Form 497K Oppenheimer Rochester

Oppenheimer Rochester Arizona Municipal Fund

Oppenheimer Rochester Maryland Municipal Fund

Oppenheimer Rochester Massachusetts Municipal Fund

Oppenheimer Rochester Michigan Municipal Fund

Oppenheimer Rochester Minnesota Municipal Fund

Oppenheimer Rochester North Carolina Municipal Fund

Oppenheimer Rochester Ohio Municipal Fund

Oppenheimer Rochester Virginia Municipal Fund

Supplement dated July 29, 2016 to the

Summary Prospectus, Prospectus, and Statement of Additional Information

This supplement amends the Summary Prospectus, Prospectus, and Statement of Additional Information (“SAI”) of each of the above-referenced funds (each, a “Fund”), and is in addition to any other supplement(s).

Effective September 28, 2016:

| 1. | All references in the Summary Prospectus, Prospectus and SAI to “Oppenheimer Cash Reserves,” “Oppenheimer Institutional Money Market Fund,” and “Oppenheimer Money Market Fund” are deleted and replaced by references to “Oppenheimer Government Cash Reserves,” “Oppenheimer Institutional Government Money Market Fund” and “Oppenheimer Government Money Market Fund,” respectively. |

| July 29, 2016 | PS0000.151 |

| Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus, Statement of Additional Information, Annual Report and other information about the Fund online at https://www.oppenheimerfunds.com/fund/RochesterMassachusettsMunicipalFund. You can also get this information at no cost by calling 1.800.225.5677 or by sending an email request to: [email protected]. |

| Class A | Class B | Class C | Class Y | ||

| Maximum Sales Charge (Load) imposed on purchases (as % of offering price) | 4.75% | None | None | None | |

| Maximum Deferred Sales Charge (Load) (as % of the lower of original offering price or redemption proceeds) | None | 5% | 1% | None | |

| Class A | Class B | Class C | Class Y | ||

| Management Fees | 0.55% | 0.55% | 0.55% | 0.55% | |

| Distribution and/or Service (12b-1) Fees | 0.25% | 1.00% | 1.00% | N/A | |

| Other Expenses | |||||

| Interest and Fees from Borrowing | 0.57% | 0.57% | 0.57% | 0.57% | |

| Interest and Related Expenses from Inverse Floaters | 0.02% | 0.02% | 0.02% | 0.02% | |

| Other Expenses | 0.25% | 0.33% | 0.26% | 0.25% | |

| Total Other Expenses | 0.84% | 0.92% | 0.85% | 0.84% | |

| Total Annual Fund Operating Expenses | 1.64% | 2.47% | 2.40% | 1.39% | |

| Fee Waiver and/or Expense Reimbursement2 | (0.25)% | (0.33)% | (0.26)% | 0.00% | |

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement | 1.39% | 2.14% | 2.14% | 1.39% | |

| 1. | Expenses have been restated to reflect current fees. |

| 2. | After discussions with the Fund’s Board, the Manager has contractually agreed to waive fees and/or reimburse the Fund for certain expenses in order to limit “Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement” (excluding any applicable interest and fees from borrowings and interest and related expenses from inverse floaters, dividend expenses, taxes, any subsidiary expenses, Acquired Fund Fees and Expenses, brokerage commissions, unusual and infrequent expenses and certain other |

| If shares are redeemed | If shares are not redeemed | ||||||||

| 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | ||

| Class A | $611 | $948 | $1,309 | $2,321 | $611 | $948 | $1,309 | $2,321 | |

| Class B | $719 | $1,047 | $1,501 | $2,413 | $219 | $747 | $1,301 | $2,413 | |

| Class C | $319 | $732 | $1,272 | $2,748 | $219 | $732 | $1,272 | $2,748 | |

| Class Y | $142 | $443 | $766 | $1,680 | $142 | $443 | $766 | $1,680 | |

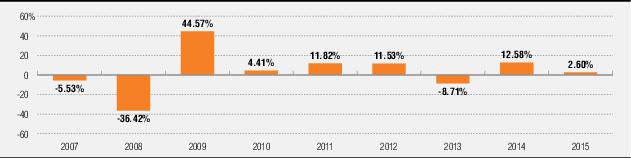

in the Fund by showing changes in the Fund’s performance (for Class A Shares) from calendar year to calendar

year and by showing how the Fund’s average annual returns for the periods of time shown in the table compare

with those of a broad measure of market performance. The Fund’s past investment performance (before and after

taxes) is not necessarily an indication of how the Fund will perform in the future. More recent performance

information is available by calling the toll-free number on the back of this prospectus and on the Fund’s website: https://www.oppenheimerfunds.com/fund/RochesterMassachusettsMunicipalFund

| 1 Year | 5 Years (or life of class, if less) | 10 Years (or life of class, if less) | ||

| Class A Shares (inception 7/18/2006) | ||||

| Return Before Taxes | (2.28)% | 4.61% | 2.04% | |

| Return After Taxes on Distributions | (2.28)% | 4.61% | 2.04% | |

| Return After Taxes on Distributions and Sale of Fund Shares | 0.74% | 4.76% | 2.67% | |

| Class B Shares (inception 7/18/2006) | (3.06)% | 4.49% | 2.08% | |

| Class C Shares (inception 7/18/2006) | 0.77% | 4.84% | 1.78% | |

| Class Y Shares (inception 7/29/2011) | 2.52% | 4.98% | N/A | |

| Barclays Municipal Bond Index | 3.30% | 5.35% | 4.85%1 | |

| (reflects no deduction for fees, expenses, or taxes) | 4.80%2 | |||

| Consumer Price Index | 0.73% | 1.53% | 1.61%1 | |

| (reflects no deduction for fees, expenses, or taxes) | 1.04%2 | |||

| 1. | As of 7/31/06 |

| 2. | As of 7/31/11 |

| Telephone: | Call OppenheimerFunds Services toll-free: 1.800.CALL OPP (1.800.225.5677) | |

| Mail: | For requests by mail: OppenheimerFunds Services P.O. Box 5270 Denver, Colorado 80217-5270 | For requests by courier or express mail: OppenheimerFunds Services 12100 East Iliff Avenue Suite 300 Aurora, Colorado 80014 |

| Internet: | You may request documents, and read or download certain documents at www.oppenheimerfunds.com | |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Šiaulių Bankas invitation to Q1 2024 Financial Results webinar

- REVIVA ALERT: Bragar Eagel & Squire, P.C. is Investigating Reviva Pharmaceuticals Holdings, Inc. on Behalf of Reviva Stockholders and Encourages Investors to Contact the Firm

- Uxin Reports Unaudited Third Quarter of Fiscal Year 2024 Financial Results

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share