Form N-CSR VANGUARD MALVERN FUNDS For: Sep 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05628

Name of Registrant: Vanguard Malvern Funds

Address of Registrant:

P.O. Box 2600

Valley Forge, PA 19482

Name and address of agent for service:

Anne E. Robinson, Esquire

P.O. Box 876

Valley Forge, PA 19482

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: September 30

Date of reporting period: October 1, 2015 – September 30, 2016

Item 1: Reports to Shareholders

Annual Report | September 30, 2016

Vanguard U.S. Value Fund

A new format, unwavering commitment

As you begin reading this report, you’ll notice that we’ve made some improvements to the opening sections—based on feedback from you, our clients.

Page 1 starts with a new ”Your Fund’s Performance at a Glance,” a concise, handy summary of how your fund performed during the period.

In the renamed ”Chairman’s Perspective,” Bill McNabb will focus on enduring principles and investment insights.

We’ve modified some tables, and eliminated some redundancy, but we haven’t removed any information.

At Vanguard, we’re always looking for better ways to communicate and to help you make sound investment decisions. Thank you for entrusting your assets to us.

| Contents | |

| Your Fund’s Performance at a Glance. | 1 |

| Chairman’s Perspective. | 3 |

| Advisor’s Report. | 6 |

| Fund Profile. | 8 |

| Performance Summary. | 9 |

| Financial Statements. | 11 |

| Your Fund’s After-Tax Returns. | 23 |

| About Your Fund’s Expenses. | 24 |

| Glossary. | 26 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: No matter what language you speak, Vanguard has one consistent message and set of principles. Our primary focus is on you, our clients. We conduct our business with integrity as a faithful steward of your assets. This message is shown translated into seven languages, reflecting our expanding global presence.

Your Fund’s Performance at a Glance

• For the 12 months ended September 30, 2016, Vanguard U.S. Value Fund returned about 11%, trailing both its benchmark index and the average return of its peer group. In general, value stocks outpaced their growth counterparts.

• All but one of the fund’s industry sectors posted positive results. The advisor’s stock selection contributed to the fund’s underperformance relative to its benchmark.

• Energy, the fund’s second-largest sector holding, weighed most on its result.

Industrials, health care, and materials were among sectors that also detracted from relative performance. Information technology and telecommunication services were the only sectors to beat the benchmark.

• Over the decade ended September 30, the fund’s average annual return was in line with that of its benchmark and slightly ahead of the average return of its peers.

| Total Returns: Fiscal Year Ended September 30, 2016 | |

| Total | |

| Returns | |

| Vanguard U.S. Value Fund | 11.09% |

| Russell 3000 Value Index | 16.38 |

| Multi-Cap Value Funds Average | 12.39 |

| Multi-Cap Value Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |

| Total Returns: Ten Years Ended September 30, 2016 | |

| Average | |

| Annual Return | |

| U.S. Value Fund | 5.85% |

| Russell 3000 Value Index | 5.84 |

| Multi-Cap Value Funds Average | 5.10 |

| Multi-Cap Value Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |

The figures shown represent past performance, which is not a guarantee of future results. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost.

1

| Expense Ratios | ||

| Your Fund Compared With Its Peer Group | ||

| Peer Group | ||

| Fund | Average | |

| U.S. Value Fund | 0.26% | 1.15% |

The fund expense ratio shown is from the prospectus dated January 27, 2016, and represents estimated costs for the current fiscal year. For the fiscal year ended September 30, 2016, the fund’s expense ratio was 0.23%. The peer-group expense ratio is derived from data provided by Lipper, a Thomson Reuters Company, and captures information through year-end 2015.

Peer group: Multi-Cap Value Funds.

2

Chairman’s Perspective

Bill McNabb

Chairman and Chief Executive Officer

Dear Shareholder,

If you think you’ve had reason to feel uneasy about the investment environment lately, you’re not imagining things. In just the past few months, we’ve seen economic uncertainty, intense political polarization, and super-low bond yields. Yet at the same time, the stock market kept pushing higher.

In this confusing and sometimes contradictory climate, you may be asking yourself a question that I hear often: How do I make sense of all this, keep investing, and still get a good night’s sleep?

As with any problem, there are multiple ways to go at it. But there’s one approach in particular that is simple, straightforward, and nearly foolproof: Save more money. Not only can saving more give you a greater sense of control over your investment plan, it can help compensate for long-term returns that, in our estimation, could fall short of historical averages.

I love the way one of our investment pros put it. Fran Kinniry this summer told The Wall Street Journal, “Investing is always a partnership between you and the markets.” He explained that the markets carried more than their fair share of the weight for a couple of decades, through the 1990s, providing outsized returns that made the investor’s half of the partnership relatively light work. “But now you are going to have to be the majority partner.”

Sobering? Sure. Hopeless? Definitely not.

3

Over the 12 months since last September, U.S. stocks returned 15%, though the rise has not been a one-way ticket straight up. International markets have also posted strong returns, but lower than those of the broad U.S. market. The decision by United Kingdom voters in June to exit the European Union came as a surprise but caused market heartburn for only a few days.

In fixed income, yields remained extremely low—about 1.60% on the 10-year U.S. Treasury note at the end of September, after dipping below 1.40% over the summer. And bond yields in some international markets were negative.

Even this relatively small window of time illustrates a truism of the financial markets: There will always be segments that perform well and others that don’t. Saving more saves you from trying to control the uncontrollable—how economies and the markets perform. And it keeps you in control of one of the most vital parts of your investment program.

Although the “save more” logic is easy to grasp, it’s not always easy to follow. Bills, illness, the loss of a job—these can affect any of us.

But whatever our circumstances, figuring out how to save more is worth the effort. It requires that we make difficult decisions to forgo some consumption today to increase the likelihood of consuming (or consuming more) in the future. This is the very heart of investing. Sacrifices are never fun, so consider carrying them out systematically and in doses that you

| Market Barometer | |||

| Average Annual Total Returns | |||

| Periods Ended September 30, 2016 | |||

| One | Three | Five | |

| Year | Years | Years | |

| Stocks | |||

| Russell 1000 Index (Large-caps) | 14.93% | 10.78% | 16.41% |

| Russell 2000 Index (Small-caps) | 15.47 | 6.71 | 15.82 |

| Russell 3000 Index (Broad U.S. market) | 14.96 | 10.44 | 16.36 |

| FTSE All-World ex US Index (International) | 9.62 | 0.71 | 6.50 |

| Bonds | |||

| Bloomberg Barclays U.S. Aggregate Bond Index | |||

| (Broad taxable market) | 5.19% | 4.03% | 3.08% |

| Bloomberg Barclays Municipal Bond Index | |||

| (Broad tax-exempt market) | 5.58 | 5.54 | 4.48 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.20 | 0.06 | 0.06 |

| CPI | |||

| Consumer Price Index | 1.46% | 1.03% | 1.25% |

4

can be comfortable with—for instance, gradually getting up to the max in your IRA, or adding a percentage point or so to the amount you stash in your employer’s retirement plan. As a point of reference, we generally suggest that investors strive for a retirement savings rate of 12%–15%, including any employer contributions.

If you need more convincing about the wisdom of the “save more” course of action, it might be helpful to examine your alternatives. This list is by no means exhaustive, but it hits on a few of the big ones, and none are without risk.

• Reach for yield. With yields so low on many types of bonds, it’s tempting to find the corners of the fixed income market where payouts are juicier. But with the juice comes considerable risk. You need to be aware that you’d be taking on more risk—and how much more.

• Go all-in on a hot-performing asset class or fund. By now, you know better than that, right?

• Sit tight. This approach isn’t a terrible idea; it’s better than panicking and deciding to just “do something,” particularly if that means changing your approach in response to the market’s movements.

Here’s the inescapably challenging part of your partnership with the markets: In the short run, your “partner” is fickle, emotional, and wildly unpredictable. But in the long run, your partner is mostly rational and extremely helpful.

The best way to minimize your vulnerability to the market’s mood swings, and to maximize the benefit of your partner’s longer-term strengths, is to expect less and save more. Maybe the markets will deliver better-than-expected returns. Maybe they’ll be consistent with our more modest expectations. In either case, a higher savings rate can help put you in a better position to reach your goals.

As always, thank you for investing with Vanguard.

F. William McNabb III

Chairman and Chief Executive Officer October 18, 2016

5

Advisor’s Report

For the fiscal year ended September 30, 2016, the U.S. Value Fund returned 11.09%. It lagged the benchmark Russell 3000 Value Index by more than 5 percentage points.

The broad U.S. equity market was up 14.96%. U.S. growth stocks, which returned 13.64%, lagged the 16.38% result for their value counterparts. Small-capitalization stocks returned 15.47%, outperforming large- and mid-cap stocks, which returned 14.93%.

Globally, developed markets performed more weakly, with the MSCI EAFE Index returning 6.52%. In comparison, emerging markets, as measured by the MSCI Emerging Markets Index, rose 16.78%. Each of the 11 industry sectors in the Russell 3000 Value Index generated positive returns. Results were best among materials, information technology, and industrial companies, but they were only mildly positive among consumer discretionary and financial firms.

Growth around the globe remained subdued. The U.S. economy grew at an annual rate of 0.8% in the first quarter of 2016 and 1.4% in the second. The second-quarter increase reflected positive contributions from personal consumption expenditures, exports, and nonresidential fixed investments, but declines in private inventory investment and residential fixed investment weighed on the economy.

The International Monetary Fund estimated global growth at 2.9% for the first half of 2016, slightly weaker than for the second half of 2015. Brexit is still unfolding, as the long-term arrangements between the United Kingdom and the European Union will be uncertain for some time. Commodity prices have partly recovered. After hitting a ten-year low in January 2016, oil prices rallied by 50 percent to $45 in August, mostly because of production outages. Nonfuel commodity prices have also increased, with metals prices rising 12% and agricultural commodity prices up 9%.

Although it’s important to understand how overall portfolio performance is affected by these macroeconomic factors, we emphasize that our investment process focuses on specific stock fundamentals and portfolio characteristics. Our stock selection model evaluates companies within our investment universe to identify those with attractive characteristics that we believe will outperform over the long run.

To do this, we use a strict quantitative process that focuses on a combination of five key themes: high quality—healthy balance sheets and consistent cash-flow generation; effective use of capital—sound investment policies that favor internal over external funding; consistent earnings growth—a demonstrated ability to grow earnings year after year; strong market sentiment—market confirmation of our view; and reasonable valuation—avoidance of overpriced stocks.

The interaction of these themes generates an opinion on all the stocks in our universe each day. Using the results of our model, we then construct our portfolio with the goal of maximizing expected return, while minimizing exposure to risks that our

6

research indicates do not improve returns, such as industry selection and other risks relative to our benchmark.

Our portfolio focuses on the attractive stocks identified by the model that we expect will exhibit future outperformance; however, as with any investment management process, there will be periods when our model does not perform as expected. Unfortunately, over the latest fiscal year, the stocks that outperformed had characteristics that our model does not pursue. Although we are disappointed with the performance results, it is important to remind our investors that through different market environments, we maintain our commitment to invest in stocks with attractive fundamentals that we believe will outperform in the long run.

For the 12-month period, our valuation and management decisions models helped performance, while our growth and quality models were weaker. However, our sentiment model was a large detractor from the fund’s performance. We always maintain a positive view of each of our five submodels, but we recently introduced a dynamic weighting process that shifts their relative importance through time. This process successfully underweighted the sentiment component and increased the weight of the management decisions component, which mitigated our underperformance over the period.

Our stock selection results across sectors were disappointing, as we were able to produce positive selections only in real estate, information technology, and telecommunication services. In real estate, our most successful positions included Government Properties Income Trust (+59.2%), Digital Realty Trust (+68.4%), and Communications Sales & Leasing (+82.1%). Performance in IT was driven by AMD (+191.6%), NeoPhotonics (+139.9%), and NVIDIA (+181.3%). Telecom benefited from our positions in Verizon (+25.1%) and Cincinnati Bell (+30.8%).

We were not able to match the outperformance across the remaining sectors, and our stock selection results were the most disappointing in energy, industrials, and financials. In energy, Alon USA Energy (–62.2%), Teekay Tankers (–56.2%), and Noble (–39.9%) significantly detracted. Industrial holdings JetBlue Airways (–33.1%), Alaska Air Group (–15.9%), and Spirit AeroSystems (–7.9%) similarly did not perform as expected. In financials, Santander (–42.4%), MGIC Investment (–37.9%), and Heritage Insurance (–25.9%) hurt results.

Portfolio Managers:

James P. Stetler, Principal

Anatoly Shtekhman, CFA

Binbin Guo, Principal, Head of Equity

Research and Portfolio Strategies

Vanguard Quantitative Equity Group

October 18, 2016

7

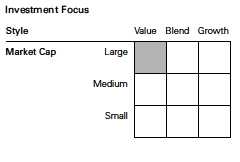

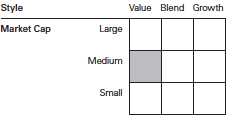

| U.S. Value Fund | |||

| Fund Profile | |||

| As of September 30, 2016 | |||

| Portfolio Characteristics | |||

| Russell | DJ | ||

| 3000 | U.S. Total | ||

| Value | Market | ||

| Fund | Index | FA Index | |

| Number of Stocks | 240 | 2,025 | 3,850 |

| Median Market Cap | $23.3B | $48.8B | $51.8B |

| Price/Earnings Ratio | 16.3x | 21.9x | 23.7x |

| Price/Book Ratio | 1.8x | 1.8x | 2.8x |

| Return on Equity | 11.0% | 12.4% | 16.6% |

| Earnings Growth Rate | 7.0% | 3.0% | 7.6% |

| Dividend Yield | 2.6% | 2.5% | 2.0% |

| Foreign Holdings | 1.0% | 0.0% | 0.0% |

| Turnover Rate | 76% | — | — |

| Ticker Symbol | VUVLX | — | — |

| Expense Ratio1 | 0.26% | — | — |

| 30-Day SEC Yield | 2.49% | — | — |

| Short-Term Reserves | 0.0% | — | — |

Sector Diversification (% of equity exposure)

| DJ | |||

| U.S. | |||

| Russell | Total | ||

| 3000 | Market | ||

| Value | FA | ||

| Fund | Index | Index | |

| Consumer | |||

| Discretionary | 5.3% | 5.3% | 12.8% |

| Consumer Staples | 8.5 | 8.4 | 8.7 |

| Energy | 12.8 | 12.8 | 6.7 |

| Financials | 23.8 | 23.9 | 13.3 |

| Health Care | 11.1 | 11.0 | 14.2 |

| Industrials | 9.7 | 9.7 | 10.3 |

| Information | |||

| Technology | 10.2 | 10.1 | 20.7 |

| Materials | 3.0 | 3.0 | 3.3 |

| Real Estate | 5.5 | 5.6 | 4.3 |

| Telecommunication | |||

| Services | 3.6 | 3.7 | 2.4 |

| Utilities | 6.5 | 6.5 | 3.3 |

| Volatility Measures | ||

| Russell | DJ | |

| 3000 | U.S. Total | |

| Value | Market | |

| Index | FA Index | |

| R-Squared | 0.97 | 0.95 |

| Beta | 0.95 | 0.93 |

These measures show the degree and timing of the fund’s fluctuations compared with the indexes over 36 months.

Ten Largest Holdings (% of total net assets)

| Exxon Mobil Corp. | Integrated Oil & Gas | 3.4% |

| Johnson & Johnson | Pharmaceuticals | 2.9 |

| JPMorgan Chase & Co. | Diversified Banks | 2.7 |

| General Electric Co. | Industrial | |

| Conglomerates | 2.4 | |

| Bank of America Corp. | Diversified Banks | 2.0 |

| Berkshire Hathaway Inc. Multi-Sector Holdings | 1.9 | |

| Citigroup Inc. | Diversified Banks | 1.8 |

| AT&T Inc. | Integrated | |

| Telecommunication | ||

| Services | 1.7 | |

| Procter & Gamble Co. | Household Products | 1.6 |

| Merck & Co. Inc. | Pharmaceuticals | 1.5 |

| Top Ten | 21.9% | |

The holdings listed exclude any temporary cash investments and equity index products.

1 The expense ratio shown is from the prospectus dated January 27, 2016, and represents estimated costs for the current fiscal year. For the fiscal year ended September 30, 2016, the expense ratio was 0.23%.

8

U.S. Value Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

Cumulative Performance: September 30, 2006, Through September 30, 2016

Initial Investment of $10,000

| Average Annual Total Returns | |||||

| Periods Ended September 30, 2016 | |||||

| Final Value | |||||

| One | Five | Ten | of a $10,000 | ||

| Year | Years | Years | Investment | ||

| U.S. Value Fund | 11.09% | 16.64% | 5.85% | $17,655 | |

| •••••••• | Russell 3000 Value Index | 16.38 | 16.09 | 5.84 | 17,647 |

| – – – – | Dow Multi-Cap Jones Value U.S. Funds Total Stock Average Market | 12.39 | 14.24 | 5.10 | 16,443 |

| Float Adjusted Index | 14.93 | 16.30 | 7.49 | 20,592 | |

| Multi-Cap Value Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |||||

See Financial Highlights for dividend and capital gains information.

9

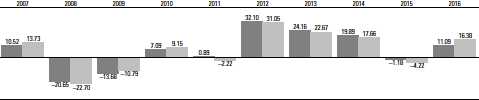

U.S. Value Fund

Fiscal-Year Total Returns (%): September 30, 2006, Through September 30, 2016

U.S. Value Fund

Russell 3000 Value Index

10

U.S. Value Fund

Financial Statements

Statement of Net Assets

As of September 30, 2016

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| Common Stocks (99.6%)1 | |||

| Consumer Discretionary (5.3%) | |||

| Target Corp. | 128,262 | 8,809 | |

| Lear Corp. | 64,472 | 7,815 | |

| Whirlpool Corp. | 42,946 | 6,964 | |

| Best Buy Co. Inc. | 178,889 | 6,830 | |

| International Game | |||

| Technology plc | 196,228 | 4,784 | |

| * | Liberty SiriusXM Group | ||

| Class A | 134,387 | 4,567 | |

| * | Cooper-Standard Holding | ||

| Inc. | 41,879 | 4,138 | |

| Darden Restaurants Inc. | 66,735 | 4,092 | |

| News Corp. Class B | 271,403 | 3,859 | |

| PVH Corp. | 30,420 | 3,361 | |

| * | Discovery Communications | ||

| Inc. Class A | 108,622 | 2,924 | |

| Carnival Corp. | 50,461 | 2,464 | |

| Ford Motor Co. | 193,509 | 2,336 | |

| Cooper Tire & Rubber Co. | 50,061 | 1,903 | |

| * | MSG Networks Inc. | 89,867 | 1,672 |

| Children’s Place Inc. | 20,317 | 1,623 | |

| Rent-A-Center Inc. | 84,459 | 1,068 | |

| Barnes & Noble Inc. | 62,888 | 711 | |

| Dana Inc. | 44,583 | 695 | |

| * | Liberty SiriusXM Group | ||

| Class C | 20,395 | 681 | |

| General Motors Co. | 16,842 | 535 | |

| Nordstrom Inc. | 7,400 | 384 | |

| 72,215 | |||

| Consumer Staples (8.4%) | |||

| ^ | Procter & Gamble Co. | 243,404 | 21,845 |

| Wal-Mart Stores Inc. | 276,872 | 19,968 | |

| Philip Morris International | |||

| Inc. | 97,887 | 9,517 | |

| Tyson Foods Inc. Class A | 116,937 | 8,732 | |

| ConAgra Foods Inc. | 167,966 | 7,913 | |

| Energizer Holdings Inc. | 148,671 | 7,428 | |

| ^,* | Herbalife Ltd. | 116,326 | 7,211 |

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| Dean Foods Co. | 396,467 | 6,502 | |

| JM Smucker Co. | 38,700 | 5,245 | |

| Ingredion Inc. | 29,460 | 3,920 | |

| Universal Corp. | 59,514 | 3,465 | |

| * | Post Holdings Inc. | 36,095 | 2,785 |

| Fresh Del Monte Produce | |||

| Inc. | 41,372 | 2,478 | |

| PepsiCo Inc. | 21,590 | 2,348 | |

| Ingles Markets Inc. Class A | 53,005 | 2,096 | |

| * | Omega Protein Corp. | 48,477 | 1,133 |

| Mondelez International Inc. | |||

| Class A | 21,801 | 957 | |

| SpartanNash Co. | 27,582 | 798 | |

| Nu Skin Enterprises Inc. | |||

| Class A | 10,895 | 706 | |

| Avon Products Inc. | 120,312 | 681 | |

| 115,728 | |||

| Energy (12.9%) | |||

| Exxon Mobil Corp. | 528,020 | 46,086 | |

| Chevron Corp. | 159,169 | 16,382 | |

| Devon Energy Corp. | 218,356 | 9,632 | |

| Apache Corp. | 136,602 | 8,725 | |

| Ensco plc Class A | 974,604 | 8,284 | |

| * | Newfield Exploration Co. | 189,330 | 8,228 |

| Rowan Cos. plc Class A | 541,316 | 8,206 | |

| Energen Corp. | 137,158 | 7,917 | |

| Valero Energy Corp. | 149,173 | 7,906 | |

| Tesoro Corp. | 86,319 | 6,867 | |

| ^ | Ship Finance International | ||

| Ltd. | 443,204 | 6,528 | |

| Schlumberger Ltd. | 76,777 | 6,038 | |

| * | Transocean Ltd. | 468,686 | 4,996 |

| ^,* | EP Energy Corp. Class A | 1,023,365 | 4,482 |

| Cimarex Energy Co. | 25,065 | 3,368 | |

| Diamond Offshore | |||

| Drilling Inc. | 188,112 | 3,313 | |

| ^ | Nordic American Tankers | ||

| Ltd. | 264,069 | 2,670 | |

| Baker Hughes Inc. | 44,148 | 2,228 | |

| * | Denbury Resources Inc. | 632,122 | 2,042 |

11

| U.S. Value Fund | |||

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| Spectra Energy Corp. | 43,259 | 1,849 | |

| DHT Holdings Inc. | 439,907 | 1,843 | |

| Scorpio Tankers Inc. | 369,702 | 1,712 | |

| * | Overseas Shipholding | ||

| Group Inc. Class A | 154,160 | 1,629 | |

| * | Laredo Petroleum Inc. | 87,229 | 1,125 |

| ^,* | Seadrill Ltd. | 440,832 | 1,045 |

| * | Sanchez Energy Corp. | 111,781 | 988 |

| Noble Corp. plc | 125,659 | 797 | |

| * | RPC Inc. | 44,973 | 756 |

| * | McDermott International | ||

| Inc. | 145,119 | 727 | |

| 176,369 | |||

| Financials (23.8%) | |||

| JPMorgan Chase & Co. | 551,781 | 36,743 | |

| Bank of America Corp. | 1,717,469 | 26,878 | |

| * | Berkshire Hathaway Inc. | ||

| Class B | 180,935 | 26,140 | |

| Citigroup Inc. | 514,133 | 24,282 | |

| Wells Fargo & Co. | 423,950 | 18,773 | |

| American Express Co. | 201,487 | 12,903 | |

| Prudential Financial Inc. | 145,879 | 11,911 | |

| Capital One Financial Corp. | 163,427 | 11,739 | |

| Bank of New York Mellon | |||

| Corp. | 289,405 | 11,541 | |

| Travelers Cos. Inc. | 95,600 | 10,951 | |

| Aflac Inc. | 149,667 | 10,757 | |

| SunTrust Banks Inc. | 213,745 | 9,362 | |

| Fifth Third Bancorp | 452,104 | 9,250 | |

| Discover Financial Services | 162,805 | 9,207 | |

| Ameriprise Financial Inc. | 86,845 | 8,665 | |

| PNC Financial Services | |||

| Group Inc. | 93,141 | 8,391 | |

| Navient Corp. | 570,454 | 8,254 | |

| Unum Group | 220,137 | 7,773 | |

| Assured Guaranty Ltd. | 263,118 | 7,302 | |

| Universal Insurance | |||

| Holdings Inc. | 269,680 | 6,796 | |

| US Bancorp | 141,686 | 6,077 | |

| * | Walker & Dunlop Inc. | 236,382 | 5,971 |

| * | INTL. FCStone Inc. | 147,113 | 5,715 |

| State Street Corp. | 80,074 | 5,576 | |

| Heritage Insurance | |||

| Holdings Inc. | 291,905 | 4,206 | |

| Goldman Sachs Group Inc. | 25,096 | 4,047 | |

| * | Flagstar Bancorp Inc. | 124,030 | 3,442 |

| Regions Financial Corp. | 259,420 | 2,560 | |

| * | KCG Holdings Inc. Class A | 146,980 | 2,283 |

| Primerica Inc. | 39,153 | 2,076 | |

| Maiden Holdings Ltd. | 137,547 | 1,745 | |

| Reinsurance Group of | |||

| America Inc. Class A | 14,058 | 1,517 | |

| Ally Financial Inc. | 62,229 | 1,212 | |

| Torchmark Corp. | 15,113 | 966 | |

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| Popular Inc. | 20,736 | 793 | |

| * | World Acceptance Corp. | 12,400 | 608 |

| American International | |||

| Group Inc. | 8,017 | 476 | |

| 326,888 | |||

| Health Care (11.0%) | |||

| Johnson & Johnson | 335,926 | 39,683 | |

| Merck & Co. Inc. | 339,768 | 21,205 | |

| Pfizer Inc. | 477,662 | 16,178 | |

| Baxter International Inc. | 205,379 | 9,776 | |

| * | HCA Holdings Inc. | 106,713 | 8,071 |

| Aetna Inc. | 67,438 | 7,786 | |

| * | Express Scripts Holding Co. | 106,366 | 7,502 |

| Medtronic plc | 86,443 | 7,469 | |

| * | WellCare Health Plans Inc. | 59,951 | 7,020 |

| * | Quintiles Transnational | ||

| Holdings Inc. | 66,196 | 5,366 | |

| Anthem Inc. | 41,972 | 5,259 | |

| Bristol-Myers Squibb Co. | 91,216 | 4,918 | |

| Eli Lilly & Co. | 51,929 | 4,168 | |

| * | INC Research Holdings Inc. | ||

| Class A | 55,800 | 2,487 | |

| * | Charles River Laboratories | ||

| International Inc. | 26,153 | 2,180 | |

| * | Healthways Inc. | 39,530 | 1,046 |

| Abbott Laboratories | 16,493 | 697 | |

| Universal American Corp. | 25,000 | 191 | |

| 151,002 | |||

| Industrials (9.6%) | |||

| General Electric Co. | 1,124,086 | 33,295 | |

| Delta Air Lines Inc. | 212,701 | 8,372 | |

| BWX Technologies Inc. | 191,732 | 7,357 | |

| Owens Corning | 136,188 | 7,271 | |

| Global Brass & Copper | |||

| Holdings Inc. | 249,871 | 7,219 | |

| Masco Corp. | 202,787 | 6,958 | |

| SkyWest Inc. | 260,632 | 6,883 | |

| General Cable Corp. | 453,807 | 6,798 | |

| Huntington Ingalls | |||

| Industries Inc. | 38,489 | 5,905 | |

| Alaska Air Group Inc. | 88,215 | 5,810 | |

| L-3 Communications | |||

| Holdings Inc. | 29,277 | 4,413 | |

| * | JetBlue Airways Corp. | 244,319 | 4,212 |

| GATX Corp. | 90,927 | 4,051 | |

| * | Wabash National Corp. | 238,647 | 3,398 |

| * | ACCO Brands Corp. | 349,183 | 3,366 |

| United Technologies Corp. | 27,219 | 2,766 | |

| * | United Rentals Inc. | 32,937 | 2,585 |

| Quad/Graphics Inc. | 96,108 | 2,568 | |

| * | Spirit AeroSystems | ||

| Holdings Inc. Class A | 52,094 | 2,320 | |

| Universal Forest Products | |||

| Inc. | 19,890 | 1,959 | |

12

| U.S. Value Fund | |||

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| Comfort Systems USA Inc. | 42,042 | 1,232 | |

| Union Pacific Corp. | 7,758 | 757 | |

| Briggs & Stratton Corp. | 40,278 | 751 | |

| West Corp. | 33,879 | 748 | |

| Southwest Airlines Co. | 18,384 | 715 | |

| Ennis Inc. | 40,828 | 688 | |

| 132,397 | |||

| Information Technology (10.0%) | |||

| Intel Corp. | 322,367 | 12,169 | |

| Cisco Systems Inc. | 379,527 | 12,039 | |

| HP Inc. | 706,845 | 10,977 | |

| Computer Sciences Corp. | 161,180 | 8,415 | |

| * | Advanced Micro Devices | ||

| Inc. | 1,175,692 | 8,124 | |

| SYNNEX Corp. | 68,718 | 7,841 | |

| * | Tech Data Corp. | 90,788 | 7,691 |

| Booz Allen Hamilton | |||

| Holding Corp. Class A | 233,000 | 7,365 | |

| NVIDIA Corp. | 99,859 | 6,842 | |

| CDW Corp. | 144,824 | 6,623 | |

| * | NeoPhotonics Corp. | 396,790 | 6,484 |

| * | Sykes Enterprises Inc. | 212,762 | 5,985 |

| Oracle Corp. | 143,966 | 5,655 | |

| * | Sigma Designs Inc. | 694,160 | 5,407 |

| EarthLink Holdings Corp. | 514,300 | 3,189 | |

| * | Extreme Networks Inc. | 638,887 | 2,869 |

| * | NETGEAR Inc. | 41,239 | 2,495 |

| Leidos Holdings Inc. | 57,170 | 2,474 | |

| * | First Data Corp. Class A | 164,927 | 2,170 |

| Avnet Inc. | 48,712 | 2,000 | |

| * | TTM Technologies Inc. | 164,896 | 1,888 |

| QUALCOMM Inc. | 23,381 | 1,602 | |

| * | VMware Inc. Class A | 20,449 | 1,500 |

| * | CACI International Inc. | ||

| Class A | 14,039 | 1,417 | |

| * | NCR Corp. | 39,289 | 1,265 |

| * | Cirrus Logic Inc. | 19,477 | 1,035 |

| * | Alpha & Omega | ||

| Semiconductor Ltd. | 40,622 | 882 | |

| Applied Materials Inc. | 22,197 | 669 | |

| * | Amkor Technology Inc. | 43,300 | 421 |

| 137,493 | |||

| Materials (3.0%) | |||

| Steel Dynamics Inc. | 300,178 | 7,501 | |

| Commercial Metals Co. | 444,528 | 7,197 | |

| * | AK Steel Holding Corp. | 1,347,512 | 6,509 |

| Cabot Corp. | 120,468 | 6,314 | |

| Rayonier Advanced | |||

| Materials Inc. | 251,740 | 3,366 | |

| Dow Chemical Co. | 55,580 | 2,881 | |

| Schnitzer Steel Industries | |||

| Inc. | 82,575 | 1,726 | |

| * | Coeur Mining Inc. | 129,864 | 1,536 |

| LyondellBasell Industries | |||

| NV Class A | 18,743 | 1,512 | |

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| Avery Dennison Corp. | 10,765 | 837 | |

| United States Steel Corp. | 37,908 | 715 | |

| Greif Inc. Class A | 13,936 | 691 | |

| * | Ryerson Holding Corp. | 57,407 | 648 |

| 41,433 | |||

| Real Estate (5.5%) | |||

| Hospitality Properties Trust | 256,239 | 7,615 | |

| Government Properties | |||

| Income Trust | 322,912 | 7,304 | |

| Lexington Realty Trust | 675,609 | 6,959 | |

| CBL & Associates | |||

| Properties Inc. | 565,875 | 6,870 | |

| Washington Prime Group | |||

| Inc. | 533,909 | 6,610 | |

| DuPont Fabros Technology | |||

| Inc. | 116,570 | 4,809 | |

| Senior Housing Properties | |||

| Trust | 200,451 | 4,552 | |

| Select Income REIT | 147,878 | 3,978 | |

| Communications Sales & | |||

| Leasing Inc. | 123,920 | 3,892 | |

| Apple Hospitality REIT Inc. | 200,051 | 3,703 | |

| Macerich Co. | 41,243 | 3,335 | |

| VEREIT Inc. | 305,670 | 3,170 | |

| NorthStar Realty Finance | |||

| Corp. | 128,377 | 1,691 | |

| GEO Group Inc. | 68,794 | 1,636 | |

| Summit Hotel Properties | |||

| Inc. | 122,604 | 1,613 | |

| Omega Healthcare | |||

| Investors Inc. | 43,238 | 1,533 | |

| Piedmont Office Realty | |||

| Trust Inc. Class A | 56,019 | 1,220 | |

| Brandywine Realty Trust | 65,561 | 1,024 | |

| Global Net Lease Inc. | 117,266 | 957 | |

| WP Carey Inc. | 14,000 | 903 | |

| Care Capital Properties Inc. | 29,299 | 835 | |

| Sabra Health Care REIT Inc. | 29,210 | 735 | |

| Sunstone Hotel Investors | |||

| Inc. | 49,267 | 630 | |

| 75,574 | |||

| Telecommunication Services (3.6%) | |||

| AT&T Inc. | 574,846 | 23,345 | |

| Verizon Communications | |||

| Inc. | 274,648 | 14,276 | |

| CenturyLink Inc. | 316,926 | 8,693 | |

| * | Cincinnati Bell Inc. | 636,851 | 2,599 |

| ^ | Windstream Holdings Inc. | 71,277 | 716 |

| 49,629 | |||

| Utilities (6.5%) | |||

| Edison International | 130,795 | 9,450 | |

| PPL Corp. | 270,908 | 9,365 | |

| FirstEnergy Corp. | 264,203 | 8,740 | |

| Entergy Corp. | 109,979 | 8,439 | |

| CenterPoint Energy Inc. | 341,938 | 7,943 | |

13

| U.S. Value Fund | |||

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| UGI Corp. | 168,004 | 7,601 | |

| NiSource Inc. | 312,840 | 7,543 | |

| MDU Resources Group Inc. | 294,043 | 7,480 | |

| Great Plains Energy Inc. | 151,039 | 4,122 | |

| AES Corp. | 319,849 | 4,110 | |

| National Fuel Gas Co. | 62,335 | 3,370 | |

| Southwest Gas Corp. | 37,180 | 2,597 | |

| ONE Gas Inc. | 40,905 | 2,530 | |

| NRG Energy Inc. | 211,551 | 2,371 | |

| DTE Energy Co. | 10,622 | 995 | |

| Ameren Corp. | 16,080 | 791 | |

| NRG Yield Inc. | 39,053 | 662 | |

| NextEra Energy Inc. | 5,004 | 612 | |

| 88,721 | |||

| Total Common Stocks | |||

| (Cost $1,218,339) | 1,367,449 | ||

| Temporary Cash Investments (1.7%)1 | |||

| Money Market Fund (1.7%) | |||

| 2,3 | Vanguard Market Liquidity | ||

| Fund, 0.640% | 230,400 | 23,042 | |

| Face | |||

| Amount | |||

| ($000) | |||

| U.S. Government and Agency Obligations (0.0%) | |||

| 4,5 | Federal Home Loan | ||

| Bank Discount Notes, | |||

| 0.339%, 11/4/16 | 300 | 300 | |

| 5 | United States Treasury Bill, | ||

| 0.341%, 12/8/16 | 100 | 100 | |

| 400 | |||

| Total Temporary Cash Investments | |||

| (Cost $23,440) | 23,442 | ||

| Total Investments (101.3%) | |||

| (Cost $1,241,779) | 1,390,891 | ||

| Amount | |

| ($000) | |

| Other Assets and Liabilities (-1.3%) | |

| Other Assets | |

| Receivables for Investment Securities Sold 3,295 | |

| Investment in Vanguard | 106 |

| Receivables for Accrued Income | 1,844 |

| Receivables for Capital Shares Issued | 798 |

| Other Assets | 145 |

| Total Other Assets | 6,188 |

| Liabilities | |

| Payables for Investment Securities | |

| Purchased | (655) |

| Collateral for Securities on Loan | (17,706) |

| Payables for Capital Shares Redeemed | (1,126) |

| Payables to Vanguard | (1,278) |

| Other Liabilities | (2,657) |

| Total Liabilities | (23,422) |

| Net Assets (100%) | |

| Applicable to 79,611,907 outstanding | |

| $.001 par value shares of beneficial | |

| interest (unlimited authorization) | 1,373,657 |

| Net Asset Value Per Share | $17.25 |

| At September 30, 2016, net assets consisted of: | |

| Amount | |

| ($000) | |

| Paid-in Capital | 1,183,106 |

| Undistributed Net Investment Income | 20,151 |

| Accumulated Net Realized Gains | 21,272 |

| Unrealized Appreciation (Depreciation) | |

| Investment Securities | 149,112 |

| Futures Contracts | 16 |

| Net Assets | 1,373,657 |

• See Note A in Notes to Financial Statements.

* Non-income-producing security.

^ Includes partial security positions on loan to broker-dealers. The total value of securities on loan is $16,588,000.

1 The fund invests a portion of its cash reserves in equity markets through the use of index futures contracts. After giving effect to futures investments, the fund’s effective common stock and temporary cash investment positions represent 100.0% and 1.3%, respectively, of net assets.

2 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield.

3 Includes $17,706,000 of collateral received for securities on loan.

4 The issuer operates under a congressional charter; its securities are generally neither guaranteed by the U.S. Treasury nor backed by the full faith and credit of the U.S. government.

5 Securities with a value of $400,000 have been segregated as initial margin for open futures contracts.

REIT—Real Estate Investment Trust.

See accompanying Notes, which are an integral part of the Financial Statements.

14

| U.S. Value Fund | |

| Statement of Operations | |

| Year Ended | |

| September 30, 2016 | |

| ($000) | |

| Investment Income | |

| Income | |

| Dividends | 36,211 |

| Interest1 | 29 |

| Securities Lending—Net | 1,369 |

| Total Income | 37,609 |

| Expenses | |

| The Vanguard Group—Note B | |

| Investment Advisory Services | 722 |

| Management and Administrative | 2,014 |

| Marketing and Distribution | 247 |

| Custodian Fees | 21 |

| Auditing Fees | 34 |

| Shareholders’ Reports | 24 |

| Trustees’ Fees and Expenses | 1 |

| Total Expenses | 3,063 |

| Net Investment Income | 34,546 |

| Realized Net Gain (Loss) | |

| Investment Securities Sold1 | 22,402 |

| Futures Contracts | 688 |

| Realized Net Gain (Loss) | 23,090 |

| Change in Unrealized Appreciation (Depreciation) | |

| Investment Securities | 81,399 |

| Futures Contracts | 127 |

| Change in Unrealized Appreciation (Depreciation) | 81,526 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 139,162 |

1 Interest income and realized net gain (loss) from an affiliated company of the fund were $27,000 and $0, respectively.

See accompanying Notes, which are an integral part of the Financial Statements.

15

| U.S. Value Fund | ||

| Statement of Changes in Net Assets | ||

| Year Ended September 30, | ||

| 2016 | 2015 | |

| ($000) | ($000) | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net Investment Income | 34,546 | 25,998 |

| Realized Net Gain (Loss) | 23,090 | 63,327 |

| Change in Unrealized Appreciation (Depreciation) | 81,526 | (107,756) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 139,162 | (18,431) |

| Distributions | ||

| Net Investment Income | (26,754) | (19,263) |

| Realized Capital Gain1 | (48,800) | — |

| Total Distributions | (75,554) | (19,263) |

| Capital Share Transactions | ||

| Issued | 306,212 | 436,088 |

| Issued in Lieu of Cash Distributions | 71,550 | 18,266 |

| Redeemed | (282,648) | (318,266) |

| Net Increase (Decrease) from Capital Share Transactions | 95,114 | 136,088 |

| Total Increase (Decrease) | 158,722 | 98,394 |

| Net Assets | ||

| Beginning of Period | 1,214,935 | 1,116,541 |

| End of Period2 | 1,373,657 | 1,214,935 |

1 Includes fiscal 2016 short-term gain distributions totaling $0. Short-term gain distributions are treated as ordinary income dividends for tax purposes.

2 Net Assets—End of Period includes undistributed (overdistributed) net investment income of $20,151,000 and $15,799,000.

See accompanying Notes, which are an integral part of the Financial Statements.

16

| U.S. Value Fund | |||||

| Financial Highlights | |||||

| For a Share Outstanding | Year Ended September 30, | ||||

| Throughout Each Period | 2016 | 2015 | 2014 | 2013 | 2012 |

| Net Asset Value, Beginning of Period | $16.48 | $16.95 | $14.41 | $11.89 | $9.20 |

| Investment Operations | |||||

| Net Investment Income | .440 | .355 | .299 | .304 | .2761 |

| Net Realized and Unrealized Gain (Loss) | |||||

| on Investments | 1.341 | (.543) | 2.531 | 2.506 | 2.632 |

| Total from Investment Operations | 1.781 | (.188) | 2.830 | 2.810 | 2.908 |

| Distributions | |||||

| Dividends from Net Investment Income | (. 358) | (. 282) | (. 290) | (. 290) | (. 218) |

| Distributions from Realized Capital Gains | (.653) | — | — | — | — |

| Total Distributions | (1.011) | (. 282) | (. 290) | (. 290) | (. 218) |

| Net Asset Value, End of Period | $17.25 | $16.48 | $16.95 | $14.41 | $11.89 |

| Total Return2 | 11.09% | -1.18% | 19.89% | 24.16% | 32.10% |

| Ratios/Supplemental Data | |||||

| Net Assets, End of Period (Millions) | $1,374 | $1,215 | $1,117 | $829 | $602 |

| Ratio of Total Expenses to Average Net Assets | 0.23% | 0.26% | 0.29% | 0.29% | 0.29% |

| Ratio of Net Investment Income to | |||||

| Average Net Assets | 2.63% | 2.10% | 1.92% | 2.26% | 2.54% |

| Portfolio Turnover Rate | 76% | 66% | 57% | 75% | 69% |

1 Calculated based on average shares outstanding.

2 Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees.

See accompanying Notes, which are an integral part of the Financial Statements.

17

U.S. Value Fund

Notes to Financial Statements

Vanguard U.S. Value Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. investment companies. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been materially affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued by methods deemed by the board of trustees to represent fair value. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value. Temporary cash investments acquired over 60 days to maturity are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services. Other temporary cash investments are valued at amortized cost, which approximates market value.

2. Futures Contracts: The fund uses index futures contracts to a limited extent, with the objective of maintaining full exposure to the stock market while maintaining liquidity. The fund may purchase or sell futures contracts to achieve a desired level of investment, whether to accommodate portfolio turnover or cash flows from capital share transactions. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market. Counterparty risk involving futures is mitigated because a regulated clearinghouse is the counterparty instead of the clearing broker. To further mitigate counterparty risk, the fund trades futures contracts on an exchange, monitors the financial strength of its clearing brokers and clearinghouse, and has entered into clearing agreements with its clearing brokers. The clearinghouse imposes initial margin requirements to secure the fund’s performance and requires daily settlement of variation margin representing changes in the market value of each contract.

Futures contracts are valued at their quoted daily settlement prices. The aggregate settlement values of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized futures gains (losses).

During the year ended September 30, 2016, the fund’s average investments in long and short futures contracts represented less than 1% and 0% of net assets, respectively, based on the average of aggregate settlement values at each quarter-end during the period.

3. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (September 30, 2013–2016), and has concluded that no provision for federal income tax is required in the fund’s financial statements.

4. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

18

U.S. Value Fund

5. Securities Lending: To earn additional income, the fund lends its securities to qualified institutional borrowers. Security loans are subject to termination by the fund at any time, and are required to be secured at all times by collateral in an amount at least equal to the market value of securities loaned. Daily market fluctuations could cause the value of loaned securities to be more or less than the value of the collateral received. When this occurs, the collateral is adjusted and settled on the next business day. The fund further mitigates its counterparty risk by entering into securities lending transactions only with a diverse group of prequalified counterparties, monitoring their financial strength, and entering into master securities lending agreements with its counterparties. The master securities lending agreements provide that, in the event of a counterparty’s default (including bankruptcy), the fund may terminate any loans with that borrower, determine the net amount owed, and sell or retain the collateral up to the net amount owed to the fund; however, such actions may be subject to legal proceedings. While collateral mitigates counterparty risk, in the absence of a default the fund may experience delays and costs in recovering the securities loaned. The fund invests cash collateral received in Vanguard Market Liquidity Fund, and records a liability in the Statement of Net Assets for the return of the collateral, during the period the securities are on loan. Securities lending income represents fees charged to borrowers plus income earned on invested cash collateral, less expenses associated with the loan. During the term of the loan, the fund is entitled to all distributions made on or in respect of the loaned securities.

6. Credit Facility: The fund and certain other funds managed by The Vanguard Group (“Vanguard”) participate in a $3.1 billion committed credit facility provided by a syndicate of lenders pursuant to a credit agreement that may be renewed annually; each fund is individually liable for its borrowings, if any, under the credit facility. Borrowings may be utilized for temporary and emergency purposes, and are subject to the fund’s regulatory and contractual borrowing restrictions. The participating funds are charged administrative fees and an annual commitment fee of 0.10% of the undrawn amount of the facility; these fees are allocated to the funds based on a method approved by the fund’s board of trustees and included in Management and Administrative expenses on the fund’s Statement of Operations. Any borrowings under this facility bear interest at a rate based upon the higher of the one-month London Interbank Offered Rate, federal funds effective rate, or overnight bank funding rate plus an agreed-upon spread.

The fund had no borrowings outstanding at September 30, 2016, or at any time during the period then ended.

7. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Premiums and discounts on debt securities purchased are amortized and accreted, respectively, to interest income over the lives of the respective securities. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

B. In accordance with the terms of a Funds’ Service Agreement (the “FSA”) between Vanguard and the fund, Vanguard furnishes to the fund investment advisory, corporate management, administrative, marketing, and distribution services at Vanguard’s cost of operations (as defined by the FSA). These costs of operations are allocated to the fund based on methods and guidelines approved by the board of trustees. Vanguard does not require reimbursement in the current period for certain costs of operations (such as deferred compensation/benefits and risk/insurance costs); the fund’s liability for these costs of operations is included in Payables to Vanguard on the Statement of Net Assets.

19

U.S. Value Fund

Upon the request of Vanguard, the fund may invest up to 0.40% of its net assets as capital in Vanguard. At September 30, 2016, the fund had contributed to Vanguard capital in the amount of $106,000, representing 0.01% of the fund’s net assets and 0.04% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and employees, respectively, of Vanguard.

C. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

The following table summarizes the market value of the fund’s investments as of September 30, 2016, based on the inputs used to value them:

| Level 1 | Level 2 | Level 3 | |

| Investments | ($000) | ($000) | ($000) |

| Common Stocks | 1,367,449 | — | — |

| Temporary Cash Investments | 23,042 | 400 | — |

| Futures Contracts—Assets1 | 40 | — | — |

| Futures Contracts—Liabilities1 | (3) | — | — |

| Total | 1,390,528 | 400 | — |

| 1 Represents variation margin on the last day of the reporting period. |

D. At September 30, 2016, the aggregate settlement value of open futures contracts and the related unrealized appreciation (depreciation) were:

| ($000) | ||||

| Aggregate | ||||

| Number of | Settlement | Unrealized | ||

| Long (Short) | Value | Appreciation | ||

| Futures Contracts | Expiration | Contracts | Long (Short) | (Depreciation) |

| E-mini S&P 500 Index | December 2016 | 56 | 6,049 | 16 |

Unrealized appreciation (depreciation) on open futures contracts is required to be treated as realized gain (loss) for tax purposes.

E. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss are recognized in different periods for financial statement and tax purposes. These differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes.

20

U.S. Value Fund

The fund used a tax accounting practice to treat a portion of the price of capital shares redeemed during the year as distributions from net investment income and realized capital gains. Accordingly, the fund has reclassified $3,447,000 from undistributed net investment income, and $2,415,000 from accumulated net realized gains, to paid-in capital.

For tax purposes, at September 30, 2016, the fund had $21,845,000 of ordinary income and $20,894,000 of long-term capital gains available for distribution.

At September 30, 2016, the cost of investment securities for tax purposes was $1,241,840,000. Net unrealized appreciation of investment securities for tax purposes was $149,051,000, consisting of unrealized gains of $175,851,000 on securities that had risen in value since their purchase and $26,800,000 in unrealized losses on securities that had fallen in value since their purchase.

F. During the year ended September 30, 2016, the fund purchased $1,050,186,000 of investment securities and sold $993,559,000 of investment securities, other than temporary cash investments.

| G. Capital shares issued and redeemed were: | ||

| Year Ended September 30, | ||

| 2016 | 2015 | |

| Shares | Shares | |

| (000) | (000) | |

| Issued | 18,669 | 24,986 |

| Issued in Lieu of Cash Distributions | 4,339 | 1,064 |

| Redeemed | (17,113) | (18,195) |

| Net Increase (Decrease) in Shares Outstanding | 5,895 | 7,855 |

H. Management has determined that no material events or transactions occurred subsequent to September 30, 2016, that would require recognition or disclosure in these financial statements.

21

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Vanguard Malvern Funds and the Shareholders of Vanguard U.S. Value Fund:

In our opinion, the accompanying statement of net assets and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Vanguard U.S. Value Fund (constituting a separate portfolio of Vanguard Malvern Funds, hereafter referred to as the “Fund”) at September 30, 2016, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at September 30, 2016 by correspondence with the custodian and brokers and by agreement to the underlying ownership records of the transfer agent, provide a reasonable basis for our opinion.

/s/PricewaterhouseCoopers LLP

Philadelphia, Pennsylvania

November 10, 2016

Special 2016 tax information (unaudited) for Vanguard U.S. Value Fund

This information for the fiscal year ended September 30, 2016, is included pursuant to provisions of the Internal Revenue Code.

The fund distributed $51,216,000 as capital gain dividends (20% rate gain distributions) to shareholders during the fiscal year.

The fund distributed $26,754,000 of qualified dividend income to shareholders during the fiscal year.

For corporate shareholders, 81.8% of investment income (dividend income plus short-term gains, if any) qualifies for the dividends-received deduction.

22

Your Fund’s After-Tax Returns

This table presents returns for your fund both before and after taxes. The after-tax returns are shown in two ways: (1) assuming that an investor owned the fund during the entire period and paid taxes on the fund’s distributions, and (2) assuming that an investor paid taxes on the fund’s distributions and sold all shares at the end of each period.

Calculations are based on the highest individual federal income tax and capital gains tax rates in effect at the times of the distributions and the hypothetical sales. State and local taxes were not considered. After-tax returns reflect any qualified dividend income, using actual prior-year figures and estimates for 2016. (In the example, returns after the sale of fund shares may be higher than those assuming no sale. This occurs when the sale would have produced a capital loss. The calculation assumes that the investor received a tax deduction for the loss.)

Please note that your actual after-tax returns will depend on your tax situation and may differ from those shown. Also note that if you own the fund in a tax-deferred account, such as an individual retirement account or a 401(k) plan, this information does not apply to you. Such accounts are not subject to current taxes.

Finally, keep in mind that a fund’s performance—whether before or after taxes—does not guarantee future results.

| Average Annual Total Returns: U.S. Value Fund | |||

| Periods Ended September 30, 2016 | |||

| One | Five | Ten | |

| Year | Years | Years | |

| Returns Before Taxes | 11.09% | 16.64% | 5.85% |

| Returns After Taxes on Distributions | 9.56 | 15.96 | 5.05 |

| Returns After Taxes on Distributions and Sale of Fund Shares | 7.44 | 13.45 | 4.57 |

23

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The accompanying table illustrates your fund’s costs in two ways:

• Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The ”Ending Account Value“ shown is derived from the fund‘s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading ”Expenses Paid During Period.“

• Based on hypothetical 5% yearly return. This section is intended to help you compare your fund‘s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the fund for buying and selling securities. Further, the expenses do not include any purchase, redemption, or account service fees described in the fund prospectus. If such fees were applied to your account, your costs would be higher. Your fund does not carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the fund’s expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to your fund’s current prospectus.

24

| Six Months Ended September 30, 2016 | |||

| Beginning | Ending | Expenses | |

| Account Value | Account Value | Paid During | |

| U.S. Value Fund | 3/31/2016 | 9/30/2016 | Period |

| Based on Actual Fund Return | $1,000.00 | $1,060.23 | $1.18 |

| Based on Hypothetical 5% Yearly Return | 1,000.00 | 1,023.85 | 1.16 |

The calculations are based on expenses incurred in the most recent six-month period. The fund’s annualized six-month expense ratio for that period is 0.23%. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period, then divided by the number of days in the most recent 12-month period (183/366).

25

Glossary

30-Day SEC Yield. A fund’s 30-day SEC yield is derived using a formula specified by the U.S. Securities and Exchange Commission. Under the formula, data related to the fund’s security holdings in the previous 30 days are used to calculate the fund’s hypothetical net income for that period, which is then annualized and divided by the fund’s estimated average net assets over the calculation period. For the purposes of this calculation, a security’s income is based on its current market yield to maturity (for bonds), its actual income (for asset-backed securities), or its projected dividend yield (for stocks). Because the SEC yield represents hypothetical annualized income, it will differ—at times significantly—from the fund’s actual experience. As a result, the fund’s income distributions may be higher or lower than implied by the SEC yield.

Beta. A measure of the magnitude of a fund’s past share-price fluctuations in relation to the ups and downs of a given market index. The index is assigned a beta of 1.00. Compared with a given index, a fund with a beta of 1.20 typically would have seen its share price rise or fall by 12% when the index rose or fell by 10%. For this report, beta is based on returns over the past 36 months for both the fund and the index. Note that a fund’s beta should be reviewed in conjunction with its R-squared (see definition). The lower the R-squared, the less correlation there is between the fund and the index, and the less reliable beta is as an indicator of volatility.

Dividend Yield. Dividend income earned by stocks, expressed as a percentage of the aggregate market value (or of net asset value, for a fund). The yield is determined by dividing the amount of the annual dividends by the aggregate value (or net asset value) at the end of the period. For a fund, the dividend yield is based solely on stock holdings and does not include any income produced by other investments.

Earnings Growth Rate. The average annual rate of growth in earnings over the past five years for the stocks now in a fund.

Equity Exposure. A measure that reflects a fund’s investments in stocks and stock futures. Any holdings in short-term reserves are excluded.

Expense Ratio. A fund’s total annual operating expenses expressed as a percentage of the fund’s average net assets. The expense ratio includes management and administrative expenses, but does not include the transaction costs of buying and selling portfolio securities.

Foreign Holdings. The percentage of a fund represented by securities or depositary receipts of companies based outside the United States.

Inception Date. The date on which the assets of a fund (or one of its share classes) are first invested in accordance with the fund’s investment objective. For funds with a subscription period, the inception date is the day after that period ends. Investment performance is measured from the inception date.

Median Market Cap. An indicator of the size of companies in which a fund invests; the midpoint of market capitalization (market price x shares outstanding) of a fund’s stocks, weighted by the proportion of the fund’s assets invested in each stock. Stocks representing half of the fund’s assets have market capitalizations above the median, and the rest are below it.

Price/Book Ratio. The share price of a stock divided by its net worth, or book value, per share. For a fund, the weighted average price/book ratio of the stocks it holds.

26

Price/Earnings Ratio. The ratio of a stock’s current price to its per-share earnings over the past year. For a fund, the weighted average P/E of the stocks it holds. P/E is an indicator of market expectations about corporate prospects; the higher the P/E, the greater the expectations for a company’s future growth.

R-Squared. A measure of how much of a fund’s past returns can be explained by the returns from the market in general, as measured by a given index. If a fund’s total returns were precisely synchronized with an index’s returns, its R-squared would be 1.00. If the fund’s returns bore no relationship to the index’s returns, its R-squared would be 0. For this report, R-squared is based on returns over the past 36 months for both the fund and the index.

Return on Equity. The annual average rate of return generated by a company during the past five years for each dollar of shareholder’s equity (net income divided by shareholder’s equity). For a fund, the weighted average return on equity for the companies whose stocks it holds.

Short-Term Reserves. The percentage of a fund invested in highly liquid, short-term securities that can be readily converted to cash.

Turnover Rate. An indication of the fund’s trading activity. Funds with high turnover rates incur higher transaction costs and may be more likely to distribute capital gains (which may be taxable to investors). The turnover rate excludes in-kind transactions, which have minimal impact on costs.

27

The People Who Govern Your Fund

The trustees of your mutual fund are there to see that the fund is operated and managed in your best interests since, as a shareholder, you are a part owner of the fund. Your fund’s trustees also serve on the board of directors of The Vanguard Group, Inc., which is owned by the Vanguard funds and provides services to them on an at-cost basis.

A majority of Vanguard’s board members are independent, meaning that they have no affiliation with Vanguard or the funds they oversee, apart from the sizable personal investments they have made as private individuals. The independent board members have distinguished backgrounds in business, academia, and public service. Each of the trustees and executive officers oversees 198 Vanguard funds.

The following table provides information for each trustee and executive officer of the fund. The mailing address of the trustees and officers is P.O. Box 876, Valley Forge, PA 19482. More information about the trustees is in the Statement of Additional Information, which can be obtained, without charge, by contacting Vanguard at 800-662-7447, or online at vanguard.com.

InterestedTrustee1

F. William McNabb III

Born 1957. Trustee Since July 2009. Chairman of the Board. Principal Occupation(s) During the Past Five Years and Other Experience: Chairman of the Board of The Vanguard Group, Inc., and of each of the investment companies served by The Vanguard Group, since January 2010; Director of The Vanguard Group since 2008; Chief Executive Officer and President of The Vanguard Group, and of each of the investment companies served by The Vanguard Group, since 2008; Director of Vanguard Marketing Corporation; Managing Director of The Vanguard Group (1995–2008).

IndependentTrustees

Emerson U. Fullwood

Born 1948. Trustee Since January 2008. Principal Occupation(s) During the Past Five Years and Other Experience: Executive Chief Staff and Marketing Officer for North America and Corporate Vice President (retired 2008) of Xerox Corporation (document management products and services); Executive in Residence and 2009–2010 Distinguished Minett Professor at the Rochester Institute of Technology; Lead Director of SPX FLOW, Inc. (multi-industry manufacturing); Director of the United Way of Rochester, the University of Rochester Medical Center, Monroe Community College Foundation, North Carolina A&T University, and Roberts Wesleyan College.

Rajiv L. Gupta

Born 1945. Trustee Since December 2001.2 Principal Occupation(s) During the Past Five Years and Other Experience: Chairman and Chief Executive Officer (retired 2009) and President (2006–2008) of Rohm and Haas Co. (chemicals); Director of Tyco International plc (diversified manufacturing and services), HP Inc. (printer and personal computer manufacturing), and Delphi Automotive plc (automotive components); Senior Advisor at New Mountain Capital.

Amy Gutmann

Born 1949. Trustee Since June 2006. Principal Occupation(s) During the Past Five Years and Other Experience: President of the University of Pennsylvania; Christopher H. Browne Distinguished Professor of Political Science, School of Arts and Sciences, and Professor of Communication, Annenberg School for Communication, with secondary faculty appointments in the Department of Philosophy, School of Arts and Sciences, and at the Graduate School of Education, University of Pennsylvania; Trustee of the National Constitution Center; Chair of the Presidential Commission for the Study of Bioethical Issues.

JoAnn Heffernan Heisen

Born 1950. Trustee Since July 1998. Principal Occupation(s) During the Past Five Years and Other Experience: Corporate Vice President and Chief Global Diversity Officer (retired 2008) and Member of the Executive Committee (1997–2008) of Johnson & Johnson (pharmaceuticals/medical devices/consumer products); Director of Skytop Lodge Corporation (hotels) and the Robert Wood Johnson Foundation; Member of the Advisory Board of the Institute for Women’s Leadership at Rutgers University.

F. Joseph Loughrey

Born 1949. Trustee Since October 2009. Principal Occupation(s) During the Past Five Years and Other Experience: President and Chief Operating Officer (retired 2009) of Cummins Inc. (industrial machinery); Chairman of the Board of Hillenbrand, Inc. (specialized consumer services), and of Oxfam America; Director of SKF AB (industrial machinery), Hyster-Yale Materials Handling, Inc. (forklift trucks), the Lumina Foundation for Education, and the V Foundation for Cancer Research; Member of the Advisory Council for the College of Arts and Letters and of the Advisory Board to the Kellogg Institute for International Studies, both at the University of Notre Dame.

Mark Loughridge

Born 1953. Trustee Since March 2012. Principal Occupation(s) During the Past Five Years and Other Experience: Senior Vice President and Chief Financial Officer (retired 2013) at IBM (information technology services); Fiduciary Member of IBM’s Retirement Plan Committee (2004–2013); Director of the Dow Chemical Company; Member of the Council on Chicago Booth.

Scott C. Malpass

Born 1962. Trustee Since March 2012. Principal Occupation(s) During the Past Five Years and Other Experience: Chief Investment Officer and Vice President at the University of Notre Dame; Assistant Professor of Finance at the Mendoza College of Business at Notre Dame; Member of the Notre Dame 403(b) Investment Committee, the Board of Advisors for Spruceview Capital Partners, and the Investment Advisory Committee of Major League Baseball; Board Member of TIFF Advisory Services, Inc., and Catholic Investment Services, Inc. (investment advisors).

André F. Perold

Born 1952. Trustee Since December 2004. Principal Occupation(s) During the Past Five Years and Other Experience: George Gund Professor of Finance and Banking, Emeritus at the Harvard Business School (retired 2011); Chief Investment Officer and Managing Partner of HighVista Strategies LLC (private investment firm); Director of Rand Merchant Bank; Overseer of the Museum of Fine Arts Boston.

Peter F. Volanakis

Born 1955. Trustee Since July 2009. Principal Occupation(s) During the Past Five Years and Other Experience: President and Chief Operating Officer (retired 2010) of Corning Incorporated (communications equipment); Chairman of the Board of Trustees of Colby-Sawyer College; Member of the Advisory Board of the Norris Cotton Cancer Center.

Executive Officers

Glenn Booraem

Born 1967. Treasurer Since May 2015. Principal Occupation(s) During the Past Five Years and Other Experience: Principal of The Vanguard Group, Inc.; Treasurer of each of the investment companies served by The Vanguard Group; Controller of each of the investment companies served by The Vanguard Group (2010–2015); Assistant Controller of each of the investment companies served by The Vanguard Group (2001–2010).

Thomas J. Higgins

Born 1957. Chief Financial Officer Since September 2008. Principal Occupation(s) During the Past Five Years and Other Experience: Principal of The Vanguard Group, Inc.; Chief Financial Officer of each of the investment companies served by The Vanguard Group; Treasurer of each of the investment companies served by The Vanguard Group (1998–2008).

Peter Mahoney

Born 1974. Controller Since May 2015. Principal Occupation(s) During the Past Five Years and Other Experience: Head of Global Fund Accounting at The Vanguard Group, Inc.; Controller of each of the investment companies served by The Vanguard Group; Head of International Fund Services at The Vanguard Group (2008–2014).

Anne E. Robinson

Born 1970. Secretary Since September 2016. Principal Occupation(s) During the Past Five Years and Other Experience: Managing Director of The Vanguard Group, Inc.; General Counsel of The Vanguard Group; Secretary of The Vanguard Group and of each of the investment companies served by The Vanguard Group; Director and Senior Vice President of Vanguard Marketing Corporation; Managing Director and General Counsel of Global Cards and Consumer Services at Citigroup (2014–2016); Counsel at American Express (2003–2014).

Vanguard Senior Management Team

|

Mortimer J. Buckley Kathleen C. Gubanich Martha G. King John T. Marcante Chris D. McIsaac |

James M. Norris Thomas M. Rampulla Glenn W. Reed Karin A. Risi Michael Rollings |

Chairman Emeritus and Senior Advisor John J. Brennan

Chairman, 1996–2009

Chief Executive Officer and President, 1996–2008

Founder

John C. Bogle

Chairman and Chief Executive Officer, 1974–1996

1 Mr. McNabb is considered an “interested person,” as defined in the Investment Company Act of 1940, because he is an officer of the Vanguard funds.

2 December 2002 for Vanguard Equity Income Fund, the Vanguard Municipal Bond Funds, and the Vanguard State Tax-Exempt Funds.

| P.O. Box 2600 |

| Valley Forge, PA 19482-2600 |

Connect with Vanguard® > vanguard.com

| Fund Information > 800-662-7447 | CFA® is a registered trademark owned by CFA Institute. |

| Direct Investor Account Services > 800-662-2739 | |