Form 497K WILLIAM BLAIR FUNDS

Summary Prospectus May 1, 2016

Growth Fund

| Class N WBGSX | Class I BGFIX |

Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus, statement of additional information and other information about the Fund online at williamblairfunds.com/prospectus. You can also get this information at no cost by calling +1 800 742 7272 or by sending an e-mail request to [email protected]. The Fund’s prospectus and statement of additional information, each dated May 1, 2016, as supplemented, are incorporated by reference into this Summary Prospectus.

INVESTMENT OBJECTIVE: The William Blair Growth Fund seeks long-term capital appreciation.

FEES AND EXPENSES: This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

Shareholder Fees (fees paid directly from your investment):

| Class N | Class I | |||||||

| Maximum Sales Charge (Load) Imposed on Purchases |

None | None | ||||||

| Redemption Fee |

None | None | ||||||

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment):

| Class N | Class I | |||||||

| Management Fee |

0.75% | 0.75% | ||||||

| Distribution (Rule 12b-1) Fee |

0.25% | None | ||||||

| Other Expenses |

0.19% | 0.14% | ||||||

|

|

|

|

|

|||||

| Total Annual Fund Operating Expenses |

1.19% | 0.89% | ||||||

Example: This example is intended to help you compare the cost of investing in shares of the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||

| Class N | $121 | $378 | $654 | $1,443 | ||||

| Class I | 91 | 284 | 493 | 1,096 |

Portfolio Turnover: The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover may indicate higher transaction costs

1

and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 78% of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGIES: The Fund invests primarily in a diversified portfolio of equity securities, including common stocks and other forms of equity investments (e.g., securities convertible into common stocks), of domestic growth companies of all sizes that are expected to exhibit quality growth characteristics. The Fund invests primarily in equity securities issued by companies that typically have market capitalizations no smaller than the smallest capitalized company, and no larger than the largest capitalized company, included in the Russell 3000® Index at the time of the Fund’s investment. Securities of companies whose market capitalizations no longer meet this definition after purchase may continue to be held in the Fund. To a limited extent, the Fund may also purchase stocks of companies with business characteristics and growth prospects similar to companies in the Russell 3000® Index, but that may have market capitalizations outside the range of companies included in the index.

The Russell 3000® Index is a widely recognized, unmanaged index that measures the performance of the 3,000 largest U.S. companies. The size of companies in the Russell 3000® Index may change with market conditions. In addition, changes to the composition of the Russell 3000® Index can change the market capitalization range of the companies in the index. As of June 29, 2015, the Russell 3000® Index included securities issued by companies that ranged in size between $12 million and $717 billion.

In choosing investments, the Adviser performs fundamental company analysis and focuses on stock selection. The Adviser evaluates the extent to which a company meets the quality growth criteria set forth below. All of the criteria are evaluated relative to the valuation of the security. The weight given to a particular investment criterion will depend upon the circumstances, and Fund holdings may not meet all of the following criteria: (a) the company should be, or should have the expectation of becoming, a significant provider in the primary markets it serves, (b) the company should have some distinctive attribute relative to present or potential competitors (this may take the form of proprietary products or processes, a unique distribution system, an entrenched brand name or an especially strong financial position relative to its competition), (c) the company should participate in an industry expected to grow rapidly due to economic factors or technological change or should grow through market share gains in its industry and (d) the company should have a strong management team.

PRINCIPAL RISKS: The Fund’s returns will vary, and you could lose money by investing in the Fund. Because the Fund invests most of its assets in equity securities of domestic growth companies, the primary risk is that the value of the equity securities it holds might decrease in response to the activities of those companies or market and economic conditions. In addition, there is the risk that individual securities may not perform as expected or a strategy used by the Adviser may fail to produce its intended result. Different investment styles (e.g., growth vs. value, quality bias, market capitalization focus) tend to shift in and out of favor depending on market conditions and investor sentiment, and at times when the investment style used by the Adviser for the Fund is out of favor, the Fund may underperform other equity funds that use different investment styles. The securities of small capitalized (“small cap”) and medium capitalized (“mid cap”) companies may be more volatile and less liquid than the securities of large capitalized (“large cap”) companies. In addition, small and mid cap companies may be traded in low volumes. This can increase volatility and increase the risk that the Fund will not be able to sell the security on short notice at a reasonable price. To the extent that the Fund focuses its investments in particular industries, asset classes or sectors of the economy, any market changes affecting companies in those industries, asset classes or sectors may impact the Fund’s performance. The Fund is not intended to be a complete investment program. The Fund is designed for long-term investors.

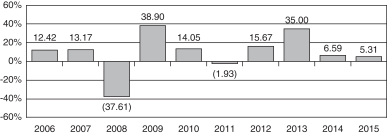

FUND PERFORMANCE HISTORY: The information below provides some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and by showing

2

how the Fund’s average annual returns for the years indicated compare with those of broad measures of market performance. The Fund’s past performance (before and after taxes) does not necessarily indicate how it will perform in the future. For more recent performance information, go to www.williamblairfunds.com or call 1-800-635-2886.

Annual Total Returns. The bar chart below provides an illustration of how the Fund’s performance has varied in each of the last ten calendar years for Class N shares.

|

Highest Quarterly Return 20.40% (2Q09) |

Lowest Quarterly (25.20)% (4Q08) |

Average Annual Total Returns (For the periods ended December 31, 2015). The table shows returns on a before-tax and after-tax basis for Class N shares and on a before-tax basis for Class I shares. After-tax returns for Class I shares will vary. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. In some instances, the “Return After Taxes on Distributions and Sale of Fund Shares” may be greater than the “Return Before Taxes” because the investor is assumed to be able to use the capital loss on the sale of Fund shares to offset other taxable capital gains. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

| 1 Year | 5 Years | 10 Years | ||||||||||

| Class N Shares |

||||||||||||

| Return Before Taxes |

5.31% | 11.44% | 8.01% | |||||||||

| Return After Taxes on Distributions |

2.23% | 9.28% | 6.57% | |||||||||

| Return After Taxes on Distributions and Sale of Fund Shares |

5.51% | 8.97% | 6.42% | |||||||||

| Class I Shares |

||||||||||||

| Return Before Taxes |

5.69% | 11.82% | 8.36% | |||||||||

| Russell 3000® Growth Index (reflects no deduction for fees, expenses or taxes) |

5.09% | 13.30% | 8.49% | |||||||||

| S&P 500 (reflects no deduction for fees, expenses or taxes) |

1.38% | 12.57% | 7.31% | |||||||||

MANAGEMENT:

Investment Adviser. William Blair Investment Management, LLC is the investment adviser of the Fund.

Portfolio Manager(s). David C. Fording, a Partner of the Adviser, and John F. Jostrand, a Partner of the Adviser, co-manage the Fund. Mr. Fording has co-managed the Fund since 2006. Mr. Jostrand has managed or co-managed the Fund since 2001.

PURCHASE AND SALE OF FUND SHARES:

Class N Share Purchase. The minimum initial investment for a regular account or Individual Retirement Account is $2,500. The minimum subsequent investment is $1,000. Certain exceptions to the minimum

3

initial and subsequent investment amounts may apply. See “Your Account—Class N Shares” for additional information on eligibility requirements applicable to purchasing Class N shares.

Class I Share Purchase. The minimum initial investment for a regular account or an Individual Retirement Account is $500,000 (or any lesser amount if, in William Blair’s opinion, the investor has adequate intent and availability of funds to reach a future level of investment of $500,000). There is no minimum for subsequent purchases. The Distributor reserves the right to offer Class I shares without regard to the minimum purchase amount requirements to qualified or non-qualified employee benefit plans when an unaffiliated third party provides administrative and/or other support services to the plan. Certain exceptions to the minimum initial investment amount may apply. Class I shares are only available to certain investors. See “Your Account—Class I Shares” for additional information on the eligibility requirements applicable to purchasing Class I shares.

Sale. Shares of the Fund are redeemable on any day the New York Stock Exchange is open for business by mail, wire or telephone, depending on the elections you make in the account application.

TAX INFORMATION: The Fund intends to make distributions that may be taxed as ordinary income or capital gains, unless you are investing through a tax-advantaged investment plan. If you are investing through a tax-advantaged investment plan, you may be subject to taxes after exiting the tax-advantaged investment plan.

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES: If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

4

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- William Blair Starts First Advantage (FA) at Outperform, 'Best-in-Class Background Screener'

- Montrose Environmental (MEG) Announces Pricing of Public Offering of Shares

- William Blair Starts On Holding AG (ONON) at Outperform, 'e see a path to three-year revenue growth above 25%'

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

William BlairSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share