Form 424B2 CITIGROUP INC

|

The information in this preliminary pricing supplement is not complete and may be changed. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. This preliminary pricing supplement and the accompanying prospectus supplement and prospectus are not an offer to sell these securities, nor are they soliciting an offer to buy these securities, in any state where the offer or sale is not permitted. SUBJECT TO COMPLETION, DATED JANUARY 23, 2017 | |

| Citigroup Inc. |

January-----, 2017 Medium-Term Senior Notes, Series G Pricing Supplement No. 2017-CMTNG1000 Filed Pursuant to Rule 424(b)(2) Registration Statement No. 333-214120 |

Non-Callable Floating Rate Notes Due January-----, 2025

| · | The notes will pay interest at a floating rate that will be reset quarterly and will equal 3-month U.S. dollar LIBOR plus a spread of 1.22% per annum, subject to a minimum interest rate of 0%. |

| · | The notes are unsecured senior debt obligations of Citigroup Inc. All payments due on the notes are subject to the credit risk of Citigroup Inc. |

| · | It is important for you to consider the information contained in this pricing supplement together with the information contained in the accompanying prospectus supplement and prospectus. The description of the notes below supplements, and to the extent inconsistent with replaces, the description of the general terms of the notes set forth in the accompanying prospectus supplement and prospectus. |

| KEY TERMS | |||

| Issuer: | Citigroup Inc. | ||

| Issue price: | $1,000 per note | ||

| Stated principal amount: | $1,000 per note | ||

| Aggregate stated principal amount: | $ | ||

| Pricing date*: | January , 2017 (expected to be January 26, 2017) | ||

| Original issue date*: | January , 2017 (three business days after the pricing date) | ||

| Maturity date*: | January , 2025 (expected to be January 31, 2025). If the maturity date is not a business day, then the payment required to be made on the maturity date will be made on the next succeeding business day with the same force and effect as if it had been made on the maturity date. No additional interest will accrue as a result of delayed payment. | ||

| Principal due at maturity: | Full principal amount due at maturity | ||

| Payment at maturity: | $1,000 per note plus any accrued and unpaid interest | ||

| Interest rate per annum*: | For each interest period, a floating rate equal to 3-month U.S. dollar LIBOR determined on the second London business day prior to the first day of the applicable interest period plus a spread of 1.22% per annum, subject to a minimum interest rate of 0.00% per annum for any interest period | ||

| Interest period: | Each three-month period from and including an interest payment date (or the original issue date, in the case of the first interest period) to but excluding the next interest payment date | ||

| Interest payment dates*: | Interest on the notes is payable quarterly on the day of each January, April, July and October (expected to be the last day of each January, April, July and October), beginning on April , 2017 (expected to be April 30, 2017) and ending on the maturity date. If any interest payment date is not a business day, then the payment required to be made on that interest payment date will be made on the next succeeding business day with the same force and effect as if it had been made on that interest payment date. No additional interest will accrue as a result of delayed payment. | ||

| Day count convention: | Actual/360 Unadjusted. See “Determination of Interest Payments” in this pricing supplement. | ||

| Business day: | Any day that is not a Saturday or Sunday and that, in New York City, is not a day on which banking institutions are authorized or obligated by law or executive order to close | ||

| Business day convention: | Following | ||

| CUSIP / ISIN: | 17298CFE3 / US17298CFE30 | ||

| Listing: | The notes will not be listed on any securities exchange and, accordingly, may have limited or no liquidity. You should not invest in the notes unless you are willing to hold them to maturity. | ||

| Underwriter: | Citigroup Global Markets Inc. (“CGMI”), an affiliate of the issuer, acting as principal. See “General Information—Supplemental information regarding plan of distribution; conflicts of interest” in this pricing supplement. | ||

| Underwriting fee and issue price: | Issue price(1) | Underwriting fee(2) | Proceeds to issuer |

| Per note: | $1,000.00 | $5.50 | $994.50 |

| Total: | $ | $ | $ |

* Expected dates are subject to change.

(1) The issue price for investors purchasing the notes in fee-based advisory accounts will be $994.50 per note, assuming no custodial fee is charged by a selected dealer, and up to $999.50 per note, assuming the maximum custodial fee is charged by a selected dealer. See “General Information—Fees and selling concessions” in this pricing supplement.

(2) CGMI, an affiliate of Citigroup Inc. and the underwriter of the sale of the notes, is acting as principal and will receive an underwriting fee of $5.50 for each $1,000 note sold in this offering (or up to $5.00 for each note sold to fee-based advisory accounts). Selected dealers not affiliated with CGMI will receive a selling concession of $5.50 for each note they sell other than to fee-based advisory accounts. CGMI will pay selected dealers not affiliated with CGMI, which may include dealers acting as custodians, a variable selling concession of up to $5.00 for each note they sell to fee-based advisory accounts. See “General Information—Fees and selling concessions” in this pricing supplement. In addition to the underwriting fee, CGMI and its affiliates may profit from expected hedging activity related to this offering, even if the value of the notes declines. See “Use of Proceeds and Hedging” in the accompanying prospectus.

Investing in the notes involves risks not associated with an investment in conventional fixed rate debt securities. See “Risk Factors” beginning on page PS-2.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the notes or determined that this pricing supplement and the accompanying prospectus supplement and prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

You should read this pricing supplement together with the accompanying prospectus supplement and prospectus, each of which can be accessed via the hyperlink below:

Prospectus Supplement and Prospectus each dated December 29, 2016

The notes are not bank deposits and are

not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency, nor are they obligations

of, or guaranteed by, a bank.

| Citigroup Inc. |

| Non-Callable Floating Rate Notes Due January-----, 2025 |

Additional Information

The notes are intended to qualify as eligible debt securities for purposes of the Federal Reserve's total loss-absorbing capacity (“TLAC”) rule. As a result, in the event of a Citigroup Inc. bankruptcy, Citigroup Inc.'s losses and any losses incurred by its subsidiaries would be imposed first on Citigroup Inc.’s shareholders and then on its unsecured creditors, including the holders of the notes. Further, in a bankruptcy proceeding of Citigroup Inc. any value realized by holders of the notes may not be sufficient to repay the amounts owed on the notes. For more information about the consequences of “TLAC” on the notes, you should refer to the “Citigroup Inc.” section beginning on page 8 of the accompanying prospectus.

We reserve the right to withdraw, cancel or modify any offering of the notes and to reject orders in whole or in part prior to their issuance.

Risk Factors

The following is a non-exhaustive list of certain key risk factors for investors in the notes. You should read the risk factors below together with the risk factors included in the accompanying prospectus supplement and in the documents incorporated by reference in the accompanying prospectus, including our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q, which describe risks relating to our business more generally. We also urge you to consult your investment, legal, tax, accounting and other advisers before you decide to invest in the notes.

| § | The amount of interest payable on the notes will vary. The notes differ from conventional fixed-rate debt securities in that the interest payable on the notes will vary based on the level of 3-month U.S. dollar LIBOR and may be as low as 0.00%. The notes will bear interest during each quarterly interest period at a per annum rate equal to the level of 3-month U.S. dollar LIBOR determined on the second London business day prior to the first day of the applicable interest period plus a spread of 1.22%, subject to a minimum interest rate of 0.00% per annum. The per annum interest rate that is determined on the relevant interest determination date will apply to the entire interest period following that interest determination date, even if 3-month U.S. dollar LIBOR increases during that interest period, but is applicable only to that quarterly interest period; interest payments for any other quarterly interest period will vary. |

| § | The yield on the notes may be lower than the yield on a conventional fixed-rate debt security of ours of comparable maturity. The notes will bear interest during each quarterly interest period at a per annum rate equal to the level of 3-month U.S. dollar LIBOR determined on the second London business day prior to the first day of the applicable interest period plus a spread of 1.22%, subject to a minimum interest rate of 0.00% per annum. As a result, the effective yield on your notes may be less than that which would be payable on a conventional fixed-rate, non-callable debt security of ours of comparable maturity. |

| § | An investment in the notes may be more risky than an investment in notes with a shorter term. The notes have a term of eight years. By purchasing notes with a longer term, you will bear greater exposure to fluctuations in market interest rates than if you purchased a note with a shorter term. In particular, if the level of 3-month U.S. dollar LIBOR does not increase from its current level, you may be holding a long-dated security that pays an interest rate that is less than that which would be payable on a conventional fixed-rate, non-callable debt security of Citigroup Inc. of comparable maturity. In addition, if you tried to sell your notes at such time, the value of your notes in any secondary market transaction would also be adversely affected. |

| § | The notes are subject to the credit risk of Citigroup Inc., and any actual or anticipated changes to its credit ratings or credit spreads may adversely affect the value of the notes. You are subject to the credit risk of Citigroup Inc. If Citigroup Inc. defaults on its obligations under the notes, your investment would be at risk and you could lose some or all of your investment. As a result, the value of the notes will be affected by changes in the market’s view of Citigroup Inc.’s creditworthiness. Any decline, or anticipated decline, in Citigroup Inc.’s credit ratings or increase, or anticipated increase, in the credit spreads charged by the market for taking Citigroup Inc. credit risk is likely to adversely affect the value of the notes. |

| § | The notes will not be listed on any securities exchange and you may not be able to sell them prior to maturity. The notes will not be listed on any securities exchange. Therefore, there may be little or no secondary market for the notes. CGMI currently intends to make a secondary market in relation to the notes and to provide an indicative bid price for the notes on a daily basis. Any indicative bid price for the notes provided by CGMI will be determined in CGMI’s sole discretion, taking into account prevailing market conditions and other relevant factors, and will not be a representation by CGMI that the notes can be sold at that price or at all. CGMI may suspend or terminate making a market and providing indicative bid prices without notice, at any time and for any reason. If CGMI suspends or terminates making a market, there may be no secondary market at all for the notes because it is likely that CGMI will be the only broker-dealer that is willing to buy your notes prior to maturity. Accordingly, an investor must be prepared to hold the notes until maturity. |

| § | Immediately following issuance, any secondary market bid price provided by CGMI, and the value that will be indicated on any brokerage account statements prepared by CGMI or its affiliates, will reflect a temporary upward adjustment. The amount of this temporary upward adjustment will steadily decline to zero over the temporary adjustment period. See “General Information—Temporary adjustment period” in this pricing supplement. |

| January 2017 | PS-2 |

| Citigroup Inc. |

| Non-Callable Floating Rate Notes Due January-----, 2025 |

| § | Secondary market sales of the notes may result in a loss of principal. You will be entitled to receive at least the full stated principal amount of your notes, subject to the credit risk of Citigroup Inc., only if you hold the notes to maturity. If you are able to sell your notes in the secondary market prior to maturity, you are likely to receive less than the stated principal amount of the notes. |

| § | The inclusion of underwriting fees and projected profit from hedging in the issue price is likely to adversely affect secondary market prices. Assuming no changes in market conditions or other relevant factors, the price, if any, at which CGMI may be willing to purchase the notes in secondary market transactions will likely be lower than the issue price since the issue price of the notes will include, and secondary market prices are likely to exclude, underwriting fees paid with respect to the notes, as well as the cost of hedging our obligations under the notes. The cost of hedging includes the projected profit that our affiliates may realize in consideration for assuming the risks inherent in managing the hedging transactions. The secondary market prices for the notes are also likely to be reduced by the costs of unwinding the related hedging transactions. Our affiliates may realize a profit from the expected hedging activity even if the value of the notes declines. In addition, any secondary market prices for the notes may differ from values determined by pricing models used by CGMI, as a result of dealer discounts, mark-ups or other transaction costs. |

| § | The price at which you may be able to sell your notes prior to maturity will depend on a number of factors and may be substantially less than the amount you originally invest. A number of factors will influence the value of the notes in any secondary market that may develop and the price at which CGMI may be willing to purchase the notes in any such secondary market, including: the level and volatility of 3-month U.S. dollar LIBOR, interest rates in the market, the time remaining to maturity of the notes, hedging activities by our affiliates, fees and projected hedging fees and profits and any actual or anticipated changes in the credit ratings, financial condition and results of Citigroup Inc. The value of the notes will vary and is likely to be less than the issue price at any time prior to maturity, and sale of the notes prior to maturity may result in a loss. |

| § | The calculation agent, which is an affiliate of the issuer, will make determinations with respect to the notes.Citibank, N.A., the calculation agent for the notes, is an affiliate of ours. As calculation agent, Citibank, N.A. will determine, among other things, the level of 3-month U.S. dollar LIBOR and will calculate the interest payable to you on each interest payment date. Any of these determinations or calculations made by Citibank, N.A. in its capacity as calculation agent, including with respect to the calculation of the level of 3-month U.S. dollar LIBOR in the event of the unavailability of the level of 3-month U.S. dollar LIBOR, may adversely affect the amount of one or more interest payments to you. |

| § | Hedging and trading activity by Citigroup Inc. could result in a conflict of interest. One or more of our affiliates will likely enter into hedging transactions. This hedging activity will likely involve trading in instruments, such as options, swaps or futures, based upon 3-month U.S. dollar LIBOR. This hedging activity may present a conflict between your interest in the notes and the interests our affiliates have in executing, maintaining and adjusting their hedge transactions because it could affect the price at which our affiliate CGMI may be willing to purchase your notes in the secondary market. Because hedging our obligations under the notes involves risk and may be influenced by a number of factors, it is possible that our affiliates may profit from the expected hedging activity, even if the value of the notes declines. |

| § | The historical performance of 3-month U.S. dollar LIBOR is not an indication of its future performance. The historical performance of 3-month U.S. dollar LIBOR, which is included in this pricing supplement, should not be taken as an indication of the future performance of 3-month U.S. dollar LIBOR during the term of the notes. Changes in the level of 3-month U.S. dollar LIBOR will affect the value of the notes, but it is impossible to predict whether the level of 3-month U.S. dollar LIBOR will rise or fall. |

| § | 3-month U.S. dollar LIBOR and the manner in which it is calculated may change in the future.The method by which 3-month U.S. dollar LIBOR is calculated may change in the future, as a result of governmental actions, actions by the publisher of 3-month U.S. dollar LIBOR or otherwise. We cannot predict whether the method by which 3-month U.S. dollar LIBOR is calculated will change or what the impact of any such change might be. Any such change could affect the level of 3-month U.S. dollar LIBOR in a way that has a significant adverse effect on the notes. |

| § | You will have no rights against the publisher of 3-month U.S. dollar LIBOR. You will have no rights against the publisher of 3-month U.S. dollar LIBOR even though the amount you receive on each interest payment date will depend upon the level of 3-month U.S. dollar LIBOR. The publisher of 3-month U.S. dollar LIBOR is not in any way involved in this offering and has no obligations relating to the notes or the holders of the notes. |

| January 2017 | PS-3 |

| Citigroup Inc. |

| Non-Callable Floating Rate Notes Due January-----, 2025 |

| General Information | |

| Temporary adjustment period: | For a period of approximately four months following issuance of the notes, the price, if any, at which CGMI would be willing to buy the notes from investors, and the value that will be indicated for the notes on any brokerage account statements prepared by CGMI or its affiliates (which value CGMI may also publish through one or more financial information vendors), will reflect a temporary upward adjustment from the price or value that would otherwise be determined. This temporary upward adjustment represents a portion of the hedging profit expected to be realized by CGMI or its affiliates over the term of the notes. The amount of this temporary upward adjustment will decline to zero on a straight-line basis over the four-month temporary adjustment period. However, CGMI is not obligated to buy the notes from investors at any time. See “Risk Factors—The notes will not be listed on any securities exchange and you may not be able to sell them prior to maturity.” |

| U.S. federal income tax considerations: |

In the opinion of our counsel, Davis Polk & Wardwell LLP, the notes will be treated as “variable rate debt instruments” for U.S. federal income tax purposes. Under this treatment, stated interest on the notes will be taxable to a U.S. Holder (as defined in the accompanying prospectus supplement) as ordinary interest income at the time it accrues or is received in accordance with the U.S. Holder’s method of tax accounting. Upon the sale or other taxable disposition of a note, a U.S. Holder generally will recognize capital gain or loss equal to the difference between the amount realized on the disposition (other than any amount attributable to accrued interest, which will be treated as a payment of interest) and the U.S. Holder’s adjusted tax basis in the note. A U.S. Holder’s adjusted tax basis in a note generally will equal the cost of the note to the U.S. Holder. Such gain or loss generally will be long-term capital gain or loss if the U.S. Holder has held the note for more than one year at the time of disposition.

Subject to the discussion below, under current law Non-U.S. Holders (as defined in the accompanying prospectus supplement) generally will not be subject to U.S. federal withholding or income tax with respect to interest paid on and amounts received on the sale, exchange or retirement of the notes if they comply with applicable certification requirements. Special rules apply to Non-U.S. Holders whose income on the notes is effectively connected with the conduct of a U.S. trade or business or who are individuals present in the United States for 183 days or more in a taxable year.

As discussed in the section of the accompanying prospectus supplement entitled “United States Federal Tax Considerations,” withholding under legislation commonly referred to as “FATCA” (if applicable) will generally apply to amounts treated as interest paid with respect to the notes and to the payment of gross proceeds of a disposition (including a retirement) of the notes. However, under an Internal Revenue Service notice, withholding under “FATCA” will apply to payments of gross proceeds (other than amounts treated as interest) only with respect to dispositions after December 31, 2018. You should consult your tax adviser regarding the potential application of “FATCA” to the notes.

You should read the section entitled “United States Federal Tax Considerations” in the accompanying prospectus supplement. The preceding discussion, when read in combination with that section, constitutes the full opinion of Davis Polk & Wardwell LLP regarding the material U.S. federal tax consequences of owning and disposing of the notes.

You should also consult your tax adviser regarding all aspects of the U.S. federal tax consequences of an investment in the notes and any tax consequences arising under the laws of any state, local or non-U.S. taxing jurisdiction. |

| Trustee: | The Bank of New York Mellon (as trustee under an indenture dated November 13, 2013) will serve as trustee for the notes. |

| Use of proceeds and hedging: |

The net proceeds received from the sale of the notes will be used for general corporate purposes and, in part, in connection with hedging our obligations under the notes through one or more of our affiliates.

Hedging activities related to the notes by one or more of our affiliates will likely involve trading in one or more instruments, such as options, swaps and/or futures, based on 3-month U.S. dollar LIBOR and/or taking positions in any other available securities or instruments that we may wish to use in connection with such hedging. It is possible that our affiliates may profit from this hedging activity, even if the value of the notes declines. Profit or loss from this hedging activity could affect the price at which Citigroup Inc.’s affiliate, CGMI, may be willing to purchase your notes in the |

| January 2017 | PS-4 |

| Citigroup Inc. |

| Non-Callable Floating Rate Notes Due January-----, 2025 |

| secondary market. For further information on our use of proceeds and hedging, see “Use of Proceeds and Hedging” in the accompanying prospectus. | |

| ERISA and IRA purchase considerations: | Please refer to “Benefit Plan Investor Considerations” in the accompanying prospectus supplement for important information for investors that are ERISA or other benefit plans or whose underlying assets include assets of such plans. |

| Fees and selling concessions: |

CGMI, an affiliate of Citigroup Inc. and the underwriter of the sale of the notes, is acting as principal and will receive an underwriting fee of $5.50 for each note sold in this offering (or up to $5.00 for each note sold to fee-based advisory accounts). The actual underwriting fee will be equal to $5.50 for each note sold by CGMI directly to the public and will otherwise be equal to the selling concession provided to selected dealers, as described in this paragraph. CGMI will pay selected dealers not affiliated with CGMI a selling concession of $5.50 for each note they sell to accounts other than fee-based advisory accounts. CGMI will pay selected dealers not affiliated with CGMI, which may include dealers acting as custodians, a variable selling concession of up to $5.00 for each note they sell to fee-based advisory accounts.

Additionally, it is possible that CGMI and its affiliates may profit from expected hedging activity related to this offering, even if the value of the notes declines. You should refer to “Risk Factors” above and the section “Use of Proceeds and Hedging” in the accompanying prospectus. |

| Supplemental information regarding plan of distribution; conflicts of interest: |

The terms and conditions set forth in the Global Selling Agency Agreement dated November 13, 2013 among Citigroup Inc. and the agents named therein, including CGMI, govern the sale and purchase of the notes.

The notes will not be listed on any securities exchange.

In order to hedge its obligations under the notes, Citigroup Inc. expects to enter into one or more swaps or other derivatives transactions with one or more of its affiliates. You should refer to the sections “Risk Factors—Hedging and trading activity by Citigroup Inc. could result in a conflict of interest,” and “General Information—Use of proceeds and hedging” in this pricing supplement and the section “Use of Proceeds and Hedging” in the accompanying prospectus.

CGMI is an affiliate of Citigroup Inc. Accordingly, the offering of the notes will conform with the requirements addressing conflicts of interest when distributing the securities of an affiliate set forth in Rule 5121 of the Conduct Rules of the Financial Industry Regulatory Authority, Inc. Client accounts over which Citigroup Inc., its subsidiaries or affiliates of its subsidiaries have investment discretion are not permitted to purchase the notes, either directly or indirectly, without the prior written consent of the client. See “Plan of Distribution; Conflicts of Interest” in the accompanying prospectus supplement for more information.

|

| Calculation agent: | Citibank, N.A., an affiliate of Citigroup Inc., will serve as calculation agent for the notes. All determinations made by the calculation agent will be at the sole discretion of the calculation agent and will, in the absence of manifest error, be conclusive for all purposes and binding on Citigroup Inc. and the holders of the notes. Citibank, N.A. is obligated to carry out its duties and functions as calculation agent in good faith and using its reasonable judgment. |

| Paying agent: | Citibank, N.A. will serve as paying agent and registrar and will also hold the global security representing the notes as custodian for The Depository Trust Company (“DTC”). |

| Contact: | Clients may contact their local brokerage representative. Third party distributors may contact Citi Structured Investment Sales at (212) 723-7005. |

We encourage you to also read the accompanying prospectus supplement and prospectus, which can be accessed via the hyperlink on the cover page of this pricing supplement.

Determination of Interest Payments

On each interest payment date, the amount of each interest payment will equal (i) the stated principal amount of the notes multiplied by the interest rate in effect during the applicable interest period multiplied by (ii) the number of days in the applicable interest period divided by 360.

| January 2017 | PS-5 |

| Citigroup Inc. |

| Non-Callable Floating Rate Notes Due January-----, 2025 |

Determination of 3-month U.S. Dollar LIBOR

3-month U.S. dollar LIBOR is a daily reference rate fixed in U.S. dollars based on the interest rates at which banks borrow funds from each other for a term of three months, in marketable size, in the London interbank market. For any relevant date, 3-month U.S. dollar LIBOR will equal the rate for 3-month U.S. dollar LIBOR appearing on Reuters page “LIBOR01” (or any successor page as determined by the calculation agent) as of 11:00 am (London time) on that date.

If a rate for 3-month U.S. dollar LIBOR is not published on Reuters page “LIBOR01” (or any successor page as determined by the calculation agent) on any day on which the rate for 3-month U.S. dollar LIBOR is required, then the calculation agent will request the principal London office of each of five major reference banks in the London interbank market, selected by the calculation agent, to provide such bank’s offered quotation to prime banks in the London interbank market for deposits in U.S. dollars in an amount that is representative of a single transaction in that market at that time (a “Representative Amount”) and for a term of three months as of 11:00 am (London time) on such day. If at least two such quotations are so provided, the rate for 3-month U.S. dollar LIBOR will be the arithmetic mean of such quotations. If fewer than two such quotations are provided, the calculation agent will request each of three major banks in New York City to provide such bank’s rate to leading European banks for loans in U.S. dollars in a Representative Amount and for a term of three months as of approximately 11:00 am (New York City time) on such day. If at least two such rates are so provided, the rate for 3-month U.S. dollar LIBOR will be the arithmetic mean of such rates. If fewer than two such rates are so provided, then the rate for 3-month U.S. dollar LIBOR will be 3-month U.S. dollar LIBOR in effect as of 11:00 am (New York City time) on the immediately preceding London business day.

A “business day” means any day that is not a Saturday or Sunday and that, in New York City, is not a day on which banking institutions are authorized or obligated by law or executive order to close.

A “London business day” means any day on which dealings in deposits in U.S. dollars are transacted in the London interbank market.

Historical Information on 3-month U.S. Dollar LIBOR

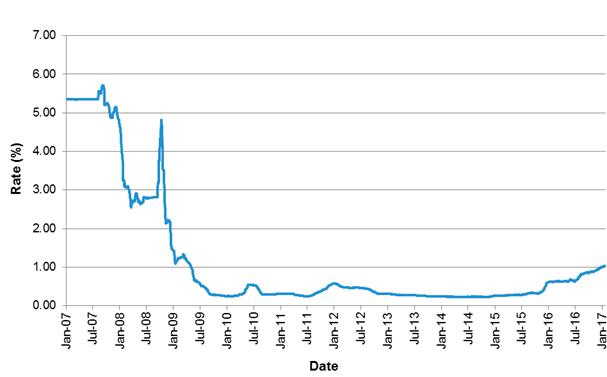

3-month U.S. dollar LIBOR was 1.04344% on January 20, 2017.

The graph below shows the published daily rate for 3-month U.S. dollar LIBOR for each day it was available from January 2, 2007 to January 20, 2017. We obtained the values below from Bloomberg L.P., without independent verification. You should not take the historical performance of 3-month U.S. dollar LIBOR as an indication of future performance.

|

Historical 3-Month U.S. Dollar LIBOR January 2, 2007 to January 20, 2017 |

|

| January 2017 | PS-6 |

| Citigroup Inc. |

| Non-Callable Floating Rate Notes Due January-----, 2025 |

Certain Selling Restrictions

Hong Kong Special Administrative Region

The contents of this pricing supplement and the accompanying prospectus supplement and prospectus have not been reviewed by any regulatory authority in the Hong Kong Special Administrative Region of the People’s Republic of China (“Hong Kong”). Investors are advised to exercise caution in relation to the offer. If investors are in any doubt about any of the contents of this pricing supplement and the accompanying prospectus supplement and prospectus, they should obtain independent professional advice.

The notes have not been offered or sold and will not be offered or sold in Hong Kong by means of any document, other than

| (i) | to persons whose ordinary business is to buy or sell shares or debentures (whether as principal or agent); or |

| (ii) | to “professional investors” as defined in the Securities and Futures Ordinance (Cap. 571) of Hong Kong (the “Securities and Futures Ordinance”) and any rules made under that Ordinance; or |

| (iii) | in other circumstances which do not result in the document being a “prospectus” as defined in the Companies Ordinance (Cap. 32) of Hong Kong or which do not constitute an offer to the public within the meaning of that Ordinance; and |

There is no advertisement, invitation or document relating to the notes which is directed at, or the contents of which are likely to be accessed or read by, the public of Hong Kong (except if permitted to do so under the securities laws of Hong Kong) other than with respect to securities which are or are intended to be disposed of only to persons outside Hong Kong or only to “professional investors” as defined in the Securities and Futures Ordinance and any rules made under that Ordinance.

Non-insured Product: These notes are not insured by any governmental agency. These notes are not bank deposits and are not covered by the Hong Kong Deposit Protection Scheme.

Singapore

This pricing supplement and the accompanying prospectus supplement and prospectus have not been registered as a prospectus with the Monetary Authority of Singapore, and the notes will be offered pursuant to exemptions under the Securities and Futures Act, Chapter 289 of Singapore (the “Securities and Futures Act”). Accordingly, the notes may not be offered or sold or made the subject of an invitation for subscription or purchase nor may this pricing supplement or any other document or material in connection with the offer or sale or invitation for subscription or purchase of any notes be circulated or distributed, whether directly or indirectly, to any person in Singapore other than (a) to an institutional investor pursuant to Section 274 of the Securities and Futures Act, (b) to a relevant person under Section 275(1) of the Securities and Futures Act or to any person pursuant to Section 275(1A) of the Securities and Futures Act and in accordance with the conditions specified in Section 275 of the Securities and Futures Act, or (c) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the Securities and Futures Act. Where the notes are subscribed or purchased under Section 275 of the Securities and Futures Act by a relevant person which is:

| (a) | a corporation (which is not an accredited investor (as defined in Section 4A of the Securities and Futures Act)) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor; or |

| (b) | a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and each beneficiary is an individual who is an accredited investor, securities (as defined in Section 239(1) of the Securities and Futures Act) of that corporation or the beneficiaries’ rights and interests (howsoever described) in that trust shall not be transferable for 6 months after that corporation or that trust has acquired the relevant securities pursuant to an offer under Section 275 of the Securities and Futures Act except: |

| (i) | to an institutional investor or to a relevant person defined in Section 275(2) of the Securities and Futures Act or to any person arising from an offer referred to in Section 275(1A) or Section 276(4)(i)(B) of the Securities and Futures Act; or |

| (ii) | where no consideration is or will be given for the transfer; or |

| (iii) | where the transfer is by operation of law; or |

| (iv) | pursuant to Section 276(7) of the Securities and Futures Act; or |

| (v) | as specified in Regulation 32 of the Securities and Futures (Offers of Investments) (Shares and Debentures) Regulations 2005 of Singapore. |

Any notes referred to herein may not be registered with any regulator, regulatory body or similar organization or institution in any jurisdiction.

The notes are Specified Investment Products (as defined in the Notice on Recommendations on Investment Products and Notice on the Sale of Investment Product issued by the Monetary Authority of Singapore on 28 July 2011) that is neither listed nor quoted on a securities market or a futures market.

| January 2017 | PS-7 |

| Citigroup Inc. |

| Non-Callable Floating Rate Notes Due January-----, 2025 |

Non-insured Product: These notes are not insured by any governmental agency. These notes are not bank deposits. These notes are not insured products subject to the provisions of the Deposit Insurance and Policy Owners’ Protection Schemes Act 2011 of Singapore and are not eligible for deposit insurance coverage under the Deposit Insurance Scheme.

© 2017 Citigroup Global Markets Inc. All rights reserved. Citi and Citi and Arc Design are trademarks and service marks of Citigroup Inc. or its affiliates and are used and registered throughout the world.

| January 2017 | PS-8 |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Bilibili (BILI) PT Raised to $13.50 at Citi

- Citi Upgrades United Microelectronics Corp (2303:TT) (UMC) to Buy 'with limited downside'

- Equifax (EFX) PT Lowered to $263 at Citi

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

CitiSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share