Form 497K WELLS FARGO FUNDS TRUST

Summary Prospectus

December 6, 2016

Wells Fargo C&B Large Cap Value Fund

Class/Ticker: Class A - CBEAX; Class C - CBECX

|

Link to Prospectus |

Link to SAI |

Before you invest, you may want to review the Fund's prospectus, which contains more information about the Fund and its risks. You can find the Fund's prospectus and other information about the Fund online at wellsfargofunds.com/reports. You can also get information at no cost by calling 1-800-222-8222, or by sending an email request to [email protected]. The current prospectus ("Prospectus") and statement of additional information ("SAI"), dated October 1, 2016, as supplemented from time to time, are incorporated by reference into this summary prospectus. The Fund's SAI may be obtained, free of charge, in the same manner as the Prospectus.

Investment Objective

The Fund seeks maximum long-term total return (current income and capital appreciation), consistent with minimizing risk to principal.

Fees and Expenses

These tables are intended to help you understand the various costs and expenses you will pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the aggregate in specified classes of certain Wells Fargo Funds. More information about these and other discounts is available from your financial professional and in "Share Class Features" and "Reductions and Waivers of Sales Charges" on pages 51 and 52 of the Prospectus and "Additional Purchase and Redemption Information" on page 61 of the Statement of Additional Information.

|

Shareholder Fees (fees paid directly from your investment) |

||

|

|

Class A |

Class C |

|

Maximum sales charge (load) imposed on purchases (as a percentage of |

5.75% |

None |

|

Maximum deferred sales charge (load) (as a percentage of offering price) |

None1 |

1.00% |

| 1. |

Investments of $1 million or more are not subject to a front-end sales charge but generally will be subject to a deferred sales charge of 1.00% if redeemed within 18 months from the date of purchase. |

|

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

||

|

|

Class A |

Class C |

|

Management Fees1 |

0.70% |

0.70% |

|

Distribution (12b-1) Fees |

0.00% |

0.75% |

|

Other Expenses2 |

0.55% |

0.55% |

|

Total Annual Fund Operating Expenses |

1.25% |

2.00% |

|

Fee Waivers |

(0.10)% |

(0.10)% |

|

Total Annual Fund Operating Expenses After Fee Waiver3 |

1.15% |

1.90% |

| 1. |

Includes the fees charged by the Manager for providing advisory services to the master portfolio in which the Fund invests substantially all of its assets. |

| 2. |

Includes other expenses allocated from the master portfolio in which the Fund invests. |

| 3. |

The Manager has contractually committed through September 30, 2017, to waive fees and/or reimburse expenses to the extent necessary to cap the Fund's Total Annual Fund Operating Expenses After Fee Waiver at the amount shown above. Brokerage commissions, stamp duty fees, interest, taxes, acquired money market fund fees and expenses (if any), and extraordinary expenses are excluded from the cap. All other acquired fund fees from the underlying master portfolio(s) are included in the cap. After this time, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. |

Example of Expenses

The example below is intended to help you compare the costs of investing in the Fund with the costs of investing in other mutual funds. The example assumes a $10,000 initial investment, 5% annual total return, and that fees and expenses remain the same as in the tables above. To the extent that the Manager is waiving fees or reimbursing expenses, the example assumes that such waiver or reimbursement will only be in place through the date noted above. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

Assuming Redemption at End of Period |

|

Assuming No Redemption |

||

|

After: |

Class A |

Class C |

|

|

Class C |

|

1 Year |

$685 |

$293 |

$193 |

||

|

3 Years |

$939 |

$618 |

$618 |

||

|

5 Years |

$1,213 |

$1,069 |

$1,069 |

||

|

10 Years |

$1,991 |

$2,319 |

$2,319 |

||

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 29% of the average value of its portfolio.

Principal Investment Strategies

Under normal circumstances, we invest:

-

at least 80% of the Fund's net assets in equity securities of large-capitalization companies.

The Fund is a gateway fund that invests substantially all of its assets in the C&B Large Cap Value Portfolio, a master portfolio with a substantially identical investment objective and substantially similar investment strategies. We may invest in additional master portfolios, in other Wells Fargo Funds, or directly in a portfolio of securities.

We invest principally in equity securities of large-capitalization companies, which we define as companies with market capitalizations within the range of the Russell 1000® Index at the time of purchase. The market capitalization range of the Russell 1000® Index was approximately $837 million to $572 billion, as of August 31, 2016, and is expected to change frequently. We manage a relatively focused portfolio of 30 to 50 companies that enables us to provide adequate diversification while allowing the composition and performance of the portfolio to behave differently than the market.

We select securities for the portfolio based on an analysis of a company's financial characteristics and an assessment of the quality of a company's management. In selecting a company, we consider criteria such as return on equity, balance sheet strength, industry leadership position and cash flow projections. We further narrow the universe of acceptable investments by undertaking intensive research including interviews with a company's top management, customers and suppliers. We believe our assessment of business quality and emphasis on valuation will protect the portfolio's assets in down markets, while our insistence on strength in leadership, financial condition and cash flow position will produce competitive results in all but the most speculative markets. We regularly review the investments of the portfolio and may sell a portfolio holding when it has achieved its valuation target, there is deterioration in the underlying fundamentals of the business, or we have identified a more attractive investment opportunity.

Principal Investment Risks

An investment in the Fund may lose money, is not a deposit of Wells Fargo Bank, N.A. or its affiliates, is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency, and is primarily subject to the risks briefly summarized below.

Focused Portfolio Risk. Changes in the value of a small number of issuers are likely to have a larger impact on a Fund's net asset value than if the Fund held a greater number of issuers.

Investment Style Risk. Securities of a particular investment style, such as a growth style or value style, tend to perform differently and shift into and out of favor with investors depending on changes in market and economic sentiment and conditions.

Management Risk. Investment decisions, techniques, analyses or models implemented by a Fund's manager or sub-adviser in seeking to achieve the Fund's investment objective may not produce the returns expected, may cause the Fund's shares to lose value or may cause the Fund to underperform other funds with similar investment objectives.

Market Risk. The values of, and/or the income generated by, securities held by a Fund may decline due to general market conditions or other factors, including those directly involving the issuers of such securities. Security markets are volatile and may decline significantly in response to adverse issuer, regulatory, political, or economic developments. Different sectors of the market and different security types may react differently to such developments.

Performance

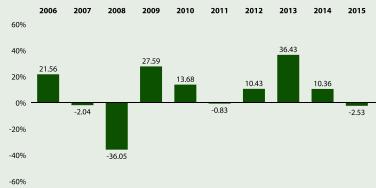

The following information provides some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year. The Fund's average annual total returns are compared to the performance of one or more indices. Past performance before and after taxes is no guarantee of future results. Current month-end performance is available on the Fund's website at wellsfargofunds.com.

Calendar Year Total Returns for Class A as of 12/31 each year

(Returns do not reflect sales charges and would be lower if they did)

Highest Quarter: 3rd Quarter 2009 +18.46% Lowest Quarter: 4th Quarter 2008 -23.75% Year-to-date total return as of 6/30/2016 is +3.42%

|

Average Annual Total Returns for the periods ended 12/31/2015 (returns reflect applicable sales charges) |

||||

|

|

Inception Date of Share Class |

1 Year |

5 Year |

10 Year |

|

Class A (before taxes) |

7/26/2004 |

-8.13% |

8.65% |

5.28% |

|

Class A (after taxes on distributions) |

7/26/2004 |

-9.00% |

8.26% |

4.81% |

|

Class A (after taxes on distributions and the sale of Fund Shares) |

7/26/2004 |

-3.89% |

6.84% |

4.20% |

|

Class C (before taxes) |

7/26/2004 |

-4.24% |

9.14% |

5.12% |

|

Russell 1000® Value Index (reflects no deduction for fees, expenses, or taxes) |

-3.83% |

11.27% |

6.16% |

|

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state, local or foreign taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) Plans or Individual Retirement Accounts. After-tax returns are shown only for the Class A shares. After-tax returns for the Class C shares will vary.

Fund Management

|

Manager |

Sub-Adviser |

Portfolio Manager, Title/Managed Since |

|

Wells Fargo Funds Management, LLC |

Cooke & Bieler, L.P. |

Andrew Armstrong, CFA, Portfolio Manager / 2015 |

References to the investment activities of a gateway fund are intended to refer to the investment activities of the master portfolio(s) in which it invests.

Purchase and Sale of Fund Shares

In general, you can buy or sell shares of the Fund online or by mail, phone or wire on any day the New York Stock Exchange is open for regular trading. You also may buy and sell shares through a financial professional.

|

Buying Fund Shares |

To Place Orders or Redeem Shares |

|

Minimum Initial Investment |

Mail: Wells Fargo Funds |

Tax Information

Any distributions you receive from the Fund may be taxable as ordinary income or capital gains, except when your investment is in an IRA, 401(k) or other tax advantaged investment plan. However, subsequent withdrawals from such a tax advantaged investment plan may be subject to federal income tax. You should consult your tax adviser about your specific tax situation.

Payments to Intermediaries

If you purchase a Fund through an intermediary, the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the intermediary and your financial professional to recommend the Fund over another investment. Consult your financial professional or visit your intermediary's website for more information.

|

Link to Prospectus |

Link to SAI |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Wells Fargo Upgrades Neurocrine Bio. (NBIX) to Overweight 'as the Company is Knocking on the Doors of the Large-Cap Club'

- Wells Fargo sees near term downside for S&P 500, remains bullish long-term

- Crescent Energy (CRGY) PT Raised to $20 at Wells Fargo

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

Wells FargoSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share