Form S-1 Inpellis, Inc.

Table of Contents

As filed with the Securities and Exchange Commission on November 10, 2015

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

INPELLIS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 2834 | 45-4772185 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

30 Washington Avenue, Suite F

Haddonfield, NJ 08033

(978) 750-0900

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Patrick T. Mooney, M.D.

President and Chief Executive Officer

30 Washington Avenue, Suite F

Haddonfield, NJ 08033

(978) 750-0900

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Thomas L. Barrette, Esq. Rodney H. Bell, Esq. Holland & Knight LLP 10 St. James Avenue Boston, MA 02116 (617) 523-2700 |

Juan M. Marcelino, Esq. Nelson Mullins Riley & Scarborough LLP One Post Office Square Boston, MA 02109 (617) 573-4700 |

Anthony J. Marsico, Esq. Greenberg Traurig, LLP 200 Park Avenue New York, NY 10166 (212) 801-9200 |

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

The Registrant is an “emerging growth company,” as defines in Section 2(a) of the Securities Act. This registration statement complies with the requirement that apply to an issuer that is an emerging growth company.

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of each class of securities to be registered |

Proposed Maximum Offering Price(1) |

Amount of Registration Fee(2) | ||

| Common stock, par value $0.001 per share(3) |

$20,000,000 | $2,014 | ||

| Representative’s Warrants to Purchase Common Stock(3)(4) |

— | — | ||

| Common Stock Underlying Representative’s Warrants(3)(5) |

$1,680,000 | $169.18 | ||

| Total Registration Fee |

$21,680,000 | $2,183.18 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price of the securities registered hereunder to be sold by the Registrant. |

| (3) | Pursuant to Rule 416 under the Securities Act, the shares of common stock registered hereby also include an indeterminate number of additional shares of common stock as may from time to time become issuable by reason of stock splits, stock dividends, recapitalizations or other similar transactions. |

| (4) | No registration fee pursuant to Rule 457(g) under the Securities Act. |

| (5) | Estimated solely for the purposes of calculating the registration fee pursuant to Rule 457(g) under the Securities Act of 1933, as amended. The proposed maximum aggregate offering price of the Representative’s warrants is $1,680,000, which is equal to 120% of $1,400,000 (7% of $20,000,000). |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS |

SUBJECT TO COMPLETION | DATED NOVEMBER 10, 2015 |

[ ] Shares

Common Stock

This is an initial public offering of [ ] shares of common stock of Inpellis, Inc. No public market currently exists for our shares. We anticipate that the initial public offering price of our shares of common stock will be between $[ ] and $[ ] per share.

We intend to apply to list our common stock on the NASDAQ Global Market under the symbol “INPL.” No assurances can be given that our application will be approved.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with certain reduced public company disclosure standards.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 8 of this prospectus for a discussion of information that should be considered in connection with an investment in our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting commissions(1) |

$ | $ | ||||||

| Proceeds to Inpellis, before expenses |

$ | $ | ||||||

| (1) | The underwriters will receive compensation in addition to the commissions. See “Underwriting” for a full description of compensation payable to the underwriters. |

The underwriters are selling the shares of common stock in this offering on a “best efforts” basis. The underwriters are not required to sell any specific number or dollar amount of common stock, but will use their best efforts to sell the securities offered. Because this is a best efforts offering, the underwriters do not have an obligation to purchase any shares of common stock, and, as a result, there is a possibility that we may not receive any proceeds from the offering.

The underwriters expect to deliver the securities to investors upon payment approximately three business days following acceptance of an order.

This offering shall terminate upon the earlier of [ ], 2015 or the receipt of a notice of termination from the underwriters.

Alexander Capital, L.P.

Prospectus dated , 2015

Table of Contents

| Page | ||||

| 1 | ||||

| 8 | ||||

| 40 | ||||

| 41 | ||||

| 42 | ||||

| 43 | ||||

| 45 | ||||

| 47 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results Of Operations |

48 | |||

| 57 | ||||

| 81 | ||||

| 86 | ||||

| 93 | ||||

| 95 | ||||

| 97 | ||||

| 102 | ||||

| Material U.S. Federal Income Tax Considerations For Non-U.S. Holders |

104 | |||

| 108 | ||||

| 117 | ||||

| 117 | ||||

| 117 | ||||

| F-1 | ||||

We are responsible for the information contained in this prospectus and in any free writing prospectus we prepare or authorize. We and the underwriters have not authorized anyone to provide you with different information, and we and the underwriters take no responsibility for any other information others may give you. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the cover of this prospectus.

We own or have rights to trademarks, service marks and trade names that we use in connection with the operation of our business, including our corporate name, logos and website names. Other trademarks, service marks and trade names appearing in this prospectus are the property of their respective owners. The trademarks that we own include Inpellis™. Solely for convenience some of the trademarks, service marks and trade names referred to in this prospectus are listed without the ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our trademarks, service marks and trade names.

i

Table of Contents

This summary highlights information contained in other parts of this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in shares of our common stock and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. You should read the entire prospectus carefully, especially “Risk factors” and “Management’s discussion and analysis of financial condition and results of operations,” before deciding to buy shares of our common stock. Unless the context requires otherwise, references in this prospectus to “Inpellis,” “the Company,” “we,” “us” and “our” refer to Inpellis, Inc.

Overview

Inpellis is a specialty pharmaceutical company developing transdermal product candidates for treating pain resulting from musculoskeletal disorders and peripheral neuropathy. Inpellis has acquired from BioChemics, Inc. (“BioChemics”) full or joint ownership of transdermal formulations which utilize the endel™ (vasoactive lipid encapsulated) transdermal drug delivery system for non-dermal pain, and to patents, patent applications, and know how related to the transdermal delivery system. Our goal is to apply this transdermal technology to provide rapid, safe and effective absorption of drugs for pain relief—through the skin—to the target tissues.

endel transdermal technology employs a transdermal delivery system that combines vasodilators, permeation enhancers, and active ingredients. Transdermal delivery has the potential to provide increased concentrations of the specified drug to target tissues, and avoid some of the acknowledged limitations of oral formulations including absorption, gastric issues, drug distribution, high serum concentrations and/or first-pass hepatic metabolism. endel technology also provides the potential to effectively transport molecules that were previously difficult to deliver transdermally. In addition, transdermal delivery, depending on the specific molecule, may result in increased safety, efficacy and/or convenience. The potential for mitigated development risk exists if the drugs that are selected for development are eligible for the streamlined 505(b)(2) regulatory-development pathway. 505(b)(2) provides an abbreviated regulatory path to US Food and Drug Administration or FDA approval for new or improved formulations, or new uses of previously approved products, by enabling an applicant to rely, in part, on the FDA’s findings of safety and efficacy for an existing product, or published literature, in support of the New Drug Application or NDA, translating into decreased regulatory costs and time to market. We believe the transdermal ibuprofen product we have in development, as described further below, may be eligible for the 505(b)(2) pathway, but until we formally seek to use 505(b)(2) we cannot be certain that it will be available to us.

We are dedicated to completing the development of two products in particular, as well as continuing work on a number of additional products in the pipeline. The two products are AX-IBU-01, a transdermal ibuprofen for moderate to severe osteoarthritis, and AX-DN-01, a transdermal benfotiamine for painful diabetic neuropathy. We are also conducting carefully focused continued research and development of other transdermal products for pain. We may develop products internally or may enter into co-development and co-commercialization of branded products, generic products, or new molecules in the therapeutic area of pain.

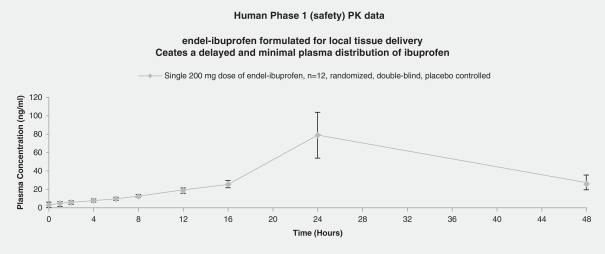

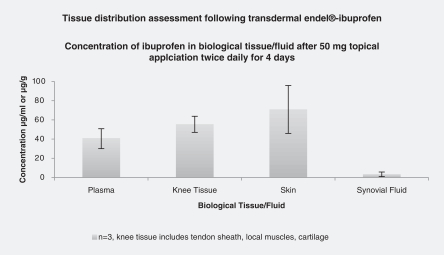

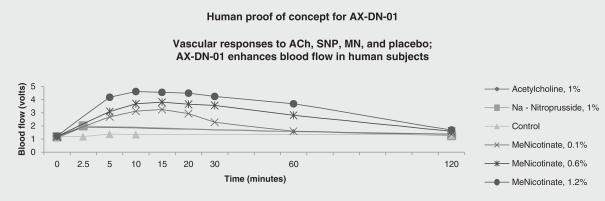

A Phase 2 study utilizing transdermal ibuprofen for the treatment of pain associated with moderate to severe osteoarthritis was conducted in Switzerland in 2011. A human proof of concept study with respect to vasodilation for diabetic neuropathy was conducted in the United States in 2002 and an animal proof of delivery study for transdermal benfotiamine was conducted in the United States in 2008. We have not yet filed an investigational new drug, or IND, application for either product in the United States or elsewhere. Based on the work that we have done with respect to our ibuprofen product candidate, we intend to perform additional studies regarding the formulation of that product in support of an IND application. Once we have done that work, we intend to submit an IND application for approval of a Phase 2B/3 study.

1

Table of Contents

The transdermal delivery system utilized for delivering transdermal ibuprofen for osteoarthritis pain and transdermal benfotiamine for painful diabetic neuropathy, as well as related formulations and methods, are covered by an International patent application. The application covers the system of transdermal drug delivery that combines vasodilators, chelators, penetration enhancers, and active ingredients.

We are open to forming strategic alliances for co-development and co-commercialization of drugs delivered transdermally for the treatment of pain. Inpellis will use third parties for manufacturing and marketing. Accordingly, the Inpellis strategy for the research, development, marketing and commercialization of its products entails entering into various arrangements with corporate partners, licensors, licensees and others; Inpellis will be dependent upon the subsequent success of these outside parties in performing their responsibilities. Inpellis may also rely on collaborative partners to conduct research efforts and clinical trials, to obtain regulatory approvals and to manufacture and market certain Inpellis products. In previous arrangements with manufacturing contractors, good manufacturing practices or GMP-quality human doses of AX-IBU-01 for Phase 1 and Phase 2 clinical trials have been produced, and we believe that this experience will allow us, through new arrangements with those, or similar, contractors, to produce GMP-quality AX-IBU-01 for our contemplated pivotal Phase 2B/3 clinical trial.

The Pain Market

The markets for pain medications are growing. By 2017, according to Nature Reviews Drug Discovery, the global pain management therapeutics market is forecast to generate sales of $35.1 billion, and is expected to grow substantially over the next decade due to population dynamics, an increase in the elderly, and co-morbidities associated with obesity and diabetes. The current market for prescription products for osteoarthritis is estimated by drugs.com at $8 billion, for oral non-steroidal anti-inflammatory drugs, or NSAIDs, $4 billion, and for transdermal NSAIDs $500 million. Neuropathic pain is estimated to be 16% of the pain market with sales of $3 billion, also according to Nature Reviews Drug Discovery.

Our Strategy

Our strategy is to build a specialty pharmaceutical company focused on developing and commercializing prescription therapeutics for pain using our proprietary transdermal technology. Our strategy includes:

| • | Rapidly advancing development of and seeking regulatory approval for endel based transdermal ibuprofen (AX-IBU-01) for the treatment of pain due to osteoarthritis. |

| • | Entering into agreements to commercialize AX-IBU-01 in the United States and build our organizational infrastructure to manage those agreements and advance the development and commercialization of AX-IBU-01 outside the United States. |

| • | Partnering with industry-leading contract manufacturing companies to ensure reliable product supply. |

| • | Collaborating with other key companies when desirable to build co-development and co-marketing relationships. |

| • | Leveraging our technology and approach to advance the additional products in our pipeline into clinical development—specifically endel based transdermal benfotiamine (AX-DN-01) for the treatment of painful diabetic neuropathy. |

| • | Develop a strategic pipeline of transdermally delivered drugs for pain utilizing existing branded and generic agents and drugs in-development. |

2

Table of Contents

Risk Factors

An investment in our common stock involves numerous risks. Any of the factors set forth under “Risk Factors” may limit our ability to successfully execute our business strategy. You should carefully consider all of the information set forth in this prospectus and, in particular, should evaluate the specific factors set forth under “Risk Factors” in deciding whether to invest in our common stock. Among these important risks are the following:

| • | We have incurred net losses of approximately $2,001,000 and $1,866,000 for the years ended December 31, 2014 and December 31, 2013, respectively, and a net loss of approximately $5,579,000 for the six months ended June 30, 2015. We anticipate that we will continue to incur substantial operating losses for the foreseeable future. We may never achieve or sustain profitability. As of June 30, 2015 and December 31, 2014 we had an accumulated deficit of approximately $10,982,000 and $5,403,000, respectively. |

| • | We have not submitted an application for, or obtained any FDA approval for, any product through the NDA process, which may impede our ability to obtain FDA approval in a timeframe that is consistent with our expectations and plans, or at all. |

| • | We will require substantial additional financing to achieve our goals, and a failure to obtain this necessary capital when needed could force us to delay, limit, reduce or terminate our development or commercialization efforts of our product candidates. |

| • | If our drug candidates fail to demonstrate safety and efficacy to the satisfaction of regulatory authorities, we may incur additional costs or experience delays in completing, or we may ultimately be unable to obtain regulatory approval for our product candidates. |

| • | If our drug candidates are approved, our future commercial success will depend upon attaining significant market acceptance among physicians, patients and health care payors and, if we fail to do so, our business will be materially harmed. |

| • | We may not be able to manufacture our drug candidates in quantities sufficient for our clinical trials and/or any commercial launch of our product candidates. If we fail to meet deadlines or perform in an unsatisfactory manner our business could be harmed. |

| • | If we are unable to obtain or protect our intellectual property rights, including proprietary information and trade secrets, related to our drug candidates, we may not be able to prevent competitors with the same or similar drugs from entering our markets. |

| • | If we fail to attract and keep senior management and key scientific personnel, we may be unable to develop our drugs successfully, conduct our clinical trials and commercialize our drug candidates. |

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to public companies. These provisions include:

| • | being permitted to provide only two years of audited financial statements in addition to any required unaudited interim financial statements with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure; |

| • | reduced disclosure obligations regarding our executive compensation arrangements; |

| • | not being required to hold a non-binding advisory vote on executive compensation or golden parachute arrangements; and |

3

Table of Contents

| • | exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting. |

We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the JOBS Act. This election allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates.

We may take advantage of these provisions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company on the date that is the earliest of (i) the last day of the fiscal year in which we have total annual gross revenues of $1 billion or more; (ii) the last day of our fiscal year following the fifth anniversary of the date of the completion of this offering; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer under the rules of the SEC.

Notwithstanding the above, we are also currently a “smaller reporting company” meaning that we are not an investment company, an asset-backed issuer, or a majority-owned subsidiary of a parent company that is not a smaller reporting company and have a public float of less than $75 million and annual revenues of less than $50 million during the most recently completed fiscal year. In the event that we are still considered a smaller reporting company at such time as we cease to be an emerging growth company, the disclosure we will be required to provide in our filings with the SEC will increase, but will still be less than it would be if we were not considered either an emerging growth company or a smaller reporting company. Specifically, similar to emerging growth companies, smaller reporting companies are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act of 2002, or the “Sarbanes-Oxley Act” requiring that independent registered public accounting firms provide an attestation report on the effectiveness of their internal control over financial reporting; and have certain other decreased disclosure obligations in their SEC filings, including, among other things, only being required to provide two years of audited financial statements in their annual reports.

Corporate Information

We were incorporated in the state of Delaware on March 13, 2012 as a wholly owned subsidiary of BioChemics. In recognition of the disgorgement and penalty obligations of BioChemics under the settlement terms of an enforcement action brought against BioChemics by the SEC, in January 2015, BioChemics transferred all of its shares in Inpellis to the Shareholder Resolution Trust, a Massachusetts trust (the “Trust”), which is currently the majority stockholder of Inpellis. The Trust is managed by three Trustees, all of whom must approve any decision. The three Trustees are Jack L. Altshuler, Esq., a Massachusetts attorney, Jan R. Schlichtmann, Esq., also a Massachusetts attorney, a director of BioChemics and the Managing Member of Sea Change Pharma LLC, which is the largest stockholder of BioChemics, and Daniel M. Glosband, a Massachusetts attorney. See “Risk Factors—Risks related to our former parent corporation,” “Business—Corporate History” and “Certain relationships and related party transactions” for additional information regarding our structure.

4

Table of Contents

THE OFFERING

| Common stock offered by us |

shares |

| Option to purchase additional shares |

The underwriter has an option for a period of 45 days to purchase up to additional shares of our common stock. |

| Common stock outstanding prior to this offering |

shares |

| Common stock to be outstanding immediately after this offering |

shares |

| Best efforts |

The underwriters are selling the shares of common stock offered in this prospectus on a “best efforts” basis and are not required to sell any specific number or dollar amount of the common stock offered by this prospectus, but will use their best efforts to sell the securities. |

| Use of proceeds |

Assuming we complete the maximum offering, we estimate that the net proceeds from this offering will be approximately $ million, or approximately $ million if the underwriters exercise their option to purchase additional shares in full, after deducting the underwriting commissions and estimated offering expenses payable by us. Since this is a “best efforts” offering, there is no assurance that any shares of common stock will be sold, and therefore no assurance that there will be any proceeds. We intend to use the net proceeds of this offering as follows: (1) approximately $ million to fund the continued development of AX-IBU-01, including our contemplated pivotal Phase 2B/3 clinical trial, approximately $ million to manufacture clinical supplies of AX-IBU-01, approximately $ million to fund other early stage pipeline development programs, and (4) the remainder for working capital and other general corporate purposes, including funding the costs of operating as a public company. See “Use of proceeds.” |

| Proposed NASDAQ Global Market Symbol |

We intend to apply to list our common stock on The NASDAQ Global Market under the symbol “INPL.” |

| Risk factors |

You should read the “Risk factors” section of this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. |

The number of shares of common stock to be outstanding after this offering is based on shares of common stock outstanding as of November , 2015 and excludes the following:

| • | shares of common stock issuable upon exercise of outstanding warrants as of November , 2015 at a weighted average exercise price of $ per share; and |

| • | shares of common stock reserved for future issuance under the Inpellis, Inc. 2015 Equity Incentive Plan, or the 2015 Equity Plan. |

Unless otherwise indicated, all information in this prospectus reflects or assumes the following:

| • | the filing and effectiveness of our amended and restated certificate of incorporation and the adoption of our amended and restated by-laws, which will occur upon the closing of this offering; |

| • | the automatic conversion of all outstanding convertible notes into shares of our common stock upon the closing of this offering; |

| • | no issuance or exercise of stock options or warrants on or after November , 2015; and |

| • | no exercise of the warrants to be issued to the Representative of the underwriters in connection with this offering as described in the “Underwriting- Representative’s Warrants” section of this prospectus. |

5

Table of Contents

SUMMARY FINANCIAL DATA

The following summary financial data for the six months ended June 30, 2015 and 2014, and for the years ended December 31, 2014 and 2013 are derived from our audited financial statements included elsewhere in this prospectus. You should read this data together with our audited financial statements and related notes included elsewhere in this prospectus and the information under the captions “Selected financial data” and “Management’s discussion and analysis of financial condition and results of operations.” The summary financial data in this section are not intended to replace our audited financial statements and related notes included elsewhere in this prospectus.

| For the six months ended June 30, |

For the years ended December 31, |

|||||||||||||||

| (in thousands, except share and per share data) | 2015 | 2014 | 2014 | 2013 | ||||||||||||

| Statements of operations data: |

||||||||||||||||

| Revenues |

$ | — | $ | — | $ | — | $ | — | ||||||||

| Operating expenses: |

||||||||||||||||

| Research and development |

44 | 221 | 294 | 620 | ||||||||||||

| Research and development—Patents |

16 | 59 | 80 | 76 | ||||||||||||

| Business legal and consulting |

207 | 210 | 623 | — | ||||||||||||

| General and administrative |

5,590 | 105 | 164 | 350 | ||||||||||||

| Consulting services |

— | 410 | 830 | 820 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

$ | 5,857 | $ | 1,005 | $ | 1,991 | $ | 1,866 | ||||||||

| Other expense |

||||||||||||||||

| Change in fair value of derivative liabilities |

(278 | ) | (93 | ) | 10 | — | ||||||||||

| Net Loss |

(5,579 | ) | (912 | ) | $ | (2,001 | ) | $ | (1,866 | ) | ||||||

| Net Loss per Share; Basic and Diluted |

(0.11 | ) | (0.02 | ) | $ | (0.04 | ) | $ | (0.04 | ) | ||||||

| Weighted-Average Number of Shares used Per Common Share Calculations: |

||||||||||||||||

| Basic and Diluted |

50,000,000 | 50,000,000 | 50,000,000 | 50,000,000 | ||||||||||||

The table below presents our balance sheet data as of June 30, 2015 on an actual basis and:

on a pro forma basis to give effect to (1) the amendment of our certificate of incorporation to increase our authorized shares of common stock to 100,000,000, (2) the issuance of 1,384,616 shares of Common Stock to the Company’s Chief Executive Officer, (3) the issuance of $6,250,000 in aggregate principal amount of original issue discount convertible notes in August and September 2015 and the receipt of net proceeds therefrom, (4) the conversion of all of the original issue discount convertible notes issued in August and September 2015 into an aggregate of shares of our common stock, which will occur upon the closing of this offering; (5) the payment of a cash bonus to the Company’s Chief Executive Officer in the amount of $ within 180 days of the closing of this offering and (6) the filing of our restated certificate of incorporation upon the closing of this offering; and

on a pro forma as adjusted basis to give effect to the sale of shares of our common stock offered in this offering at an initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, after deducting underwriting commissions and estimated offering expenses payable by us.

6

Table of Contents

| As of June 30, 2015 | ||||||||||||

| (in thousands) | Actual | Pro Forma | Pro Forma as adjusted(1) |

|||||||||

| Cash |

$ | 4 | $ | $ | ||||||||

| Total assets |

601 | |||||||||||

| Total liabilities |

11,583 | |||||||||||

| Common stock |

50 | |||||||||||

| Additional paid-in capital |

(50 | ) | ||||||||||

| Accumulated deficit |

(10,982 | ) | ( | ) | ||||||||

| Total stockholder’s deficiency |

(10,982 | ) | ||||||||||

| (1) | Each $1.00 increase (decrease) in the assumed initial public offering price of $ per share, the midpoint of the range set forth on the cover page of this prospectus, would increase (decrease) each of pro forma as adjusted additional paid-in capital, stockholders’ equity and total capitalization by approximately $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same. We may also increase or decrease the number of shares we are offering. An increase (decrease) of 1,000,000 in the number of shares we are offering would increase (decrease) each of pro forma as adjusted additional paid-in capital, stockholders’ equity and total capitalization by approximately $ million, assuming the assumed initial public offering price per share, as set forth on the cover page of this prospectus, remains the same. |

7

Table of Contents

Investing in our common stock involves numerous risks. You should carefully consider the risks and uncertainties described below together with all of the other information contained in this prospectus, including our financial statements and related notes appearing at the end of this prospectus, before deciding to invest in our common stock. If any of the following risks actually occurs, our business, prospects, operating results and financial condition could suffer materially, the trading price of our common stock could decline and you could lose all or part of your investment. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may also adversely affect our business.

Risks related to our financial position and need for additional capital

We have incurred net losses since our inception and anticipate that we will continue to incur substantial operating losses for the foreseeable future. We may never achieve or sustain profitability.

Our business plan is to develop, design and produce safe and effective products focusing on drug solutions for pain resulting from musculoskeletal disorders, cancer, and peripheral neuropathy. Our primary activities have been research and development, negotiating strategic alliances and other agreements, and raising capital. Expenses of the Company include those specifically identifiable to the Company, and allocations of expenses from the Company’s former parent. The allocated expenses were primarily based on the use of estimates. Expenses allocated from the Company’s parent were costs which benefitted the Company and were required for its operations. Certain general corporate expenses of the Company’s parent were not allocated because they did not provide a direct or material benefit to the business. In the opinion of management, the methods of allocating costs were reasonable; however, such costs did not necessarily equal costs that the Company would have incurred on a stand-alone basis. Therefore, the financial information included in this prospectus may not necessarily reflect assets and liabilities and cash flows of the Company if operated on a stand-alone basis. To date, the Company has not generated any revenues from its operations.

We have incurred net losses during each fiscal period since our inception. Our net loss was approximately $5,579,000 for the six months ended June 30, 2015, $2,001,000 for the year ended December 31, 2014 and approximately $1,866,000 for the year ended December 31, 2013. We do not know when or whether we will become profitable. To date, we have not commercialized any products or generated any revenues from the sale of products, and we do not expect to generate any product revenues in the foreseeable future. Our losses have resulted principally from costs incurred in our discovery and development activities. Our net losses may fluctuate significantly from quarter to quarter and year to year.

We have devoted most of our financial resources to research and development, including our clinical and preclinical development activities. To date, we have financed our operations only through advances from our former parent. The amount of our future net losses will depend, in part, on the rate of our future expenditures and our ability to obtain funding through equity or debt financings and strategic collaborations. We have not completed pivotal clinical trials for any product candidate and it may be several years, if ever, before we have a product candidate ready for commercialization. Even if we obtain regulatory approval to market a product candidate, our future revenues will depend upon the size of any markets in which our product candidates have received approval, and our ability to achieve sufficient market acceptance, reimbursement from third-party payors and adequate market share for our product candidates in those markets.

We expect to continue to incur significant expenses and increasing net losses for at least the next several years. We expect our expenses will increase substantially in connection with our ongoing activities, as we:

| • | submit an Investigational New Drug, or IND, application to the FDA for authorization to conduct our contemplated pivotal Phase 2B/3 clinical trial for AX-IBU-01; |

| • | seek regulatory approval for AX-IBU-01; |

8

Table of Contents

| • | submit an IND application to the FDA for authorization to begin Phase 1 clinical trials for AX-DN-01; |

| • | add personnel to support our product development and commercialization efforts; |

| • | continue our research and development efforts for new product opportunities; and |

| • | operate as a public company. |

If we are required by the FDA, or any equivalent foreign regulatory authority to perform clinical trials or studies in addition to those we currently expect to conduct, or if there are any delays in completing the clinical trials of AX-IBU-01 or AX-DN-01, our expenses could increase.

To become and remain profitable, we must succeed in developing our transdermal product candidates, obtaining regulatory approval for them, and manufacturing, marketing and selling those products for which we may obtain regulatory approval. We may not succeed in these activities, and we may never generate revenue from product sales that is significant enough to achieve profitability. Even if we achieve profitability in the future, we may not be able to sustain profitability in subsequent periods. Our failure to become or remain profitable would depress our market value and could impair our ability to raise capital, expand our business, discover or develop other transdermal product candidates or continue our operations. A decline in the value of our company could cause you to lose all or part of your investment.

The underwriters are offering the securities offered by this prospectus on a “best efforts” basis. The underwriters are not required to sell any specific number or dollar amount of common stock, but will use their best efforts to sell the securities. As a “best efforts” offering, there can be no assurance that the offering contemplated hereby will ultimately be consummated or will result in any proceeds being made to us. The success of this offering will impact our ability to finance operations over the next 12 months. If no shares of common stock are sold in this offering, or if we sell only a minimum number of shares of common stock yielding insufficient gross proceeds, we may be unable to successfully fund our operations, or execute on our business plan. This would result in a material adverse effect on our business, prospects, financial condition, and results of operations.

Our auditors have issued a going concern opinion.

Our independent auditors have indicated, in their report on our December 31, 2014 financial statements, that there is substantial doubt about our ability to continue as a going concern. A “going concern” opinion indicates that the financial statements have been prepared assuming we will continue as a going concern and do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets, or the amounts and classification of liabilities that may result if we do not continue as a going concern. Therefore, you should not rely on our balance sheet as an indication of the amount of proceeds that would be available to satisfy claims of creditors, and potentially be available for distribution to shareholders, in the event of liquidation.

We will require substantial additional financing to achieve our goals, and a failure to obtain this necessary capital when needed could force us to delay, limit, reduce or terminate our product development or commercialization efforts.

Our cash as of June 30, 2015 was $4,000 because we have funded all operations with advances from our former parent corporation, and we received an additional $5 million in cash proceeds from an original issue discount convertible note offering (the “Original Issue Discount Convertible Note Offering”) which we completed in September 2015. We believe that we will continue to expend substantial resources for the foreseeable future developing AX-IBU-01, AX-DN-01 and new transdermal product candidates. These expenditures will include costs associated with research and development, conducting preclinical studies and clinical trials, potentially obtaining regulatory approvals and manufacturing products, as well as marketing and selling products approved for sale, if any, and potentially acquiring new technologies. In addition, other unanticipated costs may arise. Because the outcome of our contemplated clinical trials is highly uncertain, we cannot reasonably estimate the actual amounts necessary to successfully complete the development and commercialization of our transdermal product candidates. Our costs will increase if we suffer any delays in our

9

Table of Contents

contemplated pivotal Phase 2B/3 clinical trial for AX-IBU-01, including delays in enrollment of patients. Upon the closing of this offering, we expect to incur additional costs associated with operating as a public company, hiring additional personnel and expanding our facilities.

Our future capital requirements depend on many factors, including:

| • | the scope, progress, results and costs of researching and developing AX-IBU-01, AX-DN-01 and our other potential transdermal product candidates and conducting preclinical studies and clinical trials; |

| • | the timing of, and the costs involved in, obtaining regulatory approvals for AX-IBU-01, AX-DN-01 and our other potential transdermal product candidates if clinical trials are successful; |

| • | the cost of commercialization activities for AX-IBU-01, AX-DN-01 and our other potential transdermal product candidates, if any of these transdermal product candidates are approved for sale, including marketing, sales and distribution costs; |

| • | the cost of manufacturing AX-IBU-01, AX-DN-01 and our other potential transdermal product candidates for clinical trials in preparation for regulatory approval and in preparation for commercialization; |

| • | our ability to establish and maintain strategic partnerships, licensing or other arrangements and the financial terms of such agreements; |

| • | our possible liability under a loan agreement to which we and our former parent are both parties and which is currently in default, as explained further below; |

| • | the costs involved in preparing, filing, prosecuting, maintaining, defending and enforcing patent claims, including litigation costs and the outcome of such litigation; and |

| • | the timing, receipt, and amount of sales of, or royalties on, our future products, if any. |

Based on our current operating plan, we believe that the net proceeds we receive from this offering, together with the $5 million in cash proceeds from the Original Issue Discount Convertible Note Offering which we completed in September 2015, will be sufficient to fund our projected operating requirements into the second half of 2016 and completion of our contemplated pivotal Phase 2B/3 clinical trial for AX-IBU-01. However, our operating plan may change as a result of many factors currently unknown to us. As a result of these factors, we may need additional funds sooner than planned. In addition, we may seek additional capital due to favorable market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. Additional funds may not be available when we need them on terms that are acceptable to us, or at all. If adequate funds are not available to us on a timely basis, we may be required to delay, limit, reduce or terminate preclinical studies, clinical trials or other development activities for one or more of our transdermal product candidates or delay, limit, reduce or terminate our establishment of sales and marketing capabilities or other activities that may be necessary to commercialize our transdermal product candidates.

Raising additional capital may cause dilution to our existing stockholders, restrict our operations or require us to relinquish rights to our technologies or transdermal products on unfavorable terms to us.

We may seek additional capital through a variety of means, including through private and public equity offerings and debt financings. To the extent that we raise additional capital through the sale of equity instruments or convertible debt securities, your ownership interest will be diluted, and the terms of such equity or convertible debt securities may include liquidation or other preferences that are senior to or otherwise adversely affect your rights as a stockholder. Debt financing, if available, may involve agreements that include covenants limiting or restricting our ability to take certain actions, such as incurring additional debt, making capital expenditures, declaring dividends or encumbering our assets to secure future indebtedness. If we raise additional funds through strategic partnerships with third parties, we may have to relinquish valuable rights to our technologies or transdermal product candidates, or grant licenses on terms that are not favorable to us. If we are unable to raise additional funds through equity or debt financing when needed, we may be required to delay, limit, reduce or terminate our product development or commercialization efforts for AX-

10

Table of Contents

IBU-01, AX-DN-01 or any other transdermal product candidates, or grant rights to develop and market transdermal product candidates that we would otherwise prefer to develop and market ourselves.

We identified a material weakness in our internal control over financial reporting and if the remediation procedures we have undertaken are unable to successfully remediate the existing material weakness, then the accuracy and timing of our financial reports may be adversely affected.

In preparing our financial statements as of and for the year ended December 31, 2014, we identified control deficiencies in the design and operation of our internal control over financial reporting that together constituted a material weakness in our internal control over financial reporting. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of our financial statements will not be prevented or detected on a timely basis. The material weaknesses identified were that we did not have adequate accounting systems and our accounting staff was inadequate both in terms of the number of personnel and their expertise in U.S. GAAP and SEC rules and regulations. As such, our controls over financial reporting were not designed or operating effectively.

Our independent certified public accounting firm is not required to perform an evaluation of our internal control over financial reporting in accordance with the provisions of the Sarbanes-Oxley Act by virtue of our status as an “emerging growth company” as defined in the JOBS Act. In light of the control deficiencies and the resulting material weakness that was identified as a result of the limited procedures we did perform, it is possible that additional material weaknesses and significant control deficiencies may have been identified if we and our independent registered public accounting firm performed an evaluation of our internal control over financial reporting in accordance with the provisions of the Sarbanes-Oxley Act. However, for as long as we remain an “emerging growth company” as defined in the JOBS Act, we intend to take advantage of the exemption permitting us not to comply with the requirement that our independent registered public accounting firm provide an attestation on the effectiveness of our internal control over financial reporting.

If we fail to remediate the material weakness or if in the future we fail to meet the demands that will be placed upon us as a public company, we may be unable to accurately report our financial results, or report them within the timeframes required by law or stock exchange regulations. Failure to comply with Section 404 of the Sarbanes-Oxley Act could also potentially subject us to sanctions or investigations by the SEC or other regulatory authorities.

Risks related to our former parent corporation

Our former parent corporation, BioChemics, recently settled claims against it by the SEC for violations of federal securities laws in connection with the private sale of securities of BioChemics.

Until January 2015, Inpellis was a wholly owned subsidiary of BioChemics. In December 2012, the SEC brought a civil enforcement action against BioChemics, its founder and then CEO, and other individuals in the United States District Court for the District of Massachusetts, entitled Securities and Exchange Commission v. BioChemics, Inc., et al., Civil Action No. 1:12-cv-12324 (District of Massachusetts), which we refer to as the BioChemics SEC Enforcement Action. In this action, the SEC alleged, among other things, that the defendants made false statements to investors about collaborations with major pharmaceutical companies and the status and results of drug trials of BioChemics’ products, and that they created fraudulent valuations of BioChemics’ stock in connection with the private sale of securities of BioChemics to certain investors. The founder and CEO of BioChemics was also sued in a 2004 SEC enforcement action alleging false and misleading statements by VASO Active Pharmaceuticals, a former BioChemics subsidiary, concerning, among other things, FDA approval of certain key products and the regulatory consequences of the future application of its primary product, which case resulted in a final judgment by consent against this individual that permanently enjoined him from violating the antifraud provisions of the federal securities laws.

In March 2015, the United States District Court for the District of Massachusetts entered judgment against BioChemics in the BioChemics SEC Enforcement Action pursuant to a consent settlement requiring BioChemics to comply with certain antifraud provisions of the federal securities laws and requiring it to pay disgorgement and penalties approximating $18 million for the benefit of certain investors in BioChemics.

11

Table of Contents

In recognition of the above-described BioChemics settlement with the SEC and its disgorgement and penalty obligations thereunder, and the prior SEC enforcement actions against BioChemics’ founder and former CEO, BioChemics has ceded all of the shares of Inpellis common stock previously issued to it to the Trust, which was established to resolve the claims arising from the settlement in the BioChemics SEC Enforcement Action. The Trust is now the majority stockholder of Inpellis and operates independently of BioChemics. The Trust is independent of BioChemics because it cannot act unless all three of its trustees approve the action and, of the three trustees, two have no connection to BioChemics. The third trustee, Jan Schlichtmann, is the Managing Member of a limited liability company that is the largest stockholder of BioChemics. See “Business—Corporate Structure.” As a result, BioChemics no longer has any ownership interest in Inpellis. Furthermore, all of the officers and directors of Inpellis are fully independent of BioChemics. In addition, the Trustees have agreed that the Trust shall not distribute any shares of Inpellis to any of the individuals who are defendants in the BioChemics SEC Enforcement Action or any entity controlled by any such individual.

The creditors of BioChemics could challenge certain transactions between us and BioChemics.

We recently acquired ownership or joint ownership of the BioChemics intellectual property as it relates to certain drugs for $750,000 in cash.

In addition, BioChemics recently agreed the Company would not be required to reimburse BioChemics for funds advanced to the Company. The creditors of BioChemics could attempt to assert that BioChemics did not receive adequate consideration for the sale of intellectual property and seek to require that the Company pay a greater amount to BioChemics. Similarly, the creditors of BioChemics could attempt to assert that BioChemics did not receive adequate consideration for its agreement not to be reimbursed and seek to require that the Company make payments to BioChemics. BioChemics has informed us that its decisions to sell intellectual property and to agree not to require reimbursement were made based on careful consideration of the alternatives, its conclusion that both arrangements would help Inpellis obtain capital it might not otherwise raise to pursue its business plan and its conclusion that the value of a well-funded Inpellis to the creditors and shareholders of BioChemics would likely exceed the value of a larger one-time cash payment and repayment of advances were Inpellis unable to obtain necessary capital. Nevertheless, if we were required, notwithstanding the conclusions of BioChemics, to pay BioChemics in connection with the sale of intellectual property, to repay the advances, or both, it could reduce the funds available to achieve our goals.

Risks related to regulatory review and approval of our products

Clinical failure may occur at any stage of clinical development, and we may never succeed in developing marketable products or generating product revenue.

Although the active ingredient in AX-IBU-01, ibuprofen, has been used safely as an oral therapeutic treatment for moderate to severe osteoarthritis for a number of years, it has not previously been approved or demonstrated to be safe over an extended period of time as a transdermal product. Early encouraging clinical results for AX-IBU-01 are not necessarily predictive of the results of our future clinical trials, including our contemplated pivotal Phase 2B/3 clinical trial. Promising results in preclinical studies of a drug candidate may not be predictive of similar results in humans during clinical trials. Any Phase 2B/3 or other clinical trials that we may conduct may not demonstrate the efficacy and safety necessary to obtain regulatory approval to market our product candidates. If the results of our clinical trials are inconclusive with respect to the efficacy of our transdermal product candidates or if we do not meet the clinical endpoints with statistical significance or if there are safety concerns associated with our transdermal product candidates, we may be prevented or delayed in obtaining marketing approval for our transdermal product candidates. In some instances, there can be significant variability in safety or efficacy results between different clinical trials of the same product candidate due to numerous factors, including changes in trial procedures set forth in protocols, differences in the size and type of the patient populations, changes in and adherence to the clinical trial protocols and the rate of dropout among clinical trial participants.

Alternatively, even if we obtain regulatory approval, that approval may be for indications or patient populations that are not as broad as intended or desired or may require labeling that includes significant use or

12

Table of Contents

distribution restrictions or safety warnings. We may also be required to perform additional or unanticipated clinical trials to obtain approval or be subject to additional post-marketing testing requirements to maintain regulatory approval. In addition, regulatory authorities may withdraw their approval of a product or impose restrictions on its distribution, such as in the form of a modified Risk Evaluation and Mitigation Strategy, or REMS. The failure to obtain timely regulatory approval of product candidates, any product marketing limitations or a product withdrawal would negatively impact our business, results of operations and financial condition.

Delays in the commencement, enrollment or completion of clinical trials of our transdermal product candidates could result in increased costs to us as well as a delay or failure in obtaining regulatory approval, or prevent us from commercializing our transdermal product candidates on a timely basis, or at all.

We cannot guarantee that clinical trials, including those associated with our contemplated pivotal Phase 2B/3 clinical trial for AX-IBU-01, will be conducted as contemplated or completed on schedule, if at all. A failure of one or more clinical trials can occur at any stage of testing. Events that may prevent successful or timely commencement, enrollment or completion of clinical development include:

| • | delays by us in reaching a consensus with regulatory agencies on trial design; |

| • | delays in reaching agreement on acceptable terms with prospective clinical research organizations, or CROs, and clinical trial sites; |

| • | delays in obtaining required Institutional Review Board, or IRB, approval at each clinical trial site; |

| • | delays in recruiting suitable patients to participate in clinical trials; |

| • | imposition of a clinical hold by regulatory agencies for any reason, including safety concerns or after an inspection of clinical operations or trial sites; |

| • | failure by CROs, other third parties or us to adhere to clinical trial requirements; |

| • | failure to perform in accordance with the FDA’s good clinical practices, or GCP, or applicable regulatory guidelines in other countries; |

| • | delays in the testing, validation, manufacturing and delivery of the transdermal product candidates to the clinical sites; |

| • | delays caused by patients not completing participation in a trial or not returning for post-treatment follow-up; |

| • | clinical trial sites or patients dropping out of a trial; |

| • | occurrence of serious adverse events, or AEs, in clinical trials that are associated with the transdermal product candidates that are viewed to outweigh its potential benefits; or |

| • | changes in regulatory requirements and guidance that require amending or submitting new clinical protocols. |

Delays, including delays caused by the above factors, can be costly and could negatively affect our ability to complete a clinical trial. If we are not able to successfully complete clinical trials, we will not be able to obtain regulatory approval and will not be able to commercialize our transdermal product candidates.

Clinical development, regulatory review and approval of the FDA and comparable foreign authorities are lengthy, time consuming, and inherently unpredictable. If we are ultimately unable to obtain regulatory approval for our product candidates, our business will be substantially harmed.

Our transdermal product candidates will be subject to extensive governmental regulations relating to, among other things, development, clinical trials, manufacturing and commercialization. In order to obtain regulatory approval for the commercial sale of any transdermal product candidate, we must demonstrate through extensive preclinical studies and clinical trials that the transdermal product candidate is safe and effective for use in each target indication.

13

Table of Contents

The time required to obtain approval by the FDA and comparable foreign authorities is unpredictable, typically takes many years following the commencement of clinical trials, and depends upon numerous factors. In addition, approval policies, regulations, or the type and amount of clinical data necessary to gain approval may change during the course of a product candidate’s clinical development and may vary among jurisdictions, which may cause delays in the approval or the decision not to approve an application. We have not obtained regulatory approval for any product candidate, and it is possible that none of our existing product candidates or any product candidates we may seek to develop in the future will ever obtain regulatory approval. In addition, we may gain regulatory approval for AX-IBU-01, AX-DN-01 or any other transdermal product candidate in some but not all of the territories available or some but not all of the target indications, resulting in limited commercial opportunity for the approved transdermal products.

Applications for our product candidates could be delayed or could fail to receive regulatory approval for many reasons, including but not limited to the following:

| • | the FDA or comparable foreign regulatory authorities may disagree with the design or implementation of our clinical trials; |

| • | the population studied in the clinical program may not be sufficiently broad or representative to assure safety in the full population for which we seek approval; |

| • | the FDA or comparable foreign regulatory authorities may disagree with our interpretation of data from nonclinical studies or clinical trials; |

| • | the data collected from clinical trials of our product candidates may not be sufficient to support the submission of a new drug application, or NDA, or to obtain regulatory approval in the United States or elsewhere; |

| • | the FDA may determine that we cannot rely on Section 505(b)(2) for any of our product candidates, for a number of reasons, including safety and efficacy issues which have already been raised; in which case we may be required to conduct additional clinical trials, provide additional data and information and meet additional standards for product approval, resulting in increased time and financial resources required to obtain FDA approval for our product candidates; |

| • | the FDA may determine that we have identified the wrong Reference Listed Drug, or RLD, or RLDs or that approval of a Section 505(b)(2) application for any of our product candidates is blocked by patent or non-patent exclusivity of the RLD or RLDs; |

| • | the FDA may require us to conduct additional clinical trials depending on the safety data from our contemplated future clinical trials, including our contemplated pivotal Phase 2B/3 clinical trial for AX-IBU-01; |

| • | we may be unable to demonstrate to the FDA or comparable foreign regulatory authorities that a product candidate’s risk benefit ratio for its proposed indication is acceptable; |

| • | the FDA or comparable foreign regulatory authorities may fail to approve the manufacturing processes, test procedures and specifications, or facilities of third-party manufacturers with which we contract for clinical and commercial supplies; |

| • | we or any third-party service providers may be unable to demonstrate compliance with GMP to the satisfaction of the FDA or comparable foreign regulatory authorities which could result in delays in regulatory approval or require us to withdraw or recall products and interrupt commercial supply of our products; and |

| • | the approval policies or regulations of the FDA or comparable foreign regulatory authorities may significantly change in a manner rendering our clinical data insufficient for approval. |

This lengthy approval process, as well as the unpredictability of the results of clinical trials, may result in our failing to obtain regulatory approval to market any of our product candidates, which would significantly harm our business, results of operations, and prospects.

14

Table of Contents

We are already aware that the FDA has safety and efficacy concerns regarding the results of our Phase 2 trial that we will need to address, and we know of at least three other areas where the FDA could require a more extensive review process with respect to the transdermal ibuprofen product. First, the product used in the Phase 2 trial used menthol as a vasodilator. Menthol, however, is also an analgesic. If the FDA concludes that further testing needs to be done to assure that the Phase 2 results were due to the ibuprofen and not the menthol, such additional testing could add significant time and expense to the commercialization of the transdermal ibuprofen product. Second, we believe that the FDA will agree with us that vasodilators are an active incipient, not an active ingredient. But if that agreement does not occur, we may have to perform much longer, multi-round clinical trials on our products. Finally, the Phase 2 trial of our transdermal ibuprofen product did not directly measure the ibuprofen levels in the blood because such measurement had been done in the Phase 1 trial. If the FDA determines that such testing needs to occur again, or if the FDA is not satisfied with further safety and efficacy testing, we would be delayed in obtaining required approvals and, therefore, commercialization.

We currently have only two transdermal product candidates, AX-IBU-01 and AX-DN-01, and are substantially dependent on these two product candidates. A failure of either product candidate in clinical development would adversely affect our business and may require us to discontinue development of other transdermal product candidates based on the same technology.

AX-IBU-01 is our lead development product candidate. AX-DN-01 has conducted a preclinical proof of concept study. While we have certain pre-clinical programs in development and intend to develop other product candidates, it will take several years and substantial additional investment for such programs to reach the same stage of development as AX-IBU-01 and AX-DN-01, respectively. If we were required to discontinue development of AX-IBU-01 or AX-DN-01 or if either product candidate does not receive regulatory approval or fails to achieve sufficient market acceptance, we would be delayed by many years in our ability to achieve profitability, if ever. In addition, since we anticipate that all of our transdermal product candidates will be based on the same endel technology, if AX-IBU-01 or AX-DN-01 fails in development as a result of any underlying problem with the endel technology, then we may be required to discontinue development of all transdermal product candidates that are based on the same technology. In such event, our business will be adversely affected.

If we fail to obtain regulatory approval in jurisdictions outside the United States, we will not be able to market our products in those jurisdictions.

We intend to market our transdermal product candidates, including AX-IBU-01 or AX-DN-01, if approved, in international markets either directly or through partnerships. Such marketing will require separate regulatory approvals in each market and compliance with numerous and varying regulatory requirements. The approval procedures vary from country to country and may require additional testing that we are not required to perform to obtain regulatory approval in the United States. Moreover, the time required to obtain approval may differ from that required to obtain FDA approval. In addition, in many countries outside the United States, a transdermal product must be approved for reimbursement before it can be approved for sale in that country. Approval by the FDA does not ensure approval by regulatory authorities in other countries or jurisdictions, and approval by one foreign regulatory authority does not ensure approval by regulatory authorities in other foreign countries or by the FDA. The foreign regulatory approval process may include all of the risks associated with obtaining FDA approval. We may not obtain foreign regulatory approvals on a timely basis, if at all. We may not be able to file for regulatory approvals and may not receive necessary approvals to commercialize our products in any market. If we or any future partner are unable to obtain regulatory approval for AX-IBU-01 or AX-DN-01 in one or more significant foreign jurisdictions, then the commercial opportunity for such product candidate, and our financial condition, will be adversely affected.

15

Table of Contents

Even if we receive regulatory approval for our transdermal product candidates, such products will be subject to ongoing regulatory review, which may result in significant additional expense. Additionally, our transdermal product candidates, if approved, could be subject to labeling and other restrictions, and we may be subject to penalties if we fail to comply with regulatory requirements or experience unanticipated problems with our products.

Any regulatory approvals that we receive for our transdermal product candidates may also be subject to limitations on the approved indicated uses for which the product may be marketed or to conditions of approval, or contain requirements for potentially costly post-marketing testing, including Phase 4 clinical trials, and surveillance to monitor safety and efficacy. In addition, if the FDA approves any of our transdermal product candidates, the manufacturing processes, labeling, packaging, distribution, AE reporting, storage, advertising, promotion and recordkeeping for the product will be subject to extensive and ongoing regulatory requirements. These requirements include submissions of safety and other post-marketing information and reports, registration, as well as continued compliance with current good manufacturing practice, or GMP, and GCP, for any clinical trials that we conduct post-approval.

Later discovery of previously unknown problems with an approved transdermal product, including AEs of unanticipated severity or frequency, or with manufacturing operations or processes, or failure to comply with regulatory requirements, may result in, among other things:

| • | restrictions on the marketing or manufacturing of the product, withdrawal of the product from the market, or voluntary or mandatory product recalls; |

| • | fines, warning letters, or holds on clinical trials; |

| • | refusal by the FDA to approve pending applications or supplements to approved applications filed by us, or suspension or revocation of product license approvals; |

| • | product seizure or detention, condemnation and destruction, or refusal to permit the import or export of products; and |

| • | injunctions or the imposition of civil or criminal penalties. |

The FDA’s policies may change and additional government regulations may be enacted that could prevent, limit or delay regulatory approval of our transdermal product candidates. We cannot predict the likelihood, nature or extent of government regulation that may arise from future legislation or administrative action, either in the United States or abroad. If we are slow or unable to adapt to changes in existing requirements or the adoption of new requirements or policies, or not able to maintain regulatory compliance, we may lose any marketing approval that may have been obtained and we may not achieve or sustain profitability, which would adversely affect our business.

Our transdermal products may cause undesirable side effects or have other properties that delay or prevent their regulatory approval or limit their commercial potential.

Undesirable side effects caused by our transdermal products could cause us or regulatory authorities to interrupt, delay or halt clinical trials and could result in the denial of regulatory approval by the FDA or other regulatory authorities and potential product liability claims. Serious AEs deemed to be caused by our transdermal products could have a material adverse effect on the development of our transdermal product candidates and our business as a whole. The most common AEs to date in the clinical trials evaluating the safety and efficacy of AX-IBU-01 have been a few incidents of skin redness. Our understanding of the relationship between AX-IBU-01 and these events may change as we gather more information, and additional unexpected AEs may occur. In addition, although ibuprofen has been in use for over 40 years, the long-term impact of using ibuprofen as a transdermal product is not well understood.

16

Table of Contents

If we or others identify undesirable side effects caused by our transdermal product candidates either before or after receipt of marketing approval, a number of potentially significant negative consequences could result, including:

| • | our clinical trials may be put on hold; |

| • | we may be unable to obtain regulatory approval for our transdermal product candidates; |

| • | regulatory authorities may withdraw approvals of our transdermal product candidates; |

| • | regulatory authorities may require additional warnings on the label; |

| • | a medication guide outlining the risks of such side effects for distribution to patients may be required; |

| • | we could be sued and held liable for harm caused to patients; and |

| • | our reputation may suffer. |

Any of these events could prevent us from achieving or maintaining market acceptance of our transdermal products and could substantially increase commercialization costs.

Risks related to manufacturing our transdermal product candidates and our reliance on third parties

We will rely on third-party manufacturers to manufacture our transdermal product candidates, including AX-IBU-01 and AX-DN-01, and any failure by a third-party manufacturer or supplier may delay or impair our ability to complete clinical trials or commercialize our transdermal product candidates, including AX-IBU-01 and AX-DN-01.

We have relied, and we expect to continue to rely, on third-party manufacturers to manufacture our transdermal product candidates for preclinical studies, including Phase 1 clinical trials and Phase 2 clinical trials of AX-IBU-01, and expect to continue to do so for our contemplated pivotal Phase 2B/3 clinical trial. We have relied, and we expect to continue to rely, on third-party suppliers of ibuprofen, the active pharmaceutical ingredient in AX-IBU-01. Similarly, we have relied, and we expect to continue to rely, on third-party manufacturers to manufacture our transdermal product candidates for preclinical studies of AX-DN-01, and expect to continue to do so for our clinical trials of AX-DN-01. We have relied, and we expect to continue to rely, on third-party suppliers of benfotiamine, the active pharmaceutical ingredient in AX-DN-01. We currently do not have contracts in place with any of these third parties. Our reliance on third parties for the manufacture of our product candidates, including AX-IBU-01 and AX-DN-01, increases the risk that we will not have sufficient quantities of our product candidates, or will not be able to obtain such quantities at an acceptable cost or quality, which could delay, prevent or impair our development or commercialization efforts. If our third-party manufacturer fails to produce GMP-quality AX-IBU-01 for our contemplated pivotal Phase 2B/3 clinical trial and we need to enter into alternative arrangements with a different manufacturer, it could delay our product development activities. If this failure of production were to occur after we received approval for and commenced commercialization of AX-IBU-01, we might be unable to meet the demand for this product and our business could be adversely affected. In addition, because we do not have any control over the manufacturing process or timing of the supply of the active pharmaceutical ingredient, there is greater risk that we will not have sufficient quantities of the active pharmaceutical ingredient at an acceptable cost or quality, which could delay, prevent or impair our development or commercialization efforts. The same risks exist for AX-DN-01 and other product candidates.

Our third-party manufacturers and suppliers may be subject to FDA inspection from time to time. Failure by our third-party manufacturers to pass such inspections and otherwise satisfactorily complete the FDA approval regimen with respect to our product candidates may result in regulatory actions such as the issuance of FDA Form 483 notices of observations, warning letters or injunctions or the loss of operating licenses. Based on the severity of the regulatory action, our clinical or commercial supply of plastic molds and other services could be interrupted or limited, which could have a material adverse effect on our business.

17

Table of Contents

Our transdermal product candidates have not been produced at a commercial scale. Our manufacturing partners may not be able to manufacture our transdermal product candidates in quantities sufficient for commercial launch of our product candidates, if our product candidates are approved, or for any future commercial demand for our product candidates.