Form 10-Q EASTMAN CHEMICAL CO For: Jun 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One) | |

[X] | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2016 | |

OR | |

[ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______________ to ______________ | |

Commission file number 1-12626

EASTMAN CHEMICAL COMPANY

(Exact name of registrant as specified in its charter)

Delaware | 62-1539359 |

(State or other jurisdiction of | (I.R.S. employer |

incorporation or organization) | identification no.) |

200 South Wilcox Drive | |

Kingsport, Tennessee | 37662 |

(Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (423) 229-2000

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES [X] NO [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

YES [X] NO [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | [X] | Accelerated filer | [ ] | |

Non-accelerated filer | [ ] | (Do not check if a smaller reporting company) | Smaller reporting company | [ ] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES [ ] NO [X]

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date.

Class | Number of Shares Outstanding at June 30, 2016 |

Common Stock, par value $0.01 per share | 147,711,985 |

--------------------------------------------------------------------------------------------------------------------------------

1

TABLE OF CONTENTS

ITEM | PAGE | |

PART I. FINANCIAL INFORMATION

PART II. OTHER INFORMATION

SIGNATURES

EXHIBIT INDEX

2

FORWARD-LOOKING STATEMENTS

Certain statements made in this Quarterly Report are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act, Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities and Exchange Act of 1934, as amended. Forward-looking statements are all statements, other than statements of historical fact, that may be made by Eastman Chemical Company (the "Company" or "Eastman") from time to time. In some cases, you can identify forward-looking statements by terminology such as "anticipates," "believes," "estimates," "expects," "intends," "may," "plans," "projects," "will," "would," and similar expressions or expressions of the negative of these terms. Forward-looking statements may relate to, among other things, such matters as planned and expected capacity increases and utilization; anticipated capital spending; expected depreciation and amortization; environmental matters; pending and future legal proceedings; exposure to, and effects of hedging of, raw material and energy costs or disruption of raw material or energy supply, foreign currencies and interest rates; global and regional economic, political, and business conditions; competition; growth opportunities; supply and demand, volume, price, cost, margin and sales; earnings, cash flow, dividends and other expected financial results, events, and conditions; expectations, strategies, and plans for individual assets and products, businesses, and segments, as well as for the whole of Eastman; cash requirements and uses of available cash; financing plans and activities; pension expenses and funding; credit ratings; anticipated and other future restructuring, acquisition, divestiture, and consolidation activities; cost reduction and control efforts and targets; the timing and costs of, and benefits from, the integration of, and expected business and financial performance of, acquired businesses; strategic initiatives and development, production, commercialization and acceptance of new products, services and technologies and related costs; asset, business, and product portfolio changes; and expected tax rates and net interest costs.

Forward-looking statements are based upon certain underlying assumptions as of the date such statements were made. Such assumptions are based upon internal estimates and other analyses of current market conditions and trends, management expectations, plans, and strategies, economic conditions, and other factors. Forward-looking statements and the assumptions underlying them are necessarily subject to risks and uncertainties inherent in projecting future conditions and results. Actual results could differ materially from expectations expressed in the forward-looking statements if one or more of the underlying assumptions and expectations proves to be inaccurate or is unrealized. The most significant known factors, risks, and uncertainties that could cause actual results to differ materially from those in the forward-looking statements are identified and discussed under "Risk Factors" in "Management's Discussion and Analysis of Financial Condition and Results of Operations" in Part I, Item 2 of this Quarterly Report.

The Company cautions you not to place undue reliance on forward-looking statements, which speak only as of the date such statements are made. Except as may be required by law, the Company undertakes no obligation to update or alter these forward-looking statements, whether as a result of new information, future events, or otherwise.

3

UNAUDITED CONSOLIDATED STATEMENTS OF EARNINGS,

COMPREHENSIVE INCOME AND RETAINED EARNINGS

Second Quarter | First Six Months | ||||||||||||||

(Dollars in millions, except per share amounts) | 2016 | 2015 | 2016 | 2015 | |||||||||||

Sales | $ | 2,297 | $ | 2,533 | $ | 4,533 | $ | 4,976 | |||||||

Cost of sales | 1,692 | 1,813 | 3,294 | 3,600 | |||||||||||

Gross profit | 605 | 720 | 1,239 | 1,376 | |||||||||||

Selling, general and administrative expenses | 174 | 194 | 357 | 374 | |||||||||||

Research and development expenses | 55 | 57 | 109 | 113 | |||||||||||

Asset impairments and restructuring (gains) charges, net | — | — | (2 | ) | 109 | ||||||||||

Operating earnings | 376 | 469 | 775 | 780 | |||||||||||

Net interest expense | 63 | 66 | 127 | 132 | |||||||||||

Early debt extinguishment costs | 9 | — | 9 | — | |||||||||||

Other income, net | (20 | ) | — | (8 | ) | (11 | ) | ||||||||

Earnings before income taxes | 324 | 403 | 647 | 659 | |||||||||||

Provision for income taxes | 67 | 104 | 139 | 188 | |||||||||||

Net earnings | 257 | 299 | $ | 508 | $ | 471 | |||||||||

Less: Net earnings attributable to noncontrolling interest | 2 | 2 | 2 | 3 | |||||||||||

Net earnings attributable to Eastman | $ | 255 | $ | 297 | $ | 506 | $ | 468 | |||||||

Basic earnings per share attributable to Eastman | $ | 1.73 | $ | 2.00 | $ | 3.43 | $ | 3.15 | |||||||

Diluted earnings per share attributable to Eastman | $ | 1.71 | $ | 1.98 | $ | 3.40 | $ | 3.12 | |||||||

Comprehensive Income | |||||||||||||||

Net earnings including noncontrolling interest | $ | 257 | $ | 299 | $ | 508 | $ | 471 | |||||||

Other comprehensive income (loss), net of tax: | |||||||||||||||

Change in cumulative translation adjustment | (70 | ) | 76 | 36 | (136 | ) | |||||||||

Defined benefit pension and other postretirement benefit plans: | |||||||||||||||

Amortization of unrecognized prior service credits included in net periodic costs | (7 | ) | (7 | ) | (14 | ) | (11 | ) | |||||||

Derivatives and hedging: | |||||||||||||||

Unrealized gain (loss) during period | 38 | (16 | ) | 20 | 39 | ||||||||||

Reclassification adjustment for losses included in net income, net | 33 | 25 | 37 | 22 | |||||||||||

Total other comprehensive income (loss), net of tax | (6 | ) | 78 | 79 | (86 | ) | |||||||||

Comprehensive income including noncontrolling interest | 251 | 377 | 587 | 385 | |||||||||||

Less: Comprehensive income attributable to noncontrolling interest | 2 | 2 | 2 | 3 | |||||||||||

Comprehensive income attributable to Eastman | $ | 249 | $ | 375 | $ | 585 | $ | 382 | |||||||

Retained Earnings | |||||||||||||||

Retained earnings at beginning of period | $ | 5,330 | $ | 4,656 | $ | 5,146 | $ | 4,545 | |||||||

Net earnings attributable to Eastman | 255 | 297 | 506 | 468 | |||||||||||

Cash dividends declared | (68 | ) | (60 | ) | (135 | ) | (120 | ) | |||||||

Retained earnings at end of period | $ | 5,517 | $ | 4,893 | $ | 5,517 | $ | 4,893 | |||||||

The accompanying notes are an integral part of these consolidated financial statements.

4

UNAUDITED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

June 30, | December 31, | ||||||

(Dollars in millions, except per share amounts) | 2016 | 2015 | |||||

Assets | |||||||

Current assets | |||||||

Cash and cash equivalents | $ | 240 | $ | 293 | |||

Trade receivables, net of allowance for doubtful accounts | 951 | 792 | |||||

Miscellaneous receivables | 226 | 246 | |||||

Inventories | 1,445 | 1,479 | |||||

Other current assets | 68 | 68 | |||||

Total current assets | 2,930 | 2,878 | |||||

Properties | |||||||

Properties and equipment at cost | 11,440 | 11,234 | |||||

Less: Accumulated depreciation | 6,278 | 6,104 | |||||

Net properties | 5,162 | 5,130 | |||||

Goodwill | 4,520 | 4,518 | |||||

Intangible assets, net of accumulated amortization | 2,585 | 2,650 | |||||

Other noncurrent assets | 385 | 404 | |||||

Total assets | $ | 15,582 | $ | 15,580 | |||

Liabilities and Stockholders' Equity | |||||||

Current liabilities | |||||||

Payables and other current liabilities | $ | 1,467 | $ | 1,625 | |||

Borrowings due within one year | 722 | 431 | |||||

Total current liabilities | 2,189 | 2,056 | |||||

Long-term borrowings | 6,082 | 6,577 | |||||

Deferred income tax liabilities | 1,014 | 928 | |||||

Post-employment obligations | 1,276 | 1,297 | |||||

Other long-term liabilities | 568 | 701 | |||||

Total liabilities | 11,129 | 11,559 | |||||

Stockholders' equity | |||||||

Common stock ($0.01 par value – 350,000,000 shares authorized; shares issued – 217,431,231 and 216,899,964 for 2016 and 2015, respectively) | 2 | 2 | |||||

Additional paid-in capital | 1,892 | 1,863 | |||||

Retained earnings | 5,517 | 5,146 | |||||

Accumulated other comprehensive loss | (311 | ) | (390 | ) | |||

7,100 | 6,621 | ||||||

Less: Treasury stock at cost (69,770,044 shares for 2016 and 69,137,973 shares for 2015) | 2,725 | 2,680 | |||||

Total Eastman stockholders' equity | 4,375 | 3,941 | |||||

Noncontrolling interest | 78 | 80 | |||||

Total equity | 4,453 | 4,021 | |||||

Total liabilities and stockholders' equity | $ | 15,582 | $ | 15,580 | |||

The accompanying notes are an integral part of these consolidated financial statements.

5

UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS

First Six Months | |||||||

(Dollars in millions) | 2016 | 2015 | |||||

Operating activities | |||||||

Net earnings | $ | 508 | $ | 471 | |||

Adjustments to reconcile net earnings to net cash provided by operating activities: | |||||||

Depreciation and amortization | 291 | 287 | |||||

Asset impairment charges | — | 89 | |||||

Gain on sale of equity investment | (17 | ) | — | ||||

Early debt extinguishment costs | 9 | — | |||||

Provision (benefit) for deferred income taxes | 47 | (30 | ) | ||||

Mark-to-market loss on pension and other postretirement benefit plans | — | 2 | |||||

Changes in operating assets and liabilities, net of effect of acquisitions and divestitures: | |||||||

Increase in trade receivables | (151 | ) | (103 | ) | |||

Decrease in inventories | 41 | 43 | |||||

Decrease in trade payables | (76 | ) | (109 | ) | |||

Pension and other postretirement contributions in excess of expenses | (43 | ) | (39 | ) | |||

Variable compensation in excess of expenses | (67 | ) | (24 | ) | |||

Other items, net | (1 | ) | 95 | ||||

Net cash provided by operating activities | 541 | 682 | |||||

Investing activities | |||||||

Additions to properties and equipment | (234 | ) | (266 | ) | |||

Proceeds from sale of assets and equity investment | 41 | 4 | |||||

Acquisitions, net of cash acquired | (22 | ) | — | ||||

Other items, net | 3 | (3 | ) | ||||

Net cash used in investing activities | (212 | ) | (265 | ) | |||

Financing activities | |||||||

Net (decrease) increase in commercial paper borrowings | (208 | ) | 157 | ||||

Proceeds from borrowings | 807 | 250 | |||||

Repayment of borrowings | (807 | ) | (625 | ) | |||

Dividends paid to stockholders | (136 | ) | (119 | ) | |||

Treasury stock purchases | (45 | ) | (31 | ) | |||

Dividends paid to noncontrolling interest | (4 | ) | (3 | ) | |||

Proceeds from stock option exercises and other items, net | 12 | 12 | |||||

Net cash used in financing activities | (381 | ) | (359 | ) | |||

Effect of exchange rate changes on cash and cash equivalents | (1 | ) | (4 | ) | |||

Net change in cash and cash equivalents | (53 | ) | 54 | ||||

Cash and cash equivalents at beginning of period | 293 | 214 | |||||

Cash and cash equivalents at end of period | $ | 240 | $ | 268 | |||

The accompanying notes are an integral part of these consolidated financial statements.

6

ITEM | Page | |

Derivative and Non-Derivative Financial Instruments | ||

Environmental Matters and Asset Retirement Obligations | ||

7

1. | BASIS OF PRESENTATION |

The accompanying unaudited consolidated financial statements have been prepared by Eastman Chemical Company (the "Company" or "Eastman") in accordance and consistent with the accounting policies stated in the Company's 2015 Annual Report on Form 10-K and should be read in conjunction with the consolidated financial statements in Part II, Item 8 of the Company's 2015 Annual Report on Form 10-K. The December 31, 2015 financial position data included herein was derived from the audited consolidated financial statements included in the 2015 Annual Report on Form 10-K but does not include all disclosures required by accounting principles generally accepted in the United States ("GAAP"). The unaudited consolidated financial statements are prepared in conformity with GAAP and of necessity include some amounts that are based upon management estimates and judgments. Future actual results could differ from such current estimates. The unaudited consolidated financial statements include assets, liabilities, sales revenue, and expenses of all majority-owned subsidiaries and joint ventures in which a controlling interest is maintained. Eastman accounts for other joint ventures and investments where it exercises significant influence on the equity basis. Intercompany transactions and balances are eliminated in consolidation. Certain prior period data has been reclassified in the consolidated financial statements and accompanying footnotes to confirm to current period presentation.

In April 2015, the Financial Accounting Standards Board ("FASB") issued new guidance for debt issuance costs as a part of the simplification initiative. Under this guidance, debt issuance costs will be presented as a direct reduction from the carrying amount of the debt liability, consistent with the presentation of debt discounts. The amortization of debt issuance costs will be reported as interest expense. The recognition and measurement guidance for debt issuance costs is not affected by the amendment. As of March 31, 2016, the new guidance was applied on a retrospective basis which resulted in a reclassification of $31 million from "Other noncurrent assets" to "Long-term borrowings" in the Unaudited Consolidated Statement of Financial Position at December 31, 2015. See Note 7, "Borrowings".

In January 2016, Eastman changed its organizational and management structure following completion of the integration of recently acquired businesses to better align similar strategies and business models. As a result, beginning first quarter 2016, the Company's products and operations are managed and reported in four operating segments: Additives & Functional Products ("AFP"), Advanced Materials ("AM"), Chemical Intermediates ("CI"), and Fibers. For further information, see Note 3, "Goodwill" and Note 18, "Segment Information".

Off Balance Sheet Financing Arrangements

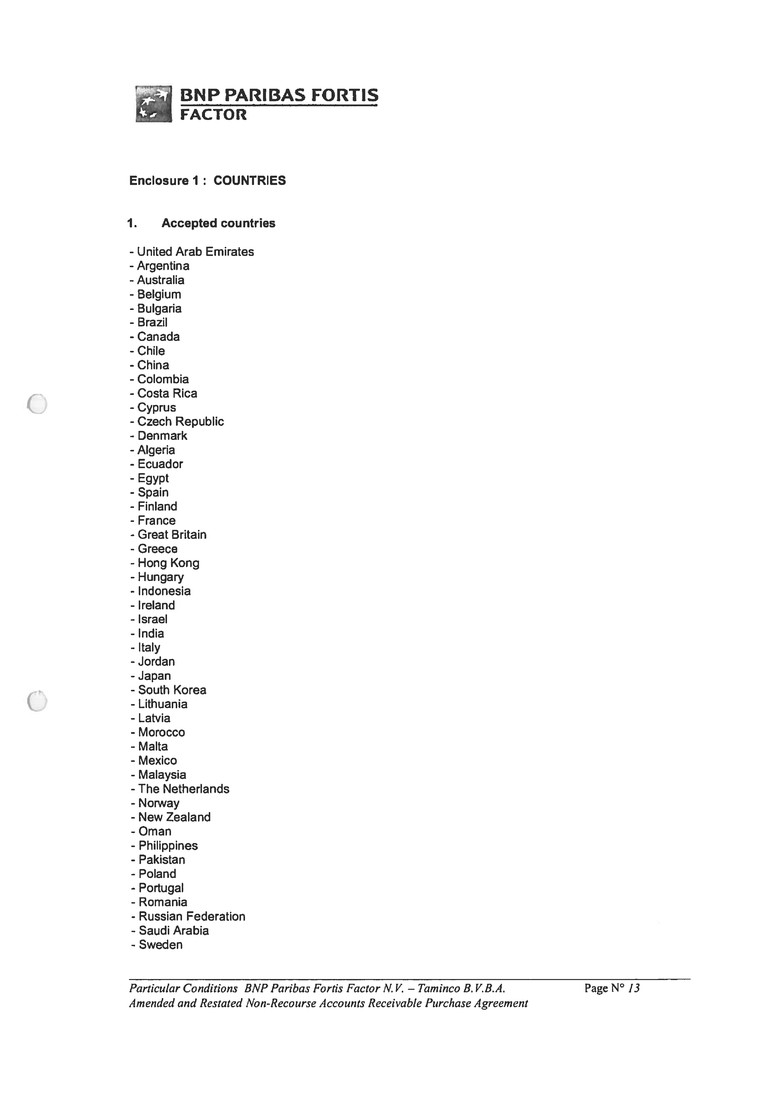

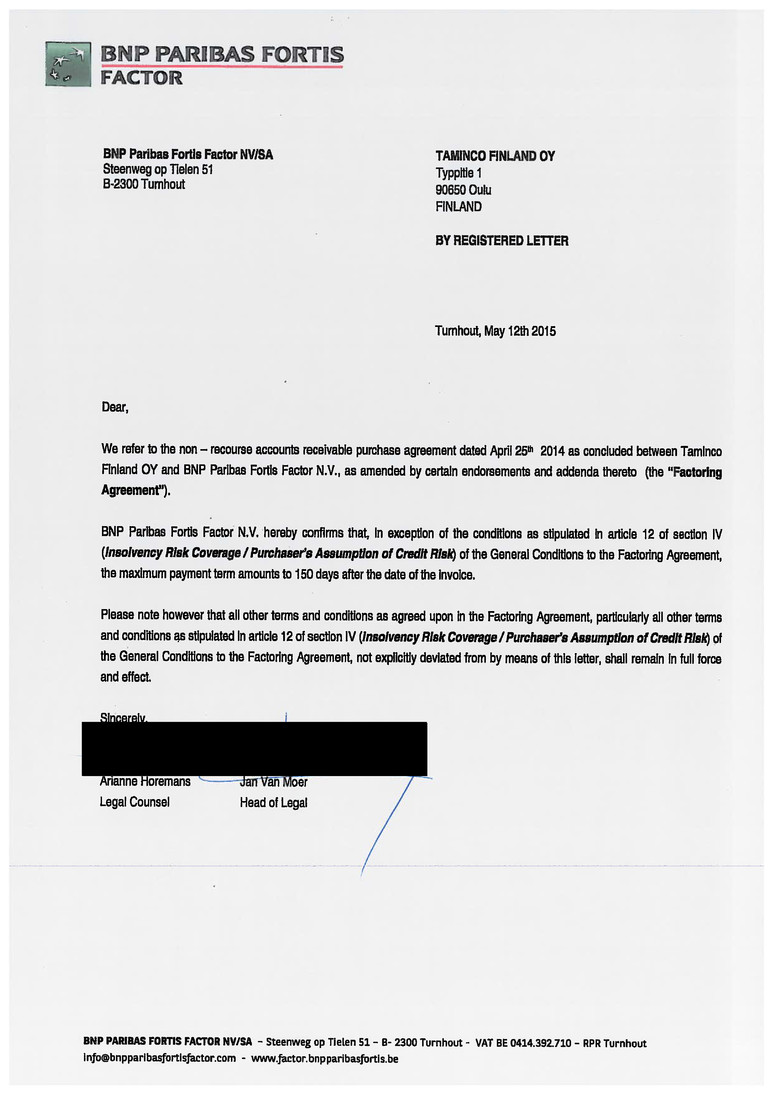

The Company has rights and obligations under non-recourse factoring facilities that have a combined limit of €158 million ($175 million) as of June 30, 2016 and are committed until December 2017. These arrangements include receivables in the United States, Belgium, Germany, and Finland, and are subject to various eligibility requirements. The Company sells the receivables at face value but receives funding (approximately 85 percent) net of a deposit amount until collections are received from customers for the receivables sold. The total amounts of cumulative receivables sold in second quarter and first six months 2016, were approximately $225 million and $460 million, respectively. The total amounts of cumulative receivables sold in second quarter and first six months 2015, were approximately $240 million and $509 million, respectively. As part of the program, the Company continues to service the sold receivables at market rates with no servicing assets or liabilities recognized. The amounts of sold receivables outstanding under the non-recourse factoring facilities were $104 million and $106 million at June 30, 2016 and December 31, 2015, respectively. The fair value of the receivables sold equals the carrying value at the time of the sale, and no gain or loss is recognized. The Company is exposed to a credit loss of up to 10 percent on sold receivables.

8

2. | INVENTORIES |

June 30, | December 31, | ||||||

(Dollars in millions) | 2016 | 2015 | |||||

At FIFO or average cost (approximates current cost) | |||||||

Finished goods | $ | 1,038 | $ | 1,063 | |||

Work in process | 209 | 212 | |||||

Raw materials and supplies | 469 | 500 | |||||

Total inventories | 1,716 | 1,775 | |||||

Less: LIFO reserve | 271 | 296 | |||||

Total inventories | $ | 1,445 | $ | 1,479 | |||

Inventories valued on the last-in, first-out ("LIFO") method were approximately 60 percent at both June 30, 2016 and December 31, 2015.

3. | GOODWILL |

In January 2016, as a result of the changes in Eastman's organizational and management structure, goodwill was reassigned to segments using a relative fair value allocation. In conjunction with the organizational changes and in accordance with GAAP, during first quarter 2016 Eastman performed an impairment assessment and concluded that no indication of an impairment existed. For further information on the organizational changes, see Note 1, "Basis of Presentation" and Note 18, "Segment Information".

Changes to the carrying value of goodwill follow:

(Dollars in millions) | Additives & Functional Products | Adhesives & Plasticizers | Advanced Materials | Chemical Intermediates | Other Segments | Total | |||||||||||||||||

Balance at December 31, 2015 | $ | 1,865 | $ | 111 | $ | 1,293 | $ | 1,239 | $ | 10 | $ | 4,518 | |||||||||||

Adjustments to net goodwill resulting from reorganization | 583 | (111 | ) | — | (472 | ) | — | — | |||||||||||||||

Currency translation adjustments | 1 | — | (3 | ) | 4 | — | 2 | ||||||||||||||||

Balance at June 30, 2016 | $ | 2,449 | $ | — | $ | 1,290 | $ | 771 | $ | 10 | $ | 4,520 | |||||||||||

As of June 30, 2016, the reported balance of goodwill included accumulated impairment losses of $23 million, $12 million, and $14 million in the AFP segment, CI segment, and other segments, respectively. As of December 31, 2015, the reported balance of goodwill included accumulated impairment losses of $35 million and $14 million in the Adhesives & Plasticizers segment and other segments, respectively.

4. | EQUITY INVESTMENTS |

In June 2016, Eastman sold its 50 percent interest in Primester, a joint venture which manufactures cellulose acetate at the Company's Kingsport site, to an affiliate of the joint venture partner for $35 million. This investment was accounted for under the equity method. Eastman's net investment in the joint venture at the date of sale was $18 million. Such amounts were included in "Other noncurrent assets" in the Unaudited Consolidated Statement of Financial Position and the gain of $17 million was recorded in "Other income, net" in the Unaudited Consolidated Statements of Earnings, Comprehensive Income and Retained Earnings.

9

5. | PAYABLES AND OTHER CURRENT LIABILITIES |

June 30, | December 31, | ||||||

(Dollars in millions) | 2016 | 2015 | |||||

Trade creditors | $ | 610 | $ | 699 | |||

Derivative hedging liability | 206 | 218 | |||||

Accrued payrolls, vacation, and variable-incentive compensation | 172 | 227 | |||||

Post-employment obligations | 96 | 120 | |||||

Other | 383 | 361 | |||||

Total payables and other current liabilities | $ | 1,467 | $ | 1,625 | |||

"Other" consists primarily of accruals for taxes, interest payable, dividends payable, and the current portion of environmental liabilities.

6. | PROVISION FOR INCOME TAXES |

Second Quarter | First Six Months | ||||||||||||||

(Dollars in millions) | 2016 | 2015 | 2016 | 2015 | |||||||||||

Provision for income taxes | $ | 67 | $ | 104 | $ | 139 | $ | 188 | |||||||

Effective tax rate | 21 | % | 26 | % | 22 | % | 29 | % | |||||||

The second quarter and first six months 2016 effective tax rates reflect a benefit from the extension of favorable U.S. federal tax provisions, primarily research and development ("R&D") tax credits and deferral of certain earnings of foreign subsidiaries from U.S. income taxes in fourth quarter of 2015. As a result, the favorable tax provisions will benefit all quarters in 2016, compared to only fourth quarter in 2015. The second quarter and first six months 2016 effective tax rates include a $16 million one-time benefit for the restoration of tax basis for which depreciation deductions were previously limited. The first six months 2016 effective tax rate also reflects a $9 million tax benefit primarily due to adjustments to the tax provision to reflect the finalization of 2014 foreign income tax returns. The second quarter 2015 effective tax rate included a $6 million benefit from the settlement of non-U.S. income tax audits. The first six months 2015 effective tax rate was negatively impacted by an unfavorable foreign rate variance due to increased earnings in higher-tax jurisdictions.

10

7. | BORROWINGS |

June 30, | December 31, | ||||||

(Dollars in millions) | 2016 | 2015 | |||||

Borrowings consisted of: | |||||||

2.4% notes due June 2017 | $ | 499 | $ | 998 | |||

6.30% notes due November 2018 | 165 | 166 | |||||

5.5% notes due November 2019 | 249 | 249 | |||||

2.7% notes due January 2020 | 795 | 794 | |||||

4.5% notes due January 2021 | 249 | 249 | |||||

3.6% notes due August 2022 | 892 | 896 | |||||

1.50% notes due May 2023 | 604 | — | |||||

7 1/4% debentures due January 2024 | 244 | 244 | |||||

7 5/8% debentures due June 2024 | 54 | 54 | |||||

3.8% notes due March 2025 | 793 | 791 | |||||

7.60% debentures due February 2027 | 222 | 222 | |||||

4.8% notes due September 2042 | 492 | 492 | |||||

4.65% notes due October 2044 | 870 | 869 | |||||

Credit facilities borrowings | 450 | 550 | |||||

Commercial paper borrowings | 222 | 430 | |||||

Capital leases | 4 | 4 | |||||

Total borrowings | 6,804 | 7,008 | |||||

Borrowings due within one year | 722 | 431 | |||||

Long-term borrowings | $ | 6,082 | $ | 6,577 | |||

On May 26, 2016, the Company sold euro-denominated 1.50% notes due 2023 in the principal amount of €550 million ($614 million). Proceeds from the sale of the notes, net of transaction costs, were €544 million ($607 million) and were used for the early repayment of $500 million of the 2.4% notes due June 2017 and repayment of other borrowings. Total consideration for the partial redemption of the 2.4% notes due June 2017 was $507 million ($500 million for the principal amount and $7 million for the early redemption premium) and are reported as financing activities on the Unaudited Consolidated Statements of Cash Flows. The early repayment resulted in a charge of $9 million for early debt extinguishment costs primarily attributable to the early redemption premium and related unamortized costs. The book value of the redeemed debt was $498 million. In conjunction with the euro-denominated public debt offering, the Company contemporaneously designated these borrowings as a non-derivative hedge of a portion of its net investment in one of its euro functional currency denominated subsidiaries. For further information, see Note 8, "Derivative and Non-Derivative Financial Instruments".

Credit Facility and Commercial Paper Borrowings

In connection with the 2014 acquisition of Taminco Corporation, Eastman borrowed $1.0 billion under a five-year Term Loan. As of June 30, 2016, the Term Loan balance outstanding was $250 million with an interest rate of 1.71 percent. In second quarter 2016, $100 million of the Company's borrowings under the Term Loan were repaid using available cash. As of December 31, 2015, the Term Loan balance outstanding was $350 million with an interest rate of 1.67 percent. Borrowings under the Term Loan are subject to interest at varying spreads above quoted market rates.

The Company has access to a $1.25 billion revolving credit agreement (the "Credit Facility") that expires October 2020. Borrowings under the Credit Facility are subject to interest at varying spreads above quoted market rates and a commitment fee is paid on the total unused commitment. The Credit Facility provides liquidity support for commercial paper borrowings and general corporate purposes. Accordingly, any outstanding commercial paper borrowings reduce capacity for borrowings available under the Credit Facility. Commercial paper borrowings are classified as short-term. At June 30, 2016 and December 31, 2015, the Company had no outstanding borrowings under the Credit Facility. At June 30, 2016, the Company's commercial paper borrowings were $222 million with a weighted average interest rate of 0.81 percent. At December 31, 2015, the Company's commercial paper borrowings were $430 million with a weighted average interest rate of 0.80 percent.

11

The Company has access to a $250 million accounts receivable securitization agreement (the "A/R Facility") that expires April 2018. Borrowings under the A/R Facility are subject to interest rates based on a spread over the lender's borrowing costs, and the Company pays a fee to maintain availability of the A/R Facility. At June 30, 2016, the Company's borrowings under the A/R Facility were $200 million supported by trade receivables with an interest rate of 1.27 percent. In second quarter 2016, $190 million of the available amount under the A/R Facility was repaid and $200 million borrowed. In first quarter 2016, $10 million of the Company's borrowings under the A/R Facility were repaid using available cash. At December 31, 2015, the Company's borrowings under the A/R Facility were $200 million supported by trade receivables with an interest rate of 1.11 percent.

The Credit Facility and the A/R Facility, and the Term Loan, contain a number of customary covenants and events of default, including the maintenance of certain financial ratios. The Company was in compliance with all such covenants for all periods presented. Total available borrowings under the Credit Facility and A/R Facility were $1,058 million and $842 million as of June 30, 2016 and December 31, 2015, respectively. Changes in available borrowings were due primarily to a decrease in commercial paper borrowings. The Company would not have violated applicable covenants for these periods if the total available amounts of the facilities had been borrowed.

Fair Value of Borrowings

The Company has classified its long-term borrowings at June 30, 2016 and December 31, 2015, under the fair value hierarchy as defined in the accounting policies in Note 1, "Significant Accounting Policies", to the consolidated financial statements in Part II, Item 8 of the Company's 2015 Annual Report on Form 10-K. The fair value for fixed-rate debt securities is based on current market prices and is classified as Level 1. The fair value for the Company's other borrowings, which relate to the Term Loan, the A/R Facility, and capital leases, equals the carrying value and is classified as Level 2.

Fair Value Measurements at June 30, 2016 | ||||||||||||||||||||

(Dollars in millions) | Recorded Amount June 30, 2016 | Total Fair Value | Quoted Prices in Active Markets for Identical Assets (Level 1) | Significant Other Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | |||||||||||||||

Long-term borrowings | $ | 6,082 | $ | 6,569 | $ | 6,116 | $ | 453 | $ | — | ||||||||||

Fair Value Measurements at December 31, 2015 | ||||||||||||||||||||

(Dollars in millions) | Recorded Amount December 31, 2015 | Total Fair Value | Quoted Prices in Active Markets for Identical Assets (Level 1) | Significant Other Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | |||||||||||||||

Long-term borrowings | $ | 6,577 | $ | 6,647 | $ | 6,094 | $ | 553 | $ | — | ||||||||||

8. | DERIVATIVE AND NON-DERIVATIVE FINANCIAL INSTRUMENTS |

Hedging Programs

The Company is exposed to market risks, such as changes in foreign currency exchange rates, commodity prices, and interest rates. To mitigate these market risks and their effects on the cash flows of the underlying transactions and investments in foreign subsidiaries, the Company uses various derivative and non-derivative instruments when appropriate in accordance with the Company's hedging strategy and policies. Designation is performed on a specific exposure basis to support hedge accounting. The Company does not enter into derivative transactions for speculative purposes.

For further information on hedging programs, see Note 10, "Derivatives", to the consolidated financial statements in Part II, Item 8 of the Company's 2015 Annual Report on Form 10-K.

12

Fair Value Hedges

Fair value hedges are defined as derivative or non-derivative instruments designated as and used to hedge the exposure to changes in the fair value of an asset or a liability or an identified portion thereof that is attributable to a particular risk. For derivative instruments that are designated and qualify as fair value hedges, the gain or loss on the derivative as well as the offsetting loss or gain on the hedged item attributable to the hedged risk are recognized in current earnings. In second quarter 2016, the Company entered into interest rate swaps to hedge the interest rate risk on the 3.8% notes due 2025. As of June 30, 2016, the total notional amount of the Company's interest rate swap was $75 million. As of December 31, 2015, there were no outstanding interest rate swap hedges that were designated as fair value hedges.

Fair Value Measurement of Derivatives Designated as Fair Value Hedging Instruments

(Dollars in millions) | Statement of Financial Position Location | Fair Value Measurement | ||||||||

Derivative Assets | June 30, 2016 | December 31, 2015 | ||||||||

Interest rate swap | Other noncurrent assets | $ | 2 | $ | — | |||||

Derivatives' Fair Value Hedging Relationships

Second Quarter | ||||||||||

(Dollars in millions) | Consolidated Statement of Earnings Location of Gain/(Loss) Recognized in Income on Derivatives | Amount of Gain/(Loss) Recognized in Income on Derivatives | ||||||||

Derivatives' Fair Value Hedging Relationships | 2016 | 2015 | ||||||||

Interest rate swaps | Net interest expense | $ | 3 | $ | 3 | |||||

First Six Months | ||||||||||

(Dollars in millions) | Consolidated Statement of Earnings Location of Gain/(Loss) Recognized in Income on Derivatives | Amount of Gain/ (Loss) Recognized in Income on Derivatives | ||||||||

Derivatives' Fair Value Hedging Relationships | 2016 | 2015 | ||||||||

Interest rate swaps | Net interest expense | $ | 7 | $ | 7 | |||||

Cash Flow Hedges

Cash flow hedges are derivative instruments designated as and used to hedge the exposure to variability in expected future cash flows that are attributable to a particular risk. For derivative instruments that are designated and qualify as a cash flow hedge, the effective portion of the gain or loss on the derivative is reported as a component of "Other comprehensive income (loss), net of tax" ("OCI") located in the Unaudited Consolidated Statements of Earnings, Comprehensive Income and Retained Earnings and reclassified into earnings in the same period or periods during which the hedged transaction affects earnings. Gains and losses on the derivatives representing either hedge ineffectiveness or hedge components excluded from the assessment of effectiveness are recognized in current earnings.

13

Total Notional Amounts

June 30, 2016 | December 31, 2015 | ||||

Foreign Exchange Forward and Option Contracts (in millions): | |||||

EUR/USD (in EUR) | €498 | €618 | |||

EUR/USD (in approximate USD equivalent) | $552 | $689 | |||

JPY/USD (in JPY) | ¥1,800 | ¥2,400 | |||

JPY/USD (in approximate USD equivalent) | $17 | $20 | |||

Commodity Forward and Collar Contracts: | |||||

Feedstock (in million barrels) | 16 | 22 | |||

Energy (in million million British thermal units) | 30 | 32 | |||

Interest rate swaps for the future issuance of debt (in millions) | $500 | $500 | |||

Fair Value Measurement of Derivatives Designated as Cash Flow Hedging Instruments

(Dollars in millions) | Fair Value Measurements Significant Other Observable Inputs | |||||||||

Derivative Assets | Statement of Financial Position Location | June 30, 2016 | December 31, 2015 | |||||||

Commodity contracts | Other current assets | $ | 2 | $ | — | |||||

Commodity contracts | Other noncurrent assets | 2 | — | |||||||

Foreign exchange contracts | Other current assets | 49 | 65 | |||||||

Foreign exchange contracts | Other noncurrent assets | 55 | 79 | |||||||

$ | 108 | $ | 144 | |||||||

(Dollars in millions) | Fair Value Measurements Significant Other Observable Inputs | |||||||||

Derivative Liabilities | Statement of Financial Position Location | June 30, 2016 | December 31, 2015 | |||||||

Commodity contracts | Payables and other current liabilities | $ | 106 | $ | 194 | |||||

Commodity contracts | Other long-term liabilities | 142 | 242 | |||||||

Forward starting interest rate swap contracts | Payables and other current liabilities | 78 | — | |||||||

Forward starting interest rate swap contracts | Other long-term liabilities | — | 30 | |||||||

$ | 326 | $ | 466 | |||||||

14

Derivatives' Cash Flow Hedging Relationships

Second Quarter | ||||||||||||||||||

(Dollars in millions) | Change in amount after tax of gain/(loss) recognized in Other Comprehensive Income on derivatives (effective portion) | Location of gain/(loss) reclassified from Accumulated Other Comprehensive Income into income (effective portion) | Pre-tax amount of gain/(loss) reclassified from Accumulated Other Comprehensive Income into income (effective portion) | |||||||||||||||

Derivatives' Cash Flow Hedging Relationships | 2016 | 2015 | 2016 | 2015 | ||||||||||||||

Commodity contracts | $ | 79 | $ | 22 | Sales | $ | — | $ | 1 | |||||||||

Cost of Sales | (65 | ) | (62 | ) | ||||||||||||||

Foreign exchange contracts | 1 | (28 | ) | Sales | 15 | 22 | ||||||||||||

Forward starting interest rate swap contracts | (9 | ) | 15 | Net interest expense | (2 | ) | (2 | ) | ||||||||||

$ | 71 | $ | 9 | $ | (52 | ) | $ | (41 | ) | |||||||||

First Six Months | ||||||||||||||||||

(Dollars in millions) | Change in amount after tax of gain/(loss) recognized in Other Comprehensive Income on derivatives (effective portion) | Location of gain/(loss) reclassified from Accumulated Other Comprehensive Income into income (effective portion) | Pre-tax amount of gain/(loss) reclassified from Accumulated Other Comprehensive Income into income (effective portion) | |||||||||||||||

Derivatives' Cash Flow Hedging Relationships | 2016 | 2015 | 2016 | 2015 | ||||||||||||||

Commodity contracts | $ | 109 | $ | 27 | Sales | $ | — | $ | 3 | |||||||||

Cost of sales | (85 | ) | (78 | ) | ||||||||||||||

Foreign exchange contracts | (25 | ) | 27 | Sales | 30 | 43 | ||||||||||||

Forward starting interest rate swap contracts | (27 | ) | 7 | Net interest expense | (4 | ) | (4 | ) | ||||||||||

$ | 57 | $ | 61 | $ | (59 | ) | $ | (36 | ) | |||||||||

Net Investment Hedges

Net investment hedges are defined as derivative or non-derivative instruments designated as and used to hedge the foreign currency exposure of the net investment in certain foreign operations. The effective portion of the gain or loss on the net investment hedge is reported as a component of "Change in cumulative translation adjustment" ("CTA") within OCI located in the Unaudited Consolidated Statements of Earnings, Comprehensive Income and Retained Earnings. Gains and losses representing either hedge ineffectiveness or hedge components excluded from the assessment of effectiveness are recognized in current earnings.

Contemporaneously with its sale on May 26, 2016 of euro-denominated 1.50% notes due 2023 in the principal amount of €550 million ($614 million), the Company designated these borrowings as a non-derivative hedge of a portion of its net investment in one of its euro functional currency denominated subsidiaries to protect the designated net investment against foreign currency fluctuations. As of June 30, 2016, the total notional value of the non-derivative net investment hedge was €544 million ($604 million). The designated foreign currency-denominated borrowings are included as part of "Long-term borrowings'" within the Unaudited Consolidated Statements of Financial Position.

15

The following table summarizes the change in the unrealized gain on the net investment hedge instruments recognized as part of the CTA within OCI during second quarter 2016. No portion of the gain was reclassified into income and there was no hedge ineffectiveness with these instruments during second quarter 2016.

Second Quarter | First Six Months | |||||||||||||||

(Dollars in millions) | 2016 | 2015 | 2016 | 2015 | ||||||||||||

Change in unrealized gain in other comprehensive income | $ | 3 | $ | — | $ | 3 | $ | — | ||||||||

Hedging Summary

Monetized positions and mark-to-market gains and losses from raw materials and energy, currency, and certain interest rate hedges that were included in accumulated OCI before taxes totaled losses of $282 million at June 30, 2016 and $333 million at June 30, 2015. If realized, $65 million net losses as of June 30, 2016 will be reclassified into earnings during the next 12 months.

Ineffective portions of raw material and energy hedges are immediately recognized in earnings within "Cost of sales" in the Unaudited Consolidated Statements of Earnings, Comprehensive Income and Retained Earnings. The Company recognized pre-tax losses for ineffectiveness of the commodity hedging portfolio of $2 million and $1 million during the first six months of 2016 and 2015, respectively.

The gains or losses on nonqualifying derivatives or derivatives that are not designated as hedges are marked to market and reported in "Other income, net" in the Unaudited Consolidated Statements of Earnings, Comprehensive Income and Retained Earnings, and, in all periods presented, represent foreign exchange derivatives denominated in multiple currencies and are transacted and settled in the same quarter. The Company recognized $23 million and $1 million net losses on nonqualifying derivatives during second quarter 2016 and 2015, respectively. The Company recognized $14 million and $12 million net losses on nonqualifying derivatives during the first six months of 2016 and 2015, respectively.

Fair Value Measurements

For additional information on fair value measurement, see Note 1, "Significant Accounting Policies", to the consolidated financial statements in Part II, Item 8 of the Company's 2015 Annual Report on Form 10-K.

The following chart shows the gross financial assets and liabilities valued on a recurring basis.

(Dollars in millions) | Fair Value Measurements at June 30, 2016 | |||||||||||||||

Description | June 30, 2016 | Quoted Prices in Active Markets for Identical Assets (Level 1) | Significant Other Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | ||||||||||||

Derivative Assets | $ | 110 | $ | — | $ | 110 | $ | — | ||||||||

Derivative Liabilities | (326 | ) | — | (326 | ) | — | ||||||||||

$ | (216 | ) | $ | — | $ | (216 | ) | $ | — | |||||||

(Dollars in millions) | Fair Value Measurements at December 31, 2015 | |||||||||||||||

Description | December 31, 2015 | Quoted Prices in Active Markets for Identical Assets (Level 1) | Significant Other Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | ||||||||||||

Derivative Assets | $ | 144 | $ | — | $ | 144 | $ | — | ||||||||

Derivative Liabilities | (466 | ) | — | (466 | ) | — | ||||||||||

$ | (322 | ) | $ | — | $ | (322 | ) | $ | — | |||||||

16

All of the Company's derivative assets and liabilities are currently classified as Level 2. Level 2 fair value is based on estimates using standard pricing models. These standard pricing models use inputs which are derived from or corroborated by observable market data such as interest rate yield curves and currency spot and forward rates. The fair value of commodity contracts is derived using forward curves supplied by an industry recognized and unrelated third party. In addition, on an ongoing basis, the Company tests a subset of its valuations against valuations received from the transaction's counterparty to validate the accuracy of its standard pricing models. Counterparties to these derivative contracts are highly rated financial institutions which the Company believes carry minimal risk of nonperformance.

All of the Company's derivative contracts are subject to master netting arrangements, or similar agreements, which provide for the option to settle contracts on a net basis when they settle on the same day and in the same currency. In addition, these arrangements provide for a net settlement of all contracts with a given counterparty in the event that the arrangement is terminated due to the occurrence of default or a termination event. Management has elected to present the derivative contracts on a gross basis in the Unaudited Consolidated Statements of Financial Position. Had it chosen to present the derivatives contracts on a net basis, it would have a derivative in a net asset position of $109 million and a derivative in a net liability position of $325 million as of June 30, 2016. The Company does not have any cash collateral due under such agreements.

9. | RETIREMENT PLANS |

Defined Benefit Pension Plans and Other Postretirement Benefit Plans

Eastman maintains defined benefit pension plans that provide eligible employees with retirement benefits. In addition, Eastman provides a subsidy for life insurance, health care, and dental benefits to eligible retirees hired prior to January 1, 2007, and a subsidy for health care and dental benefits to retirees' eligible survivors. Costs recognized for these benefits are recorded using estimated amounts, which may change as actual costs derived for the year are determined.

For additional information regarding retirement plans, see Note 11, "Retirement Plans", to the consolidated financial statements in Part II, Item 8 of the Company's 2015 Annual Report on Form 10-K.

17

Components of net periodic benefit (credit) cost were as follows:

Second Quarter | |||||||||||||||||||||||

Pension Plans | Other Postretirement Benefit Plans | ||||||||||||||||||||||

2016 | 2015 | 2016 | 2015 | ||||||||||||||||||||

(Dollars in millions) | U.S. | Non-U.S. | U.S. | Non-U.S. | |||||||||||||||||||

Components of net periodic benefit (credit) cost: | |||||||||||||||||||||||

Service cost | $ | 10 | $ | 3 | $ | 10 | $ | 4 | $ | 1 | $ | 2 | |||||||||||

Interest cost | 19 | 6 | 22 | 7 | 7 | 10 | |||||||||||||||||

Expected return on assets | (34 | ) | (8 | ) | (37 | ) | (10 | ) | (1 | ) | (1 | ) | |||||||||||

Curtailment gain(1) | — | — | — | (7 | ) | — | — | ||||||||||||||||

Amortization of: | |||||||||||||||||||||||

Prior service credit, net | (1 | ) | — | (1 | ) | — | (10 | ) | (6 | ) | |||||||||||||

Mark-to-market pension and other postretirement benefits loss(2) | — | — | — | 2 | — | — | |||||||||||||||||

Net periodic benefit (credit) cost | $ | (6 | ) | $ | 1 | $ | (6 | ) | $ | (4 | ) | $ | (3 | ) | $ | 5 | |||||||

First Six Months | |||||||||||||||||||||||

Pension Plans | Other Postretirement Benefit Plans | ||||||||||||||||||||||

2016 | 2015 | 2016 | 2015 | ||||||||||||||||||||

(Dollars in millions) | U.S. | Non-U.S. | U.S. | Non-U.S. | |||||||||||||||||||

Components of net periodic benefit (credit) cost: | |||||||||||||||||||||||

Service cost | $ | 20 | $ | 6 | $ | 19 | $ | 8 | $ | 3 | $ | 4 | |||||||||||

Interest cost | 37 | 12 | 44 | 13 | 14 | 20 | |||||||||||||||||

Expected return on assets | (68 | ) | (16 | ) | (73 | ) | (19 | ) | (3 | ) | (3 | ) | |||||||||||

Curtailment gain(1) | — | — | — | (7 | ) | — | — | ||||||||||||||||

Amortization of: | |||||||||||||||||||||||

Prior service credit, net | (2 | ) | — | (2 | ) | — | (20 | ) | (12 | ) | |||||||||||||

Mark-to-market pension and other postretirement benefits loss(2) | — | — | — | 2 | — | — | |||||||||||||||||

Net periodic benefit (credit) cost | $ | (13 | ) | $ | 2 | $ | (12 | ) | $ | (3 | ) | $ | (6 | ) | $ | 9 | |||||||

(1) | Gain in the Fibers segment due to the closure of the Workington, UK acetate tow manufacturing site. |

(2) | Mark-to-market loss due to the interim remeasurement of the Workington, UK pension plan, triggered by the closure of the site included in Other in Note 18, "Segment Information". |

The Company did not make any contributions to its U.S. defined benefit pension plans in first six months 2016 or 2015.

In first quarter 2016, the Company changed the approach used to calculate service and interest cost components of net periodic benefit costs for its significant defined benefit pension and other postretirement benefit plans. The Company elected to calculate service and interest costs by applying the specific spot rates along the yield curve to the plans' projected cash flows. The change does not affect the measurement of the total benefit obligation or the annual net periodic benefit cost or credit of the plans because the change in the service and interest costs will be offset in the mark-to-market actuarial gain or loss which typically is recognized in the fourth quarter of each year or in any other quarters in which an interim remeasurement is triggered.

18

10. | COMMITMENTS |

Purchase Obligations and Lease Commitments

The Company had various purchase obligations at June 30, 2016, totaling $1.5 billion over a period of approximately 30 years for materials, supplies, and energy incident to the ordinary conduct of business. The Company also had various lease commitments for property and equipment under cancelable, noncancelable, and month-to-month operating leases totaling $265 million over a period of approximately 40 years. Of the total lease commitments, approximately 50 percent relate to real property, including office space, storage facilities, and land; approximately 40 percent relate to railcars; and approximately 10 percent relate to machinery and equipment, including computer and communications equipment and production equipment.

Guarantees

The Company has operating leases with terms that require the Company to guarantee a portion of the residual value of the leased assets upon termination of the lease as well as other guarantees. Disclosures about each group of similar guarantees are provided below.

Residual Value Guarantees

The Company has operating leases with terms that require the Company to guarantee a portion of the residual value of the leased assets upon termination of the lease. These residual value guarantees totaled $125 million at June 30, 2016 and consist primarily of leases for railcars and the company aircraft mostly expiring in 2016 and 2017. Residual guarantee payments that become probable and estimable are accrued to rent expense over the remaining life of the applicable lease. Management's current expectation is that the likelihood of material residual guarantee payments is remote.

Other Guarantees

Guarantees and claims also arise during the ordinary course of business from relationships with customers, suppliers, joint venture partners, and other parties when the Company undertakes an obligation to guarantee the performance of others, if specified triggering events occur. Non-performance under a contract could trigger an obligation of the Company. The Company's current other guarantees include guarantees relating primarily to intellectual property, environmental matters, and other indemnifications and have arisen through the normal course of business. The ultimate effect on future financial results is not subject to reasonable estimation because considerable uncertainty exists as to the final outcome of these claims, if they were to occur. These other guarantees have terms up to 30 years with maximum potential future payments of approximately $35 million in the aggregate, with none of these guarantees being individually significant to the Company's operating results, financial position, or liquidity. Management's current expectation is that future payment or performance related to non-performance under other guarantees is remote.

11. | ENVIRONMENTAL MATTERS AND ASSET RETIREMENT OBLIGATIONS |

Certain Eastman manufacturing sites generate hazardous and nonhazardous wastes, the treatment, storage, transportation, and disposal of which are regulated by various governmental agencies. In connection with the cleanup of various hazardous waste sites, the Company, along with many other entities, has been designated a potentially responsible party ("PRP") by the U.S. Environmental Protection Agency under the Comprehensive Environmental Response, Compensation and Liability Act, which potentially subjects PRPs to joint and several liability for such cleanup costs. In addition, the Company will be required to incur costs for environmental remediation and closure and post-closure under the federal Resource Conservation and Recovery Act. Reserves for environmental contingencies have been established in accordance with Eastman's policies described in Note 1, "Significant Accounting Policies", to the consolidated financial statements in Part II, Item 8 of the Company's 2015 Annual Report on Form 10-K. The Company's total reserve for environmental contingencies was $332 million and $336 million at June 30, 2016 and December 31, 2015, respectively. At both June 30, 2016 and December 31, 2015, this reserve included $8 million related to sites previously closed and impaired by Eastman and sites that have been divested by Eastman but for which the Company retains the environmental liability related to these sites.

19

The Company's total environmental reserve that management believes to be probable and estimable for environmental contingencies, including remediation costs and asset retirement obligations, is included as part of "Payables and other current liabilities" and "Other long-term liabilities" in the Unaudited Consolidated Statements of Financial Position as follows:

(Dollars in millions) | June 30, 2016 | December 31, 2015 | |||||

Environmental contingent liabilities, current | $ | 30 | $ | 35 | |||

Environmental contingent liabilities, long-term | 302 | 301 | |||||

Total | $ | 332 | $ | 336 | |||

Remediation

Estimated future environmental expenditures for remediation costs ranged from the minimum or best estimate of $304 million to the maximum of $512 million and from the minimum or best estimate of $308 million to the maximum of $516 million at June 30, 2016 and December 31, 2015, respectively. The maximum estimated future costs are considered to be reasonably possible and include the amounts accrued at both June 30, 2016 and December 31, 2015. Although the resolution of uncertainties related to these environmental matters may have a material adverse effect on the Company's consolidated results of operations in the period recognized, because of the availability of legal defenses, the Company's preliminary assessment of actions that may be required, and if applicable, the expected sharing of costs, management does not believe that the Company's liability for these environmental matters, individually or in the aggregate, will be material to the Company's consolidated financial position or cash flows.

Reserves for environmental remediation include liabilities expected to be paid within 30 years. The amounts charged to pre-tax earnings for environmental remediation and related charges are included within "Cost of sales" in the Unaudited Consolidated Statements of Earnings, Comprehensive Income and Retained Earnings. Changes in the reserves for environmental remediation liabilities during first six months 2016 are summarized below:

(Dollars in millions) | Environmental Remediation Liabilities | ||

Balance at December 31, 2015 | $ | 308 | |

Changes in estimates recognized in earnings and other | 9 | ||

Cash reductions | (13 | ) | |

Balance at June 30, 2016 | $ | 304 | |

Closure/Post-Closure

An asset retirement obligation is an obligation for the retirement of a tangible long-lived asset that is incurred upon the acquisition, construction, development, or normal operation of that long-lived asset. The Company recognizes asset retirement obligations in the period in which they are incurred if a reasonable estimate of fair value can be made. The asset retirement obligations are discounted to expected present value and subsequently adjusted for changes in fair value. The associated estimated asset retirement costs are capitalized as part of the carrying value of the long-lived assets and depreciated over their useful life. Environmental asset retirement obligations consist primarily of closure and post-closure costs. For sites that have environmental asset retirement obligations, the best estimate accrued to date over the sites' estimated useful lives for these environmental asset retirement obligation costs was $28 million at both June 30, 2016 and December 31, 2015.

Other

The Company also has contractual asset retirement obligations not associated with environmental liabilities. Eastman's non-environmental asset retirement obligations are primarily associated with the future closure of leased manufacturing assets at Pace, Florida and Oulu, Finland. These accrued non-environmental asset retirement obligations were $45 million and $46 million as of June 30, 2016 and December 31, 2015, respectively.

20

12. | LEGAL MATTERS |

From time to time, the Company and its operations are parties to, or targets of, lawsuits, claims, investigations and proceedings, including product liability, personal injury, asbestos, patent and intellectual property, commercial, contract, environmental, antitrust, health and safety, and employment matters, which are being handled and defended in the ordinary course of business. While the Company is unable to predict the outcome of these matters, it does not believe, based upon currently available facts, that the ultimate resolution of any such pending matters will have a material adverse effect on its overall financial condition, results of operations, or cash flows.

13. | STOCKHOLDERS' EQUITY |

A reconciliation of the changes in stockholders' equity for first six months 2016 is provided below:

(Dollars in millions) | Common Stock at Par Value | Paid-in Capital | Retained Earnings | Accumulated Other Comprehensive Income (Loss) | Treasury Stock at Cost | Total Stockholders' Equity Attributed to Eastman | Noncontrolling Interest | Total Stockholders' Equity | |||||||||||||||||||||||

Balance at December 31, 2015 | $ | 2 | $ | 1,863 | $ | 5,146 | $ | (390 | ) | $ | (2,680 | ) | $ | 3,941 | $ | 80 | $ | 4,021 | |||||||||||||

Net Earnings | — | — | 506 | — | — | 506 | 2 | 508 | |||||||||||||||||||||||

Cash Dividends Declared (1) ($0.92 per share) | — | — | (135 | ) | — | — | (135 | ) | — | (135 | ) | ||||||||||||||||||||

Other Comprehensive Income | — | — | — | 79 | — | 79 | — | 79 | |||||||||||||||||||||||

Share-Based Compensation Expense (2) | — | 20 | — | — | — | 20 | — | 20 | |||||||||||||||||||||||

Stock Option Exercises | — | 11 | — | — | — | 11 | — | 11 | |||||||||||||||||||||||

Other (3) | — | (2 | ) | — | — | — | (2 | ) | (1 | ) | (3 | ) | |||||||||||||||||||

Share Repurchase | — | — | — | — | (45 | ) | (45 | ) | — | (45 | ) | ||||||||||||||||||||

Distributions to Noncontrolling Interest | — | — | — | — | — | — | (3 | ) | (3 | ) | |||||||||||||||||||||

Balance at June 30, 2016 | $ | 2 | $ | 1,892 | $ | 5,517 | $ | (311 | ) | $ | (2,725 | ) | $ | 4,375 | $ | 78 | $ | 4,453 | |||||||||||||

(1) | Includes cash dividends paid and dividends declared, but unpaid. |

(2) | Fair value of share-based awards. |

(3) | Paid in capital includes tax benefits/charges relating to the differences between the amounts deductible for federal income taxes over the amounts charged to income for book value purposes and other items. Equity attributable to noncontrolling interest includes adjustments for currency revaluation. |

Accumulated Other Comprehensive Income (Loss), Net of Tax

(Dollars in millions) | Cumulative Translation Adjustment | Benefit Plans Unrecognized Prior Service Credits | Unrealized Gains (Losses) on Derivative Instruments | Unrealized Losses on Investments | Accumulated Other Comprehensive Income (Loss) | ||||||||||||||

Balance at December 31, 2014 | $ | (68 | ) | $ | 61 | $ | (269 | ) | $ | (1 | ) | $ | (277 | ) | |||||

Period change | (216 | ) | 68 | 35 | — | (113 | ) | ||||||||||||

Balance at December 31, 2015 | (284 | ) | 129 | (234 | ) | (1 | ) | (390 | ) | ||||||||||

Period change | 36 | (14 | ) | 57 | — | 79 | |||||||||||||

Balance at June 30, 2016 | $ | (248 | ) | $ | 115 | $ | (177 | ) | $ | (1 | ) | $ | (311 | ) | |||||

Amounts of other comprehensive income (loss) are presented net of applicable taxes. The Company recognizes deferred income taxes on the cumulative translation adjustment related to branch operations and income from other entities included in the Company's consolidated U.S. tax return. No deferred income taxes are provided on the cumulative translation adjustment of other subsidiaries outside the United States, as such cumulative translation adjustment is considered to be a component of indefinitely invested, unremitted earnings of these foreign subsidiaries.

21

Components of other comprehensive income recognized in the Unaudited Consolidated Statements of Earnings, Comprehensive Income and Retained Earnings are presented below, before tax and net of tax effects:

Second Quarter | |||||||||||||||

2016 | 2015 | ||||||||||||||

(Dollars in millions) | Before Tax | Net of Tax | Before Tax | Net of Tax | |||||||||||

Other comprehensive income (loss) | |||||||||||||||

Change in cumulative translation adjustment | $ | (70 | ) | $ | (70 | ) | $ | 76 | $ | 76 | |||||

Defined benefit pension and other postretirement benefit plans: | |||||||||||||||

Amortization of unrecognized prior service credits included in net periodic costs (1) | (11 | ) | (7 | ) | (10 | ) | (7 | ) | |||||||

Derivatives and hedging: (2) | |||||||||||||||

Unrealized gain (loss) during period | 62 | 38 | (26 | ) | (16 | ) | |||||||||

Reclassification adjustment for losses included in net income, net | 53 | 33 | 40 | 25 | |||||||||||

Total other comprehensive income (loss) | $ | 34 | $ | (6 | ) | $ | 80 | $ | 78 | ||||||

First Six Months | |||||||||||||||

2016 | 2015 | ||||||||||||||

(Dollars in millions) | Before Tax | Net of Tax | Before Tax | Net of Tax | |||||||||||

Other comprehensive income (loss) | |||||||||||||||

Change in cumulative translation adjustment | $ | 36 | $ | 36 | $ | (136 | ) | $ | (136 | ) | |||||

Defined benefit pension and other postretirement benefit plans: | |||||||||||||||

Amortization of unrecognized prior service credits included in net periodic costs (1) | (22 | ) | (14 | ) | (17 | ) | (11 | ) | |||||||

Derivatives and hedging:(2) | |||||||||||||||

Unrealized gain during period | 32 | 20 | 63 | 39 | |||||||||||

Reclassification adjustment for losses included in net income, net | 60 | 37 | 35 | 22 | |||||||||||

Total other comprehensive income (loss) | $ | 106 | $ | 79 | $ | (55 | ) | $ | (86 | ) | |||||

(1) | Included in the calculation of net periodic benefit costs for pension and other postretirement benefit plans. See Note 9, "Retirement Plans". |

(2) | For additional information regarding the impact of reclassifications into earnings, refer to Note 8, "Derivative and Non-Derivative Financial Instruments". |

22

14. | EARNINGS AND DIVIDENDS PER SHARE |

The following table sets forth the computation of basic and diluted earnings per share ("EPS"):

Second Quarter | First Six Months | ||||||||||||||

(In millions, except per share amounts) | 2016 | 2015 | 2016 | 2015 | |||||||||||

Numerator | |||||||||||||||

Earnings attributable to Eastman: | |||||||||||||||

Earnings, net of tax | $ | 255 | $ | 297 | $ | 506 | $ | 468 | |||||||

Denominator | |||||||||||||||

Weighted average shares used for basic EPS | 147.8 | 148.6 | 147.8 | 148.6 | |||||||||||

Dilutive effect of stock options and other awards | 1.1 | 1.2 | 1.1 | 1.2 | |||||||||||

Weighted average shares used for diluted EPS | 148.9 | 149.8 | 148.9 | 149.8 | |||||||||||

EPS (1) | |||||||||||||||

Basic | $ | 1.73 | $ | 2.00 | $ | 3.43 | $ | 3.15 | |||||||

Diluted | $ | 1.71 | $ | 1.98 | $ | 3.40 | $ | 3.12 | |||||||

(1) | Earnings per share are calculated using whole dollars and shares. |

In second quarter and first six months 2016, options to purchase 1,056,961 and 1,076,935 shares of common stock, respectively, were excluded from the shares treated as outstanding for computation of diluted earnings per share because the total market value of option exercises for these awards was less than the total cash proceeds that would be received for these exercises. Second quarter and first six months 2016 reflect the impact of share repurchases of 344,790 and 632,071, respectively.

In second quarter and first six months 2015, options to purchase 619,418 and 272,143 shares of common stock, respectively, were excluded from the shares treated as outstanding for computation of diluted earnings per share because the total market value of option exercises for these awards was less than the total cash proceeds that would be received for these exercises. Second quarter and first six months 2015 reflect the impact of share repurchases of 65,000 and 435,000, respectively.

The Company declared cash dividends of $0.46 and $0.40 per share in second quarter 2016 and 2015, respectively, and $0.92 and $0.80 per share in first six months 2016 and 2015, respectively.

15. | ASSET IMPAIRMENTS AND RESTRUCTURING |

In first six months 2016, there were net asset impairments and restructuring gains of $2 million in the AFP segment for the sale of previously impaired assets at the Crystex® R&D site in France.

In second quarter 2015, net asset impairments and restructuring charges included $7 million of restructuring charges, primarily for dismantlement related to the closure of the Workington, UK acetate tow manufacturing site. The charges were offset by a pension curtailment gain of $7 million as a result of the site closure.

In first six months 2015, net asset impairments and restructuring charges included $81 million of asset impairments and $14 million of restructuring charges, including severance, in the Fibers segment due to the closure of the Workington, UK acetate tow manufacturing site which was substantially completed in 2015. Additionally, in first six months 2015, management decided not to continue a growth initiative that was reported in "Other". This resulted in the Company recognizing asset impairments of $8 million and restructuring charges of $4 million.

23

Changes in Reserves for Asset Impairments, Restructuring Charges, Net, and Severance Charges

The following table summarizes the changes in asset impairments and restructuring charges and gains, the non-cash reductions attributable to asset impairments, and the cash reductions in restructuring reserves for severance costs and site closure costs paid in first six months 2016 and full year 2015:

(Dollars in millions) | Balance at January 1, 2016 | Provision/ Adjustments | Non-cash Reductions | Cash Reductions | Balance at June 30, 2016 | ||||||||||||||

Non-cash charges | $ | — | $ | — | $ | — | $ | — | $ | — | |||||||||

Severance costs | 55 | — | — | (21 | ) | 34 | |||||||||||||

Site closure and restructuring costs | 11 | (2 | ) | 1 | (1 | ) | 9 | ||||||||||||

Total | $ | 66 | $ | (2 | ) | $ | 1 | $ | (22 | ) | $ | 43 | |||||||

(Dollars in millions) | Balance at January 1, 2015 | Provision/ Adjustments | Non-cash Reductions | Cash Reductions | Balance at December 31, 2015 | ||||||||||||||

Non-cash charges | $ | — | $ | 107 | $ | (107 | ) | $ | — | $ | — | ||||||||

Severance costs | 13 | 67 | 1 | (26 | ) | 55 | |||||||||||||

Site closure and restructuring costs | 15 | 9 | 3 | (16 | ) | 11 | |||||||||||||

Total | $ | 28 | $ | 183 | $ | (103 | ) | $ | (42 | ) | $ | 66 | |||||||

Severance payments in first six months 2016 relate primarily to fourth quarter 2015 actions taken to reduce non-operations workforce. Substantially all severance costs remaining are expected to be applied to the reserves within one year.

16. | SHARE-BASED COMPENSATION AWARDS |

The Company utilizes share-based awards under employee and non-employee director compensation programs. These share-based awards may include restricted and unrestricted stock, restricted stock units, stock options, and performance shares. In second quarter 2016 and 2015, $7 million and $10 million, respectively, of compensation expense before tax were recognized in "Selling, general and administrative expenses" in the Unaudited Consolidated Statements of Earnings, Comprehensive Income and Retained Earnings for all share-based awards. The impact on second quarter 2016 and 2015 net earnings of $4 million and $6 million, respectively, is net of deferred tax expense related to share-based award compensation for each period.

In first six months 2016 and 2015, $20 million and $21 million, respectively, of compensation expense before tax were recognized in "Selling, general and administrative expenses" in the Unaudited Consolidated Statements of Earnings, Comprehensive Income and Retained Earnings for all share-based awards. The impact on first six months 2016 and 2015 net earnings of $12 million and $13 million, respectively, is net of deferred tax expense related to share-based award compensation for each period.

For additional information regarding share-based compensation plans and awards, see Note 18, "Share-Based Compensation Plans and Awards", to the consolidated financial statements in Part II, Item 8 of the Company's 2015 Annual Report on Form 10-K.

24

17. | SUPPLEMENTAL CASH FLOW INFORMATION |

Included in the line item "Other items, net" of the "Operating activities" section of the Unaudited Consolidated Statements of Cash Flows are the following changes to Unaudited Consolidated Statement of Financial Position line items:

(Dollars in millions) | First Six Months | ||||||

2016 | 2015 | ||||||

Other current assets | $ | (13 | ) | $ | 15 | ||

Other noncurrent assets | 14 | 48 | |||||

Payables and other current liabilities | 40 | 139 | |||||

Long-term liabilities and equity | (42 | ) | (107 | ) | |||

Total | $ | (1 | ) | $ | 95 | ||

The above changes resulted primarily from accrued taxes, deferred taxes, environmental liabilities, monetized positions from raw material and energy, currency, and certain interest rate hedges, prepaid insurance, miscellaneous deferrals, value-added taxes, and other miscellaneous accruals.

25

18. | SEGMENT INFORMATION |

As reported in the 2015 Annual Report on Form 10-K, the Company's products and operations were managed and reported in five operating segments: Additives & Functional Products ("AFP"), Adhesives & Plasticizers ("A&P"), Advanced Materials ("AM"), Fibers, and Specialty Fluids & Intermediates ("SFI"). Beginning first quarter 2016, as a result of changes in the Company's organizational structure and management, the Company's products and operations are managed and reported in four operating segments: AFP, AM, Chemical Intermediates ("CI"), and Fibers. The new structure supports the Company's strategy to transform towards a specialty portfolio by better aligning similar businesses in a more streamlined structure.

Under the new structure, the adhesives resins product line of the former A&P segment is moved to the AFP segment, the specialty fluids product line of the former SFI segment is moved to the AFP segment, and the plasticizers product line of the former A&P segment is moved to the new CI segment. In addition to the product line changes, there were shifts in products among product lines in different segments. Acetyl and olefin products with animal nutrition and food ingredient applications of the former SFI segment are moved to the AFP segment as part of the care chemicals and animal nutrition product lines. Distribution solvents, ethylene oxide derivatives, and ethyl acetate products are moved from the AFP segment to the new CI segment in the other intermediates product line.

Second Quarter | |||||||

(Dollars in millions) | 2016 | 2015 | |||||

Sales | |||||||

Additives & Functional Products | $ | 770 | $ | 830 | |||

Advanced Materials | 646 | 647 | |||||

Chemical Intermediates | 633 | 745 | |||||

Fibers | 234 | 299 | |||||

Total Sales by Segment | 2,283 | 2,521 | |||||

Other | 14 | 12 | |||||

Total Sales | $ | 2,297 | $ | 2,533 | |||

First Six Months | |||||||

(Dollars in millions) | 2016 | 2015 | |||||

Sales | |||||||

Additives & Functional Products | $ | 1,507 | $ | 1,634 | |||

Advanced Materials | 1,235 | 1,208 | |||||

Chemical Intermediates | 1,253 | 1,527 | |||||

Fibers | 514 | 583 | |||||

Total Sales by Segment | 4,509 | 4,952 | |||||

Other | 24 | 24 | |||||

Total Sales | $ | 4,533 | $ | 4,976 | |||

26

Second Quarter | |||||||

(Dollars in millions) | 2016 | 2015 | |||||

Operating Earnings (Loss) | |||||||

Additives & Functional Products | $ | 168 | $ | 178 | |||

Advanced Materials | 132 | 135 | |||||

Chemical Intermediates | 15 | 87 | |||||

Fibers | 72 | 93 | |||||

Total Operating Earnings by Segment | 387 | 493 | |||||

Other | |||||||

Growth initiatives and businesses not allocated to segments | (24 | ) | (22 | ) | |||

Pension and other postretirement benefits income, net not allocated to operating segments | 13 | 8 | |||||

Acquisition integration, transaction, and restructuring costs | — | (10 | ) | ||||

Total Operating Earnings | $ | 376 | $ | 469 | |||

First Six Months | |||||||

(Dollars in millions) | 2016 | 2015 | |||||

Operating Earnings (Loss) | |||||||

Additives & Functional Products | $ | 321 | $ | 335 | |||

Advanced Materials | 240 | 203 | |||||

Chemical Intermediates | 82 | 205 | |||||

Fibers | 158 | 86 | |||||

Total Operating Earnings by Segment | 801 | 829 | |||||

Other | |||||||

Growth initiatives and businesses not allocated to segments | (42 | ) | (48 | ) | |||

Pension and other postretirement benefit income, net not allocated to operating segments | 25 | 17 | |||||

Acquisition integration, transaction, and restructuring costs | (9 | ) | (18 | ) | |||

Total Operating Earnings | $ | 775 | $ | 780 | |||

June 30, | December 31, | ||||||

(Dollars in millions) | 2016 | 2015 | |||||

Assets by Segment (1) | |||||||

Additives & Functional Products | $ | 6,394 | $ | 6,370 | |||

Advanced Materials | 4,315 | 4,227 | |||||

Chemical Intermediates | 3,118 | 2,930 | |||||

Fibers | 765 | 969 | |||||

Total Assets by Segment | 14,592 | 14,496 | |||||

Corporate Assets | 990 | 1,084 | |||||

Total Assets | $ | 15,582 | $ | 15,580 | |||

(1) | The chief operating decision maker holds segment management accountable for accounts receivable, inventory, fixed assets, goodwill, and intangible assets. |

27

19. | RECENTLY ISSUED ACCOUNTING STANDARDS |

In May 2014, the FASB and International Accounting Standards Board jointly issued new principles-based accounting guidance for revenue recognition that will supersede virtually all existing revenue guidance. The core principle of this guidance is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods and services. To achieve the core principle, the guidance establishes the following five steps: 1) identify the contract(s) with a customer, 2) identify the performance obligation in the contract, 3) determine the transaction price, 4) allocate the transaction price to the performance obligations in the contract, and 5) recognize revenue when (or as) the entity satisfies a performance obligation. The guidance also details the accounting treatment for costs to obtain or fulfill a contract. Lastly, disclosure requirements have been enhanced to provide sufficient information to enable users of financial statements to understand the nature, amount, timing, and uncertainty of revenue and cash flows arising from contracts with customers. In August 2015, the FASB issued new guidance to delay the effective date of the new revenue standard by one year. The deferral results in the new revenue standard being effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2017. Early application is permitted under the original effective date of fiscal years, and interim periods within those fiscal years, beginning after December 15, 2016. In April 2016, the FASB issued clarifying guidance to the 2014 revenue standard in regards to the identification of performance obligations and licensing. In May 2016, the FASB issued narrow-scope improvements and practical expedients to the new revenue standard that includes clarification of the collectability criterion, specification for the measurement of noncash considerations, clarifies a completed contract for transition purposes and clarification in regards to the retrospective application, as well as, policy elections, and practical expedients. The effective date for both amendments is the same as that of the revenue standard stated above. The Company is currently evaluating the impact on the Company's financial position and results of operations and related disclosures.