

15

Table of Contents

a minority utilizing multi-year arrangements. Simulation capacity may be purchased as software-only, to be run on the customer’s own computer hardware, or provided in the form of software-as-a-service, via our hosted ExaCLOUD or PowerFLOW OnDemand offerings. To introduce new customers to our simulation solutions, we typically perform fixed-price projects that include simulation services accessed via our hosted facilities, along with engineering and consulting services. Customers typically license our products for one application, such as aerodynamics, and over time expand to other applications such as thermal management or aeroacoustics. In our customer engagement model, our applications management teams engage with our customers in long-term relationships focused on identifying problems that we can help them solve, demonstrating the value of our solutions and ensuring that the customer achieves maximum benefit from them. In this process we interact continuously with our customers to improve our software and services and add new solutions, and at the same time deepen our knowledge of their industry.

During the six months ended July 31, 2015, revenue growth was driven by continued deployment of our simulation solutions in the installed base as well as by the addition of new customers. Investments made in field resources over the past two fiscal years are yielding growth in both project and license revenue. The strengthening U.S. dollar, particularly against the Euro and yen, had a material negative impact on revenue performance as compared to the same period last year. The geographic mix of revenue outside of the Americas is consistent with historical trends but does reflect the impact of the weaker Euro and yen. During the six months ended July 31, 2015, 72% of our revenue came from outside of the Americas as compared to 78% for the same period last year. Revenue for the six months ended July 31, 2015 was $30.2 million, with growth of 5.6% over the same period a year ago and 16.8% when measured on a constant currency basis. See “— Non-GAAP Measures” below for information about how we calculate and use revenue on a constant currency basis.

As a percent of revenue, our total operating expenses for the six months ended July 31, 2015 were relatively flat when compared to the same period last year, with only a 0.2% decrease. This reflects our previous investment in resources to drive top line growth, including sales, marketing and research and development. While the majority of our expense base is in the United States, we have field resources based in our international offices which provide some natural foreign exchange hedge. As a result, the strengthening dollar had a positive impact on total operating expenses when compared to the same period last year. For the six months ended July 31, 2015, total operating expenses were $32.8 million, with growth of 5.4% over the same period a year ago and 11.7% when measured on a constant currency basis. See “— Non-GAAP Measures” below for information about how we calculate and use operating expenses on a constant currency basis.

As a percent of revenue, our loss from operations for the six months ended July 31, 2015 was 0.2% lower than the same period last year, primarily as a result of the foreign currency impacts described above. Adjusted EBITDA for the six months ended July 31, 2015, as described in the Non-GAAP Measures section below, was slightly improved at break-even when compared to negative $0.3 million in the same period last year.

We ended the quarter with cash and cash equivalents of $30.4 million compared to $21.8 million as of January 31, 2015. This reflects strong accounts receivable collections activity and normal seasonal cash flows. Capital expenditures were consistent with historical trends.

16

Table of Contents

Results of Operations for the Three Months Ended July 31, 2015 and 2014

The following tables set forth, for the periods presented, data from our consolidated statements of operation, as well as that data as a percentage of revenues.

| Three Months Ended July 31, | ||||||||

| (in thousands) | 2015 | 2014 | ||||||

| Revenue: |

||||||||

| License revenue |

$ | 12,977 | $ | 12,316 | ||||

| Project revenue |

2,478 | 2,527 | ||||||

|

|

|

|

|

|||||

| Total revenues |

15,455 | 14,843 | ||||||

|

|

|

|

|

|||||

| Operating expenses: (1) |

||||||||

| Cost of revenue |

4,755 | 4,632 | ||||||

| Sales and marketing |

2,440 | 2,509 | ||||||

| Research and development |

5,952 | 5,404 | ||||||

| General and administrative (2) |

3,126 | 3,217 | ||||||

|

|

|

|

|

|||||

| Total operating expenses |

16,273 | 15,762 | ||||||

|

|

|

|

|

|||||

| Loss from operations |

(818 | ) | (919 | ) | ||||

|

|

|

|

|

|||||

| Other (expense) income, net: |

||||||||

| Foreign exchange (loss) gain |

(171 | ) | 175 | |||||

| Interest expense |

(54 | ) | (94 | ) | ||||

| Interest income |

2 | 2 | ||||||

| Other income, net |

— | 3 | ||||||

|

|

|

|

|

|||||

| Total other (expense) income, net |

(223 | ) | 86 | |||||

|

|

|

|

|

|||||

| Loss before income taxes |

(1,041 | ) | (833 | ) | ||||

| Provision for income taxes |

(154 | ) | (176 | ) | ||||

|

|

|

|

|

|||||

| Net loss |

$ | (1,195 | ) | $ | (1,009 | ) | ||

|

|

|

|

|

|||||

| (1) | Amounts include stock-based compensation expense as follows: |

| Three Months Ended July 31, | ||||||||

| (in thousands) | 2015 | 2014 | ||||||

| Cost of revenues |

$ | 53 | $ | 44 | ||||

| Sales and marketing |

85 | 86 | ||||||

| Research and development |

185 | 191 | ||||||

| General and administrative |

168 | 179 | ||||||

|

|

|

|

|

|||||

| Total stock-based compensation expense |

$ | 491 | $ | 500 | ||||

|

|

|

|

|

|||||

| (2) | Includes amortization expense related to intangible assets as follows: |

| (in thousands) | ||||||||

| General and administrative |

87 | 88 | ||||||

17

Table of Contents

| Three Months Ended July 31, |

||||||||

| (as a percent of total revenue) | 2015 | 2014 | ||||||

| Revenue: |

||||||||

| License revenue |

84.0 | % | 83.0 | % | ||||

| Project revenue |

16.0 | % | 17.0 | % | ||||

|

|

|

|

|

|||||

| Total revenues |

100.0 | % | 100.0 | % | ||||

|

|

|

|

|

|||||

| Operating expenses: |

||||||||

| Cost of revenue |

30.8 | % | 31.2 | % | ||||

| Sales and marketing |

15.8 | % | 16.9 | % | ||||

| Research and development |

38.5 | % | 36.4 | % | ||||

| General and administrative |

20.2 | % | 21.7 | % | ||||

|

|

|

|

|

|||||

| Total operating expenses |

105.3 | % | 106.2 | % | ||||

|

|

|

|

|

|||||

| Loss from operations |

(5.3 | )% | (6.2 | )% | ||||

|

|

|

|

|

|||||

| Other (expense) income, net: |

||||||||

| Foreign exchange (loss) gain |

(1.1 | )% | 1.2 | % | ||||

| Interest expense |

(0.3 | )% | (0.6 | )% | ||||

| Interest income |

0.0 | % | 0.0 | % | ||||

| Other income, net |

0.0 | % | 0.0 | % | ||||

|

|

|

|

|

|||||

| Total other (expense) income, net |

(1.4 | )% | 0.6 | % | ||||

|

|

|

|

|

|||||

| Loss before income taxes |

(6.7 | )% | (5.6 | )% | ||||

| Provision for income taxes |

(1.0 | )% | (1.2 | )% | ||||

|

|

|

|

|

|||||

| Net loss |

(7.7 | )% | (6.8 | )% | ||||

|

|

|

|

|

|||||

Due to rounding, totals may not equal the sum of line items in the table above.

Comparison of Three Months Ended July 31, 2015 and 2014

Revenue

| Three Months Ended July 31, |

||||||||||||||||

| (in thousands, except percentages) | 2015 | 2014 | Increase | % Change | ||||||||||||

| License revenue |

$ | 12,977 | $ | 12,316 | $ | 661 | 5.4 | % | ||||||||

| Project revenue |

2,478 | 2,527 | (49 | ) | (1.9 | )% | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total revenues |

$ | 15,455 | $ | 14,843 | $ | 612 | 4.1 | % | ||||||||

|

|

|

|

|

|

|

|||||||||||

License revenue increased 5.4% from $12.3 million for the three months ended July 31, 2014 to $13.0 million for the three months ended July 31, 2015. The $0.7 million increase was driven by new license customers and by increased utilization of simulation capacity by existing customers. Project revenue for the three months ended July 31, 2015 remained relatively flat at $2.5 million when compared to the same period in the prior year.

Foreign exchange fluctuations, particularly the weakening of the Euro and the Japanese yen, negatively impacted total revenue in the three months ended July 31, 2015 by $1.7 million as compared to the three months ended July 31, 2014. On a constant currency basis, our total revenues in the three months ended July 31, 2015 increased 15.3% compared with the three months ended July 31, 2014.

18

Table of Contents

Cost of revenues

| Three Months Ended July 31, |

||||||||||||||||

| (in thousands, except percentages) | 2015 | 2014 | Increase | % Change | ||||||||||||

| Cost of revenues |

$ | 4,755 | $ | 4,632 | $ | 123 | 2.7 | % | ||||||||

Cost of revenues for the three months ended July 31, 2015 was $4.8 million, an increase of $0.1 million, or 2.7%, compared with $4.6 million during the three months ended July 31, 2014. As a percentage of revenues, cost of revenues decreased to 30.8% for the three months ended July 31, 2015 compared to 31.2% for the three months ended July 31, 2014. Approximately $0.2 million of increased royalty costs associated with higher customer license levels and expanded use of certain embedded sublicensed product were partially offset by reductions in miscellaneous expenses and other personnel-related costs.

Sales and marketing

| Three Months Ended July 31, |

||||||||||||||||

| (in thousands, except percentages) | 2015 | 2014 | Decrease | % Change | ||||||||||||

| Sales and marketing |

$ | 2,440 | $ | 2,509 | $ | (69 | ) | (2.8 | )% | |||||||

Sales and marketing expenses for the three months ended July 31, 2015 were $2.4 million and remained relatively flat compared with the same period a year ago. As a percentage of revenues, sales and marketing expenses decreased to 15.8% for the three months ended July 31, 2015 compared to 16.9% for the three months ended July 31, 2014. Decreases in miscellaneous expenses and other personnel-related costs were partially offset by increases in costs associated with marketing programs and initiatives.

Research and development

| Three Months Ended July 31, |

||||||||||||||||

| (in thousands, except percentages) | 2015 | 2014 | Increase | % Change | ||||||||||||

| Research and development |

$ | 5,952 | $ | 5,404 | $ | 548 | 10.1 | % | ||||||||

Research and development expenses for the three months ended July 31, 2015 were $6.0 million, an increase of $0.5 million, or 10.1%, compared to $5.4 million for the three months ended July 31, 2014. As a percentage of revenues, research and development expense increased to 38.5% for the three months ended July 31, 2015 compared to 36.4% for the three months ended July 31, 2014. Increased payroll and employee-related costs accounted for essentially all of the $0.5 million increase, primarily as a result of the net addition of 15 new scientists and software engineers since the prior year period and merit-based compensation increases for existing personnel.

General and administrative

| Three Months Ended July 31, |

||||||||||||||||

| (in thousands, except percentages) | 2015 | 2014 | Decrease | % Change | ||||||||||||

| General and administrative |

$ | 3,126 | $ | 3,217 | $ | (91 | ) | (2.8 | )% | |||||||

General and administrative expenses for the three months ended July 31, 2015 were $3.1 million, a decrease of $0.1 million, or 2.8%, compared to $3.2 million for the three months ended July 31, 2014. As a percentage of revenues, general and administrative expenses decreased to 20.2% for the three months ended July 31, 2015 compared to 21.7% for the three months ended July 31, 2014. The decrease is primarily attributable to lower professional service fees, including legal and accounting fees, of approximately $0.1 million.

19

Table of Contents

Other (expense) income, net

| Three Months Ended July 31, |

||||||||||||||||

| (in thousands, except percentages) | 2015 | 2014 | Change | % Change | ||||||||||||

| Other (expense) income, net |

$ | (223 | ) | $ | 86 | $ | (309 | ) | (359.3 | )% | ||||||

Other expense, net for the three months ended July 31, 2015 was $0.2 million, compared to other income, net of $0.1 million for the three months ended July 31, 2014. Other (expense) income, net consists primarily of foreign exchange gains and losses and interest expense associated with our capital lease obligations. The period-over-period change in other (expense) income, net is primarily attributed to foreign exchange fluctuations in the Euro and Japanese yen.

Provision for income taxes

| Three Months Ended July 31, |

||||||||||||||||

| (in thousands, except percentages) | 2015 | 2014 | Decrease | % Change | ||||||||||||

| Provision for income taxes |

$ | 154 | $ | 176 | $ | (22 | ) | (12.5 | )% | |||||||

For the three months ended July 31, 2015 and 2014, our income tax provision remained relatively flat at $0.2 million. The provision for both periods primarily consists of the tax effects of foreign operating results and foreign withholding taxes.

In determining the realizability of the net United States federal and state deferred tax assets, we consider numerous factors including historical profitability, estimated future taxable income, prudent and feasible tax planning strategies and the industry in which it operates. Management reassesses the realization of the deferred tax assets each reporting period, which resulted in a full valuation allowance against our United States deferred tax assets in the first quarter of fiscal year 2015. To the extent that the financial results of the United States operations improve in the future and the deferred tax assets become realizable, we will reduce the valuation allowance through earnings.

We do not expect that our unrecognized tax benefit will change significantly within the next twelve months. We and one or more of our subsidiaries file United States federal income tax returns and tax returns in various state and foreign jurisdictions. With limited exceptions, we are no longer subject to federal, state, local or foreign examinations for years prior to January 31, 2011. However, carryforward attributes that were generated in tax years ending prior to January 31, 2012 may still be adjusted upon examination by state or local tax authorities if they either have been or will be used in a future period.

Under Section 382 of the Internal Revenue Code of 1986, as amended, substantial changes in our ownership may limit the amount of net operating loss carryforwards that could be utilized annually in the future to offset its taxable income. Specifically, this limitation may arise in the event we undergo a cumulative change in ownership of more than 50% within a three-year period. During the first quarter of fiscal year 2015, our management determined that the Company had experienced an ownership change for purposes of Section 382. This ownership change resulted in annual limitations to the amount of net operating loss carryforwards that can be utilized to offset future taxable income, if any, at the federal level. Our management has determined that, as of April 30, 2015, we have not experienced another ownership change for purposes of Section 382. However, future transactions in our common stock could trigger an ownership change for purposes of Section 382, which could limit the amount of net operating loss carryforwards that could be utilized annually in the future to offset our taxable income, if any. Any such limitation, whether as the result of sales of common stock by our existing stockholders or sales of common stock by us, could have a material adverse effect on our results of operations in future years.

20

Table of Contents

Results of Operations for the Six Months Ended July 31, 2015 and 2014

| Six Months Ended July 31, | ||||||||

| (in thousands) | 2015 | 2014 | ||||||

| Revenue: |

||||||||

| License revenue |

$ | 25,219 | $ | 23,976 | ||||

| Project revenue |

5,004 | 4,637 | ||||||

|

|

|

|

|

|||||

| Total revenues |

30,223 | 28,613 | ||||||

|

|

|

|

|

|||||

| Operating expenses: (1) |

||||||||

| Cost of revenue |

9,398 | 9,228 | ||||||

| Sales and marketing |

4,928 | 5,076 | ||||||

| Research and development |

12,122 | 10,506 | ||||||

| General and administrative (2) |

6,393 | 6,339 | ||||||

|

|

|

|

|

|||||

| Total operating expenses |

32,841 | 31,149 | ||||||

|

|

|

|

|

|||||

| Loss from operations |

(2,618 | ) | (2,536 | ) | ||||

|

|

|

|

|

|||||

| Other (expense) income, net: |

||||||||

| Foreign exchange (loss) gain |

(223 | ) | 131 | |||||

| Interest expense |

(119 | ) | (177 | ) | ||||

| Interest income |

5 | 6 | ||||||

| Other income, net |

— | 3 | ||||||

|

|

|

|

|

|||||

| Total other (expense) income, net |

(337 | ) | (37 | ) | ||||

|

|

|

|

|

|||||

| Loss before income taxes |

(2,955 | ) | (2,573 | ) | ||||

| Provision for income taxes |

(128 | ) | (15,656 | ) | ||||

|

|

|

|

|

|||||

| Net loss |

$ | (3,083 | ) | $ | (18,229 | ) | ||

|

|

|

|

|

|||||

| (1) | Amounts include stock-based compensation expense as follows: |

| Six Months Ended July 31, | ||||||||

| (in thousands) | 2015 | 2014 | ||||||

| Cost of revenues |

$ | 122 | $ | 82 | ||||

| Sales and marketing |

200 | 161 | ||||||

| Research and development |

426 | 347 | ||||||

| General and administrative |

357 | 280 | ||||||

|

|

|

|

|

|||||

| Total stock-based compensation expense |

$ | 1,105 | $ | 870 | ||||

|

|

|

|

|

|||||

| (2) | Includes amortization expense related to intangible assets as follows: |

| (in thousands) | ||||||||

| General and administrative |

175 | 175 | ||||||

21

Table of Contents

| Six Months Ended July 31, |

||||||||

| (as a percent of total revenue) | 2015 | 2014 | ||||||

| Revenue: |

||||||||

| License revenue |

83.4 | % | 83.8 | % | ||||

| Project revenue |

16.6 | % | 16.2 | % | ||||

|

|

|

|

|

|||||

| Total revenues |

100.0 | % | 100.0 | % | ||||

|

|

|

|

|

|||||

| Operating expenses: |

||||||||

| Cost of revenue |

31.1 | % | 32.3 | % | ||||

| Sales and marketing |

16.3 | % | 17.7 | % | ||||

| Research and development |

40.1 | % | 36.7 | % | ||||

| General and administrative |

21.2 | % | 22.2 | % | ||||

|

|

|

|

|

|||||

| Total operating expenses |

108.7 | % | 108.9 | % | ||||

|

|

|

|

|

|||||

| Loss from operations |

(8.7 | )% | (8.9 | )% | ||||

|

|

|

|

|

|||||

| Other (expense) income, net: |

||||||||

| Foreign exchange (loss) gain |

(0.7 | )% | 0.5 | % | ||||

| Interest expense |

(0.4 | )% | (0.6 | )% | ||||

| Interest income |

0.0 | % | 0.0 | % | ||||

| Other income, net |

0.0 | % | 0.0 | % | ||||

|

|

|

|

|

|||||

| Total other (expense) income, net |

(1.1 | )% | (0.1 | )% | ||||

|

|

|

|

|

|||||

| Loss before income taxes |

(9.8 | )% | (9.0 | )% | ||||

| Provision for income taxes |

(0.4 | )% | (54.7 | )% | ||||

|

|

|

|

|

|||||

| Net loss |

(10.2 | )% | (63.7 | )% | ||||

|

|

|

|

|

|||||

Due to rounding, totals may not equal the sum of line items in the table above.

Comparison of Six Months Ended July 31, 2015 and 2014

Revenue

| Six Months Ended July 31, |

||||||||||||||||

| (in thousands, except percentages) | 2015 | 2014 | Increase | % Change | ||||||||||||

| License revenue |

$ | 25,219 | $ | 23,976 | $ | 1,243 | 5.2 | % | ||||||||

| Project revenue |

5,004 | 4,637 | 367 | 7.9 | % | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total revenues |

$ | 30,223 | $ | 28,613 | $ | 1,610 | 5.6 | % | ||||||||

|

|

|

|

|

|

|

|||||||||||

License revenue increased 5.2% from $24.0 million for the six months ended July 31, 2014 to $25.2 million for the six months ended July 31, 2015. The $1.2 million increase was driven by new license customers and by increased utilization of simulation capacity by existing customers. Project revenue increased by $0.4 million during the six months ended July 31, 2015 compared to the six months ended July 31, 2014 due to expanded sales and engineering efforts with new and existing customers.

Foreign exchange fluctuations, particularly the weakening of the Euro and the Japanese yen, negatively impacted total revenue in the six months ended July 31, 2015 by $3.2 million as compared to the six months ended July 31, 2014. On a constant currency basis, our total revenues in the six months ended July 31, 2015 increased 16.8% compared with the six months ended July 31, 2014.

22

Table of Contents

Cost of revenues

| Six Months Ended July 31, |

||||||||||||||||

| (in thousands, except percentages) | 2015 | 2014 | Increase | % Change | ||||||||||||

| Cost of revenues |

$ | 9,398 | $ | 9,228 | $ | 170 | 1.8 | % | ||||||||

Cost of revenues for the six months ended July 31, 2015 was $9.4 million, an increase of $0.2 million, or 1.8%, compared with $9.2 million during the six months ended July 31, 2014. As a percentage of revenues, cost of revenues decreased to 31.1% for the six months ended July 31, 2015 compared to 32.3% for the six months ended July 31, 2014. Approximately $0.4 million of increased royalty costs associated with higher customer license levels and expanded use of certain embedded sublicensed product were partially offset by reduced miscellaneous expenses of approximately $0.1 million and lower recruiting fees of $0.1 million in the current period.

Sales and marketing

| Six Months Ended July 31, |

||||||||||||||||

| (in thousands, except percentages) | 2015 | 2014 | Decrease | % Change | ||||||||||||

| Sales and marketing |

$ | 4,928 | $ | 5,076 | $ | (148 | ) | (2.9 | )% | |||||||

Sales and marketing expenses for the six months ended July 31, 2015 were $4.9 million, a decrease of $0.1 million, or 2.9%, compared to $5.1 million for the six months ended July 31, 2014. As a percentage of revenues, sales and marketing expenses decreased to 16.3% for the six months ended July 31, 2015 compared to 17.7% for the six months ended July 31, 2014. Approximately $0.4 million of the decrease can be attributed to lower payroll and employee-related costs, including reduced commission expense related to the timing of customer orders and lower travel expenses. These decreases were partially offset by approximately $0.3 million of increased costs related to marketing programs and initiatives.

Research and development

| Six Months Ended July 31, |

||||||||||||||||

| (in thousands, except percentages) | 2015 | 2014 | Increase | % Change | ||||||||||||

| Research and development |

$ | 12,122 | $ | 10,506 | $ | 1,616 | 15.4 | % | ||||||||

Research and development expenses for the six months ended July 31, 2015 were $12.1 million, an increase of $1.6 million, or 15.4%, compared to $10.5 million for the six months ended July 31, 2014. As a percentage of revenues, research and development expense increased to 40.1% for the six months ended July 31, 2015 compared to 36.7% for the six months ended July 31, 2014. Increased payroll and employee-related costs accounted for essentially all of the $1.6 million increase, primarily as a result of the net addition of 15 new scientists and software engineers since the prior year period and merit-based compensation increases for existing personnel.

General and administrative

| Six Months Ended July 31, |

||||||||||||||||

| (in thousands, except percentages) | 2015 | 2014 | Increase | % Change | ||||||||||||

| General and administrative |

$ | 6,393 | $ | 6,339 | $ | 54 | 0.9 | % | ||||||||

23

Table of Contents

General and administrative expenses for the six months ended July 31, 2015 remained relatively flat when compared with the six months ended July 31, 2014. As a percentage of revenues, general and administrative expenses decreased to 21.2% for the six months ended July 31, 2015 compared to 22.2% for the six months ended July 31, 2014.

Other expense, net

| Six Months Ended July 31, |

||||||||||||||||

| (in thousands, except percentages) | 2015 | 2014 | Change | % Change | ||||||||||||

| Other expense, net |

$ | (337 | ) | $ | (37 | ) | $ | (300 | ) | 810.8 | % | |||||

Other expense, net for the six months ended July 31, 2015 was $0.3 million, an increase of $0.3 million compared to other expense, net of less than $0.1 million for the six months ended July 31, 2014. Other expense, net consists primarily of foreign exchange gains and losses and interest expense associated with our capital lease obligations. The period-over-period change to other expense, net is primarily attributed to foreign exchange fluctuations in the Euro and Japanese yen.

Provision for income taxes

| Six Months Ended July 31, |

||||||||||||||||

| (in thousands, except percentages) | 2015 | 2014 | Decrease | % Change | ||||||||||||

| Provision for income taxes |

$ | 128 | $ | 15,656 | $ | (15,528 | ) | (99.2 | )% | |||||||

For the six months ended July 31, 2015 and 2014, our income tax provision was $0.1 million and $15.7 million, respectively. The provision for the six months ended July 31, 2015 primarily consists of the tax effects of foreign operating results and foreign withholding taxes. The provision for the six months ended July 31, 2014 includes a $14.5 million non-cash charge to record a valuation allowance against the Company’s United States net deferred tax assets and a $0.7 million non-cash write-off of state deferred tax assets.

In determining the realizability of the net United States federal and state deferred tax assets, we consider numerous factors including historical profitability, estimated future taxable income, prudent and feasible tax planning strategies and the industry in which it operates. Management reassesses the realization of the deferred tax assets each reporting period, which resulted in a full valuation allowance against our United States deferred tax assets in the first quarter of fiscal year 2015. To the extent that the financial results of the United States operations improve in the future and the deferred tax assets become realizable, we will reduce the valuation allowance through earnings.

We do not expect that our unrecognized tax benefit will change significantly within the next twelve months. We and one or more of our subsidiaries file United States federal income tax returns and tax returns in various state and foreign jurisdictions. With limited exceptions, we are no longer subject to federal, state, local or foreign examinations for years prior to January 31, 2011. However, carryforward attributes that were generated in tax years ending prior to January 31, 2012 may still be adjusted upon examination by state or local tax authorities if they either have been or will be used in a future period.

Under Section 382 of the Internal Revenue Code of 1986, as amended, substantial changes in our ownership may limit the amount of net operating loss carryforwards that could be utilized annually in the future to offset its taxable income. Specifically, this limitation may arise in the event we undergo a cumulative change in ownership of more than 50% within a three-year period. During the first quarter of fiscal year 2015, our management determined that the Company had experienced an ownership change for purposes of Section 382. This ownership change resulted in annual limitations to the amount of net operating loss carryforwards that can be utilized to offset future taxable income, if any, at the federal level. Our management has determined that, as of July 31,

24

Table of Contents

2015, we have not experienced another ownership change for purposes of Section 382. However, future transactions in our common stock could trigger an ownership change for purposes of Section 382, which could limit the amount of net operating loss carryforwards that could be utilized annually in the future to offset our taxable income, if any. Any such limitation, whether as the result of sales of common stock by our existing stockholders or sales of common stock by us, could have a material adverse effect on our results of operations in future years.

Non-GAAP Measures