Form 497K AMERICAN FUNDS MORTGAGE

|

American

Funds Summary prospectus November 1, 2016 |

| Class A | B | C | F-1 | F-2 | 529-A | 529-B | 529-C | 529-E |

| MFAAX | MFABX | MFACX | MFAEX | MFAFX | CMFAX | CMFBX | CMFCX | CMFEX |

| 529-F-1 | R-1 | R-2 | R-2E | R-3 | R-4 | R-5E | R-5 | R-6 |

| CMFFX | RMAAX | RMABX | RMBEX | RMACX | RMAEX | RMAHX | RMAFX | RMAGX |

| Before you invest, you may want to review the fund’s prospectus and statement of additional information, which contain more information about the fund and its risks. You can find the fund’s prospectus, statement of additional information and other information about the fund online at americanfunds.com/prospectus. You can also get this information at no cost by calling (800) 421-4225 or by sending an email request to [email protected]. The current prospectus and statement of additional information, dated November 1, 2016, are incorporated by reference into this summary prospectus. |

Investment objective

The fund’s investment objective is to provide current income and preservation of capital.

Fees and expenses of the fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $100,000 in American Funds. More information about these and other discounts is available from your financial professional and in the “Sales charge reductions and waivers” section on page 27 of the prospectus and on page 72 of the fund’s statement of additional information.

Shareholder fees (fees paid directly from your investment) | |||||||

| Share classes | |||||||

| A

and 529-A |

B

and 529-B |

C

and 529-C |

529-E | F-1,

F-2 and 529-F-1 |

All

R share classes | ||

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | 3.75% | none | none | none | none | none | |

| Maximum deferred sales charge (load) (as a percentage of the amount redeemed) | 1.001 | 5.00% | 1.00% | none | none | none | |

| Maximum sales charge (load) imposed on reinvested dividends | none | none | none | none | none | none | |

| Redemption or exchange fees | none | none | none | none | none | none | |

Annual fund operating expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||||

| Share classes | |||||||||

| A | B | C | F-1 | F-2 | 529-A | 529-B | 529-C | 529-E | |

| Management fees | 0.24% | 0.24% | 0.24% | 0.24% | 0.24% | 0.24% | 0.24% | 0.24% | 0.24% |

| Distribution and/or service (12b-1) fees | 0.24 | 0.99 | 1.00 | 0.25 | none | 0.22 | 1.002 | 1.00 | 0.49 |

| Other expenses | 0.20 | 0.21 | 0.24 | 0.18 | 0.17 | 0.30 | 0.36 | 0.31 | 0.28 |

| Total annual fund operating expenses | 0.68 | 1.44 | 1.48 | 0.67 | 0.41 | 0.76 | 1.60 | 1.55 | 1.01 |

| 529-F-1 | R-1 | R-2 | R-2E | R-3 | R-4 | R-5E | R-5 | R-6 | |

| Management fees | 0.24% | 0.24% | 0.24% | 0.24% | 0.24% | 0.24% | 0.24% | 0.24% | 0.24% |

| Distribution and/or service (12b-1) fees | 0.00 | 1.002 | 0.75 | 0.60 | 0.50 | 0.22 | none | none | none |

| Other expenses | 0.31 | 0.24 | 0.452 | 0.432 | 0.26 | 0.19 | 0.30 | 0.15 | 0.07 |

| Total annual fund operating expenses | 0.55 | 1.48 | 1.44 | 1.27 | 1.00 | 0.65 | 0.54 | 0.39 | 0.31 |

| Expense reimbursement | — | — | — | 0.113 | — | — | — | — | — |

| Total annual fund operating expenses after expense reimbursement | 0.55 | 1.48 | 1.44 | 1.16 | 1.00 | 0.65 | 0.54 | 0.39 | 0.31 |

1 A contingent deferred sales charge of 1.00% applies on certain redemptions made within one year following purchases of $1 million or more made without an initial sales charge. Contingent deferred sales charge is calculated based on the lesser of the offering price or market value of shares being sold.

2 Restated to reflect current fees.

3 The investment adviser is currently reimbursing a portion of the other expenses. This reimbursement will be in effect through at least November 1, 2017. The adviser may elect at its discretion to extend, modify or terminate the reimbursement at that time.

1 American Funds Mortgage Fund / Summary prospectus

Example This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds.

The example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| Share classes | 1 year | 3 years | 5 years | 10 years |

| A | $442 | $584 | $ 739 | $1,190 |

| B | 647 | 856 | 987 | 1,517 |

| C | 251 | 468 | 808 | 1,768 |

| F-1 | 68 | 214 | 373 | 835 |

| F-2 | 42 | 132 | 230 | 518 |

| 529-A | 450 | 609 | 782 | 1,282 |

| 529-B | 663 | 905 | 1,071 | 1,675 |

| 529-C | 258 | 490 | 845 | 1,845 |

| 529-E | 103 | 322 | 558 | 1,236 |

| 529-F-1 | 56 | 176 | 307 | 689 |

| R-1 | 151 | 468 | 808 | 1,768 |

| R-2 | 147 | 456 | 787 | 1,724 |

| R-2E | 118 | 392 | 686 | 1,524 |

| R-3 | 102 | 318 | 552 | 1,225 |

| R-4 | 66 | 208 | 362 | 810 |

| R-5E | 55 | 173 | 302 | 677 |

| R-5 | 40 | 125 | 219 | 493 |

| R-6 | 32 | 100 | 174 | 393 |

For the share classes listed below, you would pay the following if you did not redeem your shares:

| Share classes | 1 year | 3 years | 5 years | 10 years |

| B | $147 | $456 | $787 | $1,517 |

| C | 151 | 468 | 808 | 1,768 |

| 529-B | 163 | 505 | 871 | 1,675 |

| 529-C | 158 | 490 | 845 | 1,845 |

Portfolio turnover The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the fund’s investment results. During the most recent fiscal year, the fund’s portfolio turnover rate was 1041% of the average value of its portfolio.

Principal investment strategies

Normally at least 80% of the fund’s assets will be invested in mortgage-related securities, including securities collateralized by mortgage loans and contracts for future delivery of such securities (such as to be announced contracts and mortgage dollar rolls). The fund will invest primarily in mortgage-related securities that are sponsored or guaranteed by the U.S. government, such as securities issued by government-sponsored entities that

American Funds Mortgage Fund / Summary prospectus 2

are not backed by the full faith and credit of the U.S. government, and nongovernment mortgage-related securities that are rated in the Aaa or AAA rating category (by Nationally Recognized Statistical Rating Organizations designated by the fund’s investment adviser) or unrated but determined to be of equivalent quality by the fund’s investment adviser. The fund may also invest in debt issued by federal agencies. In the case of to be announced contracts, each contract for future delivery is normally of short duration.

The fund may also invest in certain derivative instruments, such as futures contracts and swaps. A derivative is a financial contract, the value of which is based on the value of an underlying financial asset (such as a stock, bond or currency), a reference rate or a market index. The fund may invest in a derivative only if, in the opinion of the investment adviser, the expected risks and rewards of the proposed investment are consistent with the investment objective and strategies of the fund as disclosed in this prospectus and in the fund’s statement of additional information.

The investment adviser uses a system of multiple portfolio managers in managing the fund’s assets. Under this approach, the portfolio of the fund is divided into segments managed by individual managers who decide how their respective segments will be invested.

The fund relies on the professional judgment of its investment adviser to make decisions about the fund’s portfolio investments. The basic investment philosophy of the investment adviser is to seek to invest in attractively priced securities that, in its opinion, represent good, long-term investment opportunities. The investment adviser believes that an important way to accomplish this is by analyzing various factors, which may include the credit strength of the issuer, prices of similar securities issued by comparable issuers, anticipated changes in interest rates, general market conditions and other factors pertinent to the particular security being evaluated. Securities may be sold when the investment adviser believes that they no longer represent relatively attractive investment opportunities.

Principal risks

This section describes the principal risks associated with the fund’s principal investment strategies. You may lose money by investing in the fund. The likelihood of loss may be greater if you invest for a shorter period of time.

Investing in mortgage-related and other asset-backed securities — Mortgage-related securities, such as mortgage-backed securities, and other asset-backed securities, include debt obligations that represent interests in pools of mortgages or other income-bearing assets, such as consumer loans or receivables. Such securities often involve risks that are different from or more acute than the risks associated with investing in other types of debt securities. Mortgage-backed and other asset-backed securities are subject to changes in the payment patterns of borrowers of the underlying debt. When interest rates fall, borrowers are more likely to refinance or prepay their debt before its stated maturity. This may result in the fund having to reinvest the proceeds in lower yielding securities, effectively reducing the fund’s income. Conversely, if interest rates rise and borrowers repay their debt more slowly than expected, the time in which the mortgage-backed and other asset-backed securities are paid off could be extended, reducing the fund’s cash available for reinvestment in higher yielding securities.

Market conditions — The prices of, and the income generated by, the securities held by the fund may decline – sometimes rapidly or unpredictably – due to various factors, including events or conditions affecting the general economy or particular industries;

3 American Funds Mortgage Fund / Summary prospectus

overall market changes; local, regional or global political, social or economic instability; governmental or governmental agency responses to economic conditions; and currency exchange rate, interest rate and commodity price fluctuations.

Issuer risks — The prices of, and the income generated by, securities held by the fund may decline in response to various factors directly related to the issuers of such securities, including reduced demand for an issuer’s goods or services, poor management performance and strategic initiatives such as mergers, acquisitions or dispositions and the market response to any such initiatives.

Investing in debt instruments — The prices of, and the income generated by, bonds and other debt securities held by the fund may be affected by changing interest rates and by changes in the effective maturities and credit ratings of these securities.

Rising interest rates will generally cause the prices of bonds and other debt securities to fall. Falling interest rates may cause an issuer to redeem, call or refinance a debt security before its stated maturity, which may result in the fund having to reinvest the proceeds in lower yielding securities. Longer maturity debt securities generally have greater sensitivity to changes in interest rates and may be subject to greater price fluctuations than shorter maturity debt securities.

Bonds and other debt securities are also subject to credit risk, which is the possibility that the credit strength of an issuer will weaken and/or an issuer of a debt security will fail to make timely payments of principal or interest and the security will go into default. Lower quality debt securities generally have higher rates of interest and may be subject to greater price fluctuations than higher quality debt securities. Credit risk is gauged, in part, by the credit ratings of the debt securities in which the fund invests. However, ratings are only the opinions of the rating agencies issuing them and are not guarantees as to credit quality or an evaluation of market risk. The fund’s investment adviser relies on its own credit analysts to research issuers and issues in seeking to mitigate various credit and default risks.

Thinly traded securities — There may be little trading in the secondary market for particular bonds, other debt securities or derivatives, which may make them more difficult to value, acquire or sell.

Investing in securities backed by the U.S. government — Securities backed by the U.S. Treasury or the full faith and credit of the U.S. government are guaranteed only as to the timely payment of interest and principal when held to maturity. Accordingly, the current market values for these securities will fluctuate with changes in interest rates. Securities issued by government-sponsored entities and federal agencies and instrumentalities that are not backed by the full faith and credit of the U.S. government are neither issued nor guaranteed by the U.S. government.

Investing in future delivery contracts — The fund may enter into contracts, such as to-be-announced contracts and mortgage dollar rolls, that involve the fund selling mortgage-related securities and simultaneously contracting to repurchase similar securities for delivery at a future date at a predetermined price. This can increase the fund’s market exposure, and the market price of the securities that the fund contracts to repurchase could drop below their purchase price. While the fund can preserve and generate capital through the use of such contracts by, for example, realizing the difference between the sale price and the future purchase price, the income generated by the fund may be reduced by engaging in such transactions. In addition, these transactions may increase the turnover rate of the fund.

American Funds Mortgage Fund / Summary prospectus 4

Investing in inflation linked bonds — The values of inflation linked bonds generally fluctuate in response to changes in real interest rates — i.e., rates of interest after factoring in inflation. A rise in real interest rates may cause the prices of inflation linked securities to fall, while a decline in real interest rates may cause the prices to increase. Inflation linked bonds may experience greater losses than other debt securities with similar durations when real interest rates rise faster than nominal interest rates. There can be no assurance that the value of an inflation linked security will be directly correlated to changes in interest rates; for example, if interest rates rise for reasons other than inflation, the increase may not be reflected in the security’s inflation measure.

Investing in inflation linked bonds may also reduce the fund’s distributable income during periods of extreme deflation. If prices for goods and services decline throughout the economy, the principal and income on inflation linked securities may decline and result in losses to the fund.

Investing in derivatives — The use of derivatives involves a variety of risks, which may be different from, or greater than, the risks associated with investing in traditional cash securities, such as stocks and bonds. Changes in the value of a derivative may not correlate perfectly with, and may be more sensitive to market events than, the underlying asset, rate or index, and a derivative instrument may expose the fund to losses in excess of its initial investment. Derivatives may be difficult for the fund to buy or sell at an opportune time or price and may be difficult to terminate or otherwise offset. The fund’s use of derivatives may result in losses to the fund, and investing in derivatives may reduce the fund’s returns and increase the fund’s price volatility. The fund’s counterparty to a derivative transaction (including, if applicable, the fund’s clearing broker, the derivatives exchange or the clearinghouse) may be unable or unwilling to honor its financial obligations in respect of the transaction. A description of the derivative instruments in which the fund may invest and the various risks associated with those derivatives is included in the fund’s statement of additional information under “Description of certain securities, investment techniques and risks.”

Management — The investment adviser to the fund actively manages the fund’s investments. Consequently, the fund is subject to the risk that the methods and analyses employed by the investment adviser in this process may not produce the desired results. This could cause the fund to lose value or its investment results to lag relevant benchmarks or other funds with similar objectives.

It is important to note that neither your investment in the fund nor the fund’s yield is guaranteed by the U.S. government. Your investment in the fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency, entity or person. You should consider how this fund fits into your overall investment program.

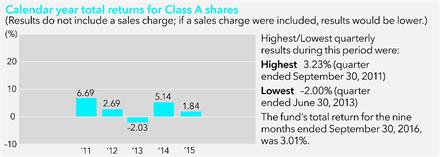

Investment results

The following bar chart shows how the fund’s investment results have varied from year to year, and the following table shows how the fund’s average annual total returns for various periods compare with a broad measure of securities market results and other applicable measures of market results. This information provides some indication of the risks of investing in the fund. The Lipper Intermediate U.S. Government Funds Average includes mutual funds that disclose investment objectives and/or strategies reasonably comparable to those of the fund. The Lipper GNMA Funds Average includes funds that disclose investment objectives and/or strategies reasonably comparable to those of the fund. Past investment results (before and after taxes) are not predictive of future

5 American Funds Mortgage Fund / Summary prospectus

investment results. Updated information on the fund’s investment results can be obtained by visiting americanfunds.com.

Average annual total returns For the periods ended December 31, 2015 (with maximum sales charge): | ||||

| Share class | Inception date | 1 year | 5 years | Lifetime |

| A — Before taxes | 11/1/2010 | –2.01% | 2.05% | 1.62% |

| — After taxes on distributions | –3.02 | 1.20 | 0.80 | |

| — After taxes on distributions and sale of fund shares | –1.13 | 1.24 | 0.92 | |

| Share classes (before taxes) | Inception date | 1 year | 5 years | Lifetime |

| B | 11/1/2010 | –3.86% | 1.65% | 1.42% |

| C | 11/1/2010 | 0.07 | 1.98 | 1.56 |

| F-1 | 11/1/2010 | 1.84 | 2.79 | 2.34 |

| F-2 | 11/1/2010 | 2.11 | 3.05 | 2.60 |

| 529-A | 11/1/2010 | –2.07 | 1.96 | 1.53 |

| 529-B | 11/1/2010 | –3.97 | 1.54 | 1.31 |

| 529-C | 11/1/2010 | 0.02 | 1.91 | 1.49 |

| 529-E | 11/1/2010 | 1.50 | 2.44 | 2.01 |

| 529-F-1 | 11/1/2010 | 1.97 | 2.93 | 2.48 |

| R-1 | 11/1/2010 | 1.48 | 2.52 | 2.08 |

| R-2 | 11/1/2010 | 0.87 | 2.07 | 1.65 |

| R-2E | 8/29/2014 | 1.98 | N/A | 2.12 |

| R-3 | 11/1/2010 | 1.51 | 2.55 | 2.11 |

| R-4 | 11/1/2010 | 1.92 | 2.87 | 2.41 |

| R-5 | 11/1/2010 | 2.13 | 3.10 | 2.64 |

| R-6 | 11/1/2010 | 2.22 | 3.15 | 2.69 |

| Indexes | 1 year | 5 years | Lifetime (from Class A inception) |

| Bloomberg Barclays U.S. Mortgage Backed Securities Index (reflects no deductions for sales charges, account fees, expenses or U.S. federal income taxes) | 1.51% | 2.96% | 2.71% |

| Lipper Intermediate U.S. Government Funds Average (reflects no deductions for sales charges, account fees or U.S. federal income taxes) | 0.57 | 2.13 | 1.66 |

| Lipper GNMA Funds Average (reflects no deductions for sales charges, account fees or U.S. federal income taxes) | 0.65 | 2.41 | 2.17 |

| Class

A annualized 30-day yield at August 31, 2016: 1.77% (For current yield information, please call American FundsLine® at (800) 325-3590.) | |||

American Funds Mortgage Fund / Summary prospectus 6

After-tax returns are shown only for Class A shares; after-tax returns for other share classes will vary. After-tax returns are calculated using the highest individual federal income tax rates in effect during each year of the periods shown and do not reflect the impact of state and local taxes. Your actual after-tax returns depend on your individual tax situation and likely will differ from the results shown above. In addition, after-tax returns are not relevant if you hold your fund shares through a tax-favored arrangement, such as a 401(k) plan, individual retirement account (IRA) or 529 college savings plan.

Management

Investment adviser Capital Research and Management CompanySM

Portfolio managers The individuals primarily responsible for the portfolio management of the fund are:

| Portfolio

manager/ Fund title (if applicable) |

Portfolio

manager experience in this fund |

Primary

title with investment adviser |

| David

J. Betanzos President |

3 years | Partner

– Capital Fixed Income Investors |

| Fergus

N. MacDonald Senior Vice President |

6 years | Partner

– Capital Fixed Income Investors |

Purchase and sale of fund shares

The minimum amount to establish an account for all share classes is $250 and the minimum to add to an account is $50. For a payroll deduction retirement plan account, payroll deduction savings plan account or employer-sponsored 529 account, the minimum is $25 to establish or add to an account.

If you are a retail investor, you may sell (redeem) shares on any business day through your dealer or financial advisor or by writing to American Funds Service Company® at P.O. Box 6007, Indianapolis, Indiana 46206-6007; telephoning American Funds Service Company at (800) 421-4225; faxing American Funds Service Company at (888) 421-4351; or accessing our website at americanfunds.com. Please contact your plan administrator or recordkeeper to sell (redeem) shares from your retirement plan.

Tax information

Dividends and capital gain distributions you receive from the fund are subject to federal income taxes and may also be subject to state and local taxes, unless you are tax-exempt or your account is tax-favored.

Payments to broker-dealers and other financial intermediaries

If you purchase shares of the fund through a broker-dealer or other financial intermediary (such as a bank), the fund and the fund’s distributor or its affiliates may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your individual financial advisor to recommend the fund over another investment. Ask your individual financial advisor or visit your financial intermediary’s website for more information.

| |

| MFGEIPX-042-1116P Litho in USA CGD/UNL/10128 | Investment Company File No. 811-22449 |

THE FUND PROVIDES A SPANISH TRANSLATION OF THE ABOVE SUMMARY PROSPECTUS IN CONNECTION WITH THE PUBLIC OFFERING AND SALE OF ITS SHARES. THE ENGLISH LANGUAGE SUMMARY PROSPECTUS ABOVE IS A FAIR AND ACCURATE REPRESENTATION OF THE SPANISH EQUIVALENT.

| /s/ | STEVEN I. KOSZALKA |

| STEVEN I. KOSZALKA | |

| SECRETARY |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- US stock futures tread water with top tech earnings on tap

- JPMorgan is worried about further S&P 500 sell-off potential

- Investors turn less bullish on S&P 500 amid inflation, geopolitical risks- Citi

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

The Capital Group CompaniesSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share