Form 8-K Third Point Reinsurance For: Mar 02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): March 2, 2015 (March 2, 2015)

THIRD POINT REINSURANCE LTD.

(Exact name of registrant as specified in its charter)

| Bermuda | 001-36052 | 98-1039994 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

The Waterfront, Chesney House

96 Pitts Bay Road

Pembroke HM 08 Bermuda

(Address of principal executive offices and Zip Code)

Registrant’s telephone number, including area code: +1 441 542-3300

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 | Regulation FD Disclosure. |

Third Point Reinsurance Ltd. is hereby disclosing the information set forth in Exhibit 99.1 hereto, which is incorporated herein by reference. The information hereunder is not deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, is not otherwise subject to the liabilities of that section and is not incorporated by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except as shall be expressly set forth by specific reference in such a filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| Exhibit No. |

Description | |

| 99.1 | Regulation FD Information. | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: March 2, 2015 | /s/ Tonya L. Marshall |

|||||

| Name: | Tonya L. Marshall | |||||

| Title: | Executive Vice President, General Counsel and Secretary | |||||

EXHIBIT INDEX

| Exhibit No. |

Description | |

| 99.1 | Regulation FD Information. | |

Investor Presentation

MARCH 2015

Exhibit 99.1 |

For

Information Purposes Only CAUTIONARY STATEMENT REGARDING FORWARD-

LOOKING STATEMENTS

2

Certain statements and information in this presentation may constitute forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995. The words “believe,” “anticipate,” “plan,” “intend,” “foresee,” “guidance,” “potential,” “expect,” “should,” “will”

“continue,” “could,” “estimate,” “forecast,” “goal,”

“may,” “objective,” “predict,” “projection,” or similar expressions are intended to identify forward-

looking statements (including those contained in certain visual depictions) in this

presentation. These forward-looking statements reflect the Company’s current

expectations and/or beliefs concerning future events. The Company has made every reasonable effort to ensure that the

information, estimates, forecasts and assumptions on which these statements are based are current,

reasonable and complete. However, these forward-looking statements are subject to a

number of risks and uncertainties that may cause the Company’s actual performance to differ

materially from that projected in such statements. Although it is not possible to identify all

of these risks and factors, they include, among others, the following: (i) limited historical

information about the Company; (ii) operational structure currently is being developed; (iii) fluctuation in results of

operations; (iv) more established competitors; (v) losses exceeding reserves; (vi) downgrades or

withdrawal of ratings by rating agencies; (vii) dependence on key executives; (viii) dependence

on letter of credit facilities that may not be available on commercially acceptable terms; (ix)

potential inability to pay dividends; (x) inability to service indebtedness; (xi) limited cash flow

and liquidity due to indebtedness; (xii) unavailability of capital in the future; (xiii)

fluctuations in market price of the Company’s common shares; (xiv) dependence on clients' evaluations of risks

associated with such clients' insurance underwriting; (xv) suspension or revocation of reinsurance

license; (xvi) potentially being deemed an investment company under United States federal

securities law; (xvii) potential characterization of Third Point Re and/or Third Point Reinsurance

Company Ltd. as a PFIC; (xviii) dependence on Third Point LLC to implement the Company's investment

strategy; (xix) termination by Third Point LLC of the investment management agreements; (xx)

risks associated with the Company's investment strategy being greater than those faced by

competitors; (xxi) increased regulation or scrutiny of alternative investment advisors affecting the

Company's reputation; (xxii) the Company potentially becoming subject to United States federal

income taxation; (xxiii) the Company potentially becoming subject to United States withholding

and information reporting requirements under the FATCA provisions; and (xxiv) other risks and factors listed under “Risk Factors” in

the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and

other periodic and current disclosures filed with the U.S. Securities and Exchange Commission.

All forward-looking statements speak only as of the date made and the Company undertakes no

obligation to update or revise publicly any forward-looking statements, whether as a result of new

information, future events or otherwise. This presentation may also contain non-GAAP financial information. The Company’s

management uses this information in its internal analysis of results and believes that this

information may be informative to investors in gauging the quality of the Company’s financial performance, identifying

trends in our results and providing meaningful period-to-period comparisons. For

additional information regarding these non-GAAP measures, including any required

reconciliations to the most directly comparable financial measure calculated according to GAAP, see in the Appendix

section of this presentation.

|

For

Information Purposes Only OUR COMPANY

•

Specialty property & casualty reinsurer based in Bermuda

•

A-

(Excellent) financial strength rating from A.M. Best Company

•

Began operations in January 2012 and completed IPO in August 2013

•

Investment portfolio managed by Third Point LLC

•

Total return focused

–

Flexible and opportunistic reinsurance underwriting

–

Superior investment management

3 |

For

Information Purposes Only KEY METRICS

4

12 Months Ended

December 31, 2014

12 Months Ended

December 31, 2013

12 Months Ended

December 31, 2012

Diluted Book Value Per Share

$13.55

$13.12

$10.89

Shareholders’

Equity

$1.45 billion

$1.39 billion

$869 million

Return on Beginning

Shareholders’

Equity*

3.6%

23.4%

13.0%

Growth in Diluted Book Value

Per Share*

3.3%

20.5%

11.9%

Cumulative Growth in Diluted

Book Value Per Share from

December

31,

2011*

1

39.2%

34.8%

11.9%

1

Diluted Book Value Per Share as of December 31, 2011 = $9.73

* Non-GAAP measure; please see descriptions and reconciliations on slides 29

and 30 |

TOTAL

RETURN BUSINESS MODEL DESIGNED TO DELIVER SUPERIOR RETURNS

5

Exceptional Resources

Optimal Deployment

Outstanding Results

+

=

Experienced

Underwriting

Team

Superior

Investment

Management

Stable Capital

Base

Underwriting

Profit

Investment

Return on Float

Investment Return

on Capital

Opportunity for

Attractive Equity

Returns to

Shareholders

Over Time

For Information Purposes Only |

For

Information Purposes Only EXPERIENCED SENIOR MANAGEMENT TEAM

6

CEO

Experience

John Berger

Chairman & CEO

•

Strong business relationships

•

Expertise in writing all lines of

property, casualty & specialty

reinsurance

•

Track record of capitalizing

on market opportunities and

producing strong underwriting

results

•

Significant business-building

experience

•

CEO, Reinsurance, Vice Chairman of the Board,

Alterra Capital Holdings Limited

•

CEO & President, Harbor Point Re Limited

•

CEO & President, Chubb Re, Inc.

•

President, F&G Re

•

CEO, Aon Benfield Securities

•

President, Aon Benfield Americas

•

CEO, Benfield U.S. Inc. & CEO, Benfield

Advisory

•

Board Member, Benfield Group PLC

•

President & CEO, JRG Reinsurance Company

•

CUO & Head of Reins. Operations, Endurance

Reinsurance Corporation of America

•

EVP & CUO, AXA Corporate Solutions

Reinsurance Company

•

EVP, Co-Head of Specialty Lines, Aon Benfield

•

President & CEO, Stockton Reinsurance Ltd.

•

President, Center Re Bermuda

Robert Bredahl

President & COO

Tony Urban

EVP Underwriting

Dan Malloy

EVP Underwriting |

For

Information Purposes Only ORGANIZATIONAL STRUCTURE

7

Third Point Reinsurance Ltd.

(Holding Company)

Third Point Reinsurance

Company Ltd.

(Class 4 Insurer)

Third Point Reinsurance

Investment Management Ltd.

(Investment Manager)

Third Point Reinsurance

Opportunities Fund Ltd.

(Fund)

Third Point Re

Marketing (UK) Ltd.

(Marketing Company)

100%

100%

100% Common Shares

(Management Voting Non

Participating)

100%

53% of Common Shares

(Non Voting Participating)

Third Point Re Cat Ltd.

(Special Purpose Insurer)

100% Common Shares (Voting

Non Participating) & 100% Preferred

Shares (Non Voting Participating)

Third Point Re (UK)

Holdings Ltd.

(Intermediate Holding Company)

100%

Third Point Re (USA)

Holdings Inc.

(Intermediate Holding Company)

Third Point Reinsurance

(USA) Ltd.

(Class 4 Insurer)

100%

100% |

For

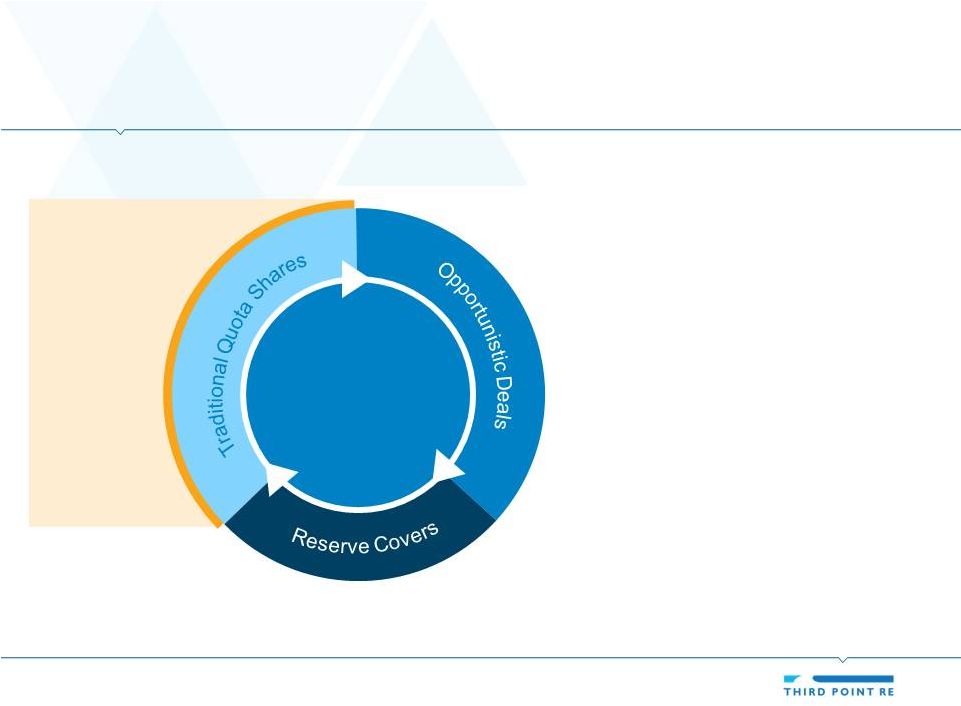

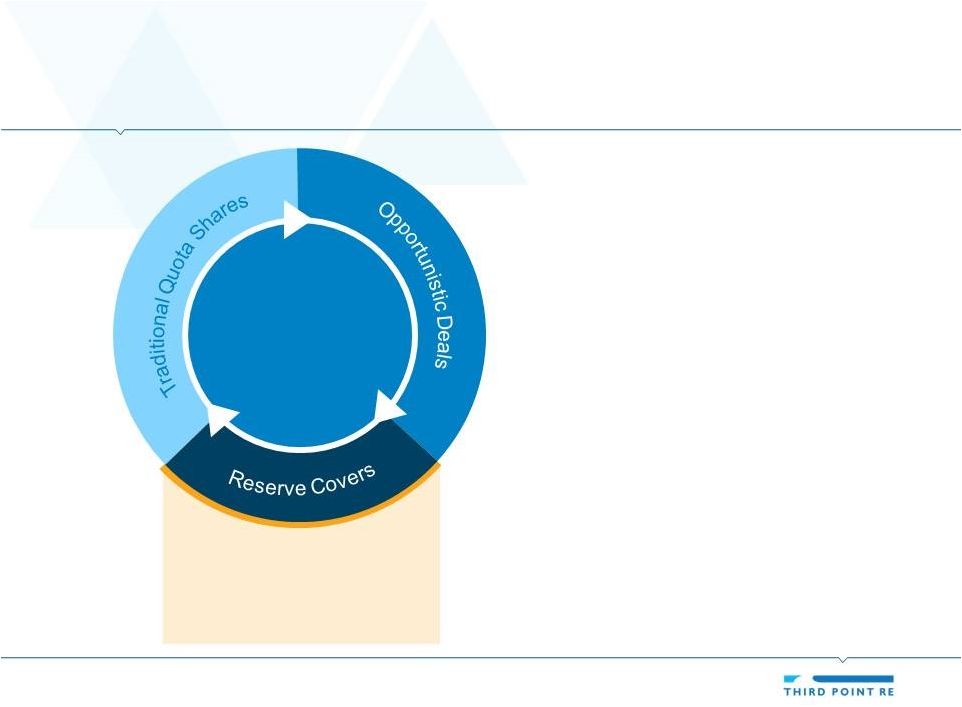

Information Purposes Only FLEXIBLE & OPPORTUNISTIC UNDERWRITING

STRATEGY 8

•

Our total return model provides

crucial flexibility in today’s

market environment

•

We leverage strong relationships

to access attractive opportunities

•

We are the lead underwriter on

most of our transactions

•

Limited property cat exposure on

rated balance sheet

For Information Purposes Only

Target Best

Opportunities |

For

Information Purposes Only TRADITIONAL QUOTA SHARES

9

•

We focus on lines of business

with lower volatility

•

We provide reinsurance

support to small and medium

size insurers seeking surplus

relief

•

These transactions are

typically relationship-driven,

since reinsurance plays such

a key role in the client’s

capital structure

•

Non-standard auto

•

Ex-wind homeowners

•

General liability

Target Best

Opportunities |

For

Information Purposes Only OPPORTUNISTIC DEALS

10

•

Our relationships allow us to

often be the first call for

many special situations

•

We look for dislocated

markets and distressed

situations where higher risk-

adjusted returns are

available

•

We manage our downside

exposure with structural

features and contract terms

& conditions

•

Regional workers’

compensation

•

Financial lines

•

Distressed situations

Target Best

Opportunities |

For

Information Purposes Only RESERVE COVERS

11

•

Reserve covers provide clients

with reinsurance protection,

capital relief and potentially

enhanced investment returns

•

Relationships are key –

decision-maker is typically the

client’s CEO or CFO

•

Our team has a reputation for

sophisticated structuring to meet

each client’s specific needs

•

Bermuda reinsurers

•

Lloyds Syndicates

•

US Insurers

•

Captives

Target Best

Opportunities |

DIVERSIFIED PREMIUM BASE

12

Traditional

Quota Shares

(49)

Reserve

Covers (7)

Opportunistic

Deals (44)

Property QS

(23)

Auto (24)

Workers

Comp (16)

Multi-Line

(22)

Agriculture (6)

Financial

Lines (4)

General

Liability (5)

Gross

Premium

Written

Since

Inception

1

by

Type of Transaction

(Percent)

Gross

Premium

Written

Since

Inception

1

by

Line of Business

(Percent)

1

As of 12/31/14

Note: All figures are for P&C Segment only

For Information Purposes Only |

For

Information Purposes Only REINSURANCE RISK MANAGEMENT

13

•

Reinsurance business plan complements our investment management

strategy: no property catastrophe excess treaties on rated balance sheet and

premium and reserve leverage lower than peer group

•

Company-wide focus on risk management

•

Robust underwriting and operational controls

Risk

Management

Culture

Holistic Risk

Control

Framework

•

Measure use of risk capital using internally-developed capital model, AM

Best BCAR model and Bermuda Monetary Authority BSCR model

•

Developed a comprehensive Risk Register that is appropriate for our business

model

•

Instituted a Risk Appetite Statement that governs overall sensitivities in

underwriting, investment, and enterprise portfolio

Ongoing

Risk

Oversight

•

Own Risk Self Assessment (ORSA) report produced quarterly and provided to

management / Board of Directors

•

Provides management with meaningful statistics on our current capital

requirement and comparisons to our risk appetite statement

•

Growing in scope |

For

Information Purposes Only REINSURANCE RISK MANAGEMENT (CONT’D)

14

•

Low premium leverage and

asset leverage compared to

peer group

•

Limited legacy reserves

mitigate the risk of adverse

reserve development

•

Catastrophe risk is largely

limited to our $59.5 million

investment in our catastrophe

fund

1

Bermuda Reinsurer Leverage Metrics

(Percent)

Premium to Equity

TPRE

Source:

Dowling

&

Co;

As

of

12/31/2014;

“Premium

to

Equity”

=

Trailing

12

months’

net

premium

written

divided

by

shareholders’

equity;

“Invested

Assets

to

Equity”

=

Invested

assets

and

cash

divided

by

shareholders’

equity;

Peer

group = ACGL, AGII, AWH, AXS, PTP, RE, XL, AHL, ENH, GLRE, MRH, PRE, RNR, VR

1

As of December 31, 2014; In January 2015, we received $21.1 million from a partial

redemption of our investment 100

150

200

250

300

350

20

40

60

80

100 |

For

Information Purposes Only REINSURANCE OPERATIONS

15

•

Strong pipeline

•

Combined ratio trending lower as we gain scale

•

Continue to expand our underwriting platform

U.K. marketing office

Physical presence in the U.S.

Opportunistically hire experienced underwriters |

For

Information Purposes Only NEW U.S. PLATFORM

•

U.S. onshore presence a key component of overall growth strategy

–

Strengthen relationships with U.S. cedents and brokers

–

Develop first-hand knowledge of cedent underwriting and

claims capabilities

•

Structure optimized for our investment strategy: Third Point

Reinsurance (USA) Ltd. is a Bermuda-domiciled reinsurer that will

apply for a 953D U.S. federal tax election

–

Assets can be invested in a separate account managed by

Third Point LLC

–

U.S. activity is permitted, including a new office in New Jersey

•

Strong financial support from Third Point Re group

–

Senior unsecured notes benefit from a full guarantee from

Third Point Reinsurance Ltd.

–

75% quota share with Third Point Reinsurance Company Ltd.

–

Net worth maintenance agreement with Third Point

Reinsurance Ltd. ($250m minimum surplus)

16

Thomas Wafer

•

Chairman Reinsurance, Alterra Capital

•

CEO Reinsurance, Alterra Capital & President,

Alterra Re USA

•

President, Harbor Point Re U.S.

•

MD International Underwriting, Harbor Point Re

•

MD International Underwriting, Chubb Re

Jonathan Norton

•

Chief Actuary, Alterra Re USA

•

Chief Actuary, Harbor Point Re

•

Chief Actuary, Chubb Re

•

Managing Director, Guy Carpenter

New Hires to Help Establish & Manage

U.S. Operations |

MARKET-LEADING INVESTMENT MANAGEMENT

17

•

Third Point LLC owned and

led by Daniel S. Loeb

•

20.6% net annualized

returns since inception in

1995

5

•

Risk-adjusted returns driven

by superior security

selection and lower volatility

Illustrative

Net

Return

1

Since

Inception

2,3,4

($ Thousands)

Third Point Partners LP

HFRI Event-Driven (Total) Index

DJ CS HFI Event Driven Index

S&P 500 (TR)

For Information Purposes Only

1

For Third Point Partners L.P. after fees, expenses and incentive allocation; 2 Past performance is not

necessarily indicative of future results; all investments involve risk including the loss of principal; 3 The historical performance of Third Point Partners L.P. (i) for the years 2001 through Dec

31, 2014 reflects the total return after incentive allocation for each such year as included in the

audited statement of financial condition of Third Point Partners L.P. for those years and (ii) for the years 1995 through 2000 reflects the total return after incentive allocation for each such year as

reported by Third Point Partners L.P. Total return after incentive allocation for the years 2001

through Dec 31, 2014 is based on the net asset value for all limited partners of Third Point Partners L.P. taken as a whole, some of whom pay no incentive allocation or management fees, whereas

total return after incentive allocation for the years 1995 through 2000 is based on the net asset value

for only those limited partners of Third Point Partners L.P. that paid incentive allocation and management fees. In each case, results are presented net of management fees, brokerage

commissions, administrative expenses, and accrued performance allocation, if any, and include the

reinvestment of all dividends, interest, and capital gains; 4 The illustrative return is calculated as a theoretical investment of $1,000 in Third Point Partners, L.P. at inception relative to the same

theoretical investment in two hedge fund indices designed to track performance of certain

“event-driven” hedge funds over the same period of time. All references to the Dow Jones Credit Suisse HFI Event Driven Index (“DJ-CS HFI”) and HFRI Event-Driven Total Index (“HFRI”) reflect

performance calculated through Dec 31, 2014. The DJ-CS HFI is an asset-weighted index and

includes only funds, as opposed to separate accounts. The DJ-CS HFI uses the Dow Jones Credit Suisse database and consists only of event driven funds deemed to be “event-driven” by the index

and that have a minimum of $50 million in assets under management, a minimum of a 12-month track

record, and audited financial statements. The HFRI consists only of event driven funds with a minimum of $50 million in assets under management or a minimum of a 12-month track record.

Both indices state that returns are reported net of all fees and expenses. While Third Point Partners

L.P. has been compared here with the performance of well-known and widely recognized indices, the indices have not been selected to represent an appropriate benchmark for Third Point

Partners L.P., whose holdings, performance and volatility may differ significantly from the securities

that comprise the indices; 5 From formation of Third Point Partners L.P. in June 1995 through Dec 31, 2014. |

For

Information Purposes Only RELATIONSHIP WITH THIRD POINT LLC

18

•

Exclusive relationship through 2016, followed by successive 3-year terms on

renewal

•

Investments are managed on substantially the same basis as the main Third

Point LLC hedge funds

•

We pay the standard 2% management fee and 20% performance allocation.

The performance allocation is subject to a standard high water mark

Investment

Management

Agreement

Risk

Management

•

Restrictions on leverage, position concentrations and illiquid, private

investments

•

Key man and performance termination provisions

•

Allowed to diversify portfolio to address concerns of A.M. Best or regulator

Liquidity

•

of investment portfolio to provide liquidity for claims and expenses

•

More than 95% of investments are within FAS 157 Levels 1 & 2

1

•

Separate account may be used at any time to pay claims and expenses

1

As of December 31, 2014

Investments are held in a separate account – Third Point Re has full ownership |

THIRD POINT LLC PORTFOLIO RISK MANAGEMENT

19

•

Portfolio diversification across industries,

geographies, asset classes and strategies

•

Highly

liquid

portfolio

–

investment

manager

can dynamically shift exposures depending

on macro/market developments

•

Security selection with extensive diligence

process

•

Approach includes index and macro

hedging and tail risk protection

•

Institutional platform with robust investment

and operational risk management

procedures

For Information Purposes Only |

For

Information Purposes Only STRONG CAPITAL BASE

20

1

As of 12/31/2014; Amounts for AM Best and BMA estimated by TPRE based on the most

recent models provided by these entities

2014

Capital

Requirements

1

($ Millions)

Available Capital

Required Capital

A.M.Best

BCAR

BMA Solvency

Requirement

TPRE Internal

Capital Model

0

500

1000

1500

•

Publicly-traded capital base

•

Significant capacity to support

growth

•

Unlike many other reinsurers,

our excess underwriting

capital is not a drag on ROE |

For

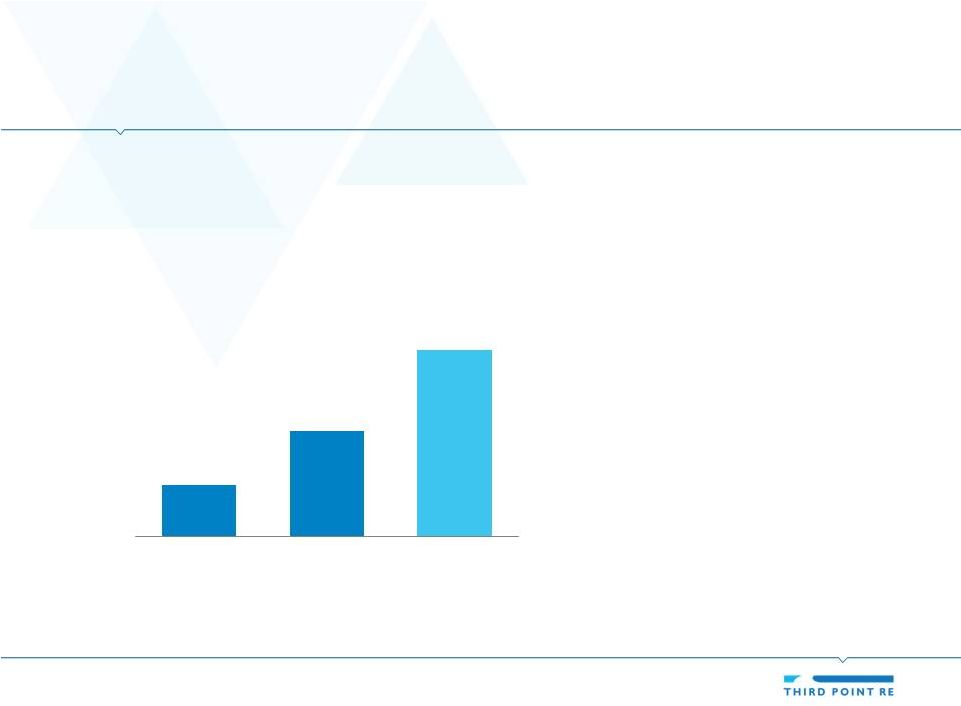

Information Purposes Only STRONG PREMIUM GROWTH

21

•

Robust growth since

inception

•

Broad range of lines of

business and distribution

sources (brokers)

•

Management views the

company’s pipeline of

opportunities as strong

Total Gross Written Premium

($ Millions)

190

402

613

0

250

500

750

2012

2013

2014 |

For

Information Purposes Only STEADY PROGRESS TOWARDS COMBINED RATIO <

100% 22

•

Combined ratio is improving

in-line with projections as

reinsurance operation gains

scale

•

We anticipate further

improvement in our

combined ratio as additional

premium is earned over the

next few quarters

•

Combined ratio for Q4 14

was 100.2%

P&C Segment Combined Ratio

(Percent)

129.7

107.5

102.2

80

100

120

140

2012

2013

2014 |

For

Information Purposes Only SIGNIFICANT FLOAT GENERATION

23

•

Float = premium held until

claims must be paid

•

If the underlying reinsurance

risk is attractive, generating

float allows a reinsurer to

access investment “leverage”

at low or no cost

•

Certain lines of business

provide reinsurers with float

for several years

Float As A Percentage of Total Shareholders’

Equity

(Percent)

Float: 12/31/2012 = $63.9 million; 12/31/2013 = $214.9 million; 12/31/2014 =

$389.2million 6.9

14.2

25.1

0

5

10

15

20

25

30

2012

2013

2014 |

For

Information Purposes Only ATTRACTIVE RETURNS SINCE INCEPTION

24

Return

on

Beginning

Shareholders’

Equity

1

(Percent)

•

Returns have been

attractive, even through the

start-up phase

•

We are reaching scale in

the underwriting operation

•

We believe that we are

well-positioned to out-

perform in a challenging

market environment

1

Non-GAAP measure; please see descriptions and reconciliations on slides 29 and

30 13.0

23.4

3.6

Average

= 13.3%

0

5

10

15

20

25

2012

2013

2014 |

For

Information Purposes Only TOTAL RETURN BUSINESS MODEL DESIGNED TO DELIVER

SUPERIOR RETURNS

25

Opportunity for

Attractive Equity

Returns to

Shareholders

Over Time

Experienced

Underwriting

Team

Superior

Investment

Management

Stable Capital

Base

Underwriting

Profit

Investment

Return on Float

Investment Return

on Capital

Exceptional Resources

Optimal Deployment

Outstanding Results

+

= |

For

Information Purposes Only 26

APPENDIX |

For

Information Purposes Only KEY FINANCIAL HIGHLIGHTS

27

Year ended

12/31/14

Year ended

12/31/13

Year ended

12/31/12

Gross premiums written

$613,300

$401,937

$190,374

Gross premiums ceded

(150)

(9,975)

-

Net premiums earned

444,532

220,667

96,481

Net investment income¹

85,582

258,125

136,868

Total revenues

$530,114

$478,792

$233,349

Loss and loss adjustment expenses incurred, net

283,147

139,812

80,306

Acquisition costs, net

137,206

67,944

24,604

General and administrative expenses

40,008

33,036

27,376

Other expenses¹

7,395

4,922

446

Total expenses

$467,756

$245,714

$132,732

Income before income tax expense

62,358

233,078

100,617

Income tax expense

(5,648)

-

-

Income including non-controlling interests

56,710

233,078

100,617

Income attributable to non-controlling interests

(6,315)

(5,767)

(1,216)

Net income

$50,395

$227,311

$99,401

Year ended

12/31/14

Year ended

12/31/13

Year ended

12/31/12

Loss ratio

3

65.5%

65.7%

83.2%

Acquisition cost ratio

4

31.5%

31.5%

25.5%

General and administrative expense ratio

5

5.2%

10.3%

21.0%

Combined ratio

6

102.2%

107.5%

129.7%

Net investment return

7

5.1%

23.9%

17.7%

Consolidated Income Statement ($000s)

Selected Income Statement Ratios

2

Generated $1.206 billion of

gross premiums written from

inception to date.

Gross premium written in the

Property and Casualty Segment

increased by 106.7% in 2013

and by 52.8% in 2014.

Combined ratio continued to

improve to 100.2% in the fourth

quarter of 2014 as we gained

scale.

Strong investment returns from

investments managed by Third

Point LLC of 17.7% in 2012,

23.9% in 2013, and 5.1% in

2014.

Highlights

1 Prior to 2014, changes in estimated fair value of embedded derivatives were recorded in net

investment income. As these embedded derivatives have become more prominent, the presentation has been modified and changes in the estimated fair value of embedded derivatives

are now recorded in other expenses in the consolidated statements of income. In addition, fixed

interest crediting features on these contracts that were recorded in net investment income are now classified in other expenses in the condensed consolidated statements of income.

2 Underwriting ratios are for the property and casualty reinsurance segment only; 3 Loss ratio

is calculated by dividing loss and loss adjustment expenses incurred, net, by net premiums earned; 4 Acquisition cost ratio is calculated by dividing acquisition costs, net by net premiums

earned; 5 General and administrative expense ratio is calculated by dividing general and

administrative expenses related to underwriting activities by net premiums earned; 6 Combined ratio is calculated by dividing the sum of loss and loss adjustment expenses incurred, net,

acquisition costs, net and general and administrative expenses related to underwriting

activities by net premiums earned; 7 Net investment return represents the return on our investments managed by Third Point LLC, net of fees.

|

For

Information Purposes Only KEY FINANCIAL HIGHLIGHTS (CONT’D)

28

As of 12/31/14

As of 12/31/13

As of 12/31/12

Total assets

$2,582,580

$2,159,890

$1,402,017

Total liabilities

1,300,532

649,494

473,696

Total shareholders’

equity

$1,552,048

$1,510,396

$928,321

Non-controlling interests

(100,135)

(118,735)

(59,777)

Shareholders' equity attributable to shareholders

$1,451,913

$1,391,661

$868,544

Year ended

12/31/14

Year ended

12/31/13

Year ended

12/31/12

Diluted book value per share*

$13.55

$13.12

$10.89

Growth in diluted book value per share*

3.3%

20.5%

11.9%

Return on beginning shareholders’

equity*

3.6%

23.4%

13.0%

Selected Balance Sheet Data ($000s)

Selected Balance Sheet Metrics

* Non-GAAP measure; please see descriptions and reconciliations on slides 29

and 30 As of 12/31/14

As of 12/31/13

As of 12/31/12

Total investments managed by Third Point LLC

$1,802,183

$1,559,442

$925,453

Investments ($000s) |

For

Information Purposes Only

NON-GAAP MEASURES

29

As of 12/31/14

As of 12/31/13

As of 12/31/12

Basic and diluted book value per share numerator:

Total shareholders’

equity

$1,552,048

$1,510,396

$928,321

Less: Non-controlling interests

(100,135)

(118,735)

(59,777)

Shareholders’

equity attributable to shareholders

$1,451,913

$1,391,661

$868,544

Effect of dilutive warrants issued to founders and an advisor

46,512

46,512

36,480

Effect of dilutive share options issued to directors and employees

61,705

101,274

51,670

Diluted book value per share numerator

$1,560,130

$1,539,447

$956,694

Basic and diluted book value per share denominator:

Issued and outstanding shares

103,397,542

103,264,616

78,432,132

Effect of dilutive warrants issued to founders and an advisor

4,651,163

4,651,163

3,648,006

Effect of dilutive share options issued to directors and employees

6,151,903

8,784,861

5,167,045

Effect of dilutive restricted shares issued to directors and employees

922,610

657,156

619,300

Diluted book value per share denominator

115,123,218

117,357,796

87,866,483

Basic book value per share

$14.04

$13.48

$11.07

Diluted book value per share

$13.55

$13.12

$10.89

($000s, Except Share and Per Share Amounts)

Book value per share

Book value per share as used by our management is a non-GAAP measure, as it is calculated

after deducting the impact of non-controlling interests. Book value per share is

calculated by dividing shareholders’ equity attributable to shareholders, adjusted for subscriptions

receivable, by the number of issued and outstanding shares at period end. In addition, diluted

book value per share is also a non-GAAP measure and represents book value per share

combined with the impact from dilution of all in-the-money share options issued, warrants and

unvested restricted shares outstanding as of any period end. We believe that long-term

growth in diluted book value per share is the most important measure of our financial

performance because it allows our management and investors to track over time the value created by the

retention of earnings. In addition, we believe this metric is used by investors because it

provides a basis for comparison with other companies in our industry that also report a

similar measure. The following table sets forth the computation of basic and diluted book value

per share as of December 31, 2014, December 31, 2013 and 2012: |

For Information Purposes

Only NON-GAAP MEASURES

(CONT’D) 30

Return

on

beginning

shareholders’

equity

($000s)

Insurance float

Calculated

by

taking

the

change

in

diluted

book

value

per

share

divided

by

the

beginning

of

period

diluted

book

value

per

share.

We

believe that long-term growth in the diluted book value per share is the most important measure of

our financial performance because it allows

our

management

and

investors

to

track

over

time

the

value

created

by

the

retention

of

earnings.

In

addition,

we

believe

that

this

metric is used by investors because it provides a basis for comparison with other companies in our

industry that also report a similar measure.

December 31, 2014

December 31, 2013

December 31, 2012

Net income

50,395

$

227,311

$

99,401

$

Shareholders' equity attributable to shareholders -beginning of period

1,391,661

868,544

585,425

Subscriptions receivable

-

-

177,507

Impact of weighting related to shareholders' equity from IPO

-

104,502

-

Adjusted shareholders' equity attributable to shareholders - beginning of

period 1,391,661

$

973,046

762,932

Return on beginning shareholders' equity

3.6%

23.4%

13.0%

For the years ended

Calculated by dividing net income by the beginning shareholders’ equity attributable to

shareholders. For purposes of determining December 31, 2011 shareholders’ equity

attributable to shareholders, we add back the impact of subscriptions receivable to shareholders’ equity attributable

to shareholders. For the year ended December 31, 2013 and December 31, 2014, we have also

adjusted the beginning shareholders’ equity for the impact of the issuance of

shares in our IPO on a weighted average basis. This adjustment lowers the stated return on beginning shareholders’

equity attributable to shareholders. We believe this metric is used by investors to supplement

measures of our profitability. Growth

in diluted book value per share In an insurance or reinsurance

operation, float arises because premiums and proceeds associated with deposit accounted reinsurance contracts are

collected before losses are paid. In some instances, the interval between premium receipts and

loss payments can extend over many years. During this time interval, insurance and

reinsurance companies invest the premiums received and seek to generate investment returns. Although float can be

calculated using numbers determined under U.S. GAAP, float is a non-GAAP financial measure

and, therefore, there is no comparable U.S. GAAP measure. We believe that net

investment income generated on float is an important consideration in evaluating the overall contribution of our property

and casualty reinsurance operation to our consolidated results. It is also explicitly

considered as part of the evaluation of management’s performance for the purposes

of incentive compensation. |

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

Third Point LLCSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share