Dick Bove Calls Out WSJ for Bad Math on Fannie (FNMA), Freddie (FMCC)

Get Alerts FNMA Hot Sheet

Rating Summary:

4 Buy, 2 Hold, 1 Sell

Rating Trend:

Up

Up

Today's Overall Ratings:

Up: 13 | Down: 11 | New: 14

Join SI Premium – FREE

After making waves on Fannie Mae (OTC: FNMA) Wednesday, after calling Senator Grassley's letters "gargantuan", Rafferty Capital's Dick Bove is calling into question the Wall Street Journal Heard on the Street columnist John Carney's math after the newspaper downplayed the importance of the letters.

Bove's latest report is entitled "Can John Carney Count?"

1+1=2

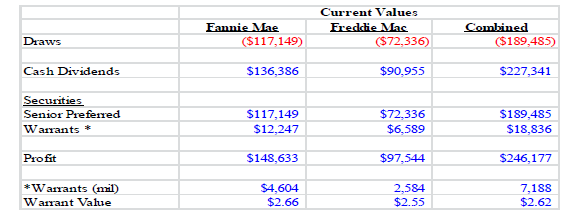

Please note the table below:

The United States taxpayer has earned a profit of $246 billion on an investment of $189 billion in the government sponsored enterprises (GSE). The Wall Street Journal and its columnist John Carney have repeatedly ignored the securities owned by the United States in their calculations of what the return has been on the investment in Fannie Mae (FNMA/$2.55/Buy) and Freddie Mac (FMCC/$2.66/Buy).

Yet we do have equity markets in this country. Preferred securities do trade in those markets. The senior preferred securities in the GSEs were issued with 10% coupons. If these securities were allowed to trade with the 10% coupon, they would sell at much higher prices than their combined $189 billion in face value. This is because they would be perpetual securities with U.S. government guaranteed backing.

Would you buy such a security in this market at par? Would you pay a premium of 75% to buy this security? If you would pay a premium, then the securities are worth $331 billion and the government profit on its investment is $387 billion.

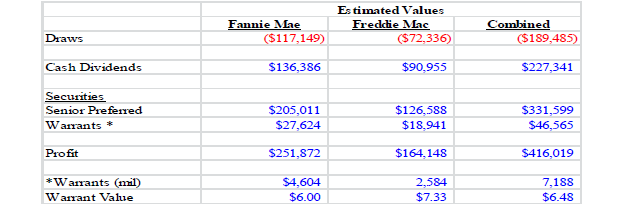

The warrants are being valued at their current market prices. However, assume that these warrants

- Would sell at 10 times projected 2016 earnings if the companies were released from their conservatorship in that year; and

- The companies were paying 10% on their senior preferreds and 8% on their junior preferreds;

- Then the warrants would be worth $6.00 per share and $7.33 per share for Fannie and Freddie, respectively.

Now the table would look like this and the government’s profit on its investment of $189 billion would be $416 billion.

I have no idea why the Wall Street Journal and John Carney refuse to make either set of figures available to the public other than my long-held view that this paper is a mouthpiece for government policy in the financial arena. You decide what is accurate. If you agree with my numbers then ask for fair reporting on the subject. Also you might consider asking Congress to look at the real numbers when viewing the GSE issue.

My belief is that Senator Grassley (R.; IA) intends to do just that. He may be tired of hyperbole and mis-statements. He may want the facts and then may decide to act upon them.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Goldman Sachs on Meta Platforms Inc. (META): 'We expect investors to have an initial negative reaction'

- FS Bancorp (FSBW) Tops Q1 EPS by 8c

- St. Joe Company (JOE) Reports Q1 EPS of $0.24

Create E-mail Alert Related Categories

Analyst Comments, Hedge Funds, Insiders' Blog, Trader TalkRelated Entities

Richard Bove, EarningsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share