Post-Election Themes a Mixed Blessing for Hedge Funds; 13 New Stocks Added to Goldman Sachs Hedge Fund VIP List

Get Alerts APC Hot Sheet

Rating Summary:

17 Buy, 25 Hold, 1 Sell

Rating Trend: = Flat

Today's Overall Ratings:

Up: 11 | Down: 18 | New: 17

Join SI Premium – FREE

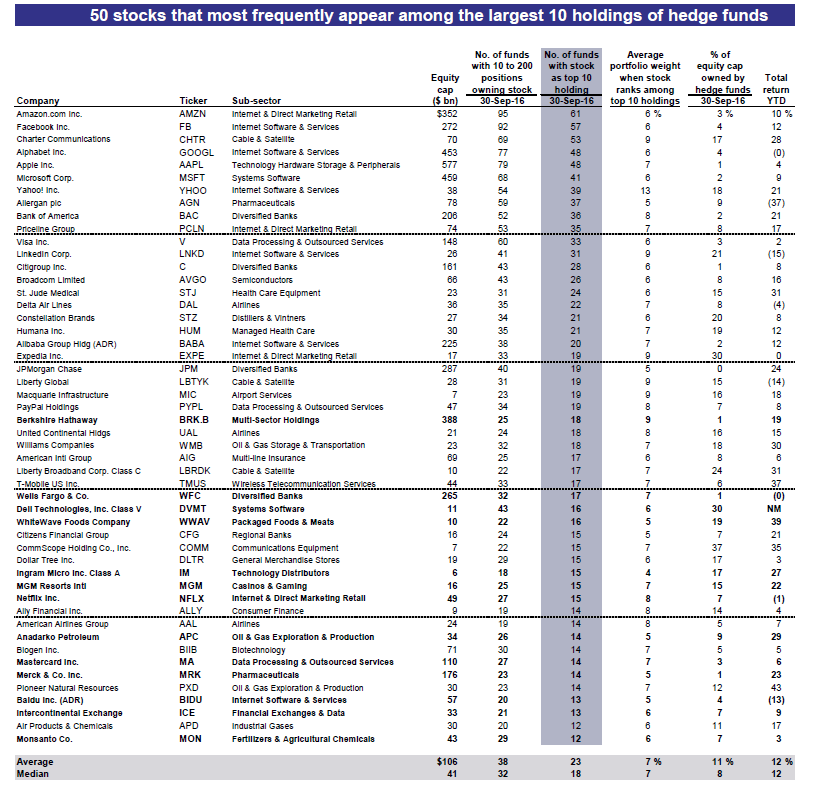

Goldman Sachs released its latest Hedge Fund Trend Monitor, including its Hedge Fund VIP list. Strategists including Ben Snider and David Kostin noted that hedge funds and mutual funds both entered 4Q 2016 with large overweights in Info Tech stocks, which outperformed S&P 500 by 650 bp through October, but have lagged by 300 bp in the past week as funds reallocated post-election. Hedge fund portfolios have received a mixed blessing from post-election market themes, benefiting from rallies in Health Care and value stocks but finding themselves underweight in Financials. They note fund positions helped drive the sharp post-election sector rotation.

Goldman added 13 new constituents to the Hedge Fund VIP list. They define stocks that "matter most" as the positions that appear most frequently among the top 10 holdings within hedge fund portfolios. New constituents to Goldman's Hedge Fund VIP list are:

- Anadarko Petroleum (NYSE: APC)

- Baidu.com (NASDAQ: BIDU)

- Berkshire Hathaway (NYSE: BRK-B)

- Dell Technologies Inc. (NYSE: DVMT)

- Intercontinental Exchange (NYSE: ICE)

- Ingram Micro (NYSE: IM)

- MasterCard (NYSE: MA)

- MGM Resorts (NYSE: MGM)

- Monsanto (NYSE: MON)

- Merck (NYSE: MRK)

- Netflix (NASDAQ: NFLX)

- Wells Fargo (NYSE: WFC)

- WhiteWave Foods (NYSE: WWAV)

Goldman's VIP Short List top five constituents are Exxon (NYSE: XOM) , IBM (NYSE: IBM), AT&T (NYSE: T), Caterpillar (NYSE: CAT), and Chevron (NYSE: CVX). The basket has underperformed the S&P 500 by 51 bp YTD (8.2% vs 8.7%).

New additions to the Short List basket include:

- Accenture (NYSE: ACN)

- American Express (NYSE: AXP)

- Carnival Corp. (NYSE: CCL)

- Comcast (NASDAQ: CMCSA)

- salesforce.com (NYSE: CRM)

- CVS Health (NYSE: CVS)

- Dominion Resources (NYSE: D)

- Digital Realty Trust (NYSE: DLR)

- Dow Chemical (NYSE: DOW)

- General Motors (NYSE: GM)

- Coca Cola (NYSE: KO)

- 3M Co. (NYSE: MMM)

- Nike (NYSE: NKE)

- Occidental Petroleum (NYSE: OXY)

- Pepsi (NYSE: PEP)

- Philip Morris (NYSE: PM)

- UnitedHealth Group (NYSE: UNH)

The firm's basket of the 20 "Most Concentrated" stocks saw six new constituents. The firm define "concentration" as the share of market capitalization owned in aggregate by hedge funds. The high hedge fund concentration strategy overcame a poor start to 2016 and has outperformed the S&P 500 by 943 bp YTD (18% vs. 9%).

- Baxter (NYSE: BAX)

- Charter Communications (NASDAQ: CHTR)

- Chipotle Mexican Grill (NYSE: CMG)

- Cabot Oil & Gas (NYSE: COG)

- Goodyear Tire (NASDAQ: GT)

- St. Jude Medical (NYSE: STJ)

Goldman noted that hedge fund returns have improved since weak 1Q but still lag S&P 500. "Despite returning -1% in 1Q 2016, the average hedge fund has gained 4% YTD. However, a 9% YTD return for the S&P 500 means funds are on pace to lag the broad market index for the eighth straight year. Equity long/short funds (+4%) have fared better than global macro funds (-1%).

Further, they note that funds continue trend of investing in “larger for longer” positions. "The typical hedge fund has 68% of its long equity assets invested in its top 10 positions, and just 14% of the largest hedge fund positions turned over in 3Q. High conviction positions are faring well."

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Growth isn't weak enough to truly undercut inflation pressures - BMO

- Rivian Automotive (RIVN) target cut at Barclays

- Nasdaq, S&P tumble as Netflix, chip stocks drag; AmEx boosts Dow

Create E-mail Alert Related Categories

Analyst Comments, Hedge Funds, Trader TalkRelated Entities

Warren Buffett, Goldman Sachs, Standard & Poor's, Hedge Funds, Wells FargoSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share