Form 6-K HSBC HOLDINGS PLC For: Mar 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a - 16 or 15d - 16

of the Securities Exchange Act of 1934

For the month of March 2015

HSBC Holdings plc

42nd Floor, 8 Canada Square, London E14 5HQ, England

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F).

Form 20-F x Form 40-F ¨

(Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934).

Yes ¨ No x

(If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ).

This Report on Form 6-K shall be deemed incorporated by reference into the

Registrant’s Registration Statement on Form F-3ASR (File No. 333-202420).

HSBC Holdings plc (the “Registrant”) hereby incorporates by reference the following exhibits to this report on Form 6-K into their Registration Statement on Form F-3ASR (File No. 333-202420).

| Exhibit No. |

Description of Document | |

| 4.1 | First Supplemental Indenture to the Contingent Convertible Securities Indenture, dated September 17, 2014 (incorporated by reference to Exhibit 4.1 to the Registrant’s report on Form 6-K (File No. 001-14930) as previously filed with the Securities and Exchange Commission on September 17, 2014). | |

| 4.2 | Third Supplemental Indenture to the Contingent Convertible Securities Indenture, dated March 30, 2015. | |

| 5.1 | Opinion of Cleary Gottlieb Steen & Hamilton LLP, special US counsel to the Registrant, dated March 30, 2015. | |

| 5.2 | Opinion of Cleary Gottlieb Steen & Hamilton LLP, special English counsel to the Registrant, dated March 30, 2015. | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| HSBC Holdings plc | ||||||

| Date: March 30, 2015 | ||||||

| By: | /s/ Iain J Mackay | |||||

| Name: | Iain J Mackay | |||||

| Title: | Group Finance Director | |||||

Exhibit 4.2

Execution Version

HSBC HOLDINGS PLC,

as Issuer

THE BANK OF NEW YORK MELLON, LONDON BRANCH,

as Trustee

HSBC BANK USA, NATIONAL ASSOCIATION,

as Paying Agent, Registrar and Calculation Agent

THIRD SUPPLEMENTAL INDENTURE

Dated as of March 30, 2015

To the Contingent Convertible Securities Indenture, dated as of August 1, 2014,

among the Issuer, the Trustee and the Paying Agent and Registrar

$2,450,000,000 6.375% Perpetual Subordinated Contingent

Convertible Securities (Callable March 2025 and Every Five Years Thereafter)

TABLE OF CONTENTS

| Page | ||||||

| ARTICLE I | ||||||

| DEFINITIONS AND OTHER PROVISIONS OF GENERAL APPLICATION | ||||||

| Section 1.01 | Definitions |

1 | ||||

| Section 1.02 | Effect of Headings |

15 | ||||

| Section 1.03 | Separability Clause |

16 | ||||

| Section 1.04 | Benefits of Instrument |

16 | ||||

| Section 1.05 | Relation to Base Indenture |

16 | ||||

| Section 1.06 | Relation to Calculation Agent Agreement |

16 | ||||

| Section 1.07 | Construction and Interpretation |

16 | ||||

| ARTICLE II | ||||||

| $2,450,000,000 6.375% PERPETUAL SUBORDINATED CONTINGENT CONVERTIBLE SECURITIES (CALLABLE MARCH 2025 AND EVERY FIVE YEARS THEREAFTER) | ||||||

| Section 2.01 | Creation of Series; Establishment of Form |

17 | ||||

| Section 2.02 | Interest |

18 | ||||

| Section 2.03 | Interest Payments Discretionary |

19 | ||||

| Section 2.04 | Restriction on Interest Payments |

20 | ||||

| Section 2.05 | Agreement to Interest Cancellation |

20 | ||||

| Section 2.06 | Notice of Interest Cancellation |

20 | ||||

| Section 2.07 | Payment of Principal, Interest and Other Amounts |

20 | ||||

| Section 2.08 | Optional Redemption |

21 | ||||

| Section 2.09 | Optional Tax Redemption |

21 | ||||

| Section 2.10 | Regulatory Event Redemption |

22 | ||||

| Section 2.11 | Notice of Redemption |

22 | ||||

| Section 2.12 | Limitations on Redemption |

23 | ||||

| Section 2.13 | Cancelled Interest Not Payable Upon Redemption |

23 | ||||

| Section 2.14 | Purchases |

23 | ||||

| Section 2.15 | Automatic Conversion upon Capital Adequacy Trigger Event |

23 | ||||

| Section 2.16 | Conversion Shares |

27 | ||||

| Section 2.17 | Conversion Shares Offer |

27 | ||||

| Section 2.18 | Settlement Procedure |

28 | ||||

ii

TABLE OF CONTENTS

(continued)

| Page | ||||||

| Section 2.19 | Failure to Deliver an Automatic Conversion Settlement Notice |

30 | ||||

| Section 2.20 | Agreement with Respect to Exercise of UK Bail-in Power |

30 | ||||

| Section 2.21 | Notice via DTC |

32 | ||||

| Section 2.22 | Records Adjustment |

33 | ||||

| ARTICLE III | ||||||

| ANTI-DILUTION | ||||||

| Section 3.01 | Adjustment of Conversion Price and Conversion Shares Offer Price |

33 | ||||

| Section 3.02 | No Retroactive Adjustments |

37 | ||||

| Section 3.03 | Decision of an Independent Financial Advisor |

37 | ||||

| Section 3.04 | Rounding Down and Notice of Adjustment to the Conversion Price and the Conversion Shares Offer Price |

37 | ||||

| Section 3.05 | Qualifying Takeover Event |

38 | ||||

| ARTICLE IV | ||||||

| DEFAULTS AND REMEDIES | ||||||

| Section 4.01 | Winding-Up |

39 | ||||

| Section 4.02 | Non-Payment Event |

39 | ||||

| Section 4.03 | Limited Remedies for Breach of Obligations (Other than Non-Payment) |

39 | ||||

| Section 4.04 | No Other Remedies and Other Terms |

40 | ||||

| Section 4.05 | Waiver of Past Defaults |

41 | ||||

| ARTICLE V | ||||||

| SUBORDINATION | ||||||

| Section 5.01 | Securities Subordinate to Claims of Senior Creditors |

42 | ||||

| ARTICLE VI | ||||||

| AMENDMENTS TO THE BASE INDENTURE APPLICABLE TO THE SECURITIES | ||||||

| Section 6.01 | Additional Amounts |

43 | ||||

| ARTICLE VII | ||||||

| MISCELLANEOUS PROVISIONS | ||||||

| Section 7.01 | Effectiveness |

44 | ||||

| Section 7.02 | Original Issue |

45 | ||||

| Section 7.03 | Ratification and Integral Part |

45 | ||||

| Section 7.04 | Priority |

45 | ||||

iii

TABLE OF CONTENTS

(continued)

| Page | ||||||

| Section 7.05 | Successors and Assigns |

45 | ||||

| Section 7.06 | Subsequent Holders Agreement |

45 | ||||

| Section 7.07 | Counterparts |

45 | ||||

| Section 7.08 | Payments Subject to Fiscal Laws |

45 | ||||

| Section 7.09 | Governing Law |

45 | ||||

| EXHIBIT A – Form of Global Security |

A-1 | |||

| EXHIBIT B – Form of Automatic Conversion Notice |

B-1 | |||

| EXHIBIT C – Form of Capital Adequacy Trigger Event Officers’ Certificate |

C-1 | |||

| EXHIBIT D – Form of Conversion Shares Offer Notice |

D-1 | |||

| EXHIBIT E – Form of Automatic Conversion Settlement Request Notice |

E-1 |

iv

THIRD SUPPLEMENTAL INDENTURE, dated as of March 30, 2015 (this “Third Supplemental Indenture”) among HSBC HOLDINGS PLC, a public limited company duly organized and existing under the laws of England and Wales (the “Company”), having its principal office at 8 Canada Square, London E14 5HQ, England, THE BANK OF NEW YORK MELLON, LONDON BRANCH, a New York banking corporation, as trustee (the “Trustee”), having its principal corporate trust office located at 101 Barclay Street, Floor 7-East, New York, New York 10286, and its Corporate Trust Office at One Canada Square, London E14 5AL, and HSBC BANK USA, NATIONAL ASSOCIATION, as Paying Agent, Registrar and Calculation Agent (each as defined herein) (the “Agent”), having its principal office at 452 Fifth Avenue, 8E6, New York, New York 10018, to the CONTINGENT CONVERTIBLE SECURITIES INDENTURE, dated as of August 1, 2014 among the Company, the Trustee and the Registrar and Paying Agent, as amended from time to time (the “Base Indenture” and, together with this Third Supplemental Indenture, the “Indenture”).

RECITALS OF THE COMPANY

WHEREAS, the Company, the Trustee and the Paying Agent and Registrar are parties to the Base Indenture, which provides for the issuance by the Company from time to time of Contingent Convertible Securities in one or more series;

WHEREAS, Section 9.01(f) of the Base Indenture permits supplements thereto without the consent of Holders of Contingent Convertible Securities to establish the form or terms of Contingent Convertible Securities of any series as permitted by Sections 2.01 and 3.01 of the Base Indenture;

WHEREAS, as contemplated by Section 3.01 of the Base Indenture, the Company intends to issue a new series of Contingent Convertible Securities to be known as the Company’s “$2,450,000,000 6.375% Perpetual Subordinated Contingent Convertible Securities (Callable March 2025 and Every Five Years Thereafter)” (the “Securities”) under the Indenture;

WHEREAS, the Company has taken all necessary corporate action to authorize the execution and delivery of this Third Supplemental Indenture;

NOW, THEREFORE, THIS THIRD SUPPLEMENTAL INDENTURE WITNESSETH:

For and in consideration of the premises and the other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Company, the Trustee and the Agent mutually agree as follows with regard to the Securities:

ARTICLE I

DEFINITIONS AND OTHER PROVISIONS OF GENERAL APPLICATION

SECTION 1.01 Definitions.

Except as otherwise expressly provided or unless the context otherwise requires, all terms used in this Third Supplemental Indenture that are defined in the Base Indenture shall have the meanings ascribed to them in the Base Indenture. The following terms used in this Third Supplemental Indenture have the following respective meanings with respect to the Securities only:

“Acquirer” means the person or persons that control (as such term is used with respect to the definition of “Takeover Event”) the Company following a Takeover Event.

“Adjusted Reset Date” has the meaning set forth in Section 2.02(b).

“Agent” has the meaning set forth in the first paragraph of this Third Supplemental Indenture.

“Approved Entity” means a body corporate that is incorporated or established under the laws of an OECD member state and which, on the occurrence of the Takeover Event, has in issue Approved Entity Shares.

“Approved Entity Shares” means ordinary shares in the capital of a body corporate that constitutes Equity Share Capital or the equivalent (or depository or other receipts representing the same) which are listed and admitted to trading on a Recognized Stock Exchange.

“Assets” has the meaning set forth in Section 5.01.

“Auditors” means (i) the Company’s auditors or, if the Company has joint auditors, any one of such joint auditors or (ii) in the event their being unable or unwilling to carry out any action requested of them pursuant to the terms of the Securities and the Indenture or in such circumstances and for such purposes as the Trustee may approve, either (x) such other firm of accountants as may be nominated by the Company and approved by the Trustee or (y) failing such nomination and/or approval within three (3) Business Days of a request by the Trustee to the Company for such nomination, as may be nominated by the Trustee.

“Automatic Conversion” means the irrevocable and automatic release of all of the Company’s obligations under the Securities in consideration of the Company’s issuance of the Conversion Shares to the Conversion Shares Depository (or to the relevant recipient pursuant to Section 2.15) (on behalf of the Holders and Beneficial Owners), all in accordance with the terms of the Securities and the Indenture.

“Automatic Conversion Notice” means the written notice (substantially in the form attached hereto as Exhibit B) to be delivered by the Company to the Trustee and the Paying Agent directly and to the Holders, in the case of Global Securities, via DTC (or, if the Securities are definitive Securities, to the Holders at their addresses shown on the Register) specifying (i) that a Capital Adequacy Trigger Event has occurred, (ii) the Conversion Date or expected Conversion Date, (iii) that the Company has the option, at its sole and absolute discretion, to elect that a Conversion Shares Offer be conducted and that the Company shall issue a Conversion Shares Offer Notice within ten (10) Business Days following the Conversion Date notifying Holders of the Company’s election and (iv) that the Securities shall remain in existence for the sole purpose of evidencing the right of the Holders to receive Conversion Shares or Conversion Shares Offer Consideration, as applicable, from the Conversion Shares Depository (or the relevant recipient pursuant to Section 2.15), and that the Securities may continue to be transferable until the Suspension Date, which shall be specified in the Conversion Shares Offer Notice.

2

“Automatic Conversion Settlement Notice” means a written notice (substantially in the form attached hereto as Exhibit E) to be delivered by the Holder or Beneficial Owner (or custodian, broker, nominee or other representative thereof) to the Conversion Shares Depository (or to the relevant recipient of the Conversion Shares pursuant to Section 2.15), with a copy to the Trustee and the Paying Agent, no earlier than the Suspension Date containing the following information: (i) the name of the Holder or Beneficial Owner (or custodian, broker, nominee or other representative thereof), (ii) the Tradable Amount held by such Holder or Beneficial Owner (or custodian, broker, nominee or other representative thereof) on the date of such notice, (iii) the name to be entered in the Company’s share register, (iv) the details of the CREST or other clearing system account or, if the Conversion Shares are not a participating security in CREST or another clearing system, the address to which the Conversion Shares (or Conversion Shares Component, if any) should be delivered, (v) for purposes of receiving any Cash Component (if not expected to be delivered through DTC), the necessary details and instructions to deposit such Cash Component to a bank account that accepts funds in dollars and (vi) such other details as may be required by the Conversion Shares Depository.

“Automatic Conversion Settlement Request Notice” means the written notice to be delivered by the Company to the Trustee and the Paying Agent directly and to the Holders and Beneficial Owners via DTC (or, if the Securities are definitive Securities, to the Holders at their addresses shown on the Register) on the Suspension Date (i) requesting that Holders and Beneficial Owners complete an Automatic Conversion Settlement Notice and (ii) specifying (a) the Notice Cut-off Date and (b) the Final Cancellation Date.

“Balance Sheet Condition” has the meaning set forth in Section 5.01(c).

“Base Indenture” has the meaning set forth in the first paragraph of this Third Supplemental Indenture.

“Beneficial Owners” shall mean (a) with respect to Global Securities, the beneficial owners of the Securities prior to the occurrence of the Final Cancellation Date and (b) with respect to definitive Securities, the Holders in whose names the Securities are registered in the Register.

“Business Day” means a day on which commercial banks and foreign exchange markets settle payments and are open for general business (including dealings in foreign exchange and foreign currency deposits) in London, England, or in New York City, New York.

“Calculation Agent” means HSBC Bank USA, National Association, or its successor appointed by the Company pursuant to the Calculation Agent Agreement.

“Calculation Agent Agreement” means the calculation agent agreement dated as of March 30, 2015 among the Company and the Calculation Agent.

3

“Cancellation Date” means (i) with respect to any Security for which an Automatic Conversion Settlement Notice is received by the Conversion Shares Depository on or before the Notice Cut-off Date, the applicable Settlement Date and (ii) with respect to any Security for which an Automatic Conversion Settlement Notice is not received by the Conversion Shares Depository on or before the Notice Cut-off Date, the Final Cancellation Date.

“Capital Adequacy Trigger Event” shall occur if the End-point CET1 Ratio is less than 7.0% as of any business day on which the Company calculates the End-point CET1 Ratio.

“Capital Adequacy Trigger Event Officers’ Certificate” has the meaning set forth in Section 2.15(b).

“Capital Instruments Regulations” means any regulatory capital rules, regulations or standards which are in the future applicable to the Company (on a solo or consolidated basis and including any implementation thereof or supplement thereto by the PRA from time to time) and which lay down the requirements to be fulfilled by financial instruments for inclusion in the Company’s regulatory capital (on a solo or consolidated basis) as required by (i) the CRR and/or (ii) the CRD, including (for the avoidance of doubt) any regulatory technical standards and implementing technical standards issued by the European Banking Authority.

“Cash Component” means that portion, if any, of the Conversion Shares Offer Consideration consisting of cash.

“Cash Dividend” means any dividend or distribution in respect of Ordinary Shares to Shareholders which is to be paid or made in cash (in whatever currency), however described and whether payable out of share premium account, profits, retained earnings or any other capital or revenue reserve or account and including a distribution or payment to Shareholders upon or in connection with a reduction of capital.

“CET1 Capital” means, as of any date, the sum, expressed in dollars, of all amounts that constitute common equity Tier 1 capital of the HSBC Group as of such date, less any deductions from common equity Tier 1 capital required to be made as of such date, in each case as calculated by the Company on a consolidated basis and without applying the transitional provisions set out in Part Ten of the CRR in accordance with the Relevant Rules applicable to the Company as at such date (which calculation shall be binding on the Trustee, the Paying Agent and the Holders). For the purposes of this definition, the term “common equity Tier 1 capital” shall have the meaning assigned to such term in CRD IV (as the same may be amended or replaced from time to time) as interpreted and applied in accordance with the Relevant Rules then applicable to the HSBC Group or by the Relevant Regulator.

“Companies Act” means the Companies Act 2006 (UK).

“Company” has the meaning set forth in the first paragraph of this Third Supplemental Indenture, and includes any successor entity.

“Conversion Date” has the meaning set forth in Section 2.15(a).

4

“Conversion Price” means $4.03488 per Conversion Share (subject to certain anti-dilution adjustments pursuant to Section 3.01 hereof). On the Issue Date, the Conversion Shares Offer Price and the Conversion Price shall be equal (based on an exchange rate of £1.00 = $1.49440).

“Conversion Shares” means Ordinary Shares to be issued to the Conversion Shares Depository (or to the relevant recipient pursuant to Section 2.15) following an Automatic Conversion.

“Conversion Shares Component” means that portion, if any, of the Conversion Shares Offer Consideration consisting of Conversion Shares.

“Conversion Shares Depository” means a financial institution, trust company, depository entity, nominee entity or similar entity to be appointed by the Company on or prior to any date when a function ascribed to the Conversion Shares Depository in the Indenture is required to be performed, to perform such functions and which, as a condition of such appointment, such entity shall be required to undertake, for the benefit of the Holders and Beneficial Owners, to hold the Conversion Shares (and any Conversion Shares Offer Consideration) on behalf of such Holders and Beneficial Owners in one or more segregated accounts, unless otherwise required for the purposes of the Conversion Shares Offer and, in any event, on terms consistent with the Indenture.

“Conversion Shares Offer” has the meaning set forth in Section 2.17(a).

“Conversion Shares Offer Agent” means the agent(s), if any, to be appointed on behalf of the Conversion Shares Depository by the Company to act as placement or other agent of the Conversion Shares Depository to facilitate a Conversion Shares Offer.

“Conversion Shares Offer Consideration” means in respect of each Security (i) if all the Conversion Shares are sold in the Conversion Shares Offer, the pro rata share of the cash proceeds from such sale attributable to such Security converted from sterling (or any such other currency in which Ordinary Shares are denominated) into dollars at the Prevailing Rate as of the date that is three (3) Depository Business Days prior to the relevant Settlement Date, as determined by the Conversion Shares Depository (less the pro rata share of any foreign exchange transaction costs), (ii) if some but not all of the Conversion Shares are sold in the Conversion Shares Offer, (x) the pro rata share of the cash proceeds from such sale attributable to such Security converted from sterling (or any such other currency in which Ordinary Shares are denominated) into dollars at the Prevailing Rate as of the date that is three (3) Depository Business Days prior to the relevant Settlement Date, as determined by the Conversion Shares Depository (less the pro rata share of any foreign exchange transaction costs) and (y) the pro rata share of the Conversion Shares not sold pursuant to the Conversion Shares Offer attributable to such Security rounded down to the nearest whole number of Conversion Shares, and (iii) if no Conversion Shares are sold in a Conversion Shares Offer, the relevant Conversion Shares attributable to such Security rounded down to the nearest whole number of Conversion Shares, subject in the case of (i) and (ii)(x) above to deduction from any such cash proceeds of an amount equal to the pro rata share of any stamp duty, stamp duty reserve tax, or any other capital, issue, transfer, registration, financial

5

transaction or documentary tax that may arise or be paid as a consequence of the transfer of any interest in the Conversion Shares to the Conversion Shares Depository (or the relevant recipient pursuant to Section 2.15) in order for the Conversion Shares Depository (or the relevant recipient pursuant to Section 2.15) to conduct the Conversion Shares Offer.

“Conversion Shares Offer Notice” means the written notice (substantially in the form attached hereto as Exhibit D) to be delivered by the Company to the Trustee and the Paying Agent directly and to the Holders, in the case of Global Securities, via DTC (or, if the Securities are definitive Securities, to the Holders at their addresses shown on the Register) specifying (i) whether or not the Company has elected that a Conversion Shares Offer be made and, if so, the Conversion Shares Offer Period, (ii) the Suspension Date and (iii) if the Company has been unable to appoint a Conversion Shares Depository, such other arrangements for the issuance and/or delivery of the Conversion Shares or the Conversion Shares Offer Consideration, as applicable, to the Holders as it shall consider reasonable in the circumstances.

“Conversion Shares Offer Period” means the period during which the Conversion Shares Offer may occur, which period shall end no later than forty (40) Business Days after the delivery of the Conversion Shares Offer Notice.

“Conversion Shares Offer Price” means £2.70 per Conversion Share (subject to certain anti-dilution adjustments pursuant to Section 3.01 hereof). On the Issue Date, the Conversion Shares Offer Price and the Conversion Price shall be equal (based on an exchange rate of £1.00 = $1.49440).

“CRD” means Directive 2013/36/EU of the European Parliament and of the Council of June 26, 2013 on access to the activity of credit institutions and the prudential supervision of credit institutions and investment firms, amending Directive 2002/87/EC and repealing Directives 2006/48/EC and 2006/49/EC, and any successor directive.

“CRD IV” means, taken together, (i) the CRR, (ii) the CRD and (iii) the Capital Instruments Regulations.

“CREST” means the relevant system, as defined in the CREST Regulations, or any successor clearing system.

“CREST Regulations” means the Uncertificated Securities Regulations 2001 (SI 2001 No. 01/378), as amended.

“CRR” means regulation (EU) No 575/2013 of the European Parliament and of the Council of June 26, 2013 on prudential requirements for credit institutions and investment firms and amending regulation (EU) No 648/2012, and any successor regulation.

6

“Current Market Price” means, in respect of an Ordinary Share at a particular date, the arithmetic average of its Volume Weighted Average Price for the five (5) consecutive Exchange Business Days ending on the Exchange Business Day immediately preceding such date (the “Relevant Period”), provided that:

| (i) | if at any time during the Relevant Period the Volume Weighted Average Price has been based on a price ex-dividend (or ex-any other entitlement) and during some other part of that period the Volume Weighted Average Price has been based on a price cum-dividend (or cum-any other entitlement), then: |

| (1) | if the Ordinary Shares to be issued do not rank for the dividend (or entitlement) in question, the Volume Weighted Average Price on the dates on which the Ordinary Shares shall have been quoted cum-dividend (or cum-any other entitlement) shall for the purpose of this definition be deemed to be the amount thereof reduced by an amount equal to the Fair Market Value of that dividend (or entitlement) per Ordinary Share as of the date of first public announcement relating to such dividend or entitlement and, for these purposes, the amount or value shall be determined on a gross basis disregarding any withholding or deduction required to be made on account of tax and disregarding any associated tax credit; or |

| (2) | if the Ordinary Shares to be issued do rank for the dividend (or entitlement) in question, the Volume Weighted Average Price on the dates on which the Ordinary Shares shall have been quoted ex-dividend (or ex-any other entitlement) shall for the purpose of this definition be deemed to have been the amount thereof increased by such similar amount; and |

| (ii) | if on each of the five (5) Exchange Business Days during the Relevant Period the Ordinary Shares have been quoted cum-dividend (or cum-any other entitlement) in respect of a dividend (or entitlement) which has been declared or announced but the Ordinary Shares to be issued do not rank for that dividend (or entitlement), the Volume Weighted Average Price on each of such dates shall for the purposes of this definition be deemed to be the amount thereof reduced by an amount equal to the Fair Market Value of that dividend (or entitlement) per Ordinary Share as of the date of first public announcement relating to such dividend or entitlement, and for these purposes, the amount or value shall be determined on a gross basis disregarding any withholding or deduction required to be made on account of tax and disregarding any associated tax credit; |

| (iii) | if such Volume Weighted Average Price is not available on each of the five (5) Exchange Business Days during the Relevant Period, then the arithmetic average of such Volume Weighted Average Prices which are available in the Relevant Period shall be used (subject to a minimum of two such closing prices); and |

| (iv) | if only one or no such Volume Weighted Average Price is available in the Relevant Period, then the Current Market Price shall be determined by an Independent Financial Adviser. |

“Default” has the meaning set forth in Section 4.04(b).

“Depository Business Day” means a day on which the Conversion Shares Depository is open for general business.

7

“Distributable Items” means the amount of the Company’s profits at the end of the last financial year plus any profits brought forward and reserves available for that purpose before distributions to Holders and to holders of any Parity Securities and Junior Securities less any losses brought forward, profits which are non-distributable pursuant to the Companies Act or other provisions of English law from time to time applicable to the Company or the Company’s Memorandum and Articles of Association (the “Articles of Association”) and sums placed to non-distributable reserves in accordance with the Companies Act or other provisions of English law from time to time applicable to the Company or the Articles of Association, those losses and reserves being determined on the basis of the Company’s individual accounts and not on the basis of the Company’s consolidated accounts.

“DTC” means The Depository Trust Company or any successor institution.

“EEA Regulated Market” means a regulated market as defined by Article 4.1(14) of Directive 2004/39/EC of the European Parliament and of the Council on markets in financial instruments, as the same may be amended from time to time.

“Effective Date” means, for the purposes of Section 3.01(c) hereof, the first date on which the Ordinary Shares are traded ex-rights, ex-options or ex-warrants on the Relevant Stock Exchange and, for the purposes of Section 3.01(d) hereof, the first date on which the Ordinary Shares are traded ex-the relevant Extraordinary Dividend on the Relevant Stock Exchange.

“End-point CET1 Ratio” means, as at any date, the ratio of CET1 Capital to the Risk Weighted Assets, in each case as of such date, expressed as a percentage.

“Equity Share Capital” has the meaning provided in Section 548 of the Companies Act.

“Exchange Business Day” means any day that is a trading day on the Relevant Stock Exchange other than a day on which the Relevant Stock Exchange is scheduled to close prior to its regular weekday closing time.

“Extraordinary Dividend” means any Cash Dividend that is declared expressly by the Company to be a capital distribution, extraordinary dividend, extraordinary distribution, special dividend, special distribution or return of value to Shareholders as a class or any analogous or similar term, in which case the Extraordinary Dividend shall be such Cash Dividend.

“Fair Market Value” means

| (i) | with respect to a Cash Dividend or other cash amount the amount of such cash; provided that any Cash Dividend or other cash amount in a currency other than dollars shall be converted into dollars at the Prevailing Rate as of the date on which the Fair Market Value is to be calculated; |

| (ii) | where securities, options, warrants or other rights are publicly traded in a market which is determined by the Company to have adequate liquidity, the fair market value of (a) such securities shall equal the arithmetic average of the Volume |

8

| Weighted Average Prices of such securities, and (b) such options, warrants or other rights shall be the arithmetic mean of the daily closing prices of such options, warrants or other rights, in each case during the period of five trading days on the relevant market commencing on such date (or, if later, the first such trading day such securities, options, warrants or other rights are publicly traded) or such shorter period as such securities, options, warrants or other rights are publicly traded; provided that any amount in a currency other than dollars shall be converted into dollars at the Prevailing Rate as of the date on which the Fair Market Value is to be calculated; and |

| (iii) | with respect to any other property on any date, the fair market value of that property as of that date as determined by an Independent Financial Adviser taking into account such factors as it considers appropriate; |

For these purposes, the amount or value shall be determined on a gross basis disregarding any withholding or deduction required to be made on account of tax and disregarding any associated tax credit.

“Final Cancellation Date” means the date, as specified in the Automatic Conversion Settlement Request Notice, on which the Securities in relation to which no Automatic Conversion Settlement Notice has been received by the Conversion Shares Depository on or before the Notice Cut-off Date shall be cancelled, which date may be up to fifteen (15) Business Days following the Notice Cut-off Date.

“Governmental Entity” means (i) the UK government, (ii) an agency of the UK government or (iii) a Takeover Person or entity (other than a body corporate) controlled by the UK government or any such agency referred to in clause (ii) of this definition. If the Company is then organized in another jurisdiction, the references to “UK government” shall be read as references to the government of such other jurisdiction.

“HSBC Group” means the Company together with its subsidiary undertakings.

“Indenture” has the meaning set forth in the first paragraph of this Third Supplemental Indenture.

“Independent Financial Adviser” means an independent financial institution of international repute appointed by the Company at its own expense.

“Interest Payment Date” has the meaning set forth in Section 2.02(a) hereof.

“Issue Date” has the meaning set forth in Section 2.01(f) hereof.

“Junior Securities” means (i) any Ordinary Shares or the Company’s other securities that rank, or are expressed to rank, junior to the Securities in the Company’s winding-up or administration as described in Article V and/or (ii) any securities issued by any other member of the HSBC Group where the terms of such securities benefit from a guarantee or support agreement entered into by the Company that ranks, or is expressed to rank, junior to the Securities in the Company’s winding-up or administration as described in Article V and /or (iii) any of the Company’s capital instruments that qualify as common equity Tier 1 instruments under the Capital Instruments Regulations.

9

“Liabilities” has the meaning set forth in Section 5.01.

“LIBOR” means the London Interbank Offered Rate.

“LSE” means the London Stock Exchange plc.

“Mid-Market Swap Rate” means the rate for dollar swaps with a five-year term commencing on the relevant Reset Date which appears on Bloomberg page “ISDA 01” (or such other page as may replace such page on Bloomberg, or such other page as may be nominated by the person providing or sponsoring the information appearing on such page for purposes of displaying comparable rates) (the “Relevant Screen Page”) as at approximately 11.00 a.m. (New York time) on the relevant Reset Determination Date, all as determined by the Calculation Agent; provided, however, that if no such rate appears on the Relevant Screen Page for such five-year term, then the Mid-Market Swap Rate shall be determined through the use of straight-line interpolation by reference to two rates, one of which shall be determined in accordance with the above provisions, but as if the relevant Reset Period were the period of time for which rates are available next shorter than the length of the actual Reset Period and the other of which shall be determined in accordance with the above provisions, but as if the relevant Reset Period were the period of time for which rates are available next longer than the length of the actual Reset Period; provided further that if on any Reset Determination Date the Relevant Screen Page is not available or the Mid-Market Swap Rate does not appear on the Relevant Screen Page, the Calculation Agent shall request the principal office in New York of the Reference Banks to provide it with its Mid-Market Swap Rate Quotation as at approximately 11.00 a.m. (New York time) on the relevant Reset Determination Date. If two or more of the Reference Banks provide the Calculation Agent with Mid-Market Swap Rate Quotations, the interest rate for the relevant Reset Period shall be the sum of 4.368% and the arithmetic mean (rounded, if necessary, to the nearest 0.001% (0.0005% being rounded upwards)) of the relevant Mid-Market Swap Rate Quotations, as determined by the Calculation Agent. If only one or none of the Reference Banks provides the Calculation Agent with a Mid-Market Swap Rate Quotation, the interest shall be determined to be the rate of interest as at the last preceding Reset Date or, in the case of the initial Reset Determination Date, 6.375%.

“Mid-Market Swap Rate Quotation” means a quotation (expressed as a percentage rate per annum) for the mean of the bid and offered rates for the fixed leg payable semi-annually (calculated on the basis of twelve 30-day months or, in the case of an incomplete month, the actual number of days elapsed, in each case assuming a 360-day year) of a fixed-for-floating interest rate swap transaction in dollars which transaction (i) has a five-year term commencing on the relevant Reset Date, (ii) is in an amount that is representative for a single transaction in the dollar swap rate market at 11.00 a.m. (New York time) with an acknowledged dealer of good credit in the swap market and (iii) has a floating leg based on six-month LIBOR (calculated on the basis of twelve 30-day months or, in the case of an incomplete month, the actual number of days elapsed, in each case assuming a 360-day year).

10

“New Conversion Condition” means the condition that shall be satisfied if (a) by not later than seven (7) Business Days following the completion of a Takeover Event where the Acquirer is an Approved Entity, the Company shall have entered into arrangements to its satisfaction with the Approved Entity pursuant to which the Approved Entity irrevocably undertakes to the Trustee, for the benefit of the Holders and Beneficial Owners, to deliver the Approved Entity Shares to the Conversion Shares Depository upon a conversion of the Securities pursuant to, and subject to the conditions specified in, Section 3.05.

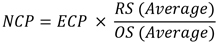

“New Conversion Price” means an amount (in dollars) per Approved Entity Share determined by the Company in accordance with the following formula:

where:

“NCP” means the New Conversion Price.

“ECP” means the Conversion Price in effect on the Exchange Business Day immediately prior to the QTE Effective Date.

“RS (Average)” means the arithmetic average of the Volume Weighted Average Price per Approved Entity Share (converted, if necessary, into dollars at the Prevailing Rate on the relevant Exchange Business Day) on each of the ten (10) Exchange Business Days ending on the Exchange Business Day prior to the date the Qualifying Takeover Event occurred.

“OS (Average)” means the arithmetic average of the Volume Weighted Average Price of the Ordinary Shares (converted, if necessary, into dollars at the Prevailing Rate on the relevant Exchange Business Day) on each of the 10 Exchange Business Days ending on the Exchange Business Day prior to the date the Qualifying Takeover Event has occurred.

“New Conversion Shares Offer Price” means the New Conversion Price initially calculated following the occurrence of a Qualifying Takeover Event converted into sterling based on an exchange rate of £1.00 = $1.49440.

“Non-Payment Event” has the meaning set forth in Section 4.02.

“Notice Cut-off Date” means the date specified as such in the Automatic Conversion Settlement Request Notice, which date shall be at least forty (40) Business Days following the Suspension Date.

“OECD” means Organization for Economic Co-operation and Development

“Ordinary Shares” means (a) prior to the QTE Effective Date, fully paid ordinary shares in the capital of the Company and (b) on and after the QTE Effective Date, the relevant Approved Entity Shares (to be delivered by the Approved Entity).

11

“Outstanding Amount” has the meaning set forth in Section 2.16.

“Parity Securities” means, (i) the most senior ranking class or classes of preference shares in the Company’s capital from time to time and any other of the Company’s securities ranking, or expressed to rank, pari passu with the Securities and/or such senior preference shares in the Company’s winding-up or administration as described in Article V, and/or (ii) any securities issued by any other member of the HSBC Group where the terms of such securities benefit from a guarantee or support agreement entered into by the Company which ranks or is expressed to rank pari passu with the Securities and/or such senior preference shares in the Company’s winding-up or administration as described in Article V.

“Performance Obligation” has the meaning set forth in Section 4.03.

“PRA” means the Prudential Regulation Authority of the United Kingdom or any successor entity.

“Prevailing Rate” means, in relation to any two currencies and any day:

| (i) | for the purposes of the definition of Conversion Shares Offer Consideration, the executable bid quotation obtained by the Conversion Shares Depository that is most favorable to the Holders, out of quotations obtained by it from three recognized foreign exchange dealers selected by the Conversion Shares Depository, for value on such day; and |

| (ii) | for all other purposes, the prevailing market currency exchange rate at the time at which such rate is determined in the relevant market for foreign exchange transactions in such currencies for value on such day, as determined by the Company in its sole discretion and acting in a commercially reasonable manner. |

“Price” means the Conversion Price or the Conversion Shares Offer Price, as applicable.

“QTE Effective Date” means the date with effect from which the New Conversion Condition shall have been satisfied.

“Qualifying Takeover Event” means a Takeover Event with respect to which: (i) the Acquirer is an Approved Entity; and (ii) the New Conversion Condition is satisfied.

“Recognized Stock Exchange” means an EEA Regulated Market or another regulated, regularly operating, recognized stock exchange or securities market in an OECD member state.

“Reference Banks” means four major banks in the swap, money, securities or other market most closely connected with the relevant Mid-Market Swap Rate (which banks shall be selected by selected by the Company on the advice of an investment bank of international repute).

“Regular Record Date” has the meaning set forth in Section 2.02.

12

“Regulatory Event” has the meaning set forth in Section 2.10.

“Relevant Regulator” means the PRA or any successor entity primarily responsible for the prudential supervision of the Company.

“Relevant Rules” means, at any time, the laws, regulations, requirements, guidelines and policies relating to capital adequacy (including, without limitation, as to leverage) then in effect in the United Kingdom including, without limitation to the generality of the foregoing, any delegated or implementing acts (such as regulatory technical standards) adopted by the European Commission and any regulations, requirements, guidelines and policies relating to capital adequacy adopted by the Relevant Regulator from time to time (whether or not such requirement, guidelines or policies are applied generally or specifically to the Company or to the Company and any of its holding or subsidiary companies or any subsidiary of any such holding company).

“Relevant Stock Exchange” means, (i) in respect of the Ordinary Shares, the LSE or if the Ordinary Shares are no longer admitted to listing, trading and/or quotation by the LSE, the principal stock exchange or securities market by which the Ordinary Shares are then admitted to listing, trading and/or quotation, and (ii) in respect of any securities other than the Ordinary Shares, the principal stock exchange or securities market on which the Approved Entity Shares or such securities, as applicable, are then admitted to listing, trading and/or quotation.

“Relevant Supervisory Consent” means as (and to the extent) required, a consent or waiver to, or, following the giving of any required notice, the receipt of no objection to, the relevant redemption or purchase from the Relevant Regulator.

“Relevant UK Resolution Authority” means any authority with the ability to exercise a UK Bail-in Power (including, without limitation, Her Majesty’s Treasury, the Bank of England, the PRA or the Financial Conduct Authority).

“Reset Date” means March 30, 2025 and each fifth (5th) anniversary date thereafter.

“Reset Determination Date” means the second (2nd) Business Day immediately preceding the Reset Date.

“Reset Period” means each period from (and including) a Reset Date to (but excluding) the following Reset Date.

“Risk Weighted Assets” means, as of any date, the aggregate amount, expressed in dollars, of the risk weighted assets of the HSBC Group as of such date, as calculated by the Company on a consolidated basis and without applying the transitional provisions set out in Part Ten of the CRR in accordance with the Relevant Rules applicable to the Company as at such date (which calculation shall be binding on the Trustee, the Paying Agent and the Holders). For the purposes of this definition, the term “risk weighted assets” means the risk weighted assets or total risk exposure amount, as calculated by the Company in accordance with the Relevant Rules.

13

“Securities” has the meaning set forth in the Recitals.

“Senior Creditors” has the meaning set forth in Section 5.01(c) hereof.

“Settlement Date” means (i) with respect to any Security in relation to which an Automatic Conversion Settlement Notice is received by the Conversion Shares Depository on or before the Notice Cut-off Date, the later of (a) the date that is two (2) Business Days after the end of the relevant Conversion Shares Offer Period and (b) the date that is two (2) Business Days after the date on which such Automatic Conversion Settlement Notice has been received by the Conversion Shares Depository and (ii) with respect to any Security in relation to which an Automatic Conversion Settlement Notice is not received by the Conversion Shares Depository on or before the Notice Cut-off Date, the date on which the Conversion Shares Depository delivers the relevant Conversion Shares or Conversion Shares Offer Consideration, as applicable.

“Shareholders” means the holders of Ordinary Shares.

“Solvency Condition” has the meaning set forth in Section 5.01(c) hereof.

“Special Event” means either a Regulatory Event or a Tax Event.

“Subsidiary” has the meaning provided in Section 1159 of the Companies Act.

“Suspension Date” means the date specified in the Conversion Shares Offer Notice as the date on which DTC shall suspend all clearance and settlement of transactions in the Securities in accordance with its rules and procedures, which date shall be no later than thirty-eight (38) Business Days after the delivery of the Conversion Shares Offer Notice to DTC (and, if the Company elects that a Conversion Shares Offer be made, such date shall be at least two (2) Business Days prior to the end of the relevant Conversion Shares Offer Period).

“Takeover Event” means any person or persons acting in concert (as defined in the Takeover Code of the United Kingdom Panel on Takeovers and Mergers) that acquires control of the Company. For these purposes “control” means (a) the acquisition or holding of legal or beneficial ownership of more than 50% of the Company’s issued Ordinary Shares or (b) the right to appoint and/or remove all or the majority of the members of the Company’s board of directors, whether obtained directly or indirectly and whether obtained by ownership of share capital, contract or otherwise.

“Takeover Event Notice” means a notice to the Holders notifying them that a Takeover Event has occurred and specifying: (1) the identity of the Acquirer; (2) whether the Takeover Event is a Qualifying Takeover Event or not; (3) in the case of a Qualifying Takeover Event, if determined at such time, the New Conversion Price and the New Conversion Shares Offer Price; and (4) if applicable, the QTE Effective Date.

“Takeover Person” includes any individual, company, corporation, firm, partnership, joint venture, undertaking, association, organization, trust, state or agency of a state (in each case whether or not being a separate legal entity) or other legal entity.

14

“Tax Event” has the meaning set forth in Section 2.09(a).

“Taxing Jurisdiction” has the meaning set forth in Section 6.01.

“Tradable Amount” has the meaning set forth in Section 2.01(j).

“Trustee” has the meaning set forth in the first paragraph of this Third Supplemental Indenture.

“UK Bail-in Power” means any statutory write-down and/or conversion power existing from time to time under any laws, regulations, rules or requirements relating to the resolution of credit institutions, banks, banking companies, investment firms and their parent undertakings incorporated in the United Kingdom in effect and applicable in the United Kingdom to the Company or other members of the HSBC Group, including but not limited to the UK Banking Act 2009, as the same may be amended from time to time (whether pursuant to the UK Financial Services (Banking Reform) Act 2013 or otherwise), and any laws, regulations, rules or requirements which are implemented, adopted or enacted within the context of Directive 2014/59/EU, or any other European Union directive or regulation of the European Parliament and of the Council establishing a framework for the recovery and resolution of credit institutions, banks, banking companies, investment firms and their parent undertakings, pursuant to which obligations of a credit institution, bank, banking company, investment firm, its parent undertaking or any of its affiliates can be cancelled, written down and/or converted into shares or other securities or obligations of the obligor or any other person.

“Volume Weighted Average Price” means, in respect of an Ordinary Share, an Approved Entity Share or a security, as applicable, on any Exchange Business Day, the order book volume-weighted average price of such Ordinary Share, Approved Entity Share or security published by or derived from the principal stock exchange or securities market on which such Ordinary Share, Approved Entity Share or security is then listed or quoted or dealt in, if any, or, in any such case, such other source as shall be determined to be appropriate by an Independent Financial Adviser on such Exchange Business Day; provided that if on any such Exchange Business Day such price is not available or cannot otherwise be determined as provided above, the Volume Weighted Average Price of an Ordinary Share, an Approved Entity Share or a security, as the case may be, in respect of such Exchange Business Day shall be the Volume Weighted Average Price, determined as provided above, on the immediately preceding Exchange Business Day on which the same can be so determined or as an Independent Financial Adviser might otherwise determine to be appropriate.

“Winding-Up Event” has the meaning set forth in Section 4.01(a).

SECTION 1.02 Effect of Headings.

The Article and Section headings herein are for convenience only and shall not affect the construction hereof.

15

SECTION 1.03 Separability Clause.

In case any provision in this Third Supplemental Indenture shall be invalid, illegal or unenforceable, the validity, legality and enforceability of the remaining provisions shall not in any way be affected or impaired thereby.

SECTION 1.04 Benefits of Instrument.

Except as otherwise provided herein, nothing in this Third Supplemental Indenture, express or implied, shall give to any person, other than the parties hereto and their successors hereunder and the Holders, any benefit or any legal or equitable right, remedy or claim under the Indenture.

SECTION 1.05 Relation to Base Indenture.

This Third Supplemental Indenture constitutes an integral part of the Base Indenture. Notwithstanding any other provision of this Third Supplemental Indenture, all provisions of this Third Supplemental Indenture are expressly and solely for the benefit of the Holders and the Beneficial Owners, and any such provisions shall not be deemed to apply to any other Contingent Convertible Securities issued under the Base Indenture and shall not be deemed to amend, modify or supplement the Base Indenture for any purpose other than with respect to the Securities.

SECTION 1.06 Relation to Calculation Agent Agreement.

In the event of any conflict between the Indenture and the Calculation Agent Agreement relating to the rights or obligations of the Calculation Agent in the Indenture in connection with the calculation of the interest rate on the Securities, the relevant terms of the Calculation Agent Agreement shall govern such rights and obligations.

SECTION 1.07 Construction and Interpretation. Unless the context expressly otherwise requires:

(a) the words “hereof,” “herein” and “hereunder” and words of similar import, when used in this Third Supplemental Indenture, refer to this Third Supplemental Indenture as a whole and not to any particular provision of this Third Supplemental Indenture;

(b) the terms defined in the singular have a comparable meaning when used in the plural, and vice versa;

(c) the terms “pounds sterling,” “sterling” and “£” mean the lawful currency of the United Kingdom;

(d) references herein to a specific Section, Article or Exhibit refer to Sections or Articles of, or an Exhibit to, this Third Supplemental Indenture, unless otherwise specified;

(e) wherever the words “include,” “includes” or “including” are used in this Third Supplemental Indenture, they shall be deemed to be followed by the words “without limitation”;

(f) references to a Person are also to its successors and permitted assigns;

16

(g) the use of “or” is not intended to be exclusive unless expressly indicated otherwise; and

(h) references to any issue or offer or grant to Shareholders “as a class” or “by way of rights” shall be taken to be references to an issue or offer or grant to all or substantially all Shareholders, as the case may be, other than Shareholders, as the case may be, to whom, by reason of the laws of any territory or requirements of any recognized regulatory body or any stock exchange or securities market in any territory or in connection with fractional entitlements, it is determined not to make such issue or offer or grant.

ARTICLE II

$2,450,000,000 6.375% PERPETUAL SUBORDINATED CONTINGENT CONVERTIBLE SECURITIES (CALLABLE MARCH 2025 AND EVERY FIVE YEARS THEREAFTER)

SECTION 2.01 Creation of Series; Establishment of Form.

(a) There is hereby established a new series of Contingent Convertible Securities under the Base Indenture entitled the “$2,450,000,000 6.375% Perpetual Subordinated Contingent Convertible Securities (Callable March 2025 and Every Five Years Thereafter).”

(b) The Securities shall be issued initially in the form of one or more registered Global Securities that shall be deposited with DTC and registered in its name or its nominee and executed and delivered in substantially the form attached hereto as Exhibit A. DTC shall be the Depository pursuant to Section 3.01 of the Base Indenture.

(c) The Company shall issue the Securities in an aggregate principal amount of $2,450,000,000. The Company may from time to time, without the consent of the Holders, issue additional securities having the same ranking and same interest rate, interest cancellation terms, redemption terms, Conversion Price and other terms as the Securities described in this Third Supplemental Indenture, except for the price to public and date of issue. Any such additional securities subsequently issued shall rank equally and ratably with the Securities in all respects, so that such further securities shall be consolidated and form a single series with the Securities.

(d) Any proposed transfer of an interest in Securities held in the form of a Global Security shall be effected through the book-entry systems maintained by DTC.

(e) The Securities shall not have a sinking fund.

(f) The Securities shall be issued on March 30, 2015 (the “Issue Date”).

(g) The Securities shall have no fixed maturity and shall not be redeemable except as provided in Sections 2.08, 2.09 and 2.10 hereof.

(h) The interest rate on the Securities shall be determined as set forth in Section 2.02(a) hereof.

17

(i) The Securities shall be issued in denominations of $200,000 in principal amount and integral multiples of $1,000 in excess thereof.

(j) The denomination of each interest in a Global Security shall be the “Tradable Amount” of such book-entry interest. Prior to an Automatic Conversion, the aggregate Tradable Amount of the interests in each Global Security shall equal such Global Security’s outstanding principal amount. Following an Automatic Conversion, the principal amount of each Security shall equal zero, but the Tradable Amount of the book-entry interests in each Security shall remain unchanged as a result of the Automatic Conversion.

SECTION 2.02 Interest.

(a) From (and including) the Issue Date to (but excluding) March 30, 2025, the interest rate on the Securities shall be 6.375% per annum. From and including each Reset Date to (but excluding) the next following Reset Date, the applicable per annum interest rate shall be equal to the sum of the applicable Mid-Market Swap Rate on the Reset Determination Date and 4.368%. Subject to Sections 2.03 and 2.04, interest, if any, shall be payable in two equal semi-annual installments in arrear on March 30 and September 30 of each year (each, an “Interest Payment Date”); provided that if such Interest Payment Date is not a Business Day, the Interest Payment Date shall be postponed to the next Business Day, and no further interest or other payment shall be owed or made in respect of such delay. Subject to Sections 2.03 and 2.04, interest on the Securities, if any, shall be computed and payable in arrear and on the basis of a year of 360 days consisting of twelve (12) months of thirty (30) days each and, in the case of an incomplete month, the actual number of days elapsed. The first date on which interest may be paid shall be September 30, 2015, for the period commencing on (and including) the Issue Date and ending on (but excluding) September 30, 2015. If a date of redemption is not a Business Day, the Company may pay interest (if any) together with the principal on the next succeeding Business Day; provided that interest shall not accrue during the period from and after the date of redemption. The “Regular Record Date” shall be the close of business (local time in the place of the Register) on the fifteenth (15th) day prior to the relevant Interest Payment Date.

(b) If any Reset Date is not a Business Day, the Reset Date shall occur on the next succeeding Business Day. For the avoidance of doubt, if the Reset Date is not a Business Day and accordingly the Reset Date occurs on the next Business Day (the “Adjusted Reset Date”), then the equal semi-annual payment of interest (if paid) on the next Interest Payment Date shall reflect interest for the entire interest period (including any portion of such interest period occurring between the originally scheduled Reset Date and the Adjusted Reset Date) at the interest rate determined based on the Adjusted Reset Date, and not at the interest rate that applied to the immediately preceding semi-annual interest period. In addition and for the avoidance of doubt, in connection with any optional redemption of the Securities pursuant to Section 2.08, if the Reset Date is not a Business Day, as described above, the Company may pay the interest (if any) together with the principal on the Adjusted Reset Date, but interest on that payment shall not accrue during the period from and after the last Interest Payment Date.

(c) All determinations and any calculations made by the Calculation Agent for the purposes of calculating the applicable Mid-Market Swap Rate will be conclusive and binding on the Holders, the Company, the Trustee and the Paying Agent, absent manifest error. The

18

Calculation Agent shall not be responsible to the Company, the Holders or any third party for any failure of the Reference Banks to provide quotations as requested of them or as a result of the Calculation Agent having acted on any quotation or other information given by any Reference Bank which subsequently may be found to be incorrect or inaccurate in any way.

(d) In addition to any other restrictions on payments of principal and interest contained in this Third Supplemental Indenture, no repayment of the principal amount of the Securities or payment of interest on the Securities shall become due and payable after the exercise of any UK Bail-in Power by the Relevant UK Resolution Authority unless, at the time such repayment or payment, respectively, is scheduled to become due, such repayment or payment would be permitted to be made by the Company under the laws and regulations of the United Kingdom and the European Union applicable to the HSBC Group.

SECTION 2.03 Interest Payments Discretionary.

(a) Interest on the Securities shall be due and payable only at the sole discretion of the Company, and the Company shall have sole and absolute discretion at all times and for any reason to cancel (in whole or in part) any interest payment that would otherwise be payable on any Interest Payment Date. If the Company does not make an interest payment in respect of the Securities on the relevant Interest Payment Date (or if the Company elects to make a payment of a portion, but not all, of such interest payment), such non-payment shall evidence the Company’s exercise of its discretion to cancel such interest payment (or the portion of such interest payment not paid), and accordingly such interest payment (or the portion thereof not paid) shall not be due and payable. For the avoidance of doubt, if the Company provides notice to cancel a portion, but not all, of an interest payment in respect of the Securities, and the Company subsequently does not make a payment of the remaining portion of such interest payment on the relevant Interest Payment Date, such non-payment shall evidence the Company’s exercise of its discretion to cancel such remaining portion of such interest payment, and accordingly such remaining portion of the interest payment shall also not be due and payable.

(b) Interest shall only be due and payable on an Interest Payment Date to the extent it is not cancelled or deemed to have been cancelled (in each case, in whole or in part) in accordance with the provisions set forth in Sections 2.03(a) and 2.04, and any interest cancelled or deemed to have been cancelled (in each case, in whole or in part) pursuant to such Sections shall not be due and shall not accumulate or be payable at any time thereafter, and Holders and Beneficial Owners shall have no rights thereto or to receive any additional interest or compensation as a result of such cancellation or deemed cancellation.

19

SECTION 2.04 Restriction on Interest Payments.

(a) Without limitation on the provisions of Section 2.03 and subject to the extent permitted in clause (b) below in respect of partial interest payments in respect of the Securities, the Company shall not make an interest payment in respect of the Securities on any Interest Payment Date (and such interest payment shall therefore be deemed to have been cancelled and thus shall not be due and payable on such Interest Payment Date) if:

(i) the Company has an amount of Distributable Items on such Interest Payment Date that is less than the sum of (x) all distributions or interest payments made or declared by the Company since the end of the last financial year and prior to such Interest Payment Date on or in respect of any Parity Securities, the Securities and any Junior Securities and (y) all distributions or interest payments payable by the Company (and not cancelled or deemed to have been cancelled) on such Interest Payment Date on or in respect of any Parity Securities, the Securities and any Junior Securities in the case of each of (x) and (y), excluding any payments already accounted for in determining the Distributable Items; or

(ii) the Solvency Condition is not satisfied in respect of such interest payment.

(b) The Company may, in its sole discretion, elect to make a partial interest payment in respect of the Securities on any Interest Payment Date, only to the extent that such partial interest payment may be made without breaching the restriction of clause (a) above.

SECTION 2.05 Agreement to Interest Cancellation. By its acquisition of the Securities, each Holder and each Beneficial Owner shall be deemed to have contracted and agreed that:

(a) interest is payable solely at the discretion of the Company, and no amount of interest shall become due and payable in respect of the relevant interest period to the extent that it has been (x) cancelled (in whole or in part) by the Company at the Company’s sole discretion and/or (y) deemed to have been cancelled (in whole or in part), including as a result of insufficient Distributable Items or failing to satisfy the Solvency Condition under Section 2.04; and

(b) a cancellation or deemed cancellation of interest (in each case, in whole or in part) in accordance with the terms of the Indenture and the Securities shall not constitute a default in payment or otherwise under the terms of the Securities or the Indenture.

SECTION 2.06 Notice of Interest Cancellation. If practicable, the Company shall provide notice of any cancellation or deemed cancellation of interest (in each case, in whole or in part) to the Holders, in the case of Global Securities, via DTC (or, if the Securities are definitive Securities, to the Holders at their addresses shown on the Register) and to the Trustee and the Paying Agent directly on or prior to the relevant Interest Payment Date. If practicable, the Company shall endeavor to do so at least five (5) Business Days prior to the relevant Interest Payment Date. Failure to provide such notice shall have no impact on the effectiveness of, or otherwise invalidate, any such cancellation or deemed cancellation of interest (and accordingly, such interest shall not be due and payable, as provided in Section 2.03), or give the Holders or Beneficial Owners any rights as a result of such failure.

SECTION 2.07 Payment of Principal, Interest and Other Amounts. Payments of principal of and interest, if any, on the Securities shall be made in dollars and such payments on Securities represented by a Global Security shall be made through one or more Paying Agents appointed under the Base Indenture to DTC or its nominee, as the Holder or Holders of the Global Security. Initially, the Paying Agent shall be HSBC Bank USA, National Association. The Company may change the Paying Agent without prior notice to the Holders, and in such an

20

event the Company may act as Paying Agent. Payments of principal of and interest on the Securities represented by a Global Security shall be made by wire transfer of immediately available funds; provided, however, that in the case of payments of principal, such Global Security is first surrendered to the Paying Agent.

SECTION 2.08 Optional Redemption. Subject to the limitations specified in Section 2.12, the Company may, at the Company’s option in its sole discretion, redeem the Securities, in whole but not in part, on any Reset Date at a redemption price equal to 100% of the principal amount of the Securities then Outstanding, together with any accrued but unpaid interest (which excludes any interest cancelled or deemed to have been cancelled as described in Sections 2.03 and 2.04) to (but excluding) the date fixed for redemption.

SECTION 2.09 Optional Tax Redemption.

(a) Subject to Section 2.12, the Company may, at the Company’s option in its sole discretion, redeem the Securities, in whole but not in part, at a redemption price equal to 100% of the principal amount of the Securities then Outstanding, together with any accrued but unpaid interest (which excludes any interest cancelled or deemed to have been cancelled as described in Sections 2.03 and 2.04) to (but excluding) the date fixed for redemption, if, at any time, the Company determines that as a result of a change in, or amendment to, the laws of a Taxing Jurisdiction, including any treaty to which the relevant Taxing Jurisdiction is a party, or a change in an official application or interpretation of those laws on or after the Issue Date, including a decision of any court or tribunal that becomes effective on or after the Issue Date:

(i) on a subsequent date for the payment of interest on the Securities the Company would be required to pay any Additional Amounts;

(ii) if the Company were to seek to redeem the Securities on a subsequent date (for which purpose no consideration shall be given as to whether or not the Company would otherwise be entitled to redeem the Securities), the Company would be required to pay any Additional Amounts (notwithstanding the Company having made such endeavors as the Company considers reasonable);

(iii) on a subsequent date for the payment of interest on the Securities, interest payments (or the Company’s funding costs as recognized in the Company’s accounts) under, or with respect to, the Securities are no longer fully deductible for UK corporation tax purposes;

(iv) the Securities would no longer be treated as loan relationships for UK tax purposes;

(v) would, as a result of the Securities being in issue, result in the Company not being able to have losses or deductions set against the profits or gains, or profits or gains offset by the losses or deductions, of companies with which it is or would otherwise be so grouped for applicable UK tax purposes (whether under the group relief system current as at the Issue Date or any similar system or systems having like effect as may from time to time exist);

21

(vi) a future write-down of the principal amount of the Securities or conversion of the Securities into the Ordinary Shares would result in a UK tax liability, or the receipt of income or profit which would be subject to UK tax, which would not otherwise have been the case as at the Issue Date; or

(vii) the Securities or any part thereof become treated as a derivative or an embedded derivative for UK tax purposes

(each such change (or deemed change) in tax law or regulation or the official application or interpretation thereof, a “Tax Event”).

(b) Subject only to the Company’s obligation to use such endeavors as provided in Section 2.09(a)(ii), it shall be sufficient for the Company to deliver to the Trustee an Officer’s Certificate stating that a Tax Event has occurred and is continuing and setting out the details thereof, as well as any opinion or certificate of an independent legal adviser on which such Officer’s Certificate is based. For these purposes, the Trustee and the Paying Agent shall accept such Officer’s Certificate without further enquiry as sufficient evidence of the existence of such circumstances and such Officer’s Certificate shall be conclusive and binding on the Holders and Beneficial Owners.

SECTION 2.10 Regulatory Event Redemption.

(a) Subject to Section 2.12, the Company may, at the Company’s option in its sole discretion, redeem the Securities, in whole but not in part, at a redemption price equal to 100% of the principal amount of the Securities then Outstanding, together with any accrued but unpaid interest (which excludes any interest cancelled or deemed to have been cancelled as described in Sections 2.03 and 2.04) to (but excluding) the date fixed for redemption, if the Company determines, at any time after the Issue Date, there is a change in the regulatory classification of the Securities that results or shall result in either (i) their exclusion in whole from the HSBC Group’s regulatory capital; or (ii) reclassification in whole as a form of the HSBC Group’s regulatory capital that is lower than additional Tier 1 capital (a “Regulatory Event”).

SECTION 2.11 Notice of Redemption.

(a) Before the Company may redeem the Securities pursuant to Section 2.08, 2.09 or 2.10, the Company shall deliver via DTC (or, if the Securities are definitive Securities, to the Holders at their addresses shown on the Register) prior notice of not less than thirty (30) days, nor more than sixty (60) days to the Holders. Such notice shall specify the Company’s election to redeem the Securities and the date fixed for such redemption and shall be irrevocable except in the limited circumstances described in clauses (b), (c) and (d) of this Section 2.11.

(b) If the Company has delivered a notice of redemption pursuant to clause (a) of this Section 2.11, but as of the date specified for redemption in such notice, the Solvency Condition is not satisfied in respect of the relevant redemption payment, such redemption notice shall be automatically rescinded and shall be of no force and effect, and no payment in respect of the redemption amount shall be due and payable.

22

(c) If the Company has delivered a notice of redemption pursuant to clause (a) of this Section 2.11, but prior to the payment of the redemption amount with respect to such redemption a Capital Adequacy Trigger Event occurs, such redemption notice shall be automatically rescinded and shall be of no force and effect, no payment in respect of the redemption amount shall be due and payable (and, for the avoidance of doubt, an Automatic Conversion shall occur after such Capital Adequacy Trigger Event pursuant to Section 2.15(a)).

(d) If the Company has delivered a notice of redemption pursuant to clause (a) of this Section 2.11, but prior to the payment of the redemption amount with respect to such redemption the Relevant UK Resolution Authority exercises its UK Bail-in Power with respect to the Company, such redemption notice shall be automatically rescinded and shall be of no force and effect, and no payment in respect of the redemption amount shall be due and payable.

(e) If any of the events specified in clauses (b), (c) and (d) of this Section 2.11 occurs, the Company shall promptly deliver notice to the Holders, in the case of Global Securities, via DTC (or, if the Securities are definitive Securities, to the Holders at their addresses shown on the Register) and to the Trustee and the Paying Agent directly, specifying the occurrence of the relevant event.

SECTION 2.12 Limitations on Redemption. Notwithstanding any other provision of this Third Supplemental Indenture, (i) the Company may redeem the Securities pursuant to Sections 2.08, 2.09 and 2.10 only if the Company has obtained the Relevant Supervisory Consent, (ii) prior to the fifth anniversary of the Issue Date, if the Relevant Rules so oblige, the Company may redeem the Securities in the case of a Special Event only if the Company has demonstrated to the satisfaction of the Relevant Regulator that (x) the Special Event was not reasonably foreseeable at the Issue Date and (y) in the case of a Tax Event, such Tax Event was material and (iii) the Company has provided notice in accordance with Section 2.11.

SECTION 2.13 Cancelled Interest Not Payable Upon Redemption. Any interest payments that have been cancelled or deemed to have been cancelled pursuant to Sections 2.03 or 2.04 shall not be payable if the Securities are redeemed pursuant to Section 2.08, 2.09 or 2.10.

SECTION 2.14 Purchases. Notwithstanding any other provision of the Indenture, including Section 6.05 of the Base Indenture, the HSBC Group may purchase or otherwise acquire any of the Securities then Outstanding at any price in the open market or otherwise in accordance with the Relevant Rules and, if required, subject to the prior consent of the Relevant Regulator.

SECTION 2.15 Automatic Conversion upon Capital Adequacy Trigger Event.

(a) If a Capital Adequacy Trigger Event has occurred, then the Automatic Conversion shall occur without delay, but no later than one (1) month following the date on which it is determined such Capital Adequacy Trigger Event has occurred (such date, the “Conversion Date”). Effective upon, and following, a Capital Adequacy Trigger Event, other than any amounts payable in the case of the Company’s winding-up or the appointment of an administrator for its administration pursuant to Section 5.01, Holders and Beneficial Owners shall not have any rights against the Company with respect to repayment of the principal amount

23

of the Securities or payments of interest or any other amount on, or in respect of, the Securities, in each case that is not due and payable, which liabilities shall be automatically released. Accordingly, the principal amount of the Securities shall equal zero at all times thereafter and any interest shall be cancelled or deemed to have been cancelled pursuant to Section 2.03 at all times thereafter, including any interest in respect of an interest period ending on any Interest Payment Date falling between the date of a Capital Adequacy Trigger Event and the Conversion Date, and shall not be due and payable. Although the principal amount of each Security shall equal zero after a Capital Adequacy Trigger Event, for the avoidance of doubt, the Tradable Amount shall remain unchanged as a result of the Automatic Conversion.