Form 6-K UBS AG For: Oct 28

�

�

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

�

�

FORM 6-K

�

�

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Date: October�28, 2014

�

�

UBS AG

Commission File Number: 1-15060

UBS Group AG

(Registrants� Names)

�

�

Bahnhofstrasse 45, Zurich, Switzerland

(Address of principal executive office)

�

�

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F��x������������Form 40-F���

This Form 6-K consists of the presentation materials related to the Third Quarter 2014 Results of UBS AG, which appear immediately following this page.

�

�

�

October 28,

2014 Third

quarter 2014 results |

Cautionary statement

regarding forward-looking statements 1

This presentation contains statements that constitute �forward-looking

statements,� including but not limited to management�s outlook for UBS�s financial performance and

statements relating to the anticipated effect of transactions and strategic initiatives on

UBS�s business and future development. While these forward-looking statements

represent UBS�s judgments and expectations concerning the matters described, a number of

risks, uncertainties and other important factors could cause actual developments and

results to differ materially from UBS�s expectations. These factors include, but are not limited to: (i) the degree to which UBS is successful in executing

its announced strategic plans, including its efficiency initiatives and its planned further

reduction in its Basel III risk-weighted assets (RWA) and leverage ratio denominator

(LRD); (ii) developments in the markets in which UBS operates or to which it is exposed,

including movements in securities prices or liquidity, credit spreads, currency exchange

rates and interest rates and the effect of economic conditions and market developments on the financial position or creditworthiness of UBS�s clients and

counterparties; (iii) changes in the availability of capital and funding, including any changes

in UBS�s credit spreads and ratings, or arising from requirements for bail-in debt

or loss-absorbing capital; (iv) changes in or the implementation of financial legislation

and regulation in Switzerland, the US, the UK and other financial centers that may

impose more stringent capital (including leverage ratio), liquidity and funding requirements,

incremental tax requirements, additional levies, limitations on permitted activities,

constraints on remuneration or other measures; (v) uncertainty as to when and to what degree the Swiss Financial Market Supervisory Authority (FINMA) will

approve reductions to the incremental RWA resulting from the supplemental operational risk

capital analysis mutually agreed to by UBS and FINMA, or will approve a limited reduction

of capital requirements due to measures to reduce resolvability risk; (vi) the degree to which UBS is successful in executing the announced creation of a new

Swiss banking subsidiary, a holding company for the UBS Group (including the pending offer to

exchange shares of UBS AG for shares of such holding company), a US intermediate holding

company, changes in the operating model of UBS Limited and other changes which UBS may make in its legal entity structure and operating model,

including the possible consequences of such changes, and the potential need to make other

changes to the legal structure or booking model of UBS Group in response to legal and

regulatory requirements, including capital requirements, resolvability requirements and proposals in Switzerland and other countries for mandatory structural

reform of banks; (vii) changes in UBS�s competitive position, including whether

differences in regulatory capital and other requirements among the major financial centers

will adversely affect UBS�s ability to compete in certain lines of business; (viii) the

liability to which UBS may be exposed, or possible constraints or sanctions that regulatory

authorities might impose on UBS, due to litigation, contractual claims and regulatory

investigations; (ix) the effects on UBS�s cross-border banking business of tax or

regulatory developments and of possible changes in UBS�s policies and practices relating

to this business; (x) UBS�s ability to retain and attract the employees necessary to

generate revenues and to manage, support and control its businesses, which may be affected by

competitive factors including differences in compensation practices; (xi) changes in

accounting or tax standards or policies, and determinations or interpretations affecting the recognition of gain or loss, the valuation of goodwill, the recognition

of deferred tax assets and other matters; (xii) limitations on the effectiveness of UBS�s

internal processes for risk management, risk control, measurement and modeling, and of

financial models generally; (xiii) whether UBS will be successful in keeping pace with competitors in updating its technology, particularly in trading businesses; (xiv)

the occurrence of operational failures, such as fraud, unauthorized trading and systems

failures; and (xv) the effect that these or other factors or unanticipated events may

have on our reputation and the additional consequences that this may have on our business and

performance. The sequence in which the factors above are presented is not indicative of

their likelihood of occurrence or the potential magnitude of their consequences. Our business and financial performance could be affected by other factors

identified in our past and future filings and reports, including those filed with the SEC. More

detailed information about those factors is set forth in documents furnished by UBS and

filings made by UBS with the SEC, including UBS�s Annual Report on Form 20-F for the year ended 31 December 2013. UBS is not under any obligation to (and

������� This presentation and the information contained

herein are provided solely for information purposes, and are not to be construed as a solicitation of an offer

to buy or sell any securities or other financial instruments in Switzerland, the United States

or any other jurisdiction. No investment decision relating to securities of or relating

to UBS AG or its affiliates should be made on the basis of this document. Refer to UBS's third quarter 2014 report and its Annual report on Form 20-F for the year

ended 31 December 2013. No representation or warranty is made or implied concerning, and UBS

assumes no responsibility for, the accuracy, completeness, reliability or comparability

of the information contained herein relating to third parties, which is based solely on publicly available information. UBS undertakes no obligation to update

the information contained herein.

� UBS 2014. The key symbol and UBS are among the registered and unregistered trademarks of

UBS. All rights reserved. Disclaimer: expressly disclaims any obligation to) update or

alter its forward-looking statements, whether as a result of new information, future events, or otherwise. |

2

3Q14 highlights�Group

Strong underlying results; significant DTA write-up and litigation

provisions

Refer to slide 36 for details about adjusted and underlying numbers, Basel III numbers and FX

rates in this presentation Underlying

profit before tax (PBT) CHF 1.7 billion

Net profit attributable to UBS shareholders CHF 762 million, diluted EPS CHF 0.20

Provisions for litigation, regulatory and similar matters CHF 1,836 million

Net upward revaluation of deferred tax assets CHF 1,420 million

PBT negative CHF 554 million, adjusted PBT negative CHF 424 million

WM, WMA, R&C and Global AM all reported higher PBT QoQ and YoY

Strong net new money CHF 14.4 billion from our wealth management

businesses

Basel III fully applied CET1 ratio 13.7%, post-stress ratio remained above 10%,

fully applied Swiss SRB leverage ratio 4.2%, CHF 7 billion reduction in RWA

|

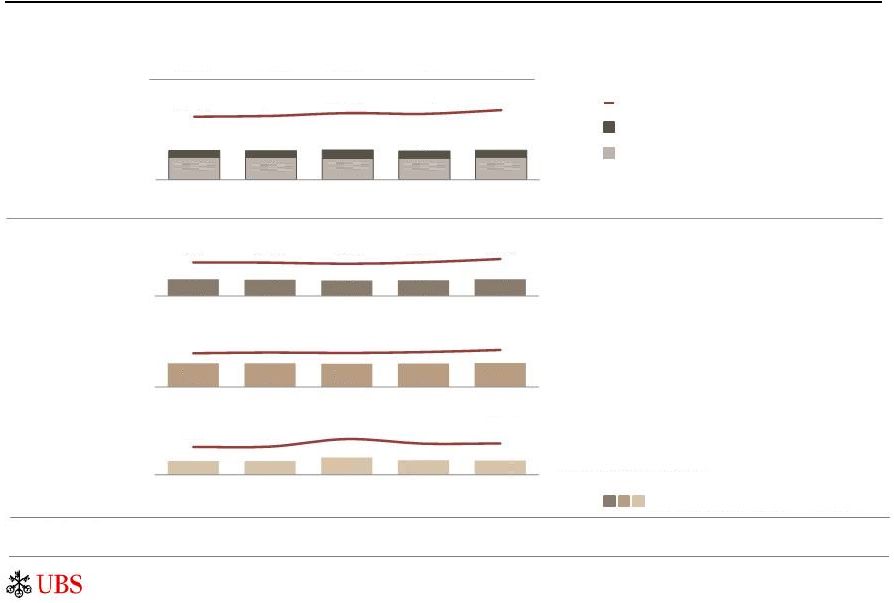

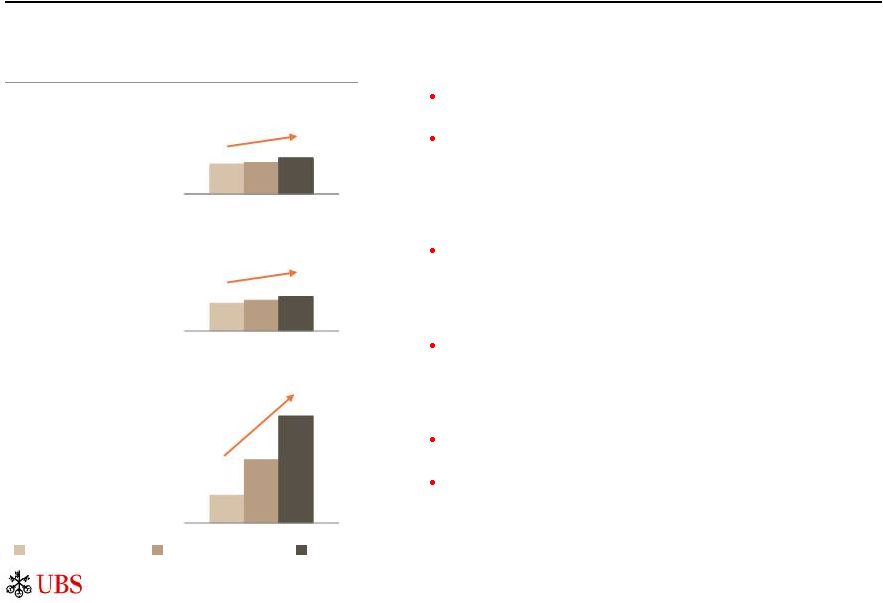

Our wealth management

franchise is unrivaled Refer to slide 36 for details about adjusted and underlying

numbers, Basel III numbers and FX rates in this presentation CHF 1.9 trillion invested

assets; combined adjusted PBT >CHF 1 billion 3

Profit before tax

adjusted, CHF million

Invested assets

CHF billion

Operating income

CHF million

Leading global franchise with superior growth prospects

and a unique global footprint

1,610

1,837

3,810

1,779

2,031

3,447

3Q13

WM

WMA

3Q14

3Q13

832

1,015

3Q14

+22%

3Q14

1,936

3Q13

1,702

+11%

+14%

248

215

767

617

970

871

966

831 |

4

3Q14

highlights�business

divisions

1

Strong performance with underlying PBT up YoY in all businesses

Refer to slide 36 for details about adjusted and underlying numbers, Basel III numbers and FX

rates in this presentation 1 Figures on an adjusted basis unless otherwise stated; 2

Refer to page 118 of the 3Q14 report for details on funding valuation adjustments (FVA)

Wealth Management:

Highest PBT since 2Q09 CHF 767 million

�

NNM CHF 9.8 billion, positive in all regions

Wealth Management Americas:

�

Record

income

on

record

FA

productivity

with

USD

1.1

million

in

annualized

revenues

per

FA

Retail & Corporate:

�

All KPIs within target ranges for 3Q14 and 9M14

Global Asset Management:

�

PBT up 41% QoQ and 16% YoY

Investment Bank:

�

Provisions for litigation, regulatory and similar matters CHF 1,687 million

Corporate Center:

implementation

of

FVA

2

�

Non-core and Legacy Portfolio RWA decreased 19%

Strong performance, PBT USD 267 million and NNM USD 4.9 billion

Highest PBT since 3Q10 CHF 446 million

Strong performance, PBT CHF 151 million and NNM CHF 3.8 billion ex-MM

Strong underlying PBT CHF 494 million, up 47% YoY

Reported pre-tax loss CHF 793 million; CHF 252 million net loss resulting from the

|

Key messages

The fundamental earnings power of our unrivaled franchise is evident

�

WM/WMA combined adjusted PBT >CHF 1 billion

�

Strong performance in Retail & Corporate with all KPIs within target ranges

�

Solid Investment Bank and Global AM performance despite challenging market conditions

Results include provisions for litigation, regulatory and similar matters

�

We continue to seek resolution of open issues

�

Timing of full resolution of complex industry-wide issues is difficult to predict

We will continue executing our strategy and are well positioned for growth

�

Seizing current revenue opportunities and positioned for future economic recovery

�

Improving efficiency will release resources to invest for growth

�

Continued reduction in the Non-core and Legacy Portfolio

Our capital position is strong and our businesses are highly capital accretive

�

Continued capital strength in an evolving regulatory environment

�

Share-for-share exchange offer in progress creating eligibility for capital

rebate �

Committed

to

payout

ratio

of

at

least

50%

subject

to

maintaining

our

capital

targets

1

5

1

Payout

ratio

of

at

least

50%

conditional

on

both

fully

applied

CET1

ratio

of

minimum

13%

and

fully

applied

CET1

ratio

of

minimum

10%

post-stress |

6

Group results

Refer to slide 36 for details about adjusted and underlying numbers, Basel III numbers and FX

rates in this presentation 1 Refer to page 118 of the 3Q14 report for details on funding

valuation adjustments (FVA) CHF million

3Q13

2Q14

3Q14

Total operating income

6,261

7,147

6,876

Total operating expenses

5,906

5,929

7,430

Profit before tax as reported

356

1,218

(554)

of

which:

own

credit

on

financial

liabilities

designated

at

fair

value

(147)

72

61

of which: gains on sales of real estate

207

1

0

of which: gain on disposals

0

43

0

of which: impairment of a financial investment available-for-sale

0

0

(48)

of which: net restructuring charges

(188)

(89)

(176)

of

which:

credit

related

to

changes

to

a

retiree

benefit

plan

in

the

US

0

0

33

Adjusted profit before tax

484

1,191

(424)

of which: provisions for litigation, regulatory and similar matters

(586)

(254)

(1,836)

of which: impairment of certain disputed receivables and other items

0

(53)

26

of which: net loss associated with implementation of FVA

-

-

(267)

Underlying profit before tax

1,070

1,498

1,653

Profit before tax as reported

356

1,218

(554)

Tax (expense)/benefit

222

(314)

1,317

Net profit attributable to preferred noteholders/non-controlling interests

(1)

(112)

(1)

Net profit attributable to UBS shareholders

577

792

762

Diluted EPS (CHF)

0.15

0.21

0.20

Return on Equity (RoE) (%)

4.9

6.4

6.1

Total book value per share (CHF)

12.58

13.20

13.54

Tangible book value per share (CHF)

10.89

11.54

11.78

1 |

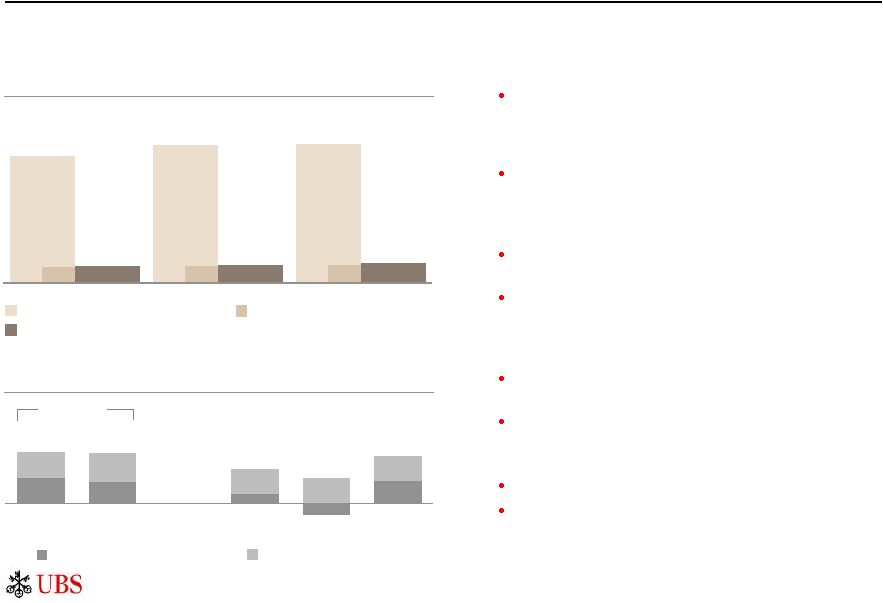

6.6

9.0

5.0

10.7

9.8

FY12

FY13

3Q13

2Q14

3Q14

Operating income and profit before tax

CHF million

Net new money

CHF billion

7

Wealth Management

Highest adjusted PBT since 2Q09; NNM CHF 9.8 billion, positive in all regions

Operating income up 6%

Recurring income up 8% to CHF 1,548 million on higher

recurring net fee income and higher net interest income

Transaction-based income up 1% to CHF 479 million

Strong net new money at CHF 9.8 billion

Positive NNM in all regions, CHF 7.8 billion from APAC

Balanced NNM inflows, UHNW share of NNM at 58%

Annualized NNM growth rate of 4.2%

Adjusted cost/income ratio 62%

Adjusted expenses CHF 1,264 million, down 17%

following lower charges for litigation, regulatory and

similar matters of CHF 14 million in 3Q14, down from

CHF 291 million in 2Q14

Excluding charges for litigation, regulatory and similar

matters, the business exercised good expense control in

the quarter

Refer to slide 36 for details about adjusted and underlying numbers, Basel III numbers and FX

rates in this presentation Operating income (as reported)

Profit before tax (as reported)

Profit before tax (adjusted)

Quarterly

average

Profit before tax (adjusted),

further excluding provisions for

litigation, regulatory and

similar matters

Mandate penetration

CHF 7.3 billion in net mandate sales, penetration up

from 24.2% to 24.5%

1,837

1,921

2,031

555

355

707

617

393

767

3Q13

2Q14

3Q14

684

684

781 |

8

Wealth Management�revenue by source

Increased gross margin on highest quarterly operating income since 3Q08

3Q14

3Q13

1Q14

2Q14

4Q13

Income (CHF million)

Gross margin (bps)

Recurring income as a % of income

Net

interest

income

Recurring net

fee income

Transaction-

based and other

income

Increase mainly due to higher revenues

allocated from Group Treasury and higher net

interest income from Lombard lending

Positive effect from invested asset growth,�

pricing measures and mandate sales more than

offset impact of cross-border asset outflows

Higher FX related trading income partially offset

by first-time fees paid to R&C for net client

shifts and referral fees

Gross margin components (bps)

871

886

899

928

966

Invested assets

CHF billion

Wealth

Management

1

Gross margin components on the slide do not add up to total due to rounding

77%

77%

72%

75%

76%

85

85

87

84

1,837

1,859

1,943

1,919

2,031

24

23

22

23

24

517

513

496

518

569

41

41

40

40

41

891

911

897

922

978

20

20

25

21

20

429

434

551

479

484

86

1 |

5.2

8.4

7.1

9.1

5.1

2.4

7.0

5.0

8.9

7.8

0.1

(1.4)

(2.2)

(0.6)

1.0

0.1

(1.6)

(2.5)

(0.7)

1.1

4.6

13.3

9.2

16.0

13.1

5.5

0.8

11.0

5.3

0.9

1.8

0.3

8.7

0.8

1.8

2.1

0.3

4.4

2.2

0.4

0.6

0.1

3.3

0.3

0.7

5.1

8.5

7.4

9.6

5.7

86

86

85

83

83

3Q13

4Q13

1Q14

2Q14

3Q14

74

74

85

78

83

3Q13

4Q13

1Q14

2Q14

3Q14

92

91

90

89

91

3Q13

4Q13

1Q14

2Q14

3Q14

90

92

93

92

97

3Q13

4Q13

1Q14

2Q14

3Q14

52

51

55

52

57

3Q13

4Q13

1Q14

2Q14

3Q14

1

Based on the Wealth Management business area structure; refer to page 25 of the 3Q14 financial

report for more information Gross

margin

bps

9

Net new

money

CHF billion

Invested assets

CHF billion

1,463

808

745

Client advisors

FTE

30.9.14

Europe

Emerging Markets

of which: UHNW

Wealth Management�by region

1

Switzerland

Asia Pacific

1,189

765

478

358

258

174

165

Net new

money

growth rate

% |

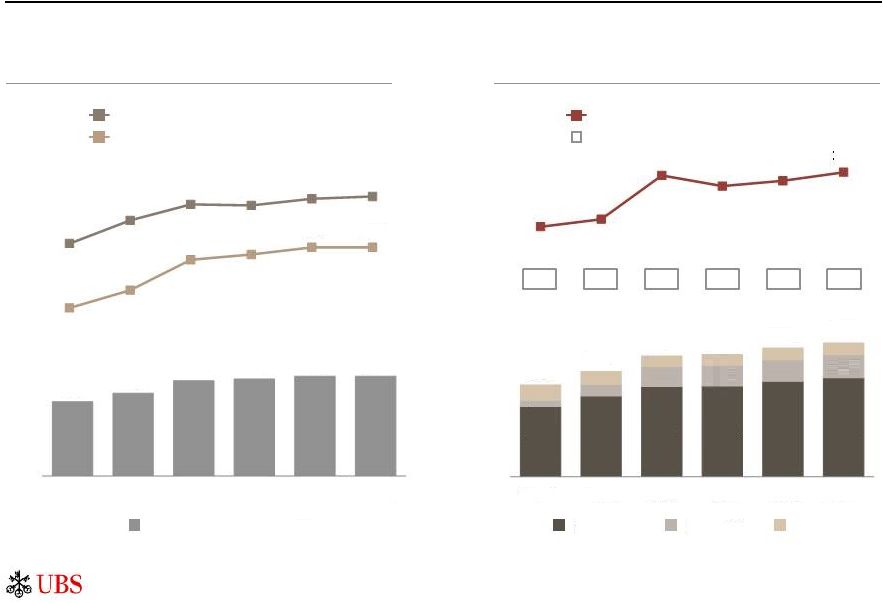

5.5

4.8

2.1

(2.5)

4.9

5.7

6.3

5.4

5.7

5.6

FY12

FY13

3Q13

2Q14

3Q14

10

Wealth Management Americas

Refer to slide 36 for details about adjusted and underlying numbers, Basel III numbers and FX

rates in this presentation USD 4.9 billion net new money

Strong same store NNM and improved

net recruiting

Annualized NNM growth rate of 1.9%

Adjusted cost/income ratio 86%

Adjusted expenses decreased slightly to USD 1,651

million

Charges for litigation, regulatory and similar matters

remained elevated at USD 50 million

Operating income up 1%

Record recurring income as net interest income rose 6%

to USD 276 million on continued� growth in lending

balances, recurring net fee income increased 3% to

USD 1,197 million on higher managed account assets

Transaction-based income decreased 5% on seasonally

lower client activity

NNM excl. dividends & interest

Dividends & interest

Operating income (as reported)

Quarterly

average

Profit before tax (as reported)

Profit before tax (adjusted)

11.2

11.1

7.5

3.2

Continued strong FA productivity

Record annualized revenue per FA of USD 1.1 million

Invested assets per FA of USD 143 million

Adjusted PBT USD 267 million on record income and record FA productivity

Operating income and profit before tax

USD million

Net new money

USD billion

10.5

1,748

1,898

1,919

218

238

254

232

246

267

3Q13

2Q14

3Q14 |

11

Wealth Management Americas�FA productivity and lending

Record invested assets and revenue per FA

Invested assets and FA productivity (USD)

NII

1

and lending balance

2

(USD)

Invested assets per FA

Annualized revenue per FA

Mortgages

Other

5

Credit lines

4

Credit loss (expense)/recovery

Net interest income

3

(5)

(16)

(2)

19

(9)

1 Net interest income 2 Period-end balances; 3 Total WMA net interest income excluding the

following effective interest rate adjustments from mortgage-backed securities

in

the

available-for-sale

portfolio

(USD):

4Q11

(3)

million,

4Q12

2

million,

4Q13

7

million,

1Q14

(9)

million,

2Q14

(3)

million

and

3Q14

4

million;

4

Mostly

collateralized; 5 Mainly margin loans

Invested assets (USD billion)

(1)

109

119

136

139

143

143

859

967

1,042

1,037

1,068

1,079

221

228

269

259

264

272

756

843

970

987

1,017

1,016

4Q11

4Q12

4Q13

1Q14

2Q14

3Q14

22.8

26.1

29.2

29.4

30.9

32.1

2.0

3.8

6.4

6.7

7.0

7.4

29.7

34.1

39.1

39.6

41.7

43.3

4Q11

4Q12

4Q13

1Q14

2Q14

3Q14 |

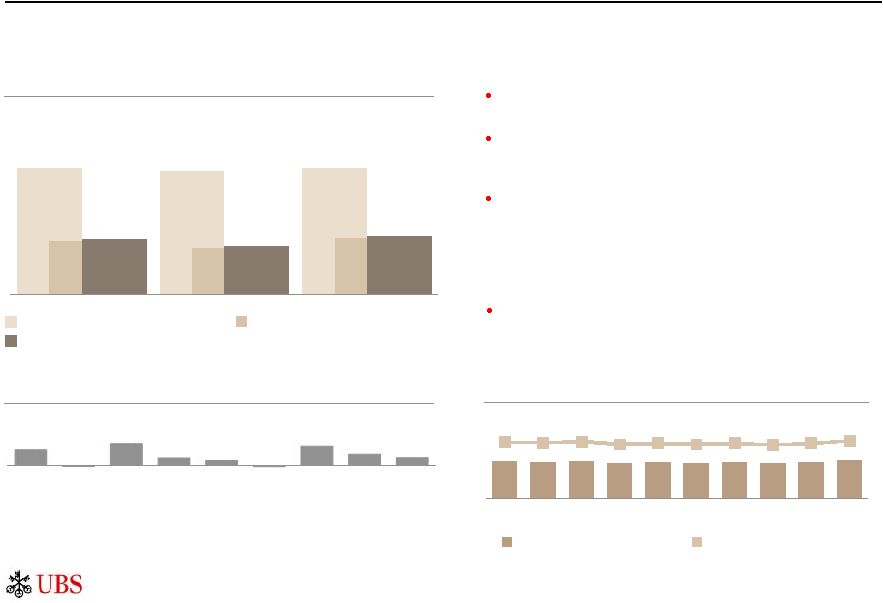

12

Operating income up 2%

Net interest income increased on higher revenues from

Group Treasury and improved loan margin

Transaction-based income increased, driven by the

implementation of client shift and referral fees from

Wealth Management

CHF 33 million net credit loss expense, up from

CHF 8 million, partly due to seasonal effects mainly in

corporates

Adjusted cost/income ratio 52%

Decreased largely due to CHF 48 million lower charges

for provisions for litigation, regulatory and similar

matters and reduced professional fees

Refer to slide 36 for details about adjusted and underlying numbers, Basel III numbers and FX

rates in this presentation 1 Net new business volume

Operating income and profit before tax

CHF million

Operating income (as reported)

Profit before tax (as reported)

Profit before tax (adjusted)

Net interest income, CHF million

Net interest margin, bps

Net interest margin

Highest adjusted PBT since third quarter 2010

NNBV

1

growth rate (retail business)

%, annualized

Retail & Corporate

958

938

958

402

354

426

417

367

446

3Q13

2Q14

3Q14

547

545

556

531

542

531

540

523

541

563

161

159

162

154

157

154

157

153

158

164

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

3Q14

3.5

(0.3)

4.9

1.7

1.1

(0.3)

4.3

2.5

1.7

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

3Q14 |

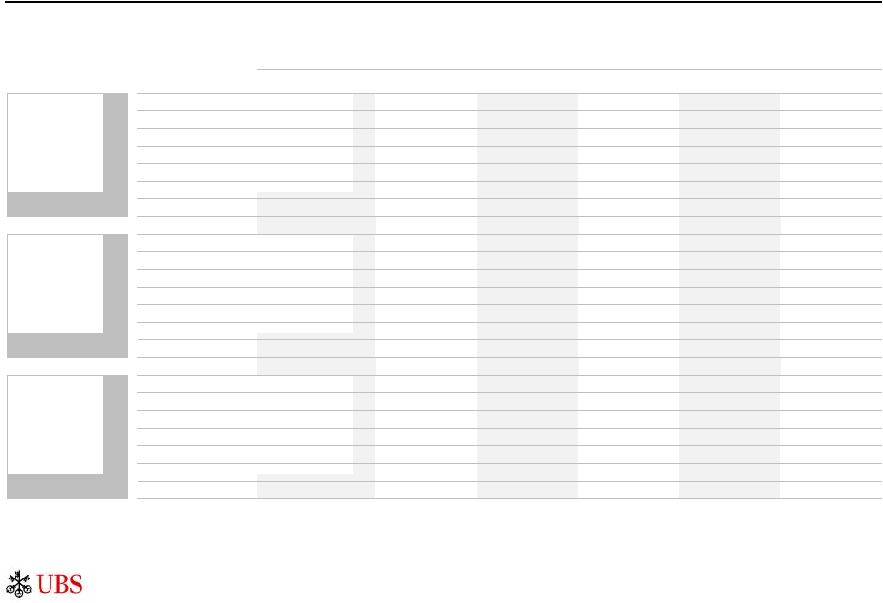

13

Investments in mobile and e-banking support business growth

Retail & Corporate

Significant business growth rate

Financial metrics all substantially higher across age groups and

segments for e-banking and mobile banking customers

Higher client loyalty

Lower attrition rate for e-banking clients, especially in higher

wealth segments

Driven by strategic investments

~40% of current R&C strategic IT investments focused on client-

facing digital and multi-channel capabilities

Investments in R&C platform also benefit our WM franchise:

direct use by WM clients booked in Switzerland; Swiss platform

leveraged by clients in other booking centers

1 9M14, for Swiss private clients (retail and WM Switzerland's high net worth clients) active

in both December 2013 and September 2014, excluding rental deposits and single-purpose

accounts

(e.g.

mono-saver

or

mortgages

only);

2

Return

on

business

volume;

3

Net

new

business

volume

Financials by client type

1

Without e-banking

With e-banking only

With e-

and mobile banking

Income per

client account

RoBV

2

NNBV

3

growth

rate per client

account

Higher client satisfaction

Excellent client feedback: continued 5-star Apple App store

ratings, award recognition, positive press coverage

E-banking and mobile banking clients have higher satisfaction,

shown by a strong uplift of the net promoter score, driving UBS

recommendation and new business

1.2x

2.9x

1.3x |

447

465

489

118

105

154

130

107

151

3Q13

2Q14

3Q14

14

Global Asset Management

PBT up 41% QoQ and 16% YoY; CHF 3.8 billion NNM excluding money markets

WM businesses

Third party

Operating income up 5%

Net management fees up by CHF 35 million, driven by

the sale of a co-investment in global real estate and

increased fees on higher invested assets

Performance fees of CHF 27 million, declined by

CHF 11 million as a decrease in the O'Connor and A&Q

business line were partly offset by increases in

traditional investments and global real estate

Adjusted cost/income ratio 69%

Adjusted operating expenses down 5%, as the prior

quarter included CHF 33 million in charges for litigation,

regulatory and similar matters

Refer to slide 36 for details about adjusted and underlying numbers, Basel III numbers and FX

rates in this presentation 1 Individual NNM channel totals may not add up to total NNM

due to rounding Investment performance:

Gross margin 31 bps

Unchanged as higher revenues were offset by the effect

of a higher invested asset base

Quarterly

average

Operating income (as reported)

Profit before tax (as reported)

Profit before tax (adjusted)

CHF 3.8 billion NNM ex-money market

NNM by channel �

excluding money market

1

CHF billion

Operating income and profit before tax

CHF million

(1.3)

(1.4)

(0.3)

2.9

3.9

(0.2)

0.2

(3.7)

8.7

0.0

FY12

FY13

3Q13

2Q14

3Q14

Strong collective fund performance vs. peers with marked

improvement in equity fund rankings

Increased NNM from WM businesses more than offset by lower

contribution from third parties |

Underlying PBT CHF

494 million, up 47% YoY 15

Refer to slide 36 for details about adjusted and underlying numbers, Basel III numbers and FX

rates in this presentation 1 Based on phase-in Basel III RWA; 2 Refer to page 118 of

the 3Q14 report for details on funding valuation adjustments (FVA) Adjusted operating

income up 16% YoY Strong delivery in a seasonally slow quarter; up YoY on

strong CCS and equities performance; FX, Rates and

Credit impacted by challenging credit trading conditions

Operating income and profit before tax

1

CHF million

Investment Bank

Adjusted cost/income ratio 161%

Adjusted operating expenses up CHF 1,818 million YoY,

driven by CHF 1,687 million in charges for litigation,

regulatory and similar matters

Underlying operating expenses up 9% YoY on higher

personnel expenses

Operating income (adjusted)

Profit before tax (as reported)

Profit before tax (adjusted)

Profit before tax (underlying)

Focused resource utilization

1,707

2,241

1,985

251

579

(1,284)

335

563

(1,205)

3Q13

2Q14

3Q14

494

CHF million

3Q13

2Q14

3Q14

Profit before tax as reported

251

579

(1,284)

Adjusted profit before tax

335

563

(1,205)

of which: provisions for litigation, regulatory

and similar matters

(2)

(11)

(1,687)

of which: net loss associated with

implementation of FVA

2

-

-

(12)

Underlying profit before tax

337

574

494

3Q13

2Q14

3Q14

Underlying

cost/income ratio (%)

80

74

75

Underlying

RoAE (%)

17

31

27

RWA (CHF billion)

59

68

62

RWA ex-operational risk (CHF billion)

46

47

46

RoRWA

1

(%, gross)

11

14

12

Funded assets (CHF billion)

172

182

173

Swiss SRB LRD

(CHF billion)

-

278

279

Front office staff (FTE)

5,318

5,167

5,285 |

16

Highest 3Q revenues in equities since 2010; CCS up YoY in all regions

Corporate Client Solutions (CCS)

Advisory up 31%

with balanced mix of M&A and

advisory revenues, strong performance from EMEA and

APAC

Equity capital markets up 20%

with a strong

participation in rights issues and IPOs

Debt

capital

markets

up

15%

as

DCM

improved

across all regions and LCM continued on its momentum

from 1H14

Financing

solutions

up

25%

on

an

improved

performance in the structured financing businesses

Investor Client Services

2�

(ICS)

Equities

up

7%

driven

by

financing

services;

named

"Structured Products House of the Year" and "Corporate

FX

Rates

and

Credit

down

7%

with

slight

improvement in FX, but was more than offset by weaker

credit revenues

Advisory

Debt capital markets

Financing solutions

Risk management

Equities

FX, Rates and Credit

Adjusted income

1

Refer to slide 36 for details about adjusted and underlying numbers, Basel III numbers and FX

rates in this presentation 1 3Q14 Equities results adjusted for a loss of CHF 48 million

(USD 50 million) from an impairment of a financial investment available-for-sale; 2 Refer to the

"Regulatory

and

legal

developments

and

financial

reporting

changes"

section

of

the

3Q14

report

for

more

information

on

the

shift

of

our

exchange

traded

fixed

income

derivatives

execution

business

from

equities

into

foreign

exchange,

rates

and

credit;

3

September

2014

Corporate

Investor

Investment Bank

CHF million

USD million

CHF million

USD million

YoY comparison in USD terms

Services

Client

Solutions

Client

(70)

33

113

149

164

197

185

216

112

143

505

738

3Q13

3Q14

(76)

35

123

161

178

214

202

233

122

153

548

796

3Q13

3Q14

939

1,003

368

341

1,307

1,344

3Q13

3Q14

864

932

338

315

1,202

1,247

3Q13

3Q14

Equity capital markets

Derivatives

House

of

the

Year"

by

Global

Capital

3 |

17

Corporate Center�Core Functions

Reported profit before tax of negative CHF 190 million

Refer to slide 36 for details about adjusted and underlying numbers, Basel III numbers and FX

rates in this presentation Operating income and profit before tax

CHF million

Operating income CHF 5 million

Operating expenses CHF 194 million

3Q13

4Q13

1Q14

2Q14

3Q14

Treasury income remaining in CC-CF

(219)

(343)

(46)

(55)

(65)

Own credit gain/(loss)

(147)

(94)

88

72

61

Other

169

72

9

6

9

Operating income (as reported)

(197)

(365)

51

23

5

Own credit gain/(loss)

(147)

(94)

88

72

61

Gains on sales of real estate

207

61

23

1

0

Early redemption/buyback of UBS debt

0

(75)

0

0

0

Adjusted operating income

(257)

(257)

(60)

(50)

(56)

Operating expenses (as reported)

282

200

227

(2)

194

Net restructuring charges

(1)

(7)

2

4

16

Adjusted operating expenses

283

207

225

(6)

178

Profit before tax (as reported)

(479)

(565)

(176)

25

(190)

Profit before tax (adjusted)

(540)

(464)

(285)

(44)

(235)

Personnel (after allocation)

1,139

1,055

951

881

916

Net treasury income remaining in Corporate

Center �

Core Functions included CHF 207

million of retained funding costs

Retained funding costs partly offset by

CHF 65 million in gains on cross-currency

basis swaps, interest income CHF 29 million

related to preferred securities and net gains

CHF 25 million related to high-quality liquid

asset portfolios

Increase largely due to net release of

CHF 141 million for provisions, for

litigation, regulatory and similar matters

in 2Q14 and CHF 69 million increase

from the difference between actual

costs incurred and the cost allocations

charged |

18

Corporate Center�Non-core and Legacy Portfolio

Operating income and profit before tax

Refer to slide 36 for details about adjusted and underlying numbers, Basel III numbers and FX

rates in this presentation 1 Refer to page 118 of the 3Q14 report for details on funding

valuation adjustments (FVA) CHF million

Reported profit before tax of negative CHF 603 million

Operating income

negative CHF 322 million

Operating expenses

CHF 280 million

3Q13

4Q13

1Q14

2Q14

3Q14

Non-core

(120)

(104)

17

(151)

(233)

of which: DVA

(47)

(68)

(19)

(44)

-

of which: FVA/DVA

-

-

-

-

(188)

Legacy Portfolio

21

(36)

13

(15)

(92)

of which: SNB StabFund option

74

(28)

(1)

0

0

Credit loss (expense)/recovery

(1)

11

0

(2)

2

Total operating income

(100)

(130)

29

(167)

(322)

Adjusted operating income

(100)

(130)

29

(167)

(322)

Operating expenses (as reported)

593

317

254

245

280

Net restructuring charges

5

24

9

(2)

10

Credit related to changes to

a retiree benefit plan in the US

0

0

0

0

(3)

Adjusted operating expenses

588

293

245

247

273

Profit before tax (as reported)

(693)

(446)

(225)

(412)

(603)

Profit before tax (adjusted)

(688)

(422)

(216)

(414)

(596)

Personnel (front office)

245

222

195

160

150

Negative income in both Non-core and

Legacy Portfolio largely driven by

CHF 252 million net loss resulting from

the implementation of FVA

Non-core:

CHF 188 million net loss related

to FVA/DVA, of which CHF 175 million was

the net loss upon implementation of FVA

Legacy Portfolio:

Negative income driven

by CHF 77 million net loss upon

implementation of FVA

Increase largely due to charges of CHF 89

million for provisions for litigation,

regulatory and similar matters vs. a net

release of 27 million in 2Q14

2Q14 included an impairment charge of

CHF 78 million related to certain disputed

receivables

1

1

1 |

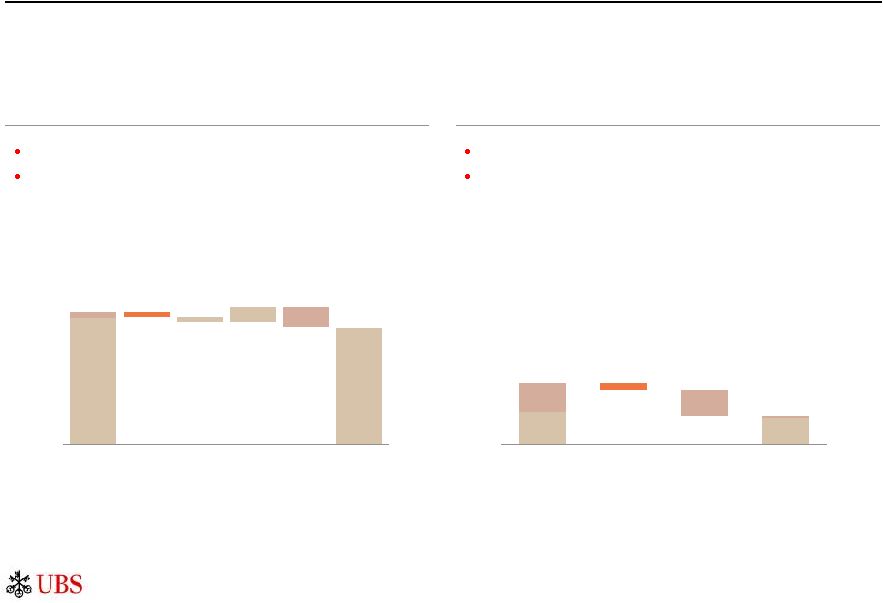

Corporate

Center�Non-core

and

Legacy

Portfolio

1

19

Non-core and Legacy Portfolio RWA

CHF billion

Operational

risk

3

Non-core

credit

Non-core

rates

Non-core

other

Legacy

Portfolio

4

Market and credit risk RWA down 17%, LRD down 12% in the quarter

Non-core OTC positions natural decay of RWA

CHF billion

Original

estimate

at

30.9.12

5

Actual at 30.9.14 and updated

projection

for

future

dates

6

1 Refer to pages 68-70 of the 3Q14 report for more information; 2 Pro-forma estimate

for 31.12.12 based on period ending balance; 3 Non-core and Legacy Portfolio

operational risk; 4 Excluding operational risk; 5 Estimates disclosed in the 3Q12 presentation;

6 Estimates based on 30.9.14 data Non-core

Legacy Portfolio

Non-core and Legacy Portfolio Swiss SRB LRD

2

CHF billion

33

30.9.14

44%

95% of Non-core RWA

ex-operational risk are

OTC positions which will

naturally decay over time

12

27

22

17

10

9

8

31.12.15

31.12.16

31.12.17

20.3

3.7

1.8

29.3

9.6

9.2

4.5

1.3

1.3

34.2

14.1

11.3

14.2

23.1

18.4

102.5

51.9

42.1

31.12.12

30.6.14

30.9.14

~255

99

87

~38

22

19

~293

121

106

31.12.12

30.6.14

30.9.14 |

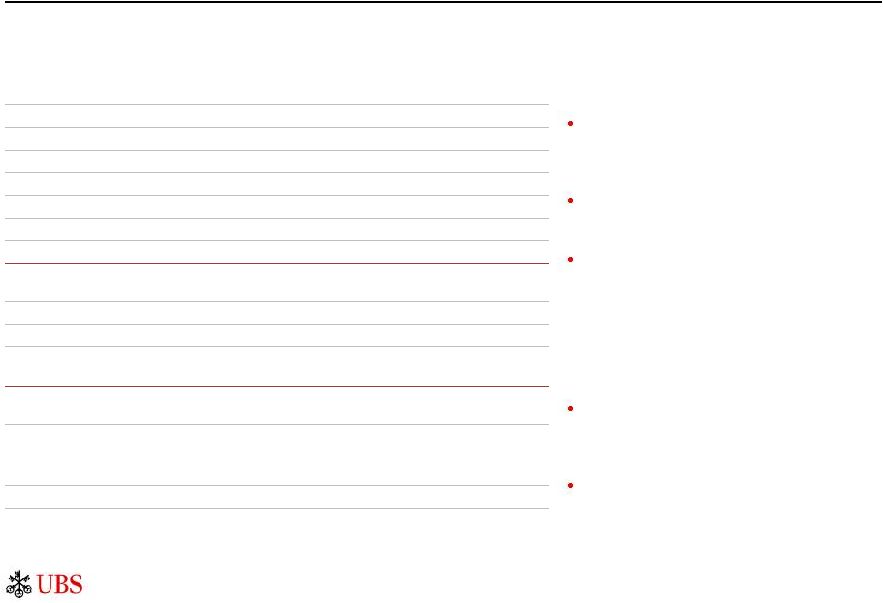

Corporate Center

cost reductions 20

Core Functions:

CHF

1.0

billion

net

cost

reduction

target

by

2015

1

Adjusted operating expenses before allocations to business divisions

CHF billion

Non-core and Legacy Portfolio:

CHF

0.4

billion

net

cost

reduction

target

by

2015

1

Adjusted operating expenses

CHF billion

Refer to slide 34 in the appendix for details about adjusted numbers; charts illustrative only

and bars not to scale 1 Refer to page 11 of the 2Q14 report for details on our cost

reduction targets Achieved net cost reduction of ~CHF 0.1 billion vs. 9M13

Annualized 9M14 costs lower than previous year primarily

due to decrease in litigation provisions

Achieved net cost reduction of ~CHF 0.2 billion vs. 9M13

Significantly lower provisions for litigation and regulatory

matters

~CHF 0.3 billion of net cost reductions achieved year-to-date

Net cost

reduction

9M13

annualized

adjusted

operating

expenses

9M14

annualized

adjusted

operating

expenses

2.8

Changes in

provisions

for litigation,

regulatory

and similar

matters

Net cost

reduction

FX

movements

Changes in

regulatory

demand of

temporary

nature

9M13

annualized

adjusted

operating

expenses

9M14

annualized

adjusted

operating

expenses

7.8

7.6

1.0

Changes in

provisions

for litigation,

regulatory

and similar

matters

(0.4)

0.3

(0.1)

(0.1)

(0.2)

(1.6) |

~0.9

~0.9

~0.4

~0.5

~1.0

~0.8

~1.5

~1.4

~0.7

~1.5

~2.2

Guidance

Actual

Updated restructuring cost guidance

21

1 Initially announced 30.10.12; 2 Additional temporary costs that are necessary to effect our

cost reduction program but not classified as restructuring charges; 3 Refer to page 154

of our 3Q14 report for the definition of restructuring charges; 4 Cumulative total initial guidance for 2011-2013 as announced 23.8.11 and 30.10.12; 5 Refer to

page 11 of our 2Q14 report for details about our cost reduction targets

2011-2013

CHF billion

2014-2015

CHF billion

2016-2017

CHF billion

Actual restructuring expenses have

been lower than guidance

4

2011-2013 restructuring costs

~CHF 0.6 billion below guidance

Committed to our CHF 1.4 billion net cost

reduction

target

for

2015

year-end

run-rate

5

Revised restructuring guidance for 2014-2015

IT infrastructure and simplification investment will

account for ~50% of total restructuring costs and

additional CtA in 2015-2017

2014

2015

Previous

guidance

1

Additional

cost-to-achieve

2

(CtA)

Restructuring

costs

3

(excluded

from

adjusted

results)

2016

2017

Committed to our CHF 0.7 billion net

cost reduction target

5

as we fully exit

the Non-core and Legacy Portfolio

Guidance period extended to

2017 as we invest to offset ongoing

incremental regulatory costs |

Net tax benefit and

deferred tax assets 1

DTA

figures

are

stated

net

of

DTL;

2

As

of

30.9.14,

the

net

DTA

recognized

on

UBS's

balance

sheet

(CHF

10,074

million)

includes

a

tax

loss

DTA

(CHF 6,860 million) and a DTA for temporary differences (CHF 3,214 million);� 3 DTA annual

revaluations performed in 3Q14 but smaller revaluations can take place at different

times for specific entities based on specific circumstances; 4 As disclosed on page 69 in our

2013 Annual Report, UBS may, depending on our financial performance, increase the future

profit recognition period. Where appropriate, such an extended DTA profit recognition period was applied in 3Q14.

5 years

Year: 1

2

3

4

5

6

8

7

�

Tax loss DTA

1

CHF billion

22

DTA revaluation

3

Illustrative example

Net tax benefit of CHF 1,317 million; DTA potential remains significant

9

6 years

2013

2014

Net

upward

revaluation

of

DTA

for

the

Group

of

CHF

1,420

million

recognized

in

3Q14,

additional

~CHF

0.4

billion

expected

to

be

recognized in 4Q14

The future profit recognition period used for DTA revaluation was extended from 5 years to 6

years Average unrecognized tax loss DTA have a remaining life of ~16 years in the US and

~2 years in Switzerland; unrecognized tax losses have indefinite life in the UK

Total

2

US

RoW

CH

UK

3

6.9

3.6

3.1

0.1

0.1

23.1

16.4

2.8

2.9

1.0

CHF million

Net

deferred

tax

benefit

with

respect

to

recognition

of

DTA

1,420

Other net tax expense in respect of 3Q14 taxable profits

(103)

Net tax benefit

1,317

Extended profit recognition period

4

Unrecognized

Recognized |

99

107

115

129

~105

~105

62

68

62

14

70

70

64

52

42

76

~40

~25

~400

225

227

219

219

<215

<200

30.9.11

31.12.13

30.6.14

30.9.14

30.9.14

by risk

type

31.12.15

target

31.12.17

target

Swiss SRB capital and leverage ratios

Fully applied CET1 capital ratio of 13.7% and leverage ratio of 4.2%

Swiss SRB RWA and capital ratios

CHF billion

Swiss SRB LRD and leverage ratio

CHF billion

Non-core and Legacy Portfolio

Leverage ratio (fully applied)

Leverage ratio (phase-in)

Swiss SRB total exposure

Refer to slide 36 for details about adjusted and underlying numbers, Basel III numbers and FX

rates in this presentation 1 At the end of the third quarter, our post-stress CET1

capital ratio exceeded our objective of achieving and maintaining a post-stress CET1 capital ratio of at least 10% on a fully

applied

basis.

Refer

to

the

"Capital

management"

section

of

the

3Q14

financial

report

for

more

detail;

2

Includes

CHF

15

billion

for

non-counterparty-related risk; 3 Full exit of Non-core and Legacy Portfolio

equivalent to ~45-55 bps increase in fully applied Swiss SRB leverage ratio based on current fully applied

Swiss SRB leverage ratio numerator and denominator; 4 Based on the rules applicable as of the

announcement of the target (6.5.14) Investment Bank

Other business divisions and

Corporate Center �

Core Functions

Non-core and Legacy Portfolio

CET1

capital

ratio

(fully

applied)

1

Total capital ratio (fully applied)

23

Operational

35%

Market 6%

Credit

2

59%

4.7%

5.3%

5.4%

3.4%

4.2%

4.2%

15.4%

18.1%

18.7%

6.2%

12.8%

13.5%

13.7%

160

121

106

3

1,020

981

985

900

31.12.13

30.6.14

30.9.14

2016

target

4 |

~22%

~21%

~35%

24

Currency sensitivites

Group

CC �

Core

Functions

Investment

Bank

CHF

USD

EUR

Other

RWA

Fully applied

LRD

Fully applied

~13%

A 10% depreciation of the Swiss

franc against other currencies

would:

Currency distribution of RWA and LRD

% of total

Percentages on charts may not add up to 100% due to rounding

1 Based on period ending balance as of 30.9.14

USD appreciation/CHF depreciation inflates RWA, balance sheet and LRD

Basel III CET1

(fully applied)

Equity attributable to

shareholders

~15%

~24%

~33%

~25%

~17%

~14%

~46%

~23%

~19%

~12%

~63%

27%

Currency distribution of equity

% of total

~10%

~6%

~35%

~56%

~24%

~67%

~3%

~6%

~3%

~6%

Operational risk RWA (CHF)

~2%

~22%

~55%

~2%

~1%

~8%

~43%

~6%

~42%

Increase fully applied RWA by ~5%

Increase fully applied LRD

1

by ~8%

Increase IFRS equity by ~5%

Increase Basel III fully applied CET1 capital by

~3%

1 |

Interest rate

sensitivities 1

Our revenues are positively geared to rising interest rates

1 For

all

scenarios,

interest

rate

increases

are

assumed

to

be

equal

across

all

currencies

and

relative

to

implied

forward

rates

based

on

static

balance

sheet

and

constant

FX rates; 2 The estimated impact is for the first year of the relevant interest rate scenario;

3 The estimated impact on OCI only applies to treasury portfolios and does not consider

pension liabilities and assets; 4 Majority of the impact on OCI would be through cash flow hedges, which would not affect regulatory capital

25

~0.7

R&C

~0.4

WM

WMA

~0.2

Scenario

overview

and

incremental

NII

by

business

division

(+100

bps

parallel

increase,

scenario

B)

3M

8Y

10Y

B

C

A

+20 bps

+100 bps

+200 bps

1Y

A

Steepener

(+20 bps to +200 bps)

B

Parallel

(+100 bps)

C

Flattener

(+200 bps to +20 bps)

Annual incremental

net interest income

2

Negative impact

on OCI

3

Negative impact

on regulatory capital

~ 0.2

(all scenarios

4

)

~0.4

~1.7

~1.3

~2.1

~2.3

~2.8

Interest

rate

scenarios:

estimated

impact

on

NII,

OCI

and

regulatory

capital

CHF

billion |

Indicative timetable

of principal events 1

1 Dates

and

duration

dependent

on

certain

conditions,

acceptance

periods

could

be

extended

one

or

several

times;

2

F-4

registration

statement

publicly

filed;

3 Two simultaneous offers are being conducted in the USA and Switzerland (to include an

international component via a EU prospectus); 4 Subject to shareholder approval through

a General Meeting; 5 Payout ratio of at least 50% conditional on both fully applied CET1 ratio of minimum 13% and our objective of achieving and maintaining a post-

stress CET1 capital ratio of at least 10%

29

Sept:

Swiss

offer

prospectus published; US

offer to exchange /

prospectus for offer

published

2

Cooling-off period

30 Sept to 13 Oct

Initial

acceptance

period

1

14 Oct to 11 Nov

12

Nov:

Publication

of

preliminary interim exchange

offer results

17

Nov:

Publication

of

definitive results

19

Nov:

First

settlement

for

UBS

shares tendered in initial acceptance

period, first trading day of UBS Group

Shares on SIX Swiss Exchange and

NYSE

2

Dec:

Publication

of

preliminary interim

exchange offer results

5

Dec:

Publication

of

definitive results

Additional

acceptance

period

1

17 Nov to 1 Dec

The

exchange

offer

may

take

up

to

three

months

from

the

publication

of

the

Swiss

and

US

prospectuses

3

to

final

settlement

of

the offer, any squeeze-out required thereafter could take several additional months

Shareholders will be able to tender their shares in an initial and additional acceptance

period A key condition for the successful completion of the offer is achieving a 90%

acceptance level by shareholders Enhanced resolvability is expected to result in UBS

qualifying for a capital rebate under Swiss Too-Big-To-Fail legislation

Following

successful

completion

of

the

transaction,

we

expect

to

propose

a

supplementary

capital

return

of

at

least

CHF

0.25

per

share

4

from

the

Group

holding

company,

which

would

be

separate

and

in

addition

to

our

targeted

capital

return

of

at

least

50%

of

net

profit

attributable

to

shareholders

5

9

Dec:

Second

settlement

for

UBS

shares tendered in additional

acceptance period

26

Group holding company: share for share exchange timeline

Initial acceptance period ending on 11 November

1 |

Key messages

The fundamental earnings power of our unrivaled franchise is evident

�

WM/WMA combined adjusted PBT >CHF 1 billion

�

Strong performance in Retail & Corporate with all KPIs within target ranges

�

Solid Investment Bank and Global AM performance despite challenging market conditions

Results include provisions for litigation, regulatory and similar matters

�

We continue to seek resolution of open issues

�

Timing of full resolution of complex industry-wide issues is difficult to predict

We will continue executing our strategy and are well positioned for growth

�

Seizing current revenue opportunities and positioned for future economic recovery

�

Improving efficiency will release resources to invest for growth

�

Continued

reduction

in

the

Non-core

and

Legacy

Portfolio

Our capital position is strong and our businesses are highly capital accretive

�

Continued capital strength in an evolving regulatory environment

�

Share-for-share exchange offer in progress creating eligibility for capital

rebate �

Committed

to

payout

ratio

of

at

least

50%

subject

to

maintaining

our

capital

targets

1

27

1 Payout

ratio

of

at

least

50%

conditional

on

both

fully

applied

CET1

ratio

of

minimum

13%

and

fully

applied

CET1

ratio

of

minimum

10%

post-stress |

Appendix

|

1 The regional

figures do not correspond precisely to the financial statements of the UBS subsidiaries and branches established in the regions because they reflect different

allocation principles; 2 Europe, Middle East, and Africa excluding Switzerland; 3 Refers to

items managed globally 29

Regional performance excluding charges for provisions for litigation, regulatory and similar

matters

1

CHF billion

2Q14

3Q14

2Q14

3Q14

2Q14

3Q14

2Q14

3Q14

2Q14

3Q14

2Q14

3Q14

WM

0.1

0.1

0.4

0.5

1.0

1.0

0.4

0.4

0.0

(0.0)

1.9

2.0

WMA

1.7

1.8

-

-

-

-

-

-

-

-

1.7

1.8

R&C

-

-

-

-

-

-

0.9

1.0

-

-

0.9

1.0

Global AM

0.2

0.2

0.1

0.1

0.1

0.1

0.1

0.1

-

-

0.5

0.5

Investment Bank

0.7

0.6

0.6

0.6

0.7

0.6

0.3

0.2

0.0

(0.1)

2.3

1.9

Corporate Center

-

-

-

-

-

-

-

-

(0.1)

(0.3)

(0.1)

(0.3)

Group

2.6

2.7

1.2

1.2

1.7

1.7

1.7

1.7

(0.1)

(0.4)

7.1

6.9

WM

0.1

0.1

0.3

0.3

0.7

0.7

0.2

0.2

0.0

(0.0)

1.3

1.3

WMA

1.4

1.5

-

-

-

-

-

-

-

-

1.4

1.5

R&C

-

-

-

-

-

-

0.5

0.5

-

-

0.5

0.5

Global AM

0.1

0.1

0.0

0.1

0.1

0.1

0.1

0.1

0.0

0.0

0.3

0.3

Investment Bank

0.5

0.5

0.5

0.4

0.5

0.5

0.2

0.2

0.0

0.0

1.7

1.5

Corporate Center

-

-

-

-

-

-

-

-

0.4

0.4

0.4

0.4

Group

2.2

2.2

0.8

0.8

1.2

1.2

1.0

1.0

0.4

0.4

5.7

5.6

WM

0.0

0.0

0.1

0.2

0.3

0.3

0.2

0.2

0.0

0.0

0.6

0.7

WMA

0.3

0.3

-

-

-

-

-

-

-

-

0.3

0.3

R&C

-

-

-

-

-

-

0.4

0.4

-

-

0.4

0.4

Global AM

0.1

0.1

0.0

0.0

0.0

0.0

0.1

0.0

(0.0)

(0.0)

0.1

0.2

Investment Bank

0.1

0.1

0.2

0.2

0.2

0.1

0.1

0.1

(0.0)

(0.1)

0.6

0.4

Corporate Center

-

-

-

-

-

-

-

-

(0.6)

(0.7)

(0.6)

(0.7)

Group

0.5

0.5

0.3

0.4

0.5

0.4

0.7

0.7

(0.6)

(0.8)

1.5

1.3

Switzerland

Corporate Center

and global�

Total

Operating

income

Operating

expenses

Profit

before tax

Americas

Asia Pacific

EMEA� |

30

Retained Treasury income in Corporate Center�Core Functions

Treasury

income

retained

in

Corporate

Center

�

Core

Functions

We continue to expect retained funding costs to decline in the mid-term

CHF million

Central funding costs retained in Group Treasury increased as a result of the issuance of CHF

8.8 billion in senior unsecured debt in 3Q14, the negative impact from the WM and

R&C methodology change in the allocation of liquidity and funding costs, and as businesses continued to

reduce their consumption of funding

Retained funding costs expected to decrease to a negligible amount in FY16

Credit spread compression

will drive down costs of the

Group's overall long term

funding along with

declining volumes as we

reduce our balance sheet

We will continue to

maintain a diversified

funding profile and

comfortable LCR and NSFR

ratios

FY13

1Q14

2Q14

3Q14

Gross results (excluding accounting driven adjustments)

664

137

174

235

Allocations to business divisions

(921)

(206)

(243)

(341)

Net revenues

(excluding accounting driven adjustments)

(257)

(69)

(69)

(108)

of which: retained funding costs

(510)

(165)

(182)

(207)

of which: profits retained in Treasury

253

96

113

99

Accounting asymmetry and other adjustments

(645)

23

16

42

Mark-to-market losses from cross currency swaps, macro cash flow

hedge ineffectiveness, Group Treasury FX, debt buyback and other

Net treasury income retained in CC-Core Functions

(902)

(46)

(55)

(65) |

31

IFRS equity attributable to UBS shareholders

30.6.14

Foreign

currency

translation

(OCI)

30.9.14

Employee share

and share

options plans

(within share

premium)

Cash flow

hedges (OCI)

Net profit

Treasury

shares

Financial

investments

available-for-

sale (OCI)

Defined

benefit plans

(OCI)

Other

QoQ movement

CHF millions, except for per share figures in CHF

Refer to slide 36 for details about adjusted and underlying numbers, Basel III numbers and FX

rates in this presentation Total book value per share:

Tangible book value per share:

11.54

13.20

Equity attributable to UBS shareholders surpasses CHF 50 billion

30.6.14

11.78

13.54

30.9.14

+2.6%

+2.1%

49,532

762

1,195

15

(38)

(889)

232

8

7

50,824 |

Other (including

net replacement)

Loans

Cash collateral on securities borrowed

and reverse repo agreements

Trading portfolio assets

Financial investments available-

for-sale

Cash, balances with central

banks and due from banks

32

Our balance sheet, funding and liquidity positions are strong

Our balance sheet structure has many characteristics of a AA-rated bank

Refer to slide 36 for details about adjusted and underlying numbers, Basel III numbers and FX

rates in this presentation 1 As of 30.9.14. Refer to liquidity and funding management

section of the 3Q14 report for further detail; 2 As of 30.9.14. Pro-forma ratios using supervisory

guidance from FINMA. Refer to the liquidity and funding management section of the 3Q14

financial report for details about the calculation of UBS�s Basel III LCR and

NSFR Due to banks (12), Short-term

debt issued (34), Trading portfolio

liabilities (28), and Cash collateral

on securities lent

and repo agreements (23)

Long-term debt issued

Due to customers

Total equity

Other liabilities

Strong funding and liquidity

Well diversified by market, tenor and currency with over 59% of funding from deposits

Limited use of short-term wholesale funding

107%

Basel

III

NSFR

2

and

128%

Basel

III

LCR

2

129%

coverage

Asset funding

1

CHF billion

89

53

310

117

130

136

94

402

56

126

Assets

Liabilities and equity |

Breakdown of changes

in Group RWA 33

30.6.14

Refer to slide 36 for details about adjusted and underlying numbers, Basel III numbers and FX

rates in this presentation 1 Incremental

operational

risk

RWA

based

on

the

supplemental

operational

risk

capital

analysis

mutually

agreed

to

by

UBS

and

FINMA;

2

Refer

to

pages

68-70

of

the

3Q14

By type

CHF billion

30.6.14

By business division

CHF billion

227

219

+4

(5)

227

219

+5

(6)

+4

(10)

30.9.14

�

�

�

Book size and other

�

�

�

FX impact

Non-core and Legacy Portfolio�

�

�

�

Investment Bank

�

�

�

30.9.14

(6)

Corporate

Center

�

Core

Functions

�

�

All other businesses�

�

�

CHF 6.7 billion decrease related to incremental operational risk

RWA�

CHF 1.3 billion increase in market risk RWA due to the annual

recalibration of risks not in VaR

CHF 1.0 billion decrease in credit risk RWA related to right way

risk trades

CHF 4.9 billion reduction in credit risk RWA as the prior quarter

included temporarily higher RWA related to aged trade

settlements

and the sale of certain collateralized loan obligation

(CLO) bond positions in the current quarter

CHF 1.0 billion reduction in market risk RWA, primarily

comprehensive risk measure as a result of the exit of the

majority of the correlation trading portfolio

CHF 1.4 billion higher non-counterparty-related risk RWA,

mainly related to deferred tax assets

CHF 4.6 billion decrease in incremental operational risk� RWA

CHF 2.2 billion reduction in market risk RWA, primarily comprehensive

risk measure as a result of the exit of the majority of the correlation

trading portfolio

CHF 2.8 billion reduction in credit risk RWA primarily due to the sale of

certain

collateralized

loan

obligation

(CLO)

bond

positions

and

termination

of derivative trades

CHF 3.0 billion increase in incremental operational risk� RWA

CHF 1.4 billion higher non-counterparty-related risk RWA mainly due to

deferred tax assets

CHF

5.5

billion

decrease

related

to

incremental

operational

risk

RWA

CHF 2.0 billion lower credit risk RWA, as the prior quarter included

temporarily higher RWA related to aged trade settlements

CHF

1.0

billion

increase

in

market

risk

RWA

primarily

due

to

the

annual

recalibration of risks not in VaR

CHF 1.4 billion increase in incremental operational risk RWA

CHF 2.3 billion increase in credit risk RWA due resulting from the

strengthening of the US dollar versus the Swiss franc and also reflecting

higher RWA related to undrawn commitments

Methodology/model-driven

financial report for more information on Non-core and Legacy Portfolio; 3 Wealth

Management, Wealth Management Americas, Retail & Corporate and Global Asset

Management |

Corporate Center

adjusted operating expenses before service allocation

34

CC -

Core Functions -

adjusted expenses before service allocation

to business divisions and CC -

Non-core and Legacy Portfolio

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

3Q14

9M13

9M14

FY13

CHF million

Personnel expenses

1,101

1,006

955

1,007

959

904

875

3,063

2,739

4,070

General and administrative expense

910

849

1,022

970

947

806

1,014

2,781

2,767

3,750

Depreciation and impairment of property and equipment

161

180

170

185

179

184

178

511

542

696

Amortization and impairment of intangible assets

1

1

1

1

1

1

2

3

4

4

Total adjusted operating expenses before service allocation to

business divisions and CC -

Non-core and Legacy Portfolio

2,173

2,036

2,148

2,163

2,087

1,895

2,069

6,357

6,051

8,520

Net allocations to business divisions

(1,931)

(1,915)

(1,865)

(1,956)

(1,862)

(1,902)

(1,892)

(5,711)

(5,655)

(7,667)

of which: Wealth Management

498

484

460

521

464

504

490

1,443

1,457

(1,964)

of which: Wealth Management Americas

274

267

264

268

250

264

265

806

778

(1,074)

of which: Retail & Corporate

316

306

305

319

275

282

268

927

825

(1,246)

of which: Global Asset Management

128

123

126

123

113

114

116

377

342

(499)

of which: Investment Bank

557

562

560

589

632

621

626

1,678

1,879

(2,267)

of which: CC -

Non-core and Legacy Portfolio

157

173

150

136

129

117

126

480

372

(616)

Total adjusted operating expenses

242

121

283

207

225

(6)

178

646

397

853 |

35

Adjusted results

Adjusting items

Business division / Corporate Center

3Q13

2Q14

3Q14

FY13

CHF million

Operating income as reported (Group)

6,261

7,147

6,876

27,732

Of which:

Own credit on financial liabilities designated at fair value

Corporate Center -

Core Functions

(147)

72

61

(283)

Gains on sales of real estate

Corporate Center -

Core Functions

207

1

0

288

Corporate Center -

Core Functions

0

0

0

(194)

Corporate Center -

Non-core and Legacy Portfolio

0

0

0

27

Gain from the partial sale of our investment in Markit

Investment Bank

0

43

0

0

Impairment of financial investments available-for-sale

Investment Bank

0

0

(48)

34

Investment Bank

0

0

0

55

Corporate Center -

Core Functions

0

0

0

(24)

Operating income adjusted (Group)

6,201

7,031

6,863

27,829

Operating expenses as reported (Group)

5,906

5,929

7,430

24,461

Of which:

Wealth Management

62

38

60

178

Wealth Management Americas

13

7

15

59

Retail & Corporate

15

13

20

54

Global Asset Management

12

2

5

43

Investment Bank

84

27

50

210

Corporate Center -

Core Functions

(1)

4

16

(6)

Corporate Center -

Non-core and Legacy Portfolio

5

(2)

10

235

Wealth Management Americas

0

0

(3)

0

Global Asset Management

0

0

(8)

0

Investment Bank

0

0

(19)

0

Corporate Center -

Non-core and Legacy Portfolio

0

0

(3)

0

Operating expenses adjusted (Group)

5,718

5,840

7,287

23,689

Operating profit/(loss) before tax as reported

356

1,218

(554)

3,272

Operating profit/(loss) before tax adjusted

484

1,191

(424)

4,141

Net loss related to the buyback of debt in public tender offer

Net restructuring charges

Credit related to changes to a retiree benefit plan in the US

Net gain on sale of remaining proprietary trading business |

Important

information related to numbers shown in this presentation

36

Use of adjusted numbers

Unless otherwise indicated, �adjusted� figures exclude the adjustment items listed on

the previous slide, to the extent applicable, on a Group and business division level. Adjusted

results are a non-GAAP financial measure as defined by SEC regulations. Refer to pages

12-13 of the 3Q14 financial report for an overview of adjusted numbers. Use of underlying numbers

Unless otherwise indicated, �underlying� figures exclude the adjusting items listed

on the previous slide as well as charges for provisions for litigation, regulatory and similar matters,

net losses associated with the implementation of FVA, impairment charges related to certain

disputed receivables and other expenses, to the extent applicable, on a Group and

business division level. Adjusted results are a non-GAAP financial measure as defined by

SEC regulations. Refer to the "Group Performance" and "Investment Bank" sections of the

3Q14 financial report for more information on underlying numbers. Basel III RWA, Basel III capital and Basel III liquidity ratios

Basel III numbers are based on the BIS Basel III framework, as applicable for Swiss

Systemically relevant banks (SRB). Numbers in the presentation are SRB Basel III numbers unless

otherwise stated. Our fully applied and phase-in Swiss SRB Basel III and BIS Basel III

capital components have the same basis of calculation, except for differences disclosed on page

84 of the 3Q14 financial report.

Basel III risk-weighted assets in the presentation are calculated on the basis of Basel III

fully applied unless otherwise stated. Our RWA under BIS Basel III are the same as under

Swiss SRB Basel III.

Leverage ratio and leverage ratio denominator in this presentation are calculated on the basis

of fully applied Swiss SRB Basel III, unless otherwise stated.

From 1Q13 Basel III requirements apply. All Basel III numbers prior to 1Q13 are on a

pro-forma basis. Some of the models applied when calculating pro-forma information required

regulatory approval and included estimates (discussed with our primary regulator) of the effect

of these new capital charges.

Refer to the �Capital Management� section in the 3Q14 financial report for more

information.

Currency translation

Monthly income statement items of foreign operations with a functional currency other than

Swiss francs are translated with month-end rates into Swiss francs. Refer to �Note 17

Currency translation rates� in the 3Q14 financial report for more information.

Rounding

Numbers presented throughout this presentation may not add up precisely to the totals provided

in the tables and text. Percentages, percent changes and absolute variances are

calculated based on rounded figures displayed in the tables and text and may not precisely

reflect the percentages, percent changes and absolute variances that would be derived

based on figures that are not rounded.

|

This Form 6-K is hereby incorporated by reference into (1)�each of the registration statements of UBS�AG on Form�F-3 (Registration Number 333-178960) and Form�S-8 (Registration Numbers 333-49210; 333-49212; 333-127183; 333-127184; 333-162798; 333-162799; 333-162800; 333-178539; 333-178540; 333-178541; and 333-178543) and into each prospectus outstanding under any of the foregoing registration statements, (2)�the registration statement of UBS Group AG on Form F-4 (Registration Number 333-199011) and into each prospectus outstanding thereunder, (3)�any outstanding offering circular or similar document issued or authorized by UBS�AG that incorporates by reference any Form�6-K�s of UBS�AG that are incorporated into its registration statements filed with the SEC, and (4)�the base prospectus of Corporate Asset Backed Corporation (�CABCO�) dated June�23, 2004 (Registration Number�333-111572), the Form�8-K of CABCO filed and dated June�23, 2004 (SEC�File Number�001-13444), and the Prospectus Supplements relating to the CABCO Series�2004-101 Trust dated May�10, 2004 and May�17, 2004 (Registration Number�033-91744 and 033-91744-05).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.