Form 10-Q CYS Investments, Inc. For: Mar 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________

FORM 10-Q

__________________________________

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2015

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission file number 001-33740

__________________________________

CYS Investments, Inc.

(Exact name of registrant as specified in its charter)

__________________________________

Maryland | 20-4072657 |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

890 Winter Street, Suite 200, Waltham, Massachusetts | 02451 |

(Address of principal executive offices) | (Zip Code) |

(617) 639-0440

(Registrant’s telephone number, including area code)

__________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. Check one:

Large accelerated filer | x | Accelerated filer | ¨ |

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

Class | April 24, 2015 |

Common Stock ($0.01 par value) | 158,135,786 |

__________________________________

Table of Contents

Page | ||

PART I. Financial Information

Item 1. Financial Statements

CYS INVESTMENTS, INC.

CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(In thousands, except per share numbers) | March 31, 2015 | December 31, 2014* | |||||

Assets: | |||||||

Investments in securities, at fair value (including pledged assets of $11,309,980 and $11,908,922, respectively) | $ | 15,065,303 | $ | 14,609,532 | |||

Derivative assets, at fair value | 91,604 | 148,284 | |||||

Cash | 7,170 | 4,323 | |||||

Receivable for securities sold and principal repayments | 345,006 | 83,643 | |||||

Interest receivable | 37,314 | 37,894 | |||||

Receivable for cash pledged as collateral | 37,216 | 11,104 | |||||

Other assets | 11,408 | 1,083 | |||||

Total assets | $ | 15,595,021 | $ | 14,895,863 | |||

Liabilities and stockholders' equity: | |||||||

Liabilities: | |||||||

Repurchase agreements | $ | 10,204,901 | $ | 11,289,559 | |||

FHLB advances | 510,000 | — | |||||

Derivative liabilities, at fair value | 38,502 | 16,007 | |||||

Payable for securities purchased | 2,767,042 | 1,505,481 | |||||

Payable for cash received as collateral | 48,229 | 72,771 | |||||

Distribution payable | 51,844 | 4,410 | |||||

Accrued interest payable (including accrued interest on repurchase agreements and FHLB advances of $3,574 and $5,334, respectively) | 31,422 | 27,208 | |||||

Accrued expenses and other liabilities | 2,445 | 5,259 | |||||

Total liabilities | $ | 13,654,385 | $ | 12,920,695 | |||

Stockholders' equity: | |||||||

Preferred Stock, $25.00 par value, 50,000 shares authorized: | |||||||

7.75% Series A Cumulative Redeemable Preferred Stock, (3,000 shares issued and outstanding, respectively, $75,000 in aggregate liquidation preference) | $ | 72,369 | $ | 72,369 | |||

7.50% Series B Cumulative Redeemable Preferred Stock, (8,000 shares issued and outstanding, respectively, $200,000 in aggregate liquidation preference) | 193,531 | 193,531 | |||||

Common Stock, $0.01 par value, 500,000 shares authorized (158,114 and 161,850 shares issued and outstanding, respectively) | 1,581 | 1,618 | |||||

Additional paid in capital | 2,012,697 | 2,049,152 | |||||

Accumulated deficit | (339,542 | ) | (341,502 | ) | |||

Total stockholders' equity | $ | 1,940,636 | $ | 1,975,168 | |||

Total liabilities and stockholders' equity | $ | 15,595,021 | $ | 14,895,863 | |||

__________________

* Derived from audited financial statements.

See Notes to interim consolidated financial statements.

1

CYS INVESTMENTS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

Three Months Ended March 31, | |||||||

(In thousands, except per share numbers) | 2015 | 2014 | |||||

Interest income: | |||||||

Interest income from Agency RMBS | $ | 80,060 | $ | 80,186 | |||

Other interest income | 790 | 4,181 | |||||

Total interest income | 80,850 | 84,367 | |||||

Interest expense: | |||||||

Repurchase agreement and FHLB advances interest expense | 9,642 | 9,423 | |||||

Swap and cap interest expense | 27,468 | 18,923 | |||||

Total interest expense | 37,110 | 28,346 | |||||

Net interest income | 43,740 | 56,021 | |||||

Other income (loss): | |||||||

Net realized gain (loss) on investments | 18,253 | 16,670 | |||||

Net unrealized gain (loss) on investments | 75,689 | 89,234 | |||||

Net realized gain (loss) on termination of swap and cap contracts | (2,568 | ) | (9,323 | ) | |||

Net unrealized gain (loss) on swap and cap contracts | (74,800 | ) | (16,240 | ) | |||

Other income | 40 | 119 | |||||

Total other income (loss) | 16,614 | 80,460 | |||||

Expenses: | |||||||

Compensation and benefits | 3,554 | 3,629 | |||||

General, administrative and other | 2,203 | 2,165 | |||||

Total expenses | 5,757 | 5,794 | |||||

Net income (loss) | $ | 54,597 | $ | 130,687 | |||

Dividends on preferred stock | (5,203 | ) | (5,203 | ) | |||

Net income (loss) available to common stockholders | $ | 49,394 | $ | 125,484 | |||

Net income (loss) per common share basic & diluted | $ | 0.31 | $ | 0.78 | |||

Dividends declared per common share | $ | 0.30 | $ | 0.32 | |||

____________

See Notes to interim consolidated financial statements.

2

CYS INVESTMENTS, INC.

CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS' EQUITY (UNAUDITED)

Cumulative Redeemable Preferred Stock | ||||||||||||||||||||||||

(in thousands) | Series A | Series B | Common Stock Par Value | Additional Paid-in Capital | Accumulated Deficit | Total | ||||||||||||||||||

Balance, December 31, 2014 | $ | 72,369 | $ | 193,531 | $ | 1,618 | $ | 2,049,152 | $ | (341,502 | ) | $ | 1,975,168 | |||||||||||

Net income (loss) | — | — | — | — | 54,597 | 54,597 | ||||||||||||||||||

Issuance of common stock | — | — | 4 | (4 | ) | — | — | |||||||||||||||||

Amortization of share based compensation | — | — | — | 954 | — | 954 | ||||||||||||||||||

Repurchase and cancellation of common stock | — | — | (41 | ) | (37,405 | ) | — | (37,446 | ) | |||||||||||||||

Preferred dividends | — | — | — | — | (5,203 | ) | (5,203 | ) | ||||||||||||||||

Common dividends | — | — | — | — | (47,434 | ) | (47,434 | ) | ||||||||||||||||

Balance, March 31, 2015 | $ | 72,369 | $ | 193,531 | $ | 1,581 | $ | 2,012,697 | $ | (339,542 | ) | $ | 1,940,636 | |||||||||||

__________________

See Notes to interim consolidated financial statements.

3

CYS INVESTMENTS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

Three Months Ended March 31, | |||||||

(In thousands) | 2015 | 2014 | |||||

Cash flows from operating activities: | |||||||

Net income (loss) | $ | 54,597 | $ | 130,687 | |||

Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | |||||||

Amortization of share based compensation | 954 | 1,115 | |||||

Amortization of premiums and discounts on investment securities | 21,450 | 10,303 | |||||

Amortization of premiums on interest rate cap contracts | 4,375 | 6,254 | |||||

Net realized (gain) loss on investments | (18,253 | ) | (16,670 | ) | |||

Net unrealized (gain) loss on investments | (75,689 | ) | (89,234 | ) | |||

Net unrealized (gain) loss on swap and cap contracts | 74,800 | 16,240 | |||||

Change in assets and liabilities: | |||||||

Interest receivable | 580 | 2,747 | |||||

Other assets | (10,325 | ) | 274 | ||||

Accrued interest payable | 4,214 | (9,631 | ) | ||||

Accrued expenses and other liabilities | (2,814 | ) | (2,602 | ) | |||

Net cash provided by (used in) operating activities | 53,889 | 49,483 | |||||

Cash flows from investing activities: | |||||||

Purchase of investment securities | (6,863,933 | ) | (7,421,216 | ) | |||

Proceeds from disposition of investment securities | 6,018,216 | 7,788,084 | |||||

Proceeds from paydowns of investment securities | 462,438 | 279,846 | |||||

Change in assets and liabilities: | |||||||

Receivable for securities sold and principal repayments | (261,363 | ) | 425,651 | ||||

Payable for securities purchased | 1,261,561 | 84,777 | |||||

Receivable for cash pledged as collateral | (26,112 | ) | — | ||||

Payable for cash received as collateral | (24,542 | ) | 18 | ||||

Net cash provided by (used in) investing activities | 566,265 | 1,157,160 | |||||

Cash flows from financing activities: | |||||||

Proceeds from repurchase agreements | 23,743,739 | 21,193,497 | |||||

Repayments of repurchase agreements | (24,828,397 | ) | (22,386,399 | ) | |||

Proceeds from FHLB advances | 1,010,000 | — | |||||

Repayments of FHLB advances | (500,000 | ) | — | ||||

Net payments from repurchase of common stock | (37,446 | ) | (133 | ) | |||

Distributions paid | (5,203 | ) | (5,204 | ) | |||

Net cash used in financing activities | (617,307 | ) | (1,198,239 | ) | |||

Net increase (decrease) in cash | 2,847 | 8,404 | |||||

Cash - Beginning of period | 4,323 | 4,992 | |||||

Cash - End of period | $ | 7,170 | $ | 13,396 | |||

Supplemental disclosures of cash flow information: | |||||||

Interest paid | $ | 28,522 | $ | 41,220 | |||

Supplemental disclosures of non-cash flow information: | |||||||

Distributions declared, not yet paid | $ | 51,844 | $ | 56,258 | |||

__________________

See Notes to interim consolidated financial statements.

4

CYS INVESTMENTS, INC.

NOTES TO CONDOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

March 31, 2015

These footnotes to our accompanying financial statements in this interim report should be read in conjunction with the footnotes to our Annual Report on Form 10-K, filed with the SEC on February 17, 2015 (the "2014 Annual Report").

1. ORGANIZATION

CYS Investments, Inc. (the "Company" "we", "us", and "our,") was formed as a Maryland corporation on January 3, 2006, and commenced operations on February 10, 2006. The Company has elected to be taxed and intends to continue to qualify as a real estate investment trust ("REIT") and is required to comply with the provisions of the Internal Revenue Code of 1986, as amended (the "Code"), with respect thereto. The Company has primarily purchased residential mortgage-backed securities that are issued and the principal and interest of which are guaranteed by a federally chartered corporation ("Agency RMBS"), such as the Federal National Mortgage Association ("Fannie Mae") or the Federal Home Loan Mortgage Corporation ("Freddie Mac"), or an agency of the U.S. government such as the Government National Mortgage Association ("Ginnie Mae"), and debt securities issued by the United States Department of Treasury ("U.S. Treasuries"). The Company may also purchase collateralized mortgage obligations issued by a government agency or government-sponsored entity that are collateralized by Agency RMBS ("CMOs"), or securities issued by a government sponsored entity that are not backed by collateral but, in the case of government agencies, are backed by the full faith and credit of the U.S. government, and, in the case of government sponsored entities, are backed by the integrity and creditworthiness of the issuer ("U.S. Agency Debentures").

The Company’s common stock, Series A Cumulative Redeemable Preferred Stock, $25.00 liquidation preference (the "Series A Preferred Stock"), and Series B Cumulative Redeemable Preferred Stock, $25.00 liquidation preference (the "Series B Preferred Stock"), trade on the New York Stock Exchange under the symbols "CYS," "CYS PrA" and "CYS PrB," respectively.

In March 2015, our wholly-owned captive insurance subsidiary, CYS Insurance Services, LLC ("CYS Insurance"), was granted membership in the Federal Home Loan Bank ("FHLB") of Cincinnati. The 12 regional FHLBs provide long-term and short-term secured loans, called “advances,” to their members. FHLB members may use a variety of real estate related assets, including residential mortgage loans and Agency RMBS, as collateral for advances. Membership in the FHLB permits CYS Insurance to access a variety of products and services offered by the FHLB and obligates CYS Insurance to purchase membership stock and activity stock, the latter being a percentage of the advances it obtains from the FHLB. We intend for CYS Insurance to seek advances of both short- and long-term indebtedness from the FHLB of Cincinnati.

2. SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying interim consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and the instructions to Securities and Exchange Commission ("SEC") Form 10-Q and Article 10, Rule 10-01 of Regulation S-X. Accordingly, the financial statements do not include all of the information and footnotes required by U.S. GAAP for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation have been included. The interim consolidated financial statements should be read in conjunction with the Company’s audited financial statements as of and for the year ended December 31, 2014, included in its 2014 Annual Report. The results for interim periods are not necessarily indicative of the results to be expected for the fiscal year.

The interim consolidated financial statements include the accounts of the Company and all of its subsidiaries. All intercompany balances and transactions have been eliminated. The interim consolidated financial statements of the Company have been prepared on the accrual basis of accounting in accordance with U.S. GAAP. The preparation of financial statements in conformity with U.S. GAAP requires management to make a number of estimates and assumptions that affect the amounts reported in the interim consolidated financial statements and accompanying footnotes. Actual results could differ from these estimates and the differences may be material.

Investments in Securities

The Company's investment securities are accounted for in accordance with Accounting Standards Codification ("ASC") 320—Investments in Debt and Equity Securities. The Company has chosen to make a fair value election pursuant to ASC 825—Financial Instruments for its securities and, therefore, our investment securities are recorded at fair market value on the consolidated balance sheets. The periodic changes in fair market value are recorded in current period earnings on the consolidated statements of operations as a component of net unrealized gain (loss) on investments. These investments generally meet the requirements to be classified as available-for-sale under ASC 320, which requires the securities to be carried at fair value on the balance sheet. Electing the fair value option permits the Company to record changes in fair value of our

5

investments in the consolidated statements of operations, which in management’s view, more appropriately reflects the results of operations for a particular reporting period as all securities activities will be recorded in a similar manner.

The Company records its transactions in securities on a trade date basis. We record realized gains and losses on securities transactions on an identified cost basis.

The Company accounts for its investment in FHLB stock as a cost method investment in "Other Assets".

Agency RMBS

The Company’s investments in Agency RMBS consist of pass-through certificates backed by fixed-rate, monthly-reset adjustable-rate loans (“ARMs”) and hybrid ARMs, the principal and interest of which are guaranteed by Fannie Mae, Freddie Mac or Ginnie Mae. Hybrid ARMs have interest rates that have an initial fixed period (typically three, five, seven or ten years) and thereafter reset at regular intervals in a manner similar to ARMs.

Forward Settling Transactions

The Company engages in forward settling transactions to purchase certain securities. The Company records forward settling transactions on the trade date, and maintains security positions such that sufficient liquid assets will be available to make payment on the settlement date for the securities purchased. The Agency RMBS purchased at the forward settlement date are typically priced at a discount to securities for settlement in the current month. Securities purchased on a forward settling basis are carried at fair value and begin earning interest on the settlement date. Gains or losses may occur on these transactions due to changes in market conditions or the failure of counterparties to perform under the contract. Along with other forward settling transactions, the Company transacts in to-be-announced (“TBA”) securities. As with other forward settling transactions, a seller agrees to issue TBAs at a future date; however, the seller does not specify the particular securities to be delivered. Instead, the Company agrees to accept any security that meets specified terms such as issuer, interest rate and terms of underlying mortgages. The Company records TBAs on the trade date utilizing information associated with the specified terms of the transaction as opposed to the specific mortgages. TBAs are carried at fair value and begin earning interest on the settlement date. Gains or losses may occur due to the fact that the actual underlying mortgages received may be more or less favorable than those anticipated by the Company. See Note 7, Pledged Assets, for disclosure regarding the fair value of collateral pledged or received on forward settling transactions.

At times, the Company may enter into TBA contracts as a means of investing in and financing Agency RMBS via “dollar roll” transactions. TBA dollar roll transactions involve moving the settlement of a TBA contract out to a later date by entering into an offsetting short position (referred to as a “pair off”), net settling the paired off positions for cash, and simultaneously purchasing a similar TBA contract for a later settlement date. The Company records such pair offs on a gross basis such that there is a sale of the original TBA and a subsequent purchase of a new TBA.

Investment Valuation

The Company has a pricing committee responsible for establishing valuation policies and procedures, as well as reviewing and approving valuations at a monthly pricing meeting. The pricing committee is composed of individuals from the accounting team, the investment team and senior management.

Agency RMBS, Agency Debentures and U.S. Treasuries are generally valued based on prices provided by third-party services, as derived from such services’ pricing models. Inputs to the models may include, but are not limited to, reported trades, executable bid and ask prices, broker quotations, prices or yields of securities with similar characteristics, benchmark curves or information pertaining to the issuer, as well as industry and economic events. The pricing services may also use a matrix approach, which considers information regarding securities with similar characteristics to determine the valuation for a security.

We generally value interest rate swaps and caps using prices provided by broker quotations. Such broker quotations are based on the present value of fixed and projected floating rate cash flows over the term of the swap contract. Future cash flows are discounted to their present value using swap rates provided by electronic data services or by brokers. No credit valuation adjustments were made in determining the fair value of the Company's interest rate swaps and caps.

Fair values of long-lived assets, including real estate, are primarily derived internally, and are based on inputs observed from sales transactions of similar assets. For real estate, fair values are also based on comparable contemporaneous sales transactions and/or discounted cash flow estimates which reflect current and projected lease profiles and available industry information about capitalization rates and expected trends in rents and occupancy.

6

All valuations from third-party pricing services or broker quotes are non-binding. We review all prices during our pricing process. To date, the Company has not adjusted any of the prices received from third-party pricing services or brokers. Our pricing review includes comparisons of similar market transactions, alternative third-party pricing services and broker quotes, or comparisons to a pricing model. To ensure the proper fair value hierarchy, the Company reviews the third-party pricing services methodology periodically to understand whether observable or unobservable inputs are being used. See Note 8, Fair Value Measurements, for a discussion of how the Company values its assets.

Interest Income

We record interest income and expense on an accrual basis. We accrue interest income based on the outstanding principal amount of the securities and their contractual terms. We amortize premium and discount using the effective interest method, and this net amortization is either accretive to or a reduction of interest income from Agency RMBS in the Company's consolidated statements of operations. The Company does not estimate prepayments when calculating the yield to maturity on Agency RMBS. We record the amount of premium or discount associated with a prepayment through interest income from Agency RMBS on our consolidated statements of operations as it occurs.

Other Assets -- Investment in FHLB Stock

The Company's subsidiary, CYS Insurance, is a member of, and owns capital stock in, the FHLB of Cincinnati. The FHLB provides CYS Insurance with credit capacity and authorizes advances based on the security of pledged Agency RMBS, provided the Company meets certain creditworthiness standards. FHLB advances, included in the "FHLB advances" line item, is a funding source for the Company of both short- and long-term indebtedness. As a condition of its membership in the FHLB, CYS Insurance is required to maintain a FHLB stock investment, both for membership and for the level of advances from the FHLB to the Company. The Company accounts for its investment in FHLB stock as a cost method investment in "Other Assets".

Repurchase Agreements and FHLB Advances

Borrowings under repurchase agreements ("repo borrowings") and FHLB advances are collateralized by the Company’s Agency RMBS and U.S. Treasuries (collectively, "Debt Securities") and carried at their amortized cost, which approximates their fair value due to their short-term nature (generally 30-90 days). The Company’s repurchase agreement counterparties are institutional dealers in fixed income securities and large financial institutions, and in the case of FHLB advances, the FHLB of Cincinnati. Collateral under repurchase agreements and FHLB advances are valued daily and counterparties may require additional collateral when the fair value of the collateral declines. Counterparties have the right to sell or repledge collateral pledged under repurchase agreements and the FHLB advances agreement. See Note 5, Repurchase Agreements.

We account for our repo borrowings and FHLB advances as short-term indebtedness under ASC 470—Debt; accordingly, these short-term instruments are accounted for in our financial statements at carrying value, or historic cost.

Interest Rate Swap and Cap Contracts

We account for our interest rate swap and cap contracts transactions under ASC 815—Derivatives and Hedging. The Company uses interest rate swaps and interest rate caps to hedge a portion of its exposure to market risks, including interest rate risk, credit risk and extension risk. The objective of our risk management strategy is to reduce fluctuations in stockholders’ equity over a range of interest rate scenarios. In particular, we attempt to manage the risk of the cost of our variable rate liabilities increasing during a period of rising interest rates.

During the term of an interest rate swap or cap, the Company makes or receives periodic payments and records unrealized gains or losses as a result of marking the swap or cap to their fair value. When the Company terminates a swap or cap, we record a realized gain or loss equal to the difference between the proceeds from (or cost of) the closing transaction and the Company's cost basis in the contract, if any. We report the periodic payments and amortization of premiums on cap contracts under interest expense in the consolidated statements of operations. Swaps involve a risk that interest rates will move contrary to the Company’s expectations, thereby increasing the Company’s payment obligation.

The Company's interest rate swap and cap contracts may be subject to a master netting arrangement ("MNA"). The Company is exposed to credit loss in the event of non-performance by the counterparty to the swap or cap limited to the fair value of collateral posted in excess of the fair value of the contract in a net liability position and the shortage of the fair value of collateral posted for the contract in a net asset position. As of March 31, 2015 and December 31, 2014, the Company did not anticipate non-performance by any counterparty. Should interest rates move unexpectedly, the Company may not achieve the anticipated benefits of the interest rate swap or cap and may realize a loss.

7

While the Company's derivative agreements generally permit for netting or setting off derivative assets and liabilities with the counterparty, the Company reports related assets and liabilities on a gross basis in our consolidated balance sheets. Derivative instruments in a gain position are reported as derivative assets at fair value and derivative instruments in a loss position are reported as derivative liabilities at fair value in our consolidated balance sheets. We record changes in fair value of our derivative instruments in net unrealized gain (loss) on swap and cap contracts in our consolidated statements of operations. Cash receipts and payments related to derivative instruments are classified in our consolidated statements of cash flows in accordance with U.S. GAAP in both the operating and investing activities sections in the Company’s consolidated statement of cash flows. See Note 4, Investments in Interest Rate Swap and Cap Contracts.

3. INVESTMENT IN SECURITIES

The available-for-sale portfolio consisted of the following as of March 31, 2015 and December 31, 2014 (in thousands):

March 31, 2015 | ||||||||||||||||

Asset Type | Amortized Cost | Gross Unrealized Loss | Gross Unrealized Gain | Fair Value | ||||||||||||

Fannie Mae Certificates | ||||||||||||||||

Fixed Rate | $ | 12,326,027 | $ | (281 | ) | $ | 201,906 | $ | 12,527,652 | |||||||

ARMs | 597,368 | (1 | ) | 8,959 | 606,326 | |||||||||||

Total Fannie Mae | 12,923,395 | (282 | ) | 210,865 | 13,133,978 | |||||||||||

Freddie Mac Certificates | ||||||||||||||||

Fixed Rate | 1,211,409 | (98 | ) | 26,432 | 1,237,743 | |||||||||||

ARMs | 119,673 | (221 | ) | 1,808 | 121,260 | |||||||||||

Total Freddie Mac | 1,331,082 | (319 | ) | 28,240 | 1,359,003 | |||||||||||

Ginnie Mae Certificates - ARMs | 61,298 | — | 1,665 | 62,963 | ||||||||||||

U.S. Treasuries | 497,553 | — | 3,781 | 501,334 | ||||||||||||

Other Investments | 6,945 | — | 1,080 | 8,025 | ||||||||||||

Total | $ | 14,820,273 | $ | (601 | ) | $ | 245,631 | $ | 15,065,303 | |||||||

December 31, 2014 | ||||||||||||||||

Fannie Mae Certificates | ||||||||||||||||

Fixed Rate | $ | 11,356,716 | $ | (2,984 | ) | $ | 158,571 | $ | 11,512,303 | |||||||

ARMs | 1,282,065 | (13,144 | ) | 4,449 | 1,273,370 | |||||||||||

Total Fannie Mae | 12,638,781 | (16,128 | ) | 163,020 | 12,785,673 | |||||||||||

Freddie Mac Certificates | ||||||||||||||||

Fixed Rate | 1,183,764 | — | 25,769 | 1,209,533 | ||||||||||||

ARMs | 394,726 | (6,753 | ) | 1,144 | 389,117 | |||||||||||

Total Freddie Mac | 1,578,490 | (6,753 | ) | 26,913 | 1,598,650 | |||||||||||

Ginnie Mae Certificates - ARMs | 66,390 | — | 1,743 | 68,133 | ||||||||||||

U.S. Treasuries | 149,585 | (534 | ) | — | 149,051 | |||||||||||

Other Investments | 6,945 | — | 1,080 | 8,025 | ||||||||||||

Total | $ | 14,440,191 | $ | (23,415 | ) | $ | 192,756 | $ | 14,609,532 | |||||||

The following table presents the gross unrealized loss and fair values of our available-for-sale Agency RMBS by length of time that such securities have been in a continuous unrealized loss position as of March 31, 2015 and December 31, 2014 (in thousands):

8

Unrealized loss positions for | ||||||||||||||||||||||||

Less than 12 Months | Greater than 12 months | Total | ||||||||||||||||||||||

As of | Fair value | Unrealized loss | Fair value | Unrealized loss | Fair value | Unrealized loss | ||||||||||||||||||

March 31, 2015 | $ | 258,991 | $ | (380 | ) | $ | 97,643 | $ | (221 | ) | $ | 356,634 | $ | (601 | ) | |||||||||

December 31, 2014 | 259,291 | (577 | ) | 1,494,884 | (22,838 | ) | 1,754,175 | (23,415 | ) | |||||||||||||||

The following table is a summary of our net realized gain (loss) from the sale of available-for-sale investments for the three months ended March 31, 2015 and 2014 (in thousands):

Three Months Ended March 31, | |||||||

2015 | 2014 | ||||||

Available-for-sale investments, at cost | $ | 5,999,963 | $ | 7,771,414 | |||

Proceeds from available-for-sale investments sold | 6,018,216 | 7,788,084 | |||||

Net gain on sale of available-for-sale investments | $ | 18,253 | $ | 16,670 | |||

Gross gain on sale of available-for-sale investments | $ | 33,979 | $ | 51,142 | |||

Gross loss on sale of available-for-sale investments | (15,726 | ) | (34,472 | ) | |||

Net gain on sale of available-for-sale investments | $ | 18,253 | $ | 16,670 | |||

The components of the carrying value of available-for-sale securities at March 31, 2015 and December 31, 2014 are presented below. The premium purchase price is due to the average coupon interest rates on these investments being higher than prevailing market rates, and conversely, the discount purchase price is due to the average coupon interest rates on these investments being lower than prevailing market rates.

(in thousands) | March 31, 2015 | December 31, 2014 | ||||||

Principal balance | $ | 14,244,501 | $ | 13,887,897 | ||||

Unamortized premium | 578,370 | 552,869 | ||||||

Unamortized discount | (2,598 | ) | (575 | ) | ||||

Gross unrealized gains | 245,631 | 192,756 | ||||||

Gross unrealized losses | (601 | ) | (23,415 | ) | ||||

Fair value | $ | 15,065,303 | $ | 14,609,532 | ||||

Our weighted-average coupon interest rate on the Company's Debt Securities as of March 31, 2015 and December 31, 2014 was 3.38% and 3.39%, respectively. Actual maturities of Agency RMBS are generally shorter than stated contractual maturities (which range up to 30 years), as they are affected by the contractual lives of the underlying mortgages, periodic payments and prepayments of principal.

As of March 31, 2015, the range of final contractual maturity of the Company’s Agency RMBS portfolio was between 2024 and 2045 and the final maturity of the Company's U.S. Treasuries was between 2018 and 2020. As of December 31, 2014, the range of final contractual maturity of the Company’s Agency RMBS portfolio was between 2024 and 2045 the final maturity of the Company's U.S. Treasuries was 2019.

Credit Risk

The Company believes it has minimal exposure to credit losses on its investment securities assets at March 31, 2015 and December 31, 2014 because it owns principally Debt Securities. Principal and interest payments on Agency RMBS are guaranteed by Freddie Mac and Fannie Mae, while principal and interest payments on Ginnie Mae RMBS and U.S. Treasuries are backed by the full faith and credit of the U.S. government. In September 2008, both Freddie Mac and Fannie Mae were placed in the conservatorship of the U.S. government. On August 5, 2011, Standard & Poor’s ("S&P") downgraded the U.S. government’s credit rating for the first time to AA+. Fitch Ratings Inc. ("Fitch") announced on October 15, 2013 that it had placed the U.S. government's credit rating on "negative watch". This negative watch was changed to "stable" on March 21, 2014.

9

As of March 31, 2015, S&P has maintained its AA+ rating, while Fitch and Moody's rated the U.S. government AAA and Aaa, respectively. Because Fannie Mae and Freddie Mac are still in U.S. government conservatorship, the implied credit ratings of Agency RMBS were similarly rated. While the conservatorship, ratings downgrade and ratings watch appear not to have had a significant impact on the fair value of the Agency RMBS or U.S. Treasuries in the Company’s portfolio, these developments increased the uncertainty regarding the credit risk of Debt Securities.

4. INVESTMENTS IN INTEREST RATE SWAP AND CAP CONTRACTS

With the intent of managing our interest rate exposure, the Company enters into interest rate swap and cap contracts. The Company had the following activity in interest rate swap and cap transactions during the three months ended March 31, 2015 and 2014 (in thousands):

Three Months Ended March 31, 2015 | Three Months Ended March 31, 2014 | |||||||||||||

Trade Date | Transaction | Notional | Trade Date | Transaction | Notional | |||||||||

January 2015 | Terminated | $ | (400,000 | ) | February 2014 | Terminated | $ | (500,000 | ) | |||||

January 2015 | Opened | 500,000 | Net Decrease | $ | (500,000 | ) | ||||||||

Net Increase | $ | 100,000 | ||||||||||||

As of March 31, 2015 and December 31, 2014, the Company had pledged Debt Securities with a fair value of $80.5 million and $60.9 million, respectively, as collateral on interest rate swap and cap contracts. As of March 31, 2015, the Company had Debt Securities of $34.6 million and cash of $47.7 million pledged to it as collateral for its interest rate swap and cap contracts. As of December 31, 2014, the Company had Debt Securities of $47.2 million and cash of $72.0 million pledged to it as collateral for its interest rate cap contracts. See Note 7, Pledged Assets. Below is a summary of our interest rate swap and cap contracts open as of March 31, 2015 and December 31, 2014 (in thousands):

Derivatives not designated as hedging instruments under ASC 815 | ||||||||||

Interest Rate Swap Contracts | Notional | Fair Value | Consolidated Balance Sheets | |||||||

March 31, 2015 | $ | 4,000,000 | $ | (38,502 | ) | Derivative liabilities, at fair value | ||||

March 31, 2015 | 3,750,000 | 11,333 | Derivative assets, at fair value | |||||||

December 31, 2014 | 2,600,000 | (16,007 | ) | Derivative liabilities, at fair value | ||||||

December 31, 2014 | 5,050,000 | 40,611 | Derivative assets, at fair value | |||||||

Interest Rate Cap Contracts | Notional | Fair Value | Consolidated Balance Sheets | |||||||

March 31, 2015 | $ | 2,500,000 | $ | 80,271 | Derivative assets, at fair value | |||||

December 31, 2014 | 2,500,000 | 107,673 | Derivative assets, at fair value | |||||||

The following table presents information about the net realized and unrealized gain and loss on swap and cap contracts for the three months ended March 31, 2015 and 2014 on the Company's interest rate swap and cap contracts not designated as hedging instruments under ASC 815 (in thousands):

Amount Recognized in Income on Derivatives | ||||||||||

Three Months Ended March 31, | ||||||||||

Derivative Type | Location of Gain or (Loss) Recognized in Income on Derivative | 2015 | 2014 | |||||||

Interest rate swaps and caps | Net realized gain (loss) on termination of swap and cap contracts | $ | (2,568 | ) | $ | (9,323 | ) | |||

Interest rate swaps and caps | Net unrealized gain (loss) on swap and cap contracts | (74,800 | ) | (16,240 | ) | |||||

Interest rate swaps and caps | Total recognized in income on derivatives | $ | (77,368 | ) | $ | (25,563 | ) | |||

We continue to reposition our hedges, and in January 2015 entered into a 7-year $500 million notional swap at a pay rate of 2.15%, cancelable in January 2016, and at the same time we terminated a 7-year $400 million notional interest rate swap at a pay rate of 2.416%, cancelable in June 2015.

10

5. REPURCHASE AGREEMENTS AND FHLB ADVANCES

The Company leverages its portfolio through repo borrowings and FHLB advances. Each of the Company's repo borrowings bear interest at a floating rate based on a spread above or below London Interbank Offered Rate ("LIBOR"). The interest rates for FHLB advances are set by the FHLB of Cincinnati. The fair value of repo borrowings and FHLB advances approximates their carrying amount due to the short-term nature of these financial instruments.

Certain information with respect to the Company’s repo borrowings and FHLB advances outstanding at the balance sheet date is summarized in the table below. Each of the repo borrowings and the FHLB advances are contractually due in one year or less.

(in thousands) | March 31, 2015 | December 31, 2014 | |||||

Outstanding repurchase agreements | $ | 10,204,901 | $ | 11,289,559 | |||

Outstanding FHLB advances | $ | 510,000 | $ | — | |||

Interest accrued thereon | $ | 3,574 | $ | 5,334 | |||

Weighted-average borrowing rate(1) | 0.34 | % | 0.35 | % | |||

Weighted-average remaining maturity (in days) | 43.6 | 28.2 | |||||

Fair value of the collateral(2) | $ | 11,212,170 | $ | 11,842,427 | |||

__________________

(1) | The weighted-average borrowing rate as of March 31, 2015 was determined as set forth in the table below. |

Collateral | Borrowing amount | Rate | ||||

Agency RMBS | $ | 10,243,805 | 0.36 | % | ||

U.S. Treasuries | 471,096 | (0.04 | )% | |||

Total / weighted-average borrowing rate | $ | 10,714,901 | 0.34 | % | ||

(2) | Collateral for repo borrowings and FHLB advances consisted of Agency RMBS and U.S. Treasuries. |

At March 31, 2015 and December 31, 2014, the Company had no repo borrowings or FHLB advances where the amount at risk with an individual counterparty exceeded 1.6% and 1.6% of stockholders' equity, respectively. In addition, we had no repo borrowings or FHLB advances with any counterparty that exceeded 4% of our total assets.

6. COMMITMENTS AND CONTINGENCIES

The Company enters into certain agreements that contain a variety of indemnifications, principally with broker dealers. As of March 31, 2015 and December 31, 2014, no claims have been asserted under these indemnification agreements. Accordingly, the Company has no liabilities recorded for these agreements as of March 31, 2015 and December 31, 2014.

7. PLEDGED ASSETS

Assets Pledged to Counterparties

The following tables summarize our assets pledged as collateral under our repo borrowings, FHLB advances, and derivative agreements by type, including securities pledged related to securities purchased or sold but not yet settled, as of March 31, 2015 and December 31, 2014 (in thousands):

March 31, 2015 | ||||||||||||||||

Assets Pledged to Counterparties | Repurchase Agreements | Derivative Instruments | Forward Settling Trades (TBAs) | Total | ||||||||||||

Agency RMBS - fair value | $ | 10,752,304 | $ | 56,339 | $ | 991 | $ | 10,809,634 | ||||||||

U.S. Treasuries - fair value | 476,142 | 24,204 | — | 500,346 | ||||||||||||

Accrued interest on pledged securities | 29,790 | 245 | 2 | 30,037 | ||||||||||||

Cash | — | 37,216 | — | 37,216 | ||||||||||||

Total | $ | 11,258,236 | $ | 118,004 | $ | 993 | $ | 11,377,233 | ||||||||

11

December 31, 2014 | ||||||||||||||||

Assets Pledged to Counterparties | Repurchase Agreements | Derivative Instruments | Forward Settling Trades (TBAs) | Total | ||||||||||||

Agency RMBS - fair value | $ | 11,697,532 | $ | 42,894 | $ | 1,453 | $ | 11,741,879 | ||||||||

U.S. Treasuries - fair value | 149,051 | 17,992 | — | 167,043 | ||||||||||||

Accrued interest on pledged securities | 31,475 | 168 | 3 | 31,646 | ||||||||||||

Cash | — | 11,104 | — | 11,104 | ||||||||||||

Total | $ | 11,878,058 | $ | 72,158 | $ | 1,456 | $ | 11,951,672 | ||||||||

Assets Pledged from Counterparties

As the estimated fair value of our investment securities pledged as collateral increases due to changes in interest rates or other factors, we may require counterparties to release collateral back to us, which may be in the form of identical securities, similar securities, or cash. As of March 31, 2015 and December 31, 2014, we also had assets pledged to us as collateral under our repurchase and derivative agreements summarized in the tables below (in thousands):

March 31, 2015 | ||||||||||||||||

Assets Pledged to CYS | Repurchase Agreements | Derivative Instruments | Forward Settling Trades (TBAs) | Total | ||||||||||||

Agency RMBS - fair value | $ | 5,154 | $ | 15,787 | $ | 646 | $ | 21,587 | ||||||||

U.S. Treasuries - fair value | 11,122 | 18,805 | — | 29,927 | ||||||||||||

Accrued interest on pledged securities | 82 | 85 | 2 | 169 | ||||||||||||

Cash | — | 47,670 | 559 | 48,229 | ||||||||||||

Total | $ | 16,358 | $ | 82,347 | $ | 1,207 | $ | 99,912 | ||||||||

December 31, 2014 | ||||||||||||||||

Assets Pledged to CYS | Repurchase Agreements | Derivative Instruments | Forward Settling Trades (TBAs) | Total | ||||||||||||

Agency RMBS - fair value | $ | 3,464 | $ | 22,112 | $ | 3,225 | $ | 28,801 | ||||||||

U.S. Treasuries - fair value | 692 | 25,115 | — | 25,807 | ||||||||||||

Accrued interest on pledged securities | 13 | 142 | 9 | 164 | ||||||||||||

Cash | — | 71,980 | 791 | 72,771 | ||||||||||||

Total | $ | 4,169 | $ | 119,349 | $ | 4,025 | $ | 127,543 | ||||||||

Cash collateral received is recognized in "Cash" with a corresponding amount recognized in "Payable for cash received as collateral" on the accompanying interim consolidated balance sheets. Securities collateral received from counterparties is disclosed as a component of our liquidity amount in Note 4, Investment in Interest Rate Swap and Cap Contracts.

Cash and Debt Securities we pledge as collateral under our derivatives agreements are included in "Cash" and "Investment in securities, at fair value" on our consolidated balance sheets.

Offsetting Assets and Liabilities

Certain of our repurchase agreements and derivative transactions are governed by underlying agreements that generally provide for a right of set-off under master netting arrangements (or similar agreements), including in the event of default or in the event of bankruptcy of either party to the transactions. Under U.S. GAAP, if the Company has a valid right of set-off, it may offset the related asset and liability and report the net amount. However, the Company reports amounts subject to its Master Repurchase Agreements (“MRA”s) and International Standard Derivative Association ("ISDA") Agreements in the consolidated balance sheets on a gross basis without regard to such rights of offset.

12

At March 31, 2015 and December 31, 2014, the Company's derivative assets and liabilities (by type) are as follows (in thousands):

March 31, 2015 | Assets | Liabilities | ||||||

Interest rate swap contracts | $ | 11,333 | $ | 38,502 | ||||

Interest rate cap contracts | 80,271 | — | ||||||

Total derivative assets and liabilities in the interim consolidated balance sheet | 91,604 | 38,502 | ||||||

Derivatives not subject to an MNA | 843 | 30,684 | ||||||

Total assets and liabilities subject to an MNA | $ | 90,761 | $ | 7,818 | ||||

December 31, 2014 | Assets | Liabilities | ||||||

Interest rate swap contracts | $ | 40,611 | $ | 16,007 | ||||

Interest rate cap contracts | 107,673 | — | ||||||

Total derivative assets and liabilities in the interim consolidated balance sheet | 148,284 | 16,007 | ||||||

Derivatives not subject to an MNA | 7,008 | 11,579 | ||||||

Total assets and liabilities subject to an MNA | $ | 141,276 | $ | 4,428 | ||||

Below is a summary of the Company's assets subject to offsetting provisions (in thousands):

Gross Amounts Not Offset in the Consolidated Balance Sheet | ||||||||||||||||||

As of | Description | Amounts of Assets Presented in the Consolidated Balance Sheet | Instruments Available for Offset | Collateral Received(1) | Net Amount(2) | |||||||||||||

March 31, 2015 | Derivative assets | $ | 90,761 | $ | 2,546 | $ | 79,995 | $ | 8,220 | |||||||||

December 31, 2014 | Derivative assets | 141,276 | 4,341 | 117,991 | 18,944 | |||||||||||||

_________________

(1) | Collateral consists of Agency RMBS, U.S. Treasuries and cash. Excess collateral received is not shown for financial reporting purposes. |

(2) | Net amount represents the net amount receivable from the counterparty in the event of default. |

Below is a summary of the Company's liabilities subject to offsetting provisions (in thousands):

Gross Amounts Not Offset in the Consolidated Balance Sheet | ||||||||||||||||||

As of | Description | Amounts of Liabilities Presented in the Consolidated Balance Sheet | Instruments Available for Offset | Collateral Pledged(1) | Net Amount(2) | |||||||||||||

March 31, 2015 | Derivative liabilities | $ | 7,818 | $ | 2,546 | $ | 5,272 | $ | — | |||||||||

March 31, 2015 | Repurchase agreements | 10,204,901 | — | 10,204,901 | — | |||||||||||||

December 31, 2014 | Derivative liabilities | $ | 4,428 | $ | 4,341 | $ | 87 | $ | — | |||||||||

December 31, 2014 | Repurchase agreements | 11,289,559 | — | 11,289,559 | — | |||||||||||||

_______________

(1) | Collateral consists of Agency RMBS, U.S. Treasuries and Cash. Excess collateral pledged is not shown for financial reporting purposes. |

(2) | Net amount represents the net amount payable to the counterparty in the event of default. |

13

8. FAIR VALUE MEASUREMENTS

The Company’s valuation techniques are based on observable and unobservable inputs. Observable inputs reflect readily obtainable data from independent sources, while unobservable inputs reflect the Company’s market assumptions. ASC 820—Fair Value Measurements. The following tables provide a summary of the Company’s assets and liabilities that are measured at fair value, and recorded and presented at fair value as of March 31, 2015 and December 31, 2014 (in thousands):

March 31, 2015 | Fair Value Measurements Using | ||||||||||||||

Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Assets | |||||||||||||||

Agency RMBS | $ | — | $ | 14,555,943 | $ | — | $ | 14,555,943 | |||||||

U.S. Treasuries | 501,335 | — | — | 501,335 | |||||||||||

Other Investments | 8,025 | 8,025 | |||||||||||||

Derivative assets | — | 91,604 | — | 91,604 | |||||||||||

Total | $ | 501,335 | $ | 14,647,547 | $ | 8,025 | $ | 15,156,907 | |||||||

Liabilities | |||||||||||||||

Derivative liabilities | $ | — | $ | 38,502 | $ | — | $ | 38,502 | |||||||

December 31, 2014 | Fair Value Measurements Using | ||||||||||||||

Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Assets | |||||||||||||||

Agency RMBS | $ | — | $ | 14,452,456 | $ | — | $ | 14,452,456 | |||||||

U.S. Treasuries | 149,051 | — | — | 149,051 | |||||||||||

Other investments | — | — | 8,025 | 8,025 | |||||||||||

Derivative assets | — | 148,284 | — | 148,284 | |||||||||||

Total | $ | 149,051 | $ | 14,600,740 | $ | 8,025 | $ | 14,757,816 | |||||||

Liabilities | |||||||||||||||

Derivative liabilities | $ | — | $ | 16,007 | $ | — | $ | 16,007 | |||||||

Other Investments is comprised of our investment in a real estate asset, which is a Level 3 asset. The table below presents a reconciliation of changes in other investments classified as Level 3 in the Company’s interim consolidated financial statements for the three months ended March 31, 2015 and 2014.

Fair values of real estate assets are valued based on comparable sales transactions and/or on discounted cash flow models. A discussion of the method of fair valuing these assets is included in Note 2, Significant Accounting Policies—Investments in Securities—Investment Valuation. The significant unobservable input used in the fair value measurement is capitalization rates, which the Company estimated to be between 3% and 6% at March 31, 2015 and December 31, 2014.

We account for our repo borrowings and FHLB advances under ASC ASC 470—Debt; accordingly, these short-term instruments are disclosed at carrying value, or historic cost.

Level 3 Fair Value Reconciliation

(In thousands) | Three Months Ended March 31, | ||||||

Other investments | 2015 | 2014 | |||||

Beginning balance Level 3 assets | $ | 8,025 | $ | 6,945 | |||

Cash payments recorded as a reduction of cost basis | — | — | |||||

Change in net unrealized gain (loss) | — | — | |||||

Gross purchases | — | — | |||||

Gross sales | — | — | |||||

Net gain (loss) on sales | — | — | |||||

Transfers into (out of) Level 3 | — | — | |||||

Ending balance Level 3 assets | $ | 8,025 | $ | 6,945 | |||

14

9. SHARE CAPITAL

The Company has authorized 500,000,000 shares of common stock having par value of $0.01 per share. As of March 31, 2015 and December 31, 2014, the Company had issued and outstanding 158,114,483 and 161,849,878 shares of common stock, respectively.

The Company has authorized 50,000,000 shares of preferred stock having a par value of $0.01 per share. As of March 31, 2015 and December 31, 2014, 3,000,000 shares of 7.75% Series A Preferred Stock ($25.00 liquidation preference) were issued and outstanding. As of March 31, 2015 and December 31, 2014, 8,000,000 shares of 7.50% Series B Preferred Stock ($25.00 liquidation preference) were issued and outstanding. The Series A Preferred Stock and Series B Preferred Stock will not be redeemable before August 3, 2017 and April 30, 2018, respectively, except under circumstances where it is necessary to preserve the Company's qualification as a REIT, for federal income tax purposes, or the occurrence of a change of control. On or after August 3, 2017 and April 30, 2018, the Company may, at its option, redeem any or all of the shares of the Series A Preferred Stock and Series B Preferred Stock, respectively, at $25.00 per share plus any accumulated and unpaid dividends to, but not including, the respective redemption date. The Series A Preferred Stock and Series B Preferred Stock have no stated maturity, and are not subject to any sinking fund requirement or mandatory redemption.

Equity Offerings

On May 23, 2014, the Company filed an automatically effective shelf registration statement on Form S-3 with the SEC. The Company may offer and sell, from time to time, shares of common stock, preferred stock and debt securities in one or more offerings pursuant to the prospectus that is a part of the registration statement. As of March 31, 2015, the Company had not issued any shares of common stock, preferred stock or debt securities under the prospectus.

Equity Placement Program (“EPP”)

Effective May 15, 2014, the Company terminated that certain Equity Distribution Agreement by and between the Company and JMP Securities LLC (“JMP”), dated as of June 7, 2011 (the “JMP Agreement”), in connection with the expiration of the Company’s prior shelf registration statement on Form S-3. Under the JMP Agreement, the Company could offer and sell, from time to time, up to 15.0 million shares of the Company’s common stock through an “at the market” offering program with JMP. For the three months ended March 31, 2015 and 2014, the Company did not sell any shares of common stock under the JMP Agreement.

Dividend Reinvestment and Direct Stock Purchase Plan (“DSPP”)

The Company sponsors a dividend reinvestment and direct stock purchase plan through which stockholders may purchase additional shares of common stock by reinvesting some or all cash dividends received on shares of common stock. Stockholders may also make optional cash purchases of shares of common stock subject to certain limitations detailed in the plan prospectus. For the three months ended March 31, 2015 and 2014 the Company did not issue any shares under the plan. As of March 31, 2015 and December 31, 2014, there were approximately 4.1 million shares available for issuance under the plan.

Share Repurchase Program

On November 15, 2012, the Company announced that its Board of Directors authorized the repurchase of shares of the Company’s common stock having an aggregate value of up to $250 million. Pursuant to this program, through July 20, 2014, the Company repurchased approximately $115.7 million in aggregate value of its shares of common stock on the open market. On July 21, 2014, the Company announced that its Board of Directors authorized the repurchase of shares of the Company's common stock having an aggregate value of up to $250 million, which included the approximately $134.3 million available for repurchase under the November 2012 authorization. Subsequently in 2014, we repurchased 172,549 shares for an aggregate of approximately $1.5 million. In the first quarter of 2015, we repurchased 4,149,571 shares at a weighted-average purchase price of $8.95, for an aggregate of approximately $37.2 million. Accordingly, the Company still had approximately $211.2 million authorized to repurchase shares of its common stock as of March 31, 2015.

Restricted Stock Awards

For the three months ended March 31, 2015 and 2014, the Company granted 438,617 and 389,880 shares of restricted stock, respectively, to certain of its directors, officers and employees.

15

10. EARNINGS PER SHARE

Components of the computation of basic and diluted earnings per share ("EPS") were as follows (in thousands except per share amounts):

Three Months Ended March 31, | |||||||

2015 | 2014 | ||||||

Net income (loss) | $ | 54,597 | $ | 130,687 | |||

Less preferred stock dividends | (5,203 | ) | (5,203 | ) | |||

Net income (loss) available to common stockholders | 49,394 | 125,484 | |||||

Less dividends paid: | |||||||

Common shares | (47,110 | ) | (51,515 | ) | |||

Unvested shares | (324 | ) | (334 | ) | |||

Undistributed earnings (loss) | 1,960 | 73,635 | |||||

Basic weighted-average shares outstanding: | |||||||

Common shares | 159,573 | 160,936 | |||||

Basic earnings (loss) per common share: | |||||||

Distributed earnings | $ | 0.30 | $ | 0.32 | |||

Undistributed earnings (loss) | 0.01 | 0.46 | |||||

Basic earnings (loss) per common share | $ | 0.31 | $ | 0.78 | |||

Diluted weighted-average shares outstanding: | |||||||

Common shares | 159,573 | 160,936 | |||||

Net effect of dilutive stock options (1) | — | — | |||||

159,573 | 160,936 | ||||||

Diluted earnings (loss) per common share: | |||||||

Distributed earnings | $ | 0.30 | $ | 0.32 | |||

Undistributed earnings (loss) | 0.01 | 0.46 | |||||

Diluted earnings (loss) per common share | $ | 0.31 | $ | 0.78 | |||

__________________

(1) | For the three months ended March 31, 2015 and 2014, the Company had an aggregate of 131,088 stock options outstanding with a weighted-average exercise price of $30.00 that were not included in the calculation of EPS, as their inclusion would have been anti-dilutive. These instruments may have a dilutive impact on future EPS. |

11. SUBSEQUENT EVENTS

On April 1, 2015, an aggregate of 21,303 shares of restricted common stock were granted to certain directors as a portion of their compensation for serving on the Company’s Board of Directors.

16

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

CYS Investments, Inc. (the "Company", "we", "us", and "our") is a specialty finance company created with the objective of achieving consistent risk-adjusted investment income. Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is intended to provide the reader of the Company’s unaudited interim consolidated financial statements and accompanying notes with a narrative of management's perspective on the business underlying those financial statements and its financial condition and results of operations during the periods presented. The Company’s MD&A is comprised of five sections:

• | Forward-Looking Statements, |

• | Executive Overview, |

• | Financial Condition, |

• | Results of Operations, and |

• | Liquidity and Capital Resources. |

The following discussion should be read in conjunction with our unaudited interim consolidated financial statements and accompanying notes included in Item 1 of this Quarterly Report on SEC Form 10-Q ("Quarterly Report"), as well as our Annual Report on Form 10-K for the fiscal year ended December 31, 2014, filed on February 17, 2015 (the "2014 Annual Report").

Forward Looking Statements

When used in this Quarterly Report, in future filings with the SEC or in press releases or other written or oral communications, statements which are not historical in nature, including those containing words such as "believe," "expect," "may," "will,” "anticipate," "estimate," "plan," "continue," "intend," "should,” or the negative of these words and similar expressions, are intended to identify “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and, as such, may involve known and unknown risks, uncertainties and assumptions. The forward-looking statements we make in this Quarterly Report include, but are not limited to, statements about the following:

• the effect of movements in interest rates on our assets and liabilities (including our hedging instruments) and

our net income;

• our investment, financing and hedging strategies;

• the effect of U.S. government actions on interest rates and the housing and credit markets;

• the effect of actual or proposed actions of the U.S. Federal Reserve Bank (the "Fed"), the Fed Open Market Committee ("FOMC"), the Federal Home Finance Agency ("FHFA"), and the Federal Home Loan Bank ("FHLB") of Cincinnati;

• the supply of Agency residential mortgage backed securities ("RMBS") and U.S. Treasuries (collectively, "Debt Securities");

• the effect of increased prepayment rates on the value of our assets;

• our ability to convert our assets into cash or extend the financing terms related to our assets;

• the effect of widening credit spreads or shifts in the yield curve on the value of our assets and investment

strategy;

• the types of indebtedness we may incur;

• our ability to quantify risks based on historical experience;

• our ability to be taxed as a real estate investment trust (“REIT”) and to maintain an exemption from

registration under the Investment Company Act of 1940, as amended (the “Investment Company Act”);

• our assessment of counterparty risk and/or the rise of counterparty defaults;

• our ability to meet short-term liquidity requirements with our cash flow from operations and borrowings;

• the effect of rising interest rates on unemployment, inflation and mortgage supply and demand;

• our liquidity;

• our asset valuation policies, and

• our dividend distribution policy.

Forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking

into account all information currently available to us. These beliefs, assumptions and expectations are subject to risks and

uncertainties and can change as a result of many possible events or factors, not all of which are known to us. If a change

occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our

17

forward-looking statements. The following factors could cause actual results to vary from our forward-looking statements:

• the factors referenced in this Quarterly Report, including those set forth under the section

captioned “Risk Factors”;

• changes in our investment, financing and hedging strategies;

• the adequacy of our cash flow from operations and borrowings to meet our short-term liquidity requirements;

• the liquidity of our portfolio;

• unanticipated changes in our industry, interest rates, the credit markets, the general economy or the real estate

market;

• changes in interest rates and the market value of our Agency RMBS;

• changes in the prepayment rates on the mortgage loans underlying our Agency RMBS;

• our ability to borrow to finance our assets;

• actions by the U.S. government, the Fed, the FOMC, the FHFA or the FHLB of Cincinnati that impact the value of our Agency RMBS or interest rates, or our access to borrowings at cost-effective rates;

• changes in government regulations affecting our business;

• changes in the U.S. government's credit rating or ability to pay its debts;

• our ability to maintain our qualification as a REIT for federal income tax purposes;

• our ability to maintain our exemption from registration under the Investment Company Act and the

availability of such exemption in the future; and

• risks associated with investing in real estate assets, including changes in business conditions and the general

economy.

These and other risks, uncertainties and factors, including those described elsewhere in this Quarterly Report, could cause our actual results to differ materially from those projected in any forward-looking statements we make. All forward-looking statements speak only as of the date on which they are made. New risks and uncertainties arise over time and it is not possible to predict those events or how they may affect us. Except as required by law, we are not obligated to, and do not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Executive Overview

We seek to achieve our objective of earning consistent risk-adjusted investment income by investing on a leveraged basis primarily in Agency RMBS. These investments consist of residential mortgage pass-through securities for which the principal and interest payments are guaranteed by a government-sponsored enterprise, such as the Federal National Mortgage Association ("Fannie Mae") and the Federal Home Loan Mortgage Corporation ("Freddie Mac"), or by a U.S. government agency, such as the Government National Mortgage Association ("Ginnie Mae") (collectively referred to as "GSE"s). We also may invest in debt securities issued by the United States Department of Treasury ("U.S. Treasuries") and, in addition, our investment guidelines permit investments in collateralized mortgage obligations issued by a government agency or GSE that are collateralized by Agency RMBS ("CMO"s), or securities issued by a GSE that are not backed by collateral but, in the case of government agencies, are backed by the full faith and credit of the U.S. government, and, in the case of GSEs, are backed by the integrity and creditworthiness of the issuer ("U.S. Agency Debentures").

We commenced operations in February 2006, and completed our initial public offering in June 2009. Our common stock, our 7.75% Series A Cumulative Redeemable Preferred Stock, $25.00 liquidation preference (the "Series A Preferred Stock"), and our 7.50% Series B Cumulative Redeemable Preferred Stock, $25.00 liquidation preference (the "Series B Preferred Stock"), trade on the New York Stock Exchange under the symbols "CYS," "CYS PrA" and "CYS PrB," respectively.

We earn income from our investment portfolio, which as of March 31, 2015, was comprised principally of Debt Securities. We fund our investments primarily through borrowings under repurchase agreements ("repo borrowings"), and advances from the FHLB of Cincinnati ("FHLB advances"). The 12 regional FHLBs provide long-term and short-term secured loans, called “advances,” to their members. FHLB members may use a variety of real estate related assets, including residential mortgage loans and Agency RMBS, as collateral for advances. We use leverage to seek to enhance our returns. Our net interest income is generated primarily from the net spread, or difference, between the interest income we earn on our investment portfolio and the cost of our borrowings and hedging activities. The amount of net interest income we earn on our investments depends in part on our ability to control our financing costs, which comprise a significant portion of our operating expenses. Although we leverage our portfolio investments in Debt Securities to seek to enhance our potential returns, leverage also may exacerbate losses.

While we use hedging to attempt to manage some of our interest rate risk, we do not hedge all of our exposure to changes in interest rates. Our investments vary in interest rate and maturity compared with the rates and duration of the hedges

18

we employ. As a result, it is not possible to insulate our portfolio from all potential negative consequences associated with changes in interest rates in a manner that will allow us to achieve attractive spreads on our portfolio. Consequently, changes in interest rates, particularly short-term interest rates, may significantly influence our net income.

In addition to investing in issued pools of Agency RMBS, we regularly utilize forward settling transactions, including forward settling purchases of Agency RMBS where the pool is "to-be-announced" ("TBA"). Pursuant to a TBA, we agree to purchase, for future delivery, Agency RMBS with certain principal and interest terms and certain types of underlying collateral, but the particular Agency RMBS to be delivered is not identified until shortly before the TBA settlement date. For our other forward settling transactions, we agree to purchase, for future delivery, Agency RMBS. However, unlike our TBAs, these forward settling transactions reference an identified Agency RMBS. Given the favorable terms available thus far in 2015 in the TBA dollar roll market and relative lower benefit of holding specific mortgage pools, we generally have continued to roll the purchases forward to a later settlement date.

In March 2015, our captive insurance subsidiary, CYS Insurance Services, LLC ("CYS Insurance"), was granted membership in the FHLB of Cincinnati, and commenced obtaining advances from the FHLB of Cincinnati in the form of secured borrowings. Membership in the FHLB permits CYS Insurance to access a variety of products and services offered by the FHLB, and obligates CYS Insurance to purchase membership stock and activity stock, the latter being a percentage of the advances it obtains from the FHLB. We intend for CYS Insurance to seek advances of both short- and long-term indebtedness from the FHLB of Cincinnati. As with our repo borrowings, if the value of assets pledged to FHLB as collateral for advances decreases, the FHLB could require posting of additional collateral to the amount of advances outstanding.

We have elected to be treated as a REIT for U.S. federal income tax purposes, and have complied with, and intend to continue to comply with, the provisions of the Internal Revenue Code of 1986, as amended (the "Internal Revenue Code"), with respect thereto. Accordingly, we generally do not expect to be subject to federal income tax on our REIT taxable income that we currently distribute to our stockholders if certain asset, income and ownership tests and recordkeeping requirements are fulfilled. Even if we maintain our qualification as a REIT, we may be subject to some federal, state and local taxes on our income.

Trends and Recent Market Activity

Overview

Agency RMBS prices ended the first quarter of 2015 (the "First Quarter") slightly higher than where they began. Interest rates generally ended the First Quarter slightly below where they began. This apparent stability masks the volatility these markets experienced during the quarter. For example, the yield on 10-year U.S. Treasuries began the year at 2.17%, but rallied briefly to 1.65% in the first few weeks of 2015. The rally was driven by growing sentiment that the U.S. economy was decelerating, being hampered by weakness in Europe and Asia and a developing harsh winter in North America. Indeed, back in December 2014, many prominent economists predicted U.S. Gross Domestic Product ("GDP") growth in the first quarter of 2015 above 3.5% and firming inflation. In actuality, GDP growth in the First Quarter will likely be around 1.5%, and inflation around 1.0%. While growth in payrolls appears to be relatively steady, there is scant wage growth, and commodity prices, notably oil, copper and lumber, have been quite soft. These indicators suggest continued sluggish economic growth globally, and that the U.S. cannot detach from the rest of the world’s economic deceleration.

The Fed continues to guide the capital markets to anticipate an interest rate hike in 2015. In the First Quarter, the yield on 10-year U.S. Treasuries fell 25 basis points ("bps"), continuing the trend of last year. The yield on 10-year U.S. Treasuries ended the First Quarter at 1.92%, suggesting that the bond market does not see accelerating growth or inflation in the U.S. Much of the volatility in rates during the First Quarter occurred in the longer portion of the U.S. yield curve, notably the 5-30 year portion. With continued signs of a sluggish global economy, strength in U.S. employment continues to be cited as support that the FOMC may begin to raise the Fed Funds Rate sometime in 2015. Market participants generally understand that the Fed would like to end the zero interest rate policy. However, with inflation risks low, and mixed signals in employment, the bond market anticipates that such a tightening will likely be at a very slow pace, with an end point much lower than a level economists would forecast in a "normalized" interest rate environment. Cautionary signals from inflation and employment data explain why the shorter portion of the yield curve has not experienced the volatility on the longer portion. The short end of the yield curve reflects expectations for a slow Fed tightening, while the long end of the yield curve reflects low long-term growth and inflation risks.

Foreign bond markets continue to reflect a different set of circumstances: given the economic deceleration in Europe, Asia, and emerging markets, government bond yields in developed markets such as Germany and Japan remain near zero. The European Central Bank announced in January 2015 an aggressive bond buying program to stimulate the European Zone economy. This program is expected to continue through September 2016, which is expected to keep European rates low for several quarters. If the Fed raises the Fed Funds Rate in 2015, we would expect our borrowing costs to rise, and therefore push down our net interest spread. While higher Fed Funds Rates could reduce the Company's earnings power, global economic conditions make it difficult to predict when and by how much the Fed will raise rates.

19

Macroeconomic Factors Driving Fed Policy

Inflation, employment and gross domestic product are the three factors that the Fed has cited most often as providing the data points that will drive its interest rate policy and directives. Set forth below is a chart containing inflation, unemployment and gross domestic product data points that are indicative as to why the Fed may be reluctant to raise interest rates:

--Inflation

While inflation, the first of the Fed's two mandates, has seen the core Personal Consumption Expenditures ("PCE") inflation index well below the Fed’s target rate of 2%, the PCE index rose in February 2015 by 0.2% for the first time since October 2014, which is the biggest increase since June 2014. Notwithstanding the February 2015 PCE index rise, the recent figures indicate that inflation is still subdued, reflecting sluggish demand for goods, services and housing, and flagging growth abroad. Many economists expect prices to remain weak in the coming months due to the strong U.S. dollar, which generally lowers the prices of imports, and low energy prices.

--Employment

Employment, the second of the Fed's two mandates, has been a problematic source of both good data and bad data for the Fed. Though the unemployment rate has fallen in the First Quarter through a combination of new jobs and falling participation, wage increases have lagged. While employers added an adjusted 264,000 jobs in February, only 126,000 jobs were added in March, and both January and February jobs numbers were revised down from what was previously reported, suggesting at least a pause in the strength in the U.S. labor market. During the First Quarter, adjusted job growth averaged 197,000 a month, down from an average of 324,000 in the fourth quarter of 2014. Through February 2015 the economy added at least 200,000 jobs for 12 straight months, the longest streak since 1995, but the March 2015 figure suggests that there is still a lot of slack in the labor market, much of which may not be fully reflected in the unemployment rate. Also, inflation-adjusted wages declined in February 2015: average hourly earnings adjusted for inflation fell 0.1% from January 2015, as the rise in consumer prices offset a 0.1% increase in average hourly pay.

--Gross Domestic Product

As in 2014, the U.S. economy's performance in 2015 to-date has been mixed. While the Fed has pointed to an improving labor market and resurgent consumers as data that might lead to an increase in interest rates, a number of signals in the First Quarter, including industrial production, retail sales and housing starts, point to sluggishness in the U.S. economy. These signals have led economists to downgrade forecasts for First Quarter growth. In early 2015, a Wall Street Journal survey of economists forecast inflation-adjusted GDP to grow 3% in 2015, better than the 2.6% rate estimated for 2014; as U.S. economic performance in the First Quarter has fallen short of expectations, more recent U.S. GDP projections are 1.5% for the First Quarter and 2.4% for the second quarter of 2015. The downbeat shift in economic data complicates matters for Fed policy makers, who have been surprised by faltering growth several times during the recovery and appear to want to be certain the economy is growing sustainably before raising interest rates. Additionally, the U.S. economy has faced challenges due to other factors, including the strengthening U.S. dollar, that could crimp U.S. exporters by making their goods more expensive, and the fall in oil prices that may be hurting U.S. energy producers and related industries.

20

Interest Rates and the Fed

--Interest Rates

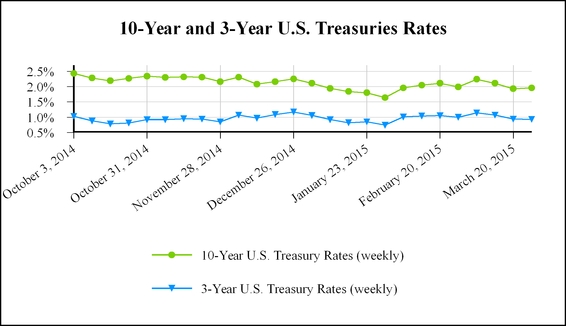

Following a relatively steady interest rate environment in 2014, when the yield curve steadily flattened over the year, interest rate markets were volatile in the First Quarter. While 10-year U.S. Treasuries began 2015 at 2.17%, they fell to 1.65% by the end of January, then rose to 2.24% in early March, only to fall again to 1.87% by mid-April, a decrease of 30 bps since the beginning of 2015. The shorter end of the yield curve, the 3-year U.S. Treasuries, has seen similar volatility at the same intervals, which we believe reflects uncertainty about the direction of the economy and the Fed’s projected actions in reaction to the economy.

Set forth below is the yield curve at March 31, June 30, September 30, and December 31, 2014 and March 31, 2015:

Set forth below is a chart of the 10-year U.S. Treasuries from the third quarter of 2014 to the end of the First Quarter:

Short-term interest rates generally remain low. The table below presents 30-Day London Interbank Offered Rate ("LIBOR"), 3-Month LIBOR and the Fed Funds Rate at the end of the respective quarter through the First Quarter. As the table illustrates, we have been able to benefit from a favorable financing environment.

21

Date | 30-Day LIBOR | 3-Month LIBOR | Fed Funds Rate | |||

March 31, 2015 | 0.176% | 0.271% | 0.25% | |||

December 31, 2014 | 0.171% | 0.256% | 0.25% | |||

September 30, 2014 | 0.157% | 0.235% | 0.25% | |||

June 30, 2014 | 0.155% | 0.231% | 0.25% | |||

March 31, 2014 | 0.152% | 0.231% | 0.25% | |||

December 31, 2013 | 0.168% | 0.246% | 0.25% | |||

September 30, 2013 | 0.179% | 0.249% | 0.25% | |||