OECD Boosts FY15 Growth Outlook on Lower Oil Prices, Monetary Easing

Growth prospects in the major economies look slightly better than at the time of the OECD November 2014 Economic Outlook, but the near-term outlook is still one of moderate, rather than rapid, world GDP growth. Lower oil prices will boost global demand and have created conditions for many central banks to lower interest rates. Bold and open-ended action by the European Central Bank has boosted asset prices in the euro area and added to easier global financial conditions.

The favourable tailwinds create an opportunity for the euro area and Japan to get back to somewhat stronger growth rates, and on balance the most recent indicators are encouraging. In the United States, a cyclical recovery continues, although one-offs like the severe winter weather in the Northeast may disrupt the quarterly profile of growth. Over the next two years India is set to grow faster than China, where growth is slowing towards the official target of around 7%. Oil and commodity exporters are facing weaker growth prospects as the result of lower prices.

However, against this backdrop of somewhat better growth prospects, abnormally low inflation and interest rates create a growing risk of financial instability with risk-taking and leverage driven by liquidity rather than fundamentals. Moreover, projected growth rates remain too low to fully repair and activate labour markets. While central bank policies remain the centrepiece of the recovery, the exclusive reliance on monetary policy to manage demand should be avoided to mitigate these risks. A more balanced approach to policy is required with fiscal and, especially, structural policies providing synergistic support to monetary policy.

The global growth outlook has improved somewhat since late 2014

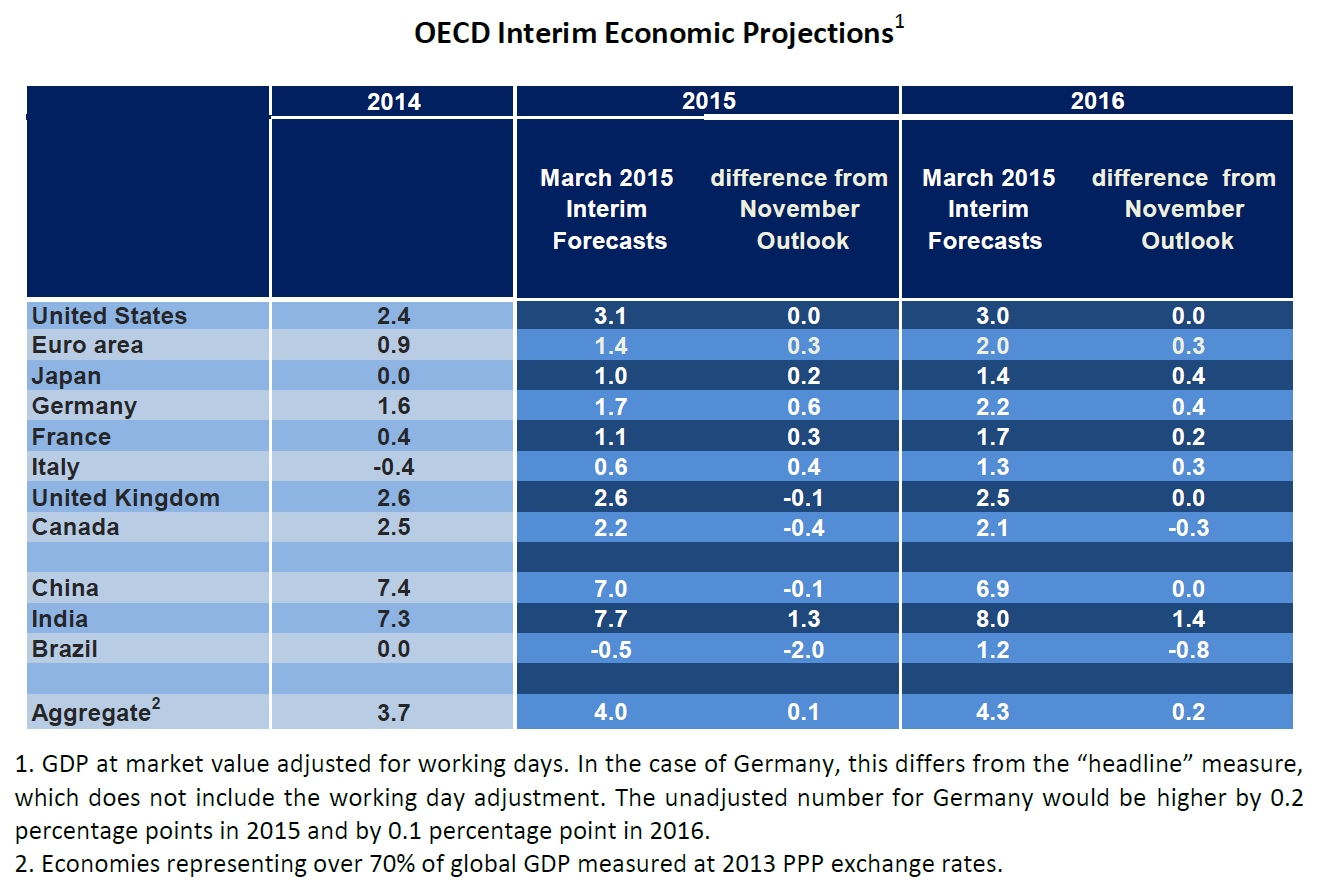

- Growth prospects in the major economies look slightly better than at the time of the OECD November 2014 Economic Outlook, with upward revisions to the main euro area economies, Japan and India. The growth outlook for the United States, China and the United Kingdom is largely unchanged from November, while significant downward revisions are made only for commodity-exporting countries (Brazil and Canada). Overall, the near-term outlook remains for moderate, rather than rapid, world GDP growth; real investment remains sluggish, and labour is not yet fully engaged.

- Tailwinds from lower oil prices and the effects of monetary policy easing are driving the overall improvement in the outlook. From June 2014 through January 2015 oil prices experienced one of their largest falls in recent decades and are about 35 percent lower than at the time of the OECD’s November projections, after a partial rebound in February-early March was erased in recent days. The steep fall in crude oil prices reflects continued increases in production, especially in the United States, which outstripped the growth in final demand. OPEC’s decision in late November not to cut production appears to have triggered a further downward move, creating consensus that excess supply would continue until high-cost production was squeezed out by the persistence of low prices.

- Lower oil prices both raise the real incomes of households and reduce costs for firms, and should therefore be beneficial for global growth, notwithstanding the loss of real income for oil producers. The fall in energy prices also puts downward pressure on consumer prices. Many central banks have responded to the shock by cutting interest rates or signalled a more accommodative policy stance.

- Probably the most significant of the decisions to ease taken in the past few months was that of the European Central Bank (ECB). The ECB announced on 22 January that it would take policy action to get inflation moving back up towards its target, including a large open-ended asset purchase programme to last until at least September 2016, building on earlier measures including purchases of asset-backed securities and negative overnight deposit rates. Unlike the many other central banks that have eased monetary policy since late 2014, the ECB signalled such a step well in advance, as inflation repeatedly undershot projections and inflation expectations drifted ever further below the ECB¡¦s target.

- The widespread easing of monetary policy over the past few months, affecting countries accounting for roughly half of global GDP, has resulted in improvements in global financial conditions. A number of the associated moves in exchange rates have been large, raising the question of overshooting in some cases.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- EUR/USD will struggle to sustain a move above 1.07: Analyst

- Analyst warns of downside risks for GBP as BoE turns dovish

- Liberty Oilfield Services (LBRT) Misses Q1 EPS by 6c, provides outlook

Create E-mail Alert Related Categories

ETFs, ForexRelated Entities

European Central Bank, Crude Oil, OPECSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share