Form 8-K Falconridge Oil Technolo For: Aug 06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) August 6, 2015

FALCONRIDGE OIL TECHNOLOGIES CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

|

000-54253

|

N/A

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

17-120 West Beaver Creek Rd., Richmond Hill, Ontario, Canada

|

L4B 1L2

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code (905) 771-6551

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

On February 7, 2014, our company entered into a management agreement (the “Pelliance Management Agreement”) with Mark Pellicane (“Pellicane”), whereby Pellicane agreed to provide services customarily provided by his profession to our company in exchange for compensation in the aggregate amount of $7,500 per month (the “Pellicane Compensation”).

Concurrently, our company entered into a management agreement (the “Morra Management Agreement”) with Alfred Morra (“Morra”), whereby Morra agreed to provide services customarily provided by his profession to our company in exchange for compensation in the aggregate amount of $7,500 per month (the “Morra Compensation”).

On August 6, 2015, we entered into amending agreement dated August 6, 2015 (the “Pellicane Amending Agreement”) with Pellicane, to amend the Pellicane Management Agreement whereby the parties agreed that all and any part of the accrued Pellicane Compensation may be converted into Series A Preferred Stock of our company at a deemed value of $0.0025 per preferred share in the sole discretion of Pellicane.

Concurrently, Pellicane notified our company of his election to convert an aggregate of $9,600 of debt owed to Pellicane from our company under the Pellicane Management Agreement into an aggregate of 3,840,000 Series A Preferred Stock (the “Pellicane Shares”) pursuant to the Pellicane Amending Agreement.

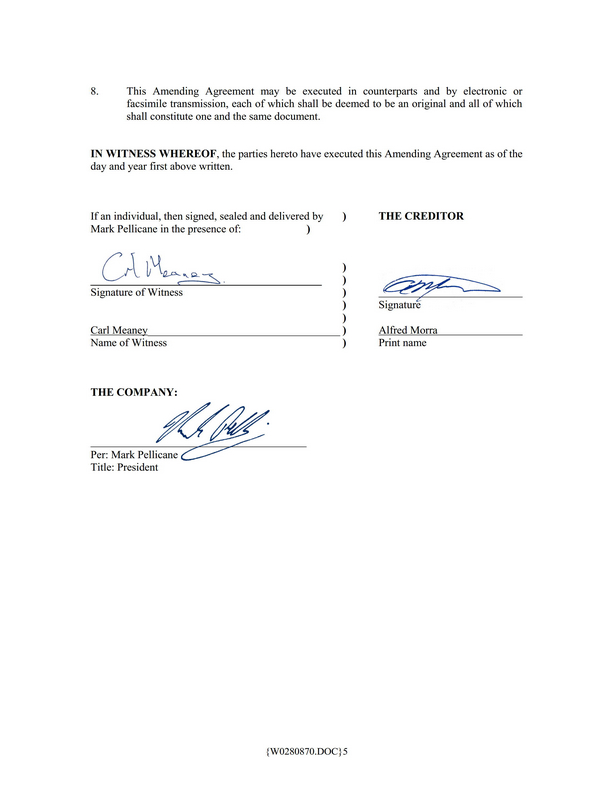

On August 6, 2015, we entered into amending agreement (the “Morra Amending Agreement”) with Morra, to amend the Morra Management Agreement whereby the parties agreed that all and any part of the accrued Morra Compensation may be converted into Series A Preferred Stock of our company at a deemed value of $0.0025 per preferred share in the sole discretion of Morra.

Concurrently, Morra notified our company of his election to convert an aggregate of $9,600 of debt owed to Morra from our companyof under the Morra Management Agreement into an aggregate of 3,840,000 Series A Preferred Stock (the “Morra Shares”) pursuant to the Morra Amending Agreement.

As our company is indebted to First World Trade Corp. (“FWT”) for an aggregate of $1,383,842 (the “Debt”), FWT and our company have agreed to settle an aggregate of $4,800 of the Debt for exchange of 1,920,000 Series A Preferred Stock issued by our company.

Item 9.01 Financial Statements and Exhibits

|

10.1

|

Amending Agreement dated as of August 6, 2015 between our company and Mark Pellicane.

|

|

10.2

|

Amending Agreement dated as of August 6, 2015 between our company and Alfred Morra.

|

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

FALCONRIDGE OIL TECHNOLOGIES, CORP.

|

|

| /s/ Mark Pellicane | |

|

Mark Pellicane

|

|

|

Principal Executive Officer and Director

|

|

|

October 8, 2015

|

3

Exhibit 10.1

Exhibit 10.2

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Report from the Annual General Meeting of Olink Holding AB (publ) on 19 April 2024

- NurExone Presenting on Revolutionary Spinal Cord Injury Therapy at European Conference on Exosomes and Regenerative Medicine

- EVe Mobility Acquisition Corp Receives NYSE Notice Regarding Late Filing of Annual Report on Form 10-K

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share