Form 8-K STOCK BUILDING SUPPLY For: Jun 03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): June 3, 2015

STOCK BUILDING SUPPLY HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 1-36050 | 26-4687975 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

8020 Arco Corporate Drive, Suite 400

Raleigh, North Carolina 27617

(Address of principal executive offices) (Zip Code)

(919) 431-1000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| ITEM 7.01. | Regulation FD Disclosure. |

On June 3, 2015, Stock Building Supply Holdings, Inc., a Delaware corporation (the “Company”), and Building Materials Holding Corporation, a Delaware corporation (“BMC”), issued a joint press release announcing the execution of an Agreement and Plan of Merger (the “Merger Agreement”), dated June 2, 2015, between the Company and BMC. Pursuant to the Merger Agreement, subject to certain conditions, BMC will be merged with and into the Company, with the Company surviving the merger (the “Merger”). A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

In addition, on June 3, 2015, the Company provided supplemental information regarding the Merger in connection with a presentation to analysts and investors. A copy of the presentation is attached hereto as Exhibit 99.2 and incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the information in this Item 7.01, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information in this Item 7.01 shall not be incorporated by reference into any filing or other document pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing or document.

FORWARD-LOOKING STATEMENTS

This document contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are typically identified by words or phrases such as “may,” “might,” “predict,” “future,” “seek to,” “assume,” “goal,” “objective,” “continue,” “will,” “could,” “should,” “would,” “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “target,” “prospects,” “potential” and “forecast,” or the negative of such terms and other words, terms and phrases of similar meaning. Forward-looking statements involve estimates, expectations, projections, goals, forecasts, assumptions, risks and uncertainties. The Company cautions readers that any forward-looking statement is not a guarantee of future performance and that actual results could differ materially from those contained in the forward-looking statement. Such forward-looking statements include, but are not limited to, statements about the benefits of the Merger involving BMC and the Company, including future financial and operating results, the Company’s or BMC’s plans, objectives, expectations and intentions, the expected timing of completion of the transaction, and other statements that are not historical facts. There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements included in this communication. Important factors that could cause actual results to differ materially from those indicated by such forward-looking statements include risks and uncertainties relating to: the ability to obtain the requisite BMC and the Company shareholder approvals; the risk that the Company or BMC may be unable to obtain governmental and regulatory approvals required for the Merger, or required governmental and regulatory approvals may delay the Merger or result in the imposition of conditions that could cause the parties to abandon the Merger; the risk that a condition to closing of the Merger may not be satisfied; the timing to consummate the Merger; the risk that the businesses will not be integrated successfully; the risk that the cost savings and any other synergies from the transaction may not be fully realized or may take longer to realize than expected; disruption from the transaction making it more difficult to maintain relationships with customers, employees or suppliers; the diversion of management time on Merger-related issues; general worldwide economic conditions and related uncertainties; the effect of changes in governmental regulations; and other factors discussed or referred to in the “Risk Factors” section of the Company’s most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on March 2, 2015, and our subsequent filings with the SEC. These risk factors, as well as other risks associated with the Merger, will be more fully discussed in the Registration Statement and the Proxy /Consent Solicitation Statement/Prospectus (as defined below). All such factors are difficult to predict and are beyond the Company and BMC’s control. All forward-looking statements attributable to the Company or persons acting on the Company’s behalf are expressly qualified in their entirety by the foregoing cautionary statements. All such statements speak only as of the date made, and the Company and BMC undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

NO OFFER OR SOLICITATION

The information in this communication is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the proposed transactions or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

The proposed transaction involving the Company and BMC will be submitted to the respective stockholders of the Company and BMC for their consideration. In connection with the Merger and special meeting of the Company’s stockholders, the Company expects to file with the SEC a registration statement on Form S-4 (the “Registration Statement”) that will include a proxy statement/consent solicitation/prospectus (the “Proxy/Consent Solicitation Statement/Prospectus”). The definitive Registration Statement and the Proxy/Consent Solicitation Statement/Prospectus will contain important information about the Merger, the Merger Agreement and related matters. This communication may be deemed to be solicitation material in respect of the proposed transaction between BMC and the Company. This communication is not a substitute for the Registration Statement, Proxy/Consent Solicitation/Prospectus or any other documents that the Company or BMC may file with the SEC or send to shareholders in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF THE COMPANY AND BMC ARE URGED AND ADVISED TO READ THE REGISTRATION STATEMENT AND THE PROXY/CONSENT SOLICITATION STATEMENT/PROSPECTUS CAREFULLY WHEN THEY BECOME AVAILABLE, AS WELL AS ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC AND ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. The Registration Statement, the Proxy /Consent Solicitation Statement/Prospectus and any other documents filed or furnished by the Company with the SEC may be obtained free of charge at the SEC’s website (www.sec.gov). The Registration Statement, the Proxy/Consent Solicitation Statement/Prospectus and other relevant documents will also be available to security holders, without charge, from the Company by going to its investor relations page on its corporate website at http://ir.stocksupply.com or from BMC by directing a request to Paul Street, Corporate Secretary of BMC, via email or telephone ([email protected], (208) 331-4300.

PARTICIPANTS IN THE SOLICITATION

The Company, BMC, their respective directors and certain of their executive officers and employees may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of the Company is set forth in the proxy statement for the Company’s 2015 Annual Meeting of Stockholders, which was filed with the SEC on April 30, 2015. Information about the directors and executive officers of BMC and more detailed information regarding the identity of all potential participants, and their direct and indirect interests, by security holdings or otherwise, will be set forth in the Registration Statement and the Proxy/Consent Solicitation Statement/Prospectus. Investors may obtain additional information regarding the interests of such participants by reading the Registration Statement and the Proxy/Consent Solicitation Statement/Prospectus when they become available. You may obtain a free copy of the proxy statement for the Company’s 2015 Annual Meeting of Stockholders by going to its investor relations page on its corporate website at http://ir.stocksupply.com. You may obtain free copies of the Registration Statement, the Proxy/Consent Solicitation Statement/Prospectus and other relevant documents as described in the preceding paragraph.

| ITEM 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit |

Description of Exhibit | |

| 99.1 | Press Release, dated June 3, 2015 | |

| 99.2 | Investor Presentation, dated June 3, 2015 | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: June 3, 2015

| STOCK BUILDING SUPPLY HOLDINGS, INC. | ||

| By: | /s/ C. Lowell Ball | |

| Name: | C. Lowell Ball | |

| Title: | Senior Vice President, General Counsel and Corporate Secretary | |

EXHIBIT INDEX

| Exhibit |

Description of Exhibit | |

| 99.1 | Press Release, dated June 3, 2015 | |

| 99.2 | Investor Presentation, dated June 3, 2015 | |

Exhibit 99.1

|

|

Stock Building Supply Holdings, Inc. and Building Materials Holding Corporation Announce Merger Creating Premier Building Materials Distribution Services and Solutions Company

Complementary Businesses Will Create Stronger, More Efficient Competitor Able to Accelerate Profitable Growth

Combination Enhances Geographic Reach in Key Growth Markets Across the United States and Expands Product and Service Offerings

Transaction Expected to Result in Annual Synergies of $30 to $40 Million and to Be Accretive to Stock Building Supply’s Earnings per Share in the First Year Following Closing

RALEIGH, NC and ATLANTA, GA, June 3, 2015 – Stock Building Supply Holdings, Inc. (NASDAQ: STCK) (“Stock Building Supply”) and Building Materials Holding Corporation (“BMC”), two leading building materials and solutions providers to professional contractors, today announced the signing of a definitive merger agreement under which the two companies will combine in an all-stock transaction. The combined company is expected to have an implied pro forma enterprise value of $1.5 billion based on Stock Building Supply’s closing price on June 2nd.

The transaction will create a premier provider of lumber, diversified building products and construction services with over $2.7 billion in pro forma 2014 revenues and enhanced product and service offerings. The combined company will have expanded geographic reach in attractive, fast-growing regions across the United States, innovative technology capabilities and deep industry expertise to drive profitable growth and provide leading customer service.

Among the numerous benefits the combined company is expected to bring to all stakeholders include:

| • | An enhanced growth, margin and return profile. |

| • | A strong balance sheet and significant cash flow to support long-term strategic growth in a highly fragmented industry. |

| • | Significant and achievable synergy potential rising to $30 - $40 million annually within two years. |

| • | An expanded footprint from 21 to 42 metropolitan areas, principally in the fast-growing South and West regions. |

| • | A shared deep commitment to providing solutions to customers while delivering a broad range of quality products and services. |

| 1

|

|

| • | Projected accretion to Stock Building Supply’s earnings per share in the first full year following close of the transaction. |

“We expect this compelling strategic merger will provide significant benefits for customers, shareholders, suppliers and associates of both companies,” said Jeff Rea, President and Chief Executive Officer of Stock Building Supply. “The continuing recovery of the U.S. housing market is expected to generate strong demand for building materials, services and solutions, and together we believe BMC and Stock Building Supply are better positioned to capitalize on this opportunity. Upon close of this transaction, I look forward to continuing on our board to support the combined company and have great faith in the combined leadership team’s ability to create significant shareholder value by accelerating the implementation of our common strategies.”

Peter Alexander, BMC’s Chief Executive Officer, said, “We are very pleased to be uniting two leading companies with complementary strategies, products and services; a shared commitment to superior customer experiences; strong internal performance-based cultures and operations in high-demand geographies. The combination of our two highly complementary platforms will enhance our ability to provide customers with best-in-class products and services across an expanded geographic footprint. We have great respect for what the team at Stock Building Supply has accomplished and upon close of this transaction, I look forward to leading the combined team as we enter the next exciting phase of our transition and the ability to fund our growth.”

Transaction Terms

Under the terms of the agreement, which has been unanimously approved by the Board of Directors of both companies, BMC shareholders will receive 0.5231 newly issued Stock Building Supply shares for each BMC share. Upon the closing of the transaction, BMC shareholders will own approximately 60% of the merged entity, with Stock Building Supply shareholders owning approximately 40%. The transaction is structured to be tax-free to the shareholders of both companies, and is expected to close in the fourth quarter of 2015, subject to approval by both Stock Building Supply and BMC shareholders and typical regulatory clearances.

Funds affiliated with Davidson Kempner Capital Management LP, Ravenswood Investment Management and MFP Partners, L.P., which collectively own approximately 52% of BMC’s outstanding common stock, and funds affiliated with Gores, Stock Building Supply’s largest shareholder, which own approximately 38% of Stock Building Supply’s outstanding common stock, have each agreed to vote in favor of and fully support the transaction.

Proven Leadership Team

Upon closing of the transaction, BMC Chief Executive Officer Peter Alexander will serve as Chief Executive Officer of the combined company and will be a member of the Board of

| 2

|

|

Directors. Jeff Rea, the current Stock Building Supply President and Chief Executive Officer, will remain a member of the Board of Directors of the company. The new leadership team is expected to include representatives of both companies, with current Stock Building Supply Executive Vice President and Chief Financial Officer Jim Major assuming the role of Chief Financial Officer, Stock Building Supply Executive Vice President and Chief Operating Officer Bryan Yeazel assuming the position of Chief Administrative Officer and General Counsel and current BMC Chief Integration Leader Tony Genito leading the integration of the two businesses. In addition to Mr. Alexander and Mr. Rea, the remainder of the combined company’s Board of Directors will be comprised wholly of independent directors, including representatives from each company’s current board. The combined company will be headquartered in Atlanta, GA and will have its main operating center in Raleigh, NC and plans to continue to operate under both the Stock Building Supply and BMC names in their respective local markets.

Mr. Alexander possesses 21 years of experience in the distribution industry. He joined BMC as a director in January 2010 and subsequently was appointed Chief Executive Officer in August 2010. He has led BMC as it has grown into one of the industry-leading providers of residential building products and construction services in fast-growing regions throughout the U.S. Prior to BMC, Mr. Alexander served as President and Chief Executive Officer at ORCO Construction Distribution. He previously served in leadership roles at several companies in the technology, retail/distribution and service industries, including GE Capital, ComputerLand (now Vanstar), Premiere Global Services and Coast to Coast Hardware.

Strategic Benefits

The transaction is expected to result in a combined company that is better positioned to accelerate its growth and deliver significant value to all stakeholders as it continues to accelerate both Stock Building Supply’s and BMC’s existing strategies of capitalizing on expansion opportunities in a fragmented building materials market to strengthen its long-term growth position.

BMC and Stock Building Supply both possess complementary product and service offerings, similar operating principles and a customer service focus that will enable a smooth and efficient integration. The combined company will have a strong position in growth markets across 17 states. Together, the companies will also provide a comprehensive portfolio of building materials, including millwork and structural frame manufacturing capabilities, consultative showrooms and value-added installation management that supports customers’ needs for turnkey solutions. Additionally, BMC’s businesses will provide expanded opportunity to introduce Stock Building Supply’s industry-leading eBusiness platform.

Customers of BMC and Stock Building Supply will continue to experience the same proactive, high-touch service and quality product offerings they have come to rely upon, while receiving the benefits of an expanded product line and stronger technology platform. In addition, the

| 3

|

|

combined company plans to continue to focus on building a high performance, teamwork-driven culture that will offer increased opportunities to its employees as the company accelerates its growth trajectory.

Financing

In connection with the transaction, Stock Building Supply and BMC have received a joint commitment from Wells Fargo Bank, N.A. and Goldman Sachs Bank USA, contingent upon the closing of the transaction, to consolidate and upsize existing revolving Asset Based Loan facilities to $450 million for use by the combined company. Available funds will be used to refinance outstanding balances under the current revolving credit facilities, support up to $75 million in letters of credit, and fund transaction costs, general corporate purposes and working capital. Additionally, $250 million of existing BMC Senior Secured Notes maturing in 2018 are expected to remain outstanding. The closing of the transaction is not subject to financing conditions.

Advisors

Barclays Capital Inc. is serving as financial advisor to Stock Building Supply, with Hunton & Williams LLP serving as legal counsel. Goldman, Sachs & Co. is serving as financial advisor and Kirkland & Ellis LLP is serving as legal counsel to BMC.

Conference Call

Stock Building Supply and BMC will host a conference call today, June 3, 2015 at 9:00 a.m. (Eastern Time) and will simultaneously broadcast it live over the Internet. The conference call can be accessed by dialing 1-877-407-0784 (domestic) or 1-201-689-8560 (international). An investor presentation, to be reviewed during the conference call, can be accessed via Stock Building Supply’s investor relations website at ir.stocksupply.com. A telephonic replay of the conference call will be available immediately after the call and can be accessed by dialing 1-877-870-5176, or for international callers, 1-858-384-5517. The passcode for the live call and the replay is 13611438. The live webcast and archived replay can be accessed on Stock Building Supply’s investor relations website at ir.stocksupply.com. The online archive of the webcast will be available for approximately 90 days.

About Stock Building Supply

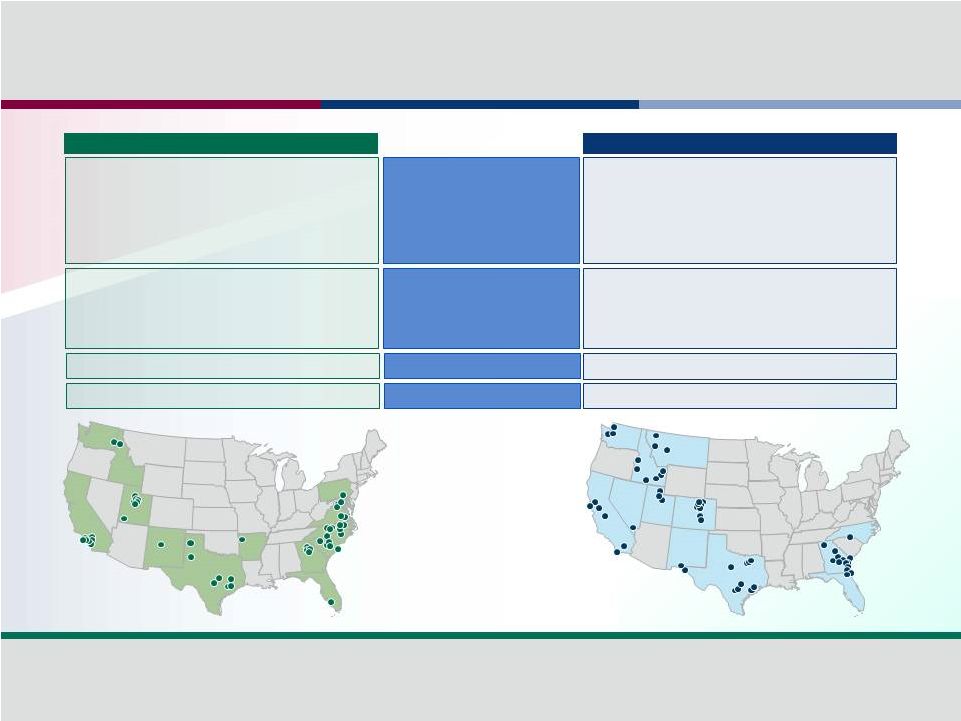

Stock Building Supply operates in 21 metropolitan areas in 14 states primarily in the South and West regions of the United States (as defined by the U.S. Census Bureau). Today, we serve our customers from 68 strategically located facilities. We offer a broad range of products, including lumber and lumber sheet goods, millwork, doors, flooring, windows, structural components, engineered wood products, trusses, wall panels and other exterior products. Our customer base includes production homebuilders, custom homebuilders and remodeling contractors.

| 4

|

|

About BMC

BMC, headquartered in Atlanta, Georgia, is a leading provider of residential building products and construction services to professional builders and contractors in the Western United States, Texas and North Carolina. The company has 38 lumber yards, 18 truss manufacturing facilities, 23 millwork operations and 3 Design Centers in 11 of the top 25 single-family construction markets.

Forward-Looking Statements

This document contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are typically identified by words or phrases such as “may,” “might,” “predict,” “future,” “seek to,” “assume,” “goal,” “objective,” “continue,” “will,” “could,” “should,” “would,” “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “target,” “prospects,” “potential” and “forecast,” or the negative of such terms and other words, terms and phrases of similar meaning. Forward-looking statements involve estimates, expectations, projections, goals, forecasts, assumptions, risks and uncertainties. Stock Building Supply cautions readers that any forward-looking statement is not a guarantee of future performance and that actual results could differ materially from those contained in the forward-looking statement. Such forward-looking statements include, but are not limited to, statements about the benefits of the proposed merger involving BMC and Stock Building Supply, including future financial and operating results, Stock Building Supply’s or BMC’s plans, objectives, expectations and intentions, the expected timing of completion of the transaction, and other statements that are not historical facts. There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements included in this communication. Important factors that could cause actual results to differ materially from those indicated by such forward-looking statements include risks and uncertainties relating to: the ability to obtain the requisite BMC and Stock Building Supply shareholder approvals; the risk that Stock Building Supply or BMC may be unable to obtain governmental and regulatory approvals required for the merger, or required governmental and regulatory approvals may delay the merger or result in the imposition of conditions that could cause the parties to abandon the merger; the risk that a condition to closing of the merger may not be satisfied; the timing to consummate the proposed merger; the risk that the businesses will not be integrated successfully; the risk that the cost savings and any other synergies from the transaction may not be fully realized or may take longer to realize than expected; disruption from the transaction making it more difficult to maintain relationships with customers, employees or suppliers; the diversion of management time on merger-related issues; general worldwide economic conditions and related uncertainties; the effect of changes in governmental regulations; and other factors discussed or referred to in the “Risk Factors” section of Stock Building Supply’s most recent Annual Report on Form 10-K filed with the Securities and

| 5

|

|

Exchange Commission (“SEC”) on March 2, 2015, and our subsequent filings with the SEC. These risk factors, as well as other risks associated with the merger, will be more fully discussed in the Registration Statement and the Proxy /Consent Solicitation Statement/Prospectus (as defined below). All such factors are difficult to predict and are beyond Stock Building Supply and BMC’s control. All forward-looking statements attributable to Stock Building Supply or persons acting on Stock Building Supply’s behalf are expressly qualified in their entirety by the foregoing cautionary statements. All such statements speak only as of the date made, and Stock Building Supply and BMC undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

No Offer or Solicitation

The information in this communication is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the proposed transactions or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Additional Information and Where to Find It

The proposed transaction involving Stock Building Supply and BMC will be submitted to the respective stockholders of Stock Building Supply and BMC for their consideration. In connection with the merger and special meeting of Stock Building Supply’s stockholders, Stock Building Supply expects to file with the SEC a registration statement on Form S-4 (the “Registration Statement”) that will include a proxy statement/consent solicitation/prospectus (the “Proxy/Consent Solicitation Statement/Prospectus”). The definitive Registration Statement and the Proxy/Consent Solicitation Statement/Prospectus will contain important information about the merger, the merger agreement and related matters. This communication may be deemed to be solicitation material in respect of the proposed transaction between BMC and Stock Building Supply. This communication is not a substitute for the Registration Statement, Proxy/Consent Solicitation/Prospectus or any other documents that Stock Building Supply or BMC may file with the SEC or send to shareholders in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF STOCK BUILDING SUPPLY AND BMC ARE URGED AND ADVISED TO READ THE REGISTRATION STATEMENT AND THE PROXY/CONSENT SOLICITATION STATEMENT/PROSPECTUS CAREFULLY WHEN THEY BECOME AVAILABLE, AS WELL AS ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC AND ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. The Registration Statement, the Proxy /Consent Solicitation Statement/Prospectus and any other documents filed or furnished by Stock Building Supply with the SEC may be obtained free of charge at the SEC’s website (www.sec.gov). The

| 6

|

|

Registration Statement, the Proxy/Consent Solicitation Statement/Prospectus and other relevant documents will also be available to security holders, without charge, from Stock Building Supply by going to its investor relations page on its corporate website at http://ir.stocksupply.com or from BMC by directing a request to Paul Street, Corporate Secretary of BMC, via email or telephone ([email protected], (208) 331-4300.

Participants in the Merger Solicitation

Stock Building Supply, BMC, their respective directors and certain of their executive officers and employees may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of Stock Building Supply is set forth in the proxy statement for Stock Building Supply’s 2015 Annual Meeting of Stockholders, which was filed with the SEC on April 30, 2015. Information about the directors and executive officers of BMC and more detailed information regarding the identity of all potential participants, and their direct and indirect interests, by security holdings or otherwise, will be set forth in the Registration Statement and the Proxy/Consent Solicitation Statement/Prospectus. Investors may obtain additional information regarding the interests of such participants by reading the Registration Statement and the Proxy/Consent Solicitation Statement/Prospectus when they become available. You may obtain a free copy of the proxy statement for Stock Building Supply’s 2015 Annual Meeting of Stockholders by going to its investor relations page on its corporate website at http://ir.stocksupply.com. You may obtain free copies of the Registration Statement, the Proxy/Consent Solicitation Statement/Prospectus and other relevant documents as described in the preceding paragraph.

Contacts

Stock Building Supply:

Investor Relations

Mark Necaise, Stock Building Supply

(919) 431-1021

Media Relations

Tom Johnson / Dana Gorman / Kate Schneiderman, The Abernathy MacGregor Group

(212) 371-5999

BMC:

Investor Relations

Paul Street, BMC

(208) 331-4381

Media Relations

Michael Freitag / Sharon Stern / Leigh Parrish

Joele Frank, Wilkinson Brimmer Katcher

(212) 355-4449

| 7

Merger

of Building Materials Holding Corporation and Stock Building

Supply A Compelling Strategic Combination

June 3, 2015 Exhibit 99.2 |

Disclaimer 1 Non-GAAP Financial Measures Forward-Looking Statements This document contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are typically identified by words or

phrases such as “may,” “might,” “predict,” “future,” “seek to,” “assume,” “goal,” “objective,” “continue,” “will,” “could,”

“should,” “would,” “anticipate,”

“estimate,” “expect,” “project,” “intend,”

“plan,” “believe,” “target,” “prospects,” “potential” and “forecast,” or the negative of such terms and other words, terms and phrases

of similar meaning. Forward-looking statements involve estimates, expectations,

projections, goals, forecasts, assumptions, risks and uncertainties. Stock Building Supply Holdings, Inc. (“STOCK” or “STOCK BUILDING SUPPLY”) cautions readers that any forward-looking statement is not a

guarantee of future performance and that actual results could differ

materially from those contained in the forward-looking statement. Such forward-looking statements include, but are not limited to, statements about the benefits of the proposed merger involving Building Materials Holding Corporation (“BMC”) and Stock Building Supply, including

future financial and operating results, Stock Building Supply’s or

BMC’s plans, objectives, expectations and intentions, the expected timing of completion of the transaction, and other statements that are not historical facts. There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking

statements included in this communication. Important factors that could

cause actual results to differ materially from those indicated by such forward-looking statements include risks and uncertainties relating to: the ability to obtain the requisite BMC and Stock Building Supply shareholder approvals; the risk that Stock Building

Supply or BMC may be unable to obtain governmental and regulatory

approvals required for the merger, or required governmental and regulatory approvals may delay the merger or result in the imposition of conditions that could cause the parties to abandon the merger; the risk that a condition to closing of the merger may not be

satisfied; the timing to consummate the proposed merger; the risk that

the businesses will not be integrated successfully; the risk that the cost savings and any other synergies from the transaction may not be fully realized or may take longer to realize than expected; disruption from the transaction making it more difficult to

maintain relationships with customers, employees or suppliers; the

diversion of management time on merger-related issues; general worldwide economic conditions and related uncertainties; the effect of changes in governmental regulations; and other factors discussed or referred to in the “Risk Factors” section of Stock

Building Supply’s most recent Annual Report on Form 10-K filed

with the Securities and Exchange Commission (“SEC”) on March 2, 2015, and our subsequent filings with the SEC. These risk factors, as well as other risks associated with the merger, will be more fully discussed in the Registration Statement and the Proxy /Consent Solicitation

Statement/Prospectus (as defined below). All such factors are difficult

to predict and are beyond Stock Building Supply and BMC’s control. All forward-looking statements attributable to Stock Building Supply or persons acting on Stock Building Supply’s behalf are expressly qualified in their entirety by the foregoing cautionary

statements. All such statements speak only as of the date made, and Stock

Building Supply and BMC undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Included in this presentation are certain non-GAAP financial measures designed to complement the financial information presented in

accordance with generally accepted accounting principles in the United States of America. Our management believes such measures are useful to investors. Because the Company’s calculations of these measures may differ from similar measures used by other companies, you should be careful when comparing the Company’s non-GAAP

financial measures to those of other companies. A reconciliation of

non-GAAP financial measures to GAAP financial measures is included in an appendix to this presentation. |

Proven

Leadership Jeff Rea

President

and CEO Joined Stock in 2010 as President and CEO Served as President of TE Connectivity’s Specialty Group and as SVP of the Building Products Group at Berkshire Hathaway’s Johns Manville 15 years of experience in various leadership roles at General Electric Jim Major Executive Vice President, CFO Joined Stock in 1998 as assistant controller 22 years of experience various in finance positions Previously served as audit manager at PricewaterhouseCoopers Bryan Yeazel Executive Vice President, COO Joined Stock in 2005 as General Counsel Previously served as Executive Vice President, Chief Administrative Officer, General Counsel & Corporate Secretary at Stock Previously served as global capital markets and M&A lawyer at Hunton & Williams Peter Alexander CEO Joined BMC in January 2010 as director and appointed CEO in August 2010 21 years of experience in the distribution industry Served as SVP for ComputerLand International, SVP for GE Capital, President of AmeriData Global and CEO of ORCO Construction Supply Michael Kestner CFO Joined BMC in April 2013 35 years of experience in senior finance positions 13 years as CFO at Hilite International, Inc., 4 years as CFO of Sinter Metals, Inc., and public company director Tony Genito Chief Integration Leader Joined BMC in 2015 34 years of experience in senior financial and M&A- related positions 10 years as CFO at Spectrum Brands Holdings Corp, and 12 years with Schering-Plough Corporation in various positions Previously served as senior audit manager at Deloitte & Touche ___________________________ Note: Check marks denote today’s presenters. 2 |

A

Compelling Strategic Combination Creates

a leading national building materials distribution platform with over $2.7 billion (1) of combined LTM net sales through March 31, 2015 Broad geographic reach, local market leadership and comprehensive product and services portfolio

Leadership in Attractive

Growth Markets Poised for

Continued Recovery Compatible Cultures, Strategies and Operating Principles Attractive Value Creation for All Shareholders Enhanced Geographic Diversity and Capabilities A Market Leader with National Scale Significant market expansion in attractive geographies: Stock footprint increases from 21 to 42 metropolitan areas on a

combined basis Both organizations focus on value-added products and services; combined capabilities increase significantly as best

practices expanded to 2x revenue

Market leadership in highly attractive long-term growth markets throughout the

U.S. New construction and R&R markets poised for continued

recovery Deep commitment to providing solutions to customers; highly

focused on delivering a broad range of quality products and

value-added services

Strong operating platforms and complimentary strategic roadmaps create significant

integration opportunities Highly attractive combined organic growth and

return profile Significant

synergies anticipated - $30 to $40 million annually Opportunities to accelerate growth on combined platform through broader service and product capabilities

Transaction expected to be EPS accretive in the first full year following closing

Strong balance sheet and financial flexibility support continued pursuit

of attractive growth opportunities All-stock transaction allows all

shareholders to participate in value creation from transaction

1 4 2 3 5 ___________________________ 1. Includes $134 million in LTM net sales from VNS Corporation, which was acquired by BMC in May 2015.

3 |

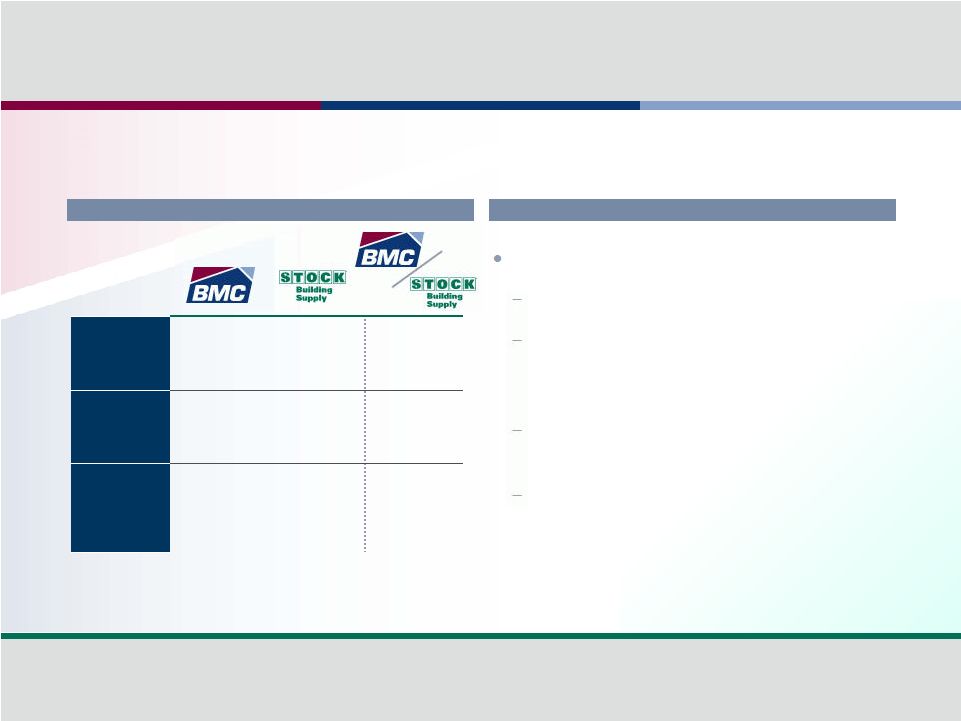

• Stock-for-stock, tax-free exchange • Stock shareholders: 40% / BMC shareholders: 60% • BMC shareholders receive 0.5231 Stock Building Supply share for each BMC share • Implied pro forma Enterprise Value of $1,538 million as of June 2, 2015 • Pro forma debt of $363 million (1) , including $250 million notes due 2018 • Committed financing at close through upsized $450 million revolving ABL facility

• Combined company will retain top talent from both companies • Jeff Rea – Will remain Board member • Peter Alexander – CEO • Jim Major – CFO • Bryan Yeazel – CAO & General Counsel • Tony Genito – Chief Integration Leader • Board of Directors: Peter Alexander, Jeff Rea, plus independent directors from each Company’s

current Board • Shareholder vote by both Stock Building Supply and BMC shareholders • Transaction supported by BMC management and over 50% of existing BMC shareholders

• Conditional on customary regulatory and shareholder approvals • Expected to close in Q4 of 2015 Transaction Overview Structure Ownership Implied Consideration Post-Close Governance and Management Timing and Closing Conditions ___________________________ 1. Pro forma debt as of 3/31/15, excludes transaction costs and includes $5 million of BMC Revolver borrowings used to fund the acquisition of VNS

Corporation in May 2015. 4 |

BMC Stock Building Supply A Combination of two Market Leading Platforms Operations • 38 Distribution Yards • 18 Truss Manufacturing Facilities • 23 Millwork Operations • Various Design Centers and Showrooms LTM 3/31/15 Net Sales • 48 Distribution Yards • 15 Truss Manufacturing Facilities • 20 Millwork Operations • Various Design Centers and Showrooms $1,449 million (1) $1,313 million Employees ~5,300 ~3,200 Key Service Capabilities • Distribution Services, Construction Services, Structures and Millwork Manufacturing Showrooms and Design Centers, Project Planning • Distribution Services, Installation Management, Structures and Millwork Manufacturing, Showrooms and Design Centers, Project Planning, eBusiness ___________________________ 1. Includes $134 million in LTM net sales from VNS Corporation. 5 |

$41

$161 $85 $1,313 $2,762 $1,449 Pro Forma LTM 3/31/15 Revenue (1) ($ in millions) Pro Forma LTM 3/31/15 Adjusted EBITDA (1) ($ in millions) 5.8% 5.9% 3.1% Highly Attractive Financial Profile Combined company will have a strong balance sheet with significant growth opportunities

Expected Run-Rate Synergies $30 - $40mm ___________________________ 1. BMC results include $134 million in LTM net sales and $6 million in LTM adjusted EBITDA from VNS Corporation.

2. Pro forma combined Adjusted EBITDA assumes the midpoint of the expected run-rate synergies range.

(2) 6 |

Building

Materials Holding Corporation Overview:

A Leader in Highly Attractive Markets |

BMC is a

market leader in highly attractive regions throughout the U.S. and is predominately focused in the West Overview of BMC Overview Historical Financial Performance Has provided local expertise to professional builders focused on residential and light commercial construction for 28 years Strong presence in attractive markets in the West, Texas and Southeast Presence in 27 metropolitan areas, primarily in the south and west Year-round construction cycle in most markets Dedicated workforce of approximately 5,300 employees Operationally well-positioned to continue to benefit from the housing market recovery Single Family Building Permits BMC Markets Rest of U.S. 2012 – 2014 CAGR: 91.3% 7 $887 $1,210 $1,311 2012 2013 2014 ($ in millions) $21 $65 $77 2012 2013 2014 350 322 394 472 476 2010 2011 2012 2013 2014 97 96 125 149 159 2010 2011 2012 2013 2014 2012 – 2014 CAGR: 21.6% |

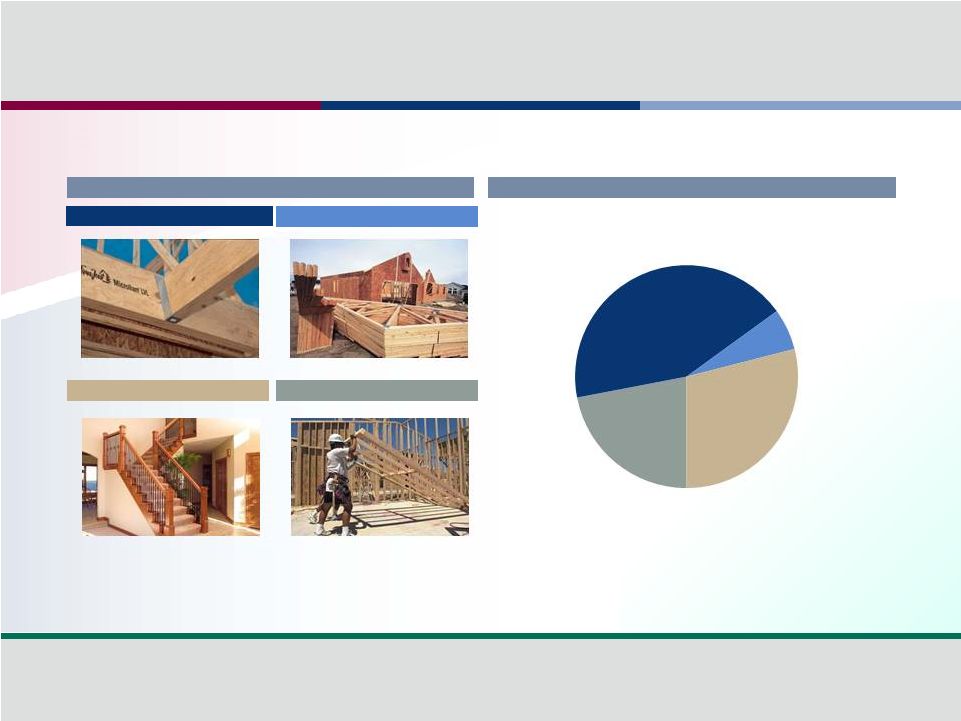

Product

Overview & Service Offering BMC 2014 Sales Mix

Lumber & Building Materials (LBM)

Truss Millwork Construction Services Overview of BMC's Product and Service Offering Over the past several years BMC has optimized its operational mix with a greater focus on value-

added business lines 8 Lumber & Building Materials (LBM) 43% Truss 6% Millwork 29% Construction Services 22% |

Differentiated, Value-Added Service Offering

Account Management BMC’s Value-Added Service Capabilities BMC distinguishes itself in the market by delivering value-added service capabilities, which in

combination with its broad product offering, delivers comprehensive solutions for

customers Job site visits

throughout project keep customers on budget and on schedule Quotes and estimates Blueprint and plan take-off services Design Centers Product Services Construction Services Project Expertise Ready-Frame Production of unique custom doors, molding and other millwork using state-of-the- art CAD design and manufacturing Manufacture of custom millwork to specifications, with CAD design service Distribute and install custom windows, built to order Delivery and installation pre- hung doors and windows, stairs, cabinets, and interior and exterior trim Specialize in light commercial and multi-family construction projects Motels Multi-family Residential Restaurants Retail Strip Malls Used by builders to construct wall panels, roof trusses, floor trusses, floors and framing solutions Utilizes proprietary commercial software & equipment creating a unique brand with a targeted sales and marketing process Design specialists help guide customers through product selection with trained eyes, construction know- how, and a commitment to excellent craftsmanship DESIGN CENTERS ___________________________ Note: Check marks represent services also provided by Stock. 9 |

An

Expanded Platform for Growth Significant Benefits for

Shareholders |

$752

$760 $942 $1,197 $1,296 2010 2011 2012 2013 2014 3/31/15 LTM Strategic Evolution Financial Evolution Combination is a Compelling Next Step Repositioned Around the Core Jeff Rea joins as CEO Acquired Bison Building Materials Company strategically restructured footprint focusing on most attractive geographies A transformational repositioning, strong execution, and strategic growth initiatives have delivered

attractive returns for stakeholders

Built an Operating Platform

Introduced e-Business logistics

service platform Launched LEAN business culture Improved integrated supply chain Implemented Field leadership structure Poised for future Profitable Growth Successfully executed IPO Added capacity / capabilities Integrated TBSG and Chesapeake acquisitions ($58) ($31) $2 $28 $37 $41 $1,313 Combination expected to close Q4; accelerates differentiated building materials distribution platform Accelerated Execution on Strategic Priorities Expansion of structural component facilities Added distribution and customer support capacity to drive growth Additional eBusiness investments ___________________________ Note: Red dotted items represent pro forma financials including BMC, VNS Corporation and the midpoint of the expected run-rate synergies

range. Evolution of Stock Building Supply

Net sales Adj. EBITDA 2010 2011 2013 2014 2015 ($ in millions) 2011 $2,762 10 $161 |

Creates

a leading building materials distribution company with enhanced scale, national and local capabilities Complementary footprint: provides a strong presence in some of the nation’s fastest growing regions Expands overall customer and supplier solutions capabilities with a synergistic suite of products and value added services Strategies are complementary: value-added products, innovative customer solutions, strong operating platform, strategic expansion capacity Enhances growth, margin and return profile Earnings accretive in the first full year following closing: combination enables significant synergies Proven execution capability: combined company has proven management with a strong track record Enhanced customer service with stronger field-oriented and service capabilities

Transaction structure: all stock merger presents opportunity for Stock shareholders to participate in

the value creation Maintains strong balance sheet and enhances credit quality

Provides growth accelerators: combined company well positioned to pursue strategic growth initiatives, including M&A Provides customer and talent benefits: customers benefit from combined service improvements;

employees have greater access to training, tools, and career

opportunities Combination is a Compelling Next Step

Significant Value Creation Strategic Rationale Enhanced Growth Enablers 11 |

An

Expanded Platform for Growth Strategic Benefits of the

Transaction |

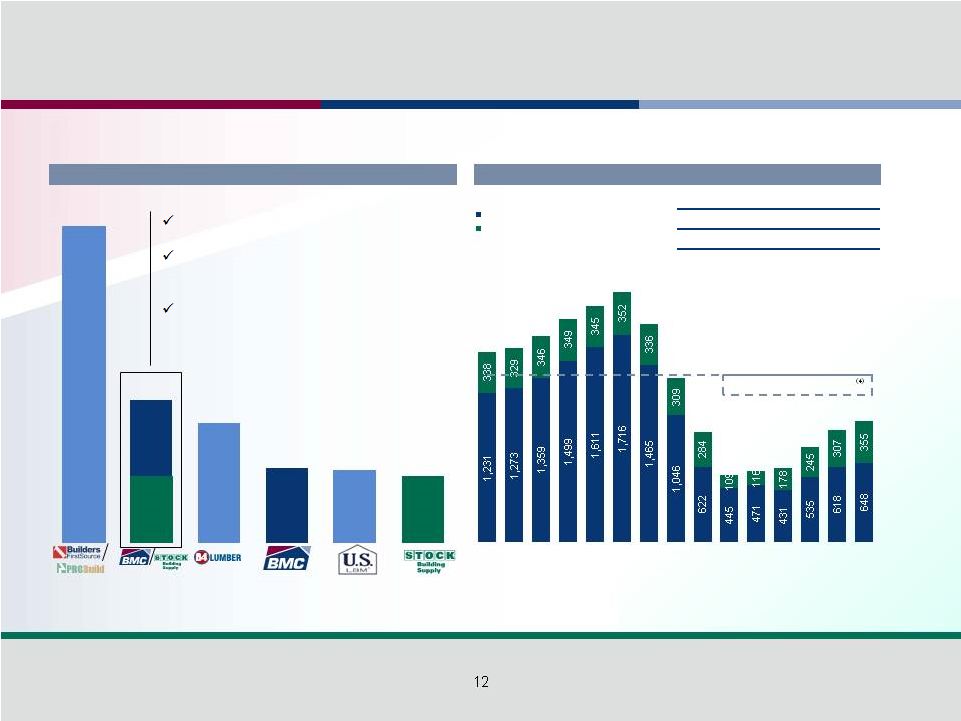

LBM

2014A Distributor Sales (1)

Creates the #2 LBM Distributor

Significant growth capabilities and

capacity Still meaningful expansion opportunities ___________________________ Source: U.S. Census Bureau. 1. BMC Financials include VNS Corporation. 2. Builders FirstSource 8-K (April 13,2015). 3. ProSales Magazine sales ranking for 2014 revenue. 4. Average housing starts from 1959 to 2014. ($ in billions) Combination Creates a Market Leader with National Scale A market leading building products distributor well positioned to grow profitably through the U.S.

housing recovery and beyond

(3) (3) (2) 2014 Starts 1,003 Peak (2005) 2,068 2014 % Growth to Peak 106.1% 2014 % Growth to Average 44.5% Historical U.S. Housing Starts Long Term Average: 1,449 (In thousands) 12 $2.3 $1.4 $1.4 $1.3 $6.1 $2.7 1,569 1,602 1,705 1,848 1,956 2,068 1,801 1,355 906 554 587 609 780 925 1,003 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Single -Family Multifamily |

Sales by U.S. Census Division (1) Highly Complementary Footprint Highly complementary branch networks, serving fast-growing regions … Commentary Presence increases from 21 to 42 metropolitan areas Locations in 17 states representing 63% of 2014 single-family building permits Strong capabilities with significant expansion opportunities Network of: — 86 Distribution Locations — 33 Truss and Structures Operations — 43 Millwork Operations — Complementary Design Centers and Showrooms BMC Locations Stock Building Supply Locations Combined Company Footprint ___________________________ 1. 2014 combined net sales including VNS Corporation. FL NM TX MT CO UT ID NV WA CA NC SC PA MD VA AR GA 13 Mid & South Atlantic 25% West South Central 37% Mountain 20% Pacific 18% |

Enhanced Capabilities - Focused on Value-Added Products and Services A comprehensive suite of value-added products and services to provide clients with holistic

solutions Design Centers Truss Manufacturing Distribution Services Millwork Manufacturing Construction Services Installation Management Truss Manufacturing LEAN eBusiness Millwork Manufacturing Stock Logistics Solutions eCFO Stock Installation Services o Stock Design Services o Stock eCommerce 38 Distribution Yards 18 Truss Manufacturing Facilities 23 Millwork Operations Distribution Services 48 Distribution Yards 15 Truss Manufacturing Facilities 20 Millwork Operations Turnkey Solutions Turnkey Solutions Expanding Design Capabilities 14 |

Leading

talent, resources and complementary strategies to accelerate growth

Value-added Products

Differentiated Services

Low Cost / High Service Operating

Platform: o eBusiness capabilities o Customer solutions o Talent productivity / enablers Strong Balance Sheet Enables Strategic and Accretive Expansion Complementary Strategies Combined … BMC and Stock have enhanced capabilities that provide Value-Added Products, Services and Solutions for our Customers 15 |

Attractive Value Creation for All Shareholders

EPS Accretion Significant Synergies Expected to deliver attractive earnings accretion in the first full year following close Projected synergies of $30 - $40m annually within 24 months Combination and resulting synergies projected to deliver pro forma EBITDA margins ~2x current margin profile with continued room for expansion Increased scale, enhanced network density, exposure to high growth markets, expanded product and service offering positions combined company to continue to deliver above-market growth Strong balance sheet and resulting financial flexibility positions the combined company for continued growth investments, including M&A Enhanced Overall Financial Profile Proposed transaction significantly enhances growth and return profile 16 |

Significant Opportunity for Synergies

Commentary Integration strategy developed with clear objectives and well- defined integration leadership team Highly identifiable and achievable cost savings Run-rate synergies of $20-$25 million within 12 months of close, rising to $30-$40 million within 24 months Total synergies represent up to 1.5% of combined sales Synergies will be achieved from: Sourcing / supply chain Operations best practices Optimization of branch support processes Deployment of best-in-class technology across enterprise Estimated costs to achieve synergies of $20-$25 million (1) Opportunities to accelerate growth on combined platform through broader services and product capabilities Estimated Run-Rate Cost Synergies Estimated Synergies by Category ___________________________ 1. Excludes transaction costs. 17 Sourcing / Supply Chain ~64% SG&A & Other Costs ~36% ($ in millions) $20-$25 $30-$40 12 Months 24 Months |

Strong

Balance Sheet And Financial Flexibility Commentary

Retain financial flexibility for growth

Pro forma 3/31/2015 debt of $363 million

$450 million revolving ABL facility with

extended maturity; less than $100 million

drawn at 3/31/15 Existing $250 million BMC 9.0% Senior Secured Notes maturing 2018 Well positioned for continued growth investments, including M&A Combined company has financial flexibility to execute on strategic initiatives and pursue additional

M&A opportunities Cash $16 $8 $24 Debt $275 $88 $363 Net Debt / LTM Adj. EBITDA 3.1x 2.0x 2.7x 3/31/15 Pro Forma Capitalization (1) ___________________________ 1. BMC adjusted to reflect cash and revolver borrowings used to fund the purchase of VNS Corporation in May 2015.

($ in millions) 18 |

BMC and

Stock: A Compelling Strategic Combination Creates a market leading national building products distribution platform with ability to accelerate strategic transformation Opportunities to accelerate profitable growth on combined platform through

broader customer services and product / solutions capabilities Significant synergies anticipated - $30 to $40 million annually Transaction expected to be EPS accretive in the first full year following closing

Strong balance sheet and financial flexibility support continued pursuit of attractive growth

opportunities All-stock transaction allows all shareholders to participate in value creation from transaction Attractive Value Creation for All Shareholders & Customers 19 |

Q&A |

Appendix |

BMC

Adjusted EBITDA Schedule ___________________________

1. Represents unaudited pro forma historical results including VNS Corporation, which was acquired by BMC in May 2015.

20 Year Ended December 31, LTM March 15 (1) ($ in thousands) 2012 2013 2014 BMC VNS Total Net (loss) income ($17,533) $21,655 $94,032 $92,145 $2,749 $94,894 Depreciation and amortization 13,248 13,767 15,457 16,466 1,228 17,694 Interest expense 14,159 18,786 27,090 27,221 258 27,479 Income tax (benefit) expense (6) 6,273 (65,577) (68,273) 1,424 (66,849) EBITDA $9,868 $60,481 $71,002 $67,559 $5,659 $73,218 Headquarters relocation - - 2,054 3,431 - 3,431 Share-based compensation 2,054 2,425 3,410 3,246 - 3,246 Insurance deductible reserve adjustments 7,462 1,772 669 897 - 897 Restructuring costs 1,729 73 134 134 - 134 Loss portfolio transfer - - - 2,826 - 2,826 Acquisition related costs - - - 533 238 771 Discontinued operations and other - - - - 560 560 Adjusted EBITDA $21,113 $64,751 $77,269 $78,626 $6,457 $85,083 |

Stock

Adjusted EBITDA Schedule ___________________________

1. LTM Results Unaudited. 21 Year Ended December 31, ($ in thousands) 2010 2011 2012 2013 2014 LTM Mar 15 (1) Income (loss) from continuing operations $(65,780) $(41,931) $(14,582) $(5,036) $10,087 $15,247 Interest expense 1,575 2,842 4,037 3,793 2,684 2,764 Income tax expense (benefit) (47,463) (22,332) (8,084) 2,874 6,340 4,247 Depreciation and amortization 36,149 16,188 11,718 12,060 13,343 14,023 Impairment of assets held for sale 2,944 580 361 432 48 - Public offering transaction-related costs - - - 10,008 508 60 Restructuring expense 7,089 1,349 2,853 141 73 258 Non-cash stock compensation expense 288 384 1,305 1,049 2,669 2,854 Severance and other items related to store closures and business optimization 12,642 6,761 2,375 1,113 779 663 Reduction of tax indemnification asset 3,056 1,937 347 - - - Management fees, acquisition costs & other items (8,487) 3,423 1,663 1,369 358 597 Adjusted EBITDA $(57,987) $(30,799) $1,993 $27,803 $36,889 $40,713 |

Disclaimer and Additional Information

22 No Offer or Solicitation

The information in this communication is for informational

purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the proposed transactions or

otherwise, nor shall there be any sale, issuance or transfer of

securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable

law. Additional Information and Where to Find It The proposed transaction involving Stock Building Supply and BMC will be submitted to the respective stockholders of Stock Building Supply and

BMC for their consideration. In connection with the merger and special

meeting of Stock Building Supply’s stockholders, Stock Building Supply expects to file with the SEC a registration statement on Form S-4 (the “Registration Statement”) that will include a proxy statement/consent

solicitation/prospectus (the “Proxy/Consent Solicitation

Statement/Prospectus”). The definitive Registration Statement and the Proxy/Consent Solicitation Statement/Prospectus will contain important information about the merger, the merger agreement and related matters. This communication may be deemed to be solicitation material in respect

of the proposed transaction between BMC and Stock Building Supply. This

communication is not a substitute for the Registration Statement, Proxy/Consent Solicitation/Prospectus or any other documents that Stock Building Supply or BMC may file with the SEC or send to shareholders in connection with

the proposed transaction. INVESTORS AND SECURITY HOLDERS OF STOCK

BUILDING SUPPLY AND BMC ARE URGED AND ADVISED TO READ THE REGISTRATION

STATEMENT AND THE PROXY/CONSENT SOLICITATION STATEMENT/PROSPECTUS CAREFULLY WHEN THEY

BECOME AVAILABLE, AS WELL AS ANY OTHER RELEVANT DOCUMENTS FILED

WITH THE SEC AND ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. The Registration Statement, the Proxy /Consent Solicitation Statement/Prospectus and any other documents

filed or furnished by Stock Building Supply with the SEC may be obtained

free of charge at the SEC’s website (www.sec.gov). The Registration Statement, the Proxy/Consent Solicitation Statement/Prospectus and other relevant documents will also be available to security holders, without charge, from

Stock Building Supply by going to its investor relations page on its

corporate website at http://ir.stocksupply.com or from BMC by directing a request to Paul Street, Corporate Secretary of BMC, via email or telephone (paul.street@buildwithbmc.com, (208) 331-4300.

Participants in the Merger Solicitation Stock Building Supply, BMC, their respective directors and certain of their executive officers and employees may be deemed to be participants in

the solicitation of proxies in connection with the proposed transaction.

Information about the directors and executive officers of Stock Building Supply is set forth in the proxy statement for Stock Building Supply’s 2015 Annual Meeting of Stockholders, which was filed with the SEC on April 30, 2015. Information about

the directors and executive officers of BMC and more detailed information

regarding the identity of all potential participants, and their direct and indirect interests, by security holdings or otherwise, will be set forth in the Registration Statement and the Proxy/Consent Solicitation Statement/Prospectus. Investors may

obtain additional information regarding the interests of such

participants by reading the Registration Statement and the Proxy/Consent Solicitation Statement/Prospectus when they become available. You may obtain a free copy of the proxy statement for Stock Building Supply’s 2015 Annual Meeting of Stockholders by going

to its investor relations page on its corporate website at

http://ir.stocksupply.com. You may obtain free copies of the Registration Statement, the Proxy/Consent Solicitation Statement/Prospectus and other relevant documents as described in the preceding paragraph. |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Jenzabar Inc., Reappoints Robert A. Maginn as CEO

- Great Neck Realty Co. to Auction IP Assets of BOA Nutrition, Inc., a US-Based Sports Nutrition & Wellness Company

- FEMSA Files 2023 SEC Annual Report

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share